TigerSoft New Service 4/23/2011

TigerSoft New Service 4/23/2011 Make Money. Use TigerSoft To Track Key Insider Buying and Selling in All Your Stocks

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

WHICH SECTORS MOVE BEST WITH

PEERLESS BUYS AND SELLS

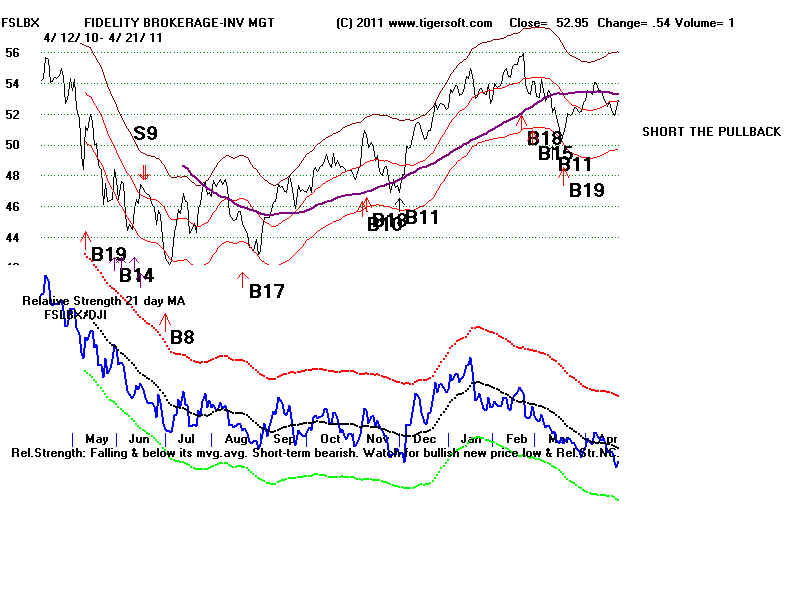

Brokerages Averaged +26%/Year since 1986

By William Schmidt, Ph.D.

Peerless Stock Market Timing: 1915-2011 gives automatic

Buys and Sells on the general market using the

DJIA and various technical tolls Tiger has developed.

The signals have been built, tested and optimized

with market data back to 1915. This study helps address

the question, "What should we best buy and sell using Peerless?"

It has long been apparent that stocks in certain

sectors make the best investments than stocks

in others when Peerless gives a reversing Buy signal.

The study of how well the different Fidelity Sector funds

do when Peerless in on a operative Buy confirms this.

This bigger study here of their performance to 2011

at these times when Peerless is on a Buy starts in

1986 when many of the Fidelity Sector funds began.

The conclusions confirm and also extend what I have learned

in earlier studies of how Peerless Performance varies

by industry sectors.

I have studied 29 Fidelity sector funds. These are the ones

that go back before the year 2000 and for which I could get

all the data needed using Dial Data.

Stocks of Brokerages usually made the best investments

as a group when Peerless goes from Sell to Buy. $1000 invested

in this group, FSLBX, in 1986 would have become $340,200 on 2011,

assuming 2% per round trip trade for commission and slippage.

Dividends were not factored in. Simply Buying when Peerless

gave an automatic Buy and Selling when Peerless gave an

automatic Sell and reinvesting fully all proceeds would grown as

shown in next table.

