TigerSoft and Peerless Daily

Hotline

http://tigersoftware.com/11HL5522/index.htm

NEW

ADDRESS after Christmas

We

will EMAIL you with the new Hotline IP address in plenty of time.

-----------------------------------------------------------------------------------------------------------------------

(C) 1985-2014 William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

Tiger Software 858-273-5900

PO Box

22784 San Diego, CA 92192

Email william_schmidt@hotmail.com

Previous Hotline -http://tigersoftware.com/112211-H/index.htm 11/22/2013-3/20/2014

http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

----------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------

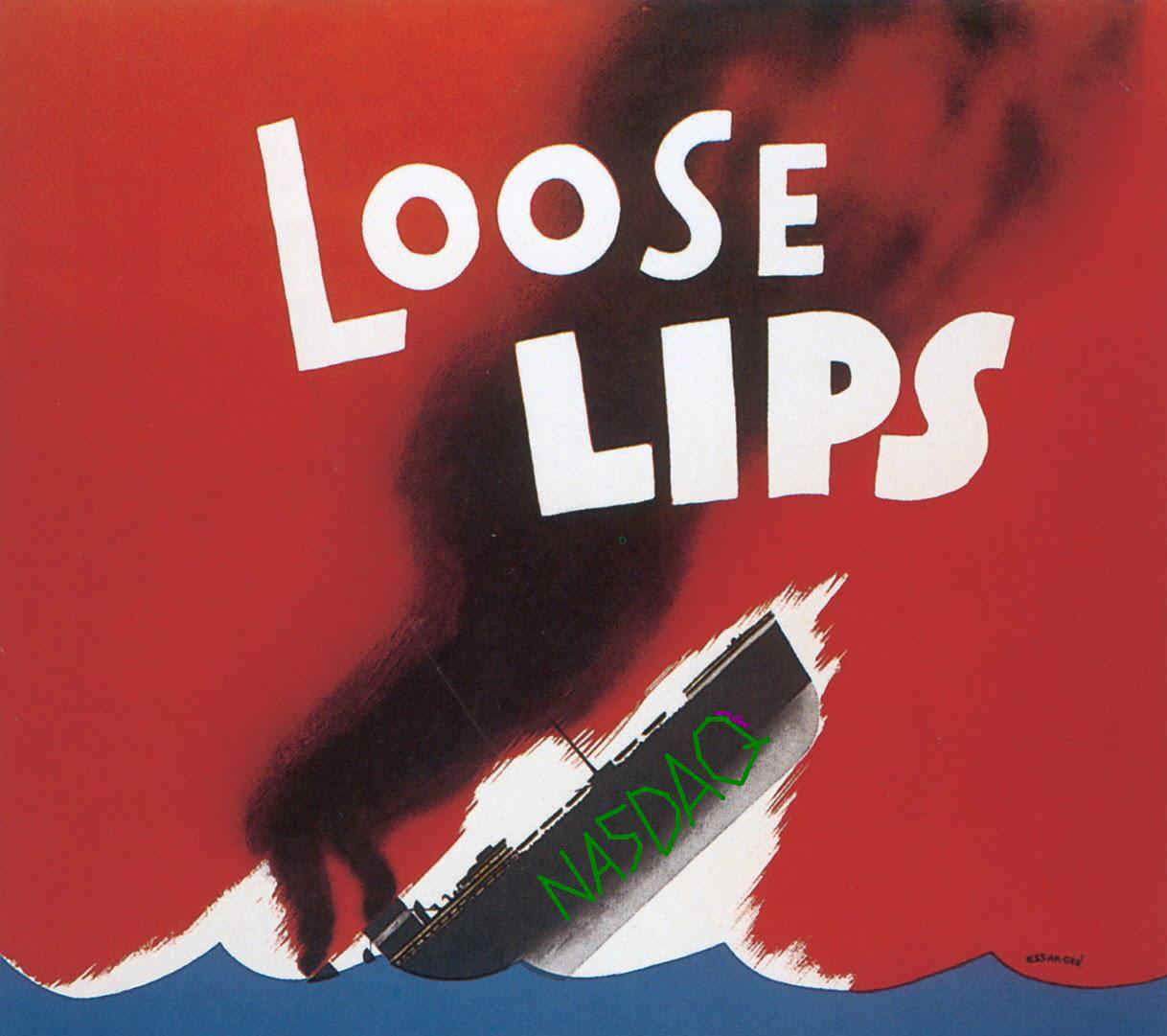

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

with you and a violation of copyright laws. I work hard for you. Respect that

effort!

---> To

renew this Hotline, order

here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

-----------------------------------------------------------------------------------------------------

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

Peerless Signals: 1915-2013

Peerless Signals: 1915-2013

New Peerless

Signals and DJI Charts - version 7/4/2013

1965 1965-6

1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70

1970

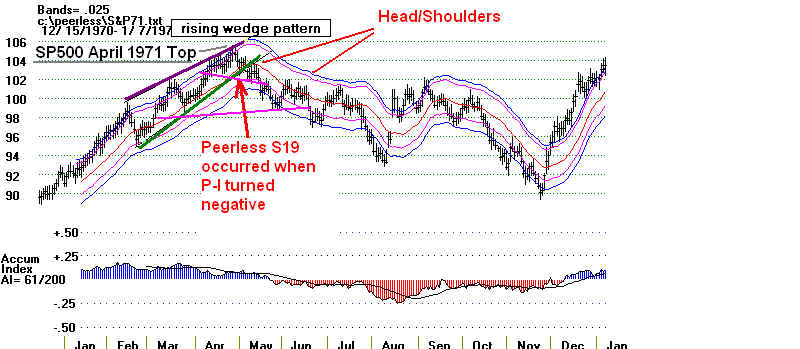

1970-1

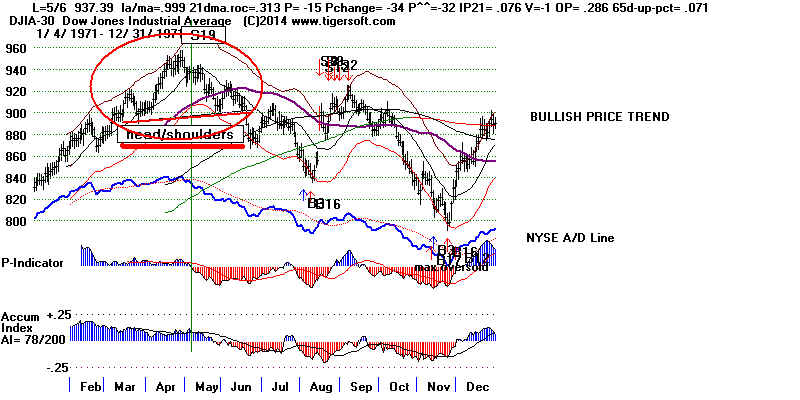

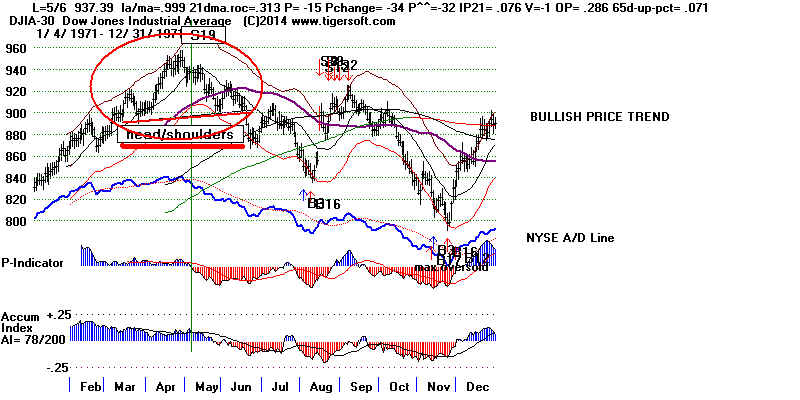

1971

1971-2

1972

1972-3

1973

1973-4

1974

1974-5

1975

1975-6

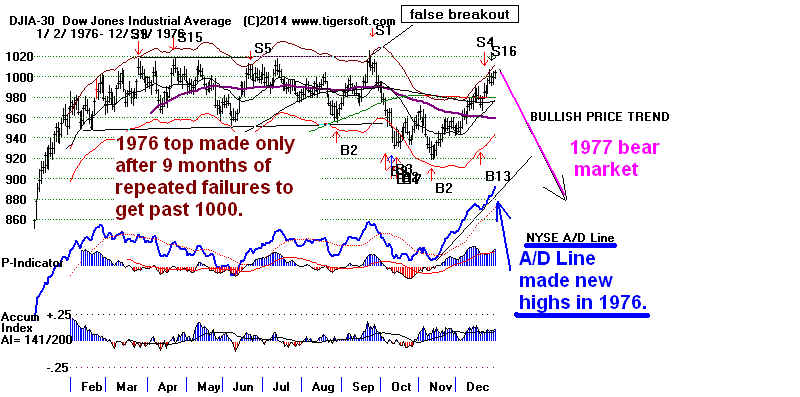

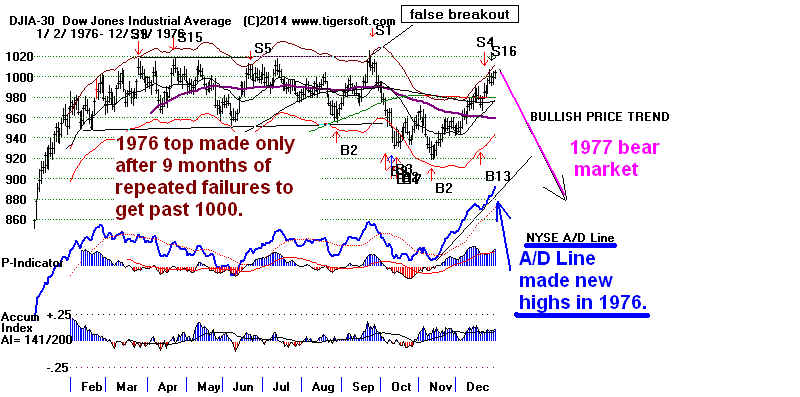

1976

1976-7

1977

1977-1978

1978 1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983

1983-1984

1984 1984-1985

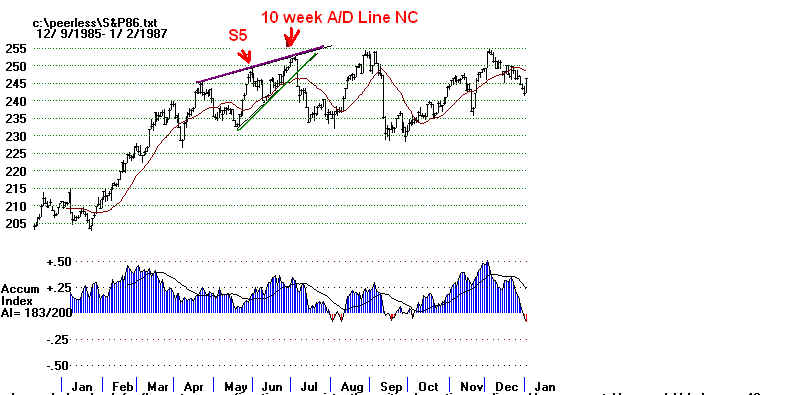

1985 1985-1986

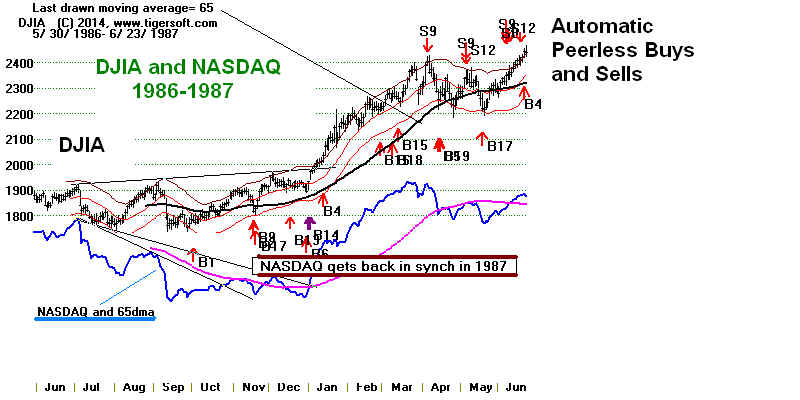

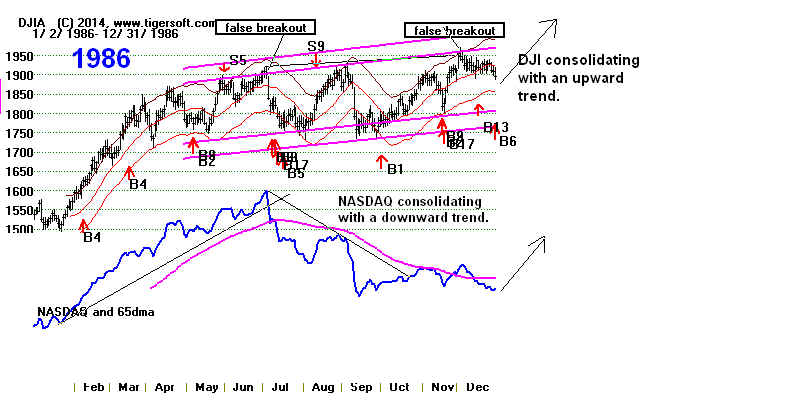

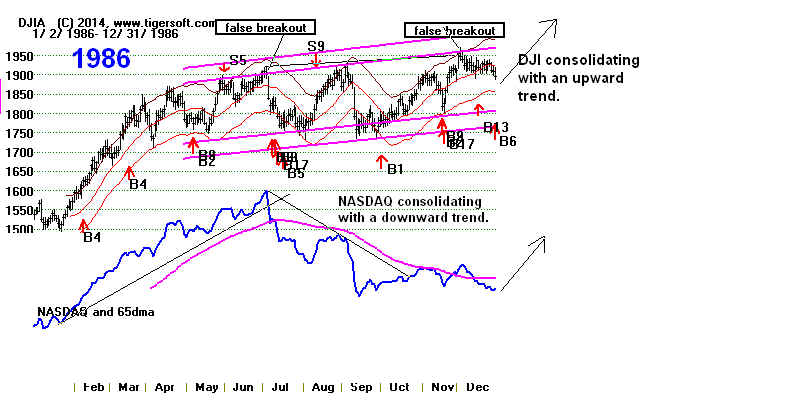

1986

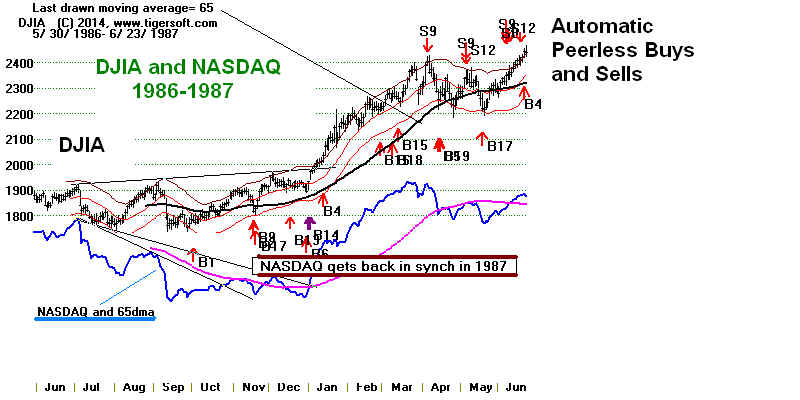

1986-1987

1987

1987-8

1988 1988-9

1989

1989-90

1990 1990-1

1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996

1996

1996-7

1997

1997-8

1998

1998-1999

1999

1999-2000

2000

2000-1

2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005

2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

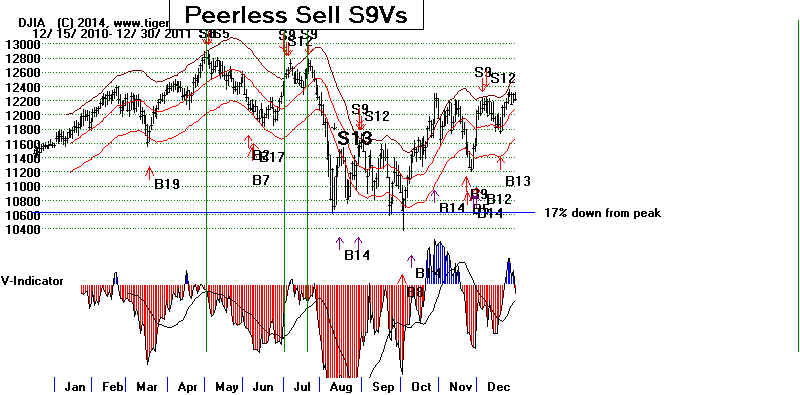

2010

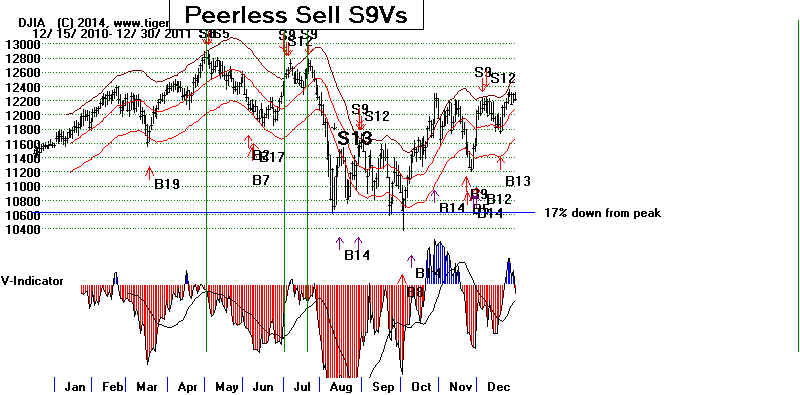

2010-11

2011

2011-12

2012

2012-2013

Background and New Studies

4/15/2014 Introduction to Tiger/Peerless Buys and Sells.

Peerless Charts and Signals

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable support

is the DJI's rising 200-day ma?

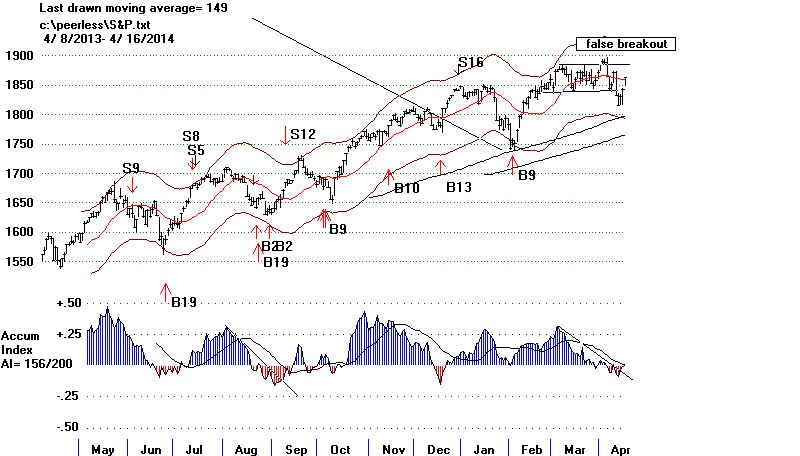

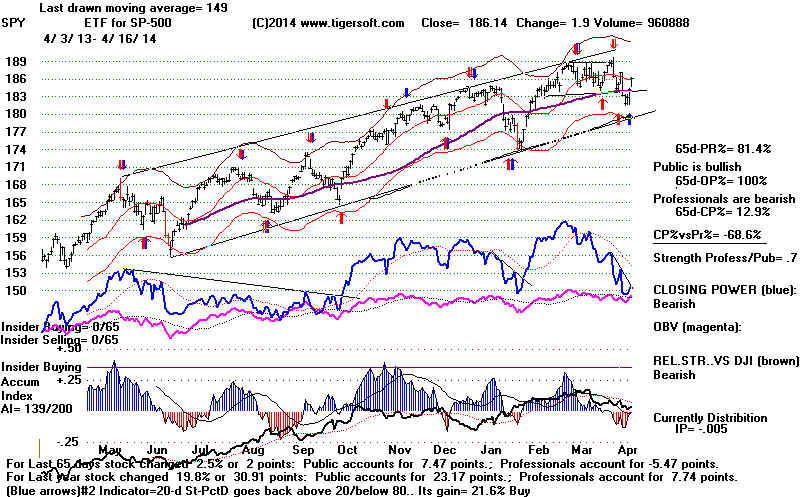

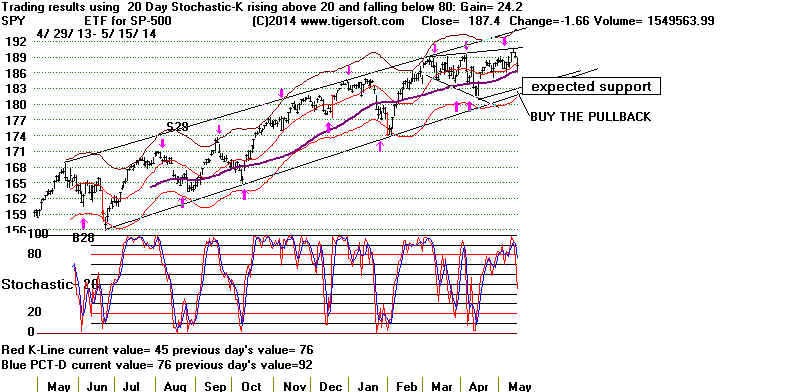

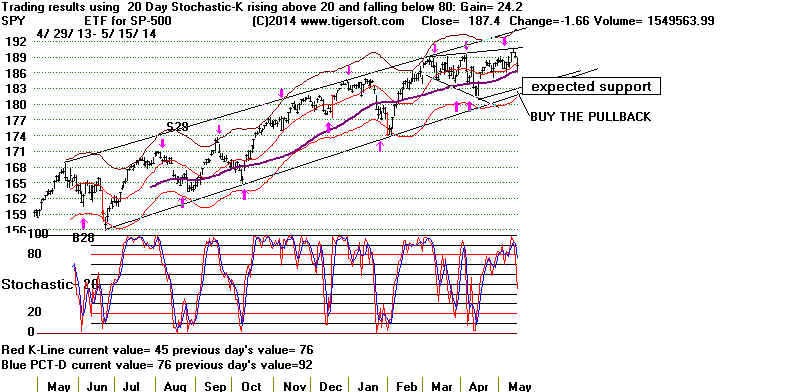

SPY Charts since 1994: Advisory Closing Power S7s,

Accum. Index, 65-dma, Optimized

Signals.

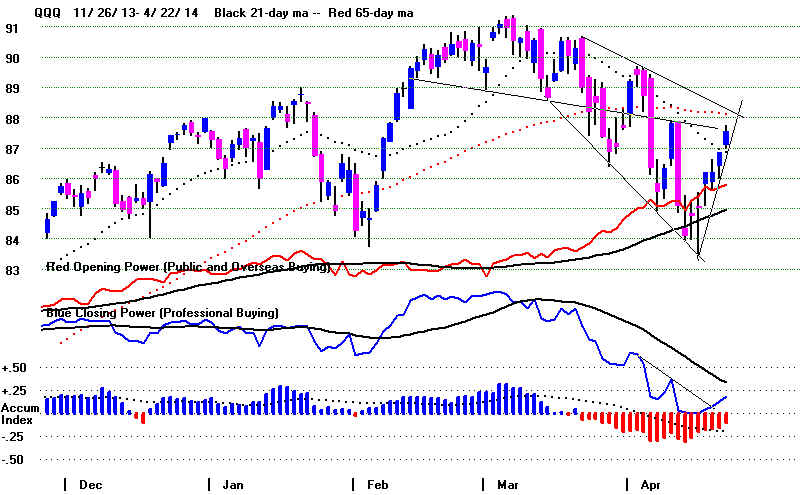

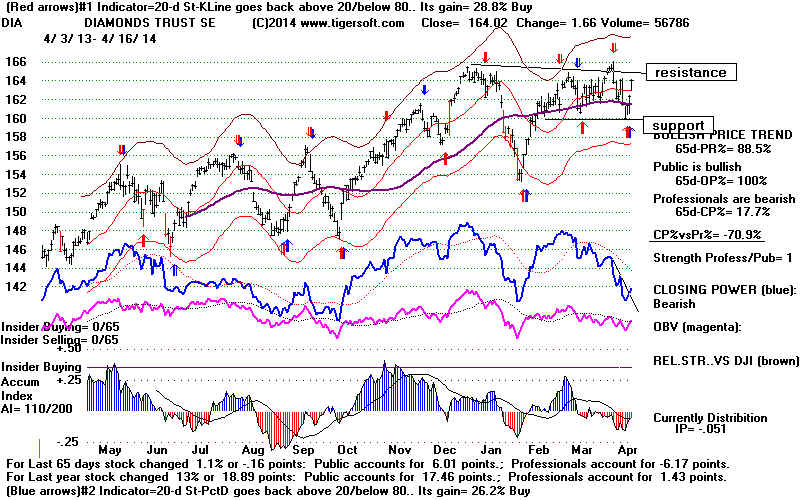

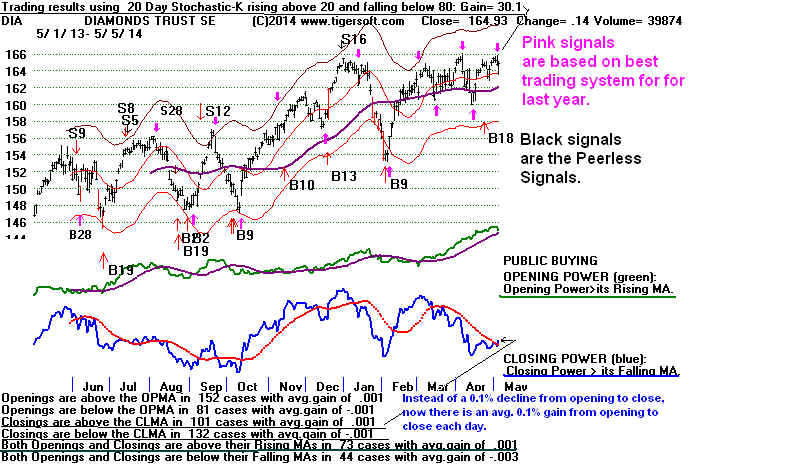

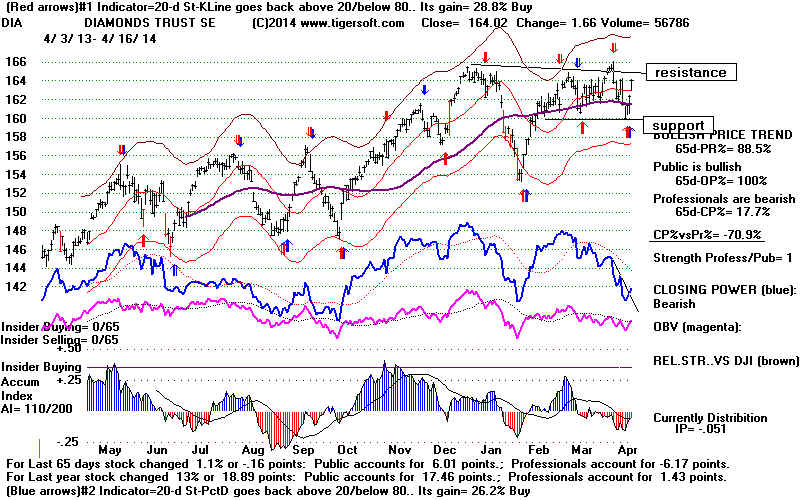

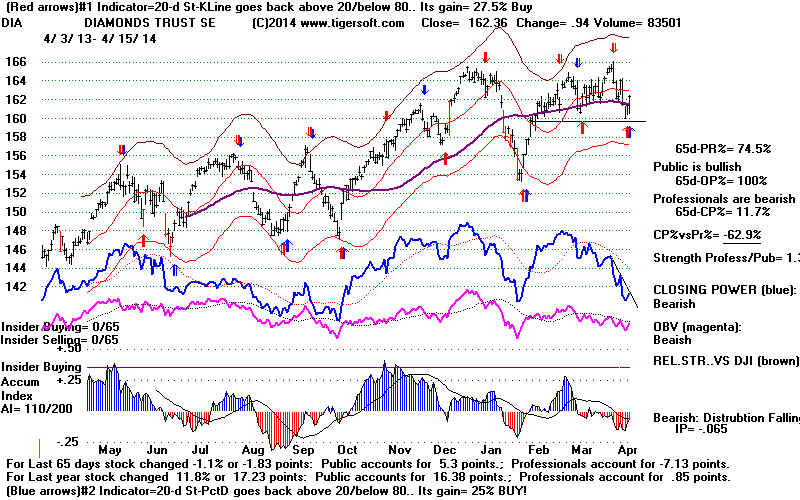

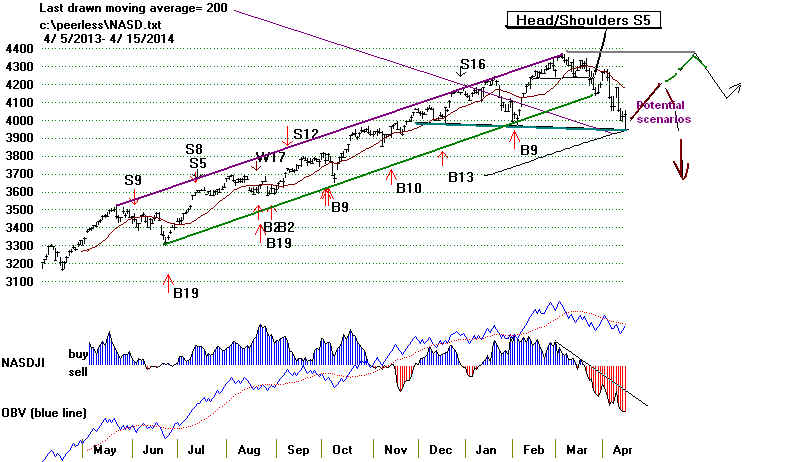

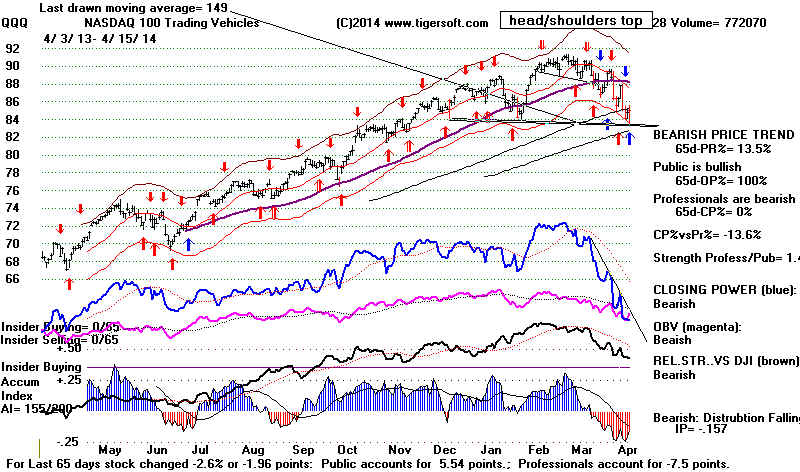

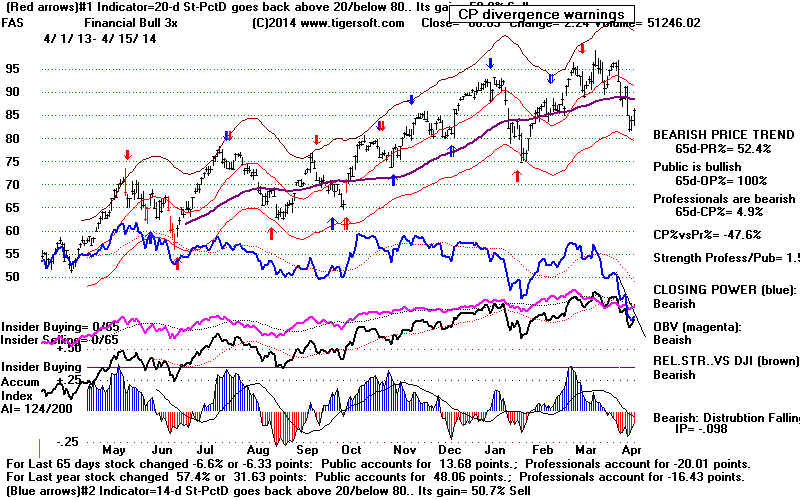

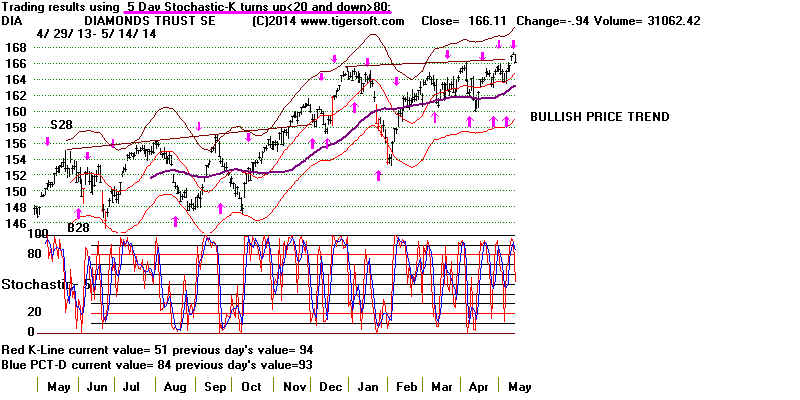

4/7/2014 Advisory Pink Closing Power S7s at ETF at top since

1994

1994 1996 1997 1998 1999 2000 QQQ SPY

DIA 2002 2007 2008 SPY 2011 2013-2014

The New 2014 Peerless.exe Software has now been posted on the Elite Stock Professional

Page.

