TigerSoft and Peerless Daily

Hotline

http://tigersoftware.com/115HL/index.htm

This is new Hotline IP address.

-----------------------------------------------------------------------------------------------------------------------

(C) 1985-2014 William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

Tiger Software 858-273-5900

PO Box

22784 San Diego, CA 92192

Email william_schmidt@hotmail.com

Previous Hotline -http://tigersoftware.com/112211-H/index.htm 11/22/2013-3/20/2014

http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

----------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

with you and a violation of copyright laws. I work hard for you. Respect that

effort!

---> To

renew this Hotline, order

here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

-----------------------------------------------------------------------------------------------------

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

Peerless Signals: 1915-2013

Peerless Signals: 1915-2013

New Peerless

Signals and DJI Charts - version 7/4/2013

1965 1965-6

1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70

1970

1970-1

1971

1971-2

1972

1972-3

1973

1973-4

1974

1974-5

1975

1975-6

1976

1976-7

1977

1977-1978

1978 1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983

1983-1984

1984 1984-1985

1985 1985-1986

1986

1986-1987

1987

1987-8

1988 1988-9

1989

1989-90

1990 1990-1

1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996

1996

1996-7

1997

1997-8

1998

1998-1999

1999

1999-2000

2000

2000-1

2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005

2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

2010

2010-11

2011

2011-12

2012

2012-2013

Background and New Studies

4/15/2014 Introduction to Tiger/Peerless Buys and Sells.

Peerless Charts and Signals

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable support

is the DJI's rising 200-day ma?

SPY Charts since 1994: Advisory Closing Power S7s, Accum.

Index, 65-dma, Optimized

Signals.

4/7/2014 Advisory Pink Closing Power S7s at ETF at top since 1994

1994 1996

1997 1998

1999 2000 QQQ SPY

DIA 2002 2007

2008 SPY 2011

2013-2014

The New 2014 Peerless.exe Software has now been posted on the Elite Stock Professional

Page.

-------------------------------------------------------------------------------------------------------------------

On Monday night, the Tiger/Peerless Hotline

On Monday night, the Tiger/Peerless Hotline

ADDRESS will CHANGE.

Look for an Email from us on Saturday

giving the new address.

------------------------------------------------------------------------------------------------------------------

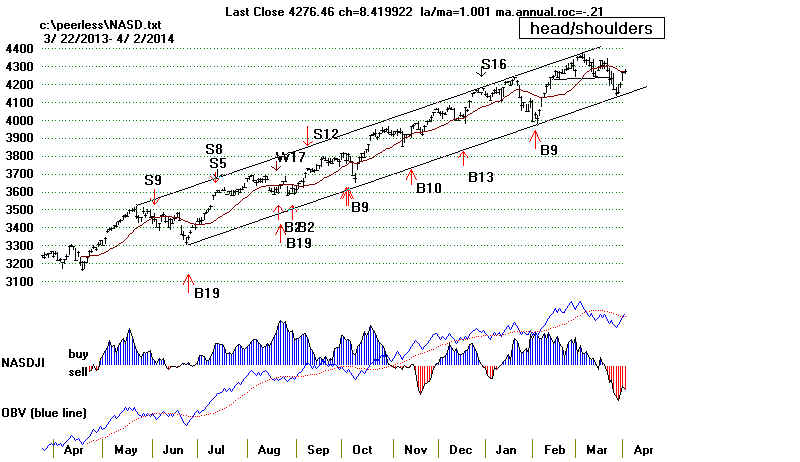

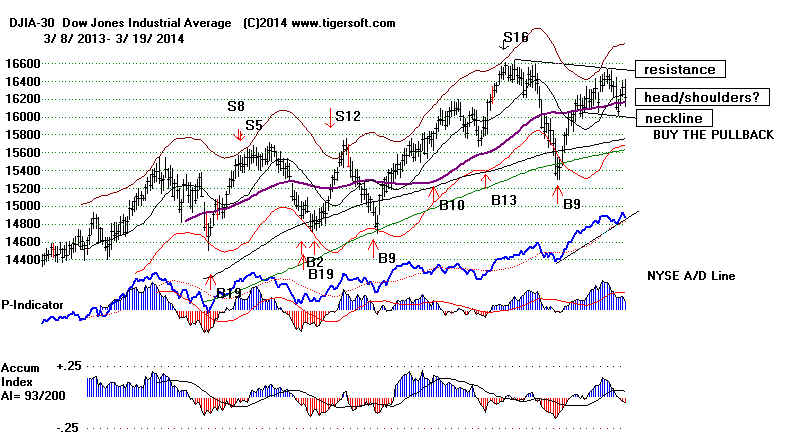

4/17/2014 There is more upside potential, but

probably not a lot,

maybe 2% more.

16600 is our target for the DJI this month. 4250 is

as high as I

expect the NASDAQ will go if the DJI does rally to 16600.

The recent

pattern has been higher openings and mostly consolidations

for the rest of

the day. There are cases in the past when the DJI can rally

all the way from

the lower band to the upper band in this fashion. But a move

beyond the upper

band with trading like this is doubtful.

As has been

happening more and more before holidays, the market turns

up a few days

early than the day before the holiday. Besides strong closings,

right now the

market needs more Bullish MAXCP stocks and greater

volume to be

impressive. The "saving grace" technically is the rising

NYSE A/D Line,

which primarily reflects the FEDs' low interest rate policies.

This is a

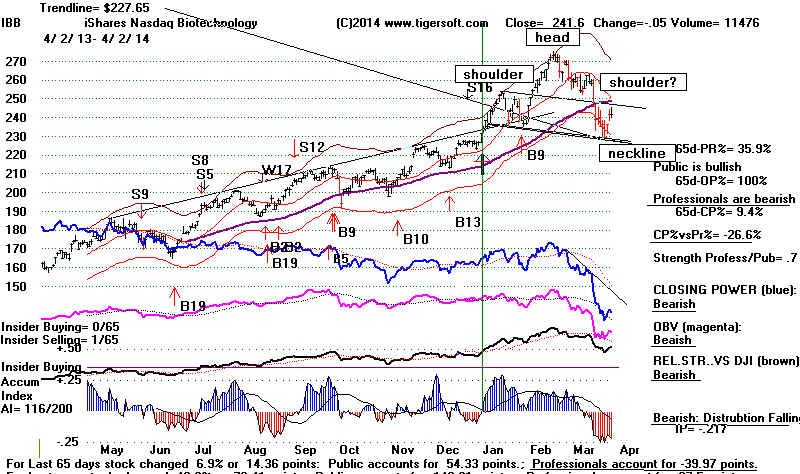

defensive market. It is not, at all clear, that the biotech stocks

that led the

market last year are only having a simple correction.

Dividend-paying

plays along with selected oil and gas stocks are now the

apparent

leaders. Rising oil and gas

prices are not helping the US economy,

but they are

boosting CVX and XOM in the

DJIA, thereby giving the

market the

appearance of strength. If these trends continue, it will become

harder for the

FED to deny that inflation is a risk to the Dollar. An inflationary

scenario that

changes FED policies seems less likely than a scary Deflationary

scenario in which

the US economy stalls out because of the limited buying

power of the

weakening Middle Class which causes lay-offs and decreasing

investor

confidence in lofty priced stocks.

4/17/2014 > To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

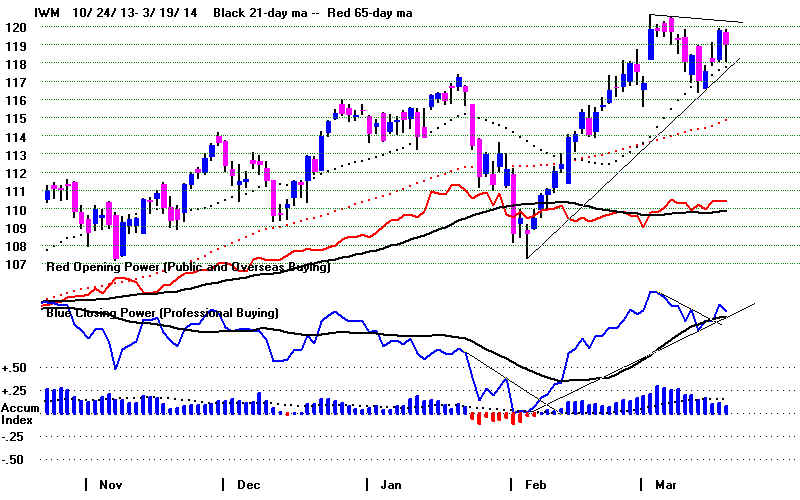

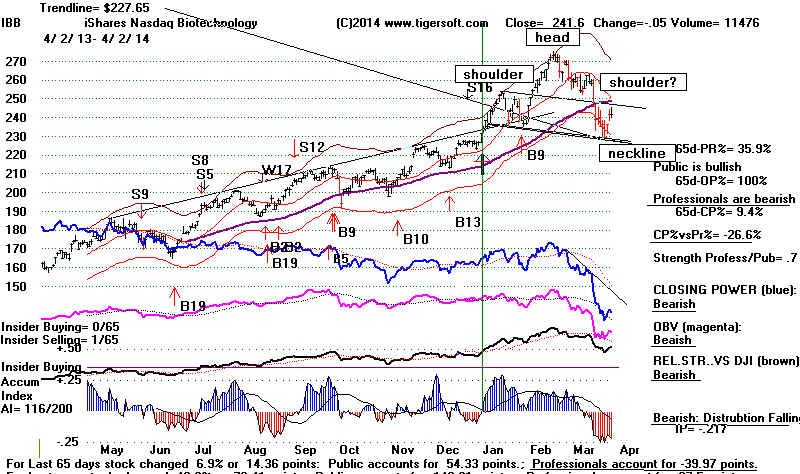

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

Hourly

DJI-OBV Hourly-MVM0735 FAS-3x Financials

--> 36

-6 MAXCP stocks Bullish MAXCP Stocks

(4/17/2014)

--> 141

-71 MINCP stocks Bearish MINCP Stocks (4/17/2014) Bearish

plurality

--> 27 + 10 New Highs on NASDAQ 14

new lows. Bullish

plurality

--> 66

-1 New Highs on NYSE 5 -1 new lows.

