TigerSoft and Peerless Daily

Hotline

www.TIGERSOFTWARE.COM/551214HL/index.htm

(C) 1985-2014

William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

Tiger

Software 858-273-5900 PO Box 22784 San Diego, CA

92192

Email william_schmidt@hotmail.com

Hotline will change Sunday night.

Look for an email from us this Friday.

-----------------------------------------------------------------------------------------------------------------------

Previous Hotlines - http://tigersoftware.com/555HL555/index.htm

10/9/2014 - 11/21/2014

http://tigersoftware.com/9933Hot/ 9/2/2014 - 10/8/2014-

http://tigersoftware.com/2233HL/index.html

6/25/2013-9/1/2014

http://tigersoftware.com/112211-H/index.htm 11/22/2013-3/20/2014

http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

Past Hotline Predictions http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

----------------------------------------------------------------------------------------------------------------------

PLEASE...Sharing this hotline address with non-subscribers is a violation of our contract

with you and a violation of copyright laws. I work hard for you. Respect that

effort!

---> To

renew this Hotline, order

here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

--------------------------------------------------------------------------------------------------------------------

A Guide To Profitably Using The

Tiger Nightly HOTLINE

Peerless Signals: 1915-2013

New Peerless

Signals and DJI Charts - version 7/4/2013

1965 1965-6

1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70

1970

1970-1 1971

1971-2

1972

1972-3

1973

1973-4

1974

1974-5

1975

1975-6

1976

1976-7

1977 1977-1978

1978 1978-79

1979

1979-80

1980

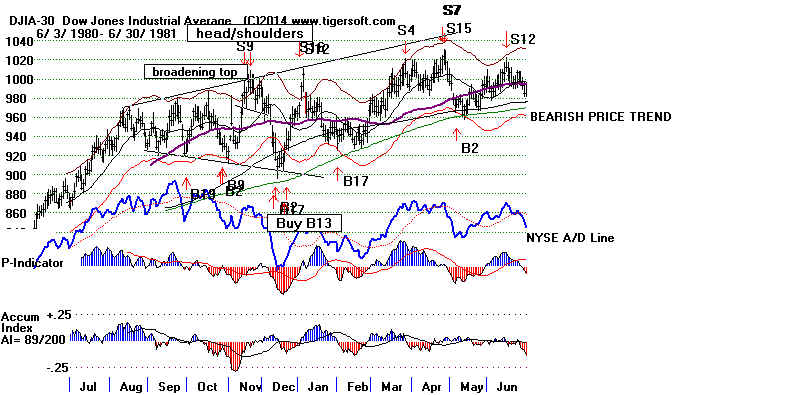

1980-1

1981

1981-2

1982

1982-1983

1983

1983-1984

1984 1984-1985

1985 1985-1986

1986 1986-1987

1987

1987-8

1988 1988-9

1989

1989-90

1990 1990-1

1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996

1996

1996-7

1997

1997-8

1998

1998-1999

1999

1999-2000

2000

2000-1

2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005

2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

2010

2010-11

2011

2011-12

2012

2012-2013

Background and New Studies

------------------------

Announcements

--------------------------------

New E-Books

1 The On-Line Explosive Stocks

is finished.

2 The On-Line Killer Short

Sales book is also finished, but

will be re-edited this coming week.

I call your attention now to the many new concepts and

the considerable new research in them: For example:

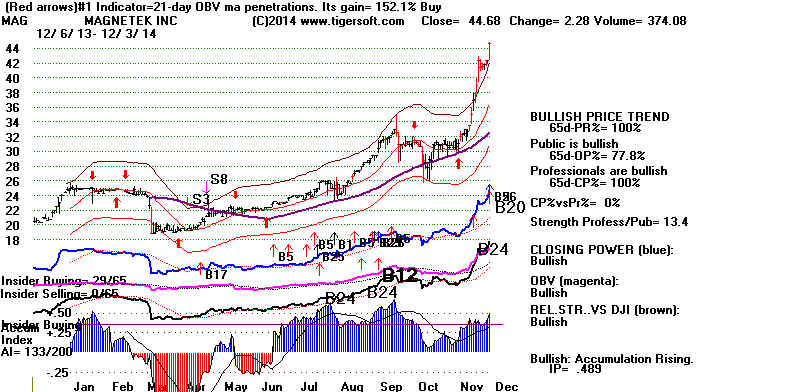

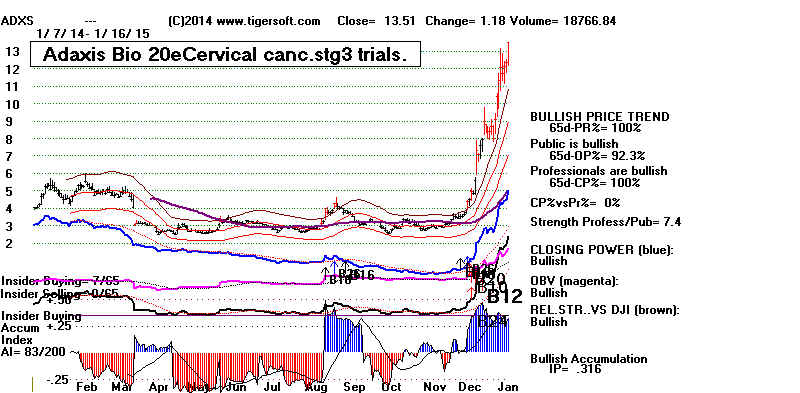

1) A very good New Tiger Buy B12 for Low Priced Stocks (1)

2) After Red high volume reversal days use CP uptrend-breaks.

3) Buy the stocks the Federal Govt wants you to buy. (1)

4) 100-Day Power Rankings... (1)

5) Using Closing Power Hooks after Buy B26s and B20s. (1)

6) How A Stock Reacts to Its Earnings Report Is Very important. (1)

7) TigerSoft Major Buy Signals' Combinations

Which are most Powerful? Reliable? (1)

8) Augmented Buy B20s' Independent Success Rate. (1)

9) What factors warn a rising 65-dma will not hold? (2)

10) The classic cluster of technical characteristics that commonly appear

in the 23 stocks falling 70% or more in the deep pullback of 2011. (2)

Purchase each all new book by CC for $42.50 or send a check

for $37.50 to me: William Schmidt, 5970 Gullstrand St., San Diego, CA 92122.

Introduction to

Tiger/Peerless Buys and Sells.

new

Sept 2014 Peerless

Buy and Sell Signals

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

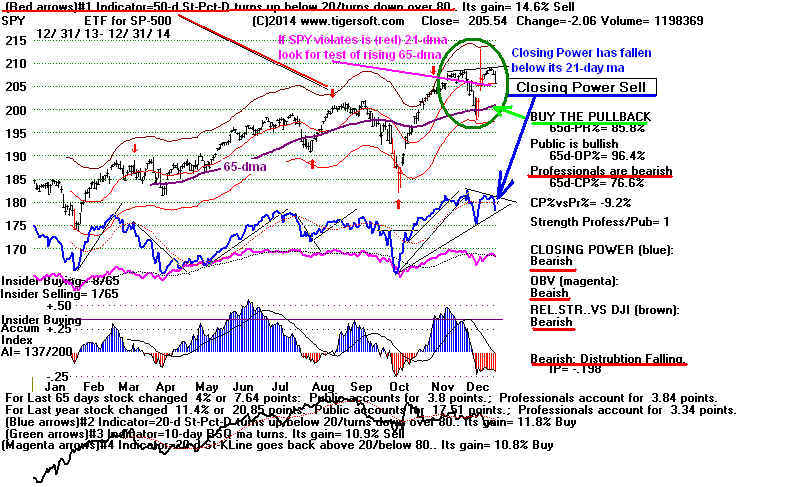

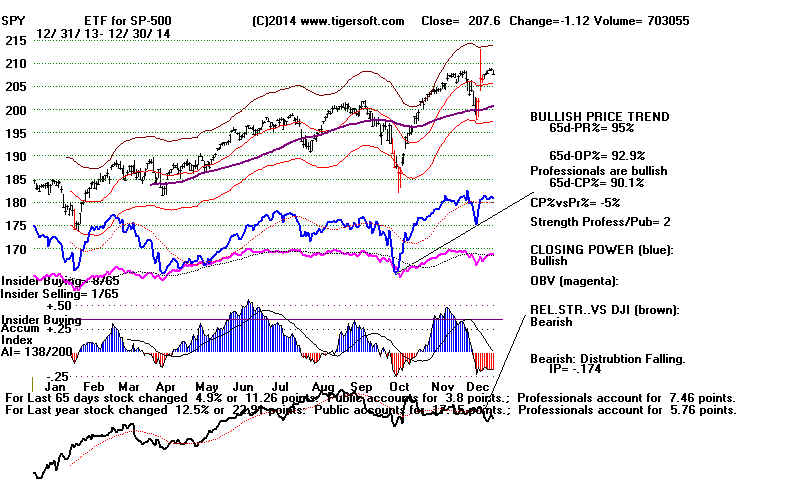

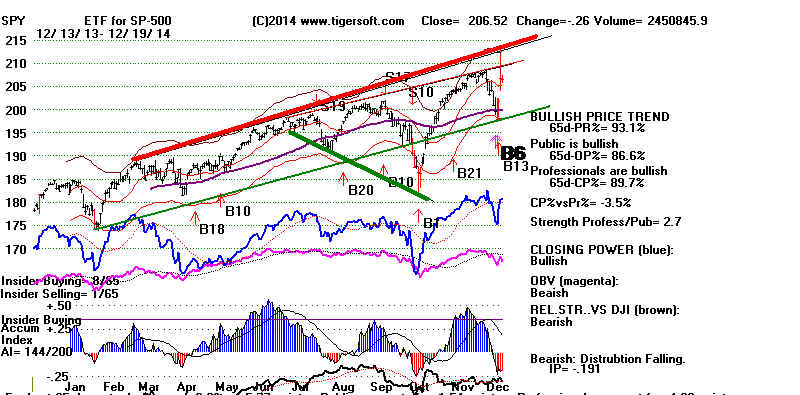

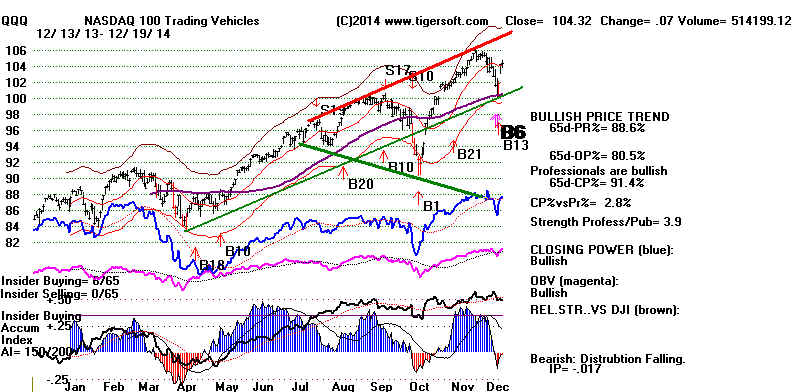

SPY Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized Signals.

"The Jig Is

Up": Calling September and October Tops.

A Keynesian's Warning

Signs.

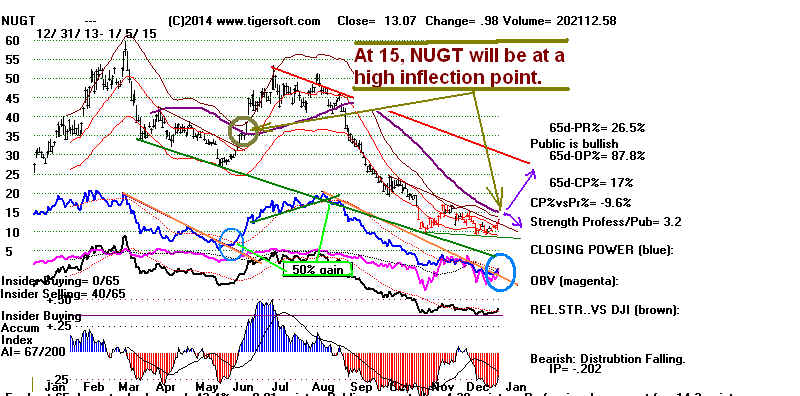

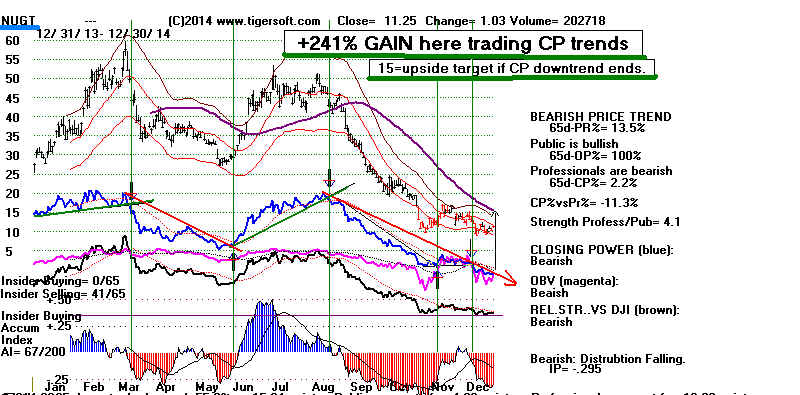

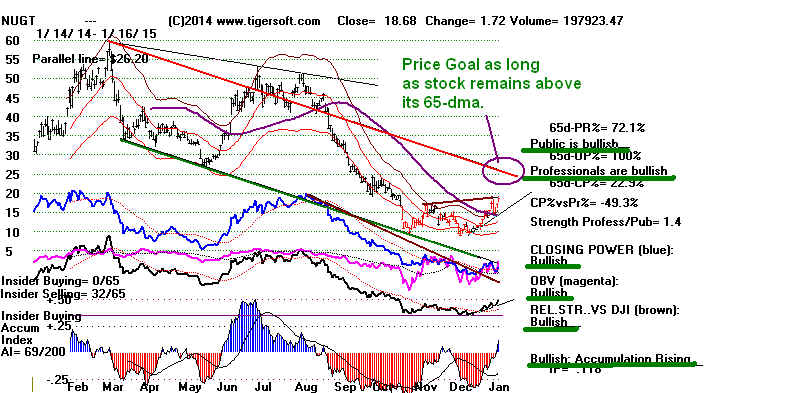

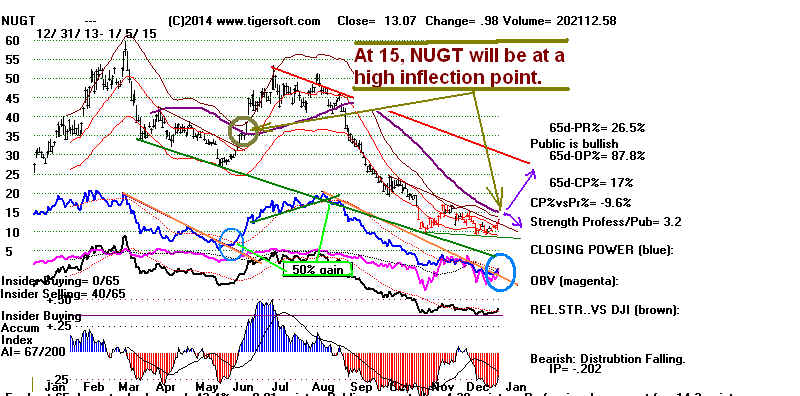

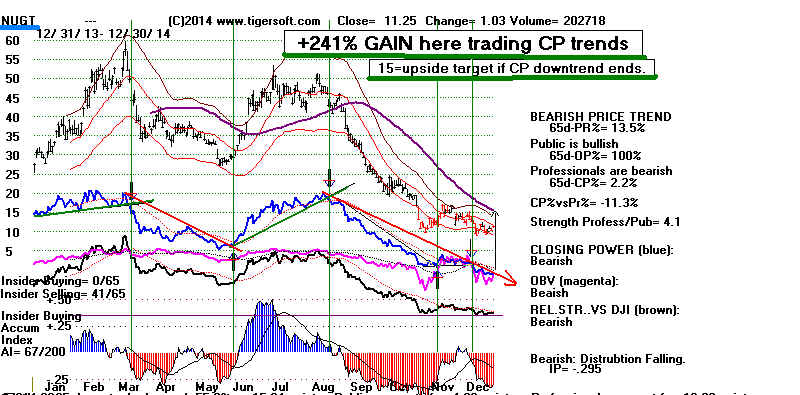

NUGT since 2012: A study of Tiger Technicals

new

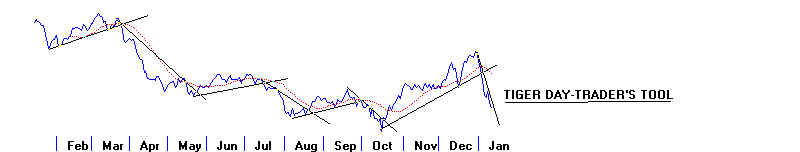

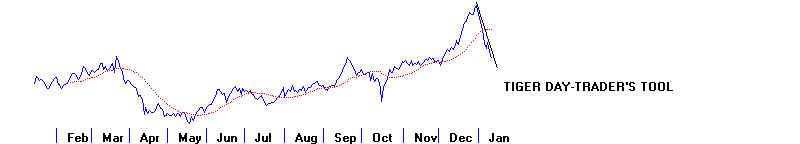

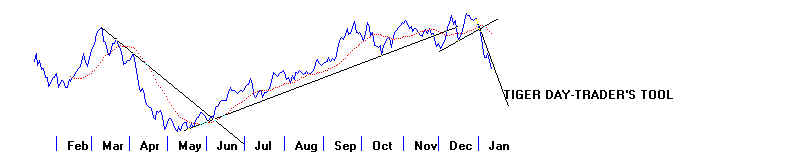

Tiger Day

Traders Tool and most active Triple Leveraged ETFs

Advisory Pink Closing Power

S7s at ETF at top since 1994

1994 1996 1997 1998 1999

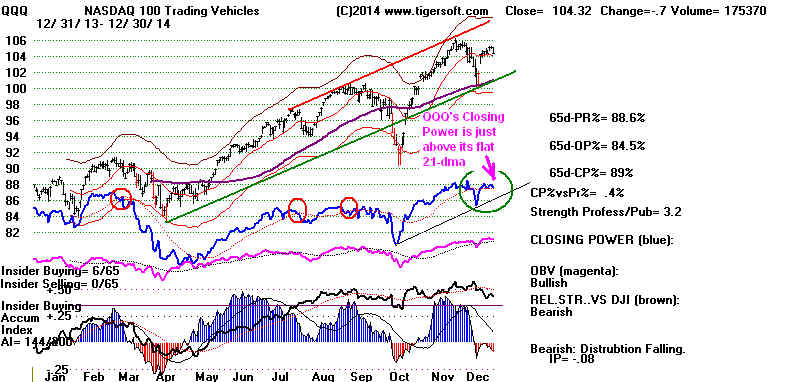

2000 QQQ SPY

DIA 2002

2007

2008

SPY 2011

2013-2014

Tiger Buy and Sell Signals: New 2014 Research:

These are randomly chosen groups.

but clearly we need to back-test them in more years.

You can replicate or do similar studies yourself

for other signals and/or other years.

9/1/2014 - 2014 Tiger B19s -

Steady rallying and no pullbacks below the 21-day ma.

9/2/2014 - 2014

Tiger B17s on 14As taken alphabetically

9/3/2014 - 2014 Tiger B17s on 60

Biotechs taken alphabetically

9/4/2014 - 2014 Tiger B18s on all

"R" stocks taken alphabetically

*

9/8/2014 - 2014 Tiger B20s

- Conclusion: Use Closing Power trendbreaks in aftermath.

9/8/2014 - 2014 Tiger B16s

- Conclusion: Use mostly when LA/MA under 1.05.

9/11/2014 - 2014

Tiger B15s - Conclusion: Certain conditions

improved the results dramatically.

9/12/2014 - 2014 Tiger B25s -

Conclusion: 87.5% success rate when other internals are

positive.

9/15/2014 - 2014 Tiger B25s

- Best conditions for using B25s with somewhat higher RSX

capitalization stocks.

9/16/2014 - New Tiger Closing Power Take-Off Buy Signal in 2014: 14s, QQQ,

DJI-30 and ETFs

9/17/2014 - New Tiger Closing Power Take-Off Buy Signal: 2009A-s

9/18/2014 - New Tiger Closing Power Take-Off Buy Signal: 2010A-s

9/21/2014 - New Tiger Augmented Sell

S8s: DJI-30 - 2014

Requiring S8s to show Negative CP%-Pr and IP21<+.15 produced a 70% success rate

in a rising market. for DJI-30 stocks and big ETFs.

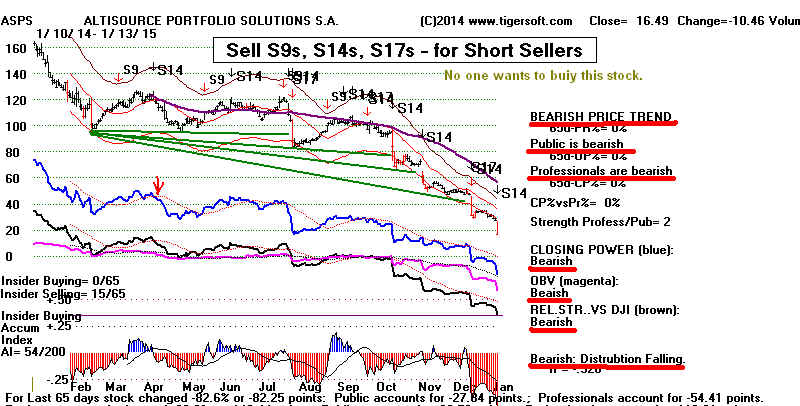

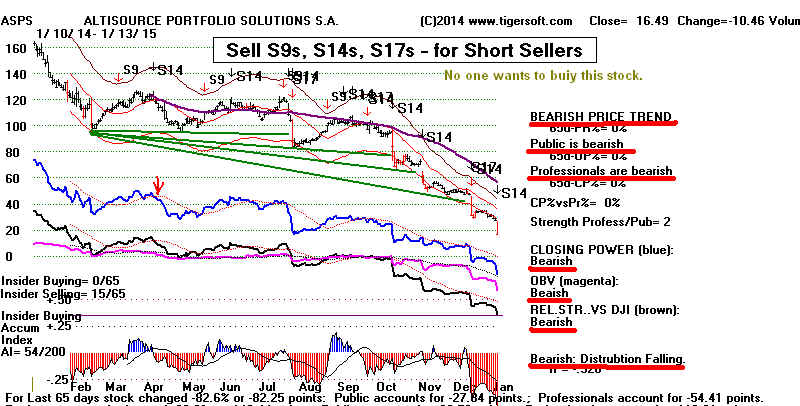

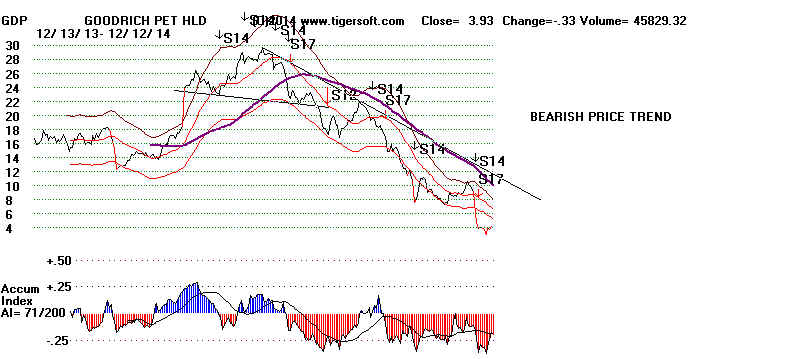

9/24/2014 - Tiger Sell S14s: They make price breakdowns very bearish.

1/15/2014 - Tiger Day Traders' Tool Explained, More

Examples.

http://www.tigersoft.com/day-traders/index.html

http://www.tigersoft.com/Indicators/index.htm

http://www.tigersoftware.com/TigerBlogs/Aug-31-2009/index.html

The New 2014 Peerless.exe Software has now been posted on the Eli te Stock Professional

Page.

---> To Previous Hotlines

=====================================================================================

NIGHTLY HOTLINE

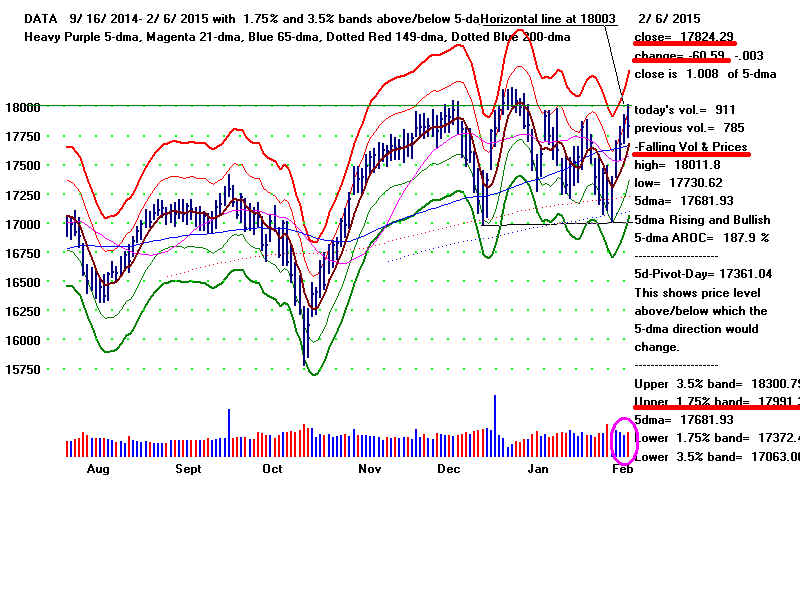

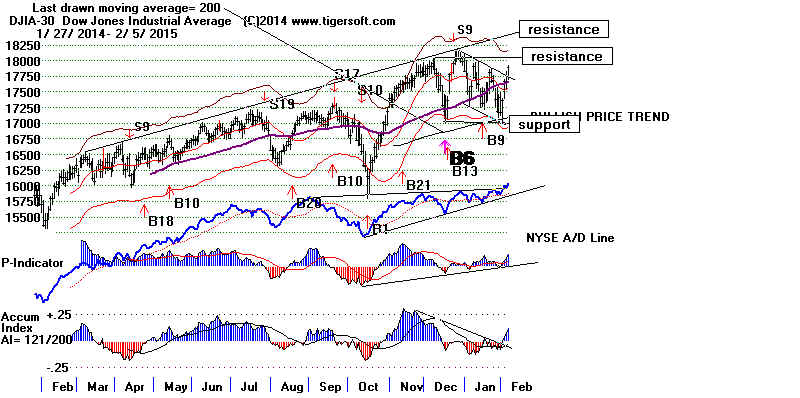

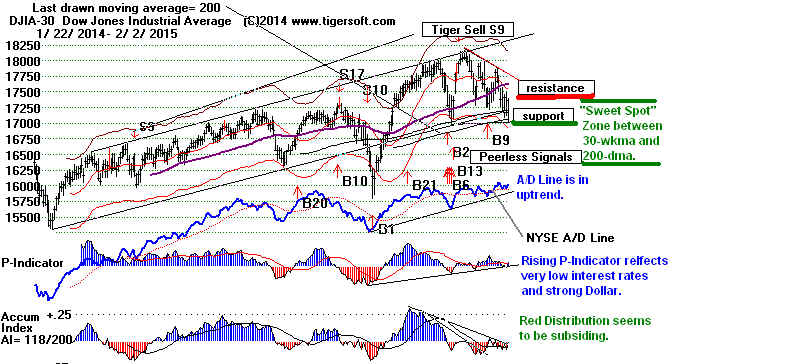

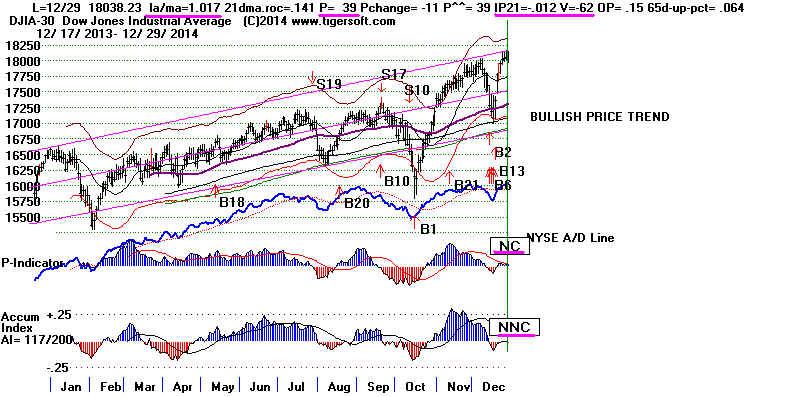

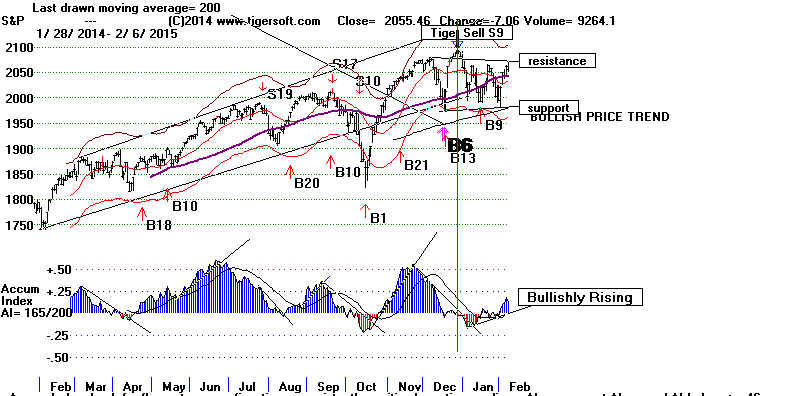

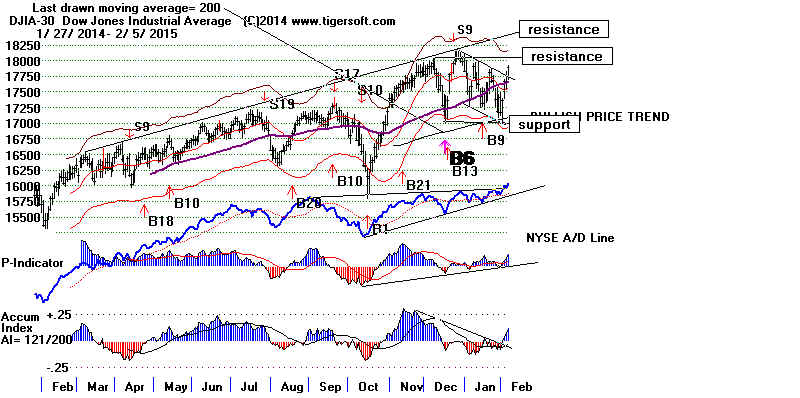

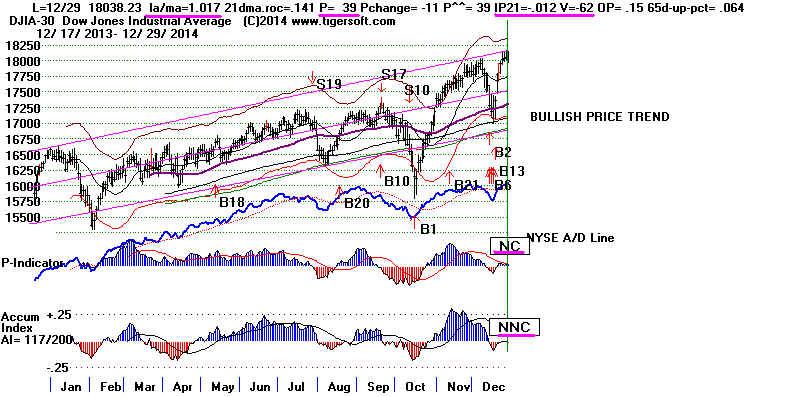

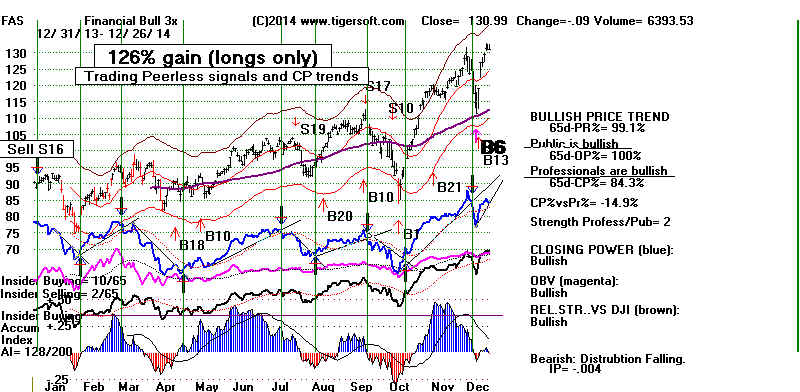

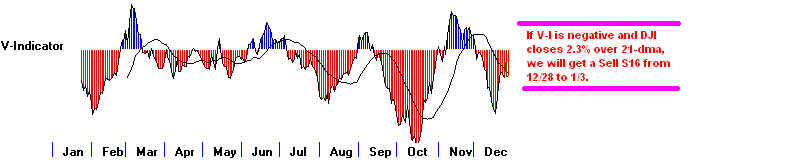

2/6/2015 Peerless Buy B9 But a

trading range between 17000

and

18000 must, I think, be assumed, until the DJI, the SP-500 and

the

NASDAQ can breakout above their well-tested flat resistance

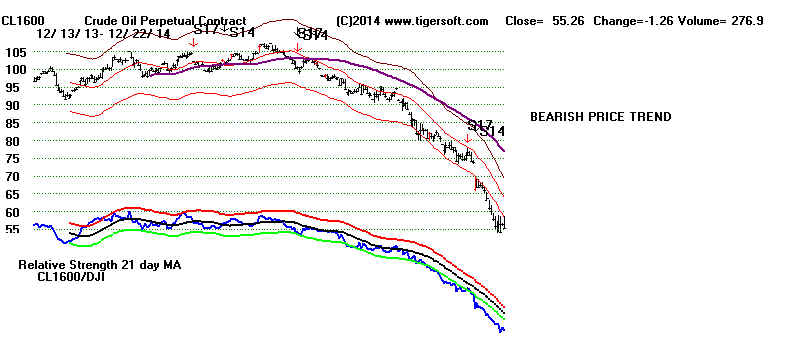

lines. Crude Oil keeps rising, but Gold got clipped

by how the Jobs'

Report seems to have made a Fed Rate hike more likely. Gold

and

NUGT should return to favor if Greece starts to default on its

debts

and

if the Euro's future is thereby called into question.