================================================================

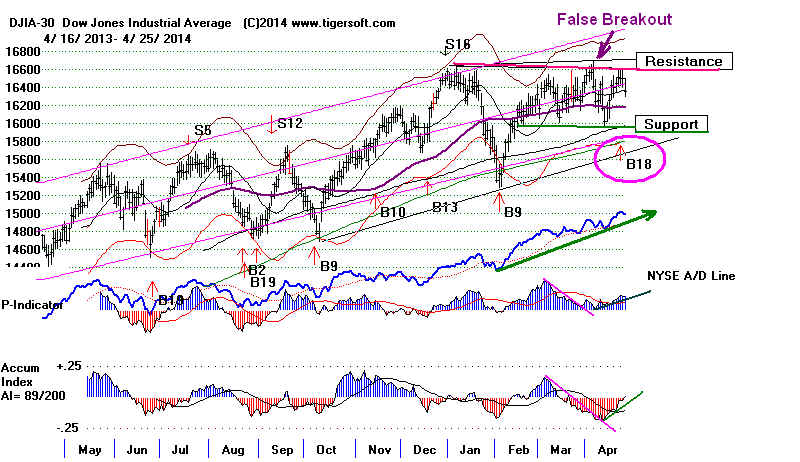

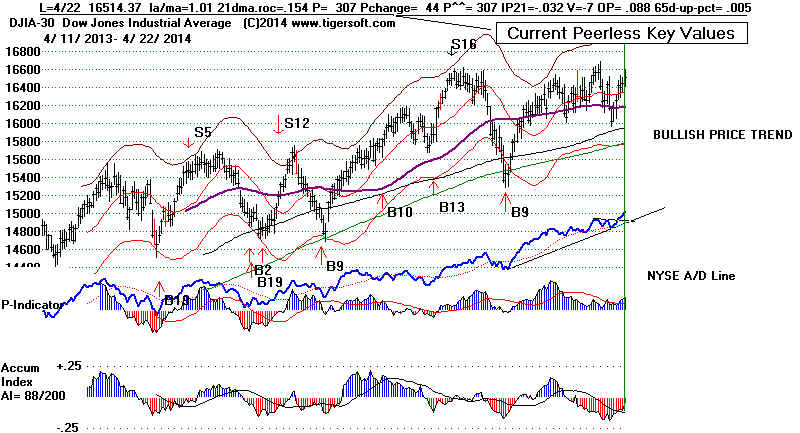

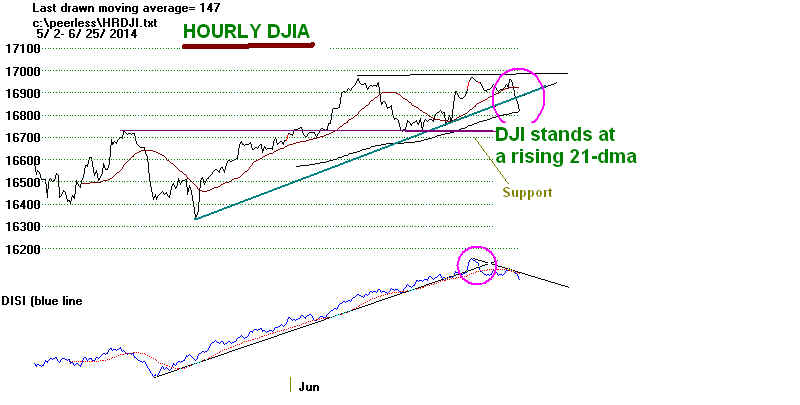

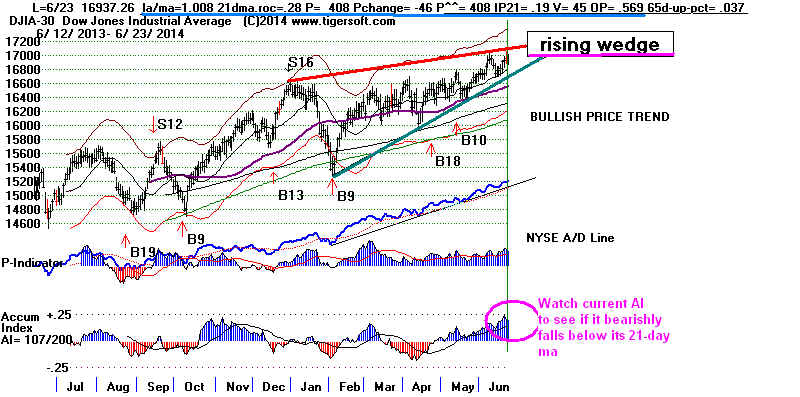

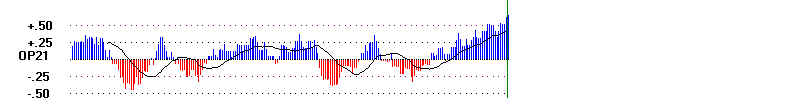

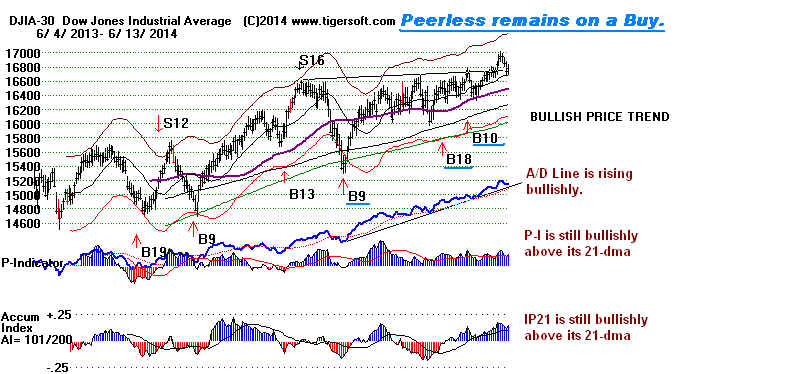

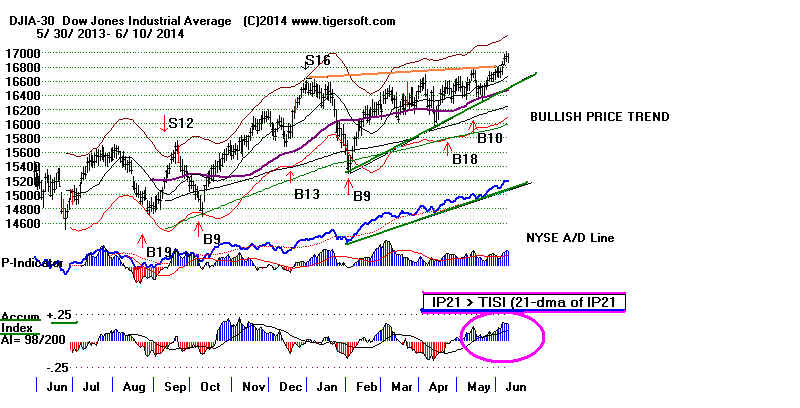

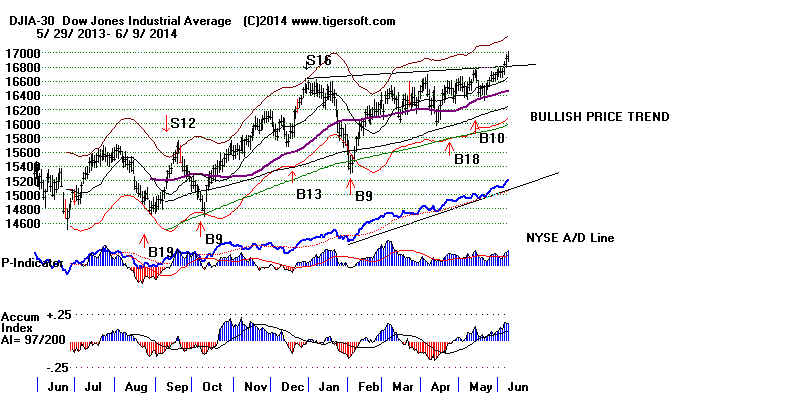

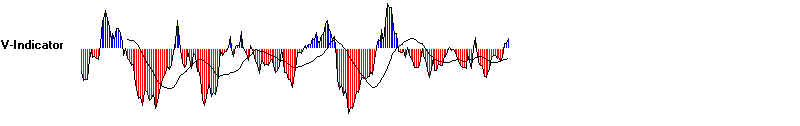

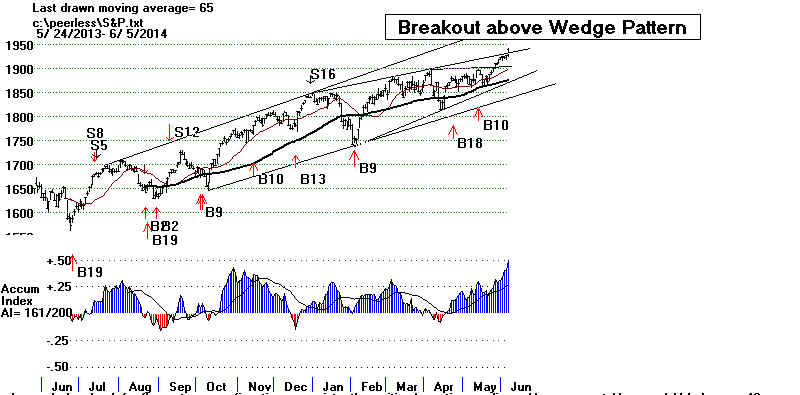

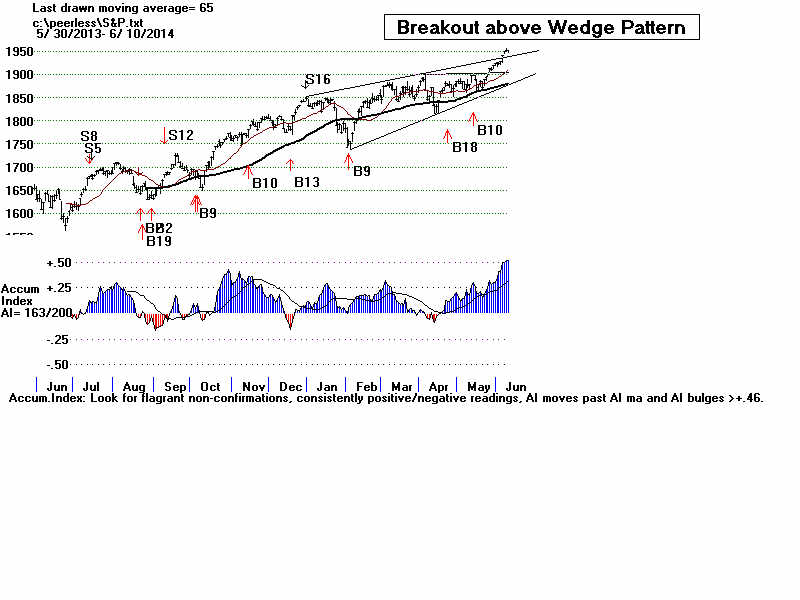

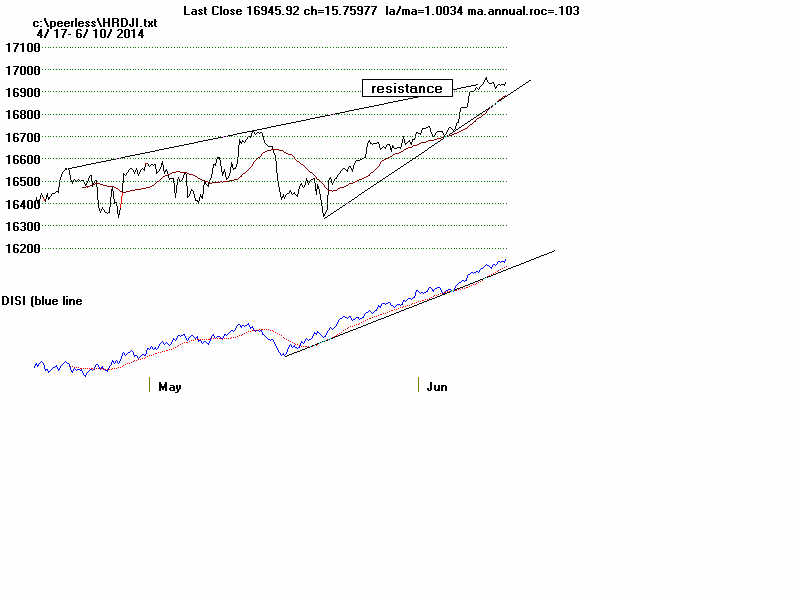

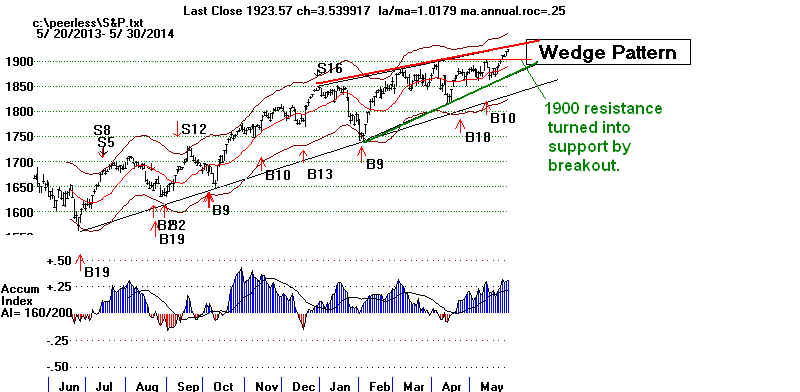

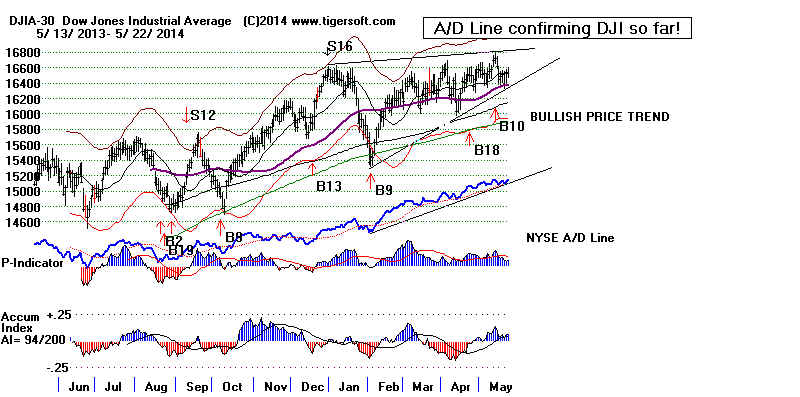

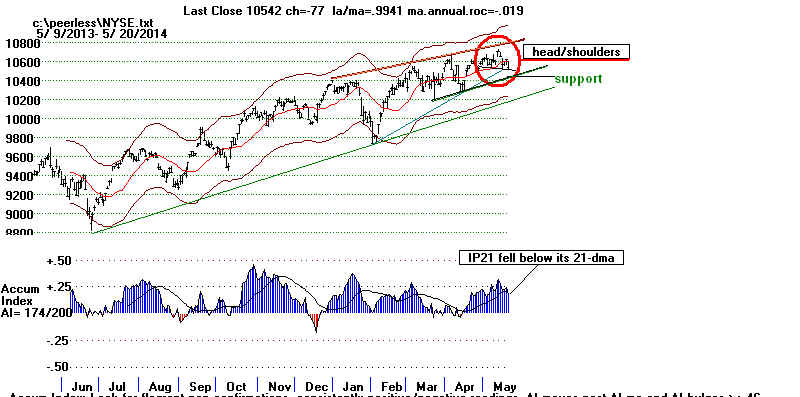

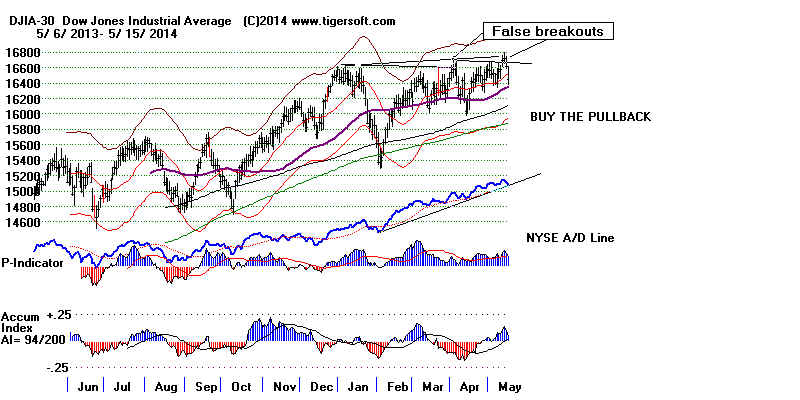

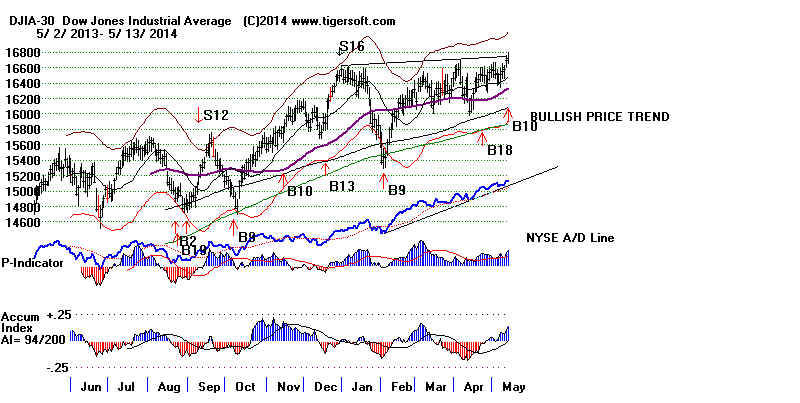

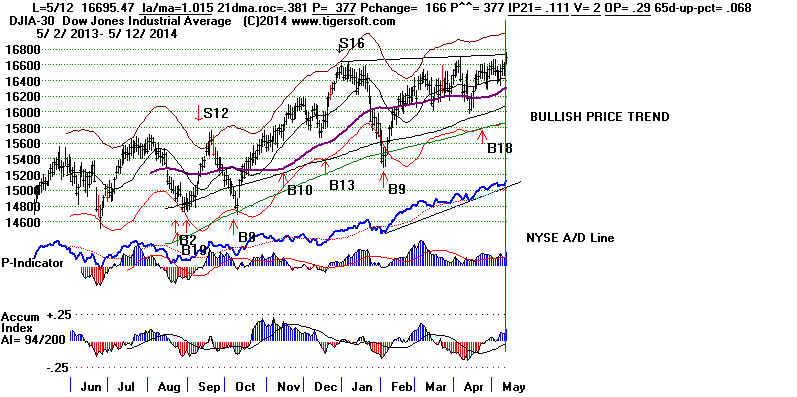

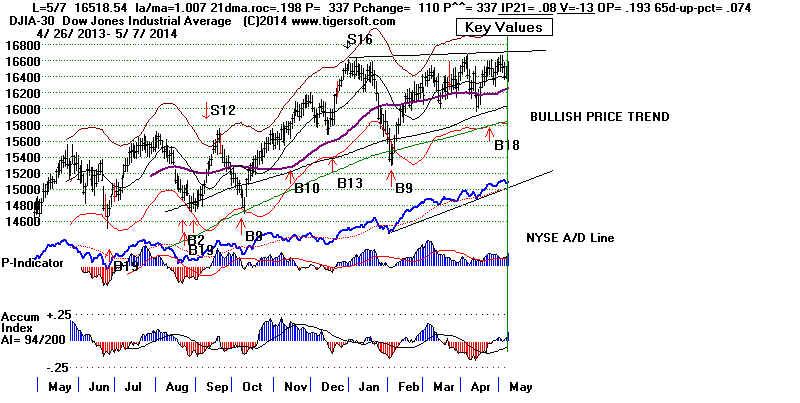

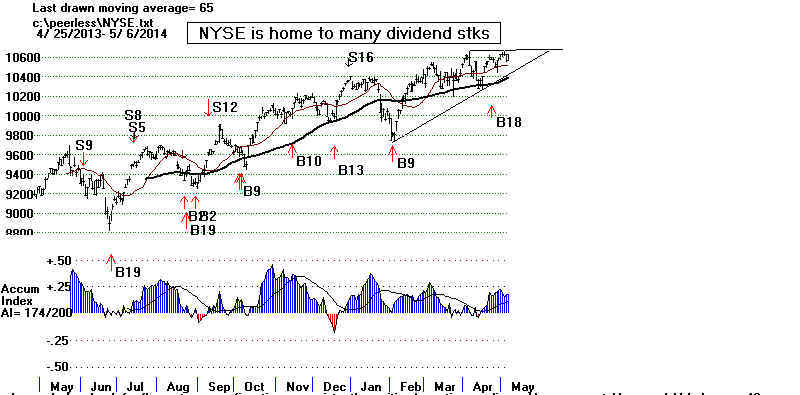

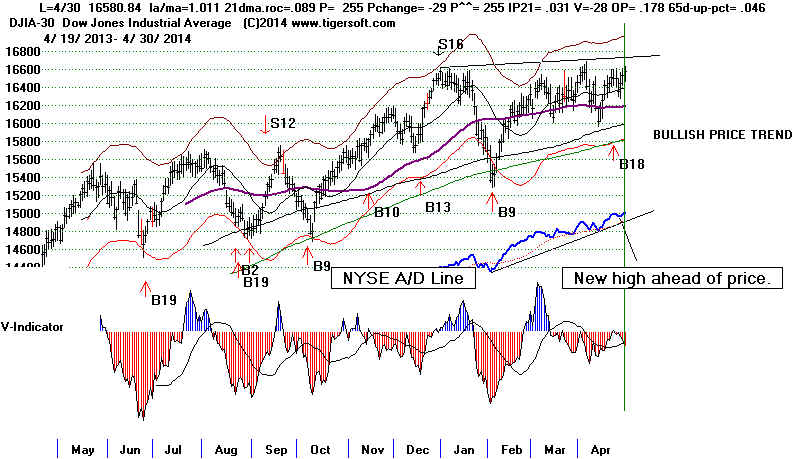

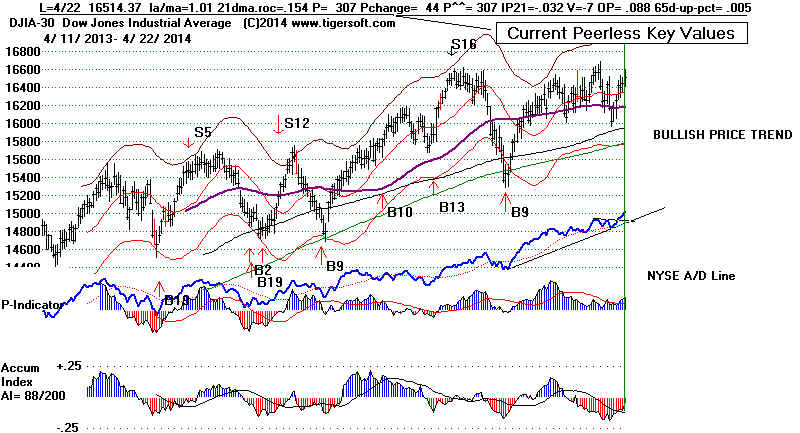

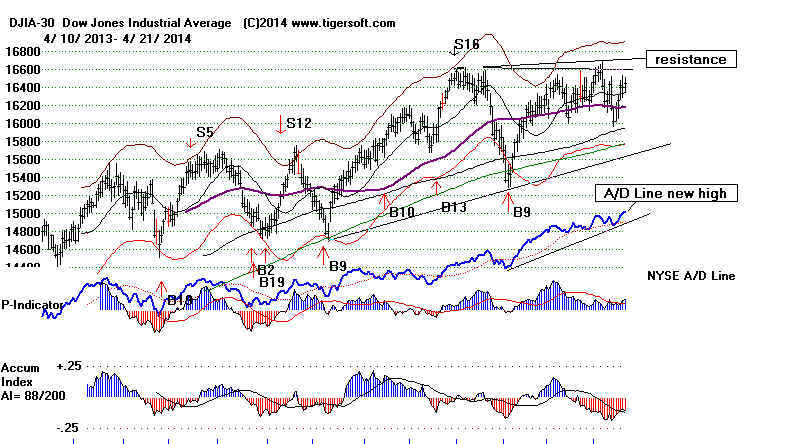

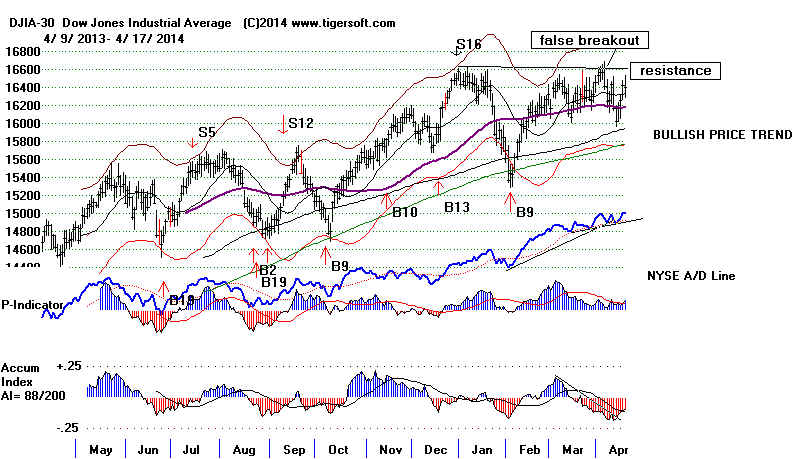

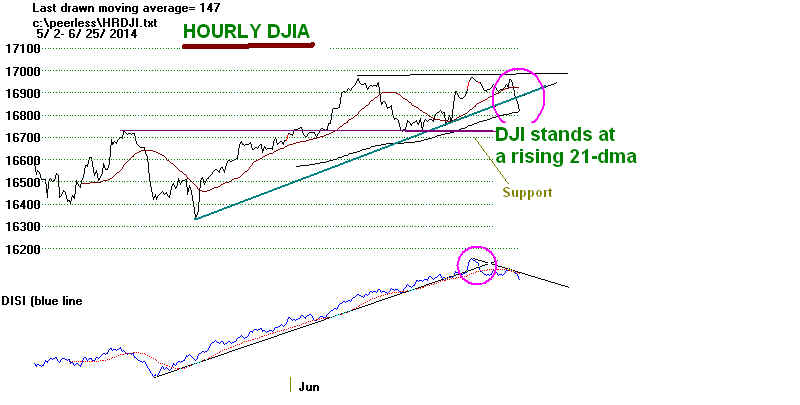

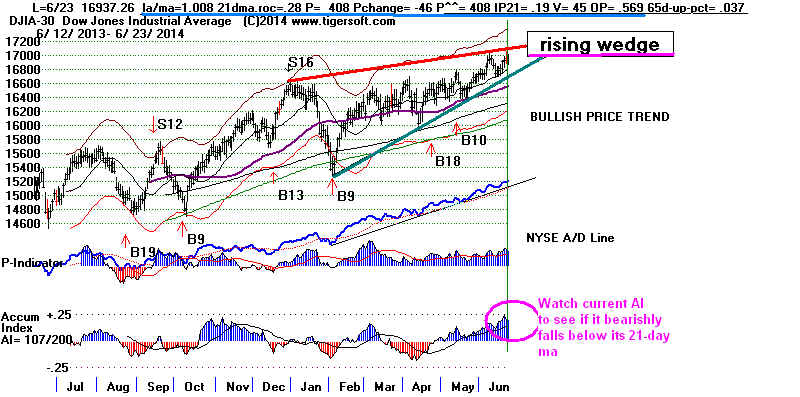

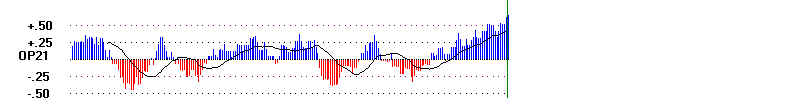

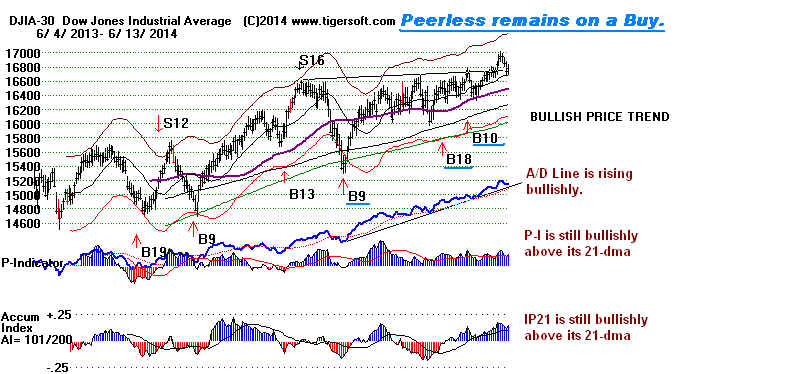

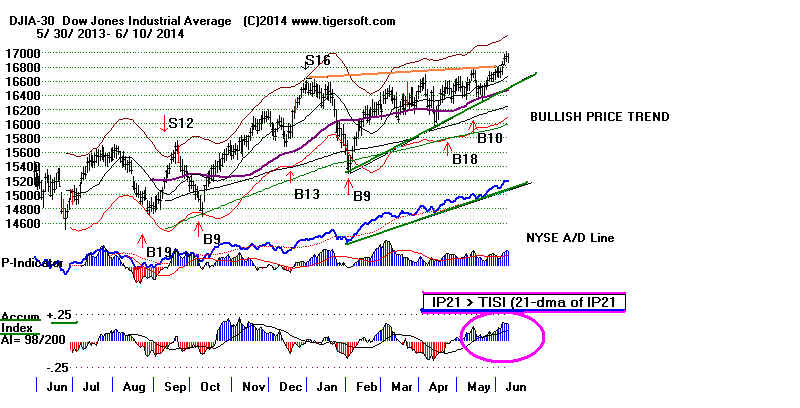

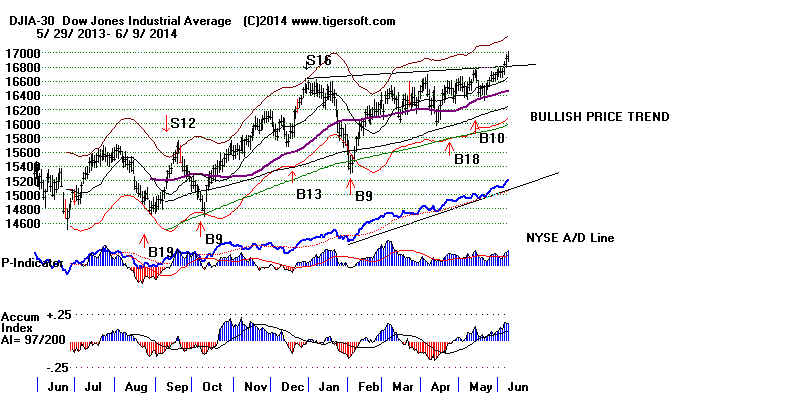

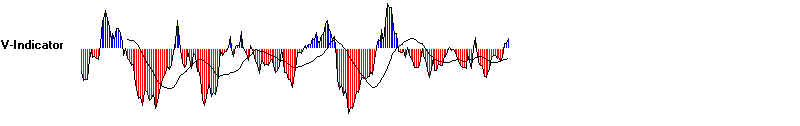

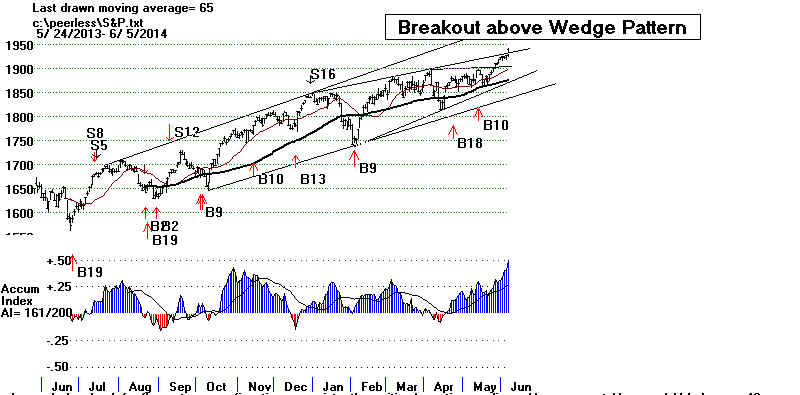

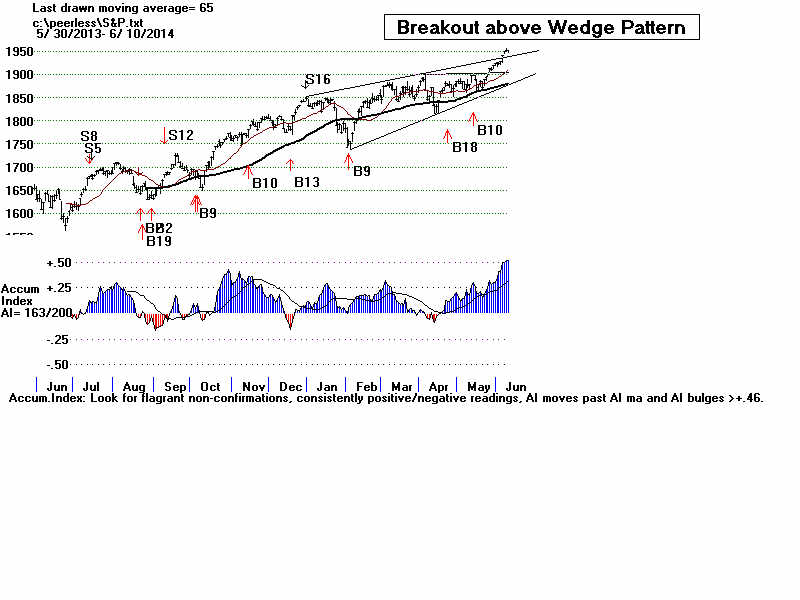

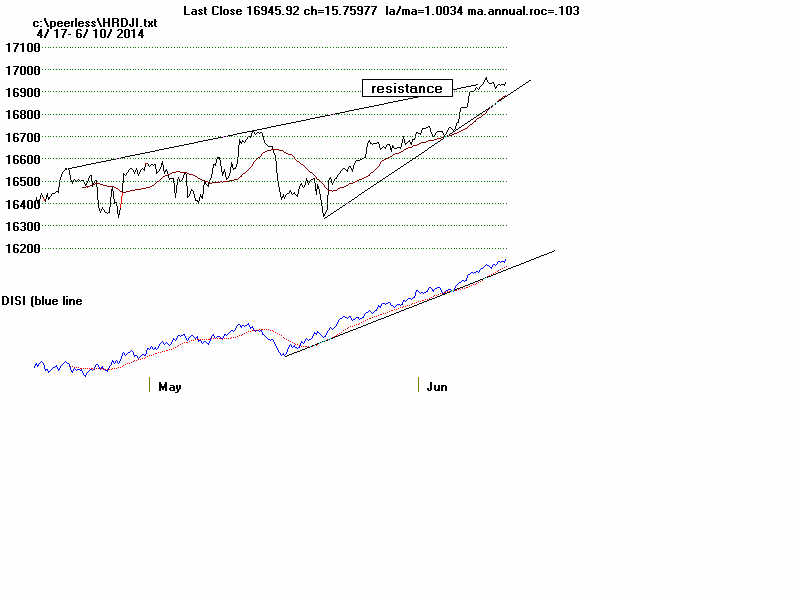

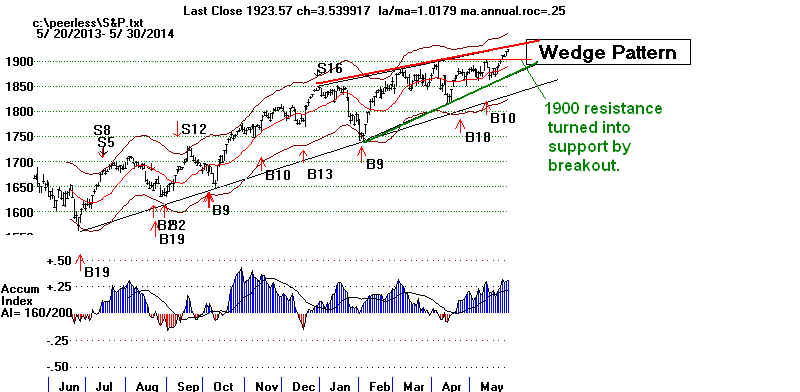

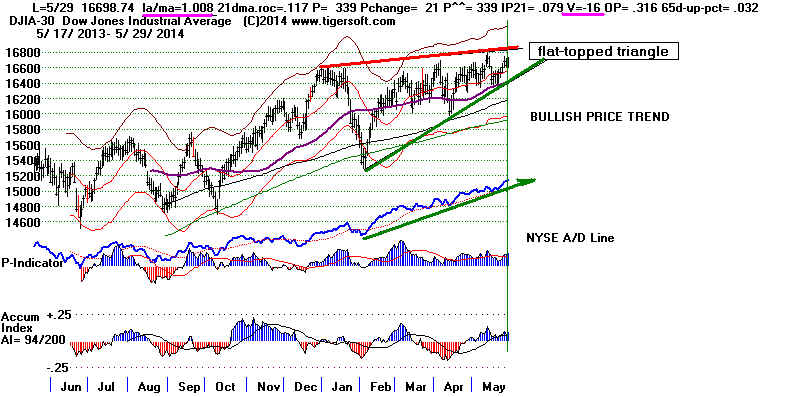

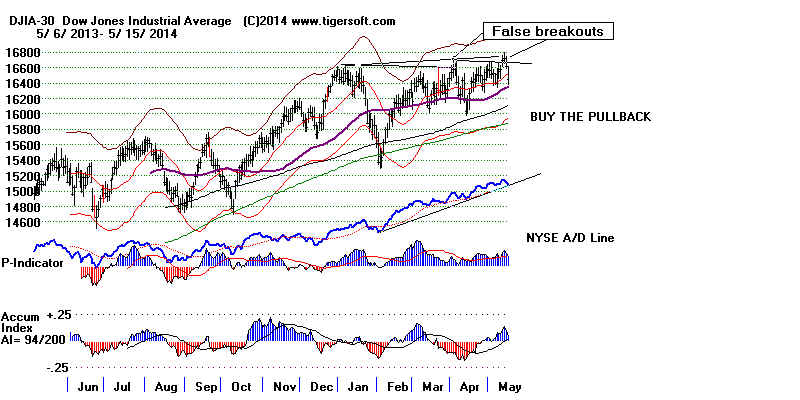

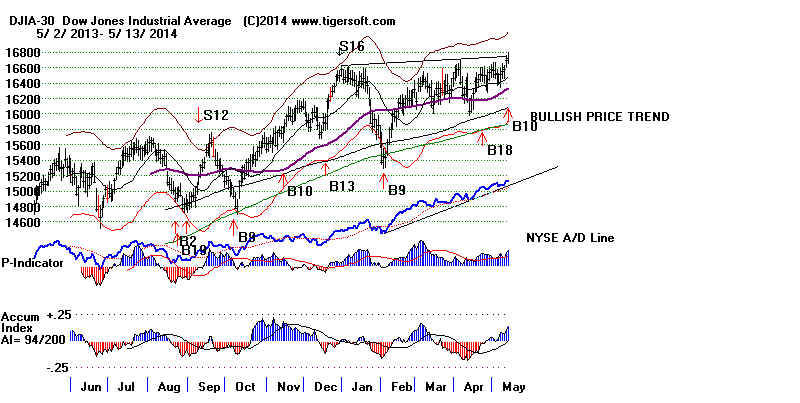

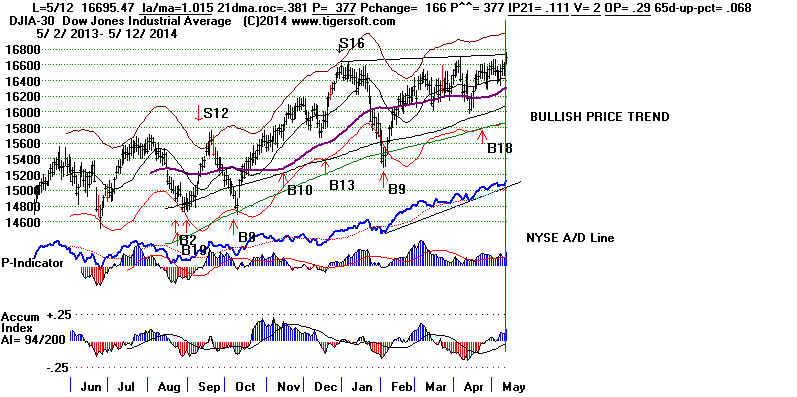

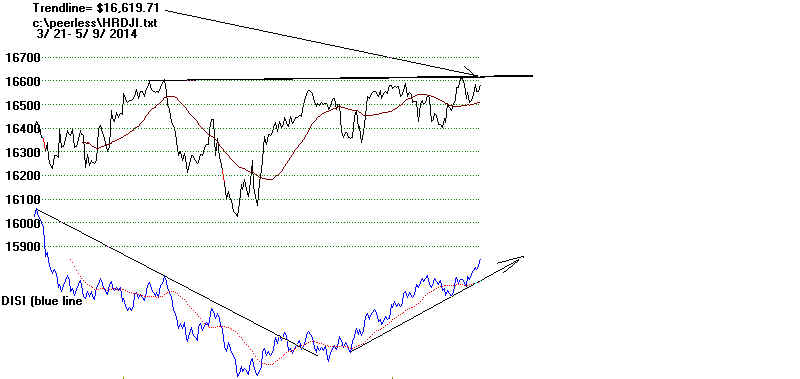

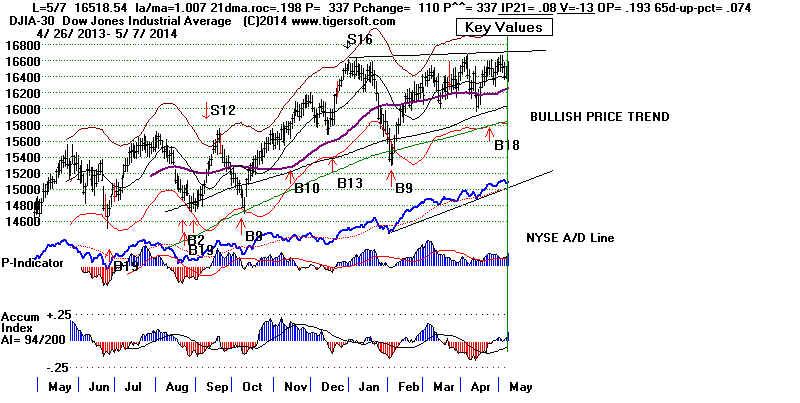

6/23/2014

Still No Peerless

Sell. However, if the current

Accumulation Index drops below its 21-day ma, it would

likely bring a decline to the lower band even if there

is no

Sell S4. In additon, if its rising price-support line is broken,

the

DJI's rising wedge pattern casts a 3:1probability spell

in

favor of a decline to the lower band. But without a Peerless

Sell,

a deeper decline seems very unlikely. The rising A/D Line

(representing the FED's lower interest rates) just gives too

much

underlying strength.

