NEW HOTLINE 7-21-2023 Tiger

Software (C) 2023

Hotline Address will change Sunday.

Look for email from us giving new address on Saturday.

---------------------------------------------------------------------------

The Hotline's price

is now $440 for a year. To renew please send a check

to William Schmidt, 5834 Kantor STREET, San Diego, CA 92122.

Visa or MC Credit Cards seem to be working again. But checks are

desired,

as the banks are declining too many cards even when the card numbers we

enter are correct. The Data Page for a year is now $240.

william_schmidt@hotmail.com

Recent Peerless Hotlines http://tigersoftware.com/707/oldindex.htm

www.tigersoftware.com/sage22/INDEX.htm

www.tigersoftware.com/dante43/INDEX.htm

www.tigersoftware.com/5HLM/INDEX.htm

-----------------------------------------------------------------------------------------

New Free Book -

DJI History by Decade: 1950-2020: Technicals, Signals

and Events

Events will be added soon for each decade. See 1950-1960 now..

Emphasis is on how FED and also political events shaped market trends.

1950 to 1959-1960 http://tigersoftware.com/z/HISTORY/1950s/decade.htm

1960 to 1969-1970 http://tigersoftware.com/z/HISTORY/1960s/deca-60s.htm

1970 to 1979-1980 http://tigersoftware.com/z/HISTORY/1970s/deca-70s.htm

1980 to 1989-1990 http://tigersoftware.com/z/HISTORY/1980s/decad80s.htm

1990 to 1999-2000 http://tigersoftware.com/z/HISTORY/1990s/deca-90s.htm

2000 to 2009-2010 http://tigersoftware.com/z/HISTORY/2000s/d-2000s.htm

2010 to 2019-2020 http://tigersoftware.com/z/HISTORY/2010s/d-2010s.htm

-------------------------------------------------------------------------------------------------------------------------------------------------

Trading SPY with Tigersoft: 1986-2023

http://www.tigersoftware.com/SPY-book-1989-2023/SPY-Book.htm

===================================================================

Friday

- 6:08 AM - 7/21/2023 - DJI

Futures +58 NASDAQ Futures +100 Data Used - 7/20/2023

| |

7/20/2023

|

|

| |

Market Comments

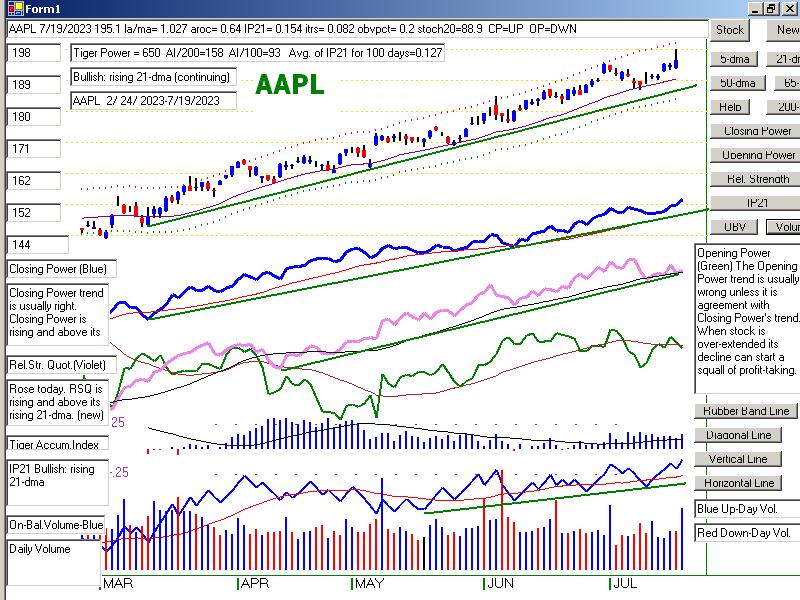

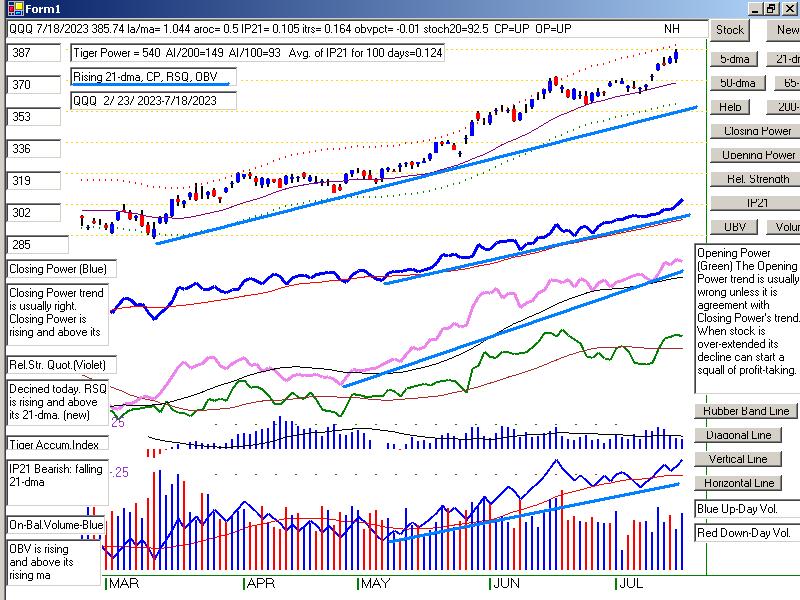

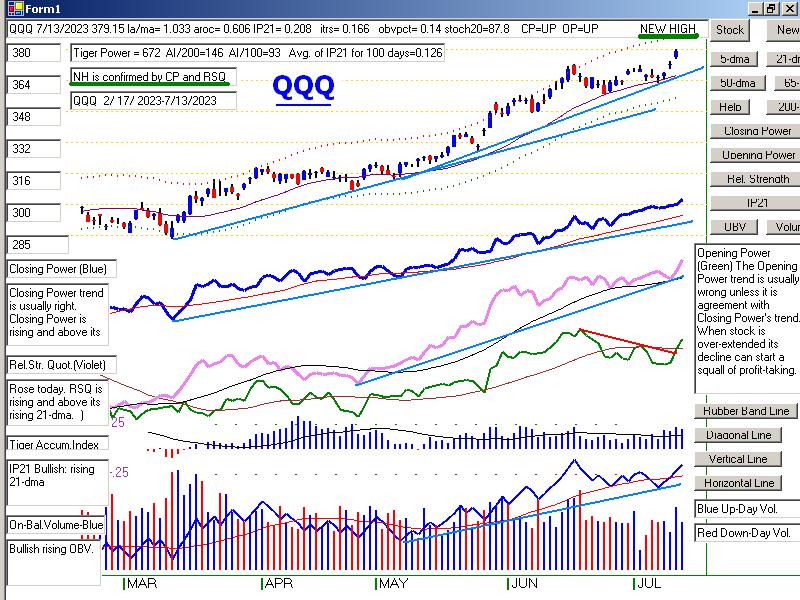

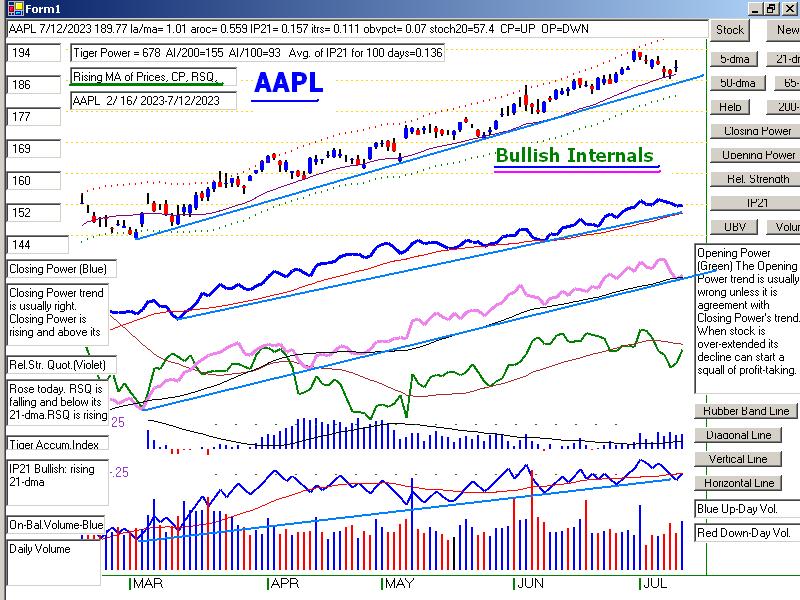

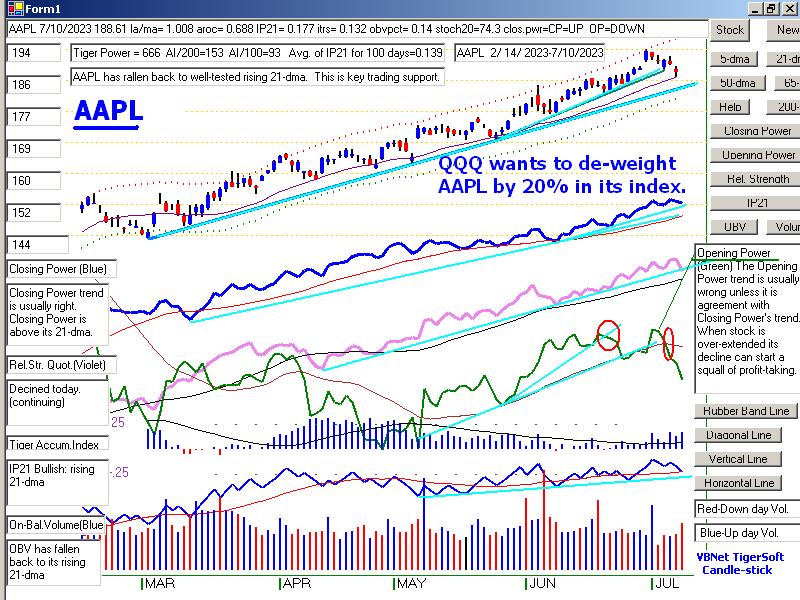

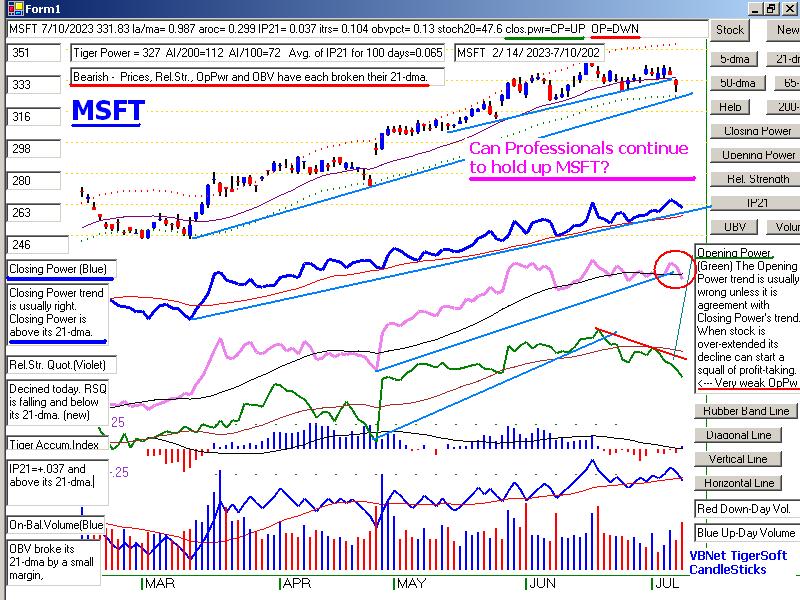

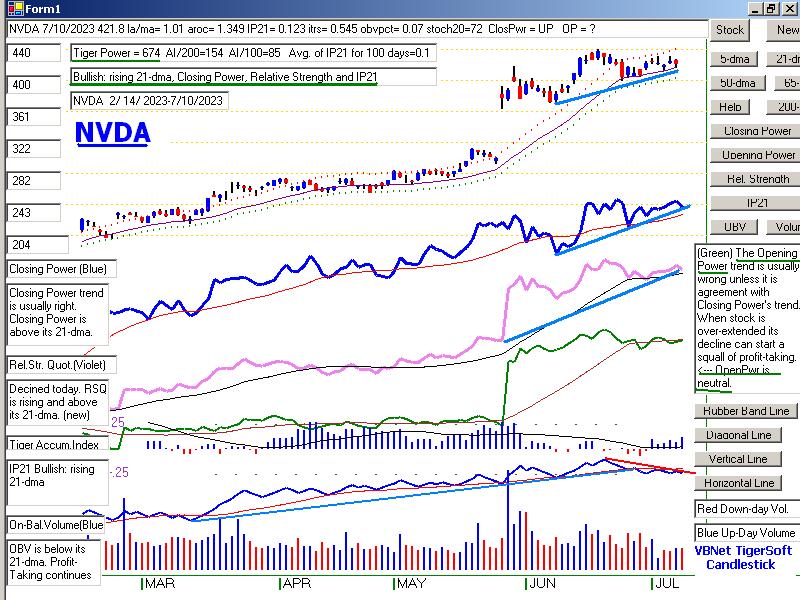

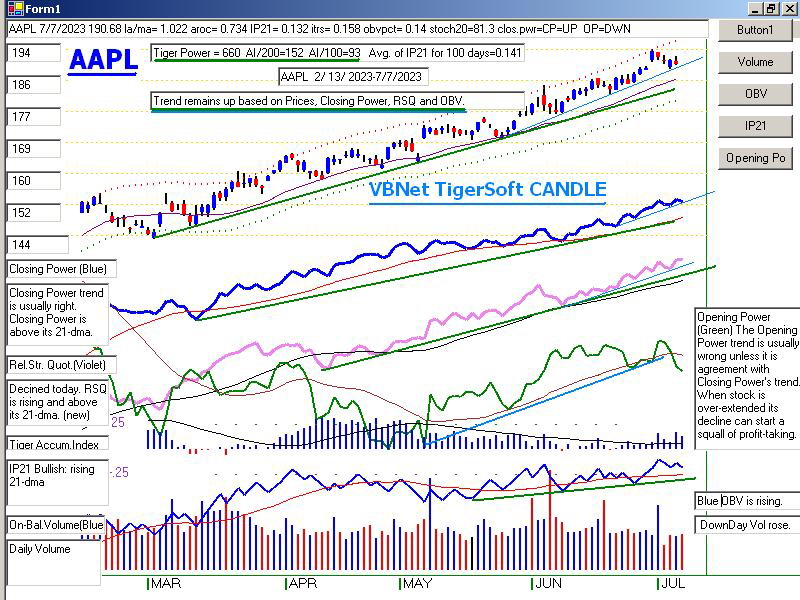

Take partial profits in QQQ tech stocks at the close. Hold others.

