Major TigerSoft Buy Signal Combinations:

(C) 2014 William Schmidt, Ph.D. 8/17/2014

We always take notice of the more powerful major

Tiger Buys: B10, B12, B20 and B24. In combination, they

are more powerful than when appearing individually.

There are 12 combinations: B10-B12, B10-20...B24-B12,

B24-B20. Our new Explosive Super Stocks has explored

the power of each of these combinations. (The report

on this will be posted Monday for purchasers of this

on-line Book.)

As one would expect, these Buys typically launch the

biggest advances, especially in the early stages of

of a bull market.

Near the end of a bull market, they must be approached

more cautiously. Here I develop some rules for trading

these Najor Buy combinations at this stage in the market

cycle.

I suggest using Closing Power hooks to buy and watching for

red high volume churning and reversal days down at the

upper band to sell. This approach gives many good trades

and should help us avoid most of the dangerous surprises

biotechs sometimes bring. In this regard, we want also

to watch for head/shoulders patterns and we want to heed

Closing Power divergences and trends as well as Accumulation

Index (IP21) weakness.

I like B10-B12-B20s. The first shows a breakout above

well-tetsed resistance. The second shows intense accumulation.

And the third shows that take-off velocity has been reached.

B24s remind us that the more bulges of Accumulation there are,

the tighter is the hold by bullish insiders of the stock's

float.

Because, B20-combinations show "take-off" strength, we see

below that they are less likely to bring convenient pullbacks

to the 21-day ma. This may affect our tactics a little.

Trading Rules for Major Buy Combinations

We always take notice of the more powerful major

Tiger Buys: B10, B12, B20 and B24. In combination, they

are more powerful than when appearing individually.

There are 12 combinations: B10-B12, B10-20...B24-B12,

B24-B20. Our new Explosive Super Stocks has explored

the power of each of these combinations. (The report

on this will be posted Monday for purchasers of this

on-line Book.)

As one would expect, these Buys typically launch the

biggest advances, especially in the early stages of

of a bull market.

Near the end of a bull market, they must be approached

more cautiously. Here I develop some rules for trading

these Najor Buy combinations at this stage in the market

cycle.

I suggest using Closing Power hooks to buy and watching for

red high volume churning and reversal days down at the

upper band to sell. This approach gives many good trades

and should help us avoid most of the dangerous surprises

biotechs sometimes bring. In this regard, we want also

to watch for head/shoulders patterns and we want to heed

Closing Power divergences and trends as well as Accumulation

Index (IP21) weakness.

I like B10-B12-B20s. The first shows a breakout above

well-tetsed resistance. The second shows intense accumulation.

And the third shows that take-off velocity has been reached.

B24s remind us that the more bulges of Accumulation there are,

the tighter is the hold by bullish insiders of the stock's

float.

Because, B20-combinations show "take-off" strength, we see

below that they are less likely to bring convenient pullbacks

to the 21-day ma. This may affect our tactics a little.

Trading Rules for Major Buy Combinations

Note stocks under $1 should not be considered here

"ma" = 21-dma unless otherwise stated.

This explores the success traders would have if they

waited after seeing a combination TigerSoft Buy until

the stock then fell back below its 21-dma and then

saw the Closing Power turned up. This assumes that

there was no head/shoulders price pattern, that Closing

Power was not in a long-term downtrend and the IP21

was not negative or nearly negative and falling rapidly.

Selling is assumed to be done when then price bar turns

red showing high volume at the upper band and there is

a RD (reversal day) downward.

Biotechs - 2014

Biotech Stocks 2013-2014

(BIOTECH.exe from www.tigersoft.com)

Buy B10-B12

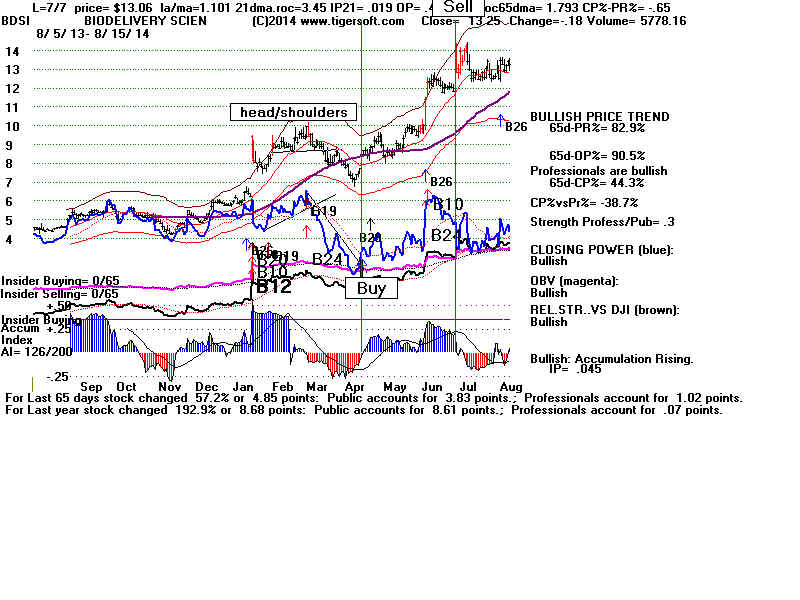

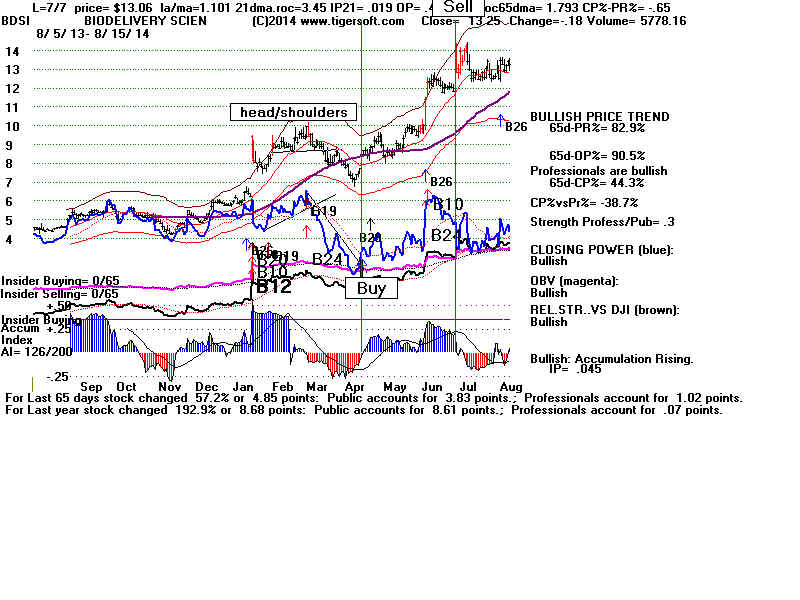

BDSI H/S ...CP rules worked well.

