---TigerSoft HOTLINE --- 11/26/2021 - (C) 2021 William Schmidt, Ph.D. - All

rights reserved.

www.tigersoftware.com/1111H/INDEX.htm

====================================================================================

Always CLICK REFRESH. To refresh -

Point mouse at page and Hold down Control Key and hit F-5.

===> Please report any broken or

out-of-date links. william_schmidt@hotmail.com

====================================================================================

IMPORTANT - HOTLINE ADDRESS WILL CHANGE THIS WEEKEND.

Look for new address on Saturday.

Friday AM

11/26 - data 11/24 - DJI is

-822 and NASDAQ - 196 2:50 AM PCT

| |

I was hoping for a day-off to work

some more on my history of "What Really Moves The DJI: 1885-2021.", but no rest

tonight.

Bloomberg is busy searching for reasons why the DJI futures are down so much. They

chiefly blame the deadly new variations on Covid and Russia's hardliners in the tensions

with the Ukraine. I would prefer to blame the DJI's wicked-looking head/shulders

pattern and the fears that the next few inflation reports will be very scary and force the

FED to raise short-term and 10-year rates.

Inflation is also eating up the buying power of lots of people who have not been in a

position to buy stocks or have been scared away from them. Stocks like Visa are in

trouble already. And the number of stocks making new 12-month lows on the NYSE and

NASDAQ is twice as large as those making new highs. The DJI's job is to hold up the

appearance that all is well. But that will be difficult until the DJI successfully

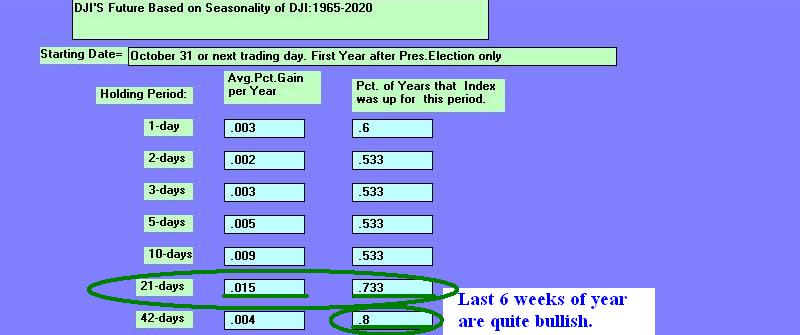

tests its lower 3.5% band. Even the bullish seasonality is not strong enough to

prevent the completion of the DJI's (and DIA's) dangerous head and shoulders

patttern. See the second table below.

We have emphasized the DJI's (and DIA's) head and shoulders

pattern and now we see all our Peerless key Indicators for the DJI in negative territory.

Watch Professionals today. They will have a very hard time holding the market

up like they did in the light trading just before Thanksgiving. The Closing Powers

for DIA did break its up-trend on Wednesday, But this occurred on a light volume day

when manipulation is much easier. We need more proof of a bottom.

Normally the day after Thanksgiving is also one of very low volume. It will be very

interesting to see if the same Professionals who bought on Wednesday to boost the DJI to

prevent a completed hand and shoulders pattern there from being completed will do so again

today in the shorter hours of trading.

When a head and shoulder pattern suddenly appears and is quickly completed, we are in

dangerous times. Wall Street is quickly adapting to some very bad news. Be

careful now.

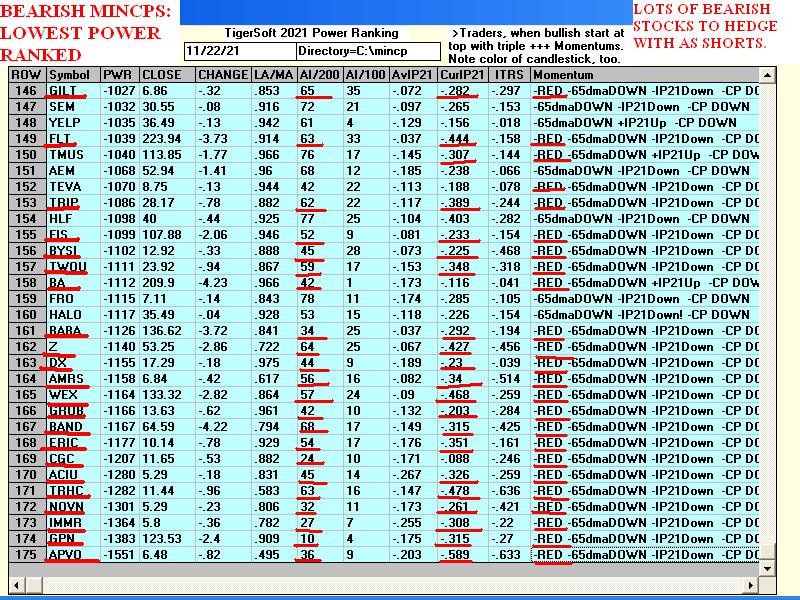

I recommend staying short the weakest Bearish MINCPS. Wait for Peerless to give a

Buy signal before buying any on the Bullish MAXCPs, except DBA which is an ETF shown below

that is a long play on agricultural commodites. Inflation, Global Warming and the

new Covid types are all lifting food prices globally. |

|

|

|

|

|

|

DBA - Agricultural Commodites

|

|

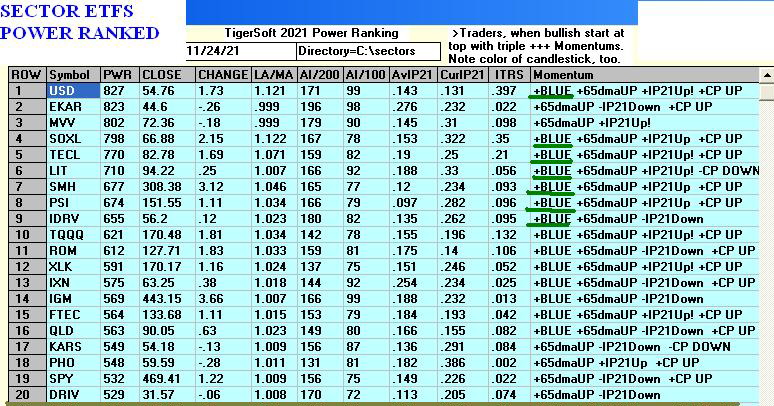

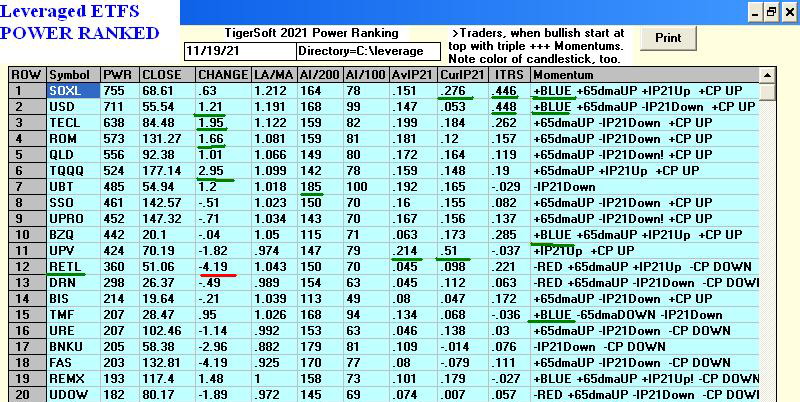

Table 1 QUICKSILVER on ETFS - 11/24/21

Bullish = 4 - RETL, SOXL (+.672), TECL, CORN

Bearish = 1 - OIH

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

======================================================================================================

DIA 358.03 .01 359.35 -25.4% Bearish BLUE .057 ---- -----

---------------------------------------------------------------------------------------------

SPY 469.44 1.25 469.73 13.9% ------- BLUE .153 .022 .175

---------------------------------------------------------------------------------------------

QQQ 398.76 1.28 401.75 14.1% Bullish BLUE .137 .028 .165

---------------------------------------------------------------------------------------------

MDY 523.63 -.16 525.91 -27.9% Bullish BLUE .078 .035 .113

---------------------------------------------------------------------------------------------

IWM 231.58 .25 234.86 -91.7% Bearish BLUE .002 .017 .019

---------------------------------------------------------------------------------------------

FAS 143.43 -.7 137 167.9% ------- BLUE -.034 .179 .145

---------------------------------------------------------------------------------------------

RETL 48.73 -2.18 55.25 -335% ------- BLUE .207 .161 .368

---------------------------------------------------------------------------------------------

SOXL 66.88 2.14 67.98 178.1% Bullish BLUE .322 .35 .672

=====

---------------------------------------------------------------------------------------------

TECL 82.78 1.69 82.53 156.7% Bullish BLUE .25 .209 .459

---------------------------------------------------------------------------------------------

IBB 153.4 .39 153.68 -22.8% Bearish BLUE .125 -.134 -.009

---------------------------------------------------------------------------------------------

GLD 167.12 -.16 173.94 -215.3% ------- BLUE .153 -.031 .122

---------------------------------------------------------------------------------------------

OIH 192.4 .09 194.14 -172% ------- BLUE -.234 -.039 -.273

---------------------------------------------------------------------------------------------

UUP 25.97 .1 25.62 54.3% Bullish ---- .017 .02 .037

---------------------------------------------------------------------------------------------

CORN 25.97 .1 21.77 938.2% Bearish ---- .078 .299 .377

---------------------------------------------------------------------------------------------

YINN 10.69 .09 11.01 -484% Bearish BLUE -.035 -.096 -.131

---------------------------------------------------------------------------------------------

RSX 28.88 -.61 30.81 -402% ------- ---- -.056 -.085 -.141

|

Table 2 Count of Stocks in Key Directories

20211124

-------------------------------

NEWHIGHS 138

NEWLOWS 263

MAXCP 39

MINCP 39

TTTNH 27

TTTNL 35

CPCROSSA 116

CPCROSSD 33

ACCUMVER 242

HIGHIP21 10

HIUPPCT 31

REDSELL 171

AUGSELS7 26

TRAPDOOR 7

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

11/24/21

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

REGBANKS .96 .96 .92 .92 .92 .96

=====

HOMEBLDG .882 .882 .882 .882 .882 .882

INSURANC .8 .84 .68 .52 .64 .68

AUTO .754 .754 .773 .735 .792 .773

SOLAR .75 .75 .75 .875 .812 1

RETAIL .744 .851 .829 .765 .851 .808

INDEXES .695 .695 .679 .673 .679 .711

SEMI .693 .683 .714 .765 .765 .795

FINANCE .679 .728 .666 .654 .679 .74

REIT .671 .633 .625 .648 .702 .717

RUS-1000 .669 .673 .638 .61 .653 .696

CHEM .652 .717 .673 .652 .739 .804

TRANSP .65 .65 .65 .6 .65 .75

SP500 .644 .648 .599 .595 .634 .687

=====

BEVERAGE .642 .714 .714 .5 .642 .714

NIFTY .638 .659 .659 .68 .723 .765

INFRA .636 .575 .575 .484 .515 .606

FOOD .612 .673 .836 .755 .795 .795

INDMATER .611 .666 .638 .597 .652 .694

NASD-100 .608 .597 .577 .577 .608 .649

HIGHPRIC .603 .589 .589 .65 .676 .72

COMPUTER .6 .55 .55 .6 .6 .7

GREEN .6 .6 .65 .65 .7 .65

ELECTRON .589 .582 .619 .686 .701 .731

SP-100 .588 .6 .511 .455 .522 .6

FIDSTKS .568 .568 .508 .514 .568 .668

COMODITY .55 .6 .775 .7 .675 .675

DJI-13 .538 .615 .461 .384 .461 .538

GUNS .538 .615 .538 .615 .692 .692

OILGAS .537 .528 .433 .433 .594 .622

GOLD .521 .565 .804 .826 .847 .826

=========================================================================================

COPPER .5 .5 .5 .5 .25 .25

DOWJONES .5 .533 .433 .366 .433 .533

====

SOFTWARE .5 .5 .517 .553 .589 .625

UTILITY .473 .473 .5 .368 .315 .368

HACKERS .444 .5 .5 .5 .5 .555

BIGBANKS .428 .857 .428 .285 .285 .571

GAMING .421 .315 .421 .421 .421 .631

CHINA .352 .333 .352 .411 .313 .49

MILITARY .346 .384 .307 .384 .461 .5

COAL .333 .5 .333 .333 .333 .333

EDU .333 .333 .333 .333 .333 .166

MARIJUAN .333 .333 .333 .5 .333 .5

HOSPITAL .312 .375 .312 .312 .437 .375

BIOTECH .245 .243 .259 .29 .287 .323

ETFS .232 .303 .285 .357 .446 .625

LOWPRICE .196 .164 .176 .204 .242 .277

BONDFUND .183 .183 .321 .321 .356 .333

JETS .076 .076 .076 .076 .153 .307

--------------------

|

======================================================================================

Wednesday AM

======================================================================================

Written 11-24- 5:45 AM DJI -145 NASDAQ -63 Data through 11/23

| |

Happy Thanksgiving, everyone.