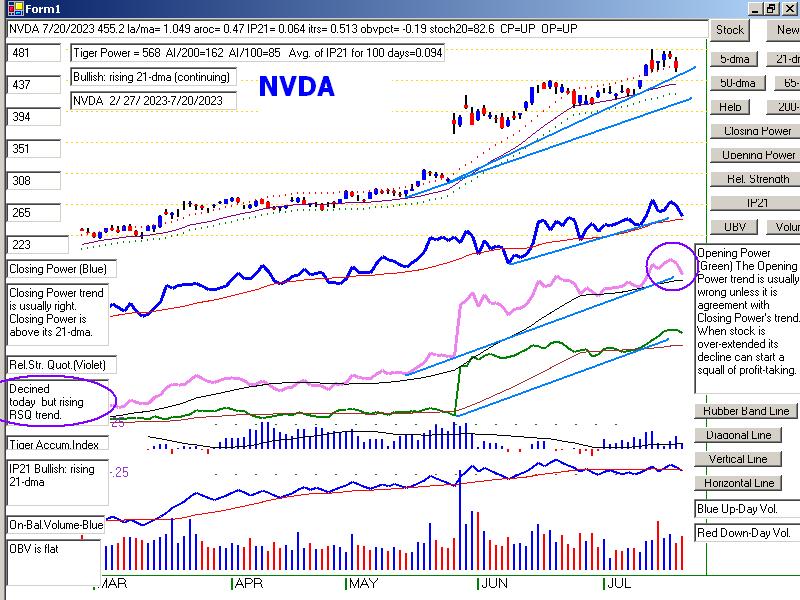

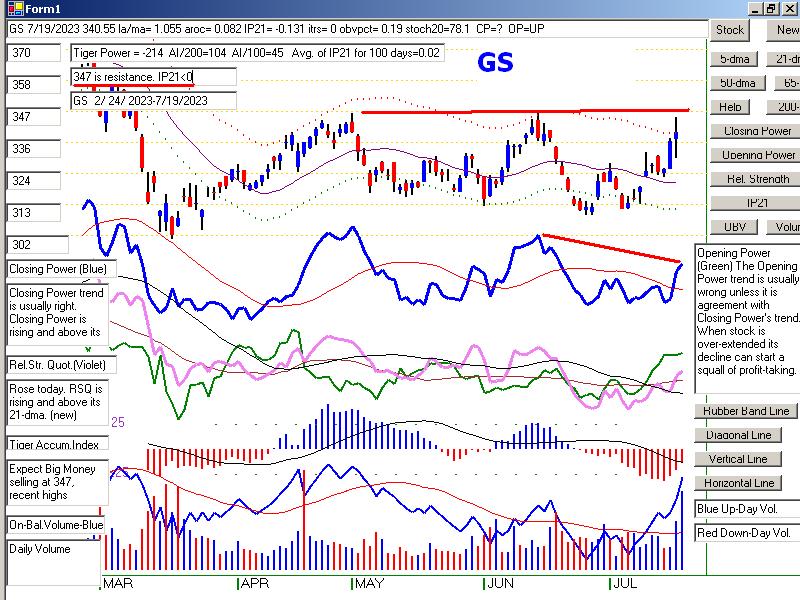

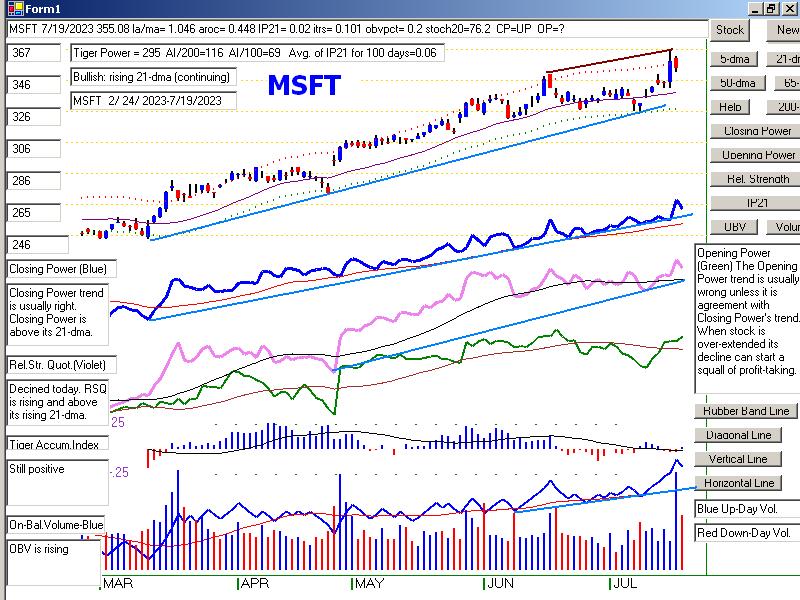

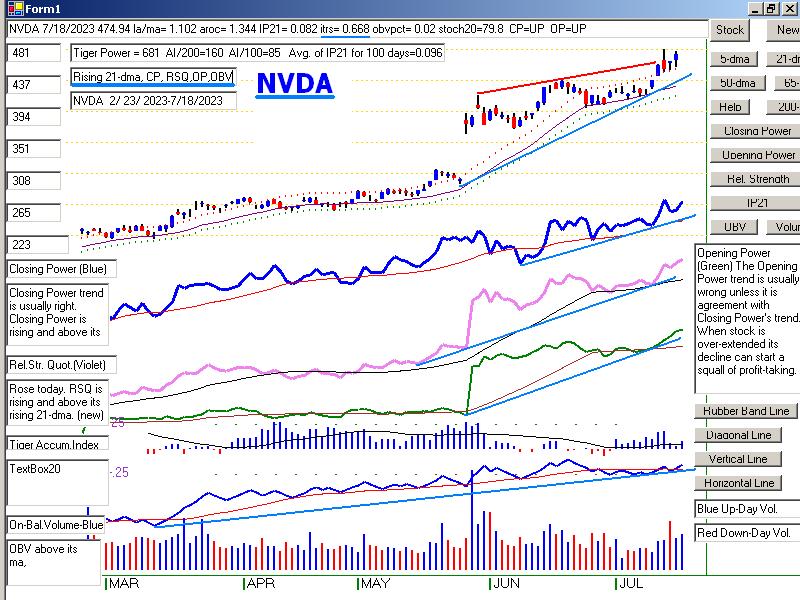

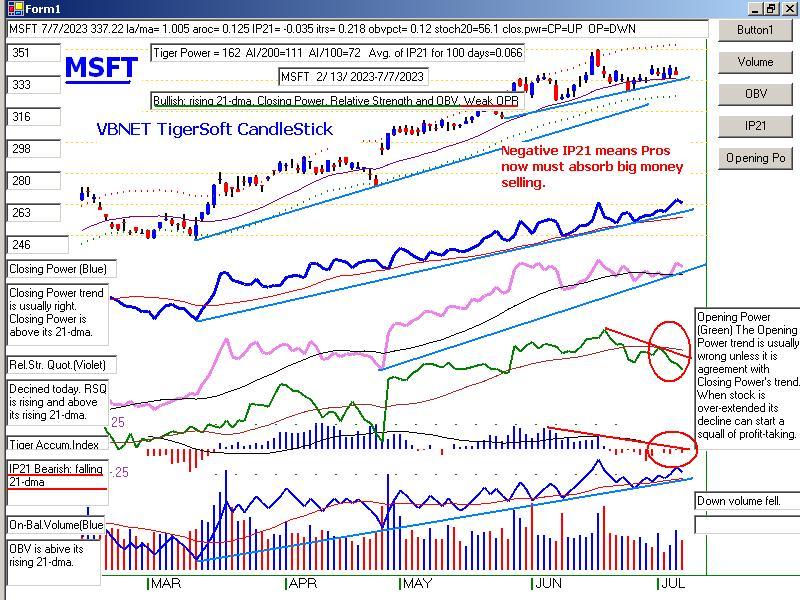

Some investors were put into panic mode by today's 2% bout of selling in

the NASDAQ. Others took some inviting profits in the NASDAQ and tech

stocks that face a coming shakeup in how high capitalization techs are

going to weighted in the QQQ. Accordingly, this shook up the complacency

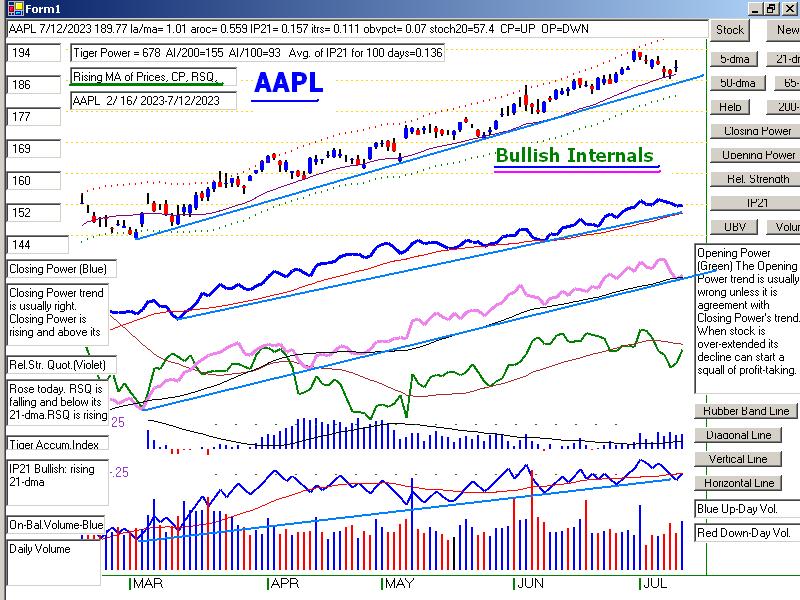

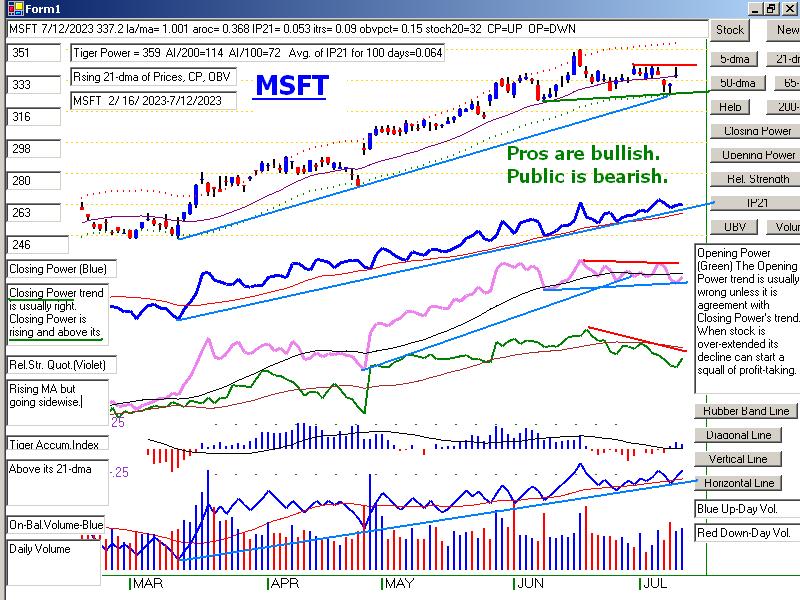

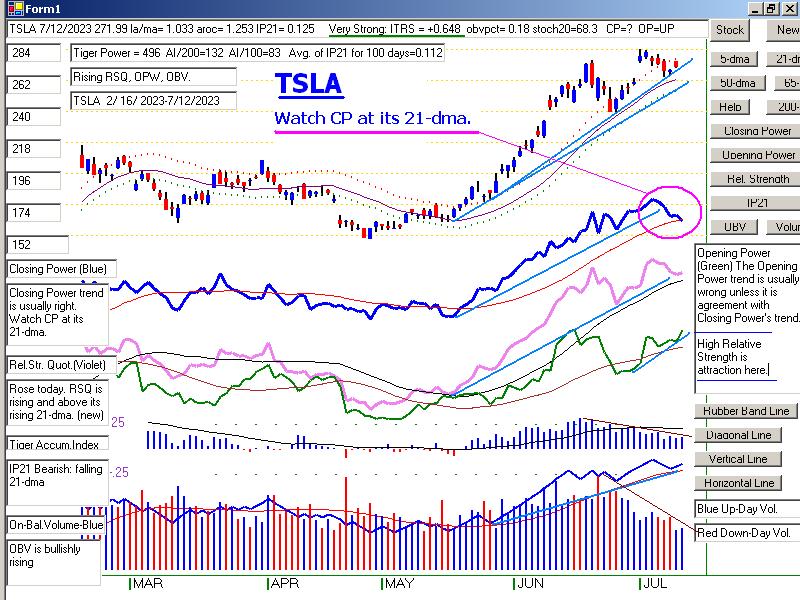

in stocks like MSFT, NVDA, AAPL, TSLA and GOOG.

While this was going on, some Professionals switched their own portfolio

weighting and bought blue chips. The DJI's breakout above 35000

looked inviting enough to buy the big banks like GS, JPM and WFC.

If this is a new bull market, the DJI should rally much more and quickly

get back to 37000.

At the end of the day, the blue-chip buying drove the DJI up to its 2.8% band with

the Peerless V-Indicator still negative. This additional surge in the DJI brought us

a Peerless Sell S9-V. These can occur if the DJI is far enough above the

21-dma and the V-I is negative, breadth is weakening on a daily basic,

the IP21 is not much above 0, and even when the P-Indicator is clearly positive.

The Sell S9-V was just barely achieved today. If the DJI had closed 25 points lower,

there would have been no Sell S9-V.

S9-Vs occurring with the P-Indicator still quite positive have been reliably

bearish.

Below are the 6 instances in the last 30 years. Five brought tradeable declines.

You may want to count the 2011 S9-Vs as a single occurrent. Either way,

the odds of a DJI drop to the lower band after a small additional advance are 80%

if we trust Peerless. But Peerless has a difficult time keeping up when the

FED's suddenly turns "dovish" and the DJI becomes very bullish.

Accordingly,

move

slowly now on account of Peerless.

S9-Vs with Positive PI since 1980

Date LA/MA V-I

P-I Result

-----------------------------------------------------------------------

7/13/2007 1.026 -15

+192 Peerless

trading gain 4.4%

Maximun Paper loss of 0.7%

------------------------------------------------------------------------

7/26/2010 1.041 -11

+442 Peerless

trading gain 2.6%

Maximun Paper loss of 1.5%

------------------------------------------------------------------------

7/5/2011 1.037 -48

+239 Peerless

trading gain 8.6%

Maximun Paper loss of 1.0%

------------------------------------------------------------------------

7/21/2011 1.025 -51

+269 Peerless

trading gain 9.8%

Maximun Paper loss of 1.0%

------------------------------------------------------------------------

7/11/2013 1.025 -25

+258 Peerless

trading gain 3.2%

Maximun Paper loss of 1.3%

------------------------------------------------------------------------

7/15/2020 1.035 -134

+138 Peerless trading loss =

2.1%

Maximun Paper loss of 2.1%

------------------------------------------------------------------------

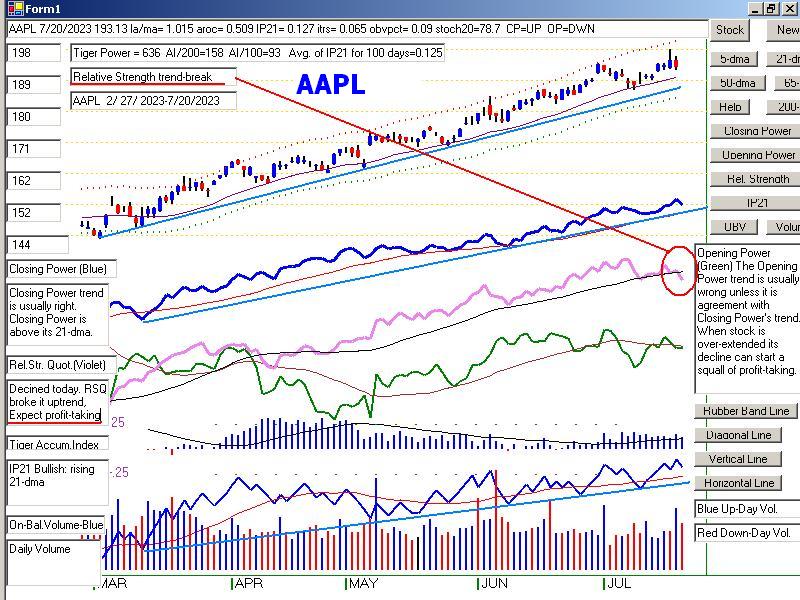

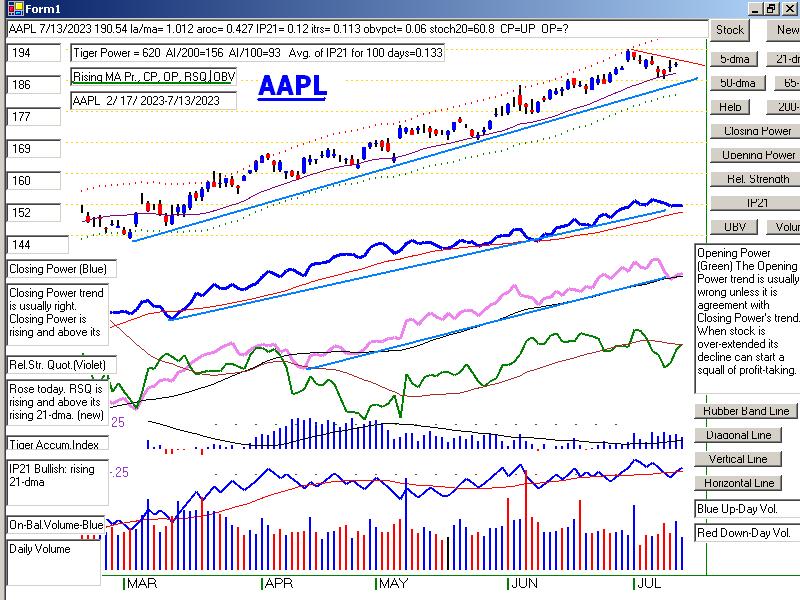

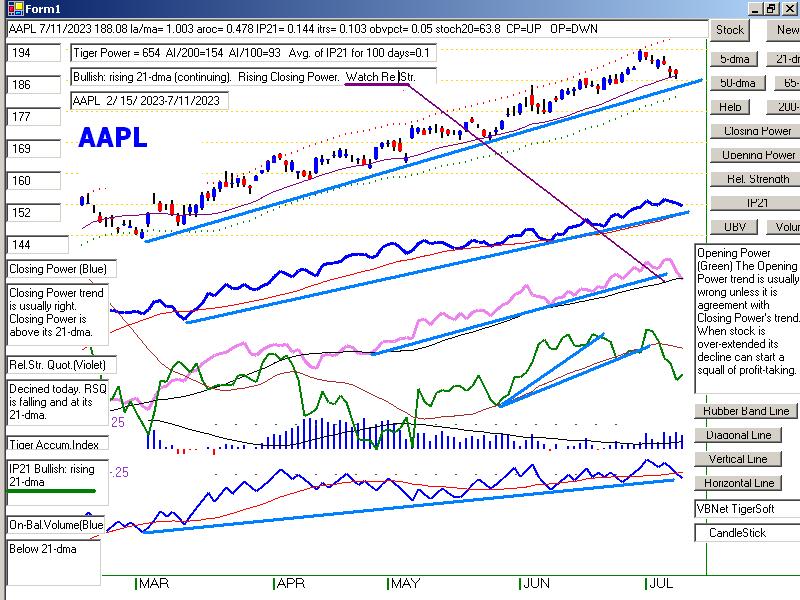

What to do about the weak techs? First, expect profit-taking after a red

candle-stick followed by a Relative Strength Quotient trend-break. Where

the IP21-Accumulation Index is negative, a deeper decline often follows.

