TigerSoft

News Service 8/29/2011 www.tigersoft.com Updated

4/15/2012

TigerSoft

News Service 8/29/2011 www.tigersoft.com Updated

4/15/2012ECONOMIC US STAGNATION

in A GATHERING GLOBAL RECESSION

Update:

Right-Wing Austerity Dogmas Are Producing

Another Depression in Europe, Exactly as Predicted Here.

European bankers: Are they just ignorant? Are they blinded by the Austrian

School of Economics? Or do they want to punish and better exploit millions?

Republican austerity measures would have same result here. Will Obama fight back?

CBS - America's 1930s are returning for many in US. Living in cars. children and parents penniless.

The Folly of Forgetting Economic History

April 15, 2012 - Spain - 23.6% unemployment in Spain and Sharply Higher Borrowing Costs.

Greece February 2012 --- 21% and rising. Half of all youth.

France Feb 2012 --- 10% and rising.

Italy Feb 2012 --- 9.3% and rising.

United Kingom Feb 2012 8.3% and rising

How Long Can The Stock Market Hold Up?

1) Escaping Job Killing Economic Orthodoxies is the first step for the US

to take to bring about a recovery.

2) DEEP CONTRADICTIONS WILL CRACK AMERICA WIDE OPEN:

3) OBAMA ALWAYS Sides with Wall Street against Main Street.

4) The Experience of the 1930s Bodes Badly for Wall Street.

by William Schmidt, Ph.D. (Columbia University) Author of www.tigersoft.com

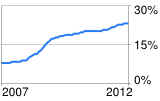

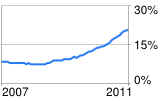

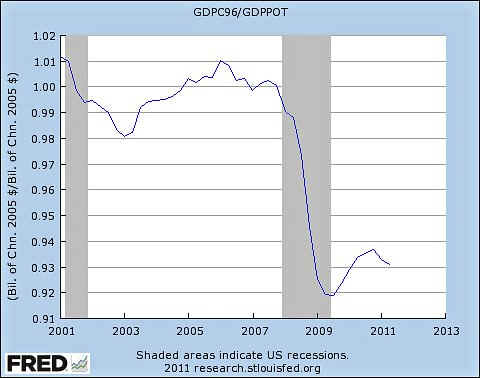

Ratio of Real GDP to CBO Estimate of Potential GDP

(GDP = Gross Domestic Natl. Product)

See 8/3/2011 The Lessons of The 1930s and Keynesianism That Obama Ignores

as He Kow Tows To Tea Party Republicans

Buy and Hold Is Dangerous See All The Peerless Real-Time Signals: 1981-2008

|

Tiger Software

Research on Individual Stocks upon

Request:

|

ECONOMIC US STAGNATION

in A GATHERING GLOBAL RECESSION

by William Schmidt, Ph.D.

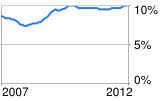

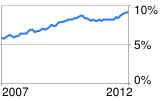

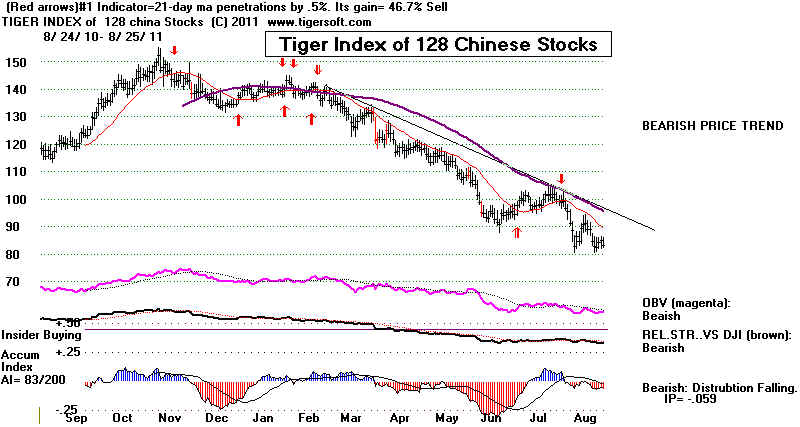

The world economy is slowing down. See the Tiger charts of Foreign ETFS

and China below. Relying on global markets will not help individual countries

or America to escape the downturn.