There will be no full Hotline Thursday night. The next one will be on Sunday. Look

for our email giving a new address on Saturday. If you need to renew, email william_schmidt@hotmail.com the CC, exp

date, Sec code & zio code

in four separate emails for security. This Hotline is still $400.00 for a year.

It will be $450 next year for a year.

-----------------------------------------------------------------------------------------------

Now let's catch up on the market.First,

the Closing Powers for the DJI (DIA), NASDAQ, SP-500 (SPY), SOXL (Semi-conductors) and

TECL are all in downtrends. This is bearish. I see no reason to fight the

Professionals right now. Possibly, the bearish pattern in DIA, the falling

Closing Powers and the shadow of the bear on so many stocks will be explained by a

forthcoming upside breakout by the short-term rates and by the 10-year bond rates breaking

out. If the CPI jumps to 7%, I think you can count on that. If this happens,

expect the DJIA and DIA to complete a new head and shoulders pattern. See their

charts below.

Second, the Peerless Sell S12 of two months ago was

recognized at the time as being premature. This has been happening a lot because of

QE-Infinity. We have adjusted to this situation by watching the Closing Powers of

the leading ETFs and stocks in the sectors we are trading.

We also stated the we would know that the continued advance might fail because of how

badly the DJI was lagging. And we would recognize the

likely final peak in the tech sectors by a big red candle stick forming. This is

exactly what happened on Monday.

Now we can see the failed breakout in the DJI and the NASDAQ and SOXL. Sell S12s do

have paper losses sometimes. Once a DJI breakout or NASDAQ breakout fails, there is

almost always a decline

to the lower band or 65-dma. That is the spot we are in now.

We should be able to spot the point where a pullback must stop. It is

the previous point of breakout. Recently, the DJI should not have

dropped below the 35800-36000 breakout point. Some of you don't like such a nuanced

Peerless because it relies on judgement. That's fine, but I see no need to suffer a

3% paper loss. I find this notation reasonable in an age of QE-Infinity and plan to

continue it. Email me if my explanations are not clear.

There were almost 700 NYSE and NASDAQ new lows. This means our short sales from the

2021 Power Ranked Bearish MINCP probably offer much more potential than do any of the

Bullish MAXCPs or ETFs,

including FAS, as long as their Closing Powers stay below their 21-dma. I can

understand not wanting to sell short. It seems un-patriotic. But if we get in

a long bear market, you will be very glad you have used our Bearish MINCPs that way.

Get the Short Selling Book I have written. It will do you a lot of good in a

serious market decline.

We should - based on history - see a rally this week, not a deline. If,

instead, the market falls, it could mean real trouble lies ahead.

|

|

======================================================================================================

=====================================================================================

Written 11-23- 6:00 AM DJI +28 NASDAQ -18 Data through 11/22

| |

Powell's renomination as FED

chairman had the expected upward push on bank stocks and FAS, but coincided with a last

minute sell-off on the DJI, as a whole. In addition, we see bearish inverted red

popsicles on most of the leading tech ETFS and tech stocks as well as the NASDAQ. I

suggested taking profits in them in this event and going short some of many bearish

MINCPs.

The number of new lows on the NYSE and NASDAQ has reached 683 on the NYSE and NASDAQ.

So a bear market has spread its shadow quite widely. But Powell has come

through time and again in holding up the market. And I would expect him to do so

again. Short-term rates fell back to 0.4% today. I suspect that the rest of

Thanksgiving week will see a small recovery of what was lost this afternoon.

But Professionals are not yet ready to buy aggressively. The many Closing Power

non-confirmations of new highs today in the tech sector followed by breaks in the steep CP

uptrends show that there are other problems for the market, such as the enormous

debt, rising Covid statistics, 6%+ inflation and limits on liquidity insertions by the

FED. Without a new Peerless Buy signal or breaks in the Closing Power downtrends of

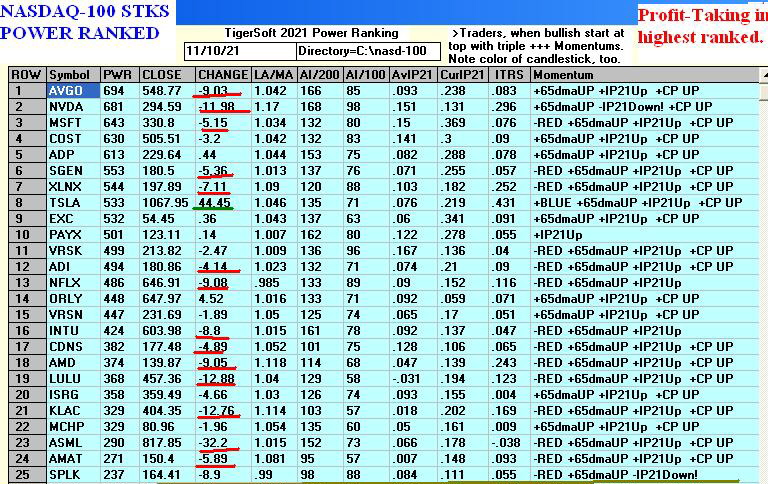

the key ETFs, I would wait to buy again. Instead, study how well the Power Ranking

work with the MINCP stocks in the third Power Ranking shown below today. We

are going to make a lot of money when the market turns broadly down using the Power

Ranker.

|

|

Charts - 11/23/2021

2021 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20

Inverted Traders Index

Graph of Pct of All Stocks above

65-dma Cum. Inverted

Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA QQQ SPY IWM TNA Short-Term Rates DOLLAR-UUP ALLSTOCKs

recent 2006 vers-Peerless signals

http://tigersoftware.com/NEWPEER/UPD71122.BMP

MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL

SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

STOCKS:

MRNA DIS GE PYPL GME ZOM XLE NRGU

AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX

CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M MRK MSFT NEM NFLX

NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM

Bullish MAXCPs http://tigersoftware.com/UPPER/11-22/BULLISH.htm

Bearish MAXCPs http://tigersoftware.com/DOWNER/11-22/BEARISH.htm

|

Approaching oversold.

|

|

|

|

|

|

|

|

Table 1 QUICKSILVER on ETFS - 11/22/21

Bullish = 4 - RETL, SOXL (+.598), TECL, CORN

Bearish = 1 - OIH

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

================================================================================================

DIA 356.2 .29 361.93 -70.1% Bearish RED -.077 ---- -----

---------------------------------------------------------------------------------------------

SPY 467.57 -1.32 469.28 1.5% ------- RED .063 .027 .09

---------------------------------------------------------------------------------------------

QQQ 399.3 -4.69 397.42 58.8% ------- RED .066 .041 .107

---------------------------------------------------------------------------------------------

MDY 524.2 .62 531.03 -55.8% ------- RED -.002 .043 .041

---------------------------------------------------------------------------------------------

IWM 231.73 -.99 238.99 -144.4% Bearish RED -.065 .02 -.045

---------------------------------------------------------------------------------------------

FAS 138.18 5.37 143.26 -193.4% Bearish BLUE -.127 .127 0

---------------------------------------------------------------------------------------------

RETL 53.25 2.19 56.2 -99.4% ------- BLUE .151 .293 .444

---------------------------------------------------------------------------------------------

SOXL 65.43 -3.18 66.15 168.7% Bullish RED .251 .347 .598

---------------------------------------------------------------------------------------------

TECL 81.66 -2.82 80.96 193% Bullish RED .112 .226 .338

---------------------------------------------------------------------------------------------

IBB 153.68 -.88 154.06 16.2% Bearish RED .027 -.117 -.09

---------------------------------------------------------------------------------------------

GLD 168.74 -3.87 172.92 -156.7% ------- RED .152 -.014 .138

---------------------------------------------------------------------------------------------

OIH 185.79 2.02 206.64 -471.2% Bearish BLUE -.299 -.047 -.346

---------------------------------------------------------------------------------------------

UUP 25.88 .13 25.74 46.7% Bullish ---- .016 .021 .037

---------------------------------------------------------------------------------------------

CORN 25.88 .13 25.74 862.2% Bearish ---- .173 .301 .474

---------------------------------------------------------------------------------------------

YINN 10.74 -.42 12.16 -445% Bearish RED -.084 -.165 -.249

---------------------------------------------------------------------------------------------

RSX 28.36 -1.56 31.03 -482.5% Bearish RED -.121 -.088 -.209

|

Table 2 Count of Stocks in Key Directories

20211122

-------------------------------

NEWHIGHS 348

NEWLOWS 683 bearish.

MAXCP 10

MINCP 175 bearish

TTTNH 23

TTTNL 117

CPCROSSA 58

CPCROSSD 56

ACCUMVER 239

HIGHIP21 12

HIUPPCT 27

VHIP21 85

LOWACCUM 154

REDSELL 181

AUGSELS7 52

TRAPDOOR 10

|

Tablle 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

11/22/21

Bullish = 30

Bearish = 16

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

REGBANKS .92 .92 .92 .96 .96 .96

HOMEBLDG .882 .882 .882 .882 .882 .882

FOOD .836 .755 .795 .795 .795 .755

RETAIL .829 .765 .851 .808 .893 .936

GOLD .804 .826 .847 .826 .869 .913

COMODITY .775 .7 .675 .675 .7 .7

AUTO .773 .735 .792 .773 .83 .83

SOLAR .75 .875 .812 1 .937 .937

BEVERAGE .714 .5 .642 .714 .714 .785

SEMI .714 .765 .765 .795 .795 .795

^^^^^

INSURANC .68 .52 .64 .68 .84 .84

INDEXES .679 .673 .679 .701 .733 .771

CHEM .673 .652 .739 .804 .826 .804

FINANCE .666 .654 .679 .74 .765 .753

NIFTY .659 .68 .744 .765 .787 .808

GREEN .65 .65 .7 .65 .7 .8

TRANSP .65 .6 .65 .75 .75 .9

INDMATER .638 .597 .652 .694 .722 .763

RUS-1000 .638 .61 .653 .696 .727 .736

ELECTRON .619 .686 .701 .731 .761 .738

REIT .618 .641 .702 .717 .74 .801

SP500 .599 .595 .634 .687 .707 .719

^^^^^

HIGHPRIC .59 .652 .677 .721 .75 .728

NASD-100 .577 .577 .608 .649 .69 .69

^^^^^

INFRA .575 .484 .515 .606 .666 .727

COMPUTER .55 .6 .6 .7 .75 .7

GUNS .538 .615 .692 .692 .692 .692

SOFTWARE .517 .553 .589 .625 .625 .589

SP-100 .511 .455 .522 .6 .633 .677

FIDSTKS .508 .514 .568 .668 .692 .704

-----------------------------------------------------------------------------------------

COPPER .5 .5 .25 .25 .5 .625

HACKERS .5 .5 .5 .555 .555 .555

UTILITY .5 .368 .315 .342 .394 .473

-----------------------------------------------------------------------------------------

DJI-13 .461 .384 .461 .538 .692 .692

DOWJONES .433 .366 .433 .533 .6 .733

^^^^^

OILGAS .433 .433 .594 .622 .735 .735

BIGBANKS .428 .285 .285 .571 .714 .714

GAMING .421 .421 .421 .631 .684 .684

CHINA .352 .411 .313 .47 .509 .509

COAL .333 .333 .333 .333 .5 .5

EDU .333 .333 .333 .166 .333 .333

MARIJUAN .333 .5 .333 .5 .5 .666

BONDFUND .329 .329 .363 .329 .352 .34

HOSPITAL .312 .312 .437 .375 .437 .437

MILITARY .307 .384 .461 .5 .538 .653

ETFS .285 .357 .446 .625 .696 .714

BIOTECH .263 .293 .291 .326 .37 .37

LOWPRICE .176 .204 .244 .277 .323 .358

JETS .076 .076 .153 .307 .307 .615

|

=====================================================================================

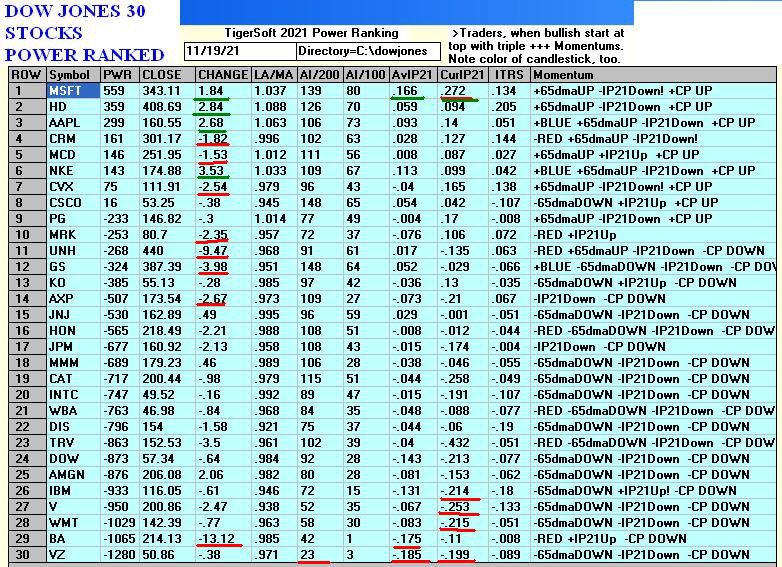

Written

11-22- 3:57 AM DJI +173 NASDAQ +63 Data

through 11/19

| |

Word may have leaked out that Biden

will re-appoint Wall Street's

friend and supporter, Jerome Powell, as Fed Chairman. That would explain the

strength this morning before the opening. If so, Professionals will likely buy

steadily all day. And we should, too. Afterall, the FAS ETF (representing

financials) has fallen back to good support at its 65-dma and there usually is a rally the

week of Thanksgiving. Historically, the DJI rises modestly two thirds of the time

over the next week, two weeks and month in the first year of a Presidential Election since

1965.

