HOTLINE 9-22-2023 Tiger Software (C) 2023

PLEASE USE ------> www.tigersoftware.com/zebra/index.htm

---------------------------------------------------------------------------------------------

Recent Peerless Hotlines http://tigersoftware.com/707/oldindex.htm

www.tigersoftware.com/sage22/INDEX.htm

www.tigersoftware.com/dante43/INDEX.htm

www.tigersoftware.com/5HLM/INDEX.htm

---------------------------------------------------------------------------------------------

new new new new new new

new

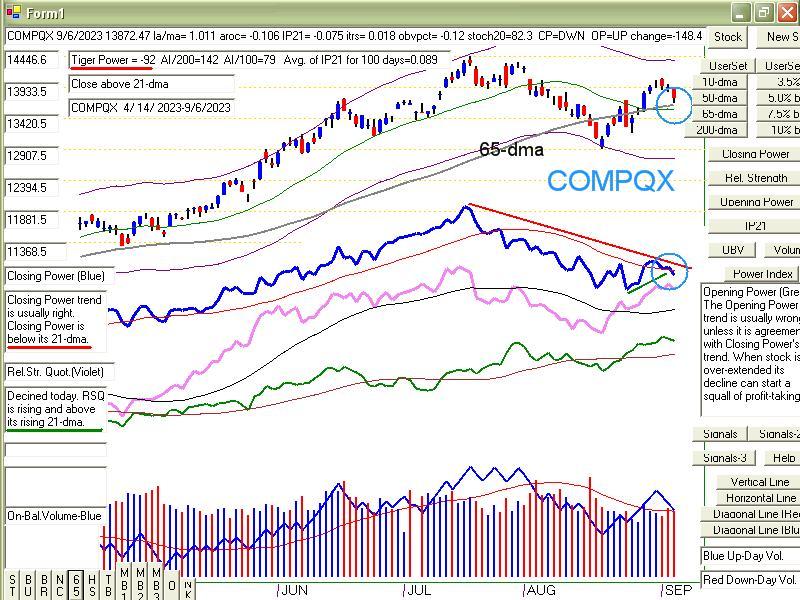

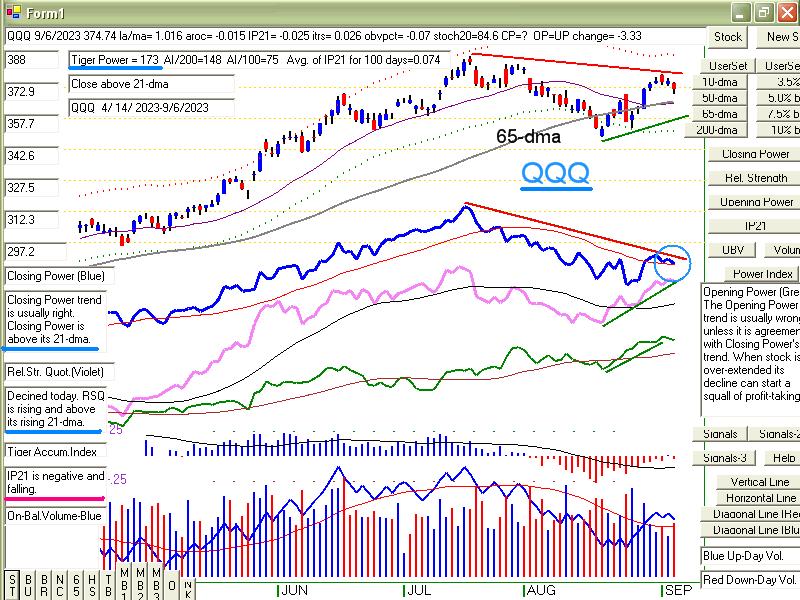

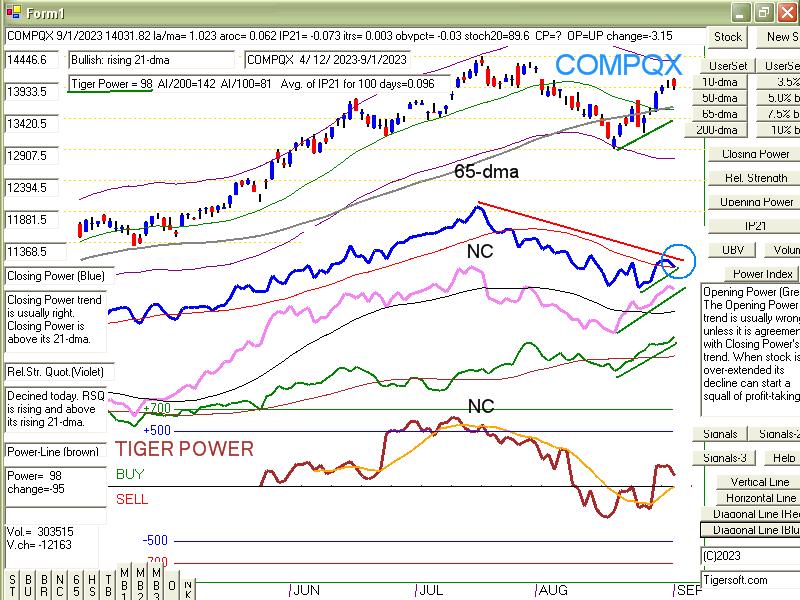

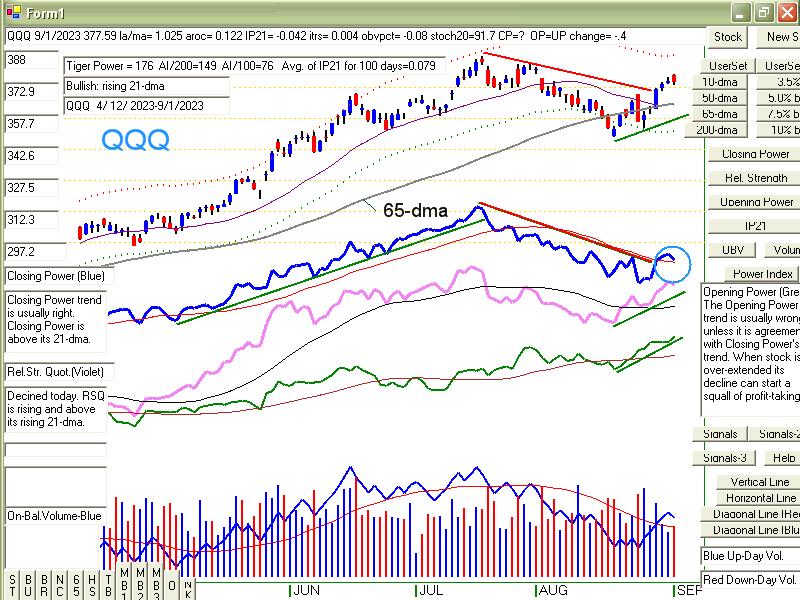

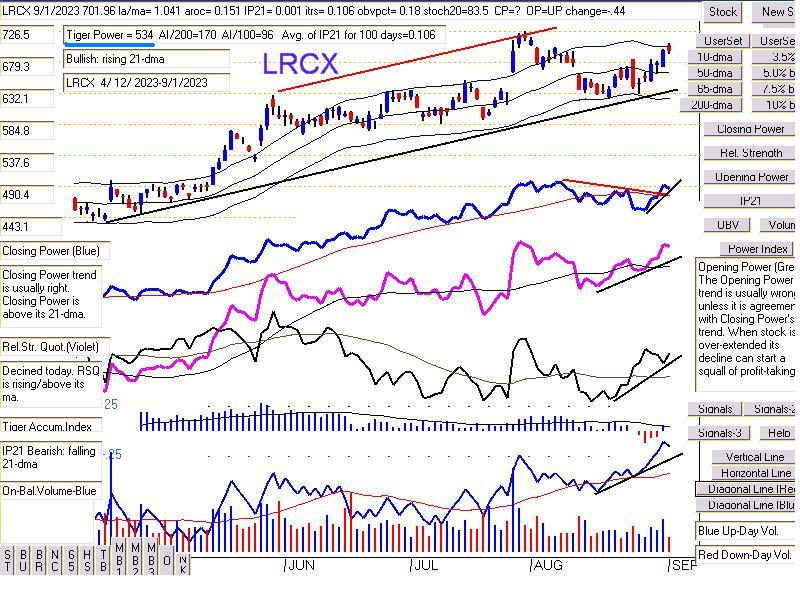

Tiger Windows-10

Candle-Stick chart programs

can now be purchased for $95. They will

require

you to get TC-2000 data for Windows10 (about

$30/month.) The Candle-Stick charting program

allows Peerless signals to be super-imposed

and shows currently provided Tiger signals as suggested

by the direction of the 65-dma. See samples below.

This is a limited time offer. I will need to get a check

by September 25th. No credit cards, please.

I will send you the programs at the end of the month,

or sooner. You will be delighed at how nice it is

to get data early in the day and how simple our

programs are to run.

William Schmidt, 5834 Kantor STREET, San Diego, CA 92122.

---------------------------------------------------------------------------------------------

The Hotline's price is still

$440 for a year. Visa or MC Credit Cards

remain a problem. The banks are declining too many cards even when

the card numbers we enter are correct. The Data Page for a year is now $240.

william_schmidt@hotmail.com

-----------------------------------------------------------------------------------------

HELP A Guide To Profitably Using The

Tiger Nightly HOTLINE

Introduction to Tiger/Peerless Buys and Sells.

Peerless Buy and

Sell Signals: 1928-2016

Individual Peerless signals explained:

http://tigersoftware.com/PeerlessStudies/Signals-Res/index.htm

Explanation of each Peerless signal

http://www.tigersoft.com/PeerInst-2012-2013/

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

Documentation for TigerSoft

Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

SPY Charts since 1994:

Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized Signals.

http://www.tigersoftware.com/SPY-book-1989-2023/SPY-Book.htm

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

1/19/2016 ---> Corrections,Deeper

Declines and Bear Markets since 1945.

1/21/2016 ---> High

Velocity Declines since 1929

2/12/2016 ---> Presidential

Elections Years and Bullish IP21 Positive Non-Confirmations at Lower Band.

2/12/2016 ---> OBV NNCs on DJI's Rally to

2.7% Upper Band when DJI's 65-dma is falling.

11/6/2016 ---> Killer Short Selling Techniques: ===> Order Here ($42.50)

TigerSoft "Combination" Short-Selling... Easy as 1-2-3 Short Sales

Recent Peerless Hotlines http://tigersoftware.com/707/oldindex.htm

www.tigersoftware.com/sage22/INDEX.htm

www.tigersoftware.com/dante43/INDEX.htm

www.tigersoftware.com/5HLM/INDEX.htm

---------------------------------------------------------------------------------------------

New Free Book - DJI History by

Decade: 1950-2020: Technicals, Signals and Events

Events will be added soon for each decade. See 1950-1960 now..

Emphasis is on how FED and also political events shaped market trends.

1950 to 1959-1960 http://tigersoftware.com/z/HISTORY/1950s/decade.htm

1960 to 1969-1970 http://tigersoftware.com/z/HISTORY/1960s/deca-60s.htm

1970 to 1979-1980 http://tigersoftware.com/z/HISTORY/1970s/deca-70s.htm

1980 to 1989-1990 http://tigersoftware.com/z/HISTORY/1980s/decad80s.htm

1990 to 1999-2000 http://tigersoftware.com/z/HISTORY/1990s/deca-90s.htm

2000 to 2009-2010 http://tigersoftware.com/z/HISTORY/2000s/d-2000s.htm

2010 to 2019-2020 http://tigersoftware.com/z/HISTORY/2010s/d-2010s.htm

-------------------------------------------------------------------------------------------------------------------------------------------------

Trading SPY with Tigersoft: 1986-2023 --- http://www.tigersoftware.com/SPY-book-1989-2023/SPY-Book.htm

Market Top of August 1937. www.tigersoftware.com/years/1937/1937.htm

=================================================================================

9/22/23 Friday

6:00 PM DJI futures +51 See https://dowfutures.org/ NASDAQ Futures +91

| |

Data

used: 9/21/2023

|

|

| |

Nightly Hotline

Don't trust the first rally after

so many necklines in head/shoulders patterns

have just been broken.

Historically, over the next week the DJI rallies only 29% of

the time in the third-year in the

Presidential 4-year cycle. The second

week is not much better.

Powell's embrace of the stance

of the FOMC "hawks world view" sent the bond

prices down sharply while the yield

on the ten-year bond jumped to a 17-year

high. The cost of 20-year

mortgages is streaking towards 8%. Smaller stocks

got clobbered again. See how

the head and shoulders patterns for IWM and

MDY showed why they are reliably

bearish. So, did the Housing Stocks.

The bigger cap index, SPY, broke

its price uptrendline convincingly. And even

the DJI-30 broke the rising

neckline at 34000 in its oblong, multi-shouldered

head and shoulders pattern.

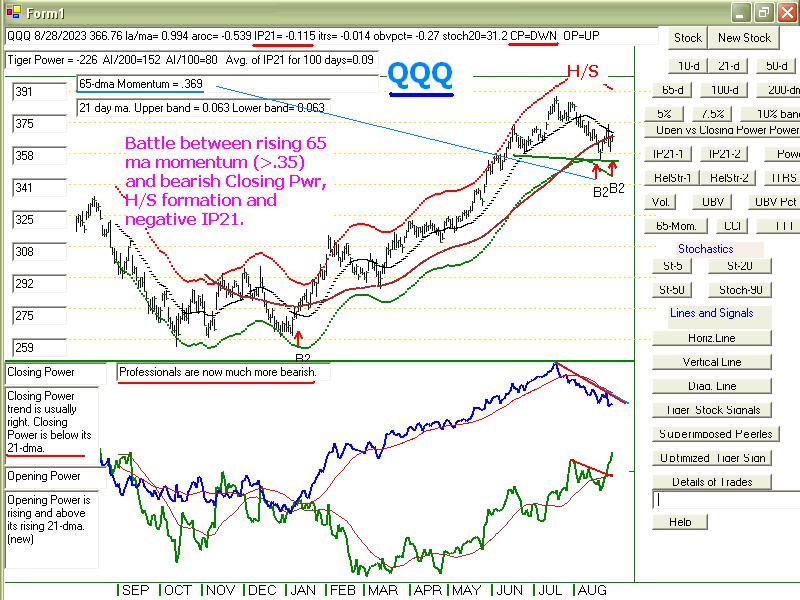

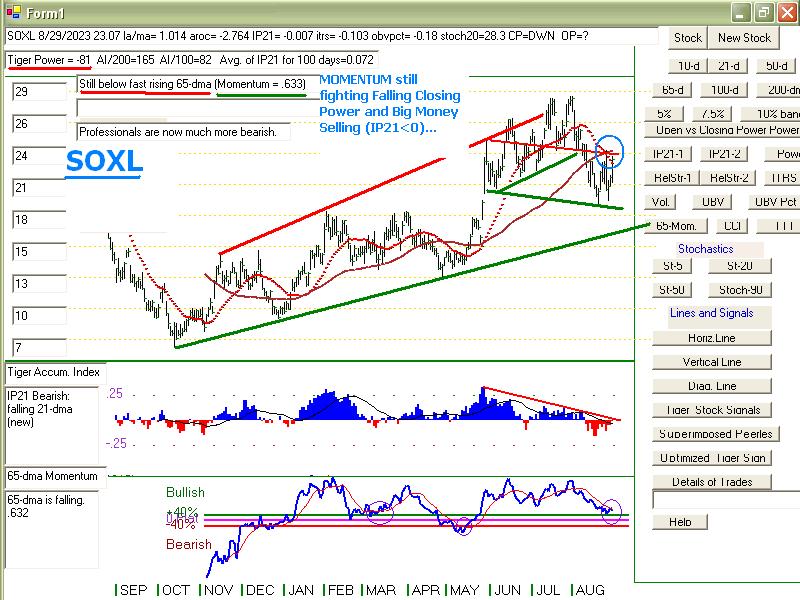

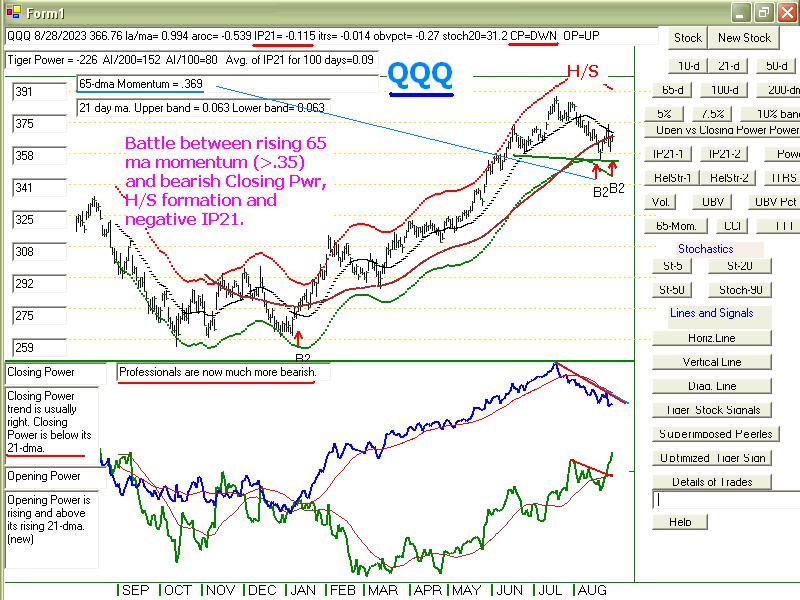

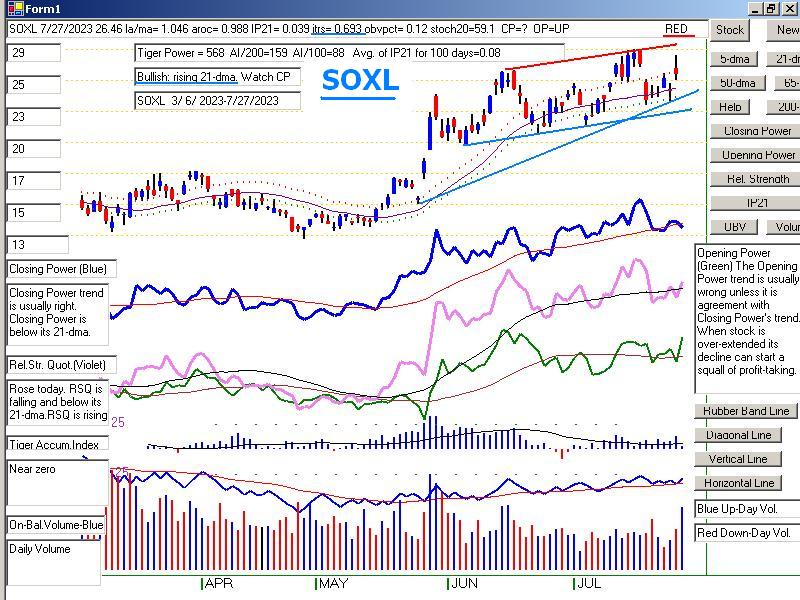

QQQ and SOXL declined to their

trendline-supports, but did not break them

even though NVDA did break its long

uptrend-line.

