FDR had just won by a record-breaking landslide. By the Summer of 1937, the worst of the Depression

seemed past; a wide range of New Deal Relief and Jobs programs had stopped the downward spiral of

Prices and the upward spiral of Unemployment and Fear. By 1937, Unemployment had dropped from

24% to about 14% or less, depending on the couning methodology. <1> The stock market had almost

recovered to its lows of 1929. But then suddenly starting in August 1937, it started a 6 month plunge

that took it down 47%.

In August 1937, the future seemed brighter than it had been since 1929. Ford no longer produced

cars painted only in black. But the facade was not to last. If Peerless had existed back then, traders would

not have been fooled. Soon Wall Street was about to panic. This hit the economy particularly hard.

A second Depression was about to start. We study this crash. It has much to teach.

What caused this stock market panic and economic collapse? Mostly, it was mis-management by the

by the President, the Treasury and the Federal Reserve of their responsibilities. This is particularly

tragic because all these leaders had to do was to read the new book written by the English economist,

John Maynard Keyes, The General Theory of Employment, Interest and Money. Had Roosevelt

done this, he would not have listened to those who demanded he balance the Federal Budget when

Unemployment was still far above 10%. Had Morgenthau, his Treasury Secretary <2>, have done this,

he might not have given FDR such poor advise about balancing the budget. Had the Federal Reserve

officials have studied Keynes, they would have seen how very dangerous it was to raise reserve

requirements on banks in the middle of a Depression. <3> Amd had FDR read Keynes'

personal letters to him, the President might not have so hurrednly curbed his Public Works programs

and taxed workers in 1937 so that they had even less discretionary income, all in the premature pursuit

of a balanced Federal budget.

1937 August Peak

The most important factors in bringing about the 1937 stock market collapse and concurrent

economic slowdown can be listed.

1) Millions of workers in the Steel and Auto-Making Industries suddenly started to successfully

organize in 1937. Labor militancy escalated in a way that scared Wall Street. 1937 saw a record

number of strikes and the Wagner - NLRB Act - was judged Constitutional by the Supreme Court

on April 12, 1937.

2) The Federal Reserve "hawkisly" increased the Reserve Requirements of Banks with the result that

"M1" (money in circulation) dropped sharply. Monetarists like Friedman and Bernanke

consider this to be the main cause for the decline. No doubt this was quite bearish, but the

other causes seem equally important. .

3) Just as important, FDR suddenly adopted the austerity policies favored by his Treasury

Secretary, Morgenthau, Southern Democrats and some of his big banker friends among

New York Democrats. Having just won a landslide victory at the polls, FDR felt secure enough

to force hard-pressed working people suddenly to lose 10%-15% of their pay checks in

Social Security taxes and to then cut back billions in the budgets of the WPA and CCC, declaring

he wanted to clear the way for private business to be self-sustaining.

4) The dark clouds of war with Fascism in Europe and Japan grew much closer. Japan suddenly

attacked and conquered much of China in 1937. General Franco with the help of Hitler and Franco

made big military gains in the Spanish Civil War. Most important, Hitler told his generals to plan for

a war of "Lebensraum" with Britain, France and the Soviet Union in two or three years, once

Germany had absorbed Austria and Czechoslovakia. <4>

1937's Beginning Looked Auspicious

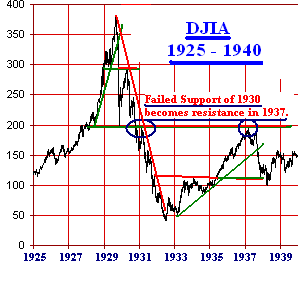

1937 started off well enough for Wall Street. The DJI rose from 179.9 at the end of 1936 to a close

of 194.1 on March 10, 1937. Those who believed that the beginning of the year on Wall Street would

set the tone for the rest of the year were sorely disappointed, for in reaching its recovery intra-day high

of 195.6, the DJI came within three points of tagging the key support level of 198.70 of November 1929.