Since the Closing Powers have not yet turned up for DIA and FAS, I would rather be

long the much stronger tech ETFs: SOXL and TECL. QQQ stands right at the

top of its price channel. Watch it. A breakout move higher by QQQ would be

quite bullish for it and other tech stocks. More shorts there will be run in.

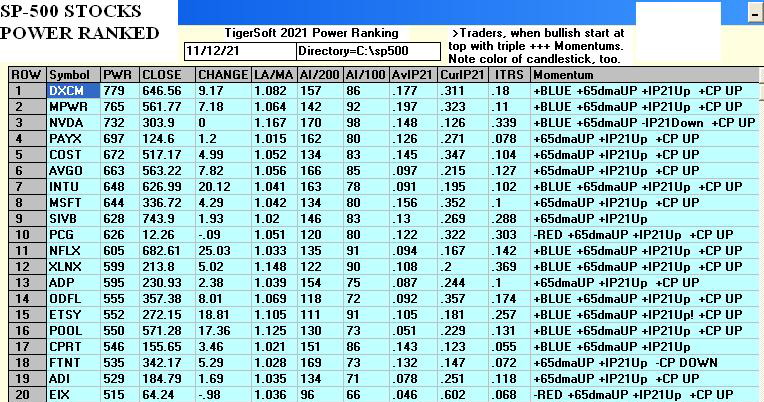

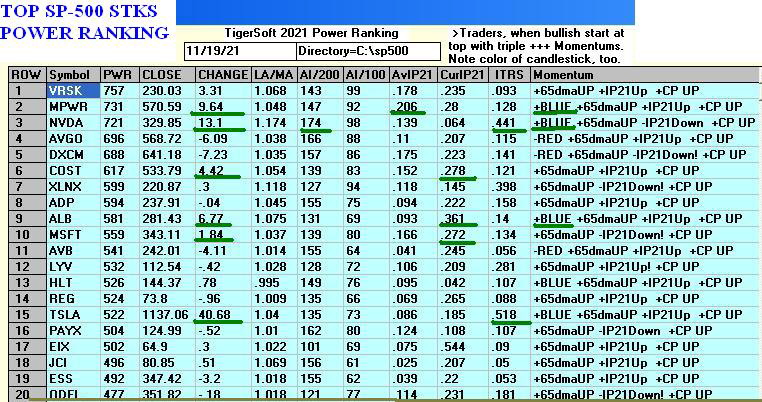

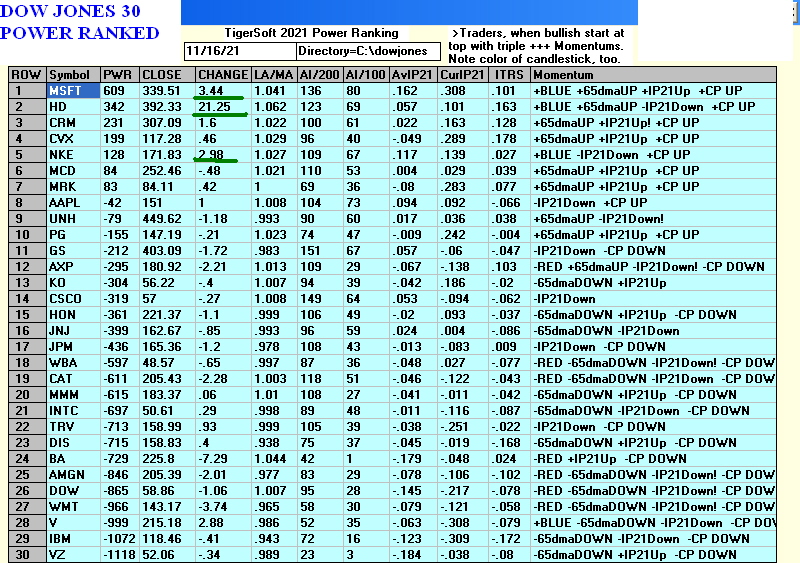

MSFT and NVDA made new highs on Friday.

This bodes well for QQQ. See their lofty position in our SP-500 Tiger power-

ranking. Note how the highest IP21 rankings. This correlates closely with big

daily gains at the top of the Power Ranking while the very lowest IP21 stocks

over-populate the stocks down the most frequently.

This is now a market where there are more new lows than new highs. Professional

money has a habit in this market environment of playing "musical chairs" and

still pushing up the best performing stocks at the end of the year and selling off quickly

those that break support. We can confirm breakdowns by looking for negative

Accumulation and falling Closing Power. Once the "dumping" starts, these

stocks often drop a long ways. Shorting them soon after they break support in this

manner, is a good way to hedge, as is shorting the very lowest Power Ranked MINCPs, which

can fall day after day until there is a selling climax.

Watch the Closing Powers for the leading tech stocks. It may be bearish

when Professionals become net sellers of them and their over-extended Closing Power

uptrends are violated. "Big red popsicles" in their candle-sticks will

cause traders to take profits in them at this point. If that

were happen today, the early rumors may be wrong and Biden may still be about to

pick a new Fed Chairman with all the risks for the market that that may bring. Biden

is probably delaying making an announcement because he using that as a bargaining chip

with some Senators over his big Public Works legislation.

|

|

Charts and Tables

Short-Term interest rates remain under 0.5% This should mean

support is good near the

DJI's 65-dma. The interest on 10-year Treasuries fell back on Friday. This

should help the

NASDAQ and tech stocks.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1 QUICKSILVER on ETFS - 11/19/21

Bullish = 4 - RETL, SOXL (+.722), TECL, CORN

Bearish = 1 - OIH

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

-------------------------------------------------------------------------------------------------

DIA 355.91 -3.44 361.24 -74.4% Bearish RED .005 --- ----

---------------------------------------------------------------------------------------------

SPY 468.89 -.84 467.43 17.3% ------- RED .132 .026 .158

---------------------------------------------------------------------------------------------

QQQ 403.99 2.24 394.61 116.9% ------- BLUE .133 .046 .179

---------------------------------------------------------------------------------------------

MDY 523.58 -2.33 530.09 -52.6% Bullish BLUE .043 .042 .085

---------------------------------------------------------------------------------------------

IWM 232.72 -2.14 238.55 -142.7% Bearish RED -.007 .024 .017

---------------------------------------------------------------------------------------------

FAS 132.81 -4.19 143.56 -383.7% Bearish RED -.079 .111 .032

---------------------------------------------------------------------------------------------

RETL 51.06 -4.19 54.32 -242% Bearish RED .098 .221 .319 +

---------------------------------------------------------------------------------------------

SOXL 68.61 .63 63.2 404.4% Bullish BLUE .276 .446 .722 +

---------------------------------------------------------------------------------------------

TECL 84.48 1.95 78.52 356.6% Bullish BLUE .184 .262 .446

---------------------------------------------------------------------------------------------

IBB 154.56 .88 153.18 18.2% Bearish BLUE .053 -.134 -.081

---------------------------------------------------------------------------------------------

GLD 172.61 -1.33 174.18 -52.9% ------- RED .198 .006 .204

---------------------------------------------------------------------------------------------

OIH 183.77 -10.37 204.41 -559.4% Bearish RED -.261 -.016 -.277

---------------------------------------------------------------------------------------------

UUP 25.75 .13 25.64 48.8% Bullish ---- -.034 .009 -.025

---------------------------------------------------------------------------------------------

CORN 25.75 .13 25.64 48.8% Bearish ---- .103 .288 .391

---------------------------------------------------------------------------------------------

YINN 11.16 .15 11.77 -353.6% Bearish ---- -.092 -.142 -.234

---------------------------------------------------------------------------------------------

RSX 29.92 -.89 31.34 -216.7% Bearish RED -.093 -.023 -.116

|

Table 2 Count of Stocks in Key Directories

20211119

-------------------------------

NEWHIGHS 251

NEWLOWS 434

MAXCP 25

MINCP 179

TTTNH 13

TTTNL 98

CPCROSSA 59

CPCROSSD 61

ACCUMVER 235

HIGHIP21 13

HIUPPCT 30

VHIP21 85

LOWACCUM 148

REDSELL 186

AUGSELS7 42

TRAPDOOR 12

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

11/19/21

Bullish = 27

Bearish = 17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

REGBANKS .92 .92 .96 .96 .96 .96

HOMEBLDG .882 .882 .882 .882 .882 .882

SOLAR .875 .812 1 .937 .937 .937

GOLD .826 .847 .826 .869 .913 .913

RETAIL .765 .851 .808 .893 .936 .893

SEMI .765 .765 .795 .795 .795 .806

FOOD .755 .795 .795 .795 .755 .734

AUTO .735 .792 .773 .83 .83 .811

COMODITY .7 .675 .675 .7 .7 .7

ELECTRON .686 .701 .731 .761 .738 .746

NIFTY .68 .744 .765 .787 .787 .787

INDEXES .668 .679 .701 .733 .766 .728

FINANCE .654 .679 .74 .765 .753 .765

CHEM .652 .739 .804 .826 .804 .891

HIGHPRIC .652 .677 .721 .75 .728 .753

GREEN .65 .7 .65 .7 .75 .75

REIT .641 .694 .717 .74 .801 .778

GUNS .615 .692 .692 .692 .692 .615

RUS-1000 .61 .653 .696 .727 .734 .739

COMPUTER .6 .6 .7 .75 .7 .75

TRANSP .6 .65 .75 .75 .9 .85

INDMATER .597 .652 .694 .722 .763 .777

SP500 .595 .634 .687 .707 .719 .722

NASD-100 .577 .608 .649 .69 .68 .721

SOFTWARE .553 .589 .625 .625 .571 .66

INSURANC .52 .64 .68 .84 .84 .8

FIDSTKS .514 .568 .668 .692 .704 .68

=========================================================================================

BEVERAGE .5 .642 .714 .714 .785 .785

COPPER .5 .25 .25 .5 .625 .625

HACKERS .5 .5 .555 .555 .555 .611

MARIJUAN .5 .333 .5 .5 .666 .833

=========================================================================================

INFRA .484 .515 .606 .666 .727 .727

SP-100 .455 .522 .6 .633 .688 .688

OILGAS .433 .594 .622 .735 .745 .773

GAMING .421 .421 .631 .684 .684 .631

CHINA .411 .313 .47 .509 .509 .588

DJI-13 .384 .461 .538 .692 .692 .615

MILITARY .384 .461 .5 .538 .653 .653

UTILITY .368 .315 .342 .394 .473 .368

DOWJONES .366 .433 .533 .6 .733 .7

ETFS .357 .446 .625 .696 .714 .732

COAL .333 .333 .333 .5 .5 .666

EDU .333 .333 .166 .333 .333 .333

BONDFUND .329 .363 .329 .352 .329 .386

HOSPITAL .312 .437 .375 .437 .437 .437

BIOTECH .295 .293 .328 .372 .372 .419

BIGBANKS .285 .285 .571 .714 .714 .714

LOWPRICE .207 .242 .277 .323 .358 .366

JETS .076 .153 .307 .307 .615 .538

|

====================================================================================

====================================================================================

Written 11-19- 5:55 AM DJI -196 NASDAQ +73 Data through 11/18

| |

That Wall Street's friend and

benefactor Jerome Powell might not be nominated is the big elephant in the room that the

DJI and dividend stocks are concerned most about right now. As a result, today we

saw more new lows than new highs on the NYSE and NASDAQ by almost 2:1. There's no

point in trying to call a bottom in the DJI until the Closing Power, representing market

professionals, turns up.

I have said for some time, that we will know a

market top is upon us because out Closing Powers for bank stocks and FAS will turn badly

down. Money, especially, at little cost is their mothers' milk. If it does

turn out, that Powell is not to be reappointed, it would explain a lot why FAS, GS,

JPM, AXP, V and the lot, all have become very weak, especially their Closing Powers.

The White House can not keep a secret any better than Wall Street.

Meanwhile, traders are hooked on the steady rise of

Semi-conductor stocks, which as a group, made another new high today. As long as the

Closing Powers of the NASDAQ (COMPQX), QQQ, TECL and SOXL remain in rising trends, stick

with them. But look how really ugly and even frightening the many Bearish

MINCPs appear. Short some.

It is highly unusual for the DJI to decline seriously and below the lower band in the last

two months of the first year after a Presidential Election.

It nearly always waits until soon after the new year starts, as in 1962, 1966, 1970, 1974,

1990, 1994, 2002, 2010, 2018.