With less than 31% of all stocks,

of the DJI-30 stocks and of the SP-500 still above

their 65-dma and with the

Closing Powers falling for all the key ETFs, I would

just let the market try to

rally, if it wants. It will probably fail and there will

soon be another leg down.

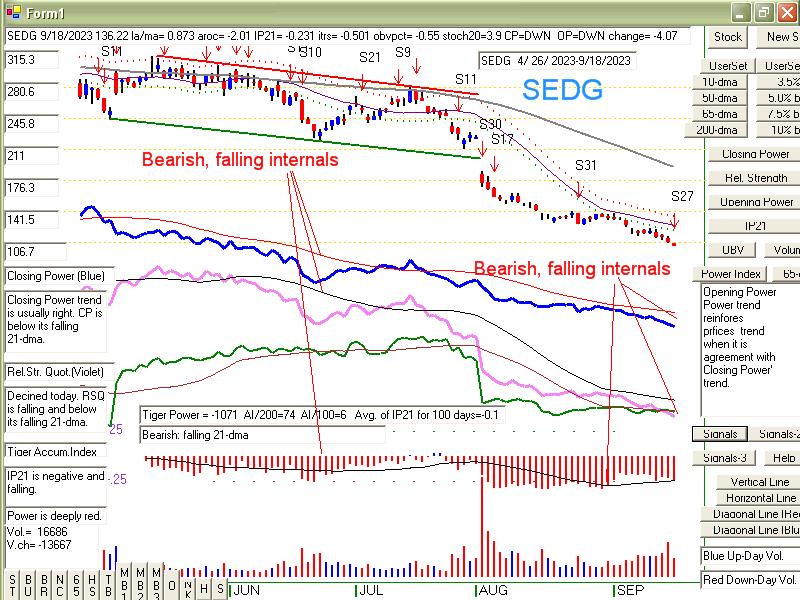

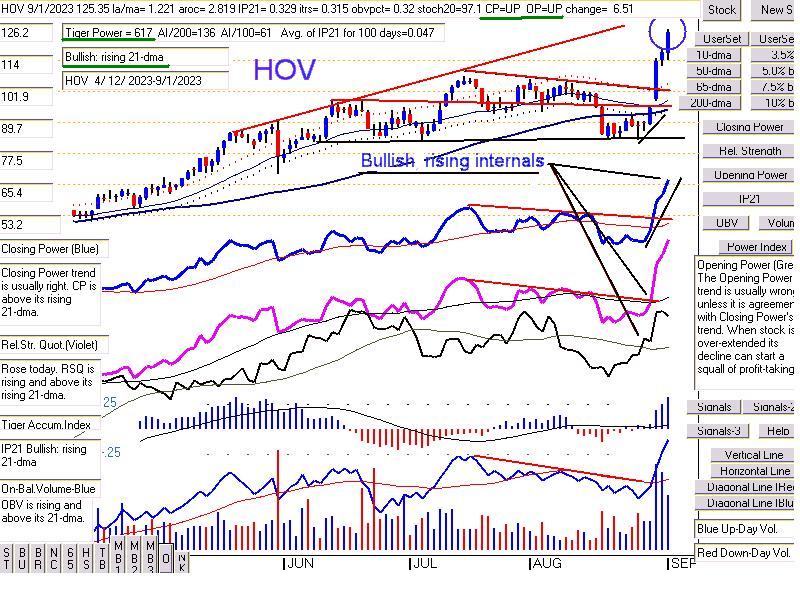

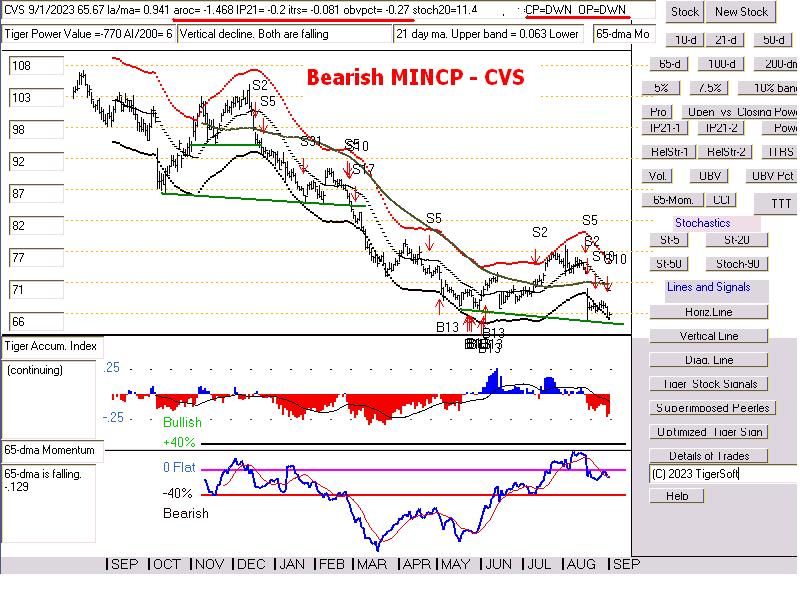

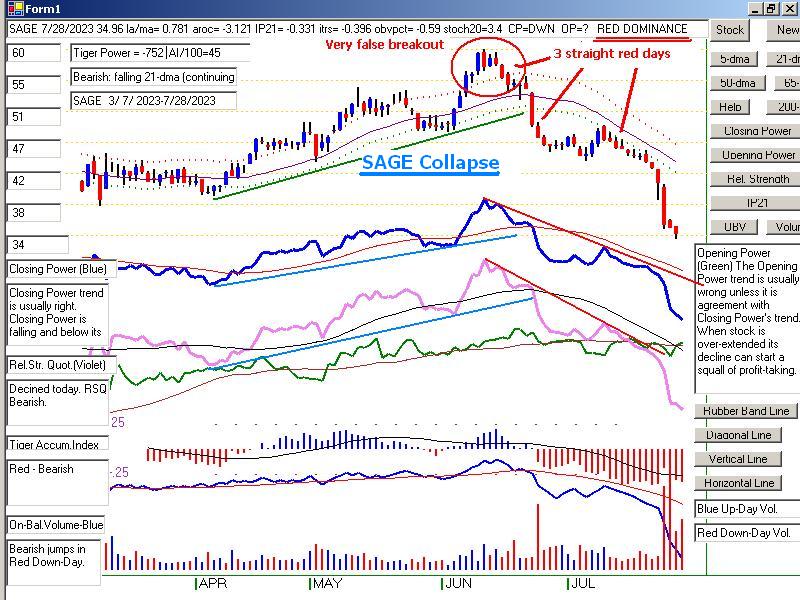

IP21 Moving Average Breaks

Big Money, as measured by our

IP21-Accumulation Index, is a nuanced

indicator that can help

traders a lot. When a stock sells off badly and its IP21

falls to -.25 or lower, watch

in the next bounce for the IP21 to fall back

below its 21-dma or go

negative again. We should flag these occurrences

and give them a special Tiger

name. See some examples below and among

our many bearish MINCPs

What Mice Can Teach

I will do this when I get a

chance. I dropped my mouse in some water

yesterday. It did not

recover. So, I used three old mice. In turn, each

froze up. So yesterday

mid-afternoon, I struggled to find a retail store that

was still open and sold wired

computer mice. I finally found a great

Logitech (the best) mouse at

one of the few Staples in San Diego that

is still open. But not

until 7:00 PM.

Lana as usual was right.

She told me to just get one quickly delivered

by Amazon. I had

previously ordered one just in case, off Ebay ten

days ago, but it still has

not arrived. The moral here is get a more expensive

Logitech mouse and a new

mouse-pad, too from Amazon.. It

would have saved me a lot of

time. And its so much faster and

. easier now. |

|

| |

9/21/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Old Peerless- 2006

version

Tiger Index of Big

Banks Bond Funds Gold Stocks Housing Stocks

Insurance-Stocks

Regional

Banks Russell-1000

Semi Conductors

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO BLDP FAS GLD HD IBB JETS JNUG KOL NAIL

NUGT NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN |

TECL TLT TMF TNA UGA USO

China: YINN

CHAU BABA BIDU

Commodities: CANE COCO CORN DBC CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks: AA AAPL ADBE AMAT AMGN AMD AMZN ANET AXP BA BAC

BSX CAT CDNS CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB

FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX

MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG

PYPL QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA

TXN XOM V VRTX WFC WMT XLE ZM ZOM

SEMI-Condctors in SOXL:

NVDA. AVGO, AMD. INTC LRCX TXN MCHP NXPI AMAT ON AAOI TSM

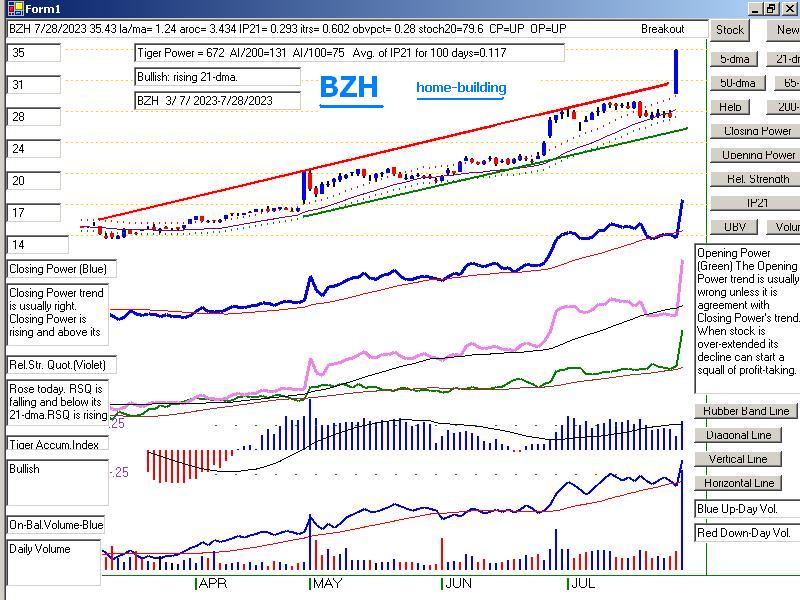

HOMEBUILDERS: BLDP NAIL

BZH HOV LEN MHO MTH PHM -

REGIONAL BANKS:

EGBN

FFIC GBCI HMST

Carl Icahn and associates: IEP

MS

JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/9-21-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/9-21-2023/Bearish.htm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1 - Daily Breadth and Volume Statistics

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,003 |

3,008 |

3,002 |

| Advances |

462 |

1,169 |

2,290 |

| Declines |

2,489 |

1,735 |

629 |

| Unchanged |

52 |

104 |

83 |

| New

highs |

14 |

50 |

64 |

| New

lows |

220 |

68 |

63 |

| Adv.

volume* |

94,691,737 |

261,471,026 |

737,401,572 |

| Decl.

volume* |

747,887,854 |

485,355,509 |

154,611,313 |

| Total

volume* |

846,041,152 |

759,415,129 |

909,838,757 |

| Closing

Arms (TRIN)† |

1.60 |

1.06 |

0.90 |

| Block

trades* |

3,939 |

3,838 |

3,994 |

| Adv.

volume |

377,661,850 |

1,260,368,631 |

2,877,840,343 |

| Decl.

volume |

3,262,523,778 |

1,986,688,800 |

712,082,132 |

| Total

volume |

3,662,344,500 |

3,308,451,449 |

3,648,725,051 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,478 |

4,545 |

4,486 |

| Advances |

1,136 |

1,495 |

2,880 |

| Declines |

3,178 |

2,839 |

1,400 |

| Unchanged |

164 |

211 |

206 |

| New

highs |

27 |

51 |

49 |

| New

lows |

443 |

262 |

185 |

| Closing

Arms (TRIN)† |

0.72 |

0.80 |

1.24 |

| Block

trades |

42,215 |

44,819 |

35,580 |

| Adv.

volume |

1,636,145,742 |

1,886,377,930 |

2,849,290,738 |

| Decl.

volume |

3,295,529,141 |

2,847,926,169 |

1,719,074,076 |

| Total

volume |

5,014,891,963 |

4,782,447,469 |

4,649,014,014 |

|

Table 2 TIGER QUICKSILVER on ETFS - 9/21/2023 ---

Bullish = 1 DBO

Bearish = 8 MDY, IWM, SOXL,TECL, RETL,IBB, GLD, TAN

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

===============================================================================================

DIA 340.58 -3.74 346.14 -135.1% Bearish RED -.159 0 ------------

---------------------------------------------------------------------------------------------