Buy B10-B20

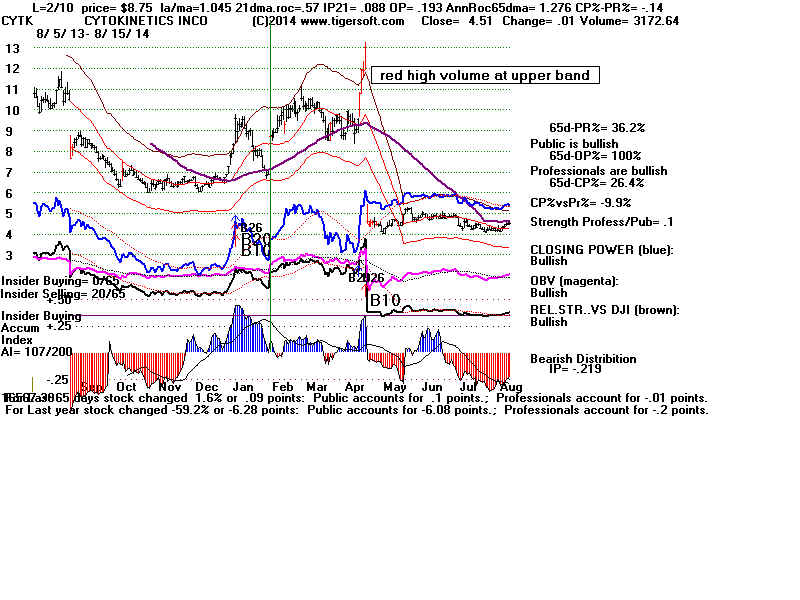

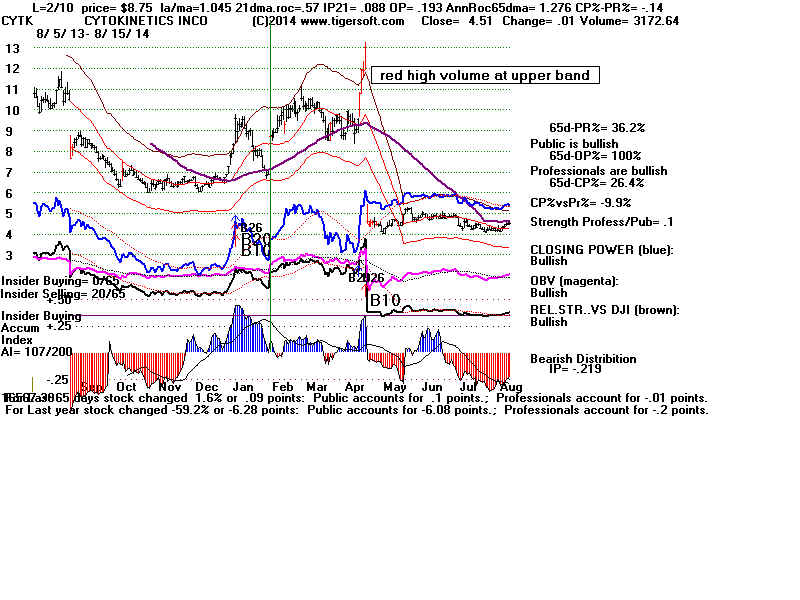

CYTK . CP rules worked well

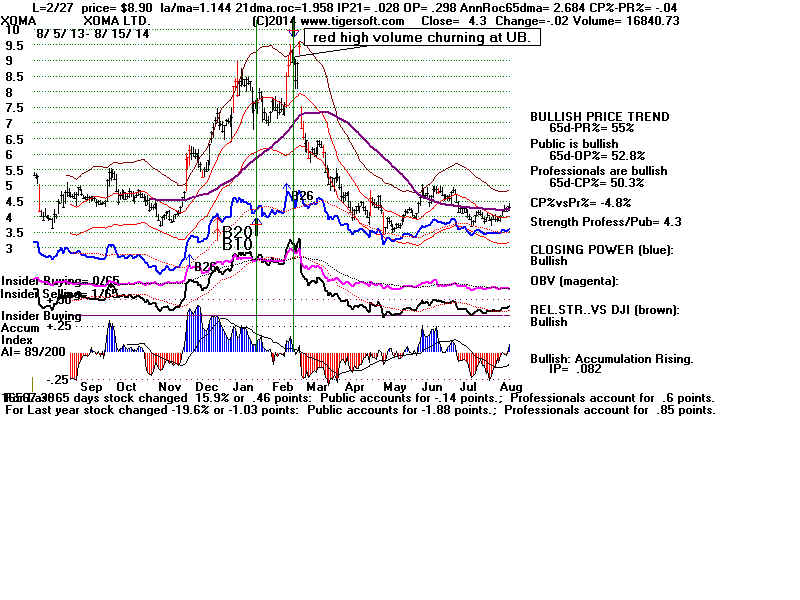

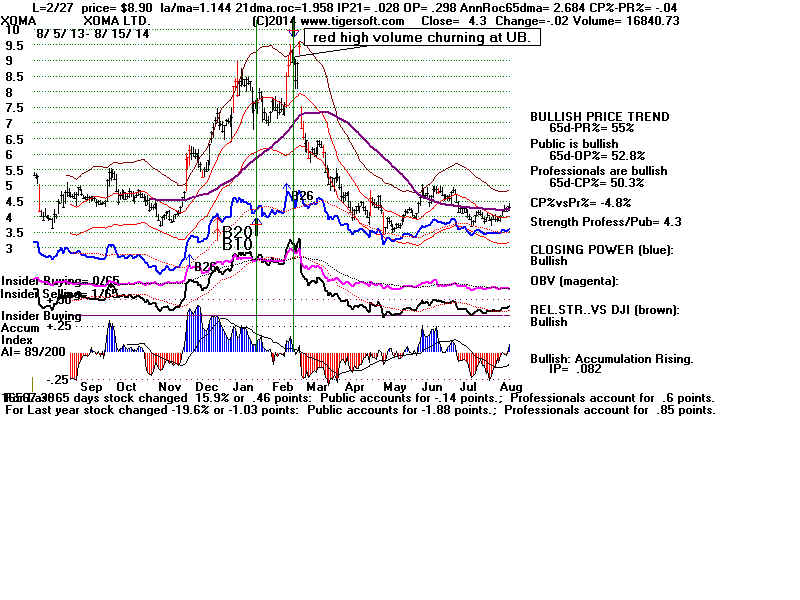

XOMA - CP rules worked well.

Buy B10-B24

-----------------------------------

Buy B12-B10

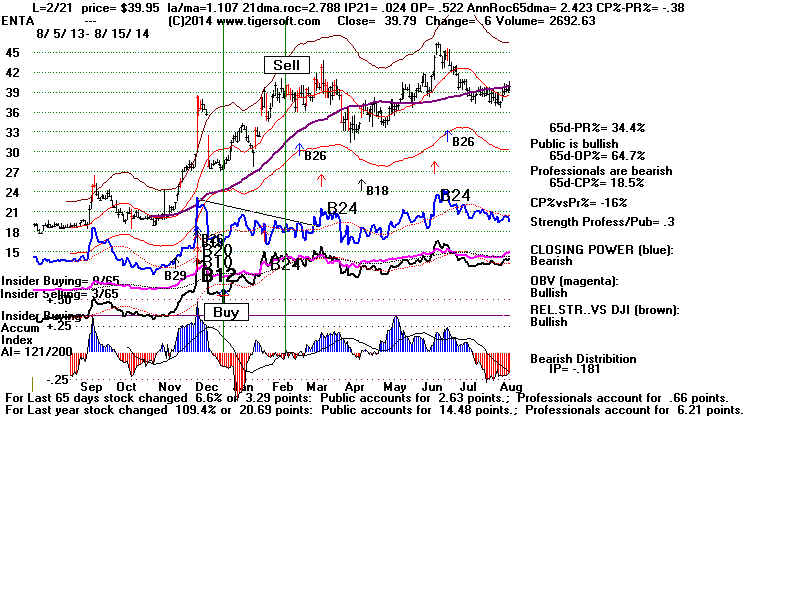

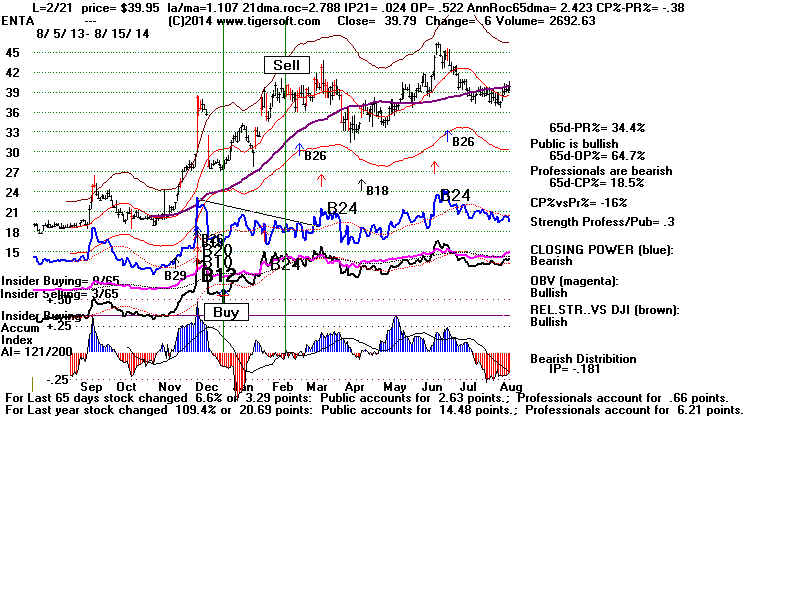

ENTA ...CP rules worked well

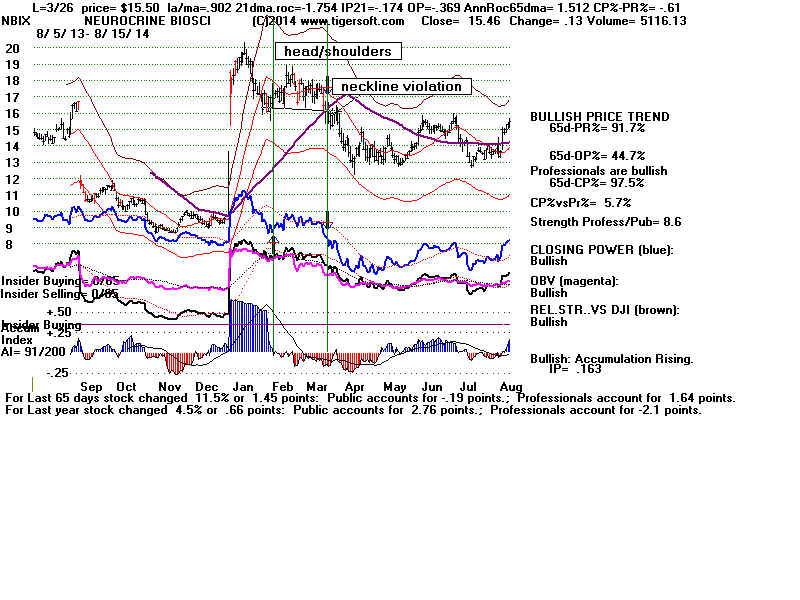

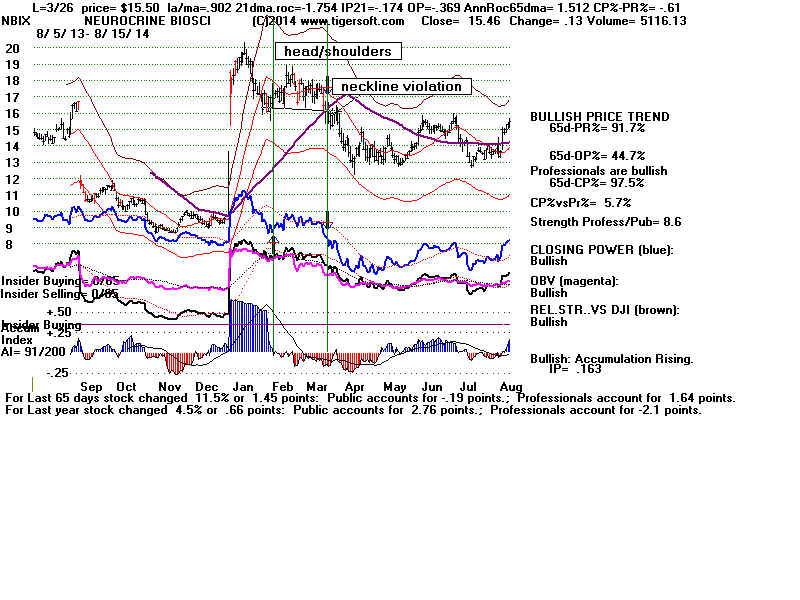

NBIX ... head/shoulders voids profitable CP trade.

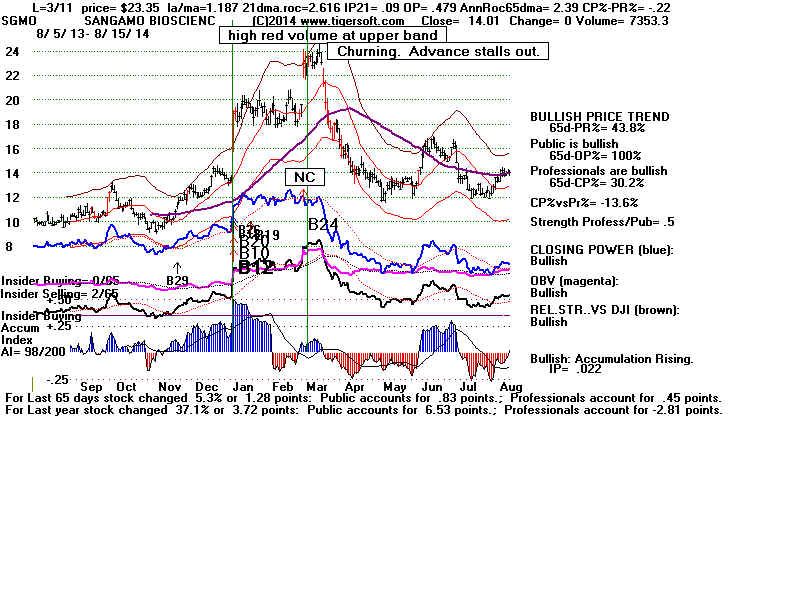

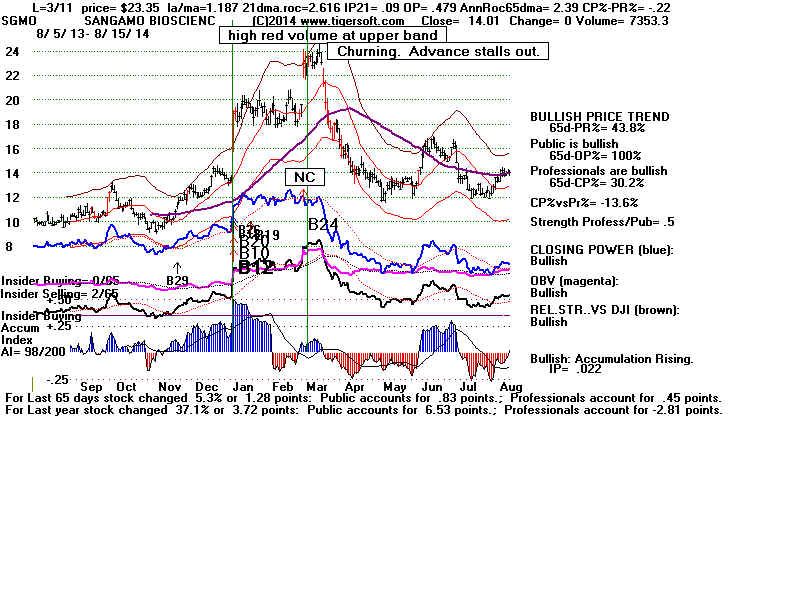

SGMO ... CP rules worked well.

