TigerSoft and Peerless Daily

Hotline

http://tigersoftware.com/112221-H/

===========> IMPORTANT <=============

Subscribers will get Friday or Saturday

a new Hotline IP address to start Sunday.

-----------------------------------------------------------------------------------------------------------------------

(C) 1985-2014 William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

Tiger Software 858-273-5900

PO Box 22784 San

Diego, CA 92192

Email william_schmidt@hotmail.com

Previous Hotline - http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

----------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

with you and a violation of copyright laws. I work hard for you. Respect that

effort!

---> To

renew this Hotline,

order here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

-----------------------------------------------------------------------------------------------------

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

Peerless Signals: 1915-2013

Peerless Signals: 1915-2013

New Peerless

Signals and DJI Charts - version 7/4/2013

1965 1965-6

1966

1966-7

1967

1967-8

1968

1968-9

1969 1969-70

1970

1970-1 1971

1971-2

1972

1972-3

1973

1973-4

1974

1974-5

1975

1975-6

1976

1976-7

1977 1977-1978

1978 1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983

1983-1984

1984 1984-1985

1985 1985-1986

1986

1986-1987

1987

1987-8

1988 1988-9

1989

1989-90

1990 1990-1

1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996

1996

1996-7 1997 1997-8

1998

1998-1999

1999

1999-2000

2000

2000-1

2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005

2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009 2009-10

2010

2010-11

2011

2011-12

2012

2012-2013

Background and New Studies

Introduction to

Tiger/Peerless Buys and Sells.

Peerless Charts and Signals

Documentation for TigerSoft

Automatic and Optimized Signals.

How reliable is a rising

200-day ma? 2/9/2014

The New 2014 Peerless.exe Software has now been posted on the Elite Stock Professional

Page.

==================================================================================

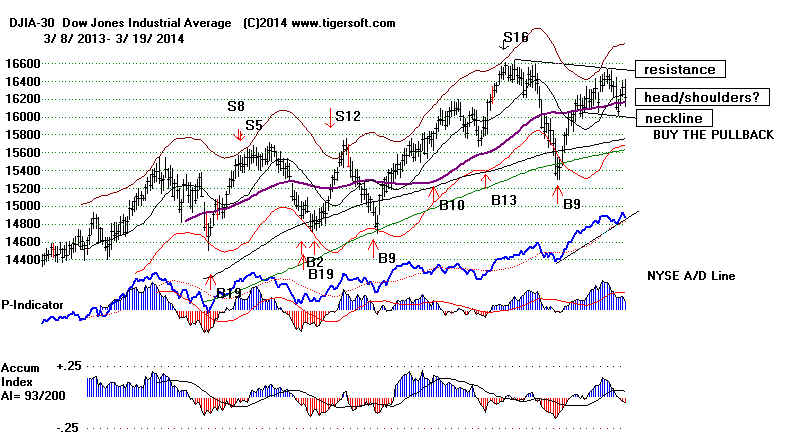

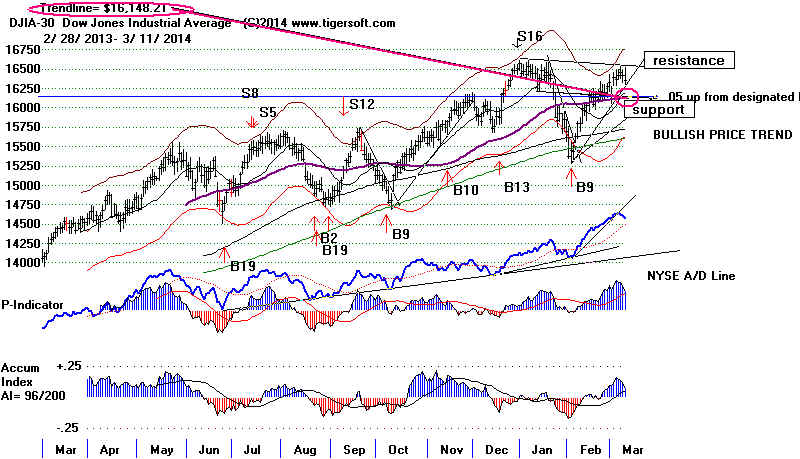

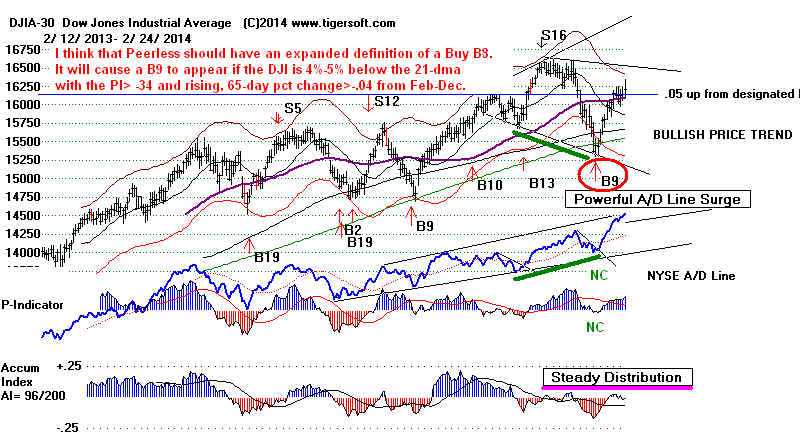

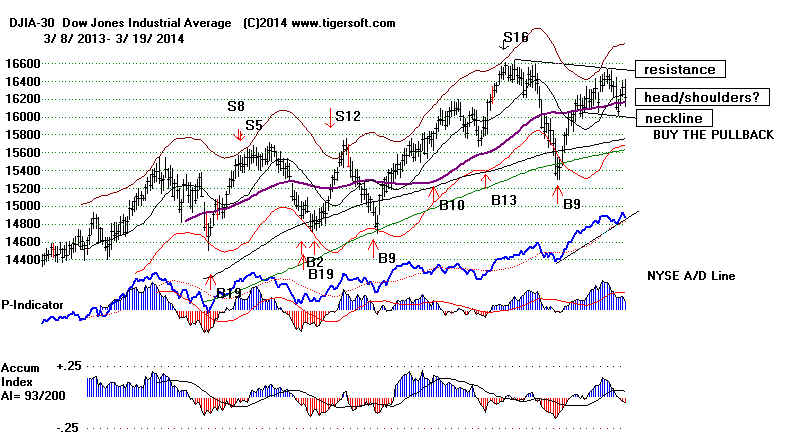

3/20/2014 If news of a more hawkish Fed cannot bring about a

correction,

the market's bullishness must be respected. In addition,

today's DJI

rally makes it appear that the "expanded Buy B9" will

probably

not be reversed by the head/shoulders pattern in the DJI.

Hold IWM

and a mix of Bullish MAXCP stocks along with some of

the weakest

Bearish MINCP stocks. Coal stocks fell sharply today

among the

bearish MINCP stocks. This illustrates the advtange of

hedging

particularly by shorting any group that is heavily represented

among the

bearish MINCP stocks. Bullishly, a number of semi-conductor

stocks like

ADEP, ADI and AMAT

are now Bullish MAXCP stocks.

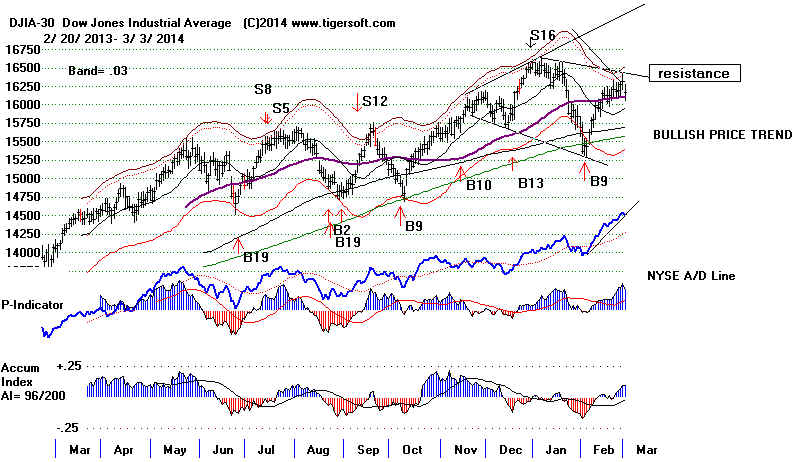

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 152 +49 MAXCP stocks Bullish MAXCP Stocks (3/20/2014) Bullish plurality

--> 70

-9 MINCP stocks Bearish MINCP Stocks (3/20/2014)

--> 92 +9 New Highs on NASDAQ 10 new lows. Bullish plurality

--> 60

-18 New Highs on NYSE 14 +9 new

lows. Bullish

plurality

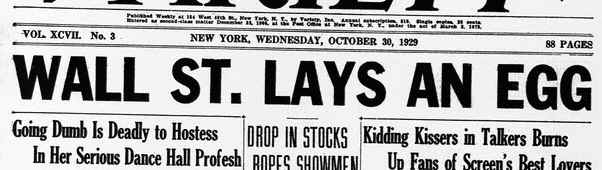

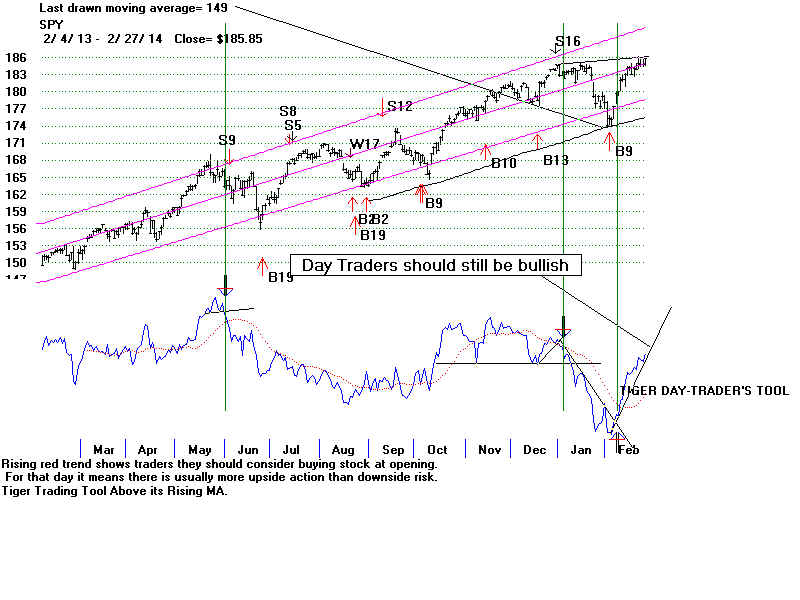

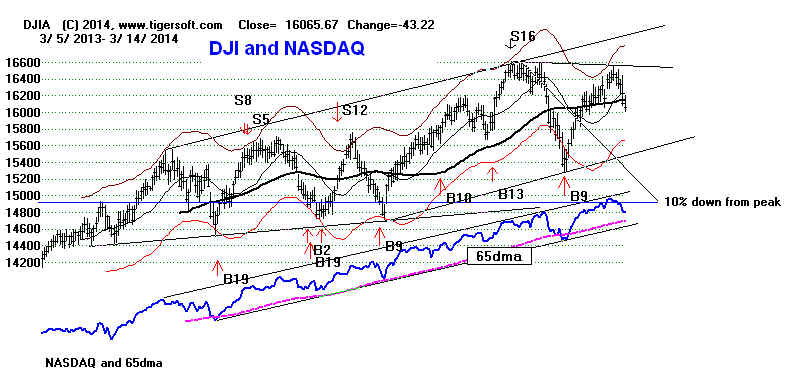

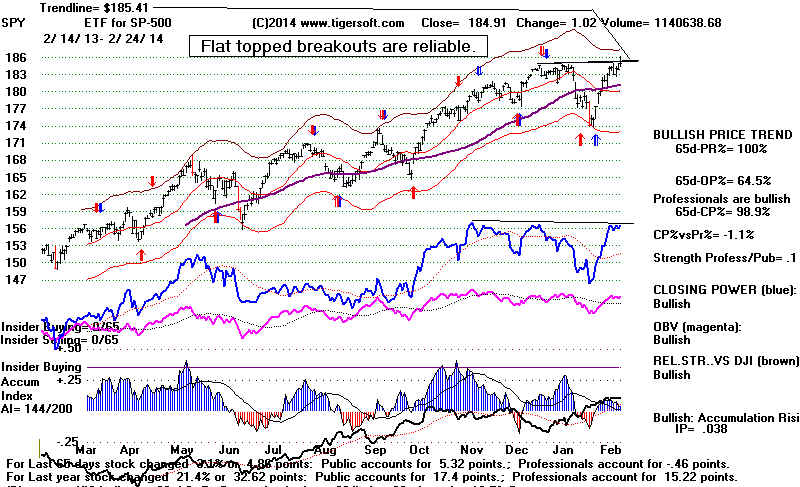

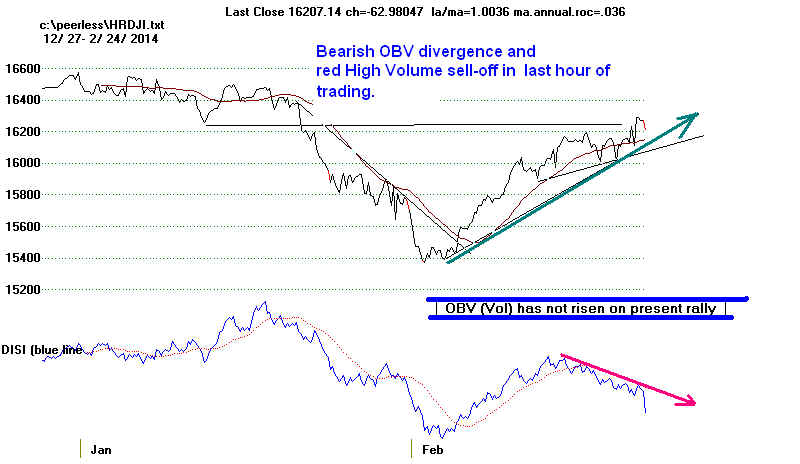

Head/Shoulders? The DJI rallied 109 up to the apex of the right shoulder in

the

potential

head/shoulders pattern mentioned last night. The Hourly DJI chart

shows this

most precisely. Now an hourly reading much above 16360 would

destroy the

symmetry of the pattern and thereby render more impotent its

bearishness. Additional strength in the DJI will force shorts in the general

market ETFs

to cover. The DJI would next be expected to challenge 16600.

and the

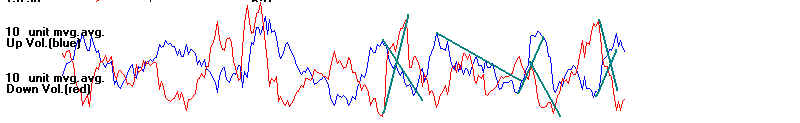

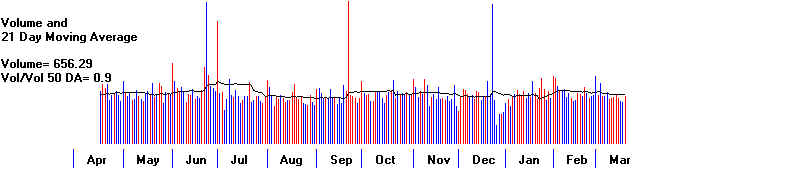

flat resistance there. Surprisingly, breadth was negative today. That

and the low

up-day and up-hour volume will work against a DJI breakout past

16000.

We will also want to watch to see if the other general market indexes'

key ETFs

can bullishly destroy their own head/shoulders pattern.

