COMMENTS ON BREAKING NEWS

and EARLIER TIGERSOFT BLOGS

TIGERSOFT INSIDER TRADING CHARTS

11/23/2010 by William

Schmidt, Ph.D. (Columbia University) - Creator of

Tiger Software

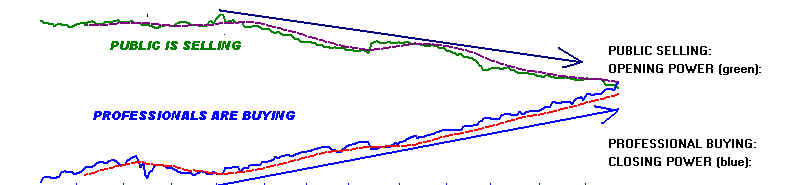

TigerSoft's Accumulation Index and Pro-Closing Power

Always Trade with the

Insiders and

Professionals.

Brought To You By

TigerSoft Insider Trading Charts

SPECIAL

TIGER-'SMART' INTRODUCTORY OFFER - Only $295.

3 months of Nightly Data, Nightly Hotline and Best Stock Trading Software Anywhere.

TigerSoft

Insider Trading Charts:

>>> Automatic Buy and Sell Signals on on any Stock,

Index, Commodity.

......

>>> Powerful

Measures of Internal Strength & Momentum

Big-Money Insider Accumulation and Distribution...

Professional Net Buying and Selling - Tiger's Pro-Closing Power

Net Public Buying and Selling

.Aggresive Buying/Selling...

Unusual volume...

Relative Strength.

Cyclical Channel Trading, Support, Resistance, Breakout BUYS, False Breakouts.

Seasonality & Cycle Studies,

Opening and Closing Targetsh

Limited Time - Only! $295

>>> ORDER

TIGER's Atomatic Signalling Software and Data

===================================================================================

TigerSoft Insider Trading Charts

Insider

Stock Trading Is Rampant Explosive

Super Stocks Killer

Short Sales

Peerless Stock Market Timing:

1915-2010 TIGER Blog Testimonials

Predictions

Q&Answers. About us.

====================================================================================

Advertising and

Link Exchange Space is now available below, on your choice

of specific Blogs

and on our Main TigerSoft Home Page - Contact william_schmidt@hotmail.com

Note that a comparable link exposure is required to be listed here.

On your site, please use the words below for our links on your

site. Then provide us your link with an explanation of comparable length. We will

post it here and apprise you of this for your approval..

Visit www.tigersoft.com InsiderTrading

Charts, Peerless Stock Market Timing: 1929-2010

and Free

Blog on The Real News as Revealed by Tiger Insider Charts. |

Nature's Plus for Energy and

Natural Food Supplements.

Their Ultra Inflam worked wonders for me. You, too, can be at your peak.

Great value. http://www.inutrilogics.com/

|

|

| |

|

|

DAILY COMMENTS ON THE

NEWS and EARLIER TIGERSOFT BLOGS

Level The Playing Field with TigerSoft.

Why Should Wall Street Make

All The Money?

Index to Tiger

Insider Trading Charts and Commentary Here.

2010

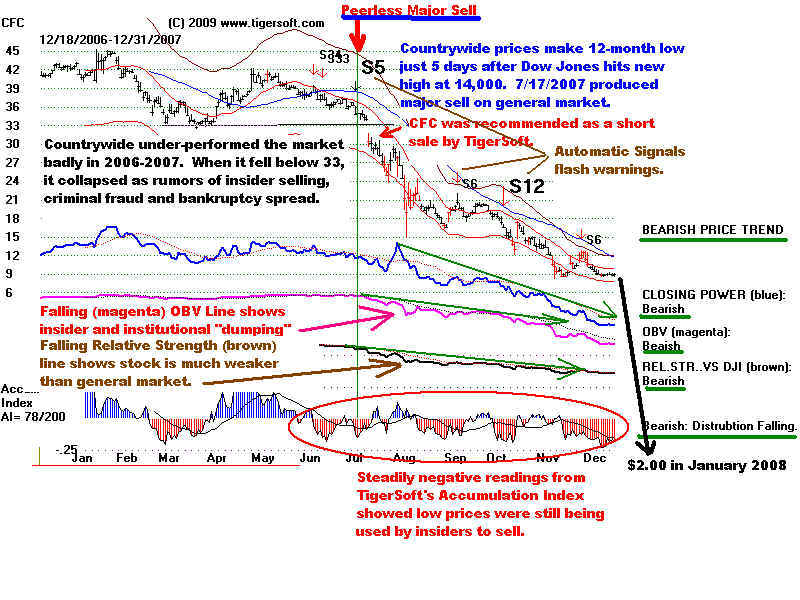

November 23, 2010 Yes, Insider Trading Is

Rampant. Yes, This Destroys Investor Confidence.

Yes,

The Investing Public Is Angry. But, They Should Use TigerSoft To Track These

Insiders.

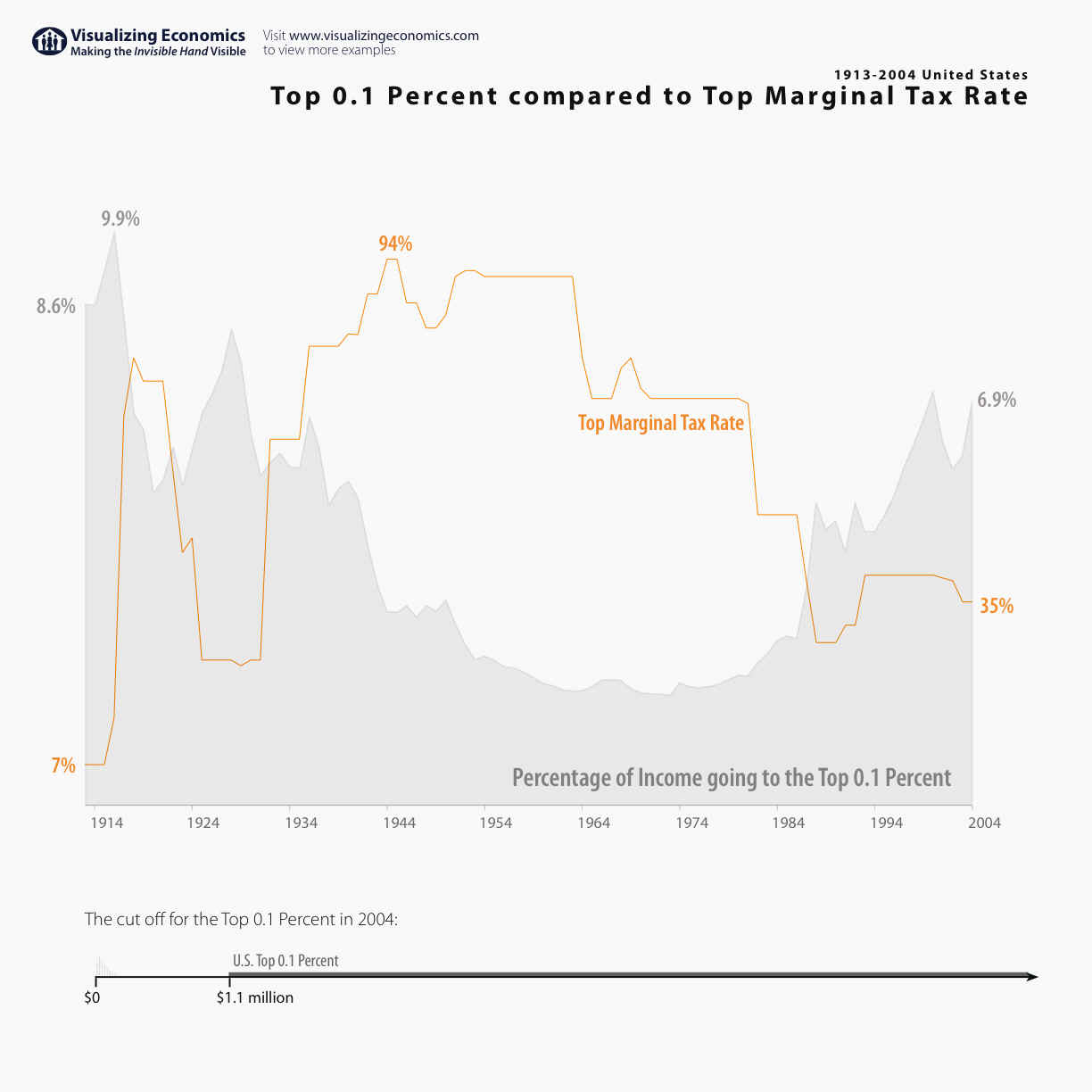

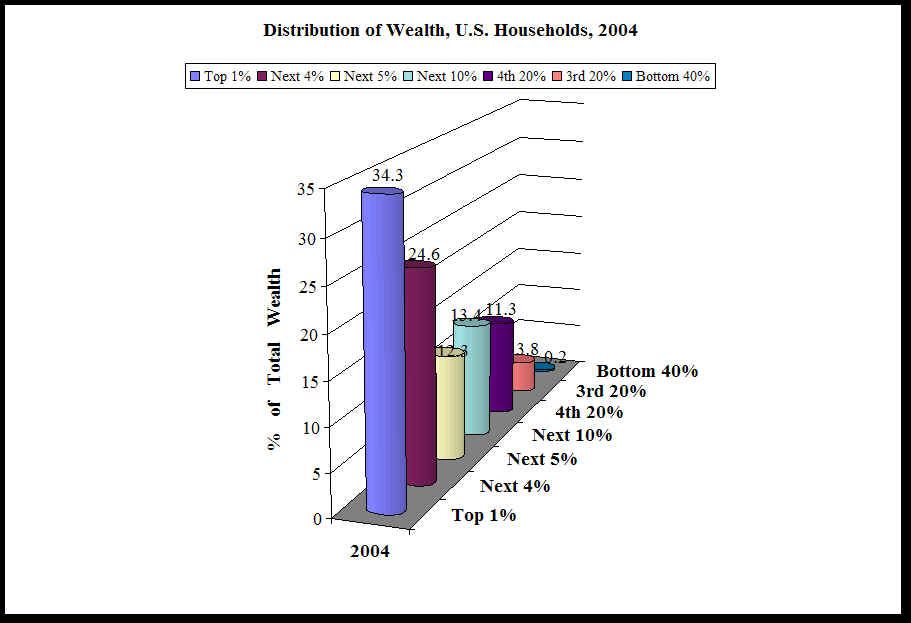

November 15, 2010 America as Plutocracy.

Tax The Rich More, for Goodness Sake. They Have Nearly All The Money.

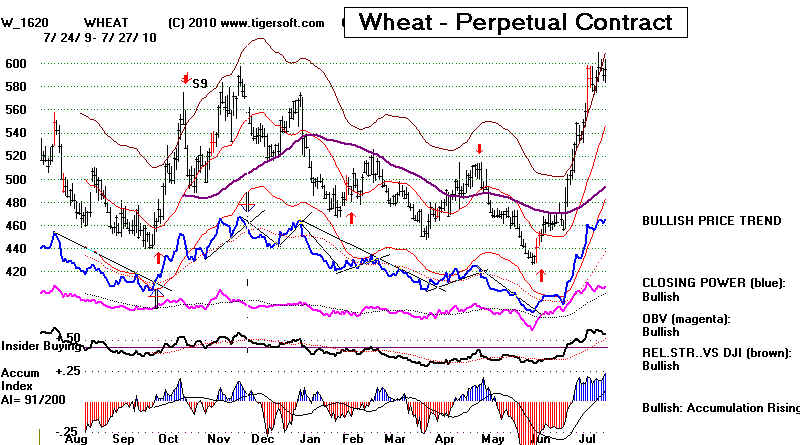

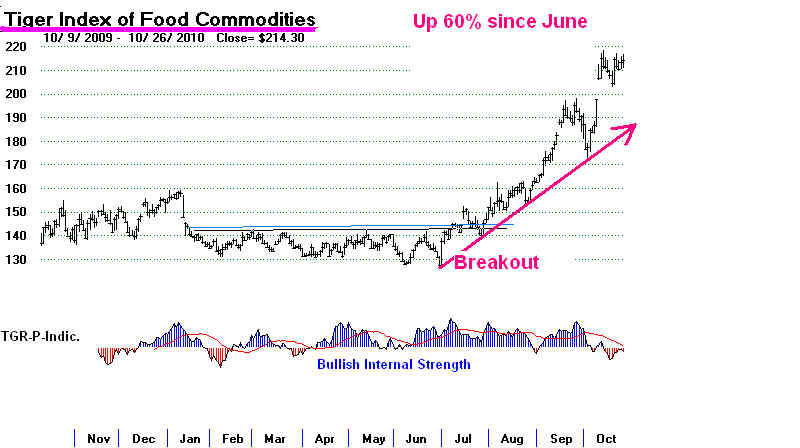

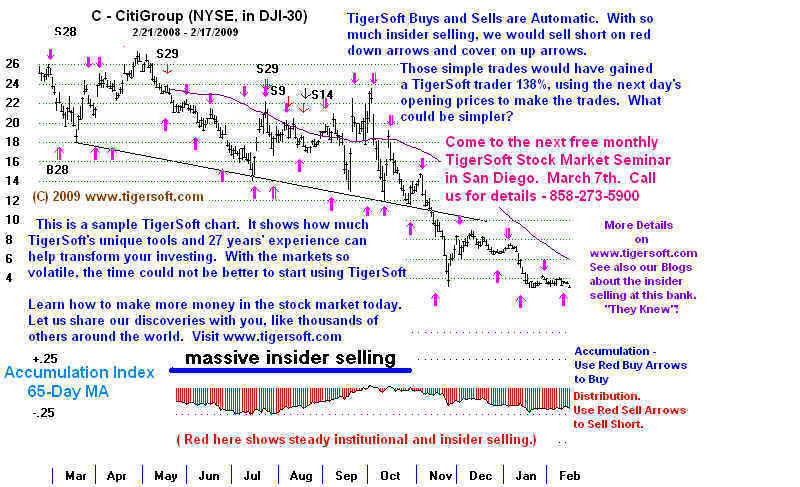

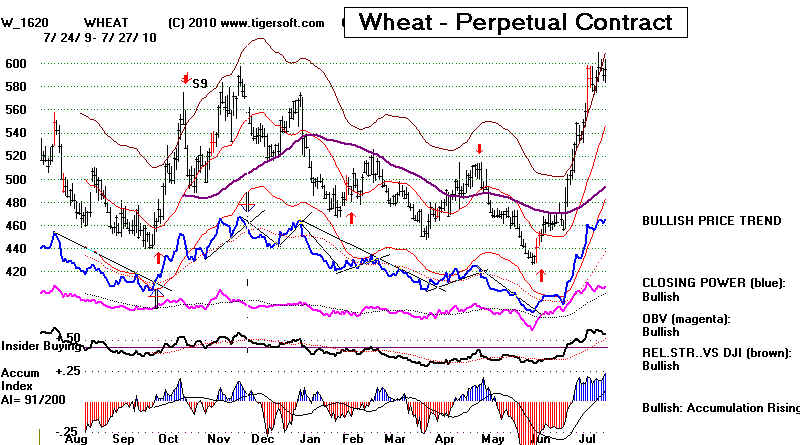

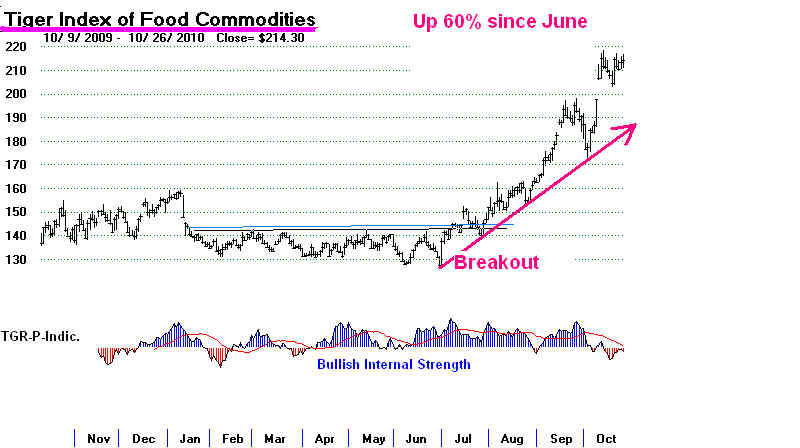

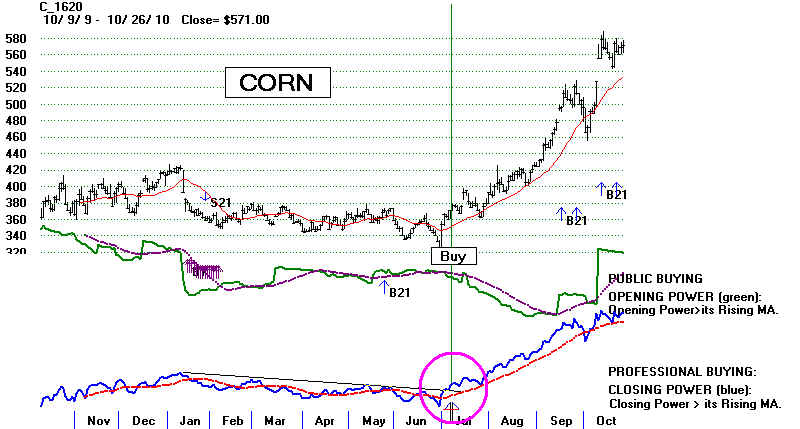

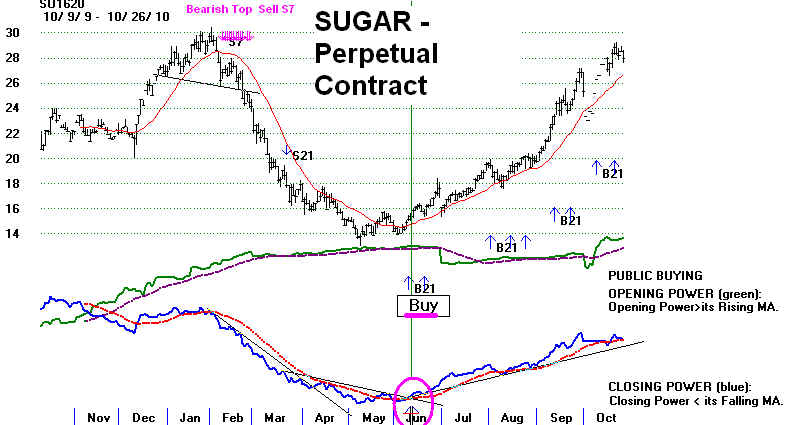

October 27, 2010 Food

Prices Rise 60% since June. TigerSoft Shows How To Spot Such

Advances Early in Their Moves: Professional Buying and Public Selling.