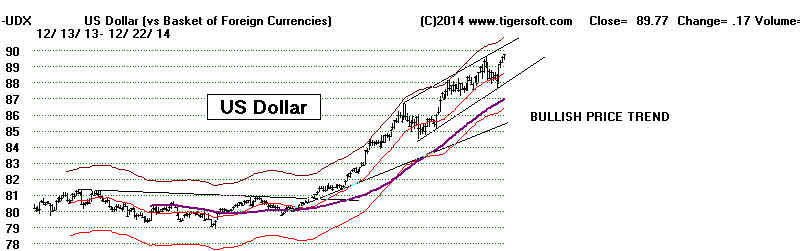

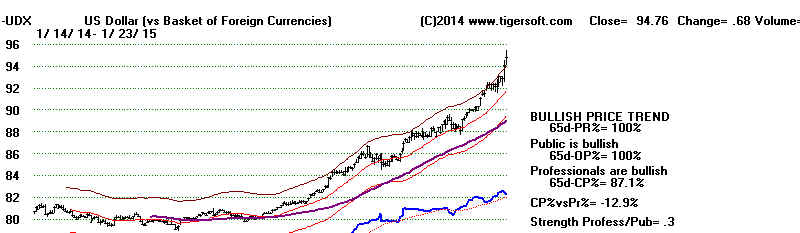

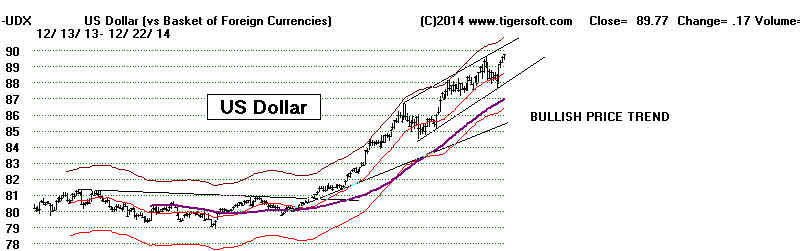

The Dollar

has

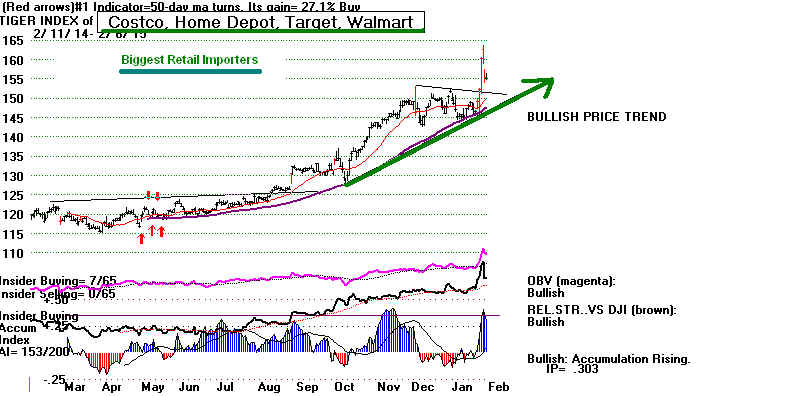

started another surge. The Biggest importing Retailers would

seem

to be the biggest beneficiaries as long as Crude Oil does not

rise

too much.

With

the ratio of NASDAQ new highs to lows still low and the ratio lower

than

the comparable NYSE ratio, traders should consider employing the

numerous short-term Tiger trading tools. See the Documents

I posted

for Tiger Users at our San Diego meeting this weekend.

I will be posting

more

materials and some new programs for very short-term traders later

this

coming week. (For example, one of our local Tigers thought it would

be

handy to see statistics on how a stock or a group of stocks behave after an

opening,

say, one percent above or below the previous close. Great idea.)

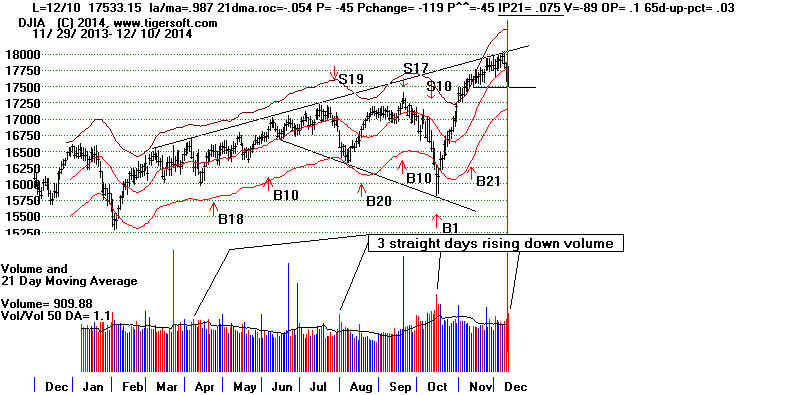

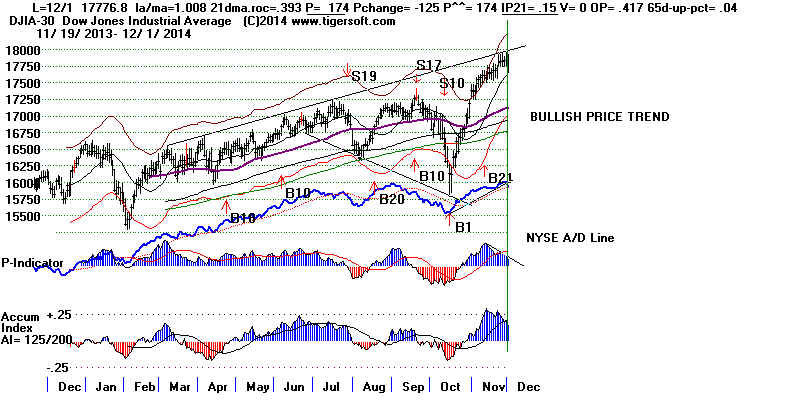

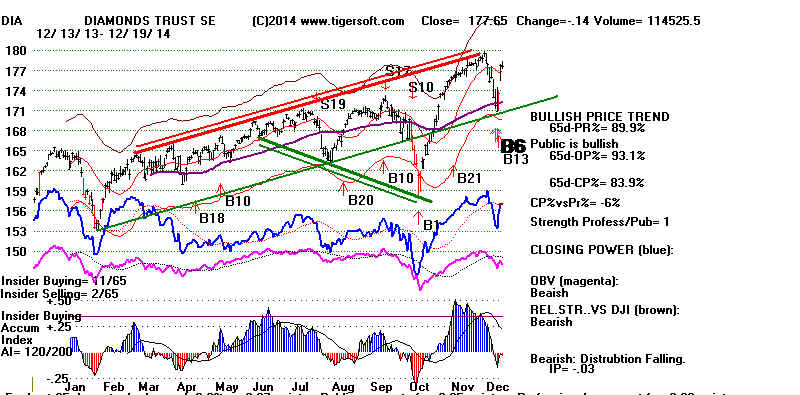

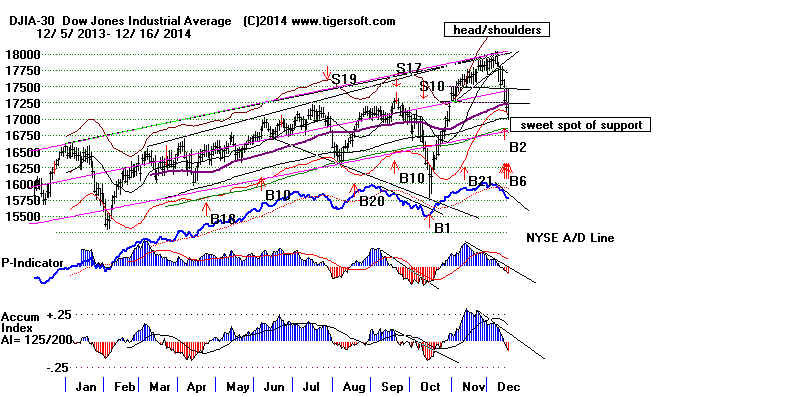

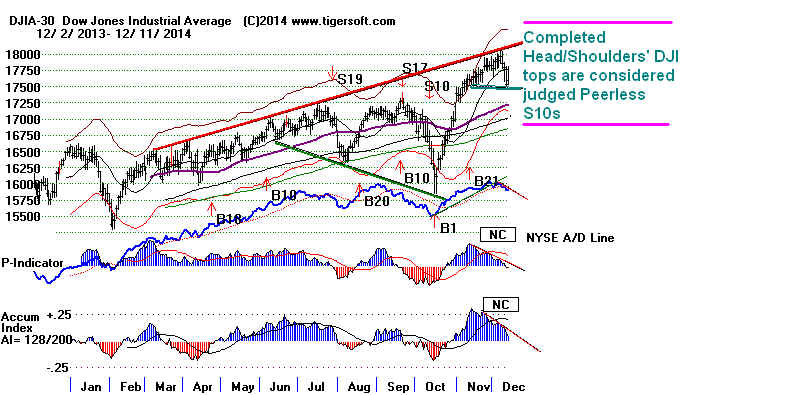

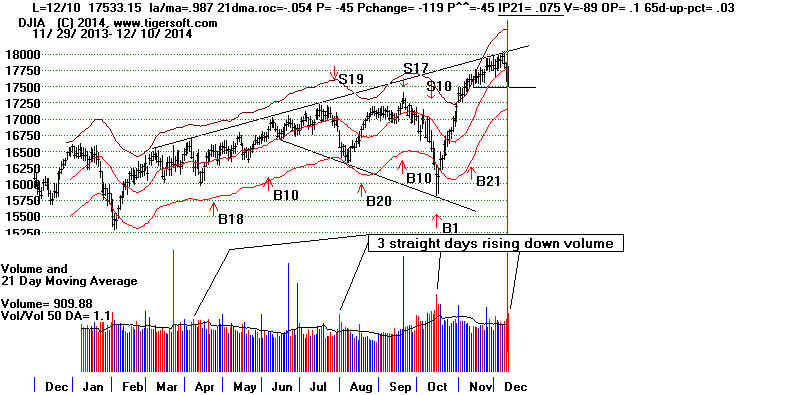

A retreat from the 17900-18000 resistance in the the DJI seems a reasonable

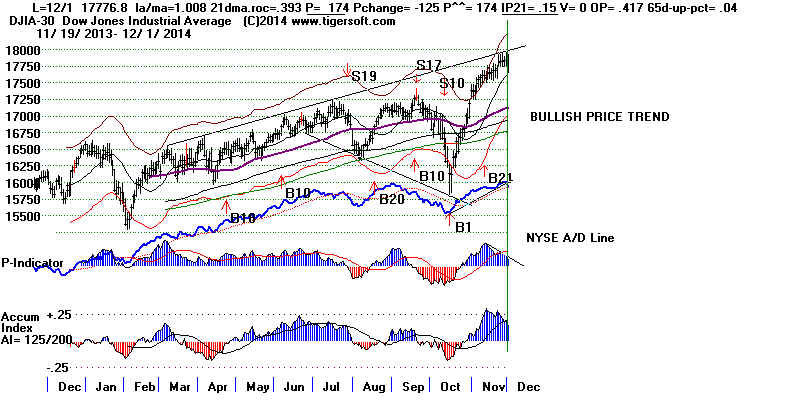

prediction. See below how (red) down-day volume was higher than the

(blue)

volume on its two previous up-days.

The Effects of The Jobs' Report

Just

look at how the market reacted on Friday to a really

super January Jobs

report that boosted the jobs' numbers very

significantly for last November and

December, too. I would ask if the stock market cannot go up on such very good

economic

news,

what will it do if news is not so good? How the market reacts to seemingly

very

bullish or very bearish news is often a very good clue about its futures

intentions.

The

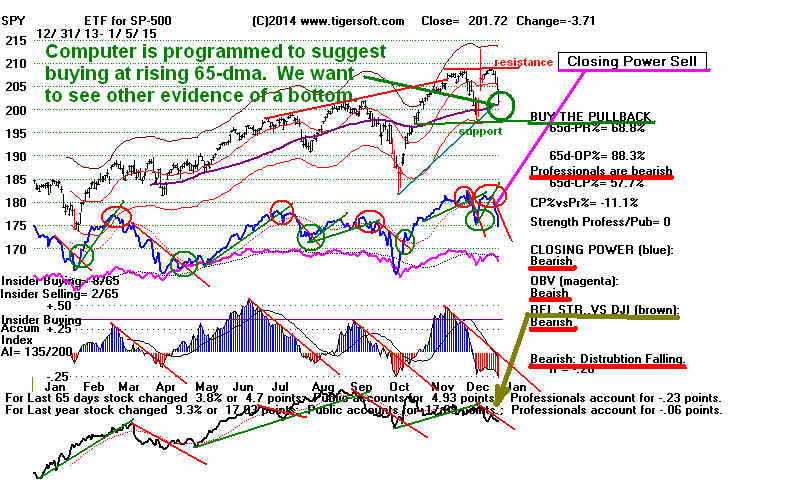

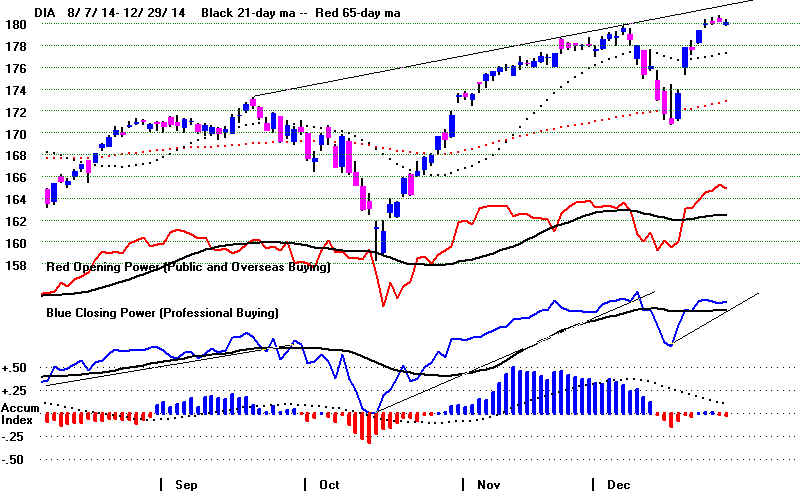

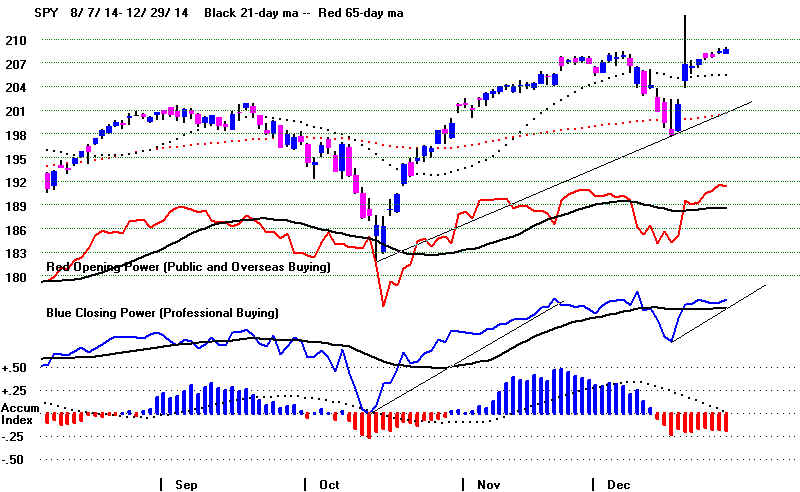

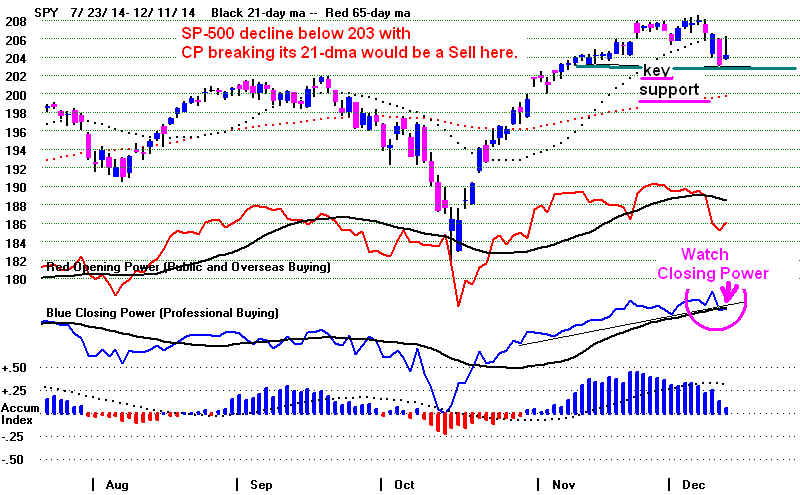

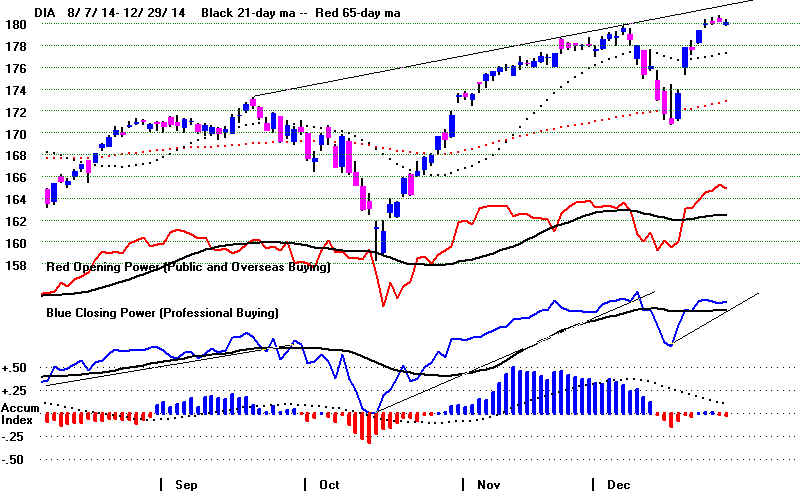

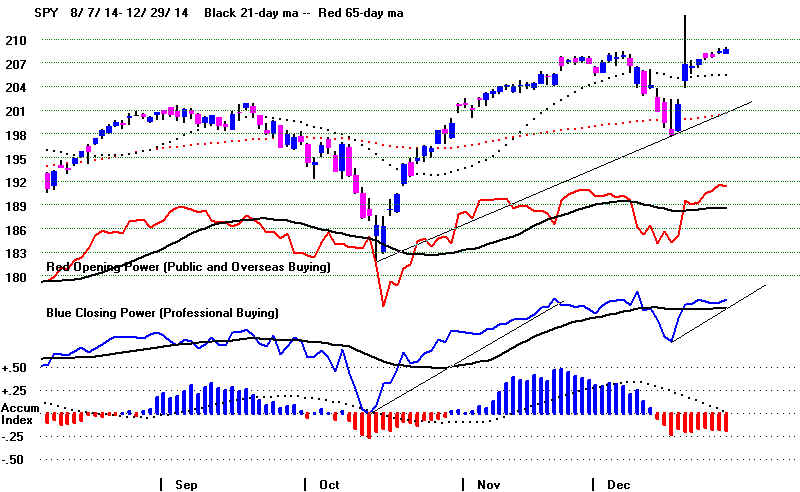

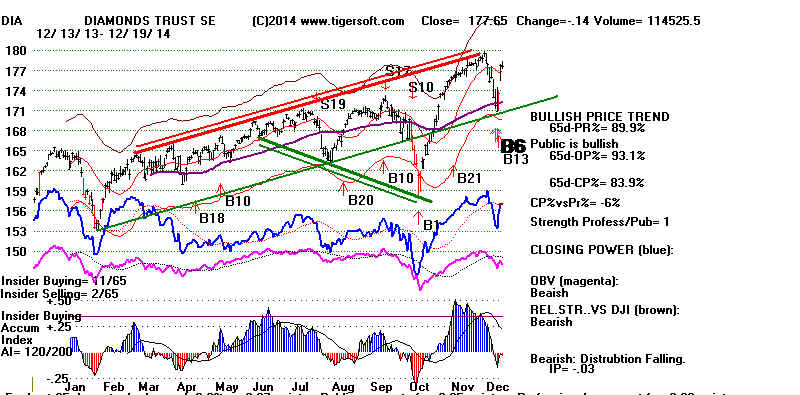

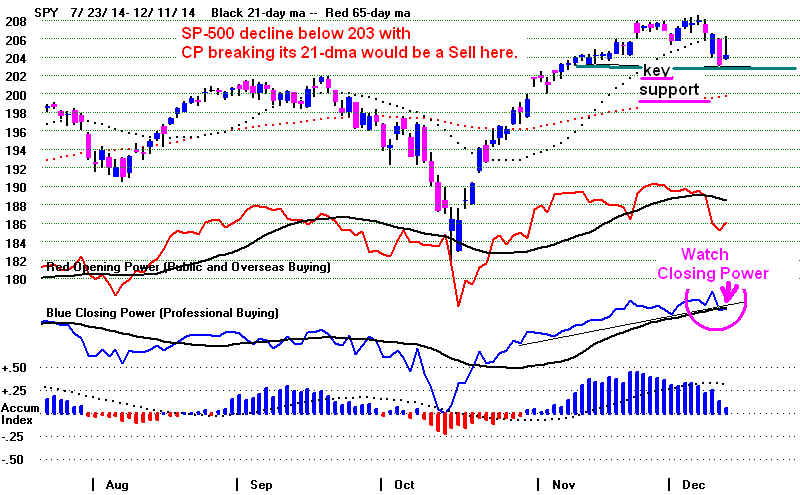

Closing Powers are still rising for DIA, SPY and QQQ. Perhaps,

Friday's

selling will not stop the DJI from reaching 18000. We must watch to

see

whether Professionals become net sellers next week. This is why we

watch

the Closing Powers.

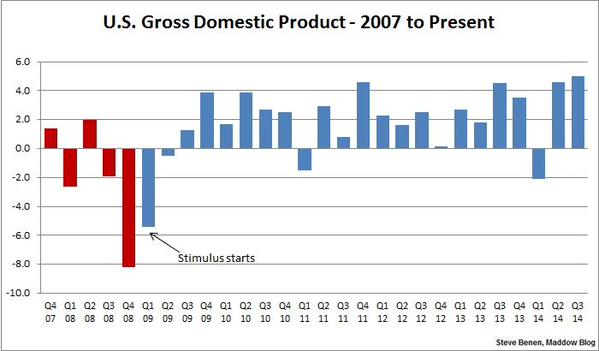

Why would traders sell on such good economic news?

First, the DJI, NASDAQ, SP-500 have reached well-tested flat

resistance.

Flat

DJI trading ranges have often lasted 8 months. See the set of materials

I presented for the Tiger User Group meeting on Saturday.

Second, short-term trading is growing as a percentage of all volume

and

Professionals need to lock in profits when they have them.

Third, the stock market has been anticipating 5% unemployment again

for a

long time. That is why it has been rising, after all, for five years.

This

is the FED's full employment goal.

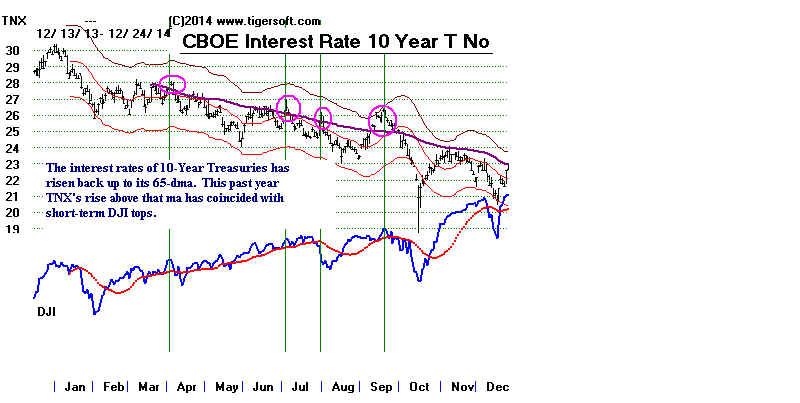

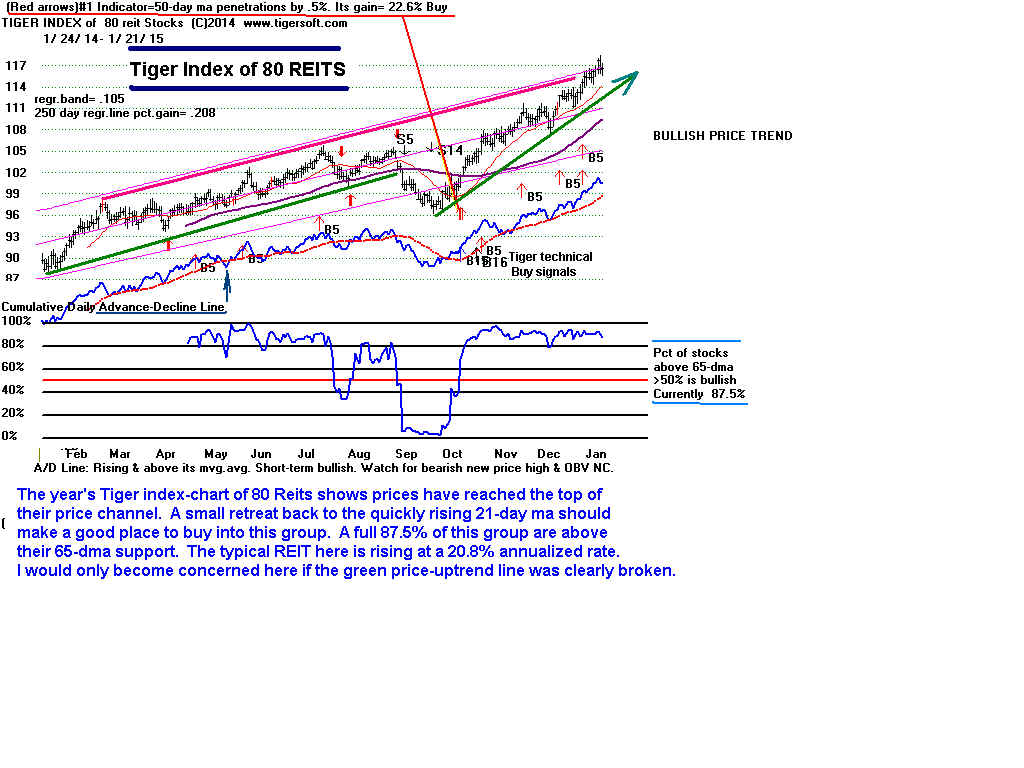

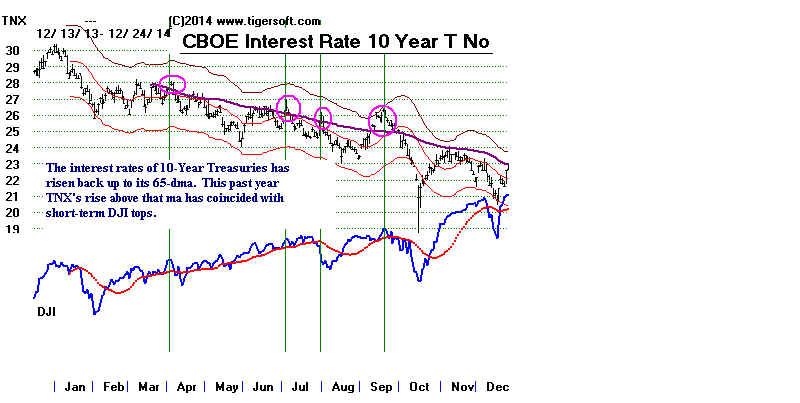

Fourth, and most important, the good Jobs' Report now gives the FED

an

excuse to raise rates, especially now that wages are starting

to

rise faster than productivity. See the TNX chart of

rates on the

10-year Treasuries. The big jump in rates on Friday spooked many

over-extended REITs. With a rate hike over-hanging the market

sometime this Summer, or maybe sooner now, many dividend stocks

will

now have a much harder time rallying. We must watch the NYSE

A/D

Line for signs of new selling in the many dividend stocks there.

Mining stocks also got clobbered at the prospects of higher interest rates

and a

stronger Dollar.

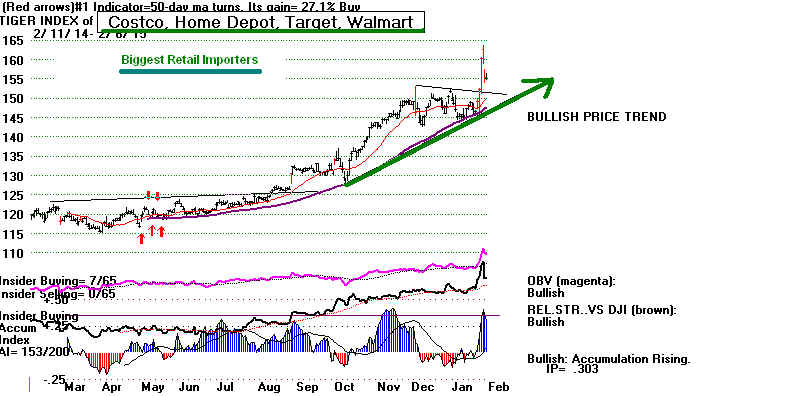

The Friends of A Strong Dollar Stocks

Liked Friday's Economic News

Not

all stock groups turned down on Friday. A very strong Dollar

is a

real boost to bank stocks. The real mission of the FED is, after all,

to

make the big banks that run the FED maximally profitable. Raising rates

lifts

the Dollar, thereby making hot foreign money seek the US as

a

haven against local falling currencies. In addition, a strong Dollar increases

the

world's dependence on US financing and US financial institutions,

much

to Wall Street's delight.

But

Big Bank stocks may not be helped as much as by the prospects

a

Stronger Dollar as Big Retail stocks are who can thereby buy foreign

goods

more cheaply for their stores. This is because the prospects of a

Greek

default on its debt raises all sorts of dangerous possibilities and

precedents for Europe and also for US banks who own the bonds of Greece,

Spain

and Italy. Higher rates would hurt consumers more if the big banks

has

passed on their own cheap borrowing costs to consumers. But they

have

not. Meanwhile, the still very low oil prices have put an estimated

$100

billion more in American consumers' pockets since last Summer.

Tiger Index of Big Banks

|

Tiger Index of Four Biggest Importing Retailers:

Wal-Mart, Target, Costco and Home Depot

|

================================================================

OLDER HOTLINES

================================================================

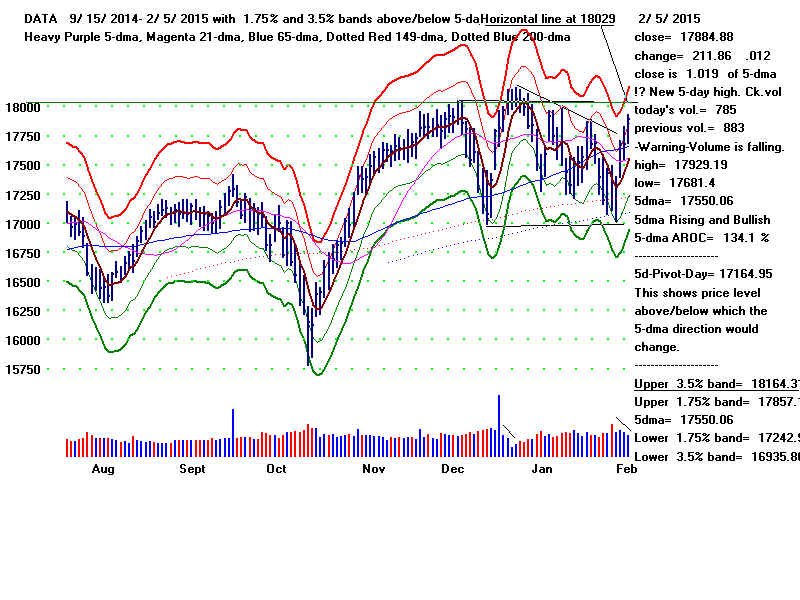

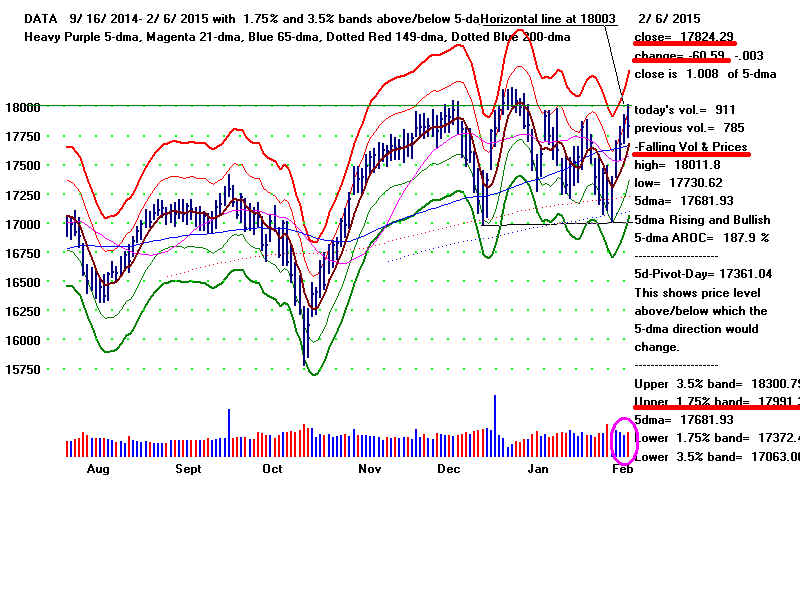

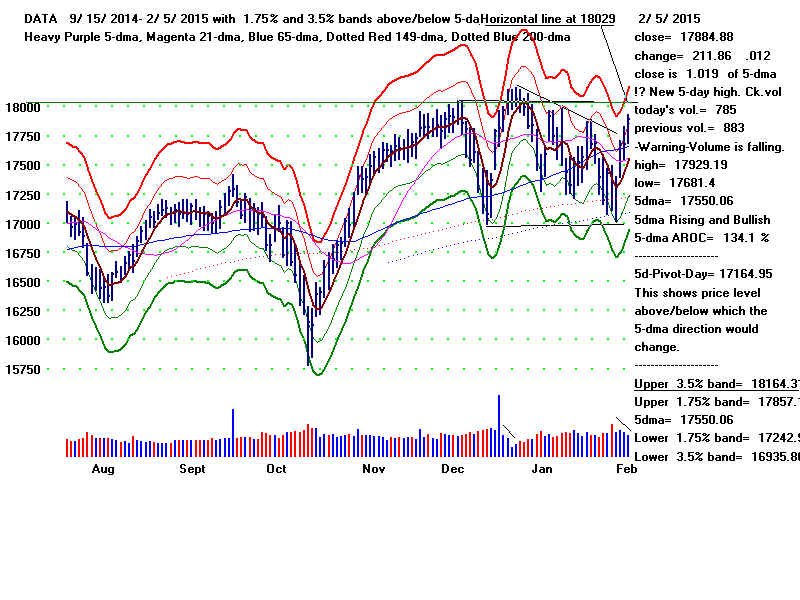

2/5/2015 Peerless Buy B9 The DJI seems headed for 18000.