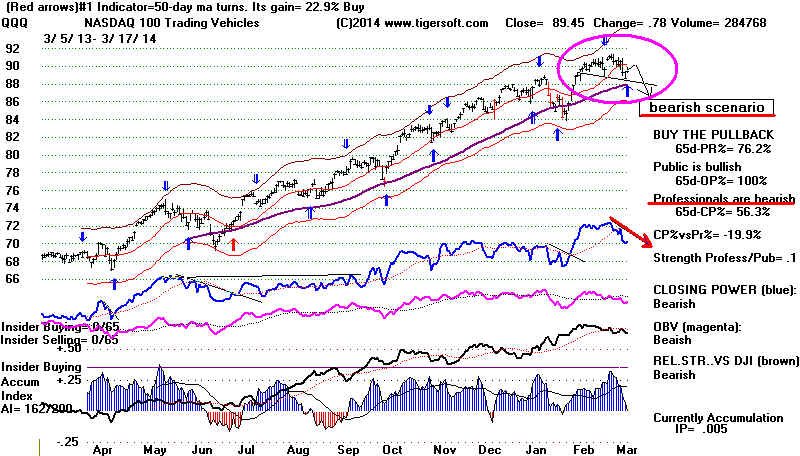

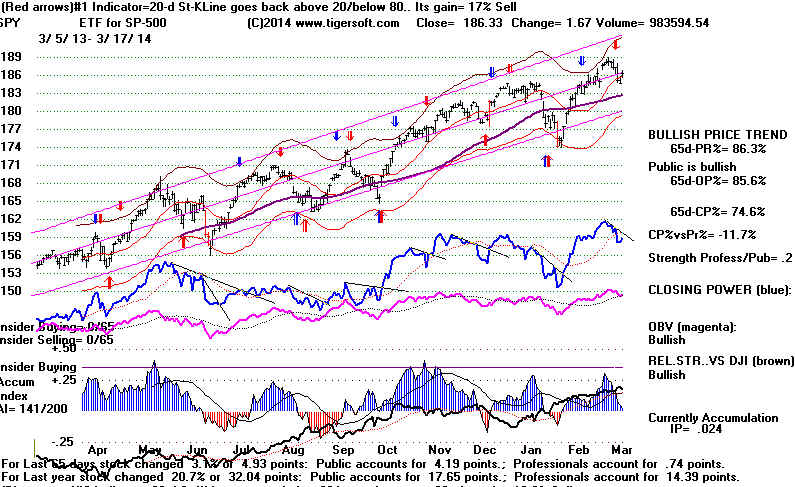

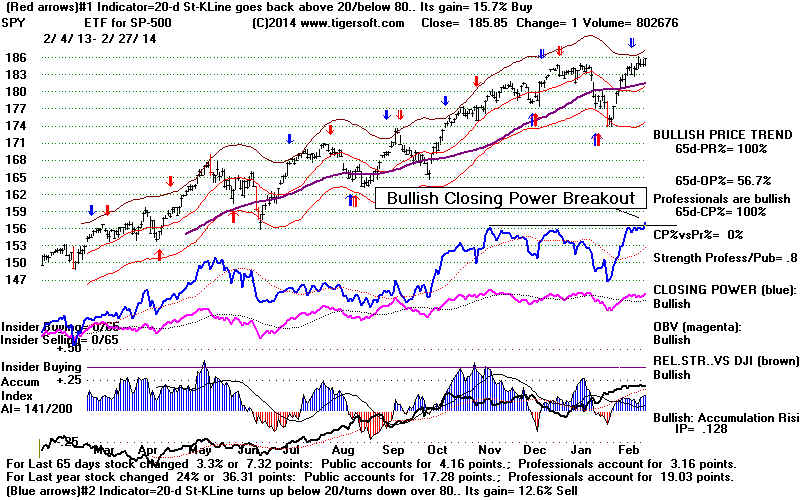

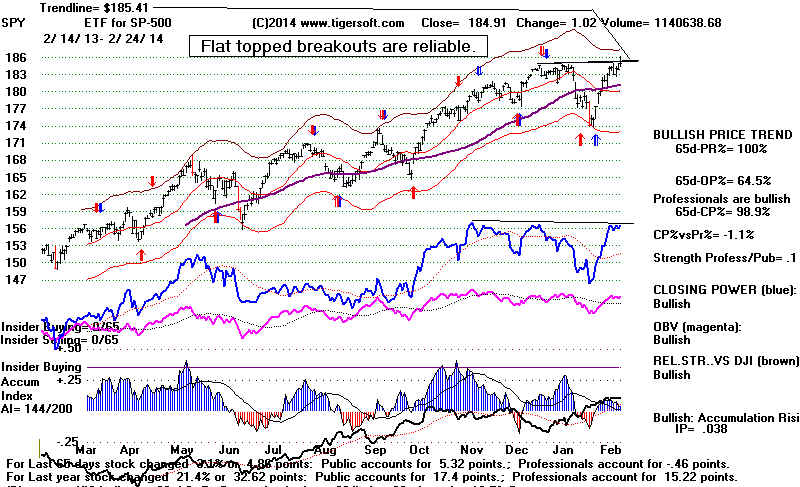

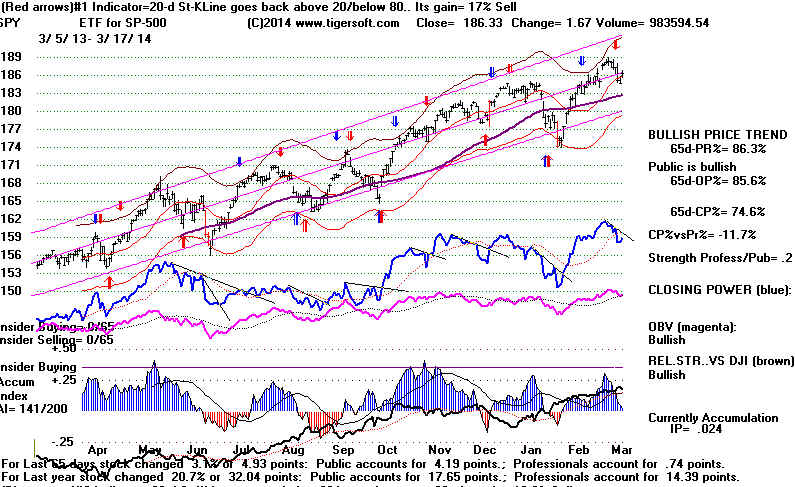

SPY's

Closing Power has broken its downtrendline. it closed at 187.75.

It seems

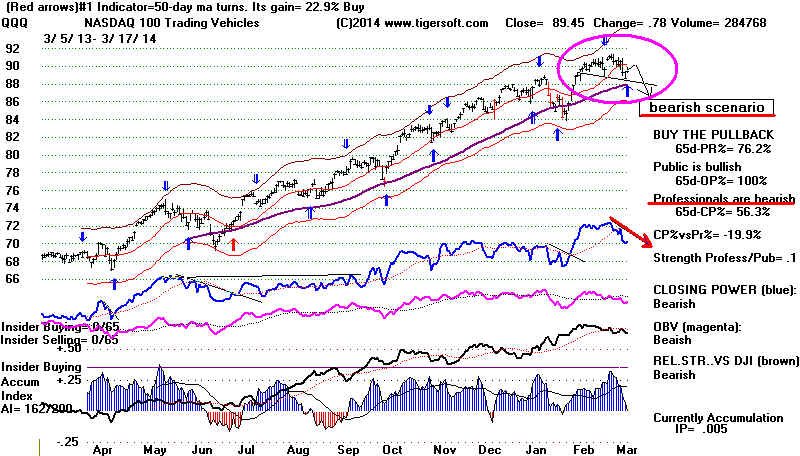

bound to make a nominal new low above 190. QQQ's Closing

Power has

not yet been pentrated. QQQ, now 90.29, will need to rise past

91.00 to

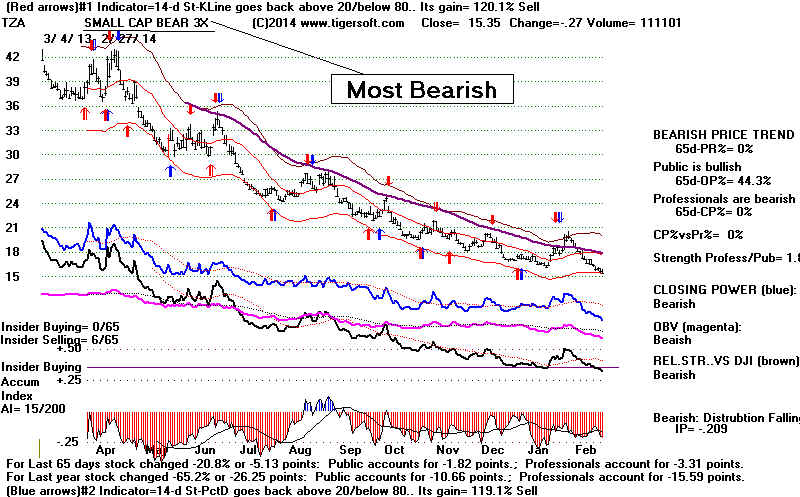

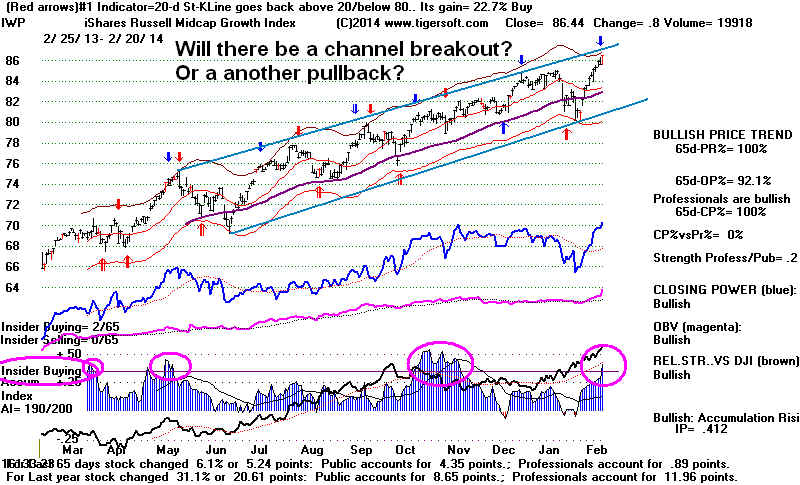

abort its Head/Shoulders. IWM shows the most underlying

Accumulation. Its Closing Power is bullishly angling up. But its rise today

was

very small. It needs to surpass 10.5 to make a new high.

While a DJI

breakout above the flat overhead resistance seems unlikely

based on

the up-day volume being lower than down-day volume this year,

a valid

breakout to 16800 would then be headed for its minimum upside

objective

of 17800.

==================================================================================

OLDER HOTLINE

==================================================================================

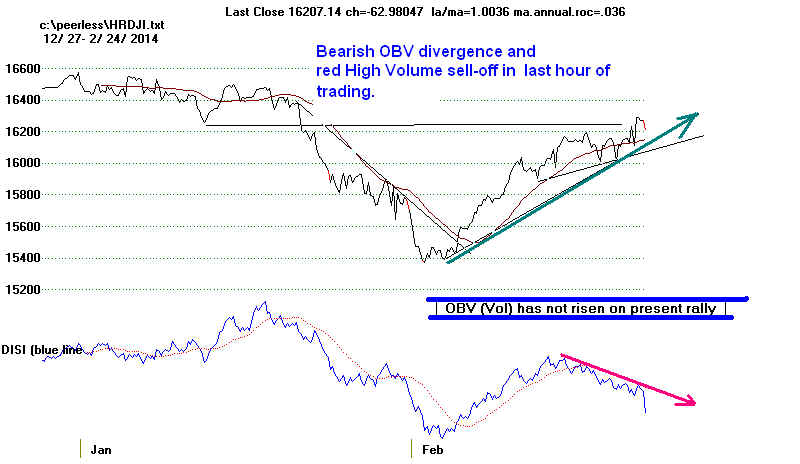

3/19/2014 The DJI seems

locked in a narrow trading range: 16000-16600.

Small caps

are favored now. A bearish head/shoulders in the DJI must be watched

for.

Stay

Hedged. The bearish scenario of a Head/Shoulder Pattern

got new

life today from a very cautious Janet Yellen today. (At one point, it almost seemed

that she

had the same scared look in her eyes that Hank Paulson showed in

October

2008.) She was no Wall Street cheer-leader today. Professionals

lnew in

advance. That was why the Closing Powers of DIA, SPY and QQQ

could not

break their recent downtrend.

No upside

breakout likely. Yellen badly disappointed the Bulls today. Now we have

to worry

about sudden head shoulders patterns suddenly appearing. This is the

way Wall

Street quickly re-adjusts to unexpected bearish news. There are many

examples of

this. This is an important part of Peerless. DJI head and shoulders

can and do

bring big market declines. We must heed a break in the DJI neckline

as a judged

Sell S10 if one occurs. A strong A/D Line helps deter such a bearish

development, but it cannot, by itself, prevent such a breakdown, especially

if there is

a sudden and unexpected change of economic policy. This is what

causes the

head/shoulders.

Usually,

such H/S Sell S10s involve invasions (North Korea-1950, Iraq-1990),

impending

attacks (Pearl Harbor-1941 and 9/11/2001) and impending assasinations

(JFK-1963)

heart attack (Eisenhower-1955). Berlin Blockade of 1948 is another

example.

Bearish

head/shoulders can also occur because of important economic developments

and policy

changes in DC (notably, Nixon's 1971 cessation of selling Gold

on demand

for Dollars), Truman's reluctance to quickly stop the many labor strikes

of 1946 and British Petroleum's

massive oil spill's threat to the Southern Gulf's

economy and

ecology. Another example: in early 1994, the Fed

suddenly boosted

short-term

rates. A quick head/shoulders appeared and the DJI dropped 10%.

Yellen

might today have taken the opportunity of speaking today to allay investor fears

that about

a stock market bubble. Instead, she

suggested interest rates might go

up

sooner than was expected. When pressed, she said the FED would probably

end QE-III

(Fed bond buying) completely in 6 months and start raising interest rates

6 months

later. This was not at the end of 2015, as Bernanke had previouly laid out

as the Fed

plan, or 2016 as has widely been assumed by Wall Street economists

going into

the meeting.

The Public

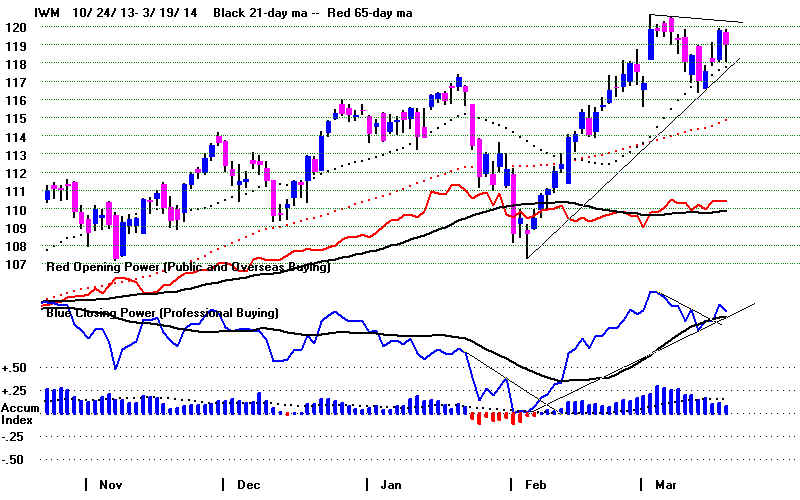

is still in a mood to speculate. High Accumulation, smaller stocks may

be the last

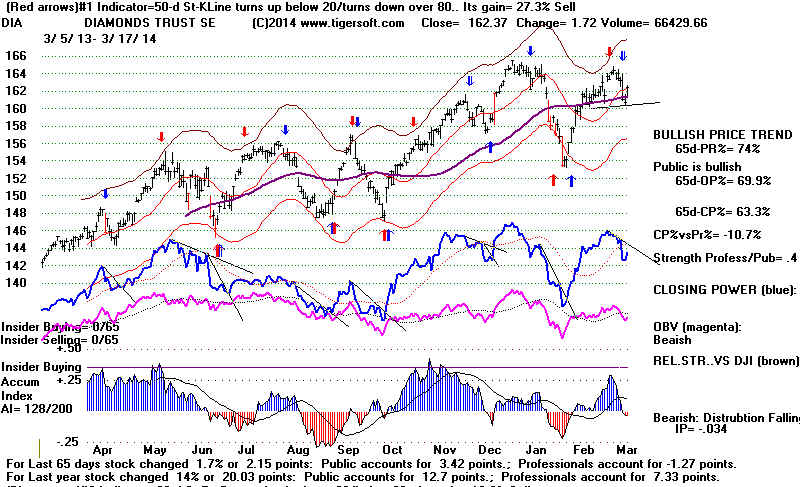

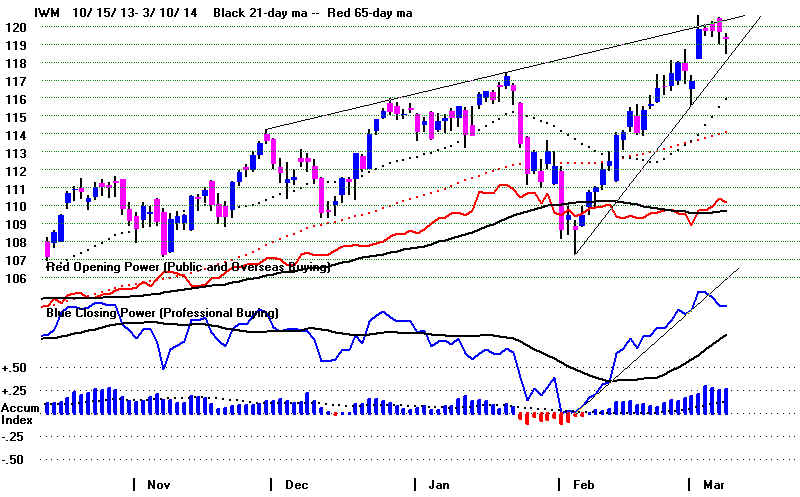

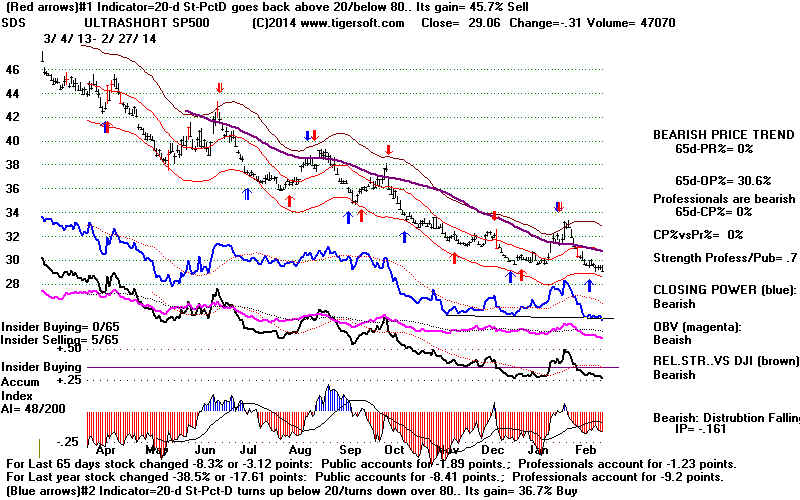

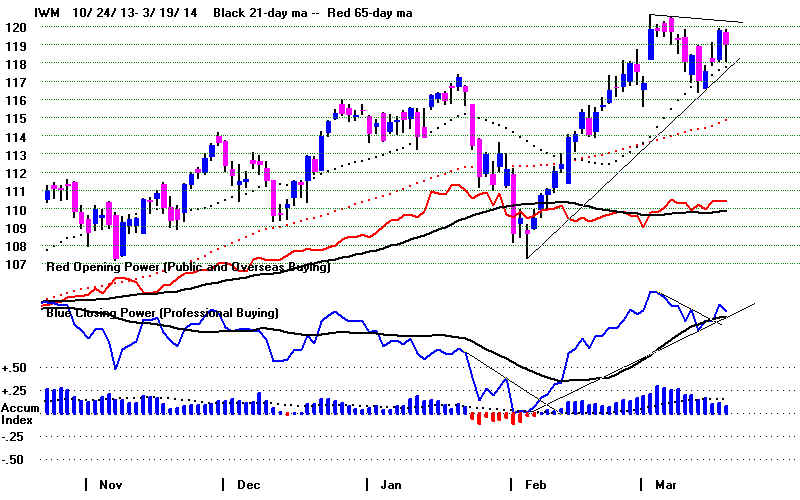

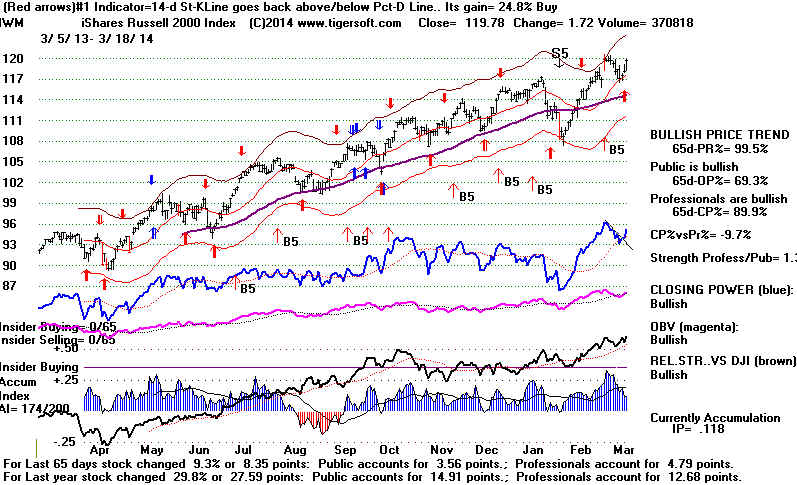

to top out. IWM's Closing Power is in an uptrend. Bearishly,

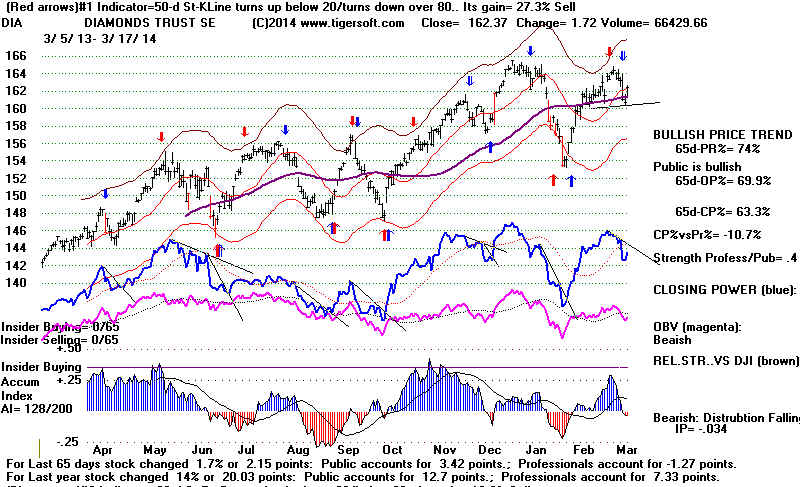

the CP of DIA, SPY and QQQ are falling. DIA is the weakest. Note its

negative

Accumulation Index, too.