October 27, 2010 America Is

for Sale - CHEAP!

September 29, 2010 The Fed's Printing Press by Any

Other Name Is A Printing Press.

September 18, 2010 Are Biotechs Going To Be Object of

Next Wave of Buyouts? CRXL up 55% on Friday,

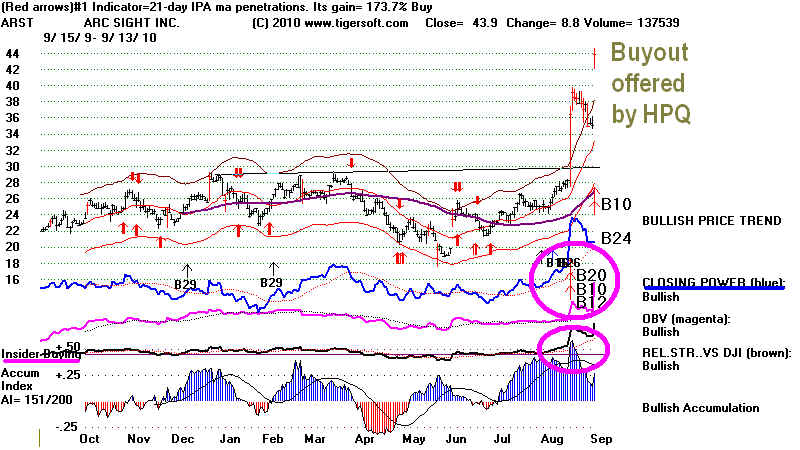

September 14, 2010 Merger Mania and Internet Security

Stocks: MFE, RDWR, AKAM, ARST, NZ

Is Symantec Next? Is This Excess A Sign of A Market Top?

September 10, 2010 "Free" Market Failures.

Lots of Reading for the Curious..

September 9. 2010 The Chicago "Free" Market Mob Is In Charge,

Obama's Has Surrounded Himself with University of Chicago Free-Market

Ideologues and Anti-Keynesians.

Paul Krugman Warns Obama's Adherence to Their Laissez-Faire Orthodoxy will

Cause A New Depression and Could Mortally Wound Democrats in 2010 and 2012..

September 6, 2010 A Labor Day Lament

We Must Tax The Rich. They Have Nearly All The Money.

Aug 31 Chinese Duties of US Chicken Invites Retaliation

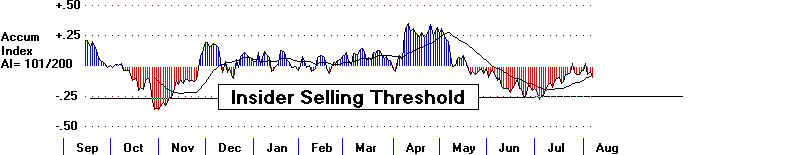

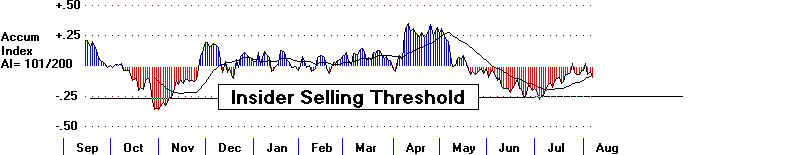

Aug 30 Massive INISDER SELLING. DGFast Channel

Shareholders Should Be Mad as Hell at CEO Scott Ginsburg.

Aug 28 The Colossal Waste of War, Private Contractors and

The Military Industrial Complex

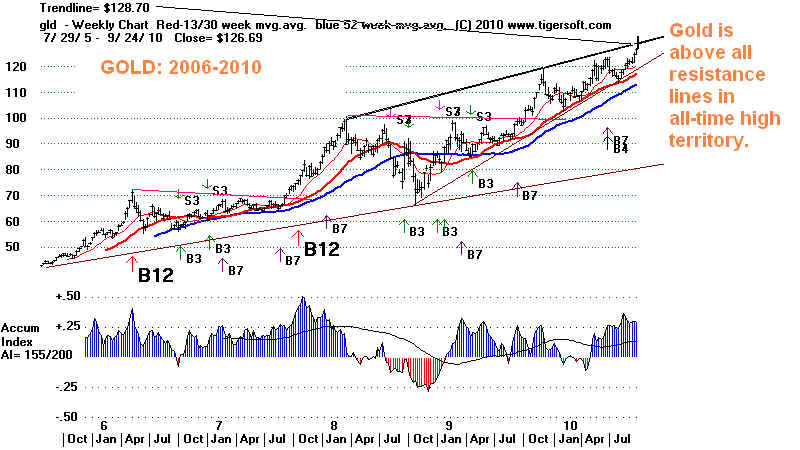

Aug 24 Crude Oil and Gold Warn of Deflation.

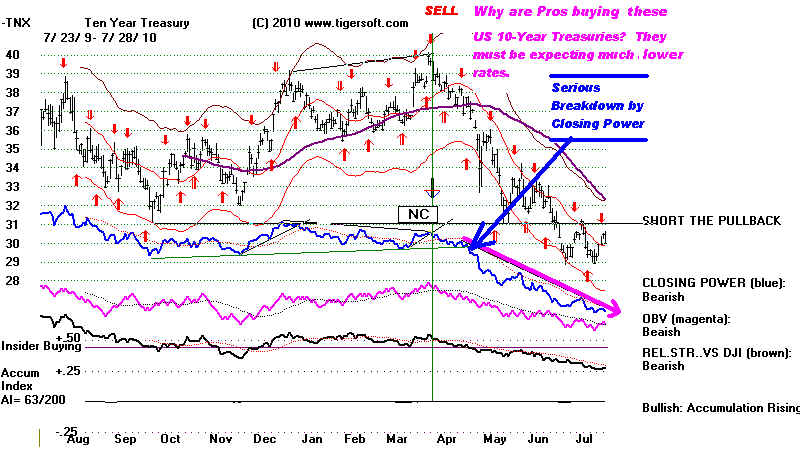

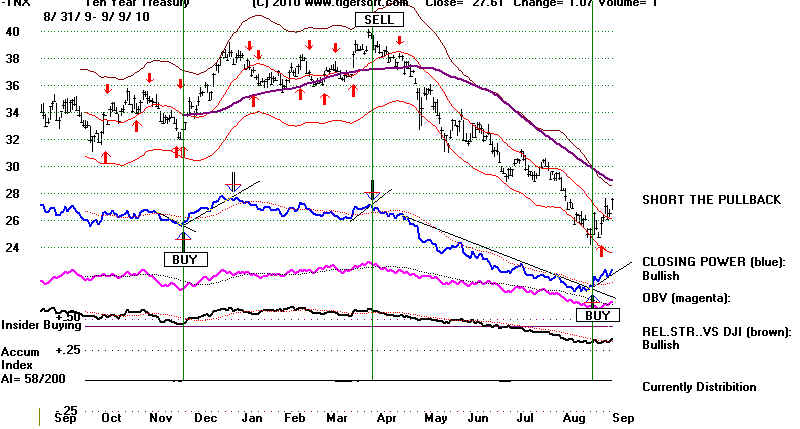

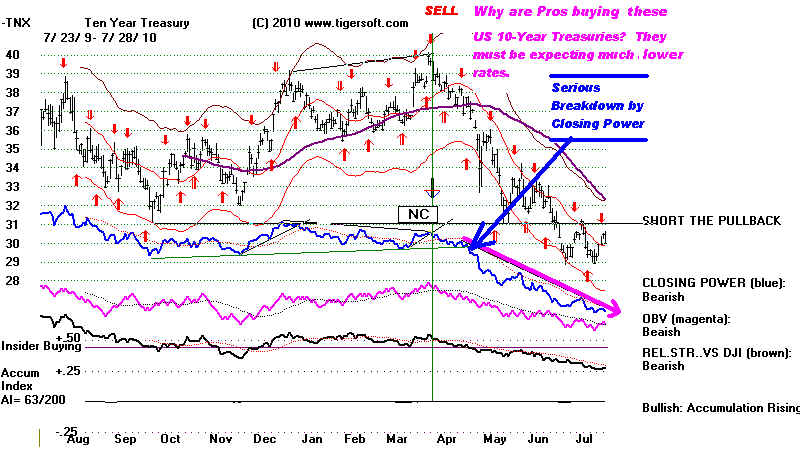

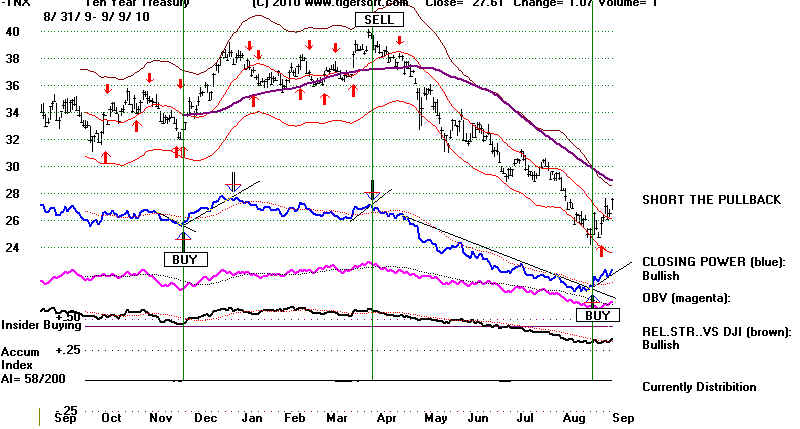

Aug 22 Ten Year Treasuries, Tiger Index of Bond Funds, MFL,

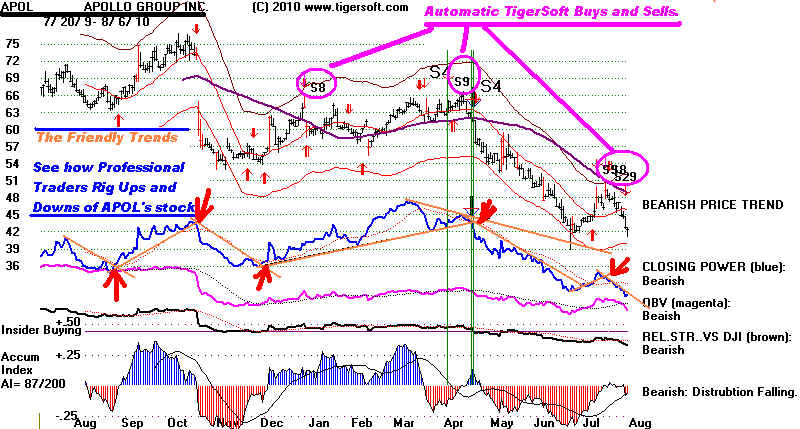

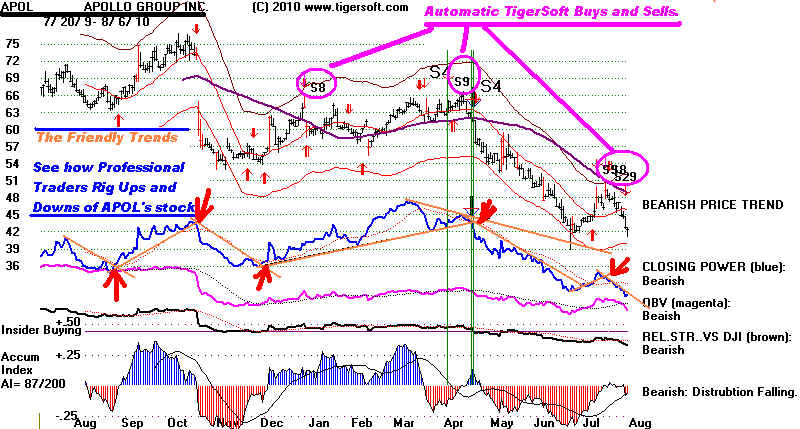

Aug 17 APOL - Peter Sperling's massive insider selling just

before GAO accuses APOL of fraud.

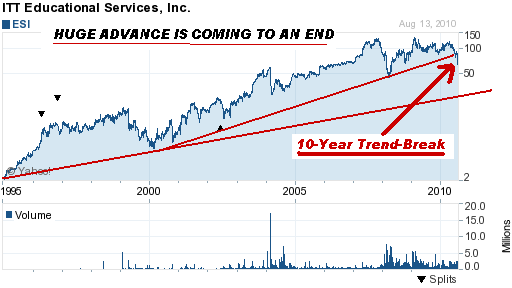

ESI - Blum Capital's costly mistake. They should have used TigerSoft.

Aug 13 Tiger Index of for PROFIT Schools show insider

selling started last November.

Aug 11 Obama is no FDR. FDR's Public Works Program

Aug 10 Peerless SELL on general market.

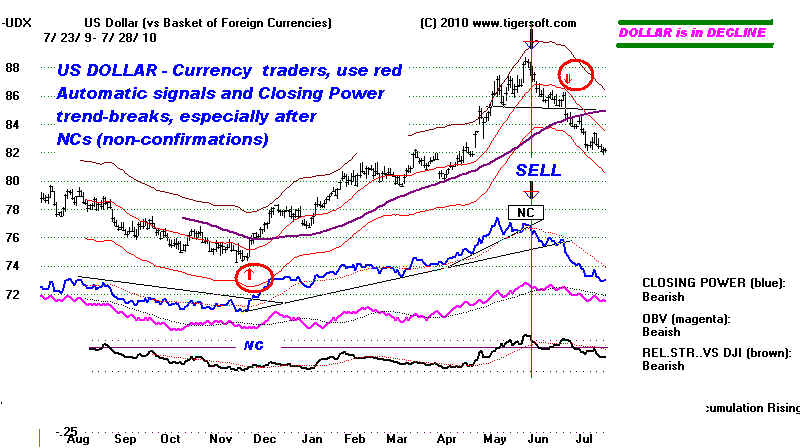

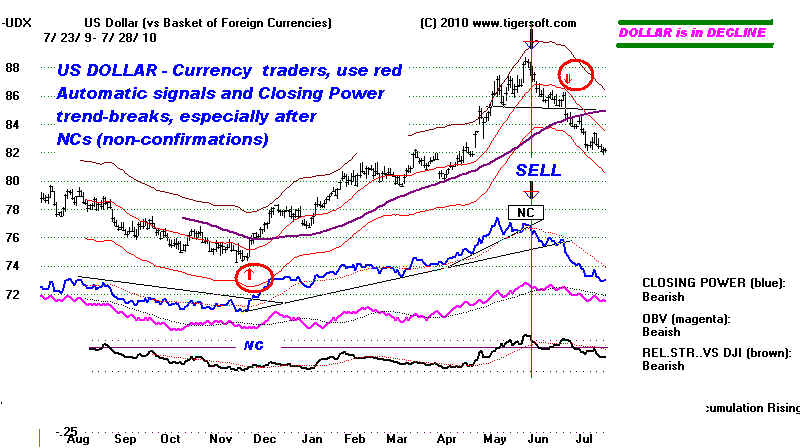

US Dollar

Aug 7 APOL

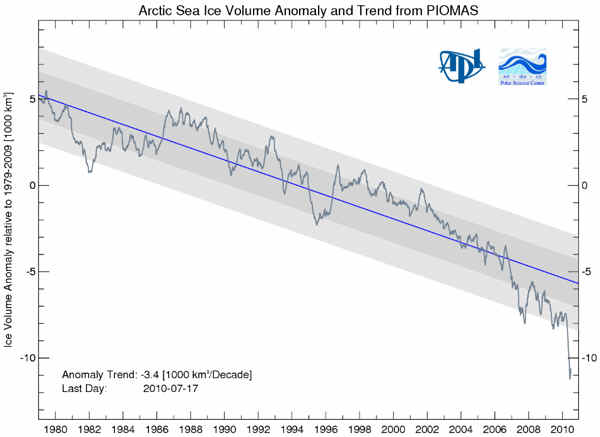

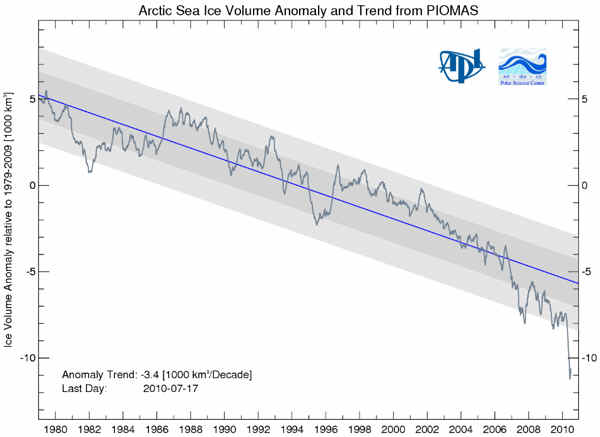

Aug 6 Global Warming and TigerSoft Chart

of Wheat

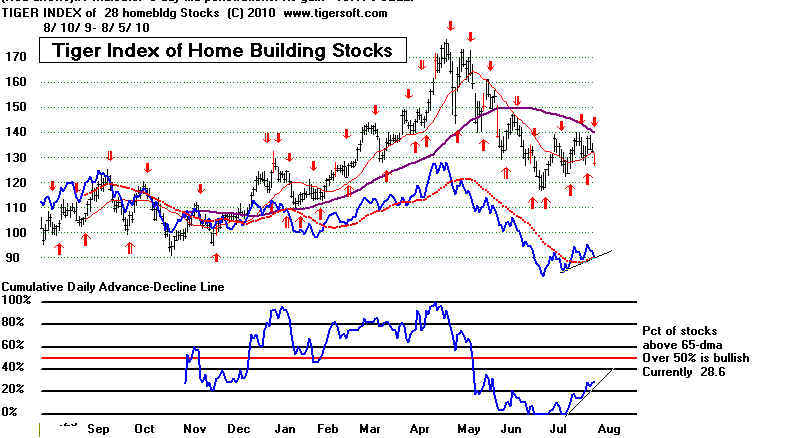

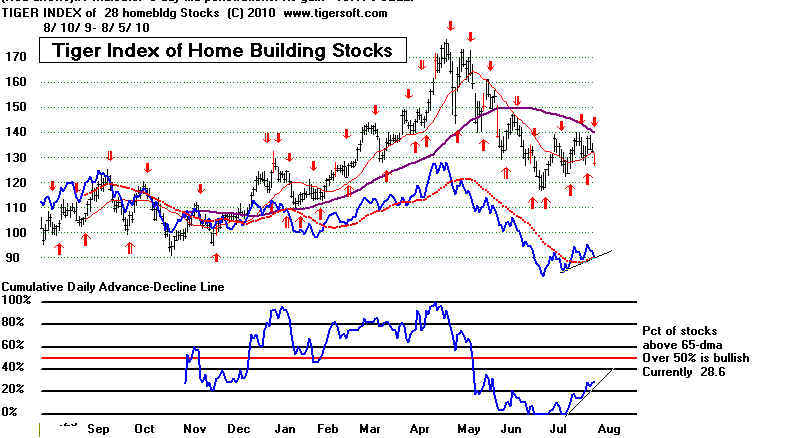

Aug 5 TigerSoft Home Building Index Chart

Aug 4 BYD - How Professionals Rig BOYD's

Stock. No Need To Gamble Here.

