Trading Mining Stocks, NUGT and DUST with Tiger Software

(C) 2015 William Schmidt, Ph.D.

See 1/31/2015 Introducing New Tiger 6-Month Charts: 5-day MA and

Volume Studies

====================================================================================

2/13/2015 See how

NUGT's red down-day volume

warned

the stock would fall back.

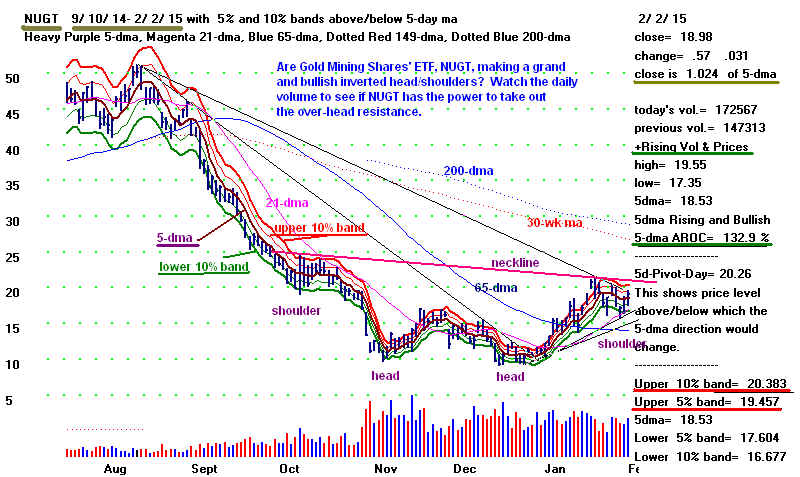

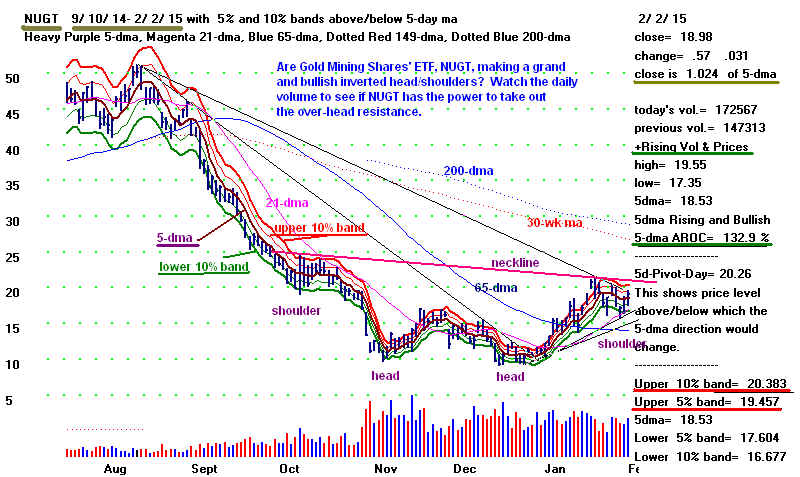

2/2/2015 Is NUGT making a grand inverted head

and shoulders, with an upside projection

50% higher? Watch the

volume on the new TigerSoft

Six-Month charts. Daily volume must increase to overcome the

overhead resistance. The 5-day ma has just turned up. It is

rising only at an annualized rate of 132.9%. This must rise in the

coming days.

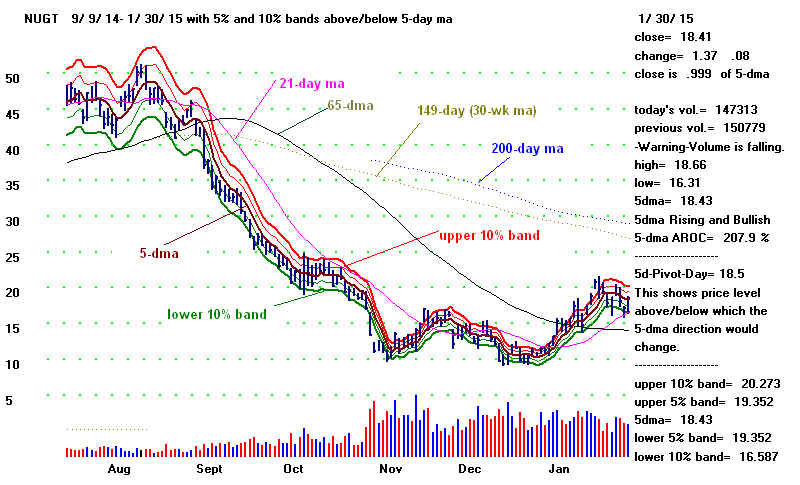

1/31/2015

Introducing New Tiger 6-Month Charts

5-day MA and Volume Studies

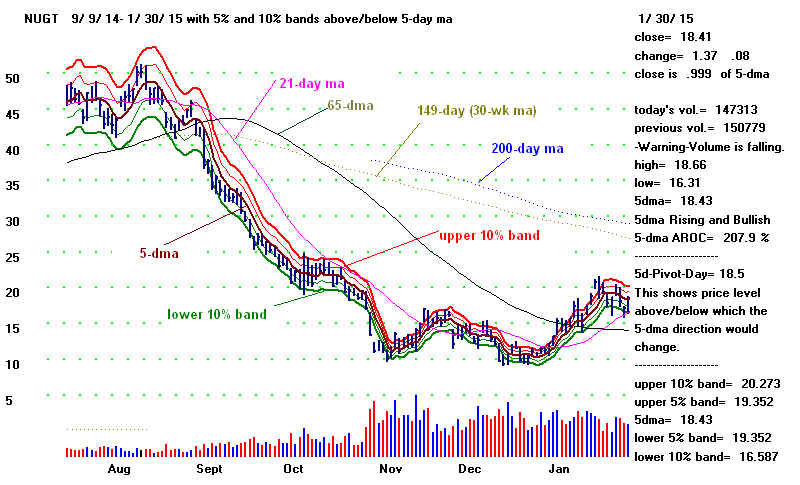

In these new 6-month Tiger charts, we emphasize the 5-day ma and upper/lower

5% and 10% bands with stocks and volatile leveraged ETFs. Note that we

will work with 1.75% and 3.50% bands with the DJI, NASDAQ, SP-500, OEX

and major market ETFs. Here the focus is on the leveraged ETF, NUGT, and several

mining stocks.

