TigerSoft News Service 8/3/2011

and Revised 5/16/2013

TigerSoft News Service 8/3/2011

and Revised 5/16/2013See also The Second Unnecessary US Depression: 1937-1938 by Wm Schmidt, Ph.D.

www.tigersoftware.com

TigerSoft News Service 8/3/2011

and Revised 5/16/2013 TigerSoft News Service 8/3/2011

and Revised 5/16/2013See also The Second Unnecessary US Depression: 1937-1938 by Wm Schmidt, Ph.D. www.tigersoftware.com |

Ignoring The Lessons of Keynes

and Forgetting Economic History

Put America in Needless Great Peril.

America Is Following The Same "Orthodox" Financial Policies

That Produced England's Locust Years: 1919-1937

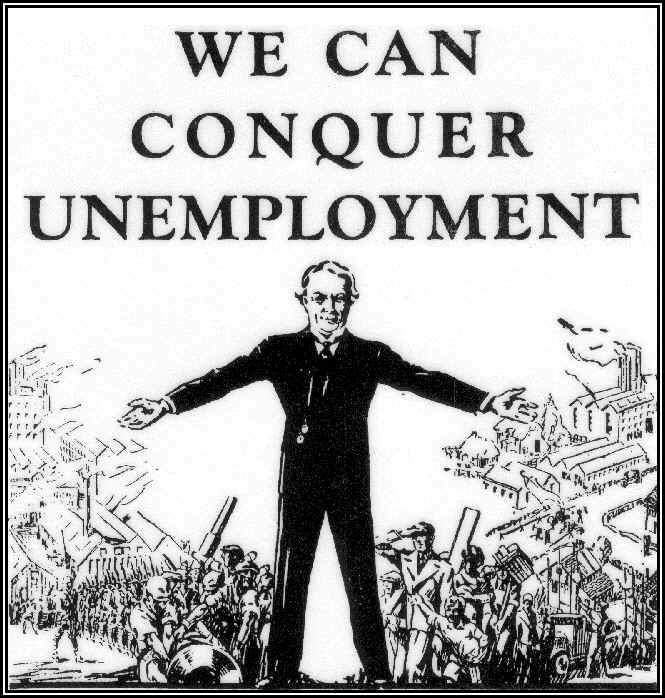

A MASSIVE PROGRAM OF PUBLIC WORKS IS

NEEDED NOW.

(8/7/2015) DEFLATION WILL BE NO FUN. IT CAN SPIRAL INTO A

DEPRESSION.

In late 2008, the Fed acted swiftly to prevent a deflationary spiral, now they

seem hell-bent on raising rates just as Deflation is taking hold. This is very

dangerous. See http://www.tigersoftware.com/TigerBlogs/October23-2008/

http://www.tigersoftware.com/tigerblogs/obamas1937/index.html

With bad policy

choices, Deflation lasted 18 years in Britain from 1920 to 1938.

Instead we only get Austerity and the very same budget balancing

that caused England's high unemployment never to fall much

below 8% for an entire generation between 1919 and 1939. Understanding

how and why these budgetary policies kept being applied despite

their dismal failure, year after years, may help us understand

what's wrong in America now. As in England then, our politicians

here only try to please the financial community.

By William Schmidt, Ph.D.

(C) 2013-2015 All rights reserved. William Schmidt, Ph.D.

www.tigersoftware.com

www.tigersoft.com

|

This

Blog in Political Economy is brought to you by William Schmidt and www.tigersoft.com Our Tiger/Peerless Stock Market HOTLINE Called The 2011 Top. Just as in 1987, 1998, 2000, 2002, 2007 and 2008. Don't be a deer in the Hotline.  |

READ KEYNES

IN THE ORIGINAL.

INVESTORS' "ANIMAL SPIRITS":

Despite the need for new investments, if capitalists

are sufficiently frightened and expect a deep recession, they will curb their

investments

and spending AND lay off their workers and cut production.

THE "MULTIPLIER EFFECT": Each Dollar spent on Public Works has a

3-4x effect

on GNP.

TARIFFS and

PROTECTIONISM - "They

do the trick."

INEQUALITY - MARGINAL PROPENSITY TO CONSUME

Poor people spend all their money very quickly. The rich do not.

They have no need to. The Government can spur a weak economy

along much more effectively by providing jobs for working people

than giving money to rich people and expect them to spend it

or invest it, epecially if they are frightened and bearish.w, not contract.

OVER SPECULATION: BOOMS and BUSTS

"Wall Street , as

an institution ...to direct new investment into the most profitable

channels in

terms of future yield, cannot be claimed as one of the outstanding

triumphs of

laissez-faire capitalism…"

THE LESSONS OF HISTORY

UK - 1919-1937

UK's GNP fell 25% between 1918 and 1921 and did not recover from

this until 1939.

Millions were unemployed for a

generation. It Did Not Have To Be This Way.

Hoover - 1930-1932

FDR - 1937

Germany -1932

France - 1930-1932

====================================================================

IGNORING ECONOMIC HISTORY

PUTS AMERICA IN GREAT PERIL

By William Schmidt, Ph.D.

(Columbia Univ.)

The British experience with Financial Orthodoxy should be a warning to all.

Unfortunately memories quickly fade after a generation, expecially when

the dominant elites supress the truth about how destructive their policies were.

Introduction

The story of the harm done working people in United Kingdom by the dominant

financial Orthodoxy of the 1920s and 1930s is seldom told in America. Still, I think

the main ideas that make up this Orthodoxy are easy enough to understand. Perhaps,

Americans will wake up and see what dire fate awaits them if they let their leaders

follow the very same Orthodoxy, wherein the highest priorities are always:

Unlimited Private Wealth -- Subservience to Private Financial Markets

Austerity -- Budget Balancing -- No Public Works Expenditures ,

Deflation -- A Strong National Currency

Throughout

the 1920s and 1930's, this 'orthodoxy' was also called the

"Treasury

view". The primacy of tradition and departmentalism is seen

here.

Treasury officials always advised their Chancellors, who were

nominally

their superiors, whenever the subject of Public Works came up in

Cabinet

discussions to to tell their Spending Minister colleagues, first, that Government

borrowing

money for Public Works would inevitably take away funds from

private

borrowing and thereby hurt trade and, second, the private economy was

self-correcting

and business conditions would seeon improve, so that no such

special

Public Works programs were necessary.

See

https://books.google.com/books?id=mWysZtLVQ2AC&pg=PA60&dq=stanley+baldwin+%22public+works%22&hl=en&sa=X&ved=0CEoQ6AEwCGoVChMIspmdl5-ZxwIVCUqICh1ligB8#v=onepage&q=stanley%20baldwin%20%22public%20works%22&f=false

A Recipe for Deflation

Americans

will readily recognize these dictates of Financial Orthodoxy as applied

by Presidents, Reagan, Clinton, Bush and Obama. Someone in Britain

now would

immediately see that these are still central features of Conservative

Party thinking,

especially under Margaret Thatcher and David Cameron.

Each one of the Chancellors of the Exchequer in the inter-war period were staunch

defenders of this Financial Orthodoxy. We might expect this from the Conservatives

who held sway throughout most of this period:

Austen Chamberlain (January 1919-April 1921),

Robert Horne (April 1921- October 1922),

Stanley Baldwin (October 1922- August 1923),

Neville Chamberlain (August 1923-January 1924)

Winston Churchill (November 1924-June 1929)

Neville Chamberlain (November 1931- May 1937)

But the very same policies were pursued by

Labor's Chancellor Philip Snowden (January 1924-November 1924,

June 1929-November 1931.

Some might excuse these Chancellor's ever unyielding attachment to

Financial Orthodoxy in the face of so high a rate of unemployment year

after year from 1920 to 1938, by saying that Chancellors were only doing

what was expected of them, namely:

1) fight government waste,

2) keep government expenditures within the limits of Government

revenues,

3) maintain the value of the Pound Sterling and prevent

a Weimar hyper-inflation,

4) gradually pay off the World War I indebtedness and,

5) above all, steer clear of the "event horizon" of the black hole

of Soviet-like socialism and central planning.

