Peerless

and Fidelity BIOTECH

Earlier Findings

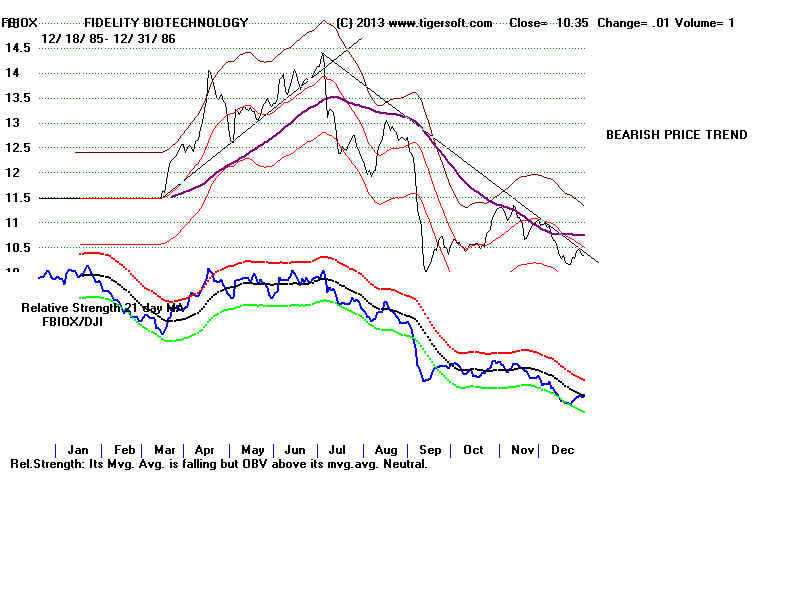

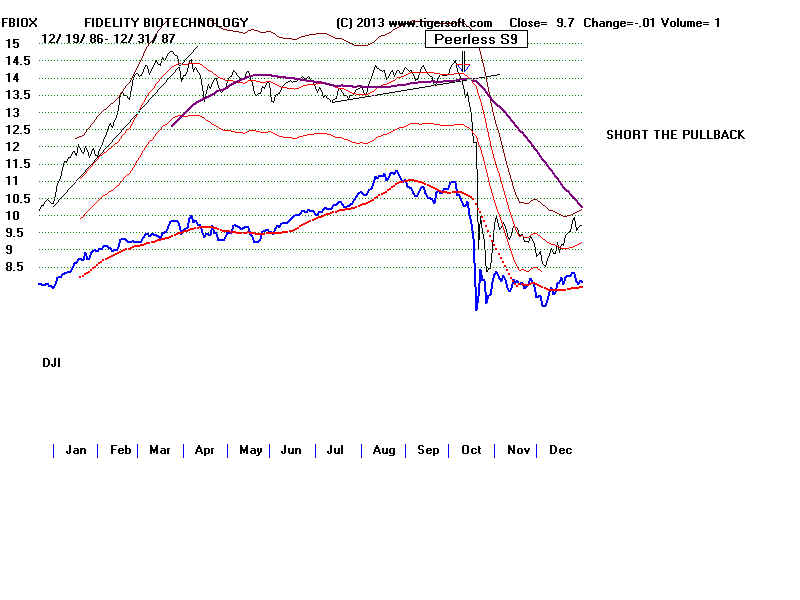

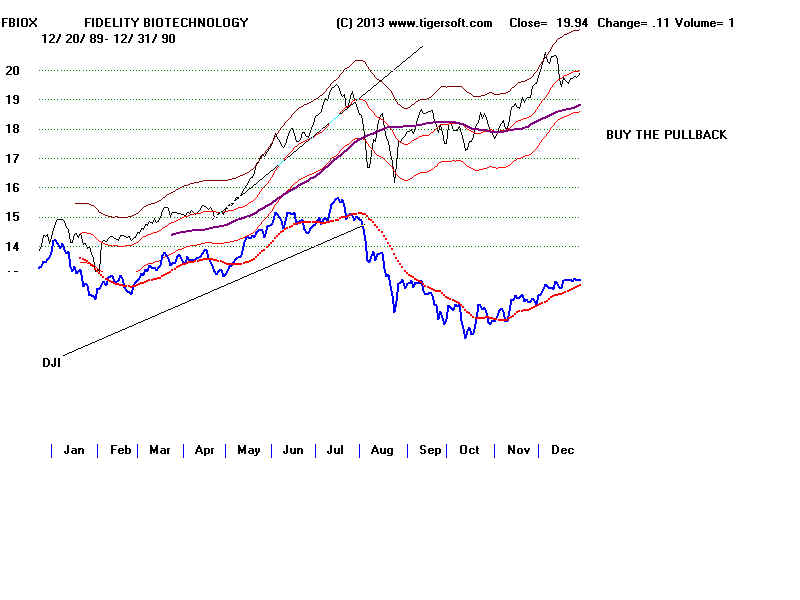

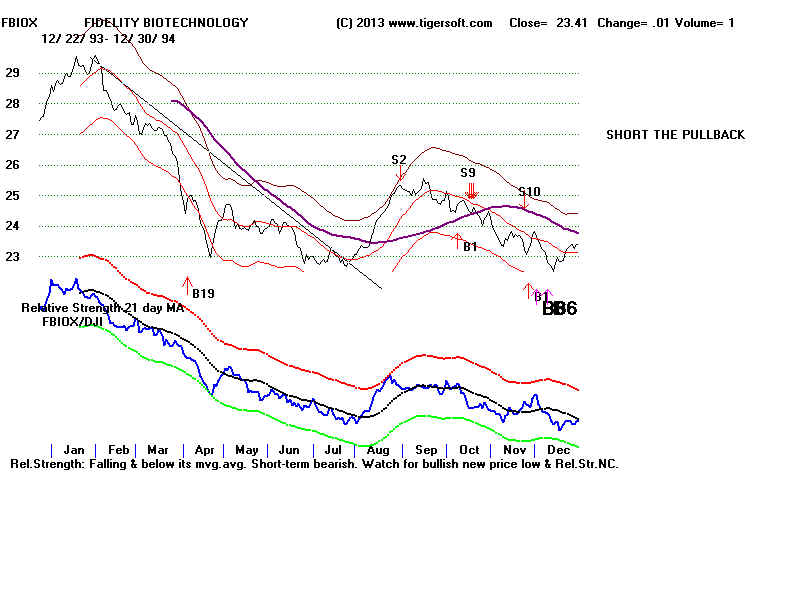

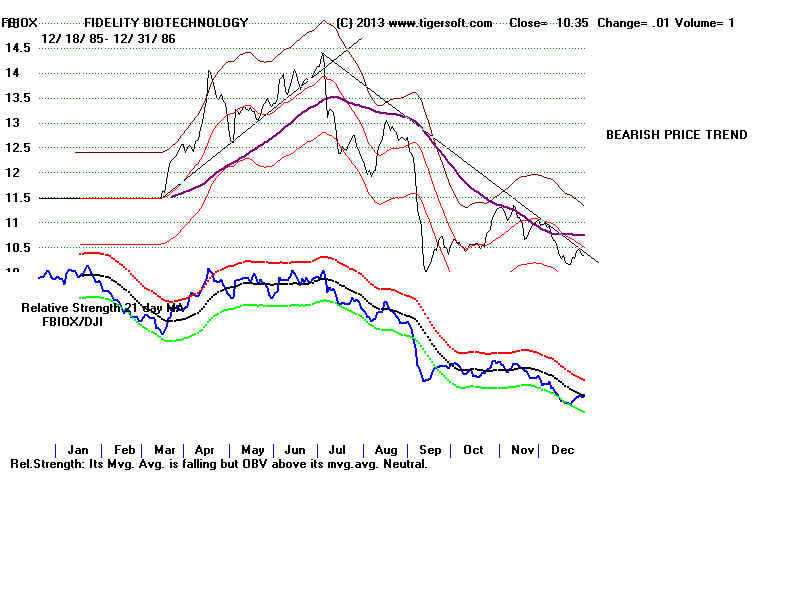

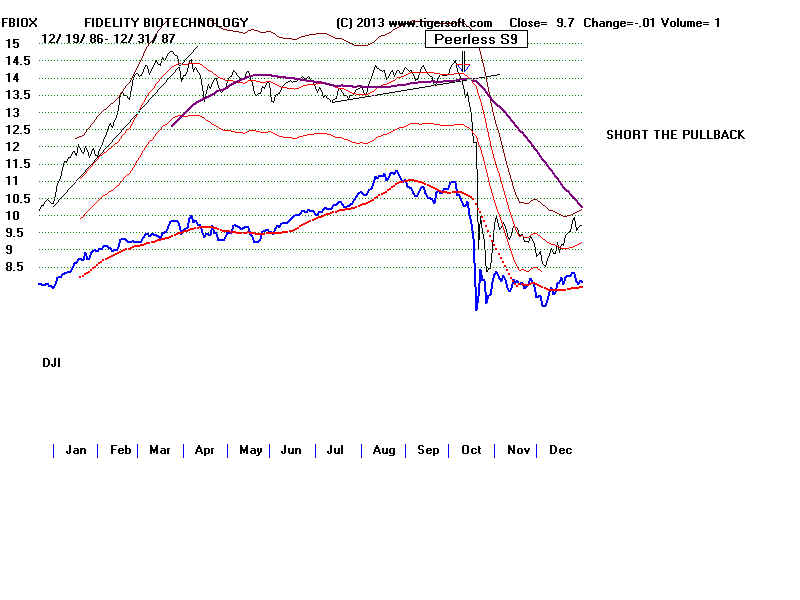

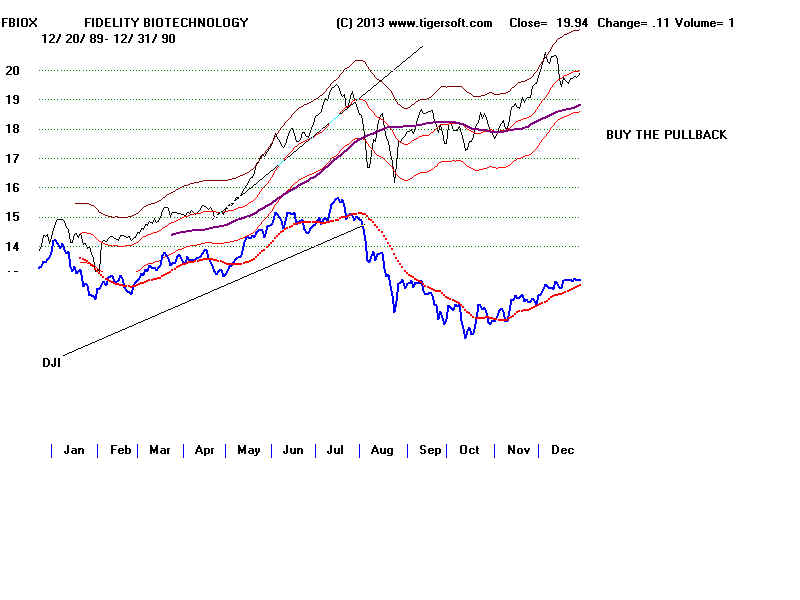

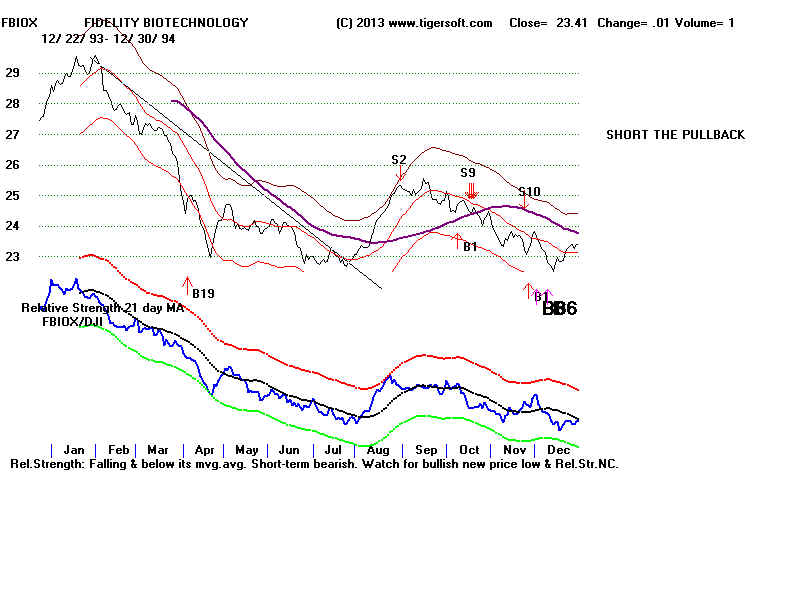

There

are many times when FBIOX is in a downtrend and a Peerless Buy signal

does

not bring a reversal. Examples April 1994, May 2004.

March 2006,

May

2010 (but DJI H/S Watch also for well-tested trendlines because

when

they are broken prices usually reverse. These often occur

after

important Peerless Sells Examples: June 1986, July 1990, Sept 1987.

From Peerless

long trades and fidelity sector funds: 1986-2011

PEERLESS LONG TRADES AND FIDELITY SECTOR FUNDS

Performance

Thru 3/23/2011

Start

N $1000

Avg.

Winning

Pct of Trades

Becomes

Gain/Trade

Trade Pct Losses>10%

FBIOX Biotech

1986

51 $28101

+10.0%

76.4%

2/51

1986 2011 N = number of trades.

=================================================================================

FSLBX Brokerage Inv Mgt

1986 51 $340200

+15.5%

86.2%

1/51

-------------------------------------------------------------------------------------------------------------------------

FSAVX Automotive

1987

47 $105099

+14.6%

74.4%

2/41

-------------------------------------------------------------------------------------------------------------------------

FSELX Electronics

1986

51 $150474

+14.3%

76.4%

3/51

-------------------------------------------------------------------------------------------------------------------------

FDCPX Computer

1986

51 $133558

+13.8%

76.4%

3/51

-------------------------------------------------------------------------------------------------------------------------

FSESX Energy Services

1987

47 $81283

+13.4%

77.5%

4/47

-------------------------------------------------------------------------------------------------------------------------

FSPTX Technology

1986

50 $110951

+13.4%

76.4%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSAIX Air Transp.

1986

50 $114355

+13.4%

76.0%

1/51

-------------------------------------------------------------------------------------------------------------------------

FSCSX Software

1986

51 $90913

+12.6%

80.3%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSDPX Select Materials

1987 49

$86967

+12.6%

75.5%

no big losses

------------------------------------------------------------------------------------------------------------------------

FSRFX Transportation

1989

44 $59394

+12.6%

79.5%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSHOX Construction & Housing 1987 49

$68828.

+12.1%

77.5%

no big losses

------------------------------------------------------------------------------------------------------------------------

FSCGX Industrial Equipment

1987 49 $64964

+11.9%

79.5%

2/51

-------------------------------------------------------------------------------------------------------------------------

FBMPX Multi-Media

1986

51 $55586

+11.5%

76.4%

3/51

-------------------------------------------------------------------------------------------------------------------------

FSRPX Retailing

1986

51 $55732

+11.5%

74.5%