Where the IP21 is clearly positive, look for a recovery from support like

the 21-day or at rising uptrend-lines. Where the IP21 is dropping and

drooping, support will not be so forthcoming. Look at the charts shown

below and see how they fared this past year when their Rel Str. Quotient

uptrend-lines were broken.

Given the Sell S9-V, it will probably be best to take trading profits on

a recovery in QQQ and SOXL late Friday. We cannot know how they

will react to the re-balancing do be done on the QQQ on Monday.

There are too few bearish MINCPs to recommend any shorting just

now. Note also that the DJI is apt to find good support at 34700-34800

because of its recent breakout above well-tested resistance.

|

|

| |

7/20/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

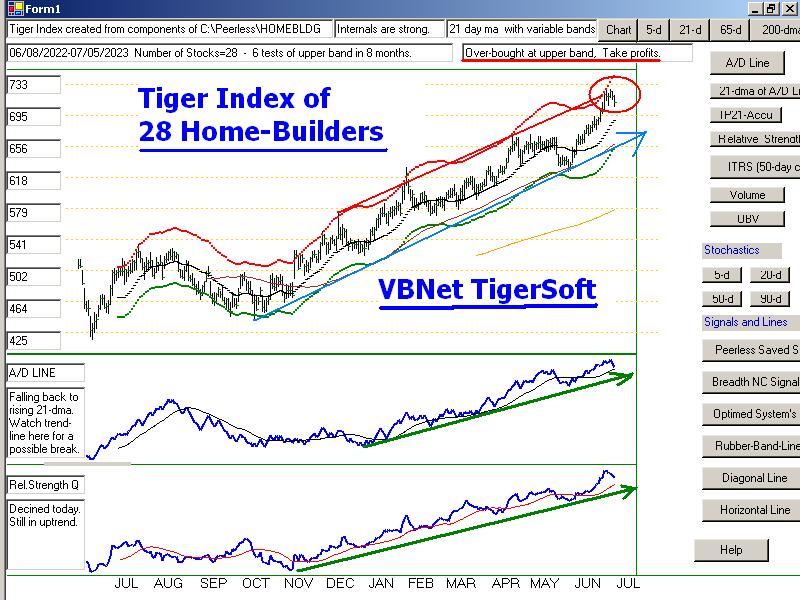

Tiger Index of Big

Banks Bond

Funds Gold Stocks

Housing Stocks

Insurance-Stocks

Regional Banks

Russell-1000

Semi Conductors

2006 vers-Peerless is no loner

vailable. Sorry. It is giving an error message and

without the code cannot be fixed.

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO

BLDP FAS GLD HD IBB JETS JNUG KOL NAIL NUGT

NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA

UGA USO China: YINN CHAU

Commodities: CANE COCO CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks

AA AAPL ADBE ALXN AMAT AMGN AMD AMZN ANET AXON AXP

BA BABA BAC BIDU BLDP BSX CAT CDNS CHKP CNX CPB CRM CVX CMG

DE DIS ENPH FB FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR

LRCX MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL

QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA TXN XOM V VRTX

WFC WMT XLE ZM ZOM

Biggest SEMI-Condctors in SOXL: NVDA. AVGO, AMD. INTC TXN MCHP NXPI AMAT ON

HOMEBUILDERS:

NAIL

BZH HOV MHO MTH PHM -

REGIONAL BANKS:

EGBN FFIC GBCI HMST

Carl Icahn and associates: IEP

MS JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/7-20-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/7-20-2023/Bearish.htm |

|

|

|

|

|

|

|

|

|

Table 1 - Daily Breadth and Volume Statistics

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,032 |

3,047 |

3,045 |

| Advances |

1,231 |

1,919 |

2,061 |

| Declines |

1,694 |

1,018 |

876 |

| Unchanged |

107 |

110 |

108 |

| New

highs |

101 |

162 |

173 |

| New

lows |

10 |

8 |

12 |

| Adv.

volume* |

374,018,282 |

601,213,769 |

579,837,448 |

| Decl.

volume* |

434,467,987 |

273,380,159 |

224,471,779 |

| Total

volume* |

818,780,646 |

891,256,922 |

828,429,787 |

| Closing

Arms (TRIN)† |

0.94 |

0.88 |

0.94 |

| Block

trades* |

3,983 |

4,408 |

4,024 |

| Adv.

volume |

1,613,881,444 |

2,746,262,010 |

2,652,391,667 |

| Decl.

volume |

2,077,935,040 |

1,275,202,033 |

1,060,100,661 |

| Total

volume |

3,761,773,015 |

4,115,674,912 |

3,839,532,858 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,555 |

4,606 |

4,613 |

| Advances |

1,521 |

2,500 |

2,904 |

| Declines |

2,863 |

1,900 |

1,523 |

| Unchanged |

171 |

206 |

186 |

| New

highs |

87 |

266 |

272 |

| New

lows |

74 |

70 |

47 |

| Closing

Arms (TRIN)† |

1.24 |

0.93 |

0.68 |

| Block

trades |

33,699 |

35,941 |

37,524 |

| Adv.

volume |

1,525,825,256 |

2,835,398,574 |

3,797,678,953 |

| Decl.

volume |

3,562,663,475 |

1,999,646,848 |

1,344,514,178 |

| Total

volume |

5,128,028,439 |

5,112,427,542 |

5,183,568,173 |

|

Table 2 QUICKSILVER on ETFS - 7/20/2023 ---

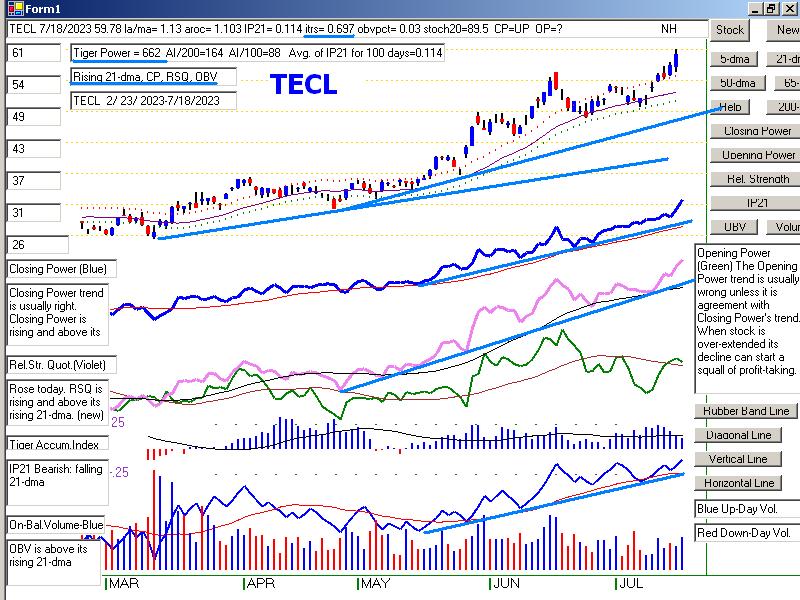

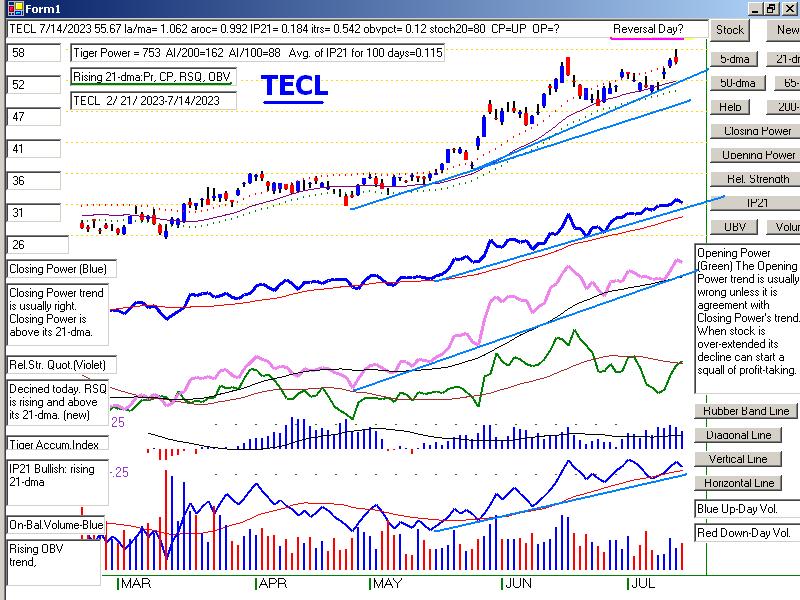

Bullish = 6 (-4) MDY, FAS, RETL, SOXL (+665), TECL (+.584), OIH (.575)

Bearish = 1 UUP

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

==================================================================================================

DIA 352.43 1.74 345.17 122.6% Bullish BLUE .055 0 ------

---------------------------------------------------------------------------------------------

COMPQX 14063.31 -294.71 14113.7 -26.4% Bullish RED .133 .099 .232

---------------------------------------------------------------------------------------------

SPY 452.18 -3.02 449.28 29% Bullish RED .148 .047 .195

---------------------------------------------------------------------------------------------

QQQ 376.76 -8.89 379.07 -31.2% Bullish RED .087 .116 .203

---------------------------------------------------------------------------------------------

MDY 494.88 -2.79 487.89 22.4% Bullish RED .202 .056 .258

---------------------------------------------------------------------------------------------

IWM 195.08 -1.72 191.53 42.7% Bullish RED .076 .073 .149

---------------------------------------------------------------------------------------------

FAS 72.93 1.42 66.35 377.4% Bullish BLUE .264 .214 .478

---------------------------------------------------------------------------------------------

RETL 7.98 -.29 7.45 199.7% Bullish RED .224 .17 .394

---------------------------------------------------------------------------------------------

SOXL 24.29 -3 26.23 -545.1% Bullish RED .055 .61 .665

---------------------------------------------------------------------------------------------

TECL 55.7 -3.61 55.67 -25.1% Bullish RED .109 .475 .584

---------------------------------------------------------------------------------------------

IBB 130.26 -.15 128.24 75.9% Bullish RED -.036 -.053 -.089

---------------------------------------------------------------------------------------------

GLD 182.74 -.93 181.43 20% Bearish RED -.033 -.075 -.108

---------------------------------------------------------------------------------------------

DBO 15.07 .06 14.92 -63.4% ------- RED .216 .021 .237

---------------------------------------------------------------------------------------------

OIH 329.1 -1.72 320.67 48.7% Bullish RED .368 .207 .575

---------------------------------------------------------------------------------------------

CPER 23.65 .1 24.2 -148.6% Bullish RED .19 -.066 .124

---------------------------------------------------------------------------------------------

TAN 71.44 -1.57 70.72 -46.9% Bullish RED -.042 -.027 -.069

---------------------------------------------------------------------------------------------

UUP 27.88 .16 27.62 56.1% Bearish BLUE -.225 -.042 -.267

---------------------------------------------------------------------------------------------

CORN 24.35 -.24 23.16 367.5% Bearish RED -.042 -.016 -.058

---------------------------------------------------------------------------------------------

WEAT 7.1 -.01 6.56 534.5% Bearish RED -.107 .034 -.073

---------------------------------------------------------------------------------------------

YINN 35.1 -.39 37.98 -672.5% Bullish BLUE .134 -.236 -.102

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

7/20/23

Bullish = 44

Bearish = 3

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 1 1 .714 .714 1

COAL 1 .666 .5 .5 .5 .5

HOMEBLDG 1 1 1 .964 .964 1

TRANSP 1 1 .947 .947 .947 1

REGBANKS .947 .947 .947 .842 .736 .894

GUNS .928 .785 .785 .785 .785 .785

FINANCE .9 .912 .9 .837 .8 .837

INSURANC .88 .64 .64 .6 .48 .52

INFRA .87 .87 .806 .806 .838 .935

NIFTY .863 .84 .84 .909 .84 .954

COPPER .857 1 1 .857 1 1

AUTO .849 .867 .849 .83 .867 .867

DJI-13 .846 .692 .692 .538 .461 .538

JETS .846 .846 .846 .846 .846 .846

ETFS .836 .854 .818 .836 .836 .872

FIDSTKS .822 .751 .739 .721 .745 .786

RUS-1000 .821 .806 .77 .753 .758 .795

OILGAS .814 .762 .773 .67 .68 .814

SP500 .812 .771 .743 .727 .747 .792

NASD-100 .811 .801 .782 .792 .801 .801

SP-100 .811 .722 .7 .655 .677 .744

HIGHPRIC .809 .818 .809 .792 .783 .779

INDEXES .805 .783 .794 .751 .762 .778

RETAIL .804 .782 .782 .76 .739 .804

COMODITY .8 .775 .7 .625 .65 .65

-------------------------------------------------------------------------------------------------

REIT .795 .844 .819 .811 .819 .877

UTILITY .794 .538 .41 .435 .564 .641

INDMATER .791 .777 .75 .694 .694 .708

CHEM .79 .767 .744 .697 .674 .744

SEMI .782 .847 .847 .847 .804 .88

BONDFUND .77 .827 .747 .655 .586 .712

HOSPITAL .769 .769 .769 .615 .692 .692

MILITARY .769 .692 .653 .73 .692 .769

SOFTWARE .767 .785 .767 .767 .732 .785

DOWJONES .766 .666 .666 .566 .533 .6

COMPUTER .75 .75 .75 .8 .8 .85

ELECTRON .744 .781 .766 .751 .729 .789

GAMING .736 .736 .684 .684 .631 .736

EAT .731 .78 .756 .682 .756 .78

BEVERAGE .714 .571 .357 .5 .642 .428

FOOD .714 .693 .673 .591 .632 .632

SOLAR .687 .687 .687 .687 .437 .687

GREEN .666 .666 .722 .666 .555 .666

==================================================================================================

EDU .5 .5 .333 .166 .166 .166

HACKERS .5 .5 .437 .437 .437 .625

MARIJUAN .5 .5 .4 .4 .3 .5

==================================================================================================

BIOTECH .484 .492 .479 .459 .426 .454

LOWPRICE .469 .466 .454 .422 .413 .495

GOLD .466 .755 .755 .466 .4 .4

CHINA .341 .341 .365 .439 .463 .56

|

=================================================================================

Thursday

- 6:08 AM - 7/20/2023 - DJI

Futures +18 NASDAQ Futures -100 Data

Used - 7/19/2023

| |

|

|

| |

The DJI is now above the psychological resistance of 35000. It did this

in part

because Professionals believe the FED has become more dovish

as a result

of falling inflation numbers and the coming resignation of St.Louis

Regional

Fed Chairman Ballard (the super hawk on the FOMC). It also made

its

breakout in no small measure because of how easily Professionals

can

minipulate the DJI, as they please.