OBAMA TO THE RESCUE?

Wall Street - Yes. Main Street - HARDLY

Obama says he will be offering a new Job plan in September after Labor Day.

Better late than never, I guess. But Obama has been in office almost 3 years and

the economic stagnation and sense of hopelessness among the jobless

is not getting better. He had his chance in 2011 to repeal the Bush tax cuts and

fund a new Public Works program. He utterly chickened out, showing his campaign

pledges to help ordinary Americans were deliberate, fraudulent lies.

Obama's advisors are economic internationalists. None appear to have argued

for curbing Wall Street's appetite for foreign investments and the exporting

of jobs. His Chief of Staff is from JP Morgan. His pick of Jeffrey Immelt,

CEO of GE, to head his "Jobs' Panel" is a deep insult to all American workers.

Not only did GE pay no taxes last year, they are very busy exporting thousand of

jobs to China, even as Immelt consults with Obama. GE is also sitting on a hoarde

$79 billion.

I do expect him next month in his new proposals to offer new subsidies to

corporations if they hire Americans rather than foreigners. Why did he not do this

when his party had a majority? And why not heavily tax corporations that

ship jobs, tax overseas investments and strictly limit Gold and Commodities

by raising margin requirement?

These things Obama dares not do. It would threaten his Wall Street campaign

contributors' profits. All thoughout his Presidency, Obama has placed his political

bets on Wall Street and trickle-down economics. Until he has a challenger in 2012,

why should he change, he thinks?

A bigger stock market crash is, nonetheless, coming I believe. What Wall Street wants

is clearly at odds with what America needs, namely a new, fair deal and a re-industrialization.

Despite Wall Street and Obama, the lessons of the 1930s show there will be bigger

populist moves for:

1) New Taxes on the Rich,

2) New and Better Regulations of Wall Street,

3) Massive Public Works,

4) Tariffs

5) Controls on the Export of Capital

6) Controls on the Speculation in Gold and Commodities.

A DIRE PREDICTION

Years of stagnation, high unemployment, mass poverty and ultimately civil unrest

lie ahead, if American policy leaders do not wake up and change their mantra of

Balanced Budgets, Free Trade and Laissez-Faire "free market" economics.

Much more aggressive, new fiscal and trade policies are desperately

needed to make capitalism work again. Is it too much to think that If changes

in such policies are not made soon, civil unrest and fascism may be real

possibilities? Surely that is one of the key lessons of the 1930s.

1. Economic stagnation. How long will the millions of long-term unemployed wait

quietly for Obama, Congress and Wall Steeet directed Capitalism to provide enough jobs?

"The portion of men holding a job—any job, full- or part-time—fell to 63.5 percent in July

—hovering stubbornly near the low point of 63.3 percent it reached in December 2009.

These are the lowest numbers in statistics going back to 1948. Among the critical

category of prime working-age men between 25 and 54, only 81.2 percent held jobs,

a barely noticeable improvement from its low point last year—and still well below

the depths of the 1982-83 recession". (Source . )

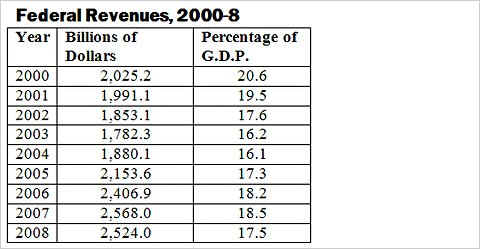

2. Tax the Rich. Obama's Trickle-Down economics has clearly not worked.

Trusting that lowering the taxes on the rich and extending more tax benefits

to them and their biggest multinational corporations has been a terrible mistake.