All these excuses pale when compared to the human cost of persistently pursuing

policies which promoted high unemployment and a stagnating capitalist economy

year after year, throughout the 1920s and 1930. Defenders of Financial Orthodoxy

in this era utterly ignored the emergence after World War I of widespread demands

that the Government properly compensate the soldiers who fought in the Great War

with decent jobs and housing. They ignore the long history of Public Works

and Council (public) Housing in the UK. And they ignore the leading

figures in the Liberal Party, like Auckland

Geddes, Alfred Mond and Christopher Addison

who advocated for a vast public works program as early as 1919, nine

years before Keynes set out a grand plan for Public Works on behalf of

the Liberal Party in 1928.

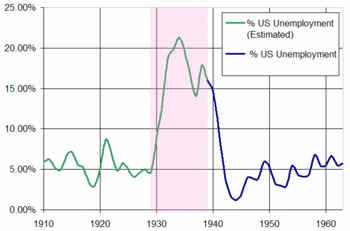

Always High Unemployment

British Unemployment in the inter-war years, 1920-1939,

never went much below 8%.

Think of the suffering, povery and the wasted potential. This did not have to

happen.

This path was chosen by the political and financial elites.

UK Unemployment UK Unemployment

US

Unemployment

Unemployed

Insured Unemployed

As a Pct. of All

as a Pct of insured

Employees

Employees

1920 2.1%

3.9%

5.8%

1921 12.2%

16.9%

16.9%

1922 10.8%

14.1%

10.9%

1923 8.9%

11.7%

4.6%

1924 7.9%

10.3%

8.0%

1925 8.6%

11.3%

5.9%

1926 9.6%

12.5%

2.8%

1927 7.4%

9.7%

5.9%

1928 8.2%

10.8%

6.4%

1929 8.0%

10.4%

4.7%

1930 12.3%

16.1%

13.0%

1931 16.4%

21.1%

23.3%

1932 17.0%

22.1%

34.0%

1933 15.4%

19.9%

35.3%

1934 12.9%

16.7%

30.6%

1935 12.0%

15.5%

28.4%

1936 10.2%

13.1%

23.9%

1937 8.5%

10.8%

20.0%

1938 10.4%

12.9%

26.4%

1939 8.5%

23.5%

Despite these dreadful numbers, year after year, the

British Chancellor of the Exchequer

and the Prime Minister always, whether they were from the Conservative or the

Labour Party, followed and preached the same financial Orthodoxy. This

Orthodoxy

was the only path to economic salvation, they always claimed.

The Conserative Mind

While High Unemployment was not the stated aim of Financial Orthodoxy, that is exactly

what its policies produced. I think it can be argued that the Conservative Party

in Britain and the "City", London's financial community, knew very well that

Orthodoxy was an excellent way to keep the workers subservient, to contol their

wage demands and to protect the rich from a successful political challenge.

If true, it means that their devotion to Orthodoxy was callous, cruel, self-serving

and based on greed. Were they biologically born without a compassion

gene? Or were the social/economic classes so separated in Britain? Certainly,

the physical separation of classes in England must have played some role.

The Cabinet Papers do not show much discussion at any time from 1921-1937

of the human costs of high unemployment. So, it was much easier to de-humanize

and disregard legitimate needs of the people one does not know. As one

English gentleman-officer in World War I famously commented: >I was quite

amazed to discover that Welsh coal miners were as "white" as I am, once the

Army washed away all their coal dust. <

Conservatives were defintely afraid a big national program of Public Works

might actually succeed. Not satisfied with criticizing Public Works as inefficient

and

unnecessary, they claimed such Government expenditures would crowd

out

legitimate private commerce and put the Government on a path toward

"Bolshevism".

They loved using this word. It stopped further thought.

When

under-paid workers rebelled by the millions in 1926 and there was a

General

Strike, this too was cakled "Bolshevism". It must be

suppressed.

No

mercy was to be shown them, said Chancellor of the Exchequer Winston Churchill.

(All

this reminds me an old IWW song.

Have

a listen - https://www.youtube.com/watch?v=eUifliF0rBU

)

Some Conservatives did think more thoroughly about Public Works. But they

never set forth a plan to reduce unemployment in this way. I suspect that they

secretly feared that such a government spending program would become very

popular and more such government programs would be demanded. After all,

the Government, had just successfully organized a massive war effort. It's

reasonable

to think, therefore, that many Conservatives at this time must have guessed the obvious:

namely, that millions would have loved a decent wage and the job security of

Government work, especially when working in private industry paid little and

was nearly always punctated by long periods of enforced idleness.

So, a much bigger but unpoken fear developed, namely: if public works

programs actually succeeded, what was the proper role for rich and for the

"City".

What would be their justification then for having so much wealth while so many

had so little. Where would bankers, stock brokers, industrialists, and

Conservative politicians position themselves in a world where the government

guaranteed everyone a decent paying job. Bankers and their rich friends

might not be needed much. Surely they would not be as important or so

well-paid.

It would be wrong to assume that Chancellors were troubled by the unemployment

and suffering they caused. The Cabinet Papers do not show they cared one whit

about the pain their policies were inflicting on millions. By going back on the

Gold Standard in 1925, Churchill immediately caused a sudden plunge in coal exports.

Miners were laid off or had their wages cut. They went on strike in strike.

The strike quickly spread. Nearly 2 million workers struck in

sympathy. (For

details.)

Churchill who was then the Chancellor of the Exchequer advocated in the Cabinets

for a full show of lethal force, including machine guns. "Either the country

will break

the General Strike, or the General Strike will break the country." He praised

the

Fascist dictator Mussolini for showing the whole world the right way to deal with

"subversive forces." The Cabinet Papers showed that Churchill wanted to

force

the miners back to work by denying their families Unemployment Relief and threatening

them with starvation. (Source.)

Tory Officer cadets were encouraged to volunteer as strike

breakers

Churchill insisted on an armed escort for a food convoy

The Minds of The

Labour Leaders

The British Labor Party's official loyalty to the Financial Orthodoxy in the

inter-war had different motivations. Realize that its leaders, MacDonald and

Snowden,

saw the Liberal Party, not the Conservative Party, as their main political enemy.

It was the Liberal Party they fought electorally most often in urban constituencies.

When the Liberal Party fully accepted and highlighted J. M. Keynes' Public Works

proposals in their official programme for the national election at the end of 1928,

Labour's leaders could not very well accept the same ideas. Keynes was a well-known

Liberal economist. Instead, they quickly proclaimed their loyalty to orthodox

Budget Balancing and the supremacy of Private Finance. They resolutely refused

to endorse public borrowing (deficit spending) to create new public jobs and

to rebuild England's infrastructure.

These two Labour leaders apparently wanted to prove to the Electorate

and to the financial Establishment that they could run the British capitalist

system better than either of the other political parties could. Were they

still socialists? Who knows. They were chosen to lead. This

was certainly

a strange position for the leaders of a Socialist Party, but MacDonald and

Snowden had reputations for independent thinking that went back to their pacifism

at the start of Worl War I. The rank and file in the Labour Party was expected

to follow their leaders, not challenge them. So, in the 1920s and until 1931,

when their leaders sought respectability and wanted to be accepted by the

financial Establishment, the rank and file accepted the Labour strategy of

first proving that they could run the country, before they would start talking

"Socialism".

Also because their Labour Party never won an outright majority in the House

of Commons, these two Labour Party's leaders in their 1924 and 1929-1931

governments, chose to follow the Orthodox Financial Policies, much like

Conservatives at the time had. They definitely did not want to give credibility

to the upstart Liberal economist Keynes.

This was even more true as the Financial Panic worsened in 1931. Seeing how

completely Private Finance froze up, they may have blamed themselves and

tried to offer the "City" even more concessions. In full crisis, the

Labour

Prime Minister MacDonald and Labour Chancellor of the Exchequer agreed

to cut the Government's budget to the point even of drastically cutting back wages

for those in Government, including even sailors in the British Navy. They also

agreed to dramatic cuts in the Unemployment Insurance benefits that millions

depended on.