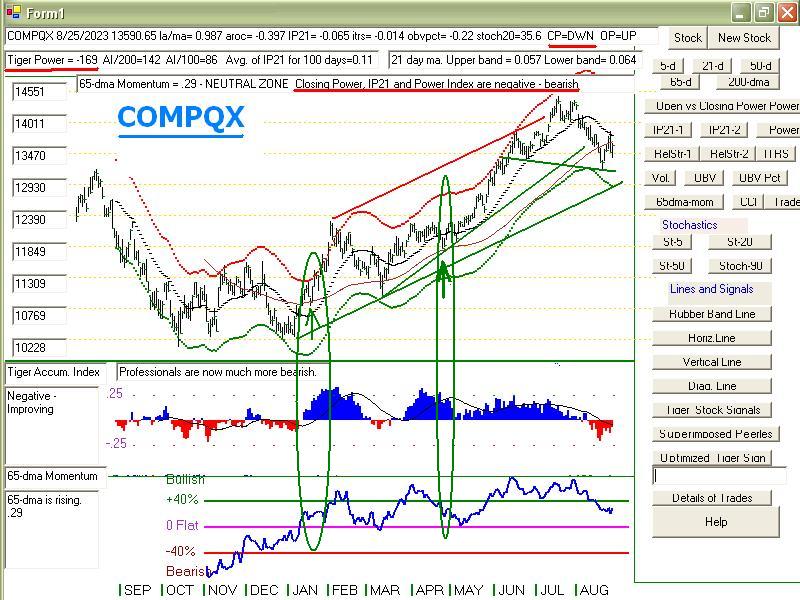

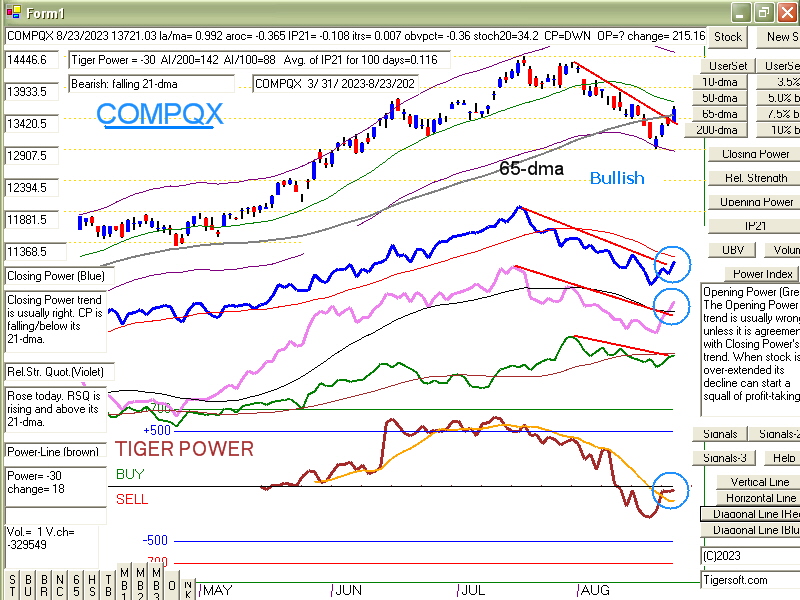

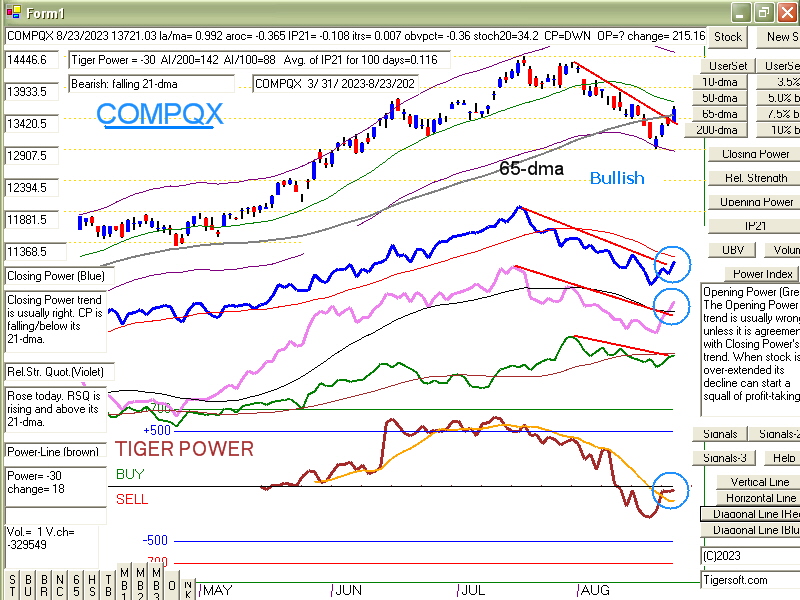

COMPQX 13223.99 -245.14 13708.34 -256.3% Bearish RED -.031 -.041 -.072

---------------------------------------------------------------------------------------------

SPY 431.39 -7.25 443.37 -213.8% Bearish RED -.062 -.024 -.086

---------------------------------------------------------------------------------------------

QQQ 357.86 -6.68 370.81 -261.9% Bearish RED -.001 -.031 -.032

---------------------------------------------------------------------------------------------

MDY 455.78 -8.4 468.54 -205.5% Bearish RED -.225 -.061 -.286

---------------------------------------------------------------------------------------------

IWM 177.07 -2.79 183.61 -232.2% Bearish RED -.301 -.068 -.369

---------------------------------------------------------------------------------------------

FAS 63.14 -3.29 67.72 -423.7% Bearish RED -.053 -.05 -.103

---------------------------------------------------------------------------------------------

RETL 5.58 -.21 6.25 -780.5% Bearish RED -.103 -.284 -.387

---------------------------------------------------------------------------------------------

SOXL 17.42 -1.06 19.79 -1065.2% Bearish RED -.023 -.313 -.336

---------------------------------------------------------------------------------------------

TECL 43.4 -2.12 47.26 -708.2% Bearish RED .001 -.186 -.185

---------------------------------------------------------------------------------------------

IBB 123.05 -1.58 126.61 -179.8% Bearish RED -.275 -.029 -.304

---------------------------------------------------------------------------------------------

GLD 178.05 -1.3 178.34 24.6% ------- BLUE -.246 -.012 -.258

---------------------------------------------------------------------------------------------

DBO 17.71 .06 17.93 -58.7% ------- RED .123 .19 .313

---------------------------------------------------------------------------------------------

OIH 342.9 -5.92 356.93 -236.8% Bearish RED -.225 .068 -.157

---------------------------------------------------------------------------------------------

CPER 22.83 -.21 23.44 -150.3% ------- ---- .056 -.031 .025

---------------------------------------------------------------------------------------------

TAN 53.59 -.95 55.92 -317.5% Bearish RED -.081 -.24 -.321

---------------------------------------------------------------------------------------------

UUP 29.46 .02 29.42 3.4% Bullish ---- .166 .07 .236

---------------------------------------------------------------------------------------------

CORN 21.91 -.29 21.97 -50% ------- RED -.034 .013 -.021

---------------------------------------------------------------------------------------------

WEAT 5.75 -.12 5.98 -135.9% ------- RED -.161 -.08 -.241

---------------------------------------------------------------------------------------------

YINN 28.21 -1.97 31.43 -610.9% ------- RED .015 -.241 -.226

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

9/21/23

Bullish =5

Bearish = 44

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

INSURANC .72 .76 .76 .8 .72 .76

EDU .666 .666 .666 .666 .833 .833

OILGAS .639 .69 .69 .721 .731 .762

MARIJUAN .6 .7 .7 .8 .8 .8

============================================================================================

HACKERS .5 .437 .437 .5 .5 .5

=============================================================================================

DJI-13 .461 .538 .384 .384 .461 .461

COMODITY .394 .578 .552 .526 .5 .5

FOOD .367 .489 .469 .469 .448 .428

GUNS .357 .428 .357 .428 .357 .428

FIDSTKS .325 .443 .431 .461 .449 .497

SOFTWARE .321 .357 .375 .41 .41 .482

SP-100 .311 .411 .422 .444 .433 .5

COPPER .285 .428 .571 .571 .571 .714

RETAIL .282 .347 .326 .326 .347 .369

INDMATER .277 .319 .361 .347 .388 .361

TRANSP .263 .21 .263 .263 .263 .315

NASD-100 .257 .415 .435 .445 .435 .504

======

HIGHPRIC .255 .329 .354 .38 .376 .51

LOWPRICE .255 .255 .272 .281 .331 .322

RUS-1000 .244 .329 .354 .372 .378 .426

INDEXES .237 .291 .286 .286 .318 .41

DOWJONES .233 .4 .333 .366 .433 .5

======

SP500 .232 .331 .35 .37 .374 .429

======

HOSPITAL .23 .23 .23 .153 .076 .153

MILITARY .23 .23 .23 .269 .23 .269

BIOTECH .205 .225 .241 .248 .266 .276

COMPUTER .2 .3 .3 .3 .35 .35

EAT .195 .243 .195 .268 .195 .268

INFRA .193 .258 .258 .225 .225 .387

AUTO .185 .259 .203 .222 .24 .296

UTILITY .179 .282 .282 .333 .333 .307

FINANCE .175 .325 .35 .387 .412 .45

ELECTRON .172 .172 .21 .187 .203 .278

GREEN .166 .222 .222 .222 .277 .277

CHEM .162 .255 .302 .325 .418 .418

GOLD .155 .355 .311 .377 .311 .2

REIT .155 .311 .377 .377 .467 .475

CHINA .146 .17 .121 .121 .146 .146

BIGBANKS .142 .428 .571 .714 .571 .571

NIFTY .113 .272 .318 .318 .295 .431

GAMING .105 .105 .105 .21 .157 .263

SEMI .097 .119 .152 .13 .141 .26

ETFS .09 .236 .236 .236 .236 .236

JETS .076 0 .076 .076 .076 .076

BEVERAGE .071 .214 .214 .214 .214 .142

HOMEBLDG .035 .071 .071 .107 .142 .285

BONDFUND .022 .045 .068 .057 .057 .057

REGBANKS 0 .052 .105 .105 .184 .236

SOLAR 0 0 0 0 0 0

|

=================================================================================

Thursday 9/21/2023 5:20 AM Data

used here is from 9/20/2023

DJI Futures -187 See https://dowfutures.org/

NASDAQ Futures -157

| |

9/20/2023

|

|

| |

Nightly Hotline

Now the market has to look

forward to yet another rate hike. A late

Septmber and early October sell-off

could be quite ugly. Wednesday,

Powell might have just said:

"We will wait on the data." Instead, he yielded

to the hawks. He fell into

the pattern of institutionalized hawkishmess

that so often occurs at the FED in

September. But, if he wanted to make

Wall Street a little poorer, so

that they would spend a little less,

then you can say he succeeded.

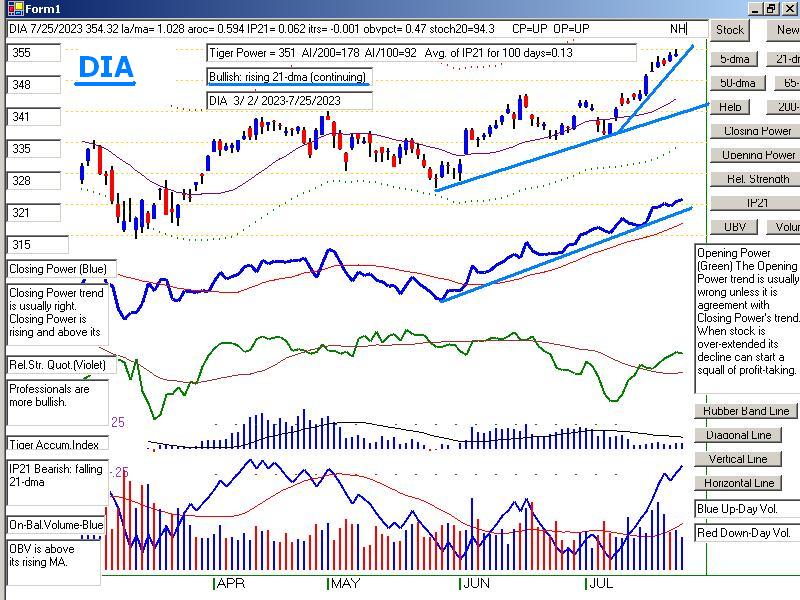

The decline was particularly

bearish for the previous leaders,

techs, semi-conductors and housing

stocks. Now Professionals are

dumping the previously resilient

indexes, too. See the steepening

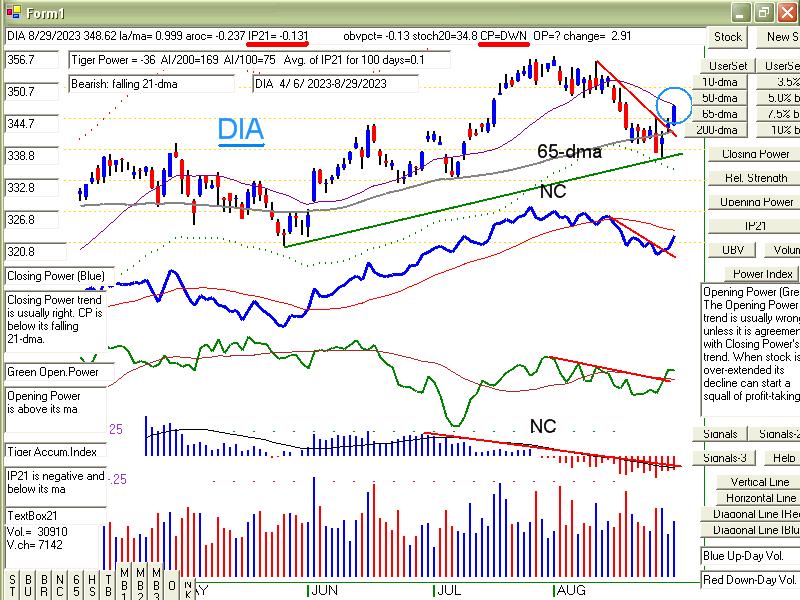

Closing Power downtrends in DIA,

SPY, QQQ (which now looks

way too bearish to hold).

Each has broken steep price-uptrends.

Each was unable to get up to its

65-dma. And a big decline today

will cause each now to show a

65-dma that has dangerously turned

down, a devlopment which will

technical trigger Sells for many chartists.

Making matters worse are the

completed head and shoulders

patterns in the md-caps (MDY)

and IWM (the Russell-2000.

Our bearish MINCPs should be

aggressively shorted. Nothing

looks safe to buy. GLD

cannot seem to rise above its 65-dma.

Powell claims a "soft

landing" is still his goal. Perhaps, he should get out

more and see the damage he's

already done to retailers, smaller banks,

all those who depend on

borrowing and all those holding stocks down

50% or more this year.

At least, his friend Jamie Diamon is still smiling.

Powell continues to please

creditors, those who benefit from a strong dollar.

Now we will watch to see how

much longer JPM can resist the decline.

Cynics will tell you that

Powell will only ease up when JPM sells

off.

The auto strike will probably

get worse, judging by the strong

uptrends in Toyota amd Honda.

Until these two break their

uptrend-lines, expect no

agreement between GM (and F)

with the UAW.

|

|

| |

9/20/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Old Peerless- 2006

version

Tiger Index of Big

Banks Bond Funds Gold Stocks Housing Stocks

Insurance-Stocks

Regional

Banks Russell-1000

Semi Conductors

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO BLDP FAS GLD HD IBB JETS JNUG KOL NAIL

NUGT NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN |

TECL TLT TMF TNA UGA USO

China: YINN

CHAU BABA BIDU

Commodities:

CANE

COCO CORN DBC CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks: AA AAPL ADBE AMAT AMGN AMD AMZN ANET AXP BA BAC

BSX CAT CDNS CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB

FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX

MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG

PYPL QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA

TXN XOM V VRTX WFC WMT XLE ZM ZOM

SEMI-Condctors in SOXL:

NVDA. AVGO, AMD. INTC LRCX TXN MCHP NXPI AMAT ON AAOI TSM

HOMEBUILDERS: BLDP NAIL

BZH HOV LEN MHO MTH PHM -

REGIONAL BANKS:

EGBN

FFIC GBCI HMST

Carl Icahn and associates: IEP

MS

JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/9-20-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/9-20-2023/Bearish.htm

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1: Daily Breadth and Volume Data

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,008 |

2,997 |

3,004 |

| Advances |

1,169 |

1,206 |

1,134 |

| Declines |

1,735 |

1,669 |

1,747 |

| Unchanged |

104 |

122 |

123 |

| New

highs |

50 |

46 |

51 |

| New

lows |

68 |

103 |

93 |

| Adv.

volume* |

261,471,026 |

336,673,129 |

295,647,636 |

| Decl.

volume* |

485,355,509 |

539,387,232 |

564,430,992 |

| Total

volume* |

759,415,129 |

888,531,853 |

872,417,944 |

| Closing

Arms (TRIN)† |

1.06 |

1.11 |

1.15 |

| Block

trades* |

3,838 |

4,276 |

3,792 |

| Adv.

volume |

1,260,368,631 |

1,398,402,640 |

1,250,477,747 |

| Decl.

volume |

1,986,688,800 |

2,156,025,266 |

2,220,055,580 |

| Total

volume |

3,308,451,449 |

3,614,882,481 |

3,529,431,146 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,545 |

4,509 |

4,480 |

| Advances |

1,495 |

1,731 |

1,637 |

| Declines |

2,839 |

2,537 |

2,645 |

| Unchanged |

211 |

241 |

198 |

| New

highs |

51 |

44 |

32 |

| New

lows |

262 |

295 |

211 |

| Closing

Arms (TRIN)† |

0.80 |

0.90 |

0.63 |

| Block

trades |

44,819 |

36,670 |

38,742 |

| Adv.

volume |

1,886,377,930 |

1,893,043,433 |

2,370,561,461 |

| Decl.

volume |

2,847,926,169 |

2,493,451,724 |

2,414,021,499 |

| Total

volume |

4,782,447,469 |

4,453,464,230 |

4,840,315,901 |

|

Table 2 TIGER QUICKSILVER on ETFS - 9/20/2023 ---

Bullish = 1 DBO

Bearish = 6 MDY, IWM, SOXL, RETL,IBB, TAN

There are no bullish Closing Power trends below.