The pro-"Supply-Side" utterances on this topic by the Heritage Foundation and

other right-wing think-tanks bought and paid for by the very wealthy cannot be trusted.

Facts differ too much: growth was greatest in the 1950s and 1960s when marginal

tax rates were highest, above 90%. The Bush tax cuts have coincided with stagnation

on Main Street. Increased "investor confidence" has not created more manufacturing

jobs here. It has helped overseas. "Trickle-down" works poorly when the rich buy

mostly imports, invest mostly overseas and travel more abroad.

And when the rich do get scared, as they are now, they hoard their money and speculate

in Gold and precious metals, rather than create jobs here with new investments. The

biggest corporations, we are told, are sitting on a record sum of cash. "Non-financial

corporations sit atop a record $1.9 trillion in liquid assets, according to the Federal

Reserve. Relative to their short-term liabilities, U.S. corporations haven't been this

flush with cash since 1956." ( Source. ) Big multinational corporations are clearly not

investing in new plants or hiring here. Wages are much cheaper elsewhere.

Consumption is too low here. The simple fact is that American workers can not

consume if they are poorly paid or unemployed and multinationals are very disloyal

to Main Street America. They only maximize profits.

Everyday Americans, if not its politicians and international bankers and CEOs,

understand that we desperately need much more taxation of the very wealthy,

their property and their income. They already use more lawyers and accountants

to dodge more taxes than other Americans. Worse, their fraud and rash and reckless

speculation crashed the economy in 2008. Yet they were massively bailed out and

barely re-regulated, Now it's time that the Government help all the rest of us

who were not bailed out and still suffer from the consequences of the unregulated

greed on Wall Street. The Bush tax cuts on the wealthy have cost America a whopping

$2.8 trillion dollars. (Source . )

http://economix.blogs.nytimes.com/2011/07/26/are-the-bush-tax-cuts-the-root-of-our-fiscal-problem/

As a result of the Bush tax cuts on the rich, each and every American's debt

via the US Government rose about $900. With this money, we could have

guaranteed health care for each child in America. Every poll shows Americans

favoring higher taxes on the rich by 2:1 and 3:1.

The sad truth is that Obama utterly reneged on his campaign pledges when he took

the Bush tax cuts off the table in 2011. How much hope can we have now that he

will reverse himself next month to help America's recovery? And if he does, it

won't it be just hollow rhetoric, given the Republican control of the House.

3. Defense Spending Is Now Destroying America. Almost everyone understands

this, except perhaps Obama and those who work for Boeing and Northrop, etc.

America just cannot afford a $600+ Billion Military budget. How long must we wait

for the unpopular wars to be ended and the vast network of costly overseas

military bases be abandoned. World War II ended 66 years ago! We spend more

on our military than all the rest of the world combined.

4. What we do need are a Vast Public Works Programs to fix the country's aging

indrastructure and potholes. This will provide millions of new jobs at a time

when corporations are not investing much in America. A new Civilian Conservation

Corps for youth would show Americans that we can learn from the accomplishments

of FDR facing the Depression.

5. And, most important, we need TARIFFS on imports, new Heavy Taxes on Overseas

investments by Americans and a President who advocates "BUY AMERICAN".

Government long range planning would prioritize the rebuilding of the country's basic

industries. Encourage private investment in America and discourage it overseas.

Without tariffs and a revived domestic manufacturing industry, the public works

programs will not properly revive the economy. Too much will still be imported.

6. State and Community Public College Education must be much less expensive. It can

not as now, be so expensive that it keeps Americans from getting the skills needed

for 21st Century jobs in a re-indistrialized America.

What will Obama propose to help the young get a college education? Not much,

I fear. He has already reneged on his campaign promises in this to the young when

he sacrificed already inadequate, means-based Pell Grants for college education

to budget cutting Republicans in Congress.