The

NYSE Volume has fallen for two days, so the Jobs Report tomorrow may

not

be positive enough to let the DJI get past this round number resistance.

When looking at the Jobs' numbers for January, we want to compare

the

most recent number with December's +252,200. The

most

recent 3 months have averaged 289,000. See Jobs Report A

number

lower

than 235,000 would be a sign that the economy is slowing down.

This

is something a market nearly at 18,000 cannot, I think, afford to see.

The budget battle between the austerity-minded Congress and the

pro-public works President could cause the market to reverse later in February.

But

as long as the Closing Power for SPY is rising, Professionals are

still

bullish. So, should we be.

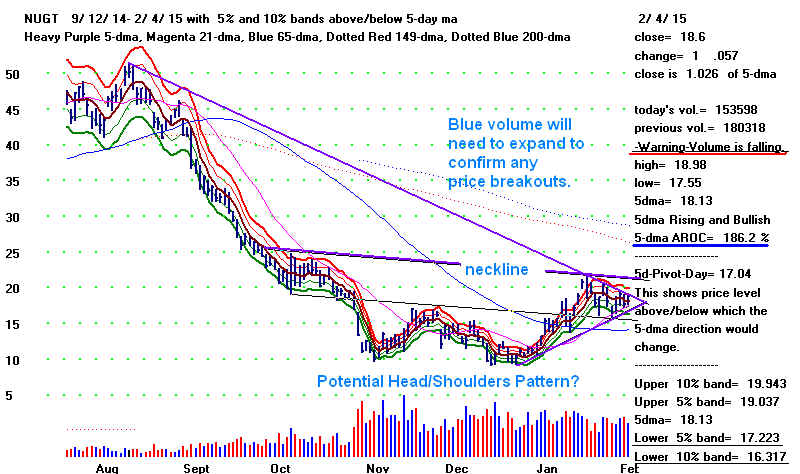

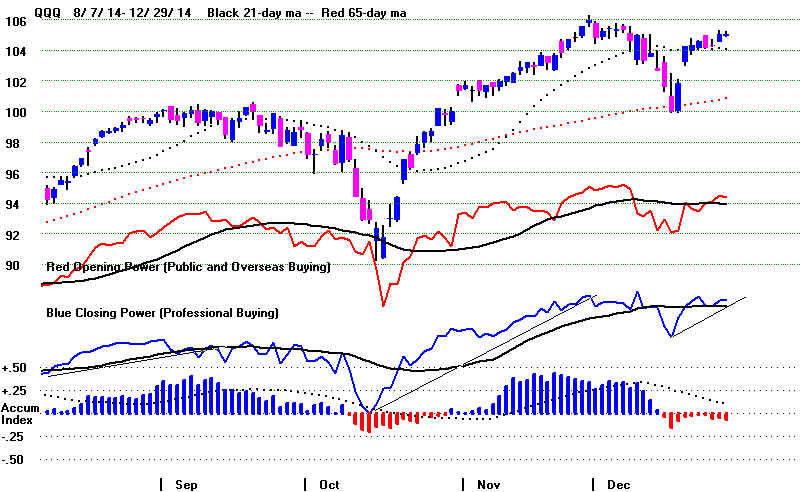

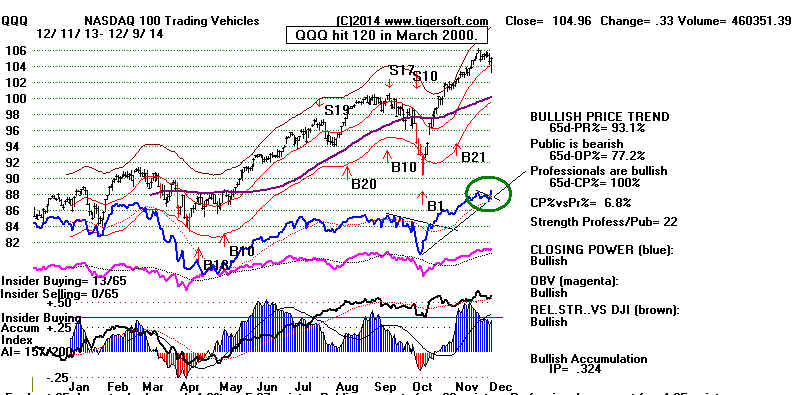

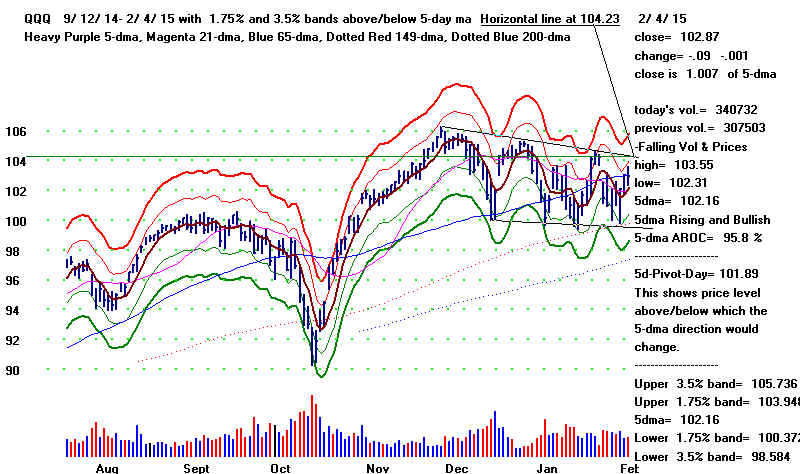

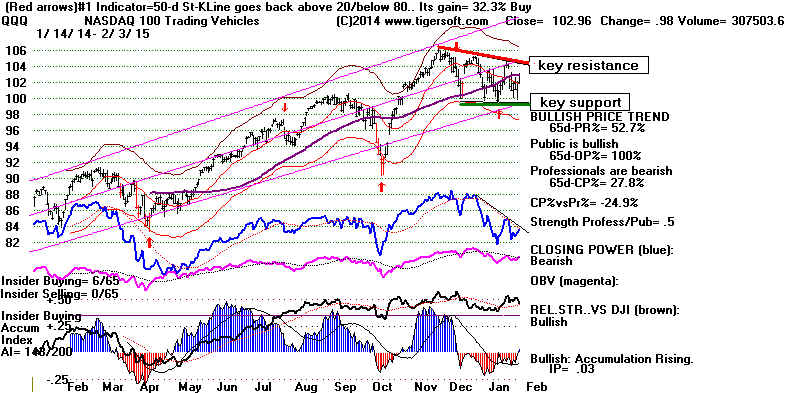

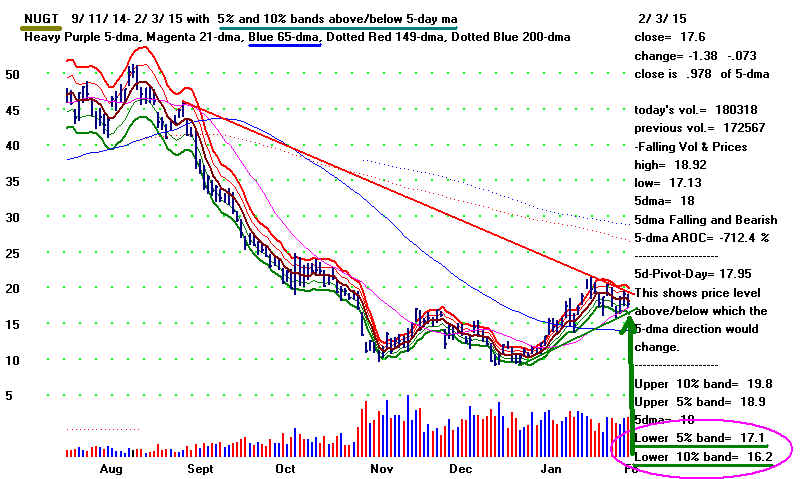

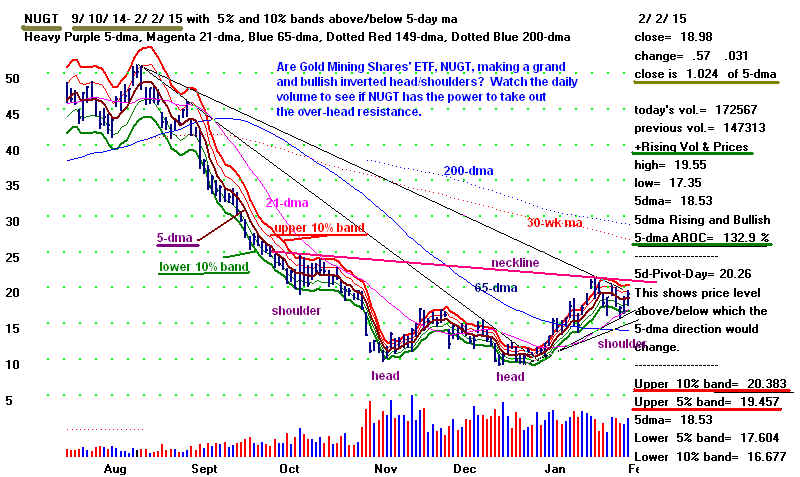

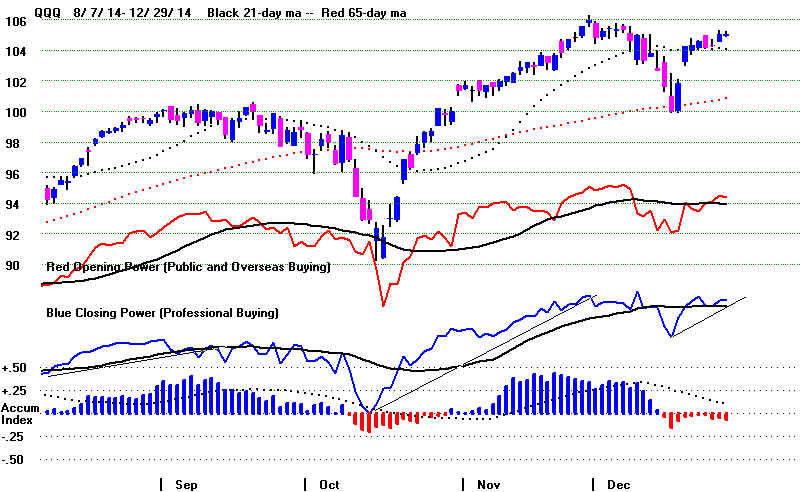

Meanwhile, I expect QQQ, Crude

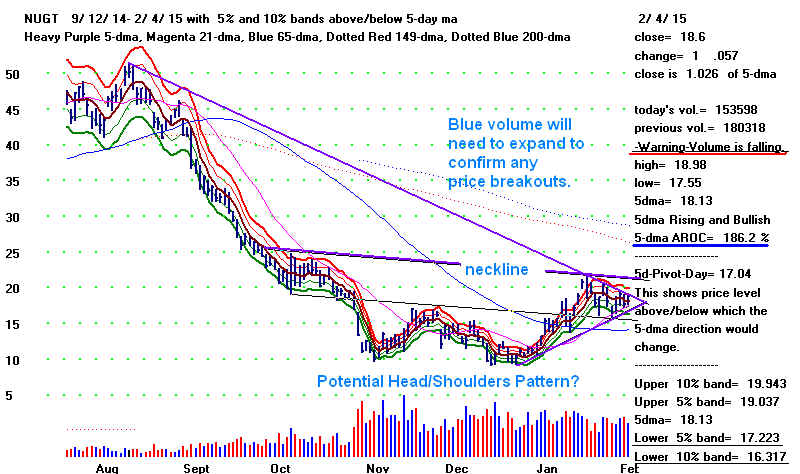

Oil and NUGT to continue to rise. NUGT

slightly broke its well-tested 6-month downtrend. Now we get to see if

if

can surpass 21 and complete a very bullish looking inverted

head/shoulders. Volume will need to pick up to accomplish this.

Breadth has been excellent. We see this in the increasing number

of

industry groups having 60% or more of their stocks above the

65-day ma: Autos 65%. Biotechs 64%. Bonds 98%. Chemicals 76%.

Computers 71%. DJI-30 50%. Mining 75%. Home-Building 80%.

Military 75%. Reits 89%. Retail 74%. Russell-1000 63%.

Semi-Conductors 65%. Software 67%. Solar 65%. SP-500 60%.

Domestic/Foreign Utilities 63%. The ratio of new highs

to new lows

remains much higher on the NYSE. So, this is far from a speculative

market.

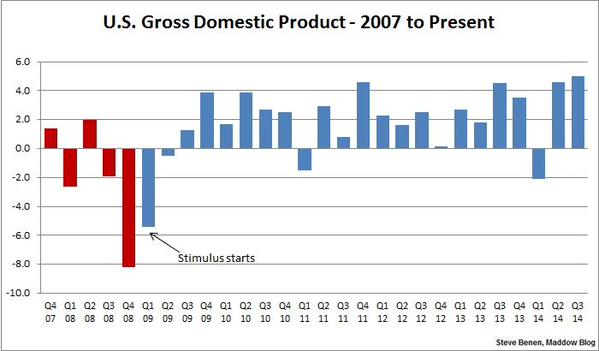

That

should give the market considerably more upside if policy-makers in

Washington do not repeat the austerity mistakes of Europe in the

last

few years and the US in 1937 AND provided the Obama Administration

does

not keep poking the motherly Russian bear too much for

protecting Russian speaking separtists in SE Ukraine from attacks by the

Ukrainian government the US played a big role in setting up.

================================================================

OLDER HOTLINES

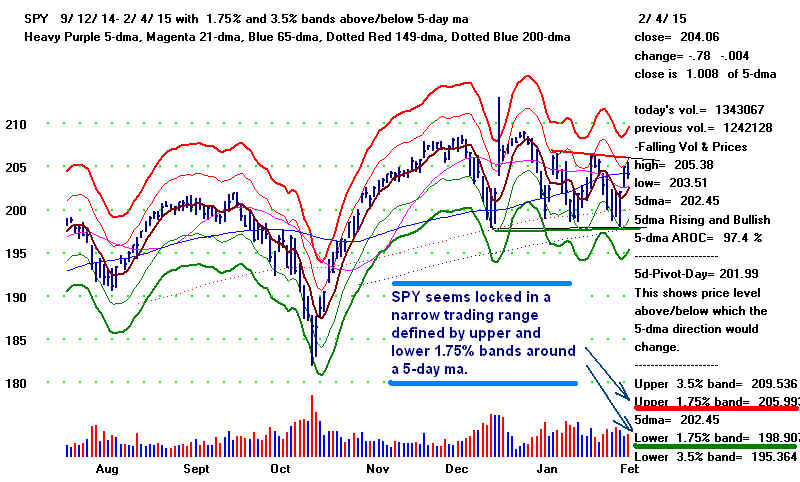

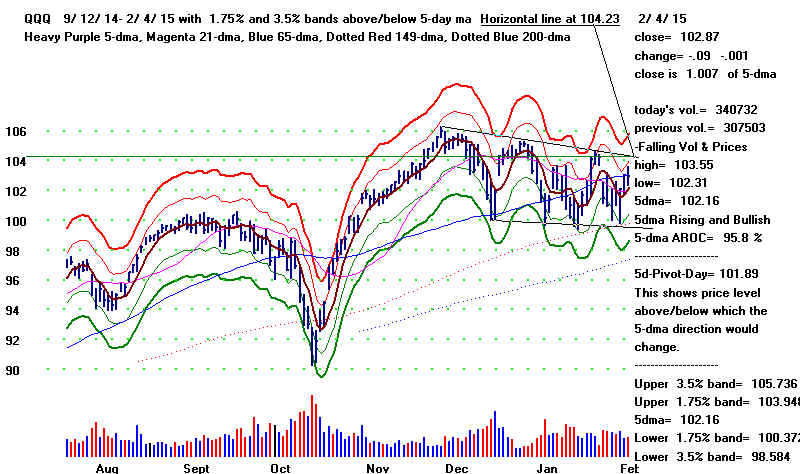

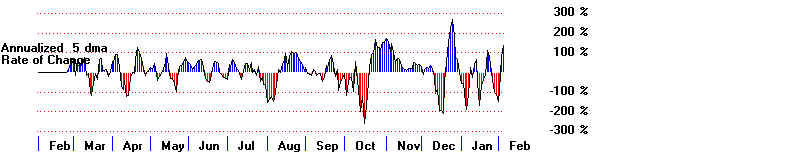

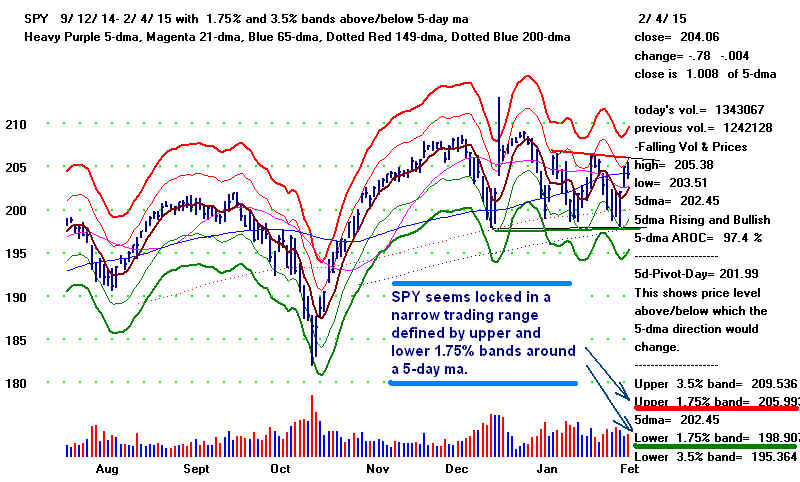

2/4/2015 Peerless Buy B9 The DJI seems headed for 18000.

The

DJI got back above its rising 65-dma. We have to be

impressed

with

the new high made by the A/D Line. Our Accum. Index (IP21)

has

made a new recovery high. The 5-day ma ANROC momentum

indicator continues to rise. Higher prices should follow, but it's not

clear

if there is enough volume for the DJI to get past its 17850

short-term resistance at its 6 month down-trendline.

We will need a big increase in volume to eat up the over-head supply of

stock

there and at the recent peaks in the other indexes and ETFs.

DJI

should reach 18000. SPY seems to be trapped in a range of

bounded by its 1.5% upper and lower bands, 199 - 206. QQQ's

range

using these parameters is 100-106.

NUGT and CRUDE OIL

We

want to watch NUGT for a possible breakout past its 6-month price

downtrendline. This will take more upside-day (blue) volume, too.

There

is a good chance here, I think, that a breakout above the 6-month

down-trendline will lead to a breaking then of the overhead neckline,

thus

completing a bullish inverted head/shoulders. This should send NUGT

much

higher. I would think that a rupture in the Greece-EURO negotiations

would

be a catalyst for this. So might more US intervention in SE Ukraine.

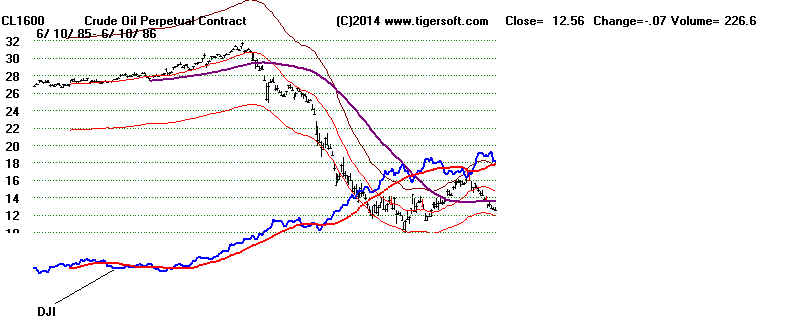

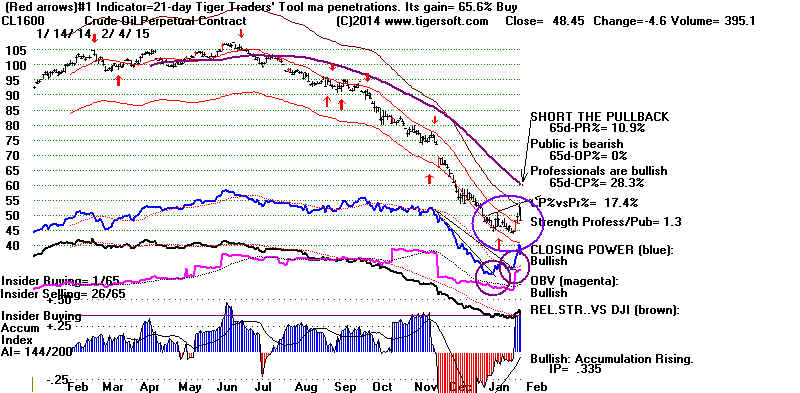

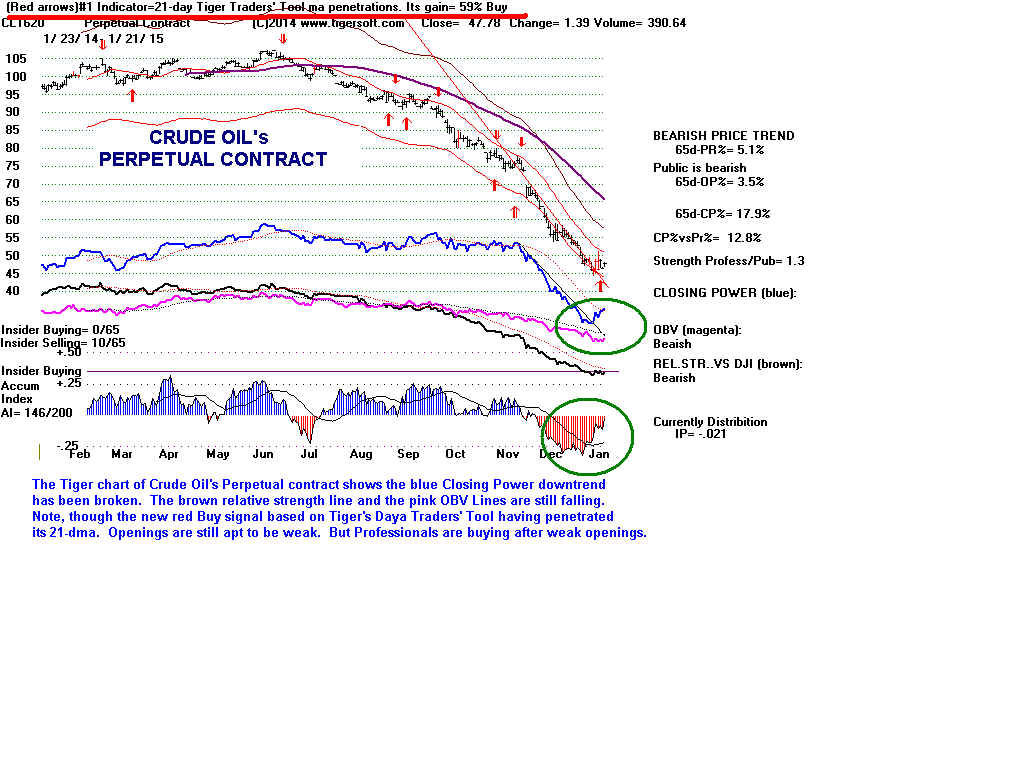

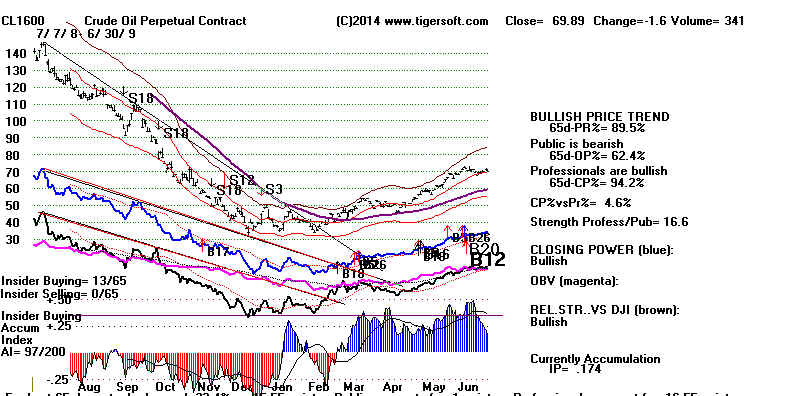

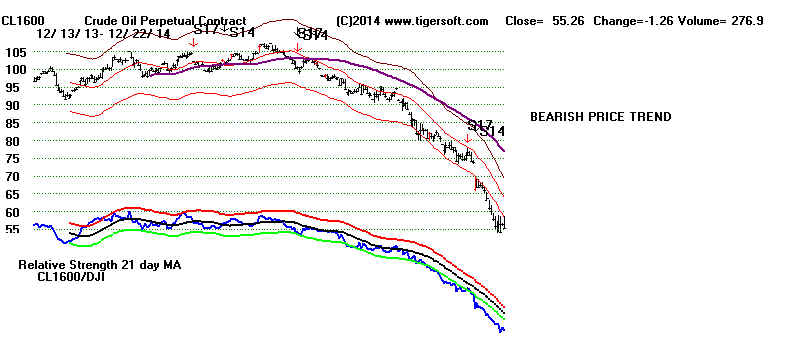

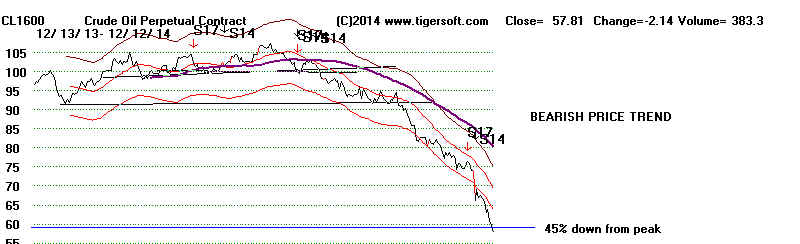

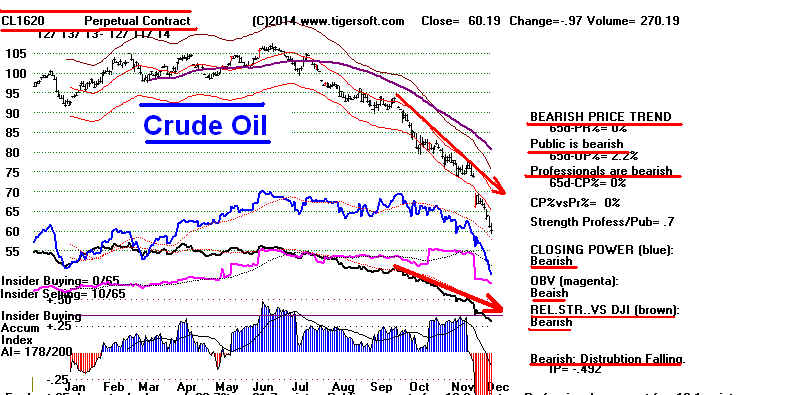

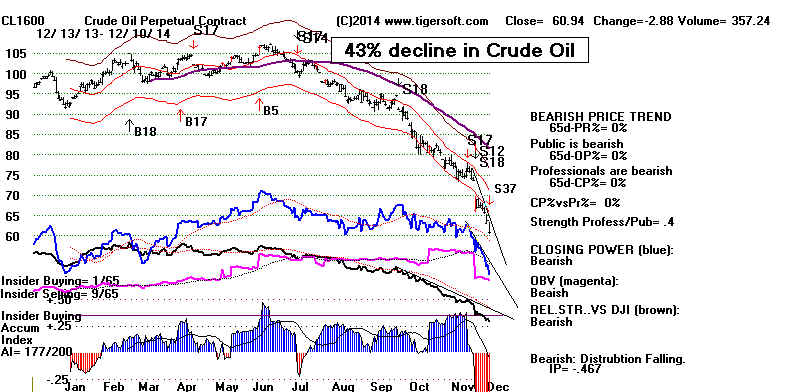

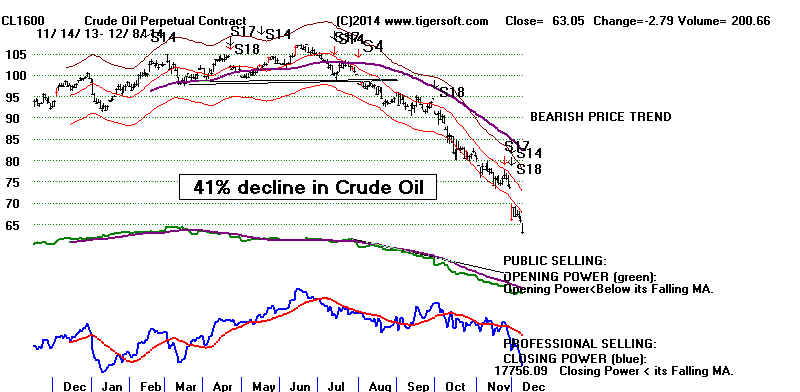

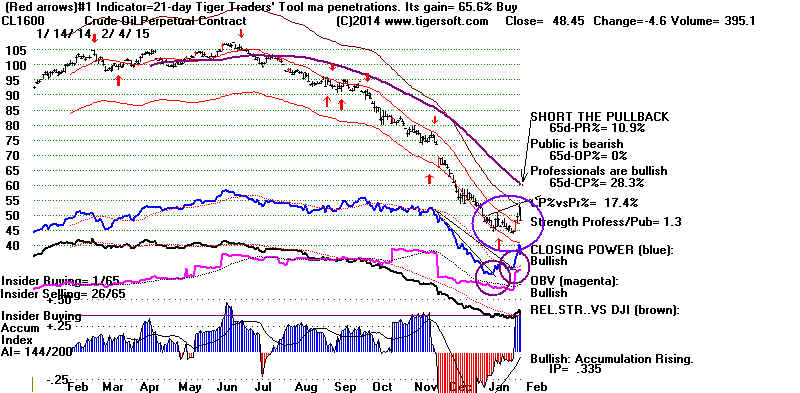

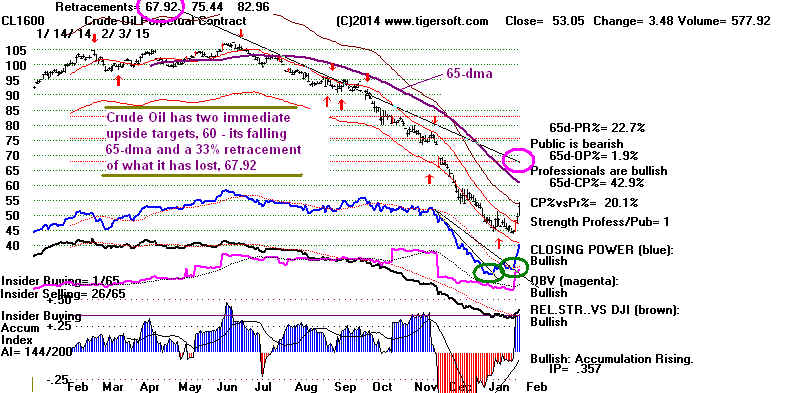

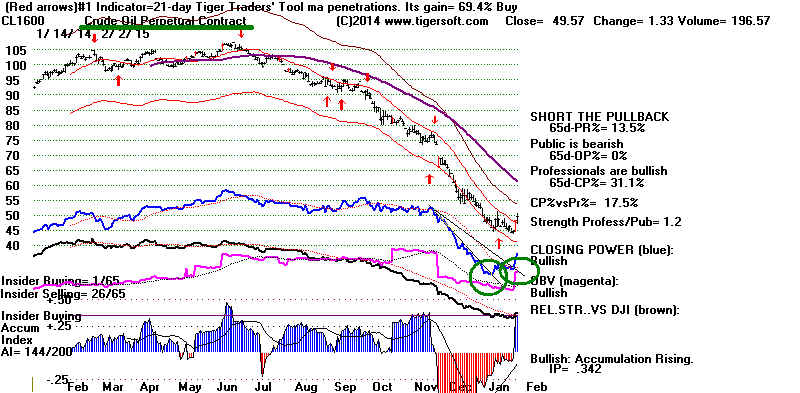

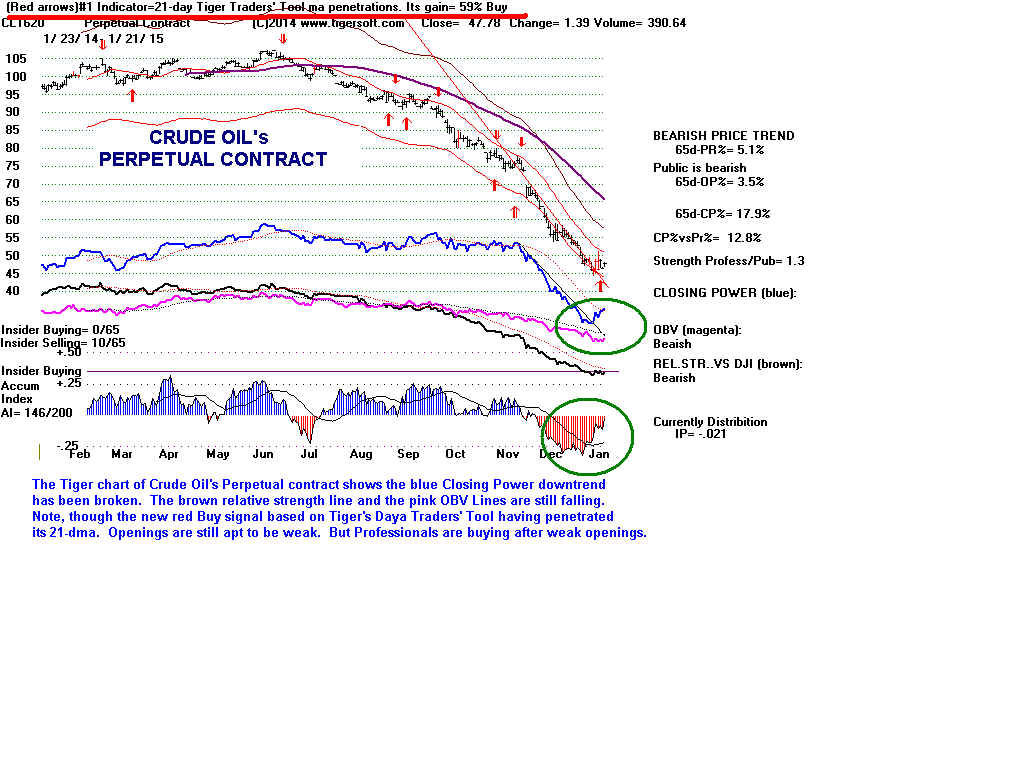

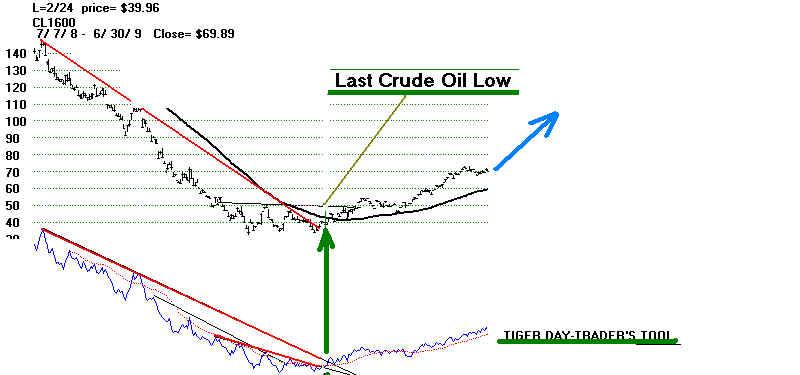

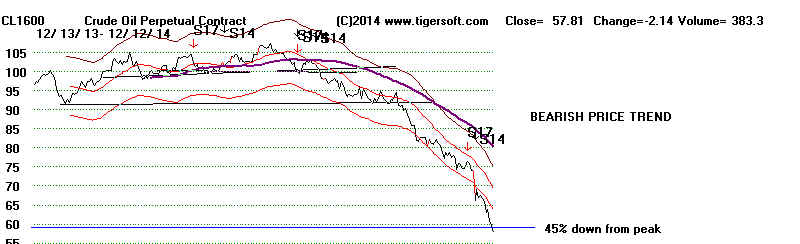

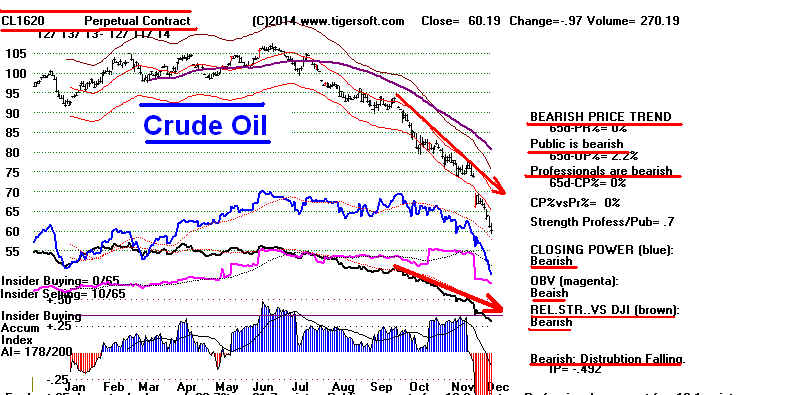

Despite Crude Oil's big drop today, I suspect we have seen the bottom.