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

=================================================================================================

DIA 344.32 -.75 349.94 -32.2% Bearish RED -.14 0 --------

---------------------------------------------------------------------------------------------

COMPQX 13469.13 -209.06 13926.05 -125.1% Bearish RED -.008 -.026 -.034

---------------------------------------------------------------------------------------------

SPY 438.64 -4.07 450.36 -88.4% Bearish RED -.03 -.014 -.044

---------------------------------------------------------------------------------------------

QQQ 364.54 -5.33 377.27 -129.8% Bearish RED .035 -.015 .02

---------------------------------------------------------------------------------------------

MDY 464.18 -2.64 475.03 -49.6% Bearish RED -.204 -.051 -.255

---------------------------------------------------------------------------------------------

IWM 179.86 -1.82 185.55 -84.9% Bearish RED -.264 -.057 -.321

---------------------------------------------------------------------------------------------

FAS 66.43 -1.43 68.89 -49.3% Bearish RED -.036 .005 -.031

---------------------------------------------------------------------------------------------

RETL 5.79 -.11 6.53 -236% Bearish RED -.13 -.269 -.399

---------------------------------------------------------------------------------------------

SOXL 18.48 -.95 21.65 -673.8% Bearish RED -.007 -.246 -.253

---------------------------------------------------------------------------------------------

TECL 45.52 -2.31 50.16 -374.6% Bearish RED .017 -.132 -.115

---------------------------------------------------------------------------------------------

IBB 124.63 -1.08 127.58 -97.7% Bearish RED -.262 -.021 -.283

---------------------------------------------------------------------------------------------

GLD 179.35 .13 177.17 63.7% ------- ---- -.215 -.005 -.22

---------------------------------------------------------------------------------------------

DBO 17.65 -.3 17.92 16.8% ------- RED .182 .187 .369

---------------------------------------------------------------------------------------------

OIH 348.82 -2.43 359.72 -80.8% Bearish RED -.208 .081 -.127

---------------------------------------------------------------------------------------------

CPER 23.04 -.09 23.53 -66.4% ------- RED .149 -.014 .135

---------------------------------------------------------------------------------------------

TAN 54.54 -.06 57.1 -97.3% Bearish RED -.096 -.219 -.315

---------------------------------------------------------------------------------------------

UUP 29.44 .05 29.44 30.6% Bullish BLUE .198 .043 .241

---------------------------------------------------------------------------------------------

CORN 22.2 .23 22.13 9.1% ------- BLUE .013 -.02 -.007

---------------------------------------------------------------------------------------------

WEAT 5.87 .04 5.91 -42.4% ------- ---- -.125 -.107 -.232

---------------------------------------------------------------------------------------------

YINN 30.18 -.58 32.01 -174% ------- RED .018 -.13 -.112

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

9/20/23

Bullish = 7

Bearish = 43

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

INSURANC .76 .76 .8 .72 .76 .72

MARIJUAN .7 .7 .8 .8 .8 .8

OILGAS .69 .69 .721 .731 .762 .731

EDU .666 .666 .666 .833 .833 .666

COMODITY .578 .578 .5 .5 .5 .447

DJI-13 .538 .384 .384 .461 .461 .461

=============================================================================================

FOOD .489 .489 .448 .448 .428 .387

FIDSTKS .443 .431 .461 .449 .502 .437

HACKERS .437 .437 .5 .5 .5 .5

BIGBANKS .428 .571 .714 .571 .571 .428

COPPER .428 .571 .571 .571 .714 .285

GUNS .428 .357 .428 .357 .428 .214

NASD-100 .415 .435 .445 .435 .514 .485

SP-100 .411 .422 .444 .433 .5 .411

DOWJONES .4 .333 .366 .433 .5 .433

=====

SOFTWARE .375 .392 .41 .41 .464 .446

GOLD .355 .311 .377 .311 .2 .177

RETAIL .347 .326 .326 .347 .369 .347

SP500 .331 .35 .37 .372 .431 .356

RUS-1000 .33 .354 .371 .378 .428 .362

HIGHPRIC .329 .354 .38 .376 .51 .441

FINANCE .325 .35 .387 .4 .45 .362

INDMATER .319 .361 .347 .388 .388 .305

REIT .311 .36 .377 .475 .475 .344

COMPUTER .3 .3 .3 .35 .35 .35

INDEXES .291 .286 .286 .318 .416 .335

UTILITY .282 .282 .333 .333 .333 .179

NIFTY .272 .318 .318 .295 .431 .409

AUTO .259 .222 .222 .24 .296 .203

INFRA .258 .258 .225 .225 .387 .258

CHEM .255 .302 .325 .418 .418 .325

LOWPRICE .255 .275 .284 .331 .319 .281

EAT .243 .195 .268 .195 .268 .195

ETFS .236 .236 .236 .236 .254 .145

HOSPITAL .23 .23 .153 .076 .153 .076

MILITARY .23 .23 .269 .23 .269 .153

BIOTECH .223 .238 .251 .266 .276 .261

GREEN .222 .222 .222 .277 .277 .277

BEVERAGE .214 .214 .214 .214 .214 .142

TRANSP .21 .263 .263 .263 .315 .263

ELECTRON .172 .21 .187 .203 .27 .255

CHINA .17 .121 .121 .146 .17 .146

SEMI .119 .152 .13 .141 .271 .239

GAMING .105 .105 .157 .21 .263 .157

HOMEBLDG .071 .071 .107 .142 .285 .25

REGBANKS .052 .105 .105 .184 .236 .105

BONDFUND .045 .057 .057 .068 .068 .068

JETS 0 .076 .076 .076 .076 .076

SOLAR 0 0 0 0 0 0

|

=====================================================================================

Wednesday 9/20/2023 6:15 AM Data

used here is from 9/19/2023

DJI Futures +112 See https://dowfutures.org/ NASDAQ Futures +55

| |

9/19/2023

|

|

| |

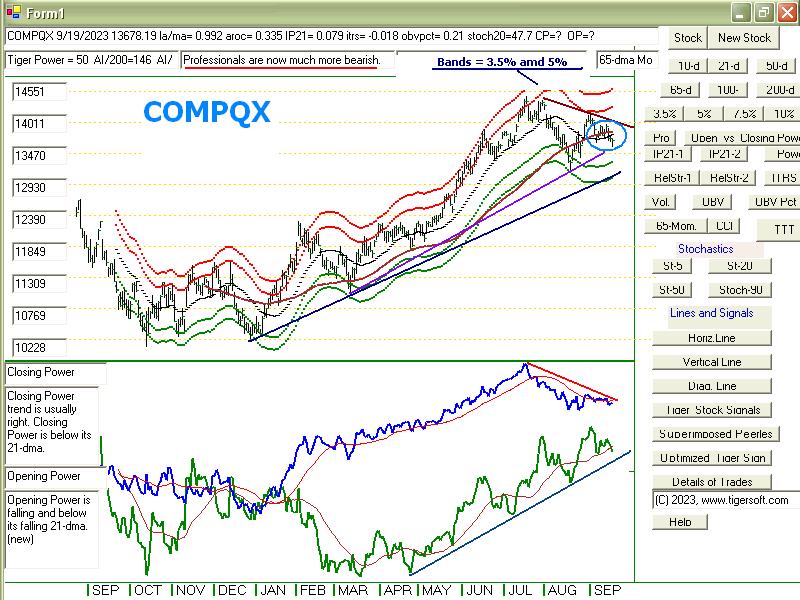

Nightly Hotline

Don't trust the key indexes to

rally much because the FED chooses not to

raise rates in September.

This is what has been expected for the

last two weeks. Look instead

at how close the yield on

10-year bonds is to making a new

high. Professionals remain net

bearish in the DJ-30, DIA, the

NASDAQ, QQQ and SPY.

IWM, MDY and small caps have formed

bearish head and

shoulders. Look at Table 3.

See how only 33% of the

30-DJI stocks are still above their

65-dma. And now all the

key indices we follow are below

their key 65-dma even as

they try to hold up above their

price-uptrends. Previous leading

groups, home-building and

semi-conductors have not turned

up. We would expect this if a

major bottom was being made.

It is not a mere coincidence the

September is the most bearish month

of the year. And we see lots

and lots of bearish MINCPs to short

to hedge. Ahead is the scary

month of October and after

this FED meeting, the FOMC will be

hard-pressed to continue to

prop up the market, especially if

Oil rises more and the Dollar

should weaken in the face of a

rally in Gold.

If there is a rally, the key

indices and their ETFs will have professionals

trying to hold up the appearance

that all is still well on Wall Street.

In that case, we hold QQQ, but will

sell it on not much of a rally.

They are well-known to do this

before a much bigger decline.

Gold is close to giving a buy from

its 90-day Stochastic. A gold

rally now would add to the ultimate

bearishness ahead. Watch

the Gold stocks I have added to the

Bearish MINCPs. |

|

| |

9/19/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Old Peerless- 2006

version

Tiger Index of Big

Banks Bond Funds Gold Stocks Housing Stocks

Insurance-Stocks

Regional

Banks Russell-1000

Semi Conductors

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO BLDP FAS GLD HD IBB JETS JNUG KOL NAIL

NUGT NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN |

TECL TLT TMF TNA UGA USO

China: YINN

CHAU BABA BIDU

Commodities:

CANE

COCO CORN DBC CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks: AA AAPL ADBE AMAT AMGN AMD AMZN ANET AXP BA BAC

BSX CAT CDNS CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB

FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX

MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG

PYPL QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA

TXN XOM V VRTX WFC WMT XLE ZM ZOM

SEMI-Condctors in SOXL:

NVDA. AVGO, AMD. INTC LRCX TXN MCHP NXPI AMAT ON AAOI TSM

HOMEBUILDERS: BLDP NAIL

BZH HOV LEN MHO MTH PHM -

REGIONAL BANKS:

EGBN

FFIC GBCI HMST

Carl Icahn and associates: IEP

MS

JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/9-19-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/9-19-2023/Bearish.htm |

|

|

|

|

|

|

|

Table 1 - Daily Statistics

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

2,997 |

3,013 |

2,995 |

| Advances |

1,206 |

1,298 |

1,361 |

| Declines |

1,669 |

1,579 |

1,520 |

| Unchanged |

122 |

136 |

114 |

| New

highs |

46 |

40 |

67 |

| New

lows |

103 |

103 |

95 |

| Adv.

volume* |

336,673,129 |

282,718,783 |

426,734,405 |

| Decl.

volume* |

539,387,232 |

555,761,596 |

338,919,889 |

| Total

volume* |

888,531,853 |

850,915,962 |

772,443,317 |

| Closing

Arms (TRIN)† |

1.11 |

1.77 |

0.75 |

| Block

trades* |

4,276 |

3,869 |

3,748 |

| Adv.

volume |

1,398,402,640 |

980,101,578 |

1,853,339,879 |

| Decl.

volume |

2,156,025,266 |

2,107,003,221 |

1,544,834,382 |

| Total

volume |

3,614,882,481 |

3,161,233,605 |

3,435,747,638 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,509 |

4,538 |

4,479 |

| Advances |

1,731 |

1,582 |

1,888 |

| Declines |

2,537 |

2,747 |

2,342 |

| Unchanged |

241 |

209 |

249 |

| New

highs |

44 |

59 |

60 |

| New

lows |

295 |

271 |

196 |

| Closing

Arms (TRIN)† |

0.90 |

0.79 |

0.69 |

| Block

trades |

36,670 |

43,942 |

34,798 |

| Adv.

volume |

1,893,043,433 |

2,034,532,091 |

2,439,222,208 |

| Decl.

volume |

2,493,451,724 |

2,778,222,001 |

2,082,401,337 |

| Total

volume |

4,453,464,230 |

4,855,887,232 |

4,595,491,826 |

|

Table 2 TIGER QUICKSILVER on ETFS - 9/19/2023 ---

Bullish = 1 DBO

Bearish = 4 IWM RETL TAN WEAT

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

=================================================================================================

DIA 345.07 -1.08 346.55 -30.8% Bearish RED -.064 0 ====

---------------------------------------------------------------------------------------------

COMPQX 13678.19 -32.05 13813.59 -34.6% ------- BLUE .08 -.017 .063

---------------------------------------------------------------------------------------------

SPY 442.71 -.92 446.51 -36.8% Bearish ---- .051 -.009 .042

---------------------------------------------------------------------------------------------

QQQ 369.87 -.79 374.21 -39.1% ------- BLUE .119 -.007 .112

---------------------------------------------------------------------------------------------

MDY 466.82 -.94 468.84 -51.7% Bearish RED -.136 -.046 -.182

---------------------------------------------------------------------------------------------

IWM 181.68 -.71 182.97 -68% Bearish RED -.203 -.049 -.252

---------------------------------------------------------------------------------------------

FAS 67.86 -.55 67.1 36.8% ------- RED .019 .051 .07

---------------------------------------------------------------------------------------------

RETL 5.9 -.06 6.08 -233.8% Bearish ---- -.105 -.22 -.325

---------------------------------------------------------------------------------------------

SOXL 19.43 -.5 21.23 -364.6% Bearish RED .079 -.217 -.138

---------------------------------------------------------------------------------------------

TECL 47.83 -.04 49.15 -90.5% ------- BLUE .116 -.093 .023

---------------------------------------------------------------------------------------------

IBB 125.71 .46 127.1 -69.8% Bearish BLUE -.178 -.024 -.202

---------------------------------------------------------------------------------------------

GLD 179.22 -.17 177.08 48.6% ------- RED -.115 -.014 -.129

---------------------------------------------------------------------------------------------

DBO 17.95 0 17.59 98.3% ------- RED .226 .223 .449

---------------------------------------------------------------------------------------------

OIH 351.25 -7.44 354.58 -154.1% Bearish RED -.173 .115 -.058

---------------------------------------------------------------------------------------------

CPER 23.13 -.2 23.35 -51.3% ------- ---- .202 -.028 .174

---------------------------------------------------------------------------------------------

TAN 54.6 .36 55.62 -195.8% ------- BLUE -.065 -.229 -.294

---------------------------------------------------------------------------------------------

UUP 29.39 .02 29.26 25.6% Bullish ---- .129 .028 .157

---------------------------------------------------------------------------------------------

CORN 21.97 .15 22.16 -4.5% ------- BLUE -.075 -.038 -.113

---------------------------------------------------------------------------------------------

WEAT 5.83 -.02 5.92 -16.9% ------- ---- -.172 -.108 -.28

---------------------------------------------------------------------------------------------

YINN 30.76 -.37 31.27 -199.5% ------- RED .107 -.106 .001

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

9/19/23

Bullish = 8

Bearish = 42

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

INSURANC .76 .8 .72 .76 .72 .76

MARIJUAN .7 .8 .8 .8 .8 .8

OILGAS .69 .721 .731 .762 .742 .752

EDU .666 .666 .833 .833 .666 .666

COMODITY .578 .526 .473 .5 .447 .473

BIGBANKS .571 .714 .571 .571 .428 .142

COPPER .571 .571 .571 .714 .285 .142

===========================================================================================

FOOD .489 .469 .428 .428 .387 .408

HACKERS .437 .5 .5 .5 .5 .562

NASD-100 .435 .445 .435 .514 .485 .485

FIDSTKS .431 .461 .449 .502 .443 .431

SP-100 .422 .444 .433 .5 .422 .4

SOFTWARE .41 .428 .41 .464 .428 .428

DJI-13 .384 .384 .461 .461 .461 .384

INDMATER .361 .347 .388 .388 .319 .333

REIT .36 .36 .475 .483 .344 .418

GUNS .357 .428 .357 .428 .214 .285

RUS-1000 .355 .371 .377 .428 .37 .393

HIGHPRIC .354 .38 .376 .51 .445 .463

FINANCE .35 .387 .4 .437 .362 .387

SP500 .35 .37 .372 .429 .362 .374

DOWJONES .333 .366 .433 .5 .433 .4

=====

RETAIL .326 .326 .347 .369 .347 .347

NIFTY .318 .318 .295 .431 .431 .386

GOLD .311 .377 .311 .2 .177 .177

CHEM .302 .325 .418 .418 .325 .372

COMPUTER .3 .3 .35 .35 .35 .35

INDEXES .286 .286 .318 .416 .351 .351

UTILITY .282 .333 .333 .333 .179 .128

LOWPRICE .275 .287 .334 .319 .278 .278

TRANSP .263 .263 .263 .315 .263 .21

INFRA .258 .225 .225 .387 .258 .193

BIOTECH .236 .248 .269 .276 .261 .271

ETFS .236 .236 .236 .254 .163 .145

HOSPITAL .23 .153 .076 .153 .076 .153

MILITARY .23 .269 .23 .269 .192 .153

AUTO .222 .24 .24 .296 .203 .203

GREEN .222 .222 .277 .277 .277 .277

BEVERAGE .214 .214 .214 .214 .142 .214

ELECTRON .21 .187 .203 .27 .248 .225

EAT .195 .268 .195 .268 .195 .17

SEMI .152 .13 .141 .271 .239 .217

CHINA .121 .121 .146 .17 .146 .219

GAMING .105 .157 .157 .315 .157 .105

REGBANKS .105 .105 .184 .236 .131 .21

JETS .076 .076 .076 .076 .076 .153

HOMEBLDG .071 .107 .142 .285 .25 .321

BONDFUND .057 .045 .068 .08 .08 .068

SOLAR 0 0 0 0 0 0

|

==================================================================================