16700 is now the likely new support

I

tested hypothetical data to see if we would get a Sell S4

if

the current AI (IP21) were to drop below its 21-day ma.

We

would not get one. As presently written, we would

not

get a Sell S4 because

1) the DJI would have to close below its 21-day ma,

2) the P-I would have to be below +1,

3) the one day in P-I would have to be below -47.

4) the OPCT would have to be below +.45

5) The DJI would have to close 9% up from its 65-day low.

Still, tonight I checked the cases where the IP21 has broken its

21-day ma in June of the 2nd year in a Presidential cycle.

The

pattern of subsequent declines is unmistakeable with

or

without a Sell S4. But our lower band should hold if there

is no

Peerless Sell. The current internal strength readings

are

much too high. See the new study tonight of IP21 breaks

of

their MAs in Junes in the Second Year of a Presidential

Election.

ISIS CRISIS

All

this is also premised on the ability of the Iraq government

to

fend off the extremeist Sunni rebels' (ISIS) attack on Baghdad.

They

have proudly killed hundreds of captive Iraq Government

soldiers. Their cruelty can only stiffen the resolve of those defending

Baghdad. It should be able to hold out. Moreover, I would think

the

Obama Administration would understand how weak and

indecisive they will seem if they were to allow thousands and

thousands more to be cruelly killed by ISIS soldiers.

See Will

ISIS brutality backfire? and ISIS

outshines al-Qaeda's cruelty - Al Arabiya News

Of

course, if the Iraq capital were to be quickly over-run it would,

no

doubt, shock the market. The big American and British

oil

stocks would then have to worry about nationalization of

Iraq

oil, as it was under Saddam Hussein.

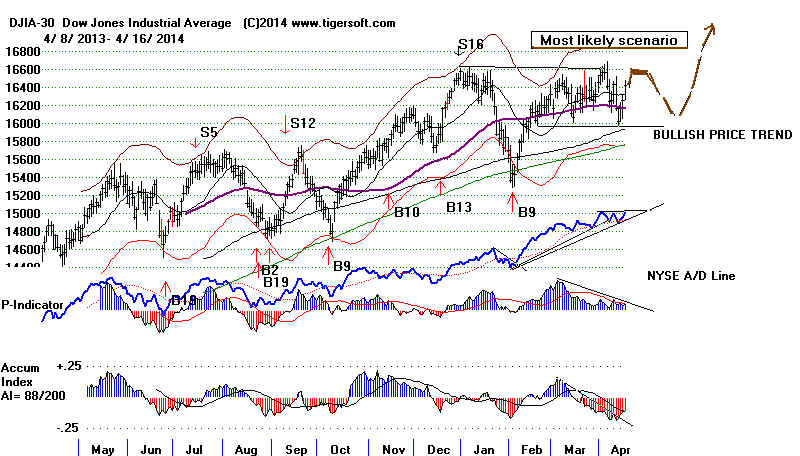

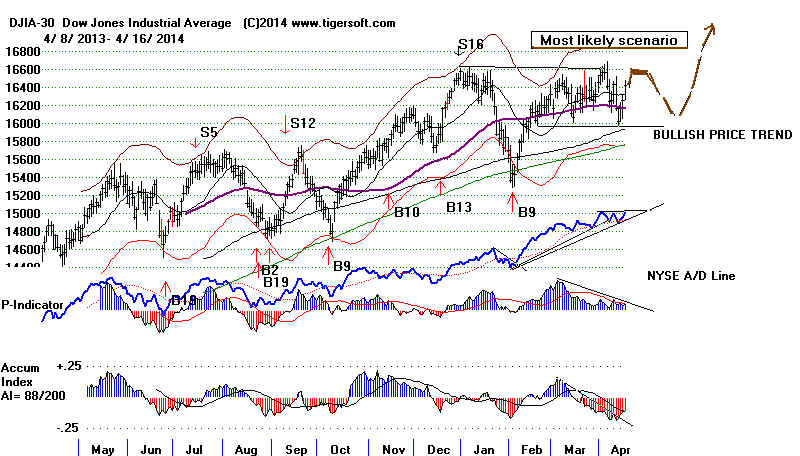

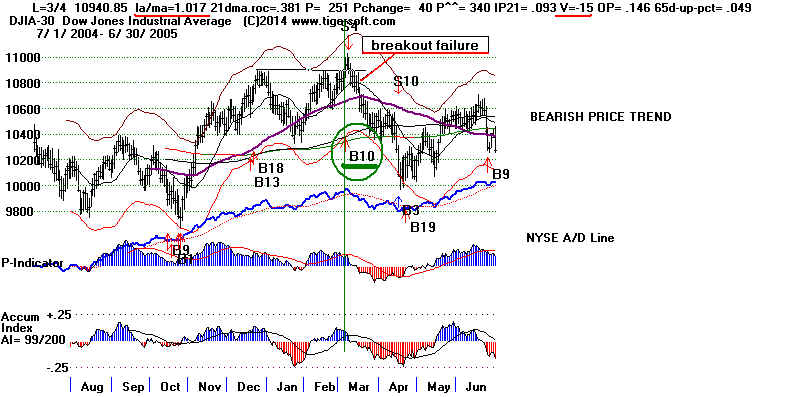

> To Key Index and Leading Stock Charts: DJI,

SP-500, etc.

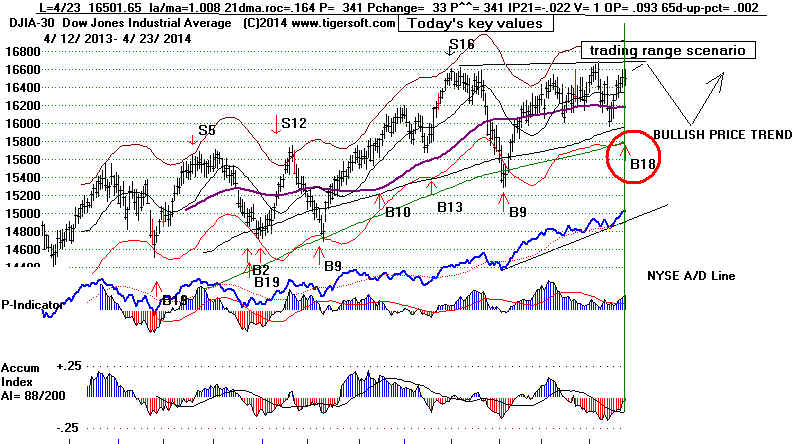

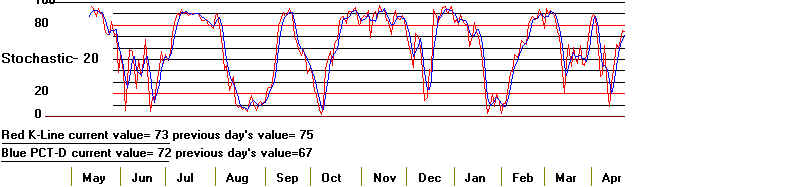

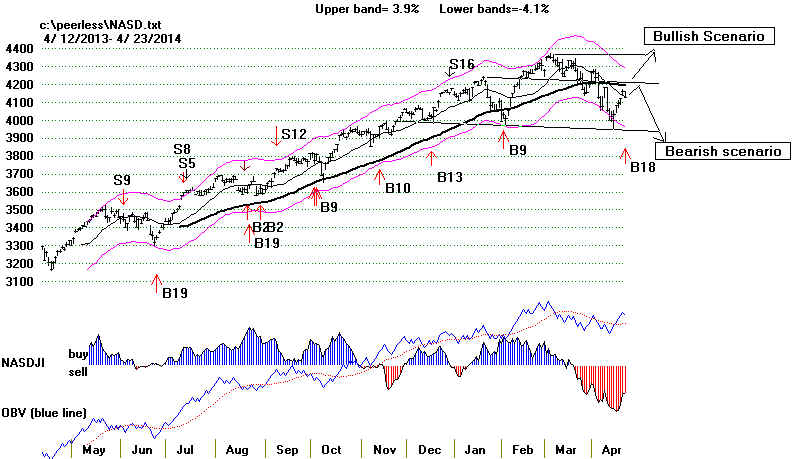

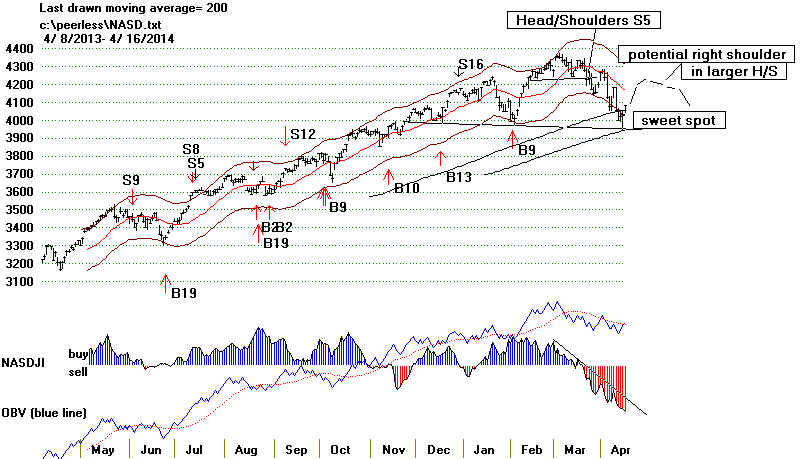

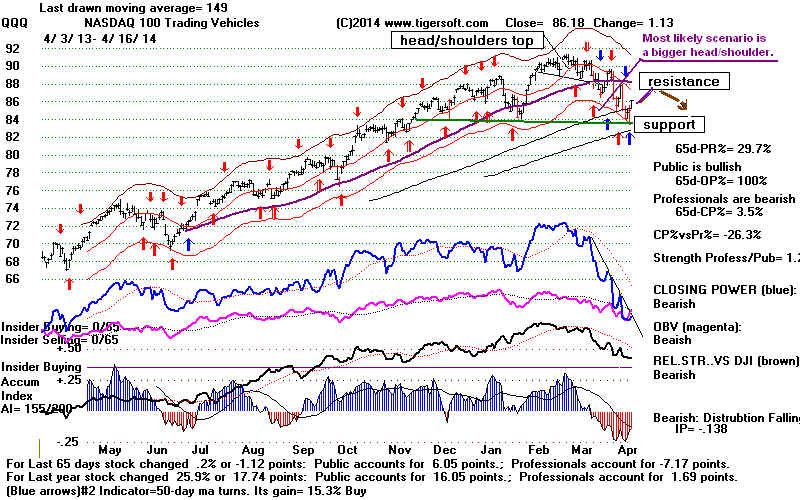

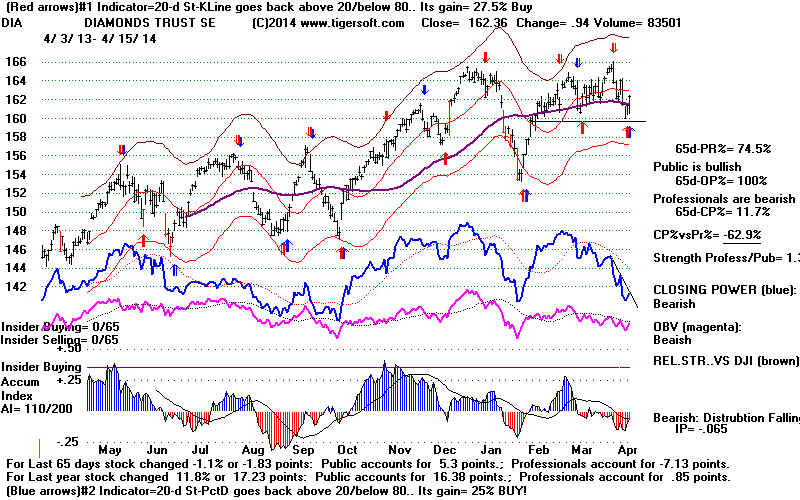

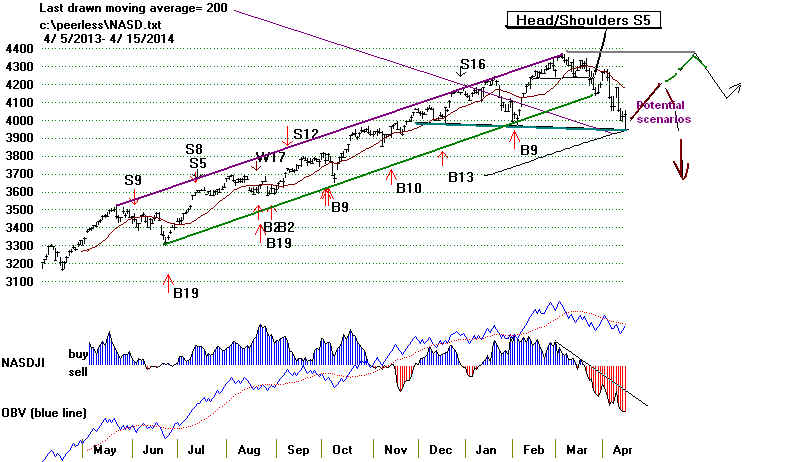

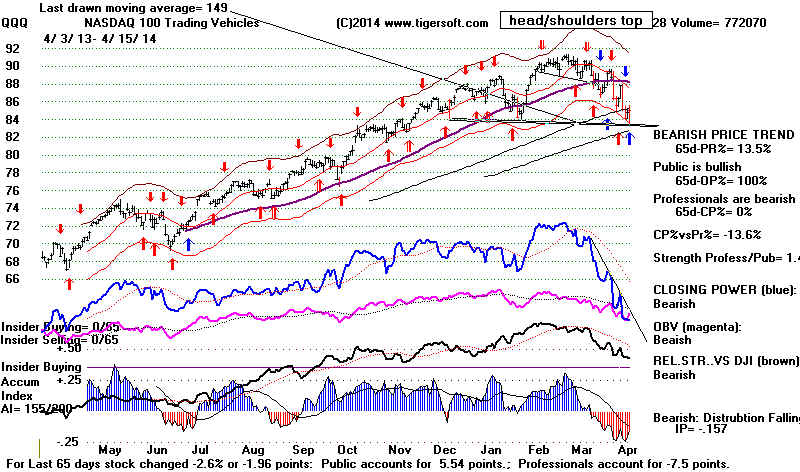

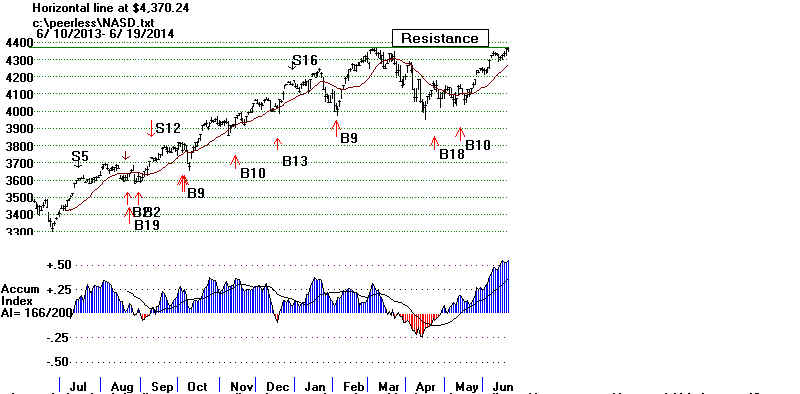

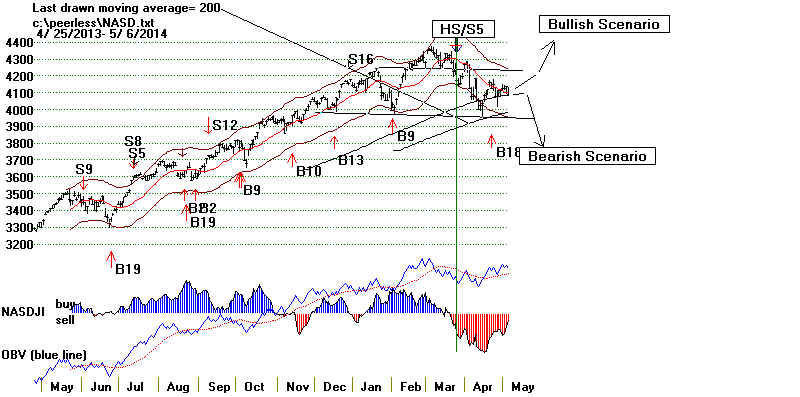

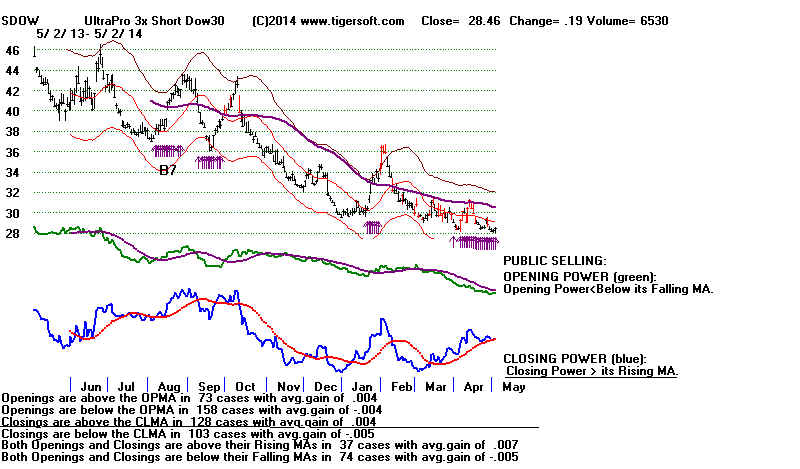

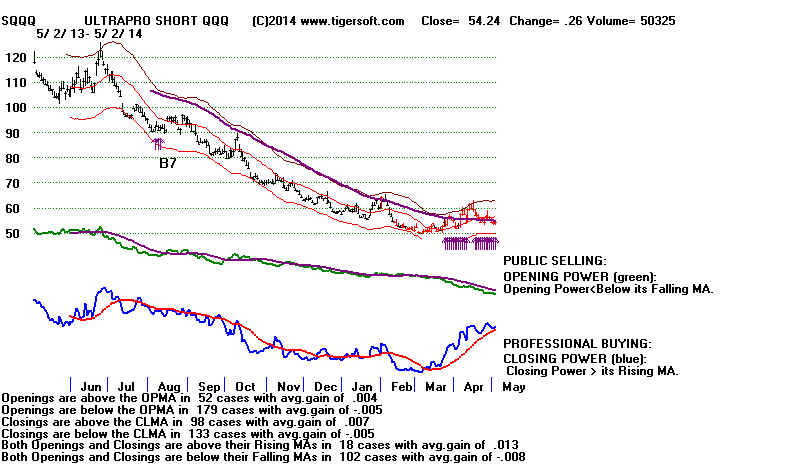

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

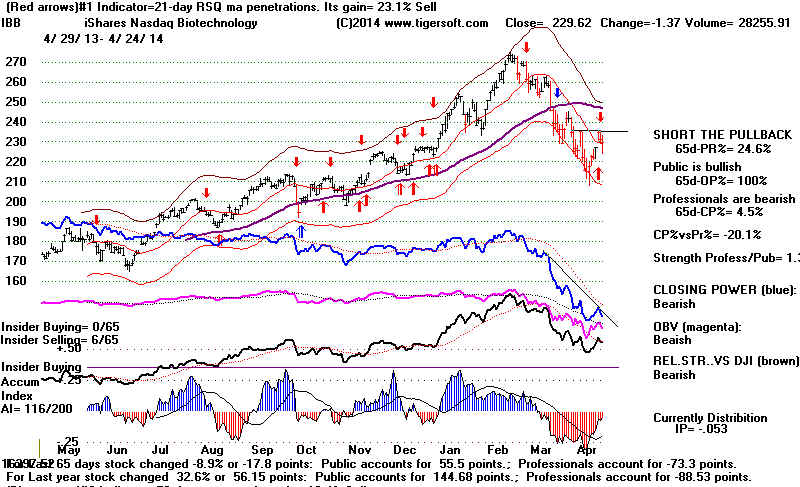

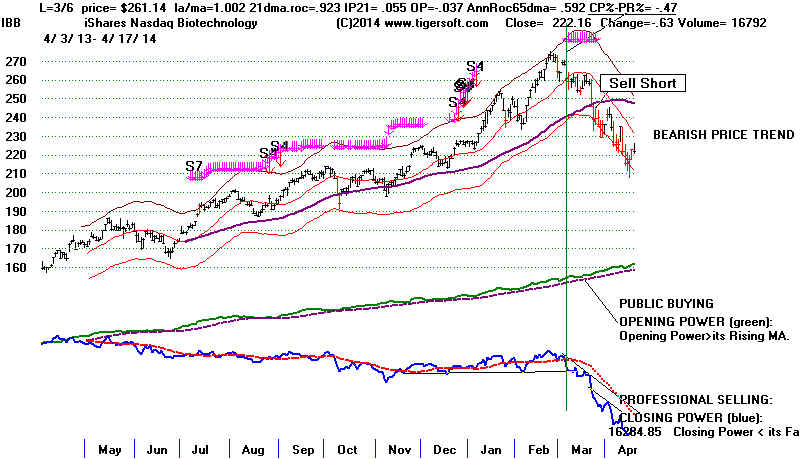

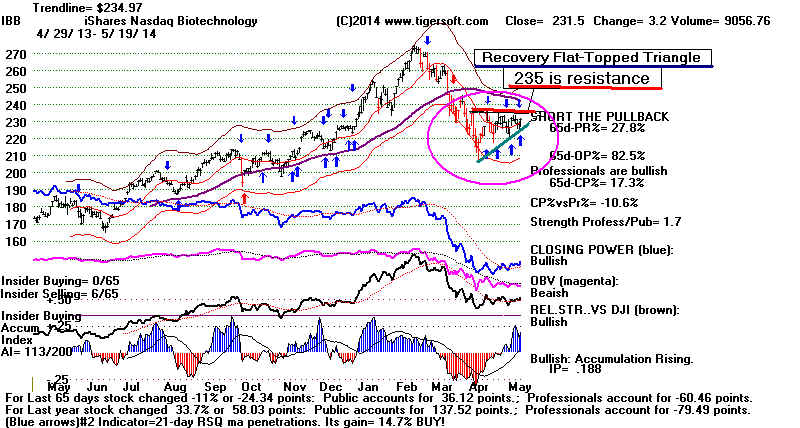

IBB

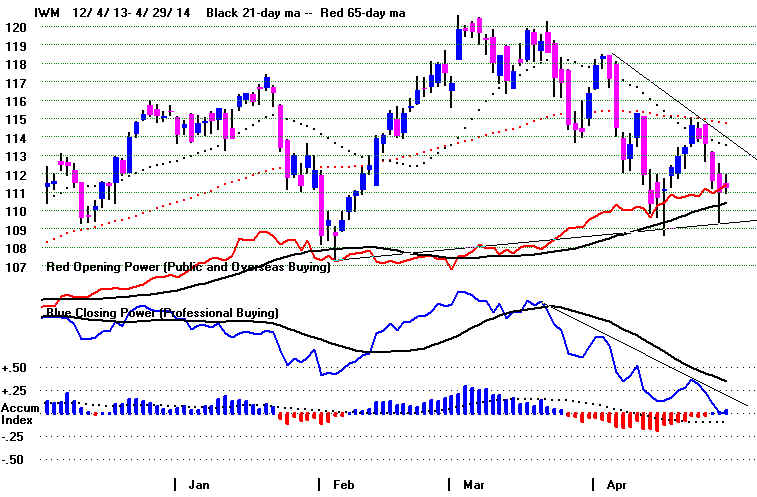

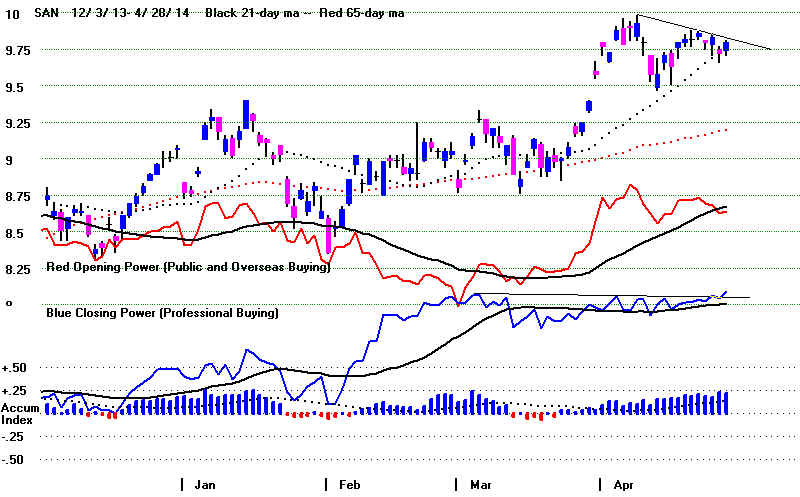

Chart IWM Chart

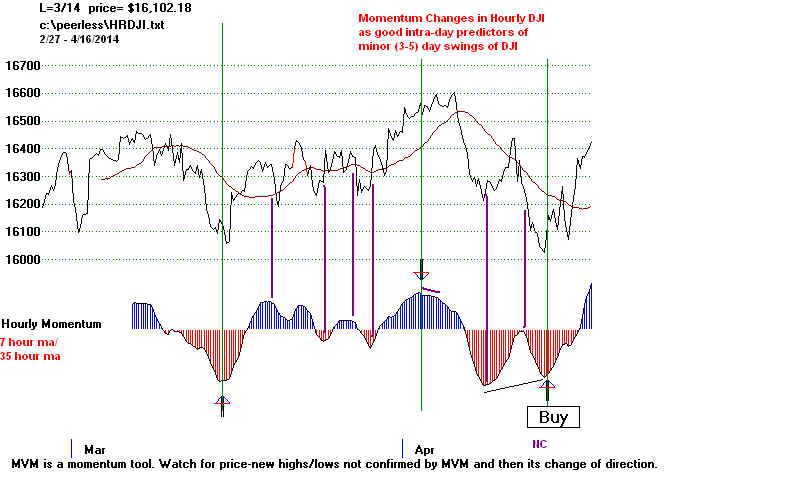

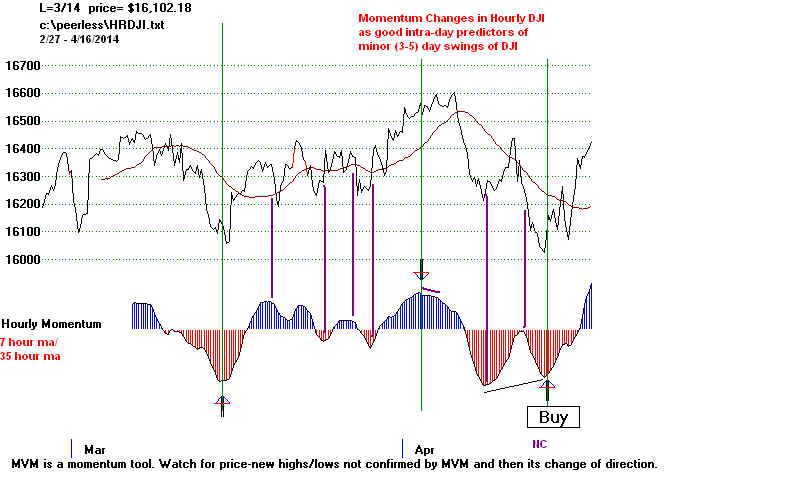

Hourly DJI-OBV Hourly-MVM0735

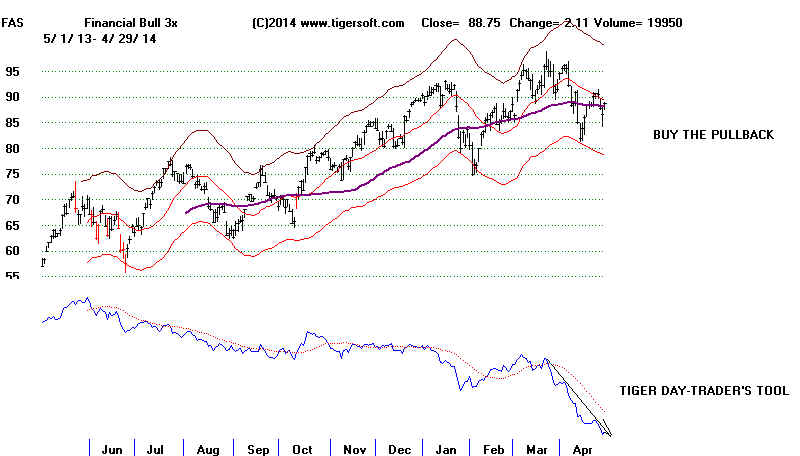

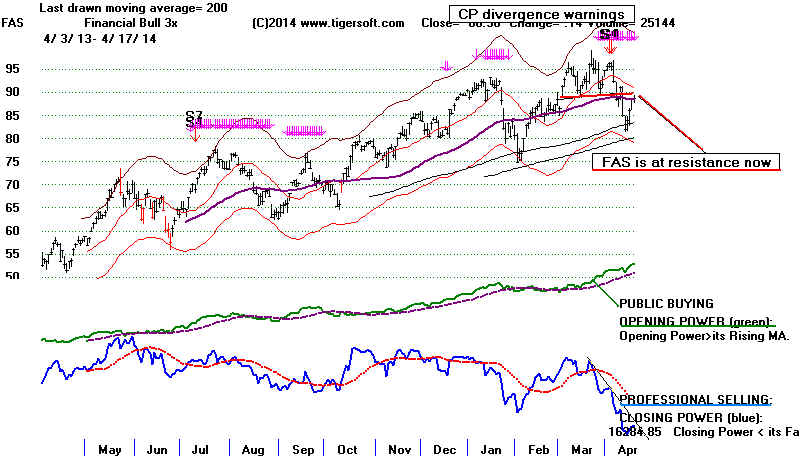

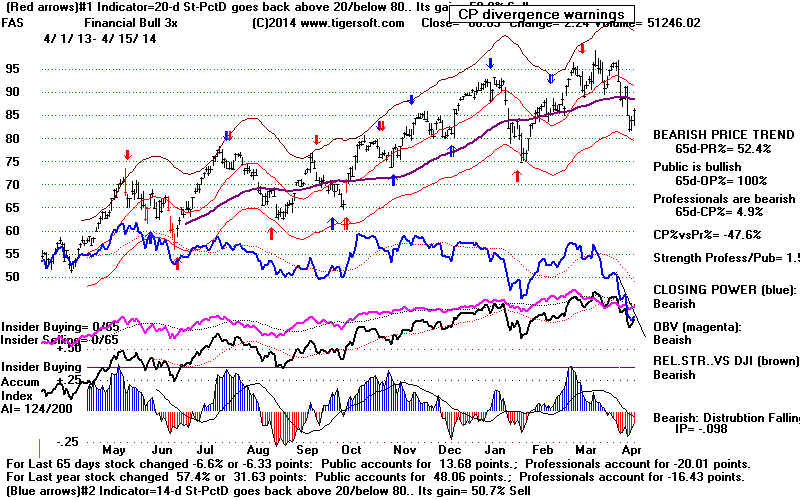

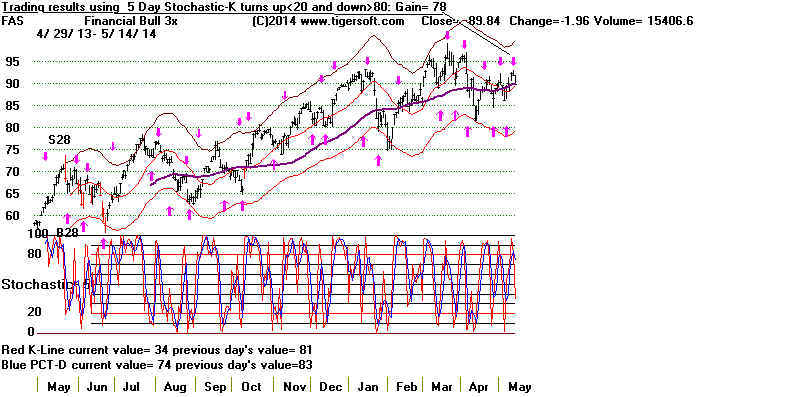

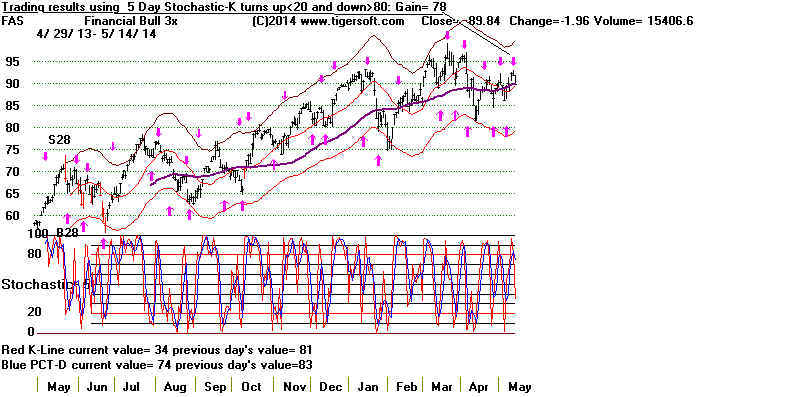

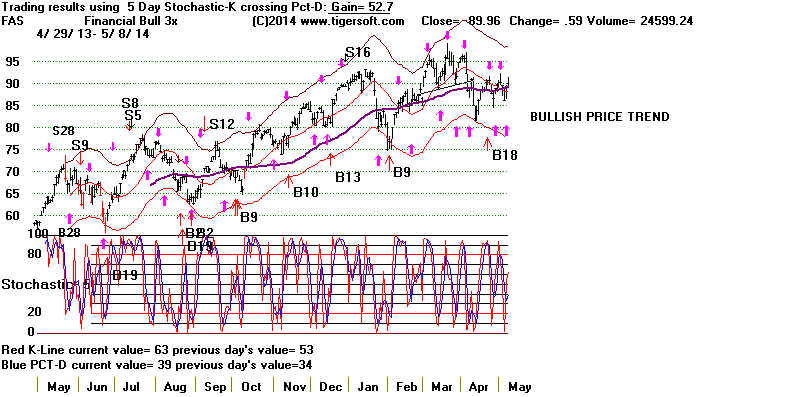

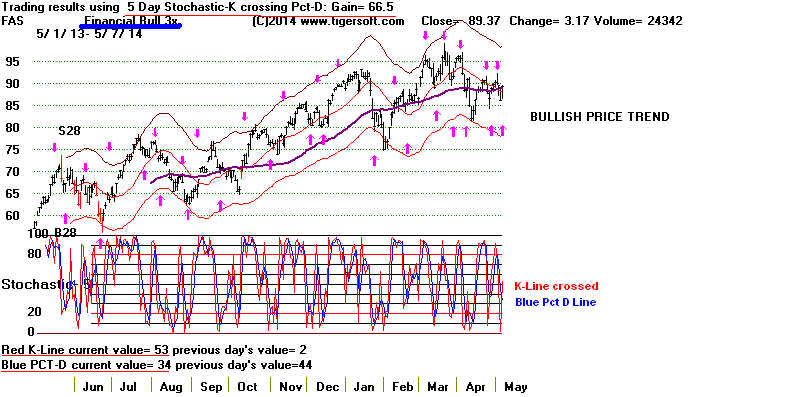

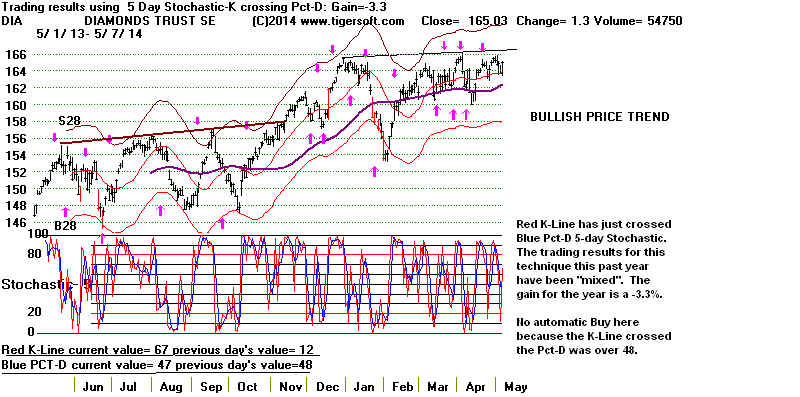

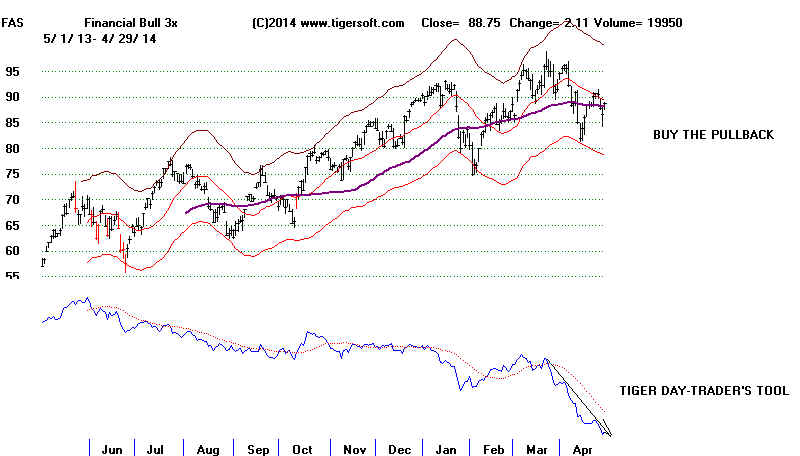

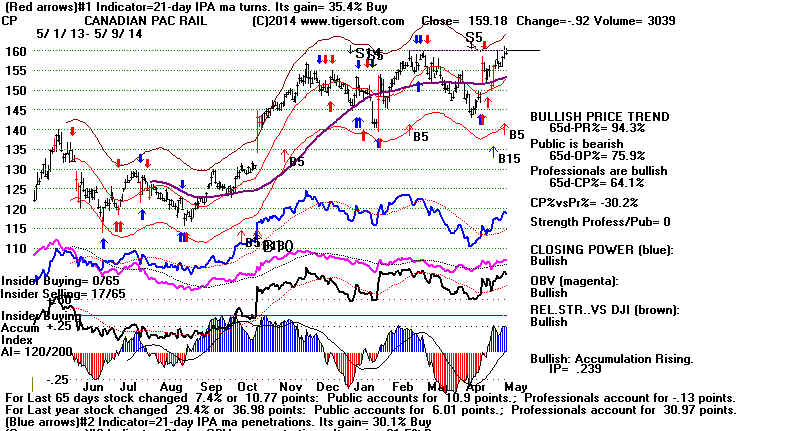

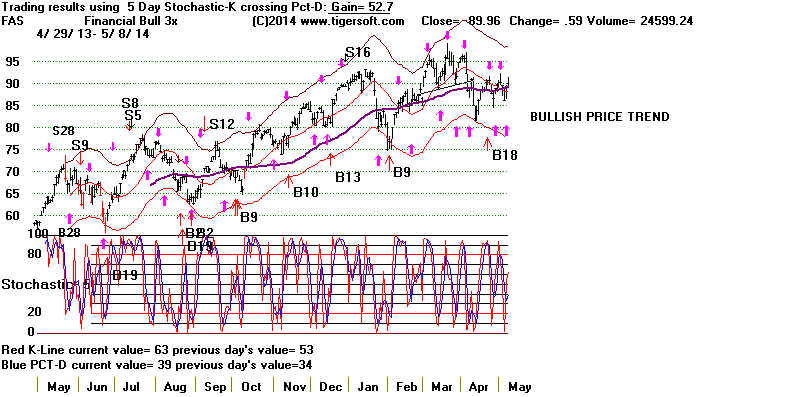

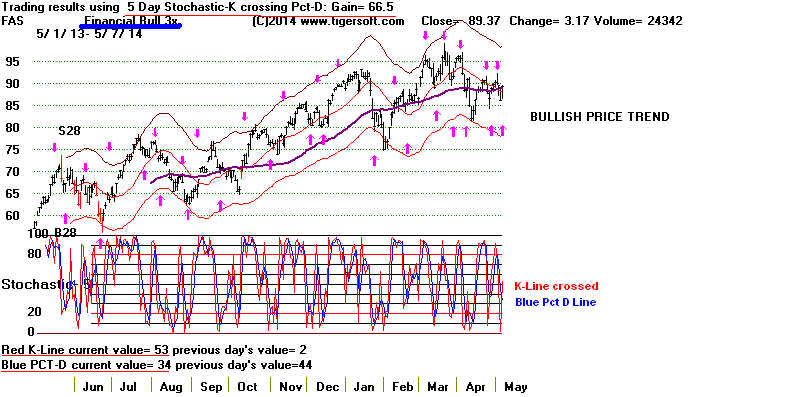

FAS-3x Financials IBB-Biotechs

--> 55 - 77

MAXCP stocks

Bullish MAXCP Stocks (6/24/2014)

--> 63 +1 MINCP stocks Bearish MINCP Stocks

(6/24/2014) BEARISH plurality

--> 22 -27 New Highs on NASDAQ 16 +4 new lows. Bullish plurality

-->

52 -49 New Highs on NYSE 14

+6 new lows. Bullish plurality

New Study

Testing A Simple Unconditional Sell S4

in Rising Markets since 1930 in Junes

in the 2nd Year of A Presidential Election Year.

