All 14-S stocks sampled.

Buy B25s occur simply when the IP21 is above +.50. Many of the

stocks sampled here are thinly traded.

Further research shows that highly traded stocks need not have their

IP21 reach +.50 to be very bullish. This commonly occurs when they are

breaking out of bases. In fact, with many high caps, waiting for the IP21

to reach levels above +.50 level often results in buying late in a move

in over-extended runups. Using Closing Power in these cases, that is

where the stock has risen a long way, will help the trader avoid most

of the cases where having a Buy B25 fails.

The next study of Russell-1000 stocks for 2014 will show the need to be more

cautious with high IP21 occurrences in high caps.

In this study, a success is a gain of 10% (intra-day) before a 10% loss at the Close.

A stock can have more than one Buy B25 but they must be a month apart.

Conclusions:

There were 55 Buy B25s in all the 14-S stocks.

These Buy B25s' success rate can be improved from 74.5% to 87.5%

by requiring posiitve readings from the key values shown with the vertical

line command on the date of the signal and by requiring the LA/MA to

be 1.0 or higher.

Buy B25s N= 56

Successes = 42 (85.0% )

Failures = 12 (21.4%)

Still in a trading range = 2 (3.6%)

The record of B25s with:

LA/MA <1:

6 successes and 3 failures

21 dma-ROC

1 successes and 0 failures

negative OPct:

2 successes and 2 failures

negative 65-dma AnnRoc:

8 successes and 4 failures

CP%-Pr% below 0:

10 successes and 2 failures and 1 trading range

Perfect Internals:

If we screen out any B25 cases with a negative or red readings from any of these 5 red conditions.

22 successes and 2 failures and 1 trading range

Success rate = 88.0%

------------------------------------------------------------------------------------------------------

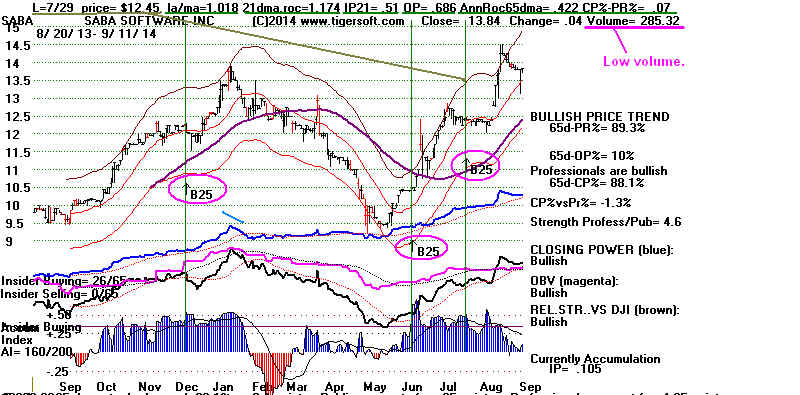

SABA 12/17/2013 12.23 ---- 13.90 Success

la/ma AnnRoc IP21 OPct 65dma CP%-Pr%

AnnRoc

1.011 .315 .53 .82 .905 .02 #1 Perfect

SABA 6/17/2014 10.49 ------ 12.75 Success

1.05 1.005 .643 .676 -.637 .70

SABA 7/29/2014 12.45 ---- 14.5 Success #2 Perfect

1.018 1.174 .51 .686 .422 .07

SAIC 1/21/2014 37.60 ---- 45.75 6 months later Success

1.099 2.34 .534 .795 .458 .17 #3 Perfect

SAP 1/10/2014 83.54 75.00 Failure

.994 .302 .532 -.027 .601 .22

---

SATS 5/28/2014 51.30 48.20 54 Caught in trading range for 3 1/2 months...