Our

Stocks' Hotline is hedged, long about the same number of Bullish

MAXCPs

as it

is short Bearish MINCPs.

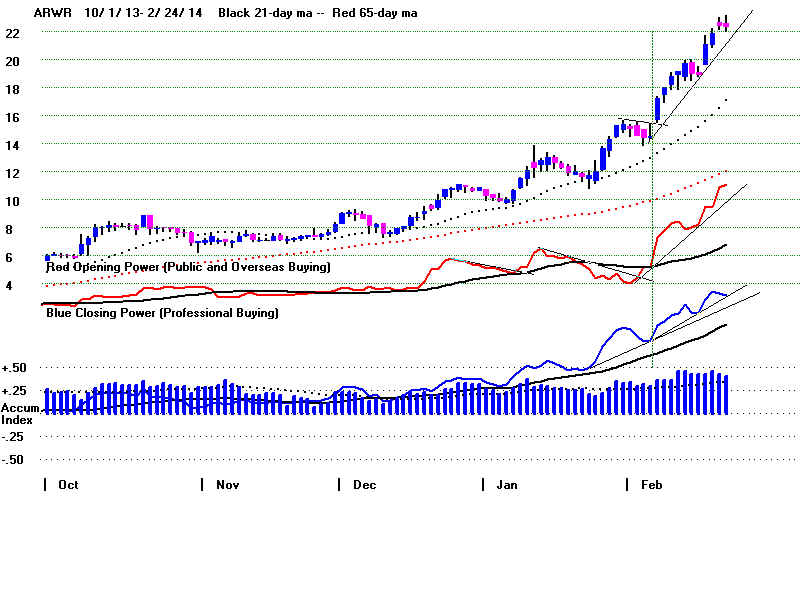

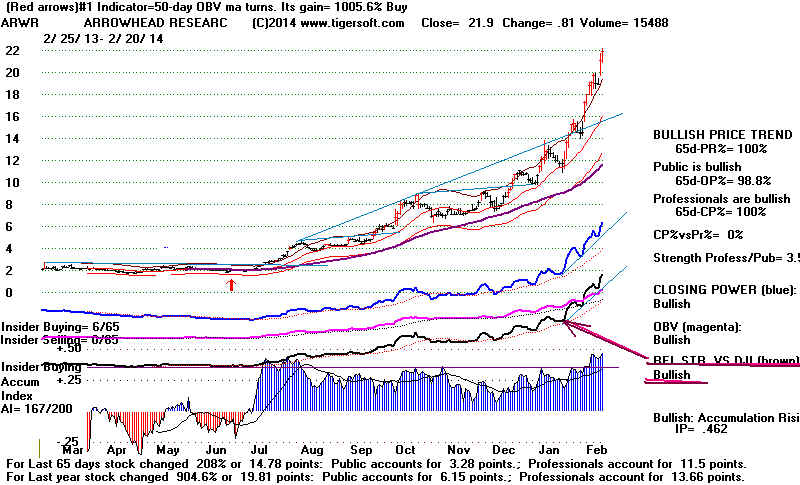

IMPORTANT. We see that the market becoming much riskier.

This is what one

must expect

after 5 years of a bull market without more than an 18% correction.

In this

context, consider hedging like our Stocks' Hotline is doing. In addition,

know when

Tiger advises selling individual stocks. See some

examples here.

1) Closing Power non-confirmations followed by CP trend breaks.

2) Peerless Sells followed by CP trendbreaks.

3) Very big advances followed by high volume reversal days (big red popsicles)

4) Very big advances followed by CP trendbreaks.

5) Very big advances followed by OBV NCs, IP21 NNCs and CP trendbreaks.

6) Very big advances followed by head/shoulders patterns.

7) Very big advances followed by breaks of their 65-dma with IP21<0.

--> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 103 -51 MAXCP stocks Bullish MAXCP Stocks (3/19/2014) Bullish plurality

--> 79

+52 MINCP stocks Bearish MINCP Stocks (3/19/2014)

--> 83 +8 New Highs on NASDAQ 10 new lows. Bullish plurality

--> 78

+27 New Highs on NYSE 5 -3 new

lows. Bullish

plurality

==================================================================================

OLDER HOTLINES

==================================================================================

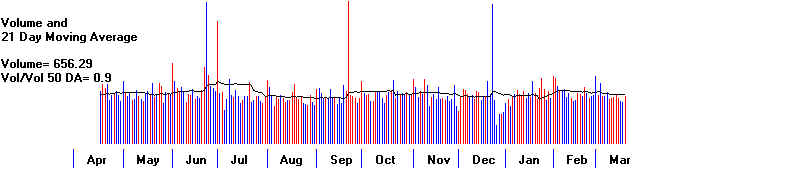

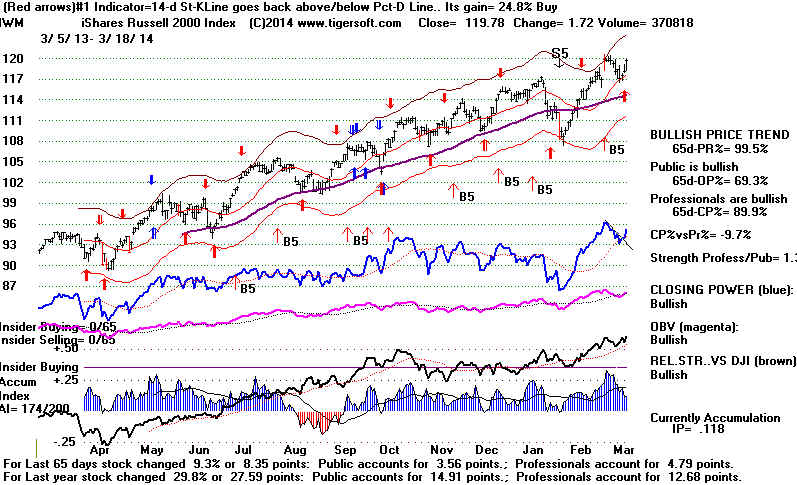

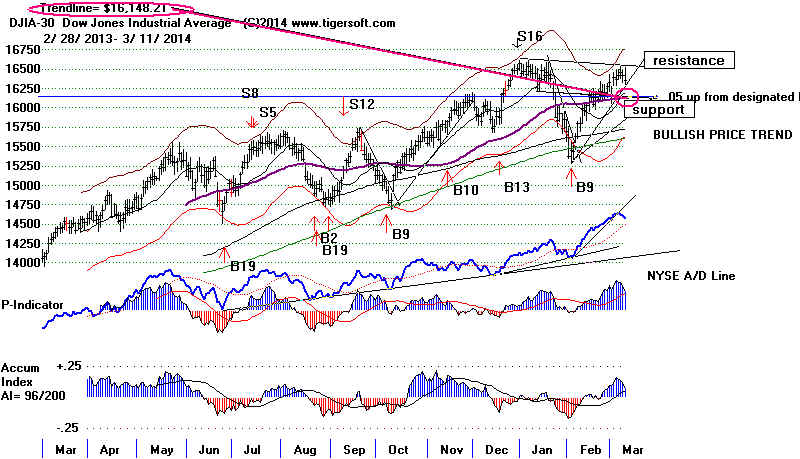

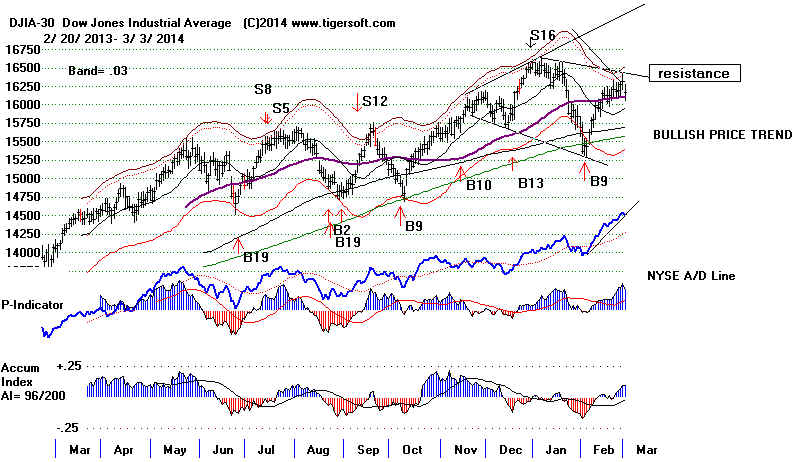

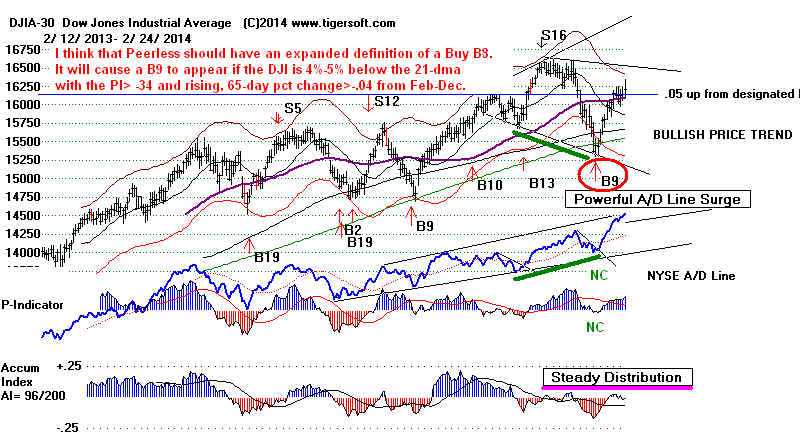

3/18/2014 Super Woman To The

Rescue!?

The NYSE A/D Line

made a new high ahead of the DJI and all the other key indexes.

This is too

bullish to argue with. IWM is the strongest of the major market ETFs.

|

Unless Yellen disappoints investors in her news conference

tomorrow the

excellent breadth (NYSE advances - declines) should allow the

DJI to challenge

the nearly flat 13600 resistance. The Accumulation Index

being negative is

a warning that the overhead supply has not been eaten up.

The relatively

low volume makes a breakout less likely. But, a breakout above

16600 by the DJI

could set up a new target of 17600 if volume and the IP21

start improving.

|

The downtrending

Closing Power of IWM has been bullishly broken above

The downtrends of

the Closing Power for SPY, QQQ

and DIA's have not yet

been broken.

QQQ will need another good day to destroy its potential head/shoulders

pattern.

When that takes

place, short-covering should become very apparent. A good

NASDAQ rally to

new highs would likely take place.

We know that

Closing Powers start to lag at the end of a bull market.

So, with the DJI back above its 65-dma and the A/D Line making

another new high

ahead of price, it's hard to argue against the broader market's

uptrend.

The "expanded Buy B9" has not been reversed by a Peerless Sell.

The number of

MAXCPs is now greater than the number of MINCPs. Traders

must expect

Yellen to assure investors again that she does not see signs of

excessive

speculation.

--> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 154 +70 MAXCP stocks Bullish MAXCP Stocks (3/18/2014) Bullish plurality

--> 47

-43 MINCP stocks Bearish MINCP Stocks (3/18/2014)

--> 83 +8 New Highs on NASDAQ 10 new lows. Bullish plurality

--> 78

+27 New Highs on NYSE 5 -3 new

lows. Bullish

plurality

With an A/I 200

score of 174 and a decisive break in its CP downtrend,

IWM looks like the best ETF to buy even now, provided one is

willing

to sell when it

breaks its new Closing Power uptrend. I would not buy the

high Power-Ranked

leveraged ETFs, URTY and TNA now. Both are working

against red and

blue automatic Sells that have worked well this past year.

UTX (United Techn.) is the highest AI/200 stock now in the

DJI-30. Our

water

desalinization stocks also seem good plays now. Our favorite silver

stock, SSRI has

now doubled since it surpassed its 65-dma in December.

Take some profits

in it. Use cross-overs of the 65-dma to buy beaten-down

stocks you

believe in is the lesson here.

MSFT broke out today. Investors believe its abandoning of

its XP market,

which is what

runs 30% of the entire world computers, will bring lots of new

customers over to

buy Windows8. We'll see. Right now one can buy a fast

refurbished DELL

XP laptop on EBAY for less than $150 that runs Tiger

and Peerless

perfectly. MSFT's move may increase the number of such

computers for

sale for a while. Take advantage of this dumping of good

Dells.

Having a backup computer to run Tiger seems a good plan. In 2006,

they cost $1500

new.

A DJI breakout

past 16600 on rising volume could give us a bullish inverted

head and shoulders

pattern with an upside target of 17600.

==================================================================================

3/17/2014 I warned

traders here two weeks ago that news of Yellen's

making a

speech should be used to BUY. Such is her "dovish" reputation

on Wall

Street.

Sure

enough, word this morning that the Fed's leading monetary dove

would speak

Wednesday or Thursday this week came to the rescue of

the stock

market again. Short-term, bews of her coming press conference

proved much

more important for the US stock market than complicated fears

that the

Ukraine might soon be pulled apart violently by long-suppressed ethnic,

religious

and political dislikes, not unlike those that broke Yugoslavia apart.

The Technical Picture

The good

news is that rally brought the DJI up above its rising

65-dma.

Along with

the break in the A/D Line downtrend and its presumed uptrend's

resumption,

its hard not to see the bulls still seem in control. The

"expanded Buy B9" has not been replaced with any Sell. The OEX's

Closing Power downtrend was even violated today, though the

other

ETFs' CP

downtrends were not.

Some

significant technical problems remain. Volume was much lower

on the

rally today than it was on the decline last week. The NASDAQ's

Relative Strength Indicator has turned negative. The

DJI's Accumulation Index

remains

negative and is in a downtrend. The DJI did not retreat close enough

to the

lower band to give a new Peerless Buy signal. And perhaps, most

important,

the QQQ

could be forming a bearish head and shoulders' pattern. Watch

it closely.

The most

bullish thing the markets can do now is keep on rallying. The

closes

should be higher than the openings. This will destroy the QQQ's

potential

head/shoulders pattern.

But when this rally is over, I think the bulls will be lucky to see

the DJI rally back

at the

early January highs. More backing and filling a little above where we are

seems the

most likely scenario for the next few days, as traders wait to see

what Janet

Yellen actually reveals about Fed intentions.

Will the

official Unemployment fall to 6.5%? Will official inflation reach +2.2%?

The Fed has

said such levels would cause it to start raising interest rates.

Is this

still the Fed's view? What else might Yellen have to say about big banks

and Wall

Street? Does she still see no bubble? My guess is that we will

probably

get a pretty good idea of what she will have to say by watching the Tiger

Closing

Powers. Right now, the DIA's, SPY's and QQQ's are still falling.

We can

afford to wait a little before adding to long positions. Our Tiger Stocks'

Hotline

remains hedged. Many of the Bearish MINCP stocks

actually fell today.

|

|

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 84 +35 MAXCP stocks Bullish MAXCP Stocks (3/17/2014)

--> 90

-55 MINCP stocks Bearish MINCP Stocks (3/17/2014) Bearish

plurality

--> 50 +14 New Highs on NASDAQ 10 -7 new lows. Bullish plurality

--> 51

+19 New Highs on NYSE 8 -8 new

lows. Bullish

plurality

==================================================================================

OLDER HOTLINES

==================================================================================

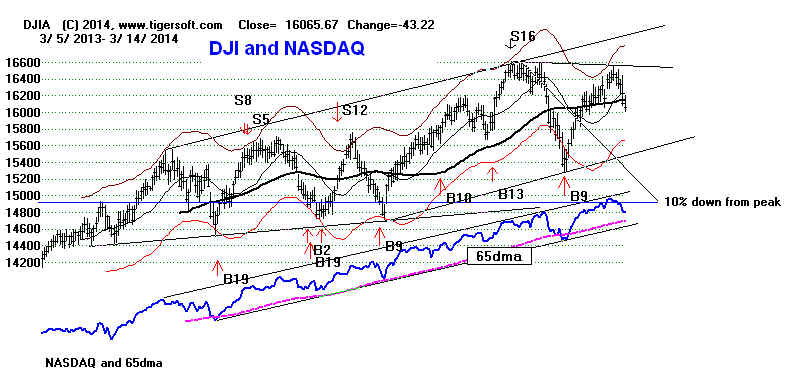

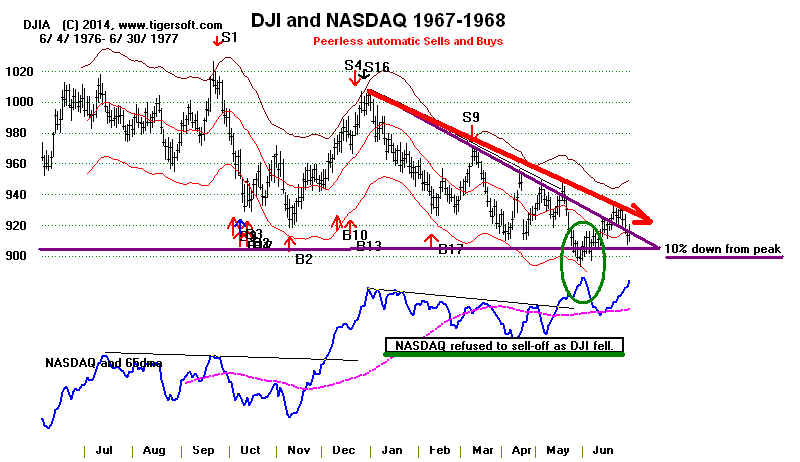

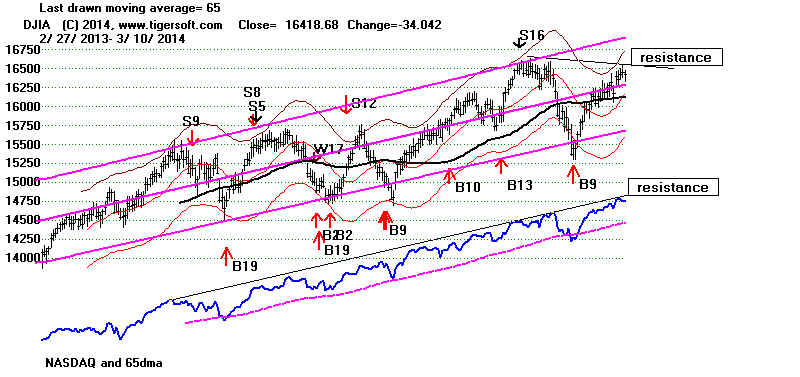

3/14/2014 It's a confusing

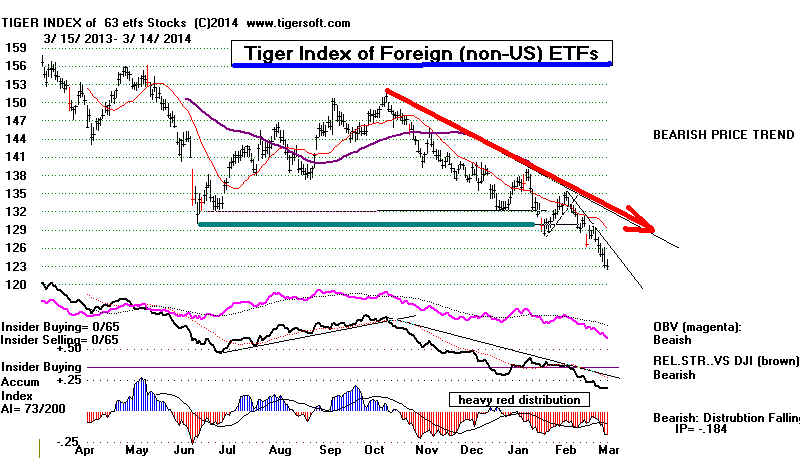

market now because the DJI and foreign markets

are so much

weaker than the other US indexes. Usually, the DJI eventually

wins such a

"tug of war", but it could take months if 2014 behaves like 1977

when the

DJI steadily eroded and stayed much weaker than the rest of the

market.

