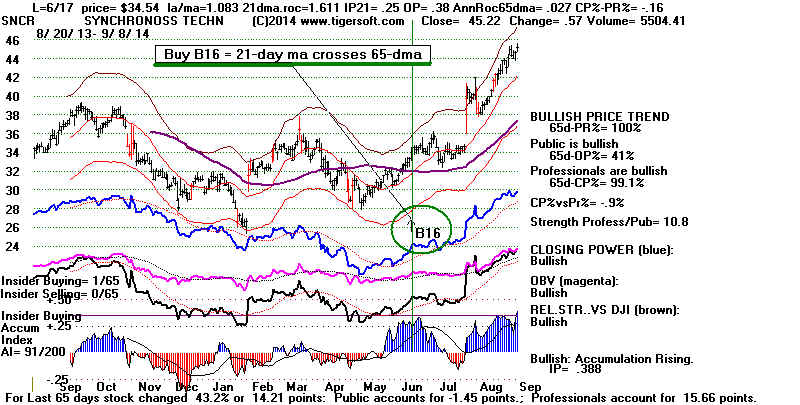

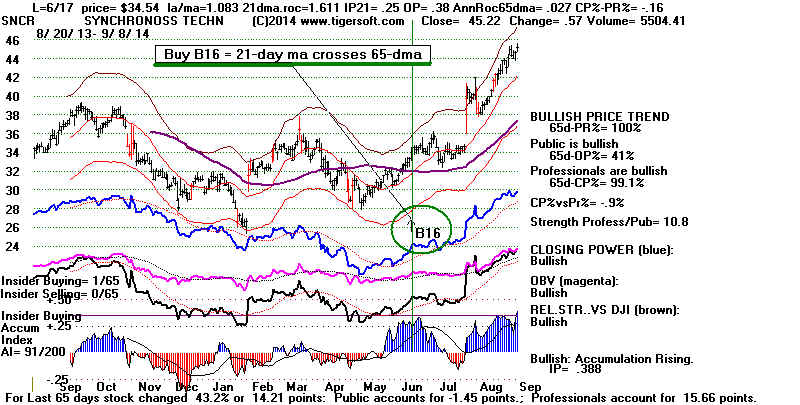

TIGER B16s in 2014

14-S's Are Sampled Alphabetically.

The B16 is the 21-day ma crossing the 30-wk ma.

Findings:

If

LA/MA under 1.05, 81% of Buy B16s were profitable.

Here we will first test and qualify the signal first by simply seeing

how well the first 30 Buy signals did making 10% before they make

10%. We then look at the results of these 30 Buy B16s to see

what best qualifies them as likely to be successful. Following

that, we see how well trading the first Closing Power trends in the

aftermath of the B16 does.

If the B16s has not achieved or lost 10% and it occurred within

three weeks of the end of the period, the case is left out here

as not having enough time to play out. But if it falls or rises in

less than three months, it is counted.

I leave out low-volatility dividend stocks and bond funds.

B16s: 10% Success or 10% Failure?

In the randomly chosen

sample of 30 Buy B16s, there were 18 successes

9 failures, and 3 that did not achieve either

gain or loss. The success rate

was 60%.

date

la/ma

21 IP21 OPct Ann

CP%- Consequence

dma

Roc

PR%

ROC

---------------------------------------------------------------------------------------------------------------------------------

SA 6/24/2014 1.133 2.558 .128 .135

.522 -.15 Fell from 9.06 to 8, rose to 11.5 Failure.

SAAS 9/8/2014 1.071 1.536 .31 .285

-.041 -.09 Fell from 9.27 to 7.6 then 9.5. Failure.

SABA 7/18/2014 1.068 2.281 .404 .720 .462

.01 Rallied from 12.65 to 14.5 in six weekes Success.

SAD 4/28/14 1.045 1.181

.078 .262 .248 .37

Fell from 24.33 to 23.5 and rose to 27.5 in five weeks.

Success.

SALM 7/1/2014 1.058

1.485 .347 .493 -.177

.26 Fell from 9.56 to 7.90. Failure.