So, we can hope that this seasonality will now act as a prop. But do

not count on it if Biden does not pick Powell. The first thing the market may do is

to shrug it off, but once his replacement takes office in January, the next thing it will

likely do is to test her by falling and crying out for help, very much like a spoiled

little child. |

|

====================================================================================

Written 11-18- 5:45 AM DJI +25 NASDAQ +83 Data through 11/17

| |

Fears that Jerome

Powell will NOT be re-nominated as Fed Chairman are working against the market now.

Powell's low interest rates

and QE-Infinity have made the FED very popular on Wall Street. Never has so much

money been distributed there with so few strings attached. Imagine borrowing at 1%

when inflation is 6%.

President Biden has announced that he will be soon make his choice

for the job of Chairman of the Federal Reserve known. Unlike Powell, Biden has

picked a relatively unknown Democratic economist named Lael Brainard as his alternative to

interview.

https://en.wikipedia.org/wiki/Lael_Brainard

It appears to me that he has staged her so that she will seem weak compared to the

experienced and well-known Powell and Biden will be seen as acting more wisely.

But we will soon see. Either way, Professionals have become heavy sellers of DIA and

most of the DJI-30 stocks including GS. Now even

FAS, which represents financials, shows a weak Closing Power. FAS is more closely

linked to the DJI's rises and falls than any sector ETF.

At the same time, there are now more new lows than new highs on the NYSE and NASDAQ and

more new lows among our Bearish MINCPs than our Bullish MAXCPs. At this point,

shorting some of the weakest Bearish MINCPs is probably called for if the DJI breaks below

35800. But stay long SOXL and QQQ. There is a lot of market history

showing the DJI topping out weeks and even months before QQQ and the NASDAQ do.

|

|

Table 1 QUICKSILVER on ETFS - 11/17/21

Bullish = 5 - RETL, SOXL (+.699), TECL, GLD and CORN

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

---------------------------------------------------------------------------------------------

DIA 359.85 -2.08 359.46 -16.9% Bearish RED .06 0 -----

---------------------------------------------------------------------------------------------

SPY 468.14 -1.14 463.77 48.5% ------- RED .188 .012 .2

---------------------------------------------------------------------------------------------

QQQ 397.63 .21 390.59 103.2% ------- RED .119 .018 .137

---------------------------------------------------------------------------------------------

MDY 526.56 -4.47 527.23 20% ------- RED .095 .035 .13

---------------------------------------------------------------------------------------------

IWM 235.86 -3.13 239.26 -31.2% ------- RED .059 .027 .086

---------------------------------------------------------------------------------------------

FAS 138.79 -4.47 142.75 -97.2% Bearish RED -.013 .145 .132

---------------------------------------------------------------------------------------------

RETL 52.25 -3.95 52.36 167.6% ------- RED .126 .227 .353

---------------------------------------------------------------------------------------------

SOXL 64.52 -1.63 61.64 526% Bullish RED .29 .409 .699

---------------------------------------------------------------------------------------------

TECL 80.21 -.75 76.06 343.7% Bullish RED .152 .148 .3

---------------------------------------------------------------------------------------------

IBB 154.1 .04 153.42 19.2% Bearish BLUE .066 -.139 -.073

---------------------------------------------------------------------------------------------

GLD 174.5 1.58 174.12 38.8% Bullish BLUE .279 .017 .296

---------------------------------------------------------------------------------------------

OIH 198.97 -7.67 209.34 -261.7% Bearish RED -.158 .08 -.078

---------------------------------------------------------------------------------------------

UUP 25.69 -.05 25.53 43% Bullish ---- -.009 .006 -.003

---------------------------------------------------------------------------------------------

CORN 25.69 -.05 25.53 43% Bearish ---- .392 .285 .677

---------------------------------------------------------------------------------------------

YINN 11.76 -.4 11.95 439.4% Bearish RED -.042 -.125 -.167

---------------------------------------------------------------------------------------------

|

Table 2 Count of Stocks in Key Directories

20211117

-------------------------------

NEWHIGHS 222

NEWLOWS 324

MAXCP 29

MINCP 118

TTTNH 22

TTTNL 79

CPCROSSA 45

CPCROSSD 76

ACCUMVER 234

HIGHIP21 16

HIUPPCT 26

REDSELL 155

AUGSELS7 50

TRAPDOOR 10

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

11/17/21

Bullish = 37

Bearish = 10

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

SOLAR 1 .937 .937 .937 .937 .812

REGBANKS .96 .96 .96 .96 .96 .96

HOMEBLDG .882 .882 .882 .882 .882 .882

GOLD .826 .869 .913 .913 .934 .847

RETAIL .808 .893 .936 .893 .851 .851

CHEM .804 .826 .804 .891 .891 .826

FOOD .795 .795 .755 .734 .755 .755

SEMI .795 .795 .795 .806 .785 .755

NIFTY .765 .787 .808 .787 .744 .787

TRANSP .75 .75 .9 .85 .9 .95

FINANCE .74 .765 .753 .765 .777 .74

AUTO .733 .8 .8 .777 .755 .711

ELECTRON .731 .761 .738 .746 .708 .694

HIGHPRIC .721 .75 .728 .753 .721 .728

BEVERAGE .714 .714 .785 .785 .785 .714

REIT .709 .732 .801 .778 .824 .824

INDEXES .701 .733 .766 .722 .75 .804

COMPUTER .7 .75 .7 .75 .75 .7

RUS-1000 .696 .727 .734 .739 .718 .705

INDMATER .694 .722 .763 .777 .791 .75

GUNS .692 .692 .692 .615 .615 .615

SP500 .687 .707 .719 .724 .703 .701

INSURANC .68 .84 .84 .8 .84 .84

COMODITY .675 .7 .7 .7 .675 .625

FIDSTKS .668 .692 .704 .68 .674 .698

GREEN .65 .7 .75 .75 .8 .8

NASD-100 .649 .69 .68 .721 .711 .69

GAMING .631 .684 .684 .631 .578 .578

ETFS .625 .696 .714 .75 .714 .571

SOFTWARE .625 .625 .571 .66 .66 .642

OILGAS .622 .735 .745 .773 .783 .745

INFRA .606 .666 .727 .727 .787 .666

SP-100 .6 .633 .688 .7 .666 .666

BIGBANKS .571 .714 .714 .714 .714 .571

HACKERS .555 .555 .555 .611 .611 .611

DJI-13 .538 .692 .692 .615 .692 .615

DOWJONES .533 .6 .733 .7 .7 .666

=========================================================================================

MARIJUAN .5 .5 .666 .833 .5 .5

MILITARY .5 .538 .653 .653 .615 .692

=========================================================================================

CHINA .47 .509 .509 .588 .588 .352

HOSPITAL .375 .437 .437 .437 .437 .437

UTILITY .342 .394 .473 .368 .421 .342

COAL .333 .5 .5 .666 .666 .5

BIOTECH .331 .375 .375 .419 .397 .369

BONDFUND .329 .352 .329 .375 .397 .352

JETS .307 .307 .615 .538 .692 .692

LOWPRICE .277 .32 .358 .366 .368 .338

COPPER .25 .5 .625 .625 .625 .25

EDU .166 .333 .333 .333 .333 .333

|

====================================================================================

====================================================================================

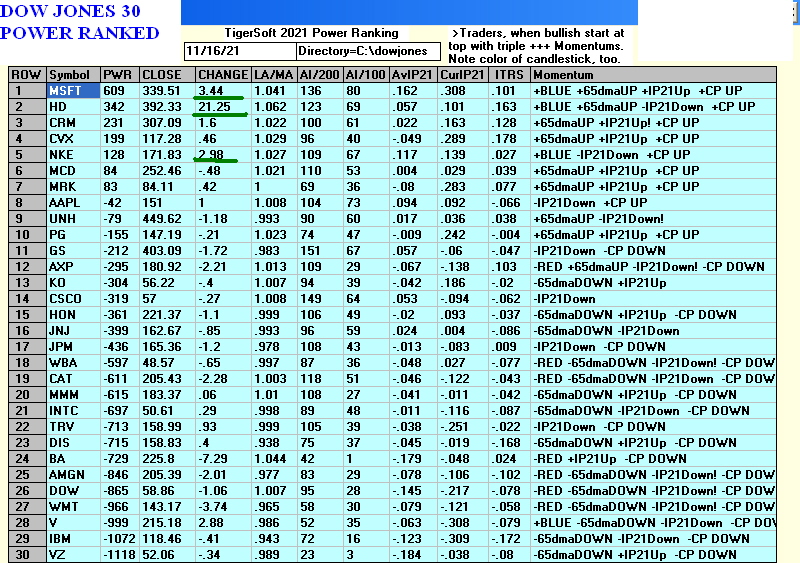

Written 11-17- 6:12 AM DJI -51 NASDAQ +8 Data through 11/16

| |

Though little changed

at the end of the day, the DJI lost 100 + point in its early gain today and closed again

at its lows. It only managed this because high priced Home Depot was up more than 21

points (thereby lifting the DJI more than 125 just by itself). Interest rates are

not going up much but President Biden says he will pick the next Fed Chairman at the end

of the week. I would expect him to be cautious about a different person, but we'll

see. This makes some blue chip and bond traders nervous.

The DJI might breakdown to a short-term new low and complete

a minor head/shoulders. But I doubt if that will be significanct. The

DIA's Closing Power's does suggest that many Professionals do not deem the DJI worthy of

being long at this time.

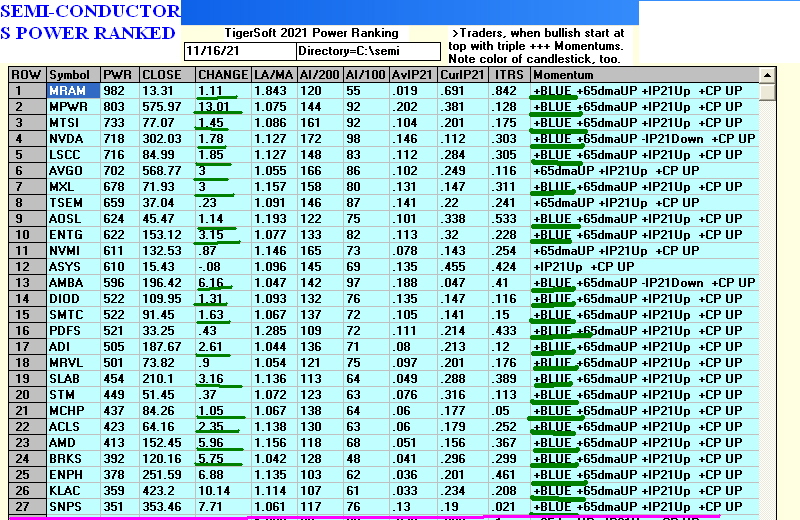

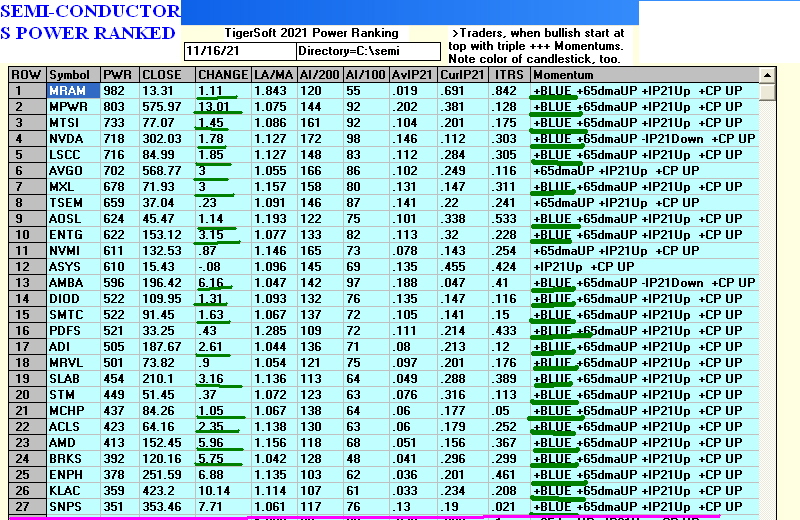

Of more importance is the fact that the volatile Semiconductors

(SOXL) roared ahead to a new high, Look at the Power Ranking below of our

Semi-conductors. Almost every top-ranked semi was up more than a point. They

are the stars of our Bullish MAXCPs, tonight. SOXL should be held. The

generation move into electric cars is playing a big role here. TSLA cannot be held

back and re-gained 50+ today. I would ignore the DJI at this time and be long some of the

plays in SOXL. They have become dominant among growth stocks. |

|

Charts - 11/16/2021

2021 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20

Inverted Traders Index

Graph of Pct of All Stocks above

65-dma Cum. Inverted

Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA QQQ SPY IWM TNA Short-Term Rates DOLLAR-UUP ALLSTOCKs

recent 2006 vers-Peerless signals

http://tigersoftware.com/NEWPEER/UPD71115.BMP

MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL

SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

STOCKS:

MRNA DIS GE PYPL GME ZOM XLE NRGU

AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX

CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M MRK MSFT NEM NFLX

NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM

Bullish MAXCPs http://tigersoftware.com/UPPER/11-16/BULLISH.htm

Bearish MAXCPs http://tigersoftware.com/DOWNER/11-16/BEARISH.htm

|

|

|

|

|

|

|

|

|

Table 1 QUICKSILVER on ETFS - 11/16/21

Bullish = 6 - SPY, RETL, SOXL (+.726), TECL, GLD and CORN

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

==================================================================================================

