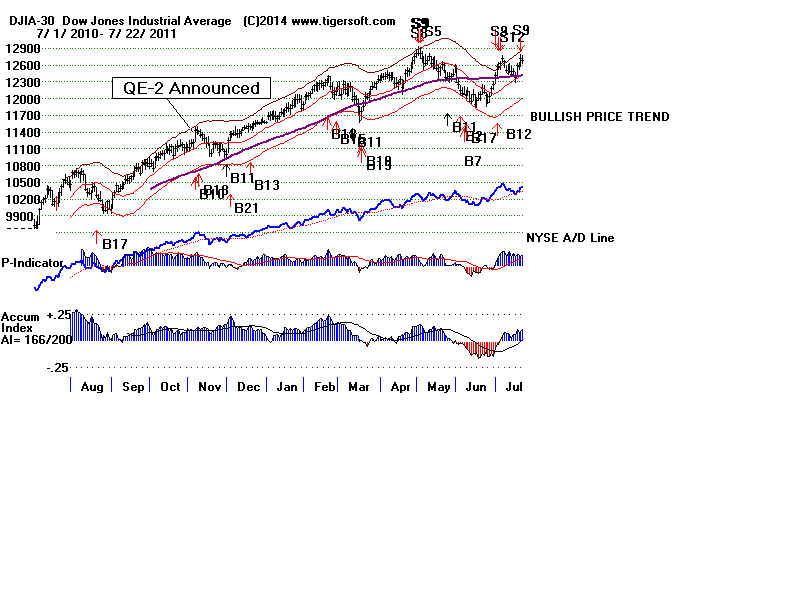

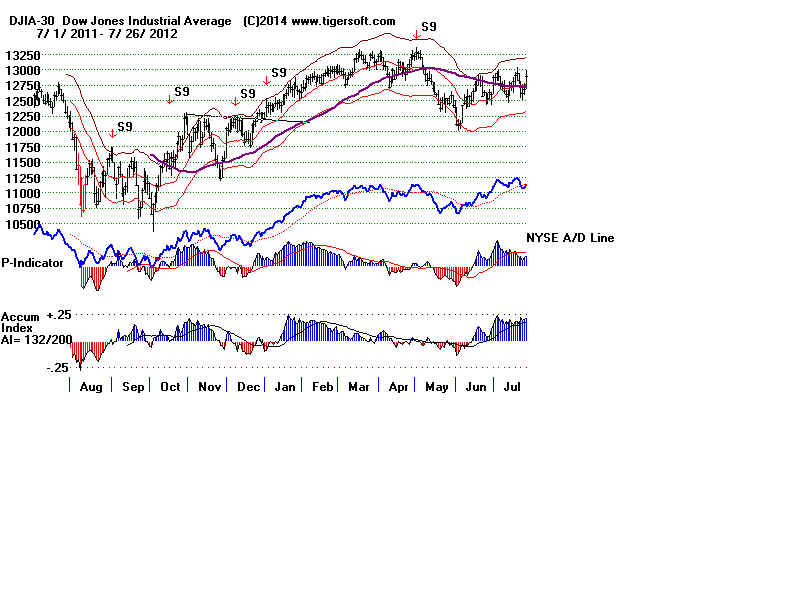

Tiger Sell S9s (IP21

NNCs of new highs)

by

month since 2010

---> Decembers: 3

of 4 fell to lower 2.0% band.

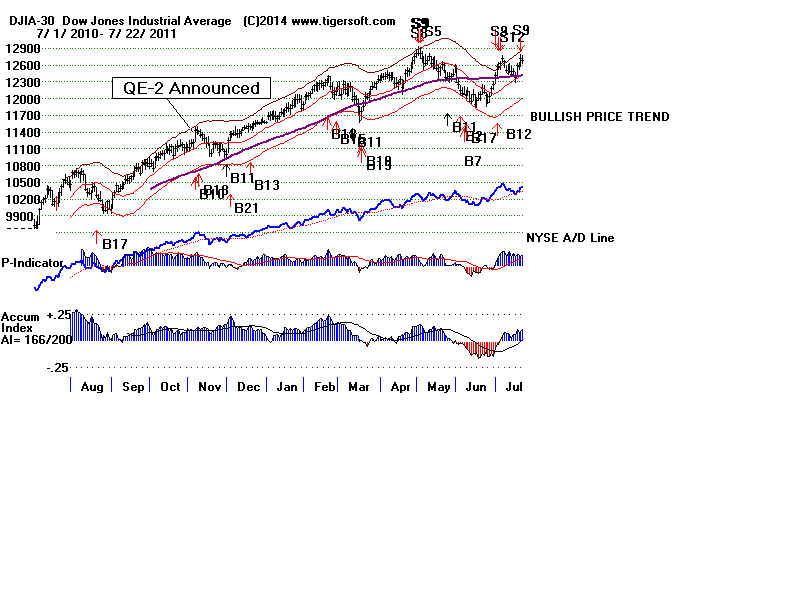

Quantiative Easing

See http://en.wikipedia.org/wiki/Quantitative_easing

Phase 1 -

In late

November 2008, the Federal Reserve started buying $600 billion in mortgage-backed securities.[37]

By March 2009, it

held $1.75 trillion of bank debt, mortgage-backed securities, and Treasury notes;

this amount

reached a peak of $2.1 trillion in June 2010. Further purchases were halted as the economy

started to

improve, but resumed in August 2010 when the Fed decided the economy was not growing robustly.