1/51

-------------------------------------------------------------------------------------------------------------------------

FIDSX Financial Servuices

1986 51 $61598

+11.4%

86.2%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSPCX Insurance

1986

51 $72925

+11.4%

94.1%

1/51

-------------------------------------------------------------------------------------------------------------------------

FDLSX Leisure

1986

51 $50011

+11.0%

80.3%

1/51

-------------------------------------------------------------------------------------------------------------------------

FSHCX Chemicals

1986

51 $54039

+10.8%

82.3%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSRBX Banking

1987

47 $28097

+10.6%

73.4%

2/51

-------------------------------------------------------------------------------------------------------------------------

FSTCX Telecommunications

1986 51 $39971

+10.5%

82.3%

3/51

-------------------------------------------------------------------------------------------------------------------------

FSNGX Natural Gas

1994

37 $13980

+10.4%

75.6%

2/37

-------------------------------------------------------------------------------------------------------------------------

FSDAX Military & Aerospac

1986 51

$41931

+10.4%

74.5%

1/37

-------------------------------------------------------------------------------------------------------------------------

FBIOX Biotech

1986

51 $28101

+10.0%

76.4%

2/51

-------------------------------------------------------------------------------------------------------------------------

FCNTX Contra Fund

1986

51 $33793

+9.7%

86.2%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSLEX Environment & Altern Energy 1989 41

$16725

+9.6%

82.9%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSVLX Home Finance

1986

51 $20947

+9.5%

72.5%

3/51

-------------------------------------------------------------------------------------------------------------------------

FDVLX Investment Value

1986

51 $29010

+9.5%

86.3%

1/51

-------------------------------------------------------------------------------------------------------------------------

FSENX Energy

1986

51 $23536

+9.4%

76.4%

3/51

-------------------------------------------------------------------------------------------------------------------------

FSPHX Health Care

1986

51 $14887

+8.1%

74.5%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSCBX Small Cap

1998

31 $5286

+8.0%

74.1%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSAGX Gold

1986

51 $6168

+7.6%

64.7%

10/51

-------------------------------------------------------------------------------------------------------------------------

FDFAX Agriculture

1986

51 $9810

+6.9%

84.3%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSUTX Utilities Growth

1986

51 $5030

+5.5%

74.5%

1/51

/

==================================================================================

2000-2004

For the

period, 2000-2004, Peerless major Buy signals would have showed an average yearly

performance of the 16.73% in trading the Fidelity Select funds, if

only long positons were taken with revering major Buy and Sell signals and there

was no short selling. Below is a ranking, showing which Select Funds were most

profitably traded by Peerless from 2000-2004.