We may not

like it, but we can better trade by watching them and seeing what

they are

tryng to accomplish. Thus, it is significant how easily they ran

up the

highest priced DJI-30 stock, UNH, when they were ready for a

breakout in

the DJI. UNH jumped up 54 points this last week. This had

the effect

of raising the DJI by 362 points. all by itelf.

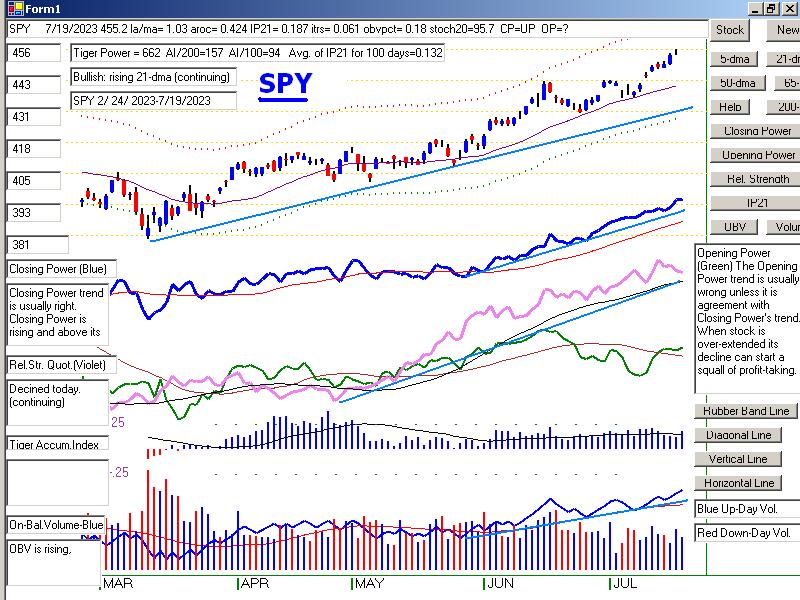

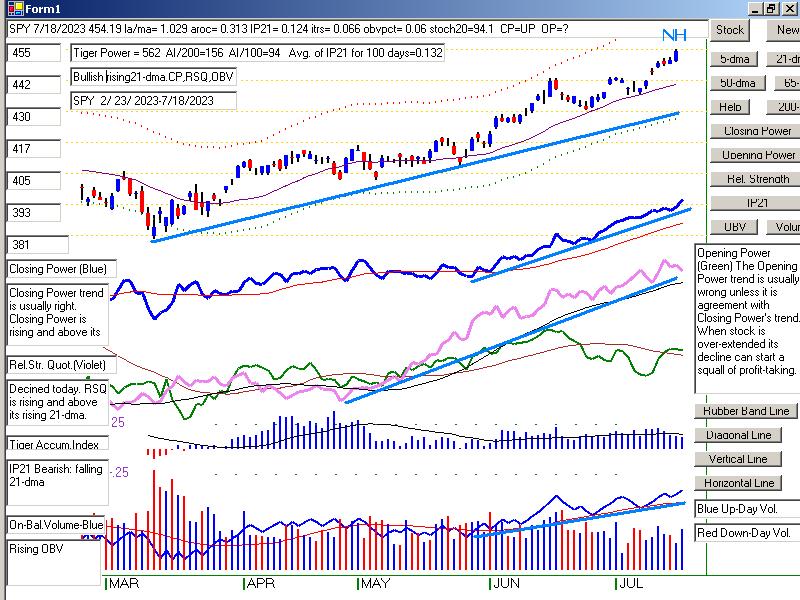

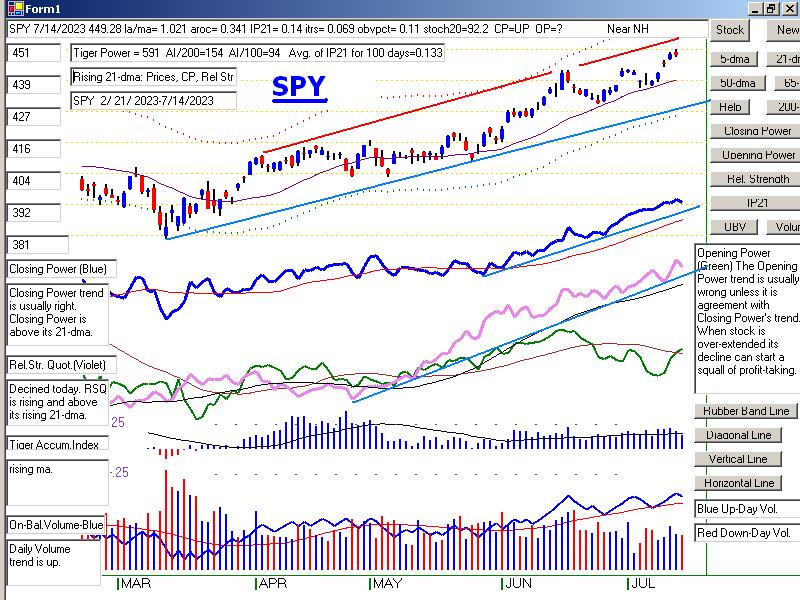

Professionals run the market to make more money. That the Closing Powers

of DIA,

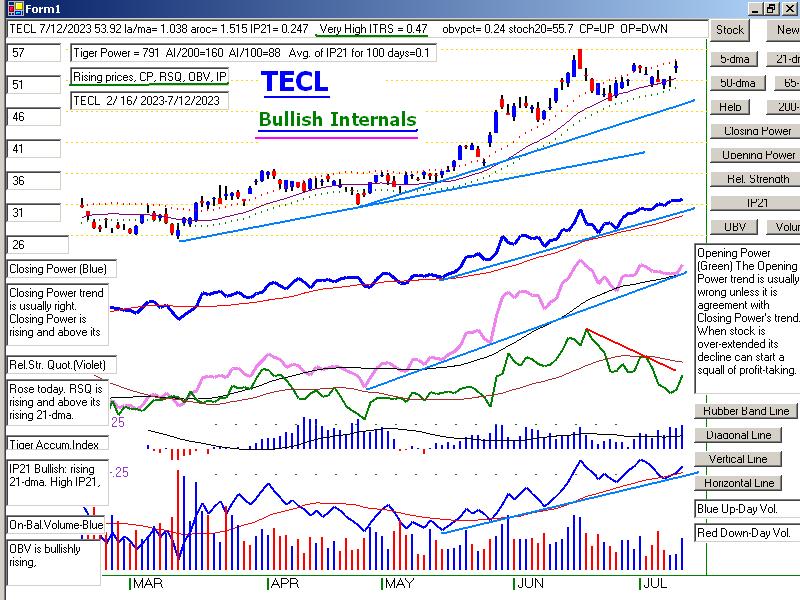

SPY, QQQ, he NASDAQ, TECL, SOXL are all now rising tells

us what to

do. While this is true, stay long the techs, NVDA and SOXL.

Any retreat

is apt to be minor. As for the DJI, it has achieved a flat-topped

breakout

with confirming breadth. This is more important than the volume

non-confirmations. The target now for the DJI is its old highs near 37000.

|

|

| |

7/19/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Tiger Index of Big

Banks Bond

Funds Gold Stocks

Housing Stocks

Insurance-Stocks

Regional Banks

Russell-1000

Semi Conductors

Recent 2006 vers-Peerless signals http://tigersoftware.com/oldpeer/UPD90719.bmp

Note the old Buy "b" trading signals. They are not safe to use when

A/D Line

is below its 21-dma: See OLD06

OLD0607

OLD07 OLD0708 OLD08 OLD0809

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO

BLDP FAS GLD HD IBB JETS JNUG KOL NAIL NUGT

NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA

UGA USO China: YINN CHAU

Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks

AA AAPL ADBE ALXN AMAT AMGN AMD AMZN ANET AXON AXP

BA BABA BAC BIDU BLDP BSX CAT CDNS CHKP CNX CPB CRM CVX CMG

DE DIS ENPH FB FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR

LRCX MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL

QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA TXN XOM V VRTX

WFC WMT XLE ZM ZOM

HOMEBUILDERS:

NAIL

BZH HOV MHO MTH PHM -

REGIONAL BANKS: EGBN FFIC GBCI HMST

Carl Icahn and

associates: IEP MS JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/7-19-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/7-19-2023/Bearish.htm |

|

|

|

|

|

SOXL

|

|

|

|

|

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,047 |

3,047 |

3,036 |

| Advances |

1,919 |

2,103 |

2,136 |

| Declines |

1,018 |

844 |

816 |

| Unchanged |

110 |

100 |

84 |

| New

highs |

162 |

202 |

216 |

| New

lows |

8 |

16 |

10 |

| Adv.

volume* |

601,213,769 |

609,465,260 |

592,978,611 |

| Decl.

volume* |

273,380,159 |

255,738,251 |

276,313,291 |

| Total

volume* |

891,256,922 |

871,986,575 |

874,027,340 |

| Closing

Arms (TRIN)† |

0.88 |

1.09 |

1.13 |

| Block

trades* |

4,408 |

4,272 |

4,211 |

| Adv.

volume |

2,746,262,010 |

2,820,658,461 |

2,723,590,320 |

| Decl.

volume |

1,275,202,033 |

1,236,988,333 |

1,174,341,830 |

| Total

volume |

4,115,674,912 |

4,090,019,323 |

3,920,298,203 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,606 |

4,569 |

4,573 |

| Advances |

2,500 |

2,692 |

2,893 |

| Declines |

1,900 |

1,689 |

1,506 |

| Unchanged |

206 |

188 |

174 |

| New

highs |

266 |

270 |

225 |

| New

lows |

70 |

99 |

52 |

| Closing

Arms (TRIN)† |

0.93 |

0.94 |

1.14 |

| Block

trades |

35,941 |

32,800 |

37,679 |

| Adv.

volume |

2,835,398,574 |

2,994,646,327 |

3,236,162,650 |

| Decl.

volume |

1,999,646,848 |

1,769,899,690 |

1,918,434,775 |

| Total

volume |

5,112,427,542 |

4,824,073,039 |

5,230,624,543 |

|

Table 2 QUICKSILVER on ETFS - 7/19/2023 ---

Bullish = 10 COMPQX, SPY, QQQ, MDY, FAS, RETL, SOXL (+.937), TECL (+.732), DBO, OIH

-------------

Bearish = 1 UUP

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

==================================================================================================

DIA 350.69 1.11 343.92 102.1% Bullish BLUE .072 0 -----

---------------------------------------------------------------------------------------------

COMPQX 14358.02 4.38 14138.57 155.1% Bullish RED .192 .132 .324

---------------------------------------------------------------------------------------------

SPY 455.2 1.01 449.56 102% Bullish BLUE .188 .062 .25

---------------------------------------------------------------------------------------------

QQQ 385.65 -.09 379.15 168.9% Bullish RED .159 .153 .312

---------------------------------------------------------------------------------------------

MDY 497.67 1.66 492.67 76.5% Bullish ---- .235 .066 .301

---------------------------------------------------------------------------------------------

IWM 196.8 .83 193.42 127.5% Bullish BLUE .119 .087 .206

---------------------------------------------------------------------------------------------

FAS 71.51 .84 67.73 326.4% Bullish BLUE .216 .205 .421

---------------------------------------------------------------------------------------------

RETL 8.27 .44 7.67 247.3% Bullish BLUE .242 .243 .485

---------------------------------------------------------------------------------------------

SOXL 27.29 -.97 27.28 295.2% Bullish RED .092 .845 .937

---------------------------------------------------------------------------------------------

TECL 59.31 -.47 55.99 475.8% Bullish RED .154 .578 .732

---------------------------------------------------------------------------------------------

IBB 130.41 .69 128.3 95.2% Bullish BLUE .014 -.053 -.039

---------------------------------------------------------------------------------------------

GLD 183.67 .03 182.01 49.1% Bearish BLUE .008 -.062 -.054

---------------------------------------------------------------------------------------------

DBO 15.01 -.02 15.26 6.7% ------- RED .252 .044 .296

---------------------------------------------------------------------------------------------

OIH 330.82 -.67 325.92 108.1% Bullish BLUE .391 .223 .614

---------------------------------------------------------------------------------------------

CPER 23.55 -.1 24.36 -46% ------- BLUE .233 -.057 .176

---------------------------------------------------------------------------------------------

TAN 73.01 .12 72.12 117.2% Bullish RED -.057 -.002 -.059

---------------------------------------------------------------------------------------------

UUP 27.72 .11 27.57 -7.2% Bearish ---- -.317 -.039 -.356

---------------------------------------------------------------------------------------------

CORN 24.59 .75 22.63 603.9% Bearish RED -.011 -.007 -.018

---------------------------------------------------------------------------------------------

WEAT 7.11 .46 6.39 617.1% Bearish BLUE -.034 .034 0

---------------------------------------------------------------------------------------------

YINN 35.49 .59 40.1 -280.6% Bullish RED .072 -.2 -.128

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

7/19/23

Bullish = 44

Bearish = 3

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 1 .714 .714 1 .857

COPPER 1 1 .857 1 1 .857

HOMEBLDG 1 1 .964 .964 1 1

TRANSP 1 .947 .947 .947 1 1

REGBANKS .947 .947 .842 .736 .894 .736

FINANCE .912 .9 .837 .787 .837 .762

INFRA .87 .806 .806 .838 .935 .806

AUTO .867 .867 .83 .867 .867 .849

ETFS .854 .818 .836 .836 .89 .763

JETS .846 .846 .846 .846 .846 .846

SEMI .846 .846 .846 .802 .868 .835

REIT .844 .811 .819 .827 .868 .86

NIFTY .84 .84 .909 .84 .954 .909

BONDFUND .827 .735 .655 .597 .712 .586

HIGHPRIC .818 .809 .792 .783 .779 .766

RUS-1000 .806 .77 .753 .758 .79 .779

NASD-100 .801 .782 .792 .801 .792 .772

GUNS .785 .785 .785 .785 .785 .785

SOFTWARE .785 .785 .767 .732 .767 .732

INDEXES .783 .794 .751 .762 .778 .74

RETAIL .782 .782 .76 .739 .782 .782

ELECTRON .781 .766 .751 .729 .781 .766

EAT .78 .756 .682 .756 .78 .756

INDMATER .777 .75 .694 .694 .708 .68

COMODITY .775 .725 .6 .65 .65 .55

SP500 .771 .743 .727 .745 .79 .763

HOSPITAL .769 .769 .615 .692 .692 .615

CHEM .767 .744 .697 .674 .744 .767

OILGAS .762 .773 .67 .68 .814 .773

GOLD .755 .755 .466 .4 .355 .333

FIDSTKS .751 .739 .721 .745 .786 .775

COMPUTER .75 .75 .8 .8 .85 .85

GAMING .736 .684 .631 .684 .736 .736

SP-100 .722 .7 .655 .677 .744 .711

FOOD .693 .693 .571 .632 .632 .53

DJI-13 .692 .692 .538 .461 .538 .538

MILITARY .692 .653 .73 .692 .769 .769

SOLAR .687 .687 .687 .437 .625 .437

COAL .666 .5 .5 .5 .5 .5

DOWJONES .666 .666 .566 .533 .6 .6

GREEN .666 .722 .666 .555 .666 .611

INSURANC .64 .64 .6 .48 .52 .52

BEVERAGE .571 .357 .5 .642 .428 .357

UTILITY .538 .41 .435 .564 .641 .564

=================================================================================================

EDU .5 .333 .166 .166 .166 .166

HACKERS .5 .437 .437 .437 .625 .625

MARIJUAN .5 .4 .4 .3 .5 .4

=================================================================================================

BIOTECH .489 .477 .461 .426 .454 .459

LOWPRICE .466 .457 .425 .413 .48 .448

CHINA .341 .365 .439 .463 .56 .463

|

===================================================================================

Wednesday - 6:03

AM - 7/19/2023 - DJI Futures +1

NASDAQ Futures +34 Data

Used - 7/18/2023

| |

7/18/2023

|

|

| |

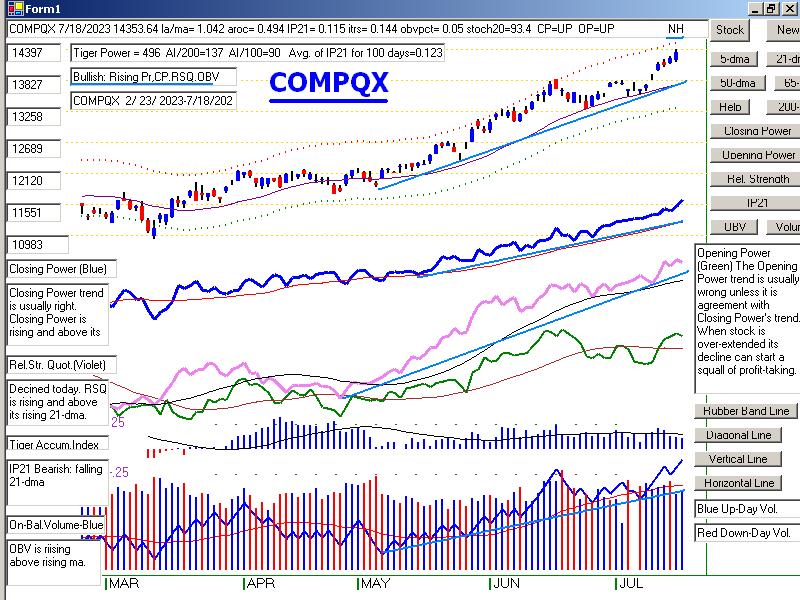

Market Comments

Give the DJI more time to get above the psychological resistance at 35000.