All

Junes might be of interest here, but time is limited and I've

found

that the 4-year cycle generally has a profound effect

on

the stock market. So, let's consider those cases where

the

DJI was in a long bull market in June of the second year

of

the 4-Year Presidential Cycle (namely a

year of Congressional

Elections.) We can compare the Peerless key values now

with

those of the cases of such Test S4s in these years.

See the charts of these Test Sell S4s here.

Keep in mind that

that

the key values we see now will be somewhat lower if

the

IP21 does break its 21-day ma.

The

current Key Values are so much more positive than those

in

the Test Sell S4 cases below, a decline to the lower band would

seem

the most the DJI might muster this month to please the bears.

LA/MA = 1.000 ANNROC = .15

P= +317 IP21 = +.143 V = +19 OPCT = +.48

65D-UpPct = +.031

high tied high

high high

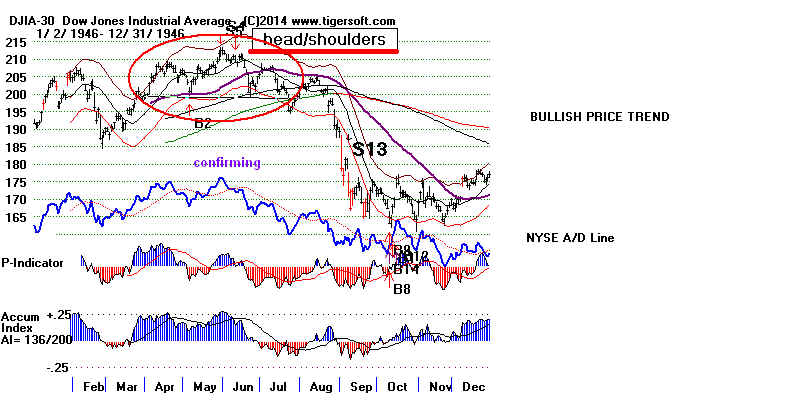

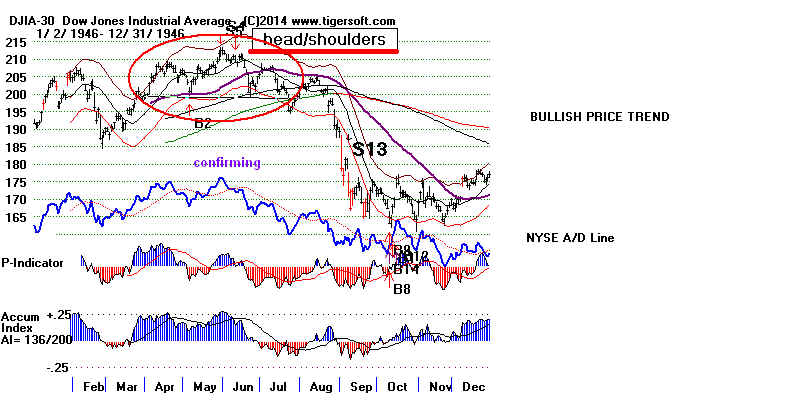

1 6/11/1946 DJI dropped below lower band. Sell S5,

S4 and head/shoulders.

LA/MA = 1.001 ANNROC = .114 P=9 IP21 = +.143 V = -55 OPCT = +.228 65D-UpPct = .073

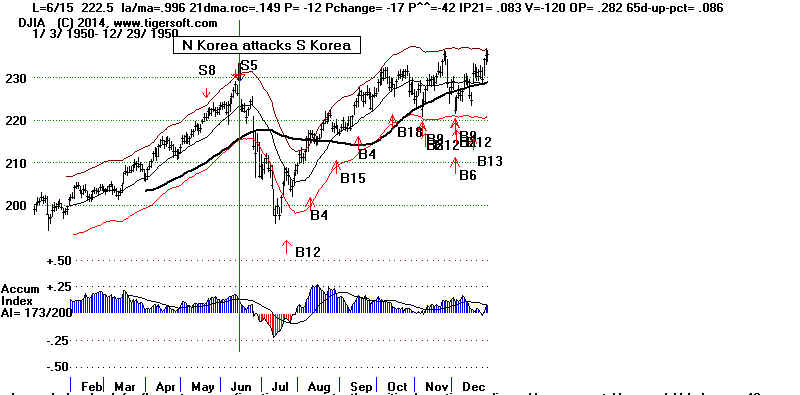

2 6/16/1950 DJI dropped below lower band Sell S8, S5 and head/shoulders.

LA/MA = 0.997 ANNROC

= .1124 P= -19 IP21 = +.073 V = -131

OPCT = +.230 65D-UpPct = .073

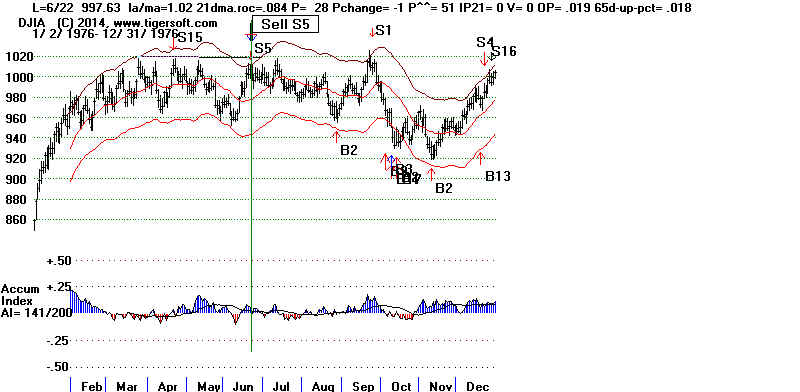

3 6/13/1978 DJI dropped to lower band

LA/MA = 1.008

ANNROC = .228 P=32 IP21 = +.016 V = 1 OPCT = +,206

65D-UpPct = .127

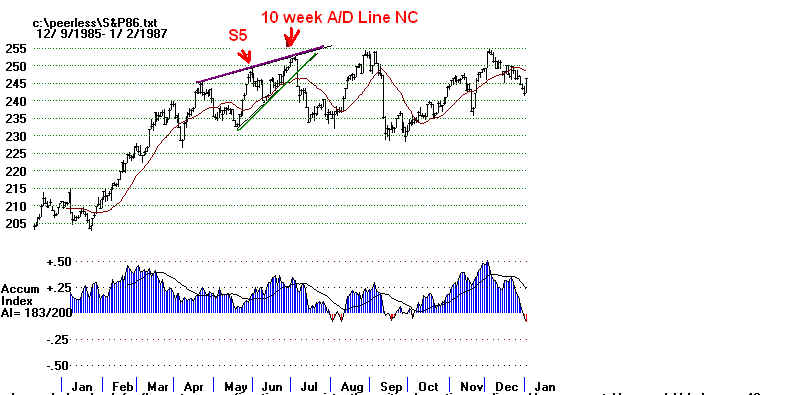

4 6/25/1986 DJI dropped below lower band

LA/MA = 1.01

ANNROC = .204 P=-48 IP21 = +.109 V = -2 OPCT =

+,089 65D-UpPct = .057

5 6/18/1990 3% rally and then bear market.

LA/MA = .999

ANNROC = .208 P= 15 IP21 = +.084 V = -1

OPCT = +,026 65D-UpPct = .069

================================================================

OLDER HOTLINES

================================================================

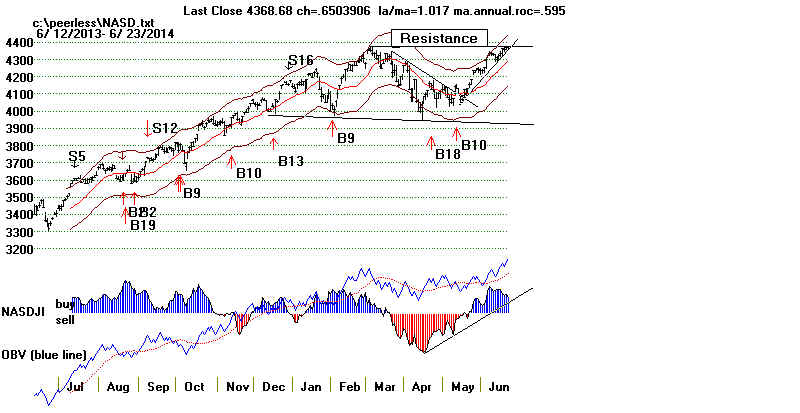

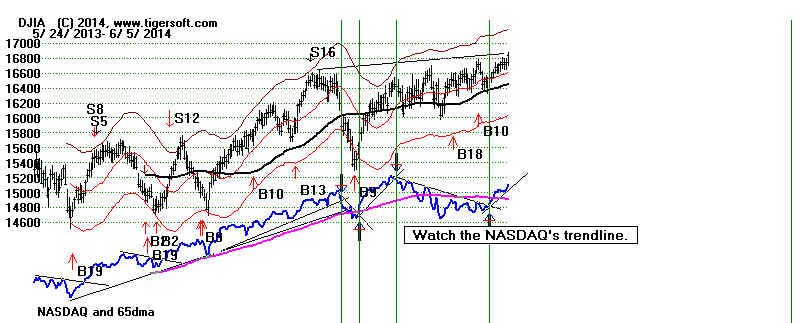

6/23/2014

Still No Peerless

Sell and none looks

imminent though we should watch the Accumulation Index

on the DJI. If the current AI (IP21) drops below its 21-day

ma, we may get a Sell S4.

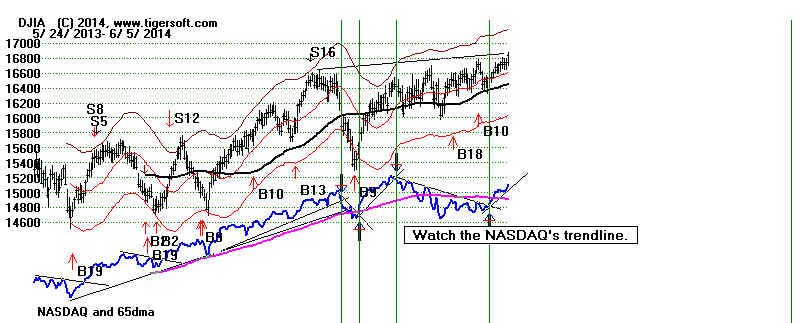

Today's shallow decline could have been much worse. So,

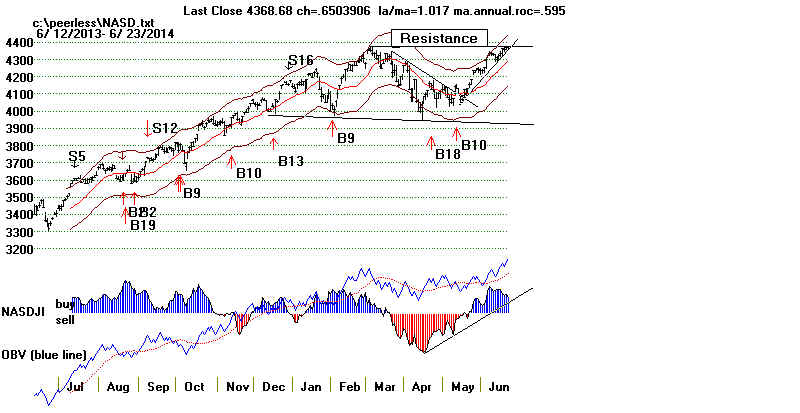

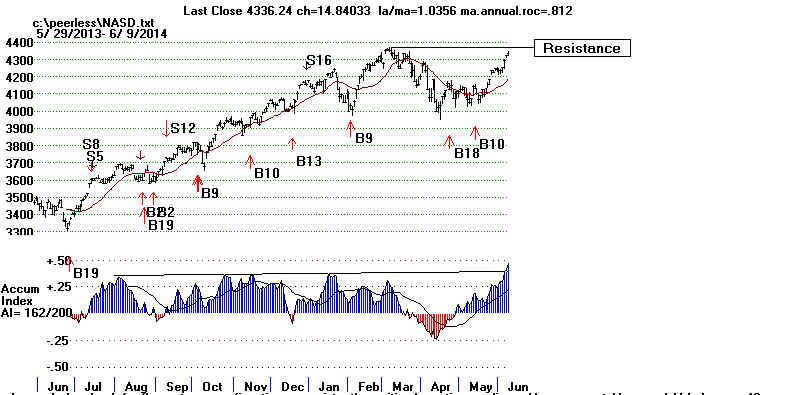

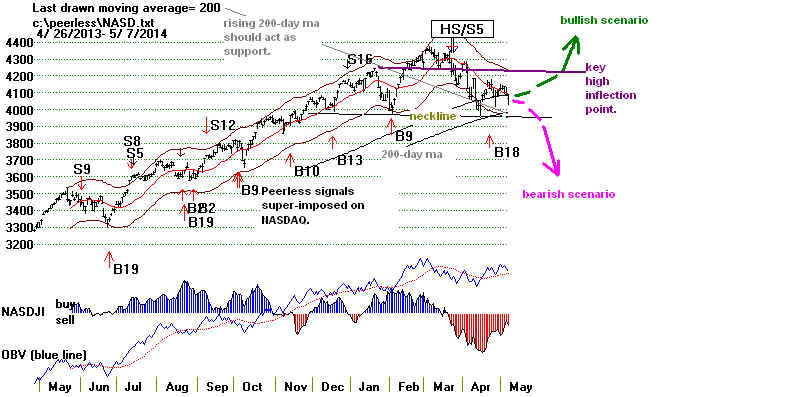

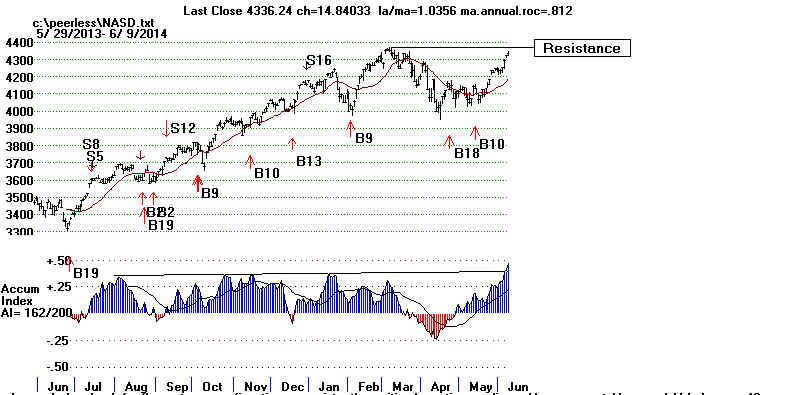

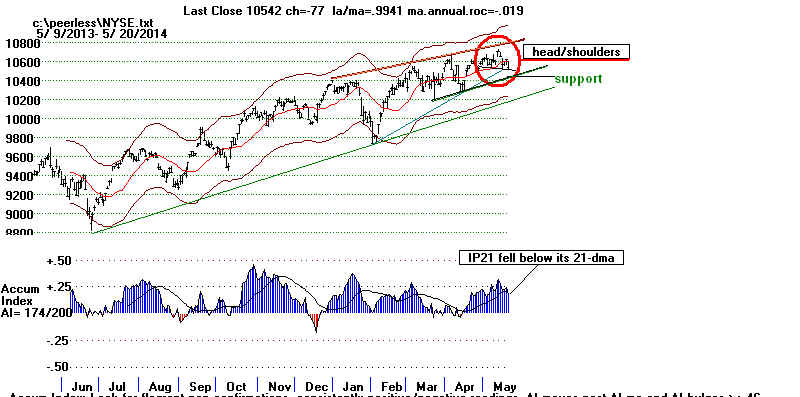

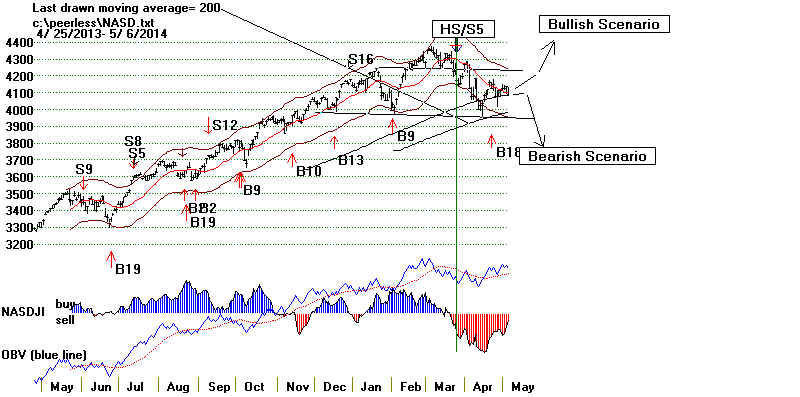

Monday sellers did only limited technical damage. Still, the

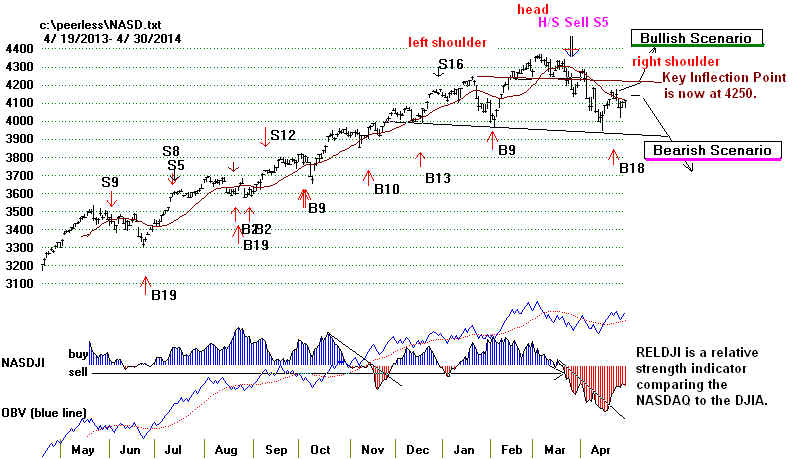

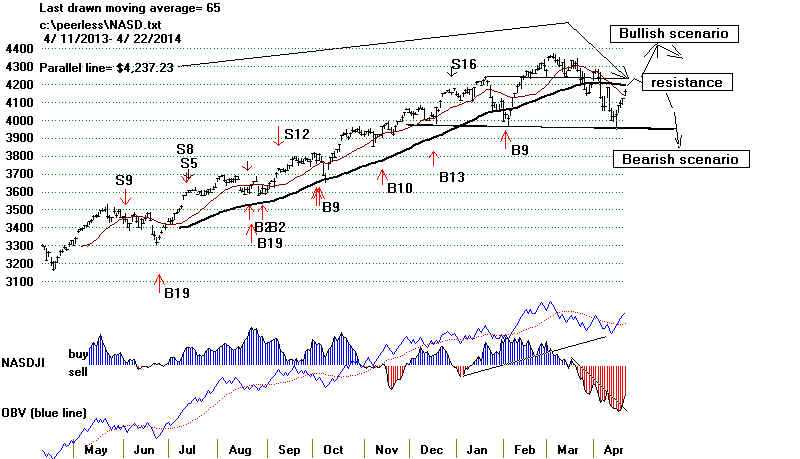

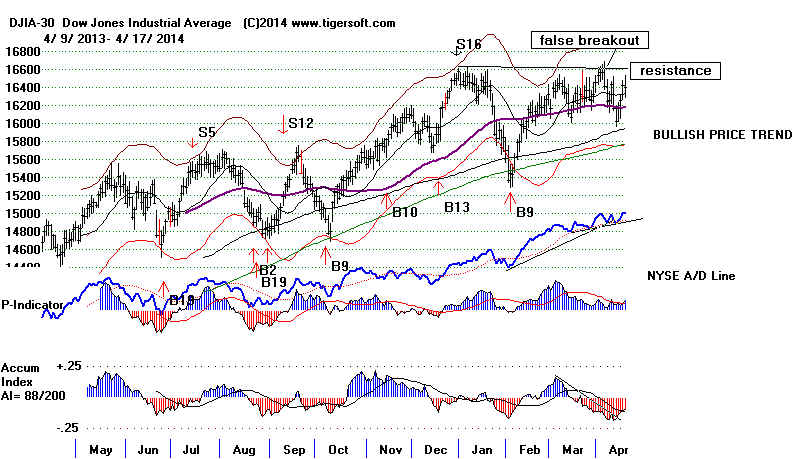

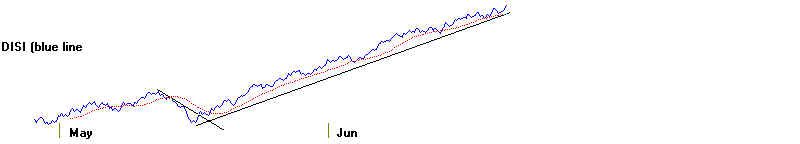

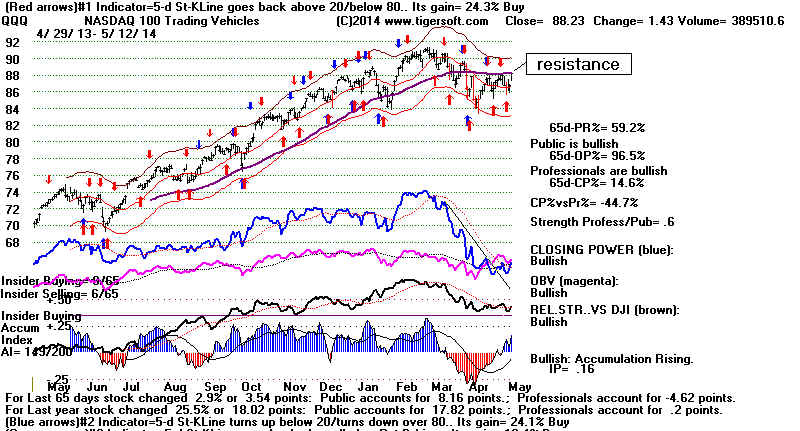

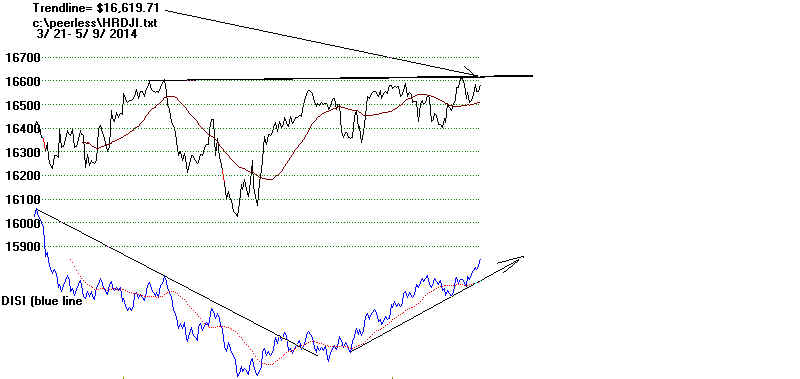

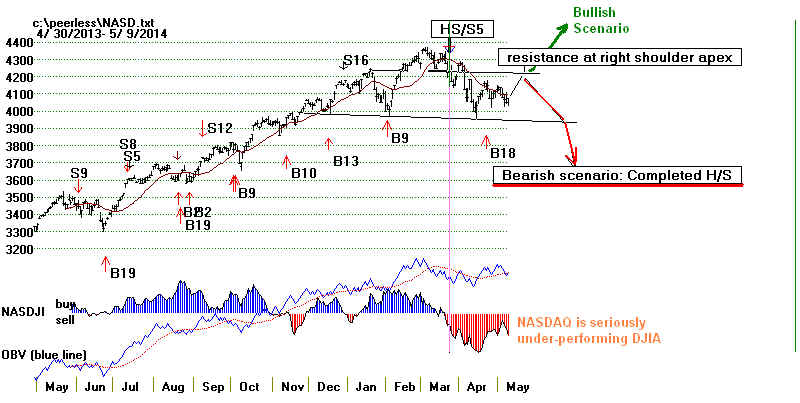

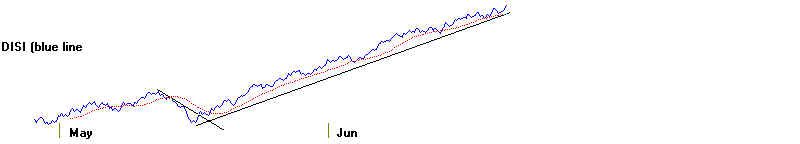

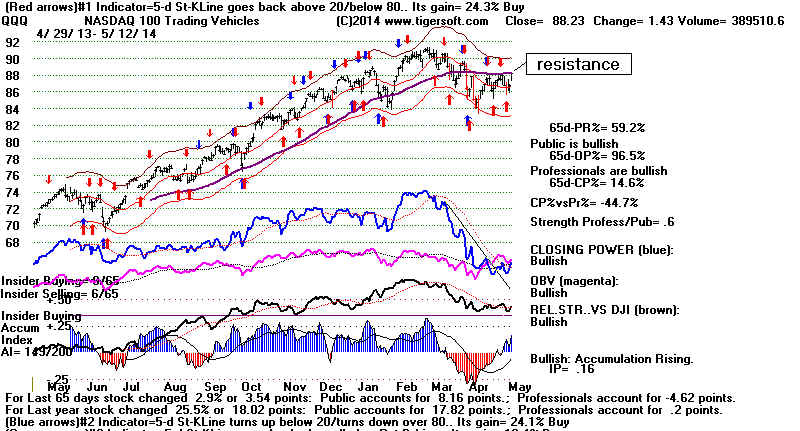

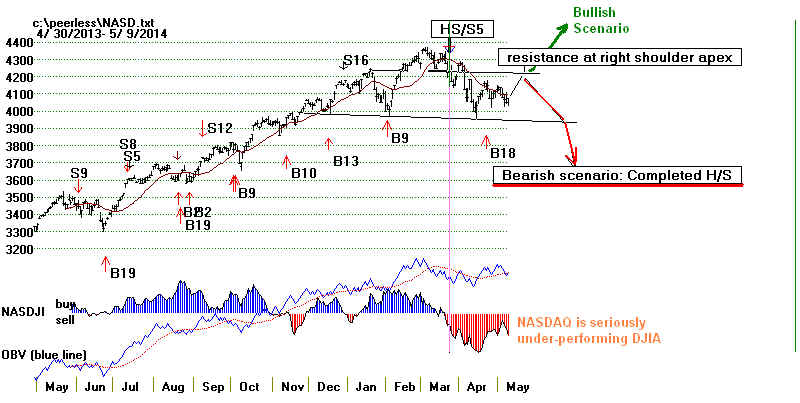

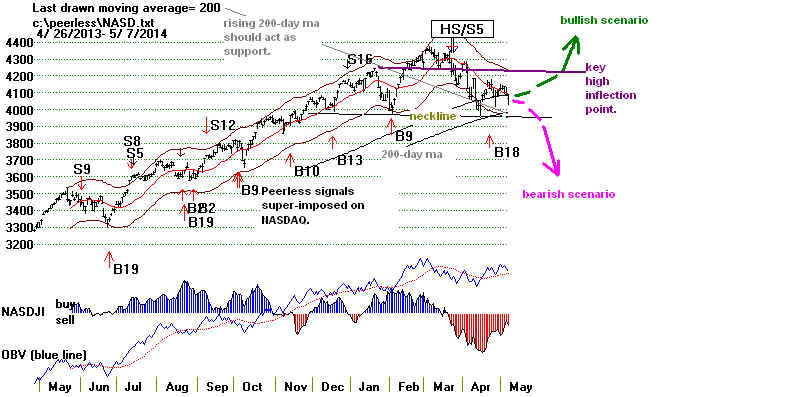

NASDAQ has stalled at its previous highs, the Hourly OBV (DISI)

Line has broken its uptrend and DJI now seems to have been

recaptured by a normally bearish rising wedge pattern. So,

watch the IP21 on the DJI.

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB

Chart IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

--> 132 - 69

MAXCP stocks

Bullish MAXCP Stocks (6/23/2014) Bullish plurality

--> 57 +1 MINCP stocks Bearish MINCP Stocks

(6/23/2014)

--> 49 -39 New Highs on NASDAQ 12 -7 new lows. Bullish plurality

--> 101

-93 New Highs on NYSE 8

-10 new lows. Bullish plurality

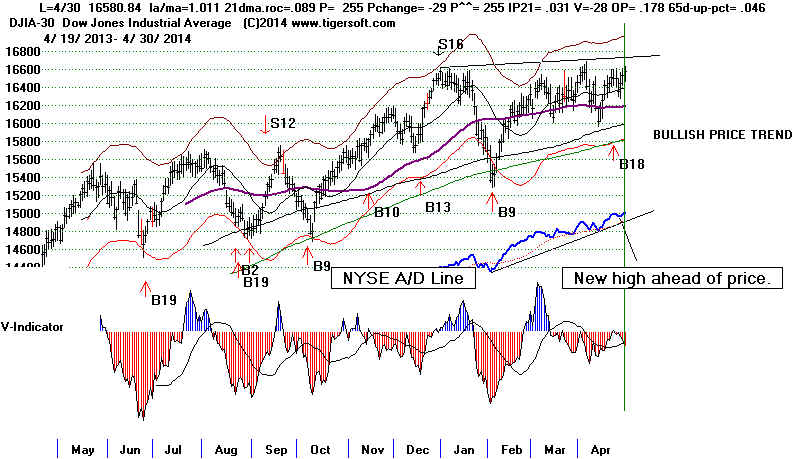

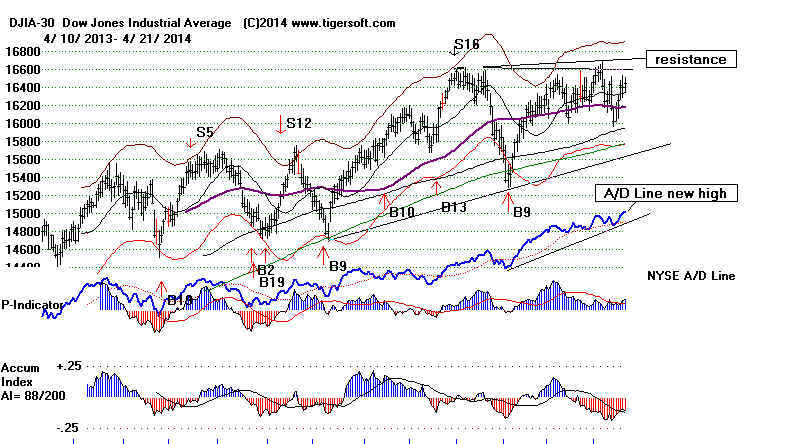

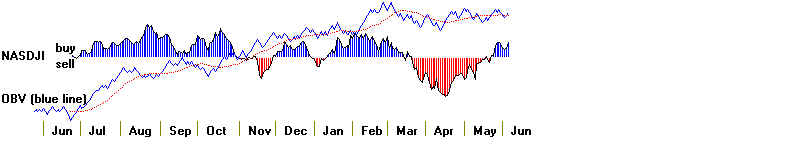

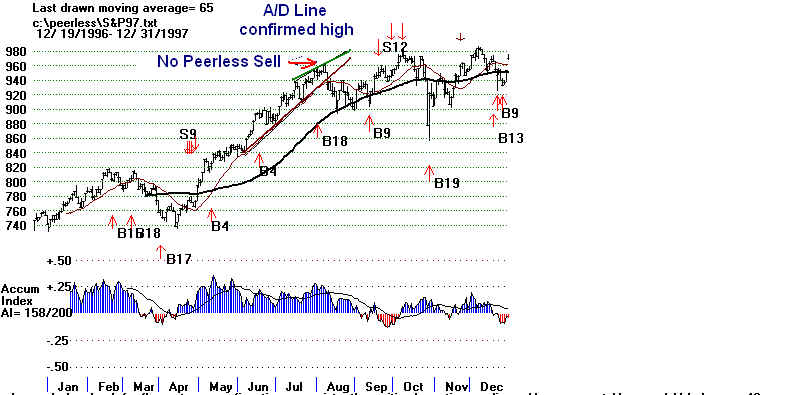

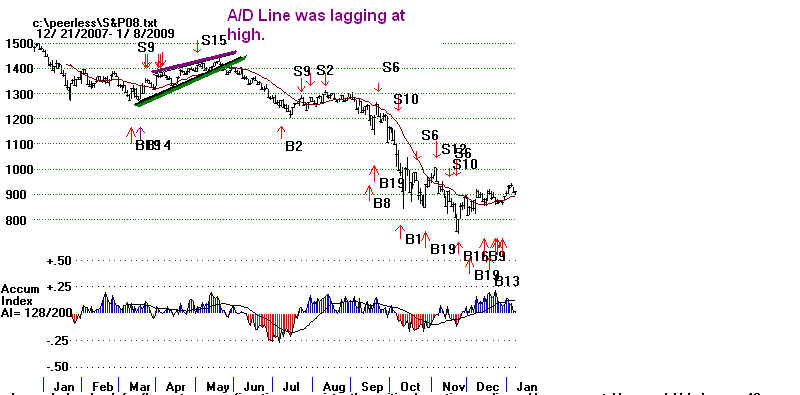

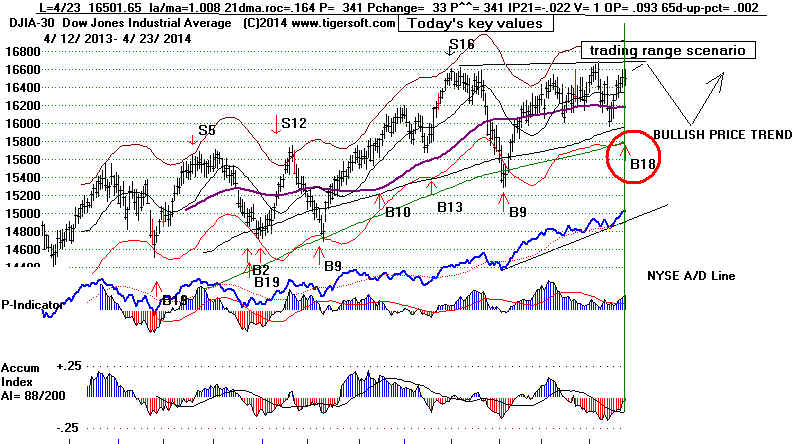

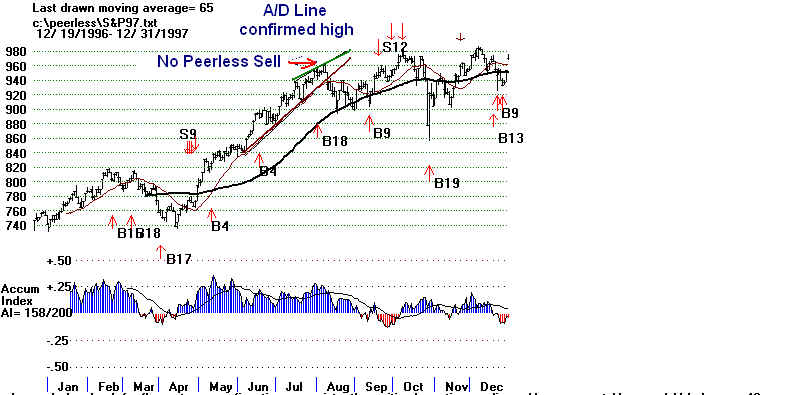

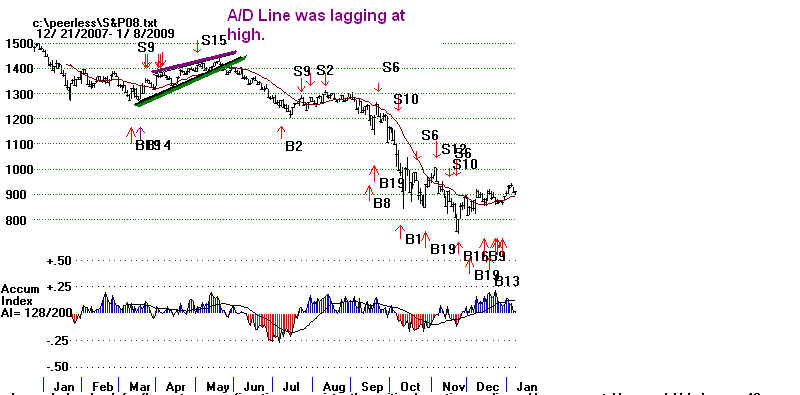

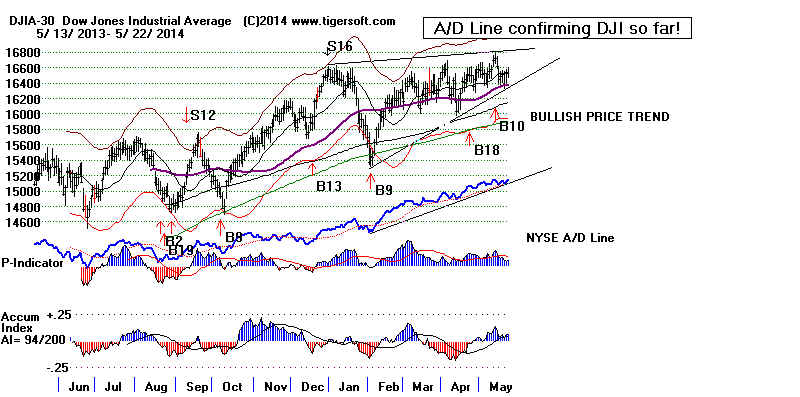

Most important, the NYSE A/D Line remains steeply up. Historically

this is the most important bullish sign the market can make.