Tuesday 9/19/2023 6:15

AM Data used here is from 9/18/2023

DJI Futures +37 See https://dowfutures.org/ NASDAQ Futures +10

|

9/18/2023

|

|

|

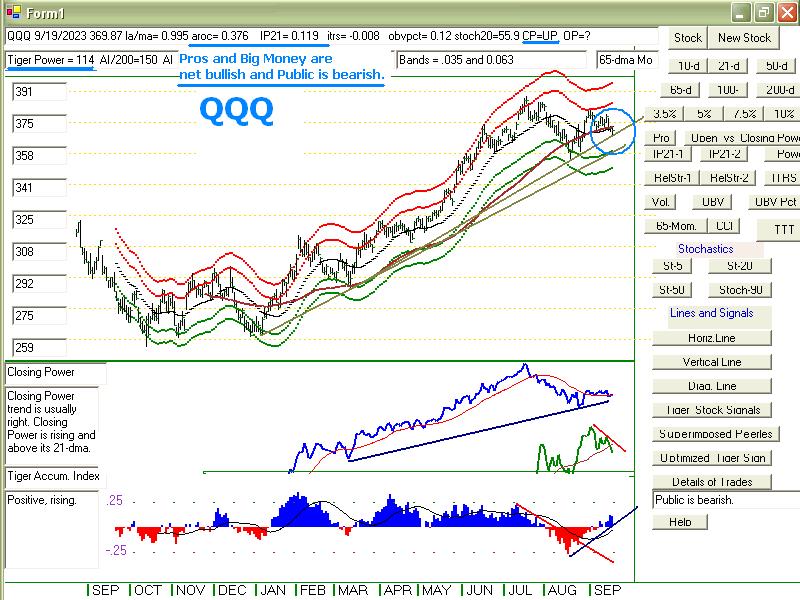

Nightly Hotline

Economics text books warn

readers of how unevenly the

effects of inflation and

highest interest rates impact businesses

by size. That certainly

is true now. See how MDY (midcaps)

and IWM (Russell-2000) have

formed potential head and

shoulders patterns. Any

higher rates now are likely to push them

over the edge, below their

necklines. They will then join the

cacading retailers (other

than WMT and AMZN). As you

can readily see, retailers

are well-repesented among our bearish

MINCPs. Consumers are

not eager to incur more debt with

interest rates so high.

Of course, what the

Government can boost with subsidies, it can

bust and break by denying

them. The solar energy stocks are hit

in two ways, by the change in

political power in the House of

Representatives and now, how

higher rates hurt housing construction.

So, our short sales in these

areas keep making traders money.

Also in need of regular

funds, by floating more stock or by

borrowing, are many,

many smaller biotechs. They are also

commonly seen among the

many bearish MINCPs. Now

we see new weakness in

the bigger biotechs. BIIB is particularly

interesting among the

bearish MINCPs. It is breaking key support

and shows heavy red

Distribution and a falling Closing Power.

Meanwhile, the blue chips,

NYSE, NASDAQ, SP-500 and

OEX hang tightly to their

still rising 65-dma and stay above

their uptrend-lines.

Semi-conductors and stocks like AAPL and

ADBE rose a little today.

Their action suggests that the

FED will not be raising rates

in September. Their internals,

their AROC (rate of change of

21-dma) and IP21 are positive,

thereby taking them out of

the "Danger Zone" for now.

Stay hedged with shorted

MINCPs. I would avoid buying

anything but QQQ. See

how its 21-day ma is rising and its

IP21 is positive, as it seeks

support at its 21-dma. |

|

|

9/18/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Old Peerless- 2006

version

Tiger Index of Big

Banks Bond Funds Gold Stocks Housing Stocks

Insurance-Stocks

Regional

Banks Russell-1000

Semi Conductors

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO BLDP FAS GLD HD IBB JETS JNUG KOL NAIL

NUGT NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN |

TECL TLT TMF TNA UGA USO

China: YINN

CHAU BABA BIDU

Commodities:

CANE

COCO CORN DBC CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks: AA AAPL ADBE AMAT AMGN AMD AMZN ANET AXP BA BAC

BSX CAT CDNS CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB

FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX

MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG

PYPL QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA

TXN XOM V VRTX WFC WMT XLE ZM ZOM

SEMI-Condctors in SOXL:

NVDA. AVGO, AMD. INTC LRCX TXN MCHP NXPI AMAT ON AAOI TSM

HOMEBUILDERS: BLDP NAIL

BZH HOV LEN MHO MTH PHM -

REGIONAL BANKS:

EGBN

FFIC GBCI HMST

Carl Icahn and associates: IEP

MS

JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/9-18-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/9-18-2023/Bearish.htm |

|

|

|

|

|

|

|

|

|

|

|

|

Table 1 - NYSE Breadth and Volume Statistics

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,013 |

3,000 |

3,018 |

| Advances |

1,298 |

966 |

1,578 |

| Declines |

1,579 |

1,916 |

1,305 |

| Unchanged |

136 |

118 |

135 |

| New

highs |

40 |

45 |

65 |

| New

lows |

103 |

91 |

75 |

| Adv.

volume* |

282,718,783 |

1,225,486,687 |

463,013,896 |

| Decl.

volume* |

555,761,596 |

2,126,628,344 |

292,902,279 |

| Total

volume* |

850,915,962 |

3,429,975,980 |

769,205,705 |

| Closing

Arms (TRIN)† |

1.77 |

0.92 |

0.76 |

| Block

trades* |

3,869 |

5,776 |

3,994 |

| Adv.

volume |

980,101,578 |

2,396,129,315 |

2,036,199,637 |

| Decl.

volume |

2,107,003,221 |

4,352,928,085 |

1,275,190,407 |

| Total

volume |

3,161,233,605 |

6,932,233,456 |

3,369,924,175 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,538 |

4,509 |

4,485 |

| Advances |

1,582 |

1,520 |

2,247 |

| Declines |

2,747 |

2,808 |

2,023 |

| Unchanged |

209 |

181 |

215 |

| New

highs |

59 |

61 |

58 |

| New

lows |

271 |

236 |

202 |

| Closing

Arms (TRIN)† |

0.79 |

0.74 |

0.57 |

| Block

trades |

43,942 |

59,044 |

32,829 |

| Adv.

volume |

2,034,532,091 |

3,396,988,883 |

2,952,966,376 |

| Decl.

volume |

2,778,222,001 |

4,667,616,691 |

1,517,149,189 |

| Total

volume |

4,855,887,232 |

8,162,212,567 |

4,538,877,923 |

|

Table 2 TIGER QUICKSILVER on ETFS - 9/18/2023 ---

Bullish = 1 DBO

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

=================================================================================================

DIA 346.15 .01 347.21 -17.6% Bearish RED -.055 0 ===

---------------------------------------------------------------------------------------------

COMPQX 13710.24 1.9 13773.62 -75.1% ------- BLUE .075 -.022 .053

---------------------------------------------------------------------------------------------

SPY 443.63 .26 445.99 -53.9% ------- BLUE .055 -.014 .041

---------------------------------------------------------------------------------------------

QQQ 370.66 -.15 372.79 -84.3% ------- BLUE .122 -.014 .108

---------------------------------------------------------------------------------------------

MDY 467.76 -.78 471.68 -40.2% Bearish RED -.088 -.041 -.129

---------------------------------------------------------------------------------------------

IWM 182.39 -1.22 184.18 -53.5% Bearish RED -.136 -.038 -.174

---------------------------------------------------------------------------------------------

FAS 68.41 .69 67.36 200.4% ------- BLUE .029 .065 .094

---------------------------------------------------------------------------------------------

RETL 5.96 -.29 6.19 -207.9% Bearish RED -.092 -.179 -.271

---------------------------------------------------------------------------------------------

SOXL 19.93 .14 20.94 -361.7% ------- BLUE .111 -.158 -.047

---------------------------------------------------------------------------------------------

TECL 47.87 .61 48.71 -374.7% ------- BLUE .119 -.095 .024

---------------------------------------------------------------------------------------------

IBB 125.25 -1.36 127.48 -95.5% Bearish RED -.196 -.019 -.215

---------------------------------------------------------------------------------------------

GLD 179.39 1.05 177.49 27.6% ------- BLUE -.128 -.022 -.15

---------------------------------------------------------------------------------------------

DBO 17.95 .02 17.6 181.1% ------- RED .266 .209 .475

---------------------------------------------------------------------------------------------

OIH 358.69 1.76 362.3 70.4% ------- RED -.083 .14 .057

------------------------------------------------------------------------------------- --------

CPER 23.33 -.11 23.37 -21.3% ------- RED .219 -.025 .194

---------------------------------------------------------------------------------------------

TAN 54.24 -1.68 56.79 -132.5% ------- RED -.006 -.229 -.235

---------------------------------------------------------------------------------------------

UUP 29.37 -.05 29.24 30.7% Bullish ---- .118 .015 .133

---------------------------------------------------------------------------------------------

CORN 21.82 -.15 21.99 -115.3% ------- RED -.082 -.05 -.132

---------------------------------------------------------------------------------------------

WEAT 5.85 -.13 5.85 17% ------- RED -.094 -.119 -.213

---------------------------------------------------------------------------------------------

YINN 31.13 -.3 32.02 -119.8% ------- BLUE .1 -.109 - .01

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

9/18/23

Bullish = 8

Bearish = 41

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

INSURANC .8 .72 .76 .72 .76 .72

MARIJUAN .8 .8 .8 .8 .8 .8

OILGAS .721 .731 .762 .742 .752 .721

BIGBANKS .714 .571 .571 .428 .142 .142

EDU .666 .833 .833 .666 .666 .666

COPPER .571 .571 .714 .285 .142 .285

COMODITY .526 .5 .473 .447 .473 .473

============================================================================================

HACKERS .5 .5 .5 .5 .562 .562

============================================================================================

FOOD .469 .448 .408 .387 .408 .408

FIDSTKS .461 .449 .502 .443 .431 .455

SOFTWARE .446 .428 .464 .428 .41 .5

NASD-100 .445 .435 .514 .485 .485 .524

SP-100 .444 .433 .5 .422 .4 .4

GUNS .428 .357 .428 .214 .285 .285

FINANCE .387 .4 .437 .35 .387 .337

DJI-13 .384 .461 .461 .461 .384 .384

HIGHPRIC .38 .376 .51 .445 .463 .515

GOLD .377 .311 .2 .177 .177 .155

RUS-1000 .372 .377 .427 .37 .394 .395

SP500 .37 .372 .429 .36 .374 .389

DOWJONES .366 .433 .5 .433 .4 .433

REIT .36 .459 .483 .352 .426 .426

INDMATER .347 .388 .388 .319 .347 .333

UTILITY .333 .333 .333 .179 .128 .128

RETAIL .326 .347 .369 .347 .369 .369

CHEM .325 .418 .418 .325 .372 .348

NIFTY .318 .295 .431 .431 .386 .477

COMPUTER .3 .35 .35 .35 .35 .35

LOWPRICE .287 .337 .322 .278 .278 .284

INDEXES .286 .318 .416 .351 .362 .416

MILITARY .269 .23 .269 .192 .153 .192

EAT .268 .195 .268 .195 .17 .195

TRANSP .263 .263 .315 .263 .21 .263

BIOTECH .246 .266 .279 .261 .269 .284

AUTO .24 .259 .296 .203 .203 .222

ETFS .236 .236 .254 .163 .163 .145

INFRA .225 .225 .387 .258 .193 .29

GREEN .222 .277 .277 .277 .277 .333

BEVERAGE .214 .214 .214 .142 .214 .285

ELECTRON .187 .203 .27 .248 .218 .225

GAMING .157 .157 .263 .21 .105 .157

HOSPITAL .153 .076 .153 .076 .153 .076

SEMI .13 .141 .271 .239 .228 .228

CHINA .121 .146 .17 .146 .219 .17

HOMEBLDG .107 .142 .285 .25 .321 .392

REGBANKS .105 .184 .236 .131 .21 .157

JETS .076 .076 .076 .076 .153 .153

BONDFUND .045 .057 .08 .091 .08 .08

SOLAR 0 0 0 0 0 0

|

======================================================================

Monday

9/18/2023 6:04 AM Data used here is from 9/15/2023

DJI Futures -37 See https://dowfutures.org/

NASDAQ Futures -53

| |

9/15/2023

|

|

| |

Nightly Hotline

Ten Year rates rose to 4.32%.

That makes them uncomfortably close to

a breakout above 4.5% that

could easily mean a run to 5%. At that

level, their yield would seem

very attractive to all the folks owning

falling stocks paying

questionable dividends. Their yield now is

already hurting tech and

semi-conductor stocks, not to mention more

more stocks on the NYSE.

And this doesn't even factor in the

hardship the high rates even

now are hurting debtors, retailer

and home buyers.

See how in unison, the DJI, DIA,

SPY, NASDAQ, QQQ and the

likes of NVDA and LRCX closed below

their 65-dma. Though these

all still show marginally rising

65-day moving averages, this united

decline is clearly bearish..

Though the 6-month+ uptrend-lines are

still in tact in most cases,

Friday's wide sell-off will probably start

a new wave of technical selling.

Who will fight the seasonal bearishness?

The bearishness of an extended

strike in the auto industry? And the

likelihood that the FED will

further tighten given the continued rise in

crude oil and gasoline prices.

All institutions develop

patterns of behavior. Over and over, as in

1966, 1973-4, 1976-1977,

1981, 1987... 2007-2008, the pattern

of rising oil prices

was each time followed by higher interest rdates.

In every case September

and October were not good times

in these years to

stubbornly hold stocks.

The break in the the leaders

(notably semi-conductors and

home-building) bodes ill for

the market. The performance game

of musical chairs is winding

down. There are fewer and fewer

stocks still holding up.

Professionals and "big money" want out of

this market, at the same

time. See the falling Closing Powers

below in the most important

ETFs and stocks. And now even

their Relative Strength Lines

are falling. When the Public and the

most stubborn bulls holding

"safe" blue chips, finally decide to sell,

the sell-off could match

other panics occuring this time of the

year. It's true

the there are still unviolated uptrends. But waiting

for that

"inevitability" could be very costly. I suspect the remaining

uptrend-lines will be

violated unless the FED acts whollly out

of character.