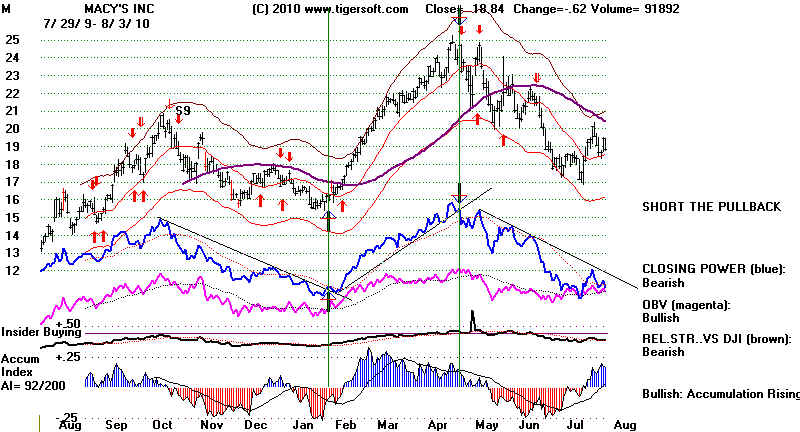

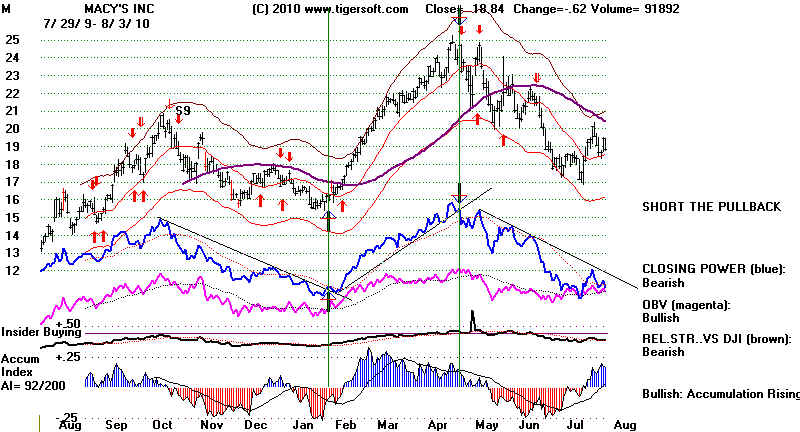

MA - MasterCard M - Macy's

Aug 3 Geithner back Big Banks and fights real

reform. The Betrayal of Main Street by Obama.

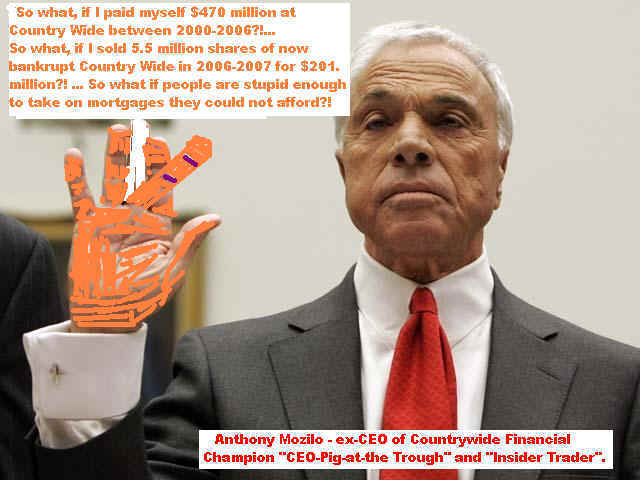

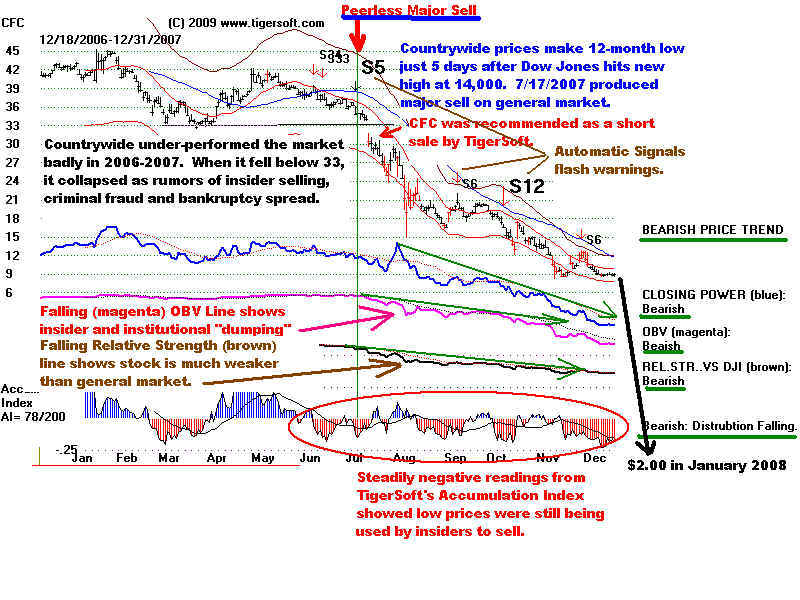

Countrywide settlement gives investors peanuts for its massive fraud..

Multinational Monopolies Do No Need American Workers.

Aug 2 Plutocracy Caused the Crashes of

1907, 1929 and 2008

Aug 1 Trading Chevron Is A Good Way To

Start

July 31 The Rich Senate's Class War against

Most Americans

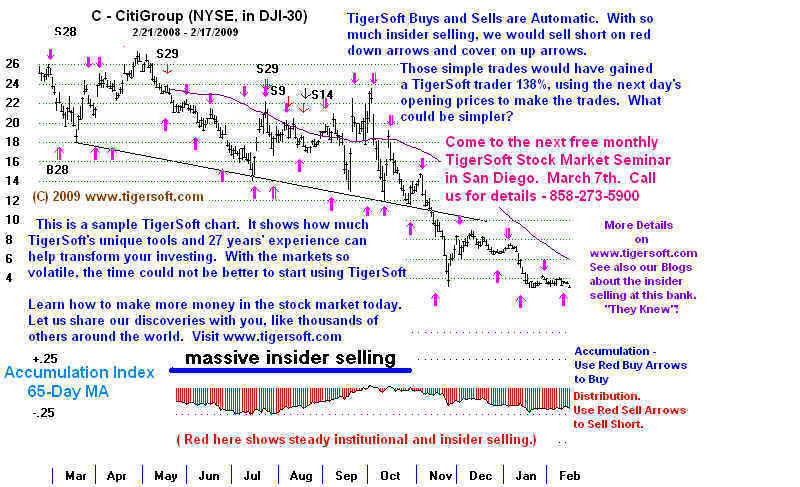

July 39 C Citigroup Proves Lying Pays

Insiders Well

MCO Who Takes Moody's Seriously

Ten Tear Treasuries Make New Lows and US Dollar Falls.

July 29 Profitably Trading Home Builders - BZH

and BHS - Long and Short.

July 28 Consumer Price Index Warns That Another

Market Decline Has Started,

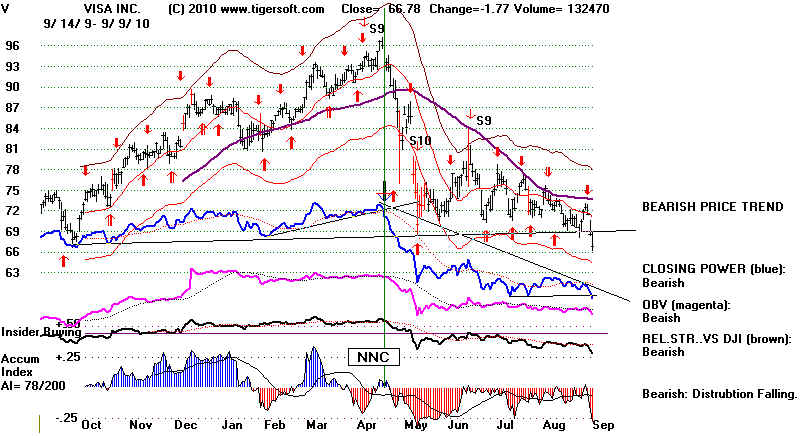

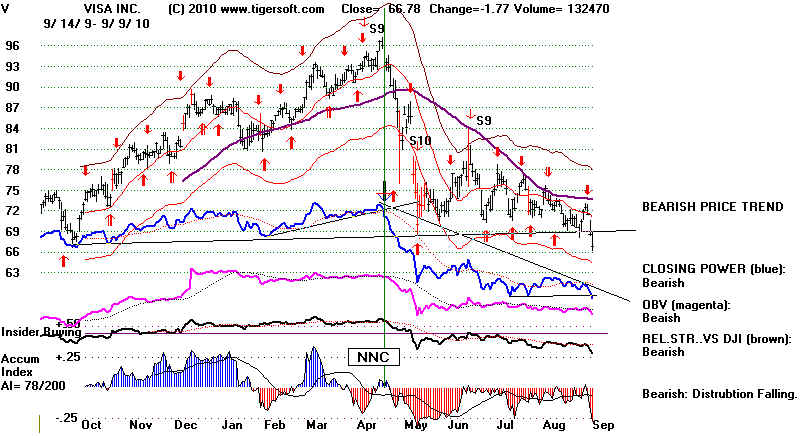

July 27 V - Visa USO - Oil

NEM Gold Stock

Low Velocity Money Supply

Russia, Wheat, Soil Exhaustion and Global Warming

The Pentagon Paper II - America, Afghanistan and WIKILEAKS.org

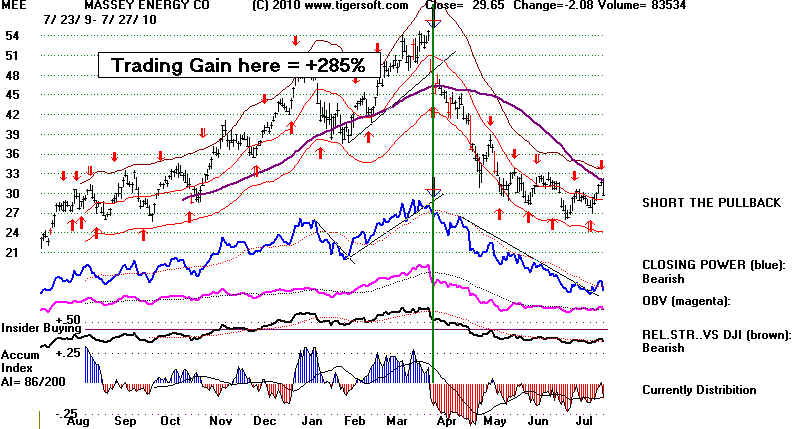

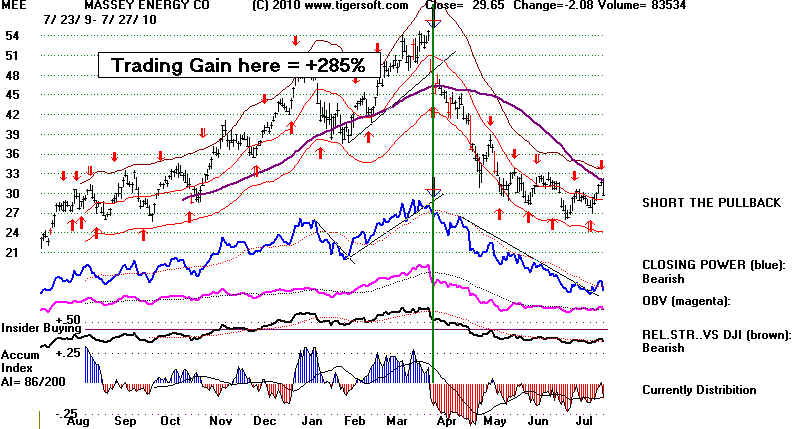

MEE - How Many More Miners Will

Massey Energy's CEO Be Allowed To Kill?

40 million Americans on Meager Food Stamps.

25 Million Americans Wait for Monopoly Finance Capitalism to Provide Enough Jobs.

====================================================================================

November 2010

11/23/2010

FBI and SEC Launch Raiding on Insider Trading.

http://finance.yahoo.com/news/The-SECs-Absurd-War-Against-cnbc-1773887254.html?x=0

Yes,

Insider Trading Is Rampant.

Yes,

This Destroys Investor Confidence.

Yes,

The Investing Public Is Angry.

But, This Is Exactly Why They Should Use

TigerSoft To Track Insiders.

See how Tiger's Inventions, The

Accumulation and Closing Power

early on distingush a stock about to rise

steeply from one about to

collapse:

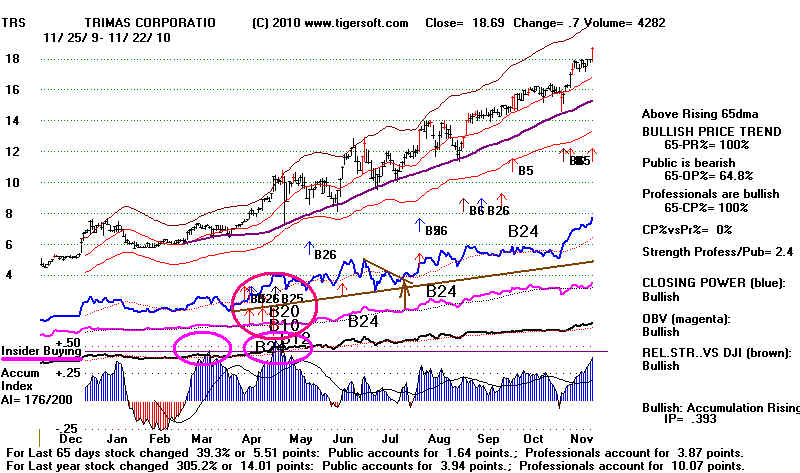

Typical

Cases of Recent Insider Buying:

TRS,

VRNT, FFIV

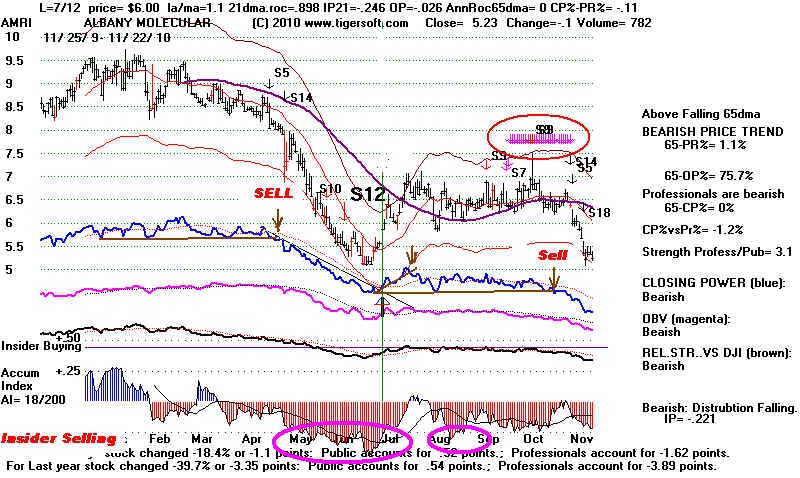

Typical

Cases of Insider Selling: ALNY, AMRI, BAC

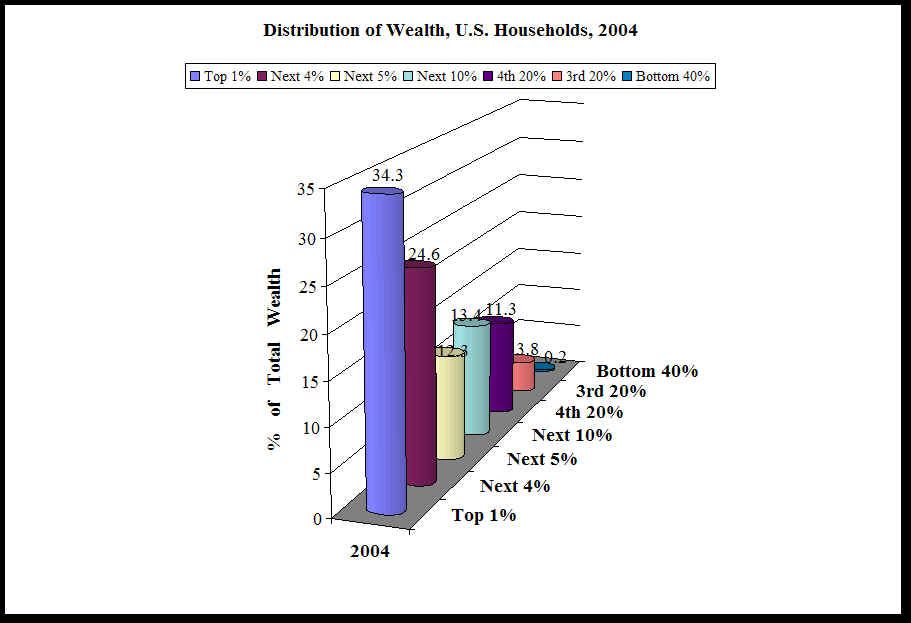

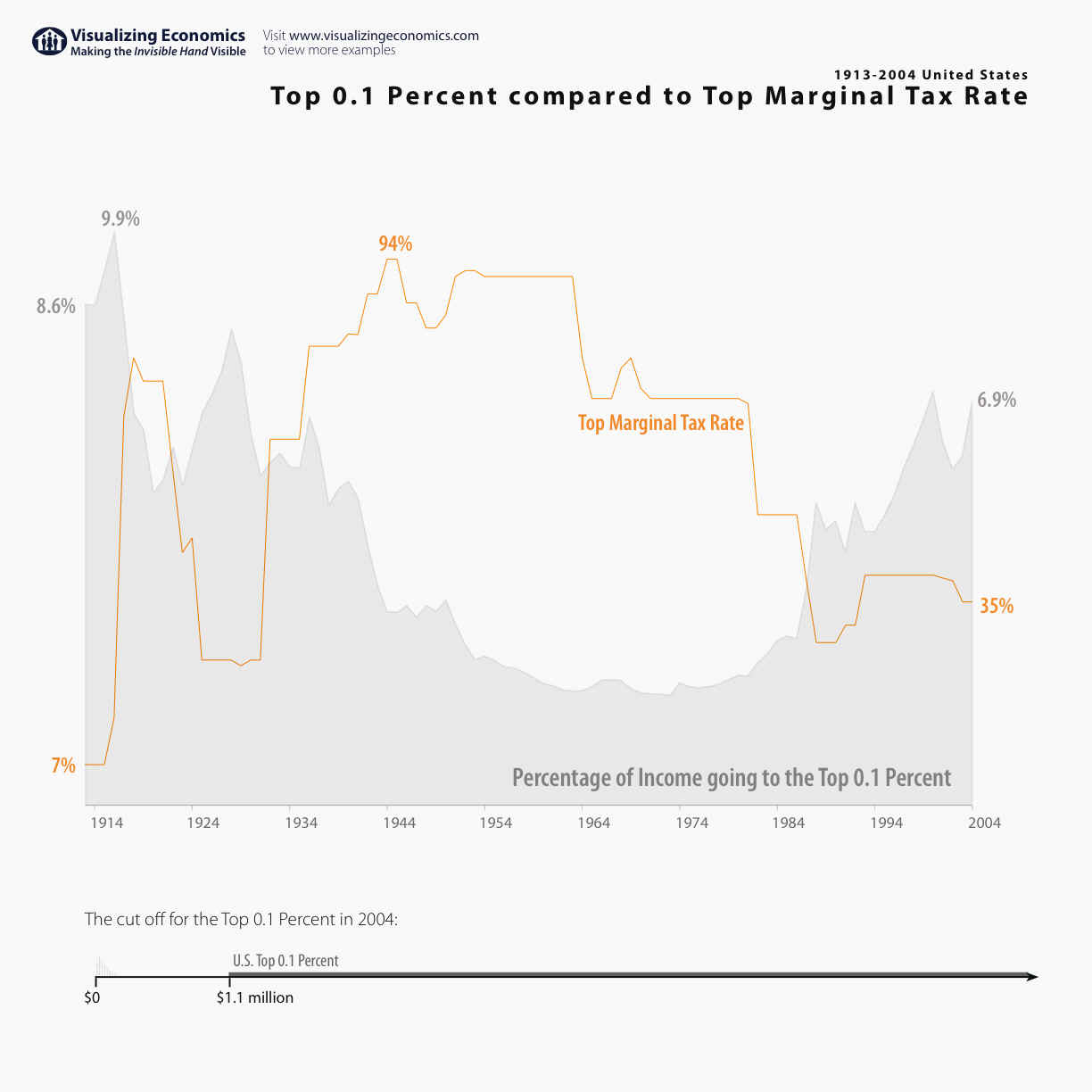

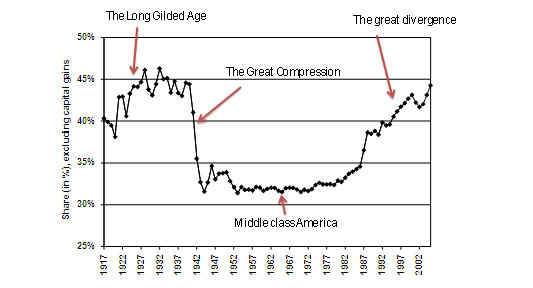

11/15/2010 Tax The Rich

More, for Goodness Sake.

They Have Nearly All The Money.

Why must Republicans be so solicitous of the

very wealthy? Why do the

rich need the Bush tax breaks? Why can't Obama stand up, just a little, for the

people who voted for him. The Treasury has been looted by Halliburton and

the Wall Street banks. The Bush tax cuts will have given the rich a trillion dollars

more by 2020 if extended. With executive pat and bonuses rising again and

real unemployment at 17% and pay down sharply, the rich have nearly all the

money now. They are the only ones who can pay any more taxes!

I remember the 1950s when the economy was booming. The marginal

iax rate for the rich was 90%.

The wage gap between the rich and poor

is the widest it has ever been.

Washington allowed this. The political system is clearly a plutocracy. The

only

thing missing are corporate logos on the American flag.

The "Democratic" Congress did

nothing about outsourcing of jobs. That's

not an oversight. Their corporate sponsors do not want things changed.

Obama's Budget Deficit Panel refuses to consider any increases of taxes

on the super rich. Instead, they want Social Security to renege on their promise

to the elederly and raise the age of retirement with full social security to 69

from 65 1/2,

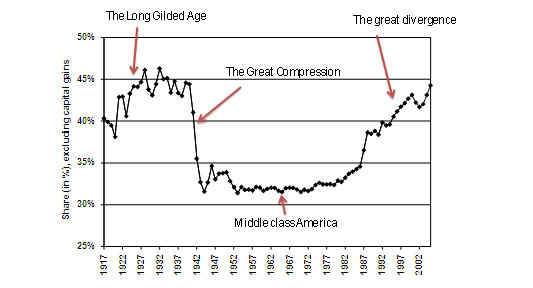

"The percent of income garnered by the wealthiest 10% of U.S. households hit 48.2%

in 2008, up from 34.6% in 1980, according to a

recent report on income equality by the Congressional Joint Economic Committee.

"Much of the spike was driven by the share of total income accrued by the richest 1%

of households. Between 1980 and 2008, their share rose from 10% to 21%, making the United

States one of the most unequal countries in the world."

"And the income gap has actually widened since the financial crisis: According to

the 2010 Census, the top 20% of workers -- those making more than $100,000 each year --

received 49.4% of all income generated in the U.S., compared with the 3.4% earned by those

below the poverty line. As

reported by Slate.com, that ratio of 14.5-to-1 was an increase from 13.6 in 2008 and

nearly double a low of 7.69 in 1968. (See: "Great

Recession" Pushes Gap Between Rich and Poor to Record Levels)

SOURCE

The Rpublicans would extend the Bush tax cuts

for the very richest.

Nobel prize winning economist Paul Krugman writes:

"What’s at stake here? According to the nonpartisan Tax Policy Center, making all of the

Bush tax cuts permanent, as opposed to following the Obama proposal, would cost the

federal government $680 billion in revenue over the next 10 years. For the sake of

comparison, it took months of hard negotiations to get Congressional approval for a mere

$26 billion in desperately needed aid to state and local governments.

"And where would this $680 billion go? Nearly all of it would go to the richest 1

percent of Americans, people with incomes of more than $500,000 a year. But that’s

the least of it: the policy center’s estimates say that the majority of the tax cuts

would go to the richest one-tenth of 1 percent. Take a group of 1,000 randomly selected

Americans, and pick the one with the highest income; he’s going to get the majority

of that group’s tax break. And the average tax break for those lucky few — the

poorest members of the group have annual incomes of more than $2 million, and the average

member makes more than $7 million a year — would be $3 million over the course of the

next decade.

"How can this kind of giveaway be justified at a time when politicians claim to

care about budget deficits? Well, history is repeating itself. The original campaign for

the Bush tax cuts relied on deception and dishonesty. In fact, my first suspicions that we

were being misled into invading Iraq were based on the resemblance between the campaign

for war and the campaign for tax cuts the previous year. And sure enough, that same

trademark deception and dishonesty is being deployed on behalf of tax cuts for the

wealthiest Americans.

"So, for example, we’re told that it’s all about helping small business;

but only a tiny fraction of small-business owners would receive any tax break at all. And

how many small-business owners do you know making several million a year?

"Or we’re told that it’s about helping the economy recover. But

it’s hard to think of a less cost-effective way to help the economy than giving money

to people who already have plenty, and aren’t likely to spend a windfall.

"No, this has nothing to do with sound economic policy. Instead, as I said,

it’s about a dysfunctional and corrupt political culture, in which Congress

won’t take action to revive the economy, pleads poverty when it comes to protecting

the jobs of schoolteachers and firefighters, but declares cost no object when it comes to

sparing the already wealthy even the slightest financial inconvenience. "

OCTOBER 2010

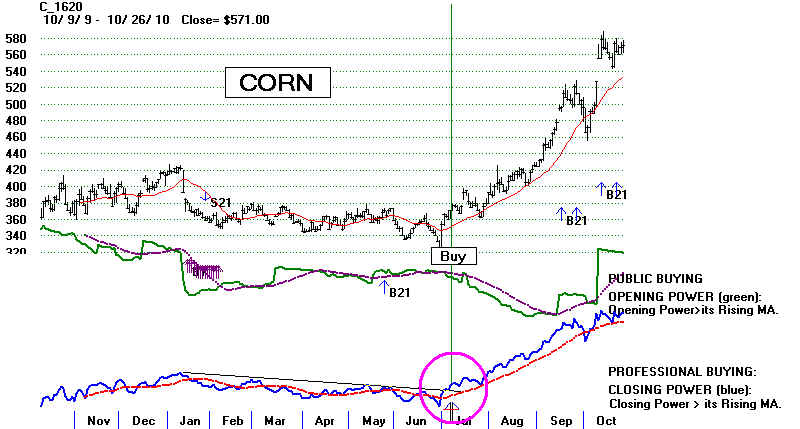

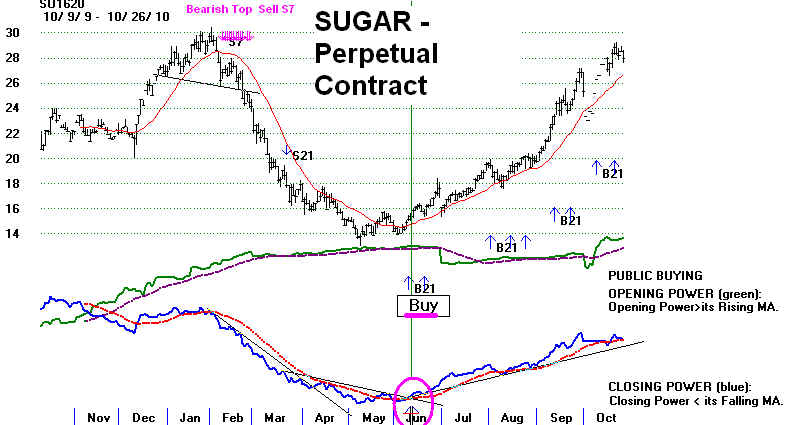

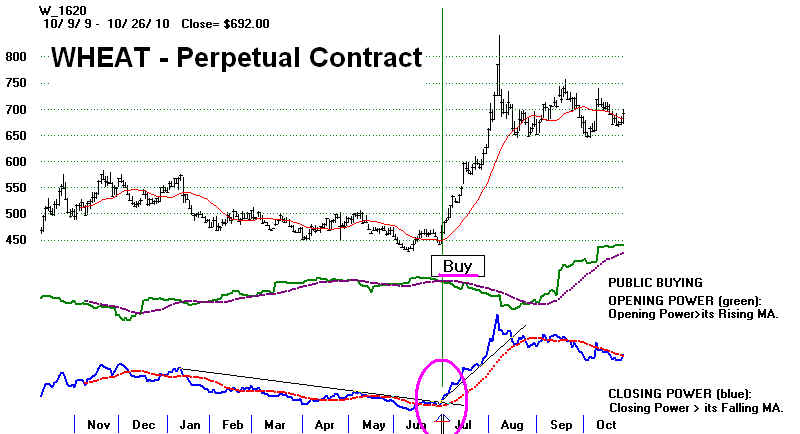

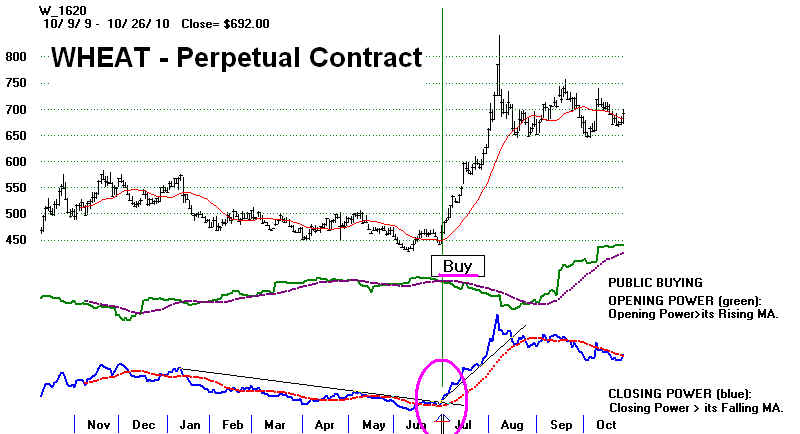

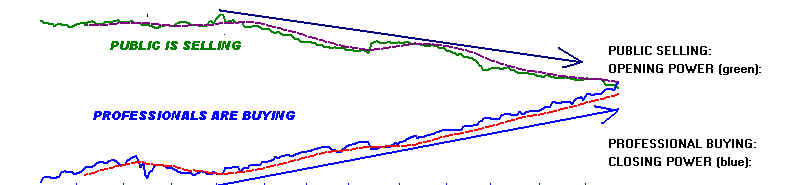

10/28/2010 Surging Food Prices

The weaker Dollar and Russian Grain

Crop failure have sent food prices up

sharply. Professional buying and Public selling as measured only by TigerSoft

marked the start of their advances.

For

many families, supermarket savings are just a few coupons away.

Get coupons at CouponMom.com, Coupons.com

and CouponCabin.com).

These commodities are traded best with

Tiger's Professionals' Closing Power.

See how its advancing while Public Buying declines maked the start of the biggest

advances in CORN, COFFEE, OATS, SOYBEANS, SUGAR and WHEAT.

CORN

|

COFFEE

|

OATS |

SOYBEANS

|

SUGAR

|

| WHEAT

|

10/26/2010

America Is For Sale Cheap...

Thank to Wall Street

sponsored boom in Crude Oil to $145/bar Middle Eastern

Sovereign Wealth Funds are loaded with cash. And they're buying parking meters

in Chicago, a A toll highway in Indiana, the Chicago Skyway. A stretch of highway in

Florida.

Parking meters in Nashville, Pittsburgh, Los Angeles, a port in Virginia, and numberous

Californian public infrastructure projects,

"America is quite literally for sale, at rock-bottom prices, and the buyers

increasingly

are the very people who scored big in the oil bubble. Thanks to Goldman Sachs and

Morgan Stanley and the other investment banks that artificially jacked up the price of

gasoline

over the course of the last decade, Americans delivered a lot of their excess cash into

the coffers

of sovereign wealth funds like the Qatar Investment Authority, the Libyan Investment

Authority,

Saudi Arabia's SAMA Foreign Holdings, and the UAE's Abu Dhabi Investment Authority.".

http://www.rollingstone.com/politics/news/17390/222206?RS_show_page=0

SEPTEMBER 2010

9/29/2010 The Fed's Printing Press IS Not Such A Bad Thing.

Would

You Prefer A Stock Market Collapse?

The FED is buying US Government Debt, but with what?

Fed

officials clash over efforts to aid economy- AP

See also Bernanke's

asset purchase program could reach $2 Trillion.

This is just printing money

by a different name. Which, by the way, I favor.