If

you own it, you may want to see the price recoveries that were made after

other

earlier bottoms. The break by the TigerSoft Closing Power is

the

key here. It would take more of a rally and then a reversal pattern to

get

me to think we will see significantly lower prices. See our study.

-------------------------------------------------------------------------------------------------------------------------------

OLDER HOTMAIL

-------------------------------------------------------------------------------------------------------------------------------

2/3/2015 Peerless Buy B9 After more backing and filling, the

DJI

should reach 18000. Since 1980, recoveries by Crude Oil like

the

one now mostly cause the DJI to go sidewise.

Today

the ratio of NYSE advances to declines rose to 3.8:1. This elevates

the

probability to 75% of a rally by the DJI back to 18000, if we trust

comparable rebounds and breadth ratios in the first two days of the

turn-arounds since 2009. (See earlier Study.) Even so, more

backing and

filling seems probable.

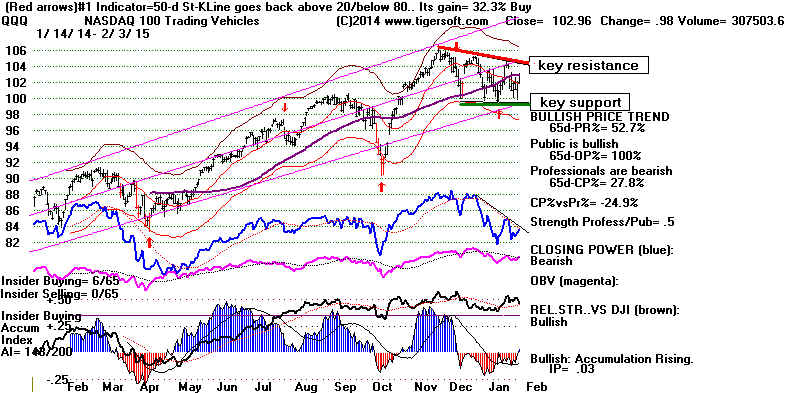

Though Biotechs were weak today, I believe QQQ is

a good play now.

It

must, however, get past two resistance lines, price and Closing Power

and,

of course, not rupture its well-tested support.

QQQ now needs to surpass its price and CP downtrendlines.

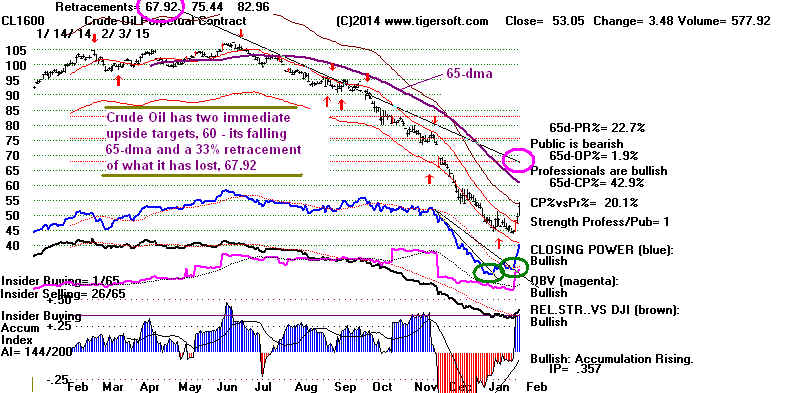

Rising Crude Oil and Hopes That

The Greek Government Will Not Default on Its Debt

Have Boosted the DJI +3.4% in The Last Two Day.

The break in the Closing Power

downtrendline has once again forewarned

of a bottom in Crude Oil. The falling 65-dma 10% higher would

seem to be

its

natural target now. That should continue to boost XOM and CVX in

the

DJI. This is the NY Times story that might be causing Oil to rise.

Saudi Oil Is Seen as Lever to Pry Russian Support From Syria's Assad

By

MARK MAZZETTI, ERIC SCHMITT and DAVID D. KIRKPATRICK

Talks have centered on persuading

President Vladimir V. Putin to stop backing the Syrian president, officials said,

in return for moves to raise the price of oil, which could bolster Russia's economy.

The Basis of The Bank Stocks' Rally Seems Uncertain

The big bank stocks in the DJI-30 have been the other

big two-day gainers.

The

news is that the European bankers and the new Greek Government are

still

talking about ways to prevent a default on Greek Government debt,

something which would be costly to big bankers in the US, too, especially

if

Greece then left the Euro zone and on it own got back on its financial feet

after

a sizeable currency devaluation. If that were to happen, Spain and

even

Italy might elect to follow Greece's course. Back

in 2008, this is path

that

Iceland took. Iceland survived and recovered without the need to follow

the

crippling austerity demands that would otherwise have been forced on it by

big

banks and the IMF.

Seasonal and Technical Problems

Seasonality is not so bullish. Since 1965, the DJI has risen only 52.2%

of

the time over the next week. And despite the big jump today, volume

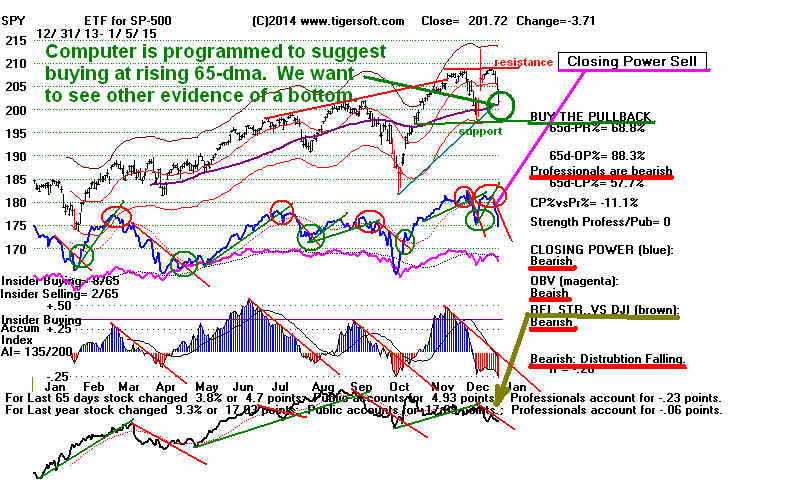

was

lower today than it was yesterday. It would also be more bullish if SPY

was

facing its downtrend-line resistance and the (blue) 65-dma below

with

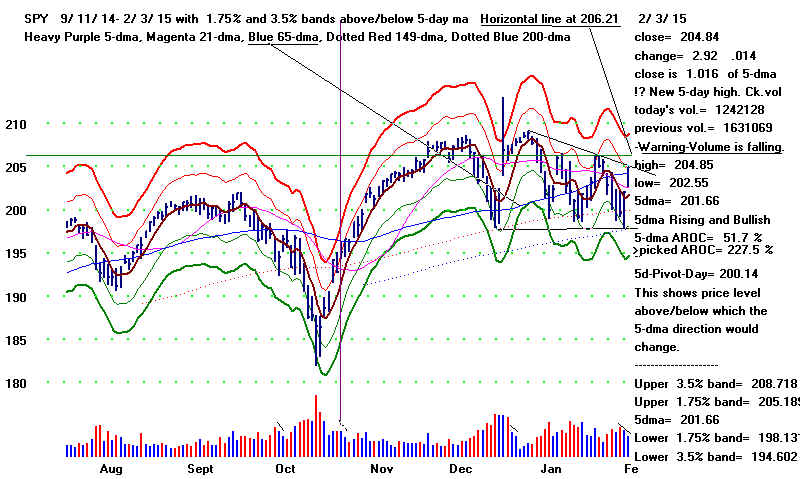

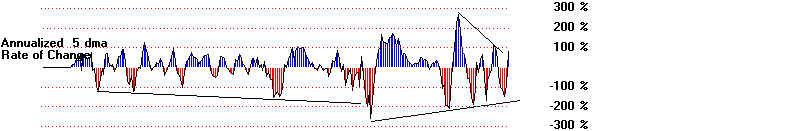

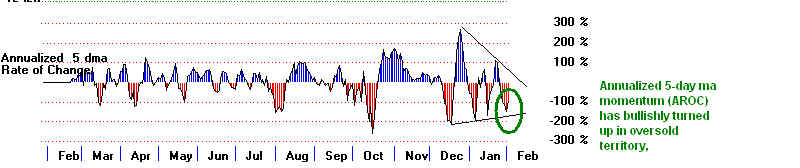

more

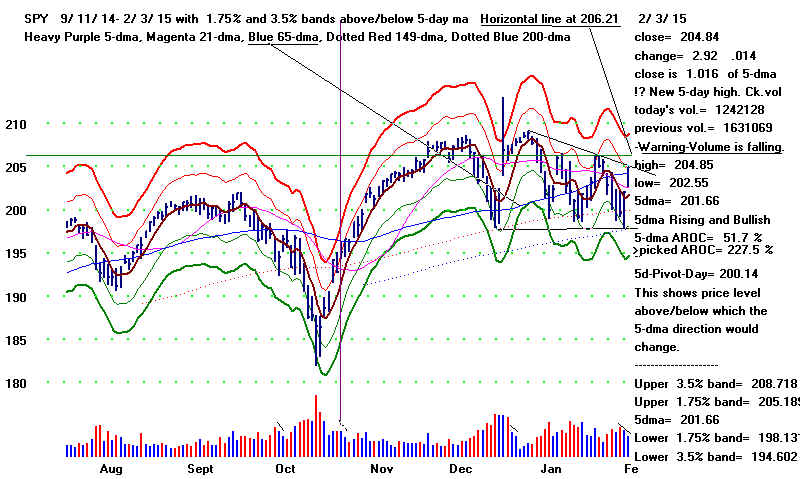

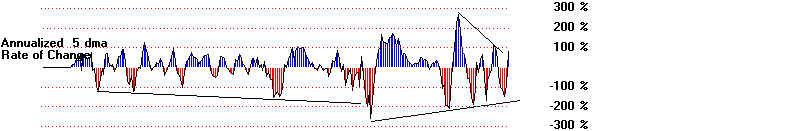

short-term upward momentum. See in the chart below how the 5-day

ma is rising only at an annualized 51.7% rate. Back in

September last year

when

SPY reached the rose above it, the 5-dma AROC was four times higher.

"Clinching" Has Become Too

Expensive"

Trading General Market ETFs.

It sure seems that we

can no longer afford to wait for one or more

of our

short-term indicators to turn up to turn upto clinch a Peerless

Buy signal.

I think we'll have to buy at price support, like the "sweet

spot"

between the 30-week ma and 200-day ma, when a Peerless

signal is

operatiove or has occurred and place stop sell order 1%

or 2%

below. The +3.4% gap up between 2:00 PM EST Monday

and the

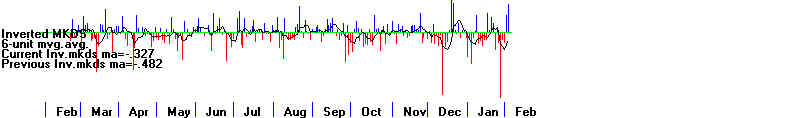

opening Tuesday just makes too expensive waiting for

indicators

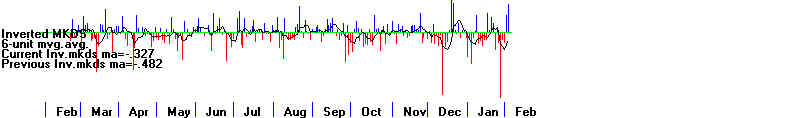

like like the 5-day ma ANROC momentum, 6-day Inverters'

Traders

Index or even the Closing Power to turn up.

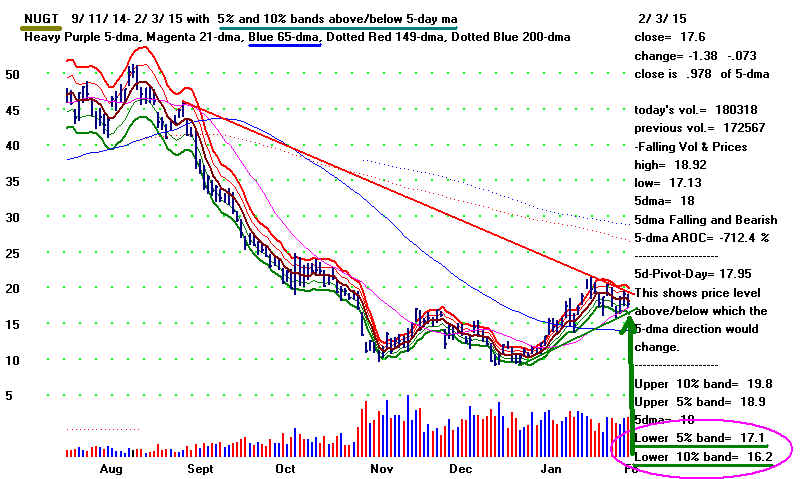

NUGT Trading

The

3x-leveraged ETF, NUGT, failed to get past its 6-month downtrendline.

But a

declining dollar and rising oil prices should be a boost for Gold.

NUGT

can be traded by buying it back to its lower 5% band and 10% bands

around its 5-day ma. As long as it is above its (blue) 65-dma in the 6-month

chart

below, I think this offers much more upside potential than downside risk.

================================================================

OLDER HOTLINES

================================================================

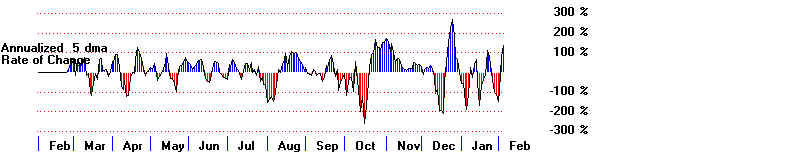

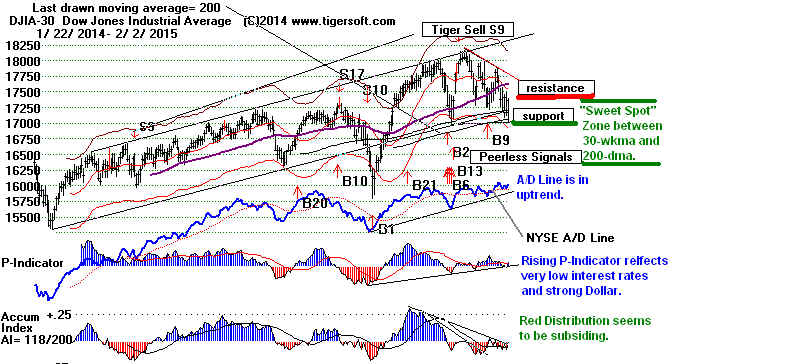

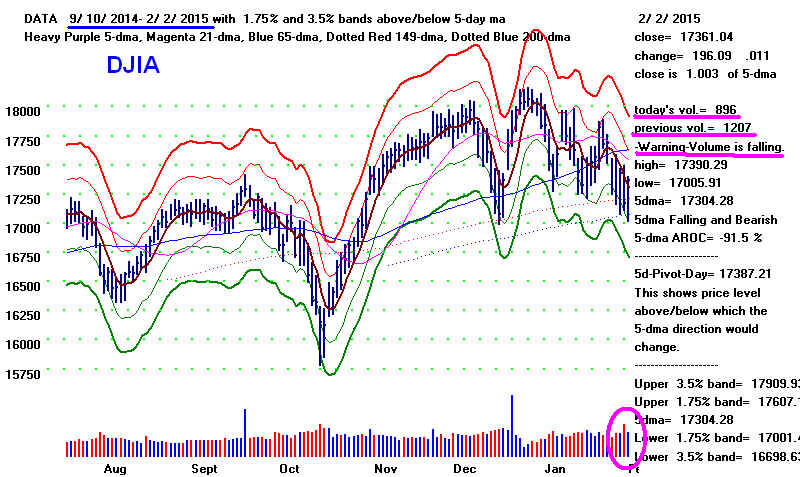

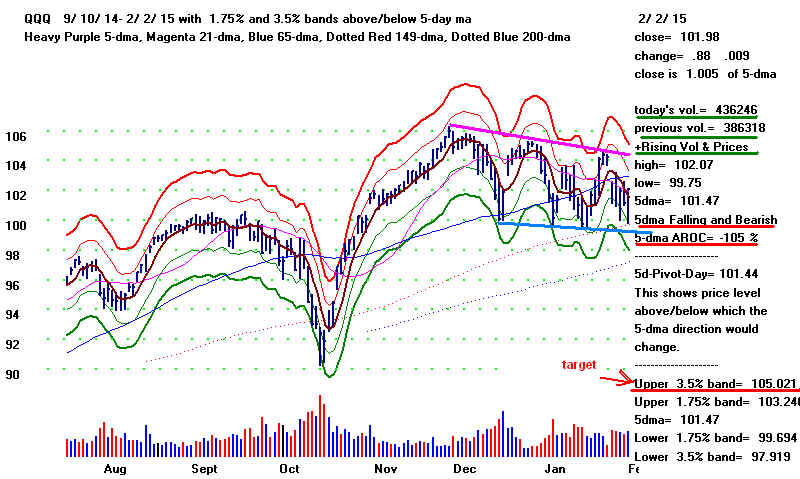

2/2/2015 Peerless

Buy B9 Buy QQQ, Crude Oil and NUGT.

The DJI bounced up 200 in the last hour after successfully testing 17000,

its rising 200-day ma and the rising 149-day ma for most of the day. Today's

ratio of NYSE advances to declines, 2.68:1, was not quite strong enough by

itself to cause us to trust the rebound.

(My study of the successful reversals since 2009 suggests a

ratio of 3:1

is the minimum needed to get a 75% degree of confidence

that the DJI

will rally up to the upper band or higher. )

More evidence of a significant reversal

from the 17000 support level

apart from the rising A/D Line would be a big help here. For that

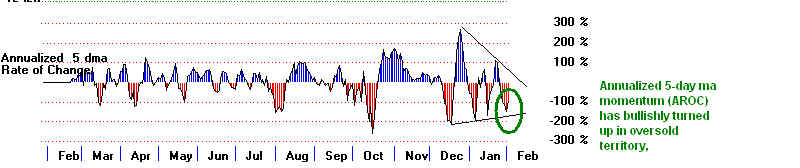

I would trust that the 5-day AROC momentum tool has turned up.

Though only a short-term tool, you can see below that it has been

reliable this past year. So, the late rally today should continue.

(This tool is now available for

downloading on the Tiger ESP Page.)

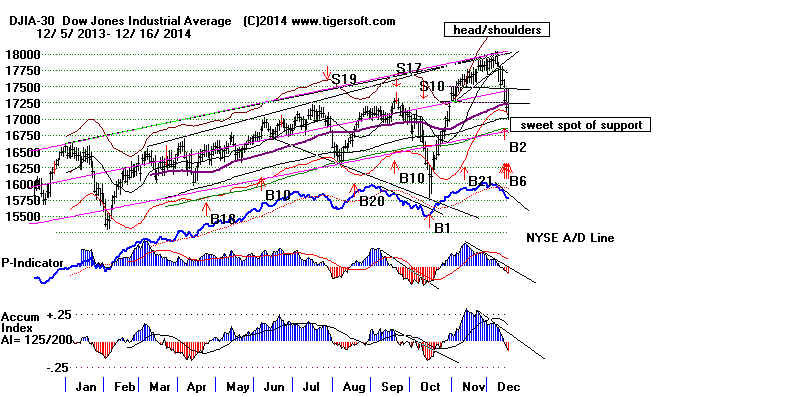

DJI has rebounded from "Sweet Spot"

It still may not get past the downtrending

resistance now at 17750.

Tomorrow I would expect to see the

breaking of the downtrend-lines

in the Closing Power for DIA, SPY, QQQ

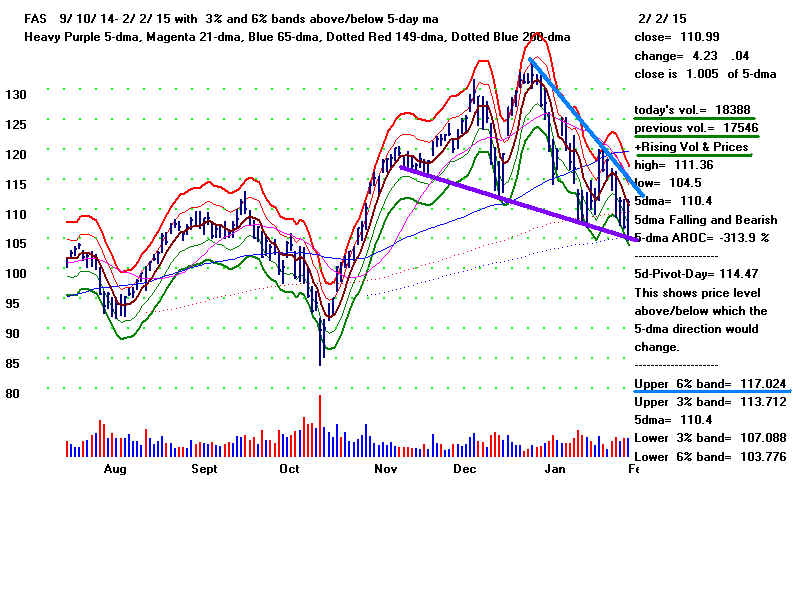

and FAS. They did turn up

today already. Such CP down-trend breaks would confirm the

market's turn-around. But the question would remain:

How much of a rally can we get when

the leadership consists

of bonds, REITs and ETFs, especially as recent rallies have all been

quickly snuffed out?

In this environment, we must watch the

daily volume closely for

the general market and for these key ETFs'. Volume

that rises day-

to-day and is higher than the previous down-day's volume is vital

if overhead resistance is to be eaten up. Without it, the next rally

will probably not be more than 3% and the resistance line in the DJI

chart will probably turn the DJI back downward.

I think we must play QQQ on the long

side now. We may be

pleasantly surprised. The beginning of February last year was

a good time to buy. With 17000 support holding up, we have to

play the long side now. But we can do more now than simply

"hold and hope" for a decent rally.

Our new 150-day volume charts for DIA,

SPY and QQQ (below) show

volume more clearly. We can more easily compare each day's volume

with the previous day's. In addition, we can use the 5-day ma and

its bands to set upside objectives, especially if volume seems to be

waning on a rally. On the other hand, if daily volume rises sharply

on the advance, 18000 on the DJI should again be achieved.

Note that today's up-day volume fell

compared to Friday's down-day

volume for the DJI, DIA and SPY. It did rise for the QQQ. Accordingly,

I would think that QQQ will be the best "long" play now.

Volume rose

very slightly for FAS. See this in the charts below.

Buy Crude Oil and NUGT

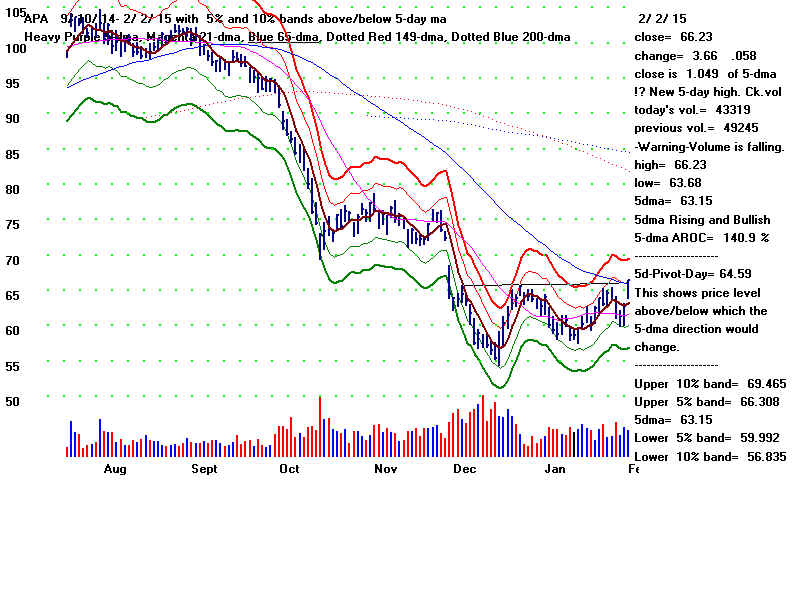

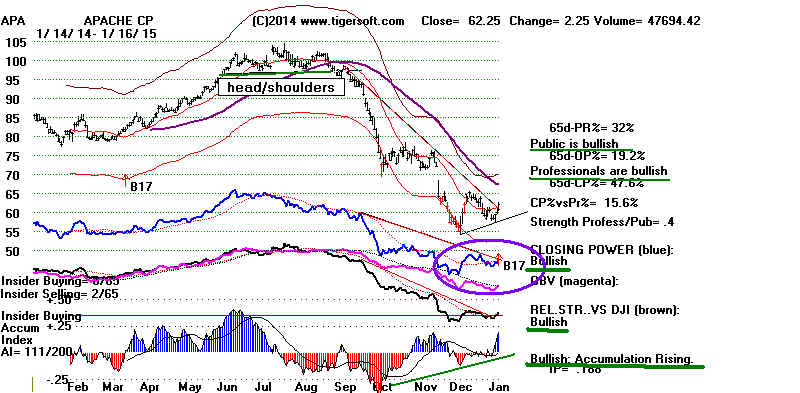

More interesting for bulls now

is Crude Oil and our favorite oil stock, APA.

The Gold Mining ETF, NUGT, looks quite appealing too, provided it can

continue to advance on rising volume. APA could soon rise above

its 65-dma, but its volume will need to pick up.

NUGT has a good chance of breaking out over 21 and even surpassing

the neckline in its inverted head/shoulders. So, watch its volume closely.

If that happens, NUGT would then have a target of 35, almost double

current levels.

(See last night's study of how typical the

current Crude Oil bottom

is when compared to its earlier bottoms since

1980.)

-------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------------------

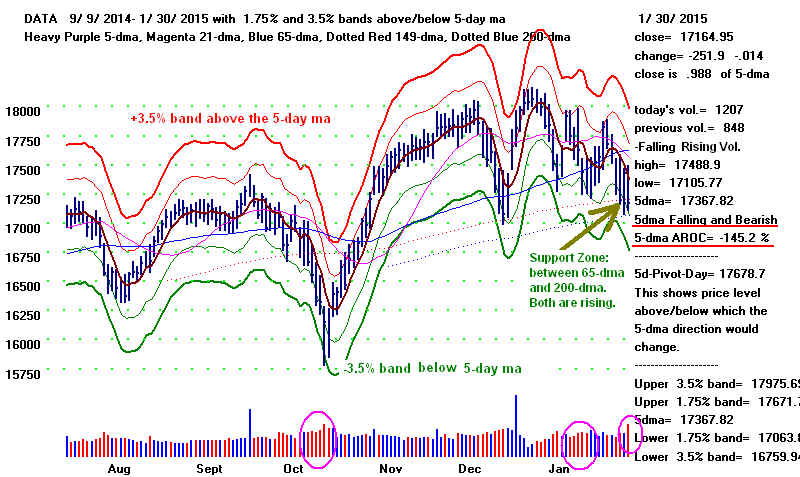

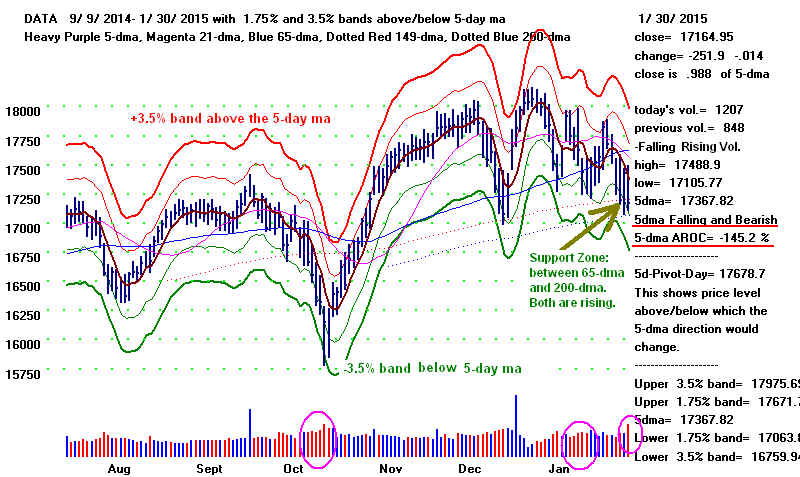

1/30/2015

Peerless Buy B9 The DJI is

testing 17000

and its rising 200-day ma. It closed in the "sweet spot" between

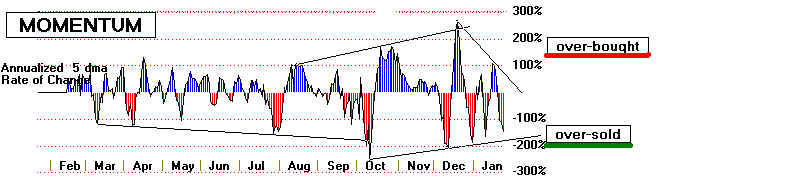

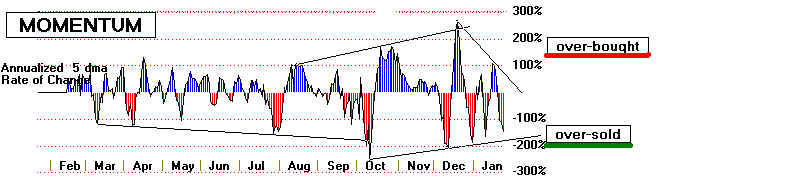

the rising 149-day and 200-day ma. The new 5-day ma annualized

rate of change shows the DJI to be oversold, but the momentum

with this remains quite negative, -145.2%. (See DJI chart below).

With the A/D Line still in an uptrend, we would normally expect

an upwards reversal from 17000. Breadth of better than 3:1

on the upside will be needed to make such a reversal look

credible and compelling now.

The main problem now is how each recent rally has quickly been

snuffed out. How much upside potential is there? Wouldn't

it be better to see the current price-downtrends be broken.

Another problem: the DJI has now gone almost 6 years without a

decline of more than 17%. We have to expect selling in blue chips

by long-term investors when these stocks individually break their

long uptrends.

Next problem: when rallies are led by defensive stocks, bonds,

REITs and utilities, how safe can more speculative stocks be?

Technically, there remains the problems of all the recent red Distribution,

the many Tiger Sell S9s on so many key charts and the steadily

heavy red down-day volume in DIA and SPY.

One might consider buying call options on the oversold OEX.