FBIOX gain for 2000-2004 was 12.6% using Peerless and only

Buying and then Selling on

Peerless signals.

FSPTX - Technology +26.06%

FSAVX - Automotive +25.58%

FSHOX - Construction & Housing +24.34%

FSENX - Energy +23.23%

FSELX - Electronics +21.55%

FDCPX - Computers +21.0%%

FSDPX - Industrial Materials +20.66%

FBMPX - Multimedia +19.89%

FSCBX - Small Caps. +19.78%

FSRFX - Transportation +18.73%

FSAIX - Air Transport +18.45%

FDLSX - Leisure/Entertainment +18.32%

FSDCX - Dev.Comm. +18.11%

FSAGX - Amer.Gold +17.82%

FSDAX - Defense/Aerospace +17.56%

FSCHX - Chemicals +17.53%

FSLEX - Environmental Services +17.13%

FSRPX - Retailing +16.81%

All Funds Averaged +16.73%

FSPCX - Insurance +16.31%

FSTCX - Tele-communications +16.00%

FDVLX - Savings & Loan +15.2%

FSESX - Energy Services +14.23%

FSCPX - Consumer +13.77%

FIDSX - Financial Servics +13.23%

FBIOX - Biotech +12.57%

FSHCX - Medical Delivery +12.03%

FSRBX - Regional Banks +10.66%

FSNGX - Natural Gas +8.9%

FSUTX - Utility Growth +8.63%

FDFAX - Agriculture +7.78%

FSPHX - Health Care +6.83%

http://www.tigersoft.com/mutuals/

==================================================================================