Experienced traders even back then knew that broken support from years before often becomes resistance

when next it is reached on the way back up. See this in the chart below.

The DJIA's broken 195-200 resistance was reached in early 1937.

From our Peerless vantage point, too, a top was clearly being made in February and March 1937.

The Peerless chart of 1936-1937 shows how the DJI tagged its 2.5% upper band right at its peak

with a negative P-Indicator reading of -5. This would have produced a major Sell S9 signal on this rally.

See how widely the NYSE A/D Line, P-Indicator, Accumulation Index and the V-Indicator failed to

confirm this rally. Seeing our always dangerous "Sell S9" would have made it hard not to have recognized

this was a time to be selling and selling short despite the still positive economic recovery news. The

NYSE's A/D Line actually peaked in January. At that point, more stocks began to decline than rise;

corporate earnings began to slide and Wall Street insiders got the sense that a business slow-down was

shaping up because consumer demand was softening all the while labor costs were about to rise

significantly and credit was tightening.

The evidence suggests that the economic recovery continued until the Spring pf 1937, at which

point the FED's decision to double the Banks' the Reserve Requirements in August 1936 made

credit much tighter. It takes a while for the reduction of money supply to be felt in the economy

and the stock market. But there is no doubt this reduced the amount of money Banks could loan.

Raising the Reserve Requirements is a much more potent tool to weaken the economy than

mere tinkering with the Federal Funds or even the Discount Rate. As a consequence, the

FED's belated lowering of the Discount Rate in the middle of the stock market decline had very

little effect on the rapidly falling stock prices.

The reader will see in the chat above that there were actually two declines in 1937. First, there

was a semi-normal 14.6% correction from March 10th to June 14th, 1937. This decline seems

to have started because of profit-raking and early signs of a business slow-down. It seems to

have ended soon after the Chicago's Police and business community re-established their dominion

over demonstrating workers at that city's steel mills on May 30th and then in the days that followed,

as official enquiries completely exonerated the police.

---------------------------------------------------------------------------------------------------

Chicago Massacre of 1937

The wave of strikes in 1937 peaked with the Chicago Steel Strike of May. Chicago Police

shot and killed ten unarmed pro-Union men and women on May 30th (Memorial Day). They had

been protesting Republic Steel's unwillingness to recognize their union. They were associated with

the Committee for Industrial Organization, or CIO, which had become particularly active in in anti-union

strongholds like General Motors and US Steel. On this fateful day, the Chicago Police shot and

beat up more than ninety of Chicago marchers. Ten died and many more were permanently injured

from blows to the head. Eight of the ten who died had been shot in the back or in their the side.

Even so, none of the police were ever prosecuted.

The corporate Press called it a "Red Riot" and FDR, in attempt to retain his popularity, simply blamed

both sides. For a while, the Paramount newsreel of these events was suppressed for fear of raising

class hatreds. But after a Congressional investigation, the frightening file was made public on July 2nd.

The film showed the Police rioting, shooting at and clubbing hundreds who had simply come out to

the park on a warm, Sunny Spring day. As usually happened in these circumstances, the DJI chose

to ignore the bloodshed and celebrated the suppression of the protestors by rising 10% over the nest month.

See testimony of witnesses and victims. http://historymatters.gmu.edu/d/138/

Full Congressional Hearings. http://usw1010.org/documents/LaFollettePart14.pdf

In 1997, the newsreel was deemed "culturally significant" by the United States Library of Congress

and selected for preservation in the National Film Registry. The footage contained in the newsreel was

illegally banned from being shown in Chicago by the Chicago Police Department for fear of causing

unrest, and later the Paramount News company agreed to refrain from screening the event elsewhere.

https://truthout.org/articles/a-memorial-day-massacre/

---------------------------------------------------------------------------------------------------

The Crash of August-November 1937

The second decline of 1937 was much worse. The DJI fell 47.6% decline from August 16th,

1937 (189.3) to March 31,1938 (98.91). Its depth matched the three-month 48% Crash of 1929.