But its CCI is not below 150 (moderately oversold) and the flat

support may still be violated. This would set up a much bigger

decline.

So, taken altogether, I see no

reason to call a bottom until the

Closing Power downtrendlines are broken or the ratio of advances

to declines on the rebound is better than 3:1.

See the heavy red down-day volume in the new TigerSoft 6-month

trading chart of the DJI. (This is the second chart below.) I offer

a new discussion of short-term trading using the 5-day ma with

bands and daily red (down-day) and green (up-day) volume.

6 Month Short Term Trading Chart on DJI

5-day ma with bands and volume at bottom.

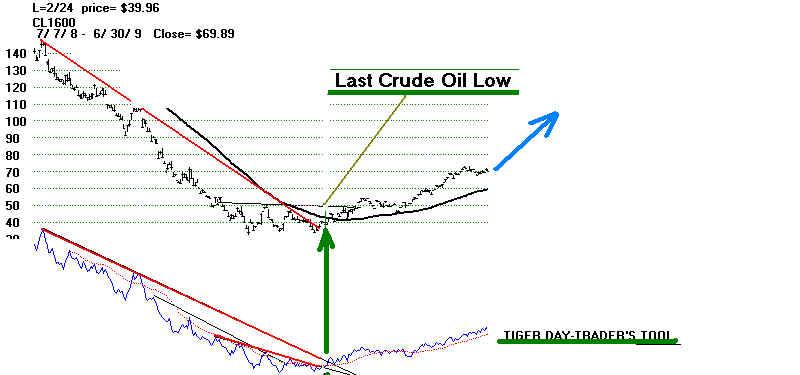

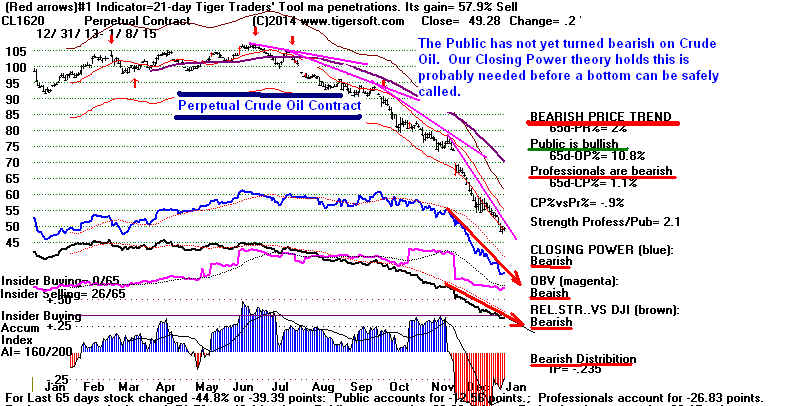

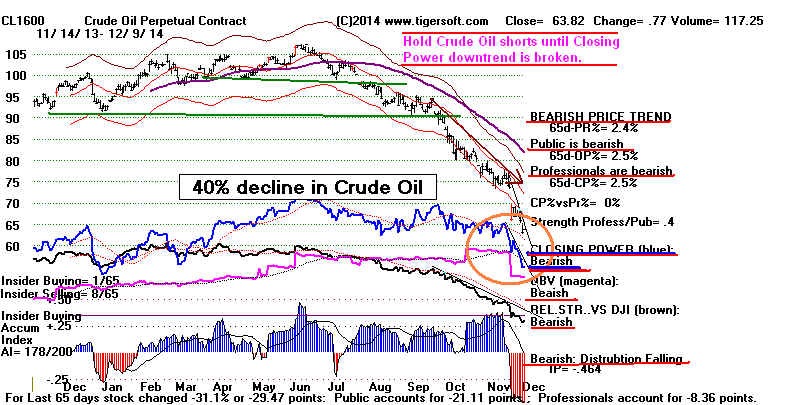

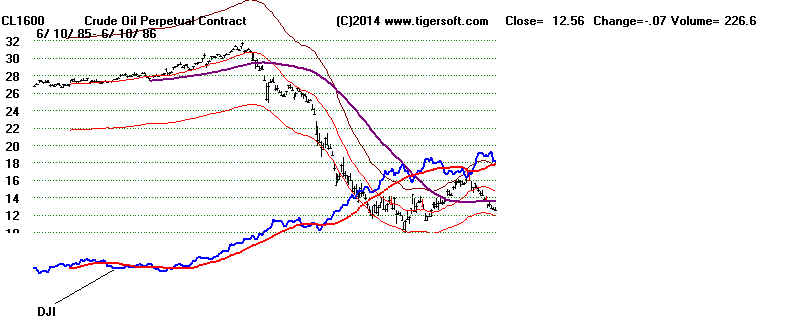

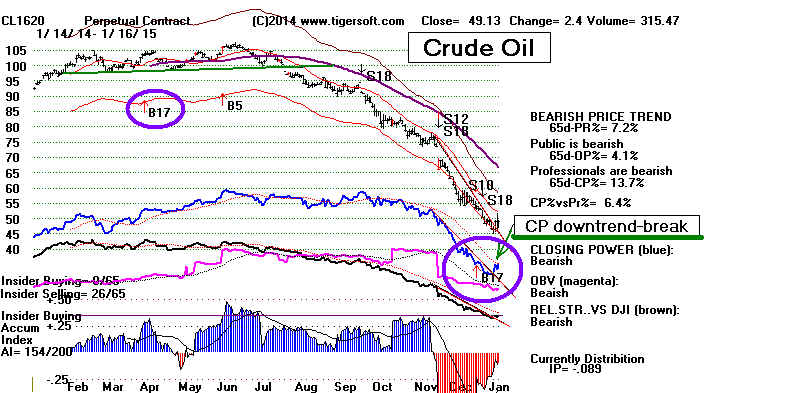

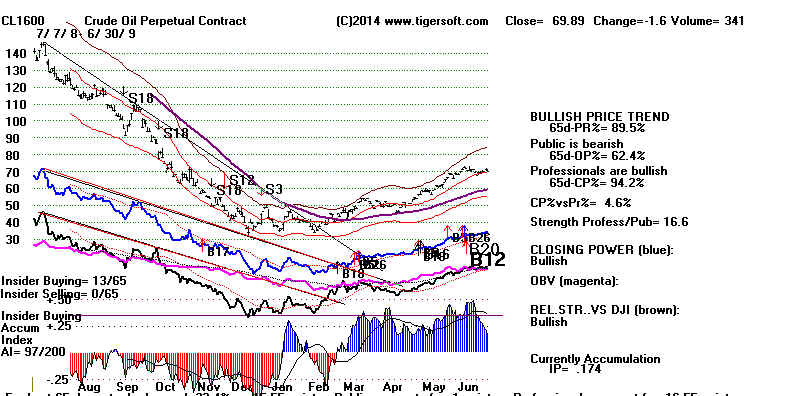

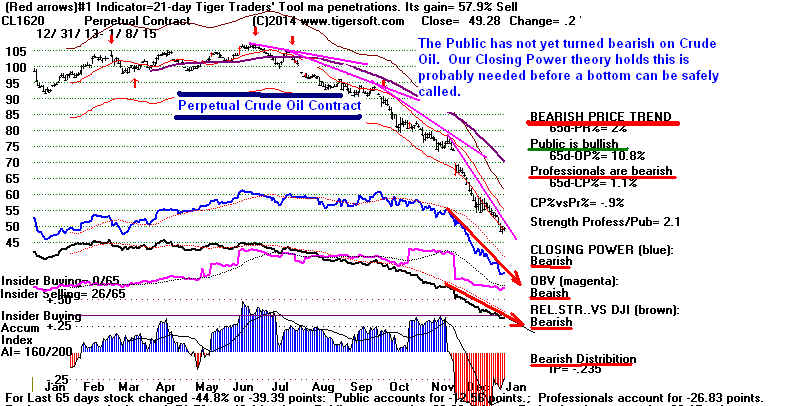

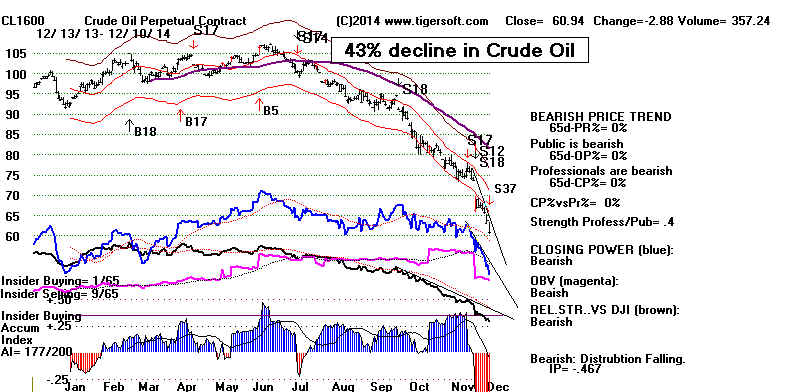

Crude Oil's Closing Power has broken its downtrend. Historically,

this is what it takes to make a bottom. See the new study of previous

Crude Oil bottoms and how they similar they are to what has just

occurred when we focus on the break in a long Closing Power

downtrend. See my new Crude Oil study. Some of you may find company's

offering long term options that lock in current crude oil prices. These sound

very interesting.

===============================================================

1/29/2015

Peerless Buy B9. Patience is Needed While We

Wait for the DJI to Move Decisively away from its Holding Pattern.

It Remains To Be See if Wednesday's Break below 17250 was

False. A Re-Test of The 17200 Seems Likely.

Just as I thought might happen, FED Chairwoman Janet

Yellen got busy

at mid-day today in the Senate and denied Wedneday's FOMC pronouncement

that a rate hike would soon occur. As soon as she said this, the DJI and

SP-500 turned up from their 30-wk (149-day) mvg.avgs. It jumped up 176

in the afternoon. The reversal does show that there is support at this level,

now 17188 on the DJI.

But breadth was not as good as its needs be to make

a convincing

turnaround. The ratio of NYSE advances to declines

today was only about 2:1.

For the last five years,

reliable reversals occur when this ratio is more than 3.0:1.

In addition, note that the Closing Power down-trends for DIA,

SPY, FAS and

QQQ remain intact. Professionals remain net bearish.

Thus, a re-test of 17200 seems likely. Moreover, there remains a good chance

that the DJI will lead lower the other averages and the A/D Line. After all, this

is January when a number of significant declines started. (See the list last night.)

And trying to get into the minds of other investors, we can imagine that a

continued slide in the DJI would put a lot of pressure on long-term investors

to lock in long-term profits.

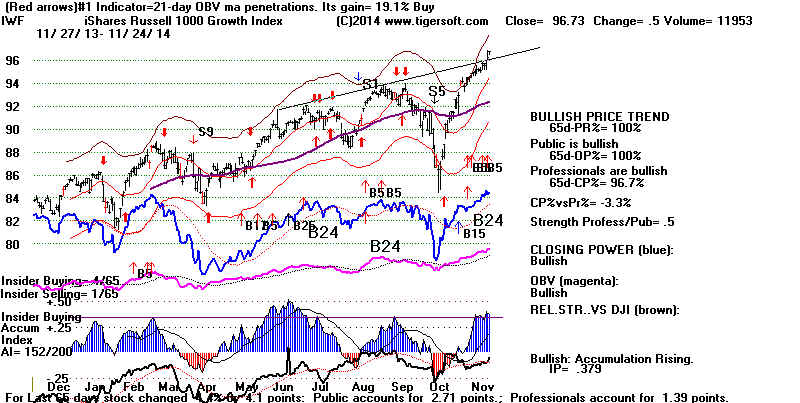

In light of the NASDAQ-100, MDY

and IWM being stronger than the DJI-30,

we should probably require a much more decisive breakdown of the 17200

DJI-support before selling many smaller stocks. Meanwhile, the pro-Super

Dollar stance of the FED will also probably keep REITs, Bonds and Utilities

in their uptrends for a while longer. As we move away from the first of the

year, I expect more and more Bearish MINCP Stocks to

choose from to go

short as hedges.

===============================================================

OLDER HOTLINES

===============================================================

1/28/2015

Can The Peerless Buy B9, Low Interest

Rates and

The Fed's Strong Dollar Policy Prop

A Bull

Market That Is Nearly Six Years Old?

The 200 point sell-off today in the last two hours was due to

FED's re-activation

of its threat to start raising interest rates in June this year. But, perhaps, one

of

the FED's Governors will tomorrow deny such an interpretation of what the FOMC

said today. If you did not sell on today's close, wait for a more decisive

breakdown.

*

The Closing Powers for all the key ETFs, DIA,

QQQ, SPY, OEX and FAS

are all angling downward. Professionals are still heavy sellers. They did not

even use the occasion of AAPL's super earnings to be net buyers. The

candle-stick charts for today show many bearish all-encompassing red down-days.

See GS for example.

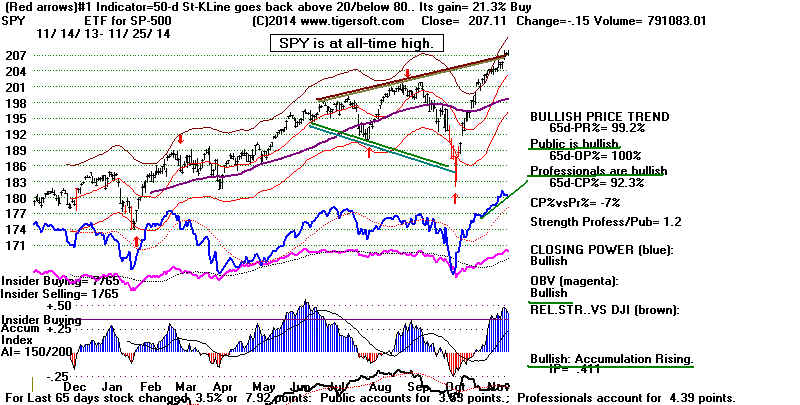

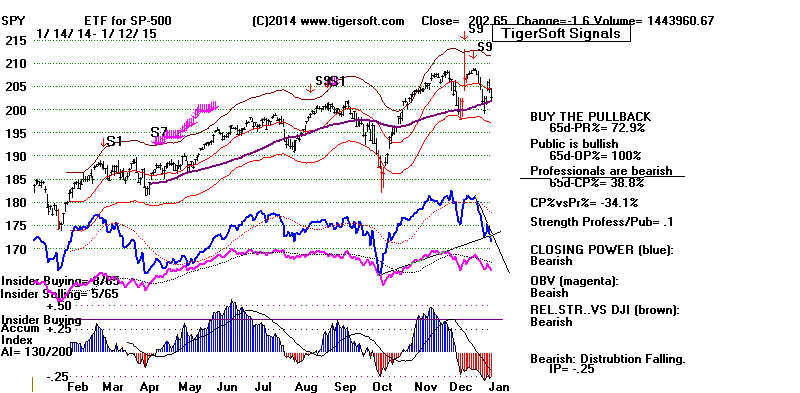

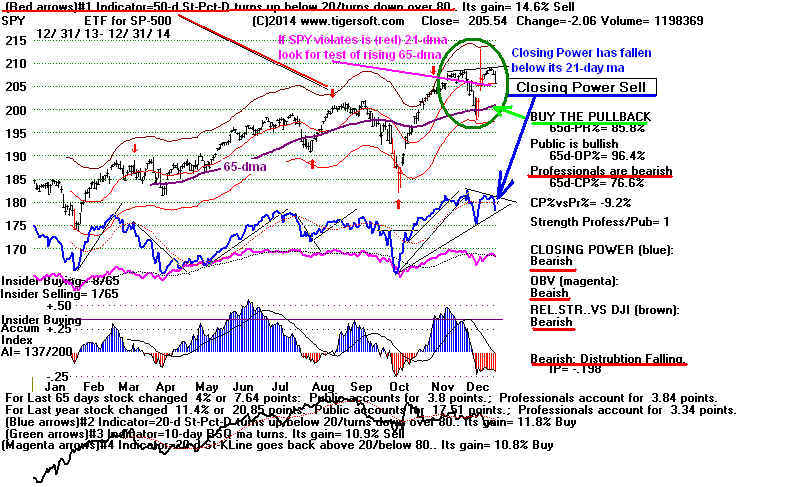

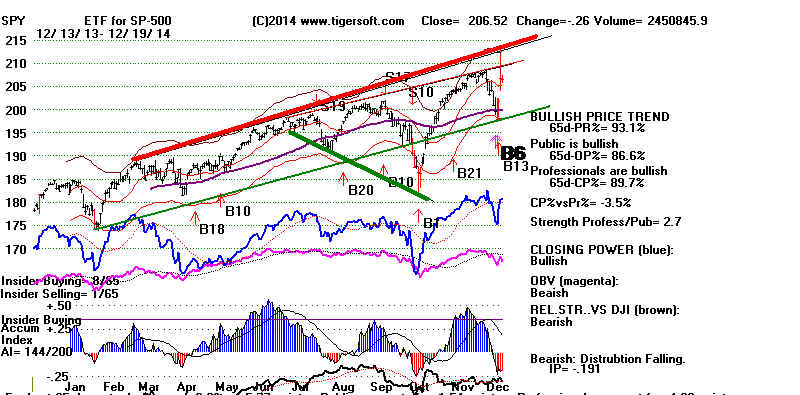

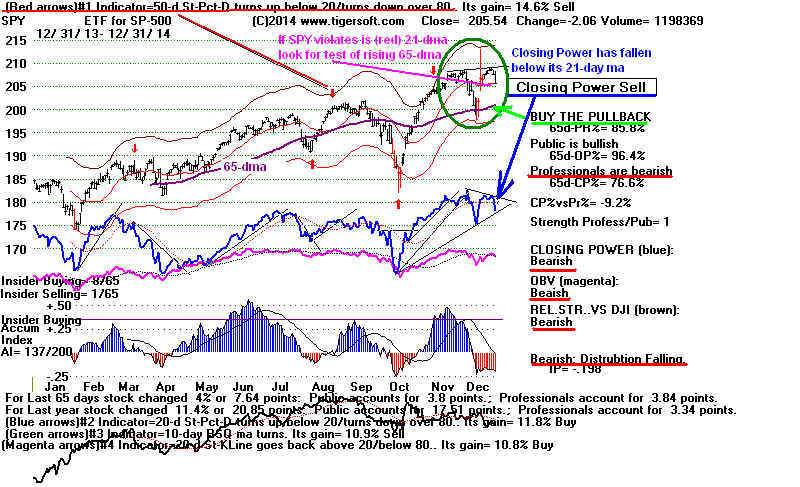

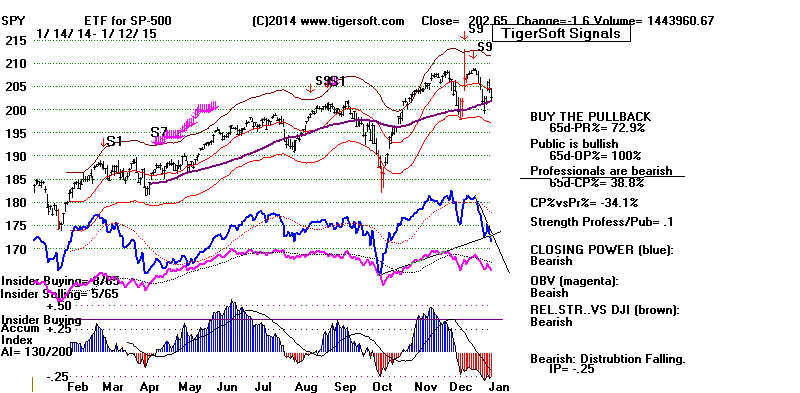

SPY has not yet broken its well-tested

support.

But until Its (Blue) Closing Power breaks above

its falling Downtrend, give SPY a chance to make

clear which way it will move from its narrowing

pattern.

We know from stock market history that Januaries have often been when

bull markets ended and deep declines began. There have been 16 cases in

the 74 years since 1939. Significant DJI support failures in January, thus,

can trigger much deeper declines.

Big January Pivots Downward since 1939

Date Peerless

Signals

DJI % Decline Date of Next Bottom

----------------------------------------------------------------------------------

1/4/1939 S16

11%

4/10/1938

1/9/1941 S12

13.5%

5/1/1941

12/31/1947 S10 a few days later

8.5%

2/11/1948

1/5/1953 S16

9.0%

6/16/1953

12/31/1956 S9/S12

8.0%

2/12/1957

1/5/1960 S12

12.0%

3/9/1960

12/28/1961 S16

Bear Market 6/26/1962

1/18/1966 S12/S4

Bear Market

1/9/1968 S12

9.0%

3/22/1968

1/11/1973 S9/S12

Bear Market

2/31/1976 S16/S4

Bear Market

1/9/1984 S12

15.0%

6/15/1984

1/2/1990 S16/S4

9.5%

1/30/1990

1/4/2000 S9/S12

16.0%

3/7/2000

1/14/2003 S12

15.0%

3/10/2003

12/31/2014 S16

7.5%

2/3/2014

|

Hedging Is Profitable, Too.

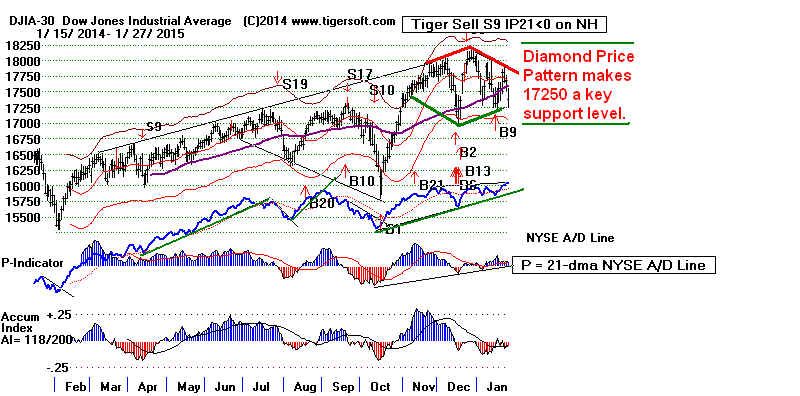

All these considerations led me to suggest last night that we should be

"hedging by shorting some bearish MINCP stocks and

closing out

long ETFs on the DIA and QQQ"

if the DJI closes below the green support

line at 17250 shown below.

The FED Shows Its Highest Prority

Is A Super-Strong Dollar.

The operative Peerless signal is still a Buy B9, but, as of

today, the FED no longer says that it will keep rates at current

levels " for a considerable time". The FOMC's official pronounce-

ments are very carefully crafter. They are telling us that

they want an even stronger Dollar. They are getting ready to

raise rates even though there is DEFLATION in commodities

and fuel prices. Also important, they are willing now to

go on record that economic conditions are getting significantly

better despite December's weak retail sales and falling US exports.

What are they up to? I said last month that they would raise

rates as soon as real avg. wages turned up. They are starting to,

In making the STRONGEST HOME CURRENCY POSSIBLE

their number one priority, as long as their is no immediate financial

crisis, they are following the most important financial orthodoxy of

nearly all central biggest banks everywhere. The FED promotes

Wall Street financial interests. They would have all the world's

financing be done in Dollars if they could. And they are delighted

to have hot foreign money flood into the US bonds and dividend

stocks.

So, until we see the FED promote a different monetary strategy,

what we have seen for the last year should continue. REITs,

BONDs and UTILITIES will be the beneficiaries. Most regular

stocks will do much less well. Some will be hurt badly. Hurt will be

American exporters, manufacturing and agricultural, as well

as companies that sell overseas for mostly local currencies.

The FED seems oblivious of this. That is the risk. And it's

a potentially very big risk. If even even huge blue chips like CAT

and MSFT are finding the FED's strong Dollar something which

hurts their profits, how many more earnings reports in the months

ahead will similarly disappont. Lower earnings' outlooks will

inevitably drop many stocks. That's the risk. Can a stock market

that has risen now for 70 months without anything more than a 17%

correction really be expected to hold up under these conditions?

And what if Congress pursues its own austerity policies? The causes

of the 1937 plunge should be required reading in Washington. But

we are probably doomed to have to relearn vital economic history lessons.

===============================================================

OLDER HOTLINES

===============================================================

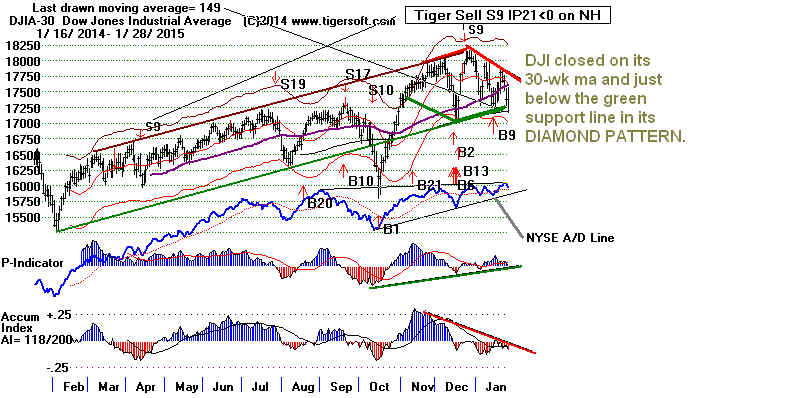

1/27/2015 Peerless Buy B9

Buy B9s are reliable and the third year in the

4-year Presidential

cycle is unusually bullish. So, I think most orthodox Peerless traders

will decide just to ride the current decline out. However, hedge

by shorting some bearish MINCP stocks and closing out long

ETFs on the DIA and QQQ if the

DJI closes below the green

support line at 17250 shown below.

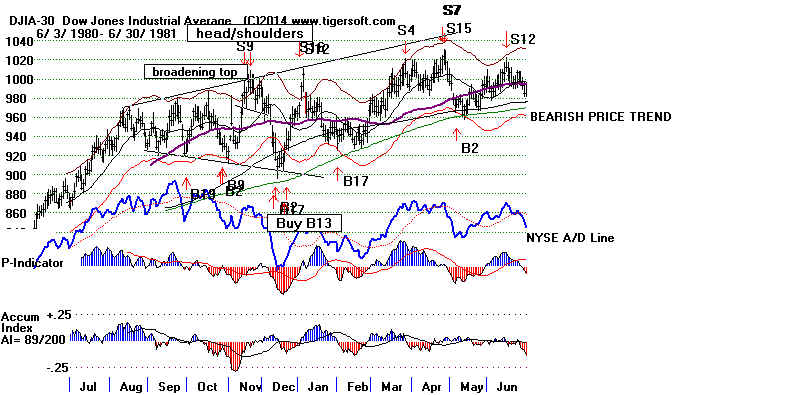

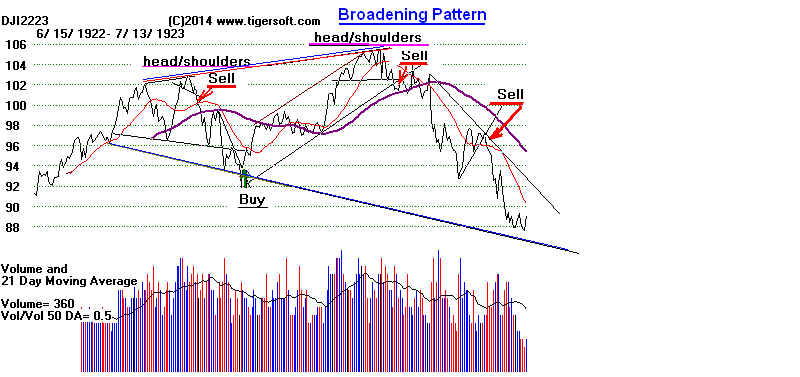

Why? Because there were two cases in bull

markets, January 1977

and January 1984, when comparably bullish breadth failed to prevent

significant declines in January In

January 1977, the DJI led the rest of

the stock market into a 15-month bear market after a Sell S16 and

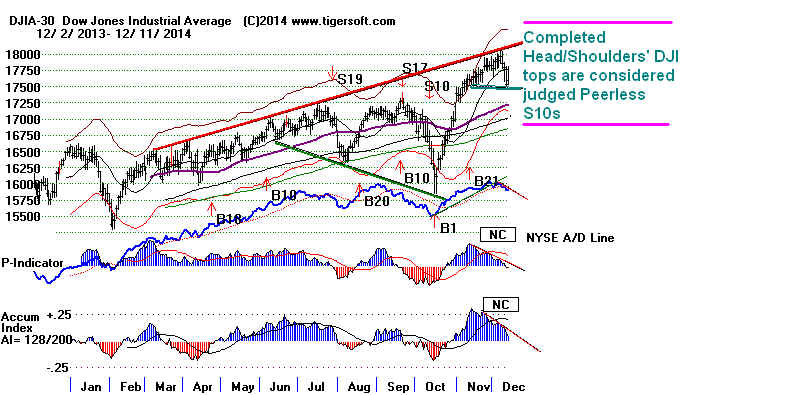

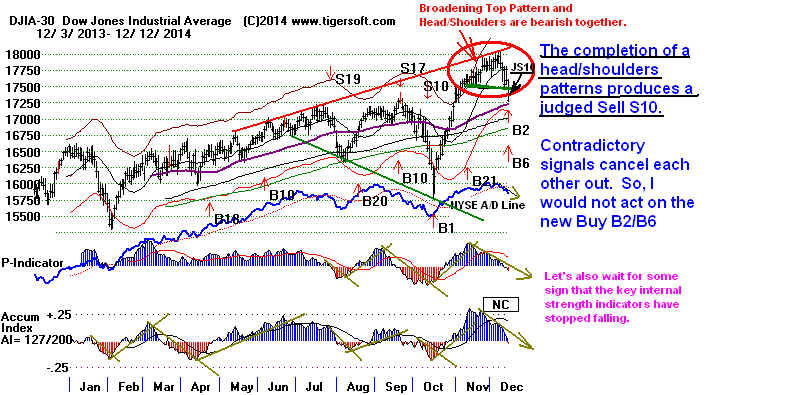

bearish head/shoulders was completed. In January 1984, the DJI

started a 7 month decline from 1200 to 1050. See how it broken below

a well-tested price uptrendline. This reinforced the earlier Sell S12

and ruled out any possible Buy B9s. Compare the current DJI and

A/D Line with these two earlier cases. In particular, see how a breakdown

below a key well-tested support-line launched these two declines.

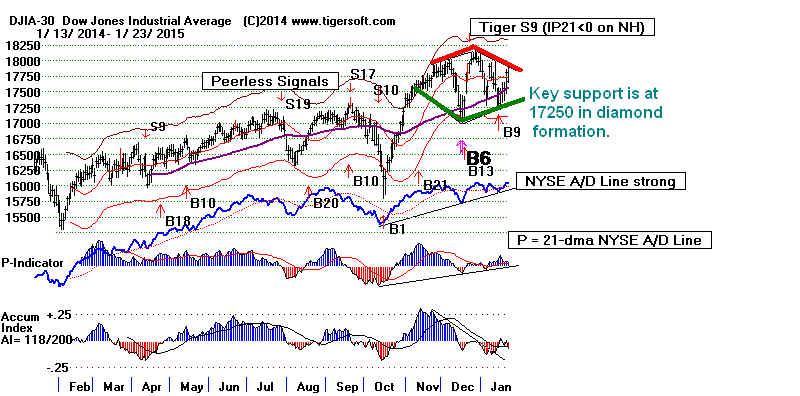

I consider the DJI's Diamond's support at 17250 to be similar.

As a result, our Stocks' Hotline has added more short short sales as hedges

from among the Bearish MINCPs. We are short nearly

as many stocks

as we are long at this time. Recall how at the end of 2014, I repeatedly

noted how close we came to getting a Sell S16 or a Sell S12, because

of the negative Accumulation Index with the DJI 1.8% over the 21-day

ma. (This is what the Tiger S9 warns of, too.) Had the DJI then risen

another 1/2% higher, we would have gotten a Peerless Sell S12 and this

would also have suppressed the recent Buy B9.

Dividend Plays Do Not Look Vulnerable

The recent B9 is a function of the still very positive breadth and the

still rising A/D Line. This means that big dividend stocks, REITS, BONDS

and UTILITIES are probably safe for now. Cyclical and growth stocks

are much more vulnerable.

Can APPL Save The Market?

AAPL's superb earnings after the close will try on Wednesday

to make up for the DJI's 290 point plunge and big drops today

by MSFT (-4.35), PG (-3.09) and CAT (-6.19). How the market

reacts to APPL's huge earnings will also tell us something

about whether it will now be paying more attention to good or bad

news. If it only responds to bad news, we are in trouble!

But, perhaps, the DJI sell-off today was artificially exacerbated

by the thinner than usual trading today, the result of the East's fierce

snow-storm. A lot now depends on what the Fed' Open Market

Committee reveals about its interest rate intentions and how it

appraises the rising Dollar. In that connection, it is probably

significant that Bank Stocks did not sell off

nearly as badly as the

DJI-30. Strikingly, there were only 382 more down than up on the NYSE.

This hardly matches a day when the DJI falls nearly 290. I would be

surprised if the FED does anything to make the market sell off more.