Of course, we could

"hold tight and hope" for the best or that the

FED will change their

deep-rooted institutional behavior. That

would be like the frog

carrying the scorpion across the river,

quite dangerous. And

wholly unnecessary. We can and should sell

short the most bearish MINCPs

both for protection and profit. |

|

| |

9/15/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Old Peerless- 2006

version

Tiger Index of Big

Banks Bond Funds Gold Stocks Housing Stocks

Insurance-Stocks

Regional

Banks Russell-1000

Semi Conductors

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO BLDP FAS GLD HD IBB JETS JNUG KOL NAIL

NUGT NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN |

TECL TLT TMF TNA UGA USO

China: YINN

CHAU BABA BIDU

Commodities:

CANE

COCO CORN DBC CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks: AA AAPL ADBE AMAT AMGN AMD AMZN ANET AXP BA BAC

BSX CAT CDNS CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB

FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX

MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG

PYPL QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA

TXN XOM V VRTX WFC WMT XLE ZM ZOM

SEMI-Condctors in SOXL:

NVDA. AVGO, AMD. INTC LRCX TXN MCHP NXPI AMAT ON AAOI TSM

HOMEBUILDERS: BLDP NAIL

BZH HOV LEN MHO MTH PHM -

REGIONAL BANKS:

EGBN

FFIC GBCI HMST

Carl Icahn and associates: IEP

MS

JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/9-15-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/9-15-2023/Bearish.htm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1 - Daily Breadth and Volume Statistics

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,000 |

3,002 |

3,015 |

| Advances |

966 |

2,290 |

1,526 |

| Declines |

1,916 |

629 |

1,380 |

| Unchanged |

118 |

83 |

109 |

| New

highs |

45 |

64 |

48 |

| New

lows |

91 |

63 |

96 |

| Adv.

volume* |

1,225,486,687 |

737,401,572 |

405,500,966 |

| Decl.

volume* |

2,126,628,344 |

154,611,313 |

311,364,304 |

| Total

volume* |

3,429,975,980 |

909,838,757 |

733,743,630 |

| Closing

Arms (TRIN)† |

0.92 |

0.90 |

0.86 |

| Block

trades* |

5,776 |

3,994 |

3,834 |

| Adv.

volume |

2,396,129,315 |

2,877,840,343 |

1,791,637,856 |

| Decl.

volume |

4,352,928,085 |

712,082,132 |

1,391,033,217 |

| Total

volume |

6,932,233,456 |

3,648,725,051 |

3,259,292,272 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,509 |

4,486 |

4,495 |

| Advances |

1,520 |

2,880 |

1,956 |

| Declines |

2,808 |

1,400 |

2,308 |

| Unchanged |

181 |

206 |

231 |

| New

highs |

61 |

49 |

40 |

| New

lows |

236 |

185 |

246 |

| Closing

Arms (TRIN)† |

0.74 |

1.24 |

0.92 |

| Block

trades |

59,044 |

35,580 |

27,572 |

| Adv.

volume |

3,396,988,883 |

2,849,290,738 |

1,976,373,573 |

| Decl.

volume |

4,667,616,691 |

1,719,074,076 |

2,138,339,634 |

| Total

volume |

8,162,212,567 |

4,649,014,014 |

4,160,361,257 |

|

Table 2 TIGER QUICKSILVER on ETFS - 9/15/2023 ---

Bullish = 1 DBO

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

=================================================================================================

DIA 346.14 -3.8 347.37 -5.3% Bearish RED -.122 0 =====

---------------------------------------------------------------------------------------------

COMPQX 13708.34 -217.71 13917.89 -19.2% Bearish RED .035 -.018 .017

---------------------------------------------------------------------------------------------

SPY 443.37 -6.99 448.45 -24% Bearish RED .012 -.012 0

---------------------------------------------------------------------------------------------

QQQ 370.81 -6.46 376.97 -23.6% Bearish RED .06 -.011 .049

---------------------------------------------------------------------------------------------

MDY 468.54 -6.49 471.55 -27% Bearish RED -.125 -.025 -.15

---------------------------------------------------------------------------------------------

IWM 183.61 -1.94 184.36 -8.4% Bearish RED -.15 -.016 -.166

---------------------------------------------------------------------------------------------

FAS 67.72 -1.17 65.71 202.8% ------- ---- -.038 .063 .025

---------------------------------------------------------------------------------------------

RETL 6.25 -.28 6.22 32% Bearish RED -.091 -.111 -.202

---------------------------------------------------------------------------------------------

SOXL 19.79 -1.86 21.45 -400.4% Bearish RED .068 -.159 -.091

---------------------------------------------------------------------------------------------

TECL 47.26 -2.9 51.57 -356.4% Bearish RED .058 -.114 -.056

---------------------------------------------------------------------------------------------

IBB 126.61 -.97 127.68 -9.4% ------- RED -.204 -.011 -.215

---------------------------------------------------------------------------------------------

GLD 178.34 1.17 178.41 7.3% Bearish RED -.204 -.015 -.219

---------------------------------------------------------------------------------------------

DBO 17.93 .01 17.31 188.2% Bullish BLUE .24 .238 .478

---------------------------------------------------------------------------------------------

OIH 356.93 -2.79 353.66 54.1% ------- RED -.131 .219 .088

---------------------------------------------------------------------------------------------

CPER 23.44 -.09 23.43 122.3% ------- RED .193 -.006 .187

---------------------------------------------------------------------------------------------

TAN 55.92 -1.18 55.73 31.2% ------- RED -.012 -.19 -.202

---------------------------------------------------------------------------------------------

UUP 29.42 -.02 29.19 15.4% Bullish ---- .129 .013 .142

---------------------------------------------------------------------------------------------

CORN 21.97 -.16 22.33 -47.4% ------- RED -.023 -.055 -.078

---------------------------------------------------------------------------------------------

WEAT 5.98 .07 5.83 42.5% ------- BLUE -.081 -.102 -.183

---------------------------------------------------------------------------------------------

YINN 31.43 -.58 31.89 120.4% ------- RED .032 -.036 -.004

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

9/15/23

Bullish = 7

Bearish = 41

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

EDU .833 .833 .666 .666 .666 .833

MARIJUAN .8 .8 .8 .8 .8 .7

OILGAS .731 .762 .742 .752 .721 .731

INSURANC .72 .76 .72 .76 .72 .68

BIGBANKS .571 .571 .428 .142 .142 .142

COPPER .571 .714 .285 .142 .285 .142

===============================================================================================

COMODITY .5 .5 .421 .473 .473 .447

HACKERS .5 .5 .5 .562 .562 .5

DJI-13 .461 .461 .461 .384 .384 .384

REIT .459 .467 .352 .434 .426 .401

FIDSTKS .449 .502 .443 .431 .455 .426

FOOD .448 .428 .367 .408 .408 .387

SOFTWARE .446 .482 .428 .41 .482 .482

NASD-100 .435 .514 .485 .485 .534 .504

DOWJONES .433 .5 .433 .4 .433 .466

=====

SP-100 .433 .5 .422 .4 .4 .4

CHEM .418 .418 .325 .372 .348 .372

FINANCE .4 .437 .35 .375 .337 .312

INDMATER .388 .388 .319 .347 .333 .347

RUS-1000 .378 .427 .369 .394 .4 .385

HIGHPRIC .376 .51 .445 .463 .519 .454

SP500 .372 .429 .36 .372 .389 .368

GUNS .357 .428 .214 .285 .285 .285

COMPUTER .35 .35 .35 .35 .35 .35

RETAIL .347 .369 .347 .369 .369 .391

LOWPRICE .337 .325 .281 .278 .281 .293

UTILITY .333 .333 .179 .128 .128 .076

INDEXES .318 .416 .351 .362 .416 .34

GOLD .311 .2 .177 .177 .155 .111

NIFTY .295 .431 .431 .386 .477 .454

GREEN .277 .277 .277 .277 .333 .388

BIOTECH .263 .276 .263 .269 .286 .266

TRANSP .263 .315 .263 .21 .263 .21

AUTO .259 .314 .203 .203 .222 .222

ETFS .236 .254 .163 .163 .163 .127

MILITARY .23 .269 .192 .153 .192 .115

INFRA .225 .387 .258 .193 .29 .29

BEVERAGE .214 .214 .142 .214 .285 .214

ELECTRON .203 .27 .248 .218 .233 .255

EAT .195 .268 .195 .17 .195 .219

REGBANKS .184 .236 .131 .21 .157 .131

GAMING .157 .263 .157 .157 .157 .105

CHINA .146 .17 .146 .219 .195 .17

HOMEBLDG .142 .285 .25 .321 .392 .392

SEMI .141 .271 .239 .228 .25 .25

HOSPITAL .076 .153 .076 .153 .076 .153

JETS .076 .076 .076 .153 .153 .076

BONDFUND .057 .068 .091 .091 .091 .057

SOLAR 0 0 0 0 0 0

|

==================================================================================