Sources:

http://articles.cnn.com/2008-12-03/living/college.costs_1_family-income-college-affordability-higher-education-report?_s=PM:LIVING

On the vital role of community colleges, see

http://www.compact.org/wp-content/uploads/resources/downloads/CCivic_role-final.pdf

7. Campaign Contributions by the rich must be limited. And Campaign Contributions

by corporations must be completely banned. Corporations are not people. They

have no heart. They have no conscience. And they are not citizens of America.

They are multinationals. Corporations are destroying American Democracy

and buying every politician in sight. The sinister and perverted interpretation

of "free speech" used by the Supreme Court to grant them unlimited powers

must be reversed or Democracy will give way to corporate fascism and repression

of dissent, as in Italy, Spain and Germany. An extreme view? How else will

corporations be able to silence the anger of millions desperately without jobs?

That is the lesson of the 1930s.

A DIRE PREDICTION

Years of stagnation, high unemployment, mass poverty and ultimately civil unrest

lie ahead, if American policy leaders do not wake up and change their mantra of

Balanced Budgets, Free Trade and Laissez-Faire "free market" economics.

AN OUTDATED ORTHODOXY IS DESTROYING AMERICA.

It should be clear by now that the solution for the US about how it will escape the

downhill, out-of-control, stagnation spiral will most certainly NOT come about by:

1) Trusting that lowering the taxes on the rich and extending more tax benefits

to them and their biggest multinational corporations will increase "investor

confidence" and create more manufacturing jobs here.

Warren Buffet sees the injustice here. The US has by far the most economically

unequal society of any industrialized country. This causes great stress and poor

health for a hundred million Americans.

See also my Blog - 8/2/2010 www.tigersoftware.com/AUG-3-2010/index.html

Uncorrected, it will eventually bring civil disorder and chaos. Greed is not good.

See also my Blog - 10/19/2011 - The Murderous Consequences of Inequality in America

See also my Blog - 9/6/2010 - The Rich Must Be Taxed. They Are The Only Ones With Much Money.

2) Allowing very rich Americans and their wealthy corporations to cont tinue

to send new and many existing jobs overseas, and with the blessing of the

US Government is the natural order of things and will boost the American economy.

Tell this to the American worker who must train his replacement in India!

See my Blog - 4/6/2008 - http://www.tigersoftware.com/TigerBlogs/4-7-2008/index.html

3) Balancing the Federal Budget at all costs in the middle of a deep recession.

See my Blog - 8/2/2011 - http://tigersoftware.com/TigerBlogs/83---2011/index.html

4) Pretending America is still so rich and prosperous that it can afford military

bases in more than 150 countries overseas, continue TRILLION DOLLAR

WARS 10,000 miles away and keep on spending on new weapons technologies

as though we were still in a Cold War with the Soviet Union.

See my Blog - 2/15/2011 - http://www.tigersoftware.com/TigerBlogs/Feb-15-2011/index.html

The Public Works Solution:

Who could argue with boosting the public America we encounter and use everyday.

.

"Public works (or internal improvements historically in the United States)[1][2][3] are

a broad category of projects, financed and constructed by the government,

for recreational, employment, and health and safety uses in the greater community.

They include bridges, parks, roads, municipal buildings, dams, railroads, schools,

hospitals, beaches, and other, usually long-term, physical assets and facilities."

( http://en.wikipedia.org/wiki/Public_works )

A massive Public Works program to fix and refurbish our crumbling infrastructure

must be combined with the public sponsorship and protection of basic industries

in the US. Tax the rich. Call it the "Patriotic Education and Infrastructure Tax."

Let the state and local governments spend most of the money. They know where

the pot holes and dangerous dams and bridges are, much better than far-away

Washington bureaucrats.

