TigerSoft

News Service May 20, 2011 www.tigersoft.com NON-PUBLIC

PAGE

TigerSoft

News Service May 20, 2011 www.tigersoft.com NON-PUBLIC

PAGE

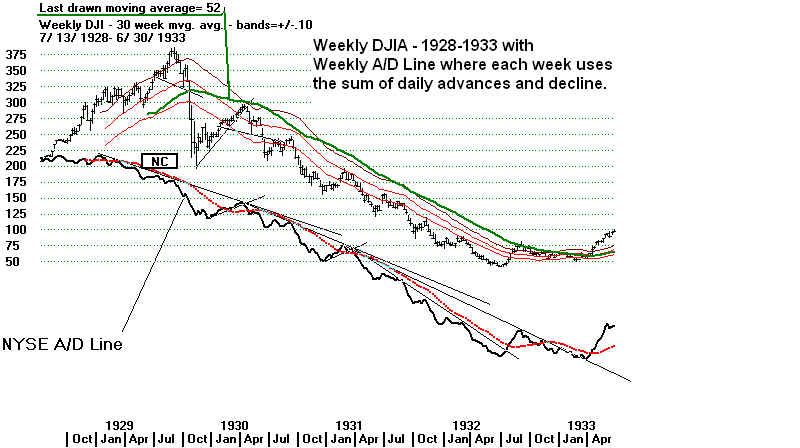