I think this is proof that these two leaders themselves panicked. They could not

reverse course and admit they had been wrong. There was too much public spotlight

on them. They rightly feared the wrath of the public. So they panicked and

clung

even more tightly to the tenets of the Orthodoxy and said they had no other choice

but make severe spending cuts. This was, of course, not true. Keynes and the

Liberals had shown their were other choices. MacDonald and Snowden simply lost their

nerve. They hid behind the orthorodox Treasury view.

In the end, so upset were rank and file members of the Labour Party. that these

two "leaders" were expelled from the Labour Party in 1931. The

Labour

rank and file, however, were so disillusioned by the Labor Party Elite's subservience

between 1929 and 1931 to the "City" and Financial Orthodoxy, that they refused

to vote in large numbers for Labour until after World War II, by which time

Labour's leader Clement Atlee

had fully embraced Keynesian Public Works and

deficit spending to promote recovery and employment. In 1945, he was elected

Prime Minster by a landslide.

The Tenets of The British and American Financial Orrthodoxy

1. Balance the Budget no matter the costs.

2.

Private sector jobs are more legitimate than Public Sector.

3.

Take pride in a rising and lofty Dollar (Pound Sterling).

4.

Wall Street rules. (The "City" know best.)

5. No taxes on stock trades. No limits on executive pay.

6. Encourage Absolutely Free International Trade.

(British Conservatives did put up some tariffs on non-Empire imports.)

7.

Permit private investment capital freely to go abroad.

8. Lower prices were desirable.

The only aspect of the British orthodoxy not followed now in America was in the

area of the Bank of England's relatively high Lending Rate. The American FED, of

course,

has made the interest rate on their loans to the the biggest banks very low and has been

buying long-term mortgages in the open market. US Big Banks, it should be said,

are

the real beneficiaries of the Fed's very low interest rates loans, though home buyers

theoretically can save a lot of money buying a home, provided they can borrow the

money from a bank for a mortgage.

American Bankers now pay very low interest on loans from the Federal Reserve.

This seems nice, until you realize that the big banks can do whatever they want

with the cheap money. They can Buy foreign bonds, make loans to allow American

corporations to export jobs, speculate aggressively, using leverage to the fullest,

in stocks, commodities, bonds, icurrencies. They are under no obligation to

pass

along the low rates to the American Public or even make any loans. And they

can and do use this cheap money make huge campaign contributions to American

politicians to bribe them so that Wall Street always gets the inside track and

its way when policies are being made. Thus, the exception of lower interest rates

has been twisted by Wall Street to ensure its hegemony continues In America,

Main Street is of lesser importance, just as working people and small shop keepers

were when the "City" in London ruled England so absolutely in the 1920s and

1930s..

This Orthodoxy, apart from the experiment in low interest rates, is

fully supported by all Republicans. Most Democrats in Congress and the President

also uphold the American Orthodoxy. In this they are doing just what

the richest Americans and the biggest corporations want, apart from occasional

rhetorical lapses by Democrats made in the middle of their political

campaigns.

The reign of financial Orthodoxy in England had the same underlying basis:

National financial and budgetary policies always had to protect and promote

the interests of the richest Englishmen and the "City", London's financial

community, just as they saw these interests.

My hope is by seeing just how badly England was served by this Orthodoxy, we Americans

may better come to understand why we have such high unemployment still and

why the Super Rich here seem to be the biggest benefactors of the Obama Administration's

financial, banking and budgetary policies. The dire economic consequences of the

British Orthodoxy are familiar to most British economists, not just Keynesians.

In America, Government was seen as the source of economic problems by Reagan

and his followers. De-Regulation was preached for two decades by Milton Friedman

and Alan Greenspan. Clinton's Treasury Secretary, Robert Rubin, continued this

laissez-faire, conservative ideology. The pervasiveness of thieir Orthodox thinking

has prevented Americans from seeing that Keynes was not a "Red". He

believed that Capitalism in Recession could only be saved from itself if the

Government launched Public Works' programs when Private Investment failed.

Government De-Regulation is now no longer held in high esteem. Most Americans

understand that the loan policies leading to the Housing Bubble, the Bank's excessive

speculation and the fraud in selling sub-prime mortgage back securites were all

caused by a lack of government regulation. On the other hand, the great need for

Public Works is not yet widely accepted by the Political and Financial Elites in

America.

But it is growing among the people. They want decent jobs! They are tired of

waiting.

Americans understand that the American Financial Orthodoxy and "Trickle-Down"

is not working. The bull market since 2009 has not seen a comparable increase in

jobs. Rising stock prices are making the rich a lot richer. But they

corporations

are not investing in new manufacturing here. They continue to sit on billions

hidden

away in foreign tax havens. Some times the corporations use this money to buy

out a competitor But mostly, big Corporarions are replacing American

workers with new overseas factories. As costs go down, the CEOs can report higher

earnngs, make Wall Street happy and get even higher pay.

Good paying manufacturing jobs in America are too scare. The Unemployment

Rate for the unskilled is way over 12%.

Americans are told by Obama and the Democrats to be patient. "Don't rock

the boat."

"The Republicans would make things worse". "We Democrats know what

we're doing."

"The slow recovery is the fault of Republican obstructionism." Do not buy

these excuses.

If the English experience of the 1920s means anything, it means that the American

Financiol Orthodoxy will keep tens of millions of America unemployed for a decade or

tow. Almost nothing is being done by Democrats and their Wall Street backed,

free-trade, free-market Othodoxy to rapidly increase the number of decent paying

manufacturing jobs.

. Even though the dire economic consequences of Orthodoxy are becoming clearer

and clearer in America, just like the terrible, high unemployment was to people in

England in the 1920s, before evem the 1930s, the elites ignore these contradictions

almost totally. So, the political problem remains. As in England in 1926 or

1931,

what can the average American worker do? Both major political parties' leaders

support the failing policy of Orthodoxy. What will change their economic

policies?

England's experience does not make for hope. Protest marches did not work.

Even a General Strike in the UK did not work. The best hope, sadly I conclude,

would seem to be to show the Elites that even the Wealthy will better promote their

own long-term interests much better if they work to expand the domestic American

economy,

and create real jobs here, let the Government rebuiild our aging public

infrastructure and

take away Wall Street's exceptional powers.

There should be no need for so many retiring Americans to have to gamble their

savings in the stock market. Wall Street may be essential, but it should not be so

dominant.

Should not more people make things than service investors and short-term trading,

which is often parasitic and has no social value. Of course, the Big Banks

must be broken up.

They're bigger than ever. They could easily shut down the whole economy in the next

"Crash".

That they have not been broken up and there are no plans to do this shows clearly

how all-powerful the Financial Elite are politically. America is every bit as much

dominated

now by Wall Street as England was in the 1920s, when the Treasury view and the needs of

the "City" over-ruled the needs of millions who were out of work and desperately

needed

Public Works jobs since the Private Sector could not and would not provide them

year after year, after year, after year.

To seek change we must, I think, explain how and why the British political and

fnancial elites clung so stubbornly to an Orthodoxy which was clearly so destructive,

even of their own interests in the long run. It's important to see that each of the

different actors on the political stage had somewhat different reasons for refusing

to reconsider their loyalty to Orthodoxy, even in the face of the terrible Unemployment

caused by it.

As you read what I write here, keep in mind the next set of statistics. They

could very well be what is in store for America if our political and financial elites

do not shake off their ideological binkers.

British Unemployment in the inter-war years, 1920-1939, never went

much below 8%.

UK Unemployment UK Unemployment

US Unemployment

Unemployed

Insured Unemployed

As a Pct. of All

as a Pct of insured

Employees

Employees

1920 2.1%

3.9%

5.8%

1921 12.2%

16.9%

16.9%

1922 10.8%

14.1%

10.9%

1923 8.9%

11.7%

4.6%

1924 7.9%

10.3%

8.0%

1925 8.6%

11.3%

5.9%

1926 9.6%

12.5%

2.8%

1927 7.4%

9.7%

5.9%

1928 8.2%

10.8%

6.4%

1929 8.0%

10.4%

4.7%

1930 12.3%

16.1%

13.0%

1931 16.4%

21.1%

23.3%

1932 17.0%

22.1%

34.0%

1933 15.4%

19.9%

35.3%

1934 12.9%

16.7%

30.6%

1935 12.0%

15.5%

28.4%

1936 10.2%

13.1%

23.9%

1937 8.5%

10.8%

20.0%

1938 10.4%

12.9%

26.4%

1939 8.5%

23.5%

What Underlay The Tenets of Financial Orthodoxy?