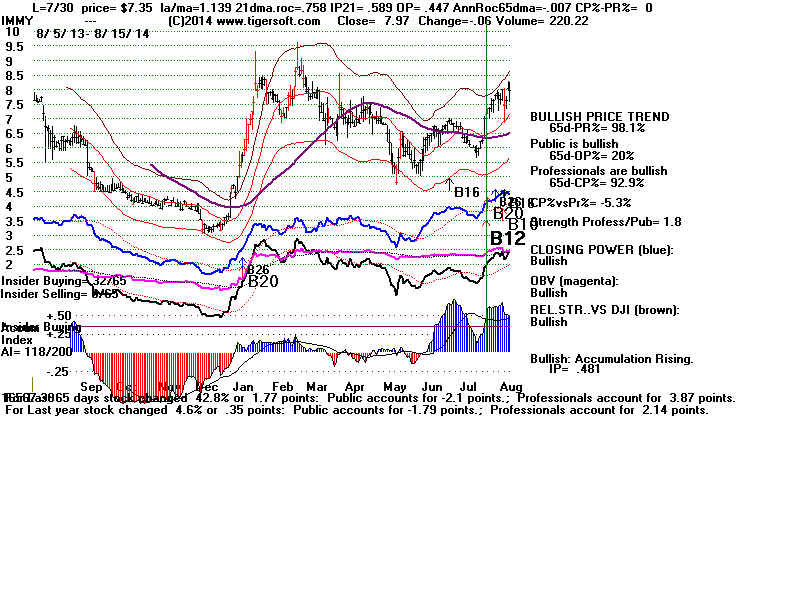

Buy B12-B20

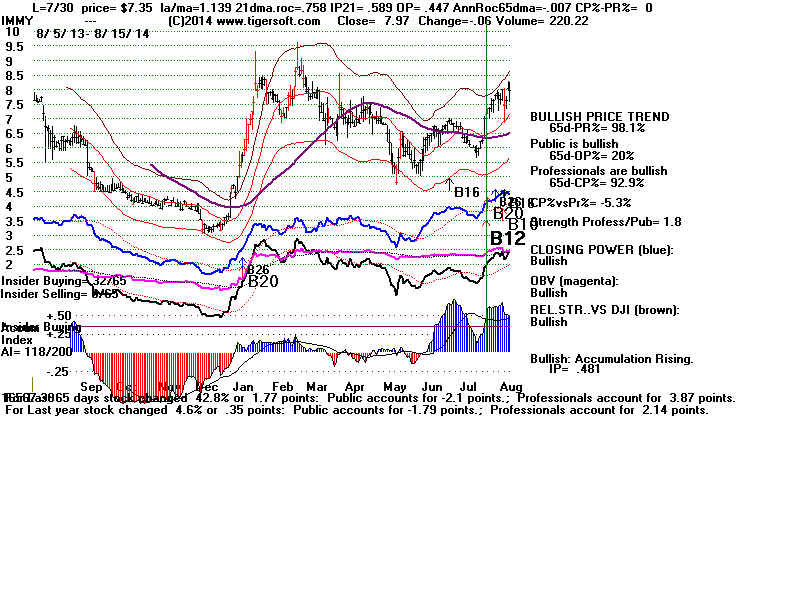

IMMY ... CP rules worked well

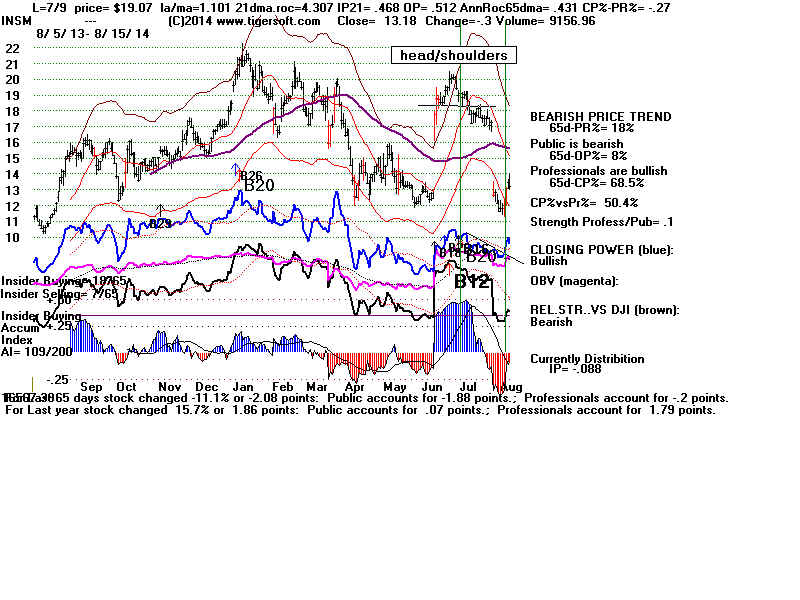

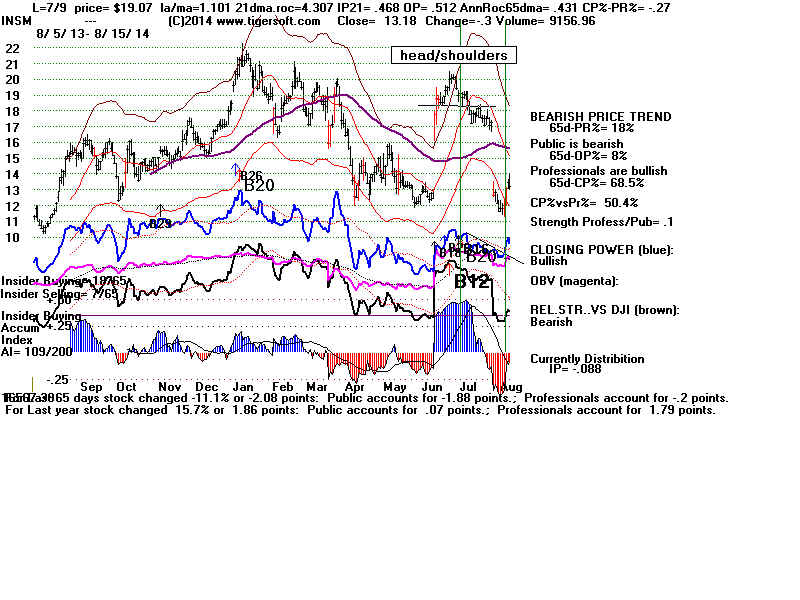

INSM ... head/shoulders cancels buy at ma on CP hook up.

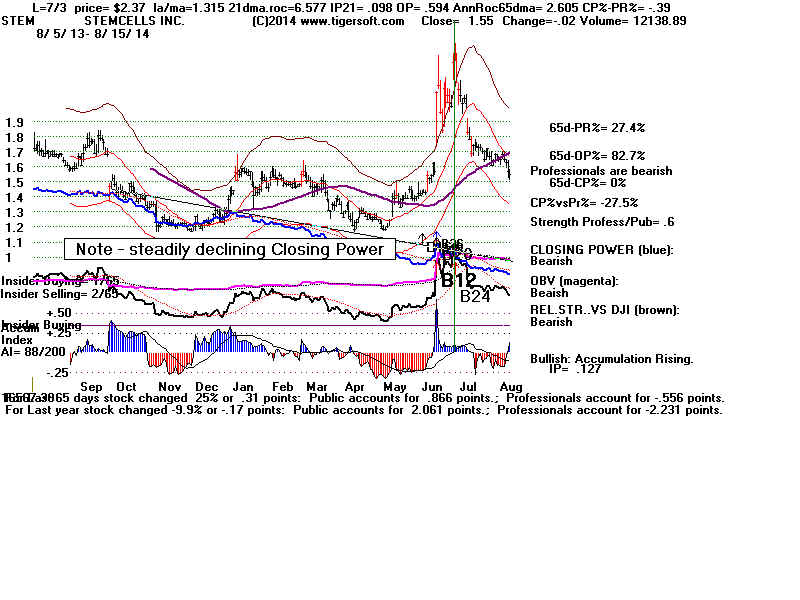

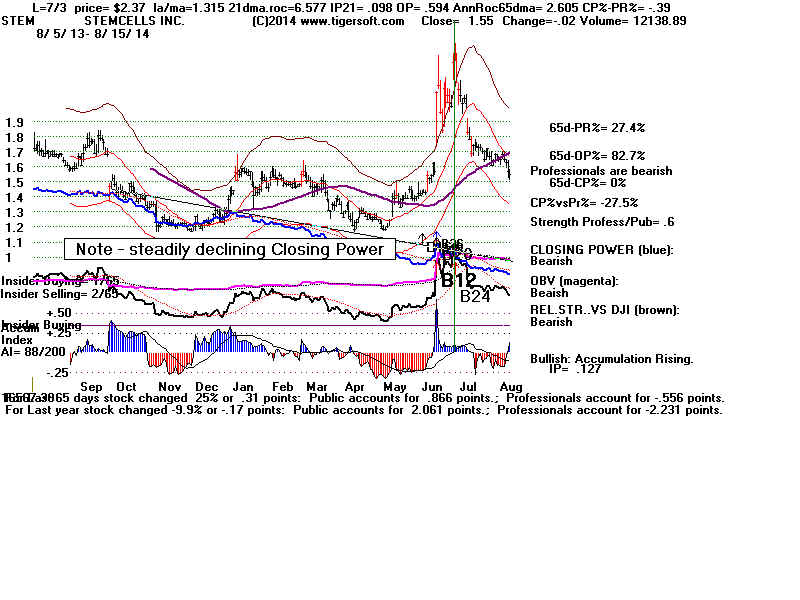

STEM ... cancelled because of Closing Power downtrend.