Friday 9/15/2023 5:45 AM

Data used here is from 9/14/2023

DJI Futures +35 See https://dowfutures.org/ NASDAQ Futures -40

| |

9/14/2023

|

|

| |

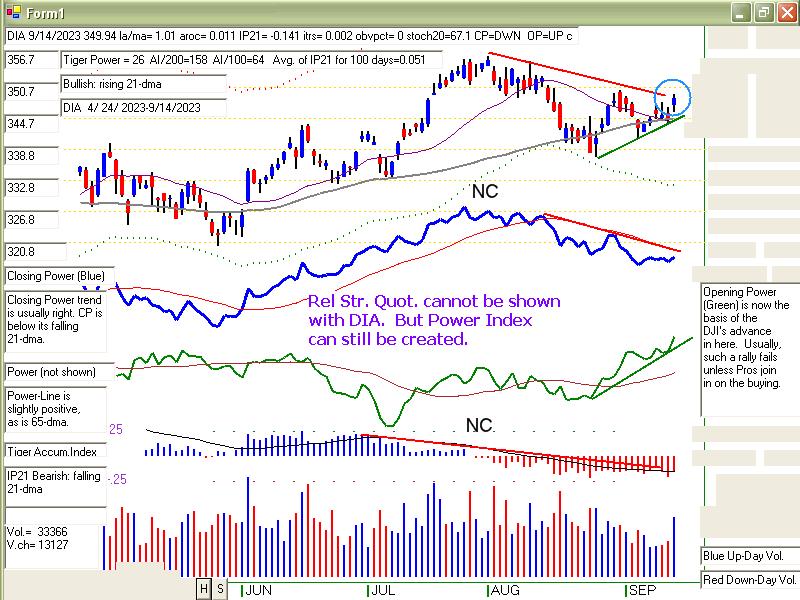

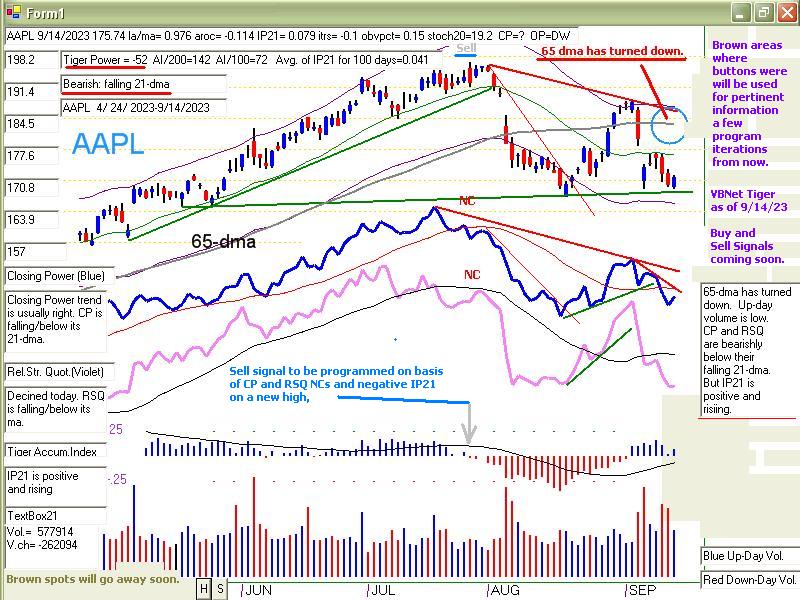

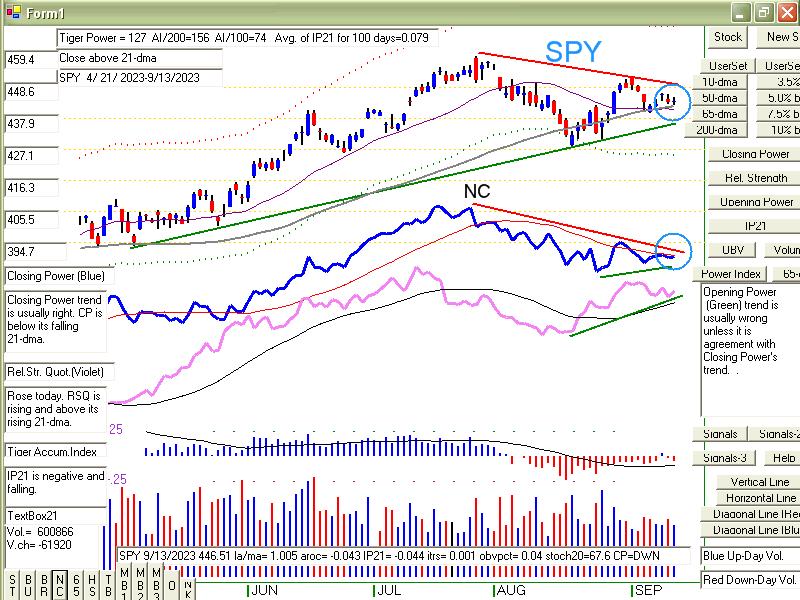

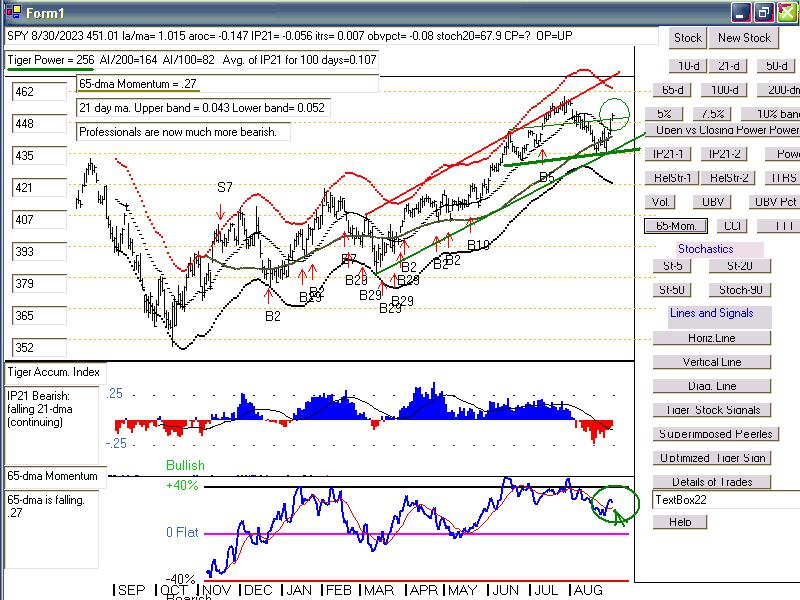

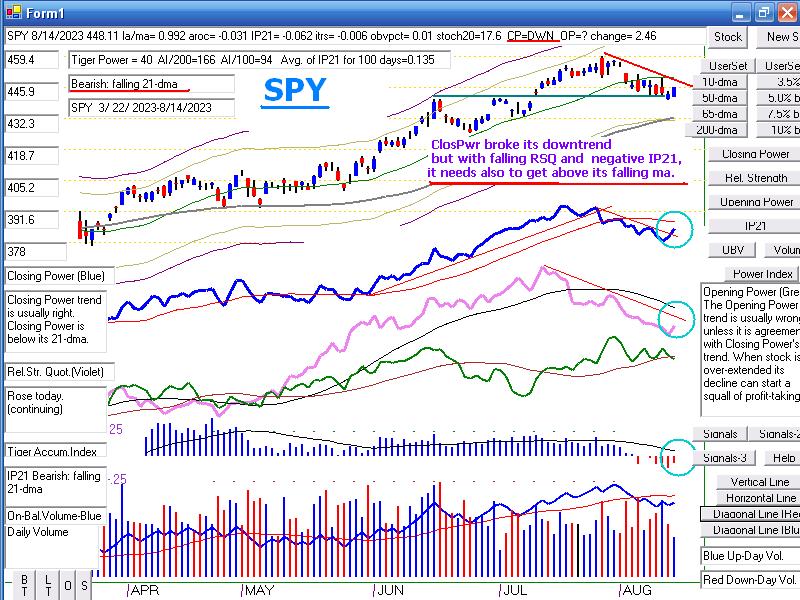

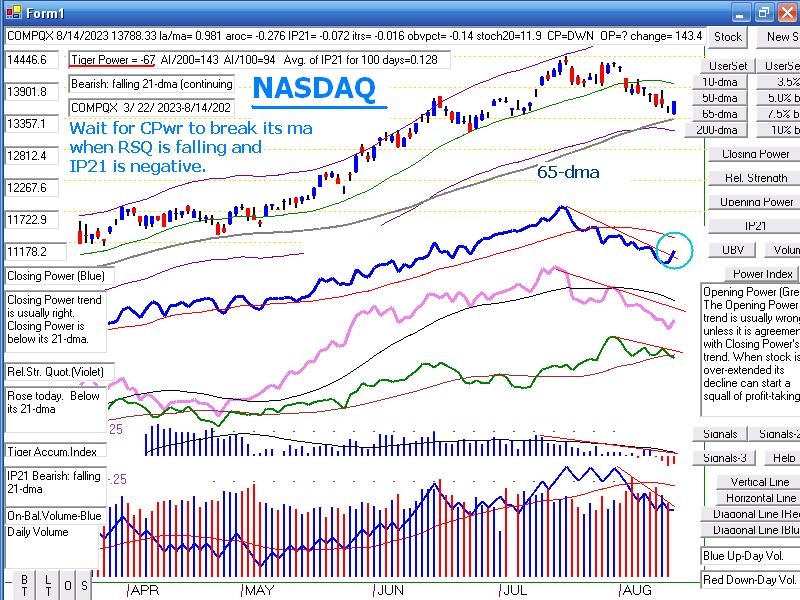

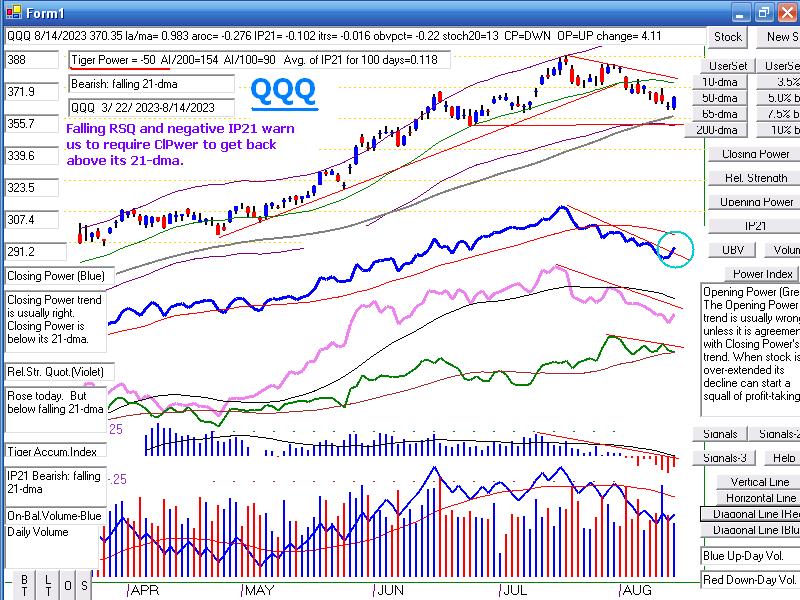

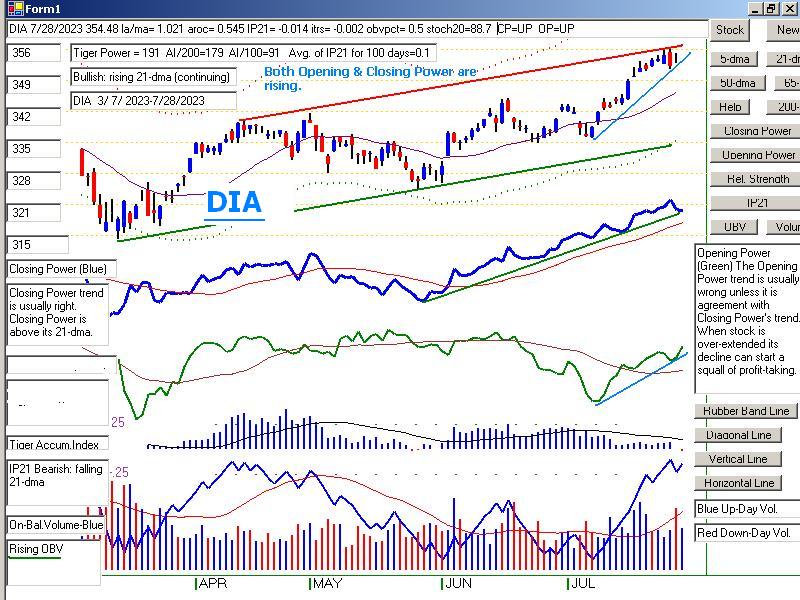

Nightly Hotline

The rally today impressively

disregarded the impending auto strike

and the still high and but

not falling interest rates. But follow-through

strength by Professionals and

a bigger advance by Closing Powers

are needed now.

Otherwise, expect another test of the 65-dma by the DJIA.

The key indexes seem to be

over-looking the well advertised bearishness

of September. But much

of that comes in the last 15 trading days

of the month. Our

seasonal data shows the DJI being up only 28.6% of

the time after two weeks from

now, September 14th, and 50% of the time

over the next month in the

third year of the four year Presidential cycle

since 1967.

So, far it looks as though

the key indexes and their main stocks

want to hold up above their

65-dma. With the help of the FEDs

and with the big banks'

determination, they may well succeed. At least

for now hold QQQ long along

with some bullish MAXCPs

and shorts among the bearish

MINCPs.

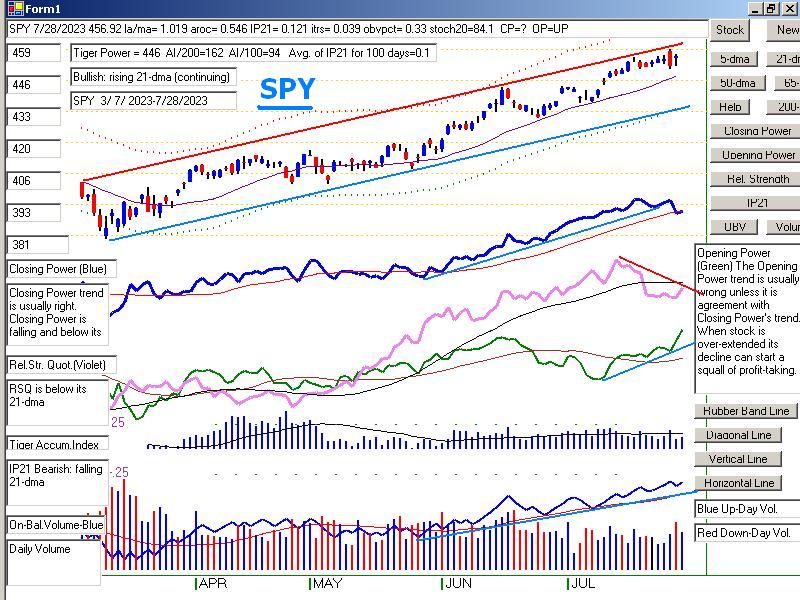

I have simplified and

de-cluttered the most important charts shown

below on the new candle stick

charts using VBNet. The buttons used

to build each graph can be

hidden. This helps simplify the charts'

appearance. The Opening

Power, which often is misleading, has

been left out. Now we

can focus on what I take to be the most important

Tiger internal strength

indicators.