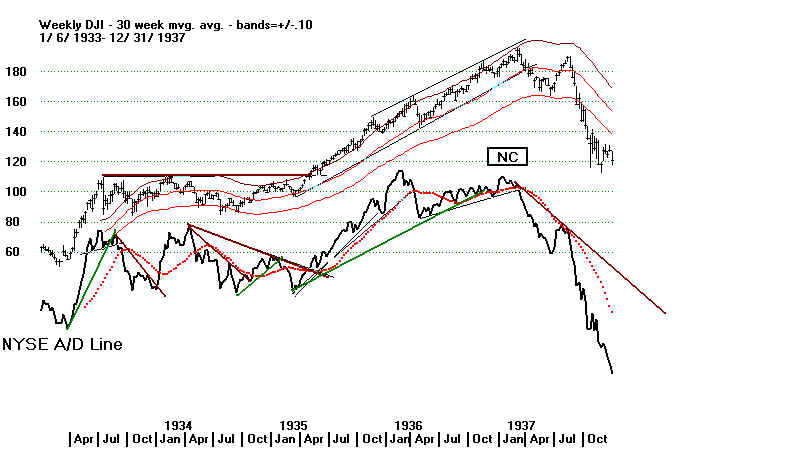

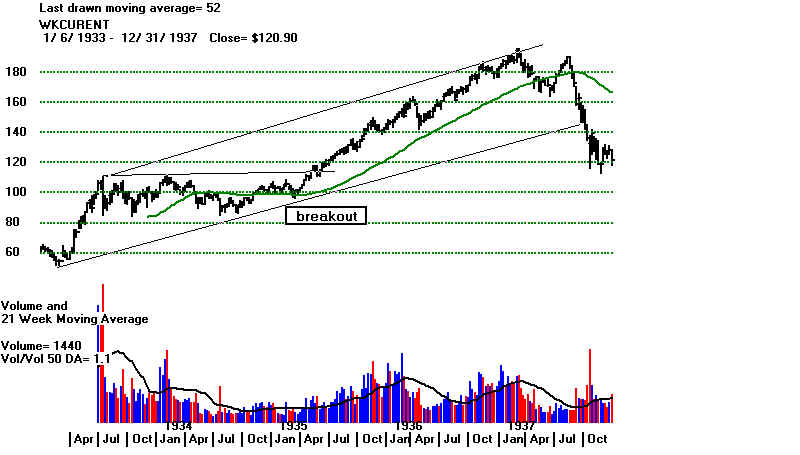

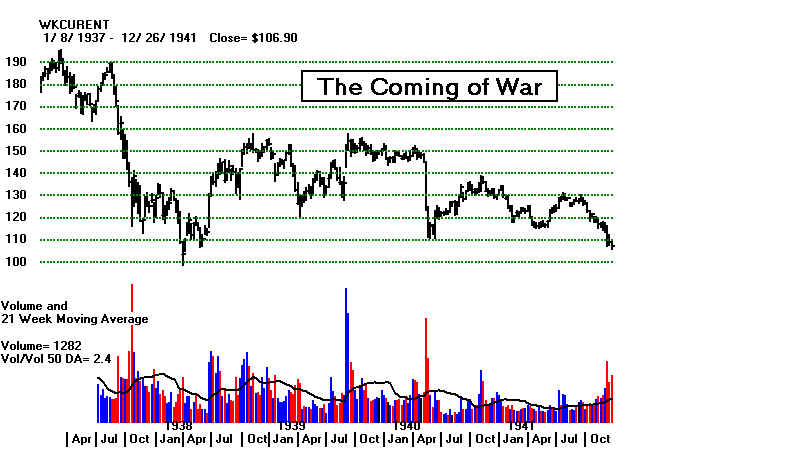

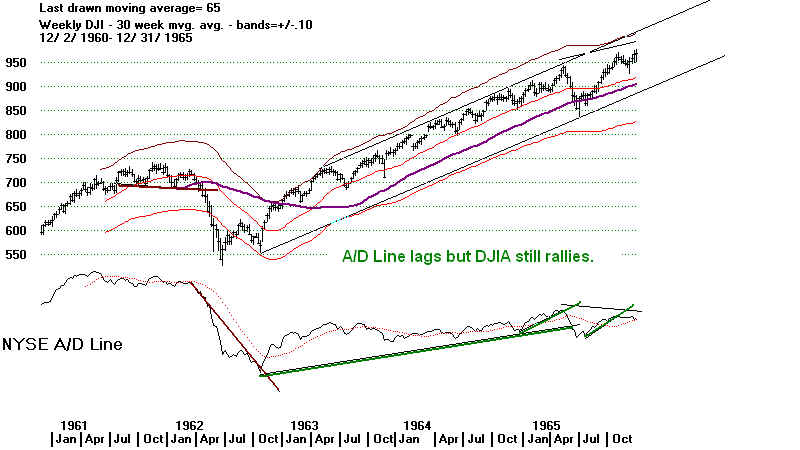