Buy B12-B24

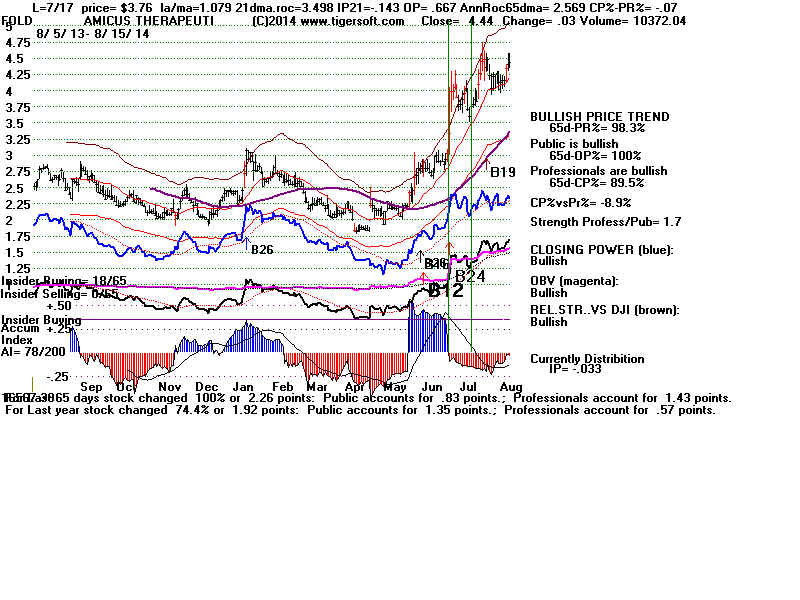

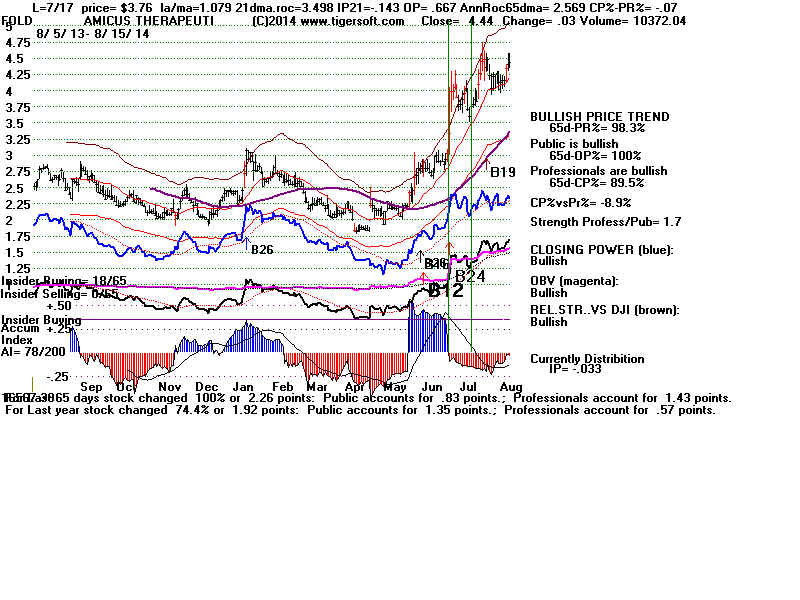

FOLD ...CP rules worked well.

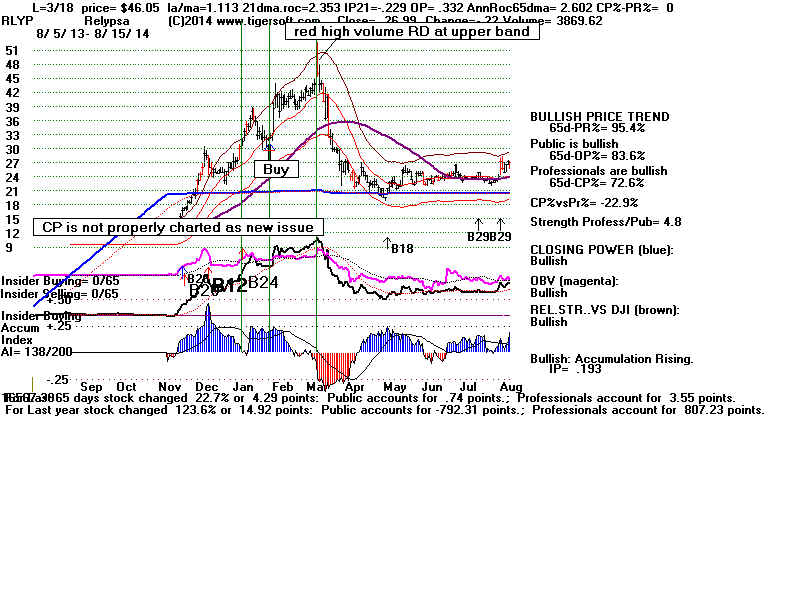

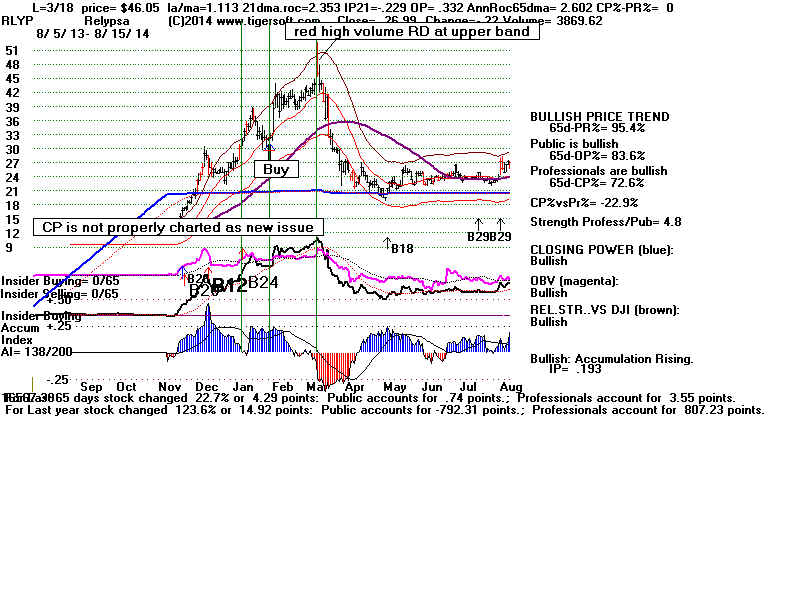

RLYP ...CP rules worked well.

-----------------------------------

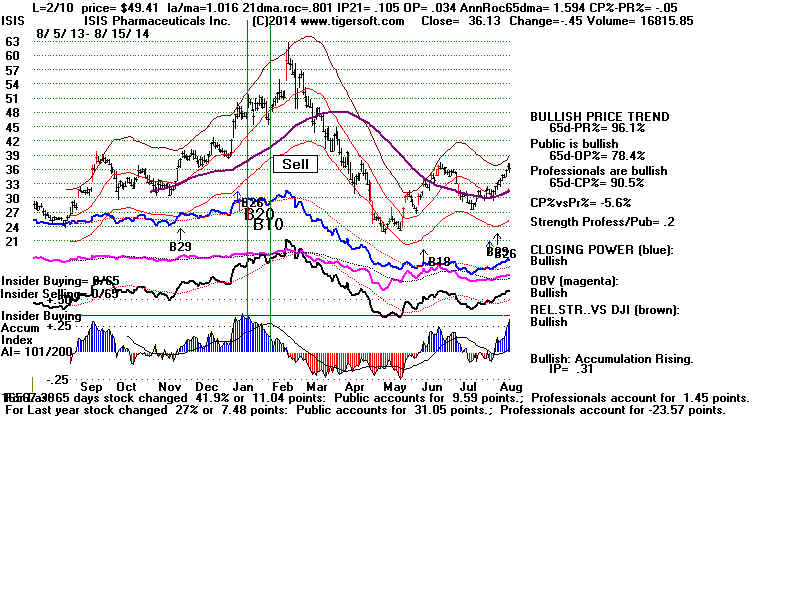

Buy B20-B10

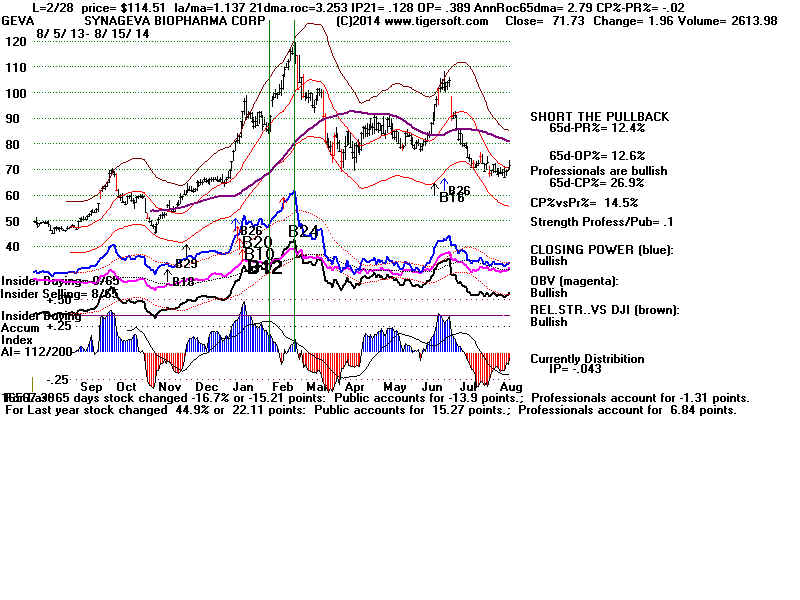

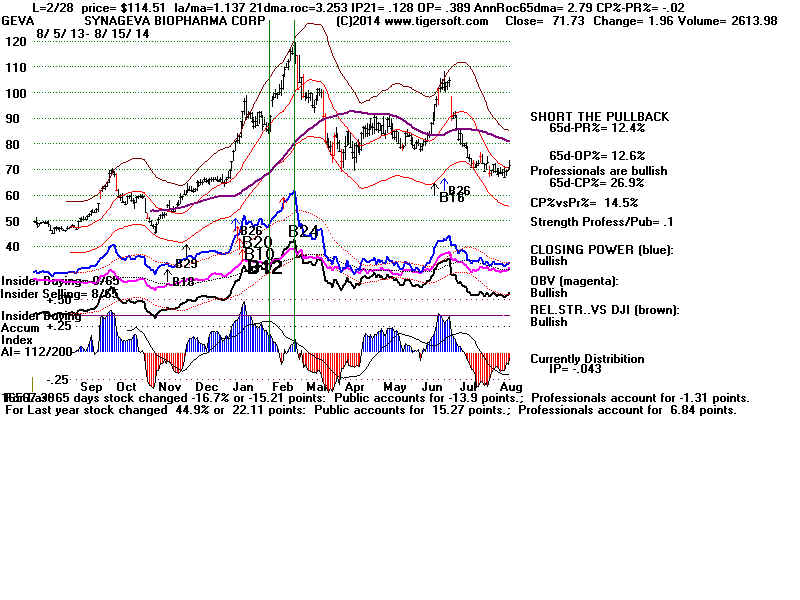

GEVA ... CP rules worked well.

