SORTING UP-PCT, OPEN-UP-PCT,

CLOSING-UP-PCT

(C) 2015 William Schmidt February 15, 2015 www.tigersoft.com

----------------------------------------------------------------------

The method for doing this from TigerSoft with the latest 2/13/2015

software is using:

PEERCOMM + CHARTS-2015 + RANKING RESULTS +

TIGER UP%, OPENPWR%, CPPWR%.

This produces a table of data as shown below.

Here I have produced the UP-PCT, etc. Table based on the

newHIUPPCT stocks from Tiger Data Page. This group is

built for users using the following criteria:

These have an UP-PCT ranging from 55 to 59. ASH for example

rose 59% of each of the past 250+ days for the past year, as of

2/13/2015. The OPEN-UP PCT shows that it opened up 51.4%

of the time and the CLOSE-UP PCT shows that it rose 56.2%

from the opening to the close this past year. Its current price is

127.58. It has risen 34.5% this past year. At the far right of these

Tiger Tables you will see a "UU" when the stock's Opening Power

and Closing Power are above their 21-day ma. To improve

trading short-term trading results buy these stocks when they

become "UU"s.

Stocks simultanously within all three of the following ranges

Daily Up % 55-59

OPEN-UP % 51-61

CLOSE-UP % 55-75

are believed to have the highest probability of advancing

day to day as long as the Closing Power is rising and does

not break a steep uptrend or break below its 21-day ma.

.

Click on any row and then the button "CHART" to see the

current graph. And re-sort the data by PCT-GAIN for the

year to see how the different values match up with how

the stock did for a year.