SAP 4/9/2014 1.032 .594

.027 .242 -.145 -.28 Fell from 81.44 to

74.2. Failure.

SATS 5/20/2014 1.057

1.556 .515 .333 .095

.01 Rose from 51.20 to 54 and then fell to 48. Trading Range.

SB 6/30/2014 1.061 2.177 .238 .027

.313 .01 Fell from 9.77 to 7. Failure.

SBBI 6/16/2014 1.032 1.348 .336 .351

.758 .02 Rose from 31.32 to 36 in two weeks.

Success.

SBLK 6/24/2014 1.098

2.266 .150 .292 -.363 -.25 Fell

from 13.33 to 10.5 and then rose to 15.39 Failure.

SBR 9/8/2014 1.012 .511 .170

.132 .115 -.49 Rose from 51.44 to 63.5.

Success.

SBS 6/2/2014 .982 .121

-.027 -.063 .012 .11 Rose from 9.68 to 11

on three weeks. Success

SBSI 7/28/2014 1.037 1.003 .518 .577

-.434 -.07 Rose from 29.29 to 34.5 in two months. Success.

SCHL 7/1/2014 1.034 .783 .204

.193 -.024 -.040 Still

in trading range.

SCLN 5/22/2014 1.057

.996 .023 .116 .164

.010 Rose from 5.07 to 7.20 in three months. Success

SCON 5/28/2014 1.158

3/237 -.111 .577 .411 -.200

Rose from 2.89 to 3.20. Success

SCS 4/11/2014 1.056 1.854 -.028 .290 .263

-.130 Rose from 16.47 to 17.90 and then fell to 15. Failure.

SCSS 5/16/2014 1.011 .670 -.044 .047

.393 -.310 Rose from 18.91 to 22.5 in three months.

Success.

SCX 6/9/2014 .979 .885

.140 .137 -.830 .480 Rose

from 15.06 to 18.7 in three months. Success.

SDLP 6/4/2014 1.080 1.057 .177 .532 .346

0 Rose from 33.70 to 36.00 in two

months. Trading Range.

SFEG 7/4/2014 1.016 5.621 .347 .285

2.045 .240 Rose from 0.06 to 0.29 Success.

SGC 6/10/2014 1.135 1.269 -.068 .258 .344

0 Rose from 17.87 to 23.0.

Success

SGNT 6/12/2014 1.036 1.164 .312 .272 .175

-.410 Rose from 23.11 to 29 in 10 months. Success

SHG 3/28/2014 1.046 .567 .195

.236 -.048 -.580 Rose from 43.59 to 52 in 5

months. Success

SHI 7/10/2014 1.041 1.112 .199 .512

.588 -.550 Rose from 28.87 to 34.70 in two months.

Success.

SID 7/21/2014 1.135 2.789 .114 .446 1.017 -.270

Fell from 5.24 to 4.19 in five weeks. Failure.

SIFY 6/9/2014 1.076 1.902 -.375 .289 .152

-.66 Rose from 2.17 to 2.60 in a week. Success.

SIGI 6/24/2014 1.014 .480 .155

.139 .216 -.05 Fell from 24.70 to

22.2 in five weeks. Failure.

SIGM 7/10/2014 1.004 1.907 .157 .457

0 .03 Rose from 4.55 to

5.09 om six weeks. Success

SIM 5/7/2014 1.052 .556 .198 .145

.379 .31 Rose from 12.20 to 15 in ten weeks. Success.

SKM 5/14/2014 1.046 .989 .352

.400 .495 -.04 Rose from 24.03 to 21.2 in 10

weeks. Success.

------------------------------------------------------------------------------------------------------------------------------------------

Where LA/MA>1.1 there are 2 successes and 2 failures.

Where LA/MA >1.05 and LA/MA <1.10, the success rate was only 30%.

3

successes

5

failures

2

trading ranges

Where LA/MA >1.00 to 1.05, the success rate was 78.6%

11

successes

2

failures

1

trading range

Where LA/MA <1 there were 2 successes and no failures.