After the halt in June 1010, holdings

started falling naturally as debt matured and were projected to fall to $1.7

trillion by 2012. The

Fed's revised goal became to keep holdings at $2.054 trillion. To maintain that level,

the Fed bought $30

billion in two- to ten-year Treasury notes per month.

Phase 2 -

In

November 2010, the Fed announced a second round of quantitative easing, buying $600

billion

of Treasury securities by the end of the second quarter of 2011.[38][39]

Phase 3 A

and B-

"QE3",

was announced on 13 September 2012. In an 11–1 vote, the Federal Reserve decided to

launch

a new $40 billion

per month, open-ended bond purchasing program of agency mortgage-backed securities.

Additionally, the

Federal Open Market Committee (FOMC) announced

that it would likely maintain

the federal

funds rate near zero "at least through 2015."

On 12

December 2012, the FOMC announced an increase in the amount of open-ended mortgage

purchases

from $40 billion to $85

billion per month.[47]

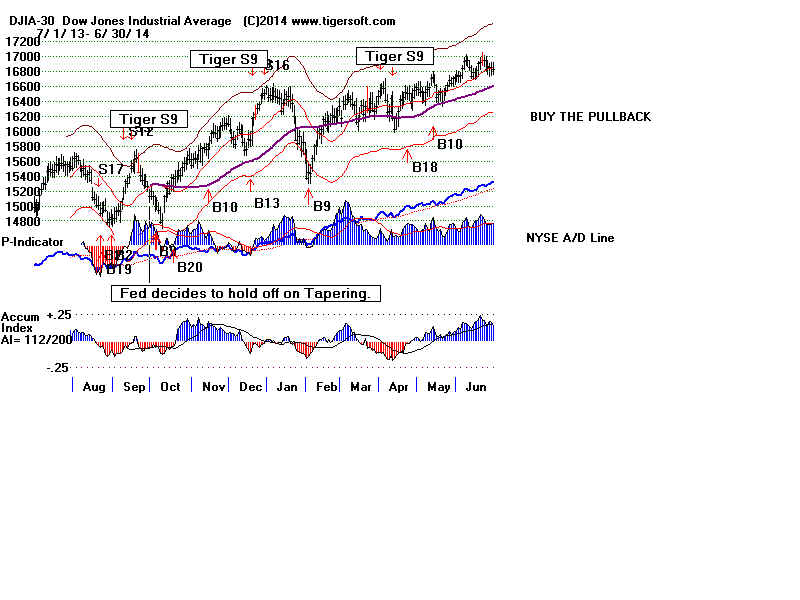

Tapering

19

June 2013, Ben

Bernanke announced a "tapering" of some of the Fed's QE policies contingent

upon

continued positive economic data.

Specifically, he said that the Fed could scale back its bond purchases

from $85 billion to $65 billion a

month during the upcoming September 2013 policy meeting.[48

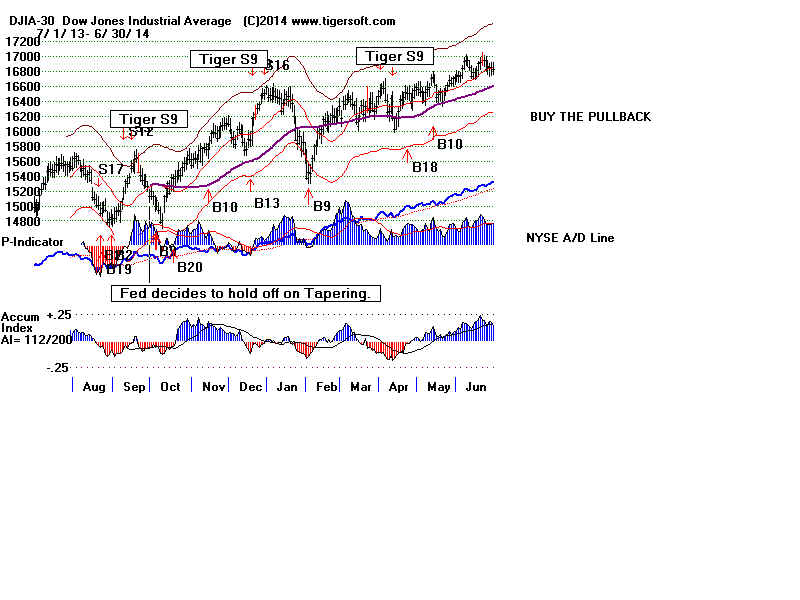

September 2013, the Fed decided to

hold off on scaling back its bond-buying program.[51]

