Crude Oil Looks Like It Has Bottomed

(C) 2015 William Schmidt, Ph.D. www.tigersoft.com

All Rights Reserved

1/30/2015

-------------------------------------------------------------------------

Crude Oil bottoms typically occur when Professionals shift from being net

sellers

and become net buyers. Professionals on Wall Street know first.

They know a

bottom has been made long before the headlines tell the average investor or

consumer.

For informed investors this simple insight can be very profitable.

That's because

Our TigerSoft Closing Power tells investors when Professionals make this

shift.

TigerSoft's Closing Power measures what professionals are doing. When

the (blue)

Closing Power is falling, they are net sellers and when the Closing Power is

rising,

they are net buyers. It follows from this that we can expect the

declining trend in

Closing Power to come to an end almost exactly when Crude Oil prices are

about

to reverse and go up significantly. And sure enough, this is exactly

what we find when

we study the past and look at every significant bottom in Crude Oil since

1980..

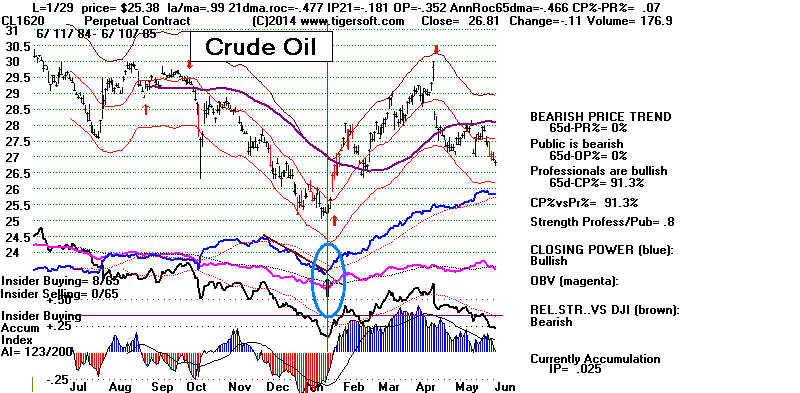

First consider the Crude Oil year's Chart for 1/30/2015. See how the

blue

Closing Power has just broken its downtrend. This is quite bullish for

Crude Oil

in our opinion.

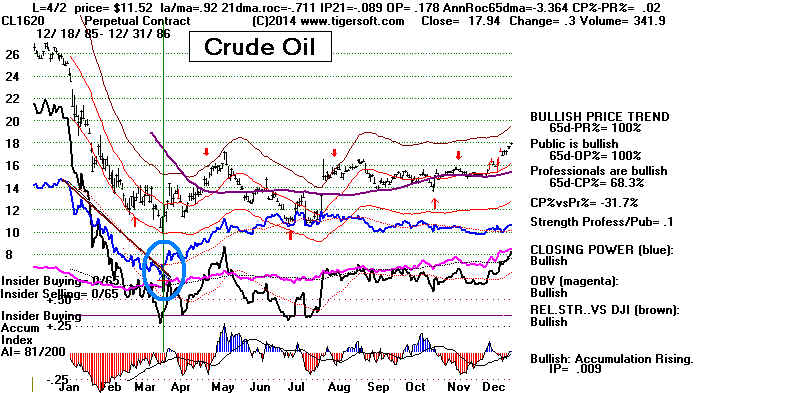

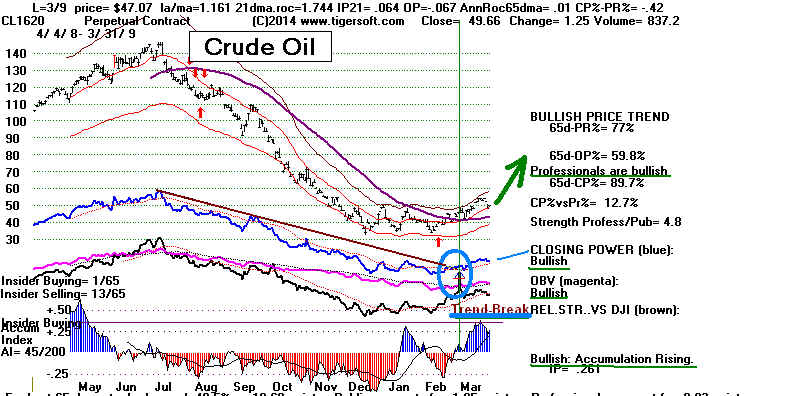

Study the charts below. You will see how Closing Power

downtrend-breaks

exactly called the most significant Crude Oil bottoms, those of 1984, 1986,

1999 and 2009. The Tiger Closing Power turns upwards show us that

Professionals have become bullish. In fact, they are buying buying from

the broader Public, who still expect lower prices, based on the stream

of headlines they read about falling fuel prices.

Crude Oil Bottom in 1984

Crude Oil Bottom in 1986

Crude Oil Bottom in 1999

Crude Oil Bottom in 2009

You can see from the very Long-Term Charts of Crude Oil that these were

the most signifiant

bottoms. http://www.macrotrends.net/1369/crude-oil-price-history-chart