DIA 361.93 .69 361.07 -18.7% ------- BLUE .128 0 .128

---------------------------------------------------------------------------------------------

SPY 469.28 1.85 463.62 20.4% ------- BLUE .238 .01 .248

---------------------------------------------------------------------------------------------

QQQ 397.42 2.81 389.51 26.7% ------- BLUE .168 .01 .178

---------------------------------------------------------------------------------------------

MDY 531.03 .94 524.45 17.6% Bullish BLUE .106 .037 .143

---------------------------------------------------------------------------------------------

IWM 238.99 .44 237.35 -45.2% ------- BLUE .086 .026 .112

---------------------------------------------------------------------------------------------

FAS 143.26 -.3 141.57 9.1% Bearish RED .065 .169 .234

---------------------------------------------------------------------------------------------

RETL 56.2 1.88 50.46 242% Bullish BLUE .211 .273 .484

---------------------------------------------------------------------------------------------

SOXL 66.15 2.95 57.95 222.1% Bullish BLUE .341 .385 .726

---------------------------------------------------------------------------------------------

TECL 80.96 2.44 74.86 133.7% Bullish BLUE .235 .141 .376

---------------------------------------------------------------------------------------------

IBB 154.06 .88 153.51 -47.4% Bearish BLUE .056 -.152 -.096

---------------------------------------------------------------------------------------------

GLD 172.92 -1.26 173.15 47% ------- RED .218 .001 .219

---------------------------------------------------------------------------------------------

OIH 206.64 2.23 209.82 -352.1% Bearish BLUE -.093 .079 -.014

---------------------------------------------------------------------------------------------

UUP 25.74 .1 25.47 106% Bullish BLUE .044 .006 .05

---------------------------------------------------------------------------------------------

CORN 25.74 .1 25.47 106% Bearish BLUE .321 .284 .605

---------------------------------------------------------------------------------------------

YINN 12.16 .39 10.73 760.5% ------- ---- .04 -.126 -.086

---------------------------------------------------------------------------------------------

RSX 31.03 -.31 31.72 -198.5% Bearish RED .01 .007 .017

|

Table 2 Count of Stocks in Key Directories

20211116

-------------------------------

NEWHIGHS 470

NEWLOWS 260

MAXCP 40

MINCP 91

TTTNH 32

TTTNL 59

CPCROSSA 101

CPCROSSD 73

ACCUMVER 232

HIGHIP21 15

HIUPPCT 22

REDSELL 149

AUGSELS7 54

TRAPDOOR 8

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

11/16/21

Bullish = 39

Bearish = 7

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

REGBANKS .96 .96 .96 .96 .96 .96

SOLAR .937 .937 .937 .937 .812 .875

RETAIL .893 .936 .893 .851 .829 .829

HOMEBLDG .882 .882 .882 .882 .882 .882

GOLD .869 .913 .913 .934 .847 .913

INSURANC .84 .84 .8 .84 .84 .8

CHEM .826 .804 .891 .891 .826 .826

AUTO .8 .8 .777 .755 .711 .711

FOOD .795 .755 .734 .755 .755 .755

SEMI .795 .795 .806 .785 .755 .775

NIFTY .787 .808 .787 .765 .723 .787

FINANCE .765 .753 .765 .777 .74 .777

ELECTRON .761 .738 .746 .708 .686 .738

COMPUTER .75 .7 .75 .75 .7 .65

HIGHPRIC .75 .728 .753 .721 .721 .768

TRANSP .75 .9 .85 .9 .95 1

OILGAS .735 .745 .773 .783 .735 .792

INDEXES .733 .766 .722 .75 .798 .777

REIT .73 .792 .776 .823 .823 .846

RUS-1000 .727 .734 .739 .718 .701 .727

INDMATER .722 .763 .777 .791 .736 .791

BEVERAGE .714 .785 .785 .785 .714 .642

BIGBANKS .714 .714 .714 .714 .571 .714

SP500 .707 .719 .724 .703 .697 .711

COMODITY .7 .7 .7 .675 .625 .7

GREEN .7 .75 .75 .8 .8 .8

ETFS .696 .714 .75 .714 .553 .66

DJI-13 .692 .692 .615 .692 .538 .615

FIDSTKS .692 .704 .68 .674 .686 .704

GUNS .692 .692 .615 .615 .615 .615

NASD-100 .69 .68 .721 .711 .69 .701

GAMING .684 .684 .631 .578 .578 .684

INFRA .666 .727 .727 .787 .666 .787

SP-100 .633 .688 .7 .666 .655 .677

SOFTWARE .625 .571 .66 .66 .642 .696

DOWJONES .6 .733 .7 .7 .633 .666

HACKERS .555 .555 .611 .611 .611 .722

MILITARY .538 .653 .653 .615 .653 .769

CHINA .509 .509 .588 .588 .313 .431

=========================================================================================

COAL .5 .5 .666 .666 .5 .666

COPPER .5 .625 .625 .625 .25 .5

MARIJUAN .5 .666 .833 .5 .5 .5

========================================================================================

HOSPITAL .437 .437 .437 .437 .437 .437

UTILITY .394 .473 .368 .421 .342 .368

BIOTECH .376 .376 .419 .397 .373 .438

BONDFUND .352 .329 .375 .397 .352 .522

EDU .333 .333 .333 .333 .333 .333

LOWPRICE .322 .355 .365 .367 .337 .425

JETS .307 .615 .538 .692 .615 .923

|

=====================================================================================

=====================================================================================

Written 11-16- 6:00 AM DJI +45

NASDAQ -16 Data through 11/15

| |

After a positive

opening of more than 100 points, the DJI gradually weakened much of the day. This

dropped the DJI's Closing Power

below its 21-dma. DIA's Closing Power's shallow rise on Friday was more than matched

by its decline today. Professionals, apparently, do not deem the DJI worthy of being

long, rather than wanting to sell it aggressively. The DIA's Closing Power is quite

a bit weaker than the Closing Powers of the NASDAQ, SPY, QQQ, SOXL or TECL, all of which

show rising Closing Power moving averages and positive IP21-values.

The moves in the DJI are very small right now. If we focus on them too much we will

lose sight of the really big moves individual sectors and stocks are making. Let me

suggest we work with longs in SOXL and QQQ now. In particular, read up on how

electrical cars are going to take over the roads in a few years. For a year-end

rally, I would buy chip-makers that are enabling car-makers to abandon higher maintenance

gasoline powered engines and I would buy the leading battery-powered vehicles when each's

intermediate-term dips are over. See three such such stocks below: MRAM, MGA

and PLUG.

Tomorrow, we will talk about the electric car and battery ETFs.

See now https://www.yahoo.com/now/10-best-battery-etfs-buy-143257314.html

Peerless: S12 or

Judge B10

My advise is watch the Closing Powers.

Professionals will know first what the FED intends to

do.

From a Peerless point of view, we must also watch the DJI's 35800-35850 level to decide if

the breakout holds. The IP21 is positive, but falling back towards negative territory.

If the support of earlier point of breakout around 35850 fails, it will also mean a

miniature Head/Shoulders will have been completed in the DJIA and DIA.

Those of you who want an automatic signal always to be easily seen are probably

disappointed here. But that is just the nature of the market now given the

incredible power of the FED. We see the FED's power in supporting the market by the

rising Closing Powers. This was the case when the Sell S12 occurred. The

Professionals would not allow a sell-off.

But we also know that breakouts judged as Buy B10's will eventually run out of steam

if the Closing Power uptrends are broken for the key ETFs. The question here is,

will the markets sell off enough to void the earlier breakouts. We are about to find

out.

Helping the market hold up are (1) short-term interest rates well below

0.5%, (2) the Dollar making new highs and now (3) the way electrical autos and trucks will

bring an eventual decline in oil and inflation.

Why Fight the FED?

The powerful FED has many friends. Despite 6% CPI inflation. there is only limited

pressure in the public on the FED to raise rates. Few citizens have any real

knowledge of what the FED is, what makes it so powerful or who it usually benefits.

If you asked them how the big rise in Wall Street since March 2020 led to inflation, they

would give you a big blank look. Instead, Biden is now being blamed for trying to

bring some stimulus-money to the "little guy". As an example, of how vast

is the power- network of the FED is, Larry Summers this past weekend on CNN blamed fiscal

spending rather than the FED for the inflation. He was quick to make clear that the

FED must remain "independent". (No one on CNN suggested that

"independence" might allow the FED to continue to support the big banks and Wall

Street at the expense of most other Americans. )

So, my belief is that we would be making a mistake now to bet against the FED and the

continuation of the bull market. Never before have the FED and Wall Street been so

powerful. They're not going to be quick tinker with something that works so well

from their point of view.

|

|

=====================================================================================

=====================================================================================

Written 11-15- 5:25 AM DJI +130 NASDAQ +70

Data through 11/12

| |

The DJI turned back up

from the support of earlier point of breakout around 35850. Along with the now quite

positive IP21-Accumulation and the bullish seasonality ahead, it looks we should judge a

Buy B10 to be operating. Professionals have turned bullish. Notice the

turns-upward by the Closing Powers of the NASDAQ, QQQ, SPY, TECL and SOXL. A

challenge of the recent highs must be expected for the DJIA, too. At that point,

resistance from the upward sloping price channels is apt to blunt the rally unless FAS

(financials) come alive.

While Gold and Silver are above their 65-day moving averages and are

advancing on the news of the highest rate of inflation in thirty years, oil's rise will

not go much higher, given the predictions that new electric cars will for the first time

be cheaper to buy and operate than gasoline run vehicles. This, of course, will be a

world-wide phenomenon. Start looking to purchase some the many plays on electric

cars again. These include NKLA, PLUG, SOLO, BLNK, FUV, KNDI, BLDP and WKHS.

More on the group tomorrow. They have a lot of catching up to do with TESLA.

Inflation, otherwise is quite real. Who would be so stupid to loan out money for

under 2% when inflation is 6%? Answer - the Federal Reserve. But who's to stop

them? Not the major net works, Congress or Biden. Remember that it was the

Democrats that passed the law in 1913 that created the Federal Reserve. So, Powell

rules to roost, as it were, and interest rates could stay as low as they are now for six

more months. That would make stocks the inevitable haven for more FED

money used by Wall Street to get even richer. "Trickle-down" is flowering

like never before.

In these circumstances, there may be stocks to short, but the obvious technology plays,

especially the most bullish Leveraged ETFs should

do well as funds begin their year-end rush to show how smart they were

to own the technology leaders. Articificial intelligence, semi-conductor

and electrically driven car-stocks should all do well now. |

|

====================================================================================

====================================================================================

Written 11-12- 6:00 AM DJI +108 NASDAQ +44

Data through 11/11

| |

The DJI

continued to retreat back in the direction of its earlier

breakout point between 35800 and 35900. Classic technical analysis-

theory tells us the resistance broken above should become support

on the next pullback by prices. Support should come in here. If not

it will validate the judged Buy B10 rendered as the surpassed 36900

on the way up recently above 36200. A failure of the DJI, on the other

hand, to hold above 35800 would mean the recent rally was a misleading failure. It

will then probably bring a sell-off back to the lower band.

We watch the Closing Power to tell us what Professionals expect at

these juncture points. DIA's Closing Power (shown below) has been

falling falling now for four straight days and has even violated its 21-day

ma. Several months ago four straight falling Closing Powers

led to a DJI decline back to its lower band, about 4% lower. Professionals

will need to make the DJI continue to rise from what looks like will be a

plus hundred point opening.

QQQ's Closing Power has now fallen five straight days, but it has now

returned almost to the support of its rising 21-dma of Closing Power,

A hook back up by it now would be bullish. Traders should use that

to buy some QQQ at the close.

Watch also FAS and short-term rates which are locked in a narrow range.

We will need to see FAS move up sharply to get the DJI rising again

with some energy. The problem with that is Inflation. See that Gold and

Silver are back above their 65-day ma. Will they start to rise like Crude Oil

and other commodities have? Friday will be a important day technically

in terms of the DJI (DIA) and QQQ.