Bailing out the banks has hurt the economy, Let the banks get paid back in money

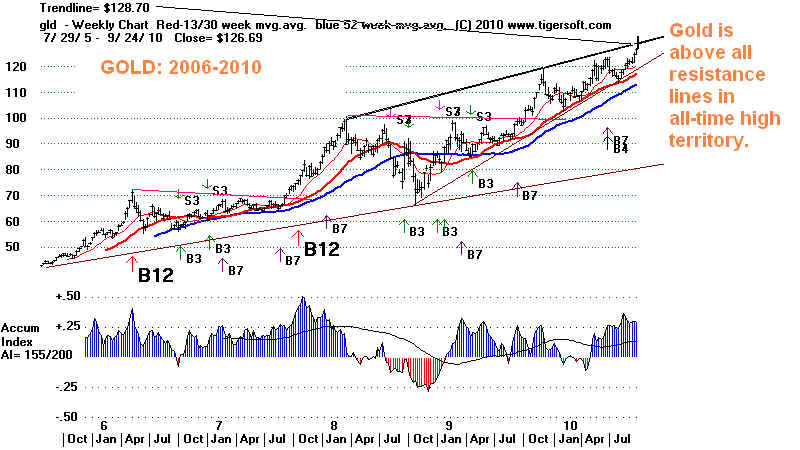

that has depreciated by 33%! Gold and

Silver will rise meanwhile.

The Dollar will not totally collapse, as right wingers say, because it is needed

internationally

as the single most important medium of exchange and the world markets are gaining

steam on their own. And because the FED is NOT the 1929-1932 FED.

In my opionion, liberal FED policies are necessary until an FDR like PUBLIC WORKS

PROGRAM ON A MASSIVE SCALE is launched to provide jobs and get the economy

back on track by boosting the urchasing power of everyday people instead of banks and

bankers.. Chicago Economic Thinking has completely hamstrung Obama. He is no FDR.

Unfortunately, Republicans are neo-Hooverites. Right now, we are doomed without Bernanke's

printing press. In the long

run, we are doomed without a new third party, a people's party,

that promotes socialism for job creation instead of just for the military. Taxing the rich

as they were taxed in the 1950s will get us out of this mess, provided US corporations are

not

allowed to export jobs! FREE TRADE thinking IS DANGEROUSLY EXPENSIVE now!

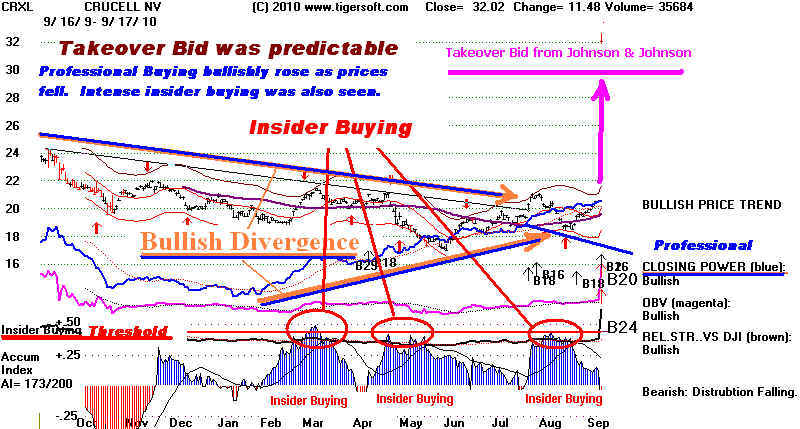

9/18/2010

Are Biotechs Going

to Become The Next Wave

of Mergers.

Going

through the Biotechs, we see how well TigerSoft's indicators measuring Insider and

Professional buying worked to predoct the big advances of

ABII - Perfect Accum Buy on pullback to 65-dma - 11/24/2009 34.00 Now 75.

ACEL - Low Priced Speculative play 0.43 + .11 on Friday.

ARTC - Perfect Accum Buy on pullback to 65-dma - 11/2/2009 19.40 Now 25.81

AZN - Perfect Accum Buy on Close back above 65-dma - 6/1/2010 45.02 Now 52.05

BMRN - Shows Insider and Professional Buying.

BVF - Running after very high insider buying and breakout.in June.

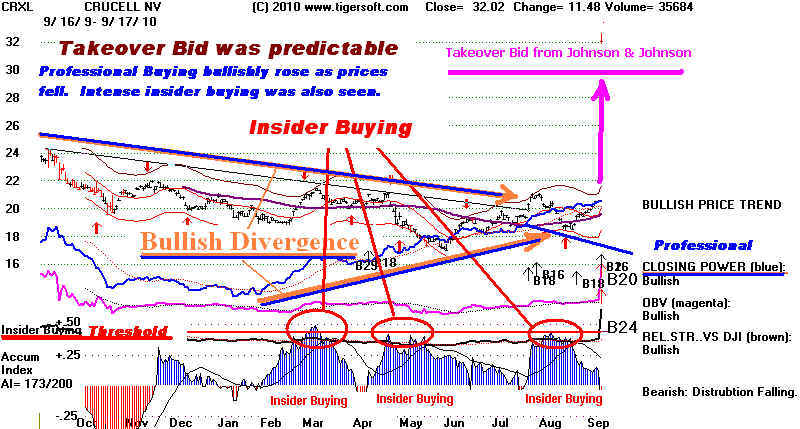

CRXL - Classic buy out: extensive insider and professional buying.

EMIS - Extensive insider and professional buying. Big Advance. Major Sells and Fizzle.

IDT - Extensive insider and professional buying. Big Advance.

ILMN - Extensive insider and professional buying. Starting up again.

MDM - Insider and professional buying.

NPSP - Insider and professional buying. Watch for new breakout run.

PCYC - Insider and professional buying.aplenty.

SNMX - Insider Buying. Resistance at 4.75. Watch CLosing Power for sign of

next advance.

TGEN - Insider Buying and Strong Closing Power. Bullish.

VPHM - Insider Buying Buy at 9.86 on 2/11. Resistance at 4.75.

Watch CLosing Power for sign of next advance.

YMI - Recent insider buying with strong Professional CLosing Power.

I See Tiger Insider Trading Charts for

these stocks.

On

Friday, Johnson & Johnson said that is planning to acquire CRXL. This is a

Swine and Bird Flu stock.

It showed all the signs we usually see before a buy-out:

1) Spikes of Insider Buying from Tiger's Accumulation Index and

2) Heavy Professional Buying from Tiger's Professional Closing Power Rise while

prices fell.

See how TigerSoft spots the

buy-outs BEFORE the public announcement.

Use TigerSoft's Insider Trading Charts to Check Who's Buying/Selling Any

Stock/Commodity...

Automatic Signals: http://www.tigersoft.com/welcome5.htm

http://www.tigersoft.com/--2--/index.html

Insider Buying/Selling http://www.tigersoft.com/Insiders/index.html

http://www.tigersoft.com/--3--/index.html

http://www.tigersoft.com/--6--/index.htm

http://www.tigersoft.com/Automatic-Signals/index.html

http://www.tigersoft.com/welcome4.htm

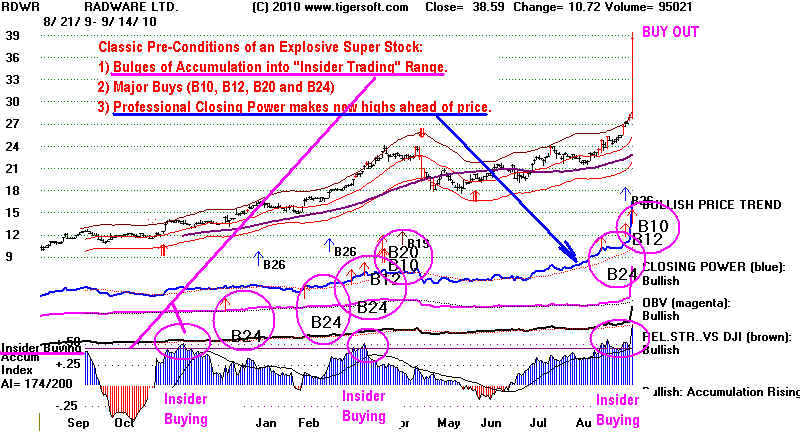

9/14/2010

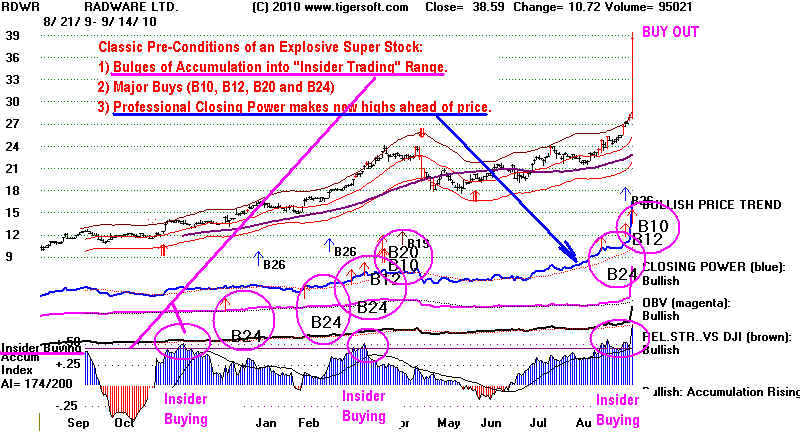

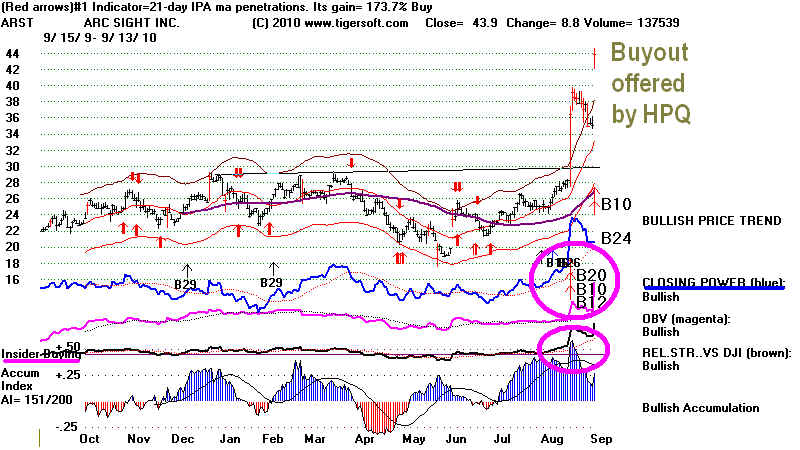

Merger Mania and Internet Security Stocks:

MFE, RDWR, AKAM,

ARST and NZ...

See how TigerSoft spots the

buy-outs BEFORE the public announcement.

Barrons.com (Wed, Sep 8)

Netezza Up 11%

On Takeover Rumors; Cancels Investor Dinner - Tech

Netezza Corporation provides data warehouse, analytic, and monitoring

appliances to enterprises, mid-market

companies, and government agencies in the United States and internationally. It offers

TwinFintm and Skimmertm data

warehouse products, which integrate database, server, and storage.

Is Symantec next?

Is Symantec next?

Can the big boys of the corporate world afford not to have one

of these security companies under their umbrella? That's the pitch given now by

Mergers and Acquisition salesmen. Could all this be just a last splashy buying

spree showing how ultimately emotional the multi-million dollar corporate heads are?

TigerSoft's Insider Trading chart of SYMANTEC (SYMC) is show below, then RDWR and

ARST, the day they took off.

SYMANTEC Netezza, Symantec

jump on takeover rumors

| Insider Purchases - Last 6

Months |

|

Shares |

Trans |

| Purchases |

60,000 |

3 |

| Sales |

1,525,580 |

42 |

Net Shares Purchased

(Sold) |

(1,465,580) |

45 |

| Total Insider Shares Held |

2.39M |

N/A |

% Net Shares Purchased

(Sold) |

(38%) |

N/A |

-------------------------------------------------------------------------------------------------------

9/10/2010

Despite How Glaringly Obvious are The Failures of

The "Free Market", Obama Still Promotes This Myth

And Lets Millions Suffer... He Was Elected To Lead

in A New Direction. He and His Party Have Failed Terribly.

Just 21 years ago after the collapse of

the Soviet Union, Socialism and Marxism

were dismissed as complete failures. The "free market" seemed vindicated

to many. But, now the boom and bust of Wall Street, the trillion Dollar bailout

of banks too big to fail, a real unemployment level of 15%, homelesness,

escalating medical insurance costs, unending wars a world away, Global Warming

and the obvious domination of both political parties by Wall Street show that

Americans needs to fundamentally change the status quo. Even now, Wall Street

behaves as though everything is back to normal.

America and The Planet Can No Longer Afford To Be Guided

by This "Free Market" Ideology Whose Sole Purpose Now

Is To Befuddle Common Sense and Protect The Rich and Powerful.

Lots of Reading for the Curious.

2008 OBAMA: "I am a pro-growth, free-market guy. I

love the market.

I think it is the best invention to allocate resources." (Source.)

In theory this means, businesses are regulated through the dictates of supply and

demand.

Prices and and distribution are controlled by business owners and investors. Profits are

distributed among the owners and shareholders. In a word, "greed is good".

Obama was either being naive or

telling the rich and powerful that he was no threat.

If we really had a free market, the Wall Street banks that made stupid investment

decisions

would now be bankrupt, to be replaced by more intelligent banks and managers. Instead

they have been “bailed out” -- at taxpayer expense -- and permitted to continue

with

hardly any new restrictions. (B

Very few industrues are competitive. Most are "oligopolies" and dominated by a

just a few corporations.

For example, as of fourth quarter 2008, Verizon, AT&T, Sprint Nextel, and T-Mobile

together control

89% of the US cellular phone market...Firms may employ restrictive trade practices

(collusion, market

sharing etc.) to raise prices and restrict production in much the same way as a monopoly. Where there

is a formal agreement for such collusion, this is known as a cartel. A primary example of

such a cartel

is OPEC which has a profound

influence on the international price of oil.

Many examples: Airlines, tire, banking, autos, steel, soft drinks, tobacco, TV networksm

film, aluminum,

cell phone, gas distribution, music companies (4), beer, healthcare insurance and corn

flakes.

Anti-trust laws are no longer enforced very much. The result is higher priced

products, slower

innovation and emphasis on TV marketing. Prices are set by leaders where outright

collusion might

bring legal action.

Corporations depend heavily upon government handouts and contracts.

Corporations have bought Congress and the Networks and subverted Democaacy..

The very rich have so much political power, they cannot be challenged and so get richer.

Corporations are run as fiefdoms with those on top getting huge salaries that often bear

no realtionship

to their true productivity and the company's success.

America has lost its indistrial and manufacturing base to the international free traders..

American workers are being impoverished more and more. It is ti the interest of the

corporation to pay as low as possible to Labor.

Boom (greed unmitigated) and Busts (unmitgated fear) cause severe unemployment for

unbearably long periods of time.

Economic decisons are made with very imperfect information, because of the pervasive

corporate

misinformation, fraud and concealment of relevant information to shareholders and

consumers.

Pollution is inevitable. Corporations want to operate as cheaply as possible.

Over-all concerns

about the planer are not the concern of a business seeking to maximize profits.

Finite and non-renewable energy resources and food (fish) are exhausted. Long-term,

future and

global concerns are secondary to exploiting resources to maximize profits in the present..

See http://www.huppi.com/kangaroo/Marketfailures.htm

--------------------------------------------------------------------------------------------------

9/9/2010

Obama and The Chicago

ECON "Free" Market Mob

9/10/2010 Adding to my concerns

about how much Obama is dependent on

on the advise of right-wing "free matket" ideologues in the middle of a

gathering

Depression, Obama announced today that he is appointing 41-year old

Austan Goolsbee to head his Council of Econimic

Austan Goolsbee to head his Council of Econimic

Advisers. Where is he from? University of Chicago Business School.

Born in Waco, Texas.

He went to Yale and was in the top secret.

well-connected internationalist Skull and Bones secret society that

helped promote 2 Bushes and John Kerry towards the Presidency.

With a Ph.D. from MIT, Goolsbee's academic research, his bio says,

has focused on the internet and government policy.

Jon Stewart describes him as "Eliot Ness meets Milton Friedman".[Source]

"

He has respeatedly advocated more international

free trade.

Is he afraid of America's loss of its manufacturing base and

the outsourcing of millions of American jobs? Not hardly!

Goolsbee says globalization is responsible for only"a small fraction"

of today's income disparities. He completely omits mention of how

exorbitant CEO pay has become. He avoids talking about misuse

of power by boardroom cronies running corporations.

He says that "60 to 70 percent of the economy faces virtually

no international competition." America's 18.5 million government

employees have little to fear from free trade; so do auto

mechanics, dentists and many others. " He has bought the

University of Chicago "free trade" nonsense hook line and sinker.

Has he any real experience in a town who manufacturing base

has left to go overseas? Source.

Obama' is destroying the Democratic Party. More and more people

do not see Democrats making any difference to the unemployed and poor.

http://finance.yahoo.com/news/Special-Report-Bluecollar-rb-1762182256.html?x=0&sec=topStories&pos=4&asset=&ccode=

The chartible view of Obama is that he is professorial, aloof and stubbornly

holds to the belief that he can win over Republicans by compromise.

Less charitable and more common view is that he a corporate sell-out

who has placed the needs of Wall Street above those who voted for him.

See

the discussion created by a piece entitled "Unilateral Disarmament

Has

Destroyed The Democrats."

THE DISCONTENT WITH DEMOCRATS IS GROWING

"We're not stupid. We know that he strode into the white house

with near historic pluralities

and MASSIVE, much more than any president since Truman, public support. He had all he

needed to

affect meaningful change which would have improved the lives of all americans..We know he

eschewed all

that from his first day. We saw him and his party take a chain saw to a "stim"

before the Rs even

demanded anything. And that was the highlight of his admin. Since then, it's been all

service to

corporations with empty rhetoric toward human beings no matter the degree of need. "

"Obama and his so called party of the people are I'd like to add

frauds. They

NEVER IMO ever had any intention of really delivering on REAL Change from day 1"

"I knew in 04 when Nancy took impeachment off the table we were fu&%#@ed".