The supreme concerns of this Orthodoxy were: balance the national budget, pay-off

past government debt and restore the Pound Sterling to the Gold Standard.

Deflation was welcomed, too. In all these things, the central policy makers,

the Chancellor and the Prime Minister heeded only the advice of Treasury

bureaucrats and the private bankers in London's financial community, the "City".

Orthodoxy's undeclared assumption must be noted, because of whose immediate

interests it best served. Only the private allocation of capital was

considered legitimate

in peace time. Government expenditures should be strictly limited. Borrowing

money

for Public purposes always took money away from Private investment. More jobs

could not be created by government housing or Public Works programs, because

such funds as would be used could only come from the same pool of Investment

Money that private investment drew from.

This was the financial Orthodoxy that underlay all budgetary decisions in the UK

for nearly 20 years. Its consequences grew more and more dire. In many ways,

England hibernated. Its economy stagnated. Its industrial north suffered most.

But everywhere there was high unemployment, widespread poverty, industrial

obsolescence and a decline in competiveness internationally.

Still the political and financial elites allowed no breaches or challenges to their

Orthodoxy. It was like a religious faith. The more its economic

consequences

brought economic suffering and pain, the more this was considered a positive development.

It meant society was paying off the price for some past indulgence or extravagance.

Soon,

purged of this sin, the economy would emmerge cleaner, stronger, purer and

more efficient. The champions of this financial Orthodoxy never wavered.

Their loyalty

to it was never shaken. Heretics were excluded from positions of power and

publicly scolded. Only loyal followers of the Orthodoxy became Chancellors and

Prime Ministers.

We Americans now seem doomed be victimized in the same way by our own leadership.

It repeats all the same mistakes and for the same reasons. The millions who

are unemployed are not heeded by our policy makers. The 40 million who rely

on food stamps are considered "takers" by the Republicans and never mentioned

by President Obama. Small business owners are forgotten and their stores are

replaced by big multi-national corporations wko import most of what they sell.

In this, the Republican and Democratic Party elites only hear and heed the orthodox

views of Wall Street, the Chamber of Commerce and the National Association of

Manufacturers.

As in England, it does not seem to matter how badly the Orthodoxy fails working

people. Clearly, it is making the rich much richer. And that is all that

seems to

count to Republicans. And truthfully, campaign rhetoric aside, this is also all that

matters to most Democrats in Washington, too.

Four

years after the Housing Bubble broke, American real unemployment remains

very high. Wall Street is happy, but Main Street is not. Why do our

government's

leaders, Republicans and Democrats, year after year, cry always for budget-balancing

Austerity and a Strong Dollar as their only solutions to what ails our economy?

Why do they not re-think their failed policies. When will they admit they were

wrong?

Studying the English experience shows how entrenched and self-perpetuating the

orthodox "Treasury view" was. Their political leaders could no more

abandon

their rich supporters, stop balancing national budgets on the back of working people.

or cease calling for Deflation and a much stronger national currency than ours can.

England was a Plutocracy in the inter-war years. America is a Plutocracy now.

The inter-war years in England are known as the "locust

years". The English

"roaring 1920s" were years of needless high unemployment, rusting

industry,

plant obsolescence, widespread poverty and needless suffering. There were

marches. There were demonstrations. There was even a General Strike.

Still the financial experts and elites clung to their erroneous and destructive views and

solutions. This is also the story of WHY the so-called experts and leaders,

year

after year, government after government, never changed their thinking. . ..

.

Unemployment in Britain was always very in the "roaring" 1920s.

There were even

hunger marches to London in 1922, 1923, 1927 and 1929. There were also

frequent clashes

between the unemployed and the police. (Source.)

The lowest English Unemployment fell to in the whole long period between 1921

and 1939 was 7.4%. Employment conditions were steadily poor in the 1920s

and awful in the 1930s. As in America now, "the incidence of unemployment

throughout the interwar period was generally higher for men (50% higher)...

and for older workers and youths between 21 and 25...It was particularly acute

amongst unskilled manual workers". (Source.)

From 1921 to 1939, British Unemployment was always above a million people.

In 1933 it reached 3 million. The number of hours typically worked also fell.

National unemployment rates can be compared, I think, even though methodologies

for their computation surely must have differed. The data above shows

that England's rate was much higher in 1923, 1925, 1926, 1927, 1928 and 1929

than in the 1920s. America's boom was brought about by new inventions,

cars, radios, washing machines... England's industry, in contrast, was slow to

adapt. Investments went overseas and imports were deliberately made cheaper

to allow England's financial community to enjoy the prestige of the Pound being

backed by Gold.

Orhtodox British Policy Making

Except for the post war Lloyd George government's acceptance of the principle

that the severe housing shortage in the UK should be alleviated by the subsidizing of

council houses in 1919-1920 (The Addison

Act) and the start of paying a

small amount of unemployment relief to manual workers in 1920, the economic

policies of the various British Governments from 1920 to 1939 were

always subordinate to a Financial Orthodoxy that was sometimes called the

"Treasury View".)

In this, the highest Cabinet priority was placed on Governmental Austerity and Balancing

the

Budget at all costs, no matter the levels of Unemployment. There was a strong

preference

for Limited Government. Furthermore, England was expected to strive to return to,

and then say on, the pre-war Gold Standard, even if it meant Deflation.

Free trade

was a Liberal Party and Labor Party Preference. The Conservative Governments

were mildly more protectionist.

By 1921, Conservatives accused the Ministry of Housing of high-handed

Bolshevism and the national government's role in helping to finance

council houses was rendered

almost meaningless.

In the Cabinet's many

deliberations on economic policies, always the

the financial community's interests were placed above

the needs of the average worker and the small shop keeper. In England,

the most power political exponents of this Financial Orthodoxy were

the Chancellor of the Exchequer, the Prime Minister who usually had

been a Chancellor and the Treasury Department who advised the

Chancellor and conveyed to the Chancellor the "City's"

preferences

and perspectives on "investor confidence" and the likely

success of

government borrowing.

Why

Did The British Government Pursue Only A Policy of

Financial Orthodoxy between

1921 and 1937 despite the continuing

high

level of Unemployment?

Economists typically place the blame for the stagnant inter-war British economy

on

the failure of private investment to keep up the country's infrastructure and

technology. The cotton, coal, steel and iron industries became uncompetitive

internationally. Newer industries, like cars and chemicals, grew more slowly

in

the UK than in the US or Germany.

Why did private investment fail in this?

The primary

answer: it was was not sufficently profitable to make such investments.

Interest

rates were kept high to support the Pound. Domestic demand was too strictly

limited to

buy what was already produced, primarily because so many

consumers

were poor, this a result of the high long-term unemployment.

The UK's budget

showed a surplus throughout the 1920s. Excluding interest

payments on

World War I debt, tax revenue was greater than government

spending.

By 1928, Conservatives might have asked themselves if balancing

a budget

just for the sake of balancing a budget served any good national

purpose.

They did not. The political reasons for laissez-faire were just

too strong.

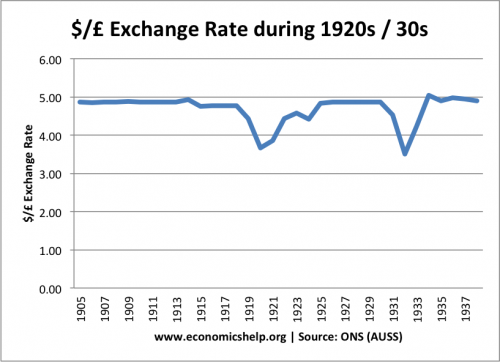

In 1925, the

Pound Sterling was restored to its pre-1914 value of $4.80/Pound

by Chancellor of

The Exchequer Winston Churchill and Stanley Baldwin, the

Prime Minister.