Just as Peerless had given one of its bearish Sell S9s at the first 1937 peak, so it gave a Sell S9

at the second peak. Traders naturally took this to be a "double-top" once prices started to

sell off badly. Once again the NYSE A/D Line failed to confirm the DJI's advance to its upper

band and both the P-Indicator and V-Indicator were negative. See the chart below.

Three Sell S9s set up a 47% DJI decline.

What Caused Such a Deep Decline in 1937?

In some ways, 1937 may, at first, seem like an avoidable tragedy. That is what Friedman

and Bernanke want us to believe. The downturn of 1937 was not the inevitable fault of

cyclic capitalism, nor could it have be avoided with more Public Works spending. It occurred,

simply because the Government made too many major errors in their fiscal and monetary policies.

But can these errors really sufficient to explain a 47% in six months?

Most observers leave out the obvious. Back in 1937, the memories of previous crashes and

sell-offs were very much alive. Certainly traders in the Fall of 1937 were mindful of the similarities

then with the September-November 1929 Crash. Perhaps, in this way the market's collapse

in the Fall of 1931 simply followed closely on the footsteps of what the market had done in

in the Fall of 1929 and in 1930. This view would argue that the general economy is very much

moved by Wall Street and the speculative energies of the most active traders. In other words,

the Second Depression was made much worse by nervous Wall Street speculators who took

no chances when a top looked to be in place. Trading strategies do seem to come and go with the

times. In 1937, traders seemed keenly aware of the old adage about "Trend is your Friend"

and "not to let a gain turn into a loss". By 1937, most good traders had read the teaching of

Jesse Livermore who taught the value of studying support and resistance levels' "pivot-points".

The reader should see that conditions in 1937 were not all bearish. There were some positives,

too. For example, there was no military or terrorist attack on the United States (as in 1941 or

2007). Secondly, the U.S. did not enter as a belligerent a European War (as in 1917 or 1941).

Thirdly, there was no stock market bubble (as in 1929, 1969 or 2000, though the extent of

the market's recovery did disturb some on the FED and in the Treasury. Fourthly, there was no

Bank failures (as in 1931, 1932 and 2008). And fifthly, there were no leveraged trading vehicles

that could quickly turn a correction into a plunge (as in 1987).

Besides the fiscal and monetary mistakes made by policy-makers and the new wave of technical

trading, we need also to understand how much a newly aggressive Labor movement impacted

Capital and Wall Street in 1937.

Union Unrest and Growth

https://www.bls.gov/wsp/1937_strikes.pdf

Non-Technical Causes of the Crash of 1937

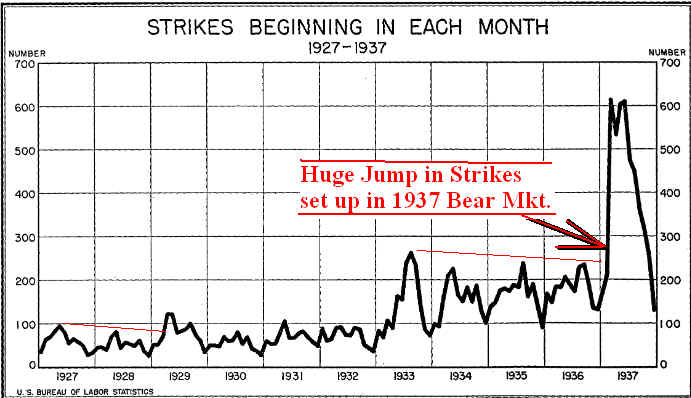

1 . Labor struggles grew greatly in size and ferocity in 1937. See the chart above.

Since 1935, the Wagner Act had granted working men and women the right to organize and

to picket. But it was only in April 1937 that the Supreme Court said that such a law was

declared constitutional. The pressures for better wages, working conditions and union recognition

had been long in coming. In 1937, Labor confidence soared, so much so, that the U.S. Dept.

of Labor counted 4,740 strikes in 1937. This was a record. <4> Their graph shows that the

number of strikes in March and May more than doubled any previous monthly high. All those

strikes in 1937 cost employers lots of profits, especially where the Unions won.