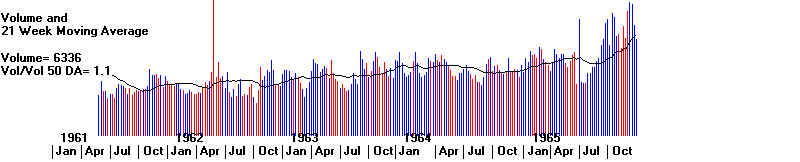

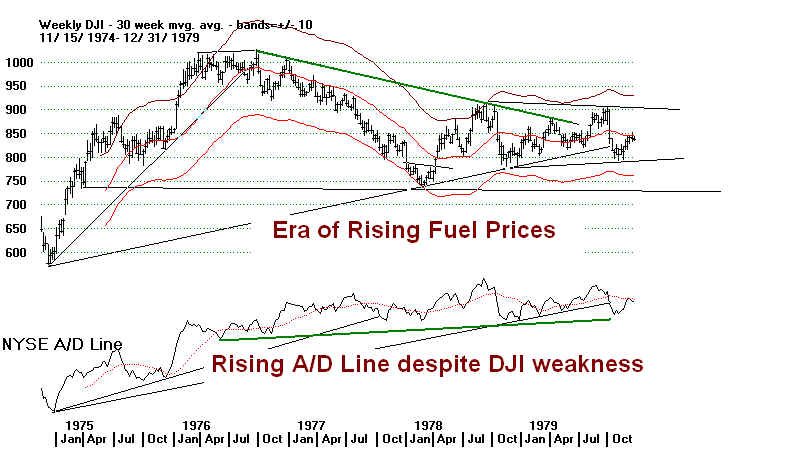

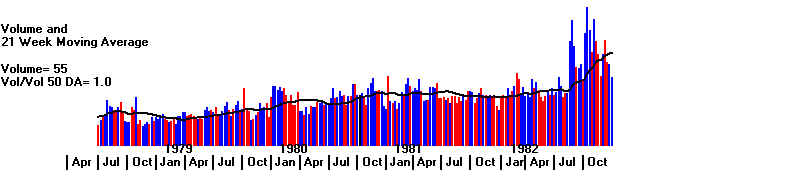

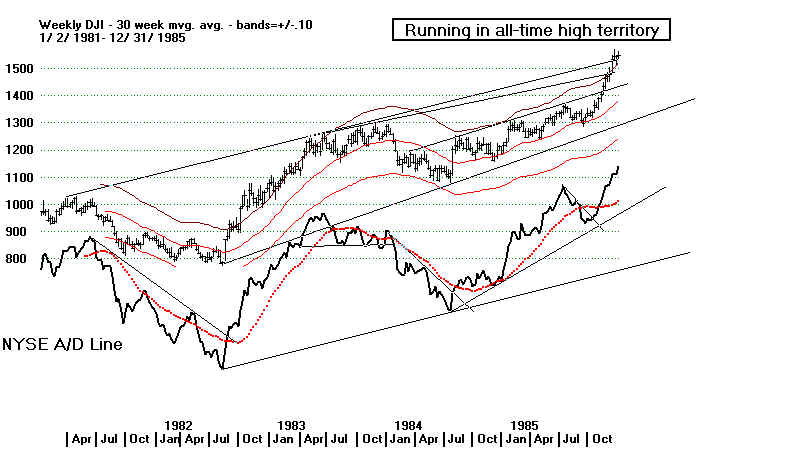

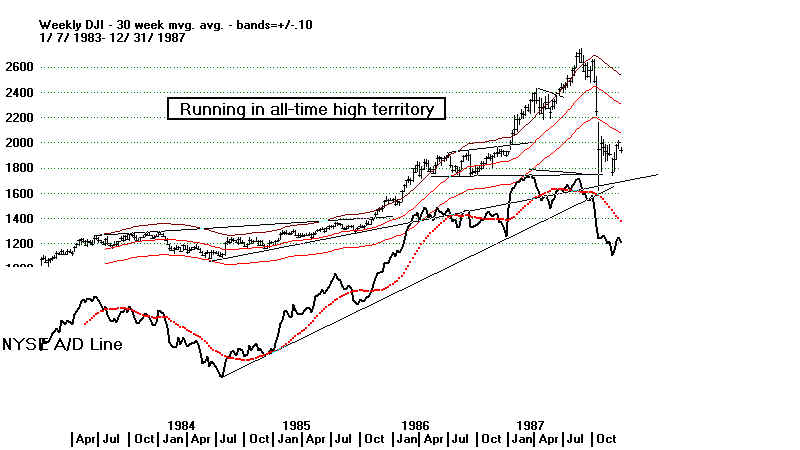

