Sample Tiger Trades with Some Key Stocks.

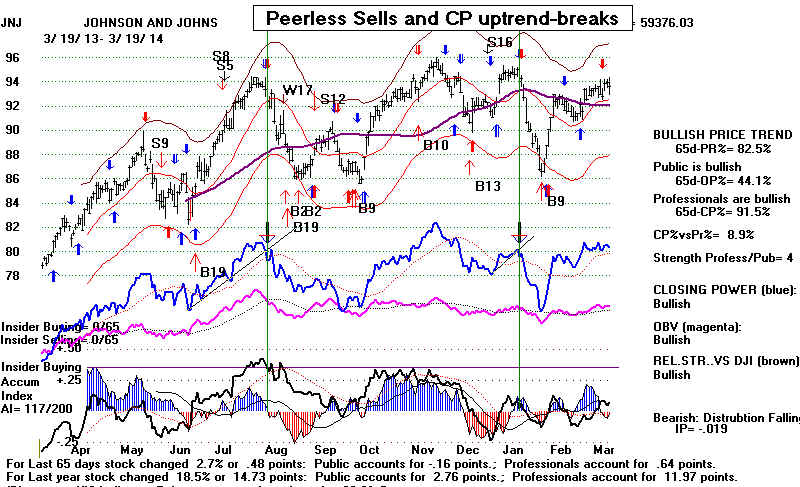

A market top is getting closer. It is important to know

when to sell. Here are some Tiger approaches.

With the Super stocks, sell 50% when you have made 50%.

Sell when the Closing Power breaks is uptrends if you

are trading. Sell these when the 65-dma is broken.

We can always buy these stocks back when curcumstances

improve. The new soon to be released books on

Explosive Super Stocks and Closing Power will fortify

these ideas.

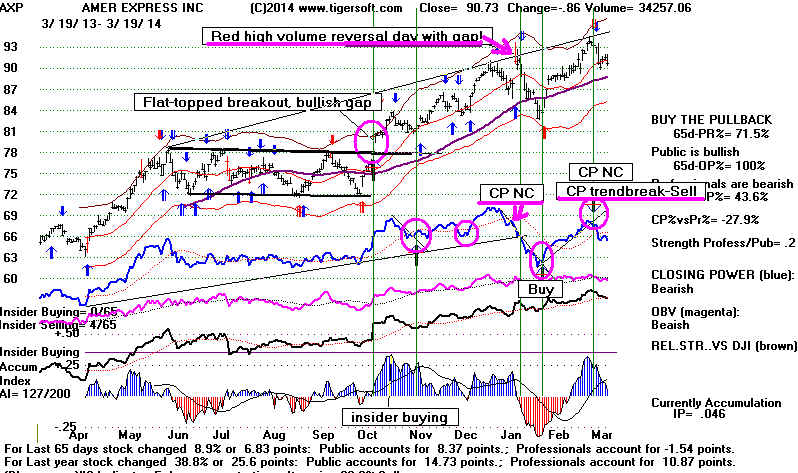

AXP AMERICAN EXPRESS COMPANY

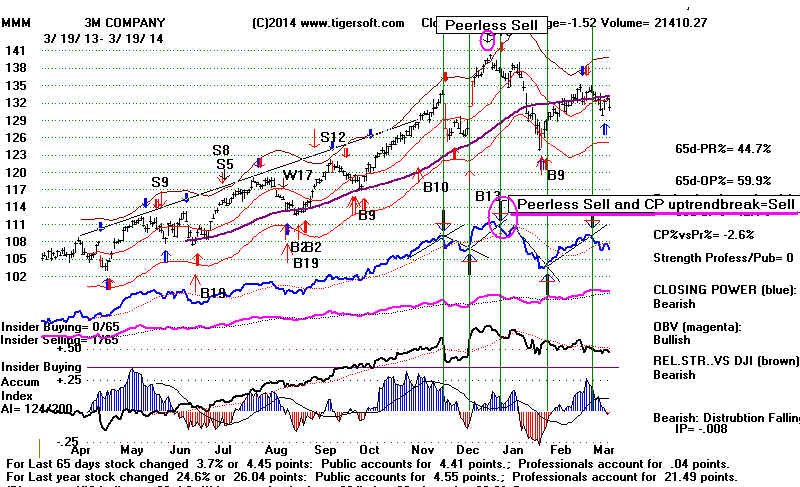

Bank stocks trade well with Peerless.

I have circled in magenta the spots that would have been appopriate for a

Tiger trader to buy or sell. Not that buying at a rising 21-day ma works OK,

too, except on the third (or higher) test. New price highs not confirmed by

Closing Power should be sold, especially when a CP uptrend is broken.g

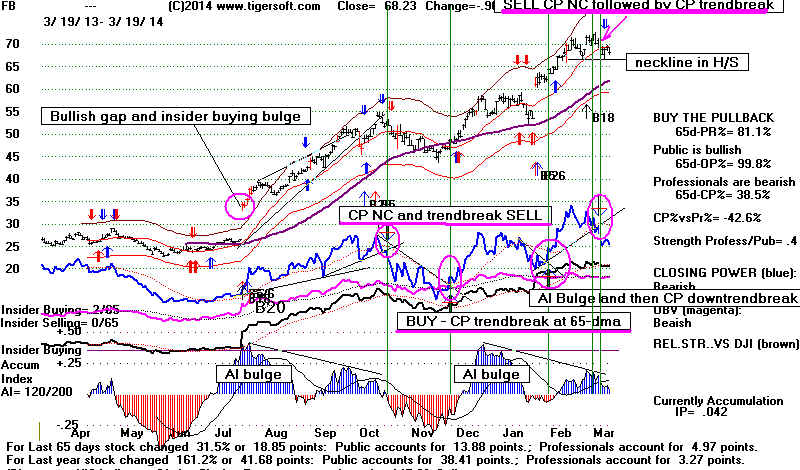

FB FACEBOOK INC CL A Buy $71.30 Still have shares today price is 68.29 as of 3/19/2014

Again, Tiger traders could profitably sell here simply by watching for Closing Power NCs

and subsequent trendbreaks. Look for CP downtrend-breaks following AI bulges of

insider buying to take the best and safest long positions.