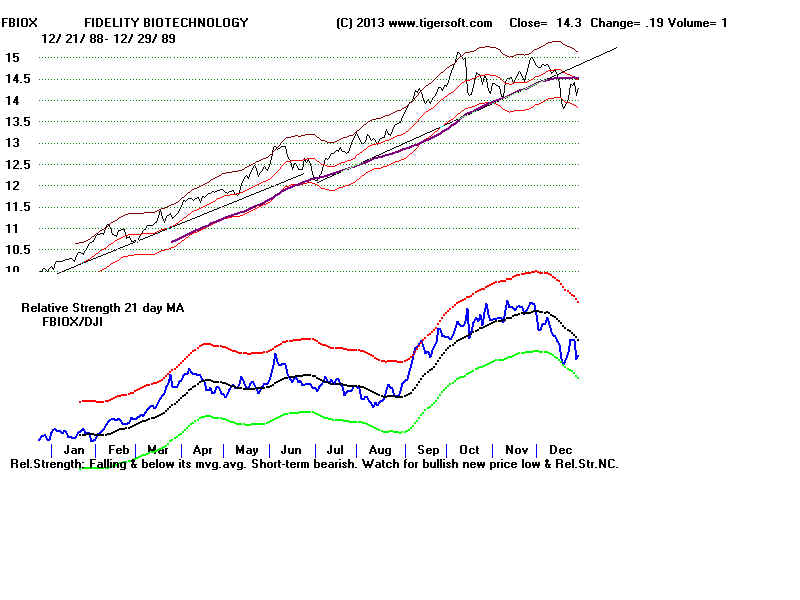

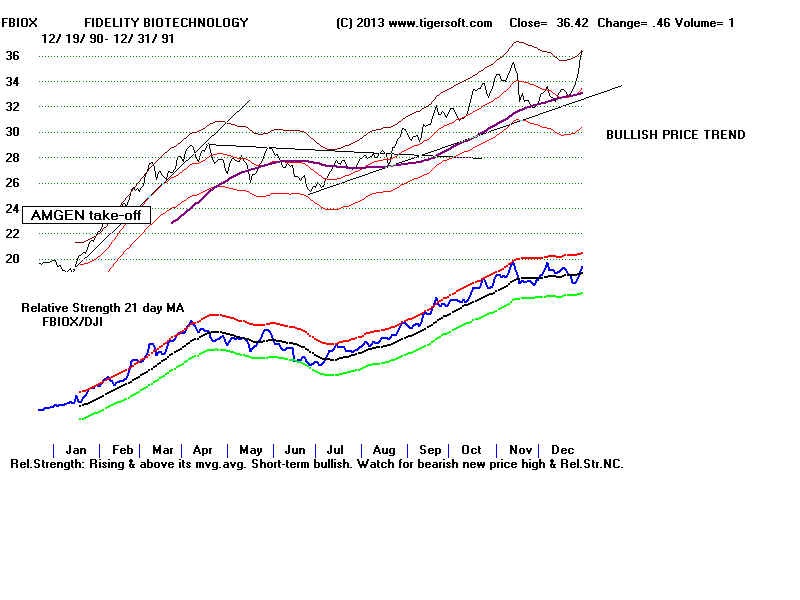

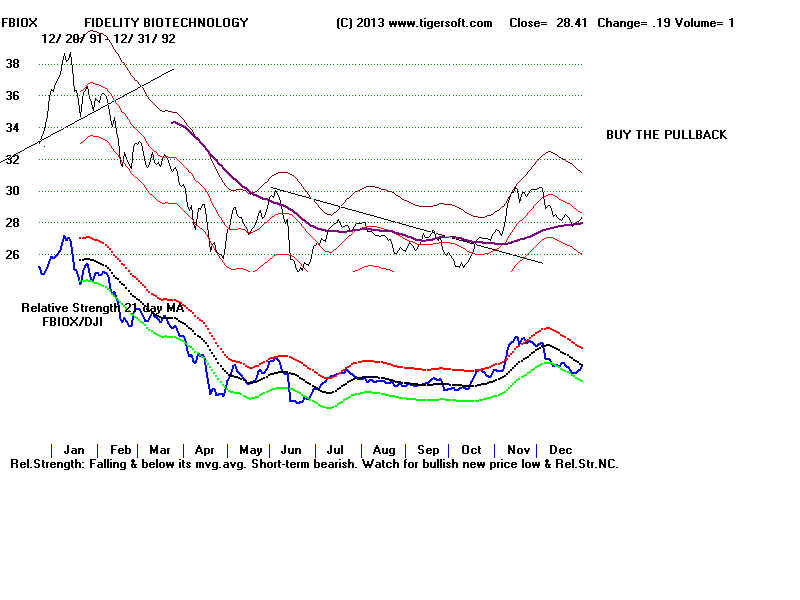

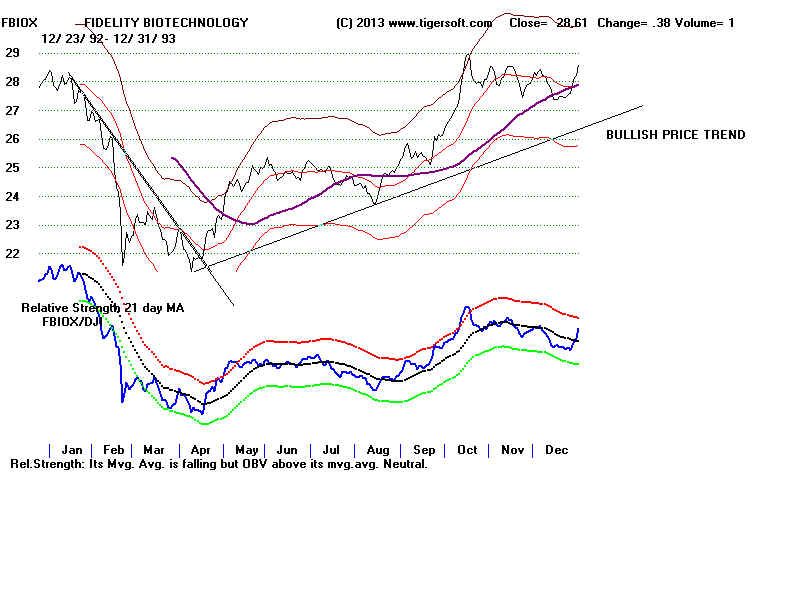

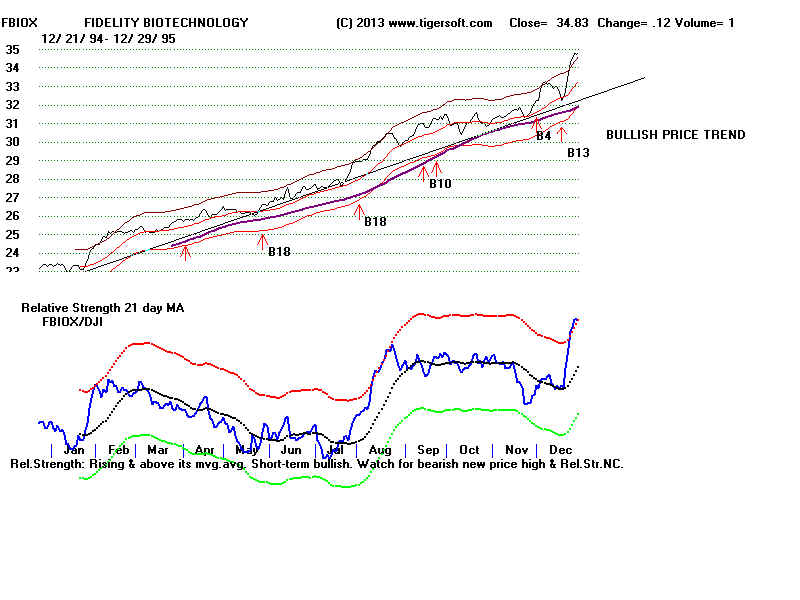

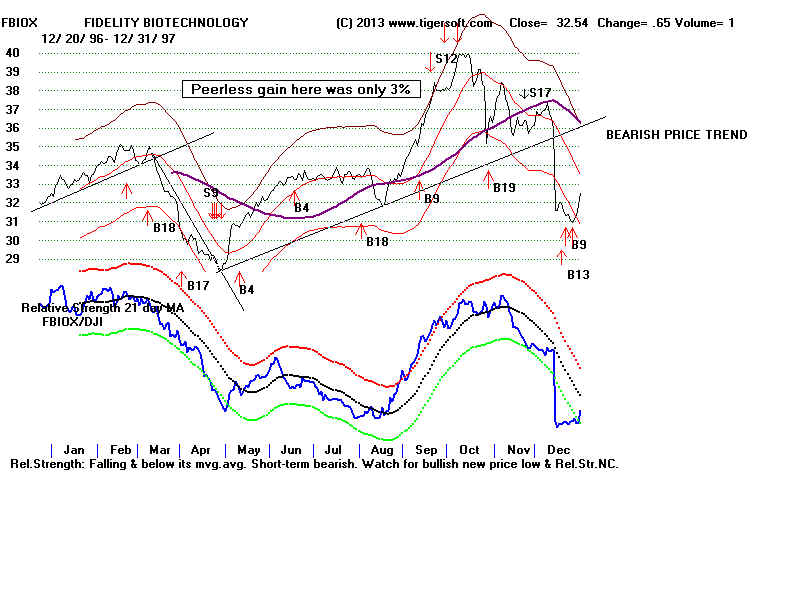