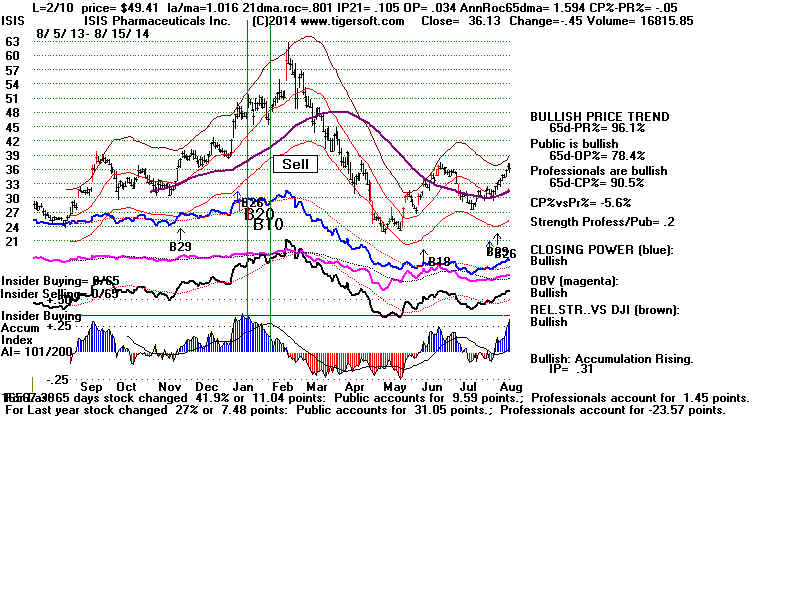

ISIS ... CP rules worked well.

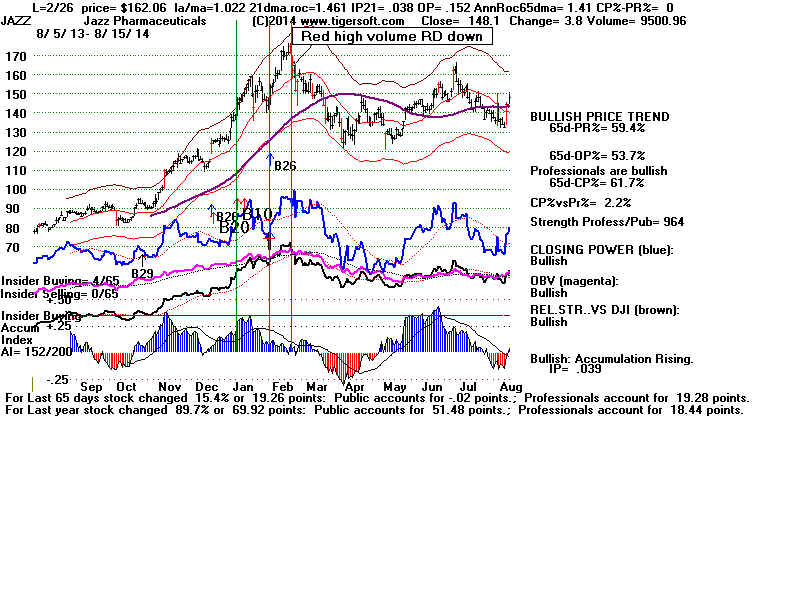

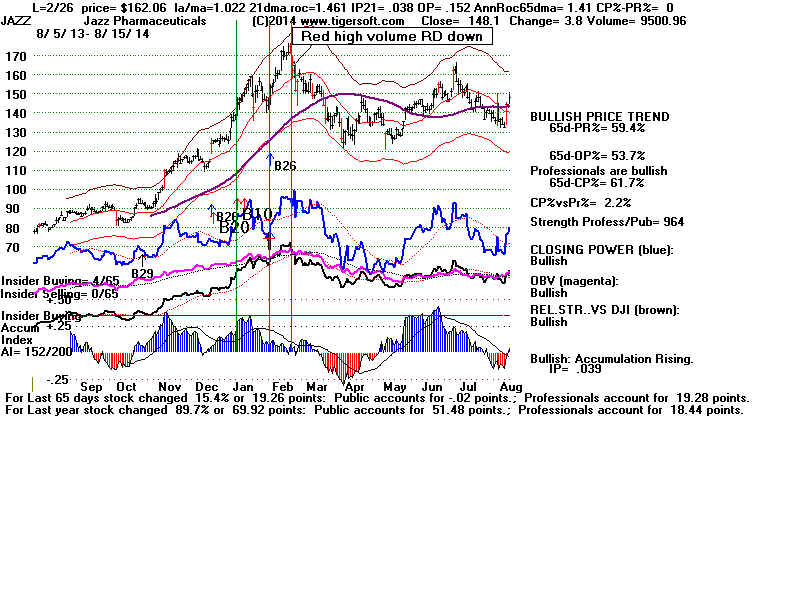

JAZZ ... CP rules worked well.

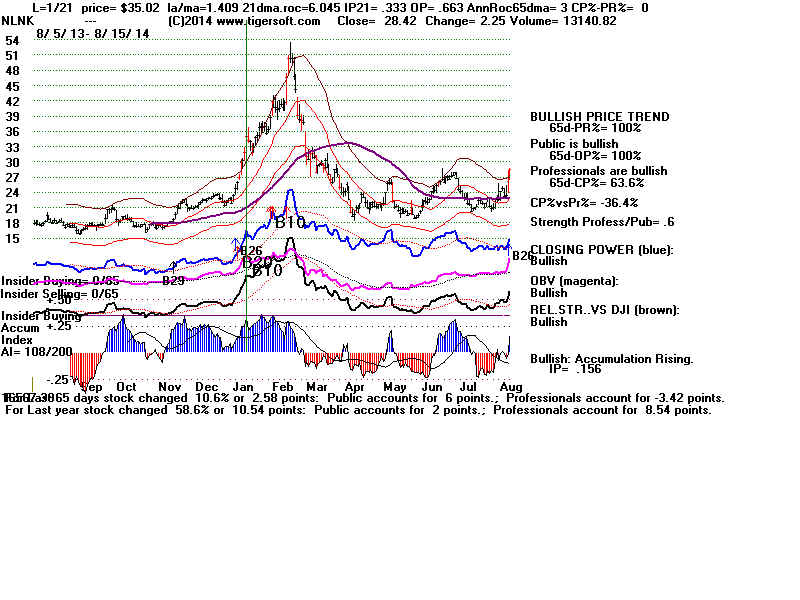

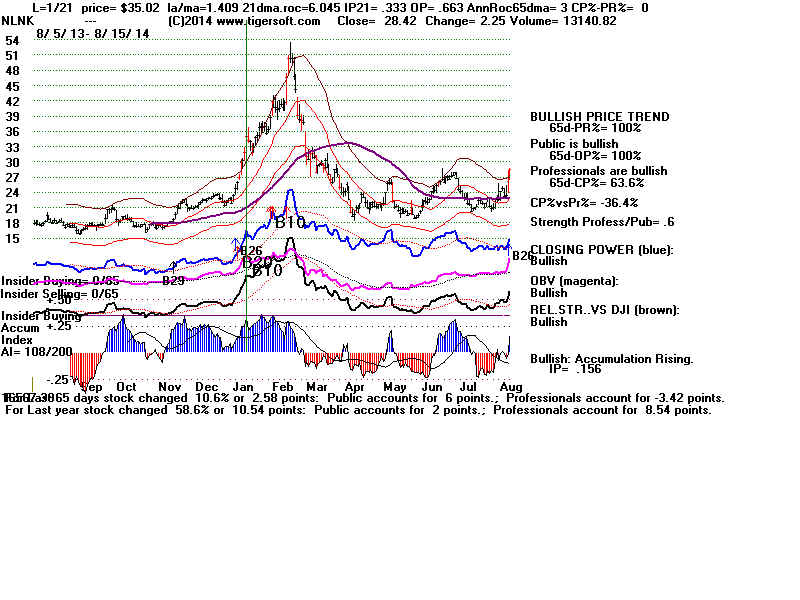

NLNK ... NO PULLBACK.

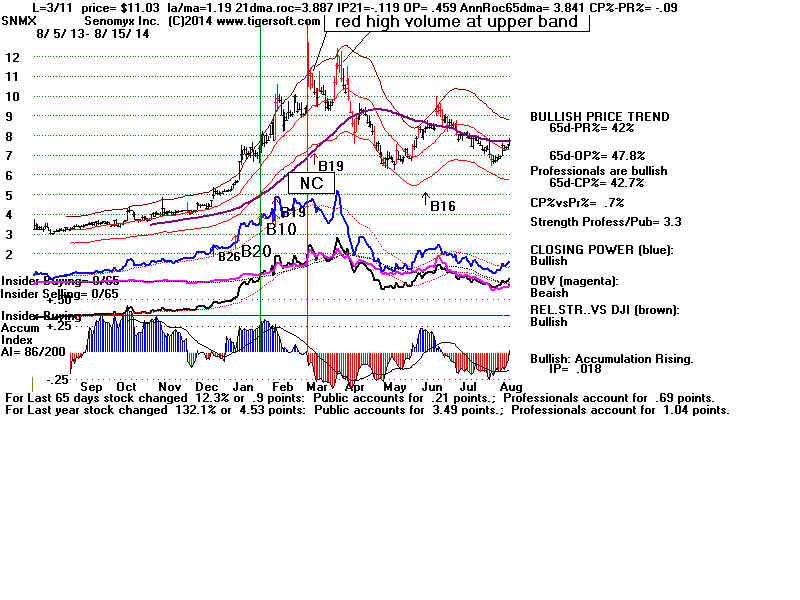

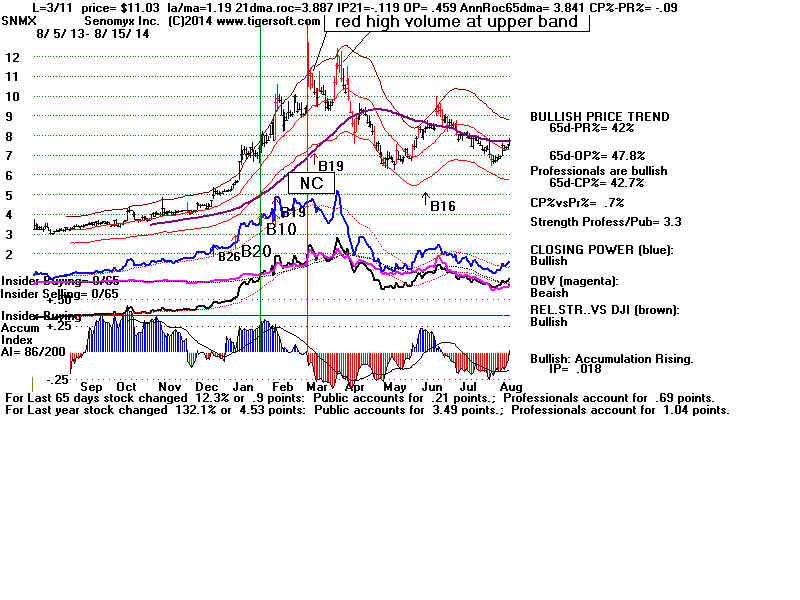

SNMX ... MO PULLBACK.