It turns out that the Peerless system is pretty smart. We did not get a Sell S9-v

or an S12 signal on the 18th because the P-Indicator was not below +199.

(You can prove this if you have the programs. If you change the declines for

18th from 844 to 2103, then the P-I falls to 198 and a S9V occurs.)

Breadth at the current levels outweighs volume as measured by the V-Indicator,

IP21 and OBVPct. The DJI may be the forgotten index, while the NASDAQ, SPY,

QQQ, TECL, SOXL and many tech stocks roar higher. But that does not mean

those who are loyal to the blue chips are willing to sell them. After all, what

choice

do they have. 10-Year Treasury bonds now yield less than 3.8%, hardly keeping

pace with inflation.

Meanwhile, the Closing Power uptrends show us how bullish Professionals

are and how confident they are that the FED will not dare raise rates much higher

with Inflation falling and down to 3%. The Relative Strength and Power Index

Lines show us where to put money, as it's usually a very good idea to bet on

"the first out of the gate" when a new bull market starts. I've seen this

strategy

work time after time, 1967, 1970, 1975, 1983, 1993-5, 2009 and 2020.

Stay long the strong. Their charts are shown below. The recovery in bank

stocks, including regional banks, shows us that bulls are now betting confidently

against the remaining "hawks" on the FOMC.

|

|

| |

7/18/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Tiger Index of Big

Banks Bond

Funds Gold Stocks

Housing Stocks

Insurance-Stocks

Regional Banks

Russell-1000

Semi Conductors

Recent 2006 vers-Peerless signals http://tigersoftware.com/oldpeer/UPD90718.bmp

Note the old Buy "b" trading signals. They are not safe to use when

A/D Line

is below its 21-dma: See OLD06

OLD0607

OLD07 OLD0708 OLD08 OLD0809

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO

BLDP FAS GLD HD IBB JETS JNUG KOL NAIL NUGT

NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA

UGA USO China: YINN CHAU

Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks

AA AAPL ADBE ALXN AMAT AMGN AMD AMZN ANET AXON AXP

BA BABA BAC BIDU BLDP BSX CAT CDNS CHKP CNX CPB CRM CVX CMG

DE DIS ENPH FB FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR

LRCX MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL

QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA TXN XOM V VRTX

WFC WMT XLE ZM ZOM

HOMEBUILDERS:

NAIL

BZH HOV MHO MTH PHM -

REGIONAL BANKS: EGBN FFIC GBCI HMST

Carl Icahn and

associates: IEP MS JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/7-18-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/7-18-2023/Bearish.htm |

|

|

|

|

|

|

|

|

|

Table 1 - Daily Breadth and Volume Statistics

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,047 |

3,056 |

3,053 |

| Advances |

2,103 |

1,664 |

2,280 |

| Declines |

844 |

1,292 |

691 |

| Unchanged |

100 |

100 |

82 |

| New

highs |

202 |

138 |

148 |

| New

lows |

16 |

21 |

9 |

| Adv.

volume* |

609,465,260 |

432,212,756 |

652,194,837 |

| Decl.

volume* |

255,738,251 |

335,480,786 |

129,979,169 |

| Total

volume* |

871,986,575 |

778,422,041 |

788,659,326 |

| Closing

Arms (TRIN)† |

1.09 |

1.08 |

0.72 |

| Block

trades* |

4,272 |

3,890 |

3,950 |

| Adv.

volume |

2,820,658,461 |

1,887,344,319 |

2,953,533,165 |

| Decl.

volume |

1,236,988,333 |

1,589,469,089 |

642,296,447 |

| Total

volume |

4,090,019,323 |

3,538,242,953 |

3,624,223,769 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,569 |

4,524 |

4,572 |

| Advances |

2,692 |

2,765 |

2,807 |

| Declines |

1,689 |

1,599 |

1,570 |

| Unchanged |

188 |

160 |

195 |

| New

highs |

270 |

221 |

136 |

| New

lows |

99 |

88 |

49 |

| Closing

Arms (TRIN)† |

0.94 |

1.02 |

0.89 |

| Block

trades |

32,800 |

31,697 |

34,532 |

| Adv.

volume |

2,994,646,327 |

2,864,323,061 |

3,207,190,850 |

| Decl.

volume |

1,769,899,690 |

1,682,088,984 |

1,594,047,668 |

| Total

volume |

4,824,073,039 |

4,593,167,946 |

4,840,955,881 |

|

Table 2 QUICKSILVER on ETFS - 7/18/2023 ---

Bullish = 8 COMPQX, QQQ, FAS, RETL, SOXL (+1.097), TECL (+.811), DBO, OIH (.624)

-------------

Bearish = 1 UUP

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

==================================================================================================

DIA 349.58 3.73 343.63 100.8% Bullish BLUE .062 0 ---------

---------------------------------------------------------------------------------------------

COMPQX 14353.64 108.69 13918.96 211.2% Bullish BLUE .154 .144 .298

---------------------------------------------------------------------------------------------

SPY 454.19 3.35 446.02 131% Bullish BLUE .125 .066 .191

---------------------------------------------------------------------------------------------

QQQ 385.74 3.13 372.82 233.4% Bullish BLUE .106 .165 .271

---------------------------------------------------------------------------------------------

MDY 496.01 4.85 490.15 97.2% Bullish BLUE .167 .072 .239

---------------------------------------------------------------------------------------------

IWM 195.97 2.39 191.87 160.6% Bullish BLUE .077 .095 .172

---------------------------------------------------------------------------------------------

FAS 70.67 2.43 67.07 362.5% Bullish BLUE .195 .264 .459

---------------------------------------------------------------------------------------------

RETL 7.83 .25 7.89 -26% Bullish BLUE .117 .259 .376

---------------------------------------------------------------------------------------------

SOXL 28.26 .2 25.69 744.7% Bullish BLUE .074 1.023 1.097

very high

---------------------------------------------------------------------------------------------

TECL 59.78 1.95 53.92 690.4% Bullish BLUE .114 .697 .811

---------------------------------------------------------------------------------------------

IBB 129.72 .48 127.96 117.1% ------- BLUE -.009 -.06 -.069

---------------------------------------------------------------------------------------------

GLD 183.64 2.08 181.88 115.6% Bearish BLUE -.061 -.091 -.152

---------------------------------------------------------------------------------------------

DBO 15.03 .28 14.99 73.6% ------- BLUE .307 .069 .376

---------------------------------------------------------------------------------------------

OIH 331.49 7.96 323.79 158.5% Bullish BLUE .377 .247 .624

---------------------------------------------------------------------------------------------

CPER 23.65 -.06 23.77 81.7% ------- BLUE .13 -.055 .075

---------------------------------------------------------------------------------------------

TAN 72.89 -.66 71.32 247.2% Bullish RED -.052 .013 -.039

---------------------------------------------------------------------------------------------

UUP 27.61 .02 27.76 -86.6% Bearish ---- -.286 -.058 -.344

---------------------------------------------------------------------------------------------

CORN 23.84 1.04 21.83 285.5% Bearish BLUE .029 -.039 -.01

---------------------------------------------------------------------------------------------

WEAT 6.65 .15 6.31 85.1% Bearish ---- -.098 -.027 -.125

---------------------------------------------------------------------------------------------

YINN 34.9 -2.49 37.6 54.6% Bullish RED .132 -.194 -.062

|

TABLE 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

7/18/23

Bullish = 42

Bearish = 7

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 .714 .714 1 .857 .571

COPPER 1 .857 1 1 .857 .428

HOMEBLDG 1 .964 .964 1 1 .928

REGBANKS .947 .842 .736 .894 .736 .605

TRANSP .947 .947 .947 1 1 1

FINANCE .9 .837 .787 .825 .762 .65

AUTO .867 .849 .867 .867 .849 .849

JETS .846 .846 .846 .846 .846 .846

SEMI .846 .846 .802 .868 .835 .802

NIFTY .84 .909 .84 .954 .886 .909

ETFS .818 .836 .836 .89 .763 .563

REIT .811 .811 .836 .877 .852 .795

HIGHPRIC .809 .792 .783 .779 .761 .753

INFRA .806 .806 .838 .935 .806 .741

================================================================================================

INDEXES .794 .751 .762 .778 .74 .724

GUNS .785 .785 .785 .785 .785 .714

SOFTWARE .785 .785 .732 .767 .732 .696

NASD-100 .782 .792 .801 .792 .772 .772

RETAIL .782 .76 .739 .782 .782 .76

OILGAS .773 .67 .68 .814 .762 .742

RUS-1000 .77 .753 .758 .79 .777 .751

HOSPITAL .769 .615 .692 .692 .615 .692

ELECTRON .766 .751 .729 .781 .759 .744

EAT .756 .682 .756 .78 .756 .756

GOLD .755 .466 .4 .355 .333 .111

COMPUTER .75 .8 .8 .85 .85 .8

INDMATER .75 .694 .694 .708 .68 .625

CHEM .744 .697 .674 .744 .767 .72

SP500 .743 .727 .745 .788 .759 .741

FIDSTKS .739 .721 .745 .786 .775 .751

BONDFUND .735 .643 .597 .724 .597 .367

COMODITY .725 .625 .625 .65 .55 .5

GREEN .722 .666 .555 .666 .611 .555

SP-100 .7 .655 .677 .744 .711 .7

FOOD .693 .591 .612 .632 .53 .51

DJI-13 .692 .538 .461 .538 .538 .461

SOLAR .687 .687 .437 .625 .437 .312

GAMING .684 .631 .631 .789 .736 .631

DOWJONES .666 .566 .533 .6 .6 .566

MILITARY .653 .73 .692 .769 .73 .807

INSURANC .64 .6 .48 .52 .52 .48

=====================================================================================================

COAL .5 .5 .5 .5 .5 .666

=====================================================================================================

BIOTECH .474 .459 .428 .454 .464 .431

LOWPRICE .457 .428 .416 .48 .439 .407

HACKERS .437 .437 .437 .625 .625 .625

UTILITY .41 .435 .564 .641 .564 .41

MARIJUAN .4 .4 .3 .5 .4 .4

CHINA .365 .439 .463 .56 .463 .439

BEVERAGE .357 .5 .642 .428 .357 .357

EDU .333 .166 .166 .166 .166 .166

|

===================================================================================

Tuesday - 6:18 AM - 7/18/2023 - DJI Futures -16 NASDAQ Futures -31 Data Used - 7/17/2023

| |

7/17/2023

|

|

| |

Market Comments

The DJI keeps trying to surpass its well-tested, flat resistance at 34500.

It lacks the volume to get past the heavy public selling there. But Professionals,

as measured by the steady rise of our Closing Power keep the rally going

there. Now the DJI is within 1% of producing a Sell S9-V because the

V-I, IP21 and OBVPct are all still negative with the DJI 1.3% over the

21-dma. If we do get a Sell S9-V, it will because the Professionals are,

more and more as a group, going off on vacation. We see this in the

aggregate, when we look at the bearish seasonality for the DJI after July

17th in the third years of the four-year Presidential cycle. The odds

of a DJI rally for the next month ordinarily drop to only 42.9% if we

use the seasonality statistics since 1967 as our guide.

But the Professionals (or their Summer replacements) are showing no

sign of backing away from their buying. Presumably, they are confident

that the FED will not soon be raising rates after the sharp recent drops in

the CPI and Producer Price numbers.

The battle in the DJI between the Professionals and the Publc make

for interesting drama. But that is not where the big profits have been

and where they are likely to continue to be. As we have been saying for

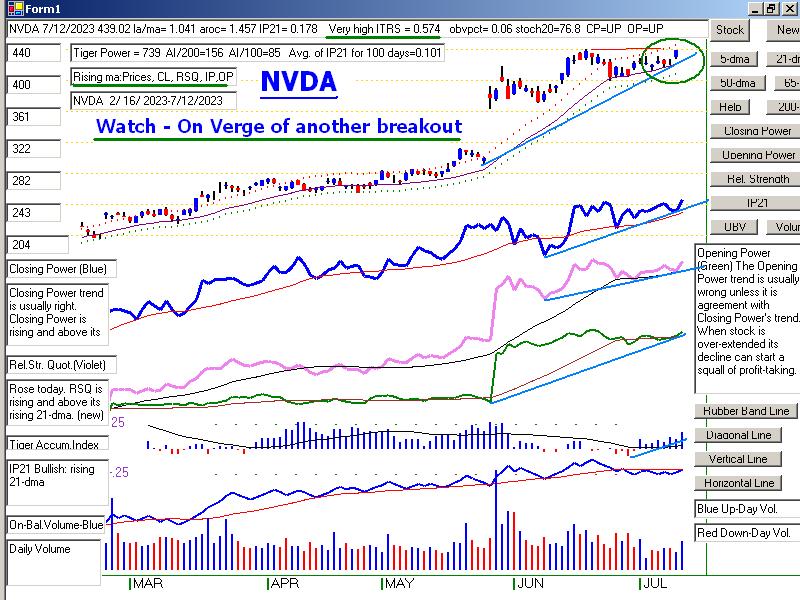

weeks, perhaps even months, stay long the AI stocks, the semi-conductors

and bullish MAXCP for as long as their Closing Powers and Relative

Strength Quoients are rising. These uptrends continue.