==============================================================

Older Hotlines

==============================================================

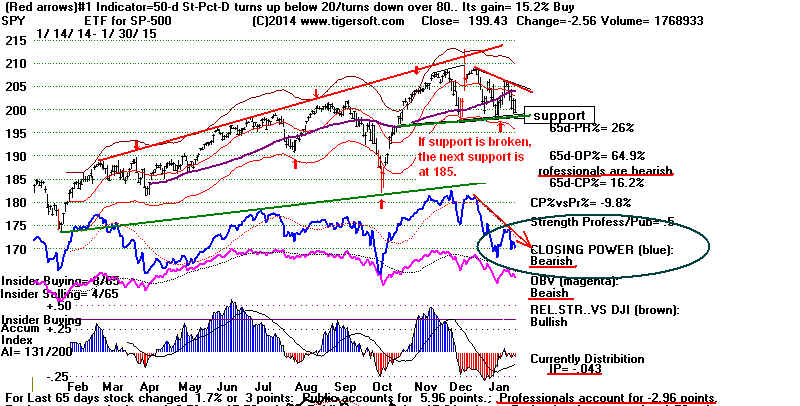

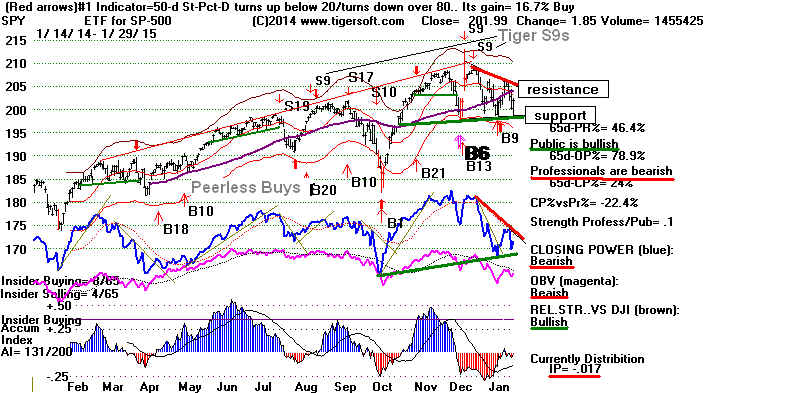

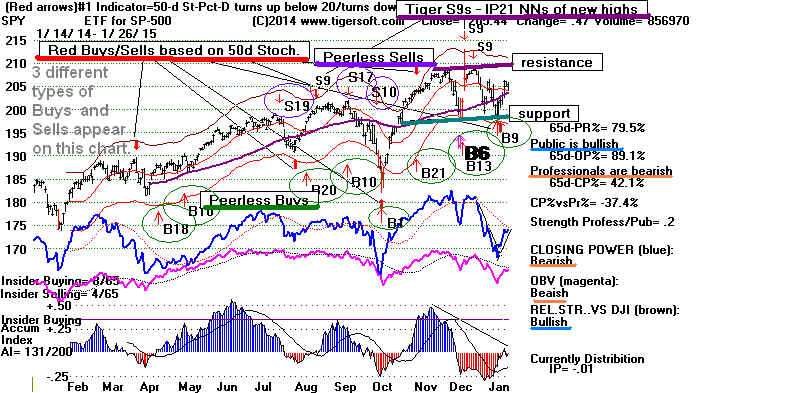

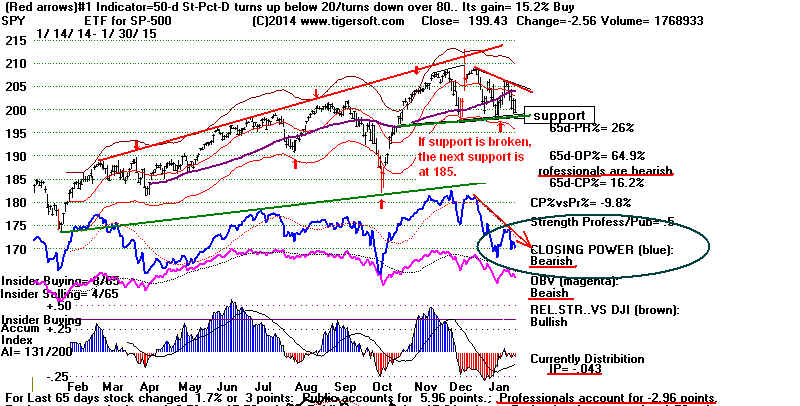

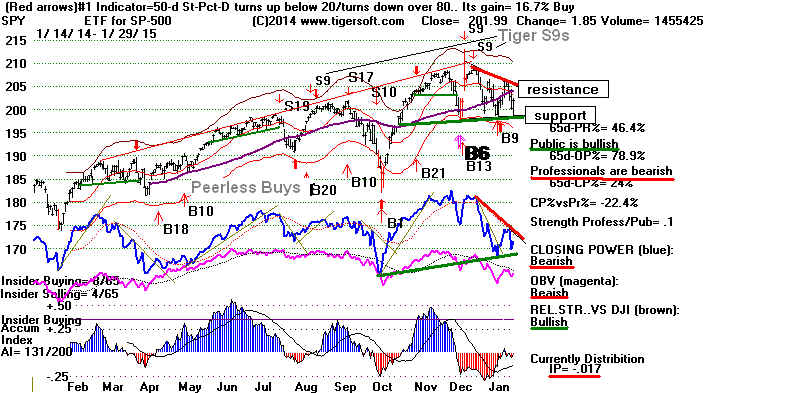

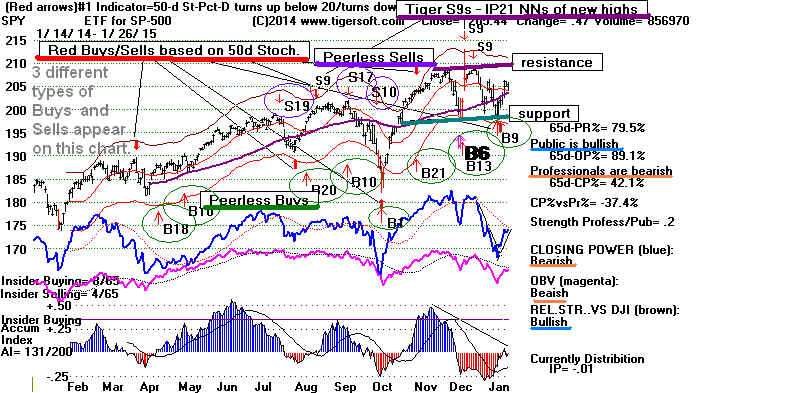

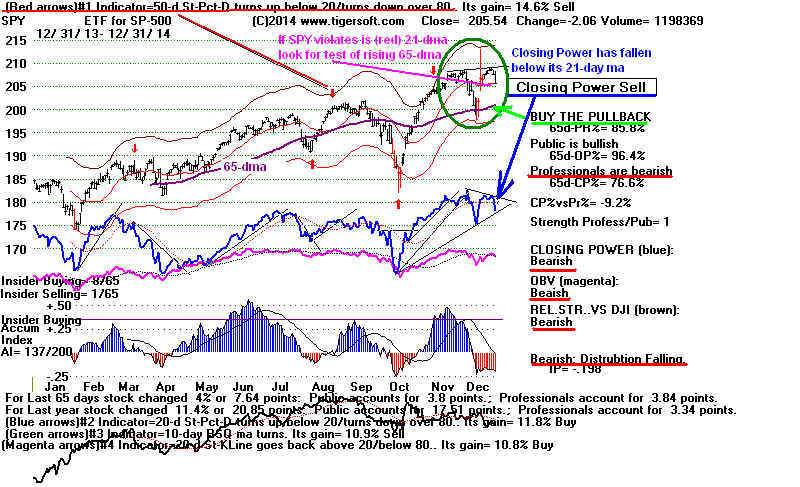

1/26/2015 Peerless Buy B9

Professionals are are cautiously bidding up

SPY. Red Distrbution is

preventing much of an advance. The recent Peerless Buy B9

was boosted by the red Optimized 50-day Stochastic-Buy.

SPY is now stronger than the DJI and shows a pattern of rising

openngs. It appears to be making its way back up to its resistance

line, having successfully tested its support.

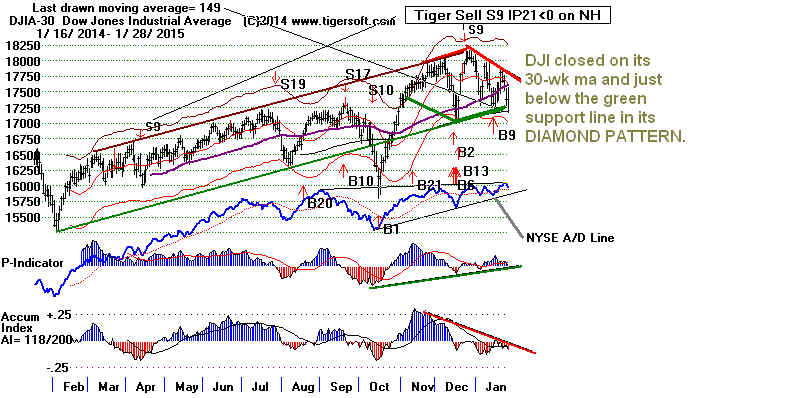

As discussed last night, the DJI is trapped in a DIAMOND

formation.

So, traders are looking for new plays. The 3x Bullish Mining Shares'

ETF NUGT rose 15% above its early morning weakness. It

should

rally back to its recent highs, at least. Biotech Indexes like IBB

and BBH made new highs today.

It may help the bulls to know that the DJI has rallied 67% of the

time since 1965 over the week following January 26th.

Tomorrow will be important. The QQQ threatens to

breakout above

its trading range's flat resistance. AAPL reports its

earnings late Tuesday.

Its earnings are expected to jump up sharply from the previous year. One

would think this could breakout QQQ. Without AAPL, the earnings

for the SP-500 would be almost flat. So, AAPL is very important

"APPLE

EARNINGS PREVIEW: Get Ready For The Big One"

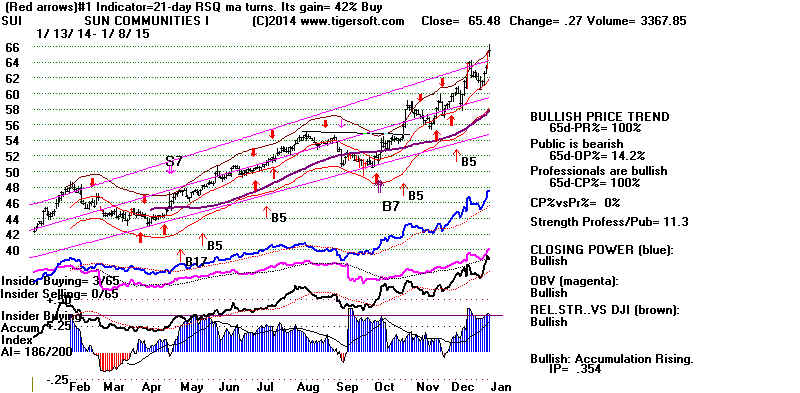

The Dividend Plays Still Look Good.

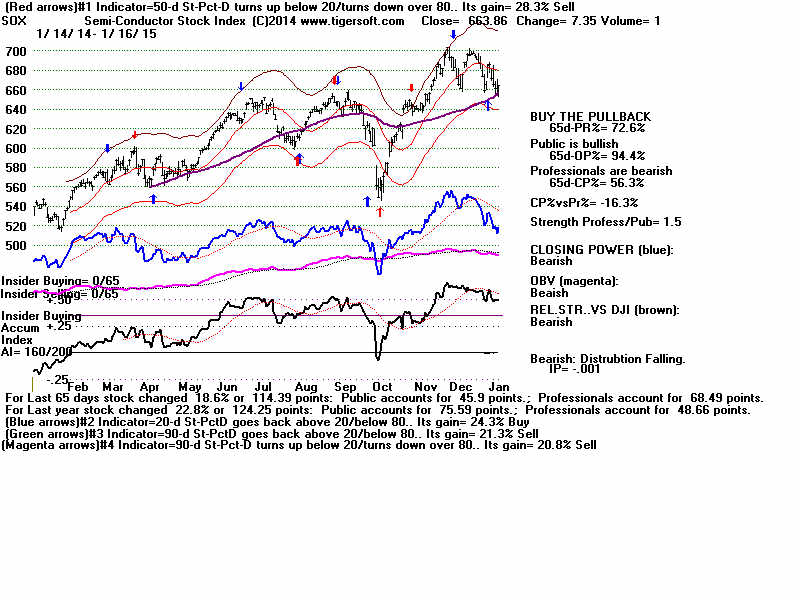

The NYSE A/D Line made a new high today.

Biotechs, Semi-conductors

and Mining Stocks rose, but most of strength continues to be in the

dividend plays, REITS, BONDS and UTLITIES. As long as the Dollar

remains strong and interest rates stay so low, it's not clear why there

dividend plays would weaken. A few years ago, when bonds did get weak

we saw a head/shoulders pattern in the Tiger Index of Bonds and mounting

red Distribution.

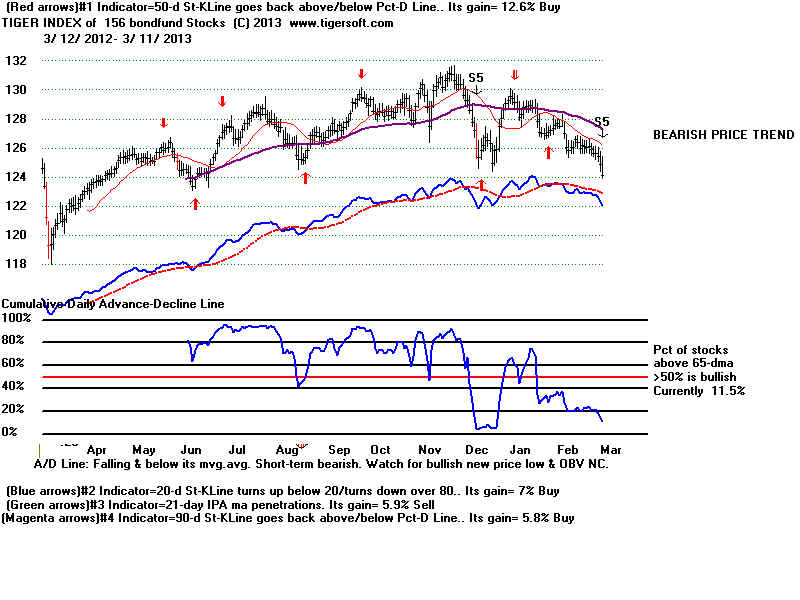

The composite Tiger Bond fund index now is rising

and shows much more

internal strength than the last time Reits, Bonds and Utilites fell 10% to 20%,

which was back in 2013. Contrast the Tiger Bond fund's chart now with the

way it topped out in March 2013.

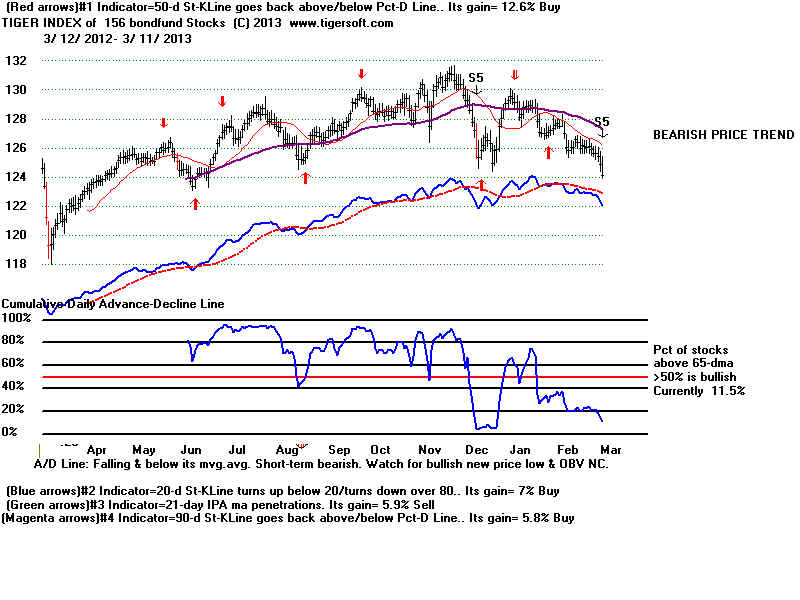

Tiger Bond Fund Index - 2014-2015

|

Tiger Bond Fund Index -

2012-2013

Just before a nig Decline in Dividend Plays

Timetable: 3/11/2013 Tiger Bond Fund completes bearish head/shoulders pattern

and shows Heavy Red Distribution.

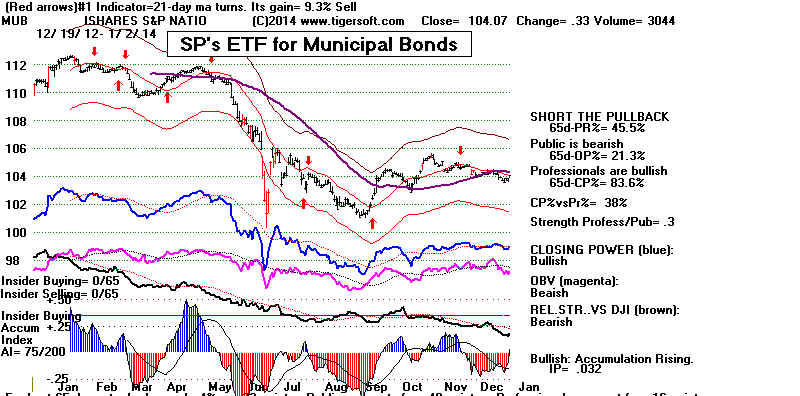

May 2013 Municipal Bonds break down below their 65-dma and typically decline

10% over the next 4 months.

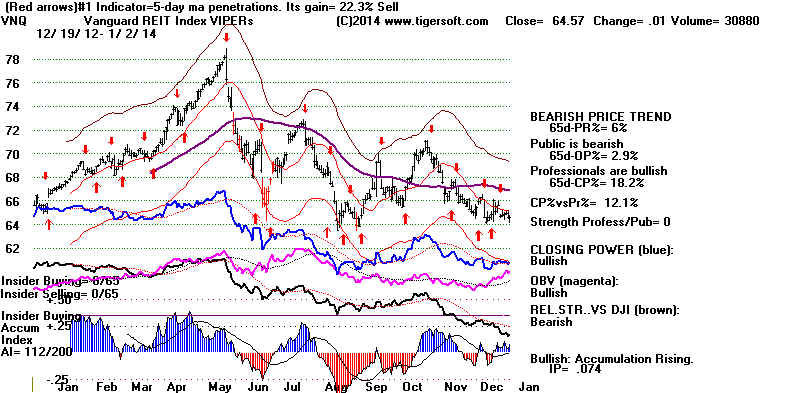

May 2013 REITs suddenly reverse swift and fall 17% over next 4 months.

|

--------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

--------------------------------------------------------------------------------------------------------------------------

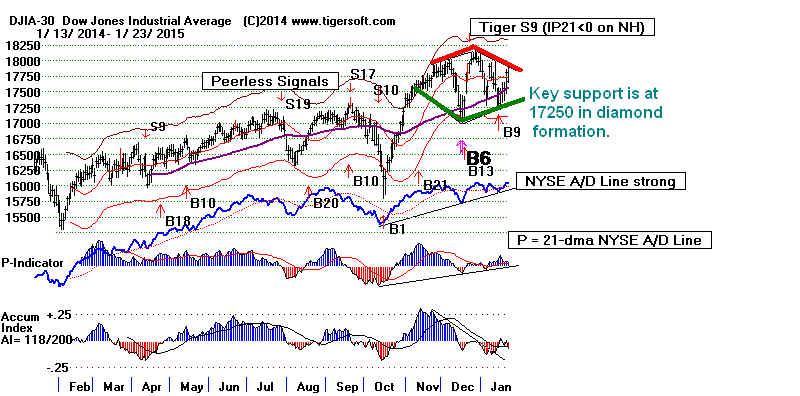

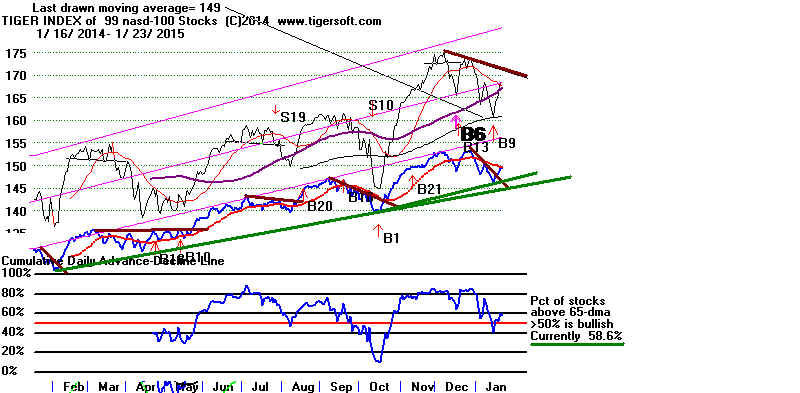

1/23/2015 Can The Peerless Buy B9, Low Interest Rates

and Very Strong Dollar Sustain A Bull Market

That is almost Six Years Old?

The NYSE A/D Line on our Peerless charts remains in

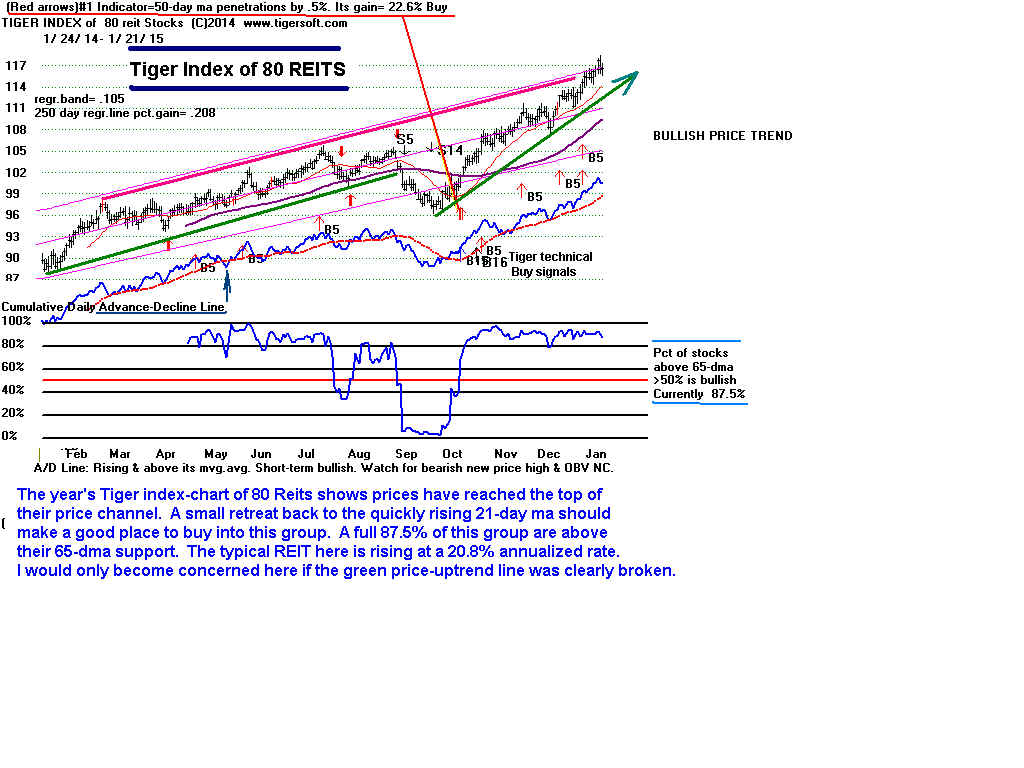

a strong

uptrend. So, US REITS, BONDS, UTLITIES are likely to remain

in their uptrends. (Of course, if these were

to start breaking their up-

trend-lines, the market's leadership would probably then be gone

and a 10%-12.5% DJI decline would then become likely. But even

then without a Peerless Sell or a DJI head/shoulders pattern, the

odds are heavily against a deeper decline.) See the Tiger composite

indexes of REITs, BONDs, Utilities here. The DJI

seems locked

in an inconclusive diamond formation.

DJI's Diamond formation is rare. I have not looked

for and studied them. But I found a link on the

internet that suggests that the odds of a breakdown

rather than a breakout are about 60%. Standard

chart analysis projects a downside objective of 16500

if the green support level is closed decisively below.

http://www.finvids.com/Chart-Pattern/Diamond-Top-Bottom

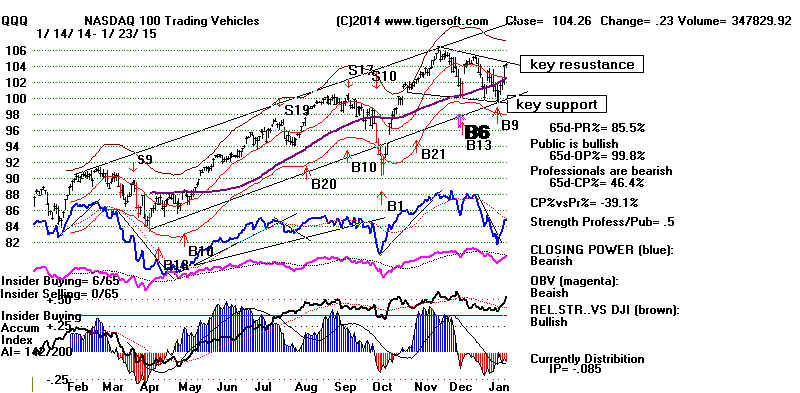

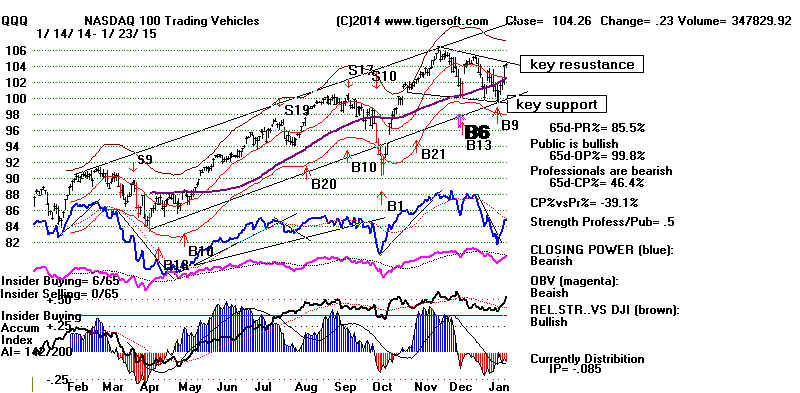

The QQQ is simply falling back from a resistance-line from its its recent

highs. This is not particularly bearish. In addition, the percentage of

Russell-1000 stocks above their 65-dma is still comfortably over 50%.

|

|

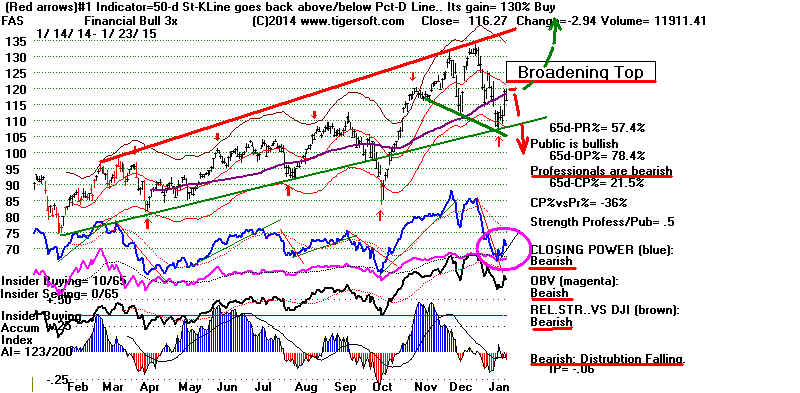

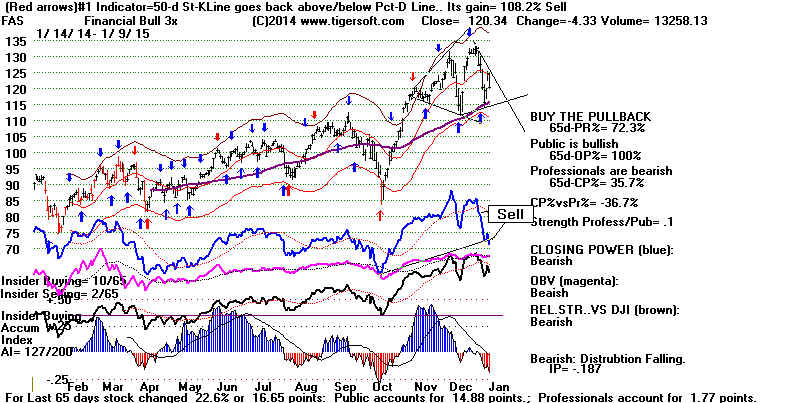

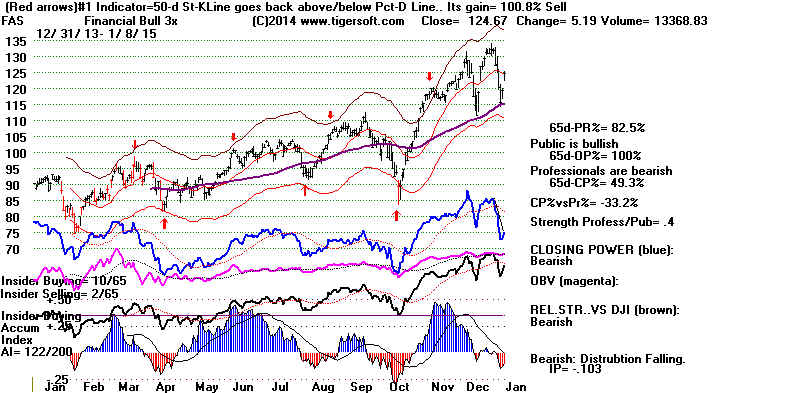

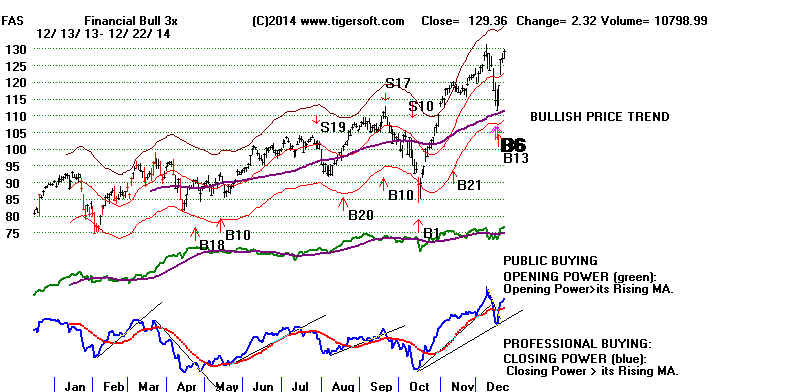

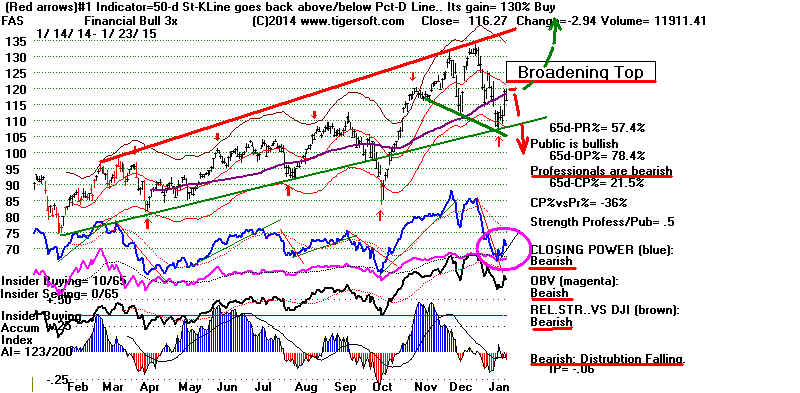

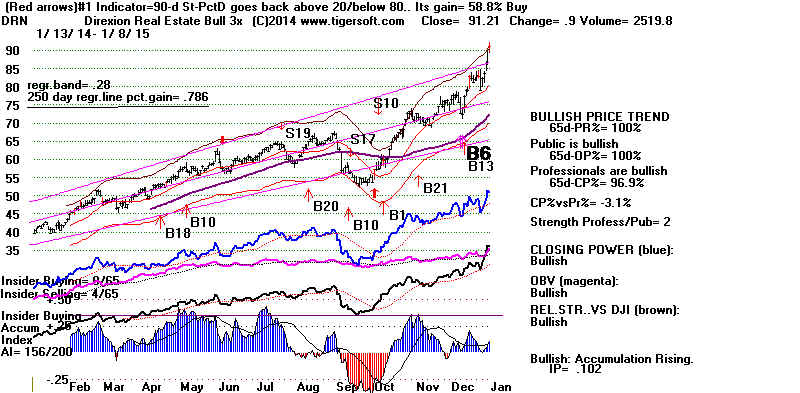

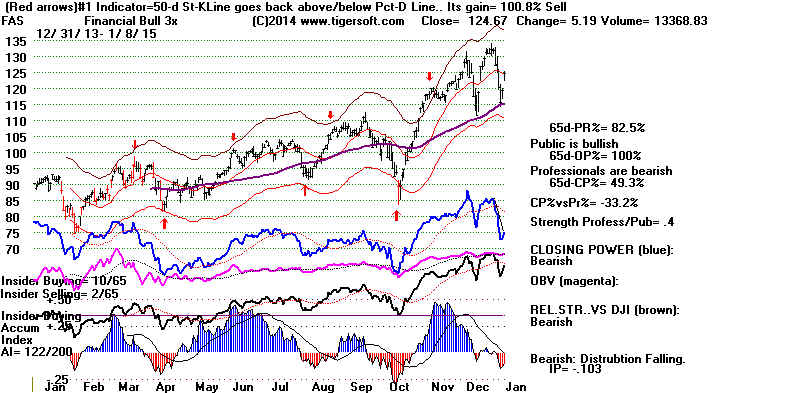

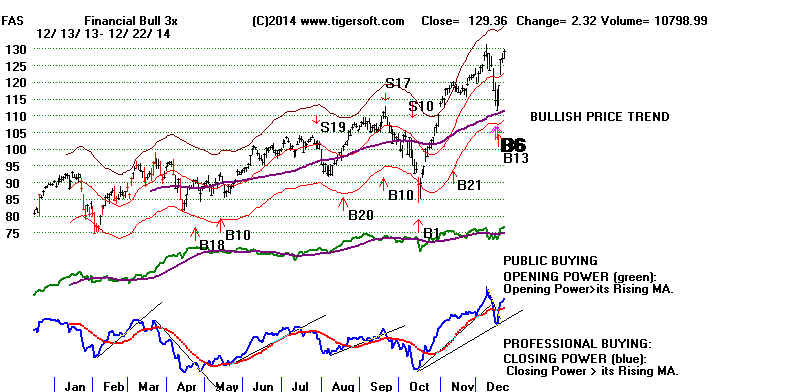

Professionals remain skittish of US big banks. Usually, until the

big bank stocks' become objects of net Professional buying, the

markets will have trouble starting a new bullish run higher. See

the chart of FAS, the financial ETF, below. What we do not want

to see is a sharp turn-downards here by FAS. That would

give the appearance of a down-sloping head/shoulders pattern

and a bearish broadening top.