Bullish

plurality

Our Hourly DJI Momentum Indicator shows momentum may start to turn down.

The DJI is 0.4%

above its 21-day ma. If it were to rally another 2%, given

the quite

negative IP21, V-I and OBVPct, we likely get a Sell S12 or a S15.

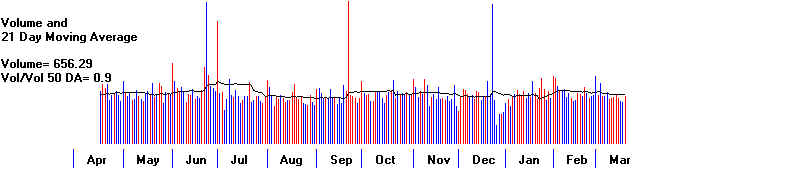

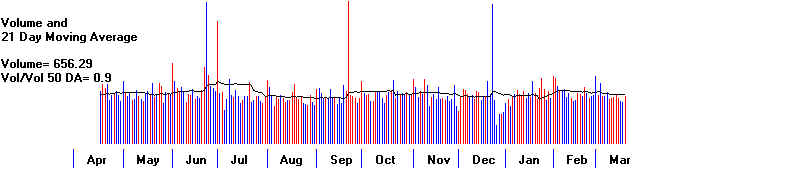

Why Is Up-Hour and Up-Day Volume

Low?

The Hourly DJI's DISI (OBV) chart shows the up-hour volume is very

low compared

to the down hour

volume. This may be because the big banks' and brokerages'

computerized

trading is mostly routed in rising markets to the "dark pools" that

do not report

volume. The NYSE and NASDAQ are more likely to be used

on down-days.

Leveraged short-ETFs make this practical. No one can know

for sure, because

such numbers are kept secret. These "pools" are unregulated.

Be that as it

may, in the past, usually rising volume is required to allow the markets

to chew up

over-head resistance and make a breakout. So, I doubt if the DJI will get

much past 16600.

If it does, Peerless probably will give a Sell which we should

respect.

Stock Market "Cozenry"

and Chicanery.

Our historical

findings suggest that higher Openings, like now, without

accompanying

higher Closings are not to be trusted.

Advisory Pink Closing Power S7s at ETF at top

since 1994

Professionals

(i.e.Closing Powers) are only half-heartedly seeking to repair

the technical

damage done in the April decline. It is the higher openings

which have

brought the last 3 days' recovery. If the Opening Powers were next

to turn down, I

would think the markets cannot not make much more upside progress.

A decline is also

possible. In such a decline, we might or might not find

much Professional

buying support. That remains to be seen

See in the QQQ,

IBB (biotech) and TWN (3x leveraged Small Cap) charts

below how strong

the green Opening Powers has been recently compared to

the blue Closing

Powers.

It is the

over-night changes (higher Openings) which account for nearly all the

gains this year.

Many of us believe

that these higher openings are often rigged

to allow market

making Professionals to reduce their inventory of shares.

I would not put it above the Federal

Reserve itself to be secretly orchestrating

such buying.

This is probably done informally, with nothing being in writing.

No law prevents

Fed Governors from telling their favorite banks what they

will say

publicly.

-------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------

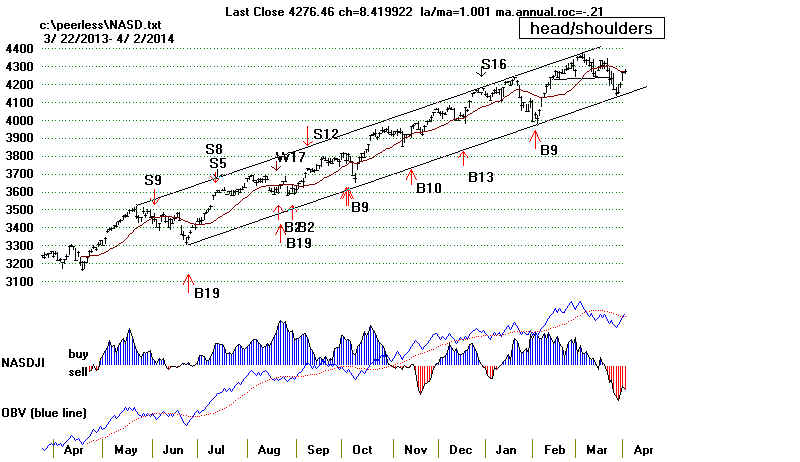

4/16/2014 The uptrends have reasserted themselves

for the DJI and

SP-500. The NASDAQ's is doubtful. It seems less likely to catch up

than

form a new and larger head and shoulders pattern. This is also true

for

QQQ, which has not yet broken its Closing Power downtrend.

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

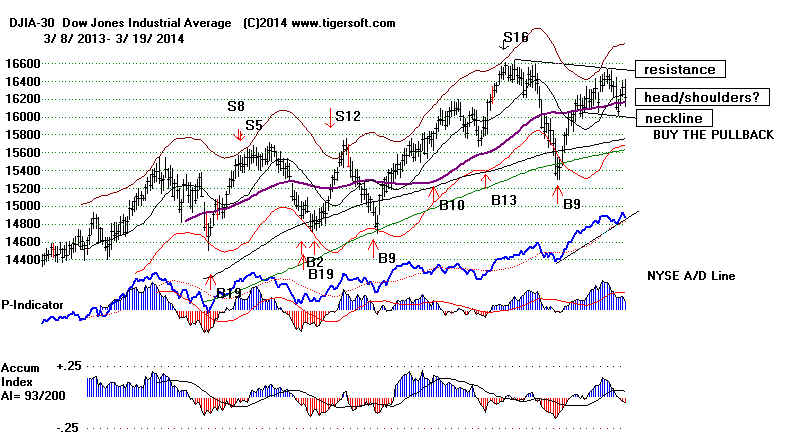

As

long as the DJI stays locked in its trading range, the 20-day Stochastic K-Line

crossing Pct-D and the and Tiger Hourly Momentum (7/35) is expected to

work

for successful short-term trading of the DJI. Look also for the Stochastic-based

red

arrows on the DIA and SPY charts, too. We start to highlight these graphs

in

the evenings to come so long as the DJI is trapped in its relatively narrow trading

range.

For

the DJI and SP-500, higher prices must be expected, based on the

history of Buy B9s and, more simply, the theory that prices generally

go

from support to resistance and vice verse. Having found support at 16000,

the

DJI must now rally to until it finds resistance. The recent false breakout

at

16600 is its most likely target. Within a trading range, prices rise and

fall

easily. But a breakout seems unlikely. DIA's Closing Power shows a

broken downtrend; however, it is still badly lagging prices. Its Closing Power is

now

only 17.5% of the way up from its 65-day low to its 65-day high while prices

are

89.5% of the way up. The resulting CP%-PR% is a bearish -70.9% for DIA.

SPY's

CP still needs to break its downtrendline, but at least it has gotten

back

above its 65-dma. A small retreat by SPY tomorrow seems a good

bet.

|

--> 42 + 3 MAXCP stocks Bullish MAXCP Stocks (4/16/2014)

--> 212

MINCP stocks Bearish MINCP Stocks (4/16/2014) Bearish

plurality

--> 17 New Highs on NASDAQ 1

-31 new lows. Bullish

plurality

--> 67 New Highs on NYSE 6 -15 new lows. Bullish plurality

-------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

4/15/2014 In the last 3 hours of trading the DJI

rose 191 points.

Two Fed Governors called for interest rates to stay

near zero for a long

time. They did not mention any

"bubble" in stocks. This over-shadowed

warnings

from Russia that the Ukraine was close to civil war and Russia must

protect

Russians there.

The Buy

B9 still operates for the DJI because the false breakout and short-term

DJI-head/shoulders Sell S5 failed to break the DJI below the 16000 support.

The Buy B9

is a major and strategic signal. The others are short-term and

tactical

signals. So, the DJI is apparently still stuck in its 16000-16600 trading

range.