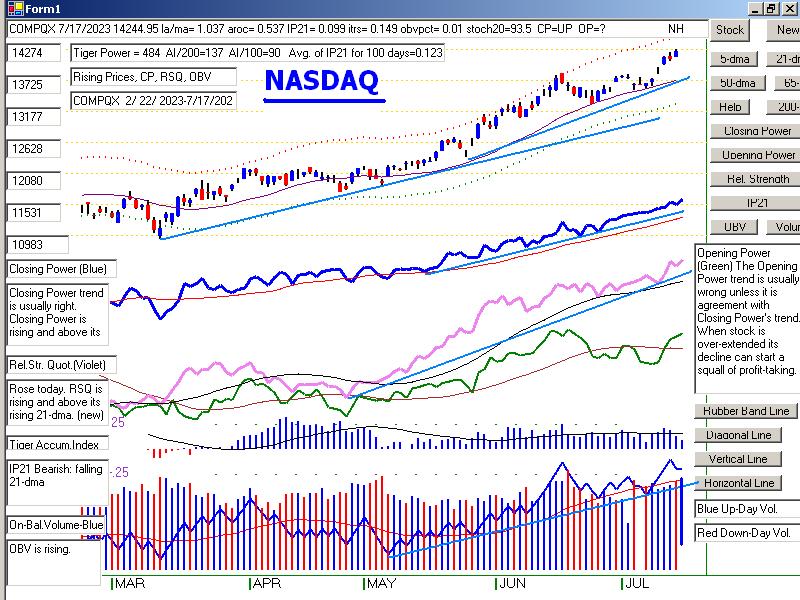

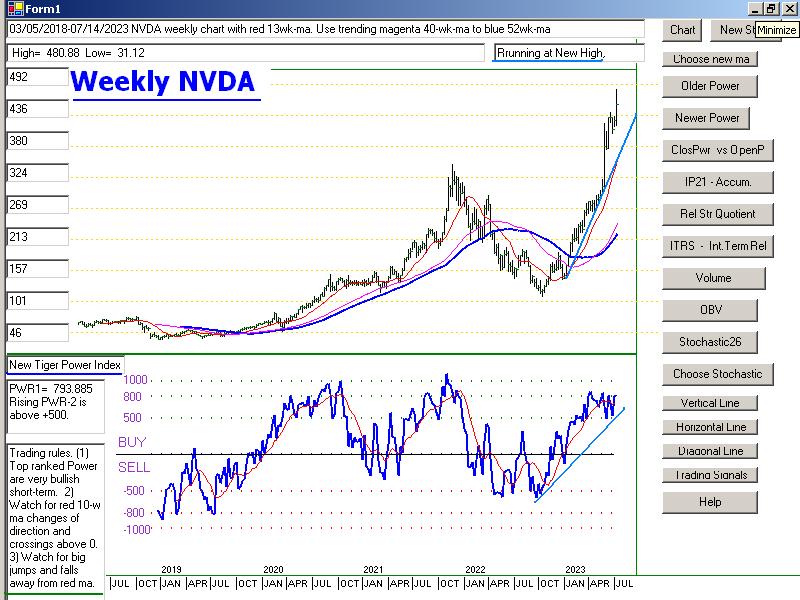

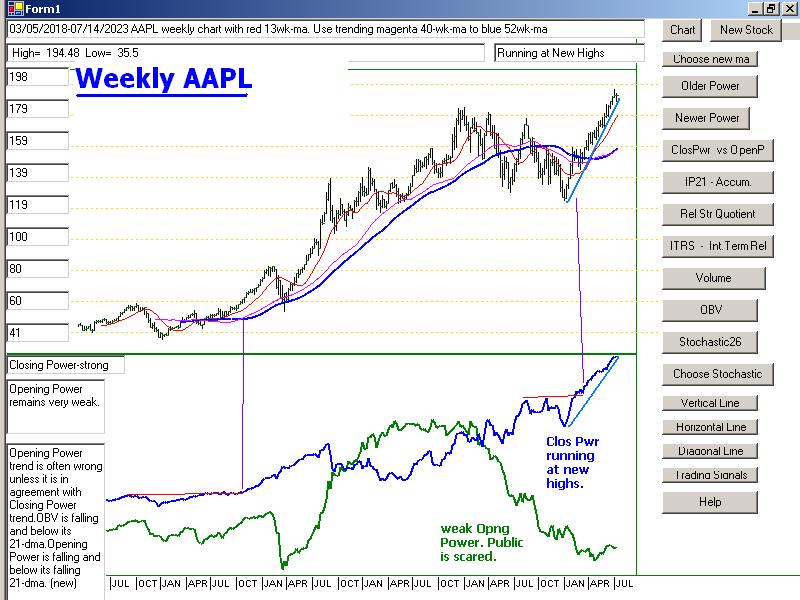

Now our Weekly charts, as developed with Visual Net, give use more

reasons to be bullish the Semi-conductors, AI stocks like NVDA and

also Housing Stocks. First, see in the charts of SOXL and NAIL

how their present prices are still far below their five year highs. This means

they could still rally much more. And see something new, how their Tiger Power

Index (2021, slghtly revised) readings are rising far above their red 13-week ma

in their charts below. This is a most bullish sign.

Finally check out how bearish the negative leveraged ETFS look

among the bearish MINCPs. This has to be a bullish sign for the market. |

|

| |

7/17/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Tiger Index of Big

Banks Bond

Funds Gold Stocks

Housing Stocks

Insurance-Stocks

Regional Banks

Russell-1000

Semi Conductors

Recent 2006 vers-Peerless signals http://tigersoftware.com/oldpeer/UPD90717.bmp

Note the old Buy "b" trading signals. They are not safe to use when

A/D Line

is below its 21-dma: See OLD06

OLD0607

OLD07 OLD0708 OLD08 OLD0809

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO

BLDP FAS GLD HD IBB JETS JNUG KOL NAIL NUGT

NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA

UGA USO China: YINN CHAU

Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks

AA AAPL ADBE ALXN AMAT AMGN AMD AMZN ANET AXON AXP

BA BABA BAC BIDU BLDP BSX CAT CDNS CHKP CNX CPB CRM CVX CMG

DE DIS ENPH FB FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR

LRCX MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL

QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA TXN XOM V VRTX

WFC WMT XLE ZM ZOM

HOMEBUILDERS:

NAIL

BZH HOV MHO MTH PHM -

REGIONAL BANKS: EGBN FFIC GBCI HMST

Carl Icahn and

associates: IEP MS JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/7-17-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/downing/7-17-2023/Bearish.htm |

|

|

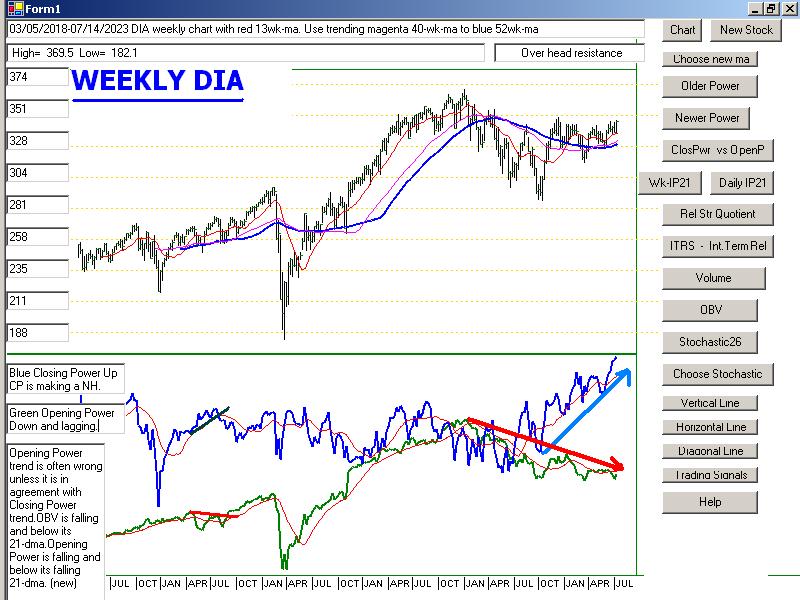

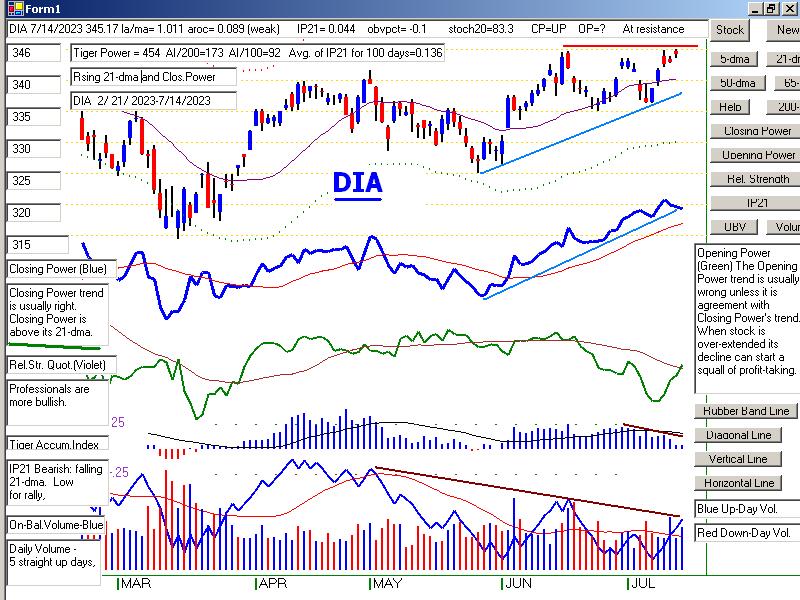

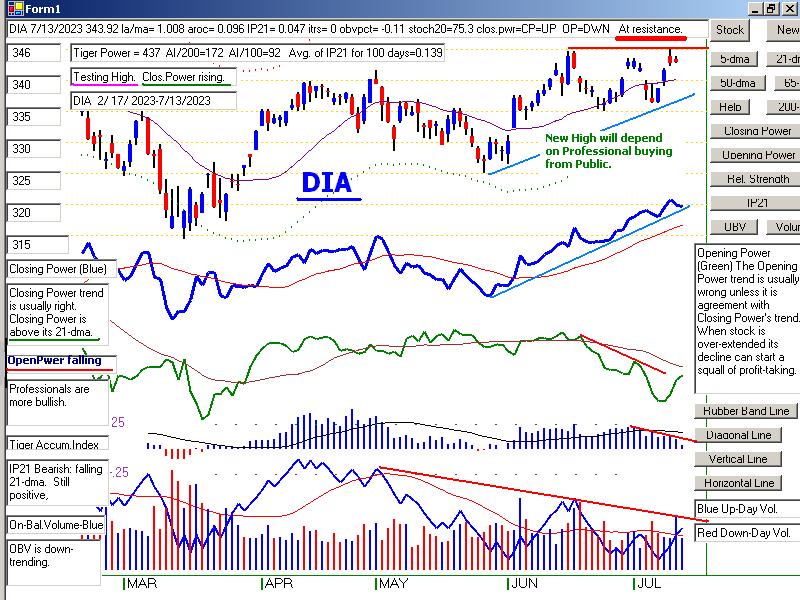

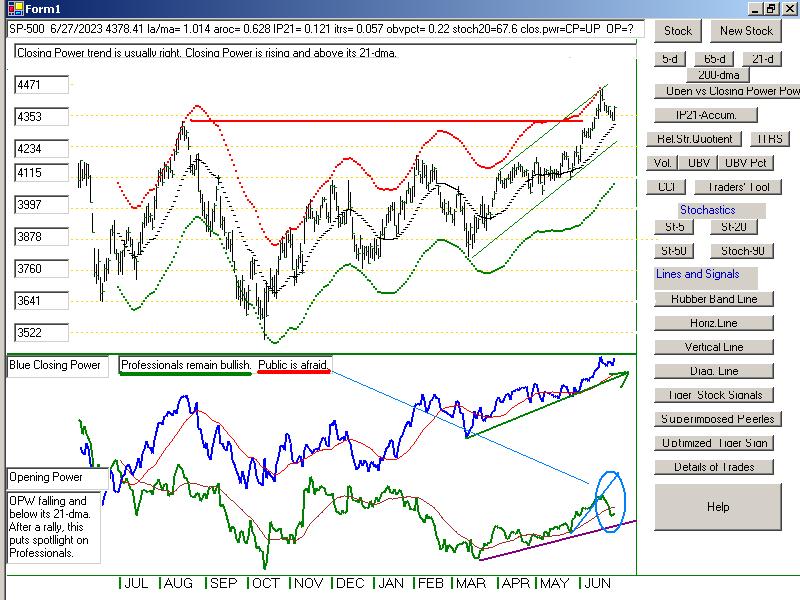

See the battle between Professionals and the Public on Weekly DIA chart.