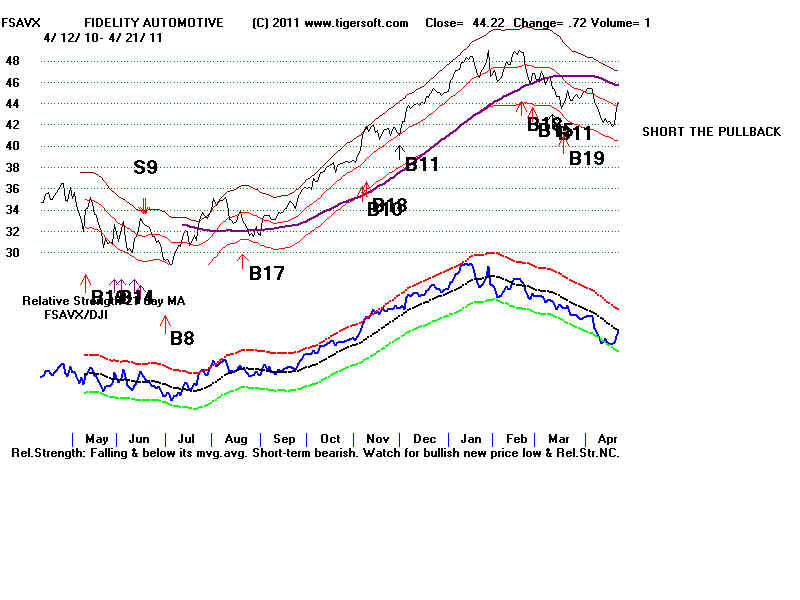

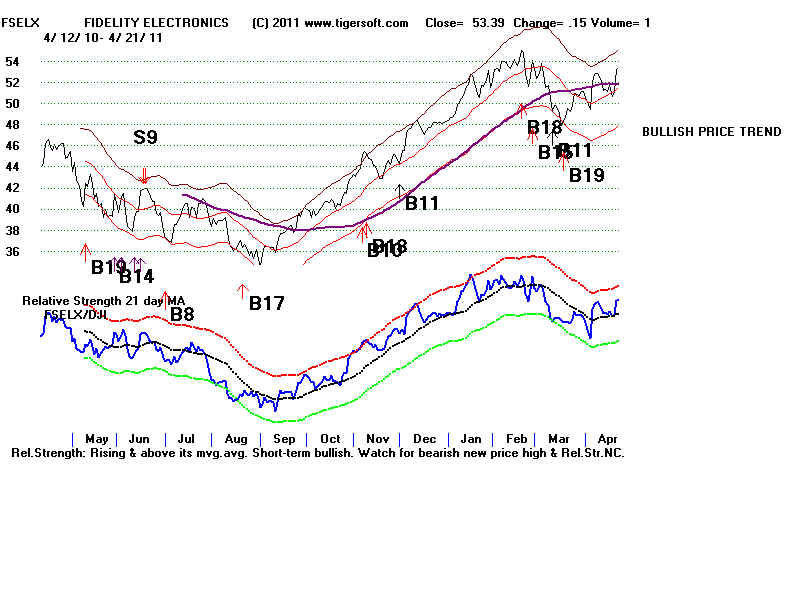

Other Select Funds that did very well were Technology,

Electronics, Computers and Oil Services. Automotives have done

very well since 2008. At the bottom were the "defensive" groups

Utilities, Agriculture and Gold.

PEERLESS TRADING FIDELITY SELECT BROKERAGE FUND

7/9/86 - 3/23/11

1986 $1000

1990 $1416

1994 $3722

1998 $10,266

2002 $32,542

2006 $87,093

2010 $283,509

2011 $340,200 (This is about 26% per year)

