------------------------------------------------------------------------------------------------------------------------------

Materials

for March 7, 2015 Tiger Software Meeting

(C) 2015 William Schmidt, Ph.D. www.tigersoft.com

Free San Diego Tiger Users'

Group Meeting

Saturday, March. 7th 12:45 -

3:45 La Jolla Coco's

4280

Nobel Dr San Diego, CA 92122 Across

SW corner of Universuity Town Center.

In

Costa Verde Shopping Center.

-------------------------------------------------------------------------------------------------------------------------------

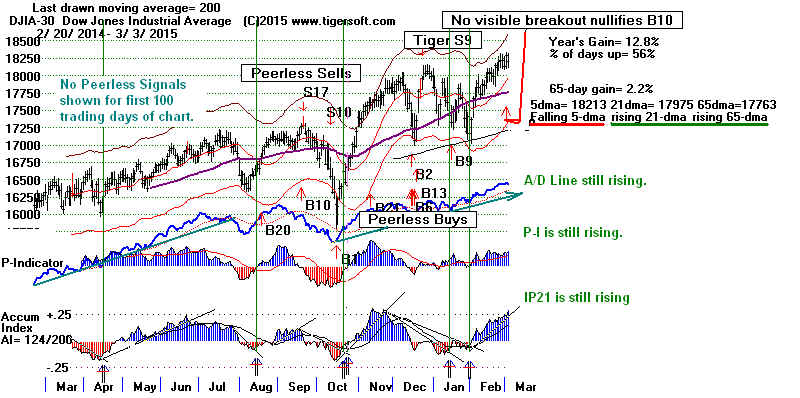

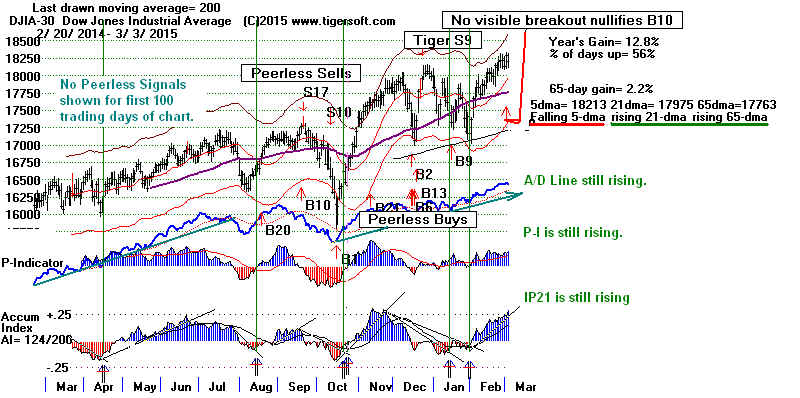

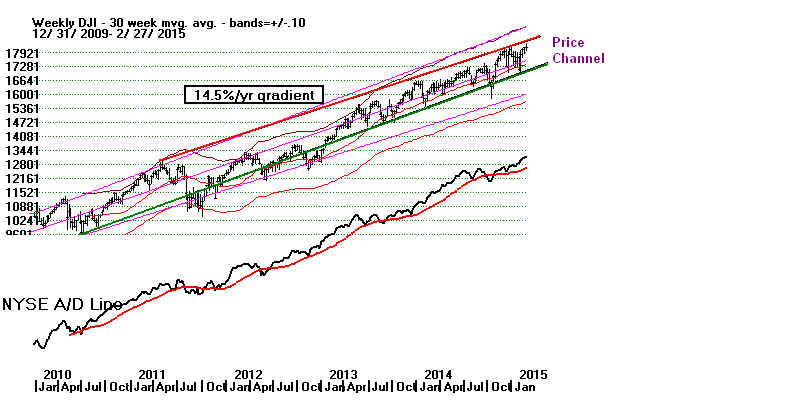

Hi, Tigers! Let's get together and celebrate

nearly 6 years of bull market. Peerless is still

on a Buy, but the short-term is problematic.

Is the Fed really going to raise interest rates

and jeopardize the limited economic recovery?

What do you think?

Peerless is still bullish. Are you?

There'll be plenty to talk about. I hope you can come.

It should be real fun to bring all our experience and knowledge

together to figure out what Wall Street has in store for us.

Join us this Saturday. We'll make it worth your while.