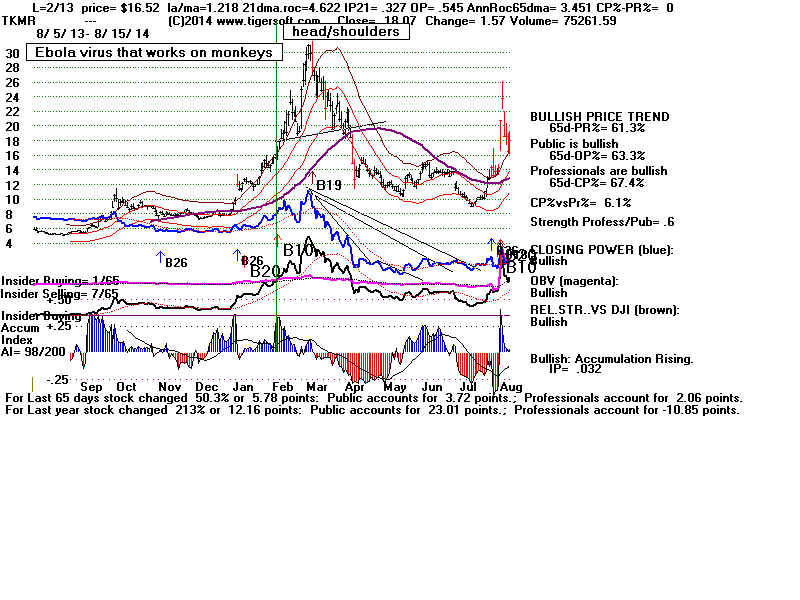

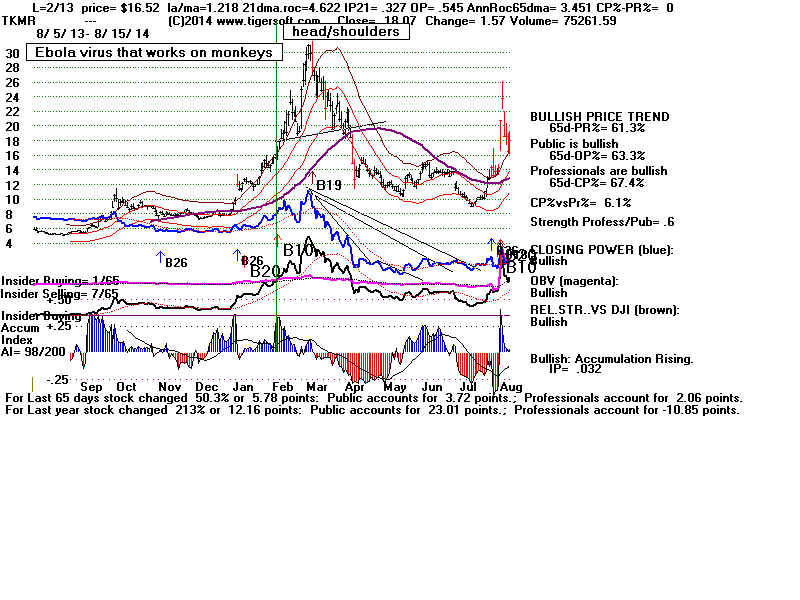

TKMR ,,, NO PULLBACK.

Buy B20-B12

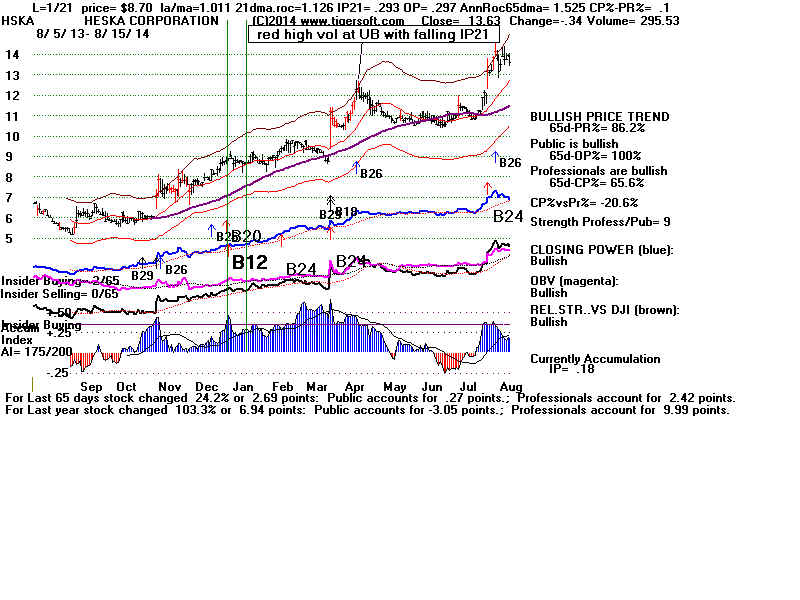

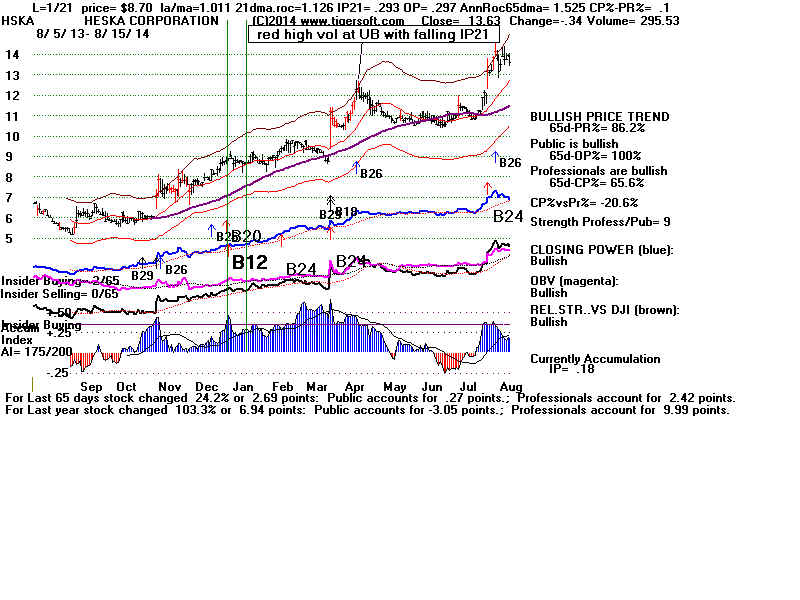

HSKA ... CP rules worked well

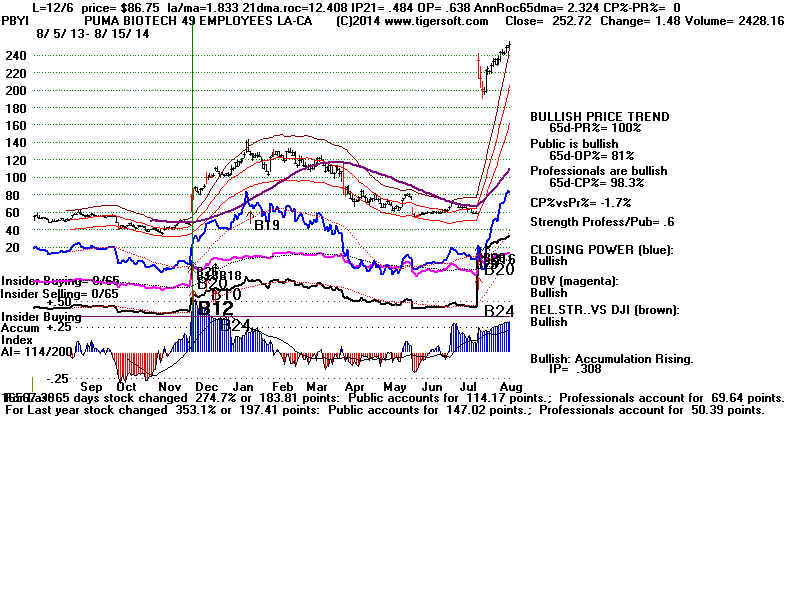

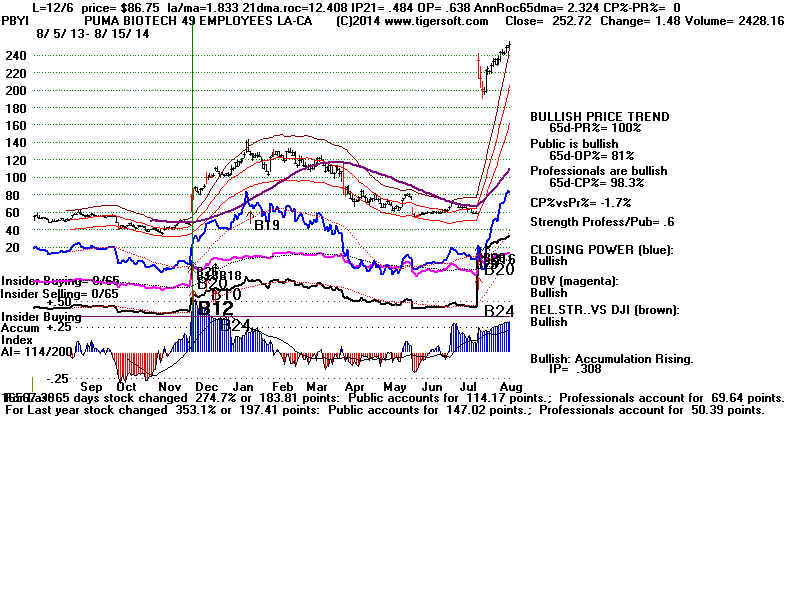

PBYI ... No Pullback.