First, note the heavy red 10% upper band, the lighter red 5% upper band and

and heavy purple 5-day ma in the chart of the 3x leveraged mining ETF, NUGT,

below. Underneath these bands are the lighter green 5% lower band and heavier

10% lower band. The 10% bands bracket about 90% of the closings in this

chart. So that most of the time, one could profitably buy at the lower 10%

despite its declining trend. This is not true, however, when prices switch from

a trading range to a steeply trading trend. Buying at the lower band is most

reliable when a stock is either going sidewise (in a trading range) or trending

up.

If you wish to overide the 5% and 10% bands, build an ascii text file in c:\peerless

named bands.txt and on each line enter the symbol and a comma

and the wider desired

band width. Examples:

DATA, .035 (DJI)

INDU, .035

DIA, .035

OEX, .035

QQQ, .035

NASD, .035

SPY, .035

IWM, .04

FAS, .06

GOOG, .08

IBM, .07

GE, .06

This will allow you to use a different set of band widths. Not that the smaller band

width

(upper and lower) will automatically be set at half the bands you have provided in

c:\peerless\bands.txt

On the right side of these 6-month Tiger charts, you will see notes about the stock's (or

ETF, index,

commodity's, currency's) closing price is relation to its 5-day ma. The "change"

is the daily price

change and the percent daily change. The next line shows how near the close is to the

5-day ma.

The ".999" means it is 0.1% below the 5-day ma. A "1.07" would

indicate the stock closed 7%

over the 5-dma. A ".912" would mean the stock has closed 8.8% below the

5-dma.

Always compare the current day's volume with the present day's volume if you are a

short-term

trader. In the chart below, the next message warns that the stock's volume fell on

the day's

rally.

Whether the 5-day ma is rising or falling and how fast it is moving up or down, gives us a

better sense of how solid is the uptrend or downtrend. Further down on the right

side of

the, the computerized notes tell you what the annualized rate of change (AROC) for the

current

5-day ma. You can use the vertical line command to see the 5-dma AROC at past points

on the chart.

We know that in computing the 5-day ma tomorrow, we will be adding the new day's closing

price and dropping off the price six days before, or the fifth day in the current set of

five

days that produce the 5-dma. This is the key "5-day pivot Day." As

long as tomorrow's

close is above the "5-day pivot Day", the 5-day ma will be rising. But a

close below will

this "5-day pivot Day", will cause the 5-d-day ma to turn down. If the

stock's internals

or volatility is worrisome, close out your long position near the close if the stock looks

like

it will close below the 5-day ma. Should you use this procredure to cur losses?

The regular

TigerSoft charts let you see how well 5-day ma turns have worked for the last year.

With

NUGT, they lost 17.6% conservatively calculated using the commands Signals-2 + MA

Turns

+ 5). When you graph these Buys and Sells, it becomes obvious that most of the many

losses

are the small whip-daws that occur as the stock remains locked in a trading range.

So, the

conclusion suggested here is to use this 5-day pivot point system as much as possible

after

there has been 6 or more weeks of consolidation and it seems the stock may be moving

the wrong way out of the consolidation zone.

At the bottom on the right, see the differnent bands' price levels, for placing limit Buy

or Sell orders.

Note these charts show moving averages other than 5-day ma. The 21-day and

65-dma tells us the intermediate-term trends, one month and three-months. The

149-day and 200-day ma are used to tell us the longer term trends.

When prices are above these other mvg.avgs., the relevant trend is considered to be rising

provided the mvg.avg itself is rising. Until the mvg.avg. itself turns up (down),

there

is a good chance a rally will fail (decline will be quickly reversed). The 65-day

and 200-day

moving averages are considered the most important. We generally try to trade mostly

in the direction these two moving averages show.. Note that any of these moving

averages

can bring short-term reversals, as can well-tested support or resistance. Thus, for

traders

they represent useful price targets on the first rallies up to them. The same thing

is true

in reverse for traders who are short when prices fall to these mvg.avgs. Unless the

internals

of the stock are very good, short-term traders are usually well-advised to take profits at

these points.

Examples:

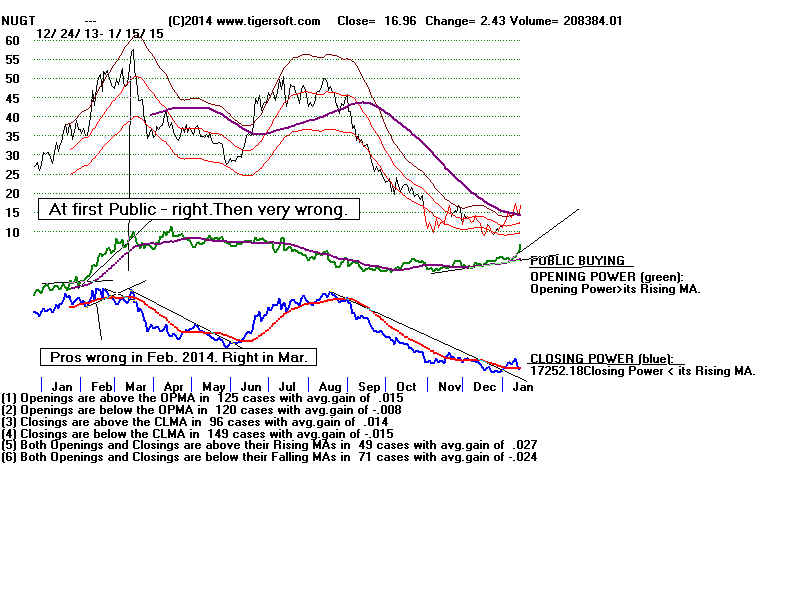

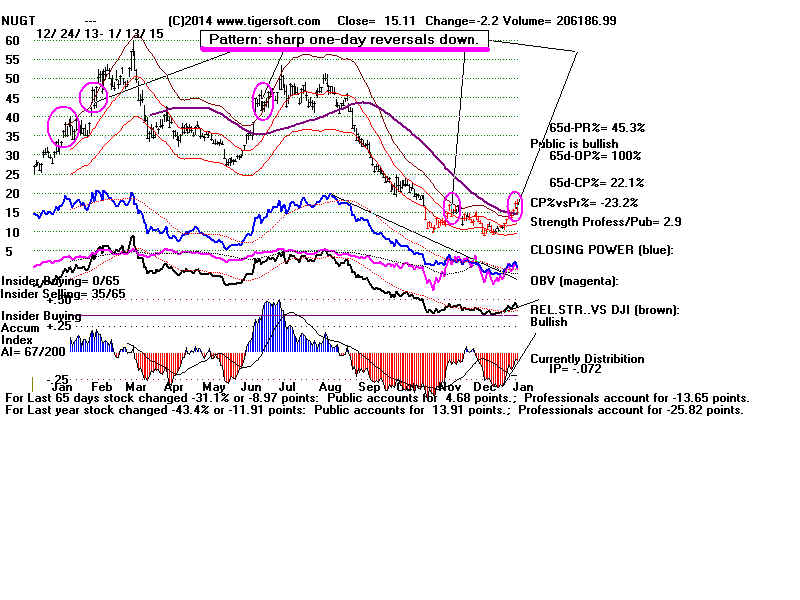

In early Sept 2014, NUGT (above) broke below its key 65-dma AND below well-tested

horizontal support. This is quite bearish. Down-day (red) volume rose on the

decline, confirming the bearishness. Prices fell sharply. The decline was further

confirmed when the (pink) 21-dma fell below the 65-dma. The declining prices managed

to stay between the lower 10% band below the 5-dma and the falling 5-day ma itself.

There was no rally back to the 21-day ma to go short until October. Short sellers

can ptofitably use any rally back to the falling 5-dma to go short when the 5-day AROC

is falling this fast, below -300% on an annualized basis. .

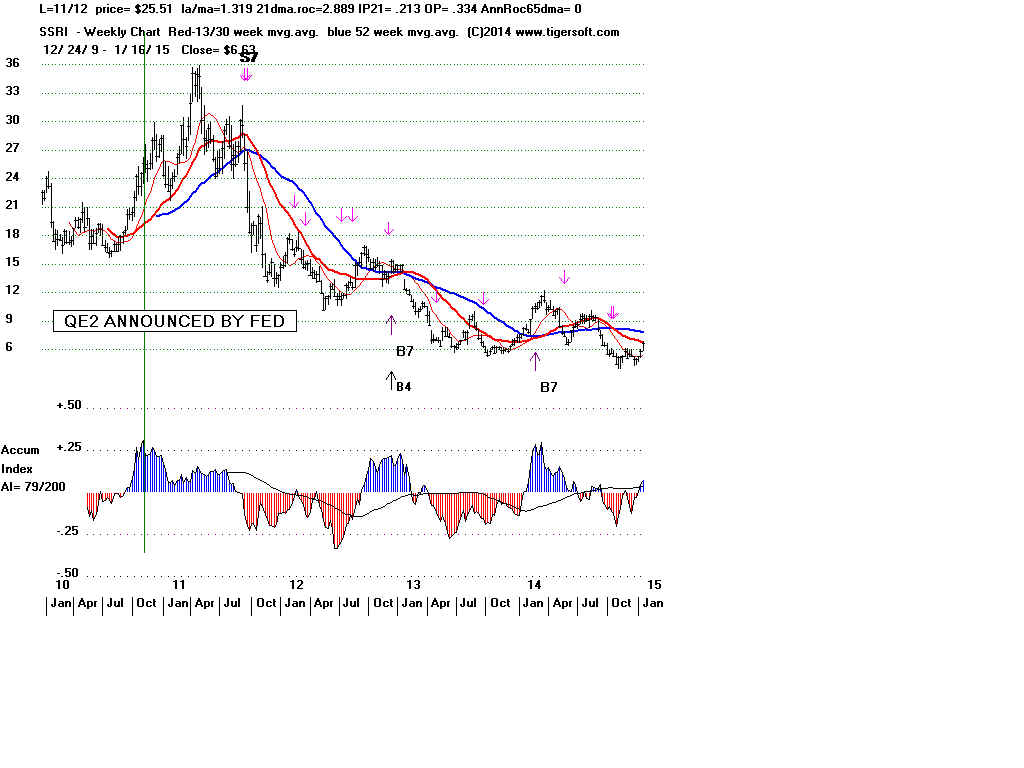

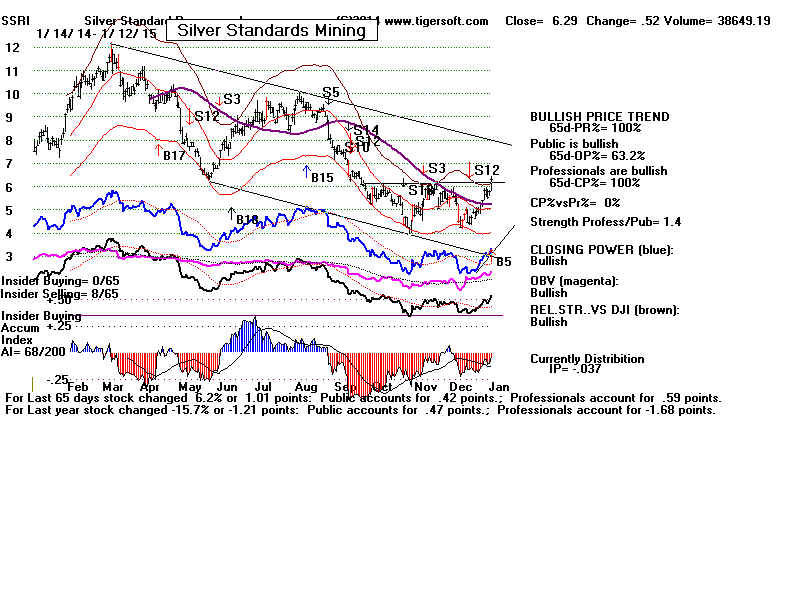

With SSRI below, 3-day clusters of increasing (red) volume on successive down-days is a

warning of dangerous institutional dumping. On the other hand, seeing the highest

(blue)

up-day volume for months is a bullish sign. Seeing the (blue) up-day volume rise

above the

previous day's (red) down-day volume is a good reason to buy if prices are at the lower

band. This was true at the November and December bottoms. See also how the

(blue)

up-day volume failed to keep growing at the January peak. That this was a short-term

top was also suggested when prices closed at the days lows after being turned back from

the falling 149-day (30-wkma).