Big manufacturing companies, in particular, had a new reason to become fearful of their profits

being lost to union organizing. At the end of 1936, workers started employing the new tactic

of plant sit-ins. The year 1937 began with a very important sit-down strike in Flint, Michigan.

It was conducted by the newly formed United Auto Workers. The strike lasted 10 weeks and

General Motors car production fell 95%. Even now, the Flint strike is remembered for the

great lessons it taught to organizers who suddenly succeeded in bringing about the greatest

expansion of unionization in the United States ever seen. The Flint strike was won by the

UAW because:

(1) The strikers occupied the plants rather than relying on picket lines. This meant that

"scabs" could not be hired to keep the plants running and violence could not be used

against the striking workers for fear of hurting the plant, tools and equipment.

(2) The union leaders' took great pains to keep their strike plans secret so that the company's

spies, who were widely used, could not feed management advance information about the

union's actions.

(3) Worker power was political power. The UAW was very aware of the need to be a part

of the larger CIO and to play an active role in American politics. As it was, the Governor of

Michigan chose to use his National Guardsmen to protect the striking workers in the plants

rather than evict them.

In the end, after only ten weeks of striking, General Motors had no choice but to recognize the

UAW and grant a 5% pay raise. Wall Street took note and became fearful about how much

unions might slice away from corporate profits. It is not accidental that Wall Street tumbled

badly in 1937 when from February to September, in only 7 months, the UAW membership

grew from 30,000 to 500,000. The The Flint strike had much wider implications. American

workers everywhere took heart and started to unionize. <5>

---------------------------------------------------------------------------------------------------

FDR Reduces Government Spending

and Increases Taxation

2. FDR became a fiscal conservative in early 1937. Probably the most potent reason

for the bear of 1937 was because FDR changed his views about the great need for Public Works jobs.

His 46-year old Treasury Secretary, Henry Morgenthau, convinced him that the recovery was now

self-sustaining and that all he had to do now was to balance the Federal Budget to boost business confidence.

So as 1937 began, FDR got Congress to approve a 17% cut in federal spending from 1936 levels for

1937 and 1938. The brunt of his cuts were in the New Deal programs, particularly the WPA and CCC.

In addition, the 10%+ Social Security taxes kick in, thereby reducing disposable income for both workers

and emp0loyers. It has been Morgenthau's preference, too, that Social Security not be paid for out of

Government, but be operated as an insurance program paid in part by the insurers', themselves.

Fed's Increase of Reserve Requirements

3. The FED's decision to double the Banks' the Reserve Requirements in August 1937 from

its level a year earlier has been mentioned as a key factor in the Crash of 1937. Monetarists like

Milton Friedman and Ben Bernanke make much of this and how it reduced money supply.

In deciding on this policy, the FED was recalling how their monetary policies had been too loose in 1927

when the stock market had just started to soar and how this had then to the disastrous over-speculation in

stocks over 1928 and 1929. (One can see their point if one only measures the four years' performance

of the DJI, from March 1933 to August 1937, when the DJI rose from 41 to 191. But this of course,

overlooks that the DJI was still far below the peak of 1929.

, The FED were determined, it seems, not to make the 1927 mistake again, thereby completely ignoring that

Unemployment in 1937 was about 14% and less than 5% in 1927. In 1937, there was still widespread

under-utlilised plant capacity and manpower. The "hawks" there, of course, saw illusionary early signs

of inflation when there were none. The kindest thing we can say of their mistaken tightening was can say

was that they were mislead by the rapid rise in certain Grain prices among food-commodities and chose

to take into account the temporary nature of the record Summer heat waves in the Midwest in the

Summers of 1936 and 1937 that were the real cause of the scarcity of certain foods and commodities.

The 4% rate of Inflation was temporary. The threat of renewed deflation and a strike by Capital was

much more real.