It is doing its job of bolstering the market when people get scared very

well with

the help of computerized trading and repeated Fed reminders that

low

interest rates are here to stay. The Red and Blue Stochastic buys on DIA

are

probably reliable here. (Blue and Red signals coming together are more reliable

than just

the red signal by itself.) Still, all in all, a break in DIA's CP downtrend

is what is

really needed technically to ratify the prospects of a rally back up to 16600.

.

> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

--> 39

+ 15 MAXCP stocks Bullish MAXCP Stocks

(4/15/2014)

--> 374

MINCP stocks Bearish MINCP Stocks (4/15/2014) Bearish

plurality

--> 13 New Highs on NASDAQ 44

-6 new lows. Bearish plurality

--> 33

+9 New Highs on NYSE 21 new lows. Bullish plurality

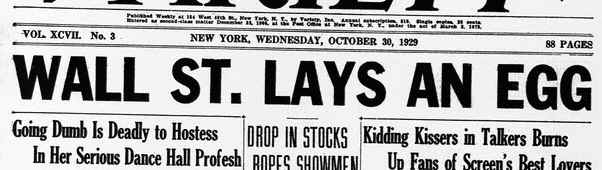

Warning for Fed Watchers.

Very "dovish" Fed

pronouncements and even very "dovish"

monetary

policy does NOT cause new business investments if too many

people are

"scraping by" and Aggregate US Demand less Government Spending

will not

support an expansion. So, can the Fed hold the market up if the

US economy

is still quite weak? The late 1920s in the US show it can for a

year or

two. But eventually stocks go up too much. Earnings can't justify the

gains on

Wall Street. When lay-offs come, the economy gets weaker and investors get

worried and

sell their shares. A financial panic can cause a near Depression.

If stocks

were again to collapse as in 1907, 1929, 1937 and 2008, the economy

would

suffer very badly and unless the FED can make interest rates go below

zero (!?),

very bad times would likely follow. We want to start comparing

earnings

reports with signs of big lay-offs.

So, I agree

with the pundits, we need some very positive earnings reports

in here and

fewer announcements of lay-offs.

It remains

to be seen if the probable rally tomorrow will swoop up the most

beaten down

stocks of the last few weeks. Most of the high-fliers on

the

NASDAQ ignored the blue chip and dividend-paying stocks' rally

today,

as did most

of our Bearish MINCP stocks.

With volume low and most of the ETF's Closing Powers still

declining,

the rally

in the NASDAQ, QQQ and biotechs will most likely be

limited.

I realize the ride is bumpy, but my advise

still is to wait for the Closing Powers

to hook up and

break the CP down-trends before closing out the QQQ

and FAS short

sales. It's true: the NASDAQ and QQQ rebounded from

expected support.

That was the zone between the rising 149-day (30-wk)

and 200-day ma

usually bring some kind of rallies. But we want confirmation

of that by seeing

the Closing Powers turn up with some conviction. The

technical problem

for the NASDAQ now is that it could be forming a

bearish

head/shoulders pattern.

QQQ rebounded from support

but its Closing Power did not rise at all.

-------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------

4/14/2014 Hold Your Shorts while the Closing Powers

are

in falling

trends. This is a very defensive market. Folks are

turning to

Utilities with very good results. Credit the Fed with

this.

See also

how impressively the Peerless signals track

the ups and

downs of the Tiger Index of Electrical Utilities.

Before rate

go back up, we should see another Peerless Sell.

But watch

the Dollar. It held at support today

We have to

always be looking for new trends. Buying and

Short-Selling on the Peerless BUY and SELL signals would have

gained more

than 31% over the last 11 months. A good many of

the

advancing stocks on the NYSE on days like today are defensive,

dividend

paying stocks. They may seem pretty sleepy, but right now

they are in

favor.

> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

Peerless

will probably need to give a new Buy signal to turn

the general

market around. Though breadth (advances-declines)

was

bullish, volume was low today. Our Hourly DJI shows a

woefully weak and bearishly diverging DISI (OBV) Line.

Without

higher volume, the overhead resistance will not easily

be

overcome, especially with red Distribution still apparent.

--> 24 + 8 MAXCP stocks Bullish MAXCP Stocks (4/14/2014) (nothing significant found here.)

--> 469 +

99 MINCP stocks Bearish MINCP Stocks (4/14/2014) Bearish

plurality

--> 11 New Highs on NASDAQ 50

-13 new lows. Bearish plurality

--> 24

+15 New Highs on NYSE 19 -16 new lows. Bullish plurality

The DJI did what was expected of it.

The DJI stabilized the market

and brought

a relief rally up from 16000 to a point just below the

falling

65-dma, which must be expected to act as resistance now.

If we were only looking at the DJI, I

would be much more

bullish and look

forward to a new buy near the lower band.

But the Closing

Powers remain very weak for many very

important bank

stocks like BAC, Visa, MA and GS. Peerless

since 1986 has

generally correlated most closely with bank

and finance

stocks. So, I think we will do well to watch their 3x-leveraged ETF,

FAS. Its

Closing Power did not turn up today, even though it

has fallen to

what should be support. Note its rising green uptrend-line-

support and the

rising-200-day ma. If the CP does turn up in here,

that could

suggest a minor, but perhaps tradable, rally will be starting.

On the other

hand, if it does not turn up, it will certainly not be a good

sign.

Watch the Financials' ETF, FAS.

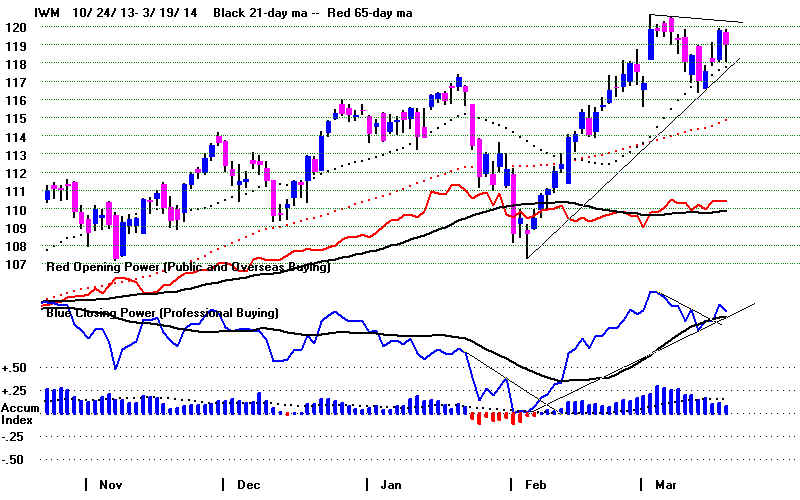

head/shoulders

The

small caps (IWM), QQQ and most of

the leading

NASDAQ stocks I follow show very usually weak Closing

Power, too.

IWM, shown below, has fallen to its rising

200-day ma.

Normally, this should bring a recovery. But

we must be very

careful here because of the completed

head/shoulders

pattern and the Closing Power new 12-month

lows. QQQ's

Closing Power also did not turn up today, even

though it has

reached a potentially effective support level.

Biotechs were the leaders up in the bull market. It seems reasonable to think

now that their Closing Powers should stop falling, before most stocks

can turn

around. Put

another way, if this is only an intermediate-term correction, they

should set up soon to

make another good advance. Another good way to spot a bottom

in them will probably

be to watch FBIOX (Fidelity Biotech)'s RSQ (Relative Strength

Quotient vs. the DJI)

and wait for it to stop falling.

===============================================================

OLDER HOTLINES

===============================================================

4/11/2014

New Tiger Sell S5s on DJI and

SP-500.

Hold Your Shorts while the Closing Powers are falling.

There is

some hope here. QQQ is at potential support. FAS in the sweet spot zone

of support between the rising 30-week and 65-dma. IWM is holding at its rising

200-day ma, but IBB (biotechs) broke

below their 200-day ma and the DJI

and SP-500 fell through their support.

Closing Power Leads Prices at Market Turns.

The

weakness in Closing Power for many volatile high-caps and ETFs

is quite

profound. The CP charts of AMGN, AMZN, BAC, BBH, BIIB,

BMRN, CMCSA, DAL, FAS, GE,

GILD, GOOG, GS, HD, IBB,

MA,

NKE, PCYC, TNA, YHOO, VRTX as well as ADP, ATVI, CA, CTRX,

EQIX, FOSL,

MNST, NFLX, PCLN, PRGO, ROST, SBUX, TSLA

and VIAB in

QQQ-100 all show Closing Power new lows even though

their

prices are far from making 12-month lows.

Tiger's Closing Power

TigerCP is

the cumulative daily difference between the close and the opening.

CP(i) = CP(i-1) + LastPrice(i) - OpeningPrice(i)

Our on-line

book on Closing Power is available here.

It is copyrighted.

The very

weak CP now shows that Professionals (computerized trading systems,

market

makers, hedge funds and aggressive funds) are still aggressively selling

the high

caps and technology stocks that are components in leveraged ETFs.

Right now

the selling is focusing on leveraged ETFs. But other groups will

probably be

affected if the selling continues.

Pink Advisory Sell S7s

On the

Tiger charts note the pink advisory Sell S7s. These and the new S4s

are

warnings. They become recommended Sells when the stock or ETF

subsequently closes below the 65-dma. Sell S7s show more extreme CP

divergences

and very weak volume and Accumulation internals. We compare

the levels

of price and Closing Power in their 65 days range. See the QQQ

chart

below. The CP%-PR% was -.56 where the vertical line

crosses below.