Some Rules for Very Short-Term Traders,

Watch the 5-day ma, its band and subtle daily

volume non-confirmation

clues about

trend-changes at the upper bands and lower around 5-dma

When the 65-dma is rising:

Buy on dips to the 5% lower band and more on dips

to the 10% lower band. Sell one or both positions at the

5% upper band.

When the 65-dma is falling:

Sell Short on rallies to the 5% upper band and more on rallies

to the 10% upper band. Cover both positions at the 5% lower band.

If the 5-day ma is falling steeply and all rallies seems to fail at it,

with no closes above it, Sell Short the stock on any intra-day rally

to that 5-day ma. Use the 5-day pivot point as a stop loss.

Provided there has not been a flat-topped breakout:

On a rally to the upper 5% band or higher, long positions should

be Sold when daily volume is below the previous day.

After a rally to the upper 10% band, it is a Sell when daily volume

increases on the next declining day.

Provided there has not been a flat-bottomed breakdown:

After a decline to the lower band, it is a Buy when daily volume

increases on the next rising day.

With stocks down a long ways, the lifting of tax-loss selling pressure

in January offers excellent long trades in beaten down stocks,

provided there is enough buying interest, as shown in surges of

(blue) up-day volume.

More Examples to study

1/23/2015 www.tigersoftware.com/DEN/index.html

Buys and Sells on Entire Mining Industry

2014

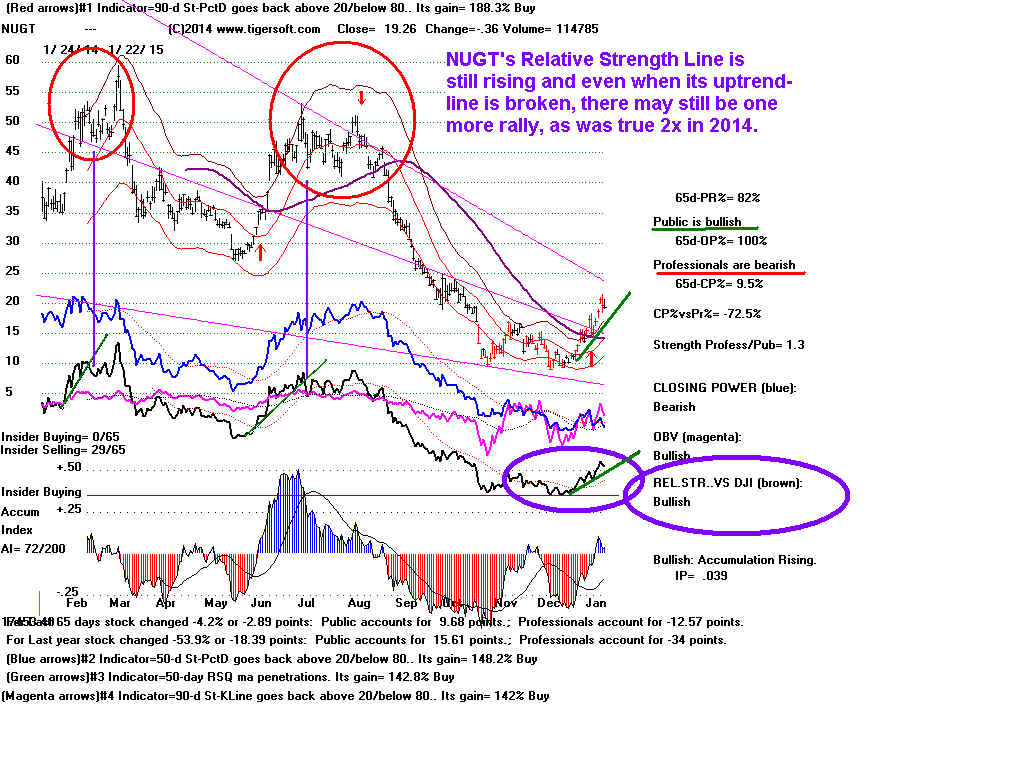

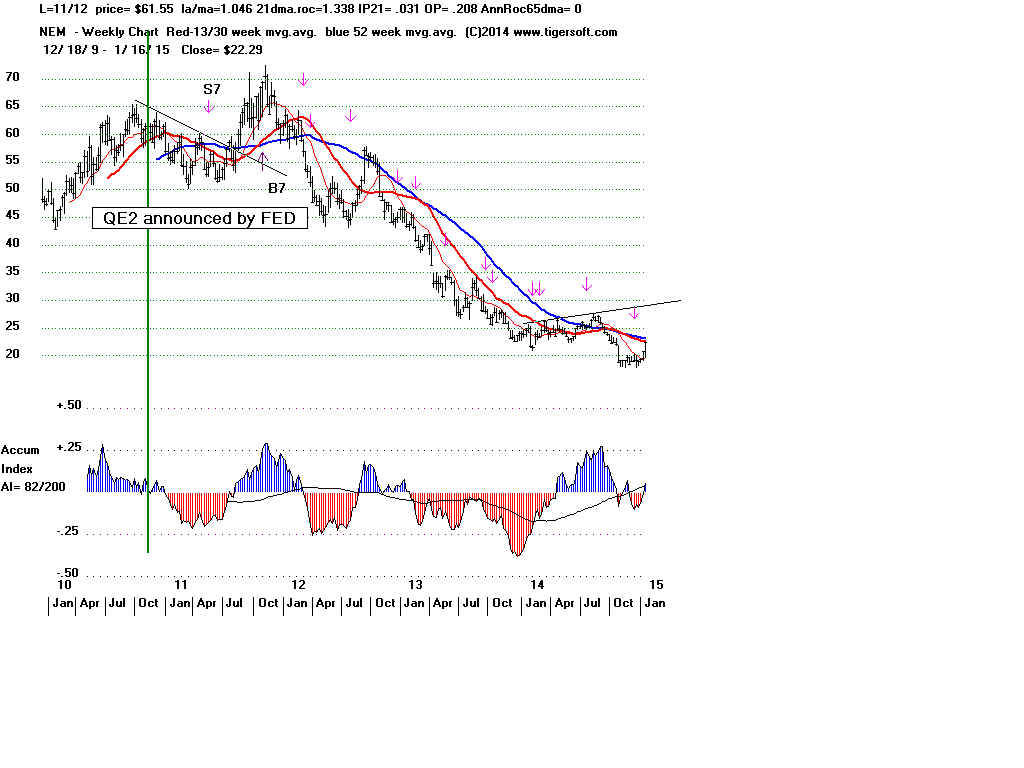

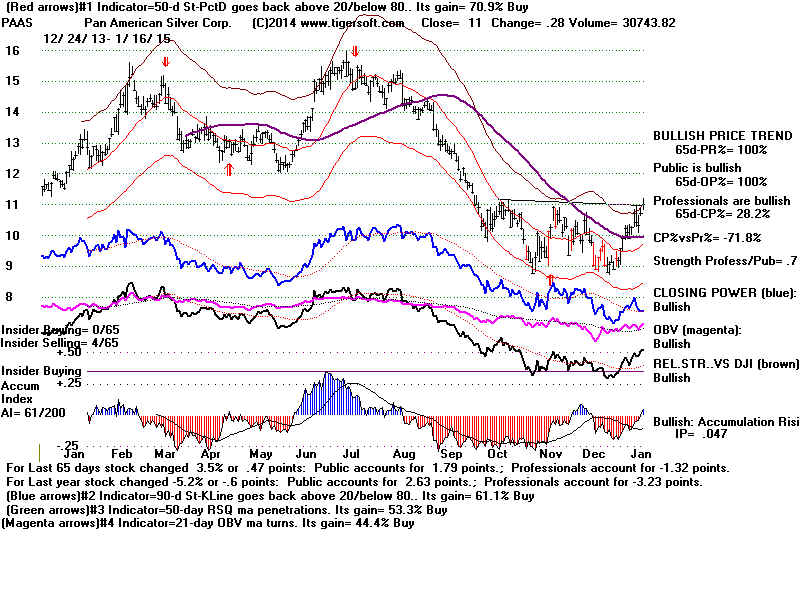

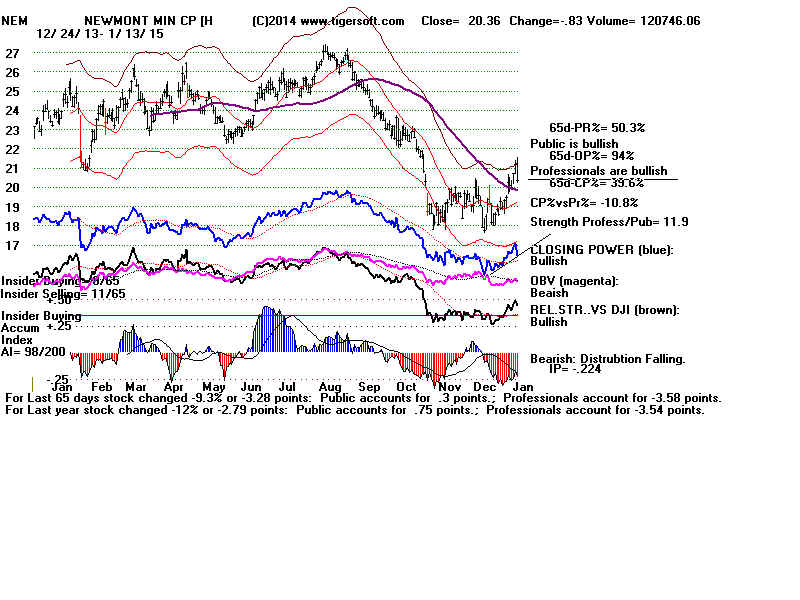

1/22/2015 www.tigersoftware.com/DEN/index.html

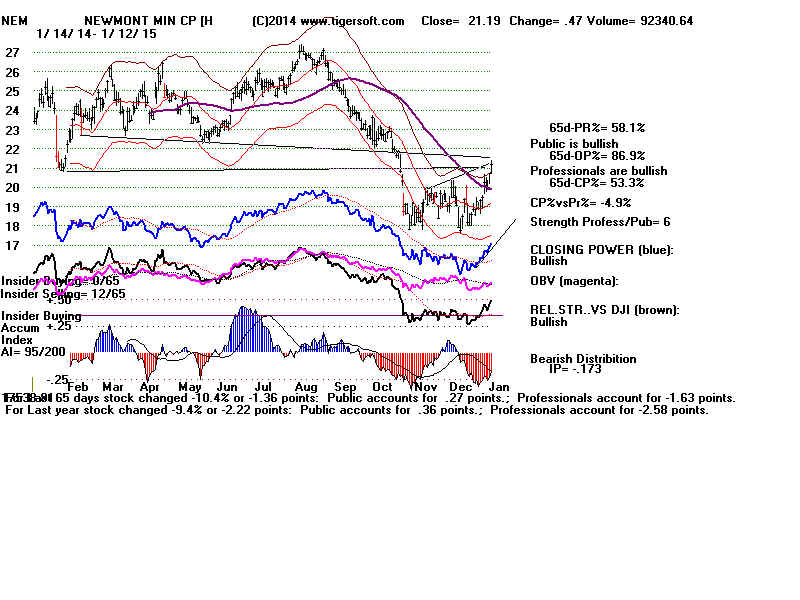

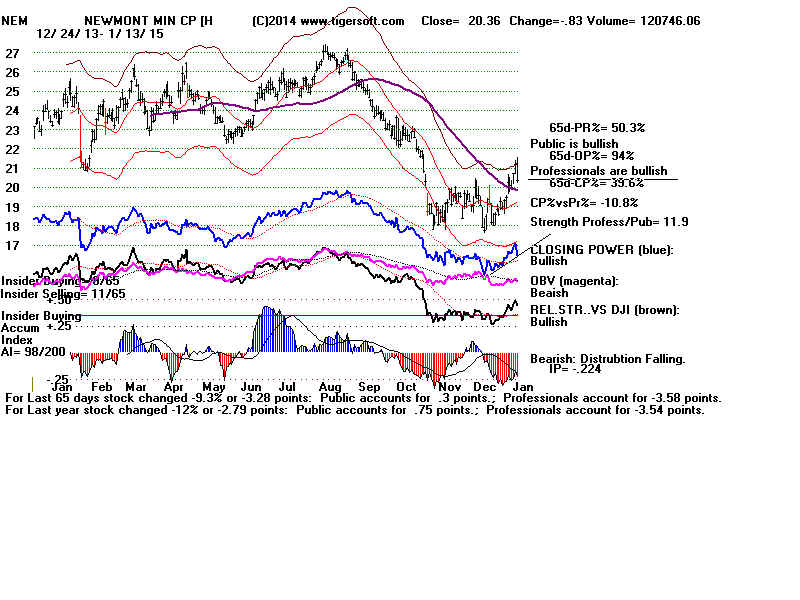

Relative Strength Lines still rising for NEM,

SSRI, PAAS and NUGT.