One other thing to notice is the greater number of bearish looking MINCPs

than bullish MAXCPs. Short-sellers are not so frightened now as to be hastening to

cover their best short sales. Hedging again should pay off.

|

Charts - 11/11/2021

2021 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20

Inverted Traders Index

Graph of Pct of All Stocks above

65-dma Cum. Inverted

Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA QQQ SPY IWM TNA Short-Term Rates DOLLAR-UUP ALLSTOCKs

recent 2006 vers-Peerless signals

http://tigersoftware.com/NEWPEER/UPD71111.BMP

MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL

SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

STOCKS:

MRNA DIS GE PYPL GME ZOM XLE NRGU

AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX

CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M MRK MSFT NEM NFLX

NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM

Bullish MAXCPs http://tigersoftware.com/UPPER/11-11/BULLISH.htm

Bearish MAXCPs http://tigersoftware.com/DOWNER/11-11/BEARISH.htm

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1 QUICKSILVER on ETFS - 11/11/21

Bullish = 7 - DIA, FAS, RETL, SPY, QQQ, SOXL (+.689), TECL

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

---------------------------------------------------------------------------------------------

DIA 359.46 -1.61 363.3 -26.1% ------- RED .278 0 .278

---------------------------------------------------------------------------------------------

SPY 463.77 .15 468.53 -33.6% ------- RED .326 .01 .336

---------------------------------------------------------------------------------------------

QQQ 390.59 1.08 398.6 -96.4% ------- RED .225 .01 .235

---------------------------------------------------------------------------------------------

MDY 527.23 2.78 529.56 22.1% Bullish BLUE .135 .03 .165

---------------------------------------------------------------------------------------------

IWM 239.26 1.91 241.81 14.8% Bullish BLUE .071 .035 .106

---------------------------------------------------------------------------------------------

FAS 142.75 1.18 143.34 -15.4% ------- BLUE .14 .15 .29

---------------------------------------------------------------------------------------------

RETL 52.36 1.9 52.6 129.8% Bullish BLUE .18 .116 .296

---------------------------------------------------------------------------------------------

SOXL 61.64 3.69 60.91 209.9% Bullish BLUE .364 .324 .688

---------------------------------------------------------------------------------------------

TECL 76.06 1.2 78.46 -86% ------- RED .307 .094 .401

---------------------------------------------------------------------------------------------

IBB 153.42 -.09 156.94 -267.7% Bearish RED .009 -.135 -.126

---------------------------------------------------------------------------------------------

GLD 174.12 .97 169.84 189.8% Bullish BLUE .193 .009 .202

---------------------------------------------------------------------------------------------

OIH 209.34 -.48 216.33 -105.9% Bearish RED -.088 .116 .028

---------------------------------------------------------------------------------------------

UUP 25.53 .06 25.28 45.5% Bullish BLUE -.051 .011 -.04

---------------------------------------------------------------------------------------------

CORN 25.53 .06 25.28 45.5% Bearish BLUE -.153 .286 .133

---------------------------------------------------------------------------------------------

YINN 11.95 1.22 10.38 484.5% ------- BLUE .059 -.093 -.034

---------------------------------------------------------------------------------------------

RSX 32.06 .34 31.93 48.4% ------- RED .047 .06 .107

|

Table 2 Count of Stocks in Key Directories

20211111

-------------------------------

NEWHIGHS 241

NEWLOWS 203

MAXCP 23

MINCP 63

TTTNH 14

TTTNL 37

CPCROSSA 82

CPCROSSD 47

ACCUMVER 227

HIGHIP21 17

HIUPPCT 24

REDSELL 132

AUGSELS7 56

TRAPDOOR 8

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

Bullish = 42

Bearish = 6

11/11/21

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

REGBANKS .96 .96 .96 .96 .96 .92

SOLAR .937 .812 .875 .937 .875 .875

GOLD .934 .847 .891 .826 .826 .652

TRANSP .9 .95 1 1 .95 .7

CHEM .891 .826 .826 .804 .804 .695

HOMEBLDG .882 .882 .882 .882 .882 .764

RETAIL .851 .829 .851 .829 .872 .851

INSURANC .84 .84 .8 .88 .88 .76

REIT .816 .816 .847 .87 .893 .748

GREEN .8 .8 .8 .8 .85 .85

INDMATER .791 .736 .777 .763 .708 .611

INFRA .787 .666 .757 .787 .696 .575

BEVERAGE .785 .714 .642 .571 .642 .642

OILGAS .783 .735 .792 .801 .764 .735

SEMI .783 .752 .773 .783 .783 .773

FINANCE .777 .74 .777 .79 .777 .753

NIFTY .765 .744 .787 .808 .765 .765

AUTO .756 .729 .702 .756 .783 .756

FOOD .755 .755 .755 .775 .755 .755

INDEXES .751 .806 .773 .756 .762 .707

COMPUTER .75 .7 .65 .7 .65 .7

HIGHPRIC .72 .72 .767 .763 .72 .738

RUS-1000 .718 .701 .723 .733 .737 .667

BIGBANKS .714 .571 .714 .714 .714 .714

ETFS .714 .553 .66 .696 .607 .571

NASD-100 .711 .69 .69 .721 .711 .711

ELECTRON .708 .686 .731 .746 .731 .731

SP500 .703 .697 .705 .709 .707 .658

DOWJONES .7 .633 .666 .733 .7 .6

DJI-13 .692 .538 .615 .692 .692 .538

JETS .692 .615 .923 1 .923 .307

COMODITY .675 .625 .675 .7 .7 .65

FIDSTKS .674 .686 .692 .721 .698 .627

COAL .666 .5 .666 .666 .666 .666

SP-100 .666 .655 .666 .7 .688 .622

SOFTWARE .66 .642 .696 .75 .696 .66

COPPER .625 .25 .5 .625 .5 .25

GUNS .615 .615 .615 .538 .615 .538

MILITARY .615 .653 .769 .73 .73 .461

HACKERS .611 .611 .722 .722 .722 .722

CHINA .588 .313 .431 .411 .352 .392

GAMING .578 .578 .684 .789 .736 .684

=========================================================================================

MARIJUAN .5 .5 .5 .666 .333 .333

=========================================================================================

HOSPITAL .47 .47 .47 .529 .47 .352

UTILITY .421 .342 .368 .368 .526 .394

BIOTECH .397 .373 .441 .468 .463 .479

BONDFUND .397 .352 .511 .42 .306 .17

LOWPRICE .367 .334 .42 .432 .397 .389

EDU .333 .333 .333 .333 .333 .333

|

====================================================================================

====================================================================================

Written 11-11- 6:05 AM DJI +30 NASDAQ +75

Data through 11/10

| |

The DJI and most of

the other indexes have stalled out at the top of their price

channels. Seeing that, Professional traders have declded to lock in their

profits on the recent advance. Gold is now above its 65-dma and though the

Dollar is strong still, short-term and 10-year rates are rising somewhat. Watch

what happens to FAS. Without strength in FAS, GS and JPM, the next rally

will probably be limited.

Our steep Closing Power steep uptrends have been broken for the key

Index ETFs shown below. Will they turn back up? DIA's is at its rising

21-day ma. QQQ's Closing Power and SPY's Closing Power have dropped

a little below their still rising 10-day ma. A strong close above their openings

would be short-term re-buy.

Their IP21-Accumulation Indexes remain quite positive. This will help

prevent a bigger sell-off. But we should wait for these Closing Powers to

turn up back up. The Sell S12 seemed unstrustworthy with the DJI's

breakout over flat resistance. But the breaks in the Closng Power uptrends now put

us on alert that professionals are short-term bearish.

The likelihood is good that the Closing Powers for DIA, SPY, COMPQX (the NASDAQ), QQQ and

TECL will see their Closing Powers' turn back above

their 10-day moving averages.

|

Charts - 11/10/2021

2021 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20

Inverted Traders Index

Graph of Pct of All Stocks above

65-dma Cum. Inverted

Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA QQQ SPY IWM TNA Short-Term Rates DOLLAR-UUP ALLSTOCKs

recent 2006 vers-Peerless signals

http://tigersoftware.com/NEWPEER/UPD71110.BMP

MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL

SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

STOCKS:

MRNA DIS GE PYPL GME ZOM XLE NRGU

AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX

CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M MRK MSFT NEM NFLX

NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM

Bullish MAXCPs

http://tigersoftware.com/UPPER/11-10/BULLISH.htm

Bearish MAXCPs

http://tigersoftware.com/DOWNER/11-10/BEARISH.htm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1

Table 1 QUICKSILVER on ETFS - 11/10/21

Bullish = 7 - DIA, FAS, RETL, SPY, QQQ, SOXL, TECL

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

---------------------------------------------------------------------------------------------

DIA 361.07 -2.21 361.35 -6.8% ------- RED .341 0 (.341)

---------------------------------------------------------------------------------------------

SPY 463.62 -3.76 466.91 -11.8% ------- RED .383 .007 .39

---------------------------------------------------------------------------------------------

QQQ 389.51 -5.81 398.22 -46.3% ------- RED .282 .005 .287

---------------------------------------------------------------------------------------------

MDY 524.45 -4.72 524.9 -20.5% ------- RED .153 .024 .177

---------------------------------------------------------------------------------------------

IWM 237.35 -3.8 238.55 -26.8% ------- RED .099 .03 .129

---------------------------------------------------------------------------------------------

FAS 141.57 -1.43 143.19 -257% ------- RED .156 .119 .275

---------------------------------------------------------------------------------------------

RETL 50.46 -3.18 51.01 -51.8% Bullish RED .187 .093 .28

---------------------------------------------------------------------------------------------

SOXL 57.95 -5.45 59.08 356% Bullish RED .323 .225 .548

---------------------------------------------------------------------------------------------

TECL 74.86 -4.03 77.4 56% ------- RED .329 .073 .402

---------------------------------------------------------------------------------------------

IBB 153.51 -2.01 161.83 -353.6% Bearish RED .008 -.129 -.121

---------------------------------------------------------------------------------------------

GLD 173.15 1.86 167.65 218.3% Bullish RED .227 0 .227

---------------------------------------------------------------------------------------------

OIH 209.82 -11.63 213.92 -110.5% Bearish RED -.019 .109 .09

---------------------------------------------------------------------------------------------

UUP 25.47 .27 25.3 59.4% Bullish BLUE -.124 .003 -.121

---------------------------------------------------------------------------------------------

CORN 25.47 .27 25.3 59.4% Bearish BLUE -.186 .28 .094

---------------------------------------------------------------------------------------------

YINN 10.73 .3 10.92 -168.2% Bearish ---- .026 -.136 -.11

---------------------------------------------------------------------------------------------

RSX 31.72 -.57 31.75 -7.8% Bearish RED .157 .063 .22

|

Table 2 Count of Stocks in Key Directories

20211110

-------------------------------

NEWHIGHS 143 + 124 = 267

NEWLOWS 38 + 130 = 168

MAXCP 14

MINCP 70

TTTNH 11

TTTNL 40

CPCROSSA 51

CPCROSSD 133

ACCUMVER 221

HIGHIP21 28

HIUPPCT 27

REDSELL 126

AUGSELS7 56

TRAPDOOR 14

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

11/10/21

Bullish = 39

Bearish = 8

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

REGBANKS .96 .96 .96 .96 .92 .96

TRANSP .95 1 1 .95 .75 .75

HOMEBLDG .882 .882 .882 .882 .764 .764

GOLD .847 .891 .826 .826 .652 .608

INSURANC .84 .8 .88 .88 .76 .88

RETAIL .829 .851 .829 .872 .851 .829

CHEM .826 .826 .804 .804 .673 .782

REIT .815 .838 .869 .892 .753 .846

SOLAR .812 .875 .937 .875 .875 .875

INDEXES .804 .766 .755 .76 .706 .766

GREEN .8 .8 .8 .85 .85 .85

FOOD .755 .755 .775 .755 .755 .612

SEMI .752 .773 .783 .783 .773 .762

NIFTY .744 .787 .808 .787 .744 .702

FINANCE .74 .777 .79 .777 .753 .802

INDMATER .736 .777 .763 .708 .611 .68

OILGAS .735 .792 .801 .764 .735 .792

AUTO .729 .702 .756 .783 .729 .756

HIGHPRIC .72 .767 .763 .72 .738 .77

BEVERAGE .714 .642 .571 .642 .642 .642

RUS-1000 .701 .723 .733 .737 .667 .704

COMPUTER .7 .65 .7 .65 .65 .75

SP500 .697 .705 .709 .707 .658 .697

NASD-100 .69 .69 .721 .711 .701 .711

ELECTRON .686 .731 .746 .731 .731 .708

FIDSTKS .686 .692 .721 .698 .633 .68

INFRA .666 .757 .787 .696 .575 .666

SP-100 .655 .666 .7 .688 .622 .677

MILITARY .653 .769 .73 .73 .461 .615

SOFTWARE .642 .696 .75 .696 .642 .625

DOWJONES .633 .666 .733 .7 .6 .7

COMODITY .625 .675 .7 .7 .65 .55

GUNS .615 .615 .538 .615 .461 .615

JETS .615 .923 1 .923 .384 .384

HACKERS .611 .722 .722 .722 .722 .666

GAMING .578 .684 .789 .736 .631 .736

BIGBANKS .571 .714 .714 .714 .714 .857

ETFS .553 .66 .696 .607 .571 .589

DJI-13 .538 .615 .692 .692 .538 .692

=========================================================================================

COAL .5 .666 .666 .666 .666 .833

MARIJUAN .5 .5 .666 .333 .333 .5

=========================================================================================

HOSPITAL .47 .47 .529 .47 .352 .529

BIOTECH .373 .441 .468 .463 .482 .525

BONDFUND .352 .511 .42 .306 .17 .147

UTILITY .342 .368 .368 .526 .394 .473

LOWPRICE .337 .42 .433 .4 .382 .42

EDU .333 .333 .333 .333 .333 .333

CHINA .313 .431 .411 .352 .392 .392

COPPER .25 .5 .625 .5 .25 .5

|

====================================================================================

====================================================================================

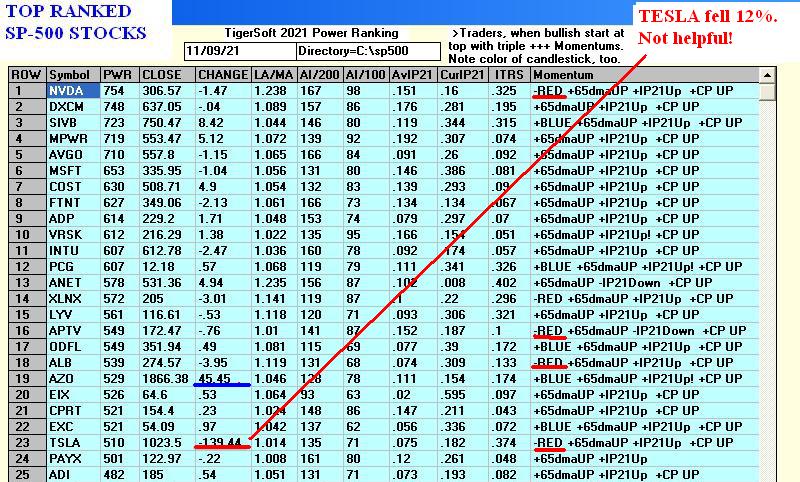

Written 11-10- 6:11 AM DJI

-57 NASDAQ -102 Data through 11/09

| |

The DJI, the NASDAQ,

OEX, SPY and QQQ could not get past the resistance of the top of their price chanels.