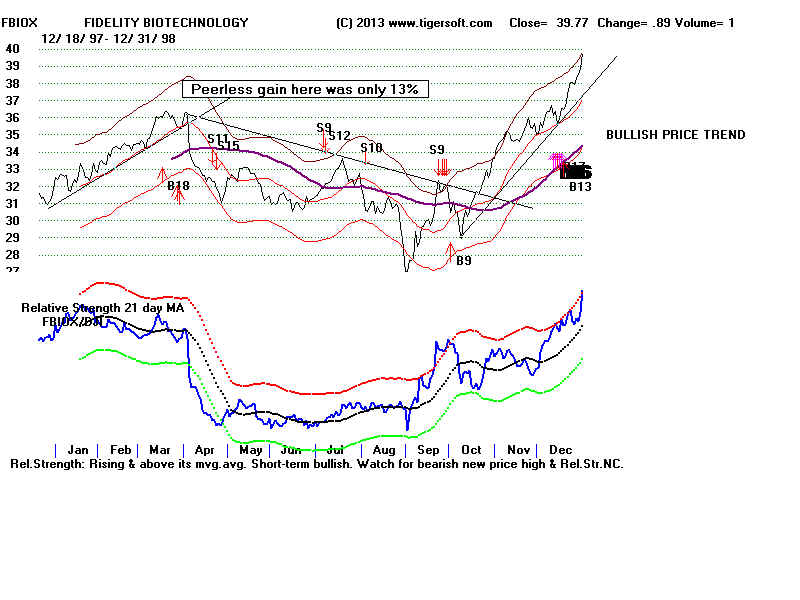

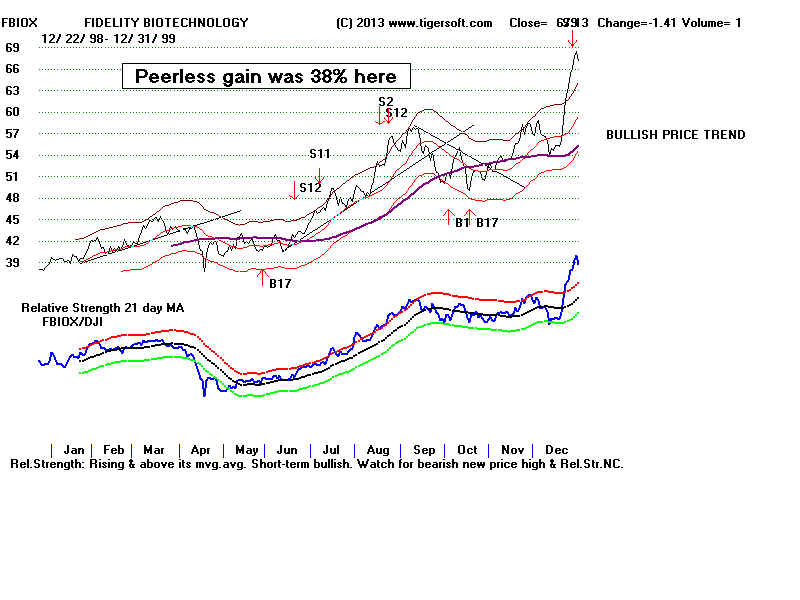

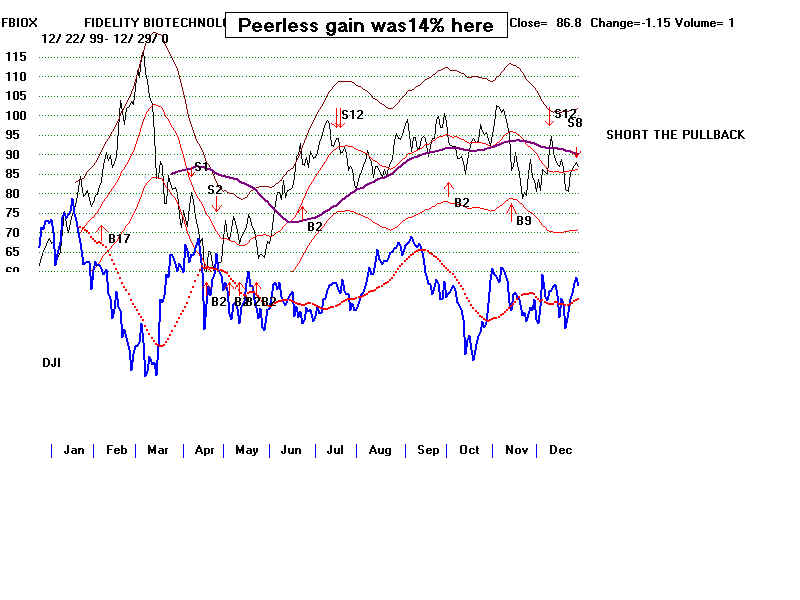

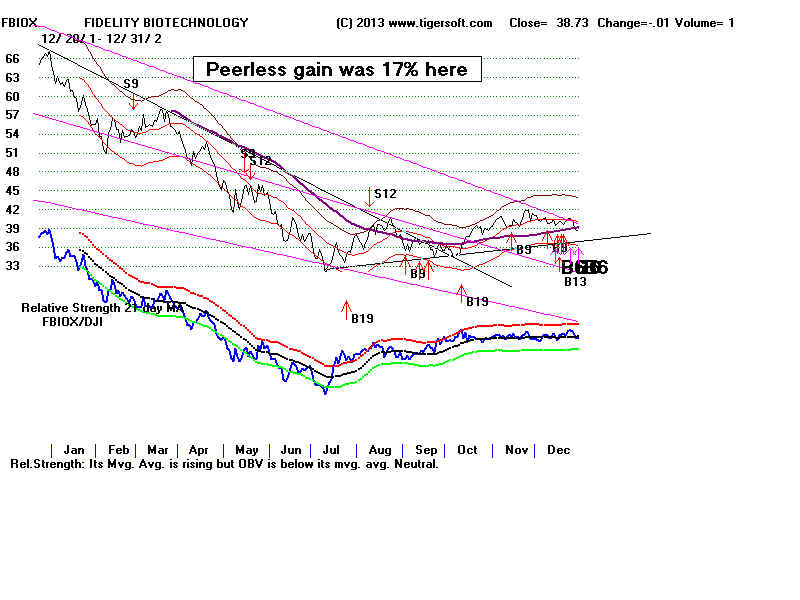

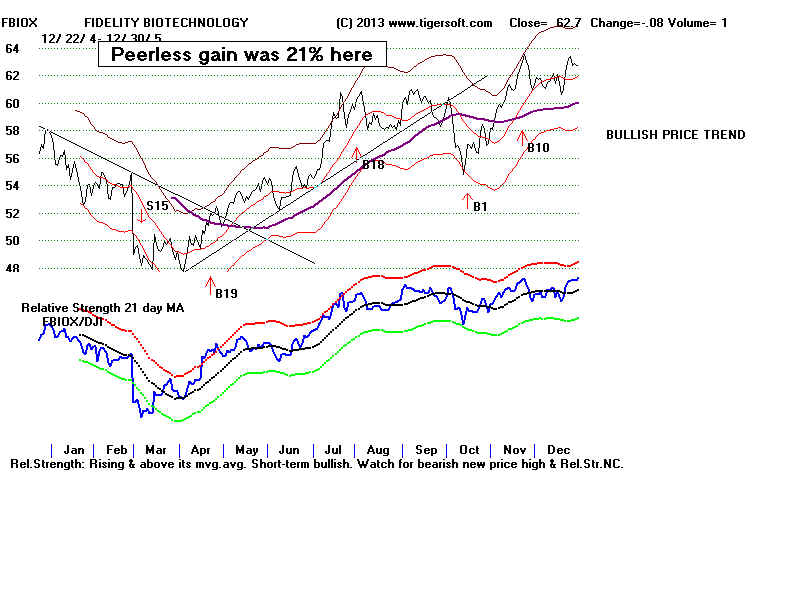

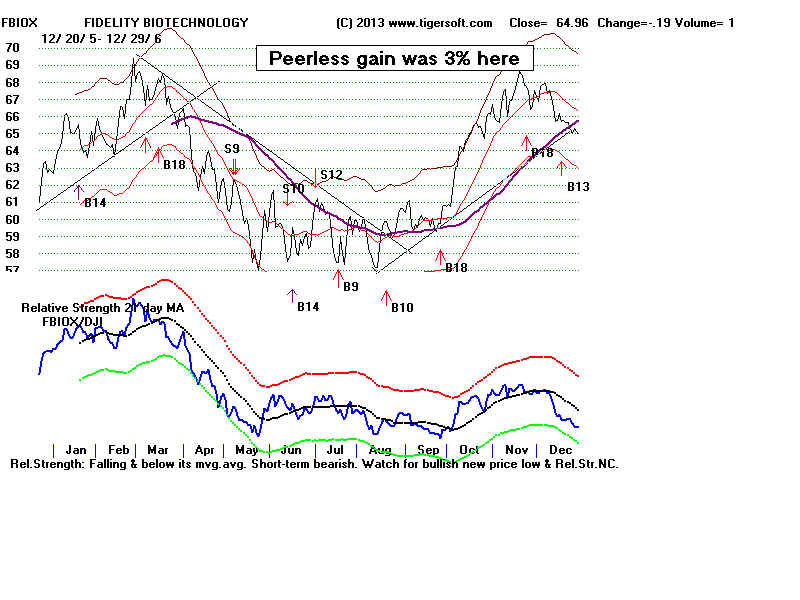

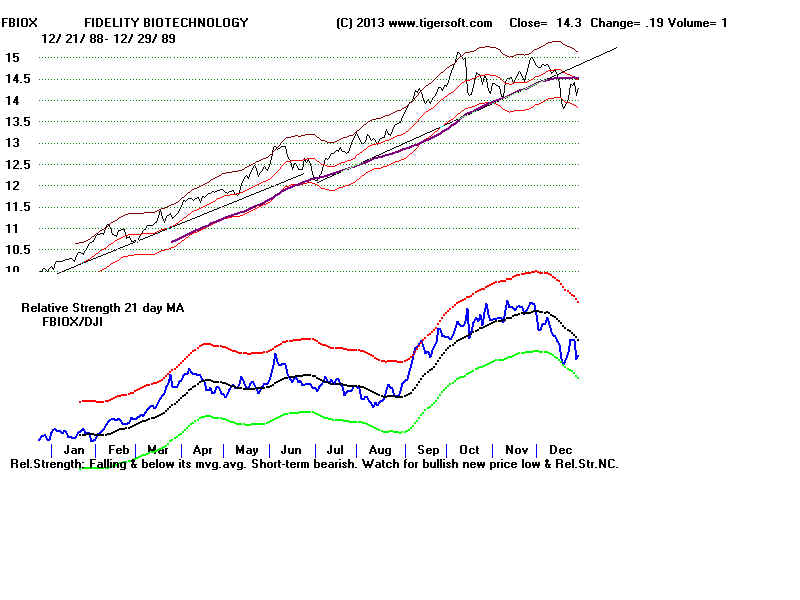