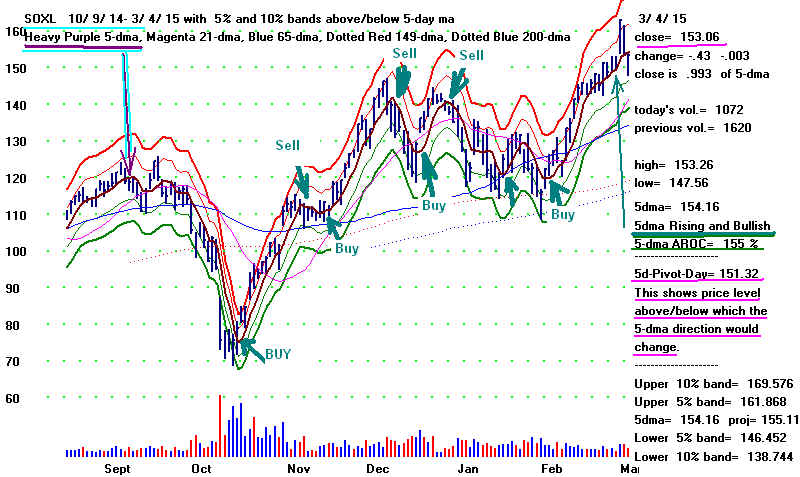

We have some

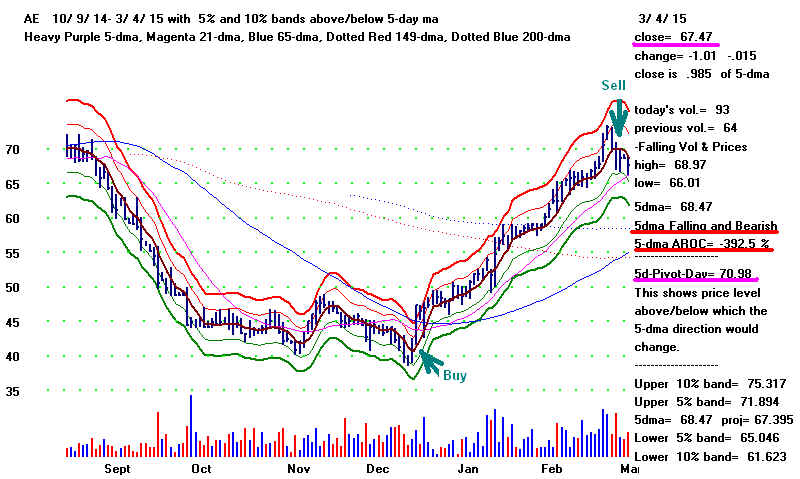

exciting new short-tools for getting in and

out of fast-moving stocks, commodities, currencies and ETFs.

The new trading tools can really help in this weakening

They show clearly where to sell and when to buy the

strongest and weakest stocks, when a reversal takes

place.

Suggestion: Screen all stocks and

find those best

traded with 5-day ma penetrations

and trade

then using the "key

pivot-points" showing when

the 5-day ma has changed direction.

A reversal has started. How serious is the threat of

rising interest rates? What are the Bank stocks and bonds

telling us. Down Volume suddenly has picked up.

The NASDAQ seems to have stalled at 5000-5250, the old high

from 2000. The number of new lows has not expanded

much.

But could this be the beginning of the end of the 6-year's bull

market? What would it take to get a Peerless Sell and for

Peerless to tell us a major top has been made?

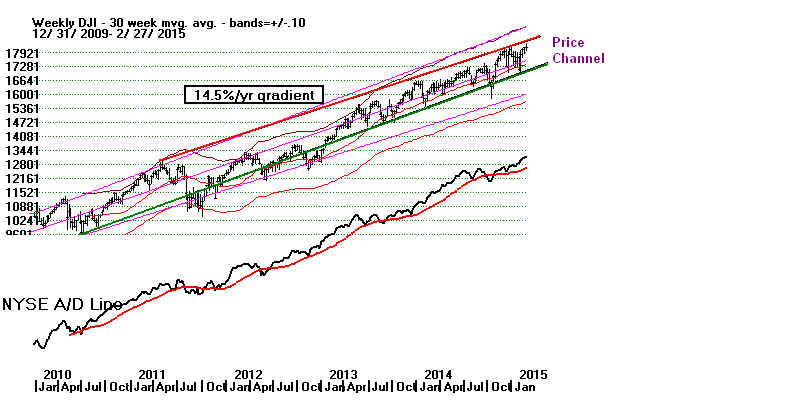

There have only been 3 longer DJI bull markets

since 1928. How did they end?