1.057 1.556 .515 .333 .085 .01 #4 Perfect

SBSI 6/24/2014 28.27 ---- 34.85 Success

1.049 1.010 .507 .553 -.369 -.13

SCMR 12/3/2014 0.48 ----- 0.65 Success

1.017 0 .552 .035 0 .37 #5 Perfect

SCMR 1/23/2014 0.57 ---- 0.68 Success

1.117 1.643 .539 .72 .551 0 #6 Perfect

SFEG 6/13/2014 0.04 - 0.29 Success

1.283 .437 .533 -.048 -2.794 .59

---

SGC 12/20/2013 16.07 14 23 Failure

1.025 .403 .559 .384 .916 .02

SGMA 1/10/2013 9.38 ---- 11.25 Success

1.115 5.07 .535 .715 2.611 0 #7 Perfect

SGU 4/2/2014 6.14 ---- 7.20 Success

1.063 1.16 .502 .445 .56 -.37

SHG 5/6/2014 44.63 ---- 52 Success

1.011 .478 .529 .243 .294 -.01

SHG 7/25/2014 46.55 --- 52.2 Success

1.024 .32 .574 .212 .163 .10 #8 Perfect

---

SHLM 7/3/2014 41.98 37.54 Failure

1.114 2.164 .504 .702 .544 0

SIF 10/30/2013 22.63 ---- 36.0 Success

1.136 2.584 .517 .52 .836 0 #9 Perfect

SIM 7/3/2014 14.83 13.25 Failure

1.064 1.591 .511 .659 1.028 0 #10 Perfect

SIR 11/13/2013 27.15 --- 31.20 Success

.995 .428 .501 .312 ,237 .09

SJT 10/3/2013 16.18 ---- 20 Success

.989 -.218 .547 .532 .032 .61

---

SKBI 6/6/2014 6.10 ----- 8 Success

1.038 1.815 .515 .40 -.228 -.04

SLP 9/18/2013 4.77 ----- 5.56 Success

.995 .149 .565 -.123 .377 -.05

SNN 11/4/2013 64.59 --- 80 Success

1.017 .598 .527 .519 .212 .04 #11 Perfect

SNN 1/21/2014 73.19 --- 100 Success

1.021 .581 .516 .468 .588 0 #12 Perfect

SOFO 11/6/2013 10.07 9.25 12.0 Success

1.069 1.82 .511 .628 .721 .04 #13 Perfect

----

SPA 1/9/2014 28.58 27 33.80 Success

1.085 1.972 .517 .283 .302 -.37

SPAN 12/11/2014 21.45 19.00 24.98 Failure

1.096 1.721 .508 .565 -.073 -.44

SPAN 3/28/2014 22.24 ---- 25 Success

1.087 1.458 .502 .579 .387 0 #14 Perfect

SPIL 3/7/2014 6.36 0000 9.0 Success(Coming out of a base, rather than occurring late in a rally.)

1.017 1.147 .50 .221 .325 .13 #15 Perfect

SPIR 9/30/2013 0.37 ---- 0.79 Success

1.079 3.698 .554 .805 -2.267 .30

---

SPIR 12/18/2014 0.55 ---- 1.16 Success

.992 -1.069 .53 .422 1.593 .35

SPIR 3/19/2014 0.99 --- Failure

1.071 3.131 .501 .712 2.344 .19 #16 Perfect

SPIR 6/19/2014 0.72 ---- Failure

.972 .645 .862 -.098 -1.214 .88

SPYG 6/9/2014 90.78 89 94 Still caught in a trading range

1.027 .62 .515 .488 .116 -.64

SQGB 12/17/2013 5.39 --- 14.25 Success

1.009 .872 .732 .119 -.252 .59

---

SRT 4/7/2014 6.90 6.75 7.8 Success

1.005 -.173 .507 .255 .233 -.51

SSBI 11/11/2013 10.09 --- 11.25 Success

1.026 .838 .554 .236 .023 .12 #17 Perfect

SSBI 3/11/2014 10.94 ---- 13.5 Success

.997 .25 .503 .407 .192 .05

|

SSBI 6/25/2014 12.39 --- 13.63 Success

1.106 1.325 .65 .69 .568 0 #18 Perfect

SSNC 11/6/2013 41.42 --- 46.5 Success

1.068 1.995 .506 .414 .59 0 #19 Perfect

---

STEM 6/19/2014 2.09 1.95 2.41 Success

1.42 5.964 .675 .832 1.771 -.34

STL 10/31/2014 11.72 ---- 13.5 Success

1.044 .937 .695 .775 .310 -.18

STLY 10/101/2013 3.80 2.50 4.02 Failure

1.037 1.011 .620 .731 -.108 0

SCNG 10/29/2013 11.88 9.0 12.5 Failure

1.126 2.415 .516 .521 -.117 .02

STRM 4/30/2014 5.00 4.42 5.6 Failure (but a little larger stop loss would have turned it into a success).

.969 -.069 .538 .358 -.814 .01

---

STS 1/22/2014 6.89 --- 8.90 Success

1.092 2.651 .504 .485 .119 .06 #20 Perfect

STS 3/5/2014 6.95 6.5 8.95 Success

1.033 .585 .515 .237 .609 0 #21 Perfect

STX 10/21/2013 50.51 47.5 62.3 Success

1.108 2.364 .524 .503 .272 0 #22 Perfect

SUBK 10/11/2014 18.25 ---- 21 Success

1.035 .291 .576 .629 .049 .06 #23Perfect

SURG 9/30/2014 4.55 3.00 5.0 (next day opened at 4.53) Success

1.087 1.115 .526 .514 .67 0 #24 Perfect

-----

SVVC 12/26/2014 24.20 20 ---- Failure

1.085 1.417 .516 .376 -.022 .05

SVVC 7/7/2014 21.14 ---- 24.0 Success

1.003 .198 .503 .439 -.076 -.06

SXC 11/5/2013 20.95 ---- 23.90 Success

1.109 2.334 .503 .816 1.108 0 #25 Perfect

SXE 1/31/2014 17.84 16.5 24.5 Success

.982 -.125 .775 .826 -.428 -.05

SYN 9/18/2014 1.57 --- 1.95 Success

1.01 .999 .526 .210 -.437 .15

----

SYNA 6/19/2014 89.32 72 ---- Failure

1.237 5.317 .503 .326 1.636 -.05

---------------------------------------------------------------------------------------------------------------------------------------------

Also some near B25s:

*SKH almost B25 4.93 ---- 7.0 Success

1.044 1.471 .485 .311 -.098 .11

*STX 10/21/2014 50.51 47.5 62.4 Success (high volume stock)

1.108 2.364 .498 .503 .272 0

====

*SYX 4/9/2014 16.09 14.6 18.8 Success

1.096 2.226 .495 .584 1.477 0

====

*SKM 5/22/2014 24.96 ---- 31 Success

1.047 1.529 .462 .603 .652 0

*SUMR 5/19/2014 3.48 2.75 4.74 (Failure)

1.643 8.545 .499 .92 2.623 0

===

-----------------------------------------------------------------------------------------------------------------------------------------------