|

PEERLESS PROFITS: 1986-2011 FSLBX - FIDELITY BROKERAGE 1 7/ 9/ 86 BUY 12.9 1%

8/ 12/ 86 SELL 13.03 $996

-------------------------------------------------------------------------

2 9/ 11/ 86 BUY 12.22 21.2%

4/ 6/ 87 SELL 14.82 $1180

-------------------------------------------------------------------------

3 5/ 19/ 87 BUY 12.07 4%

6/ 8/ 87 SELL 12.56 $1205

------------------------------------------------------------------------

4 6/ 22/ 87 BUY 12.9 1.3%

8/ 26/ 87 SELL 13.07 $1197

------------------------------------------------------------------------

5 9/ 4/ 87 BUY 12.47 -.1%

10/ 1/ 87 SELL 12.46 $1172

------------------------------------------------------------------------

6 10/ 20/ 87 BUY 7.88 4.1%

10/ 22/ 87 SELL 8.21 $1197

------------------------------------------------------------------------

7 12/ 2/ 87 BUY 7.31 -12.4% Big Loss

12/ 28/ 87 SELL 6.41 $1026

------------------------------------------------------------------------

8 1/ 8/ 88 BUY 6.62 7%

2/ 26/ 88 SELL 7.09 $1078

------------------------------------------------------------------------

9 3/ 25/ 88 BUY 7.08 5.7%

9/ 6/ 88 SELL 7.49 $1119

------------------------------------------------------------------------

10 11/ 11/ 88 BUY 7.46 32.1%

10/ 4/ 89 SELL 9.86 $1457

------------------------------------------------------------------------

11 10/ 17/ 89 BUY 8.97 -5%

1/ 2/ 90 SELL 8.53 $1356

------------------------------------------------------------------------

12 1/ 23/ 90 BUY 8.25 6.4%

7/ 12/ 90 SELL 8.78 $1416

------------------------------------------------------------------------

13 9/ 24/ 90 BUY 6.82 70.9% Big Gain

4/ 14/ 92 SELL 11.66 $2393

------------------------------------------------------------------------

14 8/ 21/ 92 BUY 11.58 59.8% Big Gain

2/ 3/ 94 SELL 18.51 $3778

------------------------------------------------------------------------

15 4/ 5/ 94 BUY 15.44 .5%

10/ 17/ 94 SELL 15.52 $3722

------------------------------------------------------------------------

16 12/ 1/ 94 BUY 14.63 27.9%

2/ 27/ 96 SELL 18.72 $4688

------------------------------------------------------------------------

17 4/ 10/ 96 BUY 18.62 5.3%

5/ 29/ 96 SELL 19.62 $4846

------------------------------------------------------------------------

18 7/ 11/ 96 BUY 18.34 33.8%

4/ 22/ 97 SELL 24.55 $6391

------------------------------------------------------------------------

19 5/ 9/ 97 BUY 26.68 28.4%

9/ 18/ 97 SELL 34.26 $8079

------------------------------------------------------------------------

20 10/ 28/ 97 BUY 34.36 29%

4/ 21/ 98 SELL 44.35 $10266

------------------------------------------------------------------------

21 10/ 1/ 98 BUY 28.26 56.1% Big Gain

6/ 18/ 99 SELL 44.14 $15830

------------------------------------------------------------------------

22 10/ 4/ 99 BUY 40.39 19.6%

12/ 10/ 99 SELL 48.33 $18625

------------------------------------------------------------------------

23 2/ 4/ 0 BUY 46.26 8%

4/ 25/ 0 SELL 49.98 $19750

------------------------------------------------------------------------

24 5/ 3/ 0 BUY 48.05 34.6%

9/ 6/ 0 SELL 64.7 $26199

------------------------------------------------------------------------

25 10/ 20/ 0 BUY 59.73 -1.3%

12/ 8/ 0 SELL 58.96 $25337

------------------------------------------------------------------------

26 3/ 23/ 1 BUY 44.56 6.5%

5/ 17/ 1 SELL 47.49 $26497

------------------------------------------------------------------------

27 9/ 19/ 1 BUY 34.5 21.5%

2/ 26/ 2 SELL 41.95 $31689