The cost to the British economy and to the British working class

of this largely

symbolic, patriotic victory was immense.

Setting the

Pound artificially high from 1926 to 1931 and from 1934 to 1939

brought

Deflation. Wholesale actually prices in Britain fell by 23%

between

1921 and 1929. Going back on the Gold Standard necessitated

high

interest rates to induce foreigners to buy British bonds. But this

made loans

more expensive and also reduced consumer borrowing.

The high

international value of the Pound ($4.80 = 1 Pound Sterling)

made it

much harder for foreigners to buy British goods. British manufactured

exports

fell while imports increased. It also became easier and much more profitable

for British

investors to take their money overseas. The wealthy, of course,

enjoyed

being able to import more foreign products. Restoring the Pound

to its

pre-War levels also made them feel that England had not lost its status

as a world

ppower. Tory nationalists like Churchill were cheered by this.

Unfortunately, the poor and the working classes lacked sufficient employment

and income

to benefit from the Deflaton.

And things

got steadily worse. The working class as a whole

steadily

lost buying power due to the high unemployment and

the way an

abundance of men seeking work tended to reduce

wages that

were paid. And without sufficient domestic buying power,

English

factories hired fewer and fewer workers. This vicious

circle

turned into a vortex in 1930.

Of course,

Conservatives in the UK, just as they do in the US now,

blamed the

introduction of unemployment benefits in 1920. These "benefits"

were so

meager, it hardly seems likely that many Englishman chose them

voluntarily over

employment.

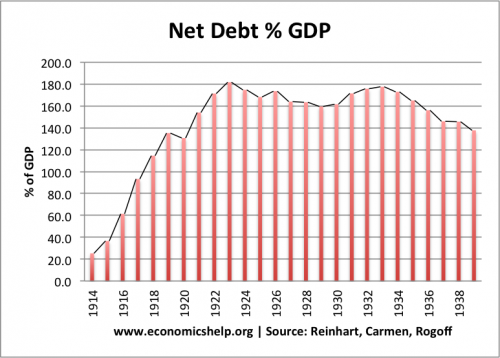

The biggest irony

of all: Years of Austerity, Budget Surpluses, the Gold

Stand and

Financial Orthodoxy did little to reduce British national debt as

a percentage of

its GDP. In 1922 the number was 180%. In 1932 it was

still 180%.

It remained little changed. Even by the Conservative's

own measuring

stick, their policies had failed. But the human costs were

huge and awful.

Look the Unemployment Percentages below. England

experienced for

17 years the same level of unemployment that Americans

have today.

Unemployment

1920 2.1%

1921 12.2%

1922 10.8%

1923 8.9%

1924 7.9%

1925 8.6%

1926 9.6%

1927 7.4%

1928 8.2%

1929 8.0%

1930 12.3%

1931 16.4%

1932 17.0%

1933 15.4%

1934 12.9%

1935 12.0%

1936 10.2%

1937 8.5%

1938 10.4%

1939 8.5%

The 1926 General Strike in Britain was called to highlight

the

continuing high unemployment and wage reductions forced on coal miners

in

the aftermath of Churchill's return to the Gold Standard.

Who Was To Blame?

I blame the governments, one after another, in this period for

failing to put

the

millions of unemployed to work rebuilding the country's rusting infrastructure

and thereby

also losing the chance to boost their buying power so that they

could buy

more British goods. This callous stubbornness doomed millions of

people in

England quite unnecessarily to long-term Unemployment, Depression

and Poverty

between 1919 and 1937.

Why were the governments so callous? Why

did they always ask what would

be the

consequences on the "City",London's financial community, but

so seldom ask why

the unemployed had to be remain unemployed so long?

The answer is

that the cold economic orthodoxy of Austerity held sway in

the

"City", in the Treasury, and in the thinking of each Prime Minister

and Chancellor of

the Exchequer. It was the dominion of this Financial

Orthodoxy among

all the political and financial elites that should be

blamed. The

same orthodoxy rules American political and financial elites

now.

America seems doomed to repeat the English experience of the 1920s

and 1930s, even more

unnecessarily than Britain did. You might think

that American

politicians might be aware of and learn something

from England's locust

years' experience. Apparently, that is asking too much.

The reasons for

America's ideological blindness and stubbornness now

seem remarkably similar

to what I learned was true in England. We should, I think,

study the British

experience closely.

This was

the subject of my Doctoral Dissertation at Columbia University.

I still

remember the rejection letter I got from Penguin. "No one will

want to

read this." Now 40 years later, it is particularly timely.

US

Policy-makers, both Republicans and Wall Street Democrats like Obama

must

somehow wake up and learn about the mistakes made year after year

by

England's top policy-makers in its dismal locust years: 1919-1937.

Stubbornly adhering to the same Financial Orthodoxy now will doom

America to

its own "locust years", with the same tragically unnecessary

consequences: high unemployment, badly neglected infrastructure,

flight of

capital abroad and poverty and poor health for tens of millions of Americans..

I have

organized the discussion below as follows:

UK - 1919-1937:

Each Chancellor of The Exchequer Demanded The Rule of Financial Orthodoxy,

despite the Continuing High Unemployment and Substantial Long-Term Poverty.

Financial Orthodoxy:

Austerity,

Budget Balancing,

Limited Government,

Going Back to Gold Standard and

Special Preeminence of the "City"(London's Financial Community)

Why Did Financial Orthodoxy Prevail?

1) The Recruitment Process for the Chancellor of the Exchequer and Prime Minister

2) The Chancellors' Political Goals Made Him More Orthodox.

3) The Treasury Department was Home to the High Priests of Orthodoxy. Why?

4) The Rich Man's Financial Orthodoxy.

Orhtodox Chancellors:

Austen Chamberlain

Robert Horne

Stanley Baldwin

Winston Churchill

Phillip Snowden

Neville Chamberlain

The Fabian Socialists' View of the Financial Orthodoxy.

Inter-War Year Challenges to the Financial Orthodoxy

1) Addison's Proposals for Health Care in 1919

2) Alfred Mond's Proposals for A Large-Scale Public Works Program in 1920

3) Keynes vs. Chruchill's Return to Gold Standard: 1914-1926

4) Liberal Party's Public Works Program: 1928

5) Keynes vs. The Treasury's Orthodoxy

6) Labor's Mosely Proposes A Massive Public Works Program: 1930-1931

7) Churchill Seeks To Dramatically Boost Spending on RAF: 1933-1936.

Keynesian Deficit Spending and Public Works

Turned down by Snowden and Neville Chamberlain: 1929-1935

Adopted by Germany and Sweden, whose economies recovered quickly.

FDR and Keynesian Deficit Spending: 1933-1936

------------------------------------------------------------------------------------

UK - 1919-1937

The theme of my 1972 dissertation at Columbia, The

Role of the Chancellor

of The Exchequer in British Cabinet Politics:

1919-1937", was quite simple.

As second in command in

the British Cabinet and heir-apparent to be

the next Prime Minister, the orthodox financial perspective and policies

of every Chancellor in this period did immense, unnecessary harm

to England and its people in its "locust years", 1919-1937. This

became clearer and clearer. Yet there was no change in their

thinking, year after year. Liberal and then Keynesian criticisms of

this financial orthodoxy were always rejected.

It cannot be said that there were no other alternatives than cutting

government spending more and more deeply to balance the national

budget. And it cannot be said accurately that these alternatives did

not get sufficient political expression to allow the Chancellors and

their defenders correctly to say that no one advised them of anything

different than the prevailing financial orthodoxy. Other solutions,

especially, massive Public Works programs and large-scale Rearmament

spending were set forth by spending ministers within the inter-war

Cabinets. Yet every Chancellor, regardless of party, year after year,

invariably fought all new government spending proposals,

no matter their merits, no matter how many

jobs they might have created,

no matter how unprepared the RAF was as Germany rearmed.