Or if we forget the good breadth, dismissing it as an artificial consequence

of

the Fed's

elongated policy of bank subsidies and low interest-rates, then the

market

takes on the appearance of 1967-1968, 1999-2000 and 2007-2008.

That is

would be bad: every new break in the A/D Line or a 65-dma will then cause

additional

heavy selling of some previously favored group, until in the

end, there

are not enough rising groups to support the market.

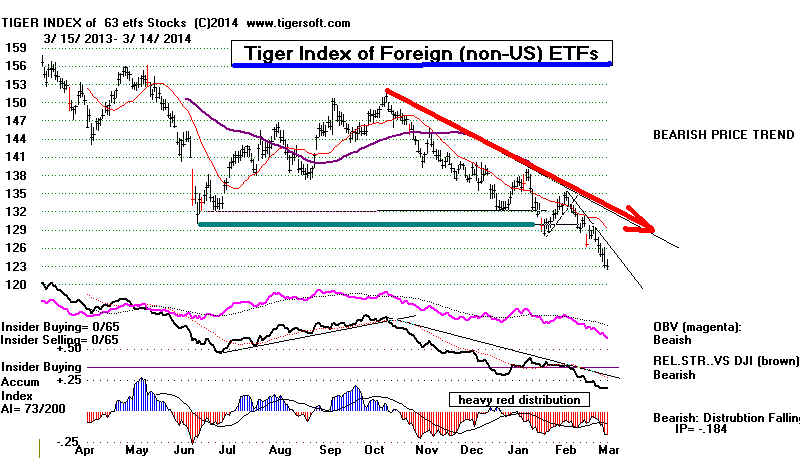

Distinguish

between the different markets and sectors by relative strength.

Trade long

the stronger markets and short the weak markets. They are going

in very

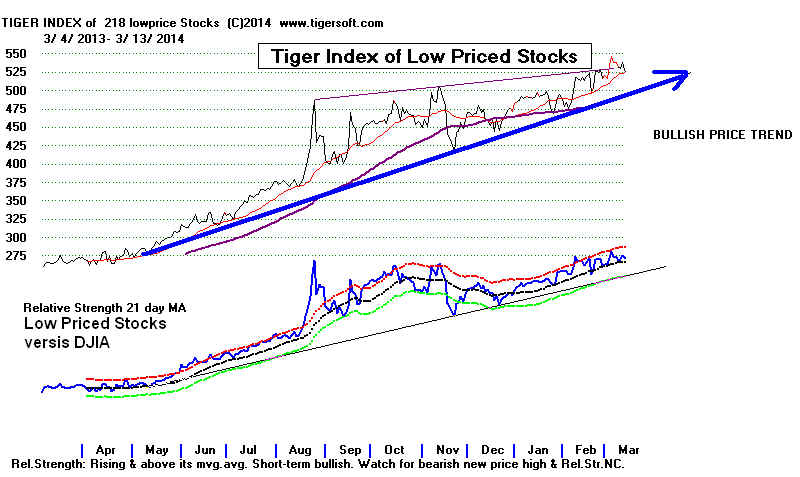

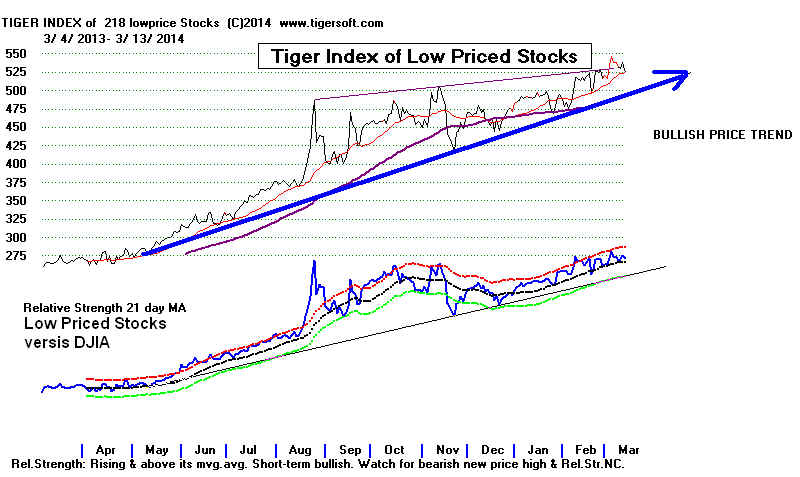

different directions. As an example, contrast the rising low-priced stocks now

with the

generally falling foreign ETFs.

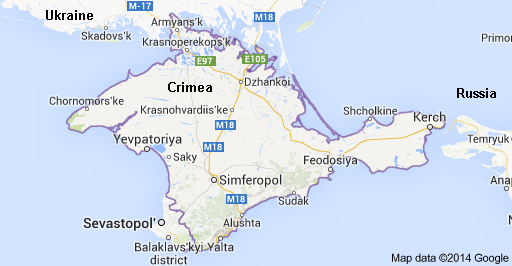

Crimea

voted to join Russia. The US has said it would employ sanctions against

Russia for

annexing it. The Europeons will be the ones who suffer from the

American

intrusion into matters 12,000 miles away. They need Russian natural

gas.

Early next week the DJI will retreat further below the support of its 65-dma.

Its next

best price support is at the February closing low of 15372.8.

|

|

The different markets' moves in this environment become quirkier and more short-term.

This means

we will want to use all our best short-term trading tools to supplement

and make

sense of the Peerless signals.

Friday, the

DJI did close below 16100, but breadth was positive and the NASDAQ

and many

secondary stocks are still strongly uptrending. It is important that

SPY and IWM have not fallen below

their 65-dma. Still, their Closing Powers

are

falling, so they are not yet "safe" to buy.

Leading biotechs fell further Friday, however. There is a flight

from well-known

growth stocks to

the safety of dividend paying stocks.

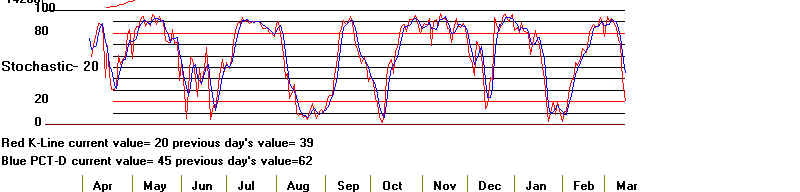

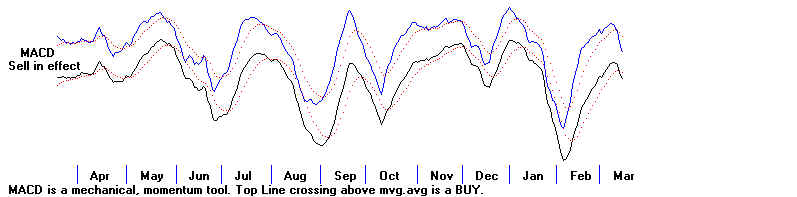

With the DIA, SPY, QQQ

and IWM Closing Powers falling, with the Stochastic-20s

not yet below

oversold (+20), with these ETFs' MACDs on Sells and their

Short-term IDOSC

readings falling, the market still seem svulnerable.

Being hedged now

with bearish MINCP stocks to match any long bullish

MAXCPs seems a reasonable approach. I see no reason

yet to buy a major

market ETF.

--> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 49 -52 MAXCP stocks Bullish MAXCP Stocks (3/14/2014)

--> 145

+68 MINCP stocks Bearish MINCP Stocks (3/14/2014) Bearish

plurality

--> 36 +13 New Highs on NASDAQ 17 -6 new lows.

--> 32

+18 New Highs on NYSE 16 -13 new

lows. Bearish plurality

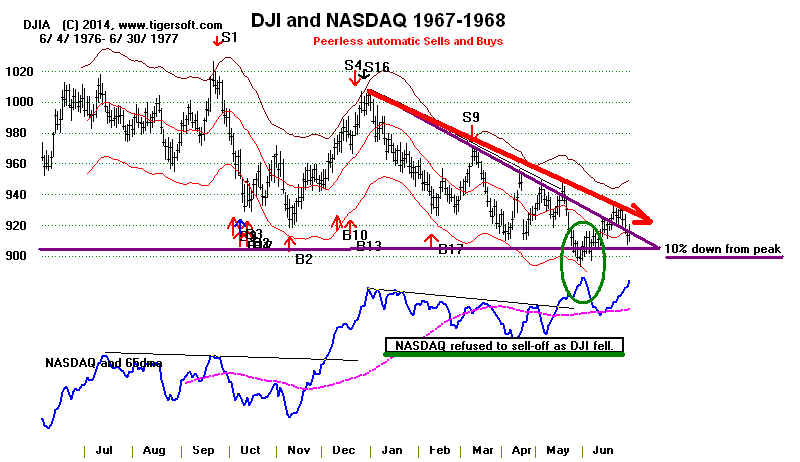

The Lessons of 1977

The best

earlier example of a failing DJI coupled with a very strong NASDAQ

and NYSE

A/D Line comes from early 1977. Like then, as now, we saw

rising

commodity, especially oil and precious metals' prices. Like then, as now,

interest

rates were soon to go back up. Back in 1977, it was not until the

DJI fell

more than 10% that breadth turned weak and not until the DJI

fell more

than 13.5% that the NASDAQ started to suffer. See the DJI-NASDAQ

1976-1977

and 1977 charts below.

|

|

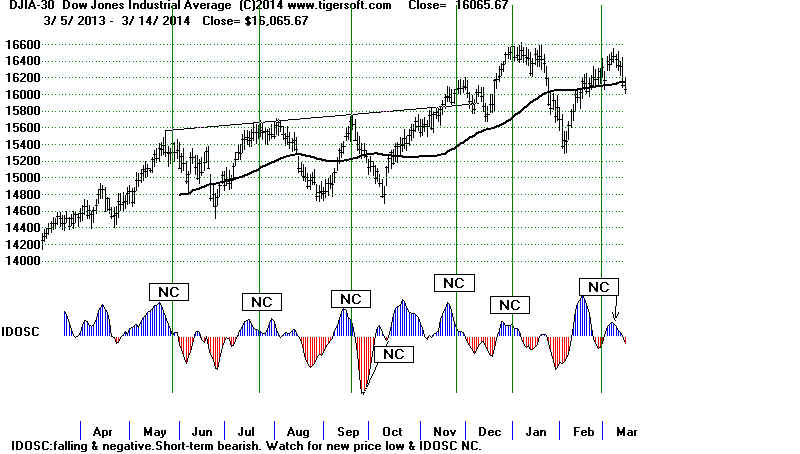

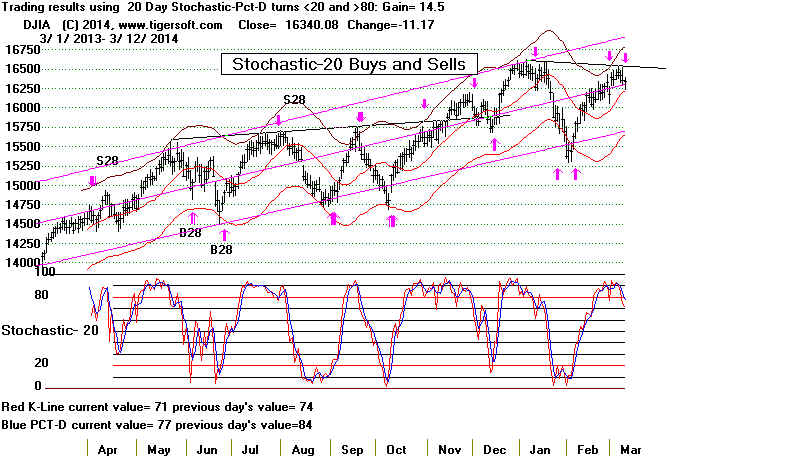

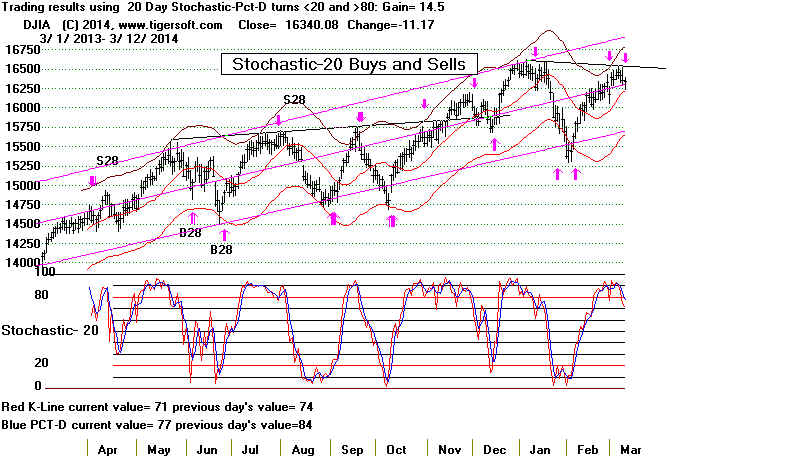

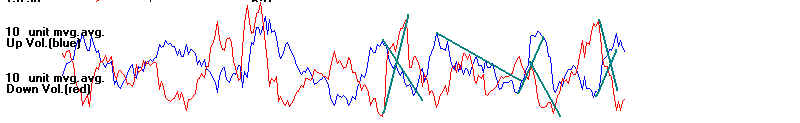

Tiger-Peerless Short-Term Indicators:

Closing Power, Stochastic-20, MACD and Chaiken Idosc

A market

like 1977 may be what lies in store for us now. The primary lesson I drew

from this

period was was that the DJI eventually wins the struggle between it and

the rest of

the market. But it could take many months.

Another

thing to note: in the first half of 1977, the DJI did not fall all the

way down to

the lower band after March, thereby preventing Buy B9s that would

have been

unsuccessful anyway. They would have failed because the DJI

consistently afterwards did not rally close enough to the upper band to get a

Peerless

Sell, something like we just saw in February. In this environment,

one could

still have made quick trades on the long side as long as one also watched

for the

ultimate breakdown by the DJI below the 10%-down-from-the high-level and

watched for

breaks in the short-term uptrends of the NYSE A/D Line, the NASDAQ

itself and

from short-term trading tools.

Until the

end of the year, short-term traders in 1977 and in the DJI needed to use

other

Peerless/Tiger tools than the automatic Peerless Buys and Sells. Recommended

are the

20-day Stochastic, MACD buys and Sells using Tiger and the Chaikin IDOSC

indicator.

See these below.

==================================================================================

OLDER HOTLINES

==================================================================================

3/13/2014 A DJI close below 16100 will probably drop it to 15300.

Closing

Power traders should see that the CP trends are now clearly down.

So, there

appears no reason to hurry in and buy on this weakness. Our Stocks'

Hotline,

which is governed by short-term expectations now, is short about

twice as

many stocks as we are long, having sold the long leveraged ETFs.

The sharp

drop in the current Accumulation Index (IP21) over the last week

is more

likely to indicate we should sell than that we should buy, though

such a

signal does not have enough occurrences in March to be very

certain of

the likely consequences.

--> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 49 -52 MAXCP stocks Bullish MAXCP Stocks (3/13/2014)

--> 145

+68 MINCP stocks Bearish MINCP Stocks (3/13/2014) Bearish

plurality

--> 23 New Highs on NASDAQ 23 new lows.

--> 14 New Highs on NYSE 29 new

lows. Bearish plurality

Note that

the DJI still has not closed below 16100, so intermediate Peerless

traders may

still win out with the "expanded Buy B9". Traders who need to try to

catch every

swing between the upper and lower bands probably acted on the

Closing

Power trend-breaks given the persistent failure of the different indexes

and general

market ETFs to get past their resistance levels. Remember

that the

market is always searching for resistance and support. When it can't

surpass a

resistance level, it goes searching for support, and vice verse.

I did

suggest some profit-taking here. The Stochastic-20 Sells I mentioned last night.

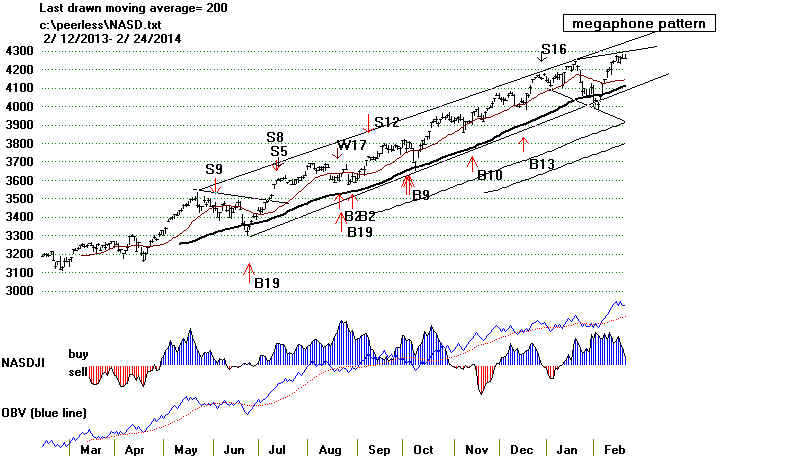

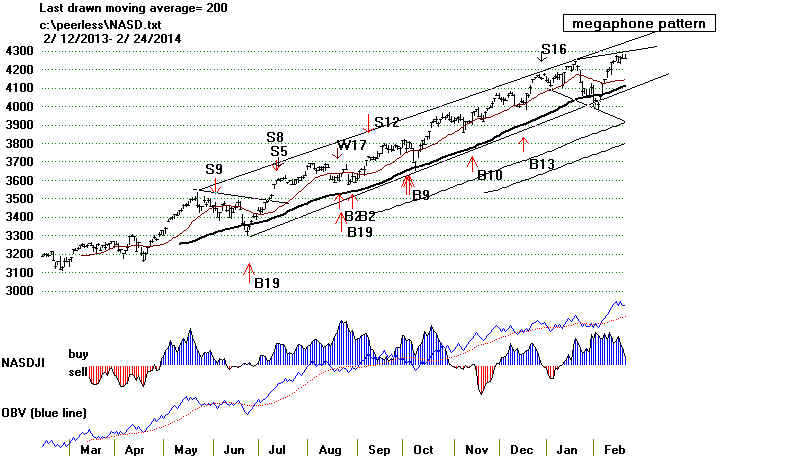

The

megaphone patterns in the DJI, SPY, QQQ and NASDAQ are a late-stage

sign of

excessive speculation. In them, the swings become wilder and wilder.