"To me Dennis Kucinich would have been our only hope, but he is marginalised by the

press,

yet Sarah Palin even immidiately after her loss for the bid of vice-president gets wall to

wall coverage, her

every stupid, jongoistic, bullshit statement getting worldwide coverage...has that EVER

happened for a

failed candidate for the under-office?"

"There's no doubt that the Demos got the heady taste of corporate money and

caved"..

"The White House is highly complicit in all this. They are not being beaten by the

Republicans.

Instead, at the orders of the Corporate interests that run both parties, and thus the

country, they are laying down

for the Republicans"/.

LOSS OF AMERICAN MANUFACTURING

DOES OBAMA REALLY CARE?

Rust Belt - Wikipedia,

Joblessness in the region increased rapidly in 2008 and 2009, surpassing 20 percent in

some areas. Contraction of manufacturing jobs has displaced many workers in this region,

particularly in Buffalo, Rochester,

Syracuse,

and Utica,

New York; Pittsburgh,

Bethlehem, and Erie,

Pennsylvania; Cleveland,

Toledo, and Youngstown,

Ohio; Detroit, Flint, Lansing,

and Saginaw,

Michigan; Gary,

Indianapolis,

South

Bend, and Elkhart, Indiana; Milwaukee, Wisconsin; and Duluth,

Minnesota;

"Outsourcing of manufacturing jobs in tradeable goods is an important issue in the

region. One culprit has been globalization and the expansion of worldwide free trade

agreements. Anti-globalization groups argue that trade with developing countries has

resulted in stiff competition from countries such as China which pegs its currency

to the dollar and has much lower prevailing wages, forcing domestic wages to drift

downward. Some economists are concerned that long-run effects of high trade deficits and

outsourcing are a cause of economic problems in the U.S.[7][8]

with high external

debt (amount owed to foreign lenders) and a serious deterioration in the United States

net international investment position

(NIIP) (-24% of GDP).[6][9][10]

Some economists contend that the U.S. is borrowing to fund consumption of imports while

accumulating unsustainable amounts of debt.[6][10]

On June 26, 2009, Jeff Immelt, the CEO of General Electric, called for the United States

to increase its manufacturing base employment to 20% of the workforce, commenting that the

U.S. has outsourced too much in some areas and can no longer rely on the financial sector

and consumer spending to drive demand.[11]

Youngstown News,

Loss of manufacturing jobs is costing us our country

Feb 7, 2010 ... Loss of manufacturing jobs is costing us our country ...

The frustrated American public, much like the French, voted for Obama... but

Next American

City » Buzz » Lansing's High-Tech Industry Goes to ...

Mar 22, 2010 ... The district projected a population loss of 1000

students...

|

Is Goolsbee dismayed about widening

income inequality?

Goolsbee's rough estimate is that technology -- meaning all that

the phrase "information economy" denotes -- accounts for more

than 80 percent of the increase in earnings disparities, whereas trade

accounts for much less than 20 percent." .

The stagnation of

middle- and working-class incomes, and the anxiety that has generated,

is, he says, a most pressing problem, but policymakers must be

mindful about trying to address its root cause, which

Goolsbee says is "radically increased returns to skill...

The solution is to invest more in education, which will

raise wages, reduce inequality and move toward

equilibrium." Source.

Toys from China?

Goolsbee is not alarmed that 90% of the tools

we might buy at Home Depot are made in China.

He maintains that "all imports are only 16.7 percent of

the U.S. economy and imports from China are a small

portion of all imports. Those from China amount to 2.2

percent of the U.S. gross domestic product. Source.

IF OBAMA KEEPS FOLLOWING THE UNIV. OF

CHICAGO's

RIGHT-WING

ECONOMIC THINKING, WE ARE LIKELY

TO BE DOOMED TO

HIGH UNEMPLOYMENT

FOR YEARS AND

YEARS...

Milton Friedman, Hayek, Knight and Lucas

Would Be Proud of Obama.,

Where FDR Deliberately Surrounded Himself with Advisors

who held many points of view, Obama has surrounded himself

with Advisers from Chicago who have all been heavily

influenced by the University of Chicago's anti-Keynesianism.

WIthout exception they are defenders of the "free market" and

de-regulation.

Could Monetary Policy Be about to Fail? Look at the troubled

charts of Visa. Interest rates are now starting to rise.

TNX - Ten Tear Treasuries

Individual Investors Pulled Out $33 Billion from Mutual Funds in 2010 So Far.

Unfair professional manipulative trading practices, it is said, are causing too many

losses for individual investors. The real reason is the more and more people

are falling out of the Middle Class and are selling the stocks in their retirement

accounts.

http://themoondrapost.blogspot.com/2010/08/market-manipulation-scaring-small.html

This link

lists a series of reforms that most non Wall Street observers think are needed.

But since Wall Street seems to own Obama, despite his rhetoric, as well as the Fed, the

Treasury and the Senate Finance Committee, there's little point in setting these

reforms

out here again. Obama and the Wall Street triumvirate believe that it's better Wall

Street

make a lot of money, that stocks keep getting artificially "juiced" and,

perhaps, there

will be enough "trickle down" to make Main Street whole again.

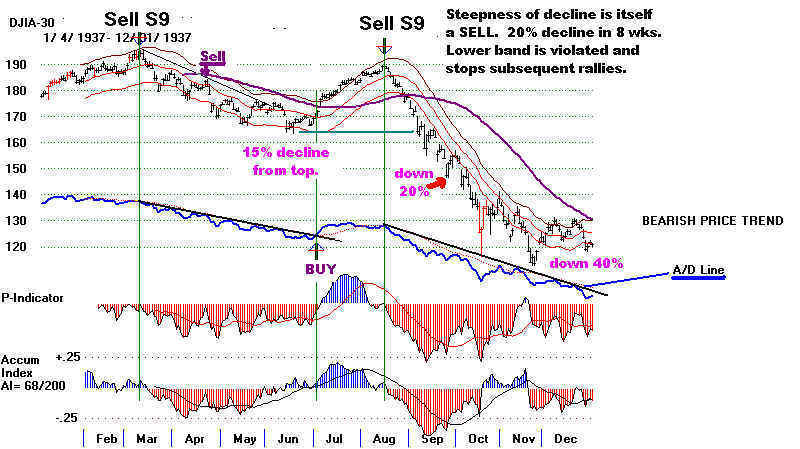

Obama Is Now Repeating FDR's 1937

Blunder of|

Pursuing Budget Austerity in The Middle

of A Depression.

Nobel Prize winning economist, Paul Krugman warns that Obama has put us back into

a 1937 scenario. This was when FDR started to listened to the conservatives in the

Treasury

headed by Morgenthau and cut back government spending so he could claim he was

balancing the budget. The public drew the tragically mistaken conclusion that

cutting

government spending would somehow create more jobs. And there was a great Stock

Market Crash and a Second Depression. I have written all this before.

February 4, 2010 Will Obama Cause

Another 1937 Crash? If Obama Keeps Taking The

Advise of Self-Serving

Bankers, the RISK of ANOTHER CRASH Is VERY HIGH.

Readers here will want to subscribe to my Nightly Hotline or get Peerless Stock Market

Timing software to see if

the current Peerless chart looks similar to the 1937 chart

when FDR started pursuing budget balancing policies to try to try to pacify

his Republican critics, just as Obama seems now to be doing, rather than listening to

progressives who call for heavy taxation of the super rich and a truly massive

public works and infrastructure rebuilding to provide a million new jobs and

make America competitive again. The result for FDR's move to the right in 1937

was a serious political defeat in the 1938 election. And only the coming of war in

Europe brought an economic recovery in the US when qualms about deficit spending

were put aside to fight the war. The result for Obama will be no better, especially

if

his temerity puts in power the very type of people and the very same economic

thinking that brought on the 1929-1932 and 2007-2008 Crashes and Depressions.

It is a terrible flaw in Obama's education that he know so little economic history

and nothing about John Meynard Keynes.

1936 A

General Theory of Employment, Interest and Money. In

the book Keynes

showed that the lack of demand for goods and rising unemployment could be

countered by increased government expenditure to stimulate the economy, which

would then provide a bigger tax base. In this way, deficit would disappear and

be funded by the recovery. Without such government efforts, unemployment,

deflation and deficits would spiral disastrously into a self-perpetuating Depression.

Keynes Deficit Spending Plans Were

Keynes Deficit Spending Plans Were

Opposed by British Labor and Conservative Parties in the 1930s.

In 1929, influenced by Keynes, UK Liberal

Leader Lloyd George published

a pamphlet, We Can Conquer Unemployment,

where he proposed a government scheme

where 350,000 men were to

be employed on road-building, 60,000 on housing, 60,000 on

telephone development and 62,000 on electrical development. The cost would be £250

million, and the money would be raised by loan. Tragically, a Keynesian deficit

spending

program was dismissed in the 1930s by Labour's Ramsay MacDonald and Phillip Snowden

and by the Conservative Chancellor of the Exchequer Neville Chamberlain.

( http://www.spartacus.schoolnet.co.uk/TUkeynes.htm

)

=================================================================================

Obama and The University of Chicago's Anti-Keynesianism

"The Chicago school is associated with neoclassical

price theory and

libertarianism

in its support of lower taxation and private sector regulation...

The school rejected Keynesianism in favor of monetarism until the

1980s,

when it turned to rational expectations. It has affected the field of finance by

the development of the efficient market hypothesis.

Frank Knight

(1885–1972) - "He believed that while the free market

Frank Knight

(1885–1972) - "He believed that while the free market

could be inefficient, government programs were even less efficient. "

Friedrich von Hayek (1899–1992) An aristocrat

from Vienna,

Friedrich von Hayek (1899–1992) An aristocrat

from Vienna,

he is best known for his defense of free-market capitalism

Milton Friedman (1912–2006) - he won the Nobel Prize in

Milton Friedman (1912–2006) - he won the Nobel Prize in

Economics in 1976 for,

among other things, A Monetary History of the United

States (1963). Friedman argued that the Great Depression had been caused

almost entirely by the Federal Reserve's policies through the

1920s, and

worsened in the 1930s. Friedman argued that laissez-faire government policy

is more desirable than government intervention in the economy.

Robert E. Lucas (b. 1937) - Dedicated "his life to unwinding

Robert E. Lucas (b. 1937) - Dedicated "his life to unwinding

Keynesianism," Micro-economics

should over-power and consume

macro-economics. "Each chapter discusses the Post Keynesian view on one

particular topic and ..... many quarters with ridicule and often with hostility,

dislike, and contempt." Source.

Criticism of

Chicago's Economic Thinking

"The Chicago school, which advocates for unfettered free markets and

little government intervention (albeit within a strict, government-defined monetary

regime), came under attack in the wake of the financial crisis of 2007–2010.[17]

The school has been blamed for growing income inequality in the United States.[18]

Economist Brad DeLong of the University of California, Berkeley says the

Chicago School has experienced an "intellectual collapse", while Nobel laureate Paul Krugman of Princeton

University, says that recent comments from Chicago school economists are "the

product of a Dark Age of macroeconomics in which hard-won knowledge has been

forgotten,"[19]

charging that the school has done nothing to help salvage the economy in the wake of the

crisis.[20]Free

market intellectuals argue that the 2007-09 economic collapse was due to government

mis-management and over regulation of the mortgage loan sector; saying Wall Street was

forced to give credit to individuals with no capacity to make payments.[21][22]"

http://en.wikipedia.org/wiki/Chicago_school_of_economics

"The University of

Chicago is where he has

drawn many crucial members of his political team. Graduate School of Business professor

Austan Goolsbee is a key economic strategist. University trustee Valerie

Jarrett has become one of his closest friends and top advisers, and fellow trustee John W.

Rogers Jr., U-High’76, a South Side entrepreneur, is a friend and fund-raiser. University board chair

James Crown heads Obama’s Illinois finance team. Former Law School colleagues Cass

Sunstein and Geoffrey Stone, JD’71, serve as informal advisers.

"Obama’s chief strategist

since 2002, David Axelrod, AB’79, studied political science in the

College, and many of the senator’s earliest allies are also alumni, including former

Hyde Park congressman and Mandel Legal Aid Clinic senior director Abner Mikva,

JD’51... Meanwhile, as might be expected with a hometown candidate, the number of Chicago professors who

have given the campaign money, support, or expertise is legion.

"Many of Obama’s economic

ideas, however, can be traced to Chicago.

Cass Sunstein, who’s starting a new job at Harvard University this fall

(he’ll maintain a visiting position at Chicago), makes the case: “Though he’s not a dogmatic

follower of Milton Friedman, Obama is someone who is

fully appreciative of the virtues of markets and how regulation can be

counterproductive.” Sunstein points to specific proposals that originated with Chicago thinkers,

including resonances from Nudge, the 2008 book on “libertarian paternalism” that

Sunstein coauthored with GSB economist Richard Thaler. On health care: “It’s

noteworthy,” Sunstein says, “that his approach is not a mandate; he didn’t

want to coerce any adult to buy health insurance.” On the housing mortgage crisis:

“His policies are oriented toward transparency and disclosure—measures that are

market-improving rather than market-eliminating.” Climate change: “His solution

is a market system that allows trading in greenhouse-gas emissions rights, and an auction

to buy those rights.”

====================================================================================

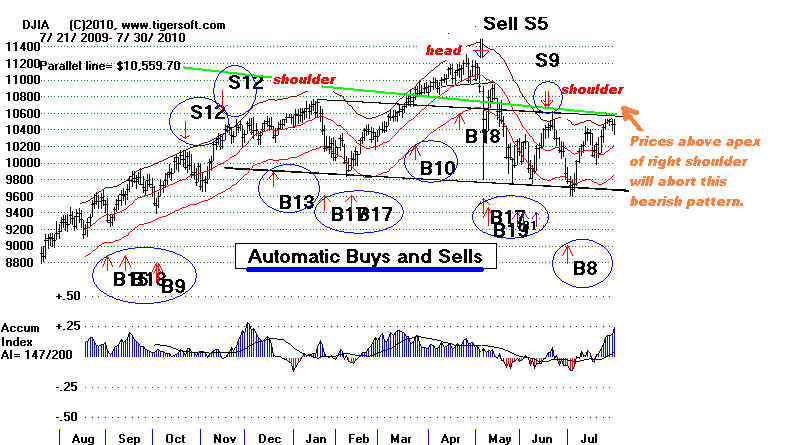

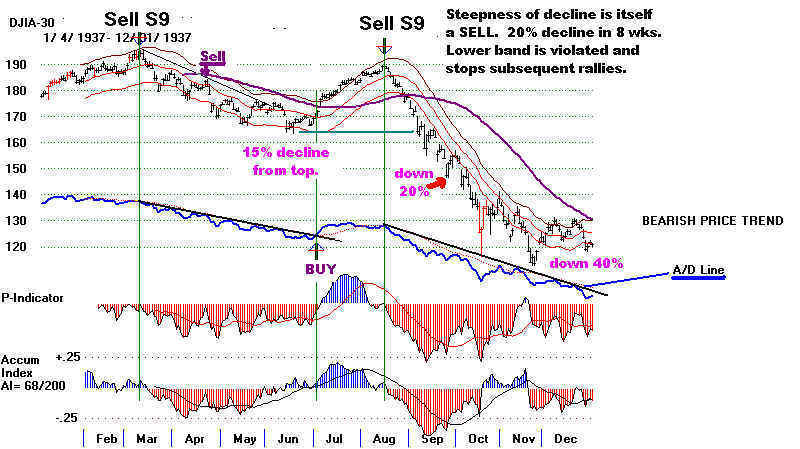

Is a 1937-1938 Collapse In Our Own Future in 2010-2012?

Peerless Sell S9s Mark Tops in 1937

I wish Krugman could show the errors in what I write so that another big market decline

and

another jump in unemployment might seem more likely. Krugman

wrote the following in the

New

York Times on September 8th.

"The story of 1937, of FDR's decision to heed those who said it was time to slash

the deficit, is well-known. Not so well-known is the extent to which the public drew the

wrong conclusions from the recession that followed: Far from calling for more New Deal programs, voters lost faith in fiscal expansion.

Consider Gallup polling from March 1938. Asked if government

spending should grow to fight the slump, 63 percent said "no." Asked if it

would be better to hike spending or cut business taxes, only 15 percent favored spending;

63 percent favored tax cuts. The 1938 election was a disaster for the Democrats, who lost

70 seats in the House and seven in the Senate.

Then came the war. From an economic point of view, World War II was, above all, a burst of deficit-financed government

spending on a scale that never otherwise would have been approved. During the war, the

federal government borrowed an amount equal to roughly twice the value of the gross

domestic product in 1940 — the equivalent of roughly $30 trillion today.

Had anyone proposed spending a fraction of that before the war, people would have said

the same things they're saying today, warning of crushing debt and runaway inflation. They

would have said the Depression was in large part caused by excess debt, then have declared

the problem impossible to fix with more debt.

But deficit

spending created an economic boom, and the boom laid the foundation for prosperity.

Overall debt — public plus private — fell as a percentage of GDP, thanks to

economic growth and, yes, some inflation, which reduced the value of outstanding debts.

Thanks to the improved financial position of the private sector, the post-war economy was

able to thrive without continuing deficits.

The economic moral is clear: When the economy is depressed, usual rules don't apply.

Austerity is self-defeating; when everyone tries to pay down debt, the result is

depression and deflation; debt grows even worse. Conversely, a temporary surge of deficit

spending, on a sufficient scale, can cure problems from past excesses.

But the story of 1938 shows how hard it is to apply these insights. Even under FDR,

there never was the political will to do what was needed to end the Great Depression; its

eventual resolution came essentially by accident.

I had hoped we would do better this time. But politicians and economists have spent

decades unlearning the lessons of the 1930s. The winners in the midterm elections are

likely to be the very people who got us into this mess, then blocked action to get us out.

