TRADING QUESTIONS TIGER CAN ANSWER FOR YOU

(C) 2015 William Schmidt, Ph.D. www.tigersoft.com

===========================================

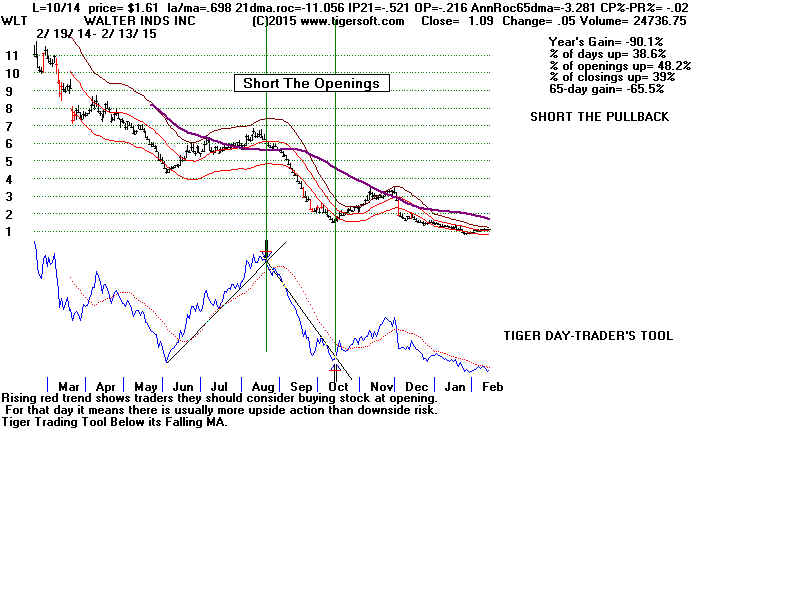

#1 What Is the Short-Term Significance of

A Strong or A Weak Opening

in A Given Stock, ETF, etc?

Don't be fooled by a strong or a weak opening.

With many stocks, the openings are traps for

the more emotional and for the broader Public.

But not always. Read more...

PEERCOMM + 2015 Graph + Daily Stocks + Symbol

+ INDIC 3 + STATISTICS: Trading Opening Strength

A table like the one below is generated for your stock based

upon the last year's data on file.

Amount the Opening Number Closing's Avg. Pct. Change

is Up or Down from of Pct Change from Opening

the Previous Close Cases from Opening

--------------------------------------------------------------------------------------------------------------

>.02 (2%) 16 .438 (43.8%) -.0021 (-0.21%)

Typically a decline

follows such a strong

opening.

.015 to .02 19 .536 -.0055 (-0.55%)

Though there a rally more

frequently occurs, the avg. decline

from the opening to the close

is relatively large, more than -1/2%.

.01 to .015 25 .52 -.0007

.005 to .01 43 .58 .0011

0 to .005 53 .585 .0027

very high probability

of prices continuing moderatly higher.

---------------------------------------------------------------------------------------------------------------------

0 to -.005 53 .60 -.0023

-.005 to -.01 35 .476 -.0033

Odds favor a continuation in lower

prices.

-.01 to -.015 20 .70 +.0031

Rebound must be expected.

-.015 to -.02 5 .40 -.0136

Continuation much lower is probable.

<-.02 12 .583 +.0093

Rebound is likely.

#2 Where Should Your Stock Open Tomorrow

if It Is Typical for the last 21 days of trading?

(You might want to sell it to advantage. Or

buy iot cheaply.)

PEERCOMM + 2015 Graph + Daily Stocks + Symbol

+ INDIC 3 + STATISTICS: Trading Openings/Closings

Also look at the new 6 month Tiger charts that show

bands around a 5-dma and let you study volume more

closely. Short-term traders should probably abide by

the direction of the 5-day ma using bands and volume, too.