That means

the next support level may be a big problem, especially with the

bull market

now a full 60 months' old.

I mentioned

that I would become worried if the DJI could not hold up above its

65-dma with

the current "expanded Buy B9". If the current case is going to be like

earlier

such B9s in strong uptrends, then it should not close decisively below

its 65-dma.

If, in fact, it does break that support, then that calls into question the

"expanded Buy B9" here. In that case, I said I would expect a decline to

the

previous

lows where we will see a test of that support.

Well, the

DJI did not close below 16100 today. That's good. The NASDAQ is still

far above

its 65-dma. That's good. And I don't think Russia is going to move

any troops

into the Eastern Ukraine. They want the Crimea because of their

naval base

there. But not the Eastern Ukraine. I believe that they still hope they

can impress

on NATO how provocative and destabilizing in their eyes it would be

for a

far-right Ukraine Gov't. to host NATO missiles pointed at Moscow 475 miles away.

If I'm

right, then the bloodshed in Donetsk and Kharkov will be tolerated if its does

not get

much worse. I certainly could be wrong; the violence in the Ukraine has

been

self-escalating. Donetsk is 49% Russian and 48% Ukraine. How can

both sides

be accommodated peacefully when compromise and tolerance are not

being given

a chance?

What Is The Meaning of A Rapid Decline in The

IP21?

Technically, it is bearish that the Accumulation Index has dropped below its

21-day ma.

Worse, I fear, is how rapidly it has fallen from its highs a week ago.

Rapid big

changes upward in the Accumulation Index can bring Buy B4s.

Should

there be a similar new Sell S4? The Accumulation Index here has

dropped,

from +.161 on 3/5/2014 to +.01 today, 6 days later. How bearish in

history are

such rapid declines of the Accumulation Index?

New Research on Steep and Quick Drop

in IP21

Below is a quick

summary of the results of using a new type of Sell S4 which would

occur when the

DJI is not below the 1% lower band and the IP21 has just fallen by

.16 in 6 trading

days from a level above +.17. For seasonal reasons, no signals are

allowed in

November or December. To simplify getting the results quickly here,

no January sells

were considered. As such, there were 27 instances. 6 would have brought

losses. 18

would have been quite profitable to use as Sells. March instances of this

type of Sell S4s

were not as bearish as those occurring later in the year.

8/2/2013

bad

9/28/2011 good

8/17/09

bad

12/22/2009 2% rally and then decline below the lower band

7/2/2004 excellent

8/29/2002 excellent

2/21/1996 DJI went widows for 3 months

--->3/8/1991 good

8/28/1987 great

--->3/25/1986 a little early, but OK

8/10/1978 early but good

4/16/1956 good

4/17/1949 excellent

6/16/1948 excellent

8/1/1947 good

5/14/1945 flat afterwards for 3 months

7/19/1944 good

6/2/1944 bad

3/27/1944 good

---->3/4/1943

bad

10/4/1940 good

7/25/1939 very good

5/16/1939

bad...quickly reversed by an IP21 B4

8/10/1937 very good

8/6/1935

bad

9/19/1933 very good

7/30/1930 good

|

Why did we

get no Sell S4 signal today with the present rules? The Assume. Index

did drop

below its 21-day ma. The reason is that the current Sell S4 requires there

first be a

DJI rally of more than 8%-9%. The February rally was less.

Still Positive Internal Strength Indicators

DJI

change la/ma

anorak

P-I

IP21

V-I Oct

65-day

Pct Change

-----------------------------------------------------------------------------------------------------------------------------------------------

3/11/14 16351

-67

1.01 .41

+439

-133 .072 -.053

+30 +.165 .029

3/12/14 16340

-11

1.007 .396

+438

-1

.078 + .006 +33

+.076 .032

==================================================================================

==================================================================================

OLDER HOTLINES

==================================================================================

3/12/2014

Remain bullish as long as the Dai's Support at 16100 is not closed

below.

The "expanded Buy B9" averages a 13% gain.

The typical behavior of

the DJI

"V" formation is bullish after two or three weeks of consolidation just below

the breakout

point and down to the 65-dma. The Closing Powers of QQQ

and

and SPY slightly broke their short-term downtrend as they

rebounded from their

rising 21-dma.

The internal strength readings for the DJI of the P-I, V-I, IP21 and

Oct are all

positive. Since 1965, the DJI has risen 66% of the time over the the month

following March

12th and has gained 1.5% on average.

Still Positive Internal Strength Indicators

DJI

change la/ma

anorak

P-I

IP21

V-I Oct

65-day Pct Change

----------------------------------------------------------------------------------------------------------------------------------------

3/11/14 16351

-67

1.01 .41 +439 -133 .072 -.053 +30

+.165

.029

3/12/14 16340

-11 1.007

.396 +438

-1

.078 +-.006 +33

+.076

.032

==================================================================================

But I sense

the pull-back/consolidation is not over. I show below the signs that

low-priced

stock speculation has just gotten much riskier in the last week.

At the very

least, the market needs to work off its over-bought condition.

Note the

pair of new automatic red Sells on TAN based on Stochastic.

In

addition, the Dai's 20-day Stochastic, Pct-D and K-Line have dropped below

80. I

have placed the signals from these on the DDI chart below.

--> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 101 +39 MAXCP stocks Bullish MAXCP Stocks (3/12/2014) Bullish plurality

--> 77

-10 MINCP stocks Bearish MINCP Stocks (3/12/2014)

--> 33 -10 New Highs on NASDAQ 10 new lows. Bullish plurality

--> 32 New Highs on NYSE 21 new

lows. Bullish

plurality

|

|

Let's Watch the Tiger Indexes of Low Priced Stocks

The Low Priced, Chinese

and Biotech groups have provided many the biggest gainers this year.

My survey of the

stocks between $1-$8, shows a number of them have had serious declines

in the last week.

Will this take the wind out of their sails or will they quickly return to favor.

I think this will

tell us how robust the speculative energies are now. Let's continue to watch

the Tiger Index

of Low Priced Stocks, $1-$7 (N=579) to see if it hold up above its recent

support. We

don't want to overstay our welcome. Low priced stocks often make a person

wait a long time

to get out even once they break-down late in a bull market.

5-day high 5-day low 3/12/2014

5-day pct change

BLDP 8.25

4.25 5.36

BSPM 3.5

2.15 2.15

CNTF 3.0

2.2 2.27

DPW 2.1

1.19 1.19

FCEL 4.6

2.65 3.37

GERN 4.6

1.5

1.69 -2.71 today

GIGM 1.71

1.40 1.49

-65%

HDY 5.30

1.10 2.19

-3.07 today -60%

HILL 6.0

3.6

3.84

-36%

HOV 6.2

4.8

4.9

HRT 7.0

4.5

5.09

AI/200=185

NVTL 2.80

2.0

2.04

SNTA 6.5

4.5

4.55

ZGNX 4.6

3.5

3.5

==================================================================================

OLDER HOTLINES

==================================================================================

3/11/2014 Remain bullish as

long as the DJI's Support at 16100 is not closed

below.

The "expanded Buy B9", the typical behavior

of DJI "V" formations

and the still

positive internal strength readings of the P-I, V-I, IP21 and OPct lend

hope that this

will be a shallow decline and that it will prove to be a constructive

consolidation.

Still Positive Internal Strength Indicators

DJI change

la/ma

annroc

P-I

IP21

V-I Opct

65-day Pct Change

----------------------------------------------------------------------------------------------------------------------------------------

3/11/14 16351

-67

1.01 .41

+439 -133

.072 -.053 +30

+.165

.029

Watch the current Accumulation Index. It fell by a large amount today.

The IP21's

dropping below its 21-day ma may give us a Sell S4. Whether it does

or not, its

falling below its 21-day ma now with the DJI having failed to make a new

high would look

bearish. It would make the DJI look a lot like when S4s stopped DJI

advances in the

Marches of 1937, 1981 and 2005.

Today's

breadth worsened as the steep A/D Line uptrendline was broken

The markets also

closed substantially below their openings and so the short-term Closing Powers

of DIA, SPY, QQQ, IWM... are all declining.

Professionals have become net sellers for now.

Several of our most Distributed bearish MINCP stocks broke their support

levels. Short-

covering can no

longer hold them up. MINCP stocks now out number MAXCP

stocks.

The number of

bullish looking stocks that warrant consideration for new purchase

has been greatly

reduced.

A "Line in The Sand"

I think we have

to draw a line in the sand, as it were, where a minor pull-back would

start

looking too much like an intermediate-term retreat. Right now the DJI's 21-day

ma

and its rising

65-day ma are nested and so should be good support. This is also

the point at

which the DJI rose more than 5% from its bottom, and so took on

a bullish

momentum despite the earlier Sell S16. However, a close below

16100

would make the

current chart appear to look different than earlier "expanded

B9s" in a

rising market. Odds would then shift for the market's outlook. The

stage then would

be set for a re-test of 15300-15400.

Watch the DJI relative to its

65-dma and

the Current Accumulation Index (IP21) relative to its 21-dma

--> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 62 -44 MAXCP stocks Bullish MAXCP Stocks (3/11/2014)

--> 87

+20 MINCP stocks Bearish MINCP Stocks (3/11/2014) Bearish plurality

--> 43 -33 New Highs on NASDAQ 10 new lows. Bullish plurality

--> 29 New Highs on NYSE 20 new

lows. Bullish

plurality

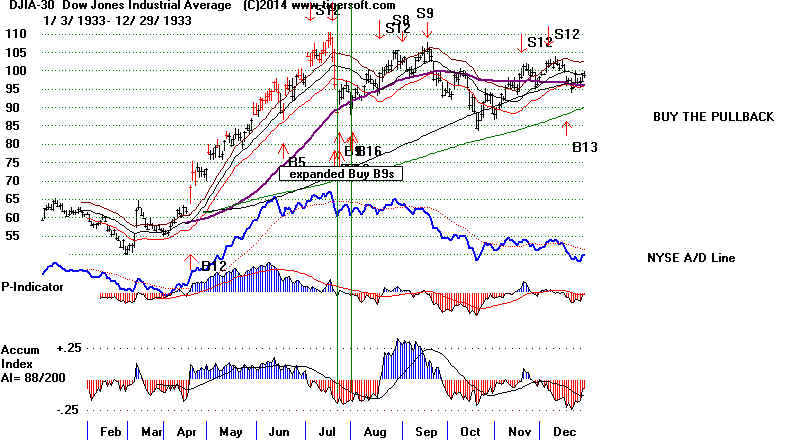

"Expanded

Buy B9s" are rare. There are only three earlier cases of it appearing in

a market

with a rising 65-dma and 200-dma. the earliest case was in December 1928.

In this

case, the DJI did not stall out before it surged to new highs. It appears

our case is

not so strong. The next two 1933 instances followed a long bear market.

But the key

moving averages were rising strongly. Here the DJI rose for

six weeks

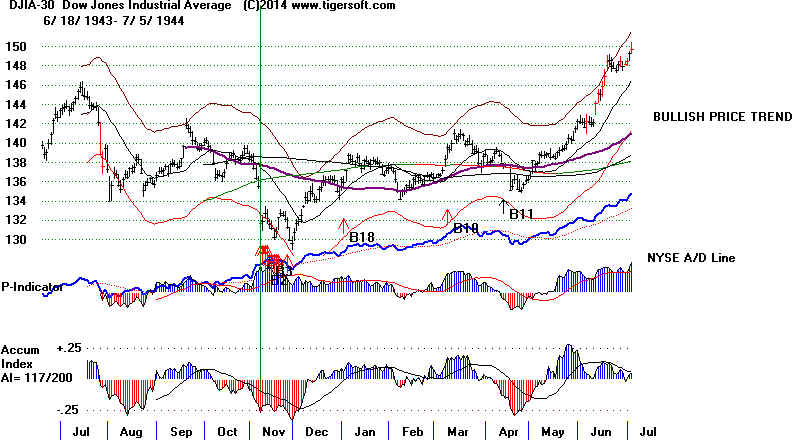

after the B9s before breaking its 65-dma. The 1943 Buy B9 was

different

from our case in that it took place below both a falling 65-day and

200-day ma.

The conclusion I reach, based on these few cases that resemble

the present

"expanded B9" is that we should not now see a clear violation of the

65-dma by

the DJI if this case is going to play out like the first three cases

below.

Earlier Expanded Buy B9s

#1 12/11/1928 very good. Gain = +.161 65-day up-pct = .126

la/ma ann-roc PI PI-ch IP21 V

Opct 65-dayup-pct

.958 .263 -24 +18 .028 -511 .13

.126

Also already a Buy B2.

------------------------------------------------------------------------------

#2 7/24/1933 94.3 Gain = +.054 65-day up-pct = .304

la/ma ann-roc PI PI-ch IP21 V Opct 65-dayup-pct

.932 .165 12 49 -.145 -528 .082 .304

Also A Buy b6

----------------------------------------------------------------------------[--

#3 8/1/1933 92.7 Gain = +.072 65-day up-pct = .268

la/ma ann-roc PI PI-ch IP21 V Opct 65-dayup-pct

.927 -.641 -19 9 -.171 -630

.012 .268

Also a buy B16

-------------------------------------------------------------------------------

#4 11/8/1943 131.7 164 Gain = +.254 65-day up-pct = -.038

la/ma ann-roc PI PI-ch IP21 V Opct

65-dayup-pct

.958 -.527 158 32 -.261 126

-.225 -.038

Already a Buy B9 under previous rules

-------------------------------------------------------------------------------

Avg.Gain = +.133

Expanded Buy B9s: 1928-2013

==================================================================================

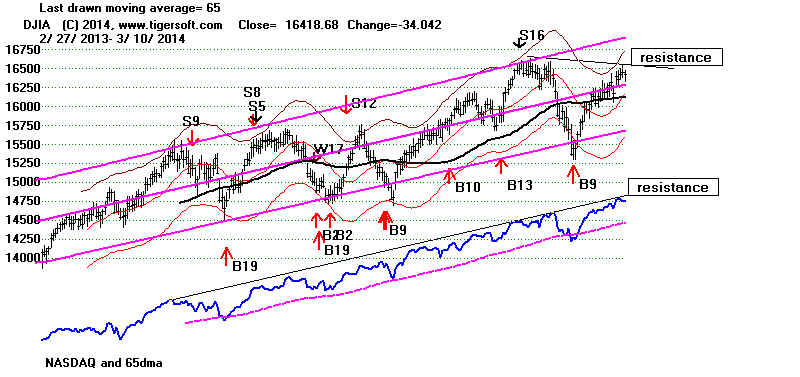

3/10/2014 Patience. Expect More Consolidation and Reduced Volatility

After a week or

two, if the good breadth continues, the "expanded B9" is not

reversed and the

internal strength reading for P-I, V-I, IP21 and OPct stay

positive on the

DJI, I think we can a 5%-10% lunge upwards to new highs.

Right now

volatility is waning. Consolidation just below resistance seems the governing

technical

principle now The different markets have reached their strongest resistance

levels. But

cannot breakout. The DJI, which Peerless focuses on, seems unable

for now to get

past 16550. But its "V" pattern is usually favorable unless the

Accumulation

Index drops all the way back below its rising 21-day ma. Most often,

after a period of

consolidation, these patterns produce upside breakouts.

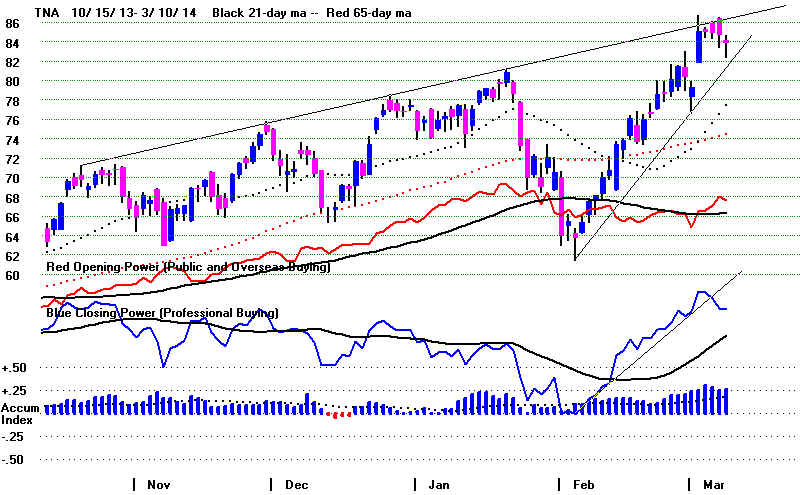

IWM and TNA also

show bearish red popsicles. It's best to take profits in them.

But I said

yesterday that I thought the pull-back will not be deep. The DJI's most likely

support is about

2% lower between 16000 and 16200, I believe.

Since 1965, the

DJI rallies only 53.2% over the next two weeks, but 66% of

the time over the

next two months. Over the past year, Mondays have

risen only 46.9%

of the time. Wednesdays are worse, rising only 43.1% of

the time.

But Tuesdays, Thursdays and Fridays are up 63.4% of the time.

Daily price

change volatility is diminishing and may wane some more.

I think the A/D

Line will firm up again dramatically if we are going to see

a breakout.

Right now, it is retreating reluctantly..

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 106 -36 MAXCP stocks Bullish MAXCP Stocks (3/10/2014) Bullish

plurality

--> 67

+5

MINCP stocks Bearish

MINCP Stocks (3/10/2014)

--> 76 +5 New Highs on NASDAQ new lows. Bullish plurality

--> 46 -45 New

Highs on NYSE +7 new lows. Bullish plurality

==================================================================================

OLDER HOTLINES

==================================================================================

3/7/2014 The "expanded Buy B9" is boosting the DJI and Bank

Stocks.

But 10-year interest rates are starting to rise, the V-Indicator has turned down

in over-bought territory, the DJI has not achieved a

breakout and the NASDAQ

seems unable to surpass it rising resistance line.