------------------------------------------------------------------------

28 7/ 24/ 2 BUY 33.46 4.6%

10/ 15/ 2 SELL 35.03 $32542

------------------------------------------------------------------------

29 11/ 13/ 2 BUY 35.68 10.3%

1/ 6/ 3 SELL 39.36 $35247

------------------------------------------------------------------------

30 1/ 22/ 3 BUY 35.98 35.3%

10/ 15/ 3 SELL 48.71 $47013

------------------------------------------------------------------------

31 11/ 3/ 3 BUY 48.74 11.7%

2/ 11/ 4 SELL 54.46 $51591

------------------------------------------------------------------------

32 5/ 18/ 4 BUY 46.62 2.2%

9/ 2/ 4 SELL 47.68 $51732

------------------------------------------------------------------------

33 10/ 14/ 4 BUY 47.3 18%

12/ 28/ 4 SELL 55.84 $60037

------------------------------------------------------------------------

34 4/ 21/ 5 BUY 51.82 46.3% Big Gain

5/ 5/ 6 SELL 75.85 $86677

------------------------------------------------------------------------

35 6/ 15/ 6 BUY 66.14 2.4%

6/ 30/ 6 SELL 67.78 $87093

------------------------------------------------------------------------

36 7/ 18/ 6 BUY 64.34 14.8%

1/ 5/ 7 SELL 73.91 $98306

------------------------------------------------------------------------

37 3/ 2/ 7 BUY 72.1 6.9%

7/ 17/ 7 SELL 77.13 $103198

------------------------------------------------------------------------

38 9/ 25/ 7 BUY 69.69 6.5%

10/ 15/ 7 SELL 74.25 $107886

------------------------------------------------------------------------

39 11/ 14/ 7 BUY 72.42 1.1%

12/ 6/ 7 SELL 73.25 $106965

------------------------------------------------------------------------

40 3/ 7/ 8 BUY 56.04 5.4%

3/ 24/ 8 SELL 59.09 $110647

------------------------------------------------------------------------

41 7/ 8/ 8 BUY 48.47 5.8%

7/ 23/ 8 SELL 51.3 $114895

-----------------------------------------------------------------------

42 9/ 15/ 8 BUY 46.03 5.6%

9/ 22/ 8 SELL 48.65 $119137

-----------------------------------------------------------------------

43 10/ 8/ 8 BUY 38 -3.9%

10/ 21/ 8 SELL 36.53 $112145

-----------------------------------------------------------------------

44 11/ 21/ 8 BUY 23.58 42.3% Big Gain

1/ 6/ 9 SELL 33.57 $157414

-----------------------------------------------------------------------

45 1/ 21/ 9 BUY 28.26 3.3%

1/ 29/ 9 SELL 29.2 $159502

-----------------------------------------------------------------------

46 2/ 17/ 9 BUY 29.22 -8.7%

2/ 27/ 9 SELL 26.68 $142447

-----------------------------------------------------------------------

47 3/ 12/ 9 BUY 25.62 60.6% Big Gain

6/ 9/ 9 SELL 41.16 $226001

-----------------------------------------------------------------------

48 6/ 23/ 9 BUY 38.41 32.8%

10/ 21/ 9 SELL 51.04 $295794

-----------------------------------------------------------------------

49 11/ 9/ 9 BUY 49.42 -1.3%

11/ 13/ 9 SELL 48.8 $286168

-----------------------------------------------------------------------

50 1/ 22/ 10 BUY 46.68 1%

6/ 16/ 10 SELL 47.18 $283509

-----------------------------------------------------------------------

51 6/ 30/ 10 BUY 42.69 21.9%

3/ 23/ 11 Study Ends 52.08 $340200

4/ 21/ 11 52.95

------------------------------------------------------------------

51 Total long trades

$1000 becomes $340200, allowing 2% slippage per round-trip trade

Average gain using Peerless Buys/Sells=15.5%

Pct of winning trades= 86.2 pct

1 trade resulted in a loss of fmore than 10%

6 gains of more than 40%

|

PEERLESS LONG TRADES AND FIDELITY SECTOR FUNDS

Performance

Thru 3/23/2011

Start

N $1000

Yearly

Avg.