This slump can be cured. It will take a little bit of intellectual clarity, and a lot

of political will. Here's hoping we find those virtues in the near future."

Read more: http://www.sacbee.com/2010/09/08/3015048/krugman-dont-forget-depressions.html#ixzz0z6e6hPhA

Read more: http://www.sacbee.com/2010/09/08/3015048/krugman-dont-forget-depressions.html#ixzz0z6djhJDg

9/6/2010

A LABOR DAY LAMENT

What Is Good for Wall Street Is Most Likely No Longer Good for Average Americans.

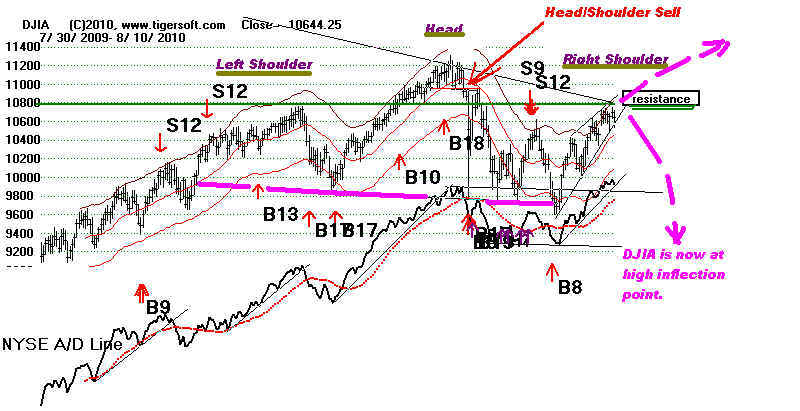

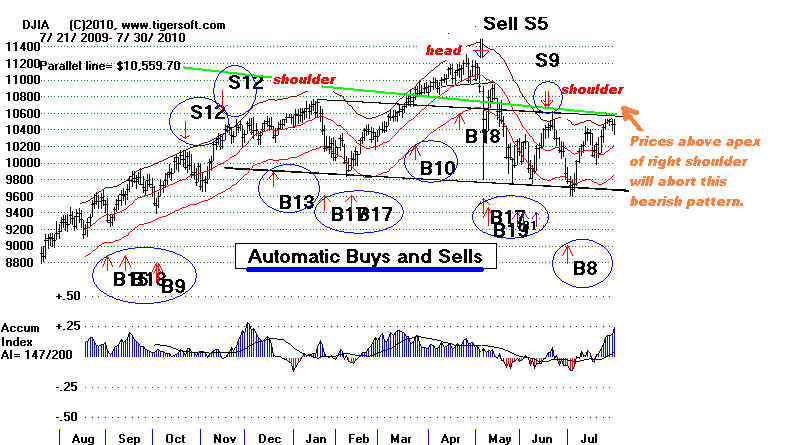

Has Wall Street Sowed The Seeds of Its Own Destruction. The bearish looking

head and shoulders patterns suggest a strong populist backlash is coming.

If the rich are taxed more, they must sell shares and the stock market will go down.

If the rich are not taxed, America will risk bankruptcy.

How

To Finance The Rebuilding of America

WE

MUST TAX THE RICH. THEY HAVE NEARLY ALL THE MONEY..

"The top 1 percent of wage earners earn more

income than the bottom 50 percent;

and the top 1 percent has more wealth than the bottom 90 percent."

http://www.politico.com/news/stories/0810/40557.html

"If the super-rich are allowed to avoid estate taxes, that money

will have to

be raised elsewhere. Any guesses on who will have to pay it? "

http://www.chattanoogan.com/articles/article_177649.asp

Bush’s tax cuts for the wealthiest Americans are thought to have

cost $830 billion over 10 years Extending all the tax cuts would increase

the deficit by $3.1

trillion dollars over the next 10 years.

http://www.seattlepi.com/horsey/viewbydate.asp?id=1835

Sources of Revenue to Pay for Re-Building America's Crumbling Infrastructure.

1 A

0.25% tax on all stock transactions would raise $150 billion to pay for

new

jobs and infrastructure re-building. Commissions are already down

to way under $8 an order. Place an INFRASTRUCTURE $25 tax on

a $10,000 transaction and we are simply back to the level that commissions

were in 1980. This will deter in and out transactions that unsettle the market.

It will place more emphasis on longer-term corporate growth and give

America the money it needs to help the infrastructure.

2 A Special Tax on

Computerized High Frequency Program Trading is Needed.

This asocial behavior is destructive of small investors. Tax these transactions

most heavily. High

frequency trading firms now account for 73% of all U.S. equity

trades See also

http://www.huffingtonpost.com/sen-ted-kaufman/unusual-market-activity-t_b_574914.html

3 Make SWITZERLAND COME

CLEAN. Same with Cayman Isl, Bermuda, Bahamas,

Arruba...

UBS

kept 52000 secret bank accounts for U.S. taxpayers - IRS ...

What about every other bank and brokerage?

Secret Swiss Bank Accounts held by Wealthy Americans to Avoid Taxation.

http://www.time.com/time/business/article/0,8599,1917648,00.html

A

Virginia doctor has pleaded guilty to conspiracy involving an undeclared Swiss bank

account

reportedly

at HSBC

Wall

Street Greek: Secret Swiss Bank Accounts Expose Switzerland

Sep 21, 2009 ... Robert

McKenzie says one of his clients told him he forgot he had $32 million

stashed

in a foreign bank account

4 Multi-Millionaire Estates

- "Stop Coddling The Rich"

"More than 16 percent of working-age Americans are unemployed or underemployed.

Long-term unemployment is the highest on record. Millions of people have lost their

homes, savings and pensions.

"Two: The United States today has a $13 trillion national debt and a

record-breaking deficit. Last year alone, the federal government spent more than $186

billion just paying interest on the public debt.

"Three: The United States has the most unequal distribution of wealth and income

of any major country. Today, the top 1 percent of wage earners earn more income than

the bottom 50 percent; and the top 1 percent has more wealth than the bottom 90 percent.

"During the Bush administration, the middle class saw a $2,200 drop in median

family income, down to slightly more than $50,000. Meanwhile, the 400 wealthiest

families’ income more than doubled, while their effective income tax rates were

slashed almost in half during the past 15 years. The wealthiest 400 Americans have

accumulated $1.27 trillion in wealth, while the highest-paid 400 Americans had an average

income of $345 million in 2007. As a result of Bush tax policy, they pay an effective

income tax rate of 16.6 percent, the lowest on record.

"Four: This year, a number of billionaires died and, for the first time since 1916,

their families will pay no inheritance tax. This occurred as a result of President George

W. Bush’s $1.35 trillion tax break, passed in 2001.

In other words, while this country has a devastatingly high unemployment rate, a huge

debt, massive unmet needs and a widening gap between the very richest people and everyone

else, we are providing enormous tax breaks to millionaire and billionaire families. This

is insane! "

http://www.marketwatch.com/story/bring-back-the-estate-tax-some-rich-americans-say-2010-07-21

5. Close Loopholds Encouraging Corporations to Ship Jobs Overseas. $9.8 Billion.

Ending

the Outsourcing Loophole « Main Street

AUGUST 2010

8/31/2010 Chinese Duties on Imported American Chicken Invites American

Retaliation.

http://finance.yahoo.com/news/China-imposes-antisubsidy-apf-3003233079.html?x=0&sec=topStories&pos=6&asset=&ccode=

Beijing and Washington also are embroiled in disputes over access to each other's markets

for

steel pipes, movies and books and other goods.

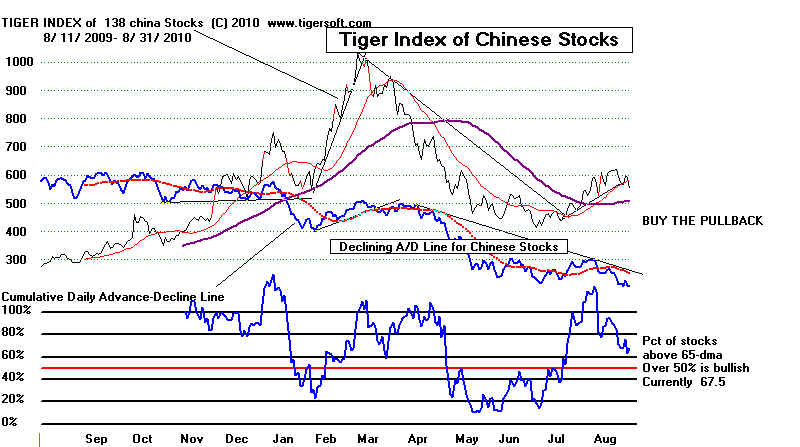

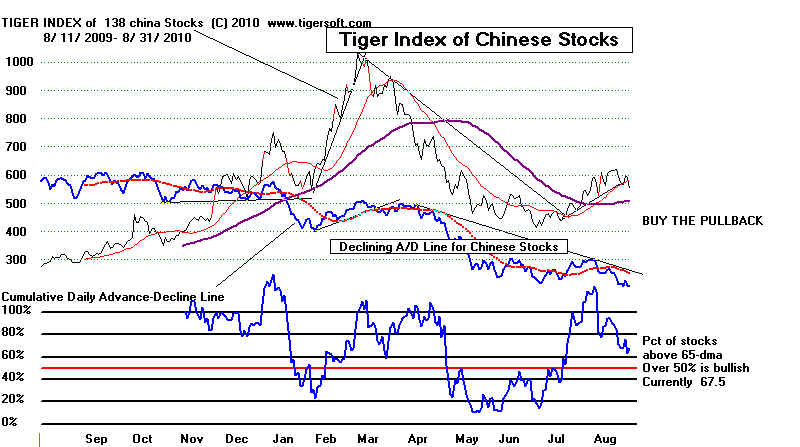

Chinese stocks are especially volatile. Use A/D Line for the group or automatic

signals,

Tiger Closing Power trends and non-confirmations plus the Tiger Accumulation Index for

individual stocks.

8/31/2010 Class

Action Law Suit against Scot Ginsburg and DGIT initiated.

See our write-up from yesterday..

http://finance.yahoo.com/news/Roy-Jacobs-Associates-bw-4247792706.html?x=0

8/30/2010 AIR POCKETS IN STOCKS ARE DISTINCTLY BEARISH.

INSIDER

AND PROFESSIONAL SELLING AT DGIT BEFORE IT CRASHES.

DGFastChannel - products/services digitially deliver commercials, syndicated

programs, and video news releases.

This was a 38.4% decline in one day. Technical weakness was easy to spot as it

topped out.

Tiger's CLosing Power failed to rally with the stock three weeks ago and then broke its

uptrend. This is a classic SELL. Margin calls must have been triggered by the

slide. Professionals and market makers steadily sold it down.

The real truth is that official insiders bought no shares in the last 6 months, but sold

1,101,900 shares.

Belatedly, the company forecast "weaker-than-expected" revenue for the thrid

quarter. The insider expected

the drop in revenue much earlier. That was why they sold. They just didn't get

around to telling shareholders

until this weekend. How convenient. Not a single complaint on the Yahoo message

board of DGIT. A bunch

of sheep?. Will Scott go SCOT-free? Will the SEC ask any questions? Don't hold

your breath. Just use

TigerSoft to level the playing field.

INSIDER

TRADING BY SCOTT GINSBURG AGAIN?

WHY DO DGIT SHAREHOLDERS NOT

COMPLAIN?

WHERE IS THE SEC?

CEO and Chairman of the Board Scott

Ginsburg was the biggest seller. He sold more than a million shares.

between 32 and 43. He was found guitly of insider trading in 2002 and was fined a

million and enjoined not

to engage in future violations of the law. Obviously, he is man on a mission of

greed.

http://www.sec.gov/litigation/litreleases/lr18632.htm

http://www.nytimes.com/1999/09/10/business/sec-names-3-in-insider-trading-lawsuit.html

| Feb 18, 2010 |

GALLAGHER

LISA CDirector |

1,000 |

Direct |

Automatic Sale at $34 per share. |

"I'M

A LONG-TERM INVESTOR"

Read the commennts on Yahoo by someone who watch the insider selling, thought it

smelled, but

lazily did nothing with his position, saying he was a long term investor. This is

very typical.

"What

a joke, DGIT CEO acting stupidly

"Please tell me that there is no stench in the air from Ginsburg's

last sale of over 250K shares at 32.5 and then immediate drop back down.

MMs ran it up for him to sell and then sell it right back down as if they know for a fact

they have nothing to fear from DGIT management from doing anything crazy like releasing

information to the public. One thing for sure the people buying at 32.5 are the same ones

selling it down. Ginsburg is acting stupid here in my opinion. I mean it is not as if he

has not given out insider info before and been prosecuted for it. He had better start

thinking more clearly if you ask me.

I keep holding long because I am a very big believer in the long term position and think

the stock will be trading above $40 before the end of the year. But it is hard to put up

with this kind of monkey business.

8/28/2010 AP

IMPACT: US wasted billions in rebuilding Iraq

They finally got the memo. Billions? Trillions Were Wasted and Stolen in Iraq and

Afghanistan.

Private Contractors like Halliburton and Blackwater and

the Military Industrial Complex

are Out of Control. Eisenhower's warning in 1961 was truly prophetic.

"This conjunction of an immense

military establishment and a large arms industry

is new in the American experience. The total influence – economic, political, even

spiritual –

is felt in every city… We must not fail to comprehend its grave implications. Our

toil, resources

and livelihood are all involved; so is the very structure of our society...

In the councils of government, we must guard against the acquisition of unwarranted

influence,

whether sought or unsought, by the military industrial complex. The potential for the

disastrous

rise of misplaced power exists and will persist. We must never let the weight of this

combination

endanger our liberties or democratic processes. We should take nothing for granted. Only

an alert

and knowledgeable citizenry can compel the proper meshing of the huge industrial and

military

machinery of defense with our peaceful methods and goals, so that security and liberty may

prosper together."

Obama's War in Afghanistan is as unpopular as Bush's in Iraq. But Congress and

President

Refuse to Stop these Useless Campaigns, Bring Home The Troops and Spend The Money

in Rebuilding The US Infrastructure. Nothing was learned from the US War in Viet

Nam.

Nothing was learned from the war in Iraq. America needs new leadership desperately.

See our March 1, 2008 Blog The

Biggest Theft in American History:

How The US

Treasury Was Bankrupted by Bush's and Cheney' Buds and Halliburton.

Military spending is sure to be challenged in this election year. Lockheed's stock

seems to

have turned down, for now.

If anythng, I have understated how dire is the state of our democracy and how much

monopolies

now prevent real competition in the most vital industries. Read from this site:

http://www.hermes-press.com/vulture.htm

how much I have left out.

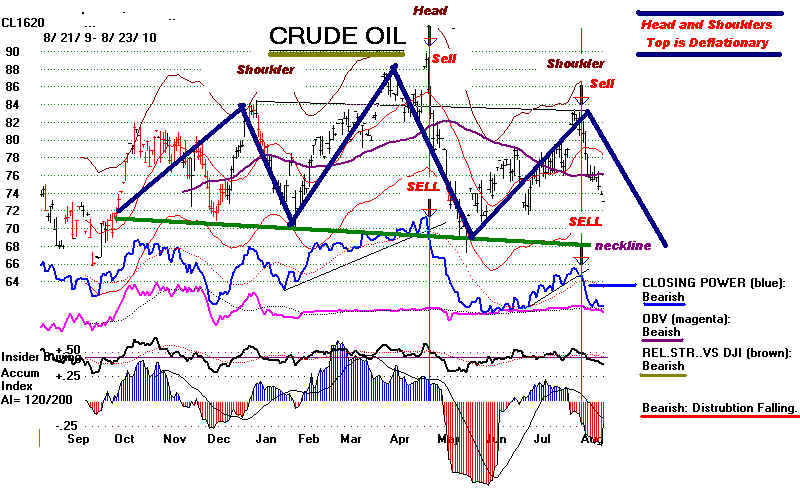

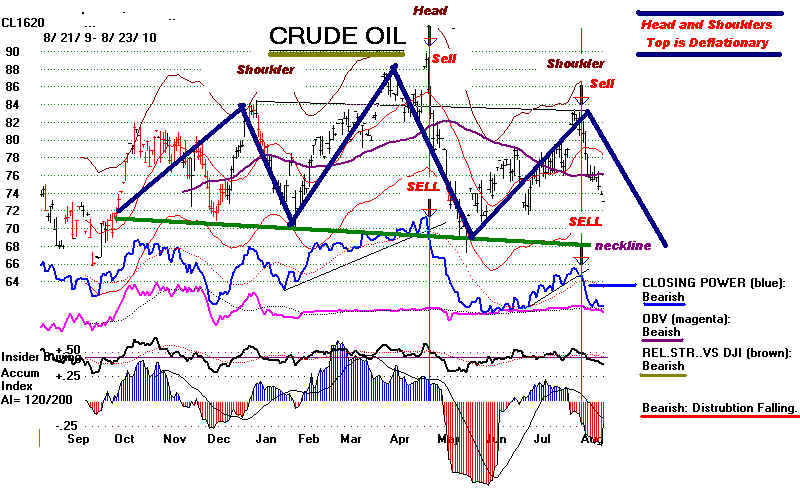

8/24/2010 Oil

falls to near $72 in Asia on economic fears- AP

World demand for crude oil seems to be topping out. As deflationary as this seems, the

less money

consumers have to give the oil cartel, the more money they have for other purchases.

Weakness

here does take pressure off the Dollar and permits low interest rates to continue longer

than

they would if oil prices were rising steeply. This is not good for Gold. Look

for Gold to retreat. shoulder

8/22/2010 "Bonds

Aren't the New Tech Stocks"

"Between 1998 and 2000, at the height of the technology bubble,

roughly $740 million a day of

U.S. retail money went into tech stocks, according to TrimTabs Research, a firm that track

investment

flows. By comparison, over the past 20 months, U.S. money has been pouring into bond funds

at an

average rate of roughly $1.5 billion per day.That is enough to make anybody's head

spin."