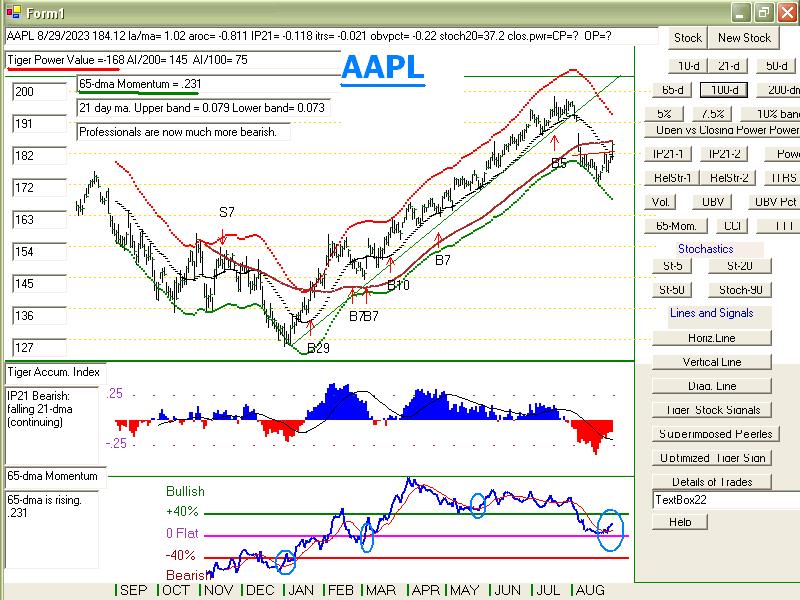

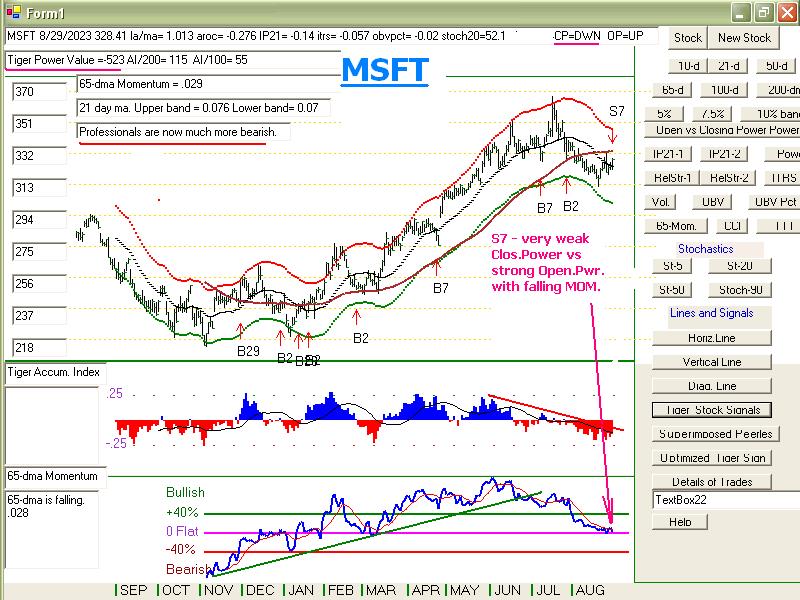

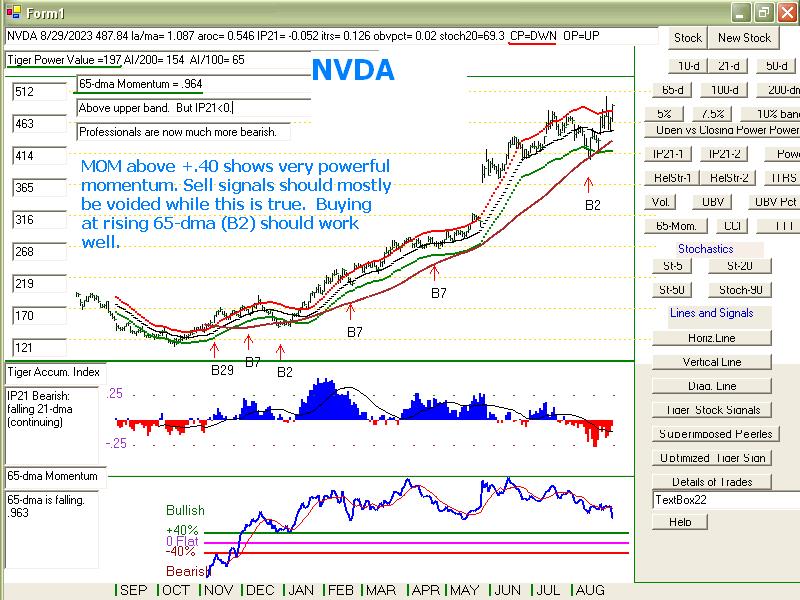

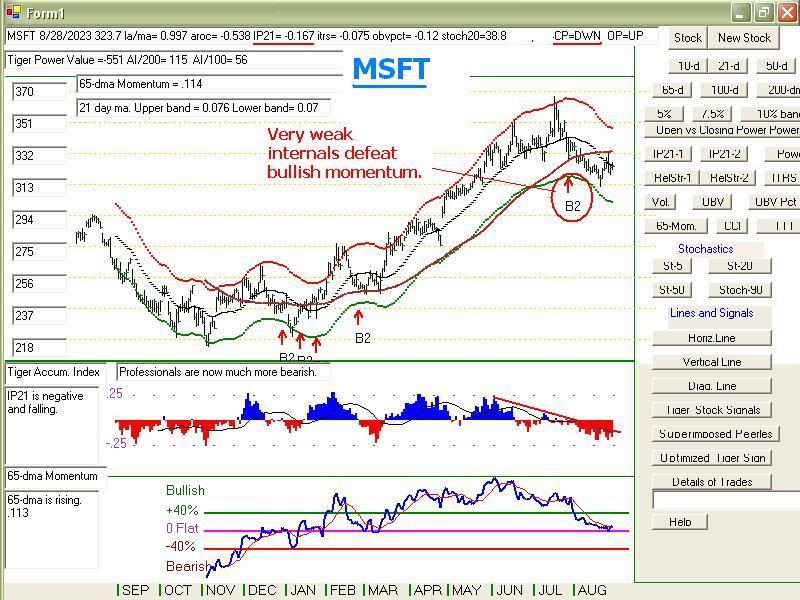

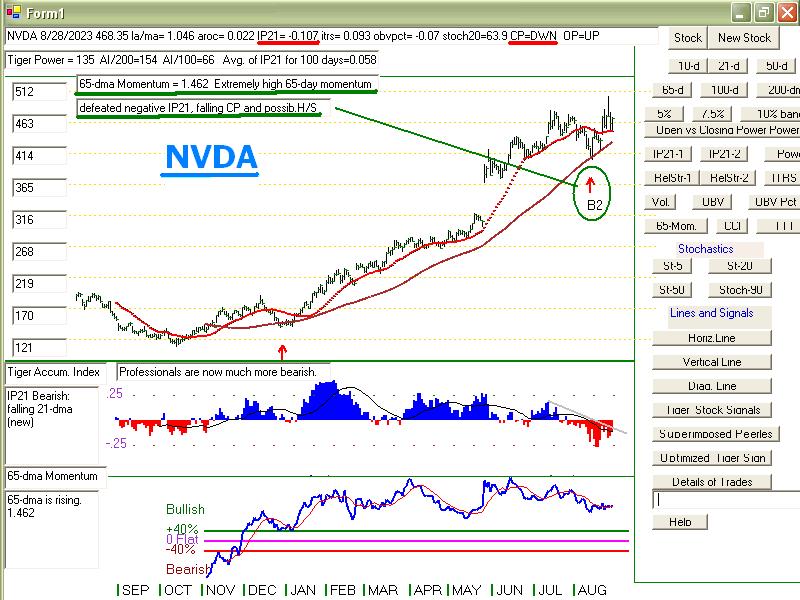

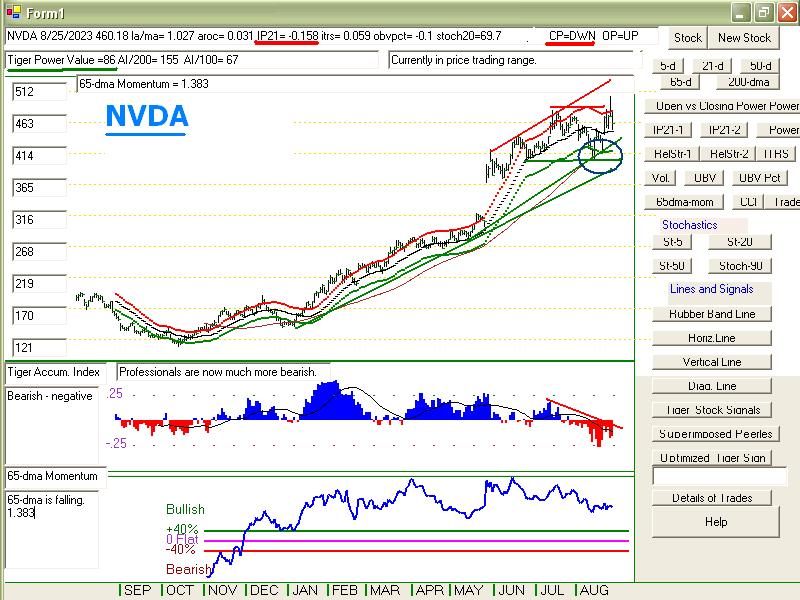

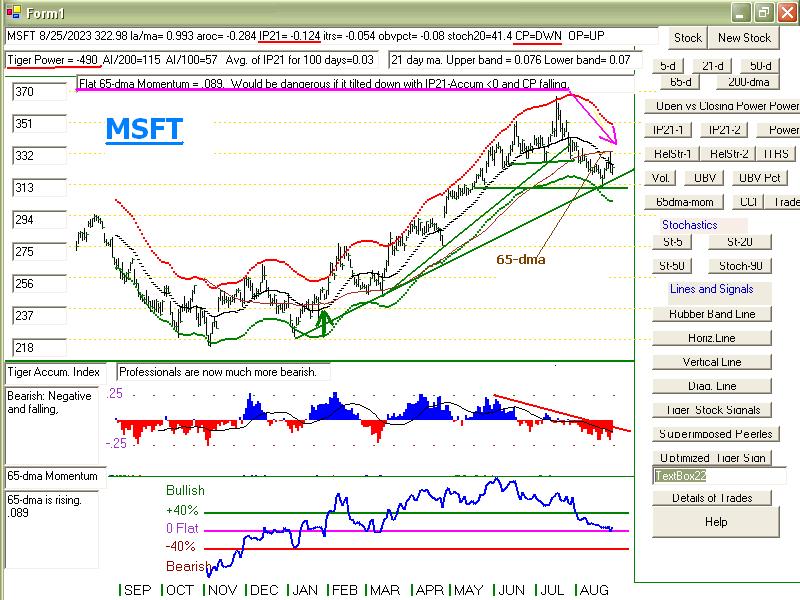

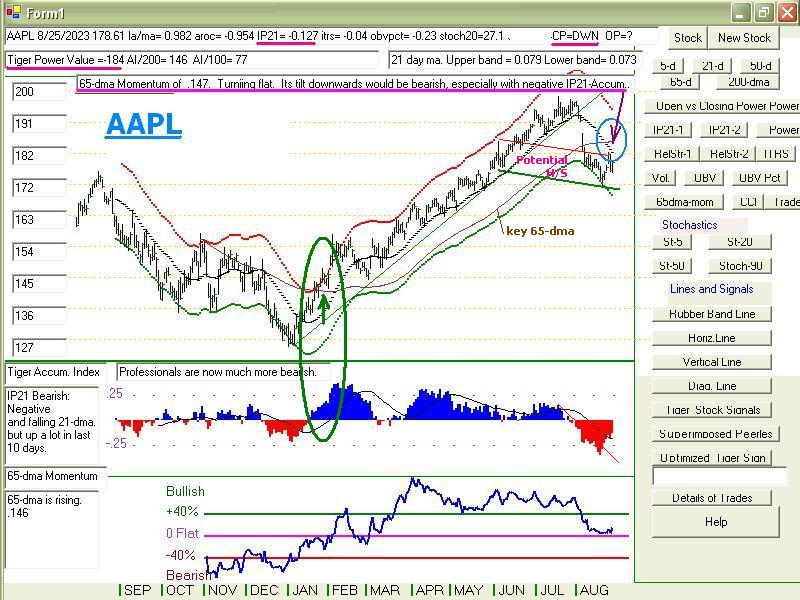

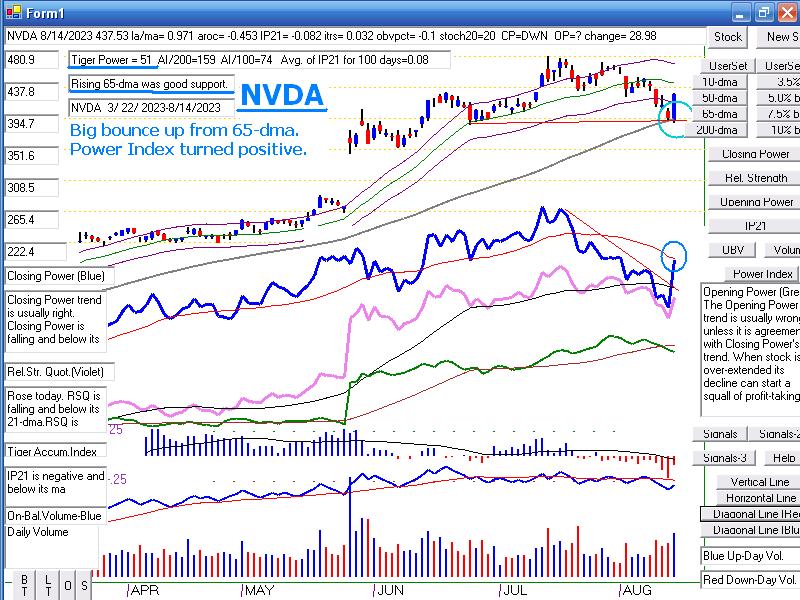

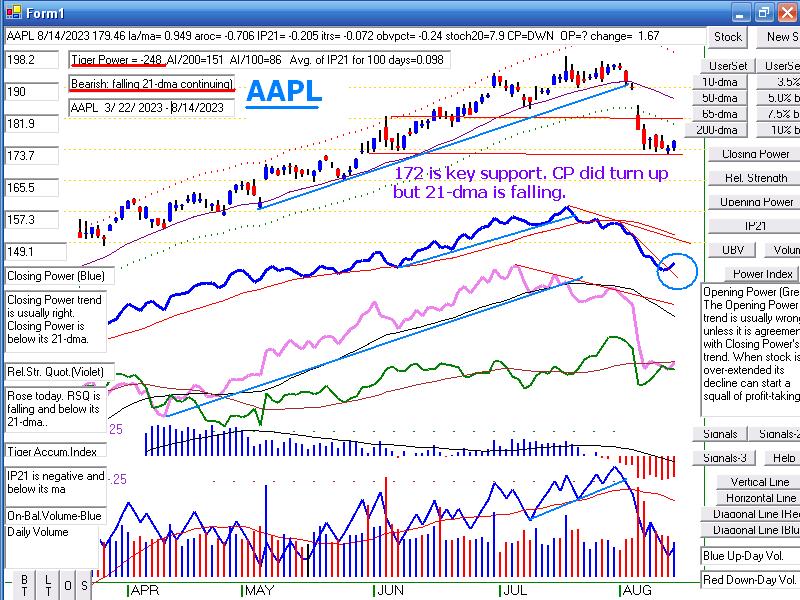

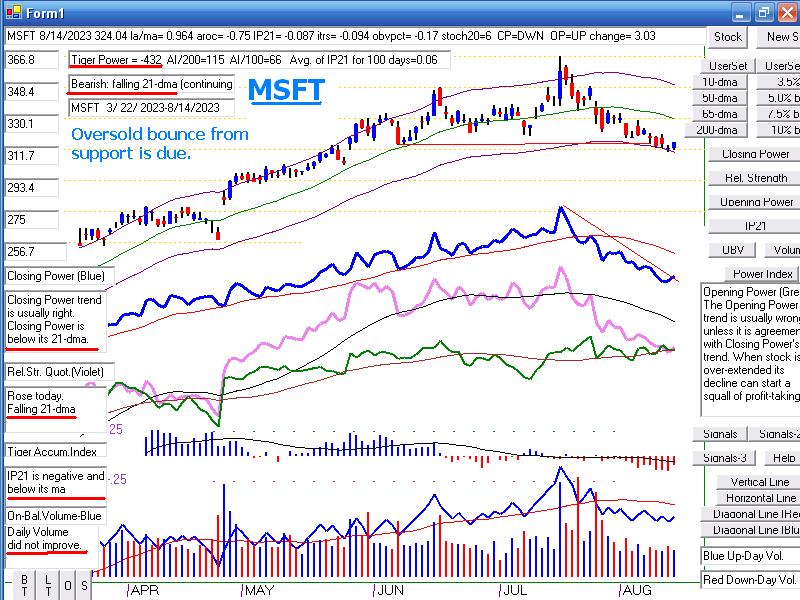

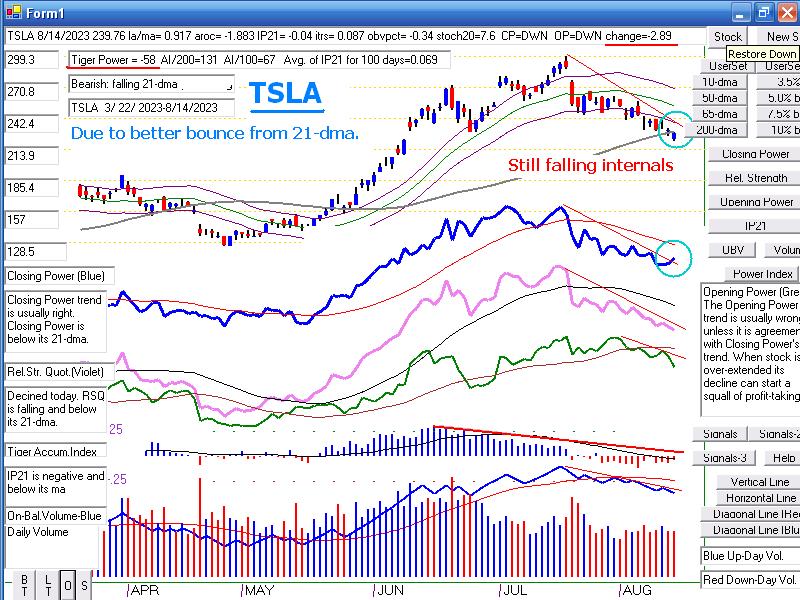

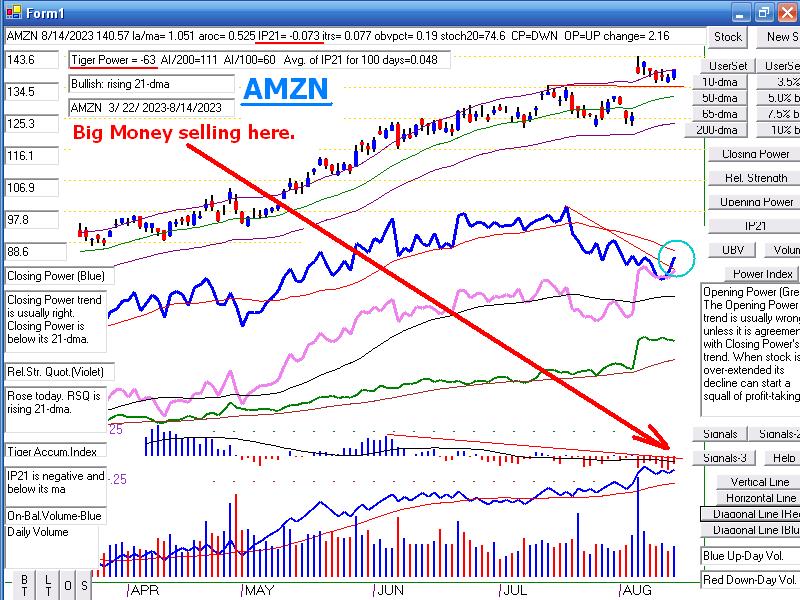

Shown below are AAPL, MSFT,

NVDA, GOOG, AMZN and BRKB.

They are the top

capitalization stocks in the SP-500 and QQQ. I left

out TSLA due to time

constraints.

1) The 65-dma's trend.

Only AAPL and IWM show falling

65-dma. The DJI, DIA, SPY,

NASDAQ, QQQ, MSFT, NVDA,

AMZN, GOOG and BRKB do not.

2) The Closing Powers are

falling for DIA, AAPL and IWM. They

could breakout bullishly or

fall back bearishly for the NASDAQ

and SPY. QQQ's is

rising but needs to show more strength to be

convincing.

3) The best Relative Strength

Quotient is shown in the charts of BRKB

and AMZN. Except for

AAPL and IWM, the RSQs are above their

rising 21-dma.

4) The IP21-Accumuations are

negative only in the cases of

DIA, NVDA and IWM. Some

of the others like the NASDAQ

and SPY are only barely

positive.

5) The Power Indexes are all

positive except for AAPL and IWM.

QQQ's is the highest in the

key charts shown here. |

|

| |

9/14/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Old Peerless- 2006

version

Tiger Index of Big

Banks Bond Funds Gold Stocks Housing Stocks

Insurance-Stocks

Regional

Banks Russell-1000

Semi Conductors

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO BLDP FAS GLD HD IBB JETS JNUG KOL NAIL

NUGT NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN |

TECL TLT TMF TNA UGA USO

China: YINN

CHAU BABA BIDU

Commodities:

CANE

COCO CORN DBC CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks: AA AAPL ADBE AMAT AMGN AMD AMZN ANET AXP BA BAC

BSX CAT CDNS CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB

FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX

MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG

PYPL QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA

TXN XOM V VRTX WFC WMT XLE ZM ZOM

SEMI-Condctors in SOXL:

NVDA. AVGO, AMD. INTC LRCX TXN MCHP NXPI AMAT ON AAOI TSM

HOMEBUILDERS: BLDP NAIL

BZH HOV LEN MHO MTH PHM -

REGIONAL BANKS:

EGBN

FFIC GBCI HMST

Carl Icahn and associates: IEP

MS

JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/9-14-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/9-14-2023/Bearish.htm |

|

|

|

|

|

|

|

|

|

|

|

|

Table

1 - Daily Breadth and Volume

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,002 |

3,004 |

3,010 |

| Advances |

2,290 |

1,134 |

1,041 |

| Declines |

629 |

1,747 |

1,862 |

| Unchanged |

83 |

123 |

107 |

| New

highs |

64 |

51 |

40 |

| New

lows |

63 |

93 |

116 |

| Adv.

volume* |

737,401,572 |

295,647,636 |

279,240,788 |

| Decl.

volume* |

154,611,313 |

564,430,992 |

621,527,299 |

| Total

volume* |

909,838,757 |

872,417,944 |

912,068,467 |

| Closing

Arms (TRIN)† |

0.90 |

1.15 |

1.38 |

| Block

trades* |

3,994 |

3,792 |

4,068 |

| Adv.

volume |

2,877,840,343 |

1,250,477,747 |

1,073,111,229 |

| Decl.

volume |

712,082,132 |

2,220,055,580 |

2,639,352,244 |

| Total

volume |

3,648,725,051 |

3,529,431,146 |

3,763,765,222 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,486 |

4,480 |

4,437 |

| Advances |

2,880 |

1,637 |

1,407 |

| Declines |

1,400 |

2,645 |

2,865 |

| Unchanged |

206 |

198 |

165 |

| New

highs |

49 |

32 |

39 |

| New

lows |

185 |

211 |

274 |

| Closing

Arms (TRIN)† |

1.24 |

0.63 |

0.89 |

| Block

trades |

35,580 |

38,742 |

26,085 |

| Adv.

volume |

2,849,290,738 |

2,370,561,461 |

1,529,859,850 |

| Decl.

volume |

1,719,074,076 |

2,414,021,499 |

2,757,897,852 |

| Total

volume |

4,649,014,014 |

4,840,315,901 |

4,320,836,734 |

|

Table 2 TIGER QUICKSILVER on ETFS - 9/15/2023 ---

Bullish = 1 DBO

Bearish = 1 TAN

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

=================================================================================================

DIA 349.94 3.39 346.51 61.3% Bearish BLUE -.14 0 ------

---------------------------------------------------------------------------------------------

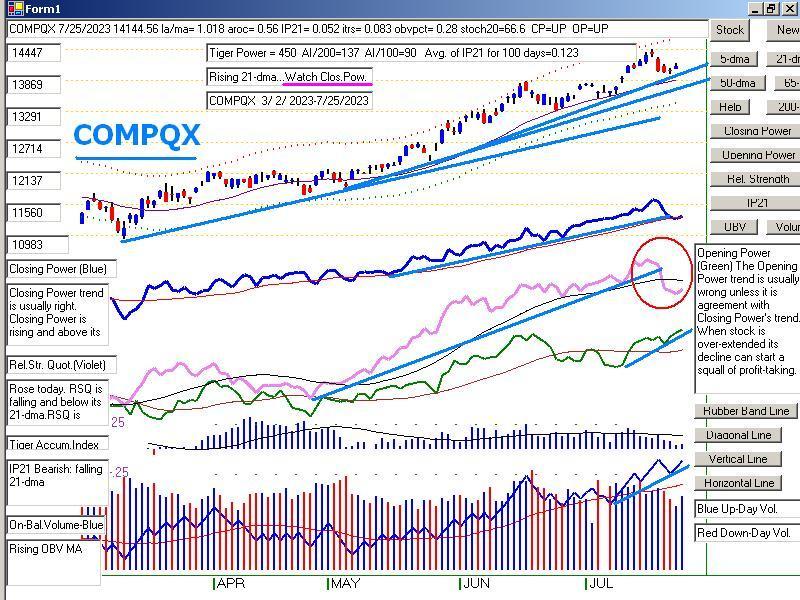

COMPQX 13926.05 112.46 13761.53 64.2% Bearish BLUE .005 -.011 -.006

---------------------------------------------------------------------------------------------

SPY 450.36 3.85 445.52 61.7% Bearish BLUE .024 -.004 .02

---------------------------------------------------------------------------------------------

QQQ 377.27 3.06 372.58 69.7% ------- BLUE .059 -.002 .057

---------------------------------------------------------------------------------------------

MDY 475.03 6.19 471.09 37.7% Bearish BLUE -.137 -.023 -.16

---------------------------------------------------------------------------------------------

IWM 185.55 2.58 183.92 33.2% Bearish BLUE -.184 -.022 -.206

---------------------------------------------------------------------------------------------

FAS 68.89 1.79 65.01 315.2% ------- BLUE -.052 .051 -.001

---------------------------------------------------------------------------------------------

RETL 6.53 .45 6.21 161.1% Bearish BLUE -.109 -.105 -.214

---------------------------------------------------------------------------------------------

SOXL 21.65 .42 21.5 -51.4% Bearish RED .069 -.113 -.044

---------------------------------------------------------------------------------------------

TECL 50.16 1.01 50.83 -34.9% ------- BLUE .047 -.068 -.021

---------------------------------------------------------------------------------------------

IBB 127.58 .48 126.85 27.5% Bearish BLUE -.22 -.016 -.236

---------------------------------------------------------------------------------------------

GLD 177.17 .09 178.08 -23.9% Bearish BLUE -.207 -.025 -.232

---------------------------------------------------------------------------------------------

DBO 17.92 .33 17.27 212.8% Bullish BLUE .153 .231 .384 bullish

---------------------------------------------------------------------------------------------

OIH 359.72 5.14 353.07 108.6% ------- RED -.144 .218 .074

---------------------------------------------------------------------------------------------

CPER 23.53 .18 22.87 68.8% ------- BLUE .106 -.005 .101