The US Fed's QE-2 was more bullish

for silver than gold.

------------------------------------------------------------------------------------------------------------------------------

1/15/2015 www.tigersoftware.com/DEN/index.html

Relative Strength

Lines rising for NEM, SSRI, PAAS and NUGT.

Both Professionals and Public

are net buyers.

Expect higher prices.

Charts here are re-sized

owing to loss of main computer on Monday.

========================================

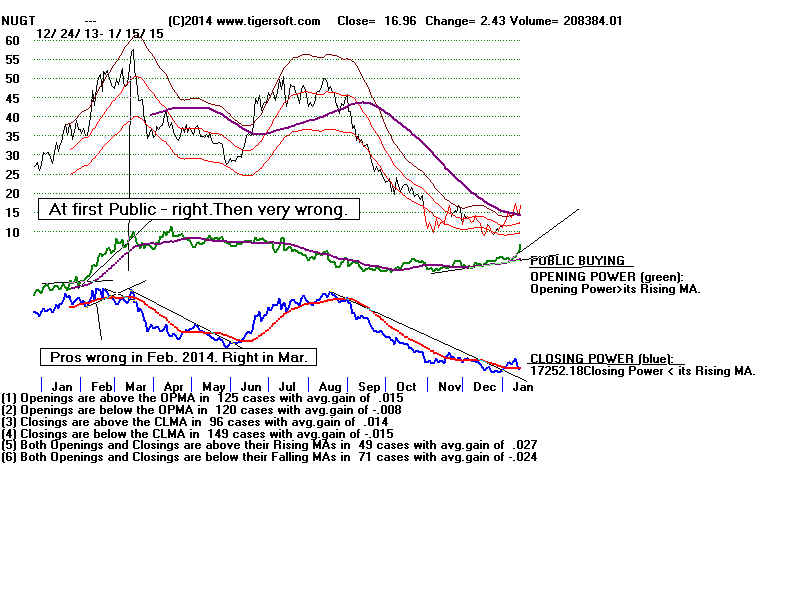

1/15/2015 www.tigersoftware.com/DEN/index.html

PUBLIC ARE NOW BIG BUYERS OF NUGT.

Red Distribution shows there still is resistance overhead.

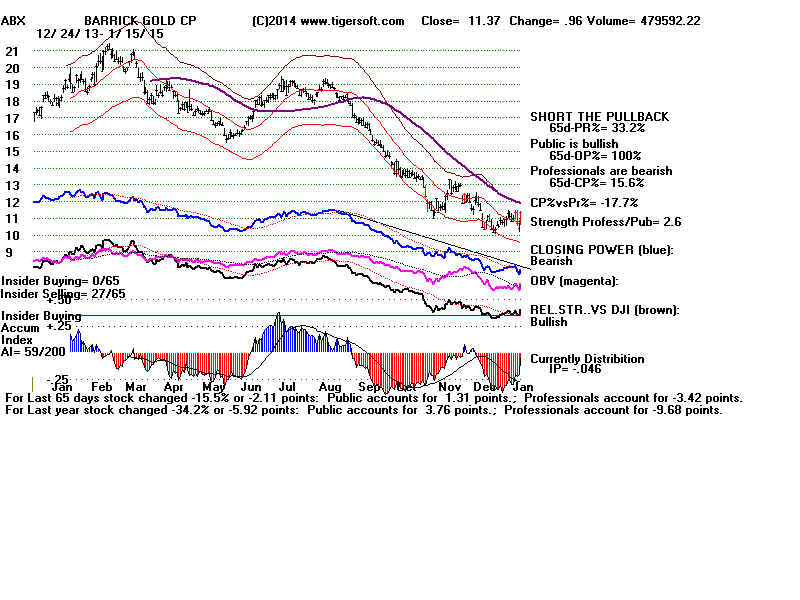

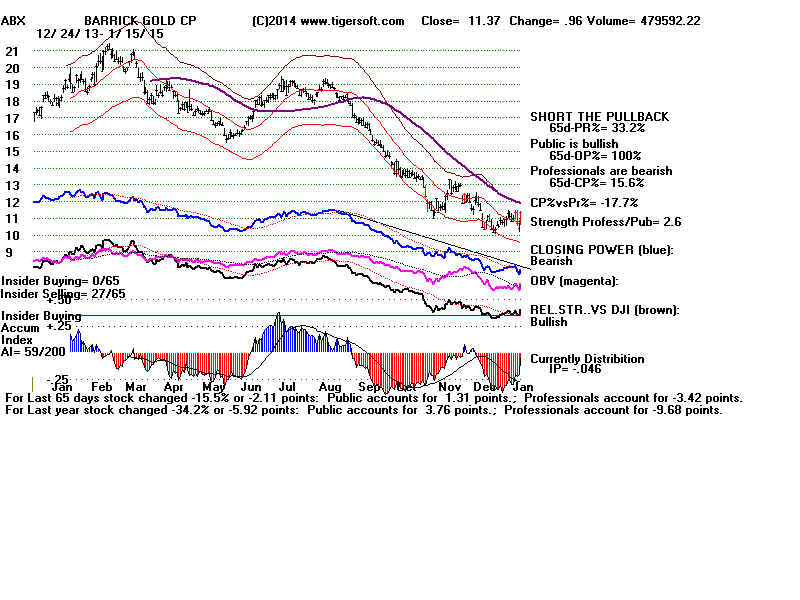

See ABX chart below and 1/13/15

charts.

In Jan-Feb 2014, this still allowed

a big advance for a month.

Then disaster struck NUGT and Pros

were vindicated.

Back then, the broader equities

market did not look so vulnerable,

but DJI did decline until the end

of January.

NUGT is bullishly back above

65-dma. A rally forces shorts to cover.

The last decline can be seen as a

successful test of 65-dma. 27 is

apparent resistance.

65% of Gold and Silver stocks are back above their

65-dma. See Tiger

Index of these stocks and their long ETFs below. The

biggest Gold stock,

ABX, is lagging badly.