Despite the "B9" we should worry, I think, about the NASDAQ's megaphone pattern.

In particular, the weakening biotechs may cause speculators generally a change of

heart.

There's a limit to how far even biotechs can rally and how much the Government

may be willing to pay for pills under the new Obama Care.

We see lot of warnings in the form of red popsicles in the key ETFs. The

steep uptrendines in the Closing Powers have mostly been broken. But such

breaks are more potent after they fail to confirm a new high. That has not

happened yet. Breaks in CP confirmed uptrendlines often means

"consolidation"

rather than "retreat".

--> To Key Index and Leading Stock

Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 142 -70 MAXCP stocks Bullish MAXCP Stocks (3/7/2014) Bullish

plurality

--> 62

+16

MINCP stocks Bearish

MINCP Stocks (3/7/2014)

--> 71 - 40 New Highs on NASDAQ 7 new lows. Bullish plurality

--> 91 -26 New

Highs on NYSE 6 new lows. Bullish plurality

The good news is that the NYSE A/D Line remains in an uptrend, the V-Indicator

is positive, the current Accumulation Index is above its 21-day ma and there

is no DJI head/Shoulders pattern. So a major March top is unlikely for the DJI

and, since history shows how closely bank stocks correlate with Peerless, for

the Big Banks. We must watch to see if the NASDAQ continues to weaken

relative to the DJI

The fact remains, the NASDAQ's broadening pattern is dangerous without an

upside breakout above the rising resistance. It shows a speculative market and

often there is not much support underneath the market for a long ways down. Added

to that, the leading biotechs keep selling off on high volume and many show a

Closing

Power that is near the stock's yearly lows. As we know from the 1999-2000

speculative top, Crude Oil in 2008 and Gold/Silver stocks 18 months ago, it is the

Closing Powers that turn down first and start making new lows ahead of prices.

This is how over-speculated, "bubble" stocks top out and turn down after a wild,

public-buying binge.

Dangerous to Your Health

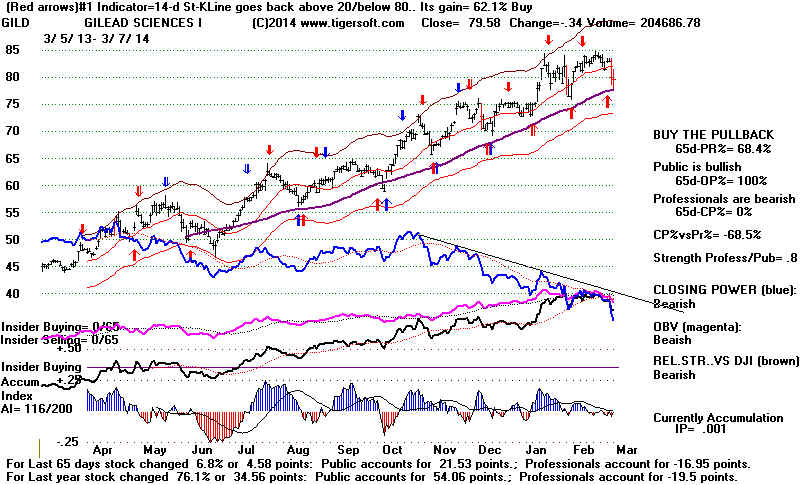

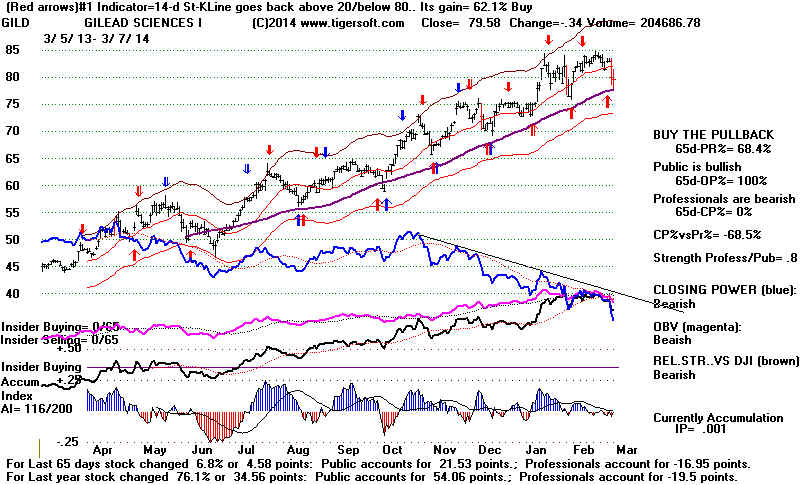

Biotechs are now dangerously priced. Consider GILD. It has a great

hepatitis drug,

which another company (VRUS) developed before GILD bought them out. Lots of

people are starting to question if GILD's CEO should now be worth a Billion

because its Hepatitis Drug's treatment for 12-weeks sells for $84,000.

Biotechs

are now being priced as though there will be no populist backlash against

biotech profiteering. They are probably correct given the current Congress and

President. But investors should look further ahead, too.

Gilead

CEO Becomes Billionaire on $84000 Hepatitis Drug

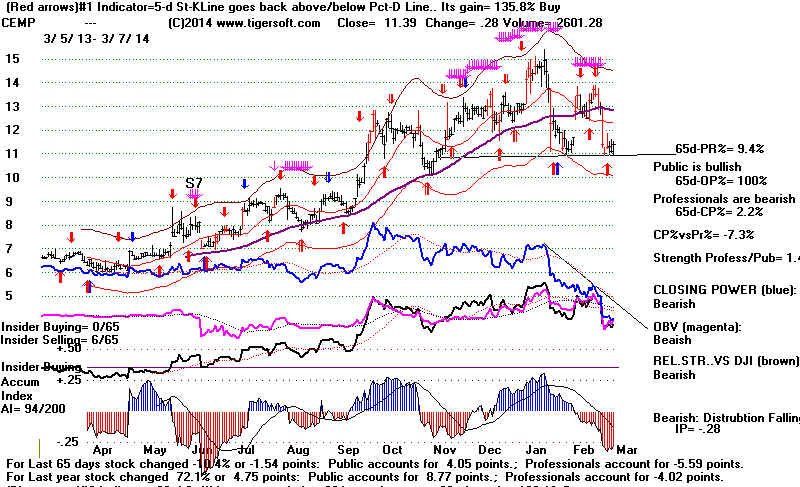

A number of leading biotechs over $40 now show Closing Power

close to or at

their 12 month lows, thus far ahead of price: AEGR,

BAX, BBH, CELG, GILD,

PCYC and PCYC. A few have already fallen through a

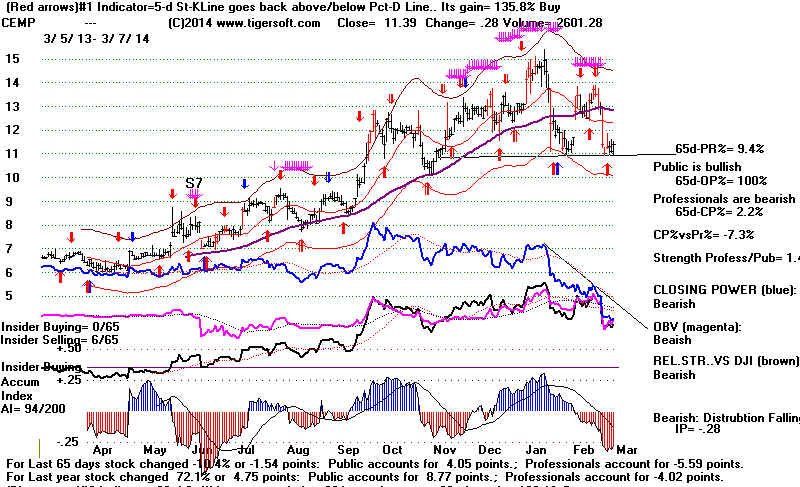

trap-door. CEMP seems

to be on the verge of doing that. It has only 38 employees, But its lead

drug to treat

hospital-born bacterial pneumonia is in Stage -III. Why are

Professionals dumping the stock? As long as the Closing Power is falling, it

must be considered a candidate for a serious breakdown.

Watch The DJI's Accumulation Index.

If It Falls below Its 21-dma, We May Get A Sell Sell S4

The DJI's "V" pattern is more auspicious. Compare the V-pattern now with

the "V" pattern of last September-October. Back then it took a two week

consolidation to prepare a run to new highs. I suspect that's what the DJI

must do now. Study the DJI-formations in

history. We probably should

mostly pay attention to the cases where the DJI first retreats back below

the lower band and then rapidly recoveries back to the old highs. After a pause

and consolidation, V-formations usually bring breakouts unless the internal

strength indicators have turned negative or we get a Sell Signal.

The two notable exceptions to the rule that V-formations bring breakouts are

December 1976 and October 2007. In both cases, the internal

strength indicators

are were positive at the top. So, Sell S4s are important. They occur when the

Accumulation Index falls below its 21-day ma. These can occur in the year of

mid-term Elections, as February 1994 shows.

==================================================================================

OLDER HOTLINES

==================================================================================

3/6/2014 Give The Market a 'Chance to Dance Higher'. For now,

the

"expanded Buy B9" seems to be living up to its advanced billing, where its

past signals have gained 13% on the DJI.

The A/D Line remains very bullish. Professionals are

not yet selling. March

is not usually a market of tops. The NASDAQ could

still breakout above its

rising resistance line and go hyperbolic to 5000. On the NYSE, the number

of new highs expanded. TNA still seems a good ETF to

play the market now.

But don't over-look high Accumulation breakouts among the Bullish

MAXCPs.

--> To Key

Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart

NASDAQ

Chart IBB Chart

IWM Chart

--> 212 -67 MAXCP stocks Bullish MAXCP Stocks (3/6/2014) Bullish

plurality

--> 46

+1

MINCP stocks Bearish

MINCP Stocks (3/6/2014)

--> 111 -1 New Highs on NASDAQ 8 new lows. Bullish plurality

--> 117 +35 New Highs on NYSE 3 new

lows. Bullish

plurality

Biotechs have weakened somewhat, but big banks, a good

measure of Fed intentions,

all rose today. It's bullish that leveraged BAC and leveraged semi-conductors

generally advanced. True, gold and silver rose; so, this could bring on a much

weaker

Dollar and then higher interest rates. However, TNX is still below its falling 650dma

at 2.8%,

For now, the Bullish MAXCP stocks remain strong.

This confirms the Buy B9, I think.

There just are not many Bearish MINCP stocks to

consider much shorting

for hedging purposes.

The Dangers of Macho Election-Year Posturing

You Probably Do Not Know How Close We Came to WW-III in 1962?

China will be likely be the beneficiary as the US risks a new Cold War, with Obama and

Kerry

trying to claim the high moral ground in condemning Russia for invading the Crimea

based on lies and trumped up charges. As I've said before, there is no way Russia

will be dislodged from the Crimea, its naval base there pre-dates the founding of the

United States.

But all this heavy-handed posturing could become very dangerous. What would be very

dangerous would be if new Ukrainian Government were to join NATO and point missiles at

Moscow, just 467 miles away from Kiev. This would bring on a highly dangerous reverse

Cuban Missile Crisis! The DJI fell 27% in the first half of 1962.

For now, the stock market seems to like all this macho posturing. As always, it sees

profits in war preparations. It's the actual fighting it reacts badly to. If you

doubt this,

see how the DJI rose in 1916 but fell apart in 1917; how it rose in 1939 and much of 1940

but fell apart with the German

torpedoing of the US Greer in 1940 and then

with the US Oil Embargo of Japan, which was the prelude to Japan's attack on the US.

Or how the DJI rose throughout the 1950s and until 1962 when the Cuban Missile

Crisis came very much closer to starting a nuclear exchange than most Americans realize.

Most do not know how close we came to war. Read the story of how Vasili Arkhipov

single-handed

stopped the Soviet submarine K-19

from launching a nuclear-headed torpedo at the height of the US embargo

of Cuba in 1962.

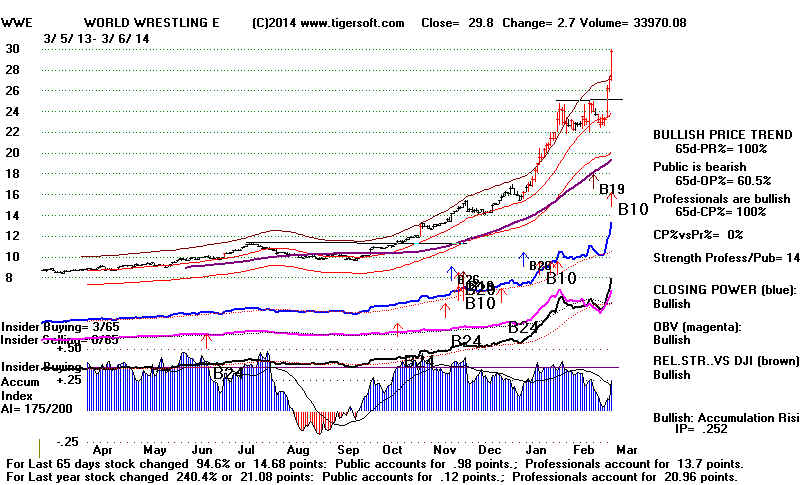

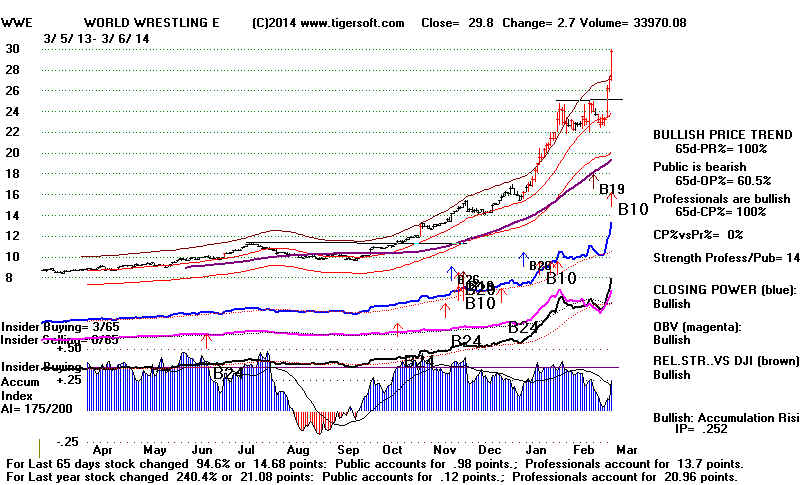

MACHO is In Style Now.

WWE

(WorldWide Wrestling) has found a way to cut out the middle-man, lower prices

for

consumers and make money for shareholders. If successful, its model will be

closely

studied by other companies that still hold the rights to their media content.

Long-Term Drought and De-Salinization

Leading de-salinization stocks are starting to move. This is another story-area

for investors that will surely quench the thirst for some big profits long-term.

The four best de-salinization stocks I can find are CWCO, ERII, TTEK and LIQT.

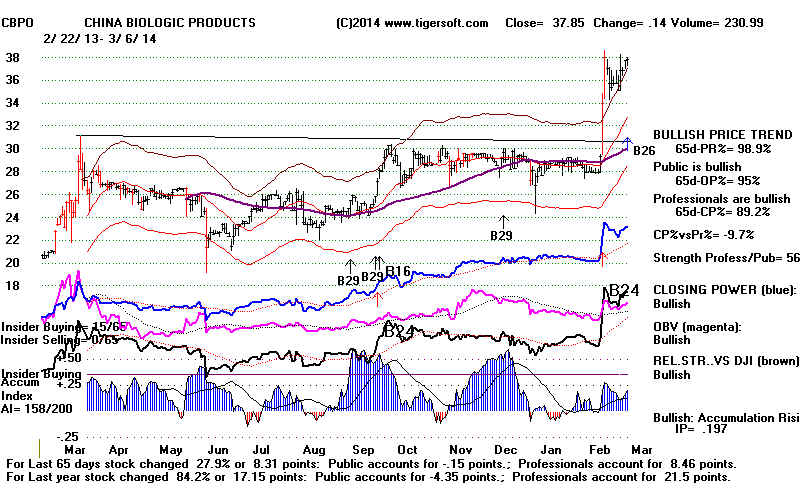

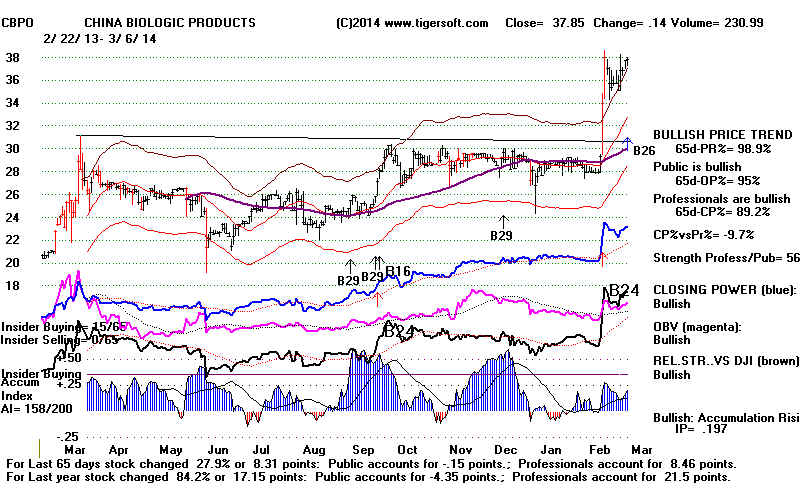

China Looks Better and Better to Speculators

Look at how low priced Chinese stocks jumped today. CPSL rose 94% today. Other

big gainers among Chinese stocks were: ZA 2.12 +13%, YGE 6.78 +12%, TSL 18.19

+ 11%.

None showed much prior Accumulation. So, they are probably not tightly held and

should quickly give back their gains. China will surely emerge as the victor

of a new Cold

War between Russia and the US. CBPO, China Biologic Properties,

on the other hand

shows lots on insider buying and should run much higher on a move past 38.