Sell S7s

occur when CP%-PR% is below -.38. (Continue reading for a better

definition.)

New Tiger Sell S4s

This weekend I

searched for past cases where ETFs' Closing Powers show

such extreme

bearish divergences as we are seeing now. At no time since 1990

have so many

leading stocks shown such wide and bearish divergences. To do

the study, I

created a new Tiger Sell S4. It shows where the 65-day Closing

Power Percent -

65-day Price Percent is below -.47 with the stock or ETF also one pct.

over the 21-day

ma and IP21 and OBVPct both less than zero. When the ETF breaks the

65-day ma after

one of these new Sell S4s, much bigger declines usually followed.

---> The

interesting thing I discovered was that in nearly every Sell S4 case, to make

a good short sale trade

all one has to do was to go short on the violation of the 65-dma

and cover the S4 short

when the steep Closing Power down-trend was broken.

The "65-day

...Percent shows how far up from their 65-day low to their 65 day high,

Closing Power,

Price and Opening Power are. Our Tiger charts show this mumber on

the right side

and at the top when a vertical line is shown. Below are the charts of

DIA and FAS along

with the new Sell S4.

If The Decline Is Not Soon Stopped...

The broken

bubble of March 2000 suggests that the first decline in BBH (biotechs)

and QQQ

(large Nasdaq technology stocks) could be 50% and 37.5% respectively

in 2 months

if Professionals keep driving prices lower. This is not so far-fateched.

The 1987

Crash shows a decline of 34% in the indexes is possible when leveraged

derivatives

are wildly traded by computers. As in 1987, Professional Traders now

see added

risks because the DJI has been rising for 5 years without a 20% decline.

They

probably also know that the DJI fell 47% in 10 weeks in 1929, 40% in 14

weeks in

1937 and 27% in 13 weeks in 1962. In all these earlier periods, short sales

were not

officially allowed on down-ticks. Now they are. Showing what puppets they

are of Wall

Street, the SEC back in 2007 legalized short-selling on down-ticks very

conveniently weeks before the market's peak and 52% decline.

What's

worse? We still don't know what bad news is coming down the pike

to hit the

market. But we do know that completed head/shouldrs patterns usually pose

some

unexpectedly grim news, like invasions (1950, 1990), attacks (1941, 2001),

major

economic news (1971), Presidential assassination/hear attack (1963, 1955)

and

super-power stand-offs (1948, 1962).

--> 16 MAXCP stocks Bullish MAXCP Stocks (4/11/2014) (nothing significant found here.)

--> 370

MINCP stocks Bearish MINCP Stocks (4/11/2014) Bearish

plurality

--> 6

New Highs on NASDAQ

63 new lows. Bearish plurality

--> 9

New Highs on NYSE 36 new lows.

Bearish

plurality

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

Tiger Sell S5s - Support Failures

The DJI

broke its head/shoulders neckline. If you request a Tiger S5s

(support

failures) on your Peerless chart, you see a new Sell S5

There is

still some support at the round number 16000, but if that level is

closed

below, it will look like the DJI will have to test its rising 200-day ma

and its

uptrendline at 15700. There is still hope for the bulls in that the

NYSE A/D

Line did not confirm the new low.

The SP-500

broke its well-tested support, too. Now we should expect it

to fall

back to its rising 200-day ma, too. A Tiger Sell S5 also shows the

neckline-support failure.

The much

weaker NASDAQ has now fallen to within 50 points of its rising

200-day ma.

Ordinarily, we would expect 3950 to be a point of reversal.

===============================================================

OLDER HOTLINES

===============================================================

4/10/2014 Today was a terrible day for the Bulls.

Yesterday's

rebound was completely

swallowed up by today's decline. Traders

IMMEDIATELY took

advantage of the rally to dump shares. They

did not even wait to

see if there would be any more of a rally. This

is a characteristic

most commonly seen in Extreme Bear Markets.

--> 19 MAXCP stocks Bullish MAXCP Stocks (4/9/2014) (too few tonight).

--> 421 MINCP stocks Bearish MINCP Stocks (4/10/2014) Bearish

plurality

--> 8 New Highs

on NASDAQ 35 new

lows. Bearish plurality

--> 13 New Highs on NYSE 22 new lows.

Bearish

plurality

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

If The DJI Continues To Fall...

If the DJI should close

below 16000, it will bring a Tiger Sell S5 (just as

occurred in May 2010.

See the 2010 chart below. Such a decline will break

the well-tested

horizontal support there and complete a head/shoulders pattern.

That would cause us to

judge a Peerless Sell S10, whether or not Peerless

automatically generates

a Sell S10.

Compare Top Now with the DJI's in May

2010.

Professionals Are Particularly Heavy-Handed

Sellers Now

The weak Closing Powers

got much weaker today. A real panic is

shaping up.

Professionals are rushing to the exits. They are

using leveraged short

ETFs to sell short large numbers of shares

without having to wait

for an up-tick. Where you find a leveraged short

ETF, you will also find

a big decliner. Now it is not only QQQ, biotechs

and small-caps that show plunging Closing Powers. Banking stocks also

have collapsing Closing

Powers. The group's 3x leveraged

ETF, FAS, has completed a classic head and shoulders pattern.

There will be more bad

days ahead if computerized trading

coupled with leveraged

Short ETFs create another Flash Crash,

as in 2010.

Because regulators seem so clueless and sheepish,

I cannot rule out

another Crash like the 35% DJI decline of

October 1987, which

lasted just 3 weeks.

I have no wish to scare

folks. But this a dangerous market given

how far and long the

DJI has risen without a 20% bear market.

It has been rising for

5 years. The DJI is up 150%. Profits

are always very

clumsily taken when a bubble breaks. The first

break in biotechs in

2000, dropped BBH by 50% in 10 weeks.

Trading the Closing Power downtrends now is

recommended. This

should allow us to play

the downtrend for as long as it is likely to

continue. This

approach will help us avoid emotional mistakes.

It worked well with the Bearish MINCP short sales we picked in

2008. Right now

our Stocks' Hotline is short 3x-4x more than it is long.

I have recommended

shorting Biotechs and QQQ here.

Bank stocks

should probably be

added to that list, at least, for so long as the

Closing Power of FAS

(below) is falling.

Let's hope the FED

knows what it's doing. In 2008, they did not.

. My sense is that the FED is

fighting the last war again in focusing mainly on

interest rates.

They should be limiting computer driven short sales of

leverage ETFs on

down-ticks. Even now, they should be increasing

margin requirements.

They should enforce the Volcker Rule. But

I don't wish unduly to

blame the Fed. They are not in charge of fiscal policy.

Deliberate deficit

spending, a la Keynes, is politically out of the question.

The FED cannot create a

massive infrastructure re-building/jobs program.

If there is another

bitter bear market, it is Congress and the Presidency

that deserve the real

blame.

The US's Handing of The Ukraine Is A Trigger for

The Decline

My fear is what the

4-month strength seen in Gold,

Crude Oil, Food Commodities,

Natural Gas are suggesting. The Dollar may become too weak

in a few months

to let the Feds

continue their policy of low interest rates.

A New Cold War's Costs

America's confrontation

with Russia over Crimea has probably

exacerbated selling in

the Dollar by China and Russia. By secretly

encouraging the

right-wing nationalists to overthrow the democratically

elected (if also very

corrupt) Ukraine government, the US

has unleashed forces

that could well break up the Ukraine just as

Yugoslavia was.

The end result of this will be a new cold war between

Russia and America.

Russia cannot tolerate anti-Russian missiles

pointed at Moscow

anymore than the US could tolerate Soviet

missles pointed at the

US from Cuba. Russia denies moving troops

into a position where

it could act "to defend" the Russians of Donetsk

and Kharkov. But

perception is what will rule the day. NATO says

there are new troops

there. So, a new cold war is growing in intensity.

Europe is caught in the

middle of this struggle. Europe wants

Russian natural gas and

a continuation of good economic ties with

Russia. America

can strong-arm some of the more conservative

Europeon governments,

but an anti-America backlash is developing

even in Germany, which

is usually very pro-American.

The main consequence of

this back-lash against American cold-war

thinking could be a

sharp drop in the Dollar if China and Russia

continue to dump it.

A Dollar decline would be very hard to stop

without the Fed

imposing much higher interest rates in the US.

That would unwind all

the rise in stock prices that the Fed has

accomplished since

2010, when the DJI was about 10,000.

Worse, it could create

another 1937-like 47% decline in the DJI.

The American middle

class is weaker and smaller now, so with rich folks

abruptly cutting back

their spending, we may see a Wall Street Panic,

perhaps like in 1907,

back in the gilded age.

===============================================================

OLDER HOTLINES

===============================================================

4/9/2014 The Fed Does Not Want A Market Decline.

But Are They Still in

Control? The Weak Closing Powers

Show Professionals Have

Lots of Doubts.

Cover Shorts if their steep Closing Power

downtrends are violated.

We will likely short

them again if they fail at their overhead resistance,

either their old highs

or their falling 65-day ma.