Surely, the Chancellors must have read the dismal economics news

month after month, year after year. They could see the suffering and

poverty that extended high unemployment and then Depression

brought. Yet, they all dismissed these dismal facts as inevitable

and unalterable. They chose not to see them as the direct consequences

of years and years of Austerity, Balanced Budgets and their own

"No"s to all new spending programs.

In this period, only financially orthodox policies were approved by the

British Cabinet despite 18-years of steadily high unemployment and

misery for the millions of people stuck in poverty and poor health.

The political

leadership and the political system utterly failed, much like

has now in the US. Each year it should have become clearer and clearer

that completely new financial policies were needed. Instead, the Prime Ministers

and Chancellors, year after year, stuck to the same old policies which had

always failed to bring about a real economic recovery and full employment.

Such suffering we now realize was the result of the way Prime Ministers

(who were often ex-Chancellors) and Chancellors of the Exchequer

clung stubbornly to a financial orthodoxy that still grips most politicians

in the US, the UK on in Europe. This was the Ideology of Austerity.

Its principal tenets were:

1) Always, they said, "Balance The National Budget", no matter how much

unemployment already existed, no matter how much it would be increased

by more government lay-offs and no matter how much suffering would ensue

among the poorest in society.

2) Always Protect or Enhance the National Currency. The Gold Standard

represented the natural order of things. Returning to it would bring

pre-war imperial greatness, glory and normalcy. Clearly, the reasoning here

had a big emotional component.

3) Never Challenge the Financial Community in their assessment of

how best to ensure sufficient confidence to accommodate government

borrowing needs and maximize private investment and economic growth.

If the Treasury said that the "City"'s confidence would be jeopardized

by public borrowing to finance Public Works, than that should be

the end of discussion. Always there was the danger that Public borrowing

would "crowd out" private finance.

Why did the

political leadership fail so badly?

1) The Political Recruitment

Process

The complete adherence to the Financial Orthodoxy, just laid out, by each

Chancellor of the Exchequer and each inter-war Government

came about, first, because each Conservative Prime Minister in this period

had himself been Chancellor and it was the Prime Minster, of course,

who picked who would be his own Chancellor in his Cabinet. Naturally,

these Prime Ministers picked as their Chancellor and #2 man in

the Cabinet, someone who held views and opinions like their own.

That their official residences, #10 and #11 Downing Street, were right next

to each other also reinforced like thinking.

Strikingly, except for the Labor Governments, 1924 and 1929-1931, the

man who picked the Chancellor, had himself been Chancellor and, therefore,

had himself been heavily influenced by the same recruitment process

that favored orthodoxy. In addition, the high priests of Orthodoxy in the Treasury

Department heavily influenced the thinking of the Chancellors

who became Prime Ministers as well as the current Chancellors of the

Exchequer.

2)

The Conservative Chancellor's Political Goals

Chancellors

chose financial Orthodoxy and Austerity because

they thought it served their political interests. They were already

second-in-command and heir-apparent to the office of Prime Minister.

Why, they thought, take a chance and risk becoming Prime Minister?

Why surprise or shock others, and there were many, who expected the

Chancellor to stick to an orthodox financial path.

In fact, many inter-war Chancellors did become Prime Ministers.

(Austen Chamberlain, an exception, did become the Parliamentary leader

of his party, but chose to remain loyal to Liberal Lloyd George's

government rather than seek the Prime Ministership when Conservative

back-benchers decided to break free.) Four inter-war Conservative Prime

Ministers, Bonar Law, Stanley Baldwin, Neville Chamberlain and

Winston Churchill, were each very orthodox Chancellors before they

became Prime Ministers.

Importantly, as heir apparent, the Chancellors saw no reason to give

the wherewithal to a spending minister that potentially might enable

that minister to build up such a favorable reputation on his own that it

would allow him to successfully challenge the Chancellor when it came time

for a new Prime Minister to be selected. Why help a spending minister,

up the same promotion ladder the Chancellor was on? Intra-Cabinet,

political alliances were less important to the Chancellor than keeping

the favor and trust of the Prime Minister. They knew that the Prime Minister

could ask the Chancellor to resign at any time.

Furthermore, It clearly would not help the Chancellor's chances to succeed

to the Prime Ministership if he said anything that would disturb the "City"

or weaken the Pound Sterling. So, why not continue being hard-nosed and make

a reputation as being resistant to government waste?

I believe that this deep-rooted ideology of Austerity and Orthodoxy

were promoted by the Chancellor not because the Financial

Community secretly pulled political strings, as Marxists might allege.

The Financial Community did not have to pull any strings or make

make big campaign contributions, as in America, There was no such need.

All the Chancellors were already their natural allies. The Chancellors shared

the same thinking and fully appreciated the political advantages of adhering

to the financial orthodoxy. They were already on the fast track

to become

Prime Minister provided they did not do something foolish and provided they

did not allow a spending ministers to gain a grander reputation that would

threaten their own. .

Their adherence to the prevailing financial orthodoxy was thus a matter

of political convenience. Chancellors in this period opposed all increases

in government spending. Exceptions I could not find. They did not pick

and chose some new spending proposals to reject and some to

accept. When they were over-ruled in the Cabinet, they formally dissented.

They believed that encouraging any one spending proposal would

encourage others. And they said this quite openly. In this way there

was no need to think hard and develop a subtle, layered, nuanced

view of national finance and macroeconomics. Rather, they could claim

to be maintaining the grand tradition of the Treasury and the Chancellor.

Chancellors of the Exchequer were not part of a hidden financial cabal

Their Orhtodox views and loyalties were openly expressed. And it served

their political goals to work hard to reinforce, rather than challenge,

the Financial Orthodoxy in the mind of the Public and the Press.

A complete acceptance of the tenets of Austerity and Orthodoxy were

viewed by the Chancellor as the best way to keep the financial community

happiest and to avoid financial panics. Interestingly, Snowden the

Labour Chancellor was as devout a believer of Austerity and Financial

Orthodoxy as any of the Conservative Chancellors. We will look at his

case closely further below.

Orthodoxy was expected of Chancellors in the secret and private Cabinet

discussions of public policy and finance. Orthodoxy is what they delivered

behind the scenes. One might think that given the secret nature of Cabinet

deliberations (This is the so-called "collective responsibility"), they

might have voiced a heterodox view now and then. I could find

no instances of this in all the Cabinet memoranda and minutes I read

at the Public Records office in London.

It was as though they turned off their "free will" and their ability to do

critical thinking. All the inter-war Chancellors played this orthodox role

in exactly the same way. The arguments a Chancellor used against spending

proposals to build Council Houses in 1920, to launch a Public Works program

in 1920 or 1930, or to expand and modernize the RAF (Royal Air Force) in 1934

were always the same. Such expenditures would cost too much. The budget

could not afford them. They would cause a bigger budget deficit. In

turn, this

would jeopardize investor confidence, hurt the Pound (and the stock market)

and drive up the costs of borrowing from home and abroad. At best, such

spending proposals were "ill-timed". Usually, they were considered

"wasteful",

"dangerous if they encouraged others to also seek new spending" and

"damaging to investor confidence".

3) The

Treasury Was Home to The High Priests of Financial Orthodoxy.

.

The Chancellor depended upon the Treasury's civil servants to advise

him and give him the arguments and numbers that he used in the

Cabinet papers and discussion, as well as in his speeches in Parliament,

including his annual presentation of the Government's budget. It was

much easier to get the Treasury to do what it had always done, namely

demonstrate how a budget must be balanced, than to get it to

advance arguments in favor or public borrowing that would break

with its traditions. None of the Chancellors I studied questioned the

traditional, orthodox view that each year the national budget must always

be balanced.

The Chancellor with Cabinet approval could seek or modify taxation,

but with one exception, he never challenged the Treasury's position

on how much revenue might be raised by different taxes and through

government borrowing. The Treasury's views and recommendations

seem always to have been accepted. They were never challenged.

The only exception, perhaps, was Chancellor Bonar Law in 1915, when

he proposed that the Government issue War Bonds with a lower

interest rate than the Treasury advised. Law claimed correctly that

an appeal to patriotism would be successful.