==================================================================================

OLDER HOTLINES

==================================================================================

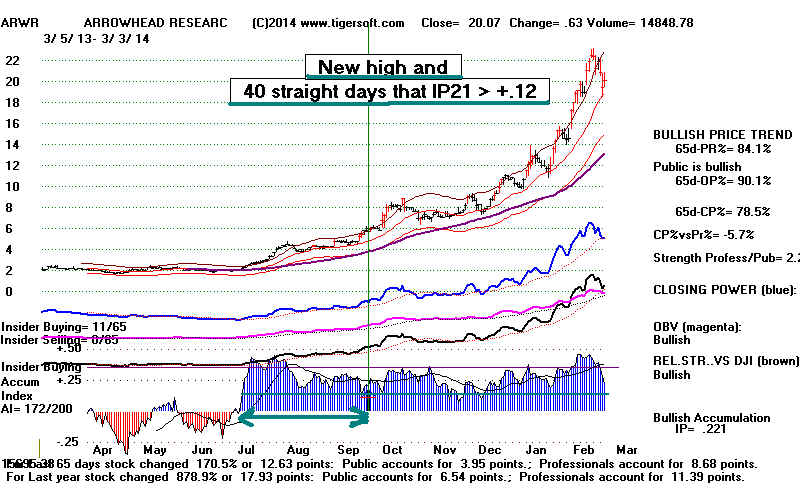

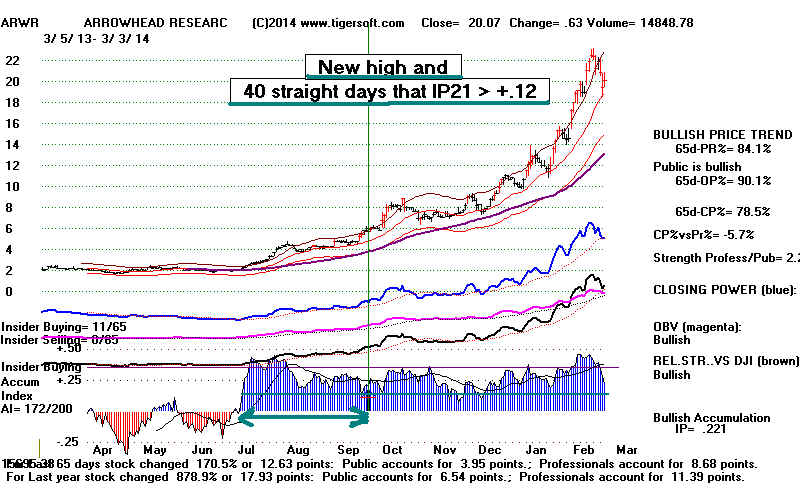

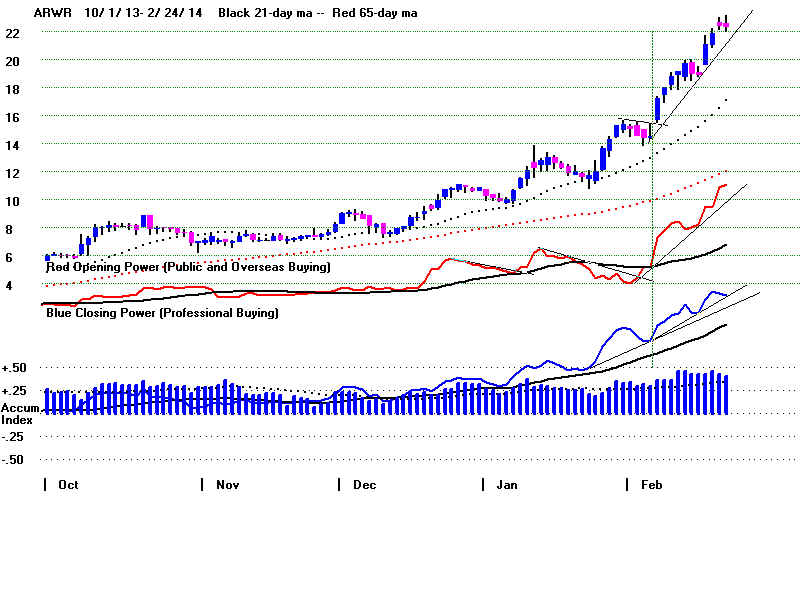

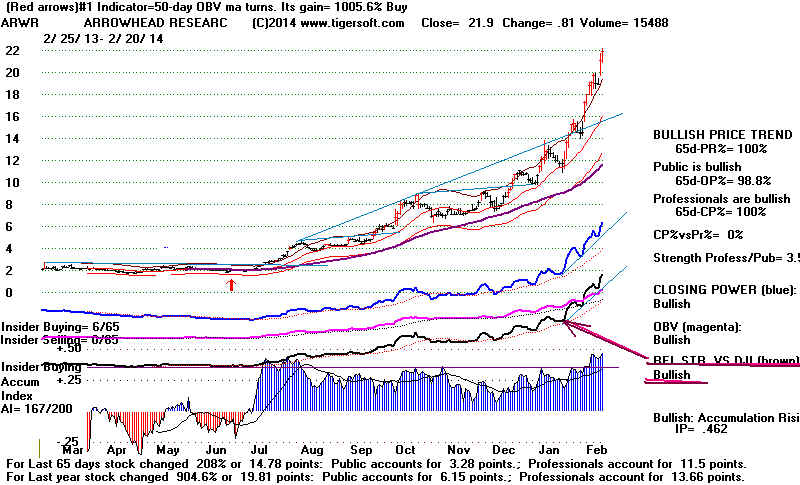

3/5/2014 Give The Market a 'Chance to Advance'. The "Expanded Buy

B9"

has caused a number of our Bullish MAXCP stocks to explode to new highs. This

is entirely in keeping with a late-bull market small cap and NASDAQ vertical ascent.

A number of high Accumulation NASDAQ stocks are running upwards ahead of

the slower moving and lagging DJI.

Positive Internal Strength Indicators

DJI change

la/ma

annroc

P-I change IP21

V-I

Opct 65-day Pct Change

----------------------------------------------------------------------------------------------------------------------------------------

3/5/14 16360

-35 1.02

.735 +695

+101 +.161 +99

.255 .016

3/4/14 16396 +228 1.025

.520 +593

+134 +.115 +60

.234 .020

3/3/14 16168 -124 1.013

.239 +458

-124

+.095 +12 .115

.005

2/28/14 16322 +49

1.024

.436 +582

+109 +.096 +41

.203 .015

2/27/14 16273 +75

1.023

.258 +473 -21

+.076 +15 .095

.016

2/26/14 16198 +19

1.019

.270 +493

+103 +.057 +20

.091 .018

All our key internal strength indicators remain positive.

This makes it hard

for a Sell signal of any kind to appear. It makes it very hard to get a top before

a DJI decline of more than 15%,

--> To Key Index and Leading Stock

Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart

NASDAQ

Chart IBB Chart

IWM Chart

--> 279 -82 MAXCP stocks Bullish MAXCP Stocks (3/5/2014) Bullish

plurality

Quite a few low

priced stocks (<20) with IP21>.33 produced Buy B12s and new highs

this week.

See the charts of MXWL, PPHM, RENN, GRO, RFMD, and NPD in the

Bullish MAXCP

stocks tonight.,

--> 45

+1

MINCP stocks Bearish

MINCP Stocks (3/5/2014)

--> 113 -78 New Highs on NASDAQ 8 new lows. Bullish plurality

--> 78 -124 New

Highs on NYSE 4 -5 new lows. Bullish plurality

When one looks back at stock market history, one is struck by

how nearly always a

major top requires months of Advance Decline bearish diivergence and/or a

negative readings from either the P-Indicator, Accumulation or V-Indicator

with the DJI at the upper band. I count 21 major DJI sell-offs of more than 15%.

Negative Non-Confirmations of a DJI advance to the upper band were the way

bull market normally signed off. The NNCs came most frequently from

the V-Indicator at these major tops.

Frequency of NNCs at Major Market Tops: 685.5-566

PI<0

1929

1937 1939 1957

1969 1972 1980

1987 (8)

IP21<.008 1929

1960 1961 1966

1972

1980 1984

1987 (8)

VI<= 0 1929

1937 1939 1957 1960

1969 1972 1980 1981 1984 1987 (11)

OPct<0

1939 1957

PI<0

1990

2000 2007

total

11

IP21<.008

1998 2000

total 10

VI<=0

1990 1998 2000 2007

2011 total 16

OPct<0

Tops before DJI Declines of

More Than 20%: 1928-2014

(C) 2014 William Schmidt, Ph.D. www.tigersoft.comLength of A/D Resulting Bear Market

Divergence

---------------------------------------------------------------------------------------------------------

1 7

months 1929-1932

9/3/1929-7/8/1932 (35 months) 381.2 to 41.2

9/3/1929-2/27/1933

381.2 to 98.1

Sells at top: Sell S7, S12, S9

4/30/1969: la/ma 1.051, P= -14,

IP21 =-.126, V= -351 Opct= + .146, 65-day pct

ch= .281

---------------------------------------------------------------------------------------------------------

2 6

months 1937-1938 8/13/1937-

3/31/1938 (7 months) 189.3-98.9

Sells at top: Sell S4,S7,S9,S8

8/13/1937: la/ma 1.024, P= --2 , IP21 = .042, V=

-43, Opct=+.279, 65-day pct ch= .099

---------------------------------------------------------------------------------------------------------

3 8 months

1939

11/9/1939 - 4/11/1939 (

months) 158.1- 123.8

No Sell at top:

Later S16 12/30/1939 - 4/11/1939

154.4-123.8

and later still: S12, S3

12/30/1939: la/ma 1.029, P= --4 , IP21 = .046, V= 0, Opct=- .28, 65-day pct ch= .151

----------------------------------------------------------------------------------------------------------

4 8 months

1939-1942

9/12/1939-4/28/1942 (31 months) 155.9-92.9

Sell at top: Sell S9...later S16, S1

9/13/1937: la/ma 1.095, P= -43 , IP21 = .138, V=+56, Opct=+.326, 65-day pct ch= .107

---------------------------------------------------------------------------------------------------------

5 None

1946

5/29/1946-10/9/1946 (5 months) 212.5-163.1

H/S

Sell S5,S4

529/1946: la/ma 1.029, P= +64 , IP21 = .269, V=+43, Opct= +.375, 65-day pct ch=

.142

----------------------------------------------------------------------------------------------------------

6 16 months

1957

7/12/1957- 10/22/1957 520.8-419.8

Sell S7, S9, S4

7/12/1957: la/ma 1.022, P= --40, IP21 = .062, V=

-214,

Opct=- .248, 65-day pct ch= .078

----------------------------------------------------------------------------------------------------------------------------

7 8

months 1960

1/5/1960 - 10/25/1960 685.5 - 566.0

Sell S12, S16, S15, S1

7/12/1957: la/ma 1.018, P= +4, IP21

=-.038, V= -170, Opct=+ .099, 65-day pct ch= .085

----------------------------------------------------------------------------------------------------------------------------

8 5 months

1961-1962

11/16/1961-5/25/1962

734.3 - 536.7

Early S9, S16 (nearly perfect)

8/3/1961: la/ma 1.025, P= +34, IP21 =- .042, V= +6, Opct= + .378,

65-day pct ch= .058

-----------------------------------------------------------------------------------------------------------------------------

9 22 days

1966

2/9/1966-10/7/1967

995.15-744.32

Sell S4, S12

1/6/1966: la/ma 1.025, P= +34, IP21 =- .042, V= +6, Opct= + .378,

65-day pct ch= .058

-----------------------------------------------------------------------------------------------------------------------------

10 none at top

1968-1970 12/3/1969-5/26/1970

985.21 - 631.16

Sell S1

4 months 1969-1970

5/14/1969-5/26/1970

968.85 - 631.16

Sell S9,

S3

4/30/1969: la/ma 1.025, P= -30, IP21 =+ .083, V=

-1, Opct= + .219, 65-day pct ch= .01

----------------------------------------------------------------------------------------------------------------------------

11 7

months 1972-1973

1/11/1973 - 12/6/1974

1051.7 -

577.6

Sell S1, S9, S4, S12

1/11/1973: la/ma 1.024, P= -96, IP21 =+ .002, V= -2, Opct= + .059, 65-day pct ch= .117

----------------------------------------------------------------------------------------------------------------------------

12

none

1976-1978 9/21/1976 -

2/28/1978

1014.79 - 742.12

Sell S1, S4, S16

9/21/1977: la/ma 1.033, P= +178, IP21 =+.181, V= +2, Opct= + .18,

65-day pct ch= .012

---------------------------------------------------------------------------------------------------------------------------

13

6 months 1980

2/13/1980 -

3/27/1980 903.84 -

759.98

Sell S4, S9, S15

2/13/1980: la/ma 1.028, P= -26, IP21 =- .01, V= -1, Opct= + .212, 65-day pct ch= .12

----------------------------------------------------------------------------------------------------------------------------

14

7 months 1981-1982

4/27/1981 - 8/11/1982

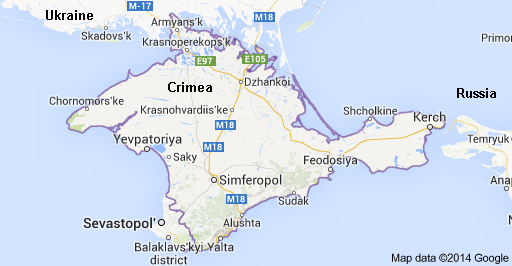

1024.05 - 777.21

Earlier S9s, Sell S4, S7, S15

4/27/1981: la/ma 1.02, P= +11, IP21 =+.026, V= 0, Opct= + .217, 65-day pct ch=

.098

---------------------------------------------------------------------------------------------------------------------------

15

7 months 1984

1/9/1984 - 7/24/1984

1286.22 - 1086.57

Sell S4, S12

1/9/1984: la/ma 1.021, P= +36, IP21

=+.007, V=-1, Opct= - .169, 65-day pct ch= .04

--------------------------------------------------------------------------------------------------------------------------

16

5 months 1987

8/25/1987-10/19/1987

2722.42 - 1738.74

Sell S4

Later S8, S9, S12 10/2/1987-10/19/1987

2640.99 - 1738.74

10/2/1987: la/ma 1.026, P=

-56, IP21

=- .017, V= -7, Opct= + .072, 65-day pct ch=

.095

----------------------------------------------------------------------------------------------------------------------------

17

7 months 1990

7/17/1990-

10/11/1990 2999.75

- 2365.1

Sell S9,

S8, S5

7/17/1990: la/ma 1.032, P= -1, IP21 =+ .024, V=

-4, Opct= + .414, 65-day pct ch= .09

---------------------------------------------------------------------------------------------------------------------------

18 4 months

1998

7/17/1998 - 8/31/1998

9337.97 - 7539.07

Sell S9, S12

7/8/1998: la/ma 1.03, P=+2, IP21 =- .025, V= -17, Opct= + .061, 65-day pct ch= .021

---------------------------------------------------------------------------------------------------------------------------

19 18 months

2000-2003

1/14/2000 - 3/11/2003

11722.98 - 7286.27 (10/9/02)

Sell S9, S12. S15, S4

1/7/2000: la/ma 1.021, P=-23, IP21 =- .028, V= -59, Opct= + .356, 65-day pct ch= .088

----------------------------------------------------------------------------------------------------------------------------

20

4 months 2007-2009

10/9/2007 - 3/9/2009

11722.98 - 6547.05

Earlier Sell S9 and S5; concurrent S2, S4

7/19/2000: la/ma 1.028, P=-51, IP21 =+ .024, V= -131, Opct= + .054, 65-day pct

ch= .096

----------------------------------------------------------------------------------------------------------------------------

21

2011

5/2/2011 - 10/3/2011

12807.36 - 10655.3

Sell S5, S8

5/2/2010: la/ma 1.028, P=+212, IP21 =+ .147, V= -17, Opct= +

.349, 65-day pct ch= .068

Later S9V

7/21/2010: la/ma 1.025, P=+269, IP21 =+. 085, V= -51, Opct= +

.005, 65-day pct ch= .042

---------------------------------------------------------------------------------------------------------------------------- |

===================================================================================

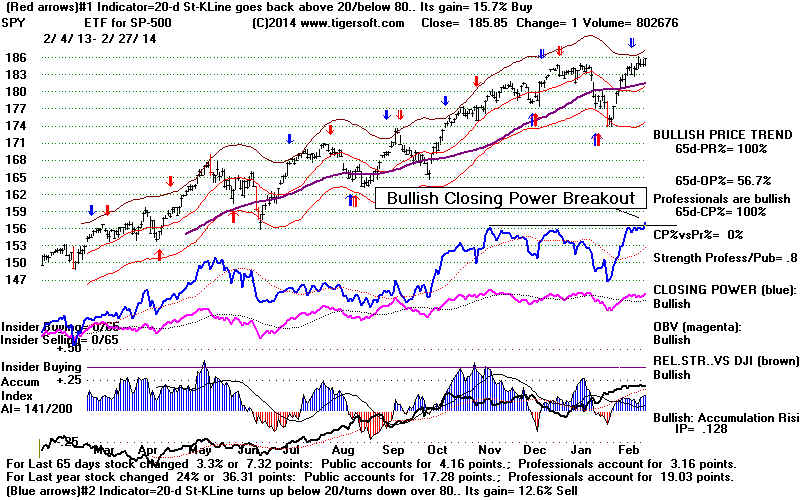

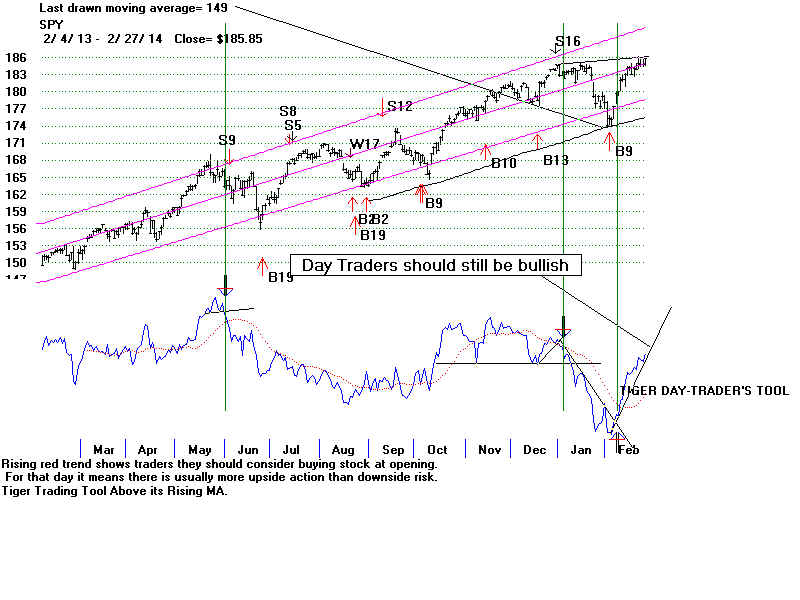

3/4/2014

Closing Power Is Exceptionally strong

The Unusual Momentum Favors More of An Upside Run.

TNA looks like the best ETF play for a Nasdaq vertical accent run to

5000.

The "expanded Buy B9 is proving its worth. The simplicity of just

waiting for an A/D Line uptrtend-break or a Closing Power uptrend-line break before

taking long profits is also being vindicated. Small caps are now the leaders.

--> To Key Index and Leading Stock

Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart

NASDAQ

Chart IBB Chart

IWM Chart

--> 371 +111 MAXCP stocks Bullish MAXCP Stocks (3/4/2014) Bullish

plurality

--> 44

-1

MINCP stocks Bearish

MINCP Stocks (3/4/2014)

--> 191 +113 New Highs on NASDAQ ? new lows. Bullish plurality

--> 202 +107 New Highs on NYSE 9 -6 new

lows. Bullish

plurality

We saw quite a recovery today. The NASDAQ has soared

to a new high and

closed at 4351.97. A move by it above 4400 would likely start a swift vertical

ascent

to 5000. The NYSE and S&P

both made a new highs and completed bullish inverted

head/shoulders pattern. The OEX close right at its

December and January highs.