What happens

after a much higher opening day, like we saw today, is a

good way to

distinguish a developing bear market from a healthy correction.

See research

below comparing the post-gap behavior of the NASDAQ in

2000, 2001, 2002,

2008 (which were tops) with those of 2003, 2006, 2012 and

2013-2014 (which

saw mostly minor corrections).

--> 33 +15 MAXCP stocks Bullish MAXCP Stocks (4/9/2014)

--> 76 MINCP stocks Bearish MINCP Stocks (4/9/2014) Bearish

plurality

--> 28 New Highs

on NASDAQ 6 new

lows. Bullish Plurality

--> 53 New Highs on NYSE 2 new lows.

Bullish Plurality

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

Peerless signals rely more upon breadth than distribution or

volume:

thus the

importance of our P-Indicator, the 21-day ma of NYSE advances

minus declines.

It and the NYSE A/D Line have been holding up better

than our other

key Peerless indicators because the Fed's low interest

rate policies

boost the many dividend plays on the NYSE. Today's much higher

opening and broad

surge are yet another example of how determined

the FED is to

prevent even a modest decline, presumably for fear that

any market

decline could quickly get out of hand. I take this close concern

by the Fed to be

a distinctly bearish warning.

.

The Fed Minutes

emphasized their unanimity that interest rates should be

low.

This provided the excuse for today's sharp rebound from key support levels:

for the DJI, DIA, SP-500

and SPY from their rising 65-dma,

for the QQQ and NASDAQ from their rising

rising 30-wk (149-day ma.) and

for the

biotech ETFs, BBH and IWM, from

their rising 200-day ma).

Those indexes and stocks that are below now falling

65-day ma,

like QQQ,

NASDAQ, BBH and IWM will now face resistance at their 65-dma.

This

technical rule also applies now to stocks that have had big sell-offs recently.

Watch IWM

tomorrow. It closed just below its 65-dma. See also how very weak

its Closing

Power is. Avoid buying at openings stocks or commodities showing

such weak

Closing Powers.

The expanded Peerless Buy B9 reflects the Fed's determination

to prop up he

market. Market Professionals are skeptical about

how powerful the

FED still is. We see this in the collapsed

Tiger Closing

Powers, which were making new 6-month lows

on Monday.

But Pros are not

stubborn and inflexible. Undoubtedly, they appreciate

the gaps upwards

in the openings such as we saw on the NASDAQ

have had a

bullish track record for the last few years.

What Happens after A

Price Gap Says A Lot

about whether The Market Is Topping out

or Simply Experiencing a Healthy Correction.

The problem with

higher openings when the market is turning

over is that they

are often followed by much lower closing. We

should be

cautious that this pattern may assert itself. We can

see that it is

usually bearish when higher opening gaps do not bring

higher prices at

least for a few days. When there were bullish

follow-throughs

after a gap-NASDAQ opening, I have circled the

charts below in

GREEN. When there was no upwards follow-through

and prices

quickly declined, you will see red circles around the

gaps. RED

circled gaps are much more common when the market was about

to suffer a

serious drop, as in 2000, 2001, 2002, 2007 and 2008

then when the

gaps are circled in green as in 2003, 2006, 2012, 2013-2014.

Post-Gap Behavior of NASDAQ (Tops)

2000 2001 2002 2007 2008

Post-Gap Behavior

of NASDAQ (Ending Corrections)

2003 2006

2012 2013-2014

-------- Peerless Internal Strength Key Values ---------

Date

DJIA LA/MA

ANN.ROC

P-I

P-I ch

IP21 V-I

OPct

65-day Pct Change

4/9/2013 16437 1.007 +.063

+ 246 +119 -.125 -20

-.151 0.0

4/8/2013 16256 0.996 -.118

+ 126 +71 -.173 -46

-.236 -.013

4/7/2013 16246 0.995 -.151

+ 55 -44

-.170

-65 -.326 -.012

4/4/2013 16413 1.004

-.007

+ 99 -66

-.145

-47 -.228 -.01

4/3/2013 16573 1.014

.155 +165

-23

-.109

-25 -.135

.004

4/2/2013 16573 1.015

.129 +188

-77

-.116 -18

-.136

.005

4/1/2013 16533 1.013

.266 +264

+110 -.108

-1

-.121 .005

3/31/2013 16458

1.009 .099 +154

+47 -.109

-29 -.211

.006

===============================================================

OLDER HOTLINES

===============================================================

4/8/2014 False Breakout by DJI.

DJI should now retest 16000.

--> 18 +10 MAXCP stocks Bullish MAXCP Stocks (4/7/2014)

--> 268 -146 MINCP stocks Bearish MINCP Stocks (4/7/2014) Bearish

plurality

--> 15 New Highs

on NASDAQ 22new lows.

Bearish plurality

--> 21 New Highs on NYSE 10 new lows. Bullish Plurality

Declining Closing Powers, negative Accumulation Index readings and numerous

head/shoulders patterns in key indexes taken altogether should keep us

mostly short now. Peerless is officially still on an expanded Buy B9. But

this

can be over-ridden by judged Sell S10s from completed head/shoulders

patterns, such as shown by the NASDAQ and QQQ. It is also reasonable

to

sell when the DJI makes an obvious "false breakout" above well-tested

flat

resistance. Experience suggests we should not be afraid to judge these

Sells

when they occur.

I

take the absence of a Peerless Sell signal to mean the DJI and dividend stocks

will

probably hold up reasonably well, not dropping more than 7%, at which

time

we will probably get a new Peerless Buy.

Waiting for Professionals to show that they are net buyers again when key

support has been tested is recommended. This will be noted when the

key

ETFs Closing Powers turn up after testing their key support, in this

case,

most likely the zone of support between the rising 149-day (30 week)

ma

and the 200-day ma.

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

Raising Bank Reserve Requirement is Bearish.

Now

we know why financial stocks have hastily formed a bearish head

and

shoulders.

The

Fed has announced it is raising the reserve requirements for big banks.

Typically, this cuts into their more speculative loan-making. It slows down

the

economy especially in cyclical sectors. In our market, it should cut into

their

derivatives trading. It may force them to sell some stocks. So, it is

bearish. Reserve requirements are not often changed by the Fed because

they

are believed to have a disproportionately large effect on the national

economy. Why would the Fed do this now, when they say the economy is

still

weak? I think it's because they think the market has become quite

vulnerable, though this is not what they are saying publicly. They want to try

to

ensure that the big banks have plenty of time to raise capital to become

more

solvent in case there is another financial crash.

I

cannot find a list of the times in the past when the Reserve Requirement

Percentage was raised. But I remember that my basics ECON 101 books

all

mentioned how powerfully deflationary and bearish for stocks this was,

though I don't think they gave any examples after 1945. Let's watch tomorrow

to

see if the Wall Street Journal presents such historical data.

Watch Biotechs; They Must Hold

Biotechs led the

market down. They are weakly trying to find a bottom at their rising

200-day ma. If they break down from here, a new head/shoulders pattern will be

completed.

Much

lower prices will then become the minimum price objective. This is not so

far-fetched.

Historically, it is usually quite bearish when a group's Closing Power falls this fast and

makes

12 month new lows far ahead of price. we

-------- Peerless Internal Strength Key Values ---------

Date

DJIA LA/MA

ANN.ROC

P-I

P-I ch

IP21

V-I

OPct 65-day Pct Change

4/8/2013 16256 0.996 -.118

+ 126 +71 -.173 -46

-.236 -.013

4/7/2013 16246 0.995 -.151

+ 55 -44

-.170

-65 -.326 -.012

4/4/2013 16413 1.004

-.007

+ 99 -66

-.145

-47 -.228 -.01

4/3/2013 16573 1.014

.155 +165

-23

-.109

-25 -.135 .004

4/2/2013 16573 1.015

.129 +188

-77

-.116 -18

-.136 .005

4/1/2013 16533 1.013

.266 +264

+110 -.108

-1

-.121 .005

3/31/2013 16458

1.009 .099 +154

+47 -.109

-29 -.211

.006

===============================================================

OLDER HOTLINES

===============================================================

4/7/2014 False Breakout by

DJI. DJI should now retest 16000.

> To Key Index and Leading Stock Charts:

DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

For

the DJI and Peerless, only the P-I is still positive among our internal strength

indicators. A new study tonight suggests that the key major market's TigerSoft

Closing Power making a 6-month low ahead of declining prices

is quite bearish.

Last

night's study of DJI false breakouts shows

that the lower band is quite possibly

where

the DJI must now go to find support. (Programming for false breakouts is

tricky. So, for now, we will have to spot them ourselves.)

-------- Peerless Internal Strength Key Values ---------

Date

DJIA LA/MA

ANN.ROC

P-I

P-I ch

IP21

V-I

OPct 65-day Pct Change

4/7/2013 16246 0.995 -.151

+ 55 -44

-.170

-65 -.326 -.012

4/4/2013 16413 1.004

-.007

+ 99 -66

-.145

-47 -.228 -.01

4/3/2013 16573 1.014

.155 +165

-23

-.109

-25 -.135 .004

4/2/2013 16573 1.015

.129 +188

-77

-.116 -18

-.136 .005

4/1/2013 16533 1.013

.266 +264

+110 -.108

-1

-.121 .005

3/31/2013 16458

1.009 .099 +154

+47 -.109

-29 -.211

.006

"The Buy B9 is still the operative signal. But it should

be applied right now

mainly to dividend paying NYSE stocks and the DJI. We have apparently

reached the point that commonly occurs in a long bull market where the

broader, more speculative market separates from and starts to lag the DJIA."