Winning

Pct of Trades

Becomes

Gain Gain/Trade

Trade Pct Losses>10%

=================================================================================

FSLBX Brokerage Inv Mgt

1986 51 $340200

+15.5%

86.2%

1/51

-------------------------------------------------------------------------------------------------------------------------

FSAVX Automotive

1987

47 $105099

+14.6%

74.4%

2/41

-------------------------------------------------------------------------------------------------------------------------

FSELX Electronics

1986

51 $150474

+14.3%

76.4%

3/51

-------------------------------------------------------------------------------------------------------------------------

FDCPX Computer

1986

51 $133558

+13.8%

76.4%

3/51

-------------------------------------------------------------------------------------------------------------------------

FSESX Energy Services

1987 47

$81283

+13.4%

77.5%

4/47

-------------------------------------------------------------------------------------------------------------------------

FSPTX Technology

1986

50 $110951

+13.4%

76.4%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSAIX Air Transp.

1986

50 $114355

+13.4%

76.0%

1/51

-------------------------------------------------------------------------------------------------------------------------

FSCSX Software

1986

51 $90913

+12.6%

80.3%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSDPX Select Materials

1987 49

$86967

+12.6%

75.5%

no big losses

------------------------------------------------------------------------------------------------------------------------

FSRFX Transportation

1989

44 $59394

+12.6%

79.5%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSHOX Construction & Housing 1987 49

$68828.

+12.1%

77.5%

no big losses

------------------------------------------------------------------------------------------------------------------------

FSCGX Industrial Equipment

1987 49 $64964

+11.9%

79.5%

2/51

-------------------------------------------------------------------------------------------------------------------------

FBMPX Multi-Media

1986

51 $55586

+11.5%

76.4%

3/51

-------------------------------------------------------------------------------------------------------------------------

FSRPX Retailing

1986

51 $55732

+11.5%

74.5%

1/51

-------------------------------------------------------------------------------------------------------------------------

FIDSX Financial Servuices

1986 51 $61598

+11.4%

86.2%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSPCX Insurance

1986

51 $72925

+11.4%

94.1%

1/51

-------------------------------------------------------------------------------------------------------------------------

FDLSX Leisure

1986

51 $50011

+11.0%

80.3%

1/51

-------------------------------------------------------------------------------------------------------------------------

FSHCX Chemicals

1986

51 $54039

+10.8%

82.3%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSRBX Banking

1987

47 $28097

+10.6%

73.4%

2/51

-------------------------------------------------------------------------------------------------------------------------

FSTCX Telecommunications

1986 51 $39971

+10.5%

82.3%

3/51

-------------------------------------------------------------------------------------------------------------------------

FSNGX Natural Gas

1994

37 $13980

+10.4%

75.6%

2/37

-------------------------------------------------------------------------------------------------------------------------

FSDAX Military & Aerospac

1986 51 $41931

+10.4%

74.5%

1/37

-------------------------------------------------------------------------------------------------------------------------

FBIOX Biotech

1986

51 $28101

+10.0%

76.4%

2/51

-------------------------------------------------------------------------------------------------------------------------

FCNTX Contra Fund

1986

51 $33793

+9.7%

86.2%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSLEX Environment & Altern Energy 1989 41

$16725

+9.6%

82.9%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSVLX Home Finance

1986

51 $20947

+9.5%

72.5%

3/51

-------------------------------------------------------------------------------------------------------------------------

FDVLX Investment Value

1986

51 $29010

+9.5%

86.3%

1/51

-------------------------------------------------------------------------------------------------------------------------

FSENX Energy

1986

51 $23536

+9.4%

76.4%

3/51

-------------------------------------------------------------------------------------------------------------------------

FSPHX Health Care

1986

51 $14887

+8.1%

74.5%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSCBX Small Cap

1998

31 $5286

+8.0%

74.1%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSAGX Gold

1986

51 $6168

+7.6%

64.7%

10/51

-------------------------------------------------------------------------------------------------------------------------

FDFAX Agriculture

1986

51 $9810

+6.9%

84.3%

no big losses

-------------------------------------------------------------------------------------------------------------------------

FSUTX Utilities Growth

1986

51 $5030

+5.5%

74.5%

1/51

/