The divergence is unmatched at any time in last five years,

|

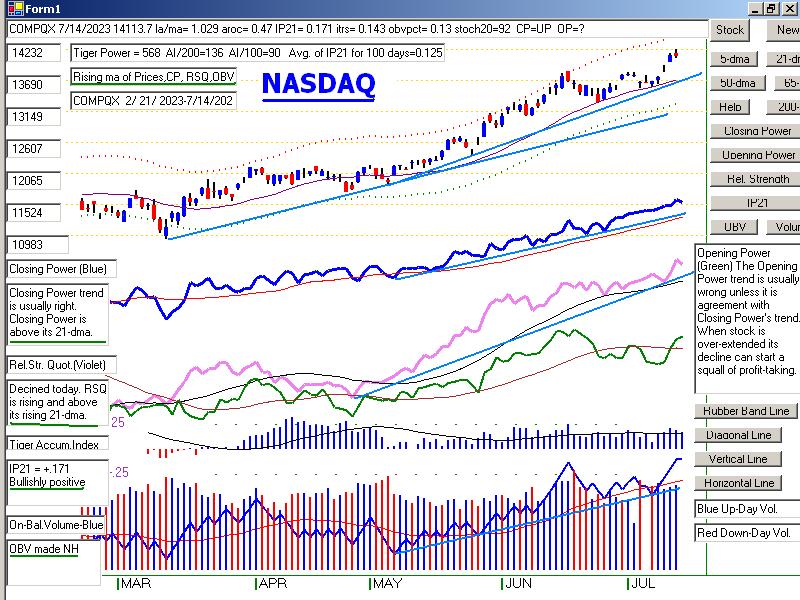

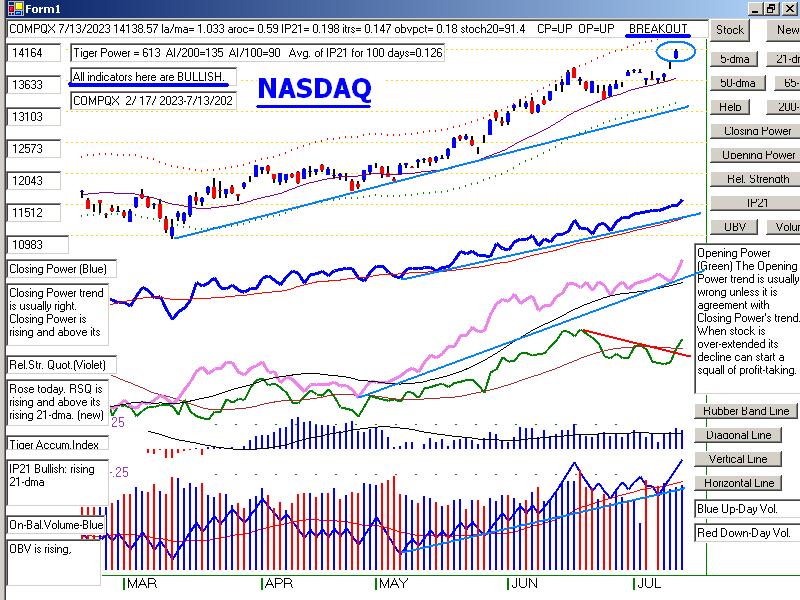

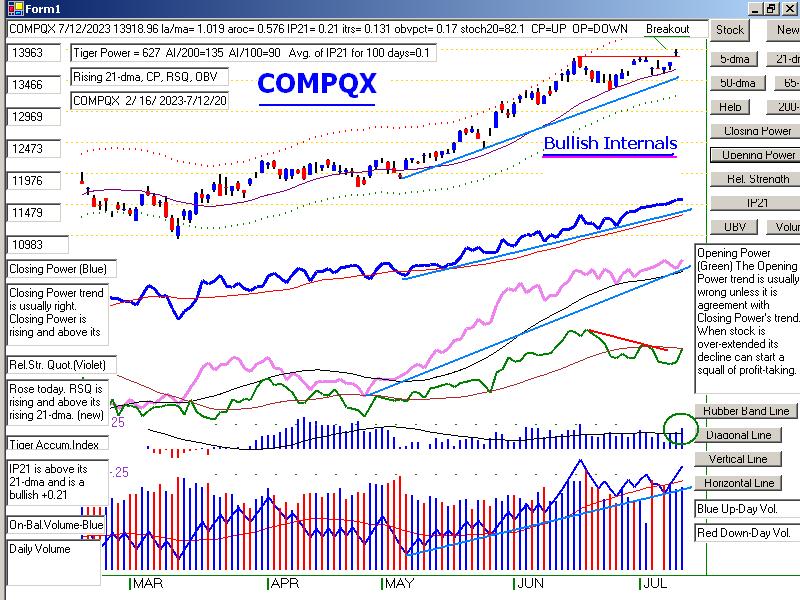

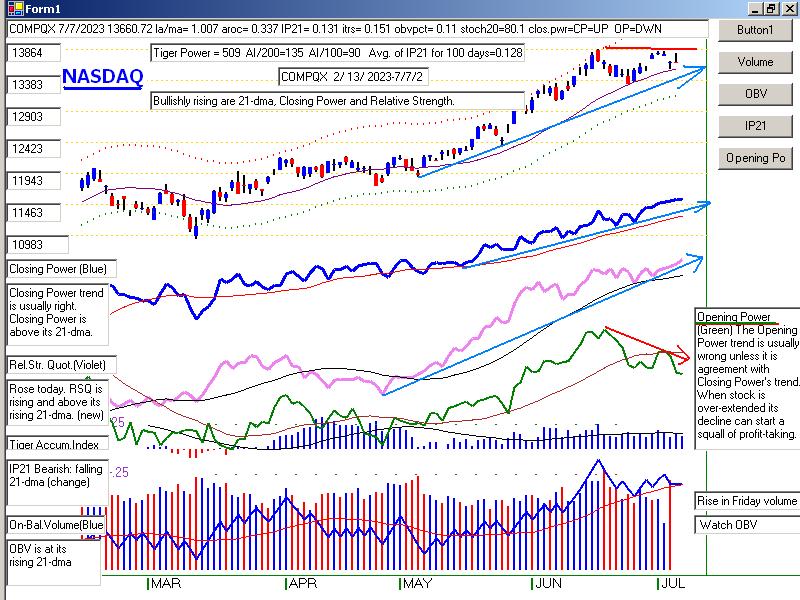

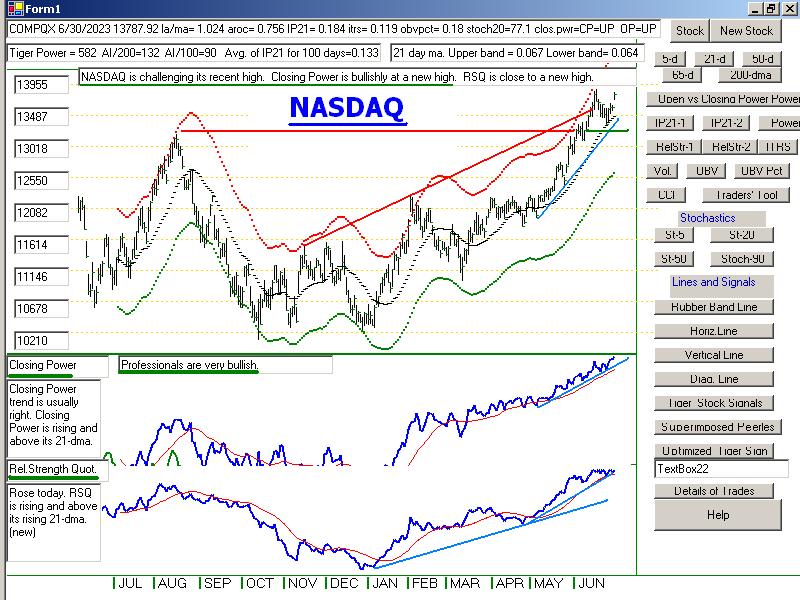

The NASDAQ's advance is supported by upwards Price, CP, RSQ and OBV momentum.

|

|

|

| |

|

|

Table 1 - Daily Breadth and Volume Statistics

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,056 |

3,035 |

3,049 |

| Advances |

1,664 |

734 |

2,049 |

| Declines |

1,292 |

2,224 |

899 |

| Unchanged |

100 |

77 |

101 |

| New

highs |

138 |

112 |

81 |

| New

lows |

21 |

24 |

25 |

| Adv.

volume* |

432,212,756 |

148,547,177 |

562,565,023 |

| Decl.

volume* |

335,480,786 |

654,416,041 |

240,906,675 |

| Total

volume* |

778,422,041 |

807,490,807 |

812,609,429 |

| Closing

Arms (TRIN)† |

1.08 |

1.65 |

0.91 |

| Block

trades* |

3,890 |

3,807 |

3,844 |

| Adv.

volume |

1,887,344,319 |

605,704,178 |

2,409,569,232 |

| Decl.

volume |

1,589,469,089 |

3,023,726,919 |

959,859,670 |

| Total

volume |

3,538,242,953 |

3,647,457,047 |

3,429,609,476 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,524 |

4,603 |

4,578 |

| Advances |

2,765 |

1,344 |

2,924 |

| Declines |

1,599 |

3,099 |

1,445 |

| Unchanged |

160 |

160 |

209 |

| New

highs |

221 |

185 |

73 |

| New

lows |

88 |

77 |

58 |

| Closing

Arms (TRIN)† |

1.02 |

0.64 |

0.55 |

| Block

trades |

31,697 |

40,457 |

41,170 |

| Adv.

volume |

2,864,323,061 |

1,999,205,571 |

4,116,120,602 |

| Decl.

volume |

1,682,088,984 |

2,957,987,247 |

1,122,154,752 |

| Total

volume |

4,593,167,946 |

5,366,893,388 |

5,275,394,582 |

|

Table 2 QUICKSILVER on ETFS - 7/17/2023

Bullish = 8 COMPQX, QQQ, FAS, RETL, SOXL (+1.032), TECL (+.767), DBO, OIH

-------------

Bearish = 1 UUP

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

==================================================================================================

DIA 345.85 .68 342.64 91.4% Bullish BLUE .052 0 ----

---------------------------------------------------------------------------------------------

COMPQX 14244.95 131.25 13760.7 200.9% Bullish BLUE .163 .149 .312

---------------------------------------------------------------------------------------------

SPY 450.84 1.56 442.46 125.5% Bullish BLUE .133 .07 .203

---------------------------------------------------------------------------------------------

QQQ 382.61 3.54 368.17 217.8% Bullish BLUE .113 .171 .284

---------------------------------------------------------------------------------------------

MDY 491.16 3.27 486.49 101.5% Bullish BLUE .181 .062 .243

---------------------------------------------------------------------------------------------

IWM 193.58 2.05 189.8 149.6% Bullish BLUE .096 .088 .184

---------------------------------------------------------------------------------------------

FAS 68.24 1.89 65.81 354% Bullish BLUE .152 .19 .342

---------------------------------------------------------------------------------------------

RETL 7.58 .13 7.87 111% Bullish BLUE .165 .18 .345

---------------------------------------------------------------------------------------------

SOXL 28.06 1.83 24.34 731.3% Bullish BLUE .04 .992 1.032

---------------------------------------------------------------------------------------------

TECL 57.83 2.16 52.17 556.4% Bullish BLUE .131 .636 .767

---------------------------------------------------------------------------------------------

IBB 129.24 1 126.72 101.5% Bullish BLUE .024 -.046 -.022

---------------------------------------------------------------------------------------------

GLD 181.56 .13 179.45 76.9% Bearish BLUE -.04 -.075 -.115

---------------------------------------------------------------------------------------------

DBO 14.75 -.17 14.81 87.3% ------- ---- .296 .073 .369

---------------------------------------------------------------------------------------------

OIH 323.53 2.86 321.25 203.5% Bullish BLUE .367 .241 .608

---------------------------------------------------------------------------------------------

CPER 23.71 -.49 23.26 63% ------- ---- .104 -.03 .074

---------------------------------------------------------------------------------------------

TAN 73.55 2.83 69.36 296.1% Bullish BLUE .078 .035 .113

---------------------------------------------------------------------------------------------

UUP 27.59 -.03 28.09 -102.4% Bearish RED -.328 -.038 -.366

---------------------------------------------------------------------------------------------

CORN 22.8 -.36 22.55 75.5% Bearish RED .042 -.065 -.023

---------------------------------------------------------------------------------------------

WEAT 6.5 -.06 6.54 62.1% Bearish RED -.09 -.026 -.116

---------------------------------------------------------------------------------------------

YINN 37.39 -.59 34.49 486.5% Bullish BLUE .207 -.042 .165

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

7/17/23

Bullish = 40

Bearish = 8

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

HOMEBLDG .964 .964 1 1 .928 .928

TRANSP .947 .947 1 1 1 .947

NIFTY .909 .84 .954 .886 .909 .795

COPPER .857 1 1 .857 .428 .285

AUTO .849 .886 .867 .849 .849 .792

JETS .846 .846 .846 .846 .846 .846

SEMI .846 .802 .868 .835 .813 .78

REGBANKS .842 .736 .894 .736 .605 .578

FINANCE .837 .787 .825 .75 .65 .625

ETFS .836 .836 .89 .763 .581 .454

REIT .811 .827 .885 .86 .786 .729

INFRA .806 .838 .935 .806 .741 .709

COMPUTER .8 .8 .85 .85 .8 .75

-----------------------------------------------------------------------------------------------

HIGHPRIC .792 .783 .779 .761 .748 .727

NASD-100 .792 .801 .792 .772 .762 .742

GUNS .785 .785 .785 .785 .714 .571

SOFTWARE .785 .75 .767 .732 .696 .678

RETAIL .76 .739 .782 .782 .76 .673

RUS-1000 .753 .758 .79 .777 .749 .698

ELECTRON .751 .729 .781 .759 .736 .736

INDEXES .751 .762 .778 .74 .729 .724

MILITARY .73 .692 .769 .73 .769 .576

SP500 .727 .745 .788 .757 .741 .676

FIDSTKS .721 .745 .786 .775 .745 .662

BIGBANKS .714 .714 1 .857 .571 .571

CHEM .697 .674 .744 .767 .72 .674

INDMATER .694 .694 .708 .68 .625 .583

SOLAR .687 .437 .625 .437 .312 .25

EAT .682 .756 .78 .756 .756 .756

OILGAS .67 .68 .814 .762 .742 .587

GREEN .666 .555 .666 .611 .555 .555

SP-100 .655 .677 .744 .711 .7 .611

BONDFUND .643 .586 .724 .609 .379 .356

GAMING .631 .631 .736 .789 .631 .631

COMODITY .625 .65 .625 .55 .475 .375

HOSPITAL .615 .692 .692 .615 .692 .692

INSURANC .6 .48 .52 .52 .44 .44

FOOD .591 .632 .612 .53 .489 .387

DOWJONES .566 .533 .6 .6 .566 .533

DJI-13 .538 .461 .538 .538 .461 .461

=============================================================================================

BEVERAGE .5 .642 .428 .357 .357 .428

COAL .5 .5 .5 .5 .666 .5

=============================================================================================

GOLD .466 .4 .355 .333 .111 .111

BIOTECH .456 .426 .456 .464 .431 .428

CHINA .439 .463 .56 .463 .439 .439

HACKERS .437 .437 .625 .625 .625 .562

UTILITY .435 .564 .641 .564 .41 .307

LOWPRICE .428 .419 .483 .439 .407 .401

MARIJUAN .4 .3 .5 .4 .4 .2

EDU .166 .166 .166 .166 .333 .166

|

===================================================================================

Monday - 6:01 AM - 7/17/2023 - DJI Futures -69 NASDAQ

Futures +1 Data Used - 7/14/2023

| |

7/14/2023

|

|

| |

Market Comments

The DJI again challenged its well-tested, flat resistance at 34500, thanks

to the 200-point lift giveni it by UNH's 31-point bounce off an opversold

condition. If there had not been a late sell-off in the DJI, Peerless might

have closed 2.4% over its 21-day ma with the Peerless V-Indicator in

negative terrtory. This would have produced a Summer-time Sell S9-V.

As it was, instead, we are likely to see another challow retreat by the DJI

because all the volume based indicators on the DJI chart are negative

and show a lack of sufficient buying power to allow the DJI's overhead

resistance to be eaten through.

Elsewhere home-building stocks were strong. But big ol looks vulnerable/

And semi-conductors are due for some profit-taking. The tech ETFs

and SPY still show rising Closing Powers and Relative Strength Lines.

So, we should just continue to hold them,

We have a few more bearish MINCPs. But breadth has been good

and the number of new lows not large enough to allow much shorting.

Weekly Charts.

I am a little ahead of schedule in the conversion of Tiger VB Basic

charts to Visual Net so that they can run on Wondows 10 machines.

I produced weekly charts this weekend using Visual Net for the first

time. For the first time, we will able to compare the trends of

Opening and Closing Power over a four and a half year period.

And for the first time, we will be able to look at the Power values

shown in the 2021 Ranking over a five year span. See them below.

I make brief mention of some of their trading rules on their charts

below. |

|

| |

7/14/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Tiger Index of Big

Banks Bond

Funds Gold Stocks

Housing Stocks

Insurance-Stocks

Regional Banks

Russell-1000

Semi Conductors

Recent 2006 vers-Peerless signals http://tigersoftware.com/oldpeer/UPD90714.bmp

Note the old Buy "b" trading signals. They are not safe to use when

A/D Line

is below its 21-dma: See OLD06

OLD0607

OLD07 OLD0708 OLD08 OLD0809

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO

BLDP FAS GLD HD IBB JETS JNUG KOL NAIL NUGT

NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA

UGA USO China: YINN CHAU

Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks

AA AAPL ADBE ALXN AMAT AMGN AMD AMZN ANET AXON AXP

BA BABA BAC BIDU BLDP BSX CAT CDNS CHKP CNX CPB CRM CVX CMG

DE DIS ENPH FB FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR

LRCX MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL

QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA TXN XOM V VRTX

WFC WMT XLE ZM ZOM

HOMEBUILDERS:

NAIL

BZH HOV MHO MTH PHM -

REGIONAL BANKS: EGBN FFIC GBCI HMST

Carl Icahn and

associates: IEP MS JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/7-14-2023/Bullish.htm

Bearish MINCPs

www.tigersoftware.com/downing/7-14-2023/Bearish.htm

|

|

|

|

|

|

|

|

|

New VB Net Weekly Charts

---- TigerSoft 2021 Power Index (improved)

SPY and NVDA

---- Closing Power versus Opening Power |

|

|

|

Table 1

| NYSE |

Latest Close |

Previous Close |

Week Ago |

| Issues traded |

3,035 |

3,045 |

3,043 |

| Advances |

734 |

2,061 |

2,108 |

| Declines |

2,224 |

876 |

821 |

| Unchanged |

77 |

108 |

114 |

| New highs |

112 |

173 |

54 |

| New lows |

24 |

12 |

21 |

| Adv. volume* |

148,547,177 |

579,837,448 |

675,401,900 |

| Decl. volume* |

654,416,041 |

224,471,779 |

247,274,619 |

| Total volume* |

807,490,807 |

828,429,787 |

934,517,413 |

| Closing Arms (TRIN)† |

1.65 |

0.94 |

0.86 |

| Block trades* |

3,807 |

4,024 |

4,147 |

| Adv. volume |

605,704,178 |

2,652,391,667 |

2,656,424,392 |

| Decl. volume |

3,023,726,919 |

1,060,100,661 |

893,879,217 |

| Total volume |

3,647,457,047 |

3,839,532,858 |

3,630,485,582 |

| NASDAQ |

Latest Close |

Previous Close |

Week Ago |

| Issues traded |

4,603 |

4,613 |

4,503 |

| Advances |

1,344 |

2,904 |

2,878 |

| Declines |

3,099 |

1,523 |

1,445 |

| Unchanged |

160 |

186 |

180 |

| New highs |

185 |

272 |

57 |

| New lows |

77 |

47 |

66 |

| Closing Arms (TRIN)† |

0.64 |

0.68 |

1.29 |

| Block trades |

40,457 |

37,524 |

41,934 |

| Adv. volume |

1,999,205,571 |

3,797,678,953 |

3,072,507,227 |

| Decl. volume |

2,957,987,247 |

1,344,514,178 |

1,991,239,107 |

| Total volume |

5,366,893,388 |

5,183,568,173 |

5,098,120,228 |

|

Table 2

Table 2 QUICKSILVER on ETFS - 7/14/2023 ---

Bullish = 6 COMPQX, QQQ, SOXL (+.886), TECL (+.726), DBO, OIH

Bearish = 1 UUP

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

==================================================================================================

DIA 345.17 1.25 339.58 113.3% Bullish RED .044 0 --------

---------------------------------------------------------------------------------------------

COMPQX 14113.7 -24.87 13685.48 163.7% Bullish RED .169 .144 .313

---------------------------------------------------------------------------------------------

SPY 449.28 -.28 439.66 121% Bullish RED .141 .069 .21

---------------------------------------------------------------------------------------------

QQQ 379.07 -.08 366.36 173.1% Bullish RED .147 .162 .309

---------------------------------------------------------------------------------------------

MDY 487.89 -4.78 481.26 130.8% Bullish RED .13 .065 .195

---------------------------------------------------------------------------------------------

IWM 191.53 -1.89 187.87 179.9% Bullish RED .053 .091 .144

---------------------------------------------------------------------------------------------

FAS 66.35 -1.38 63.56 276.8% Bullish RED .088 .124 .212

---------------------------------------------------------------------------------------------