Why

were the Treasury civil servants so orthodox in their thinking?

Wikopedia says Treasury orthodoxy

was the view that fiscal policy

has no effect on the total amount of economic activity. In his 1929

budget speech, Winston Churchill said the

"The orthodox Treasury view ... is that when the Government borrow[s]

in the money market it becomes a new competitor with industry and

engrosses to itself resources which would otherwise have been employed

by private enterprise, and in the process raises the rent of money to all

who have need of it."

Chicago's

Milton Friedman agreed with the Treasury view. He helped make

Libertarian economics popular in the 1980s and 1990s. The Crash of

2008 now shows just how fatally flawed this orthodoxy is..

Rebuttal is easy. In the first place, the Government could instruct

the Bank of England to print a lot more money, which the government

would borrow and then spend on Public Works. The pool of money

to be borrowed could thereby be made much bigger.

But let's assume there was no new printing of money. The Treasury

orthodoxy falsely assumed that the private sector borrowed in order

to invest the money immediately in the UK and that employment readily

followed. Only by making this assumption, could they assume

that private sector borrowing would be exactly as effective in boosting

employment. Yet, clearly relying on private investment failed to

create enough jobs for nearly two decades in England.

Showing its own bias, and how completely its collective thinking was

captured by the ideology of the promoters of financial capitalism, the

Treasury managed to assume that private investors would use

borrowed money at least as constructively as the Government would,

That it would help create jobs in the UK, that such private investments

would rebuilding the infrastructure as needed, that it would bring about

innovation and a modernization of the manufacturing base and otherwise

that it would make more of the things that working people needed.

This was clearly not true and did not happen. A lot of the borrowed

money in this era went overseas. This was encouraged by the artificial

pegging of the Pound to the Gold Standard. Some of the borrowed

money also went to rich Englishmen who bought yachts, took around-

the-world trips or purchased homes on the Riviera. A lot of the borrowed

money allowed British brokerages and banks to speculate in stocks.

Certainly, there is little evidence to make us believe that private investments

boosted employment as much as planned public works would have.

Even more telling problems arose for the Orthodoxy when the speculative

bubble in shares broke and the economy turned down. In a deflationary

period, there is every incentive for rich people to borrow money and then

just to sit on it, waiting for lower prices to deploy it. In the severe Depression

of the 1930s, the private sector lost its nerve completely. Private investment

was paralyzed. It largely stopped altogether. Left to sort itself out, there is

no telling how long the Depression would have lasted. The private sector

froze up in panic and chose to wait for someone else to boost the economy

and start buying things again. Private borrowing for plant modernization

stopped completely.

,What was the government to do, just wait around until the private sector

got their nerve back? This inter-war era and our own experience in 2010-2011

show how readily corporations in panic mode choose to hoard rather than

spend their savings, though some may buy out competitors when their

shares have fallen far enough. Banks also enter a panic mode. They refuse

loans to even reliable and good customers. So the "velocity" of money flow

may in these bad times slow down to close to zero and unemployment

sky-rockets up and falls only very slowly, as inventories of necessities

must be replaced. By contrast, when massive Public Works jobs were

launched, as they were by FDR in 1934-1936, thousands and thousands

of workers gained badly needed employment. And they, unlike rich

people, spent almost 100% of their new income immediately. The benefits

did not stop there to the economy. The money spent in this public employment

meant immediate income for shop-keepers in poorer areas. As their inventories

started finally to go down, the would buy more inventory and even

hire new help themselves.

These points seem simple enough. The real question is why

did the Treasury side with the rich against the unemployed poor?

When Churchill

wanted political arguments to make on behalf of

Laissez-faire, Austerity, Balanced Budgets and Going back on the

Gold Standard, the Treasury was happy to comply and produce

a lengthy series of "rebuttals" to Keynesian arguments on behalf

of the 1928 Liberal Public Works' investments' Plan.

Why?

First, and foremost, Orthodoxy was their "meal ticket". The

Treasury

enjoyed their special financial position. In trying to refute Keynes,

they fought to maintain their authority and prestige. They wanted to

pretend and believe that only they were masters of the arcane complexities

of national finance. After all, they knew the sum of all the spending

departments' demands on the Treasury. They liked to pretend that

only they, among civil servants, could argue from a national viewpoint

and responsibly match government spending with government revenue..

They enjoyed their authority vis-a-vis other departments. They were the

ones most responsible for preventing wasteful spending. They could

get and challenge the spending of any other department.

There is another answer to the question of why they clung to their orthodoxy

in the face of so much evidence in the Unemployment numbers

that their preferred policies were failing the country. This was TRADITION.

It was always easier for Treasury civil servants to do what they had always done.

Using the long familiar techniques to measure Spending and Revenue

was a lot easier than developing new measures of Marginal Consumption,

Marginal Investment, Hoarding, Money Flow, Capital Outflow or the Multiplier.

There is another reason why the Treasury was home to Financial Orthodoxy

in the British civil service. Years of close relations with the London

Financial community took their toll on independent thinking. The Treasury

depended on stock and bond brokers to carry out the government's

financing needs. They got many of their numbers from the big banks

of the times. "Public" finance was completely dependent on the

"City";

The Bank of England did not print more money in bad times.

Always, it was the Treasury that articulated the "City's" views

on changing events to the Chancellor.

Treasury officials seem to have accepted with no debate or question

the City's preference for keeping the Pound as strong strong as possible,

The City naturally wanted London to remain the dominant international

financial center of the era. They wanted the Pound back on the Gold

Standard, so it would be widely used as an international currency, thereby

attracting

foreign capital to and making bigger profits for London's

key

banks and brokerages. It was the Treasury, on behalf of the"City"

that persuaded Churchill as Chancellor to return to the Gold Standard

in 1925.

Lastly, the simple answer is that Treasury bureaucrats, like any groups

of government workers is apt to do, sought security. Why draw attention

to themselves by doing anything unconventional? Why risk demotion or

dismissal. There was nothing to be gained by challenging the Orthodoxies

of Austerity, Budget Balancing, the Gold Standard and the Supremacy

of Private Finance and the "City". Reading the Treasury's rebuttals

of

Keynesian Public Work proposals in 1929-1931 makes it clear that all

the higher Treasury officials, namely the ones who wrote the official papers

the Chancellor circulated in the Cabinet and the ones who communicated

regularly with the Chancellors, fully accepted the prevailing Orthodoxy.

Implicit or explicit in everything they wrote or said was that the national

budget had to be balanced. Otherwise, the financial trust needed for the

government to continue to borrow successfully from rich people would

be jeopardized. Under no circumstances except in war-time, should

the government's borrowing needed be allowed to threaten the private

investment market or the London financial community in the "City".

community.

4)

The Rich Man's Perspective

Rich people bought most of the government's bonds. They

paid most of the taxes that the government ran on. The Conservative

Political Party leadership in the 1920s and 1930s were all very well-off.

To understand why Austerity, Balanced Budgets , Limited Government

and the Gold Standard always dominated the Chancellors perspectives

and policies, we have to consider what I call the "Rich Man's Perspective."

Why court disaster with new economic policies? I'm rich. I don't

want my savings to deteriorate in value? I want it to appreciate in value.

I want my loans paid back in money that is more dear than when I loaned it?

By all means, return to the Gold Standard. I want my expensive

imports to be cheaper. And if the Pound goes up, will not my Shares

on the Bourse also rise? And what's this about more public employment?

All my friends at the Club agree, they are lazy and drunken incompetents.

The only honest work is private work. Worse, why should we let the people

see that the government can provide council houses cheaper than

our private builders can make? Soon, workers will want public

health care? They'll want the trains to be run by the government?

They'll

start thinking that there need not be millions who are unemployed

for years and years, at a time? What if they realize that we wealthy

people are really good job creators, at all? Keep workers dependent

on us employers. We'll take care of them. We don't need government

to tell us how to run our factories or stores.