OVER-EXTENDED?

But there's hope. We could be getting another good buying

opposrtunity. March is usually a very bullish month.

Just how bullish? What about in rising markets?

What about in the third year of the Presidential 4-year cycle?

What about

when a Democrat is President and Republicans

control

Congress in 1947-1948? Or 1996-2000? Forbes

analysis?

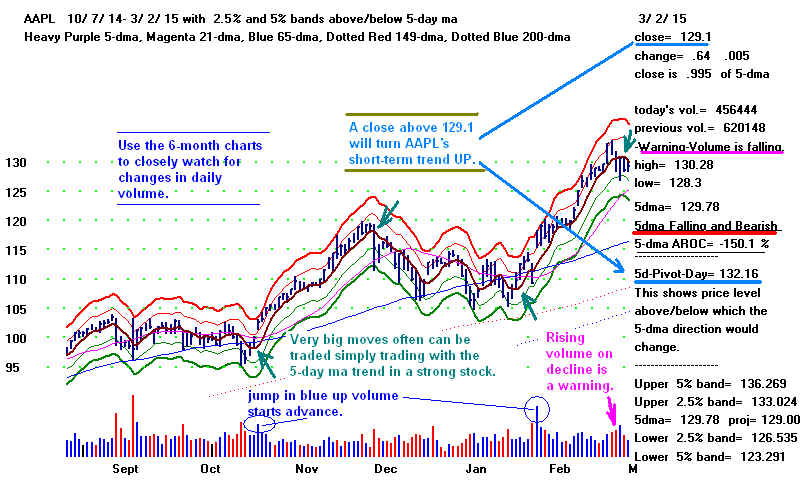

How about the NASDAQ's challenge of 5000? Biotechs

rose today (Wednesday) even as the DJI fell more than 100.

Along with oil stocks, biotechs are often among the last

groups to top out ar the end. What at about the the highest

UP% stocks, those that rise the more days than any others?

What stocks could carry the NASDAQ up more?

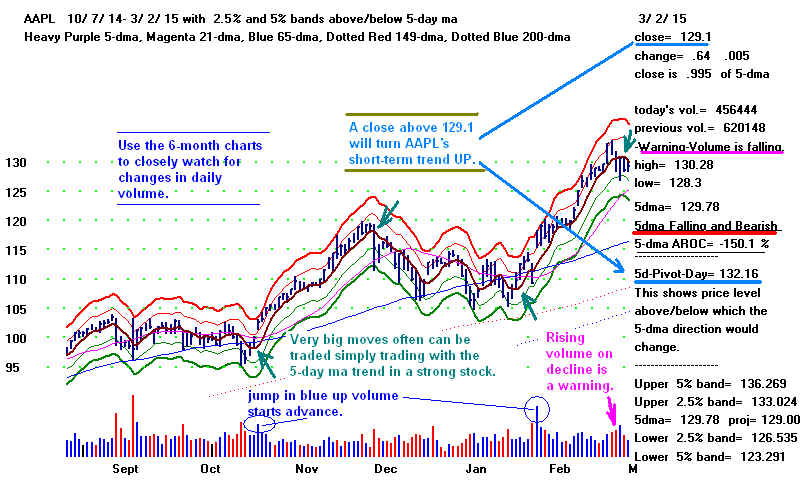

Is AAPL capable of any more heavy lifting?

What is the short-term trend of AAPL? When can we get

back aboard this fast moving train?

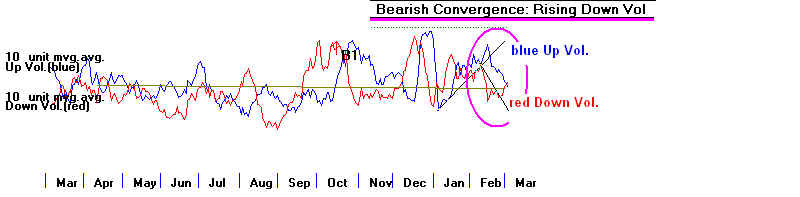

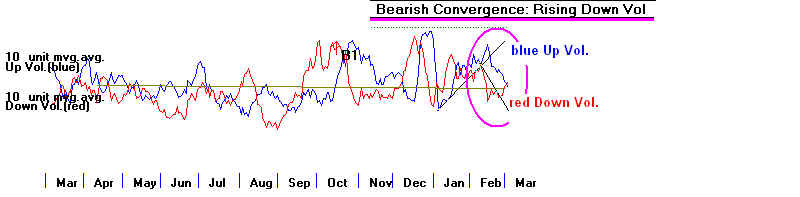

What about the rising Down Volume on the NYSE?