TigerSoft charts show it is not the public which is buying bonds, it is professionals on

their behalf,

perhaps. For now the trend for bond funds is up. Use our software to see when

this trend is over.

Read our Nightly Hotline to see specifically what will change the picture and stop their

rally.

10-Year Treasury Rates are now 2.61%. In April they were 4.0%

Tiger Index of Bond Funds

Best Bond Fund?

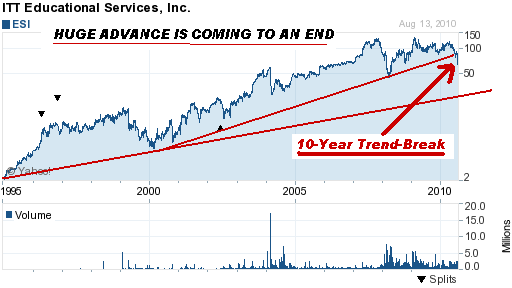

8/18/2010 WHAT MAKES

A PROFESSIONAL BUY RIGHT AT THE TOP?

Just when Insiders and other professionals are selling. Ask San Francisco's Blum Capital.

Not enough due diligence about ESI's students' very high default rates on their loans.

The Department of Education is considering putting an end to government-backed loans at

schools

with very low repayment rates. Their graduates are not getting schooled very well

and are not

getting jobs. Companies like ESI depend upon the government subsidizing them through

its student loans programs. But now, with each Dollar being more important, it is

demanding

results. About time, I say. Is that

for-profit certificate worth the debt?

See also TigerSoft's Blog August 14,

2010

APOLLO SHAREHOLDERS

SHOULD BE MAD AS HELL AT

PETER SPERLING's

INSIDER SELLING!

For-Profit Colleges

Are Getting A Grade of Double "F"

The "FF"

Stands for Fraud and Failure To Educate.

Some of the Professionals made poor decisions here to buy: Blum Capital Management's

dumb decision

to buy proves they do not use TigerSoft, which have clear warnings about the stock as they

were buying.

| Apr 30, 2010 |

BLUM CAPITAL PARTNERS LPBeneficial Owner (10% or more) |

61,200 |

Direct |

Purchase at $103.02 per share. |

$6,304,82 |

.

Reported Insider Selling:

| Jun 1, 2010 |

FEICHTNER EUGENE WOfficer |

3,000 |

Direct |

Sale at $99.73 - $100.66 per share. |

$301,000 |

| May 12, 2010 |

WEBER VINDirector |

2,500 |

Direct |

Sale at $106.30 per share. |

$265,750 |

| May 5, 2010 |

DEAN JOHN EDirector |

3,077 |

Direct |

Sale at $104.56 per share. |

$321,731 |

ITT Educational Services, Inc. provides postsecondary degree programs in the United

States. The company offers master, bachelor, associate, and career-oriented education

programs in various fields, such as information technology, electronics technology,

drafting and design, business, criminal justice, and health sciences.

Mr. Kevin M. Modany , 43

Chairman and Chief Exec. Officer |

2.16M in executive pay |

TIGERSOFT INSIDER TRADING CHART

ON ESI

Blum Capital Management's dumb decision to buy at the end of April proves they do not use

TigerSoft,

which save clear warnings about ESI just as they were buying it. .

8/15/2010 For-Profit Collegse Are Failing Scrutiny of GAO and

Government Subsidizers.

For-Profit Jail Should Get The Heat Next. Guess who is the biggest financial backer

of

Arizona's new arrest on sight anyone who looks like they are an illegal allien. The

for-Profit Prisons.

would be very big gainers if Arizona starts arresting everyone who looks like they could

be an illegal

allien. . Source.

Other for profit "public" industries like for-profit-prisons are

sure to be treated to the

same type of questions that the for profit-schools are, especially in view of the recent

escape

of killers ftom Arizona's for-profit prison system..

Warden, security chief resign after prison

escape from a prison ran

for profit by a contracting

company called Management & Training Corporation

Criminal Prosecution of these

For-Profit Schools for Fraud is very likely.

Some of the schools have even instructed students about how to lie in order to get Federal

Govertnment

student aid. In an era of retrenchment, their lobbyists will have to start doling

out a lot

of huge bribes to Congressmen. But that's what unlimited corporate campaign contributions

are for, thanks to the Supreme Court. See original article in Barrons.

Below is the Tiger Index for these education stocks. Note the heavy insider selling

in the deeply red

readings from TigerSoft's Insider Ttrading Indicator - the Tiger Accumulation Index. Sell

short

on rallies after you see this and on red Sell Signals. See our warnings and

news about this industry

on 8/7/2010.

This is definitely a time when investors should be watching how Wall Street Professionals

are treating these stocks. They are becoming pariahs. They now have a stench of

criminal

fraud. Watch TigerSoft's now red Accumulation Index for these stocks and the (blue)

downtrend of their Professional Closing Power. Click on the links to see these

stocks

APOL Apollo Group

DV DeVry

LOPE Grand Canyon Education

CECO Career Education

COCO Corinthian Colleges

STRA Strayer Education

LINC Lincoln Educational Services

Below is the Tiger Index for these 9 atoxka.

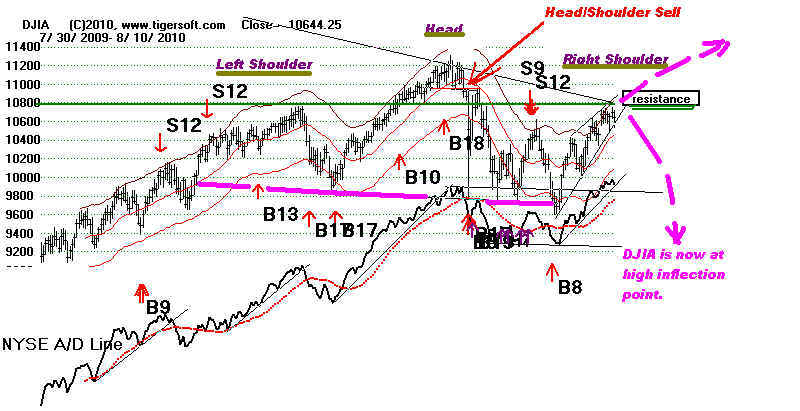

8/11/2010 Obama Is No FDR. FDR Saved Capitalism. Obama Seeks to

Save Monopoly Banks.

That's Not Much To Campaign

on When Unemployment Is Higher Now Than When He Took

Office.

Why does Obnma hides his course work at Columbia and the fact that he either dId poorly in

basic ECON 101, or perhaps never even took It. As a result, he appears utterly

unaware of

how FDR dealt with Big Banks and FDR's Public Works' Programs or how FDR responded

in 1934 when right-wingers attacked the New Deal as socialism.

Wall

Street's "perverse incentive structures" guarantee another crisis

"Excessive pay on Wall Street, which Black says is the biggest

culprit of the financial crisis"

The Financial regulation reform utterly fails to deal with this, Obama's rhetoric not

withstanding.

Fed takes action as economy sinks further

What the Fed says: "it would spend a relatively small amount of money -- about

$10 billion a month,

economists estimate -- buying government debt. The move is designed to drive interest

rates on

mortgages and corporate borrowing at least a little lower and help the economy grow

faster."

Peerless DJIA Chart - August 10, 2010 from TigerSoft Hotline

VERY BEARISH. I think, are

Bernanke's ramarks that he wants the FED to buy

US Treasury instruments. The strong implication is that he will backstop them when

the

Chinese start to sell their huge holdings. He may have meant well, but Bernanke's comments are

most unreassuring. Are the Chinese selling

already? Is he preparing us for that contingency?

Is the prospect of the Chinese dumping US debt instruments big part of why the Dollar has

turned

weak. TigerSoft's Closing Power leads its price trends. Currency traders

should be using

TigeerSoft. 10 years of Closing Price charts are available for $125 on the British

Pound, Japanese.

Closing Power's downtrend should be respected for now. Get TigerSoft and see our

rules for

trading our Professional Closing Power.

DEFLATION

Is the pace of economic recovery so slow that no one will borrow to buy a house at 4% or

build a US factory?. The Fed is getting desperate. It is "pushing on a

string". Monetary policy

is not the answer. Fiscal stimulus and federal public

works programs are the only solution.

But Obama's financial advisers are hopelessly beholden to big banks and fearful that the

right

wing radio chorus will scream "socialism". So an FDR like New Deal with

massive public works

programs is not even talked about.

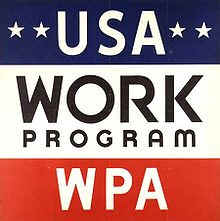

REAL NEW DEAL HISTORY

WPA - Works Progress

Adm. WPA - Works Progress

Adm.

WPA was the largest employer in the country until WWII.

"The goal of the WPA was to employ most of the unemployed people on relief until the

economy recovered. Harry Hopkins testified to Congress during January 1935 why he

set the number at 3.5 million, using Federal Emergency Relief Administration

data. Estimating costs at $1200 per worker per year, he asked for and received $4

billion."

"largest New Deal agency, employing millions to

carry out public

works projects, including the construction of public buildings and roads, and operated

large arts, drama, media, and literacy projects. It fed children and redistributed food, clothing,

and housing. Almost every community in the United States

had a park, bridge or

school constructed by the agency, which especially benefited rural and Western

populations. Expenditures from 1936 to 1939 totaled nearly $7 billion.[1]...Created

by order of President Franklin Delano Roosevelt, the

WPA was funded by Congress with passage of the Emergency Relief Appropriation Act of

1935 on April 8, 1935. The legislation had passed in the House of Representatives by a margin of

329 to 78, but was delayed by the Senate.[1]...Headed

by Harry

Hopkins, the WPA provided jobs and income to the unemployed during the Great Depression in the United States.

Between 1935 and 1943, the WPA provided almost eight million jobs.[2]

(Source: http://en.wikipedia.org/wiki/Works_Progress_Administration

)

WPA mural in Cincinnati. Now at airport. See

more WPA murals.

New

Deal/WPA Art Project

BLUES MUSIC HISTORY PROJECT -

Robert Johnson

lives because WPA people recorded his music for the Library of Congress...

Eric Clapton has called Johnson "the most important blues

singer that ever lived" He was ranked fifth "

in Rolling Stone's list of 100 Greatest Guitarists of All Time.[4]

Eric

Clapton described Johnson's music

as "the most powerful cry that I think you can find in

the human voice." In two takes of "Me and the Devil Blues"

he shows a high degree of precision in the complex vocal

delivery of the last verse: "The range of tone

he can pack into a few lines is astonishing."[49

Listen to him...

http://www.youtube.com/watch?v=Yd60nI4sa9A

http://www.youtube.com/watch?v=3MCHI23FTP8

FDR's

New Deal Music WPA

Blues That Man on The WPA

"The

Federal Music Project of the WPA was keeping singers and musicians alive" and

performing

in the middle of the Depression.

"The most concerted broadening of musical education and performance came from

the federally sponsored WPA Federal Music Project (FMP). Like other artists, musicians

were devastated by the Depression in the early 1930s. Headed by Nikolas Sokoloff, the FMP,

founded in 1935, sponsored radio broadcasts and musical-education classes and commissioned

work from composers such as George Antheil, William Schuman, and Elliot Carter. The FMP

funded an index of American composers from colonial times to the present and sponsored

folklorists traveling through the South. Between 1935 and 1939 some seven thousand

musicians worked for the FMP in twenty-eight symphonies, ninety small orchestras,

sixty-eight brass bands, and thirty-three opera or choral groups. The FMP sponsored

African American composers and had a hit with The Swing Mikado, Gilbert and

Sullivan done to African rhythms in Chicago and New York in 1938 and 1939. Music spread

and flourished despite decreased economic activity Music

in the 1930s

Civilian

Conservation Corps (CCC) Civilian

Conservation Corps (CCC)

1933-1942

"As part of the New Deal legislation proposed by President Franklin

D. Roosevelt (FDR), the

CCC was designed to provide relief for unemployed youth who had a very hard time finding

jobs

during the Great Depression while implementing a

general natural resource conservation program on

public lands in every U.S. state, including the territories of Alaska, Hawaii, Puerto Rico, and

the U.S. Virgin

Islands. The CCC became the most popular New Deal program among

the general public, providing jobs

for a total of 3 million young men from families on relief.[1]

Implicitly the CCC also led to awareness and

appreciation of the outdoors and the nation's natural resources, especially for city

youth.[2]

The CCC was

never considered a permanent program and depended on emergency and temporary legislation

for its

existence.[3]

... During the time of the CCC, volunteers planted nearly 3 billion

trees to help reforest America,

constructed more than 800 parks nationwide that would become the start of most state

parks, developed

forest fire fighting methods and a network of thousands of miles of public roadways, and

constructed

buildings connecting the nation's public lands.[5]"

(Source: http://en.wikipedia.org/wiki/Civilian_Conservation_Corps

"

Tennessee Valley Authority Tennessee Valley Authority

Est. May 18, 1933.

"Tennessee

Valley Authority (TVA) is a federally owned corporation in the

United States

created by congressional charter in May 1933 to provide navigation, flood control, electricity

generation, fertilizer

manufacturing, and economic development in the Tennessee

Valley, a region particularly affected by the Great

Depression. The enterprise was a result of the efforts of Senator George W. Norris of

Nebraska. TVA was envisioned not only as a provider, but also as a regional economic

development agency that would use federal experts and electricity to rapidly modernize the

region's economy and society.

TVA's service area covers most of Tennessee, parts of Alabama, Mississippi, and Kentucky, and small slices of Georgia,

North

Carolina, South

Carolina, West

Virginia, Indiana

and Virginia. It was

the first large regional planning agency of the federal government and remains the

largest. Under the leadership of David Lilienthal ("Mr. TVA"),

TVA became a model for America's governmental efforts to modernize Third World agrarian

societies.[1]

"the agency was given authority to enter into long-term (20 years)

contracts for the sale of power to government agencies and private entities, to construct electric power transmission lines to areas not

otherwise supplied and to establish rules and regulations for electricity

retailing and distribution. TVA is thus both a power supplier and a

regulatory

agency.

Today, TVA is the nation's largest public power company, providing electric power to

over nine million customers in the Tennessee Valley. ( http://en.wikipedia.org/wiki/Tennessee_Valley_Authority

)

Grand

Coulee Dam

Grand

Coulee Dam

In 1933, President Franklin D. Roosevelt authorized the dam

as a Public Works Administration project, and Congress

appropriated funding...It is the largest electric power-producing

facility[5]

and the largest concrete

structure in the United States.[6]

It is the fifth largest producer of hydroelectricity

in the world, as of the year 2008.

(Source: http://en.wikipedia.org/wiki/Grand_Coulee_Dam

) |

DOES OBAMA KNOW ANY ECONOMIC HISTORY?

Obama seems so utterly ignorant ot the economic history of the New Deal. He never mentions

FDR, even though the challenges were similat for both Presidents. We know that he

studied

Political Science and International Relations at Columbia. Having gone to Columbia

myself,

I can say, it would be quite easy for an undergraduate to major in international relations

and learn relatively little about macronomics or economic history. Why does he speak

so

little of this time in his life? Why does no one remember him? Obama has

refused to release

his college transcripts.

"Federal law limits the information that Columbia can release about Mr. Obama's time

there.

A spokesman for the university, Brian Connolly, confirmed that Mr. Obama spent two years

at Columbia College and graduated in 1983 with a major in political

science.

He did not receive honors, Mr. Connolly said, though specific information

on his grades

is sealed".

As a result, Obama gives only hollow economic speeches full of rhetoric, but showing a

pathetic

understanding of alternative economic policies that might be argued applied in a period of

chronic high unemployment and high deficits. Not surprisingly, Obama is completely

dependent

on advisers who are repeating the same mistakes that the Japamese did in the 1990s,

thnking that

monetary policy and very low interest rates would make a difference. he studied political

science

and international relations at Columbia.

At best, we are risking the experience of the Japanese. At worst, if fiscal spending

is curtailed,

we are risking a 1937-1938 Stock Market Crash, when FDR backslid towards fiscal austerity

and balancing a budget with 20% still unemployed.,.

See TigerSoft's Blog "The Limits of Monetary

Policy" February 5, 2008

"A

Deflationary Spiral Is The Biggest Danger Now" October 23, 2008

"Lessons of

Japan Stagnation: 1990-2003" February

25, 2009

"The Real Obama

Will Protect Wall Street, not Main Street"

From FDR's 1932 Innaugural

Speech

A "...host of unemployed citizens face the

grim problem of existence, and an equally great number toil with little return. Only a

foolish optimist can deny the dark realities of the moment.And yet our distress comes from no failure of substance. We are

stricken by no plague of locusts. Compared with the perils which our forefathers

conquered, because they believed and were not afraid, we have still much to be thankful

for. Nature still offers her bounty and human efforts have multiplied it. Plenty is at our

doorstep, but a generous use of it languishes in the very sight of the supply.

Primarily, this is because the rulers of the exchange of mankind's

goods have failed, through their own

stubbornness and their own incompetence, have admitted their failure, and have abdicated. Practices

of the unscrupulous money changers stand indicted in the court of public opinion, rejected

by the hearts and minds of men.

True, they have tried. But their efforts

have been cast in the pattern of an outworn tradition. Faced by failure of credit, they

have proposed only the lending of more money. Stripped of the lure of profit by which to

induce our people to follow their false leadership, they have resorted to exhortations,

pleading tearfully for restored confidence. They only know the rules of a generation of self-seekers. They

have no vision, and when there is no vision

the people perish.

Happiness lies not in the mere possession of

money; it lies in the joy of achievement, in the thrill of creative effort. The joy, the moral stimulation of work no

longer must be forgotten in the mad chase of evanescent profits. These