A very visible A/D non-confirmation of a new DJI high is the most

frequent technical warning the market gives at major tops.

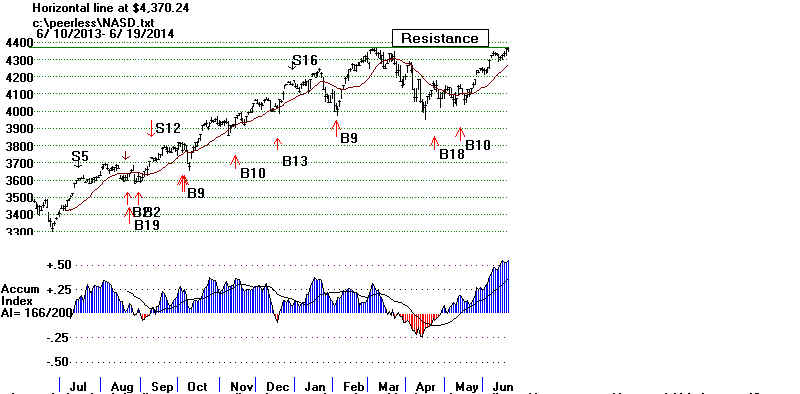

A NASDAQ breakout now would be very bullish. It would remind

older traders of how the NASDAQ launched past take-offs with

breakouts above flat resistance propelled by very high Accumulation.

as in February 1995, April 1996, June 1997, December 1998, November

1999, August 2003, July 2009, July 2014. See

these NASDAQ charts here.

The market has held up well, considering how badly Iraq could blow

up and how readily American Presidents usually are in involving

the American military in civil wars all around the world. Certainly,

the way oil stocks are rising tells us the new Iraq civil war will probably

get much worse. Being long oil stocks and oil/drilling ETFs and short

their leveraged inverts remains recommended. Moves in oil

stocks can often take place over extended periods when any of

the many Mid-East political volcanoes become active and erupt.

================================================================

OLDER HOTLINES

================================================================

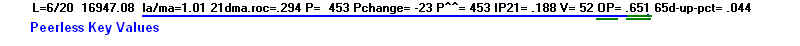

6/20/2014

Still No

Peerless Sell and none looks

likely or imminent.

There's more bullish evidence about the market now.

A steady advance from February to June without a decline

to the lower band is ordinarily bullish. So are the very high

OBVPct readings from the DJI (See tonight's new research)

and the very high IP21 levels on the NASDAQ, OEX and SP-500.

July may be a problem Significant tops did occur in July

when Peerless gave a Sell Signal in 1943, 1957, 1975, 1983

and 1990 despite a strong February to July advance.

Steady Feb-July Advances

1943

July 14 S4 a week earlier. DJI reached 2.5% upper band before selling off to

LB.

1954

DJI rose steadily all year.

1957

July 5 Sell S4, S9, S7 DJI reached 2.5% upper band before selling off. Bear Mkt.

1975

June 23 Sell S18 (OPCT NNC at 3.7% upper band.) DJI fell 10%

1983

July 26 Sell S9. DJI then fell to lower band.

1990

July 13 Sell S9 and S8. Big decline followed.

1993

DJI rose steadily all year.

1995

DJI rose steadily all year.

The Peerless internals all look

constructive. Before a top can be

made, I would expect there to

be one of five technical developments:

1) A new DJI high that is

widely unconfirmed by the NYSE A/D Line.

This would potentially bring

a Peerless P-Indicator negative non-confirmation

of a DJI new high and a Sell

S9. Presently, the A/D Line is leading the DJI,

not lagging.

2) A weakening in the

Accumulation Index (IP21) which would make it drop

below its 21-dma and give a

Sell S4. The IP21 now stands at .188. The

21-day ma of the IP21 stands

now at .14. We would need to see three of

four straight days of the DJI

closing near its low on high volume for

this to occur. As

I mentioned recently, the crossing of +.50 by the IP21

for the NASDAQ, OEX and

SP-500 are quite reliably bullish until a regular

Peerless Sell Signal occurs..

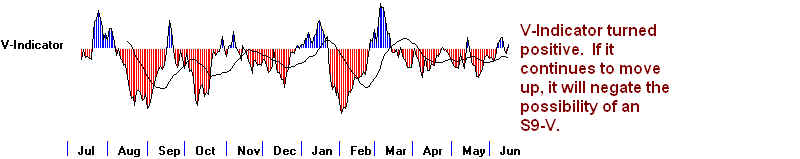

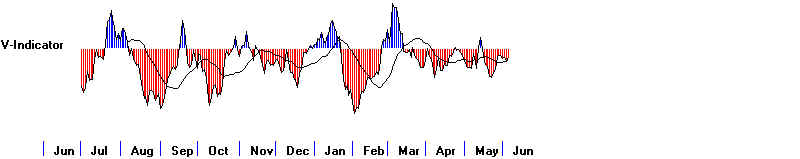

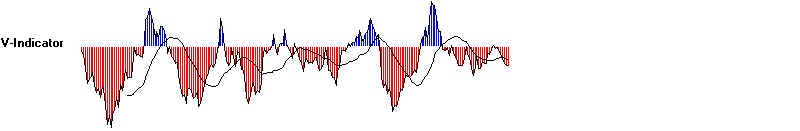

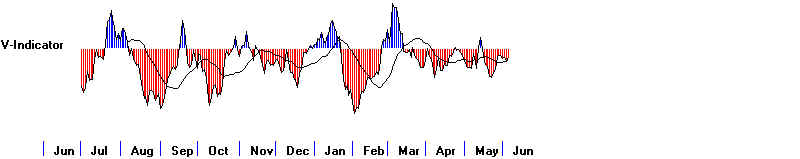

3) The V-Indicator would have

to turn negative as the DJI moves closer

to the upper band and produce

a Sell S9V. It now stands at +52. So,

this seems unlikely.

4) A DJI head and shoulders

would suddenly develop as a result of unexpected

bad international news or a

dramatic change in economic policies by the White House.

5) The OBVPct would have to

turn negative as the DJI rises to the 3%

upper band. This

can produce a rare Sell S18. The value for OBVPCT is now +.651

Such high readings are

usually bullish provided Peerless has not given

a sell. See the

new study below. In 8 of the 10 cases since 1928 where the

OBVPCT reached .65, the DJI

moved much higher.

DJI OPCT readings above +.65 and Subsequent DJI Action

1929-2014

1 7/9/1929 .732

DJI rose from 345.6 to 381.2 on 9/3/1929. Then t utterly collapsed.

(4/14/1930 .63 DJI peaked here and collapsed. IP21

was only .117 and VI was -94.)

2 8/8/1932 .676 DJI rose from

67.7 to 79.9 before declining 35%.

3 6/29/1938 .701 DJI rose from 135.9 to 158.1.

(10/13/1942 .624 DJI rose from 115

to 145.8 on 7/14/1943 before declining

to lower band.

Note that IP21 was +.251 and VI was +114.)

4 7/14/1943

.711 DJI immediately peaked and declined from 145.8 to 129.6

(There had just been a Sell S4 and a Sell S8 a month before. )

(12/7/1954 ,632 DJI rose from

393.9 to 419.7 on 3/4/1955 before falling

to lower band. )

5 6/22/1955 .712

DJI rose from 447.4 to to 468.4 on 7/26/1955 and falling to lower band.

(7/25/1958 .641

DJI rose from 501.8 to 5917.7 on 1/21/1959 and falling to lower band.)

6 6/9/1960 .651 DJI peaked and fell from

656.4 to 601.7 on 7/25/1960.

(There had been a Sell S2 on June).

7 8/20/1962 .650 DJI peaked and fell from 612.9 to 558.0 on

10/23/1962.

8 7/7/1964 .657

DJI rose from 844.9 to 891.7 on 11/18/1964 and falling to the lower band.

(4/30/1968 .637 DJI peaked and fell from 912.22 to 869.65 on 8/9/1968 )

9 12/3/1970 .655 DJI rose from 808.53 to

950.82 on 4/28/1971.

(5/23/1990

.637 DJI rose

from 2856.26 to 2999.75 on 7/17/1990.

DJI then fell to 2375 on 10/11/1990 )

10

7/19/2007 .719 DJI rose from 13105.5 to 14000.41 on

7/19/2007 and then fell back 10%.

6/20/2014 .651 outcome?

> To Key Index and Leading Stock Charts: DJI,

SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB

Chart IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

--> 201 + 19

MAXCP stocks

Bullish MAXCP Stocks (6/20/2014) Bullish plurality

--> 56 +25 MINCP stocks Bearish MINCP Stocks

(6/20/2014)

--> 88 +28 New Highs on NASDAQ 19 +7 new lows. Bullish plurality

--> 194

+28 New Highs on NYSE 18

+12 new lows. Bullish plurality

================================================================

6/19/2014 Still No Peerless Sell

A Peerless Sell is being made more unlikely by our

still improving

technical Indicators. More and more, a DJI of 17700-17800

seems a valid target, In particular, see from our rising Inverted

MKDS how NYSE volume is disproportionately high in rising stocks.

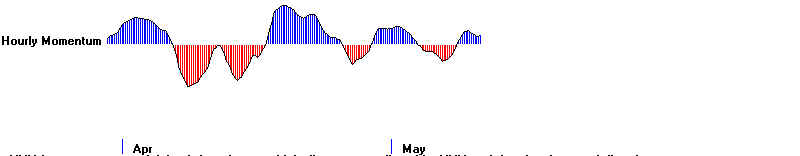

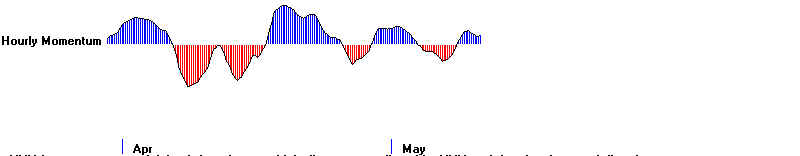

The Hourly DJI's DISI Line is now sending the same

message.

The FED's assurances that interest rates will remain low for the

foreseeable future plus what appears to be a stable Dollar make

US stocks an inevitable choice for most big investors.

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB

Chart IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

--> 182

MAXCP stocks

Bullish MAXCP Stocks (6/19/2014) Bullish plurality

--> 31 +7 MINCP stocks Bearish MINCP Stocks

(6/19/2014)

--> 60 -16 New Highs on NASDAQ 12 -3 new lows. Bullish plurality

--> 168

+27 New Highs on NYSE 6

+3 new lows. Bullish plurality

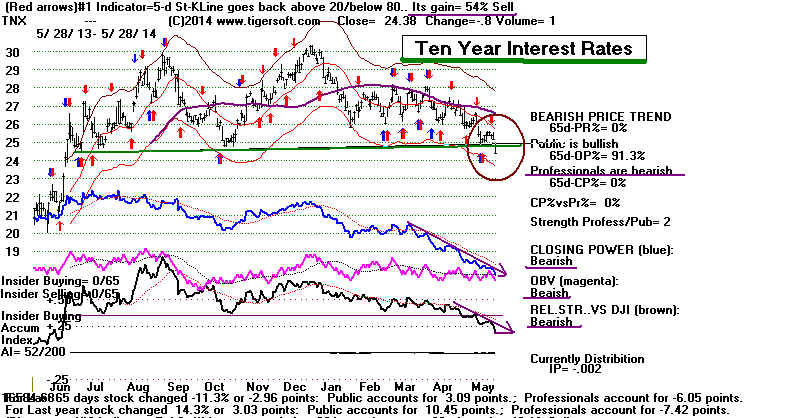

Dangers Inherent in The Feds' Policies

These are not long-term bullish signs, however. What we have now

is far from a fresh new bull market. Rather than a vibrant economic

recovery which lifts the incomes of the working middle class, we

have a a market whose rising prices have mainly been boosted

by the twin Fed policies of low interest rates and deliberate

"transparency". The latter offers very high predictability

and more investor confidence, but only for so long as rates are

seen as being kept low by an all-powerful FED. When rates

start to rise, the FED's transparency will back-fire.

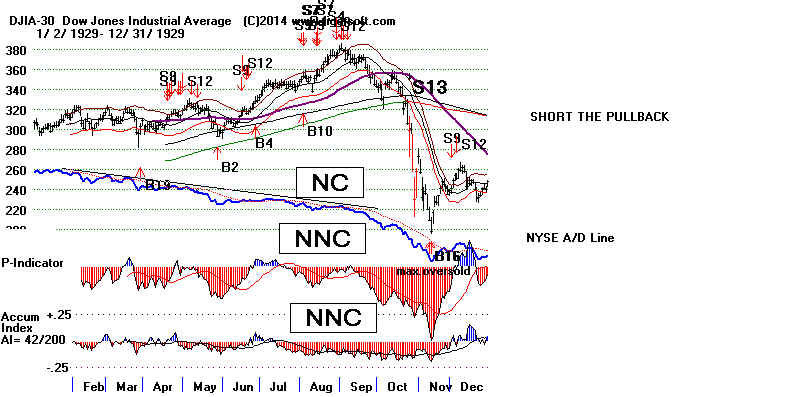

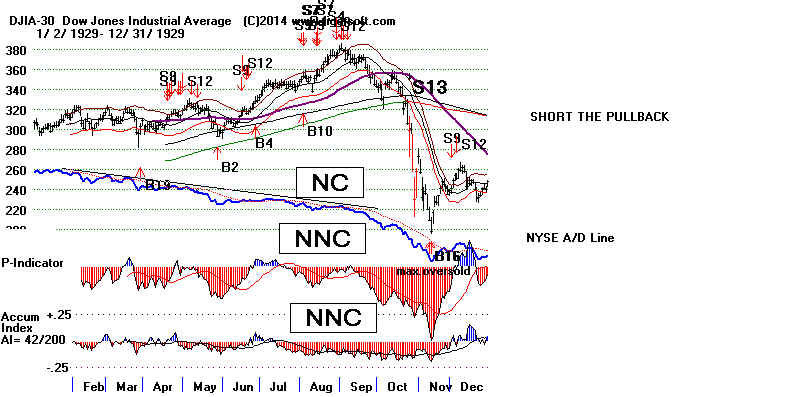

As in the late 1920's, I have to think that the current Income inequality

in the US will eventually cause over-production, a lack of consumer

demand and then a fall in profits and stock prices. But first the DJI

may "melt up". This is exactly what happened between August 1928

(DJIA - 215) and September 1929 (DJIA - 382). It is exactly what

happened for the NASDAQ between October 1999 and March 2000.

Now with the Fed's help, we could see another "melt-up" bubble.

Early Warning

Signs

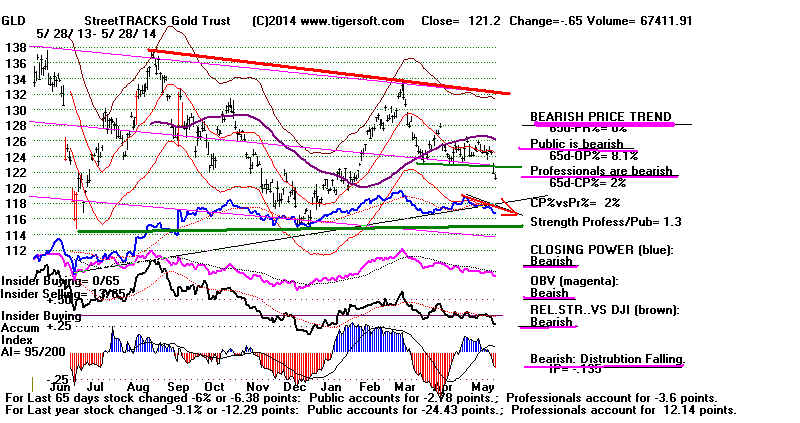

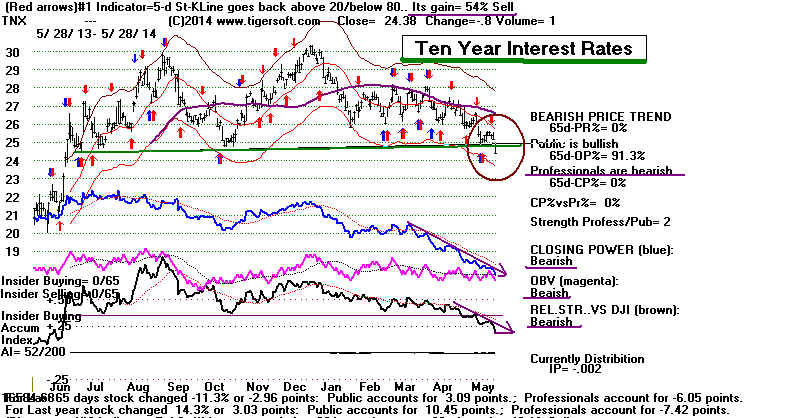

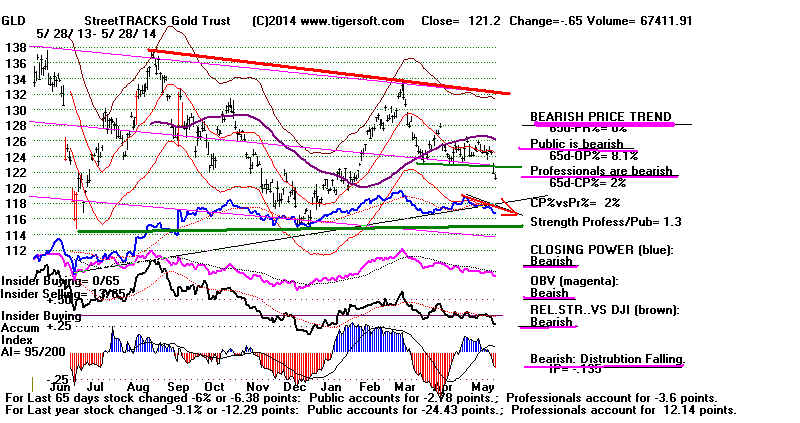

Today we saw the red high volume moves by Gold and Silver above their

falling 65-dma. (See also how these advances followed failures by their

Closing Powers to confirm recent lows.) This and rising

oil prices may

pose real problems for a stable Dollar and low interest rates by August or

September. If hot money starts selling currencies and the Dollar in favor

of oil, gold and silver, in part because of developments in Iraq, it will probably

force the Fed to allow interest rates to rise in order to protect the Dollar.

With

so much US indebtedness, the FED has sought to prevent higher interest rates

from producing runaway indebtedness. But it is not all powerful. International

pressures may build a lot more quickly than almost anyone may expect. A quick

rise in 10-yr interest rates from the 2.6% level now to a level clearly above 3.0%

(December's peak) to, say, 3.5% would bring out new fears that the Fed has

lost control. If rates do go up, dividends paying stocks will surely tumble.

Right now, these dangers and fears are only something to watch for.

Usually Gold and Silver must rise steeply by, say, 20% for at least 2 months

before the DJI sets up a significant top. (This was the case with the August

1987 DJI top before it fell 37% by the third week of October.)

But as long as the NYSE A/D Line keeps making new highs, most investors

still do not see a rise in interest rates as much of a threat. They trust that

the FED means what that they say and that they are all powerful. But they

wrong to think these things. The FED can change their minds. They have

made many, many mistakes over the years. And if international events

develop too quickly, they could lose control.

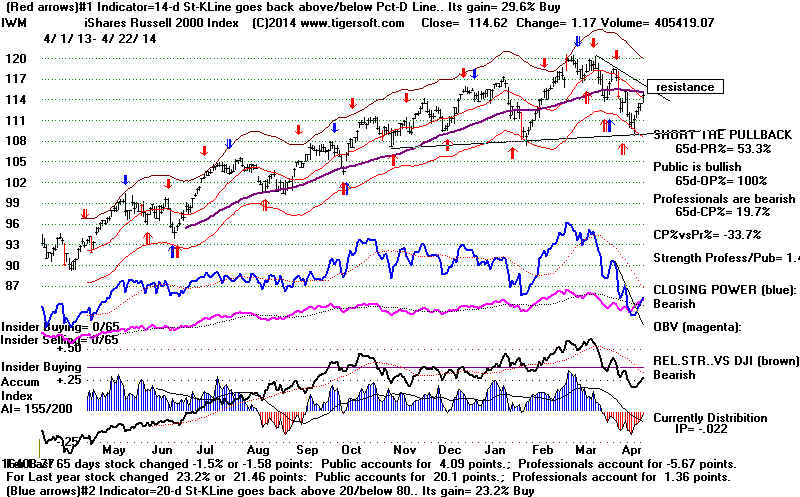

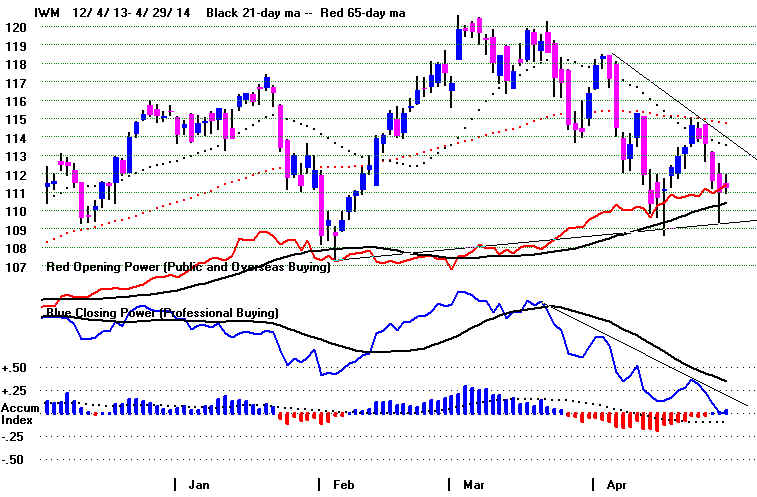

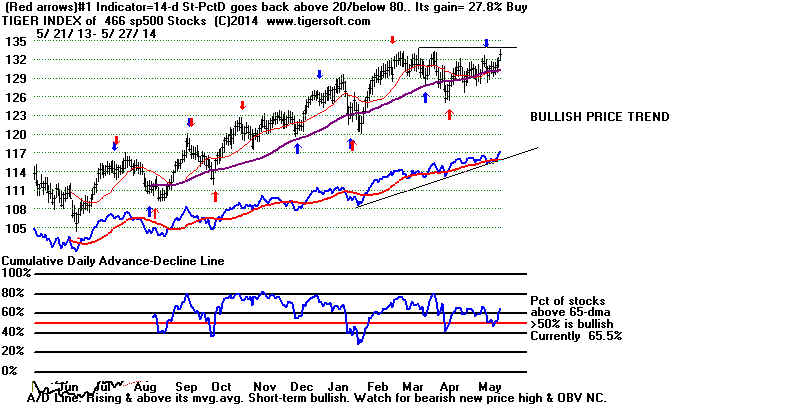

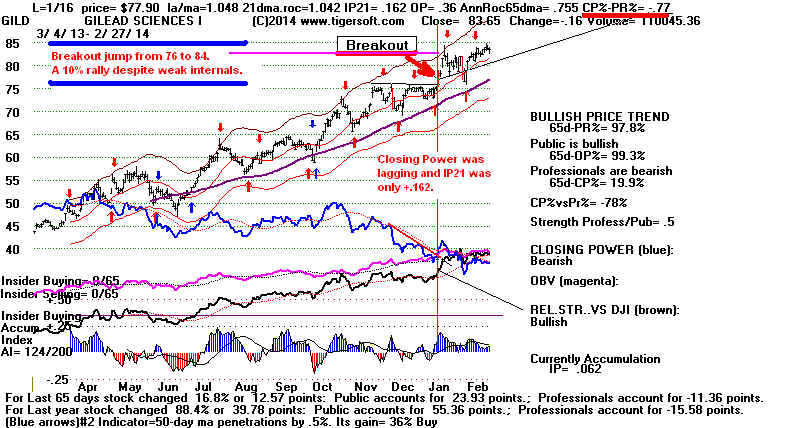

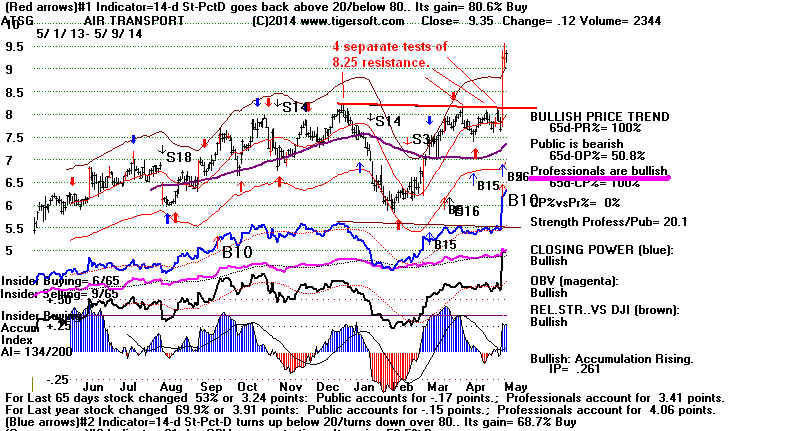

Breakouts now in the NASDAQ and our Tiger

Russell-1000

next would be a big boost to speculative interest in smaller

oil and tech stocks. See below how both are at their

resistance levels from their previous highs. These represent

the stocks that small investors watch. Typically, they need

to surge to a bubble before the bull market can climax.

================================================================

OLDER HOTLINES

================================================================

6/18/2014 Still No Peerless Sell

The bull market is broadening. Technology stocks and

foreign

ETFs are now

participating in the advance. Some heavily shorted

stocks are ralllying,

too, as shorts are getting nervous about the

strength the market is

showing despite the gathering Sunni threat to the

Iraq that America and

Britain set up after an expenditure of $3 billion.

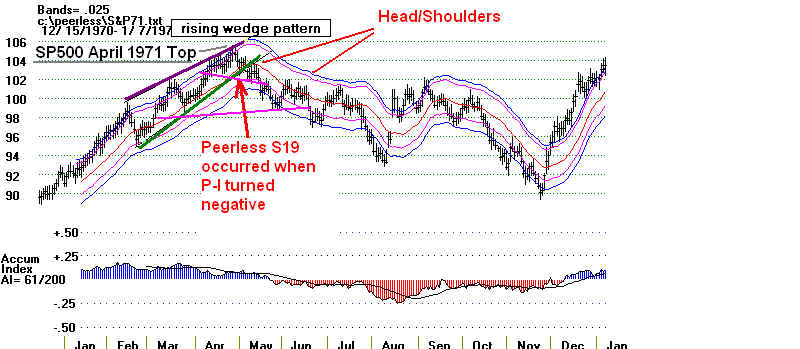

With all he internal

strength indicators quite positive, it looks as though

the only way Peerless

will give a Sell will be when the P-Indicator

finally turns negative

after being positive for 5 straight months. That

signal, an Sell S19,

cannot occur before July 10th. Moreover, the DJI's

price objective, if it

can get past 17000 will be 17800 based on the

height of the previous

1200-point trading range and the breakout at

16600.

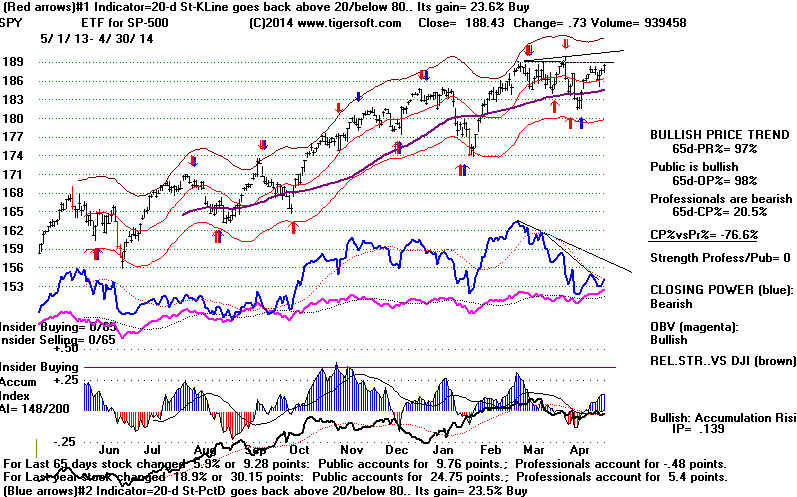

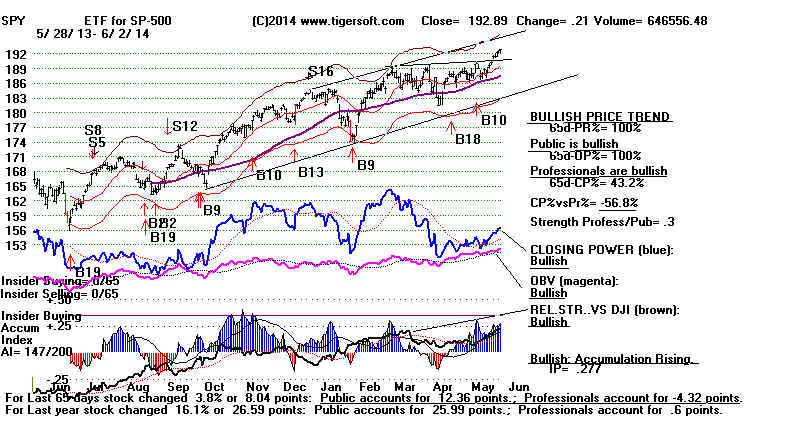

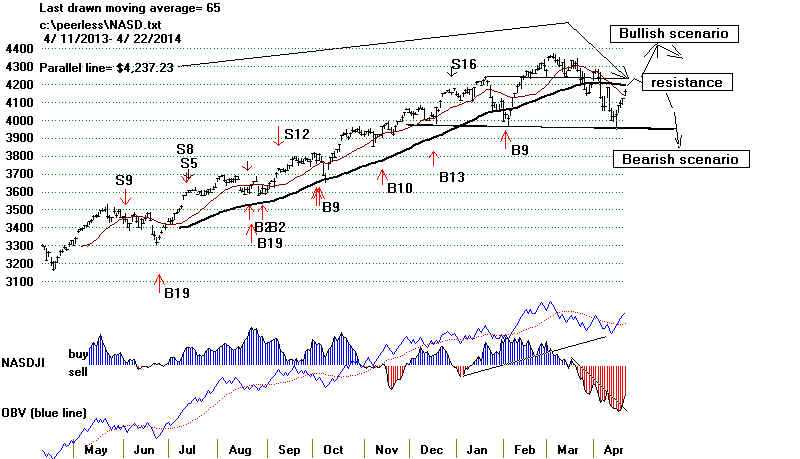

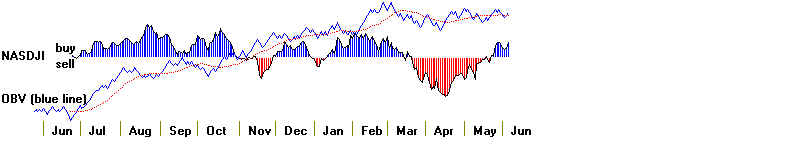

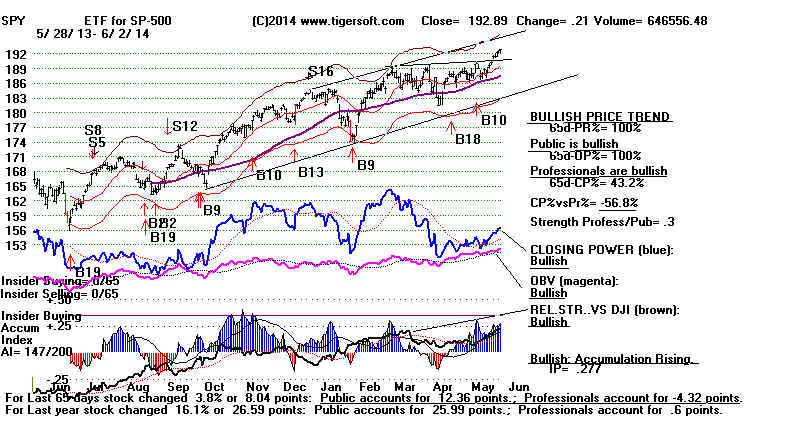

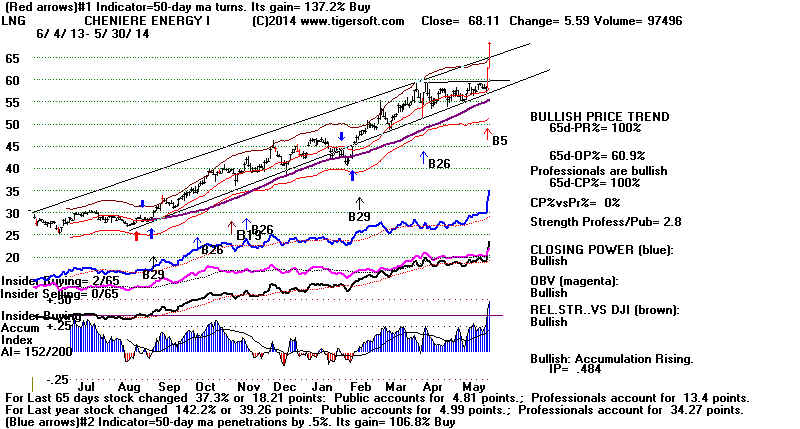

Bullishly, The SP-500, like the NASDAQ and OEX, now have IP21

readings

above +.50. Moves

by this indicator above +.50 have always been

bullish in the 5

previous cases since 1990. (See below). Once again

the NYSE A/D Line has

made a new high ahead of price. This is usually

a characteristic of a

very healthy bull market.

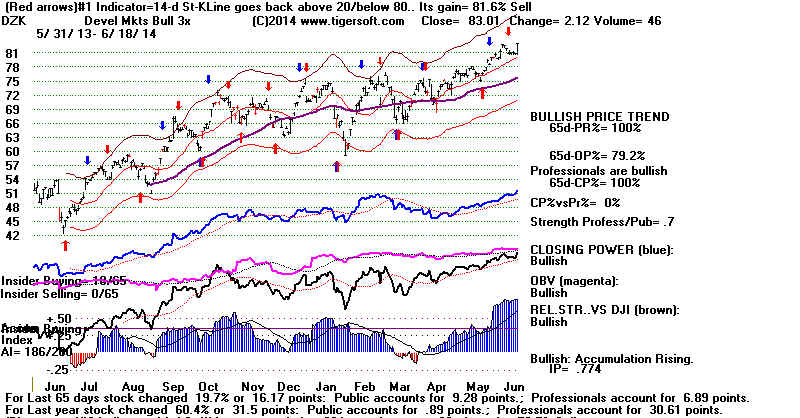

Foreign ETFs' ETF DZK

is the highest ranking leveraged ETF.