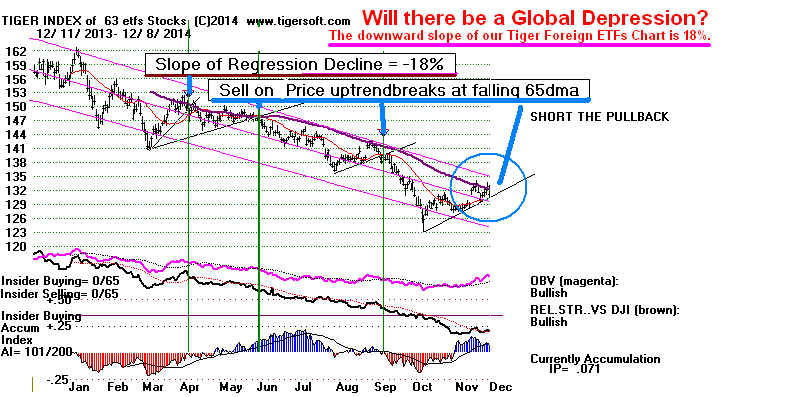

The ourcome of the Greek Election, wherein a populist-leftist coalition will

denounce the austerity demands upon Greece by Europe's central bankers

seems bound to make Greece the first Euro zone country to leave

the Euro. This is scary for central bankers. It is scary for Greek bond-

holders, in Europe and also in New York. And it could easily lead to

similar political challe nges by similar anti-central bank politicians in Italy,

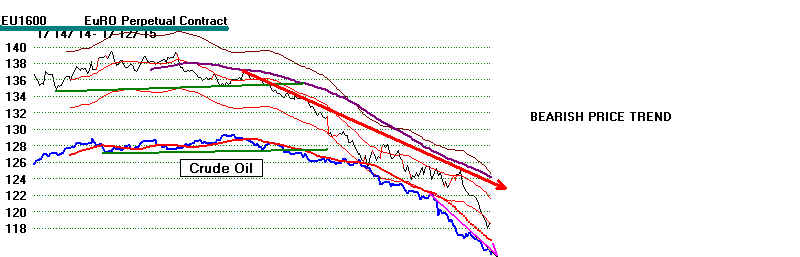

Spain and Portugal. This has put a lot of pressure on the Euro. See below.

Until we see how all this plays put, I would think the Euro will stay weak and

that will boost the Dollar. The new Quantiative Easing by the European

bankers comes very late. Will it be taken as a sign of desperation and

vulnerability for the EURO. Wall Street is scared, too. They fear

"radical leftist" majority rule. They recognize that a popular

uprising

against the rule of the big banks has just gained significant momentum.

Greek

Vote Sets Up New Europe Clash Wall Street Journal

BBC

News - Greece election: Anti-austerity Syriza wins

http://www.nytimes.com/2015/01/26/opinion/paul-krugman-ending-greeces-nightmare.html?emc=edit_th_20150126&nl=todaysheadlines&nlid=58223894

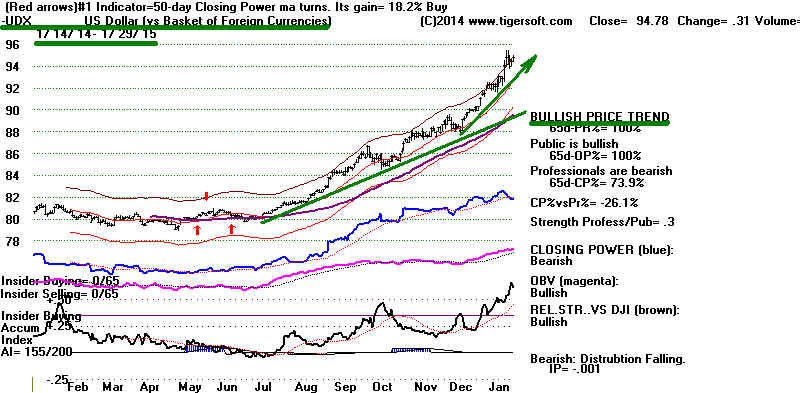

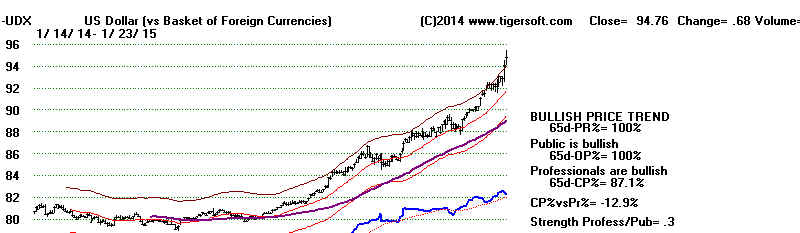

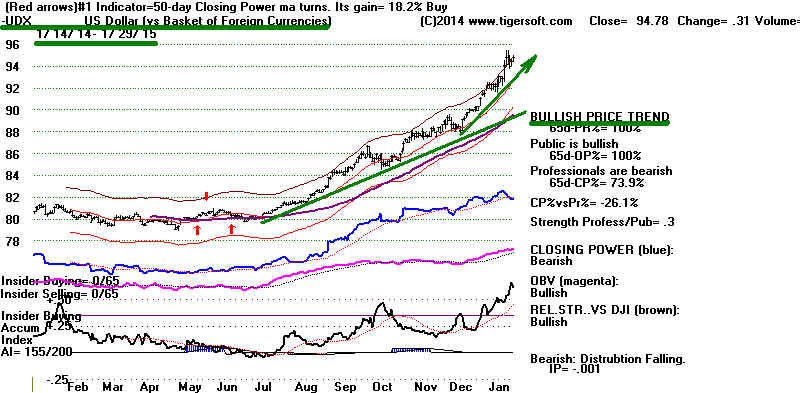

70 Months Old Bull Market:

What If The Stong Dollar

Fails to Lift The DJI To New Highs?

We can't help but notice that the DJI is no longer able to keep

up with the super-strong Dollar. In a new bull market, this is

not significant. But after a long bull market, a rising Dollar

that fails to lift the DJI into new high territory is a definite

warning. It means the US equities' market is getting very tired.

Here are some cases of this....

What do DJI NCs (non-confirmations)

of Dollar new high mean in 6 month uptrend?

Bull Market Cases:

1 October 2014 - DJI declined to lower band.

(July 2001 - DJI declined below lower band.)

(2000 (2) - two declines below lower band.)

2 June 1999 - Correction in DJI started a month later.

3 August 1998 - 19.5% correction followed.

See the new Tiger Study tonight of "The Dollar and The DJI".

Calling Gold

and Silver Mining Shares

Intermediate-Term Reversals.

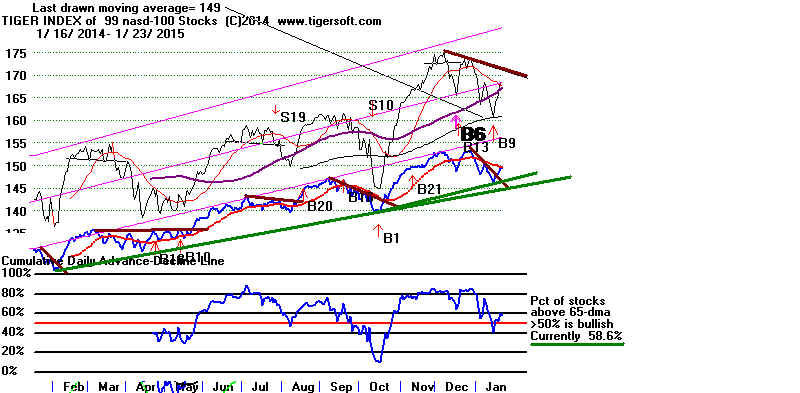

Crude Oil is trying to find a bottom. The steep

Closing Power

downtrend has been broken. But we will need to see more up-days

here. The charts of GLD (Gold ETF) and Silver futures look like they

are making a rather typical January reversal upwards. One of

the simplest approaches is to watch the Tiger chart of all the

gold and silver mining stocks, and the A/D Line here io particular.

As long as the A/D Line is in an uptrend, I would think we will

see more of a recovery.

Tiger Mining Stocks' Index

------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

------------------------------------------------------------------------------------------------------------------------

1/22/2015 Peerless BUY Buy B9 and Low Interest Rates

Flexed Their Muscles Today as the DJI Soared Nearly 300

in aftermath of Europe's Big and Bold Quantitative Easing.

America's QE-2 brought a

very good rally in 2010-2011.

Europe's should produce the same here. But it all depends on what

bankers and well-to-do Europeans choose to do with their

money. Their reaction could be very different the reaction

of bankers in the US. I suspect that will decide to buy US bonds

and US dividend plays where the currency and market are stronger.

Just as there were no strings attached to the Fed's loose money

policies for the last four years, I know of none in Europe. The

EURO's reaction was almost a panic, as it broke it easily

broke

below the 116 support of 2006. This sent the Dollar

soaring, to

to the delight of American big banks' stock holders.

The Peerless Buy B9 on

the DJI was clinched yesterday;

the Closing Power downtrend lines for DIA, SPY and QQQ were violated.

We take encouragement in the unusual power of Buy B9s in January and

in the fourth year of the Presidential cycle.

(See Buy B9

Statistics).

I have suggested

buying DIA, QQQ, APA, Crude Oil

and lots of REITs

via their extended stays on the Bullish MAXCP lists. Our Stocks'

Hotline covered most of the shorts, even though we know that some

of the Bearish MINCP stocks will decline even in a rising

general market.

A recovery back to 18250 for the blue-chip DJI-30 seem very

likely,

provided the DJI can breakout above its falling (red) resistance line in

its DIAMOND PRICE pattern. Watch to see if the A/D Line can

make a breakout to new high territory. That would be bullish for

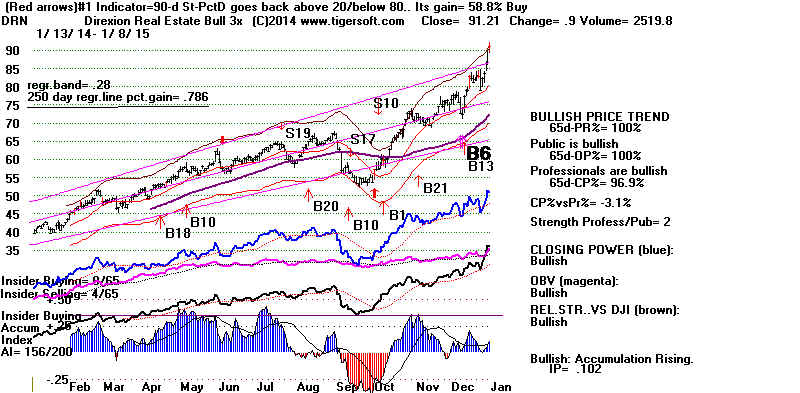

dividend players. The way REITs soared today, I would think we

will see even higher prices there. The Tiger Index of the REITs

is bullish breaking above its rising resistance line.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

A Dividend Stock and DJI Rally Up

to 18000

Must Now Be Expected.

1/21/2015 The

Peerless Buy B9 on the DJI was clinched today; the Closing Power

downtrend lines for DIA, SPY and

QQQ were violated. We take encouragement

in the unusual power of Buy B9s in January and in the fourth year of the

Presidential cycle. (See Buy B9 Statistics). A recovery back to 18000 for

the blue-chip DJI-30 would now seem likely, at a minumum.

But we can't escape noting now how much weaker the broader market, excluding

dividend stocks is. Here Professionals are still aggressive net sellers of more

stocks

than they are buyers. Thus, the number of MINCP stocks making Closing Power

new lows today was higher than the number of MAXCP making new highs, by 131 to 68.

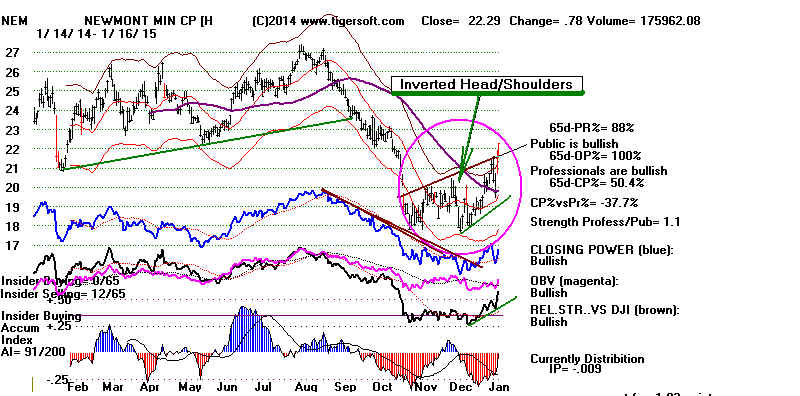

Mining stocks are due for a rest. Interestingly, though they rose today, the 3x

leveraged

ETF for the group, NUGT, fell 5%. Now the futures are

down this morning for gold

and silver. This another case of the heavily traded and leveraged derivative (NUGT)

wagging the dog, the entire industry's regular stocks. I still like the technical

and

intermediate-term prospects, however for the group. Look at the bullish inverted

head/shoulders patterns in NEM and GLD

and the bullish Accumulation in Silver's

Perpetual contract, SV1620.

The ratio of new highs to new lows on the

NASDAQ remains bearish.

So, this remains a defensive market for the

most part. Dividend stocks,

particularly REITS, Bonds and Utility stocks dominate our

Bullish MAXCPs.

These should be bought now on any dips they may individually make to their

rising 21-dma.

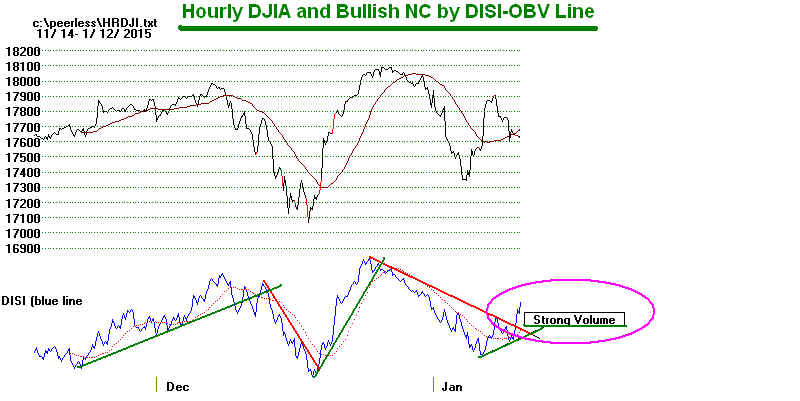

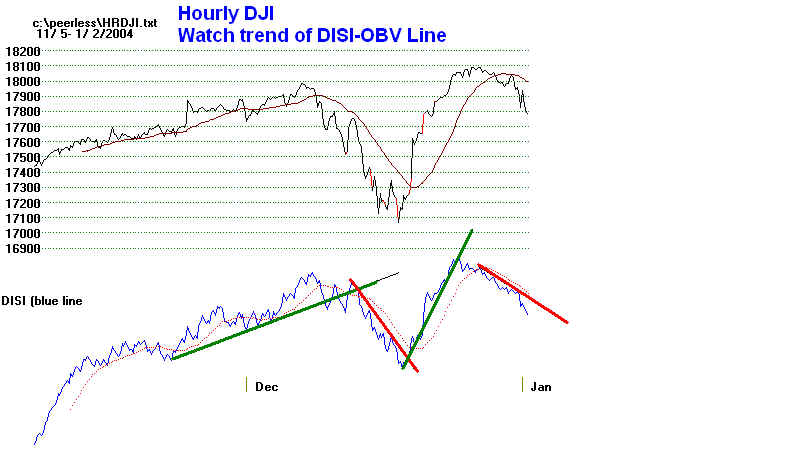

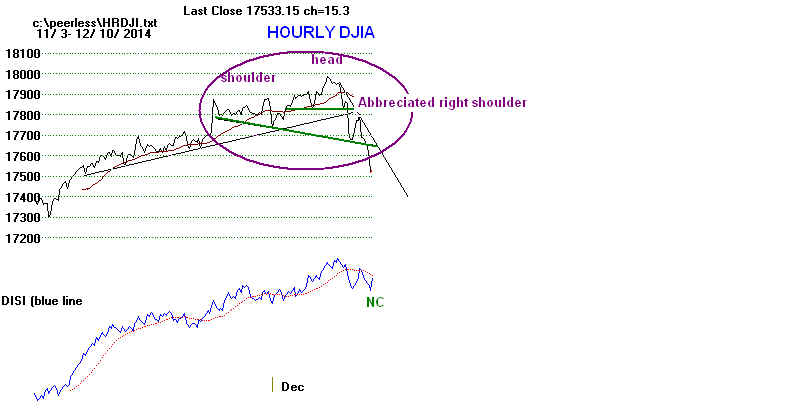

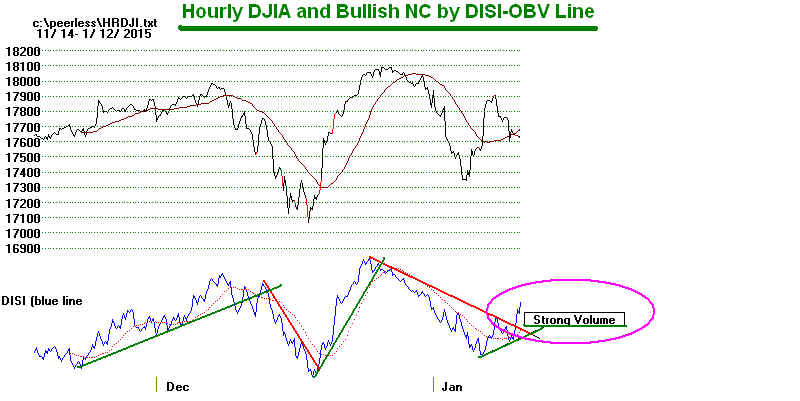

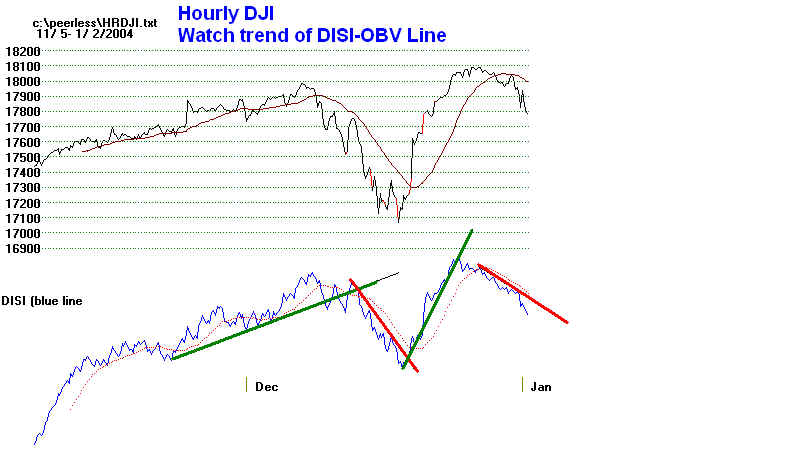

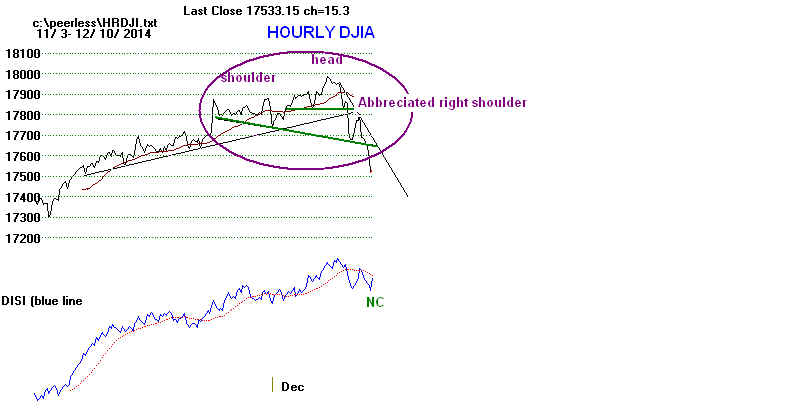

Bullishly, the Hourly DJI's

DISI-OBV Line is bullishly rising faster than the DJI.

I believe QQQ should rally well now, too. But the most

interesting play now

would seem to be the beaten down oil stocks like APA and AREX. Below is

the perpetual chart of Crude Oil. See how its Closing Power downtrend

has been violated. This is not true of its Opening Power.

============================================================================================================

============================================================================================================

OLDER HOTLINES

============================================================================================================

1/20/2015 The Buy B9 still stands.

But today's DJI gain was not

matched

by good breadth; there was 670 more down than up on NYSE today. A lot

more NASDAQ stocks are making new lows than new highs. The opposite is

true on the NYSE. This reflects the defensiveness of the stock market now.

In effect, the NYSE and the Federal Reserve are propping up the general

market. The Buy B9 tells us that the Fed can succeed in this for a lot longer

than most super bears can remain credible and solvent.

Utility stocks, REITs and mining

stocks are the market leaders. If you own

these stocks, you love this market. But this type of leadership is troublesome

for the rest of us. Gold, Silver, mining stocks and NUGT show special strength

very often 4-8 weeks before there is a significant top and general market decline.

See http://www.tigersoftware.com/TigerBlogs/02-21-2008/

Without more speculative interest, who will buy as more and more SP-500 stocks

break their 65-dma. Right now, about only about 51% are above their

65-dma.

For the time being though, the Hourly volume does seem recently to be heavily on the upside.

The apparent continued political stalemate in Washington, at first glance, would

seem to safeguard the special previleges and power of corporate America. But should

the economy turn down, one must wonder how would the President

and Congress ever agree on what to do.

The history of Buy B9s shows that

small 0.8%-4.6% paper losses on the DJI

are not uncommon. They occurred in 24 (36.5%) of the 66 Buy B9s since 1928.

See the next table. With the average Buy B9 gain on the DJI more than 10%

per trade when closed out on the next Peerless Sell, we should be buyers of

DIA when its Closing Power clearly breaks its downtrend.

( More statistics on Buy B9s )

The key Closing Powers are still in falling trends. So, Professionals are not

ready yet to become net buyers of the DIA, QQQ, SPY or FAS.

Buy B9s:

1928-2014

Returns by Size of Gain after B9

------------------------------------

Size of Gains No. Pct.of Total

=>.10 30

.455

=>.05 - <.10 18

.273

=>.02 - <.05 14

.212

=>0 - <.02 3

.045

<0

1 .015

--------------------------------------

Total

66 1.0 (100%)

BREAKDOWN of BUY B9 TRADES: 1929-2014

=====================================

No. Date Peerless DJI Pct Paper

Signal Gain Loss

==========================================================

1 19340910 B9 89.3 .038 .029

----------------------------------------------------------------------

2 19341220 B9 99.6 .044 None

----------------------------------------------------------------------

3 19350531 B9 110.64 .198 None

----------------------------------------------------------------------

4 19351213 B9 140.2 .114 .009

-----------------------------------------------------------------------

5 19431108 B9 131.7 .245 .016

-----------------------------------------------------------------------

6 19431117 B9 130.2 .26 .004

----------------------------------------------------------------------

7 19431126 B9 131.3 .249 .013

----------------------------------------------------------------------

8 19440907 B9 143.6 .142 .004

----------------------------------------------------------------------

9 19440914 B9 142.9 .148 None

----------------------------------------------------------------------

10 19450326 B8 152.3 .077 None

----------------------------------------------------------------------

11 19460225 B9 187.2 .135 .006

----------------------------------------------------------------------

12 19461009 B9 163.1 .126 None

----------------------------------------------------------------------

13 19480920 B9 177.4 .07 .007

----------------------------------------------------------------------

14 19481122 B9 176.3 .022 .029

----------------------------------------------------------------------

15 19481129 B9 172 .048 .004

----------------------------------------------------------------------

16 19481201 B9 173.2 .040 None

----------------------------------------------------------------------

17 19501205 B9 225.4 .15 .003

----------------------------------------------------------------------

18 19550117 B9 388.2 .207 None

----------------------------------------------------------------------

19 19581125 B9 540.5 .203 None

----------------------------------------------------------------------

20 19661201 B9 789.95 .124 .005

----------------------------------------------------------------------

21 19670412 B9 844.65 .051 None

----------------------------------------------------------------------

22 19670519 B9 874.55 .063 .031

----------------------------------------------------------------------

23 19740207 B9 828.46 .033 .03

----------------------------------------------------------------------

24 19741009 B9 631.02 .038 None

----------------------------------------------------------------------

25 19750528 B9 817.04 .058 .002

----------------------------------------------------------------------

26 19751209 B9 824.15 .225 None

----------------------------------------------------------------------

27 19761005 B9 966.76 .018 .046

----------------------------------------------------------------------

28 19771206 B9 806.91 -.017 .017

----------------------------------------------------------------------

29 19780223 B9 750.95 .154 None

----------------------------------------------------------------------

30 19781218 B9 787.51 .125 None

----------------------------------------------------------------------

31 19790206 B9 822.85 .077 .008

----------------------------------------------------------------------

32 19801028 B9 932.59 .058 .016

----------------------------------------------------------------------

33 19811023 B9 837.99 .04 .008

----------------------------------------------------------------------

34 19820930 B9 896.25 .179 None

--------------------------------------------------------------- -------

35 19821123 B9 990.99 .067 None

----------------------------------------------------------------------

36 19830124 B9 1030.17 .207 None

----------------------------------------------------------------------

37 19860122 B9 1502.29 .215 None

----------------------------------------------------------------------

38 19860407 B9 1735.51 .052 None

----------------------------------------------------------------------

39 19860711 B9 1821.43 .008 .029

----------------------------------------------------------------------

40 19861118 B9 1817.21 .324 None

----------------------------------------------------------------------

41 19880108 B9 1911.31 .059 None

----------------------------------------------------------------------

42 19880122 B9 1903.51 .063 None

----------------------------------------------------------------------

43 19880325 B9 1978.95 .056 None

----------------------------------------------------------------------

44 19930921 B9 3537.23 .122 None

----------------------------------------------------------------------

45 19960110 B9 5032.94 .103 None

----------------------------------------------------------------------

46 19960410 B9 5485.98 .048 None

----------------------------------------------------------------------

47 19960507 B9 5420.95 .06 None

----------------------------------------------------------------------

48 19961213 B9 6304.87 .087 .005

----------------------------------------------------------------------

49 19970911 B9 7660.98 .034 None

----------------------------------------------------------------------

50 19971219 B9 7756.29 .183 .012

----------------------------------------------------------------------

51 19981001 B9 7632.53 .459 None

----------------------------------------------------------------------

52 19990524 B9 10654.67 .045 .011

----------------------------------------------------------------------

53 20001124 B9 10470.23 .042 .014

----------------------------------------------------------------------

54 20001220 B9 10318.93 .058 None

----------------------------------------------------------------------

55 20010323 B9 9504.78 .183 None

----------------------------------------------------------------------

56 20011101 B9 9263.9 .092 None

----------------------------------------------------------------------

57 20020918 B9 8172.45 .074 .121

----------------------------------------------------------------------

58 20021209 B9 8473.41 .035 .02

----------------------------------------------------------------------

59 20021216 B9 8627.4 .017 .038

----------------------------------------------------------------------

60 20041014 B9 9894.45 .103 .014

----------------------------------------------------------------------

61 20041022 B9 9757.81 .118 None

----------------------------------------------------------------------

62 20050624 B9 10297.84 .124 .008

----------------------------------------------------------------------

63 20060718 B9 10799.23 .148 None

----------------------------------------------------------------------

64 20081223 B9 8419.49 .063 None

----------------------------------------------------------------------

65 20111121 B9 11547.31 .048 .028

----------------------------------------------------------------------

66 20131007 B9 14936.24 .105 .01

----------------------------------------------------------------------

Total N0.= 64 .108 .009

|

_______________________________________________________________________________________________

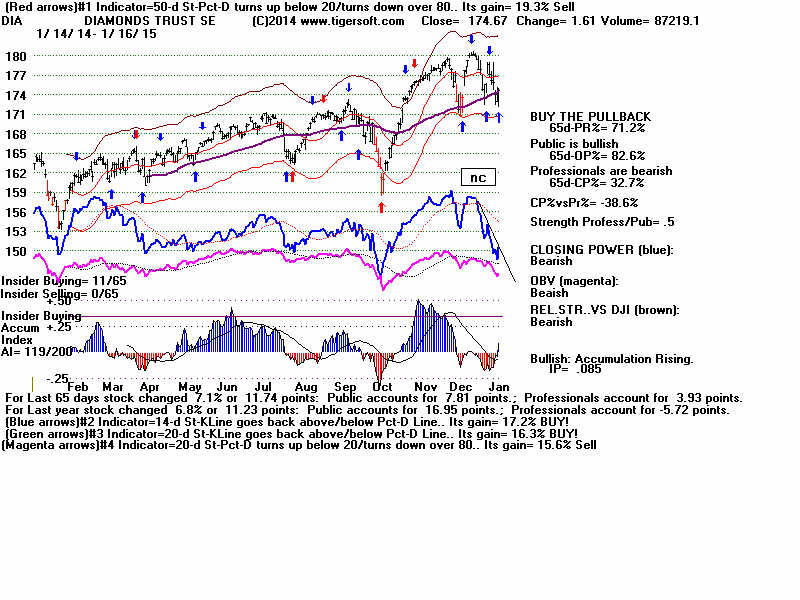

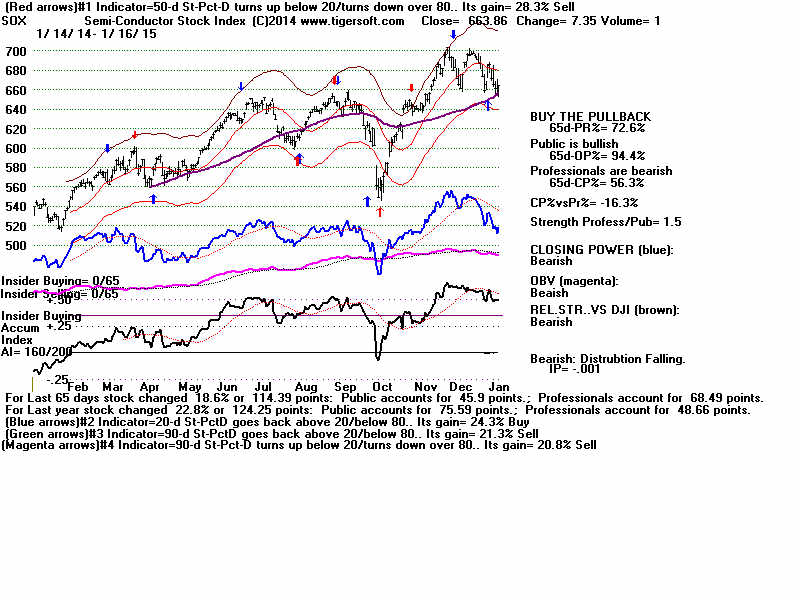

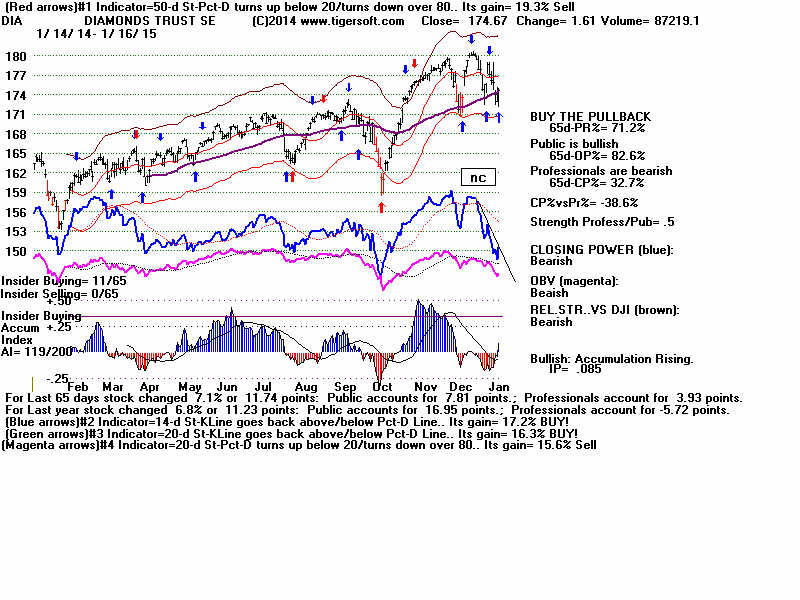

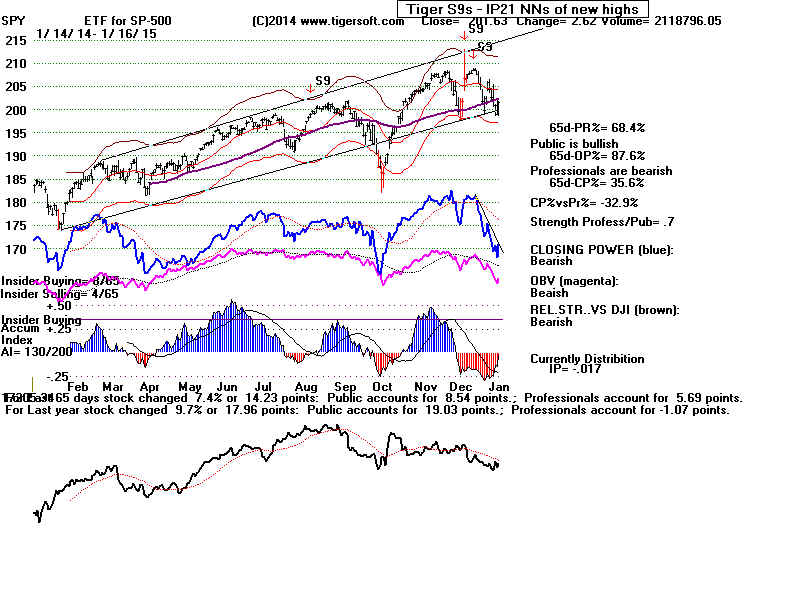

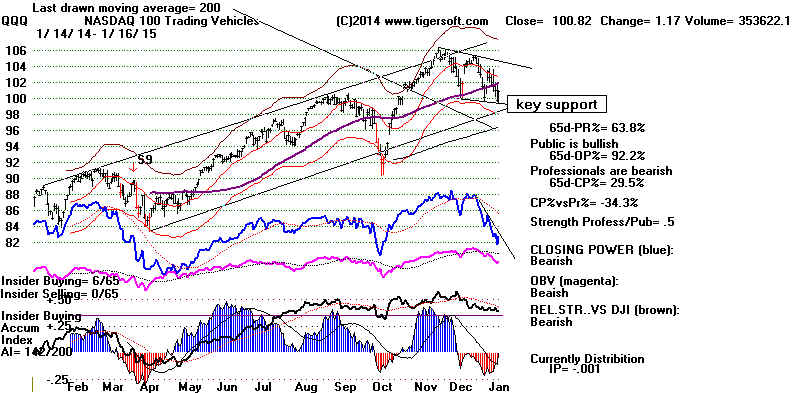

1/16/2015 The Buy B9 and Friday's Strong Rebound Suggest

A Weak DJI Rally to 18000 if the DJI can Stay above 17000. The

Peerless Internals for the DJI are now improving. Close out

Bearish MINCP stocks' hedges if their Closing Power downtrends

are violated. Our Stocks' Hotline recommended closing out most

shorts this week-end.