(See the example of 1986).

SPY has reached the support of its recent lows and its rising 65-dma. A rally

attempt may be made. But any rally right now will probably be very brief

and limited. There is too much internal strength weakness in the speculative,

growth and technology stocks.

Bull markets die slowly over

time and in segments.

The Peerless internal strength indicators, except for the the breadth P-I are

are all quite negative. With the bull market now more than 5 years old, there

are lots of anxieties that the advance cannot continue. But bull markets

die slowly over time and in segments, not all at once. With each group and

ETF, the rising 200-day ma should act as support one more time. Be careful, however,

the many head/shoulders in important stocks, ETFs and indexes like NASDAQ,

tell us there is more unexpected very bearish news coming our way that the market

is quickly trying to adjust, too. Not for nothing are Professionals are rushing

to the exists, judging from the very rapid declines in Closing Powers.

Professionals are agile. They may turn bullish only for a few days. They

change their mind quickly. Some will try to play a rally when the rising 200-day

ma are reached in IBB, BBB, QQQ, TNA and FAS. But for most of us,

until the Closing Power downtrends are violated, there is no hurry to buy.

Professionals will tell us when to expect a good reversal. And for most

of us, except the very nimble, it will be a lot safer if we wait for either a new Peerless

Buy or the Accumulation Index also turn positive.

--> 8 -11 MAXCP stocks Bullish MAXCP Stocks (4/7/2014)

--> 414 +92 MINCP stocks Bearish MINCP Stocks (4/7/2014) Bearish

plurality

--> 12 -1 New Highs on NASDAQ 53

+13 new lows. Bearish plurality

--> 10 -19 New Highs on NYSE 17 new lows. Bearish plurality

===============================================================

OLDER HOTLINES

===============================================================

4/4/2014 False Breakout by

DJI. DJI should now retest 16000.

The Buy B9 is still the operative signal. But it should be applied right now

mainly to dividend paying NYSE stocks and the DJI. We have apparently

reached the point that commonly occurs in a long bull market where the

broader, more speculative market separates from and starts to lag the DJIA.

The failure on Friday of the DJI to stay above the 16600 resistance created a

bearish "false breakout".

This is a reliable short-term sell even if Peerless

did not give a new Sell signal. So a decline to 16000 would

seem a good bet.

Remember that only be stretching the Peerless rules did we get the early

February Buy B9. Now with both the 20-day Stochastic K- and Pct-D Lines

have dropped below 80, the DJI will likely have to plumb for support now.

That means the dividend stocks and the DJI will have to work very hard

to hold the market up.

But that's not the problem now. For the many reasons mentioned below,

the NASDAQ, the QQQ, Biotechs and smaller stocks seem to be

at

considerable risk.

--> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

Peerless Key Values

Date

DJIA LA/MA

ANN.ROC

P-I

P-I ch

IP21

V-I

OPct 65-day Pct Change

4/4/2013 16413 1.004

-.007

+ 99 -66

-.145

-47 -.228 -.01

4/3/2013 16573 1.014

.155 +165

-23

-.109

-25 -.135 .004

4/2/2013 16573 1.015

.129 +188

-77

-.116 -18

-.136 .005

4/1/2013 16533 1.013

.266 +264

+110 -.108

-1

-.121 .005

3/31/2013 16458

1.009 .099 +154 +47

-.109 -29

-.211 .006

--> 18 -41 MAXCP stocks Bullish MAXCP Stocks (4/4/2014)

--> 322 +218 MINCP stocks Bearish MINCP Stocks (4/4/2014) Bearish

plurality

--> 13 -14 New Highs on NASDAQ 40

+30 new lows. Bearish plurality

--> 29 -34 New Highs on NYSE 7 +3 new

lows. Bearish plurality

We are getting closer to a violent shake-out. Confidence in the stock market has

been

eroding. Remembering 2008, even many long-term investors are not going

to want to just buy and hold if the market behaves badly.

There is a lot of talk now about a COMPUTER DRIVEN FLASH CRASH.

That

may put the flash boys on good behavior for the time being. But it is not only that

much of the market's trading is now driven by computers following automatic

instructional codes and acting in unregulated and opaque "dark

pools". That

problem is now compounded by all the new leveraged short ETFs which permit

very quick short-selling on a scale much larger than ever seen before. No

up-tick or borrowing of stock is needed now to go short. In addition, the price

uptrend-breaks now will take away many of the bids and cause many stop sell orders

to be invoked one after another. "Gunning for the stops" could take on a

whole

new meaning now. In many ways,

de-regulation and derivative trading have set the stage

for another

computer driven debacle not unlike the one that occurred in October 1987.

Such a decline early or late in the day could bypass past Exchange's circuit-breaker

rules.

I suggest staying hedged, especially with shorts in biotechs. Close out

most NASDAQ and smaller stock positions if their Closing Power uptrends

are broken. Shorting QQQ or IBB even now may seem reckless,

but as long

as you use our Closing Power's downtrend to guide you in knowing how long to

stay short, the risk:reward ratio is still favorable.

Note below the QQQ's bearish head and shoulders pattern and its

price trend-break on

red high volume Friday. The Tiger Closing Power is plunging. NY Professionals

are hurriedly selling to the Public and to overseas buyers. The Tiger Accumulation

Index

has fallen to the lowest levels for the last year. After an advance for 5 years

this is very dangerous. There will not be much support until the QQQ reaches

83.50 and that may not hold.

Current QQQ

The DJI's intra-day false breakout over 16600 Friday suddenly invites

a comparison with 1986. To Tiger users, "False

Breakouts" are a familiar

concept. They are dangerous. They are even more dangerous when they

produce

breaks in well-tested price-uptrendlines going back more than 6 months, especially

with a bull market that has been rising for 4 or 5 years. What's worse?

Add into that risky mix the possibility of another "Flash Crash" as in 2010,

such as Michael Lewis has been talking about, or another Computer Driven

Crash based on derivatives as in October 1987 with OEX puts and calls. (The

good news is that the breadth is much better now than in either 2010, 1987

or 1986. The bad news is that without a Peerless Sell in 3 cases the DJI

fell to the lower band after a false breakout.)

Current DJI and NASDAQ

What if the Fed cannot hold up the market? Greenspan lowered rates in 2001

and 2002, but that did not held the NASDAQ or QQQ very much. With average

wages now falling, where is the consumer demand going to come from if a

declining stock market clips the buying of the well-to-do? Another big stock

market

decline would have devastating effects on the US economy and elsewhere.

Will We Get

Another 1937?

The deflationary Republican resistance to a badly needed public works and

highway/infrastructure re-building programs, such as the Republicans Coolidge

and Eisenhower sponsored could, I'm afraid, be setting up another 1937-like

Crash which even a loose monetary policy may not be able to prevent. The 1987

Crash resulted from FDR's efforts in 1937 to balance the budget in the middle

of an on-going Depression. He mistakenly started to listen to his Treasury

Secretary (Morgenthau) who told him that the rising stock market from

1933 to early 1937 had become too speculative. (FDR should have listened

to Keynes at this point. His mistake in 1937 can be

compared with Chruchill's

choosing to take ngland

back on the Gold Standard in 1925.)

If the NASDAQ breaks down badly, as it did in 1986 or 1987, under the pressure

of stop-loss orders, clumsy profit-taking and computerized sell orders in a market

without many bids, it could fall 20-30% in the next few months. Is that too

scary? Internals other than the A/D Line are weaker now than in 1986. Prices

have risen further, by comparion. Remember that Biotechs fell

50% in their first decline after they broke their bubble in March 2000.

the coming week. That is why we have been advocating hedging with Bearish

MINCP stocks.

Current DJI and NASDAQ

Usually the different markets,

DJI and NASDAQ move together in direction

and magnitude. But that is not always true. The closest parallel I can find

now is

1986. By the middle of 1986, the DJI had been rallying for almost four years.

In our case, it has been rallying five. But then the DJI made a false breakout

over 1900 and in the sell-off that followed, the NASDAQ broke its 6-month+

uptrendline. This turned the NASDAQ down for 6 months. Its decline was

much longer and deeper than the DJI's. The NASDAQ fell 16% in 10 weeks,

compared to the DJI's 8%.

1986 DJI and NASDAQ

Bearish Insider, Institutional and Professional Selling

The NASDJI and QQQ are much weaker than the DJI. This is what the very negative

Tiger relative strength NASDJI indicator shows. There is heavy distribution

by institutions and insiders. The negative Accumulation Index shows this.

The completed head/shoulders patterns in NASDAQ, QQQ and IBB show

institutions are very hastily selling because there is unexpectedly bearish news

coming. Look at the swift declines in the Tiger Closing Power for the

QQQ, IWM and IBB. Why are professionals in such a hurry to sell now?