=====================================================

1/13/2014 www.tigersoftware.com/DEN/index.html

NUGT, DUST, NEM, SSRI and Precious

Metals' Mining Stocks.......

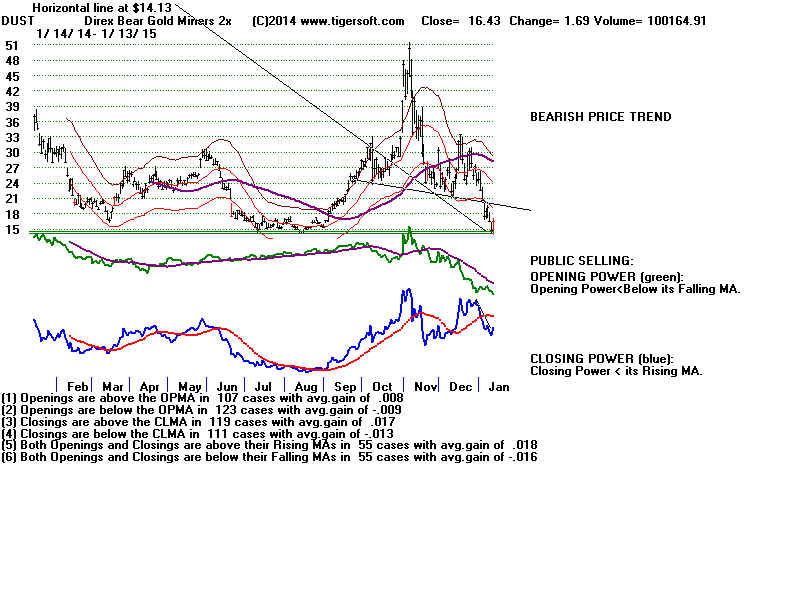

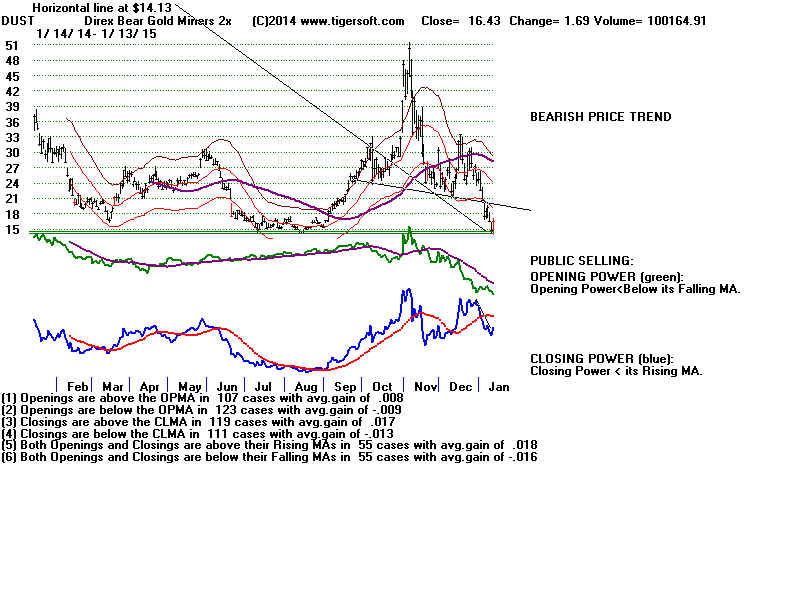

DUST

It pays to keep an eye on

DUST, the 3x leveraged short ETF on gold/silver

mining stocks. It

rebounded from the well-tested support of its lows. Seeing

this technical situation

would have helped recognize more vulnerability in

NUGT, its opposite.

DUST is often used in retirement accounts to match and neutralize

long

mining stock positions.

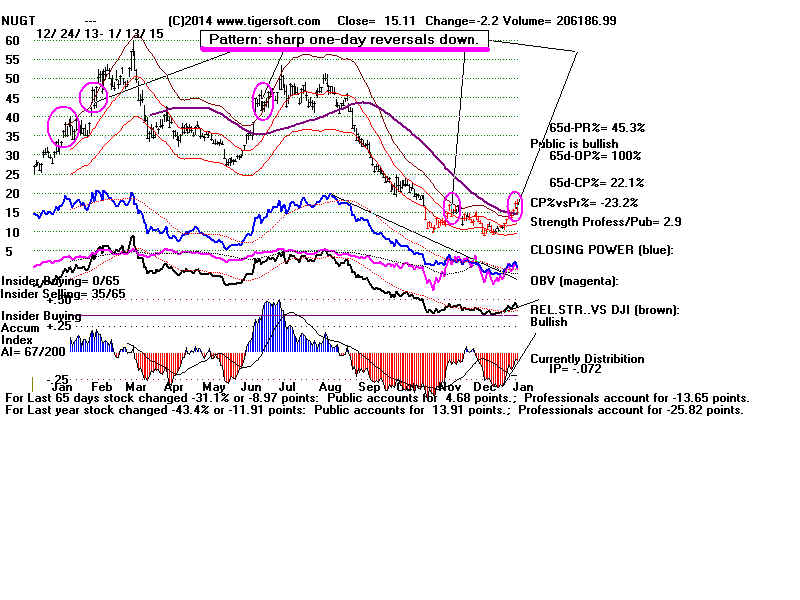

NUGT:

15 is key closing support

here. With red Distribution, Tiger users should consider

any such closing clearly

below the 65-day ma to be a SELL. Has the recent

rally only been a January

bounce in a stock driven down too far by excessive

year-end tax loss selling.

Patterns of sharp one-day

sell-offs (circled in pink)

were always followed by

immediate recoveries in last year.

The Accum. Index still has

not turned positive. So a rally to

17-18 is about all that can

be expected. This shows big selling

on strength.

This was a red popicicle day

for NUGT.

With most stocks (not

leveraged ETFs) a 2-point reversal

down fromt he opening would

be quite bearish. Here this

was short-term bearish enough

to bring an immeiate

re-test the 65-dma.

The steep CP uptrend and Day

Traders; uptrends were

easily violated by a 1-point

decline. Hence, the test of

the 65-dma, as the next

support.

But that level (15) should

hold on NUGT.

Silver, Gold and NEM did not

break their 65-day ma today.

Background

Two things happened today

that affected gold. More

bullish job news was released

by Labor Dept. The likely

next Prime Minister of Greece

said he would honor

existing debt. That was

what many were worried about.