But morthage purchases were halted

on October 29, 2014.[52]

after accumulating $4.5 trillion in assets.[53]

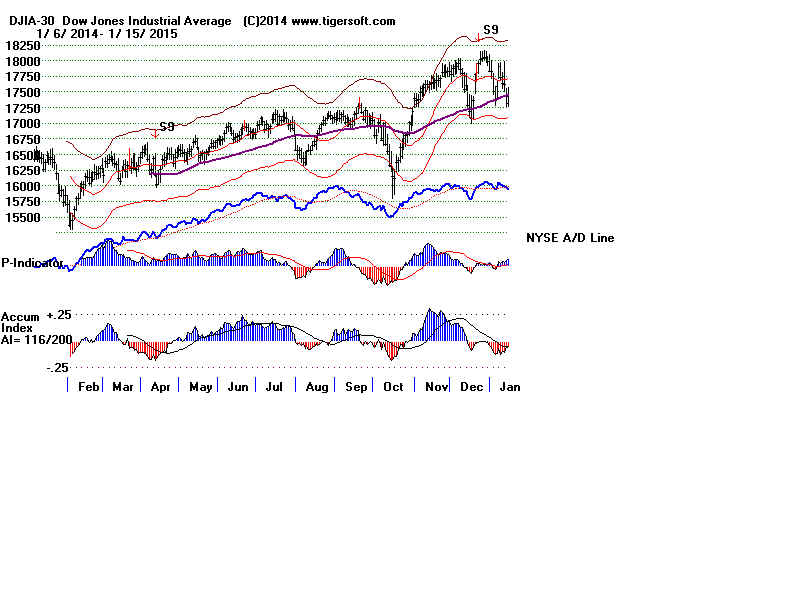

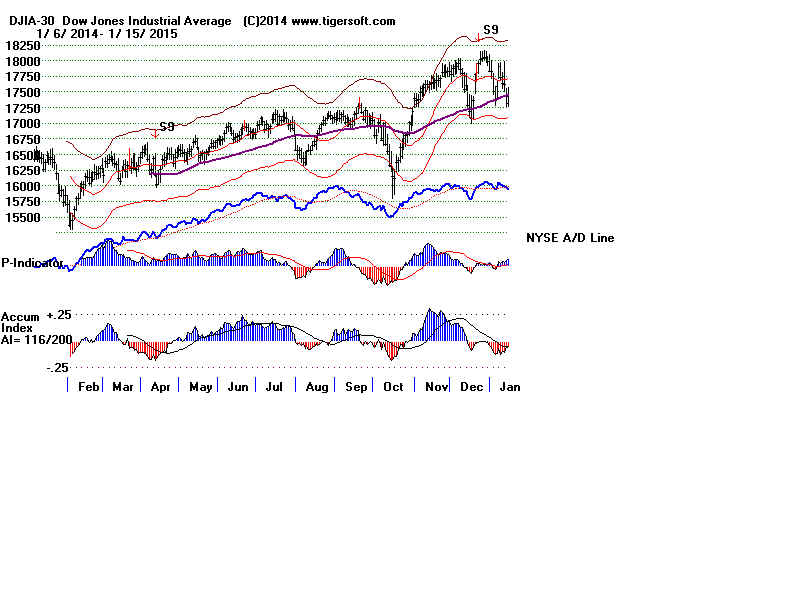

Dec 2014 - fell

to 2.0% lower band, so far

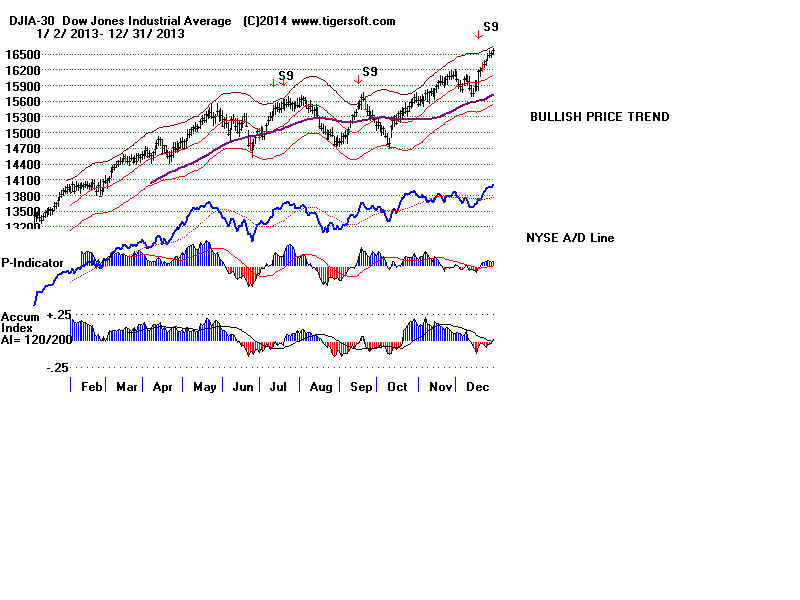

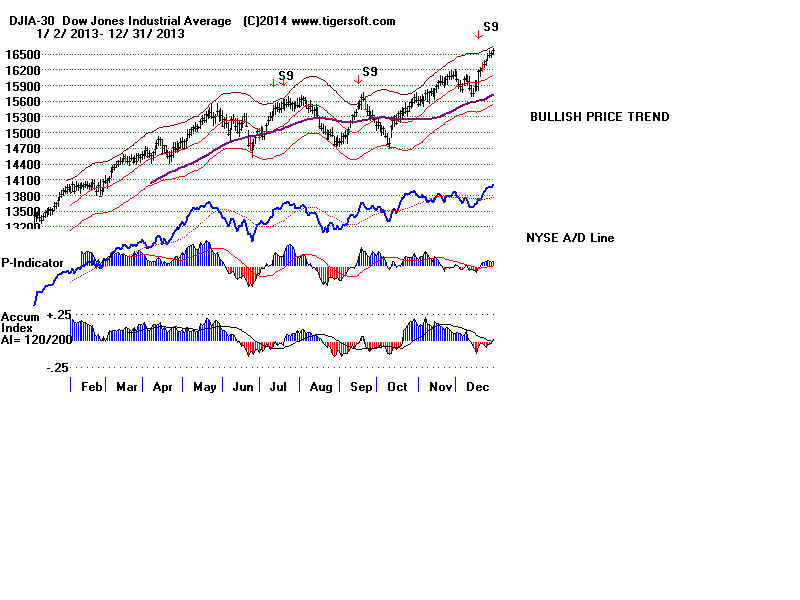

Dec 2013 - rose 2% and then fell below 3.5% band.

Dec 2011 - DJI fall

only to 21-dma and then DJI rallied strongly.

Dec 2009 - rose 2% and then fell slightly below 3.5%

band.

----------------------------------------------------------------------