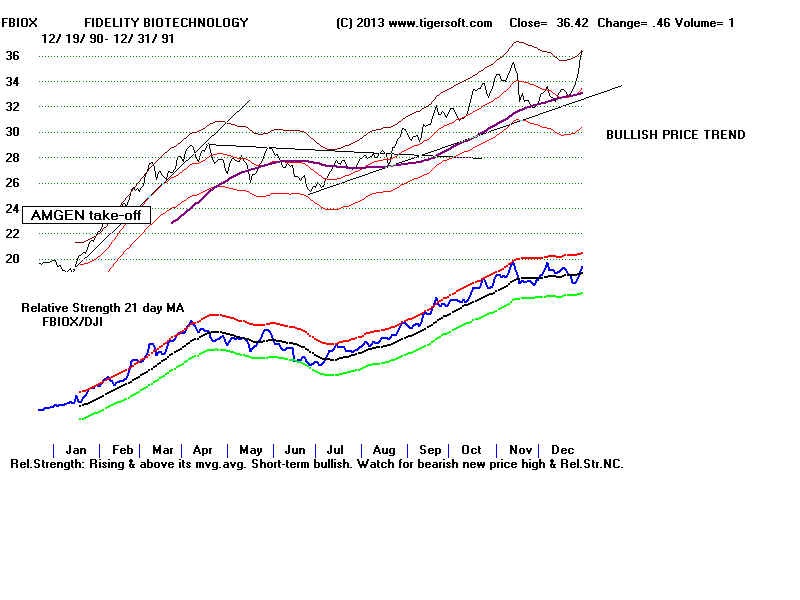

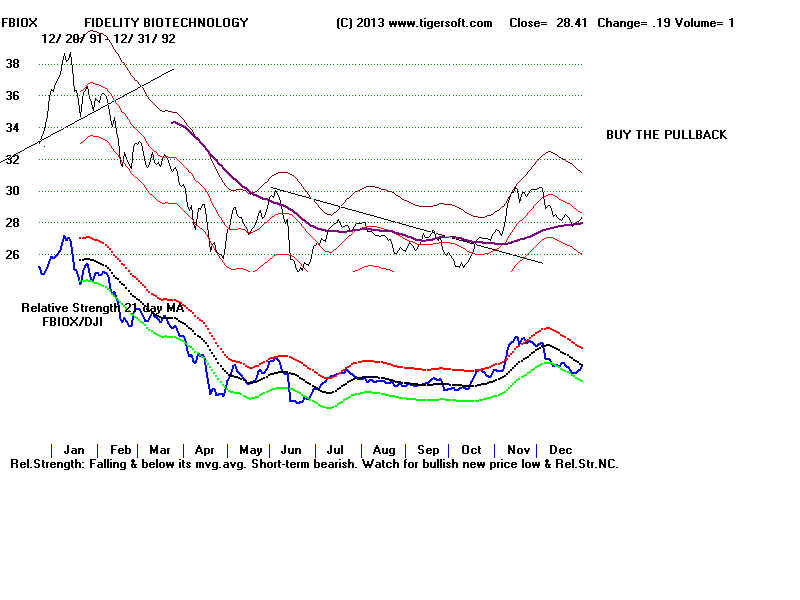

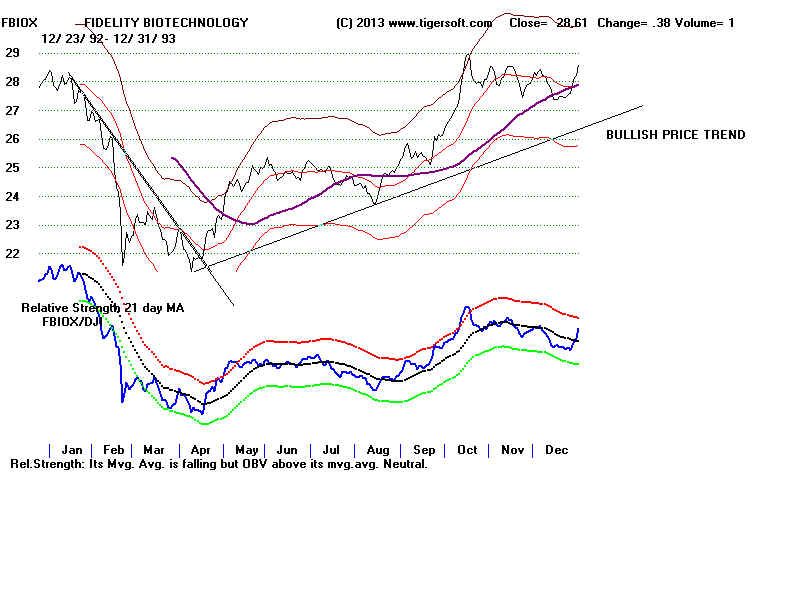

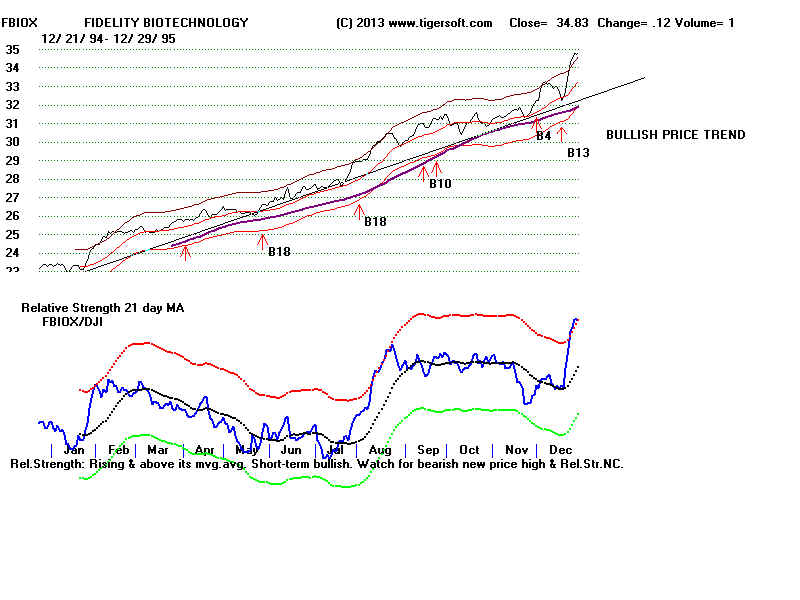

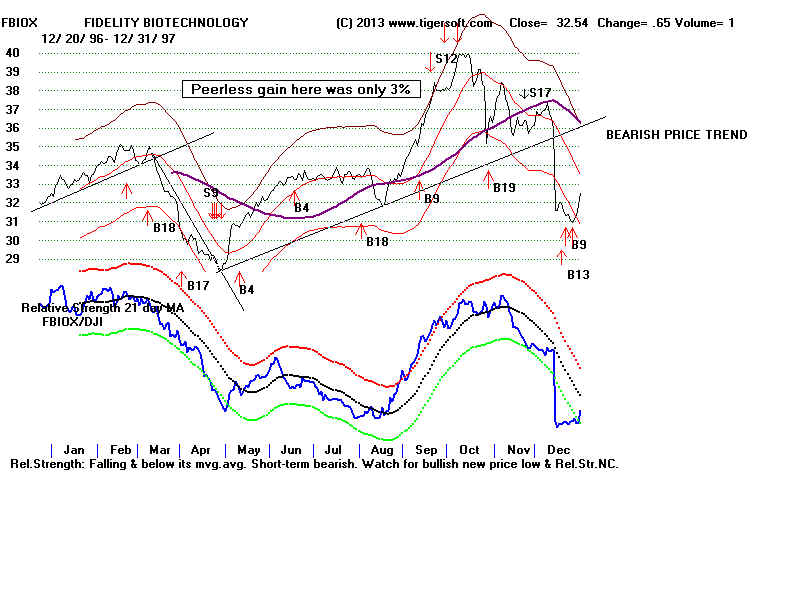

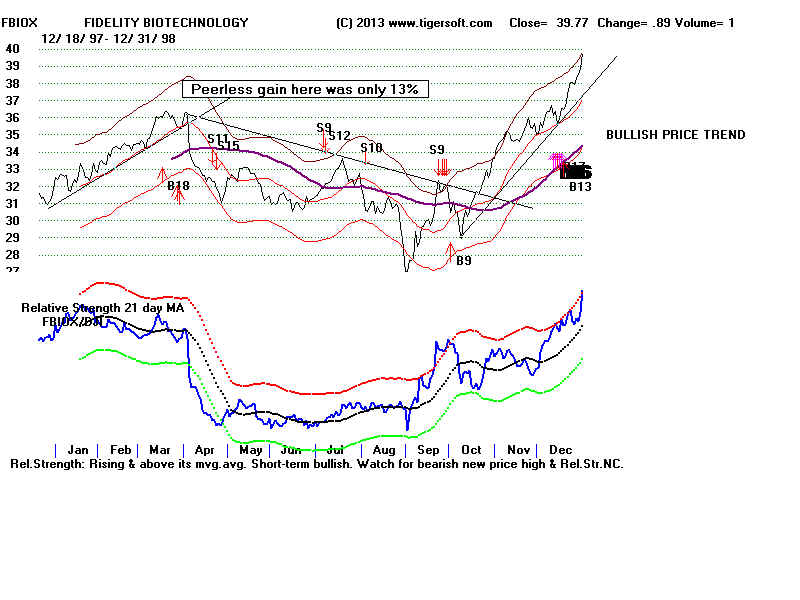