RETL 7.45 -.22 7.41 270.6% Bullish RED .1 .149 .249

---------------------------------------------------------------------------------------------

SOXL 26.23 -1.05 24.32 656.2% Bullish RED .083 .803 .886

---------------------------------------------------------------------------------------------

TECL 55.67 -.32 51.83 401.4% Bullish RED .184 .542 .726

---------------------------------------------------------------------------------------------

IBB 128.24 -.06 126.65 152.2% ------- ---- .014 -.037 -.023

---------------------------------------------------------------------------------------------

GLD 181.43 -.58 178.78 77.4% Bearish RED -.094 -.057 -.151

---------------------------------------------------------------------------------------------

DBO 14.92 -.34 14.49 128.2% ------- RED .291 .054 .345

---------------------------------------------------------------------------------------------

OIH 320.67 -5.25 310.49 204% Bullish RED .339 .224 .563

---------------------------------------------------------------------------------------------

CPER 24.2 -.16 23.41 188.4% ------- RED .047 -.004 .043

---------------------------------------------------------------------------------------------

TAN 70.72 -1.4 69.37 190.6% ------- RED -.001 .003 .002

---------------------------------------------------------------------------------------------

UUP 27.62 .05 28.16 -109.1% Bearish ---- -.388 -.032 -.42

---------------------------------------------------------------------------------------------

CORN 23.16 .53 22.46 181.1% Bearish BLUE .068 -.02 .048

---------------------------------------------------------------------------------------------

WEAT 6.56 .17 6.42 85.6% ------- BLUE -.036 .042 .006

---------------------------------------------------------------------------------------------

YINN 37.98 -2.12 33.81 561.3% Bullish RED .196 -.024 .172

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

7/14/23

Bullish = 39

Bearish = 10

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COPPER 1 1 .857 .428 .285 .285

HOMEBLDG .964 1 1 .928 .928 .892

TRANSP .947 1 1 1 .947 .947

AUTO .886 .886 .849 .849 .792 .773

JETS .846 .846 .846 .846 .846 .846

NIFTY .84 .954 .886 .909 .795 .772

INFRA .838 .935 .806 .741 .709 .709

ETFS .836 .89 .763 .581 .472 .454

REIT .827 .877 .868 .795 .721 .688

SEMI .802 .868 .835 .813 .78 .736

NASD-100 .801 .792 .772 .762 .742 .683

COMPUTER .8 .85 .85 .8 .75 .75

--------------------------------------------------------------------------------------------------------------

FINANCE .787 .825 .75 .637 .625 .587

GUNS .785 .785 .785 .714 .642 .5

HIGHPRIC .783 .779 .761 .748 .727 .683

INDEXES .762 .778 .74 .729 .718 .686

RUS-1000 .758 .79 .777 .749 .7 .667

EAT .756 .78 .756 .756 .756 .682

SOFTWARE .75 .785 .732 .696 .696 .66

FIDSTKS .745 .786 .775 .745 .656 .633

SP500 .745 .788 .757 .739 .676 .651

RETAIL .739 .782 .782 .76 .673 .608

REGBANKS .736 .894 .736 .605 .552 .526

ELECTRON .729 .781 .759 .736 .721 .699

BIGBANKS .714 1 .857 .571 .571 .428

INDMATER .694 .708 .68 .625 .583 .583

HOSPITAL .692 .692 .615 .692 .692 .692

MILITARY .692 .769 .73 .769 .576 .576

OILGAS .68 .814 .762 .742 .577 .567

SP-100 .677 .744 .711 .7 .611 .566

CHEM .674 .744 .767 .72 .651 .604

COMODITY .65 .65 .525 .475 .4 .35

BEVERAGE .642 .428 .357 .357 .428 .428

FOOD .632 .632 .51 .489 .408 .367

GAMING .631 .736 .736 .684 .631 .526

BONDFUND .586 .712 .609 .39 .344 .252

UTILITY .564 .641 .564 .41 .307 .358

GREEN .555 .666 .611 .555 .555 .555

DOWJONES .533 .6 .6 .566 .533 .5

=================================================================================================

COAL .5 .5 .5 .666 .5 .5

=================================================================================================

INSURANC .48 .52 .52 .44 .44 .44

CHINA .463 .56 .463 .439 .439 .39

DJI-13 .461 .538 .538 .461 .461 .461

HACKERS .437 .625 .625 .625 .562 .5

SOLAR .437 .625 .437 .312 .25 .187

BIOTECH .423 .454 .467 .431 .431 .357

LOWPRICE .419 .486 .442 .407 .401 .39

GOLD .4 .355 .333 .111 .111 .111

MARIJUAN .3 .5 .4 .4 .2 .2

EDU .166 .166 .166 .333 .166 .333

|

===================================================================================

Friday - 4:16 AM - 7/14/2023 - DJI Futures +139 NASDAQ Futures

-12 Data Used - 7/13/2023

| |

7/13/2023

|

|

| |

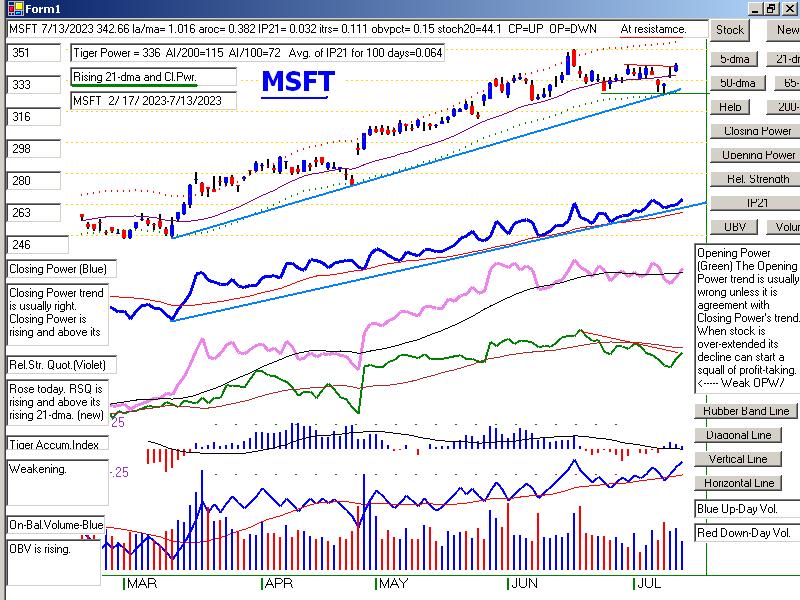

Market Comments

The DJI may or may not be able to surpass the round number resistance

at 35000 on this run. On the one hand, breadth has become very good -

it reflects the bulls' hopes for a pause in the FED rush to raise interest rates -

on the other hand, big volume is clearly missing on the rally. According

to most books on technical analysis (starting with Edwards and Magee),

rising volume is considered a necessity for successful head and shoulders

patternbreakouts. The idea here is simple. It takes rising volume to eat

up the supplies of stock overhead at the neckline of the formation. In the

present case, here, the OBV is badly lagging on the DJI chart and the

V-Indicator is still negative, thus making a Sell S9V a possibility if the

DJI closes up 1% higher today or Monday.

But is that so important? Our take on the market right now is that the DJI

is a distraction from the best way to make money, namely in semi-conductors

and AI leaders like NVDA and MSFT. See our Tiger Index of 91-semi

below. These stocks along with SOXL, TECL, QQQ, SPY and COMPQZ

(the NASDAQ) still show rising Closing Power and Relative Strength Lines.

So, hold them tightly. We are in the begiining of a new industrial eveolution,

of sorts, only this one uses artificial brain power and is not measured in

pyhsical (horse) power.

I preach that Professionals are usually correct in their assessments

of the market and individual stocks, especially when the Public,

as measured by our Opening Power, is still fearful and even bearish.

I have shown how often this lesson work outs in my Closing Power book.

First hand, I have seen play new bull market leadership take the form of semi-

conductors back in early 1967, when I first became interested in the market.

Next I saw it in August of 1982, in 2003, 2009 and 2020 when a new bull

market was just starting. Each time, Professionals eagerly bought the most

volatile tech growth-stocks they could find. It didn't hurt that they had the

inside track when it came to Fed-watching.

Perhaps, the FED will remain more stubborn and obdurate. Perhaps, it

will over-shoot the market this time to make up for their being so far behind

the curve as Inflation grew in 2021. But clearly, that is not how most

Professionals are playing the market. Nor should we. |

|

| |

7/13/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30

Tiger Index of Big

Banks Bond

Funds Gold Stocks

Housing Stocks

Insurance-Stocks

Regional Banks

Russell-1000

Semi Conductors

Recent 2006 vers-Peerless signals http://tigersoftware.com/oldpeer/UPD90713.bmp

Note the old Buy "b" trading signals. They are not safe to use when

A/D Line

is below its 21-dma: See OLD06

OLD0607

OLD07 OLD0708 OLD08 OLD0809

ETFs: DIA QQQ SPY IWM MDY

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

COIN (Bit

Coin ETF)

USO-CrudeOil DBO

BLDP FAS GLD HD IBB JETS JNUG KOL NAIL NUGT

NRGU OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA

UGA USO China: YINN CHAU

Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks

AA AAPL ADBE ALXN AMAT AMGN AMD AMZN ANET AXON AXP

BA BABA BAC BIDU BLDP BSX CAT CDNS CHKP CNX CPB CRM CVX CMG

DE DIS ENPH FB FSLR FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR

LRCX MRK MRNA MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL

QCOM QDEL REGN REV RE SCHW SNOW SO SQUARE TSLA TXN XOM V VRTX

WFC WMT XLE ZM ZOM

HOMEBUILDERS:

NAIL

BZH HOV MHO MTH PHM -

REGIONAL BANKS: EGBN FFIC GBCI HMST

Carl Icahn and

associates: IEP MS JEF

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs http://tigersoftware.com/upping/7-13-2023/Bullish.htm

Bearish MINCPs

www.tigersoftware.com/downing/7-13-2023/Bearish.htm

|

|

|

AI is in the beginning phase of a new Industrial

Revolution.

Semi-conductor chips are at tis center.

|

|

|

|

|

|

|

| NYSE |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

3,045 |

3,036 |

3,041 |

| Advances |

2,061 |

2,136 |

462 |

| Declines |

876 |

816 |

2,521 |

| Unchanged |

108 |

84 |

58 |

| New

highs |

173 |

216 |

28 |

| New

lows |

12 |

10 |

34 |

| Adv.

volume* |

579,837,448 |

592,978,611 |

96,480,498 |

| Decl.

volume* |

224,471,779 |

276,313,291 |

792,742,249 |

| Total

volume* |

828,429,787 |

874,027,340 |

893,306,527 |

| Closing

Arms (TRIN)† |

0.94 |

1.13 |

1.58 |

| Block

trades* |

4,024 |

4,211 |

4,172 |

| Adv.

volume |

2,652,391,667 |

2,723,590,320 |

380,688,749 |

| Decl.

volume |

1,060,100,661 |

1,174,341,830 |

3,279,897,404 |

| Total

volume |

3,839,532,858 |

3,920,298,203 |

3,682,029,802 |

| NASDAQ |

Latest

Close |

Previous

Close |

Week

Ago |

| Issues

traded |

4,613 |

4,573 |

4,558 |

| Advances |

2,904 |

2,893 |

1,033 |

| Declines |

1,523 |

1,506 |

3,350 |

| Unchanged |

186 |

174 |

175 |

| New

highs |

272 |

225 |

36 |

| New

lows |

47 |

52 |

140 |

| Closing

Arms (TRIN)† |

0.68 |

1.14 |

0.33 |

| Block

trades |

37,524 |

37,679 |

64,447 |

| Adv.

volume |

3,797,678,953 |

3,236,162,650 |

2,945,937,000 |

| Decl.

volume |

1,344,514,178 |

1,918,434,775 |

3,125,786,967 |

| Total

volume |

5,183,568,173 |

5,230,624,543 |

6,113,085,949 |

|

Table 2 QUICKSILVER on ETFS - 7/13/2023 ---

Bullish = 10 COMPQX, SPY, QQQ, MDY, FAS, RETL,

SOXL (+.98), TECL (+.746), DBO(, OIH

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

==================================================================================================

DIA 343.92 .29 337.43 68.9% Bullish RED .048 ---- ----- ---[--[---------------------------------------------------------------------------------------------

COMPQX 14138.57 219.61 13660.72 167.2% Bullish BLUE .232 .147 .379

---------------------------------------------------------------------------------------------

SPY 449.56 3.54 438.55 112.2% Bullish BLUE .187 .071 .258

---------------------------------------------------------------------------------------------

QQQ 379.15 6.33 366.24 158.7% Bullish BLUE .209 .166 .375

---------------------------------------------------------------------------------------------

MDY 492.67 2.52 475.2 230.5% Bullish BLUE .18 .074 .254

---------------------------------------------------------------------------------------------

IWM 193.42 1.55 184.71 283.9% Bullish BLUE .075 .093 .168

---------------------------------------------------------------------------------------------

FAS 67.73 .66 62.73 407.3% Bullish BLUE .179 .081 .26

---------------------------------------------------------------------------------------------

RETL 7.67 -.22 7.04 539.4% Bullish RED .159 .179 .338

---------------------------------------------------------------------------------------------

SOXL 27.28 1.59 22.96 893.7% Bullish BLUE .13 .85 .98

---------------------------------------------------------------------------------------------

TECL 55.99 2.07 51.41 369.1% Bullish BLUE .225 .521 .746

---------------------------------------------------------------------------------------------

IBB 128.3 .34 124.38 112.9% Bullish RED .029 -.035 -.006

---------------------------------------------------------------------------------------------

GLD 182.01 .13 178.64 131.1% Bearish ---- -.105 -.021 -.126

---------------------------------------------------------------------------------------------

DBO 15.26 .27 14.54 345.5% ------- BLUE .334 .039 .373

---------------------------------------------------------------------------------------------

OIH 325.92 2.13 307.7 610.8% Bullish BLUE .311 .182 .493

---------------------------------------------------------------------------------------------

CPER 24.36 .59 23.31 267.4% ------- BLUE .092 -.001 .091

---------------------------------------------------------------------------------------------

TAN 72.12 .8 68.05 344.5% Bullish BLUE .017 .003 .02

---------------------------------------------------------------------------------------------

UUP 27.57 -.19 28.23 -159.9% Bearish RED -.379 -.022 -.401

---------------------------------------------------------------------------------------------

CORN 22.63 .8 22.35 -26.8% Bearish BLUE 0 -.036 -.036

---------------------------------------------------------------------------------------------

WEAT 6.39 .08 6.45 -93.1% ------- BLUE -.095 .019 -.076

---------------------------------------------------------------------------------------------

YINN 40.1 2.5 33.94 1190.6% Bullish BLUE .179 -.017 .162

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

7/13/23

Bullish = 44

Bearish = 4

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

BIGBANKS 1 .857 .571 .571 .428 .428

COPPER 1 .857 .428 .285 .285 .142

HOMEBLDG 1 1 .928 .928 .892 .857

TRANSP 1 1 1 .947 .947 .947

NIFTY .954 .886 .909 .795 .772 .772

INFRA .935 .806 .741 .709 .709 .58

REGBANKS .894 .736 .605 .552 .526 .394

ETFS .89 .763 .581 .472 .472 .29

AUTO .886 .867 .849 .792 .773 .754

REIT .877 .86 .803 .729 .68 .614

SEMI .868 .835 .813 .78 .736 .758

COMPUTER .85 .85 .8 .75 .75 .75

JETS .846 .846 .846 .846 .846 .846

FINANCE .825 .75 .637 .612 .575 .5

OILGAS .814 .762 .742 .577 .556 .371

============================================================================================

NASD-100 .792 .772 .762 .742 .693 .673

RUS-1000 .79 .777 .749 .7 .67 .64

SP500 .788 .757 .739 .674 .651 .635

FIDSTKS .786 .775 .745 .656 .644 .621

GUNS .785 .785 .714 .642 .5 .571

SOFTWARE .785 .75 .696 .696 .66 .66

RETAIL .782 .782 .76 .673 .586 .608

ELECTRON .781 .759 .736 .721 .699 .706

EAT .78 .756 .756 .756 .682 .634

HIGHPRIC .779 .761 .748 .727 .688 .688

INDEXES .778 .74 .729 .718 .686 .643

MILITARY .769 .73 .769 .576 .576 .653

CHEM .744 .767 .72 .651 .604 .558