Is that a sign of simple profit-taking? A sign that

dividend stocks are being sold as rates go higher?

Highest UPO% Stocks: There are only a handful of stocks

and ETFs that have risen more than 57% of the time on any

given day for the last year. Fewer of these have a CLOSEUP%,

that reliably close higher than their opening. How safe

are these HIUPPCT stocks to buy. These stocks can now

be screened for and are also now downloadable

as a group from the Tiger Data page. Run HIUPPCT.exe.

Do you trade short-term. Michael M. suggested a report

showing how stocks do after the opening to the close

given various sized openings away from the previous

close. Now we have a new report that shows that.

FAST-MOVING TRAINS

Lots of folks want to know how to get aboard a fast-moving

stock. This can be dangerous. One can pay too much

and not know when to sell. WE CAN HELP HERE.

Getting aboard a fast-moving train is dangerous.

But Tiger has new tools to help you. Our Closing

Power has a companion indicator now for this.

And the new tools may get us out before Closing

Power does.

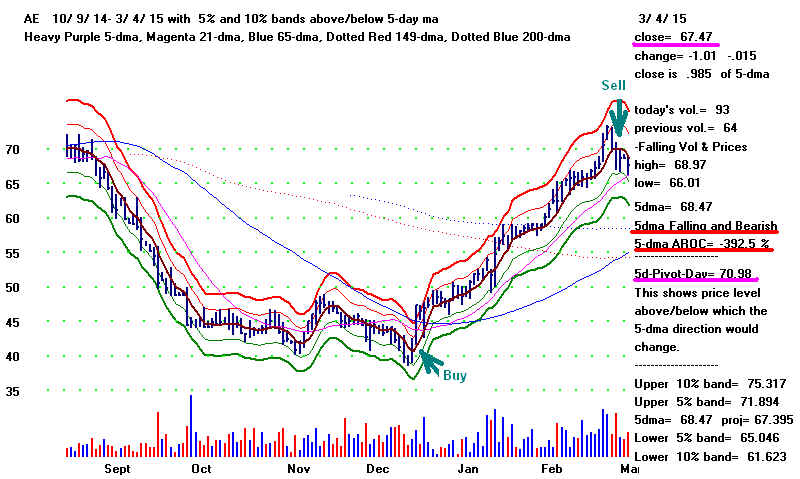

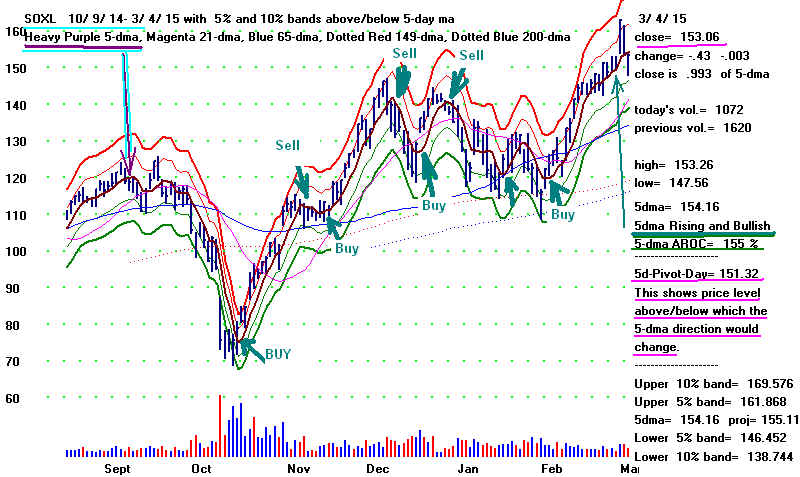

Our new six month chart shows a 5-day ma, bands around it,

the velocity of the 5-day ma and the "pivot point". This

is the point beyond which the 5-dma would reverse |

direction. A lot of stocks' best moves can be timed

using the 5-day ma. We'll study this closely at the meeting.

Late in a Bull Market, how do we find the last ETFS

standing, the ones that are still the leaders. We

have a new ranker, the Pct Up%, the Opening Up%

and the Closing Up%. We can easily find the highest

stocks in each category and the lowest, too, for

short selling.