Its IP21 (Accumulation

Index) is a very high, +.774. DZK is now

challenging its old

highs of 84 in April 2011 and 90 in October 2010.

Iraq and Obama

The fight for the biggest oil refinery in Iraq continues and

Obama

has authorized

surveillance flights on the ISIS jihadists moving

south towards

Baghdad. The administration seems to be waiting for

al-Maliki to be

replaced or for him to agree to unspecified US

conditions before

using air power to stop the militant's convoys

moving South in

the deserts north of Baghdad.

(The CNN

campaign for removal of Al-Maiiki reminde me of the TV news

in 1963 in

the month before the CIA removal of Diem as President

of Viet Nam

in December 1963.)

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB

Chart IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

--> 182

+68 MAXCP stocks

Bullish MAXCP Stocks (6/18/2014) Bullish plurality

--> 24 -4

MINCP stocks Bearish MINCP Stocks

(6/18/2014)

--> 76 -8 New Highs on NASDAQ 15 -7 new lows. Bullish plurality

--> 141

-33 New Highs on NYSE 3

new lows. Bullish plurality

New Research

SP-500

IP21 Breakouts over +.50

SP-500

IP21 Subsequent OEX move

2/6/1991 358.07 .550 Advanced to 390.45 on 4/17/1991

(1/17/1991 418.86 .471 Declined to 394.50)

9/28/1995 585.87 .536 Advanced to 660.51 on 2/13/1996

2/7/1996 649.93 ,541 Advanced to 660.51 on 2/13/1996 and then fell to 631.18 on 4/11/1996.

1031/2006 1377.95 .501 Rose to 1459.70 on 2/20/2007 and then fell to 1374.10 on 3/5/2006

8/5/2010 1002.70 .535 Rose to 1148.45 on 1/14/2010 and then fell to 1056.75 on 3/5/2006.

(1/20/2012 1315.40 .499 Rose to 1419.04 on 4/2/2012.)

6/10/2014 1950.79 .516 ? sp-500 is now at1956.98 on 6/18/2014.

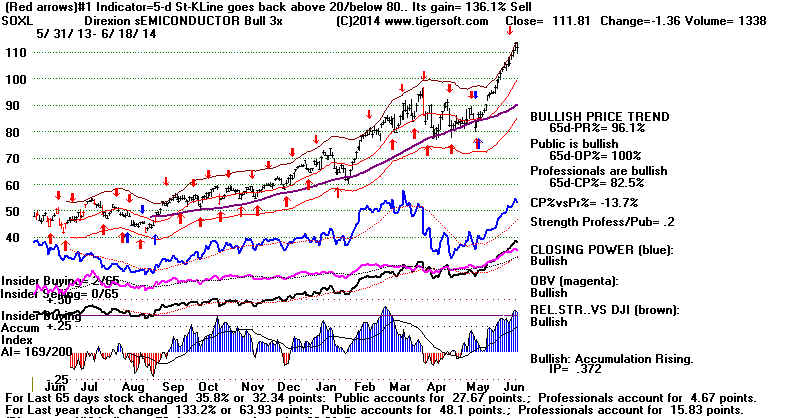

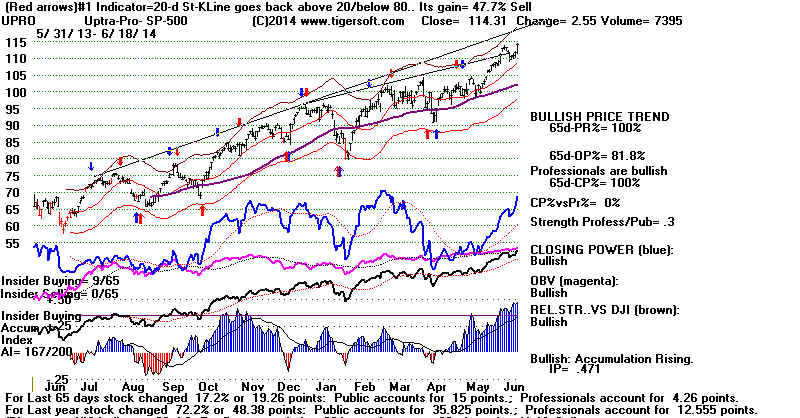

Power Ranking of Leveraged ETFs

Last AI/200 IP21 Closing Power

#1 3x Developing Markets, DZK

83.01

186 .774

New high

#2 3x Bullish Semiconductors, SOXL

111.81 169 .372

Lagging.

#3 Bullish

SP-500, UPRO

114.31 167 .471

Rising.

#4 Ultra Oil/Gas,

DIG

87.2 155 .221

Rising

#5 3x Technology, TECL

111.4 167 .344

Rising

#6 3x Energy Bull, ERX

127.09 153 .323

New High

================================================================

6/17/2014 Still No Peerless Sell

Due to server problems, the www.tigersoft.com DATA

page is not working right now. It has been switched to

www.tigersoftware.com/114411 If

you have problems

with this new site, let me know.

Last night I showed how often is was bullish when

the

NASDAQ's IP21 rose clearly above +.50. The same thing

is true for the OEX (SP-100). Without a Peerless Sell

signal the current IP21 breakouts above +.50 in the

NASDAQ and OEX give us very good historical odds that

the markets will keep on rising.

OEX IP21 Breakouts over +.50

OEX

IP21 Subsequent OEX move (12/2/1987 240.95 .485 4% decline...then advanced to 293.63 on 4/6/87)

2/6/1991 330.75 .523 Advanced to 367.85 on 4/18/1991

9/25/1995 554.63 .529 Advanced to 634.64 on 2/12/1996

3/8/1996 630.38 .608 Went narrowly sidewise for 3 month before rising out of trading range

(7/16/1999 733.78 .477 OEX fell to 651.86 on 10/15/1999)

1/12/2004 559.42 .523 Rose to 573.44 on 1.26.2004 and then fell to 530.40 on 5/17/2004

10/26/2006 645.42 .511 Rose to 670.22 on 2/14/2007 and then fell to 630.48 on 3/5/2006

8/5/2010 466.22 .529 Rose to 529.60 on 1/14/2010.

6/10/2014 864.67 .522 ? OEX is now at 858.12 on 6/17/2014.

|

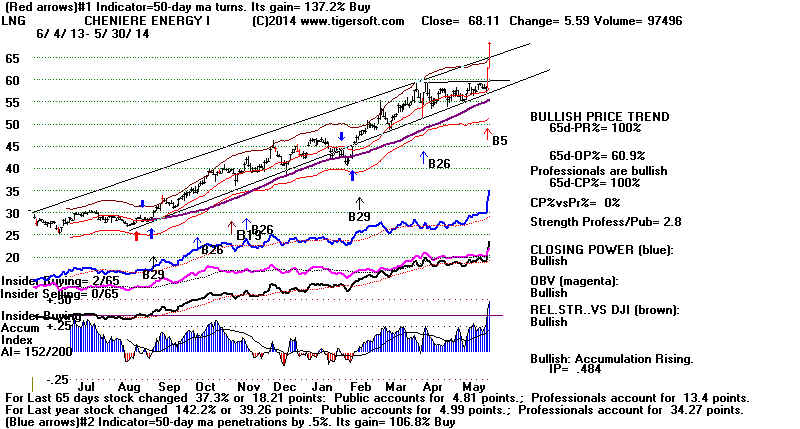

IRAQ's WOES HELP OIL STOCKS

The conflict in Iraq and Professional

cautiousness will temper

the bullishness of the excellent NYS A/D Line and the positiveness

of all the Peerless indictors now.

Also worrisome, the FED seems

on the verge of throwing its hands up in the air and saying "there's

nothing more we can still do to bring about a broad national economic

recovery. It's up to Congress to begin to rebuild the country's

public infrastructure."

The BBC reports:

"Islamist-led militants have

invaded Iraq's biggest oil refinery,

after pounding it with mortars and machine guns from two directions.

Miltants now control 75% of the Biji refinery (Iraq's biggest)

130 miles nore of Baghdad."

Leading oil stocks moved higher today. The Tiger Index of the

group shows its A/D Line has made another new high. 81.2%

of the 202 stocks we follow in the group are above their 65-dma.

11% (23) of these stocks are up more than 30% in the last 65 trading

days. Of these, very high IP21 readings (>.35) are seen in:

NFX 41.72 AI/200-132 IP21 =

.36 ( running above upper band.)

WFT 22.35 AI/200=166 IP21 = .38 ( nice pullback to rising 21-dma

seems over)

PDS 13.97 AI/200= 168 IP21 = .47 (comsolidating near upper band.)

SU 42.66 AI/200= 114 IP21 = .39 (Above upper band).

I remember how oil stocks rose in 1972-1973, in 1976-1977,

in 1979-1980

and in 2007-2008. They keep advancing until their low priced members

run up wildly in a fenzied bubble. We are nowhere near that point.

And these stocks rise even after the DJI has topped out. Owning

some of the bullish oil/gas MAXCP stocks seems appropriate now.

> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB

Chart IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

--> 114

+8 MAXCP stocks Bullish MAXCP Stocks (6/17/2014) Bullish plurality

--> 28 -15

MINCP stocks Bearish MINCP Stocks

(6/17/2014)

--> 84 +60 New Highs on NASDAQ 22 +16 new lows. Bullish plurality

--> 108

New Highs on NYSE 7

new lows. Bullish plurality

================================================================

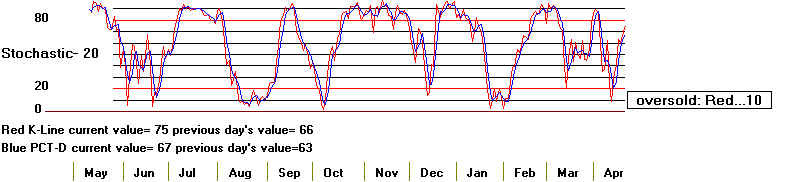

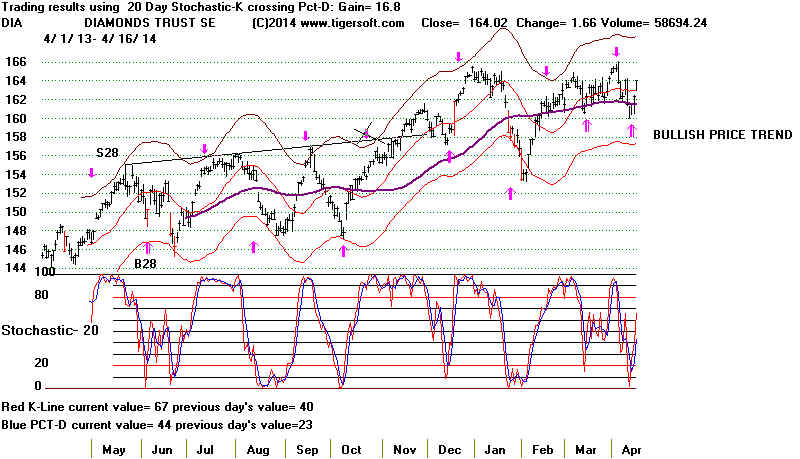

6/16/2014 Still No Peerless Sell.

The NASDAQ

bullishly just crossed clearly above +.50 today.

Of the 8

similar cases in the past, in 6 the NASDAQ made

significant

gains. In the other two cases, Peerless

gave major

Sells and only then NASDAQ sold off badly.

Professionals remain cautious, but there appears to

be

very good support now for the DJI at its 21-day ma.

The IP21

has moved up quite a ways above its 21-day; so, that removes

the chances for now of a Sell S4. In addition, the V-Indicator

is up more in positive territory; so, that eliminates the chance

of a Sell S9V. The Hourly OBV (DISI) Line is very

bullishly

rising much faster than the DJI.

Bullishly, the Iraq Government claims it has turned back the

ISIS Sunni fighters, so that Baghdad and the US Embassy look

much safer than they did last week. As a result, the DJI and

the market looks like they may move back up to their recent highs

in search of resistance. Professionals will need to resume

their buying, for this to occur: the DJI must make further gains

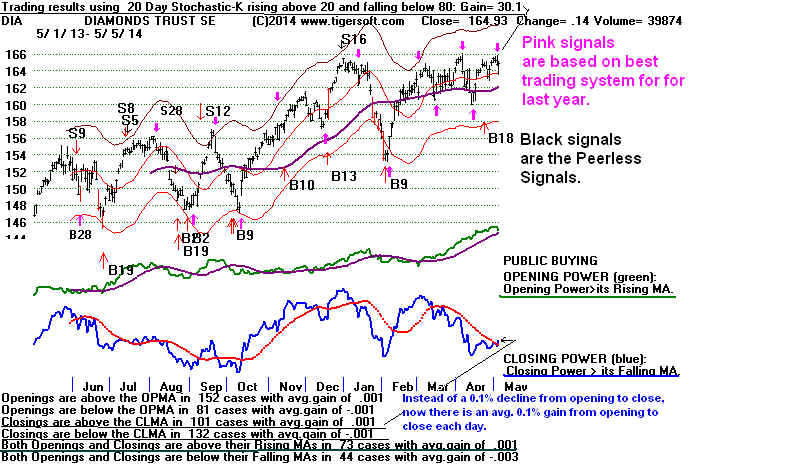

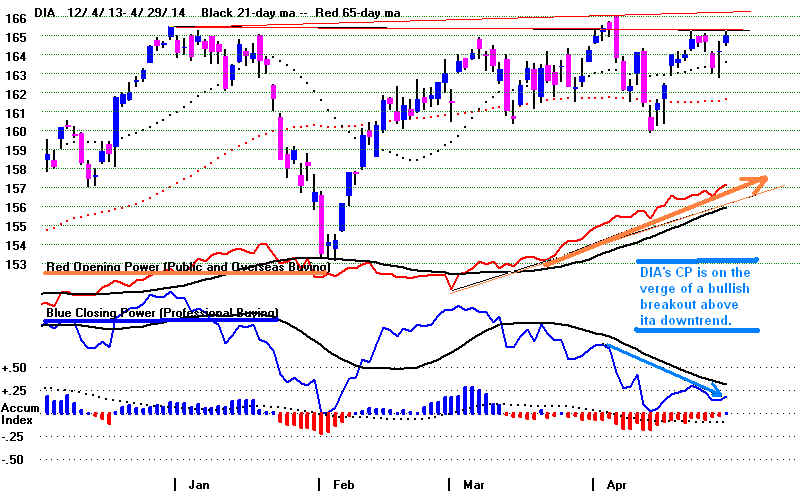

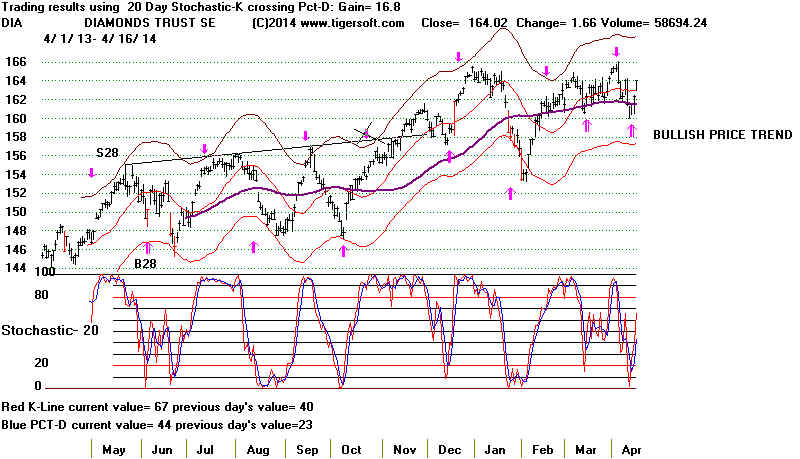

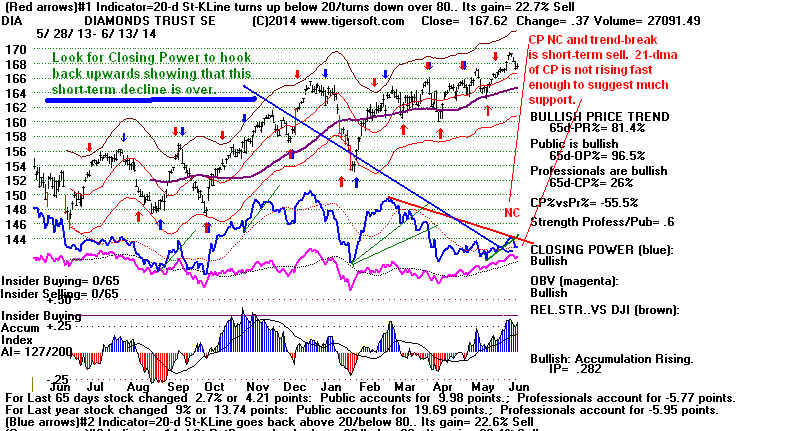

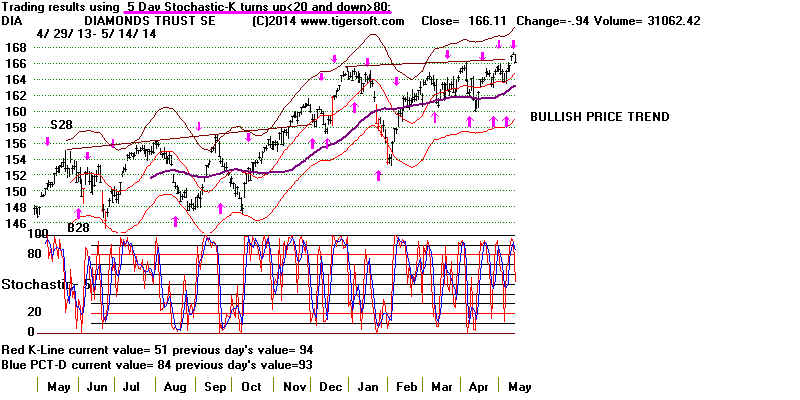

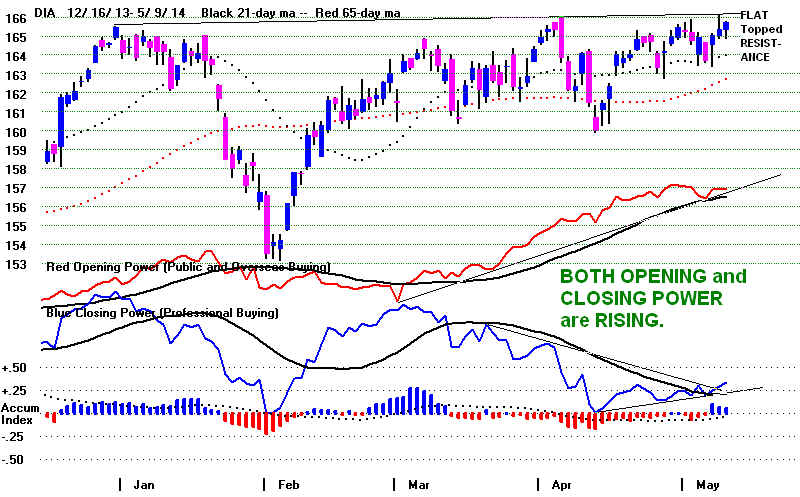

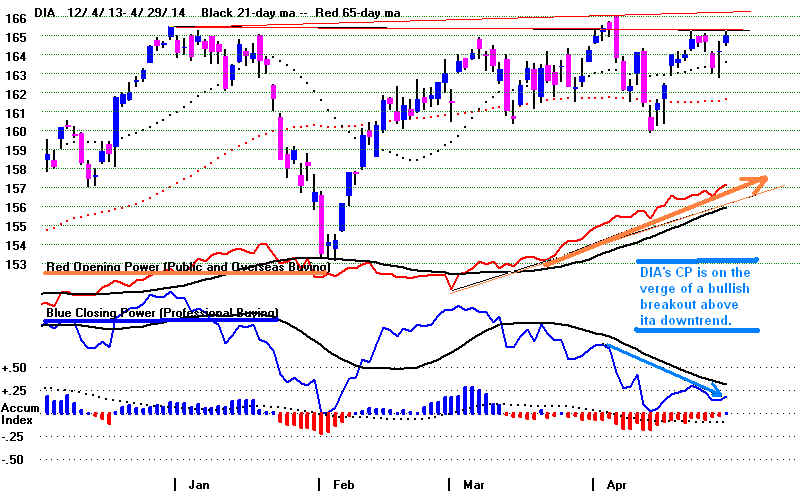

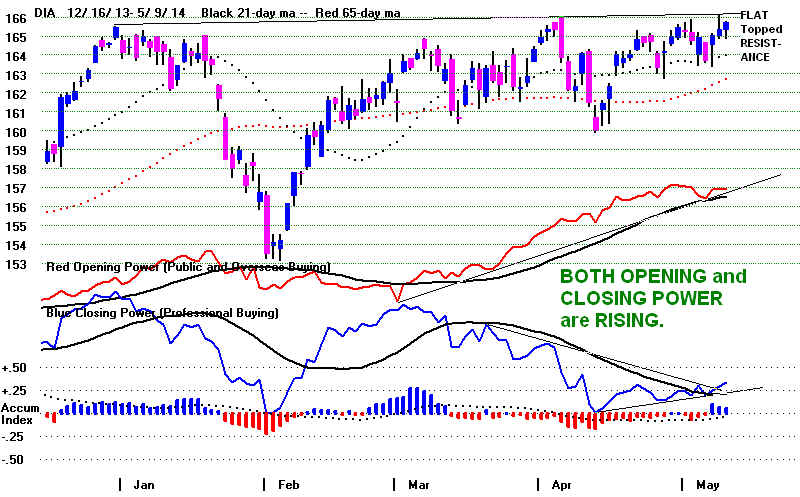

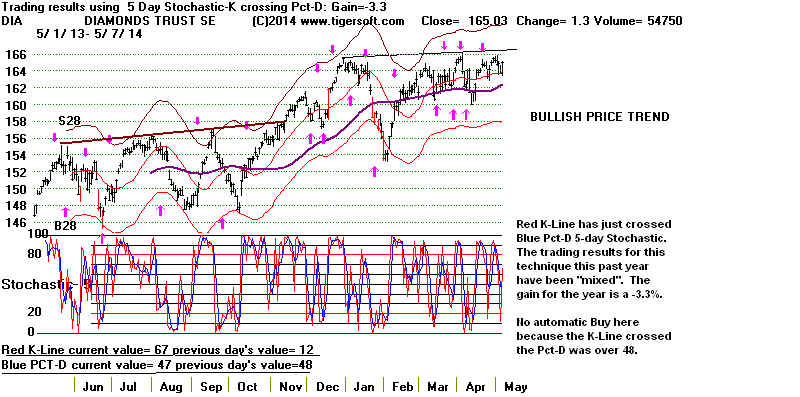

after the opening. The DIA's Closing Power downtrend

needs to

be broken. .

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 106

+50 MAXCP

stocks Bullish

MAXCP Stocks (6/16/2014) Bullish plurality

--> 43 -3

MINCP stocks Bearish MINCP Stocks

(6/16/2014)

--> 24 -9 New Highs on NASDAQ 6 new

lows. Bullish plurality

--> 61

+13 New Highs on NYSE 5 new lows. Bullish plurality

Oil stocks made additional gains today, as did many semi-

conductors. (See the pop in WMB today.) On the other

hand,

many retail stocks dropped to new lows. (PNRA, for example).

This shows that the broad mass of consumers are not in a

position to buy as might be expected if this were a solid

recovery. Eventually, profits' growth will no longer be

sustainable and there will be a big decline, perhaps like

in 2008, when oil stocks and AAPL were a big part of the stocks

having one "last hurrah". Rising oil stocks help hold up the

DJI via XOM and CVX, so: I

think we can continue to make money

being hedged, long bullish oil stocks and short bearish retail stocks

that are breaking down. This will probably be more lucrative

than trading the very small percentage moves in the major

ETFs.

What Is Significance of NASDAQ IP21 Clearly Rising above .50?

In 6 of 8 past cases the NASDAQ subsequently made very good gains.

In 1994 and 1998, the NASDAQ then sold off significantly.

4/19/1989 NASDAQ

rose from 421.91 to 453.99 on 6/8/1989 and the fell 5% and then rose to 485.73 on

10/9/1989.

5/21/1990 NASDAQ

rose from 452.89 to 469.60 on 7/16/1990 (Sell S9) and fell to 325.61.

11/11/1992 NASDAQ rose

from 634.92 to 707.16 on 1/26/93.

1/14/1994 NASDAQ rose from 792.31 to

797.24 on 2/1/1994 or 803.95 on 3/17/1994

and then fell to 705.52 on 4/20/1994.

7/7/1995 NASDAQ

rose from 969.76 to 1066.96 on 9/14/1995 and then fell back 8%.

7/17/1998 NASDAQ top.

It fell 30%. Peerless did give a S9 and S12 a week before NASDAQ peak.

5/27/2005 NASDAQ went sidewise

for 6 weeks and then rose 12% before falling 8%

8/6/2009 NASDAQ at 1973.16. It fell

back 3.5% and then rose to 2176.32 on 10/19/2009.

6/16/2009 IP21 rose to .549 today,

=================================================================

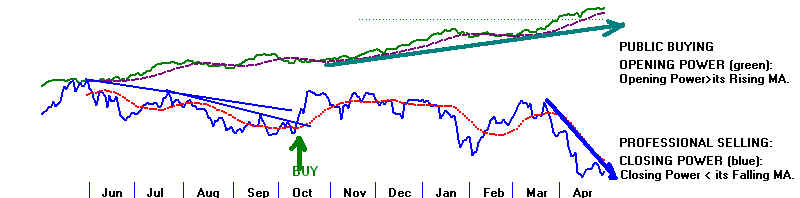

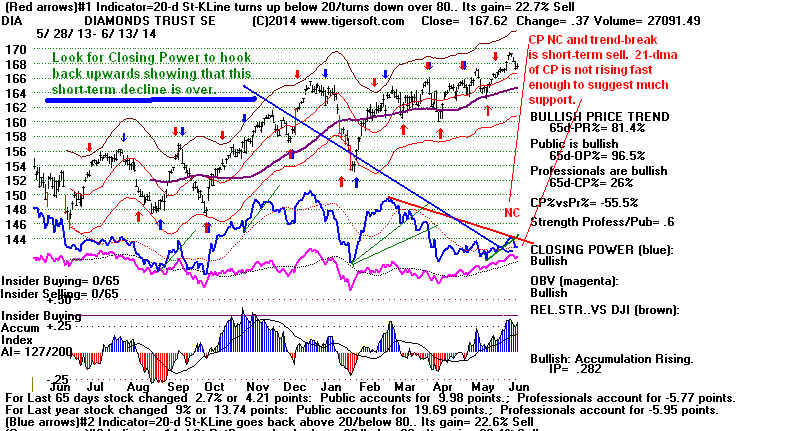

6/13/2014 Still No Peerless Sell.

Tiger's Closing Power on DIA has broken its uptrend

after failing

to confirm the last advance. This sets up a short-term Sell based

on Closing Power rules. Its 21-dma is not rising fast enough to

suggest reliable support. So, we need a hook back upwards

by the blue Closing Power before we can become bullish based

on what Professionals are doing.

It remains to be seen if the market can rally much

until Iraq

cools off. Watch the IP21 (Current Accumulation)

Index.

If it falls below its 21-day ma, I would think the

DJI will

fall to the lower band now at 16100. Normally

we would

suggest hedging with some bearish MINCP

stocks.

But buying some of the most Accumulated

Oil stocks

now may work out better.

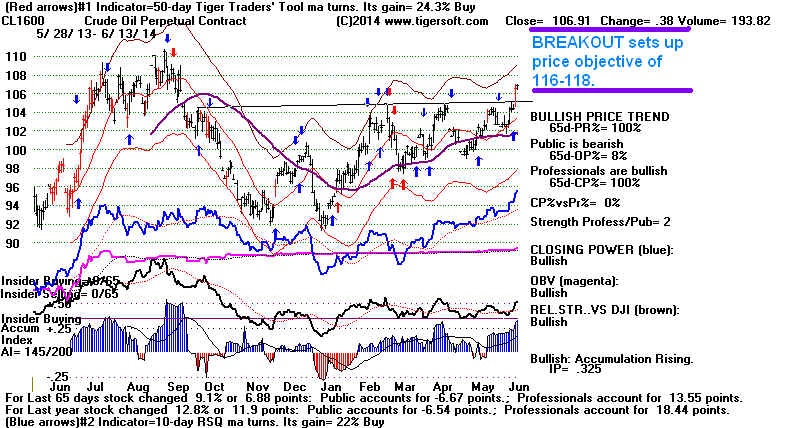

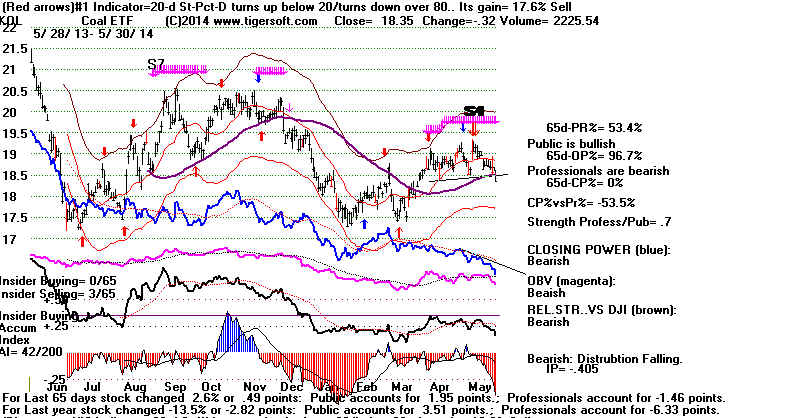

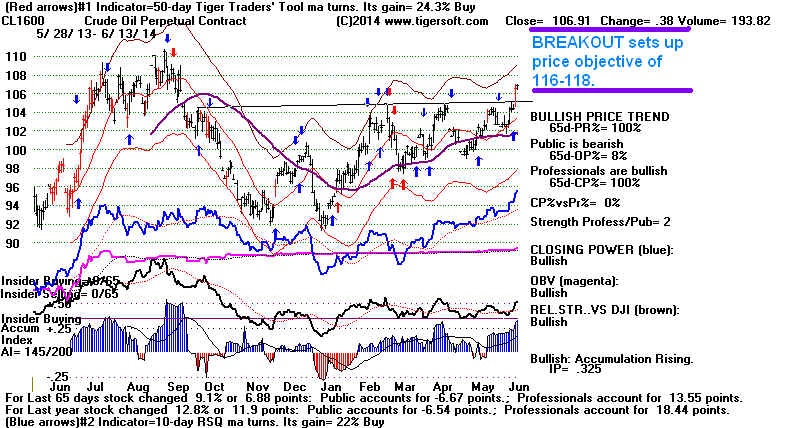

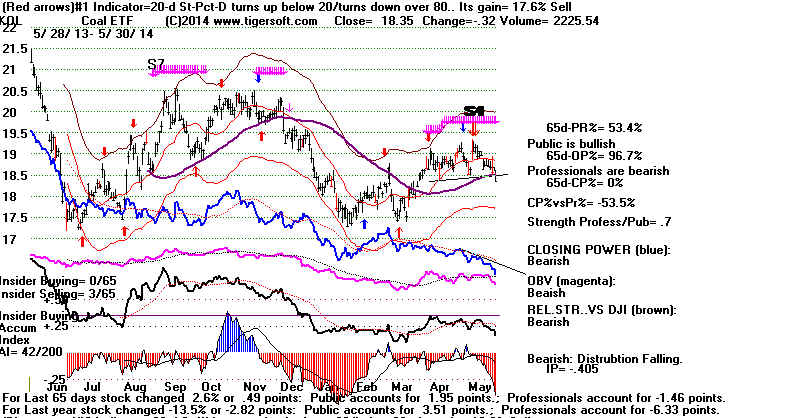

Crude Oil's High Volume Breakout

was confirmed by Closing Power,

Relative Strength, OBV and high Accumulation.

Now We Have To Worry about

A Dangerous Bubble in Oil/Gas Stocks

There is no question

but that traders must now

favor long positions in the many oil and gas stocks

among our Bullish MAXCP stocks.

Oil and gas stocks have a quite a history of making

new highs even after the DJI has topped out. See the

chart fo Crude Oil in 2007-2008.

Oil and gas stocks are in considerable demand now.

The obvious explanation is the jump in Crude Oil

prices occasioned by a new investor appreciation of

the dangers that Iraq's oil production (the second biggest

in OPEC) will fall to the control of Sunni religious fanatics

who wish to set up a new Syrian-Iraq caliphate.

Such

a regime, it can be reasoned, would be very infriendly

to US and British control, given the lengthy effort Bush's

and Obama's armies went to eliminate them.

Most of the new highs made this week are oil and gas

stocks. This is reminiscent of the first half of 2008 and

also 1976-7 and 1980-1. Each of these bull markets in

oil stocks were followed bear markets in US stocks.

> To Key Index and Leading Stock Charts:

DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 56

+13 MAXCP

stocks Bullish

MAXCP Stocks (6/13/2014) Bullish plurality

--> 46 +7

MINCP stocks Bearish MINCP Stocks

(6/13/2014)

--> 24 -9 New Highs on NASDAQ 6 new

lows. Bullish plurality

--> 61

+13 New Highs on NYSE 5 new lows. Bullish plurality

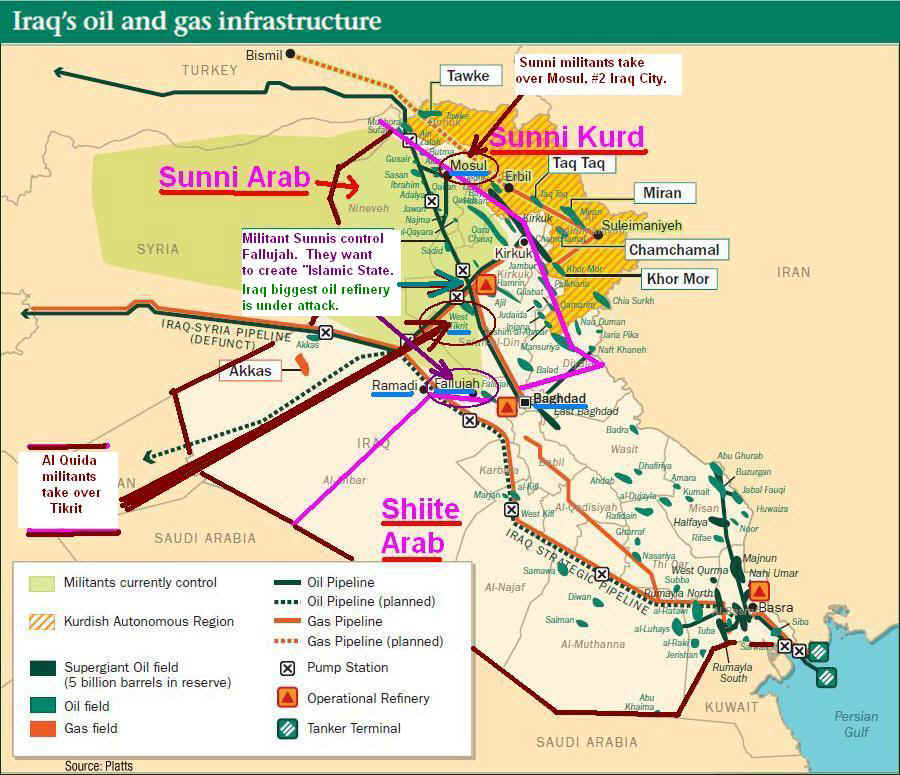

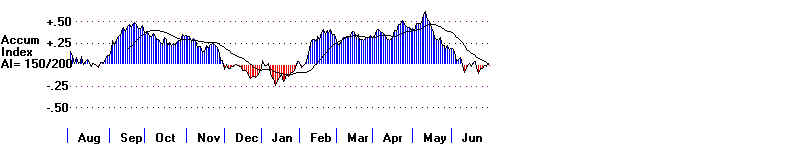

IRAQ Simplified

The stock market recovered Friday as Iraqi government

forces stalled

the Sunni militants' forces 60 miles north

of Baghad.

Iraq's biggest oil refinery (300,000 bar/day)

is still

controlled by the government. See

my efforts

to simplify the reports of fighting now in

Iraq. Below is

a map showing

where the oil is and who controls it now.

More than 60% of

Iraq's oil is much further South in the

area that is

heavily Shiite and more easily government

controlled.

President Obama

is considering air strikes to support

the mainly Shiite

supported Iraq Government. In the

long run, it is

the people of Iraq who will have to decide

how they will be

governed and by whom. Facilitating

peace talks in

this most uncivil Civil War and helping

provide a safe

zone for civilian refugees, it can be argued,

would best serve

our long-range interests,

But the Obama

Government will make it's decisions

in the short run,

just like the Bush Government did, based

on how best to

sustain oil production and Anglo-American

corporate control

of the biggest share of it.

Listen to the

talking heads on CNN. They do not mention

"OIL".

Why not? What are they afraid of? Instead, they say

that ISIS may

attack America like Al Qida did. (Dick Cheney

is alive and

well!) And they say America has a duty as an

"Exceptional

Nation". (Does that mean Gods talks more

to us?)

"Iraq has always been

about the oil." Keep this in mind now.

This is what

controls our Government's policies and it

probably controls

the destiny of the market now.

I take the

current rise in oil and gas stocks to be based

not only on

higher Crude Prices but the Obama Administration's

latest show of of

loyalty to the interests of the oil and gas industry.

If I am right, we

will soon see the Obama Administration

open up more

off-shore drilling in US coastal waters and not

insist on British

Pete's full compensation for the lingering

costs of its

off-shore mega-drilling disaster.

================================================================

6/12/2014 Still No Peerless Sell.