In varing degree, their blue candle sticks have previously turned to red and their

Closing Powers had already started drifting down, causing their Closing Powers to fall,

Today we saw bearish red popcicles from them. If there is no reversal at the

close today, the leading ETFs will be at or very close to sell-points. (Added late: TESLA ( TSLA ) fell 12% today. If that decline

continues, the tech stocks will under a lot more pressure.)

The trick now is to decide how far they will sell-off. The ones that are the

farthest up from their Closing Power 21-day moving averages (which will act as support)

would seem to have the most risk. Selling SOXL at the close today (11-9) was

recommended. We should evaluate other high Power ranked ETFs one by one, by the

size of their red "popsicles" today and whether they have broken their 10-day

Closing Power moving averages.

As background, we see that short-term and 10-year interest rates remain very low.

That should prop up the market, as should November's and December's general

bullishness as long as the various key ETFs do not drop back below their breakout points.

The Sell S12 seemed unstrustworthy with the DJI's breakout over flat resistance.

But the breaks in the Closng Power uptrends now put us on alert that professionals

are short-term bearish. That the Accumulation Index for the DIA and the DJIA have

become positive should keep these items from falling very fast.

The likelihood is good that the Closing Powers for DIA, SPY, COMPQX (the NASDAQ), QQQ and

TECL will retreat to their Closing Powers' 10-day ma and then turn up from there quite

swiftly. Be ready for

that contingency. |

|

Charts - 11/09/2021

2021 PEERLESS DJI, Signals,

Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20

Inverted Traders Index

Graph of Pct of All Stocks above

65-dma Cum. Inverted

Traders Index

DJI-IPA DJI-OBV

NASDAQ S&P OEX NYSE COMPQX DJI-15 DJI-20 DJI-30

DIA QQQ SPY IWM TNA Short-Term Rates DOLLAR-UUP ALLSTOCKs

recent 2006 vers-Peerless signals

http://tigersoftware.com/NEWPEER/UPD71109.BMP

MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF

USO-CrudeOil DBO FAS GLD BBH IBB JETS JNUG KOL NUGT OIH PALL RSX RETL

SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA (gasoline) USO (oil) and China: YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, SOYB WEAT UUP (Dollar) LIT

(Lithium)

STOCKS:

MRNA DIS GE PYPL GME ZOM XLE NRGU

AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX

CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX M MRK MSFT NEM NFLX

NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM

Bullish MAXCPs

http://tigersoftware.com/UPPER/11-9/BULLISH.htm

Bearish MAXCPs

http://tigersoftware.com/DOWNER/11-9/BEARISH.htm |

|

|

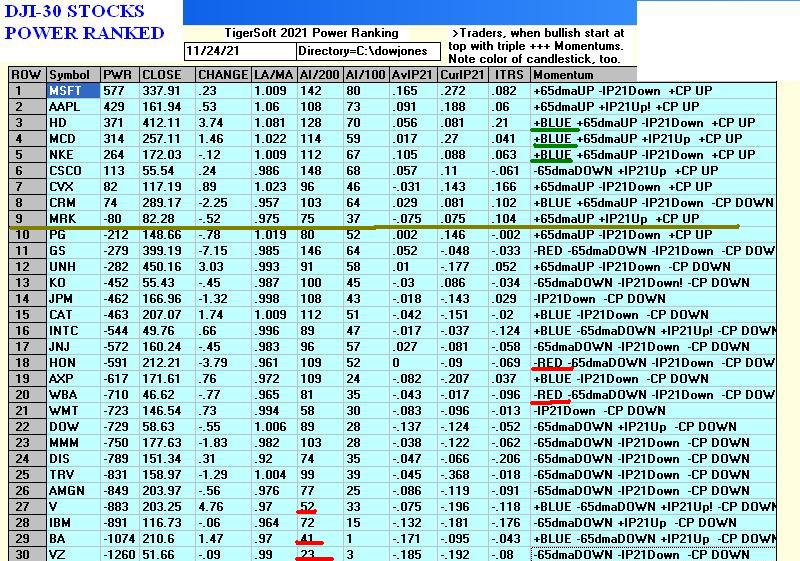

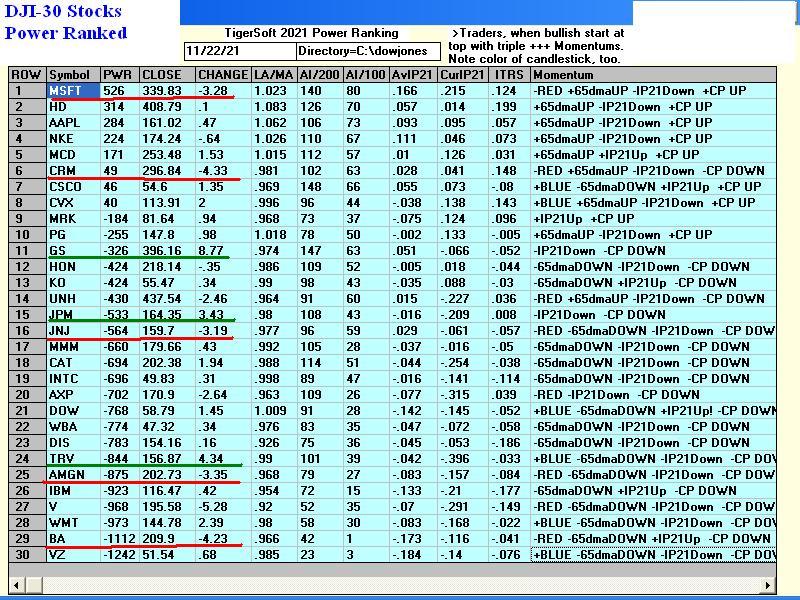

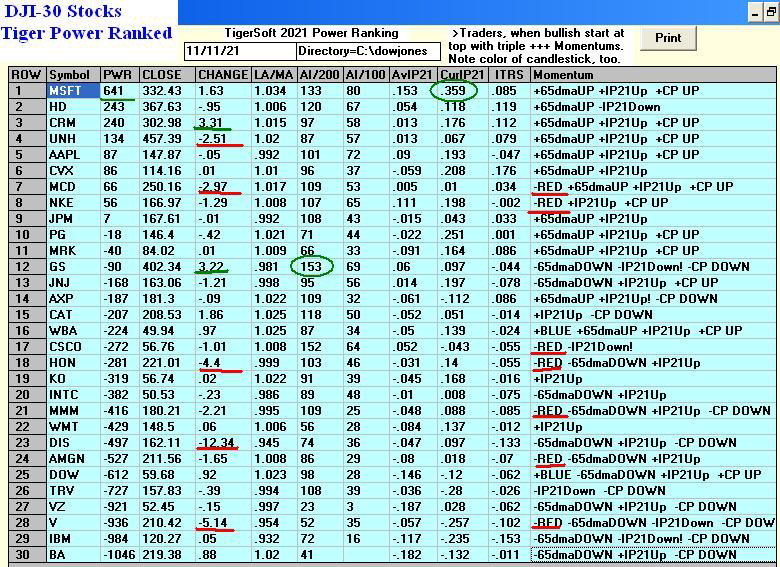

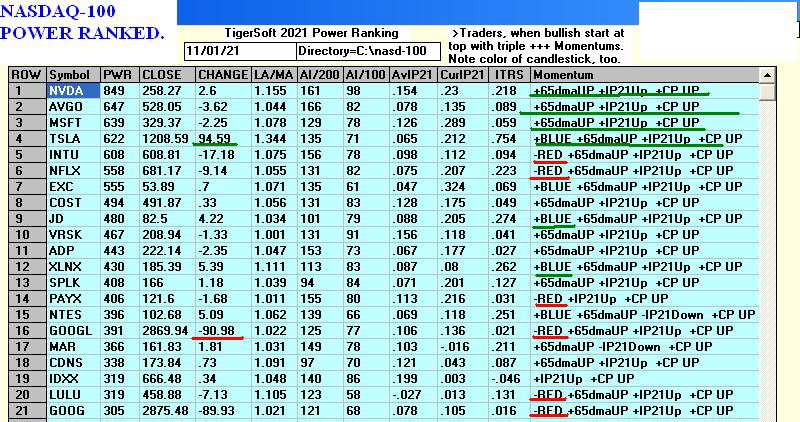

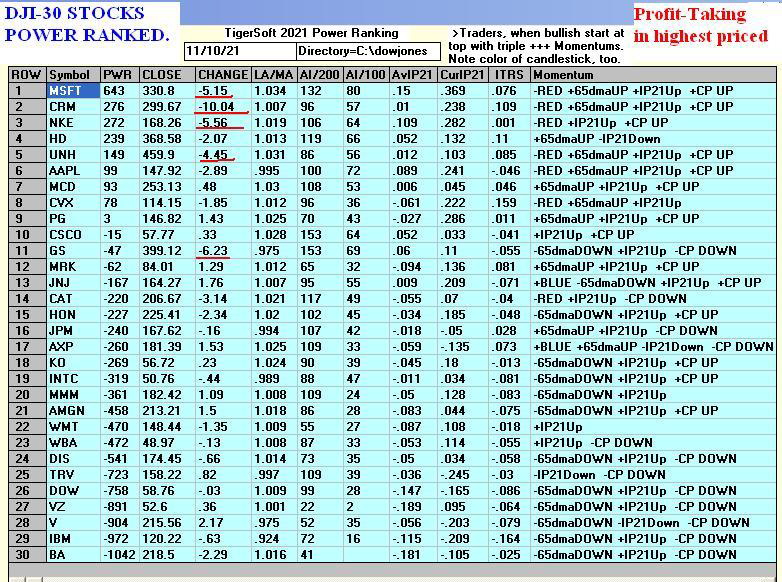

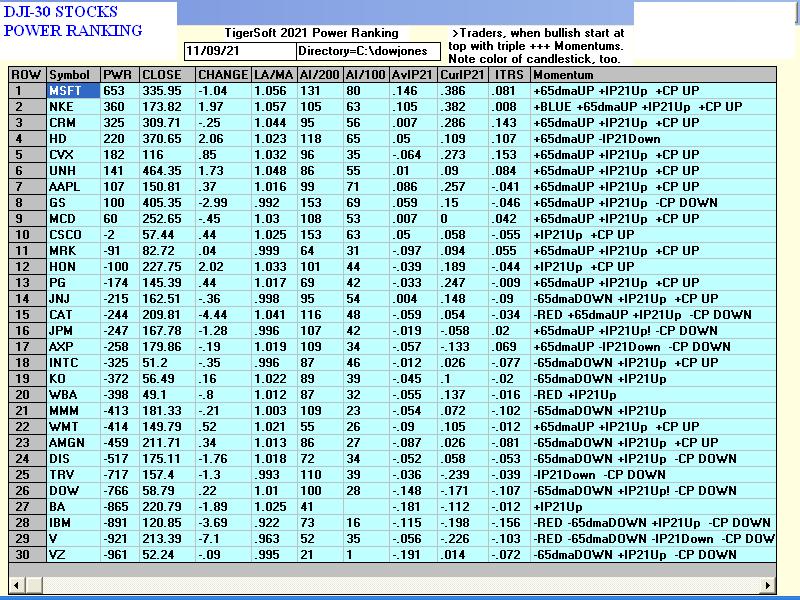

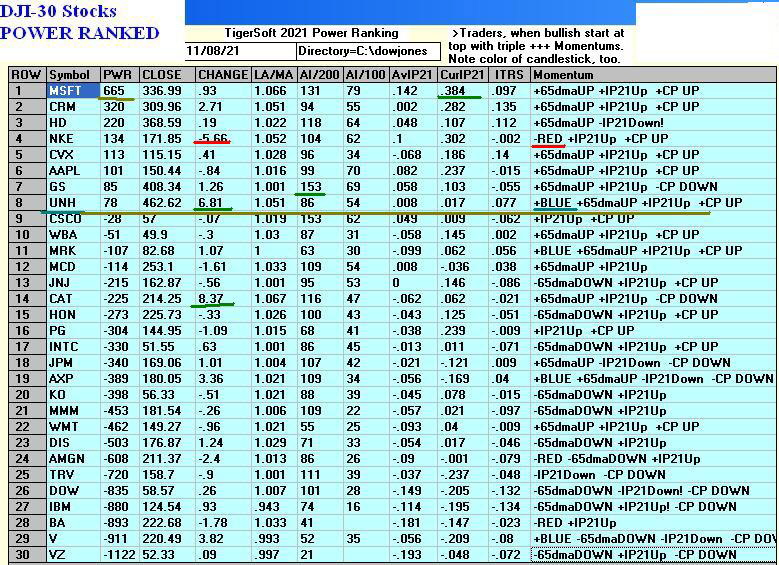

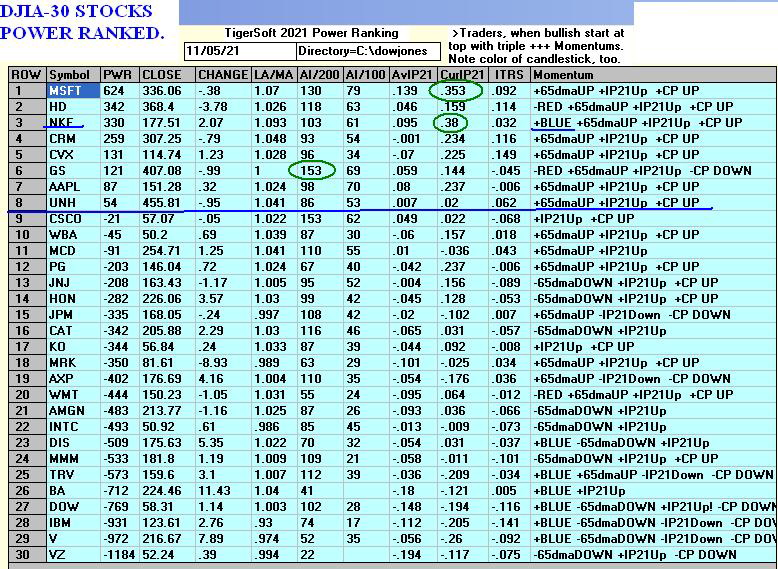

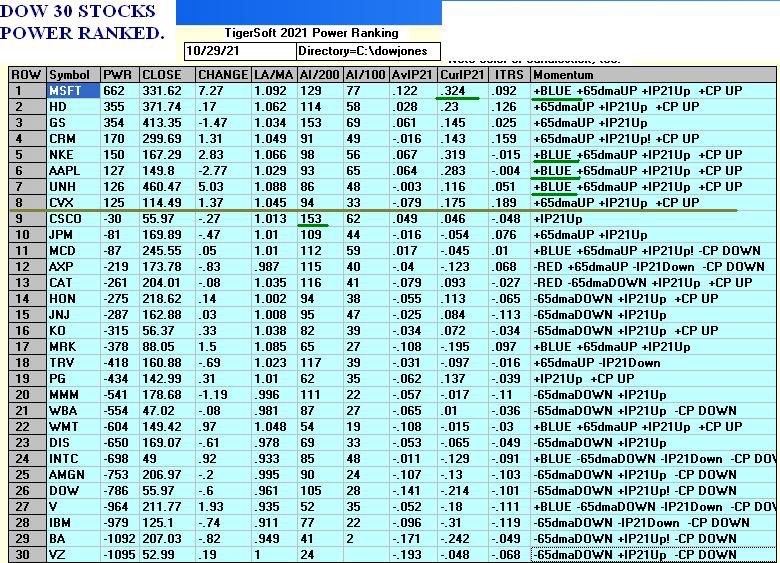

DJI - POWER RANKING

|

|

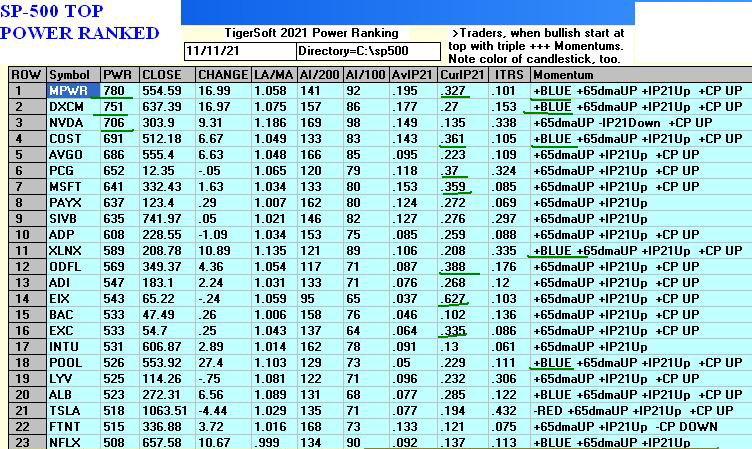

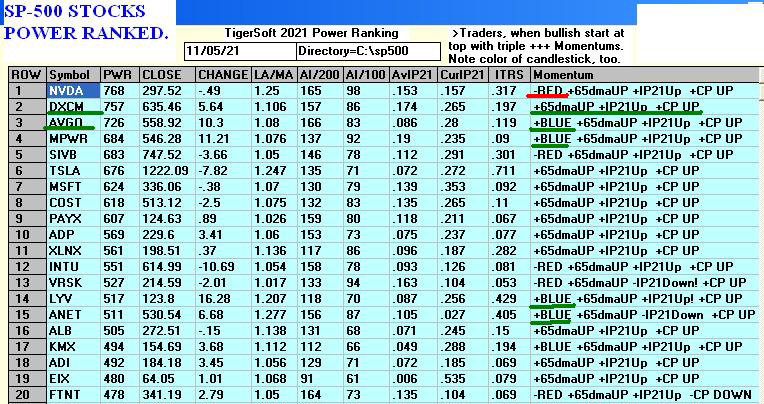

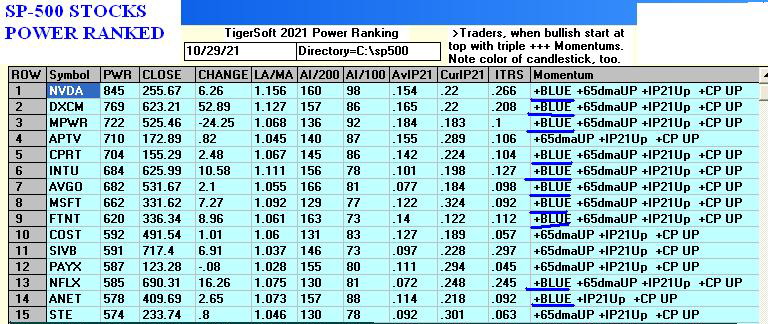

|

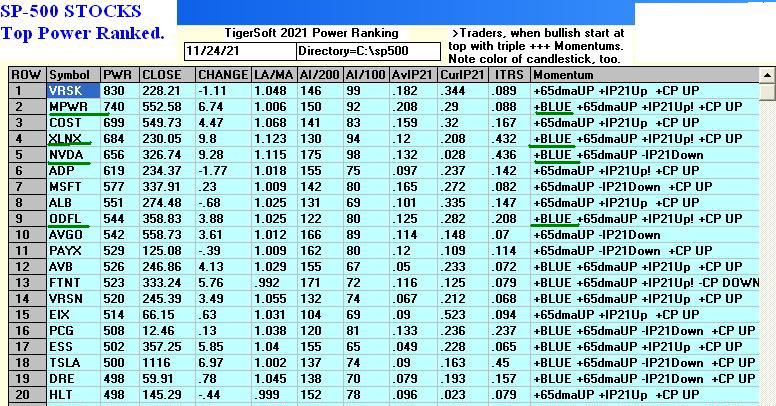

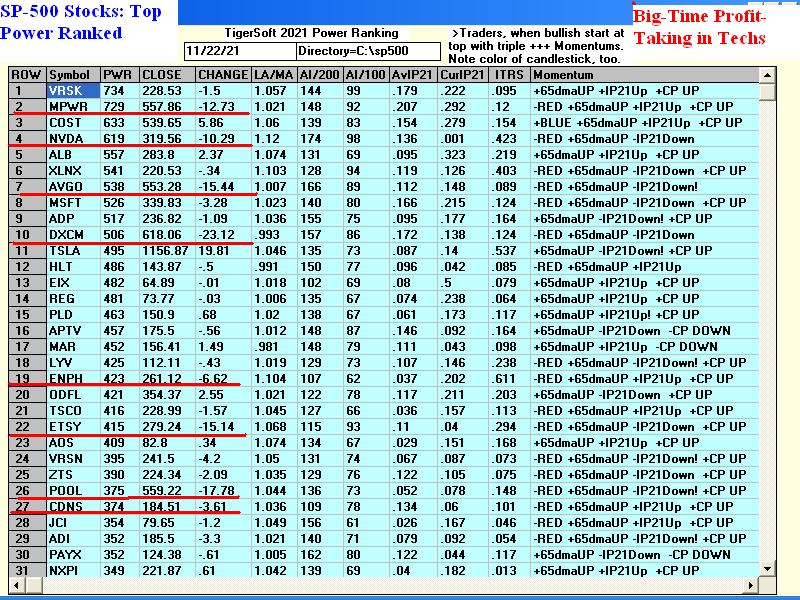

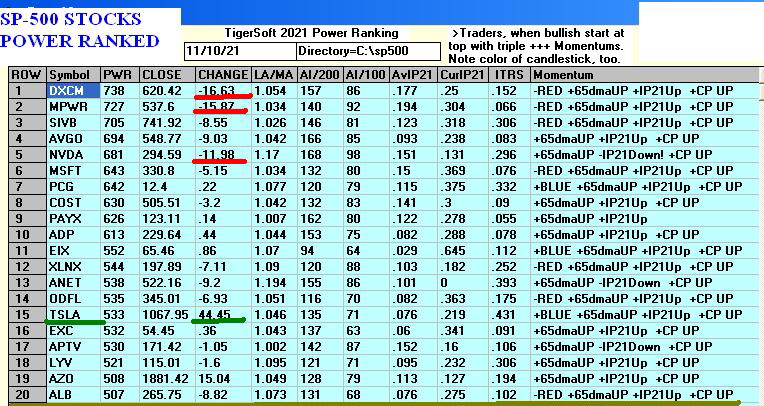

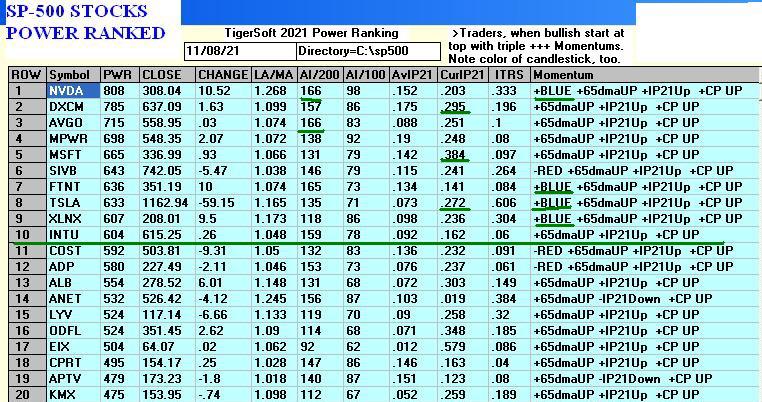

SP-500 - TOP POWER RANKING

|

|

|

|

|

|

|

|

|

Table 1 QUICKSILVER on ETFS - 11/09/21

Bullish = 7 - DIA, RETL, SPY, QQQ, SOXL, TECL, RSX

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

---------------------------------------------------------------------------------------------

DIA 363.28 -1.04 361.56 37.4% ------- RED .32 0 ------

---------------------------------------------------------------------------------------------

SPY 467.38 -1.55 464.72 58.8% ------- RED .376 .008 .384

---------------------------------------------------------------------------------------------

QQQ 395.32 -2.74 393.18 79.3% ------- RED .288 .014 .302

---------------------------------------------------------------------------------------------

MDY 529.17 -.68 526.61 79.8% Bullish RED .173 .025 .198

---------------------------------------------------------------------------------------------

IWM 241.15 -1.41 238.64 140% Bullish RED .143 .044 .187

---------------------------------------------------------------------------------------------

FAS 143 -2.13 149.01 -130.6% ------- BLUE .141 .122 .263

---------------------------------------------------------------------------------------------

RETL 53.64 1.32 51 785.7% Bullish BLUE .223 .143 .366

---------------------------------------------------------------------------------------------

SOXL 63.4 -.14 53.67 1001.7% Bullish RED .321 .302 .623

---------------------------------------------------------------------------------------------

TECL 78.89 -.94 73.99 403.4% ------- RED .362 .109 .471

---------------------------------------------------------------------------------------------

IBB 155.52 -2.11 164.78 -222.4% Bearish RED .061 -.122 -.061