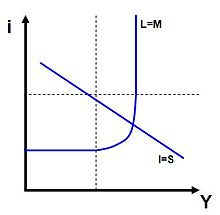

Can Pumped Up Stocks Escape Trouble?

The world economy still has huge problems. Will stocks be able to stay up? The Fed has

done a marvelous job in keeping the stock market rally alive for 27 months by generously

loaning vast sums to all the biggest banks at very little cost, by printing new money to buy

bonds and by keeping interest rates low, despite quickly rising gold and commodity prices.

Bernanke is fighting the forces of economic stagnation and high unemployment

with only monetary policies. They are not enough, he is the first to say. More stagnation,

higher unemployment and the loss of more manufacturing to Asia and Europe are in

the cards. A longer economic stagnation and higher unemployment will cause, I expect,

a re-thinking of economic orthodoxies, especially free trade and balanced budgets.

The Lesson of the 1930s: Globalism Will Likely Break Down

The 1930s high unemployment and stagnation caused many countries and economists

to re-think orthodox economics (balanced budgets, trickle-down, gold standard, the

superiority of private over public enterprises and free trade), I think the same will happen

again. If I had to pick a date, I would say we are in the 1930, when Hoover tried to balance

the budget. There are big differences, of course. We are at war. If the wars were ended,

there would be even higher unemployment.

Right now budget balancing is all the rage in Washington, London, Berlin, Paris and

now Spain. Its dire effects in Europe and the US in the 1930s seem unknown or forgotten.

But if history repeats, when these countries' economies worsen and unemployment jumps

to unacceptable levels, as happened in 1931 and 1932, when budget balancing had made

things much worse, there will be more and more cries for Deficit Spending, Protectionism,

Public works, Curbs on Exports of Capital, Wage and Price controls and even the Confiscation

of Gold.

Sudden Shifts of Thinking and Herr Schact

Germany's leading banker of the 1920s, Hjalmar Schact, a free trader and budget balancer,

read Keynes and dramatically reversed himself completely in 1929. (Keynes himself switched

to protectionism in 1933, as did Neville Chamberlain, the Chancellor of the Exchequer.)

Imagine in our time, if someone like Bernanke or Buffett suddenly switched to strongly

favoring Public Works, Tariffs, Autarchy (national economic self-sufficiency) and even the

Repudiation of International Debts, as Schact did. Wall Street would take a very big hit!

Yet these were many of the policies adopted in the aftermath of the world wide economic

collapse of 1931 and 1932. Wall Street has bet big on multinationals. The biggest "American"

stocks are all multinationals. I think wrenching challenges lie ahead to stock prices,

especially if the current rally fails and Obama and the Tea Party leaders offer no new ideas

in early September about how to create millions of jobs by re-industrializing America.

Many economists think that the 1929 stock market collapse was partly a response to the growing

realization then that the Smoot Hawley legislation was going to pass, with its big jump in tariffs.

The dependence on international trade is much greater now. Wall Street and the major

corporations would never happily allow such an increase in tariffs. Yet, without some restrictions

on imports or subsidized industrial production here, a massive pubic works program, like TVA,

the Hoover, Grand Coulee Dam or Civilian Conservation Corp., would be much less effective

as an economic stimulus.

Take an example. Consider high speed trains as a US public works program to modernize

the infrastructure. Presently, much of the steel would have to be imported. And the newly

hired workers would probably buy lots of Chinese imports from Wal-Mart. Keynes'

"multiplier effect" with public works projects in the US in 2012 will be much lower now than

it was in 1933-1937.

Tennessee Valley Authority

Grand Coulee Dam

Hoover Dam

CCC

Muddling Through Will Not Work

England in the 1930s tried to muddle through. It did

not work well. Unemployment

remained very high until the war and the Pound fell

sharply, giving them inflation, too.

This is like the late 1970s, except that Bernanke's

approach is the opposite of Paul

Volker's higher and higher interest rates.