The decline has been hastened by unexpected

civil strife in Iraq. As long as the US does not

militarily intervene, I doubt if the current bull market

will end. Oil stocks will likely get more of a boost as

the markets adjust to the new uncertainties about the

availablity of Iraq's oil. A hook back upwards by the

Closing Powers of the key ETFs will be a short-term bullish sign.

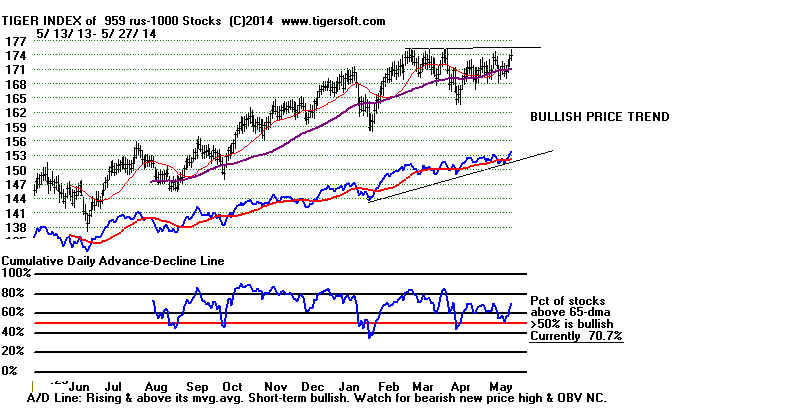

Examination of the Russell-1000's A/D Line shows

the underlying momentum of the market is still

upwards. Without an orthodox Peerless Sell signal,

any decline following an IP21 break of its 21-day ma

should be limited and shallow.

However, if there is

a further decline, the IP21 may break

its 21-day ma. With the V-Indicator negative as this occurs,

the historical odds back to 1929 are 85% that there will then

be a decline at least to the lower 3% band. Whether or not we get

a Peerless Sell signal, this occurrence is sufficiently bearish to

reduce long positions in over-extended stocks that are not REITs

or Oil/Gas stocks.

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 53

-34 MAXCP stocks Bullish MAXCP Stocks

(6/12/2014) Bullish plurality

--> 39 +19

MINCP stocks Bearish MINCP Stocks (6/12/2014)

--> 33 -6 New Highs on NASDAQ 6 -2 new

lows. Bullish plurality

--> 48

New Highs on NYSE 10

new lows. Bullish plurality

ERROR: I mistakenly said this might produce a Peerless Sell "S5".

In fact, it may well produce a Sell "S4". Regardless of what we

name this occurrence, it has a reliably bearish June track record,

as you can see below.

New Research:

How serious would a drop by the current Accumulation

Index (IP21) below its 21-day ma in the next few trading

days?

We can best answer that in advance. I think, by looking at

similar June IP21 trendbreaks (drops below its 21-dma),

paying special attention to cases where the internal

strength readings are like those now, especially where

the V-Indicator is negative as now.

There have been 39 June IP21 breakdowns since 1929.

I rate 71.8% (28) of the subsequent outcomes as being (red)

bearish. By this I mean the DJi fell at least to the lower 3%

band without rallying more than 5% first.

More relevant, I think, there have been 20

such breakdowns

with the V-I indicator in (red) negative territory. Of these

85% (17 ) were followed by bearish (red) outcomes. Nor

should

we worry if the DJI is as much as 1% below the 21-dma when

this IP21 break occurs. We should still do some selling.

There were 7 instances where the LA/MA (DJI close divided by 21-dma)

was below 1.0. In 6 of the 7 cases like this, a bearish outcome followed.

These cases are highlighted with Green LA/MA numbers.

Current DJI's Key Peerless ValuesDate LA/MA P^^ IP21 V-I OPct 65-dpct

6/12/2014 1.003 269 .114 -12 .324 .023

IP21 Breakdowns below TISI in June.

Subsequent declines are shown in RED.

Negative internal strength readings are shown in red.

DJI below its 21-day ma are shown in pink.

Date LA/MA P^^ IP21 V-I OPct 65-dpct Outcome

--------------------------------------------------------------------------

6/13/1933 1.081 1402 .111 772 .326 .805 94.8 to 88.7 and then up.

----------------------------------------------------------------------------

6/27/1933 1.057 671 .069 247 .292 .704 DJI rallied 98.7 to 108.7

-----------------------------------------------------------------------------

6/20/1934 1.024 -13 -.036 -17 .265 -.015 98.3 to 85.5

-----------------------------------------------------------------------------

6/24/1935 1.035 165 -.024 -76 .069 .203 DJI rallied 120 to 134.1

-----------------------------------------------------------------------------

6/18/1936 1.031 233 -.058 22 .337 .01 DJI rallied 157.4 to 169.1

------------------------------------------------------------------------------

6/23/1939 1.001 81 .047 -5 .418 -.016 137.4 to 130.1

------------------------------------------------------------------------------

6/19/1942 1.018 298 .090 24 .111 .034 104.8 to 102.7 then to 108.9

--------------------------------------------------------------------------------

6/4/1943 1.020 40 .085 -83 .173 .094 142.3 to 138.8 to 145.8

--------------------------------------------------------------------------------

6/16/1943 .995 133 .106 -29 .291 .070 DJI rallied 139.8 to 145.8

then to 134.0

--------------------------------------------------------------------------------

6/18/1945 1.00 239 .009 9 -.158 .052 166.9 to 160.9

----------------------------------------------------------------------------

6/27/1945 1.007 299 .016 28 .035 .108 168.8 to 160.9

--------------------------------------------------------------------------------

6/11/1946 1.001 1 .143 -55 .228 .079 209.1 to 163.1

----------------------------------------------------------------------------

6/9/1948 1.017 375 .162 119 .354 .148 192.6 to 176.0

--------------------------------------------------------------------------------

6/14/1950 1.001 17 .121 -94 .316 .099 223.3 to 197.5

---------------------------------------------------------------------------

6/27/1955 1.027 199 .062 -17 .664 .085 DJI rose 449.9 to 467.4

---------------------------------------------------------------------------

6/7/1957 1.006 -69 .035 -191 .098 .064 505.6 to 520.2 to 423.1

-------------------------------------------------------------------------------

6/17/1957 1.016 -149 .024 -247 .08 .082 513.2 to 520.2 to 423.1

--------------------------------------------------------------------------

6/16/1958 1.014 441 .039 177 .188 .038 DJI rallied very strongly.

--------------------------------------------------------------------------- ---

6/3/1959 1.02 13 .068 -196 .461 .084 678.1 to 616.5

-------------------------------------------------------------------------------

6/16/1960 1.02 88 .012 -158 .300 .058 648.3 to 601.7

----------------------------------------------------------------------------

6/27/1960 .999 67 .030 -172 .167 .029 642.4 to 601.7

-------------------------------------------------------------------------------

6/7/1963 .999 106 .042 -181 -.111 .081 722.4 to 688.7

-------------------------------------------------------------------------------

6/12/1978 1.009 136 -.008 2 .225 .142 856.72 to 805.79

-------------------------------------------------------------------------------

6/3/1980 1.015 401 .077 3 .273 -.023 DJI rallied strongly from

bear mkt bottom.

------------------------------------------------------------------------------

6/17/1980 1.027 443 .116 5 .452 .083 DJI rallied strongly.

----------------------------------------------------------------------------

6/23/1983 1.018 61 .051 1 .168 .105 1241.79 to 1189.90

---------------------------------------------------------------------------

6/25/1986 1.01 -91 .109 -2 .089 .057 1885.05 to 1766.87

--------------------------------------------------------------------------- --

6/27/1988 1.009 259 .122 20 .154 .041 2108.46 to 1989.33

---------------------------------------------------------------------------

6/14/1989 1.004 231 .105 13 .312 .085 2503.36 to 2440.06 then up.

------------------------------------------------------------------------------

6/7/1990 1.017 295 .119 19 .230 .082 2897.93 to 2999.75 to 2365.1

----------------------------------------------------------------------------

6/7/1995 1.009 184 .124 5 .327 .116 DJI rose 4462.03 to 4732.77

-------------------------------------------------------------------------------

6/26/1995 1.014 121 .114 5 .157 .113 DJI rose 4551.25 to 4732.77

-------------------------------------------------------------------------------

6/23/1996 1.011 428 .086 27 .275 .114 DJI rose 7604.26 to 8259.31

---------------------------------------------------------------------------- --

6/25/1999 .989 -45 -.012 -49 .044 .091 DJI rose 10552.55 to 11194

------------------------------------------------------------------------------

6/12/2000 .993 85 -.022 -38 -.004 .055 10564.21 to 10376.12

----------------------------------------------------------------------------

--

6/13/2001 .982 148 .057 -79 .189 .064 10871.62 to 8235.81

------------------------------------------------------------------------------

6/20/2003 1.022 476 .100 106 .54 .113 9200.75 to 8985.44 and then up.

----------------------------------------------------------------------------

6/3/2009 1.027 205 .008 -96 -.018 .282 8675.24 to 8183.17

--------------------------------------------------------------------------------

6/17/2009 .99 64 -.003 -150 -.033 .177 8497.18 to 8183.17

----------------------------------------------------------------------------

|

================================================================

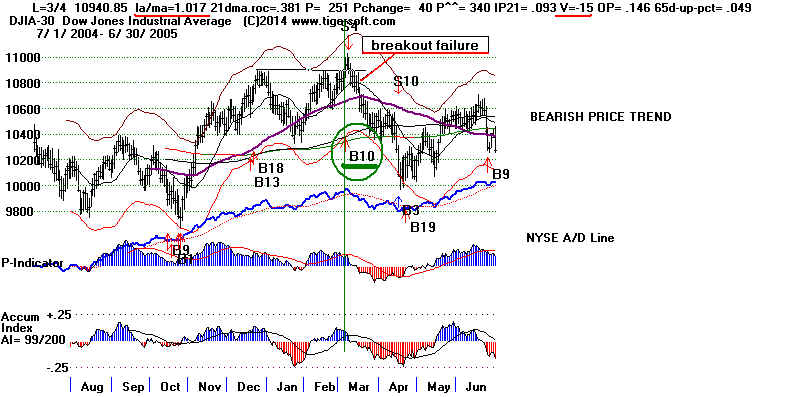

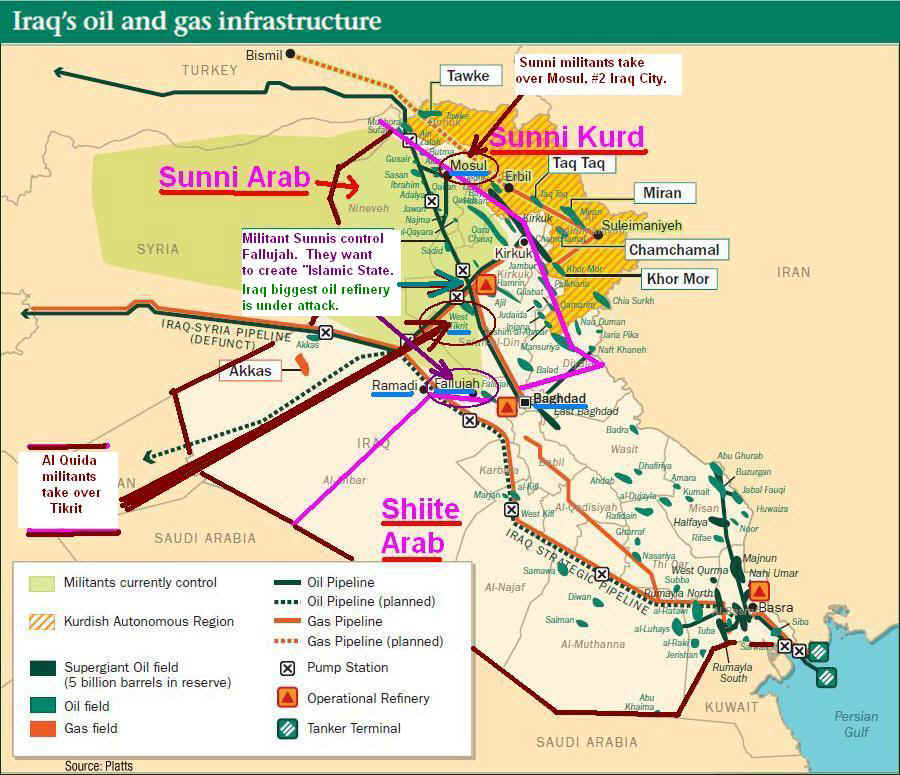

6/11/2014 Still No Peerless Sell. Breadth was not

very bad today. The decline was almost entirely at

the Opening. That is ususually not the way a big decline

begins.

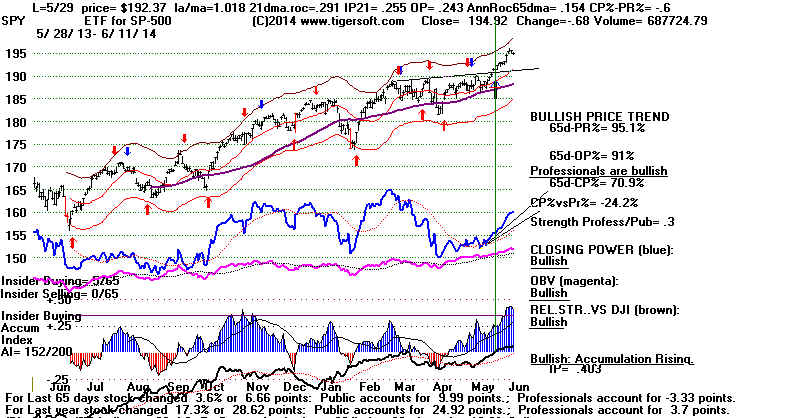

The SPY's blue Closing Power is above its uptrendline and all its main

indicators are considered "Bullish" by the Tiger charting program.

The DJI's Current

Accumulation Index (IP21)

is still above its 21-day ma. So, no Sell S5. But

now we also have to worry about a Sell S9V if a rally

above 17000 should occur; the V-I is now -.2. And eventually,

the Peerless P-Indicator (based on the A/D Line)

will turn negative. That would then bring a Sell S19

(or old S9B, using the pre-2014 parlance.)

More Sell S5 Research

Since 1928 there have been 4

Sell S5s in June after the 11th

when the DJI was not in a bear market. All four ended

up being profitable for the short seller. None occurred after

.1978, however. You can see these four charts below.

Conclusion

With the Hourly DJI's OBV or DISI line still uptrending, I

doubt

if we will get a Sell S5 tomorrow. In addition, the other internal

strength indicators may still be too positive to produce a Sell S5.

I could not produce an S5 tonight by dummying in hypothetical numbers

representing a steep decline tomorrow back to 16500. Still,

considering last night's study of IP21 peaks below .20, etc which showed how

reliably bearish breaks in the IP21's 21-day ma then have been,

I would certainly do some selling in over-extended stocks if that should

occur later in the week.

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 87

-13 MAXCP stocks Bullish MAXCP Stocks

(6/11/2014) Bullish plurality

--> 20 -12

MINCP stocks Bearish MINCP Stocks (6/11/2014)

--> 39 -11 New Highs on NASDAQ 8 +1 new

lows. Bullish plurality

--> 47

-40 New Highs on NYSE 7 +1 new lows. Bullish plurality

Since 1965 the DJI has a slight tendency

to rise for the next

week

(53.2% probability), but only a 46.8% probability over the

next

two months.

June Peerless Sell Signals after the 11th of the

Month in Rising Markets

Two of the 12 would have brought a loss if

the DJI has been sold short.

Only

one would have brought a trading gain of more than 10%. The

median subsequent decline was only about 5%. 1 19290614 S9 313.7 -.047

19290617 S12 319.3 -.029

2 19340619 S5 99 .098

19340620 S9 98.3 .092

(The DJI here was in an intermediate-term doowntrend.)

3 19480615 S2 193.2 .05

4 19500612 S5 228.4 .091

5 19750623 S18 864.83 .054

6 19760621 S5 1007.45 .047

7 19780606 S5 866.51 .05

8 19810615 S12 1011.99 .172

9 19870610 S8 2353.61 -.039

19870618 S8 2408.13 -.016

10 20100616 S9 10409.46 .061

20100616 S12 10409.46 .061

11 20110630 S12 12414.34 .075

12 20130604 S19 15177.54 .027

|

================================================================

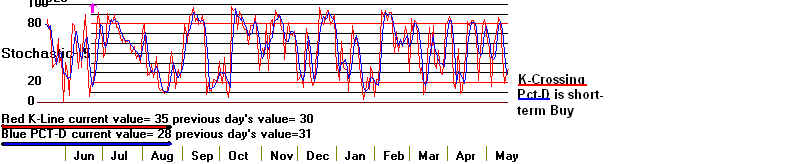

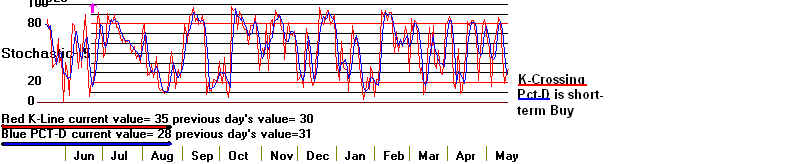

6/10/2014 Still No

Peerless Sell. The A/D Line NC

today is short-term bearish. Watch NYSE breadth and

the DJI's Accum. Index. New Research Tonight

Warns Us That A Peerless Sell S5 Could Be Setting Up.

New research tonight shows that for

the past 30 years it has always

been bearish when the current DJI's Accumulation Index (IP21) for the

DJI peaks in June below .200 when the DJI is not more than 1.9% over

the 21-day ma. See the study below tonight. The conditions just mentioned

are highlighted in pink. Bearish outcomes are shown in red in the table.

These "pink" conditions all were applicable on the recent high of the IP21

indicator.

In addition, today the DJI made a very nominal new high with the

NYSE A/D Line lagging. By itself, this is only a mild warning sign.

Our way of knowing that an IP21 top has probably been made is for

the IP21 to fall clearly below its 21-day ma. That has not happened yet.

With the DJI up more than 10% in the last 3 months, it is quite possible

that we will see a reversing Peerless Sell S5 if the IP21 falls back below

its 21-day ma. Sell S5 signals are based on this concept. They average

8.7% DJI declines. Paper losses are usually very small. (More tomorrow

night).

30 Years' Peak IP21

Readings and Their Aftermath

Date IP21 Peak

CL/MA Outcome

--------------------------------------------------------------------------------

6/9/2014 .168

1.017

?

11/6/2014 .218

1.02

2 more

months' rally ahead

5/20/2013 .199

1.024

Top. Start of

5% decline was one week away.

7/3/2012 .235

1.026

3 more months'

rally ahead

2/22/2011 .223

1.007

Top. Start of

5% decline immediately.

8/4/2010 .294

1.031

Immediate top. 6%

decline.

8/5/2009 .303

1.050

5 more months'

rally ahead.

5/16/2008 .124

1.008 Major top.

4/17/2007 .223

1.024

3 more months'

rally left in bull market.

10/31/2006 .207

1.009

3.5 more

months' rally before decline to lower band.

5/27/2005 .187

1.017

two weeks'

more rise before decline to lower band

and 5-month trading range.

9/8/22004 .172

1.021

Top. DJI

about to decline to lower band.

6/23/2004 .166 1.018

Top. DJI about to decline to lower band.

9/4/2003 .214

1.026

Top. DJI

about to decline to lower band.

6/18/2003 .158

1.039

Top. DJI

about to decline to 2.5% lower band.

4/2/2003 .252

1.034

Beginning of bull

market.

11/7/2002 .256

1.03

Two

weeks before top and 20% final decline in bear market.

8/21/2002 .302

1.044

Top in bear

market. DJI failed to surpass 65-dma.

20% decline.

3/11/2002 .124

1.046

Top before

bear market resumes.

10/25/2001 .248

1.032

Top before brief

decline to 3% lower band.

5/4/2001 .203

1.048

Two weeks

before bear market resumes.

8/29/2000 .111

1.019 A week's rally before 12% DJI decline.

9/9/1999 .106

1.004

Top before 9%

DJI decline.

5/3/1999 .125

1.049 A week's

rally before DJI decline to lower band.

3/12/1998 .194

1.02

Five

weeks before DJI decline to lower band.

5/12/1997 .225

1.057

3 months' rally before

top that brought 13.5% decline.

2/14/1996 .41

1.039 DJI went

sidewise for 3 months before bull market resumed.

7/27/1995 .160

1.015

Top and 3% retreat before bull market resumed.

6/14/1994 .182

1.016 Top before decline to lower band.

1/31/1994 .195

1.028

Top before 11% DJI

decline.

9/17/1993 .164

.996 Immediate 3%

DJI decline followed by bull market.

8/5/1992 .116

1.008 Top before 7% decline.

2/13/1991 .303

1.068

DJI rose for 2 more

weeks and then went sidewise

6/4/1990

.216 1.04

5 more

weeks before top and start of bear market..

7/31/1989 .226

1.044

2.5 months' rally before decline to lower band.

10/21/1988 .253

1.027

Top before decline

to lower band.

6/22/1988

.202

1.042

Top before decline to

lower band.

8/20/1987 .268

1.041

Top before steep

37% bear market.

4/6/1987 .187

1.039 Top before decline

to lower band.

9/4/1986 .260

1.032

Top before 9%

decline.

6/6/1986

.207 1.034

Top before 7% decline.

2/21/1986 .292

1.058

Six weeks's rally before

decline to lower band.

11/22/1986 .241

1.038

Early in

bull-market take-off

7/22/1985 .198

1.016

Top before 5% decline

8/3/1984 .169

1.075

2 more weeks' rally before top

and decline to lower band.

5/5/1983 .228

1.031

Top before decline to

lower band.

> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 100

-23 MAXCP stocks Bullish MAXCP Stocks

(6/10/2014) Bullish plurality

--> 32 +6

MINCP stocks Bearish MINCP Stocks (6/10/2014)

--> 50 -53

New

Highs on NASDAQ 7

+3 new lows. Bullish plurality

--> 87

-60 New Highs on NYSE 6 +2 new lows. Bullish plurality.

================================================================

6/9/2014

Still No Peerless Sell.

__________________________________

Special

Notice to Tiger Data users:

Server problems tonight do not

allow me

to change the date on the Data

Page even

though all data has been added. Until

further please notice use

http://www.tigersoft.com/NEW114411/index.html

__________________________________

> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 123 -30

MAXCP stocks Bullish MAXCP Stocks

(6/9/2014) Bullish plurality

--> 26 -5

MINCP stocks Bearish MINCP Stocks (6/9/2014)

Mostly

bearish ETFs look good enough to short!

--> 103 -9

New

Highs on NASDAQ 4

-7 new lows. Bullish plurality

--> 147 New Highs on NYSE 4 new lows.

Bullish

plurality

As the

market rallies, it is only natural to consider when we might want

to take

profits. Here are the technical developments that we would

have to be

concerned about.

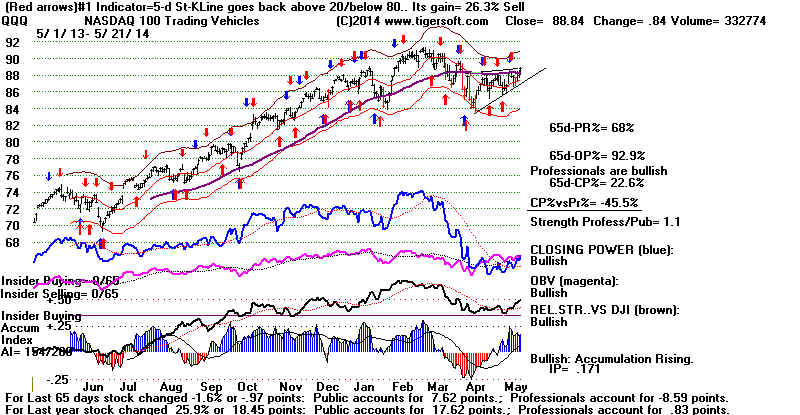

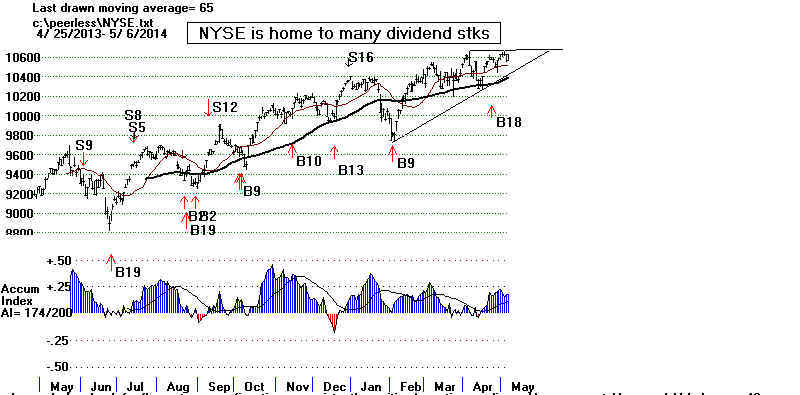

#1 The NYSE

A/D Line is rising strongly. Its advance is pushed upwards

by the many

dividend stocks and bond funds on the NYSE. Given the

FED's emphasis on

"transparency" and predictability, I think we can

safely bet that

there will be no untoward FED surprises until the NYSE

A/D Line uptrend

is broken.

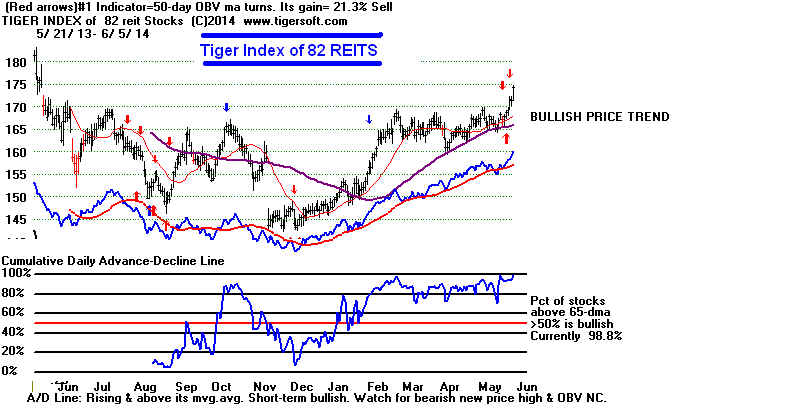

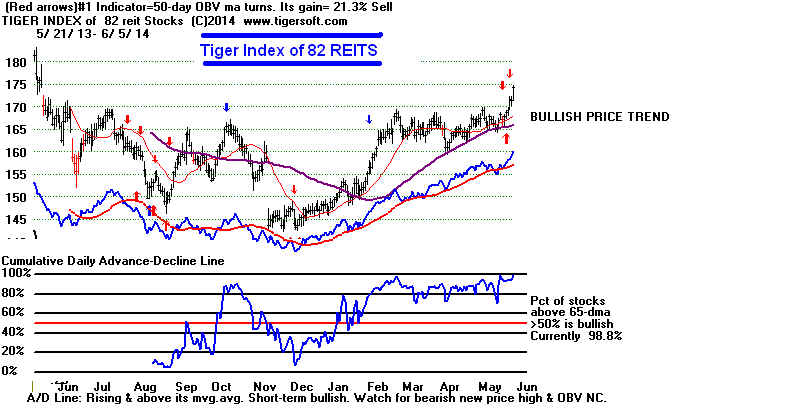

#2 The

failure now of the NASDAQ to confirm the new highs made

by the DJI,

SP-500, NYSE and OEX. This would be a warning that

we will

have to continue to carefully limit the stocks we may want

to play on

the long side and focus rather exclusively on the dividend-rich

REITS,

oil/gas drilling and a few semi-conductor stocks that have

been

resiging in our Bullish MAXCP stocks.

#3

and #4 We must watch the V-Indicator and the current Accumulation

Index. Negative readings with the DJI 2.5% over the 21-day ma could

bring

a Sell S9V. Right now, the V-Indicator is positive and rising.

A

drop by the DJI's IP21 Indicator back below its 21-day ma could

bring

a Sell S4 signal. These are as bearish as Sell S9Vs are. The

IP21

(current Accumulation Index) is currently considerbly above this

IP21

21-day ma (which we call the "DISI").

5)

Though the IP21 readings for the NASDAQ and SP-500 are making

12-month highs and are way above +.40, the DJI's IP21, which is what

we

track the most, has not yet reached the +.30, or so, levels that

usually have allowed a "lift-off" in prices in the Summer.

Recent High IP21 Readings and Their Aftermath

Date IP21 Peak

CL/MA Outcome

--------------------------------------------------------------------------------

6/9/2014 .168

1.017

?

11/6/2014 .218

1.02

2 more months in rally ahead

5/20/2013 .199

1.024

Top. Start of 5% decline was one

week away.

7/3/2012 .235

1.026

3 more months in rally ahead

2/22/2011 .223

1.007

Top. Start of 5% decline

immediately.

8/4/2010 .294

1.031

Immediate top. 6% decline.

8/5/2009 .303

1.050

5 more months in rally ahead.

(More on this tomorrow night.)

================================================================

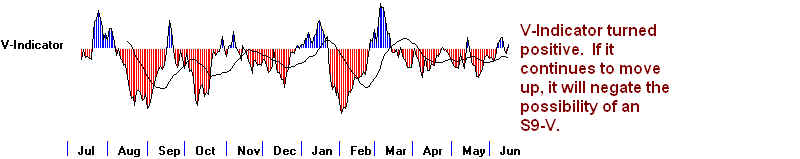

6/6/2014

Peerless Internal Strength Indicators

Remain Bullish.

But will V-Indicator remain positive?

The Very Positive

"IP21" Readings Are Bullish.

Global Warming

Also Means Cheaper Solar Energy.

Avoid Big

Electric Utilities.

> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 153 +2

MAXCP stocks Bullish MAXCP Stocks

(6/6/2014) Bullish plurality

--> 31 -6

MINCP stocks Bearish MINCP Stocks (6/6/2014)

Many

heavily distributed and shorted stocks remain very weak.

--> 112

New

Highs on NASDAQ 11

-15 new lows. Bullish plurality

--> 216

+100 New Highs on NYSE 6 -4 new lows. Bullish plurality

If the V-I slips back into negative

territory and the DJI rallies to 17000,

we may still get a Sell here. Fortunately, the high IP21 (current Accumulation

Index)

readings of the major market ETFs are in accord with a further advance. It is also

more

bullish that the DJI, OEX and SP-500 made all-time highs, as did the weekly NYSE

A/D Line.

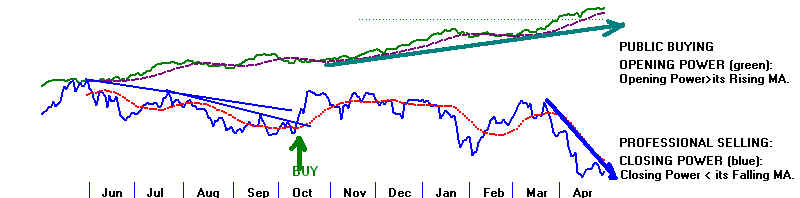

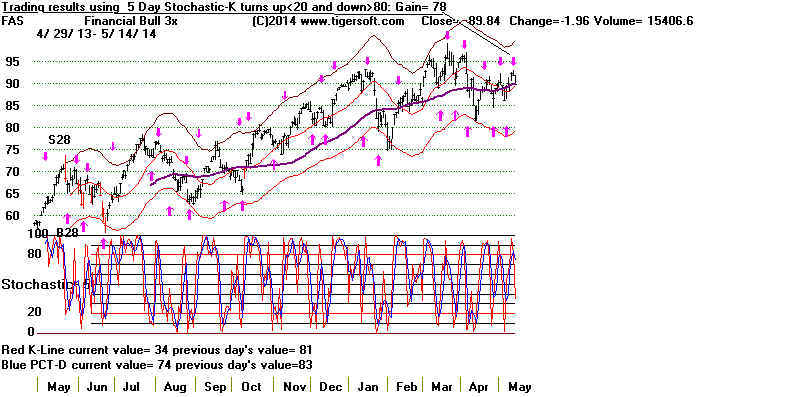

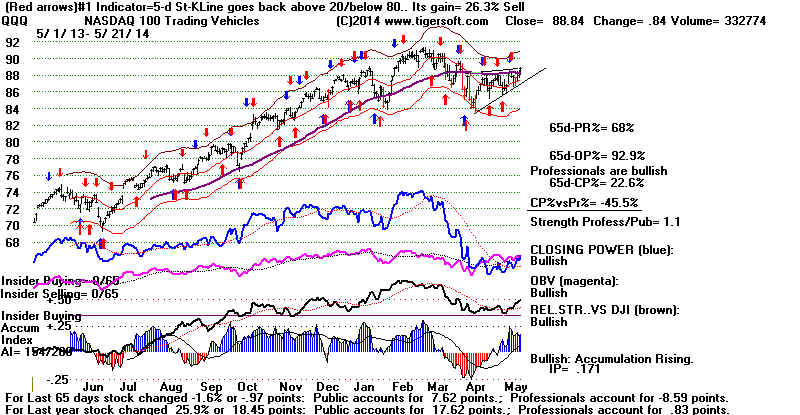

IP21 Technical Condition

---------------------------------------------------------------------------------

DIA

+.29 BOTH UP: Public and Professionals are bullish.

OEX

+.488 BOTH UP: Public and Professionals are bullish.

QQQ

+.412

BOTH UP: Public and Professionals are bullish.

SPY

+.41 BOTH UP: Public and Professionals are bullish.

IWM

+.251 BOTH UP: Public and Professionals are bullish.

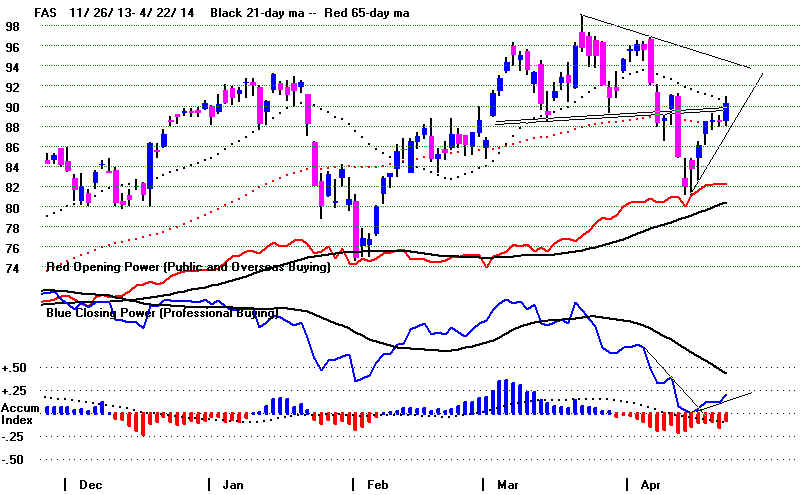

FAS

+.41 BOTH UP: Public and Professionals are bullish.

DJIA

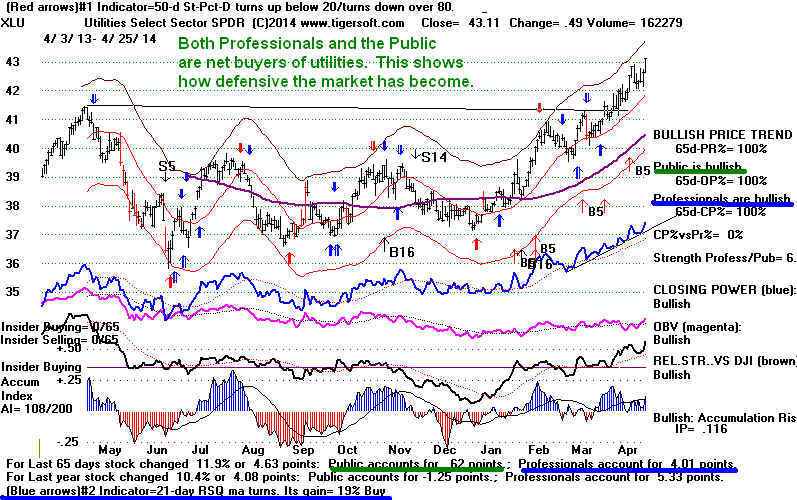

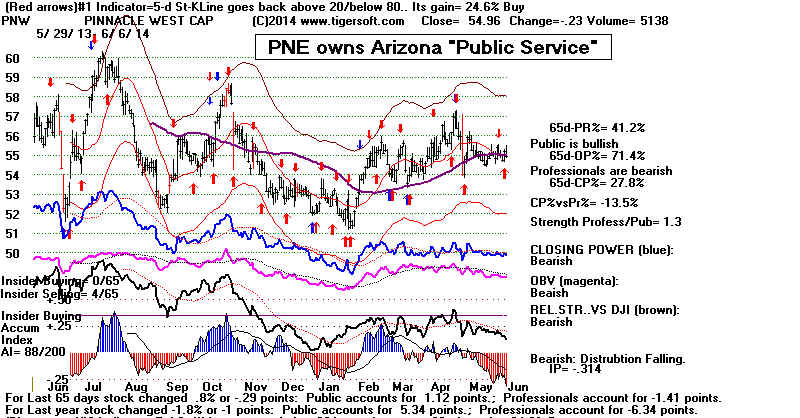

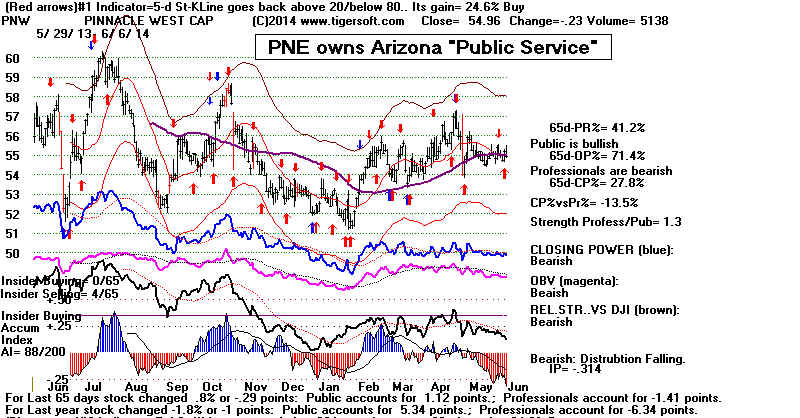

Avoid Big Electric Utilities

Reits, oil/gas drilling and

semi-conductors remain the three most favored groups

populating our Bullish MAXCP stocks. Utilities are lagging somewhat for

good reason. Many

analysts

think the electrical utilities will inevitably fade

as

solar power storage comes down in price. The way Arizona and California

electric utilities are fighting the widespread use of solar panels on roof tops

suggests they are very fearful of a trend towards decentralized roof-top energy.