The lagging DJI closed at a a downtrending resistance line

drawn through its December

and January peaks.

The Best Leveraged ETFS Now.

Running the Tiger Power Ranking program now against the leveraged ETFs

should give us a good idea where to place aggressive trading money. TNA +5.83

the 3x Small Cap ETF is the highest Power Ranked. It appears to be on the verge of

moving past its rising resistance line. Its internals are superb. AI/200=174,

IP21 = .253. Both Opening and Closing Power are rising. URTY+6.79

-Russell-2000-Ultra

looks very similar. The third highest Power Ranked is TQQQ +2.59

There is no evidence yet that Putin wants to force a showdown over the Easter Ukraine

region.

The Russian ETF, RSX, even rallied. Perhaps, cooler heads and diplomats will win

out.

Obama's solution, a billion dollar loan to the new Ukrainian government, should bring

much needed stability and public safety if the Svoboda tough guys go back home.

Recall how Hitler rose to power with much help from the Brown Shirt street thugs

A key question now: Can

Ukraine Control Its Far Right Ultranationalists? How

popular are they when elections are next held? Will they accept the result and calm

down? Will their party be given police powers in the new government? Giving a

a billion dollars to these extremeists seems absurd? How can that be avoided?

==================================================================================

OLDER HOTLINES

==================================================================================

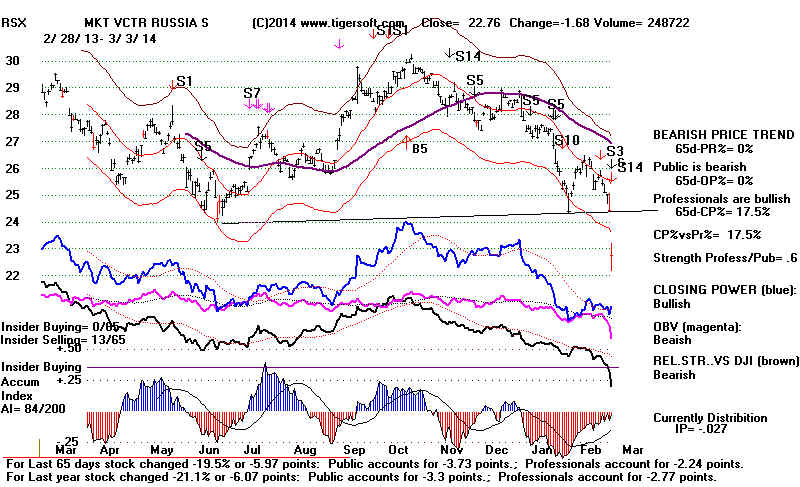

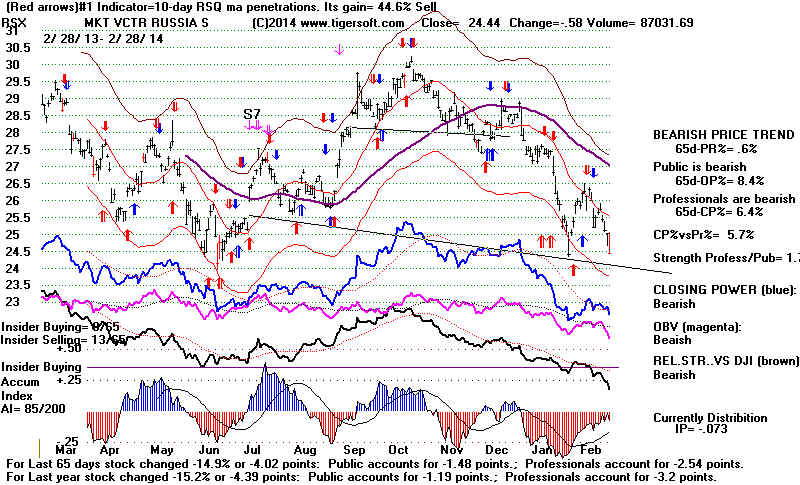

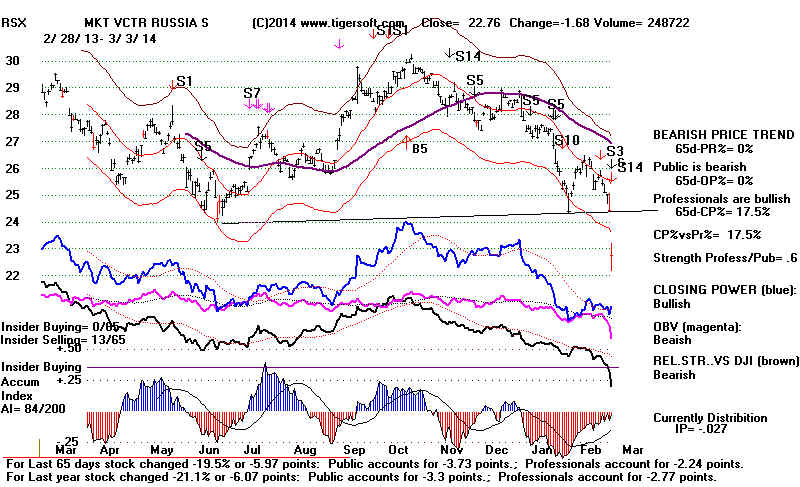

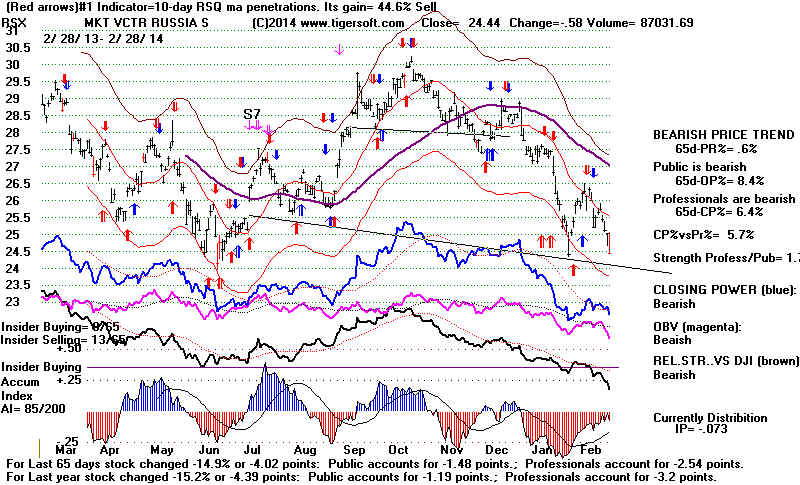

3/3/2014 Russia has its

hands full digesting the Crimea and the consequences

of

its re-taking it nack by force. RSX's sharp break today is the way the West plays

financial

hardball with the Kremlin. As expected, the US has responded verbally and

diplomatically, but

not

militarily. US interests are not at stake presently. Russia has had de jure or

de facto

control of the Crimea for almost as long as there was a USA. We'll keep watching

this

chart

to see when the crisis over.

Cooler Heads

It

will take a while for the players to sort through the complications of the civil strife

in

the rest of the Ukraine. But as long as there is no Russian military action in

Eastern Ukraine,

Western Europe, the US and NATO will likely accept the Russian control of the

Crimea.

The

rebound in the Futures today partly reflects the return of control to "cooler

heads"

both

there and 10000 miles and 9 time-zones away back in New York.

Professionals started buying after 4 hours of selling today. The Opening

Powers decline in

the

key ETFs - DIA, SPY, QQQ and IWM - has largely

been matched by the Opening Power's

rise.

Now tomorrow we get to see with a much higher opening, if the Professionals

will

continue to buy even though the DJI has reached its falling resistance-line

and

its upper 3% band. The excellent breadth (NY A/D Line, P-I and new highs -

new

lows) are firming up the market. At last, the low interest rates may be getting

some

traction with Main Street.

--> To Key Index and Leading Stock

Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart

NASDAQ

Chart IBB Chart

IWM Chart

--> 263 +17 MAXCP stocks Bullish MAXCP Stocks (3/3/2014) Bullish

plurality

--> 45

+9

MINCP stocks Bearish

MINCP Stocks (3/3/2014)

--> 78

+9 New Highs on NASDAQ ? new lows. Bullish plurality

--> 95 +8 New Highs on NYSE 9 -6 new

lows. Bullish

plurality

The

"expanded" Buy B9 has not been reversed even short-term. The Closing

Powers

are

rising and the A/D Line is uptrending. Next, it may be the DJI will be able to take

out

the

overhead resistance line this coming week. Since 1965, the DJI has risen 70.2%

of

the time over the two weeks following March 3rd. But the upper band will not make

that

easy.

Positive Internal Strength Indicators

DJI change

la/ma

annroc

P-I change IP21

V-I

Opct 65-day Pct Change

----------------------------------------------------------------------------------------------------------------------------------------

3/3/14 16168 -124 1.013

.239 +458

-124

+.095 +12 .115

.005

2/28/14 16322 +49

1.024

.436 +582

+109 +.096 +41

.203 .015

2/27/14 16273 +75

1.023

.258 +473 -21

+.076 +15 .095

.016

2/26/14 16198 +19

1.019

.270 +493

+103 +.057 +20

.091 .018

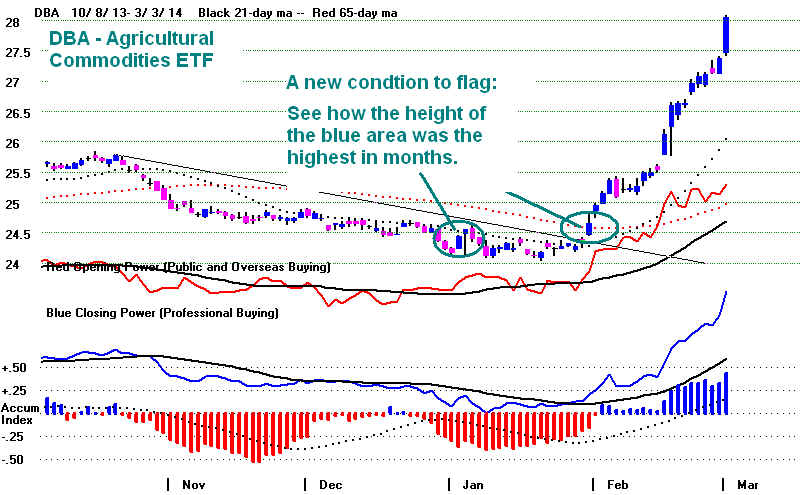

Commodity Prices in Upswing.

There

is another thing to worry about. It only a matter of time before the

very

sharp rise in commodities, especially food prices, gets press and public attention.

This,

in turn, will likely accelerate the Fed's decommissioning of the FED's QEIII

buying of long-term mortgages. This makes it seems risky now to take on more than

very

short-term long positions.

But

bull markets usually end with A/D Line non-confirmations. And this seems remote

now.

So, perhaps, the expanded Buy B9 and the DJI's surpassing of the 5%-up-level

from the

late

January bottom will bring DJI new highs, after all. If that happens, then there

remains

a

good chance for the NASDAQ to go vertical.

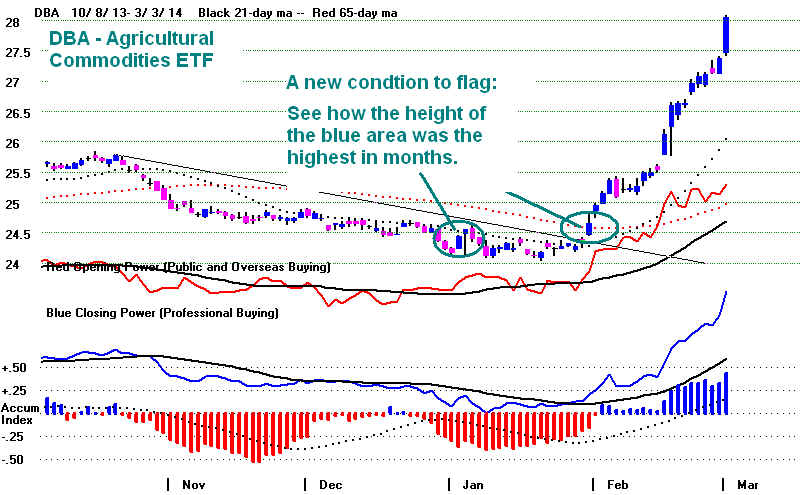

Three New Conditions to

Watch for and

for Me To Test and Write Programs To Flag

2 Bullish New Conditions

1 New Bearish Condition

==================================================================================

2/28/2014

Russia is not going to back down about the Crimea, which

is

virtually an island, connected very narrowly to the Ukraine. For now, we are in for

a

return to new Cold War. Listen to Boehner

s tough talk: Putin is a "thug:",

The

US military stocks will love this. Russian ETFs will be punished. A 10%

decline might occur, but breadth is very good and US interests are not so evident.

The

real danger is what happens elsewhere in Ukraine. The Russian claim to the

Ukraine is much stronger. I do not expect Obama to admit this. So, we could be

led

back into a new period of war preparations and cold war. In the past, such

crises brought 10%+ sell-offs. It all depends on the diplomats and the American

mass

media coverage. The Russians are not going to turn over the Crimea again

to

the Ukraine as Krushchev (a Ukrainian) did in 1954.

Fortunately, the Operative Peerless Signal is an "expanded B9". Breadth

is

just too good to predict a big market decline. We need a new Peerless Sell signal

to even consider that a possibility. The 6%+ rally up from the late January bottom

is too much to be consistent with setting up a big decline at this time. March tops

are

relatively rare. When they occur, they usually occur because the P-I or IP21 is

negative

at the upper band. All our Peerless key values are positive now. I think we

are safe

for now.

Positive Internal Strength Indicators

DJI change

la/ma

annroc

P-I

IP21 V-I

Opct 65-day Pct Change

----------------------------------------------------------------------------------------------------------------------------------------

2/28/14 16322 +49

1.024

.436 +582

+109 +.096 +41

.203 .015

2/27/14 16273 +75

1.023

.258 +473

-21 +.076 +15

.095 .016

2/26/14 16198 +19

1.019

.270 +493

+103 +.057 +20

.091 .018

However, the DJI could not get past its well-tested resistance line and it has

nearly tagged its upper 3% band. Looking back at DJI charts for the last 10 years,

you can will see it is rare for the DJI to break above the 3.5% band. But without

a Sell signal, the declines have been limited to only dropping the DJI a little

below the 21-day ma.

The Ukrainian Crisis looks like it will bring such a pull-back. However, the

Closing Power and A/D Lines have not broken their uptrends. Our Tiger Stocks'

Hotline is fully hedged while we wait for Peerless to give a Sell Signal or for breaks

in these uptrends. There are times to take risks in the market. This is not

one of them.

Stock prices for the moment are now dependent upon political rather than market forces.

--> To Key Index and Leading Stock

Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart

NASDAQ

Chart IBB Chart

IWM Chart

--> 246 +9 MAXCP stocks Bullish MAXCP Stocks (2/28/2014) Bullish

plurality

--> 54

+9

MINCP stocks Bearish

MINCP Stocks (2/28/2014)

--> 78

+9 New Highs on NASDAQ ? new lows. Bullish plurality

--> 95 +8 New Highs on NYSE 9 -6 new

lows. Bullish

plurality

Fears of a new Europeon War in the Ukraine will surely bring a pullback.

The DJI's Futures are down 122. At this week's Tiger Meeting (see work materials

from it), I expressed the belief that this would all soon blow over. The market's

technicals,

I said, should be sturdy enough to limit the decline to the DJI's 21-day ma. The

Russian ETF, RSX, will probably be hit a lot more than the DJI. Look at the

heavy

trading in it.

If Eastern Ukraine Becomes A Battlefield,

A Much Bigger Decline Could Start.

Upon further reflection today, I'm not sure Obama is strong enough to resist

the pressure on him from the American right. He may get us involved in yet

another civil war 10,000+ miles away. Surely, one hopes, he realizes that

history in such matters has not been kind to such American involvements.

Unfortunately, all my adult life, America keeps making the same mistake, in my view,

over and over again getting involved in distant foreign civil wars when they can be

couched in a US versus Russian or Communist framework for average TV

American viewers by the mass media here. America better back down.

Russia will not. They see the new Ukrainian leaders very differently than

our media shows them to us. They see them as the new Nazis next door.

Crimea, A Warm Water Port in The

Black Sea.

It's not clear what difference to America or Europe the formal Russian

control over the Crimea really means. The Russian fleet has been there since 1800

except during the German occupation in WWII. The peninsula's population now

is 60% Russian speaking. Ukrainian and Tatar speakers are a minority.

For Russia, the Crimea represents a warm port, a wonderful place to go on

Summer vacation and a show case for Russian movies. Krushchev, a Ukrainian,

turned the Crimea over to the Ukraine in 1954 in what seemed to be only

a token administrative change back then. The Ukraine's claim to it now

is too weak for NATO to make much of a fuss about. But memories of the

Cold War, which really began in 1917, do not fade quickly.

It is the rest of "the Ukraine" which is the big problem. Too many

Ukrainians

seem to see their country's divisions as being beyond peaceful resolution. The Eastern

half is Russian speaking and orthodox. The Western half is Ukrainian and

Catholic.

To them, this matters. To someone far away, the differences between the Russian

and Ukrainian languages seem limited to certain letters. A Russian can understand

most

basic Ukrainian and with a little study vice verse. The same is true of the

religious

differences. To a non-Christian, the similarities between these two priest-oriented

Chistian religions are not so easy to distinguish.

New Nazis Right

Next Door?

Svoboda's Oleh Tyahnybok doing their party salute when re-elected their

leader.Ukraine party accused of anti-Semitism receives top positions in new government

Euromaidan:

The Dark Shadows Of The Far-Right In Ukraine Protest

Russia

says the Ukrainian protesters are fascists and Nazis. Are they? |

The Political Divide Is Very Wide.

People from Western Ukraine (Gallicia) speak a

language more similar to Polish. Poland ruled much of Gallicia, as late as 1941.

In the Russian Civil War, the White Army in Kiev fought the Red Army of Kharkov

(Ukraine). When the NAZIs came, many in Western Ukraine were quick to collaborate

against the Red

Army.

The dynamic leader of the fiercely anti-Communist

Svoboda Party, Oleh Tyahnybok,

gets much of his

support from northwestern Ukraine. Collaborating with the NAZIs is not a disgrace in

Svoboda's Party circles. Those days are remembered with some sympathy by the contemporary

Svoboda Party. Early on, it chose the name Social Nationalists (reversing Hitler's

"National Sociaist" party. It uses the Nazi Party salute and

the same Wolfsangel symbol that was used by the

Waffen SS.

The Eastern half of the Ukraine gives this Svoboda

Party only a miniscule portion of their vote. But the Svoboda is a major

member of the new de facto government running Kiev now. This scares all Ulrainians

minorities, especially Jews, not just the Russian speaking Ukrainians in the East.

Russian Fears run Deep

20,000,000 Russians died in World War II because

of Fascism. There is no way a Russian leader could

permit a new Ukrainian Fascism to threaten Russians a mere 800 miles from Moscow.

When will our mass media talk about this very dark