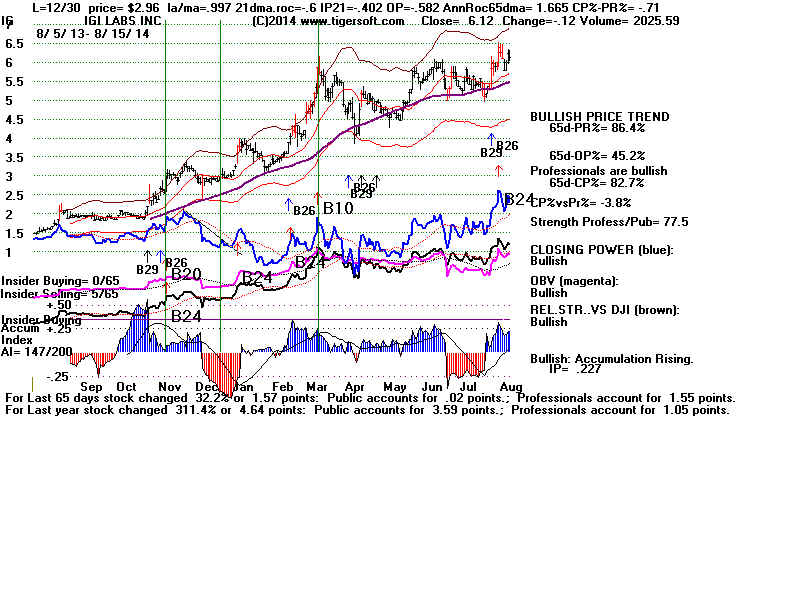

Buy B20-B24

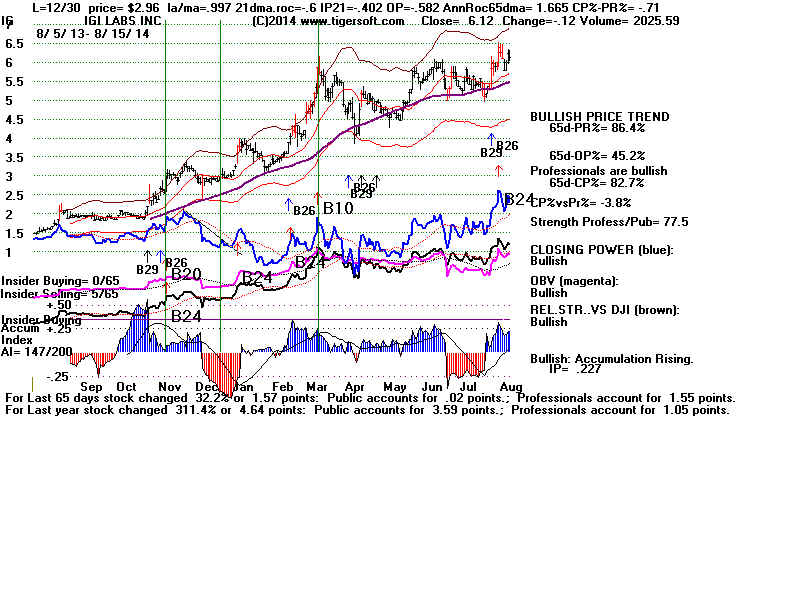

IG ... CP rules worked well.

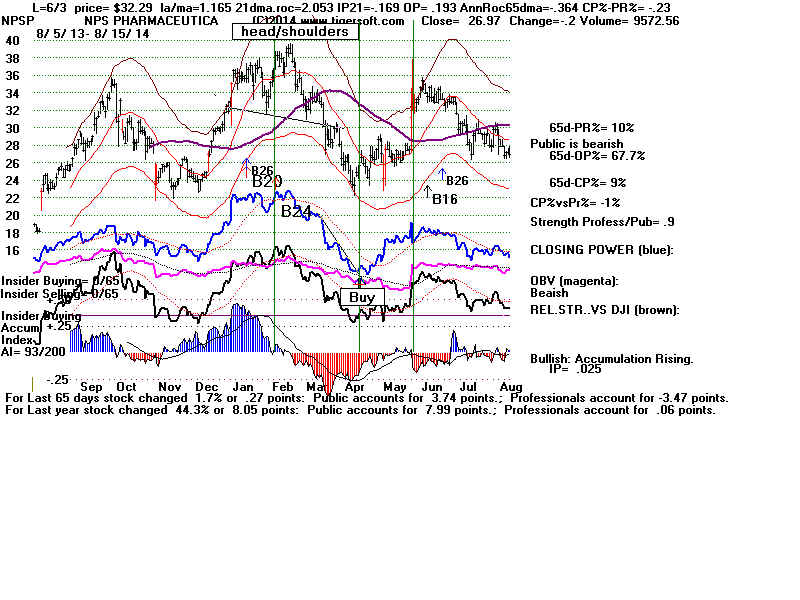

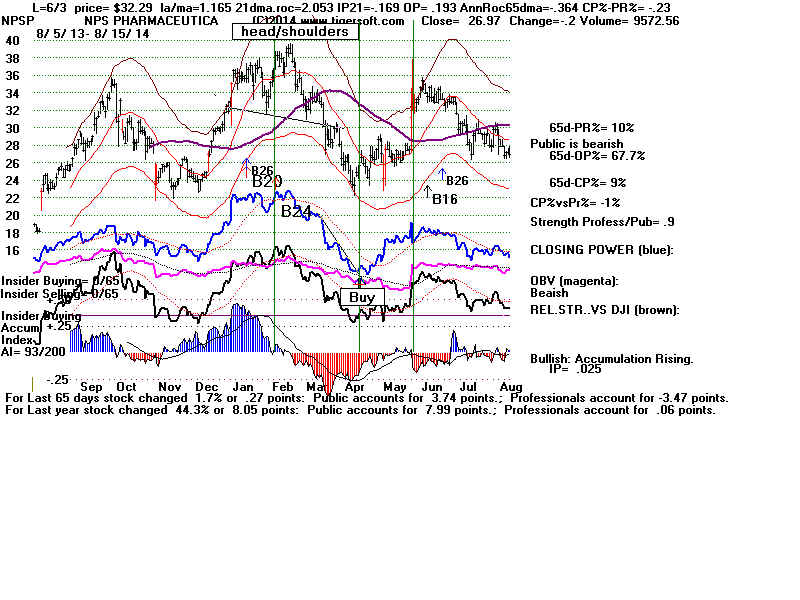

NPSP ... Head/shoulders cancels nuy at ma on CP hook up.