Electric utility stocks in Germany have fallen substantially as solar technology

has been much more widely adopted there. See:

How

Arizona Could Soon TAX Thousands of Residents For Going Solar.

Fight

over Solar Power Returns to White House Roof [Video) Scientific American.

Arizona

Fights for Its Solar Energy Rights

ARIZONA "Public Service" Co stock is not benefitting from the low

interest rates. The trend toward decentralized, roof-based solar energy

will surely take a big toll on electric utilities. The utility company there

considers Arizona's sun is a very threat to its profits and its CEO's pay.

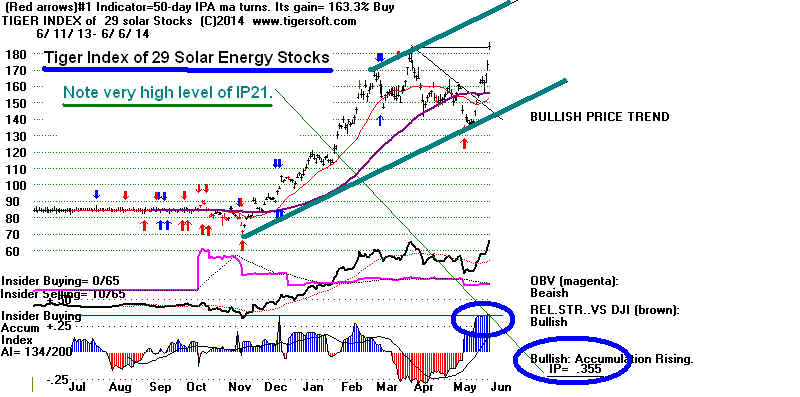

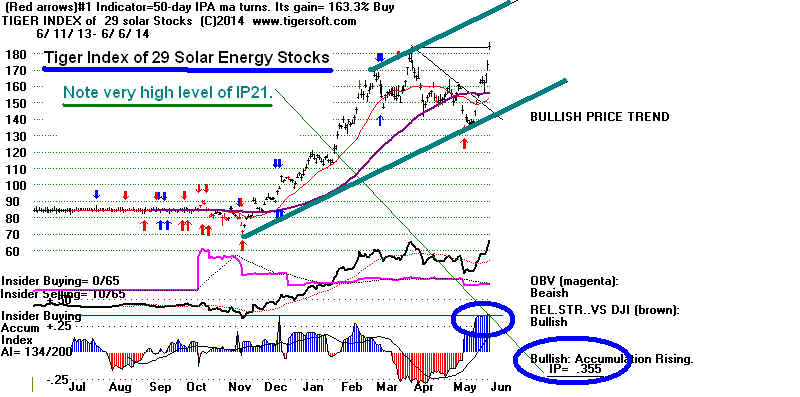

Solar Energy Stocks

Only 41.4% of the Solar Energy stocks are above their 65-dma. But there are

a handful of high

Accumulation stocks in the group showing very high relative

strength and

Closing Power new highs. The SOLAR stocks will be posted

on the Tiger Data

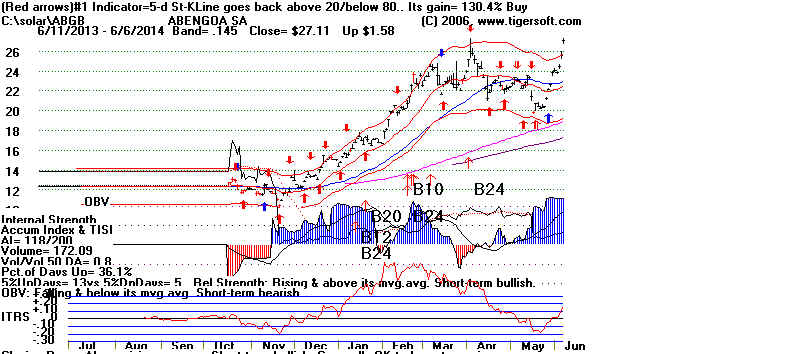

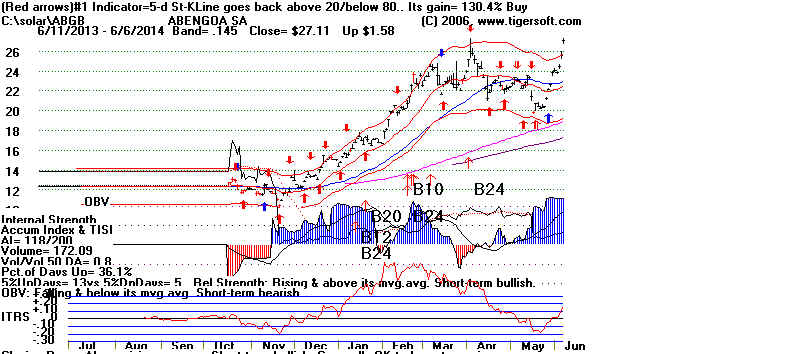

page tomorrow. New Issue ABGB looks great and its country

ETF (Spain) has

just made a breakout with very high Accumulation, too.

.

.

ABGB (Spain) designs

and constructs solar, ethanol, biodiesel, and biomass plants;

power transmission lines; conventional energy plants; and water treatment,

desalination plants, other hydraulic infrastructures, and industrial installations,

as well as provision of operation and maintenance services for conventional

and renewable energy power plants. Spain's ETF now looks quite positive, too.

=================================================================

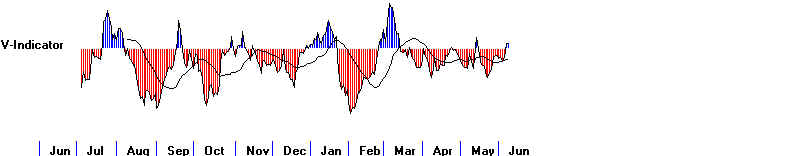

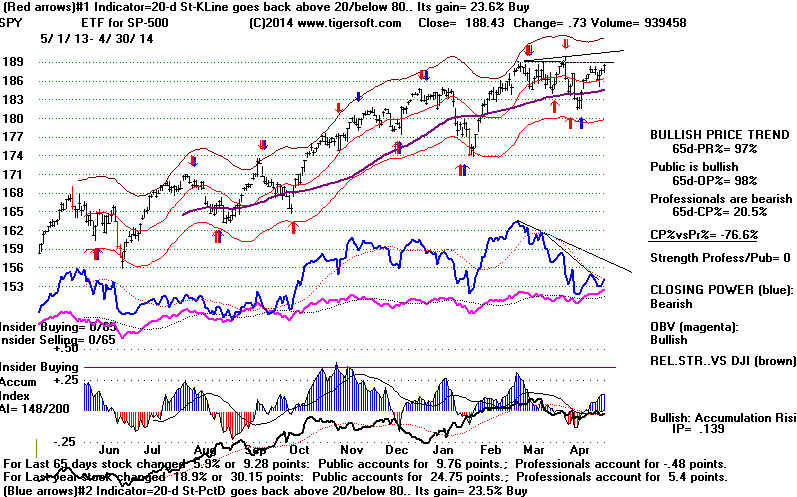

6/5/2014 Central Bank Interest Rates below 0 in Europe.

High Accumulation and SP-500

Breakout. S9V seems unlikely.

A 1000-point DJI take-off

might be starting. A Peerless Sell seems

not very

close.

This Brings A Clear Breakout by OEX, SP-500 (below), QQQ and

NASDAQ. Shorts taken day or two ago because of

the SP-500's

Rising Wedge patterns should be covered. The V-Indicator

has turned positive and the Accum. Indexes have risen

sharply. REITs and other dividend stocks are in demand.

They

show lots of Accumulation and their Closing Powers are

making new highs.

I

would expect the present stock leadership from REITS, OIL/GAS,

SEMI-CONDUCTORS and BIG MILITARY STOCKS (especially GD)

to

become even more apparent if the market is taking-off here as it did

in

December 2004 or January 1986. For a broad market "take-off" to

occur

now, the NASDAQ will have to play catch up and be stronger than the

the

DJI

Interest Rates

below Zero for European Banks

The European Central Bank will now charge

Euro banks

for

depositing there money with the central bank. The theory

is

that this will give the Euro banks an added incentive to loan

reserves out. But they do not have to. They can just keep the

extra

funds in their vaults, in which case nothing happens.

One

country, Denmark, has tried setting its rates below zero

two

years ago and nothing much happened.

The new

policy in Europe will serve slightly to strengthen the US

Dollar

because the FED could end up getting more deposits made

indirectly

from European banks, as it actually pays big bank a very

small

amount for money they place on deposit with the FED.

As for the US stock market, the new

European policy of negative

interest

rates for big banks there is a big psychological boost for our

dividend-paying stocks, as it seems to put further out into

the future

the prospects of competing higher interest rates in the US.

> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 151 +56

MAXCP stocks Bullish MAXCP Stocks (6/5/2014) Bullish

plurality

--> 37 -34

MINCP stocks Bearish

MINCP Stocks (6/5/2014)

Many

heavily distributed and shorted stocks remain very weak.

--> 51 +15 New Highs on NASDAQ 26 -9 new

lows. Bullish plurality

--> 116

+34 New Highs on NYSE 10 -7 new lows. Bullish plurality

================================================================

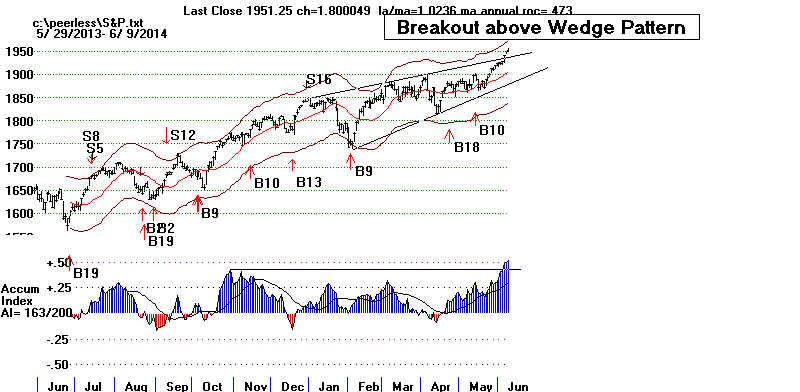

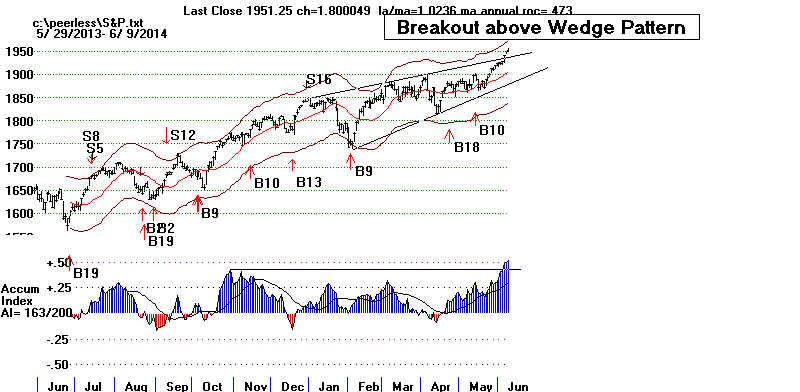

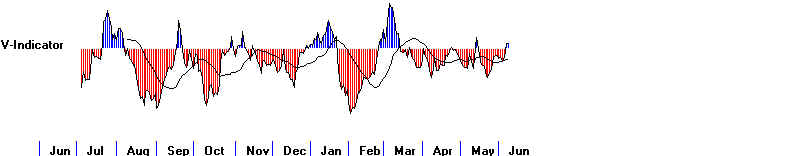

6/4/2014

The markets remain divided and dull. The

SP-500's price pattern, a Rising

Wedge, mostly brings

7% declines not upward breakouts

even when Peerless

is on a Buy and breadth is good.

(See last night's Hotline.)

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 95 +20

MAXCP

stocks Bullish

MAXCP Stocks (6/4/2014) Bullish plurality

--> 71 -40

MINCP stocks Bearish MINCP Stocks (6/4/2014)

Many

heavily distributed and shorted stocks remain very weak.

--> 51 +15 New Highs on NASDAQ 26 -9 new

lows. Bullish plurality

--> 116

+34 New Highs on NYSE 10 -7 new lows. Bullish plurality

Peerless is still on a Buy and the NYSE's

A/D Line uptrend

is intact. But, Bearish MINCP stocks remain unusually

weak.

Many Professionals see their downward moves as offering the

greatest potential for profits now available. Slower-moving

Dividend and REITs contine to be strong. We are seeing a few oil stocks

and semi-conductors making confirmed new highs, but not

enough yet to ignite another leg up in this bull market. The

example of 1986's second half may give us the best sense of what

lies agead. Back then, for six months, the DJI could not breakout

above its rising price channel and the weaker NASDAQ needed

to consolidate until early in 1987 they got back in synch and the

markets rallied 30% in 7 months.

The NASDAQ was lifted by advances of APPL and

the Biotech Index up past its expected resistance but

the SP-500 and DJI are still contained by their wedge

pattern's rising resistance lines.

The DJI (below) is 0.9% over its 21-day ma and shows

a negative V-I at -21. A 1.5% price advance from here that leaves

the V-I negative would probably bring a Sell S9v. For the bulls,

it would be better for the markets to show improving breadth

and volume before there is a breakout.

We also have to watch for a clear break in the A/D Line uptrend-line.

It is well-tested and its break would likely mean the DJI would

breakdown from its rising wedge pattern.

---------------------------------------------------------------------------------------------------------------------

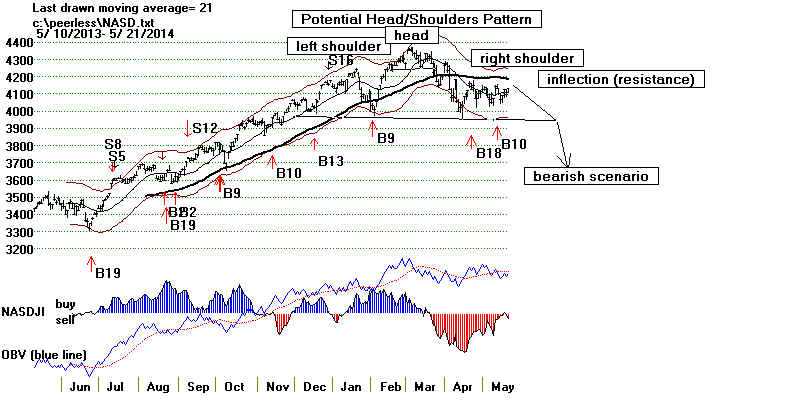

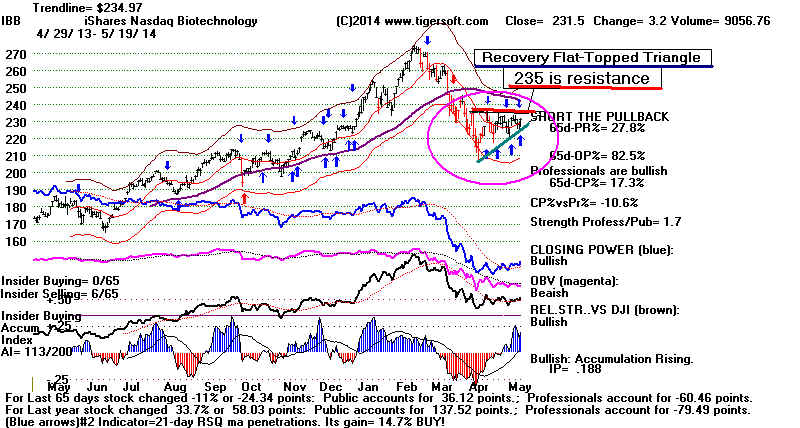

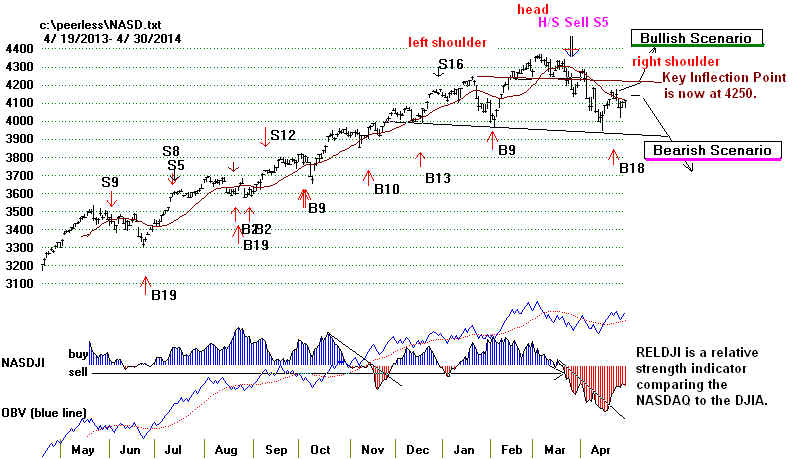

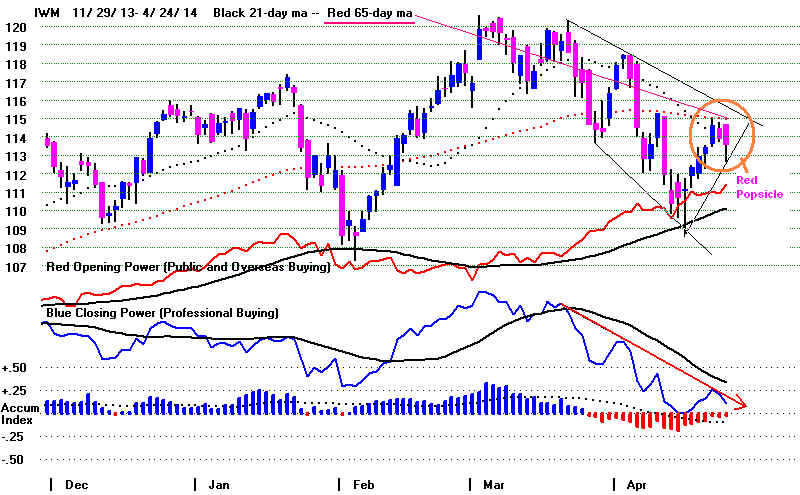

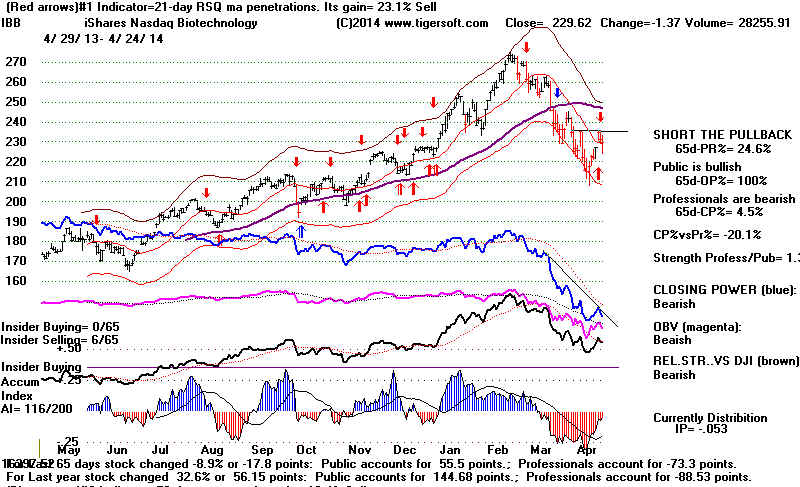

6/3/2014 Do Some Selling and Short Selling

The absence of a Peerless Sell and a recently strong A/D Line should

protect us from a serious "June swoon", but the NASDAQ

could start

falling down from a perfectly symetrical head/shoulder pattern's right

shoulder apex. Moreover, IWM and IBB have dangerously stalled out

at their falling 65-dma. And even the safer OEX

and SP-500 show bearish

rising wedges. Meanwhile, we could be making good money shorting

heavily distributed stocks below their 65-dma that show Closing Power

new lows. If they cannot advance in a rising trend, what will they do

if the market sells off for a month. Even dividend stocks could be hurt

if the 10-year rates continue their short-term rise.

There is much evidence in Arthur Merrill's "Behavior of Prices on Wall

Street" that Junes in the second year of the Presidential cycle produce

sell-off bottoms from which come very good recoveries and Summer rallies.

(More on this in the new Peerless book). Fow the present, we know that

the next 4 weeks produce DJI gains only 46.8% of the time. since 1965.

> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 75 +4

MAXCP stocks Bullish MAXCP Stocks

(6/3/2014)

--> 121 +10

MINCP stocks Bearish MINCP Stocks (6/3/2014) Bearish

plurality

Many

heavily distributed and shorted stocks remain very weak.

--> 36 -4 New Highs on NASDAQ 35 +19 new

lows. Bullish plurality

--> 82

-29 New Highs on NYSE 17 + 3 new lows. Bullish plurality

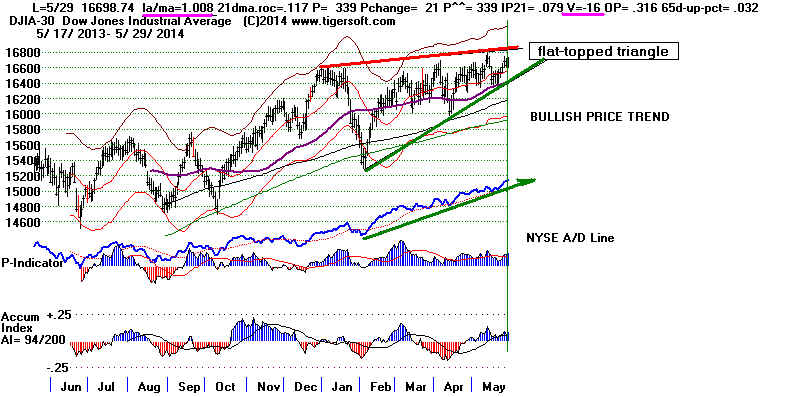

Will SP-500 be able to breakout above its rising

resistance line?

Rising Wedge Patterns in SP-500

usually nring price breakdowns.

In fact, since 1970 even when A/D Line is strong (confirming)

and there is no Peerless Sell, the odds are still 3:1 against an upside

breakout and in favor of a DJI or SP-500 decline of about 7%.

See the new study below.

Shorting more Bearish MINCP stocks seems the

best

way to play the odds favoring a breakdown

in

the SP-500. Clearly, this is what

Professionals are doing

with stocks breaking down under the pressure of heavy institutional

and insider selling.

New Study: RISING WEDGE

SP-500 PATTERNS:

1970-2014

An upside breakout is a possibility, as

shown in the breakout of December 2003.

Here the NYSE A/D Line was very strong. Remember that this case occurred

only 9 months after a major bear market bottom. The new bull market then

was relatively young. It also occurred at the start of a new year after a strong

Santa Claus rally.

|

But mostly, breakdowns occur

from rising SP-500 wedge patterns

even when the operative Peerless signal is still a Buy

and the A/D

Line has been strong. Consider the technicals and the attitude of

Peerless in each case of a rising wedge in the SP-500. This pattern

combined with a confirming (strong) A/D Line and no Peerless Sell

has occurred only in 3 cases other than the bullish instance mentioned

above. In each of these other cases the SP-500 declined about 6%-7.5%

and the DJI a little less.

Bearish SP-500 Rising Wedge Patterns

with no Peerless Sell and a Strong A/D Line.

July 1985 7/22/1985 LA/MA = 1.016 V= +.11

5.0% DJI decline

7.5% SP-500 decline from 7/18/85 to 9/25/1985

July 1997 7/31/1997 LA/MA=1.027 V= +.32

7.0% DJI decline

6.0% SP-500 decline from 8/6/87 to 8/29/1997

January 2010 1/25/2010 LA/MA = 1.017 V= +.16

7.5% DJI decline

7.5% SP-500 decline from 1/20/2010 to 2/8/2010

Like now, the NYSE A/D Line did confirm

the high here.

|

Like now, the NYSE A/D Line did confirm

the high here.

|

Like now, the NYSE A/D Line did confirm

the high here.

|

|

Like now, the NYSE A/D Line did confirm the

high here

|

Like now, the NYSE A/D Line did confirm the high here

|

|

|

Like now, the NYSE A/D Line did confirm the high here

|

================================================================

6/2/2014

The Dull Slow-Moving Side-wise

Correction

in NASDAQ and many tech stocks continues. Without

a Peerless Sell, what we are seeing now should continue.

The Bearish MINCPs are a lot more numerous and

exciting than most of the Bullish MAXCPs. Small wonder

that Professionals are not playing the long side

as much right now. Shorting some of these Bearish

MINCP stock is recommended for hedging and for profit.

This remains a dividend-stock bull market. Thus, most bullish

REITs

again rallied today.

> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials IBB-Biotechs

--> 71 -1

MAXCP stocks Bullish MAXCP Stocks

(6/2/2014)

--> 111 +30

MINCP stocks Bearish MINCP Stocks (6/2/2014) Bearish

plurality

Many

heavily distributed and shorted stocks remain very weak.

--> 40 +2 New Highs on NASDAQ 16 +6 new lows. Bullish plurality

--> 111

+6 New Highs on NYSE 14 + 2 new lows. Bullish plurality

Today the dividend Stocks' grinding advance of late

was hurt somewhat by higher 10-year bond rates. Without

much momentum or volume, the overhead resistance

levels stopped many stocks not in SP-500 or DJI. See

below how the Tiger Index of the Russell-1000 has

held up well but still is unable to make a breakout past

its flat resistance. The steady uptrend of its A/D Line is

distincly bullish even as many of leading stocks and ETFs

we follow each night show uninspired Closing Power recoveries.

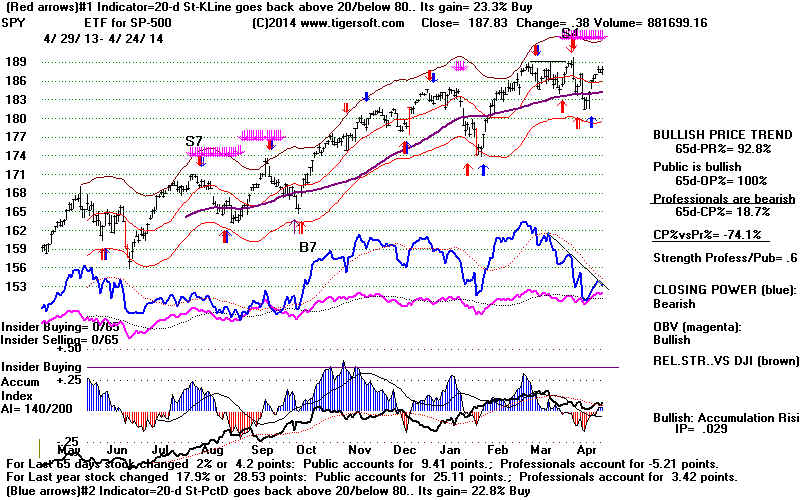

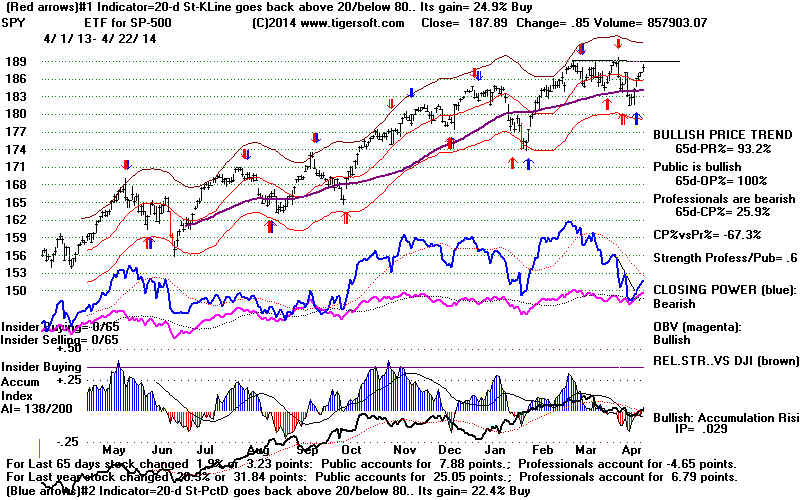

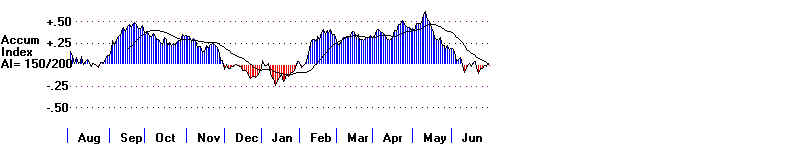

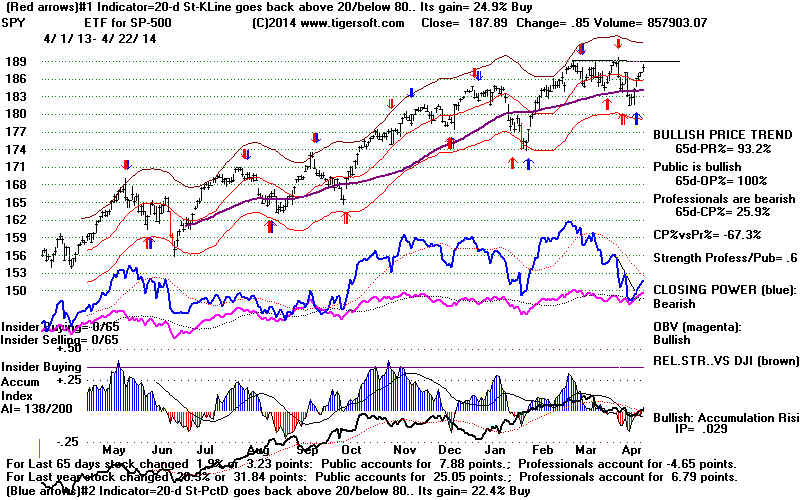

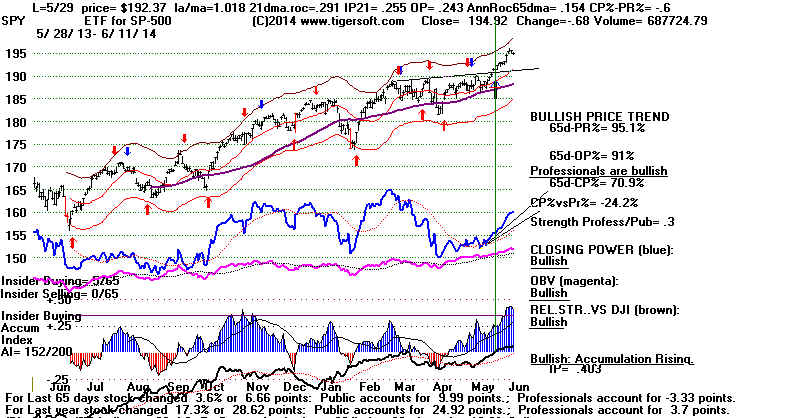

Peerless Signals on SP-500 ETF. Note bullish Accumulation

despite

lagging (blue) Closing Power. Professional wariness

(weak

CP%-Pr%) more than heavy institutional selling

(which

red and negative IP21 would show) is probably

the

biggest deterrent to a good rally now. The Accumulation

Index

readings on most of our indexes and ETFs are still quite positive.

The DJI and SP-500's

Advance today was not confirmed by a corresponding

rise in NYSE A/D Line.

In the last six months this simple divergence

has tended to bring small retreats. Bigger, longer, more obvious NCs

(non-confirmations)

are needed to bring declines to the lower band and Peerless Sells. Note that

the DJI is now 1.0% over its 21-day ma. It's V-I remains negative, at -21. So,

any 1.5% DJI jump up from here would likely bring a Sell S9-V.

Seasonally, the rally would

seem to be running out of time. Since 1965, the

DJI has risen 59.6% of the time over the next three trading days, but thereafter

weakness tends to follow for the rest of June. The DJI produced a gain only

44.7% of the time for the 21 trading days after June 2nd.

The Hourly DJI does show a steady uptrend

with confirming DISI (OBV).

A break in this uptrend will

likely bring a sell-off back to 16600. Because of

the absence of Peerless sells and still strongly uptrending A/D Line, 16600

will probably hold.

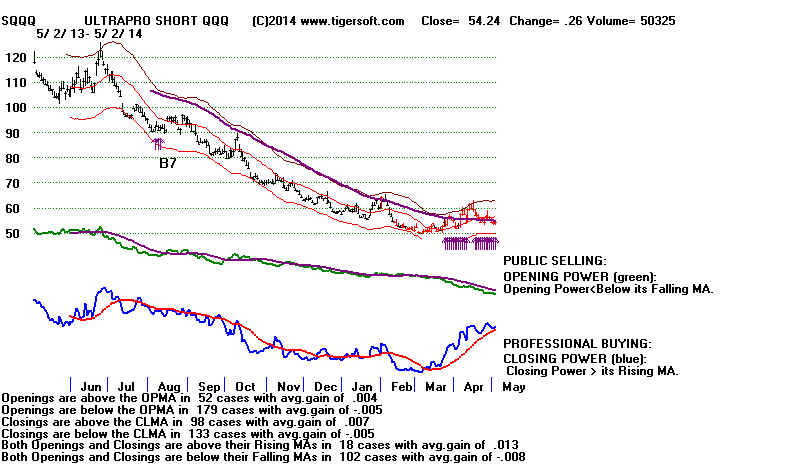

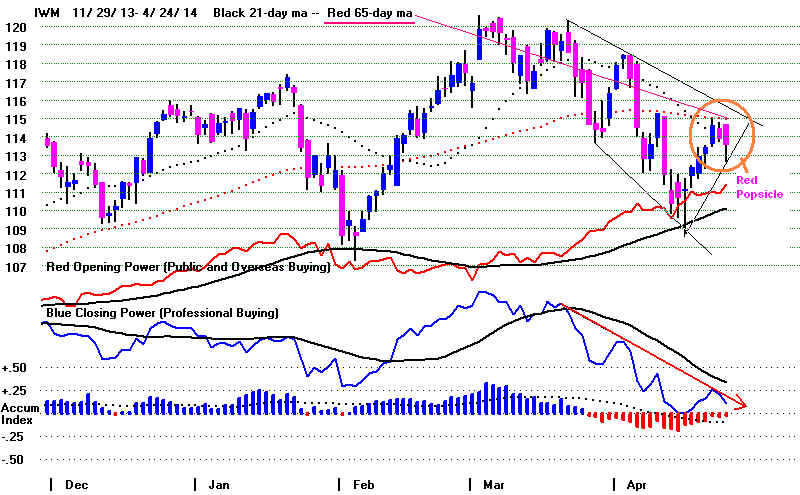

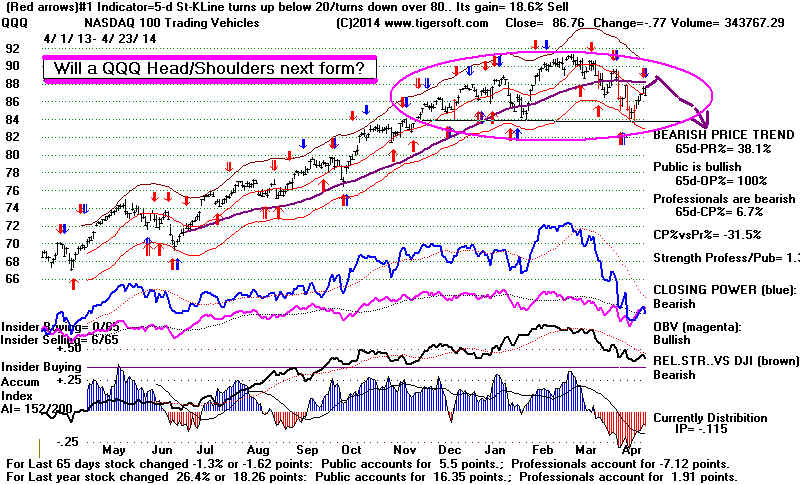

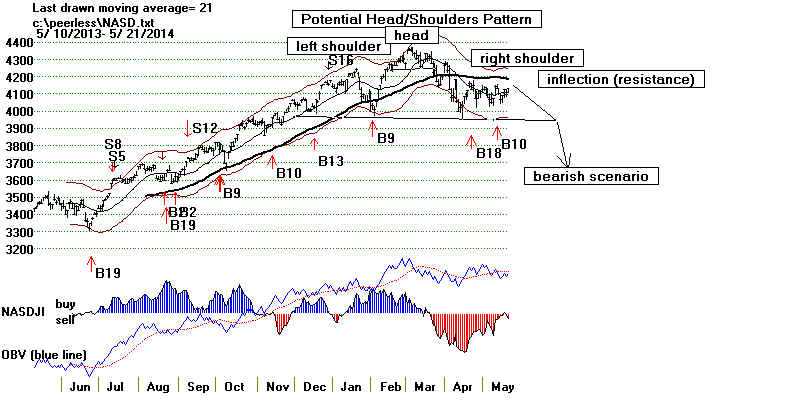

QQQ was again unable to make a new

high. Biotech IBB and

IWM (Russell-2000( retreated from 65-dma. The NASDAQ

has stalled at the resistance created by the left shoulder

apex of a potential head/shoulders pattern.

================================================================

5/30/2014

NYSE A/D Line keeps rising.

No Peerless Sell.

Only A Shallow Retreat Seems Likely.

The FED

has chosen not to risk a decline of more than 10%. They remain intent

on bolstering the market and thereby the economy as best they can with 10-year interest