TigerSoft

News Service 8/4/2010 www.tigersoft.com

TigerSoft

News Service 8/4/2010 www.tigersoft.com

SAN DIEGO STOCKs Through The Lens

of TigerSoft's Power Stock

Ranker

by William Schmidt, Ph.D.

(Creator of www.tigersoft.com )

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

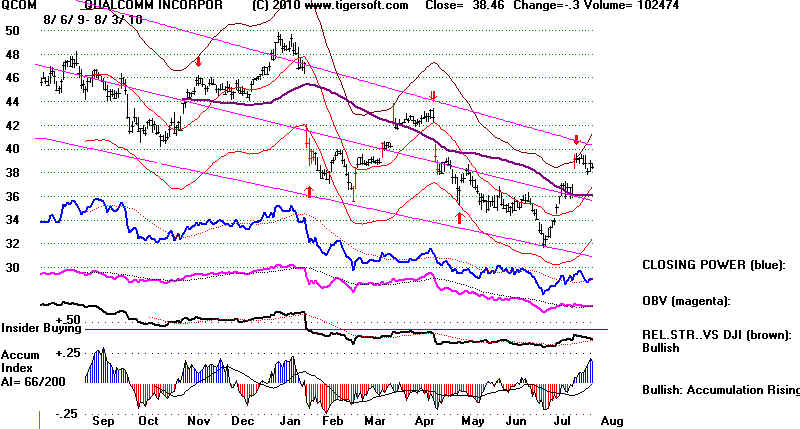

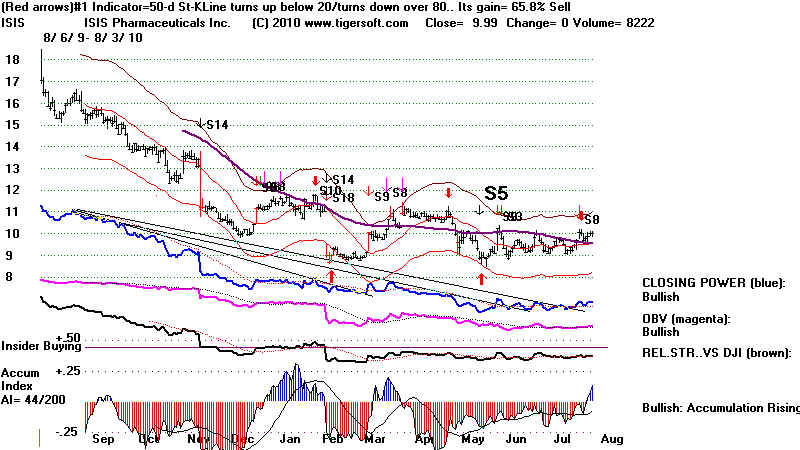

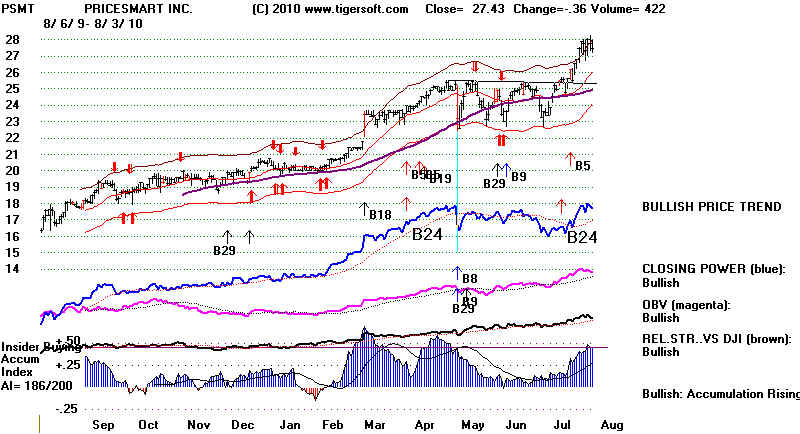

| SAN DIEGO STOCKs Through The Lens of TigerSoft's Power Stock Ranker by William Schmidt, Ph.D. (Creator of www.tigersoft.com ) The Tiger Power Ranker has many uses. Job Search and Targets for Salesmen (See Table 1 below) For someone looking for work or seeking advertising customers, for example, we generally would expect that the companies whose stocks have fone best over the last six months would be the best prospects. Table 1 below is produced by TigerSoft using the following commands. Peercomm + Older Charting + Ranking Results + User Set Rankings + 147 +1 See the resulting table on the screen or see the file containing the table, c:\peerless\RESU.txt The top 12 stocks based on their 2010 stock percentage gain were all in the field of health care. For a young person here, that would seem to be the field to specialize in. PriceSmart (Price Club or Costco) is doing very well and should be contacted. Stock Trading and Investing (See Table 2 below) For a stock trader, the Tiger Power Ranker lets you quickly find the strongest stocks. from a technical point of view, among all your stocks or a selected set of stocks. The highest ranked show not only very positive price momentum, they show Insider and Professional Buying on good volume. Year after year the highest ranked stocks outperform the lowest, except for brief period when there is heavy short-covering because the market's direction has changed. It is from the highest Power Ranked stocks that we usually find the bullish explosive super stocks. Related, to this is our simple screen for "Bullish" stocks, which eliminates a few top power ranked stocks that have recently, fallen below key support. Using the "Bullish" criteria, we see PSMT (which is consolidating constructively after a buce 20% advance since late June); WDFC (which has pulled back to the support of its rising 21-dma but shows Tiger Closing Power weakness). PSMT is the choice for intermediate-term traders.. || Short-Term Stock Trading Short-Term traders will want to run the Power-Ranker's scan to see which stocks have new red Buys where the best trading system, as tested by Tiger in a flash even before the shart appears on your monitor. Look for "Buy!" Today only ove was shown. It chart appears immediatelybelow: System Year's Gain from System ---------- --------------------------------- 5-day +51.5% RFIL 51.5% --------------------------------------------------- RFIL- New Short-Term Buy --------------------  ---------------------------------------------------- PSMT - Most Bullish Intermediate Term --------------------  |