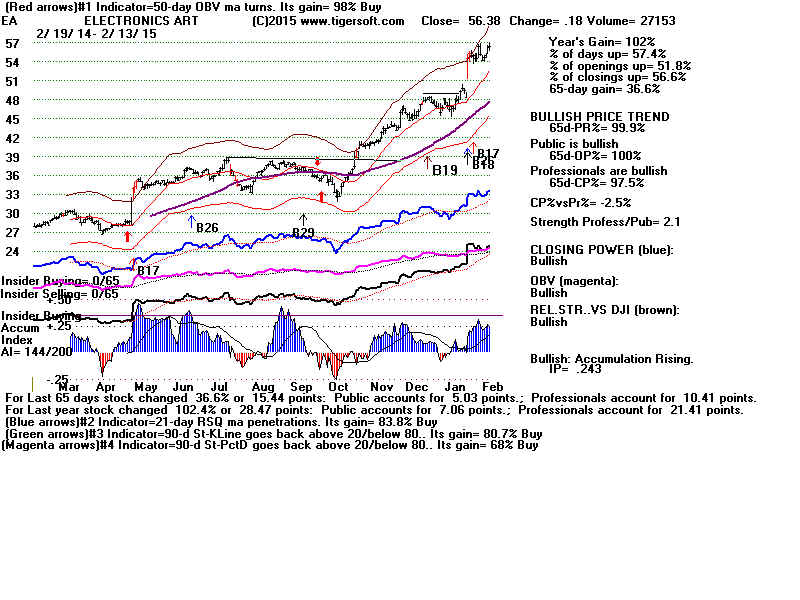

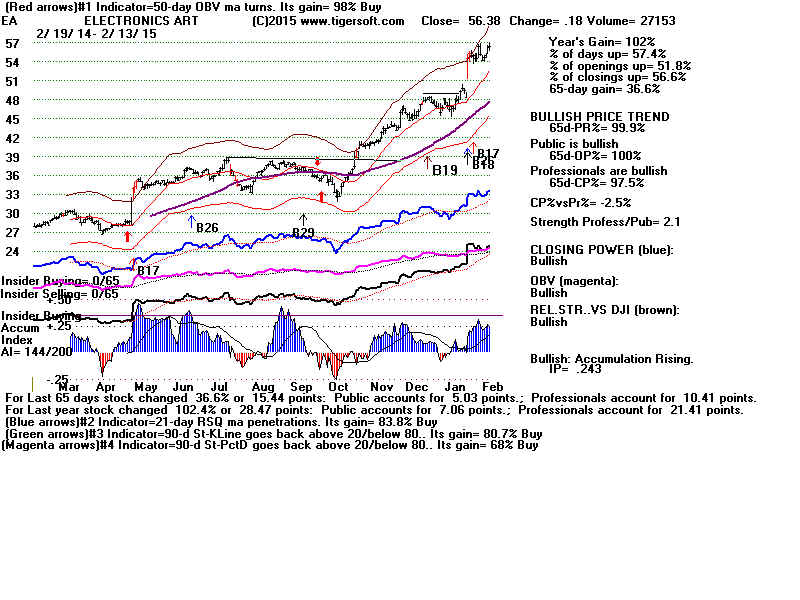

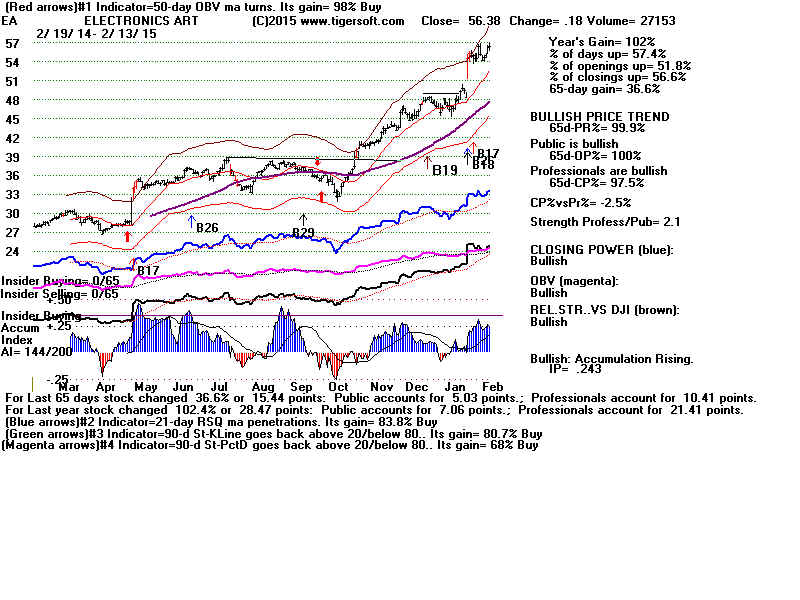

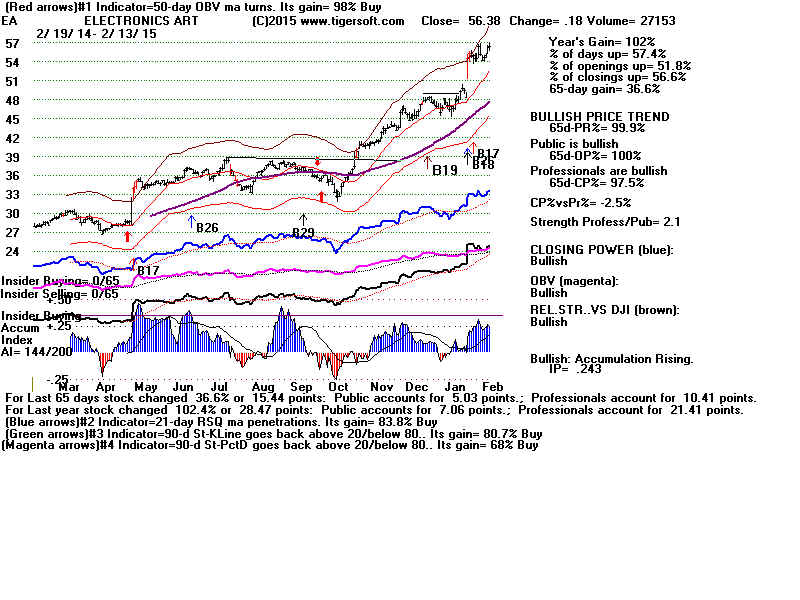

20 of these 39 stocks and ETFs closed up more than 34%.

EA (102%) and SKX (+90.7%) were the best performers.

And since their "TGR" signature is "UU", they may still go

higher short-term.

18 of these trading instruments were actualy ETFs at this time.

If we eliminate them, then 14 (66.7%) of the 21 stocks

gained more than 34%. But don't disregard the ETFs.

They also include some big gainers:

IIF +71.2%

TQQQ + 64.9%

FAS +48.2%

QLD +41.8%

Stock

UP-PCT

OPEN-UP

CLOSE-UP

CURRENT

PCT

PCT

PCT

PRICE

GAIN

------------------------------------------------------------------------------------------------------------------------------

ASH 59 51.4 56.2 127.58 .345 UU ESS 59 53.4 59.4 226.59 .368 DU FDS 59 51.8 57.4 155.05 .501 ?U IVE 59 55.4 57.4 94.7 .13 UU MO 59 53.4 56.6 54.76 .558 UU SKX 59 57 57.8 66.09 .907 UU IIF 58.6 51.8 61 28.87 .712 ?U IWD 58.2 55 57 105.39 .131 UU BRCM 57.8 53.4 56.2 45.69 .483 UU PPC 57.8 60.2 55 26.75 .602 ?D REZ 57.8 51.4 59.4 62.12 .254 UD EA 57.4 51.8 56.6 56.38 1.02 UU NSC 57.4 55.8 59.8 109.91 .217 DU VGT 57.4 62.2 55.8 108.04 .192 UU CTL 57 59 56.2 39.46 .277 ?U DDM 57 59.4 56.6 137.98 .276 UU DFT 57 53.4 56.2 31.83 .226 D? IGM 57 60.6 58.6 105.17 .159 UU IVV 57 57 55.4 211.26 .147 UU LOW 57 53.4 57.8 72.05 .548 UU NOC 57 55.4 57 167.14 .404 UU QLD 57 61.8 56.2 145.97 .418 UU RSG 57 59 56.6 39.34 .166 ?D SHW 57 54.6 57 285 .476 UU TQQQ 57 61.4 56.2 106.86 .649 UU TSO 57 52.6 56.6 81.92 .629 DU XLK 57 59.8 57 42.65 .186 UU BR 56.6 51.8 55.4 52.59 .412 UU DIA 56.6 59.8 58.6 180.34 .123 UU FAS 56.6 58.2 56.2 125.53 .482 UU MAR 56.6 53 57.8 79.4 .541 DU QQQ 56.6 60.2 55.4 106.91 .193 UU CB 56.2 52.2 55.4 102.02 .186 DU UPRO 56.2 56.6 55.4 139.44 .503 UU VDC 56.2 57.4 56.2 127.48 .201 U? IYW 55.8 59 57 107.68 .193 UU BLL 55.4 53 55 74.93 .365 UU KIE 55.4 54.2 56.2 67.42 .125 UU XLY 55.4 58.6 57.4 74.89 .157 UU

|

|