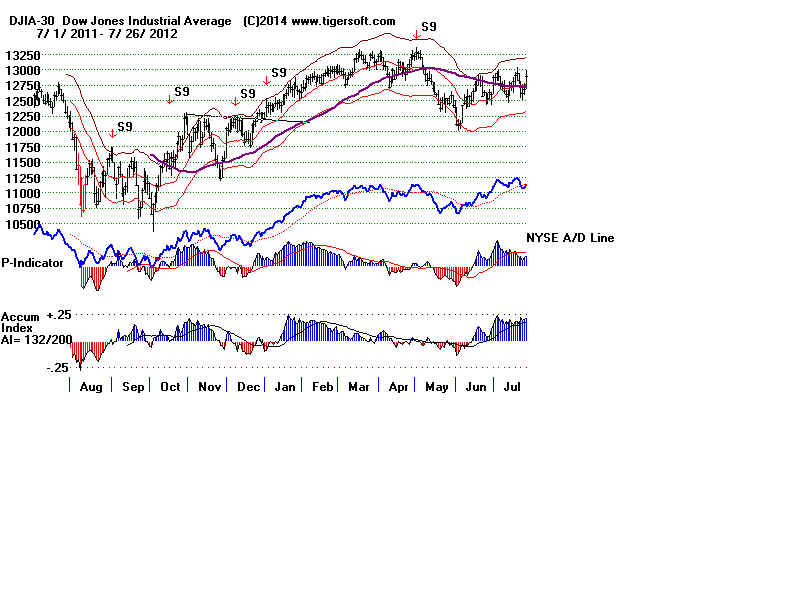

Oct 2012 - fell below lower 3.5% band

Oct 2011 - Tiger S9 failed.

Sept 2013 - fell to

lower 3.5% lower band

Aug 2011 - fell below lower 3.5% band

July 2013 - fell

to lower 3.5% band.

July 2011 - fell far below lower 3.5% band

May 2012 - fell below lower 3.5% band

Apr 2014 - Tiger S9 failed.

March 2014 - fell to 1.75% lower band

Jan 2012 -

Tiger S9 failed.

Jan 2011 -

Tiger S9 failed.

----------------------------------------------------------------------------

|

|

|

|

|

|

|