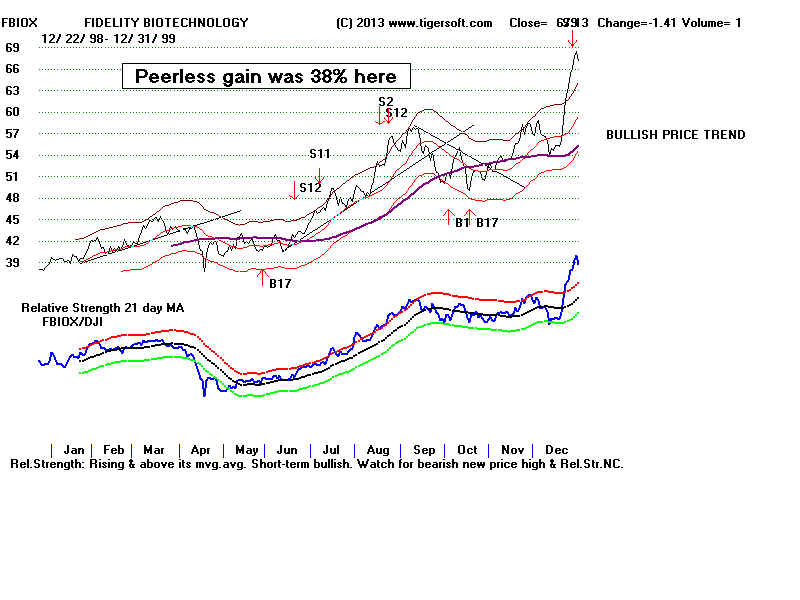

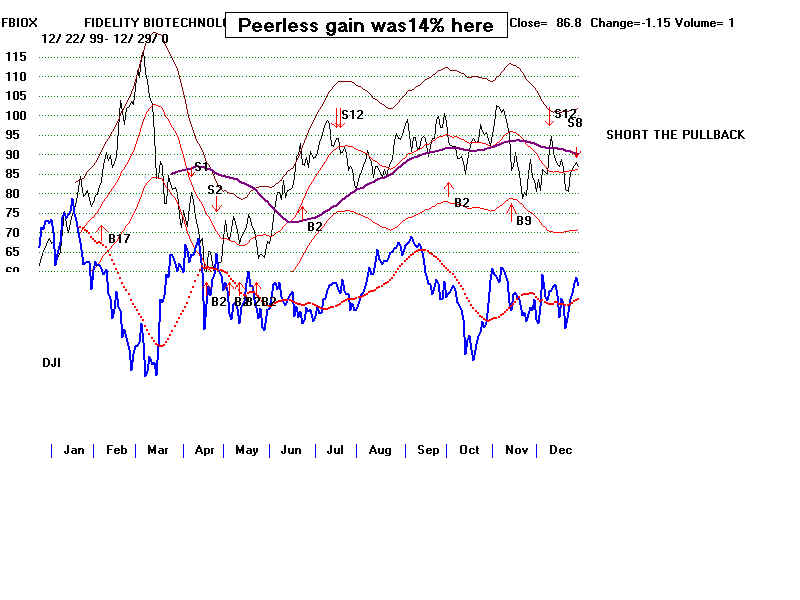

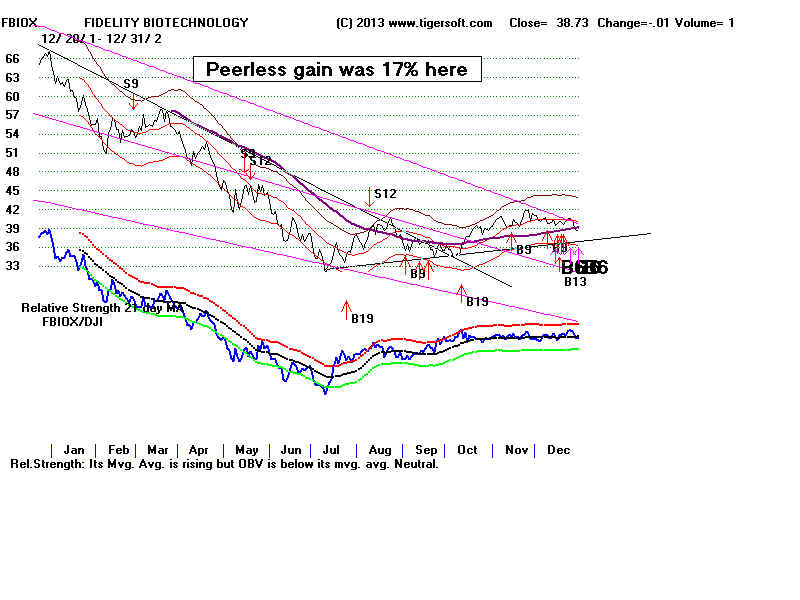

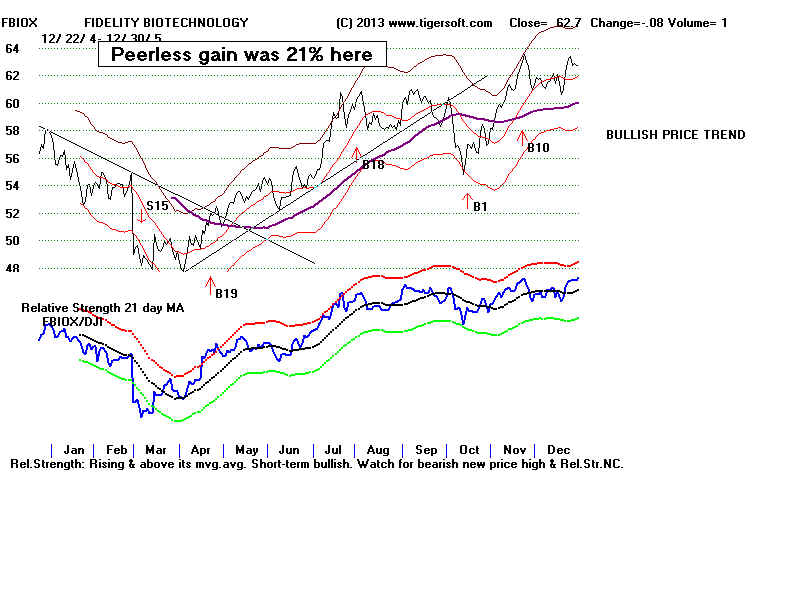

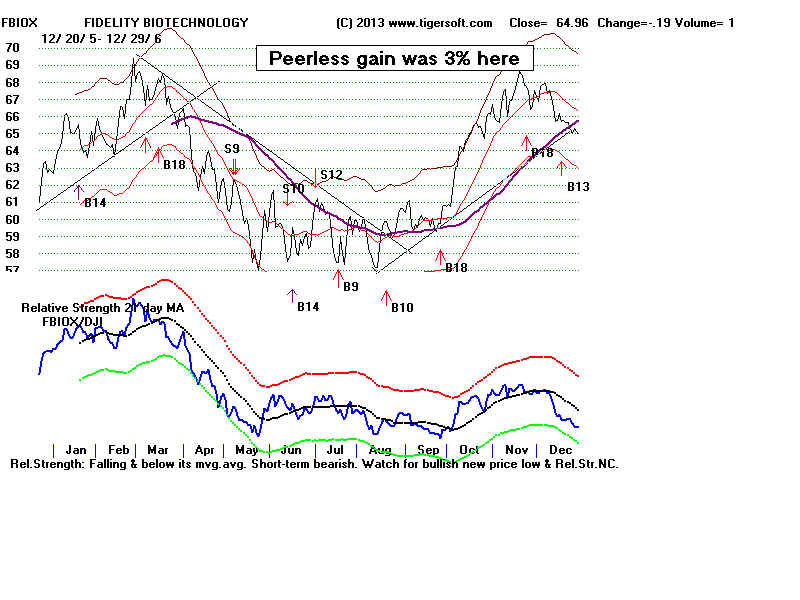

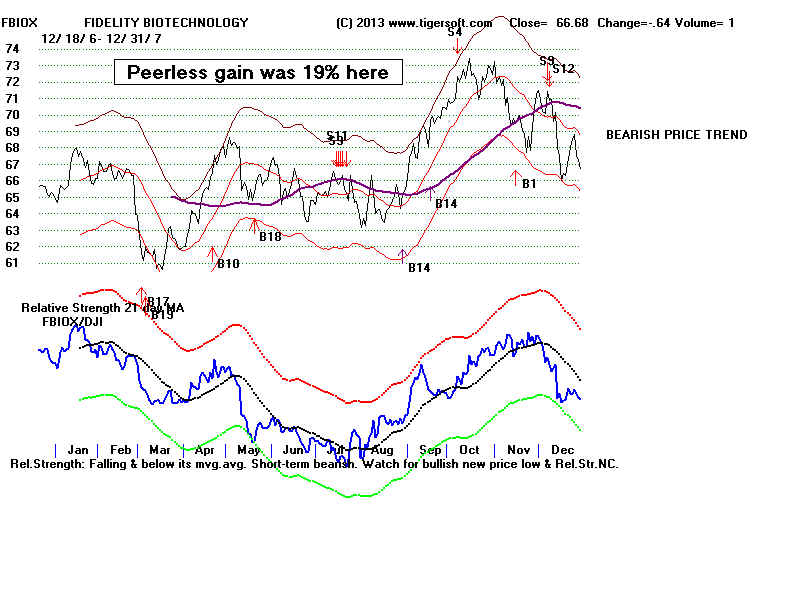

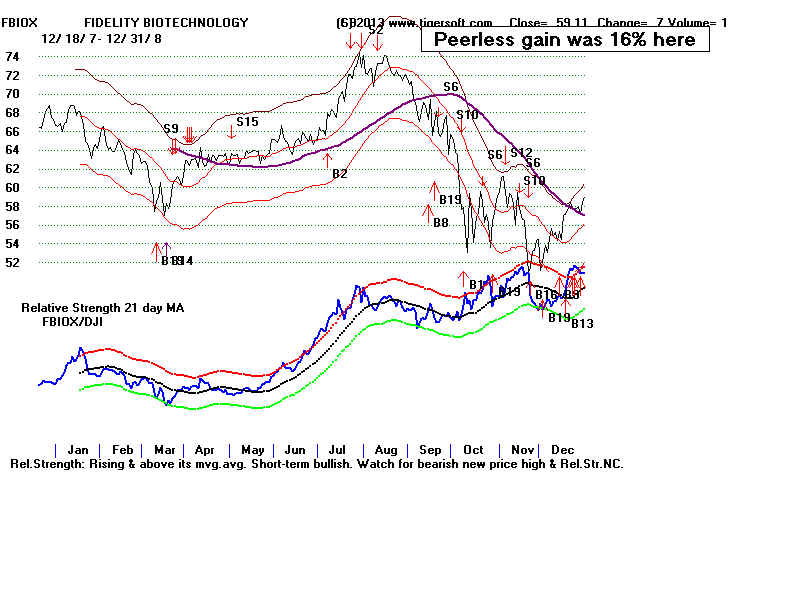