|

Table 1 San Diego Percent Change Ranking of Perfromance in 2010.

147 trading days 12/31/2009 - 8/3/2010

Rank Symbol Name Price Pct.Gain Accum ----------------------------------------------------------------- 1 SOMX Somaxon Pharm 3.6 233% 24 2 NBIX NEUROCRINE BIOSCI 6.09 123% 93 3 ARNA Arena Pharma 7.29 105% 43 4 PURE PURE BIOSCIENCE 2.66 83% 143 5 AVNR AVANIR PHARMACEUT 3.3 73% 71 6 BOFI BofI Holding 16.79 67% 158 7 ILMN Illumina Inc. 44.92 46% 128 8 RDEA ARDEA BIOSCIENCES 20.5 46% 94 9 DXCM DexCom 11.72 45% 133 10 SQNM Sequenom Inc. 5.92 42% 66 11 AMLN Amylin Pharm. c. 19.71 38% 98 12 DIVX DIVX INC. 7.62 35% 157 13 PSMT PriceSmart 27.43 34% 186 retain 14 ALDA ALDILA INC. 4.5 29% 65 golf clubs 15 RMD ResMed Inc. 67.39 28% 152 16 O REALTY INCOME CP 32.63 25% 141 17 ECPG Encore Capital 21.51 23% 132 18 ACCL Accelrys Inc. 6.89 20% 127 19 RFIL RF INDUSTRIES LTD 5.4 20% 151 20 RUBO Rubio's Restaur. 8.65 19% 124 21 BMR BioMed Realty Tr 18.5 17% 128 22 VSAT VIASAT INC. 37.19 17% 154 23 SNMX Senomyx Inc. 4.35 15% 146 24 SHW SHERWIN WILLIAMS 70.49 14% 106 25 WDFC WD-40 COMPANY 36.21 11% 171 26 CUB CUBIC CP 41.02 9% 122 27 GPRO Gen-Probe Inc. 47.2 9% 113 28 COHU COHU INC. 15.11 8% 98 29 NUVA NuVasive 33.81 5% 93 30 WBSN Websense Inc. 18.48 5% 122 31 MITI MICROMET INC. 6.97 4% 116 32 VICL VICAL INCORPORATE 3.39 3% 102 --------------------------------------------------------------------- 33 PICO PICO Holdings 31.54 -4% 134 34 ANDS Anadys Pharm. 2. -6% 101 35 INO Inovio Biomed. 1.08 -6% 76 36 QDEL QUIDEL CORP. 13.05 -6% 79 37 CDFB --- 3.1 -7% 64 38 ELY CALLAWAY GOLF 7.07 -7% 100 39 SRE SEMPRA ENERGY 51.36 -9% 110 40 ACAD Acadia Pharm. 1.18 -11% 99 41 ISIS ISIS Pharm. 9.99 -11% 44 42 SAI SAIC INC 17.02 -11% 126 43 CYMI CYMER INC. 34.02 -12% 155 44 DRAD Digirad Corp. 1.75 -17% 126 45 QCOM QUALCOMM INC 38.46 -17% 66 46 CYTX Cytori Therap. 5.05 -18% 86 47 HOFD HomeFed Corp. 20.05 -19% 147 48 NVTL Novatel Wireless 6.44 -20% 75 49 LGND LIGAND PHARMACEUT 1.67 -24% 44 50 PXG Phoenix Footwear .38 -24% 132 51 ROYL ROYALE ENERGY INC 2.02 -24% 10 52 OVRL OVERLAND STORAGE 1.69 -27% 131 53 MXWL MAXWELL TECHNOLOG 12.8 -29% 77 54 AHS AMN HEALTHCARE SV 5.89 -35% 101 55 LEAP LEAP WIRELESS INT 11.56 -35% 94 56 CYPB CYPRESS BIOSCIENC 3.75 -36% 59 57 TNXI --- .035 -41% 104 58 HILL Dot Hill Systems 1.12 -42% 97 59 SNTS Santarus Inc. 2.7 -42% 93 60 XNN Xenonics Holdings .295 -72% 71 61 LJPC LA JOLLA PHARMACE .04 -77% 30

|

|

| |