The Socialists'

Perspective

The Treasury's view was not accepted by rank and file members of the

Labor Party. They had a more Marxist view of "financial

orthodoxy",

budget balancing and protecting the Pound Sterling at all costs.

They saw the private interests' resistance to government spending

to build public housing, better railroads, new parks, schools and

libraries, etc. as class warfare. Public works were very badly needed

after World War I. Millions of returning soldiers were looking for

jobs. Why they wondered the jobless put to work building houses?

Why did orthodox financial thinking reject such obvious solutions to

social needs?

Both revolutionary and Fabian socialists considered the government's

policies to protect the financial community at all costs as proof that the

government was controlled by rich and powerful capitalists, especially

those in high finance. Marx had taught that capitalists seeking higher

profits inevitably try to drive wages down. They are actually

quite

pleased when high unemployment causes real wages to fall. And

such was exactly the experience of England's large working class.

There can be little doubt that the capitalist upper class had always

been afraid that the masses would use greater economic security,

such as Keynesian public works programs would provide, to organize

workers for higher wages. This the financial community and the

business community knew full well would threaten their political power

as well as their profits.

Even more fearful for the well-to-do, was that the masses would

see that Government actually could do a fine job in many areas

of the economy. Health care. Schools. Housing. Transportation.

BBC.

This was very dangerous for the rich. Once the lower class majority

saw that the rich were dispensable and that private interests seeking

profits hurt the general welfare, depriving ordinary people of much

needed goods and services, more and more sectors of the economy

might be nationalized and run as public charters. Private interests would

then no longer be able to compete. Weakened, the special influence of

the rich would gradually shrink until it was not significant. This was

the Fabian view of Sydney and Beatrice Webbs and George Barnard Shaw

who founded the London School of Economics.

In their view socialism could come about peacefully through small,

discrete changes. Sadly, we realize now, the Webbs seriously

underestimated how fiercely the wealthy would fight even piecemeal

growth of government services and how the career interests of Chancellors

of the Exchequer would sustain the failing status quo. Fabians also

did not understand how entrenched orthordoxies like "balanced budgets",

"austerity" and a strong Pound Sterling were in the Treasury bureaucracy

and civil service. If only to keep themselves on a status above bureaucrats

in other spending ministries, these orthodoxies fit the needs of the Treasury staff.

They delighted in thinking themselves as the Elite among civil servants in the UK.

What better way to promote the status and importance of the Treasury

and its staff in all intra-governmental relationships, than enshrine as Gospel

the Orthodoxy of Budget Balancing No Matter The Cost. This way even

moderate sized expenditures elsewhere had to be approved by the Treasury.

London School of

Economics was founded by Fabians.

Chancellors of The Exchequer: 1919-1937

Conservative Austen Chamberlain, brother of Neville Chamberlain.

Chancellor of the Exchequer: 1918-1921 and then Conservative

Party Leader.

Following the victory of the Lloyd George coalition in the elections of 1918,

Austen Chamberlain was appointed to the position of Chancellor of the

Exchequer in January 1919. In his view, his major task was to return

war time government spending to more normal levels. He fervently

resisted efforts within the Cabinet by Liberal spending ministers

to put returning veterans to work building public housing and

hospitals. Government

spending was cut by 75% from 1918 to

1920.

Austen Chamberlain served as Chancellor until 1921 when he rose to

the pre-eminent position of Leader of Conservatives in the

House of Commons. Bonar Law, himself a Chancellor during

the war, stepped down for reasons of health. It appeared that

Austen Chamberlain was in position to become the next Prime Minister.

Lesser known Robert Horne became Chancellor for a few months.

But Chamberlain's loyalty to the Liberal Prime Minister, Lloyd George,

cost him politically among Conservative MPs. Because of the rules

of Cabinet Secrecy, they had no way of knowing how fiercely

Chamberlain had fought Liberal spending ministers. "In the autumn

of 1922, Chamberlain faced a backbench revolt (largely led by Stanley

Baldwin)

designed to oust Lloyd George, and when he summoned a

meeting of Conservative

MPs ...a motion was passed in favor of

fighting the forthcoming election as an independent party. Chamberlain

resigned the party leadership ...and was succeeded by a revived Bonar Law.

In the aftermath of the back benchers's revolt, Bonar Law formed a

new government and Chamberlain was not offered a position. Instead,

Stanley Baldwin was made the new Chancellor in recognition of his

role in endin g the Lloyd George national government.

Robert Horne, who was Chancellor between 1921 and 1922,

refused work in Bonar Law's new Cabinet in a lesser role.

Two years later, he also refused to be Minister of Labour in

Baldwin's government, preferring private work in the "City"

in the area of foreign investments.

Stanley Baldwin was Chancellor of The Exchequer, 1922-1923,

in the Bonar Law Conservative Government. He was Prime Minister

between 1923-1929 and 1935-1937. In 1923 he served as Prime Minister

and Chancellor of the Exchequer.

Baldwin's career points to how positions with the Treasury served as

among the best political posts to step up from to become Prime Minister.

His relationship as Chancellor to the spending ministers was typical,

apart from his efforts to get the rich to voluntarily pay more to the Government

based on a patriotic appeal during World War I and his promotion of

tariffs while Chancellor and later as the new Prime Minister. He imbibed

the standard Treasury financial orthodoxy not just as Chancellor but

as Financial Secretary to the Treasury.

Baldwin's Background

"After receiving a third-class degree in history at

Cambridge, he went into

the family business of iron manufacturing... Baldwin proved to be very adept

as a businessman, and acquired a reputation as a modernizing industrialist.

Later he inherited £200,000 and a directorship of the Great

Western Railway

upon the death of his father in 1908...During the First World War he

became Parliamentary Private Secretary to

Conservative leader

Andrew Bonar Law...

In 1917 he was appointed to the junior ministerial post of

Financial Secretary to the Treasury where he sought

to encourage

voluntary donations by the rich in order to repay the United Kingdom's

war debt...He personally donated one fifth of his fortune...in the form of

£120,000 of war loan stock to the Treasury.[3

In late 1922 dissatisfaction

was steadily growing within the Conservative Party over its coalition

with the Liberal David

Lloyd George. At a meeting of Conservative

MPs

at the Carlton

Club in October, Baldwin announced that he would no longer

support the coalition and famously condemned Lloyd George for being a

"dynamic force" that was bringing destruction across politics. The meeting

chose to leave the coalition, against the wishes of most of the party leadership.

As a result Bonar Law, the new Conservative leader,

was forced to search

for new ministers for his Cabinet and so promoted Baldwin to the position

of Chancellor of the Exchequer. In the November 1922 general election

the Conservatives were returned with a majority in their own right. Bonar

Law resigned in January 1923 and Baldwin succeeded him, serving

as

Prime Minister and until August 1923, as Chancellor.

1923

was a year of falling prices and rising unemployment. The Bank of England

paid

no heed to these Deflationary signs. They sought to prepare the way for

the

return of the Pound Sterling to the Gold Standard so that the City of

London

could again become the center of international finance. With the

Chancellor

of the Exchquer's (Stanley Baldwin) approval, they raised the

base

interest rate from 3% to 4%. In July 1923, Keynes publicly condemned the

the

City's "narrow" interest in this, saying such a deflationary policy

would

soon prove to be a "horrible" mistake. Liberal Party Lloyd George

went

further and called for a large scheme of Public Works. (Source.)

Neither

the Conservatives nor the Labour Party Leadership seriously

considered

such a plan. Baldwin, Neville Chamberlian (the new Chancellor

in

August 1923) and then Phillip Snowden, the next Chancellor in 1924

dismissed

an expansionary program of massive Public Works quite

of

hand. (Source.)

Snowden claimed Lloyd George had made false

proposals

like this at the end of the Great War and nothing had come

of

it when he was Prime Minister.

Baldwin

appointed Winston Churchill as Chancellor in January 1924.

Churchill's Admits His Biggest Mistake

Churchill said that the biggest mistake of his long political career was trying in 1924

to push up the Pound by putting it back on the Gold Standard in the middle of an

economic slow-down and trying then to cut government spending to balance

the budget. He claimed he wanted Britain to return to pre-war conditions.