But he also said he would not

let Greece go further

down the road of

bank-enforced Govt retrenchment

and austerity, which is how

this debt would be paid.

(So, he was trying to make

the big European banks

not worry so much.)

Interestingly, US banks jumped

on this news.

They have some of the Greek and Greek

influenced debt.

But now they are selling off, as though

the big bankers' fears

are a long way from being removed.

All this influences the

price of Gold, because it may

bring about the end of

the EURO. Spain and Italy

could go as Greece

goes, unless the big bankers from

Northern Europe loan

them one way or another a

huge sum, a trillion

Euros is talked about. If the Euro

weakens more, and it

could cease to exist even,

then Gold should go up

in value.

Right now the trend of

NUGT's Closing Power is still

up. It is still

above its 65-dma. The Greek ELections

are Sunday a week.

Between then and now, there

will be more Greek

populist speeches. They will scare

the big bankers of

Northern Europe. And that should

bring more rallies to

Gold and NUGT.

GLD - ETF for Gold 1/10 of ounce gold

|

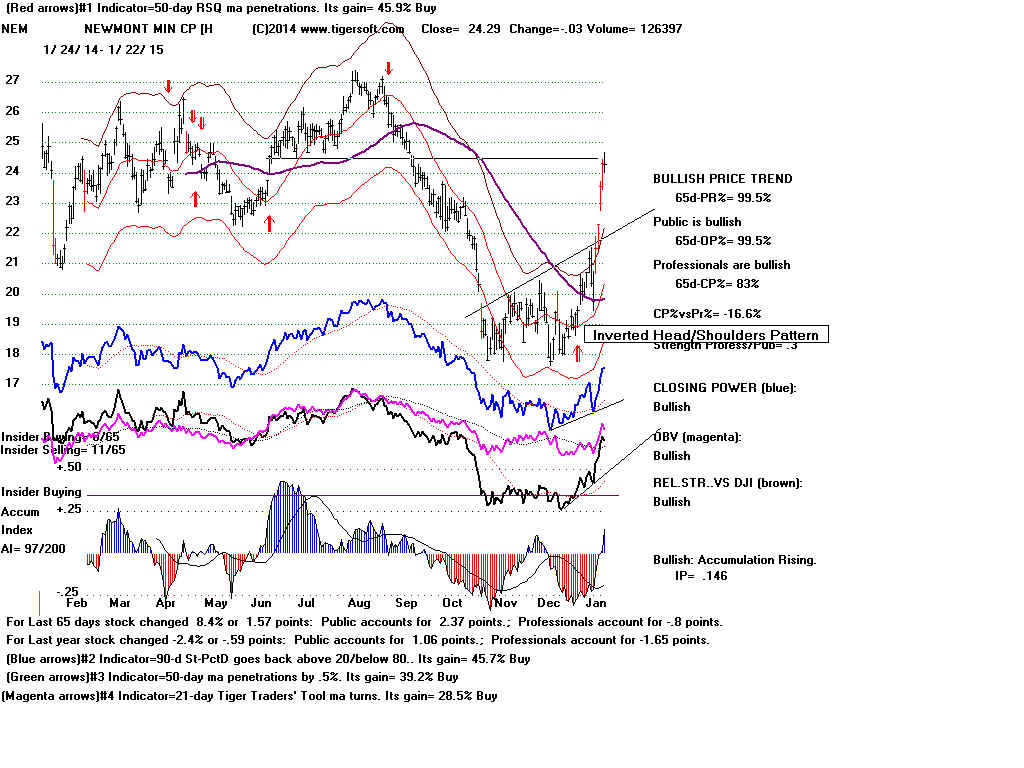

NEM -

|

GLD - ETF for Gold 1/10 of ounce gold

|

-------------------------------------------------------------------------------------------

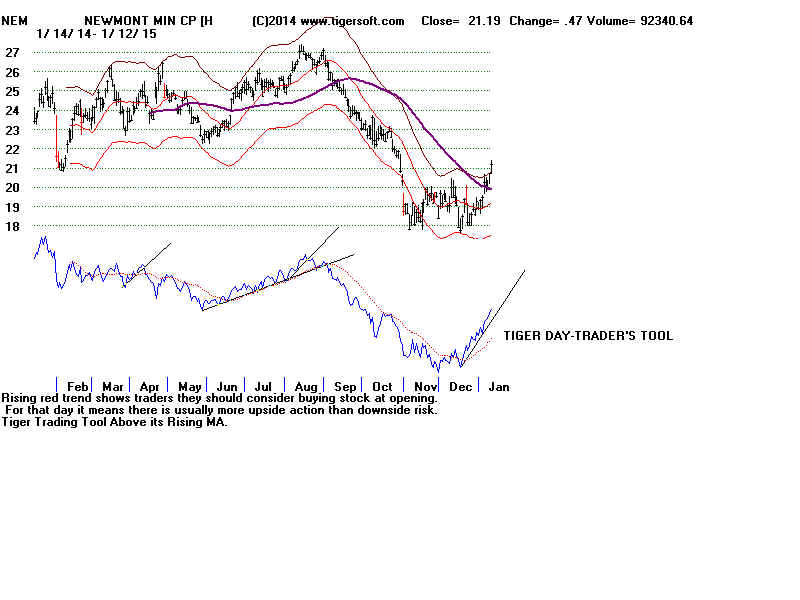

1/12/2014 NUGT, NEM and SSRI:

Watch the Closing Power and Tiger Day Trader Trends

------------------------------------------------------------------------------------------

NUGT

Bullish

Closed back above 65-dma|

Tiger Day Ttraders' Tool shows a bullish

take-off just as it did the last time NUGT took off.

This

shows whether Day Traders should buy or sell a stock at the opening, i.e. whether

there

is more upside potential (to the highs) than danger (to the lows).

Note

the pattern above 41. It has broken support there at 41. That will pose a big

barrier,

assuming prices gets there. The economy will have to in big trouble for such a big

rally.

What

will be the source of that? Deflation in Europe? That works against Gold.

More

terrorist attacks and war with ISIS and radical Islam, maybe.

Closing Power has nice uptrendline to watch and

use.

Both Public and Professionals are bullish.

21-day

pattern of opening higher and closing still higher.

22 3 and 27.0 appear to be next price targets.

Parallel resistance line is now 29.

IP21 is still negative but rising fast tenough

to give B17