The easiest path politically now in the US is still relying

on Bernanke to boost Wall Street

through very loose monetary policy and hope that there with

be more business loans

and some trickle-down to American workers, even though the

export of jobs goes

on unabated and banks .

Tariffs Are Needed, but Wall Street Will Never Allow Them

Tariffs do have their downside. Which industries should be protected?

Across-the-board?

Should goods produced unsafely by underpaid

serfs be allowed into the US? When it comes

to campaign contributions, the multinational

importers generally speak far louder than the

unemployed workers that have been displaced.

Whereas once up a time, the corporations

that made steel, sneakers, autos or amplifiers here

might have complained bitterly, now they

own many of the factories abroad that are sending

goods here.

Tariff legislation, though incresingly popular on Main Street now, as a way to save jobs here,

would almost certainly mean antagonizing China, which has built whole industries

around exports to the US. There would be retaliation by all the trading partners in

the US. Foreign US Debt holders would likely sell. That would panic Wall Street. The

Dollar would crash. The Fed would have to print lots more Dollars or a sharply raise

interest rates.

If not tariffs, what about fairer trade agreements. The links below argue that the

Obama Adminstration has not bargained any more aggressively with US trading partners,

particularly China, than he did with the tea party Republicans. There are numerous

references to Obama's failure to fight against unfair foreign trade practices that hurt

American manufacturing:

http://www.examiner.com/political-buzz-in-lafayette-la/obama-s-trip-to-china-could-further-destroy-america-or-is-that-the-plan

http://www.highbeam.com/doc/1G1-233548728.html

http://americanmanufacturing.org/blog?p=12026

http://citizen.typepad.com/eyesontrade/2011/08/pelosi-pushes-back-against-obama-backed-unfair-trade-agreements.html

http://www.punxsypage.com/news/start/68431_Casey_to_Obama__Protect_dairy_farmers_from_unfair_trade_practices.htm

http://www.mittromney.com/blogs/mitts-view/2011/07/president-obamas-retreat-china-costing-america-jobs http://www.prnewswire.com/news-releases/dnc-chair-debbie-wasserman-schultz-mitt-romney-will-not-stand-up-for-american-workers-in-the-global-economy-126280603.html

Obama's soft touch when it comes to regulating Wall Street or fighting for fairer

trade agreements is not accidental. Wall Street was his biggest campaign contributor

in 2008. Nearly all of his economic advisors and his Treasury Secretary are from there.

Almost every day, we see evidence that Obama is their puppet of Wall Street.

See my Blog - http://www.tigersoftware.com/TigerBlogs/April-9-2010/Index.html

and also http://www.globalresearch.ca/index.php?aid=18960&context=va

Today, he apponted Alan Kruger to head his advisors. Kruger is a micro-economist.

Tariffs, public works and taxation policies are outside his kin. He specialized in the

decision making of individual firms and employees, not broader economic issues.

If Obama were serious about Public Works he would have picked Paul Krugman.

His failure to appoint Elizabeth Warren to head the new Consumer Protection Dept.

of the Fed also showed how conservative and unimaginative Obama is.

economic issues. I said earlier that Obama's next Jobs speech will favor

Tax Credits, not taxes. Obama's choice today of Kruger is consistent with that.

CONCLUSION

So, the future does not look

good. Wall Street and Main Street are at odds.

The 1930s should warn us about how

quickly the world can deteriorate. Gold is a haven

until there is another violent Crash, as

in October 2008. That Gold turned up sharply

the last two trading days this week

suggests a crash is not imminent, but it probably

is coming, The tension

between Wall Street and Main Street and between Obama

and his supporters is too great to last

much longer. Peerless is on a Buy now, but

how long will it last? Get Peerless

or the Hotline and Find out.

More

Reading:

http://en.wikipedia.org/wiki/Alvin_Hansen

http://finance.yahoo.com/career-work/article/113390/disappearance-american-working-man-businessweek