This cannot be anything but bearish. Given all the attention that Michael

Lewis'

Flash Boys has received in the media for last few days, the market seems

perfectly set up to show significant weakness on Monday.

I fear the recovery rallies in QQQ, IBB and IWM will be quite limited until

we see an end to the TigerSoft Closing Power and Accumulation Index downtrends

come to an end.

Can The FED and Peerless Still Prevail?

Peerless has not given a Sell and Janet Yellen is the most dovish Fed Governor

ever. That should still give us some hope that after the current sell-off has

played itself out, the DJI will make more new highs before its bull market

comes to an end. Since 1928, Peerless charts have nearly always gives a timely

sell before a big decline below of more than 7%. But, if the NASDAQ does

break down really badly, the DJI's decline will likely be more like 10%.

15000 would have to be re-tested.

Why has there been no Peerless Sell? No Peerless sell has occurred because

the DJI did not recently rise to a point more than 2.5% over the 21-day ma

with negative readings from the IP21 (Accum. Index), V-I and OBVPct. If it

has we would have seen a Sell S12 or a Sell S15. At its recent highest

closing,

it did reach 1.6% above the 21-day ma. But the P-Indicator waspositive.

Positive breadth (P-I) coupled very negative volume readings like this are

very rare. I can find only two previous cases since 1928 where this occurred.

In one case, selling short then would have produced a big loss. In the other

case,

December 1982, after a 3% paper loss, the short selling of the DJI would have

gained 2.5%.

-------------------------------------------------------------------------------------------------------------------

4/3/2014

The "expanded

Buy B9" and usual bullishness of

flat tops cause us to expect a DJI breakout. The Jobs'

Report tomorrow

could well be the pretext for that jump. Bad economic news would be

interpreted to mean the Fed cannot back away anytime soon from

its low interest rates while good economic news would still not change

Yellen's deep-rooted commitment to "dovishness".

However, a failure by the DJI to breakout soon will show resistance now is

too great for the bulls to over-come. When this is

perceived, the

market usually declines and starts to plumb for new support. With

Peerless still operating under a Buy, I would think the DJI will not

fall below 16000 before trying for a breakout again.

The bulllisness of the Buy B9 does not extend now to

the NASDAQ

or Biotechs. The smaller cap IWM is also in doubt.

Its Closing Power

is falling. Our Stocks' Hotline remains hedged, long

some of the Bullish MAXCP

stocks and short about an equal number of the Bearish MINCP stocks.

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

The Buy B9s bullishness is limited now

mostly to dividend paying stocks and semi-conductors.

The problem now is that if there is a decisive

breakout by the DJI past 16700,

the upper band would probably be as much as we can hope for. There probably

will not be much follow-through on a breakout: volume is too low and

among the Peerless key values, the IP21, V-I and OPct remain quite negative.

We could easily get a new Sell S12 or Sell S15. These will signal negative

non-confirmations by these indicators with the DJI more than 2.5%

above the 21-day ma.

Peerless Key Values

Date

LA/MA ANN.ROC

P-I

P-I ch

IP21

V-I

OPct 65-day Pct Change

4/3/2013 1.014

.155 +165

-23

-.109

-25 -.135 .004

4/2/2013 1.015

.129 +188

-77

-.116 -18

-.136 .005

4/1/2013 1.013

.266 +264

+110 -.108

-1

-.121 .005

3/31/2013 1.009 .099

+154

+47 -.109 -29

-.211 .006

The healthiest thing the market could do now would be consolidate

and for its various components to get back into synch. Its weakening growth/

speculative components are out of synch with its strengthening dividend-paying

components. That was clear today. Utilities were strong. The market

is becoming much more defensive.

Let's See if Utilities Can Breakout Past Their

Resistance.

The NASDAQ and Biotechs like GILD

or IBB were much weaker

than the DJI or NYSE again today. As a result, there more than 540 down

than up on the NYSE. This has made the P-Indicator fall back and makes it

even more likely that any DJI rally to 16700-16800 will easily bring a

Peerless S12 or S15.

See the DJIA chart. Under Peerless rules, it should be noted that if

there is a Buy B10 on the breakout as well as a simultaneous Sell S12 or S15,

the new Buys and Sells would cancel each other out and the Buy B9

would remain, intact. In this unusual case, the DJI will probably rally up

more and reach the 3.5% upper band where there will likely be new Sells.

Professionals are still net sellers in DIA, SPY, QQQ and IWM as

well as with the IBB (NASDAQ Biotechs). We

cannot recommend

them while their Closing Powers are in downtrends. Studying the earlier

cases of SPY where Closing Power has bearishly lagged prices, one

comes to see that this by no means guarantees a substantial decline.

Normally, we just wait for the CP downtrends to end before buying.

Rarely is there a big rally until the Closing Powers break their downtrends.

Note that when these ETFs (or stocks) show pink Sell S7 Closing Power

divergence-warnings, as they all do now, their CP weakness typically only becomes

a serious problem when they break below their 65-dma. That's the point at

which we sell them short. (You can download such stocks each night, under

the name of "AUGSEL7", from our Data Page).

When Financial

Stocks Breakdown,

the DJI usually becomes much weaker.

Watch now the Big Banks like BAC and FAS,

the 3x-Leveraged Bullish Bank ETF.

These are still well above their 65-dma, so they still should have ample

underlying support. (After all, the FED is still there to backstop them).

But they do show head/shoulders-like price patterns emerging. If they

break their neckline, they should then decline 5% further down. At that point,

they must find support or the market will be in trouble.

--> 59 -29 MAXCP stocks Bullish MAXCP Stocks (4/3/2014)

--> 104 +54 MINCP stocks Bearish MINCP Stocks (4/3/2014) Bearish

plurality

--> 27 -39 New Highs on NASDAQ 10

+4 new lows. Bullish plurality

--> 63 New Highs on NYSE 4 new

lows. Bullish

plurality

-------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------

4/2/2014

No New Sell. The flat DJI top

"beckons for a breakout".

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

The first half of Aprils most often brings a nice advance,

presumably

so that we all can have more money to pay our taxes with. More important,

Janet Yellen's speech Monday was the "most dovish" ever delivered by

a head of the Fed, says the Wall Street Journal. "Don't fight the Fed"

has been indelibly imprinted on my mind. As a result, the ratio of NYSE

(which has the most dividend stocks) new highs to new lows is 101:1.

If breadth can stay positive, we should see the DJI surpass 16600 for a

breakout above well-tested resistance into all-time high ground.

The NYSE, OEX and SP-500 made marginal new highs today. Normally,

with a Peerless Buy signal still operating, all this would provide us

a very bullish outlook even with volume lagging a little.

But how far up can any breakout advance go? IP21, V-I and OPct

are each

quite negative. Not only that, but the weak Biotech ETFs

have formed

their own potential head and shoulders pattern. They must keep advancing

now to destroy these patterns.

Another concern: it's getting much harder to find attractively Accumulated

Closing Power new highs to buy. Professionals and Insiders are turning

quite cautious.

--> 88 +13 MAXCP stocks Bullish MAXCP Stocks (4/2/2014)

--> 50 -1 MINCP stocks Bearish MINCP Stocks (4/2/2014) Bullish plurality

--> 66 -15 New Highs on NASDAQ

6 -7 new lows. Bullish plurality

--> 111 New Highs on NYSE 1 new

lows. Bullish

plurality

My guess is the Jobs' Report on Friday morning will bring a breakout

surge. But it may also bring a Peerless Sell S12 or S15. So, stayed hedged

and watch the NASDAQ biotech ETF, IBB, to see if it can rally and destroy

its nascent head/shoulders or if it will turn sharply down.

Peerless Key Values

Date

LA/MA ANN.ROC

P-I

P-I ch

IP21 V-I

OPct

65-day Pct Change

4/2/2013 1.015

.129 +188

-77

-.116 -18

-.136 .005

4/1/2013 1.013

.266 +264

+110 -.108

-1

-.121 .005

3/31/2013 1.009 .099

+154

+47 -.109 -29

-.211 .006

Lagging Closing Power

Closing Power Divergence Sell S7s are warnings. But until the SPY breaks

below

its 65-dma, the situation is not precarious. Even then, if Closing Power

belatedly turns up and breaks above the CP well-tested resistance, there

is a

good chance SPY will move up quickly. Professionals do not make

the

mistake of being net short when prices start a big advance. They somehow

know

in advance and they are not stubborn.

Please see the SPY charts since 1994 to get a better sense

of this.

The Biotech and NASDAQ Head/Shoulders Patterns

are scaring away chart-minded traders. Watch to

see if the patterns are aborted or play out bearishly.

Moves above the right shoulder apexes usually

destroy the pattern and allow prices to advance quickly

as shorts are forced to cover.

-------------------------------------------------------------------------------------------------------------------

4/1/2014

No New Sell. The flat DJI top

"beckons for a breakout".

But how far up can it go? The Peerless DJI chart shows lots of red

Distribution. IP21 is -.093. Volume

appears to be too low to sustain

a breakout advance. The negative -.121 is particularly low for a

DJI trying to breakout. It is likely we will get a

Peerless Sell signal

in April if the P-Indicator falls back a little and the DJI rises from

1.6% above the 21-day ma to 3% above the 21-day ma. This will be

based on the negative volume key values for IP21, V-I and OBVPct.