Unfortunately, another test of the recent lows is probably necessary

when this reversal and rally runs out of momentum. Professionals would

need to become much more aggressive buyers to prevent a retest

of 17400 at some point in next month.

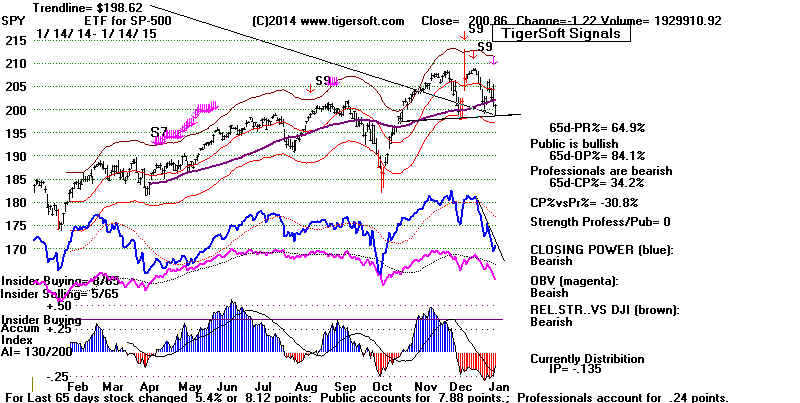

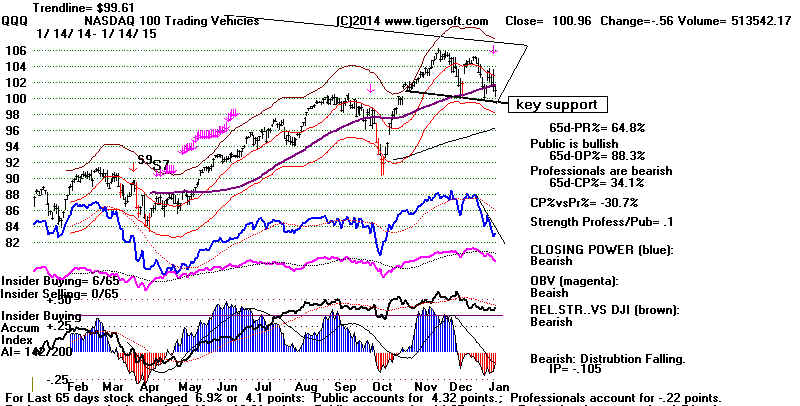

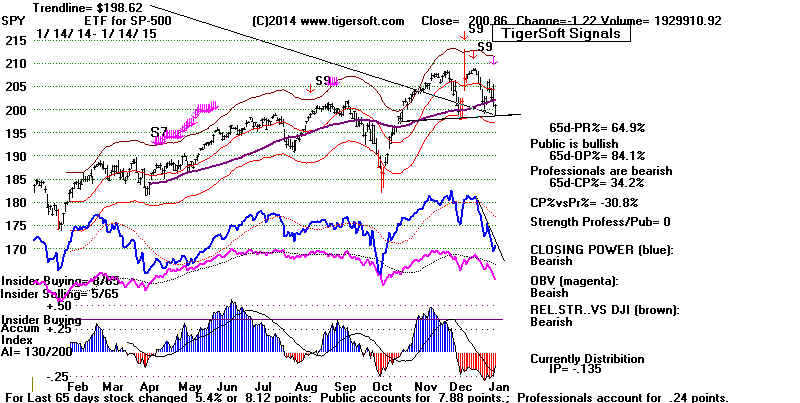

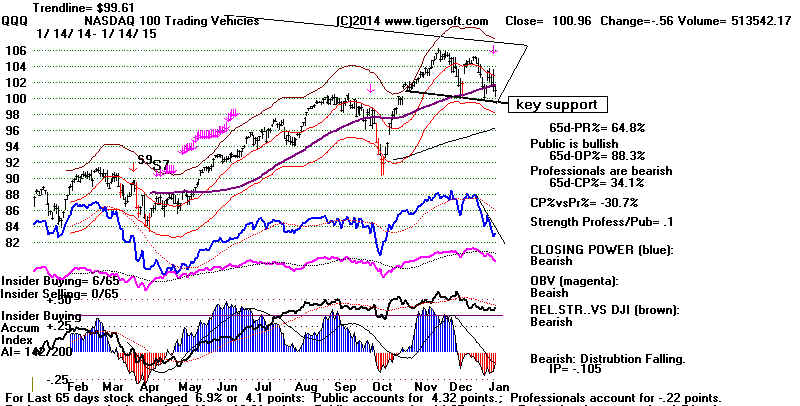

With DIA, SPY and QQQ each still showing falling Closing Power trends,

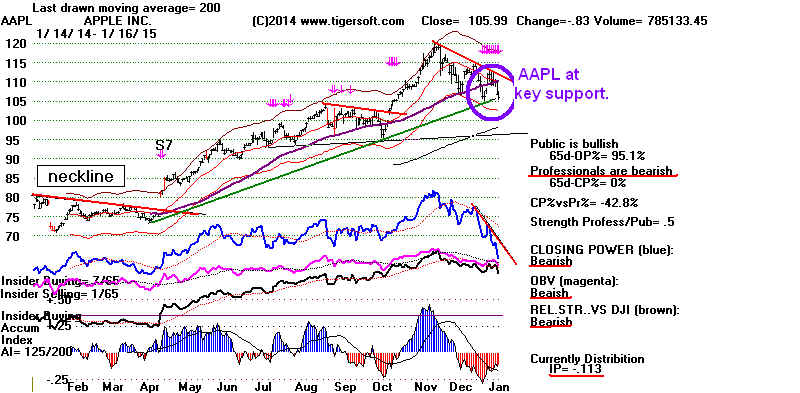

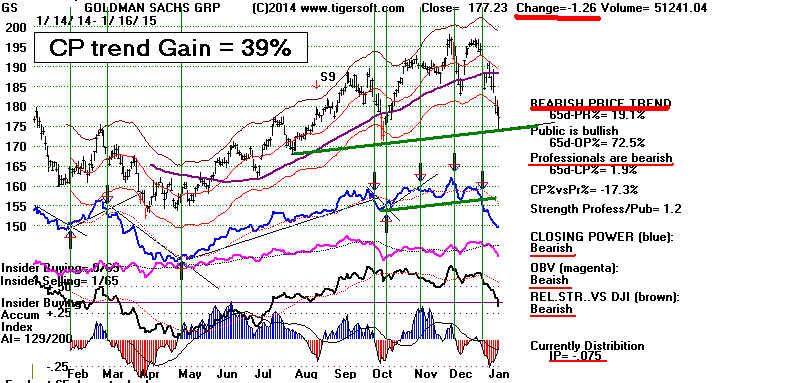

be careful. Also watch AAPL and GS. They did not rally on Friday.

That is not a good sign.

Consider buying our Biotech favorites and also some beaten down

Oil and Gas Stocks, like APA and possibly AREX, instead of DIA or

SPY, if these oil stocks' Closing Power downtrends are clearly broken.

Gold's strongly Bullish Reversal Price Pattern is probably a warning for the

General Market. But NUGT could go to 25 just on the

basis of higher

openings. See www.tigersoftware.com/DEN

The DJI jumped upwards 190 points and got

back marginally above its rising

65-dma. Friday's ratio of

NYSE advances to declines bullishly correlates

with further gains.

Friday's +1% gain was bigger than occurred at anytime

in the aftermath of the January 1977 and January 1984 cases mentioned

in Thursday's Hotline. This means the January Buy B9 signal probably

precludes a big break in the market. But right now, only a rally back to 18000

seems possible. The support 200 points lower on the DJI has apparently been

successfuly tested. But that does mean a big rally yet. Most of Bull Market

January B9s bring rallies later in the month and not all Buy B9 are equally

powerful and modest B9 paper losses are fairly common.

Professionals Remain Skeptical

The big problem now is that the Closing Powers for the DIA, SPY and QQQ

did not clearly break their downtrends. So, the rally had a lot to do with it

being Friday, the day before a three day holiday. As a result, there will probably

need to be another dip. (If there is no dip, the markets would then have to make

most of their gains based on a string of higher openings. This seems unlikely.)

I interpret the still falling trend of the key Closing Powers to mean that market

Professionals are not yet convinced the decline is over. They are watching

for the President's State of the Union Speech, the Republicans' counter-budget

and the results of the Greek Election, not to mention signs that Moslem

extremeists' terror has ended for a while.

Europeans are aggressive buyers now. That would explain the jump in the

opening as we start the new week. Europeans expect a quantitative easing scheme

to be announced by the EURO's Central Banks later this week. This would also explain

some of the boost that Gold has gotten. The Swiss Franc's big jump

shows the World's wealthiest are ever seeking a "haven" for their money

when local currencies and governments fall.

I fear that the US domestic economic situation could turn down sharply this year.

Keep in mind how weak Austerity has made the European economy. The average rate

of national Unemployment there is over 12%. Think what domestic spending

Austerity would do in the US to the stock market unless there is

a bold Quantitative Easing - Phase 4.

The lessons of the 1937 Crash should

be required reading in Washington. The December retail figures show that

the average American had to buy lower priced gifts despite the extra $100

a month he gained from falling gasoline and fuel costs. Consumers without

much spending money and a juiced-up stock market are a dangerous combination

if Austerity comes "a-calling" and the Fed does not provide a QE-4.

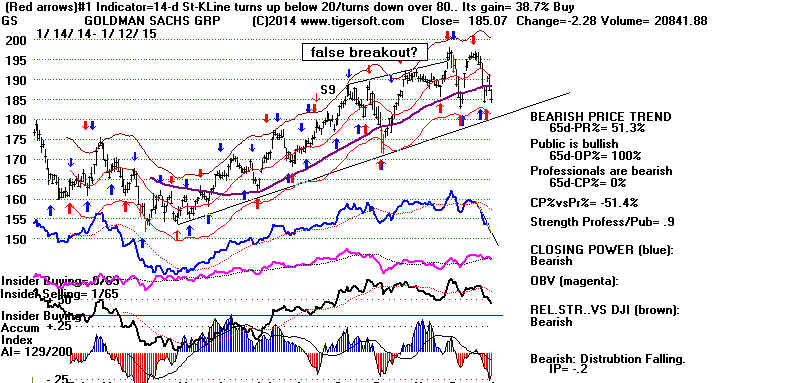

AAPL, the leader of the NASDAQ was down. So was Goldman Sachs among

the bank stocks. If they do not turn up on Monday, another retest of the

recent lows will be very likely.

Breadth was excellent Friday; the low interest rates helped REITS

the most. In addition, our favorite Biotech Super Stock candidates for

2015 (AGRP, KITE and BLUE) did well.

Crude Oil is trying to reverse its slide. I reported its Closing Power's downtrend

was broken on Wednesday. The most interesting depressed oil stock I

can find are APA and AREX. They are on the verge of having their Closing

Power downtrends broken. This would make them Buys using Tiger's Closing

Power rules. Interestingly, Wall Streets pundits are belatedly becoming

super-bears on Crude Oil. See this weekend's bearish write-ups. If Oil can

rally against these bearish pronouncements, a rally to the fallign 65-dma at

a minimum would seem very likely.

Oil

To Collapse Below $40, J.P. Morgan Downs Barrons

Gold's big jump is still not believed by institutions. But its has completed

an inverted head/shoulders pattern. So has Newmont Mines, the second

biggest gold producer. Last year's mining stock rally, as

shown by NUGT,

was mainly confined to higher openings until its top in March. NUGT's

internals

are now all positive. I suspect it can rally back to 25, even if much of the buying

is short-covering by hedge funds. We probably can trade it best now

simply monitoring its simple price uptrend.

==============================================================

OLDER HOTLINES

==============================================================

1/15/2015 The DJI Broke below Its 65-dma Support.

Today's Buy B9 shows breadth is very good. But can

low interest rates alone save stocks when Professionals

and Institutions remain heavy sellers?

DJI-17000 would seem to be the best place to buy

index

call options. Closing Power trend-breaks are

needed

now to show us that Professionals are becoming net

buyers. The lessons of January 1977 and January

1984 should be reviewed now. Stay fully hedged.

The DJI closed 2.2% below its 21-day ma

with the P-Indicator (21-day ma of NYSE

advances minus declines) still positive. In fact, it stands at a +181. This is

what

produced today's Peerless Buy B9 at the close. The January track record for Buy

Buy B9s is quite bullish. See www.tigersoftware.com/PeerlessStudies/January-B9s/index.html

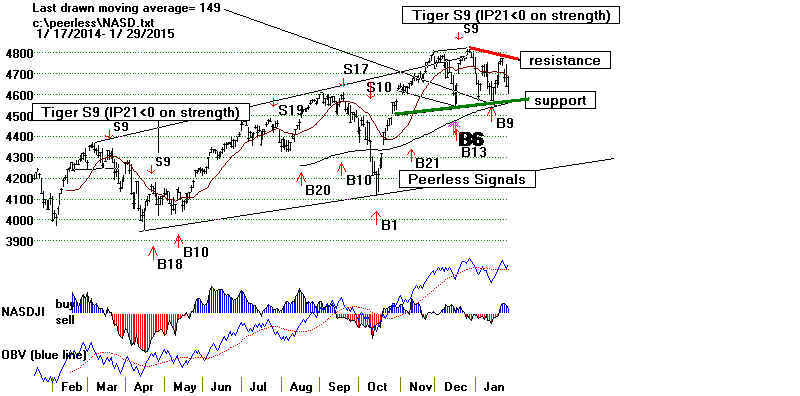

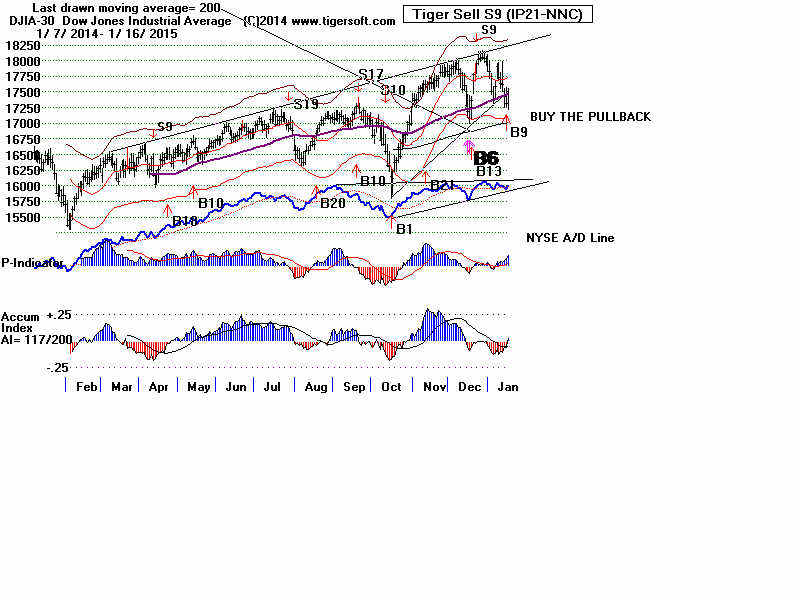

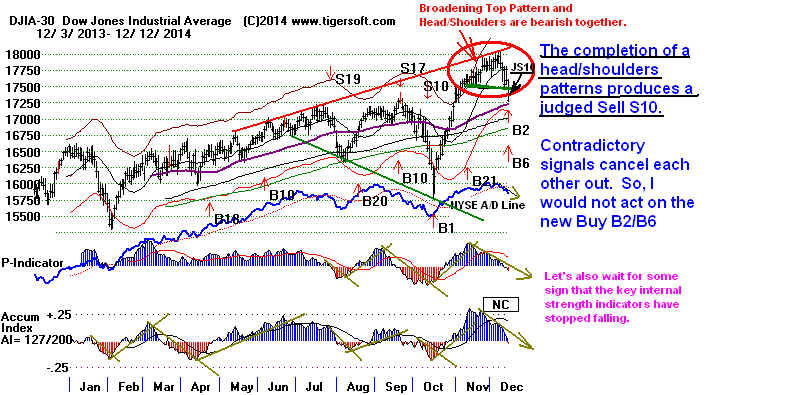

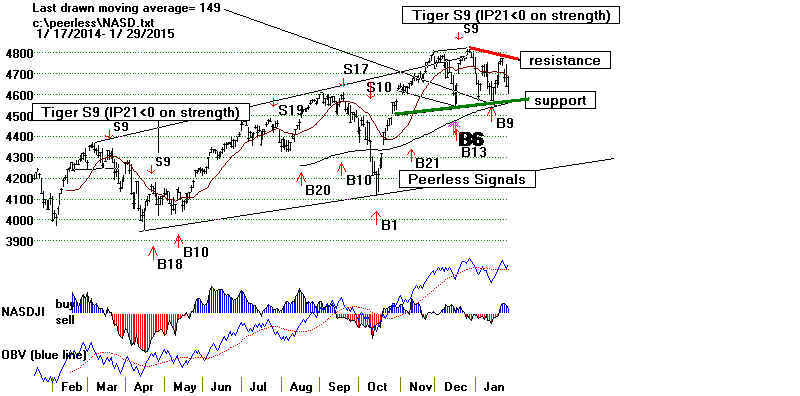

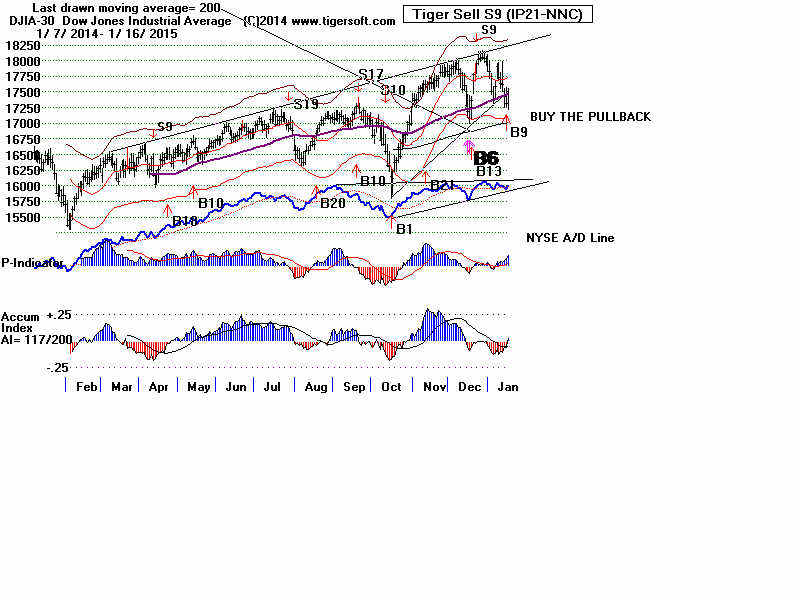

DJI, Peerless Signals and Tiger S9 (IP21 NNC)

Unfortunately. there are several problems with becoming super-bullish right now.

1) We have not reached the

lower 3.5% band yet.

With the 65-day ma broken, this

would seem to be the logical place for a reversal to take place, if there is to

be one. 17000 on the DJI would also coincide with the location of the rising

200-day ma; we can expect many institutions to place their bids there.

2) Professionals are still

heavy sellers. The Closing

Powers for the key ETFs fell again

today. Red Distribution still is very apparent in SPY, for example. The Tiger

S9s

are useful warnings in December for the DJI and the general market. (Tiger S9s

are produced by new price highs that are negatively (red) non-confirmed by our

Accumulation Index. They are important warnings, especially when the DJI

has just broken the 65-dma. See a

new study of Tiger S9s and the DJI since 2009.)

www.tigersoftware.com/PeerlessStudies/January-B9s/index.html

3) We know from January 1977 that a strong A/D Line does not guarantee against

a bear market when new Federal budget austerity looms over a fragile economy.

The 1920's were the exception. Then a consumer-based technological boom

changed everything. By 1926 millions of model-T were sold on easy credit. And

Even Coolodge appreciated the need for Federal highway spending.

4) After a long bull market, the appearance of a rising but very stubborn

resistance and then a false new high showing a negative Accumulation Index

can be quite bearish. In this situation, Buy B9s should probably be suppressed

for a month from the negative IP21 non-confirmation. This is important to

consider.

This was the case in January 1984. Such a situation - an extended bull market,

stubborn rising resistance and a new DJI that is negatively not confirmed by

our IP21-Accumulation Index - brought about a 16% DJI decline in the first

6 months of 1984. An Tiger S9 now also shows false new highs where the IP21

was negative on a new high with the DJI only 1.7% over the 21-day ma.

Compare this with Peerless S12s that are based on the same flagrantly negative

non-confirmations by the IP21 but the DJI must be farther up from the 21-day ma.

This is significant now because after Sell S12s, B9s are suppressed for a month.

Should the current B9 be suppressed because of the Tiger S9, which is such

a close relative of Peerless S12s?

What Happens

Next Probably Depends on The Fed

The charts from 2009 to 2014 repeatedly show

that the FED has the power to rescue

the market any time they choose, though it

takes much longer once a financial

panic sets in. Their standing

aside could therefore be a sign that they are still optimistic,

I suppose. But they delayed too long in 2008. They could make that mistake

again here.

See the new study of the effects of QE-1, QE-2, SE-3a, QE-3b and Fed Tapering

our charts of the DJI with Peerless and Tiger S9 signals.

www.tigersoftware.com//TigerStudies/TS9sonDJIA/QEs.html

Or perhaps, they fear the coming Austerity and want to have recourse left.

For Now, The FED Is Standing Aside.

If the Fed were about to launch a QE-4, I would think the big bank stocks would

show rising, not falling, Closing Powers. So, it's hard to be optimistic or bullish

at the moment even with the Buy B9. But this could change quickly if the big

banks' Closing Power surged upward. I think we can safely assume that they

will be the first to know if a QE-4 is to be announced.

|

|

==========================================================

OLDER HOTLINES

==========================================================

1/14/2015

DJI Breaks below and Then Closes back

at 65-dma Support. The Decline Has Set up

Key Support at Today's Lows. Now Crude Oil

and Natural Gas Are Breaking Long Closing

Power Down-trends.

Early on Wednesday the DJI broke below its 65-dma. Then it

fought back up to that level

at the

close. But now in pre-market trading, the DJI is back below this key support.

Peerless is still

on a Buy, so I would continue to stay long the surging Biotechs

and REITs. But stick with the Bearish

MINCPs, too. The rising A/D Line

is important, but

it does not guarantee against big capitalization declines,

such as in 1977,

2001 and 2002.

Wall Street 's Two Edged Swords

The abolition of the rule against selling short on down-ticks and the

heavy usage of

leveraged ETFs poses some real problems for the markets

if the key

support levels fail. Leveraged derivatives showed the damage

they could do in

2008 and 2009. In the last five years, leveraged ETFs

have helped the

DJI and SP-500 rise a lot further than they might

otherwise have.

Now leveraged short-ETFs could destroy rapidly

these gains.

Of course, the Fed will try to prevent this. But they failed

miserably in

2008. I think it will be a lot safer to hedge now rather than try to

outlast the next

bear market by stubbornly sticking to the long side.

A rupture of this

65-dma support now on a closing basis would be distinctly

bearish.

As chartists who believe in the bearish importance of breaks

in

well-tested

support with accompanying red Distribution and falling Closing Powers,

we should watch

for breaks in today's lows in the DIA, SPY and QQQ. If these

occur, consider

buying the 3x-leveraged short ETFs: SPXS, FAZ and SOXS.

If the 200-day

mvg. averages are then violated, a much bigger decline might be

just starting.

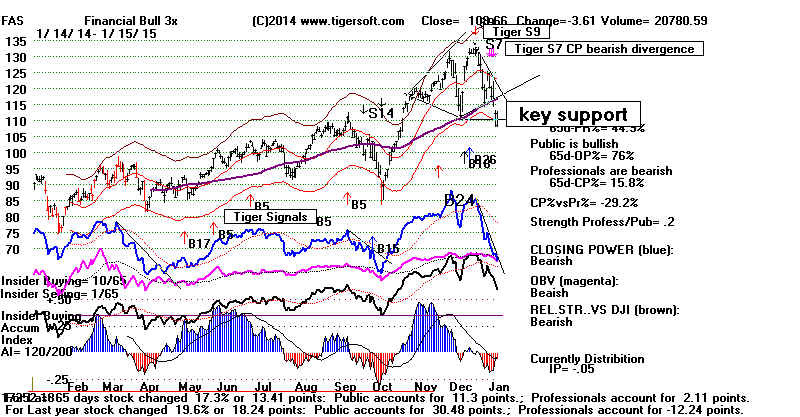

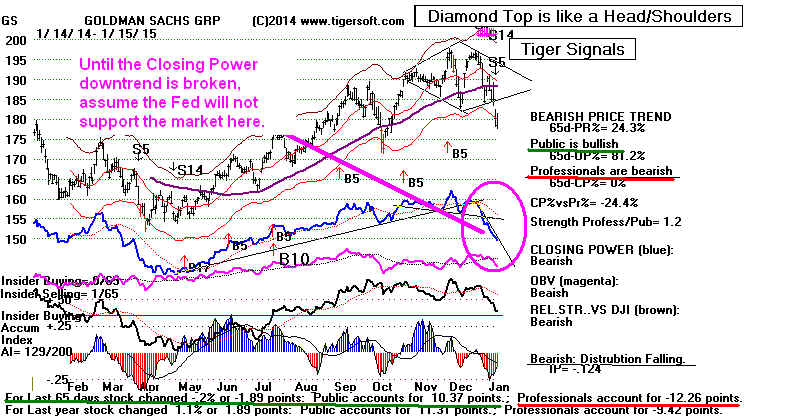

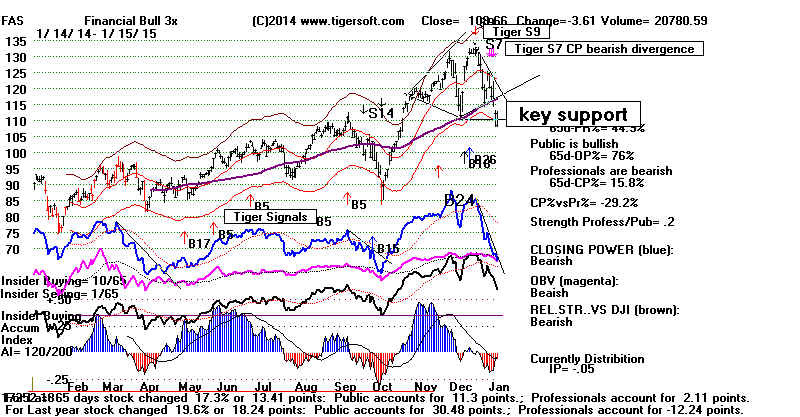

Pink Tiger Signals here: S7s warn of bearish CLosing Power

divergence from price. S9s show insider selling into price

strength.

|

|

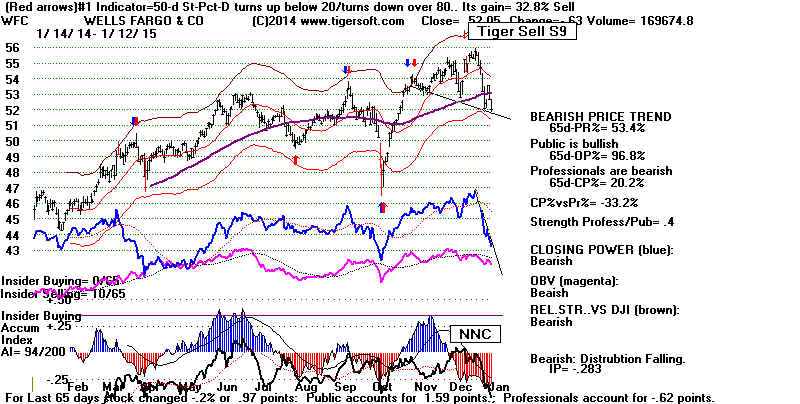

Insider Selling and Tiger "S9s"

The

"S9" shown below is the Tiger Signal warning of a new price high which

occurs with

the Accumulation Index (IP21) in negative territory. This is often

a very

useful warning. It denotes "insider selling". It most frequently

occurs

in rising

stocks days before bearish news (i.e. weaker than expected December

retail

sales at Walmart, Costco, Nordstom, or Target) or poorer earnings

than

expected

are released. Insider trading, as we measure it, is just as common

with bank

stocks. Wells Fargo showed an S9s last week and today we

found

out why,

poor than expected earnings were reported. At JPMorgan

the word

of coming

lower earnings circulated two weeks ago. The stock's advance to new

highs was

widely, negatively unconfirmed then. Insiders certainly were busy

selling.

That's why its IP21 negative on the last rally. Professionals soon got

the word

and have been selling and selling short JPM on every higher opening.

These are

Wall Street's leaders. If they cannot hold up, trouble elsewhere is

almost

certain. Are they looking ahead to the bearish effects a new fiscal Austerity

in the US?

I think so.

Crude Oil and Natural Gas have bullishly

broken their Closing Power Downtrends.

I would

suggest buying the OIL and UGAZ. See the way the 2008-2009

Crude

Oil bear market ended in the last Hotline. :

|

|

===============================================================

OLDER HOTLINES

===============================================================

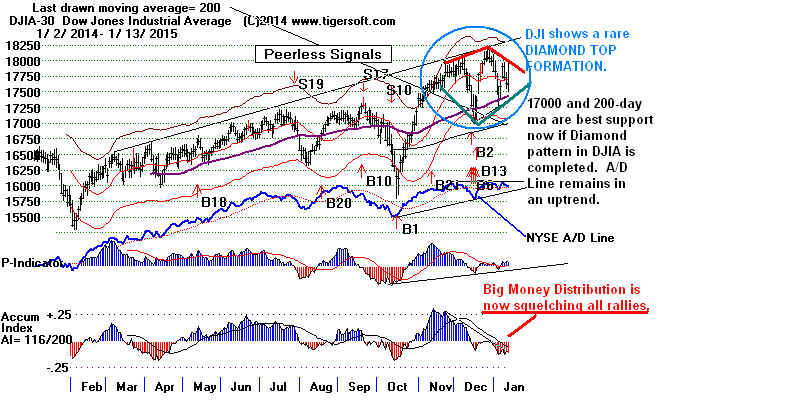

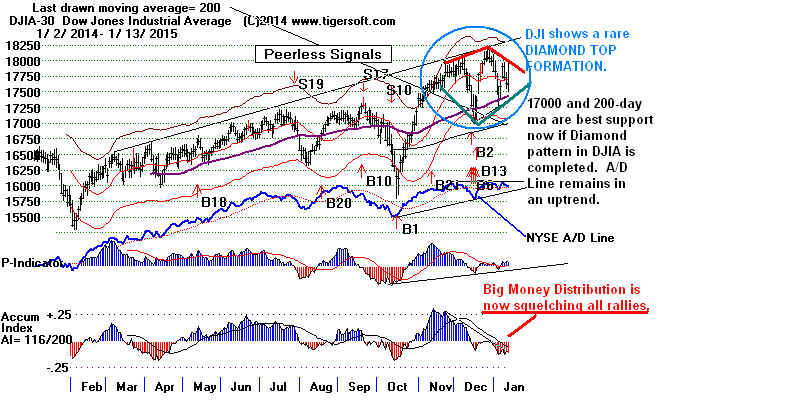

1/13/2014

DJI 17000 Is Very Important

Support.

This will also become a dangerous market if the 65-dma at 17400 is closed below.

It looks very scary when the DJI loses ALL of an early 200+ point. Actually,

this does not necessarily mean that the 65-dma will be violated. But such

reversal days down just after the 65-day ma has been violated are deadly.

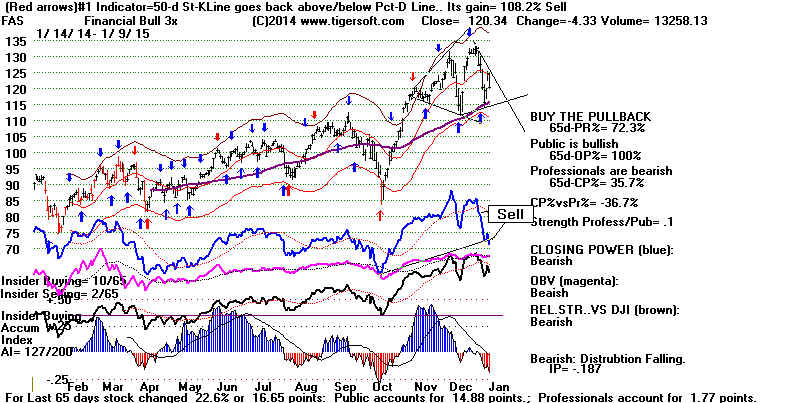

<1>

It's not very safe when the Big Banks' shares look as ugly and risky as they

do now. <2> Big Banks are the group that correlates most closely with

Peerless and the DJI since the mid 1980s.

And it's not certainly now safe when the leveraged ETFs take control of the

underlying equities. What will happen when Professionals and Institutions

pile all at once into these leveraged short derivatives to try to protect their

long-term gains when the 65-day or the 200-day ma is violated? <3>

(See the footnotes at bottom of this night's Hotline.)

A Rising A/D Line and

Fiscal Austerity.

Yes, the 65-day ma on the DJI has not been violated. Yes, the NYSE A/D Line

remains in an uptrend and Yes, Peerless remains on a buy signal, but why are

the big banks so weak? Why are Professionals selling stocks so aggressively,

not even allowing more than hour or two of rising prices before dumping?

One could hope it's just normal January rotation, I suppose.

But we can study history here. For example, we know from the way the market

turned down going in January 1977 that a strong A/D Line does not always prevent

a bear market, especially when Federal budget balancing becomes the