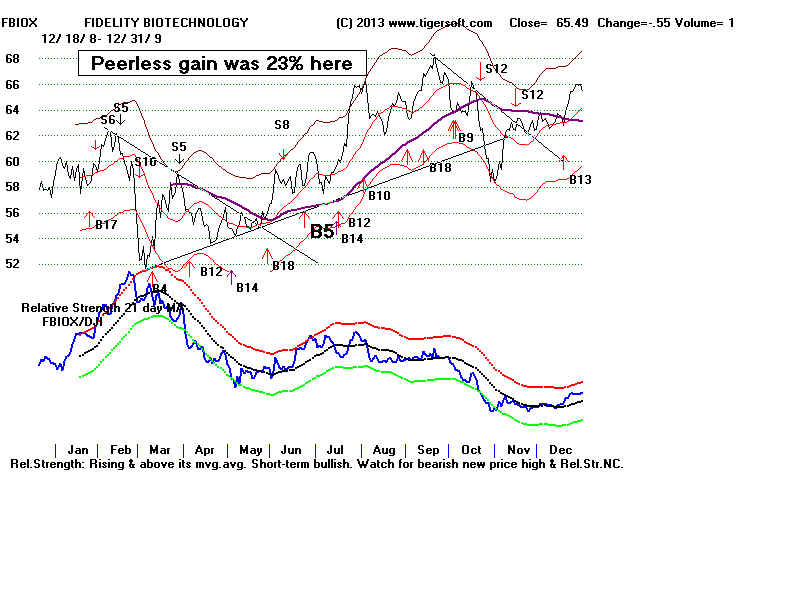

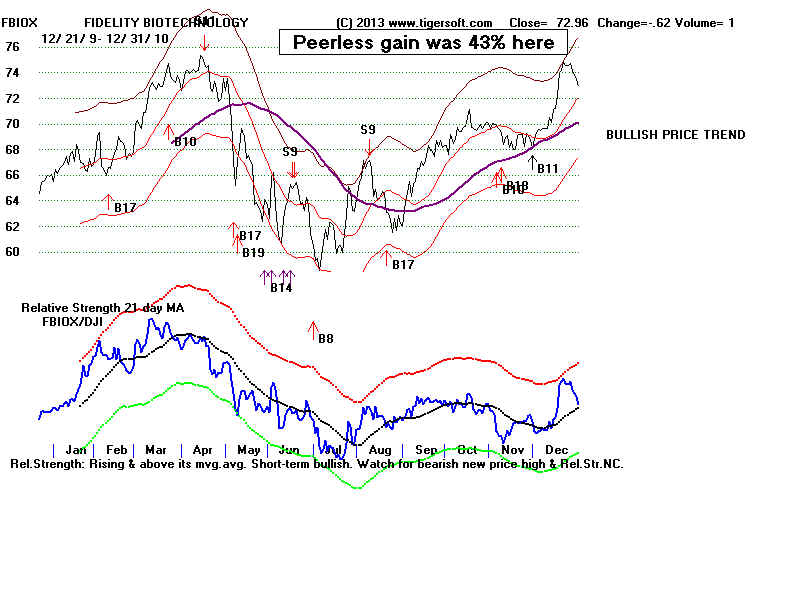

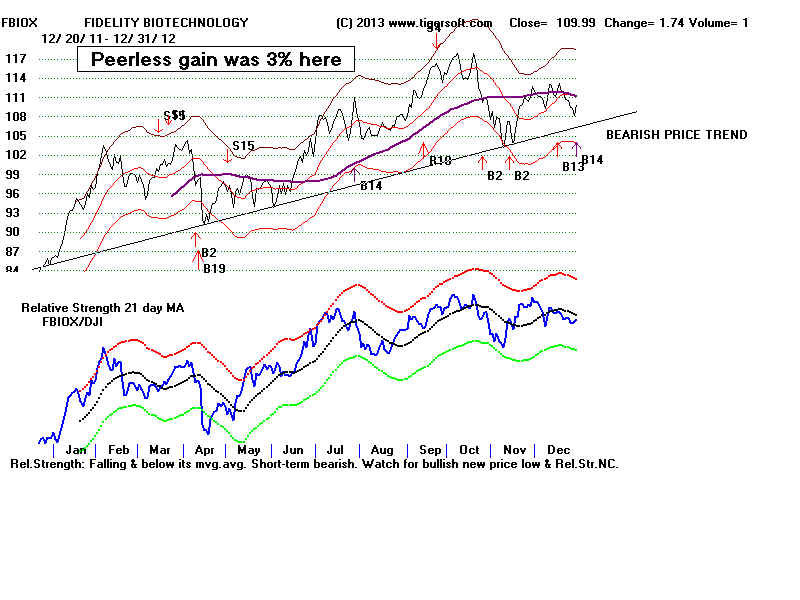

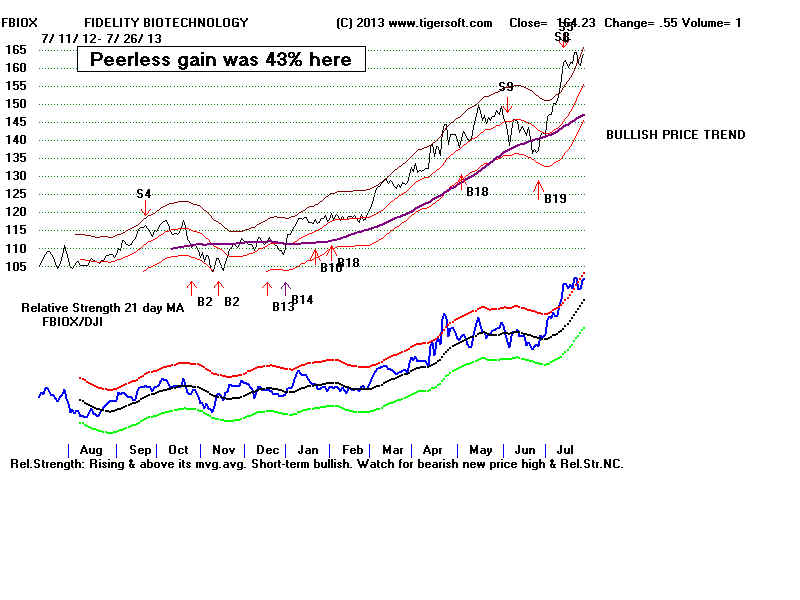

FBIOX Charts and Peerless Signals

2000-2004

Use

Breaks in well-tested trendlines, too.