For example, if the DJI were to spike up tomorrow to 16750 with

flat breadth and internals, which would leave the volume indicators

negative and drop the P-Indicator, we would get a Sell S15.

Peerless Key Values

Date

LA/MA ANN.ROC

P-I

P-I ch

IP21 V-I

OPct

65-day Pct Change

4/1/2013 1.013

.266 +264

+110 -.108

-1

-.121 .005

3/31/2013 1.009 .099

+154

+47 -.109 -29

-.211 .006

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

Janet To The Rescue

What the market has going for it now is very low interest

rates and a

Fed Chairwoman who is a very devout "dove". The Wall Street Journal

Tuesday morning called her speech yesterday "the most dovish"ever

heard from the head of the Federal Reserve. The force of this should

not be underestimated. Dividend stocks are attractive in this environment.

And the Fed has removed one of the sources of uncertainty that holds

back speculators from pushing prices up, up and up even further.

OEX Seems Best ETF To Buy if There is A Breakout.

The OEX (SP-100) is the strongest of the major ETFs. It

has already

very marginally broken out with a confirming Closing Power. This shows

the strength in dividend and some of the highest quality oil/gas stocks.

Technical Rebound?

The NASDAQ today did get back above

its rising 65-dma. It will need to

keep advancing. So will the biotechs. Only a NASDAQ high high will

really

destroy its potentially bearish head/shoulders pattern. The leading

biotechs saw big technical bounces today from support levels and rising

longer term mvg .avgs. Their very steep Closing Power downtrendlines

were broken, but their CPs will now face resistance at their falling 21-day

ma. Continued strength after the openings will show Professionals are

doing more than trading them for a quick over-sold bounce.

Hedging with our bullish MAXCPs and bearish MINCPs still

seems advised.

--> 75 +22 MAXCP stocks Bullish MAXCP Stocks

(4/1/2014)

--> 51 -69 MINCP stocks Bearish MINCP Stocks (4/1/2014) Bullish plurality

--> 81 New Highs on NASDAQ

13 new lows. Bullish plurality

--> 115 New Highs on NYSE 3 new

lows. Bullish

plurality

Highest Power Ranked Stocks/ETFs at Start of 2nd Quarter

Leveraged ETFS - UWM AI/200=155 IP21 = .299 65-day Opening Power

100% 65-Closing Power 42.2% New red Buy.

SOXL NH...

AI/200=141 IP21 = .12 65-day Opening Power 100% 65-Closing Power

75.7% on red Buy.

DJI-30 - UTX has highest AI/200 but IPA%-Pr% is -35 making it

ineligible to be a Tahiti stock.

SP-500 - HP AI/200-176 98.42

-------------------------------------------------------------------------------------------------------------------

3/30/2014

No New Sell. STAND-OFF. More backing

and filling

by the DJI between 16000 and 16600 seem likely.

Peerless Key Values

Date

LA/MA ANN.ROC

P-I

P-I ch

IP21

V-I

OPct

65-day Pct Change

3/31/2013 1.009 .099

+154

+47 -.109 -29

-.211 .006

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart SPY Chart NASDAQ Chart IBB

Chart IWM Chart

The blue-chip DJI-30 will not easily top out when interest rates are so low.

The stock market really likes the new Fed Chairwoman. It's easy to see

why. Low interest rates are expected for a long time. The

FED, she explained, was

in

agreement that there was way too much "slack" in

the economy. The official

Unemployment

rate significantly overstates the present recovery. Consumer buying

needs

encouragement. As a result, inflation was not expected. She avoided

talking about stock bubbles.

The market's bullish April seasonality (DJI rises in 71% of Aprils since 1965)

will help, too. Last Friday's and today's excellent Breadth are impressive.

Dividend

stocks are favored. They are taking away the leadership from the NASDAQ,

apart from chip-makers. Good breadth can overcome the NASDAQ

head/shoulders

and the BioTech breakdown.

Is Trading Volume Really This Low?

The lack of up-volume could be a problem, however, if a breakout above 16600 is

attempted. Breakouts can be manipulated using Opening Price jumps. But it

takes volume to make prices continue to rise. 100-point higher openings can also be

staged to bring a relief rally, as when Yellen is expected to chirp her dovish

message.

But what will happen when she is not on stage? Worse, what would happen when

Professionals decide to rig or over-extend and exploit a bear market?

Why is reported volume so low? Because many institutional trades are now sent to the

murky "black

pool" operators who do not have to report trading or follow any regulations.

See the lengthy piece in the New York Times on Flash Trading and "black pool"

operators. Real trading volume is much higher. Including "dark

pool" trading

would require including nano-second flash trading numbers. This would make

a revised volume figure quite useless. (Better to tax such trading away and continue

to use NYSE numbers. If Obama could break away from his role as puppet to

Wall Street, we might actually see reform here.)

So there could be a DJI breakout past 16600. In fact, flat DJI tops usually

beckon for a price breakout. But we will need to see an increase in volume

and breadth will need to be positive to avoid a reversing Sell. If breadth

deteriorates,

a price breakout past 16600 to the upper 2.5% band will likely bring a Peerless Sell

and a dangerous false breakout.

Breadth is still the key. If the excellent breadth continues on the breakout, an

early

April Sell can be prevented.

Our Stocks' Hotline added a few more Bullish MAXCPs and closed a few of

the Bearish MINCPs. But it remains essentially hedged.

There were some

attractive high volume, high Accumulation breakouts tonight. If all is well,

they should move higher. If they quickly fall back below their breakout point,

it will be a sign that breakouts now are bearish traps. We will watch them

and report what we see.

The

negative V-Indicator and very weak Hourly OBV are warnings that

a DJI breakout past 16600 will probably not rise past the upper band.

But first we may see such a breakout. That is the significance of the

"expanded Buy B9". It is also the conclusion I reach based on the

discovery a few years ago that negative V-I non-confirmations (S9Vs)

are not reliable until late April or May. In other words, the Bullish

seasonality of April ordinarily trumps low volume. April can produce

Sell S12s and S15s 2.5% over the 21-day ma where the P-Indicator is

not too positive. (More on this tomorrow night.)

--> 53 +18 MAXCP stocks Bullish MAXCP Stocks (3/302014)

--> 110 -81 MINCP stocks Bearish MINCP Stocks (3/30/2014) Bearish plurality

--> 46 New Highs on NASDAQ

8 new lows. Bearish plurality

--> 88

New Highs on NYSE 6 new

lows. Bullish

plurality

April Peerless Sells in Bull Markets

With

our P-Indicator positive now, I have highlighted in blue

the past

non-Sell S9s where the P-Indicator was positive and

the volume

indicators were mostly negative (3 of 3 or 2 of 3).

19290418 S9 311.9 .059

19290426 S9 314.2 .066

19290430 S12 319.3 .081

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.036 .732 -3 -.038 -216 .066

.031 8.1% gain

19360401 S15 158.9 .058

1.010 .206 -40 -.097 -265 .063 .111

4.9% gain 3% paper loss

19360402 S9 160.4 .067

19360402 S1 160.4 .067

1.026 .282 -27 -.089 -231 .047 .113

19510430 S9 259.1 .064

1.024 .50 16

.179 -23 .363 .0619530423 S10 270.7 .027 Support Failure

19560404 S5 518.7 .079

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.024 .636

39 .144 -79 .468 .062

19560409 S2 518.5 .079

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.016 .61

12 .109 -147 .455 .071

19620409 S10 692.9 .131 Support Failure

19670424 S12 887.53 .015

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.026 .15

33 -.02 1

.19 .048

19670427 S3 894.82 .027

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.032 .326

45 .05 3

.284 .055

19690430 S9 950.18 .175

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.025 .189 -30 .083 -1 .219

.01

19720406 S15 959.44 .025

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.02 .159

-70 .036 -1 -.09 .075

19720412 S9 966.96 .033

1.023 .403 -2 .087 0

.246 .064

19720418 S7 968.92 .035

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.019 .327 -20 .054

-1 .155 .068

19760421 S15/S7 1011.02 .05

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.019

.345 -1 .038

-1 .074 .071

19810424 S15/S7 1020.35 .046

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.018 .061

1

-.012 -1 .114 .078

19860429 S19 1825.89 .028

19870406 S9 2405.54 .063

19920415 S9 3353.76 .03

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.03

.358 =56 /-49 =11 .249 .033

19920421 S5 3348.61 .028

19970422 S9 6833.59 -.049

19980422 S15 9176.72 .168

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.021 .478

17 .057 -8 .053

.183

20000425 S2 11124.82 .049

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.015 .013 -25 -.034 -43 -.096 -.012

20040405 S12 10558.37 .056

Close Parallel.

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.027 -.043

24 -.069 -145 -.152

.009

20080402 S9 12608.92 .097

20080421 S4 12825.02 .112

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.024 .442

281 .027 4 -.012 .028

20100416 S11 11018.66 .086

LA/MA ANN.ROC

P-I

IP21 V-I

OPct

65-day Change

1.009 .311

185 .061 -65 .304 .036 |

-------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------

3/27/2014 Friday was a good day