-----------------------------------

Buy B24-B10

Buy B24-B12

Buy B24-B20

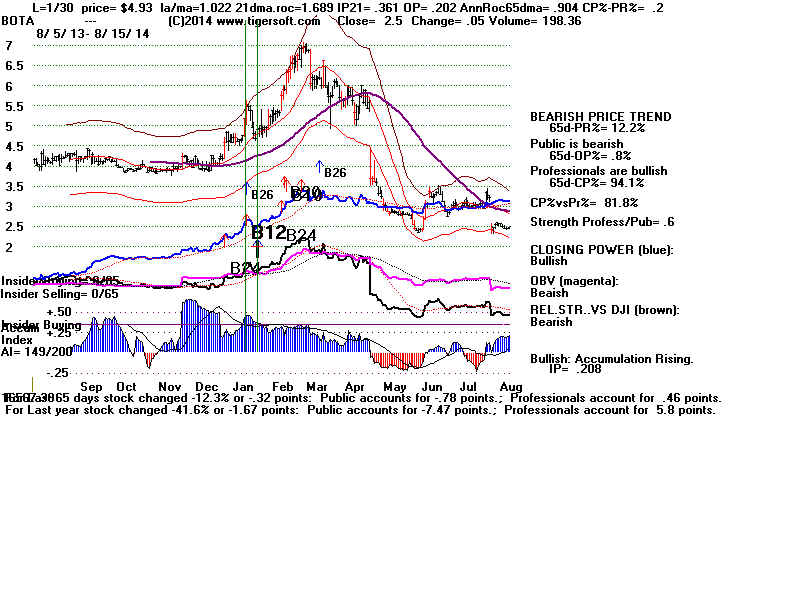

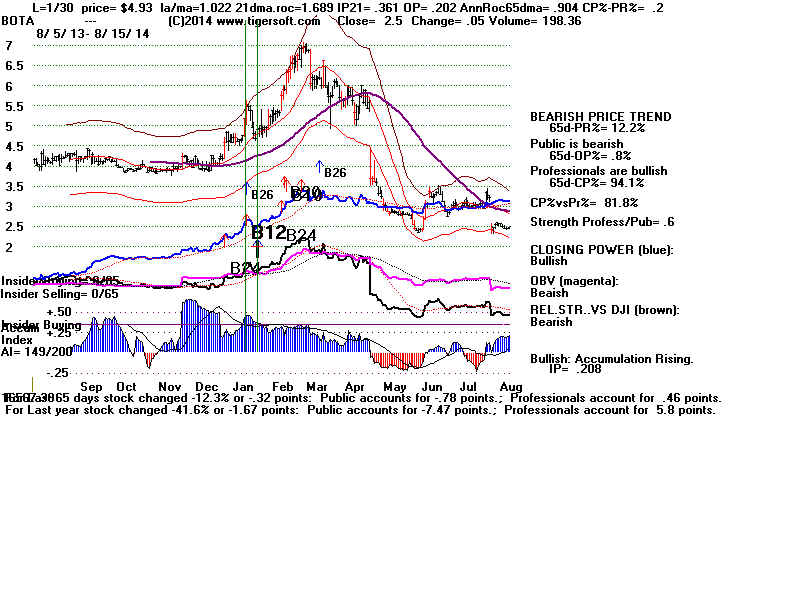

BOTA CP rules worked well

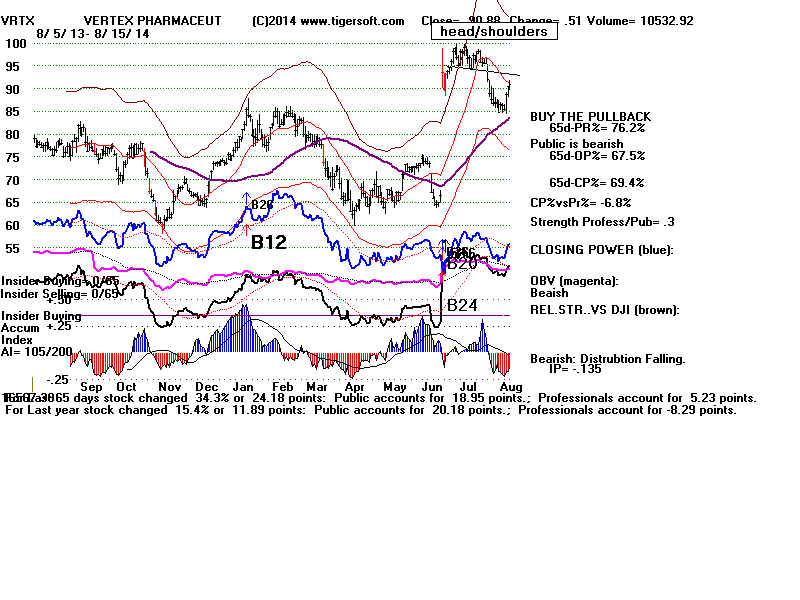

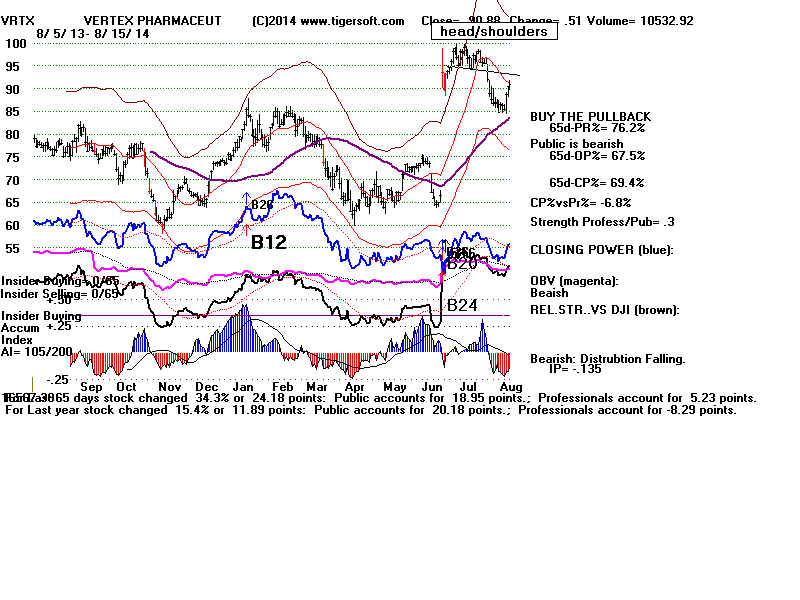

VRTX head/shoulders voids quick buying on pullback.

-----------------------------------------------------------------------

Combination Buys of Biotechs: 2014

2014 BDSI B12-B10-B20 (Simultaneous)

1/24/14 9.41 - sidewise until Mid May - 7/9/14 13.94 (red RD at UB)

Trading using CP worked well.

Note head/shoulders. This should cause us not to buy on

next CP up on a decline to the MA. Instead watch for CP downtredn-break.

Next CP hook up after CP trend-break was at 8.47. Buy there.

Sell on Red high Volume RD at upper band at 13.06.

2014 BOTA B24-B12 Good. 5.49 to 6.94 red high volume at upper band.

Next CP hook up at ma - 4.93 - 6.94 high

2014 CMXI B24-B20 Bad (under 50 cents)

2014 CYTK (Simultaenous) B10-B20 Good 9.58 to 12.99

Next CP hook up at 65-dma - 8.75 - 12.0 (Red high vol at upper band).

2014 ENTA B12-B10-B20 38.14 --> 27 --> 46.14 (June high)

Next CP hook up at ma - 28.28 - --> Sell 39.35 Red high volume churning,

CP falling and IP21 nearly negative.

2014 FOLD B12-B24 Good 3.34 --> 4.44 (now)

Next CP hook up at ma - 3.76 --> 4.44 (now)

2014 GEVA B20-B10 (also B12 and B24 a day or two later) 92.62 to 118.42

Next CP hook up at ma - 90.63--> 114.51 (churning at upper band)

(2014 GOVX Simultanous B12-B20-B24 0.57 tp 0.95 intra-day)

2014 HSKA B20-B12 Good 8.95 ---> 13-14 Red High Volume at Upper Band.

Next CP hook up at ma - 8.70 --> 12.19 (red high vol. at upper band with falling IP21)

(2014 IBIO Simultaneous B12-B20 0.64 to 0.84 intra-day.)

2014 IG Simultaneous B20-B24 Good 2.93 ---> 5.73 (Red high volume RD at UB)

Next CP hook up at ma - 2.96 --> 5.73 (Red high volume RD at UB)

2014 IMMY B12-B20 (and later B10) on 8/11/2014 8.00 - Now 7.97

Now decline to MA and CP hook upwards.

2014 INSM B12-B20 Bad -- on 7/9/2014 19.07 - 13.18

Development of Head/shoulders warns to wait for CP trend-break to buy.

Buy on CP trend-break on 8/13/2014 at 13.09 Now 13.18

2014 ISIS B20-B10 Good - 50.95 to 59.00 (red high volume warning at upper band)

Next CP hook up at ma -49.41 --> 59.00 (Red high volume RD at UB)

2014 JAZZ B20-B10 Good - 146.84 - 174.98. (red high volume warning at upper band)

Next CP hook up at ma -153.10 -->162.08 (Red high volume RD at UB)

2014 NBIX Bad - Simultanous B12-B10 (also B20) 19.15 - 19.65 amd back to 13.

Next CP hook up at ma - 16.91-->15.50 (head/shoulders)

2014 NLNK Good B20-B10 - 35.02 - 50.40 (red high volume followed by RD)

No pullback to ma for 2 months.

2014 NPSP BAD B20-B24

Severe IP21 NNC. Don't be in a hurry to buy on CP hook back upwards.

CP downtrend-break Buy at 25.65. Sell on red high volume RD at upper band at 32.29.

2013-4 PBYI Good B20-B12 99.85 (Also B10-B24) -> 139.92

No early pullback to 21-dma

2014 PBYI Good B24-B20 233.43 --> 252.72 PM 8/15/2014

No early pullback to 21-dma

2014 SGMO Good Simultaneous B12-B10-B20 18.88 => 23.35

Next CP hook up at ma - 19.14 -->23.35 (red high volume churning at UB, RD and CP

NC.)

2014 SNMX Good B20-B10 (6 weeks later) 7.94 --> 11.03 (red high volume at UB, CP NC, IP21 NNC)

No early pullback to 21-dma

2014 STEM Bad B12-B20 Bad (Note steadily declining Closing power)

Primarily a short covering rally.

2014 TKMR Good B20-B10 (6 weeks spearation) 16.52 to 38.02 (Red high volume RD down at UB)

No early pullback to 21-dma

Note head/shoulders.

Don't be in a hurry to buy after a head/shoulders top.

2014 VRTX Bad B24-B20

50% one-day jump! Head/shoulders quickly develops.

Best to avoid...

2014 XOMA OK B10-B20 8.17 to 7.01 to 9.44

Buy on CP hook up after decline to ma - 1/29/14 7.65

2014 XOMA OK B10-B20 8.17 to 7.01 to 9.44

Buy on CP hook up after decline to ma - 1/29/14 7.65

2014 RLYP Good B12-B24

Buy on CP hook up after decline to ma - 2/7/14 32.46

Sell on red high volume RD at upper band at 46.05

2014 RLYP Good B12-B24

Buy on CP hook up after decline to ma - 2/7/14 32.46

Sell on red high volume RD at upper band at 46.05

|

We always take notice of the more powerful major

Tiger Buys: B10, B12, B20 and B24. In combination, they

are more powerful than when appearing individually.

There are 12 combinations: B10-B12, B10-20...B24-B12,

B24-B20. Our new Explosive Super Stocks has explored

the power of each of these combinations. (The report

on this will be posted Monday for purchasers of this

on-line Book.)

As one would expect, these Buys typically launch the

biggest advances, especially in the early stages of

of a bull market.

Near the end of a bull market, they must be approached

more cautiously. Here I develop some rules for trading

these Najor Buy combinations at this stage in the market

cycle.

I suggest using Closing Power hooks to buy and watching for

red high volume churning and reversal days down at the

upper band to sell. This approach gives many good trades

and should help us avoid most of the dangerous surprises

biotechs sometimes bring. In this regard, we want also

to watch for head/shoulders patterns and we want to heed

Closing Power divergences and trends as well as Accumulation

Index (IP21) weakness.

I like B10-B12-B20s. The first shows a breakout above

well-tetsed resistance. The second shows intense accumulation.

And the third shows that take-off velocity has been reached.

B24s remind us that the more bulges of Accumulation there are,

the tighter is the hold by bullish insiders of the stock's

float.

Because, B20-combinations show "take-off" strength, we see

below that they are less likely to bring convenient pullbacks

to the 21-day ma. This may affect our tactics a little.

Trading Rules for Major Buy Combinations

We always take notice of the more powerful major

Tiger Buys: B10, B12, B20 and B24. In combination, they

are more powerful than when appearing individually.

There are 12 combinations: B10-B12, B10-20...B24-B12,

B24-B20. Our new Explosive Super Stocks has explored

the power of each of these combinations. (The report

on this will be posted Monday for purchasers of this

on-line Book.)

As one would expect, these Buys typically launch the

biggest advances, especially in the early stages of

of a bull market.

Near the end of a bull market, they must be approached

more cautiously. Here I develop some rules for trading

these Najor Buy combinations at this stage in the market

cycle.

I suggest using Closing Power hooks to buy and watching for

red high volume churning and reversal days down at the

upper band to sell. This approach gives many good trades

and should help us avoid most of the dangerous surprises

biotechs sometimes bring. In this regard, we want also

to watch for head/shoulders patterns and we want to heed

Closing Power divergences and trends as well as Accumulation

Index (IP21) weakness.

I like B10-B12-B20s. The first shows a breakout above

well-tetsed resistance. The second shows intense accumulation.

And the third shows that take-off velocity has been reached.

B24s remind us that the more bulges of Accumulation there are,

the tighter is the hold by bullish insiders of the stock's

float.

Because, B20-combinations show "take-off" strength, we see

below that they are less likely to bring convenient pullbacks

to the 21-day ma. This may affect our tactics a little.

Trading Rules for Major Buy Combinations

2014 XOMA OK B10-B20 8.17 to 7.01 to 9.44

Buy on CP hook up after decline to ma - 1/29/14 7.65

2014 XOMA OK B10-B20 8.17 to 7.01 to 9.44

Buy on CP hook up after decline to ma - 1/29/14 7.65

2014 RLYP Good B12-B24

Buy on CP hook up after decline to ma - 2/7/14 32.46

Sell on red high volume RD at upper band at 46.05

2014 RLYP Good B12-B24

Buy on CP hook up after decline to ma - 2/7/14 32.46

Sell on red high volume RD at upper band at 46.05