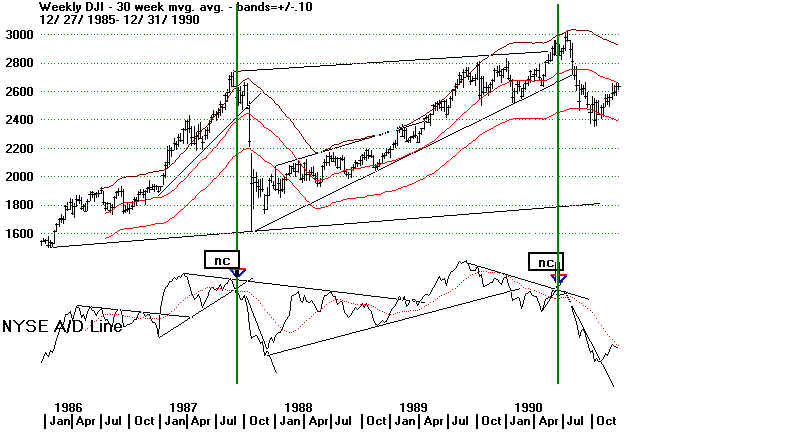

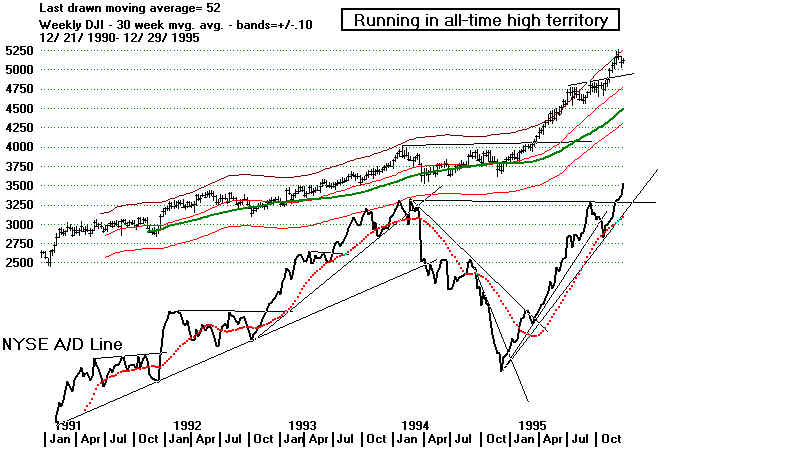

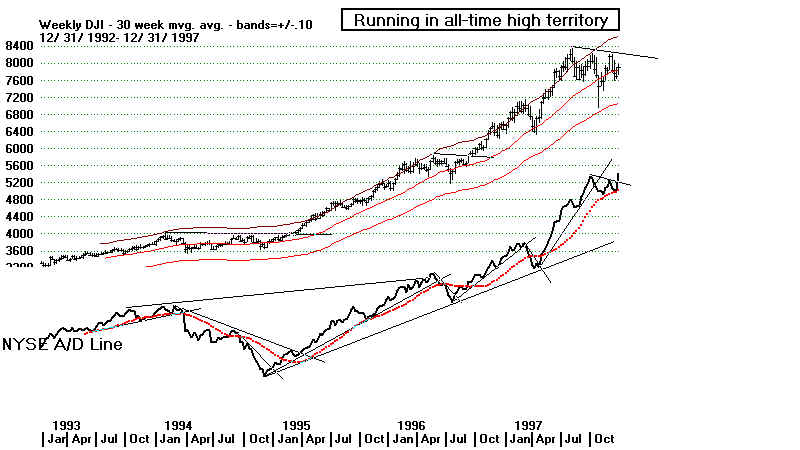

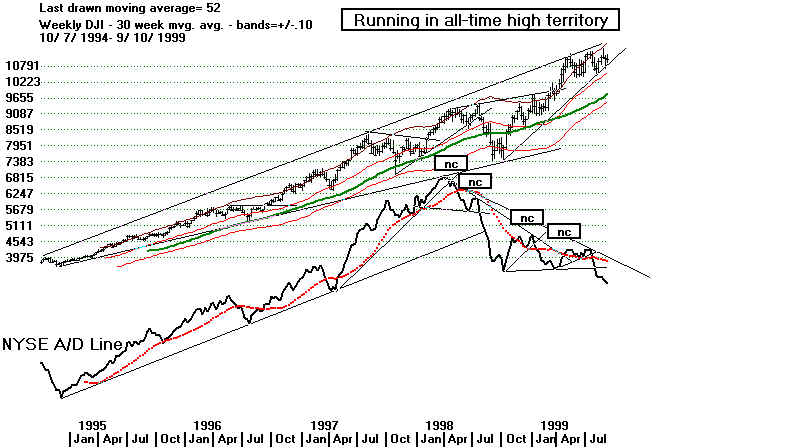

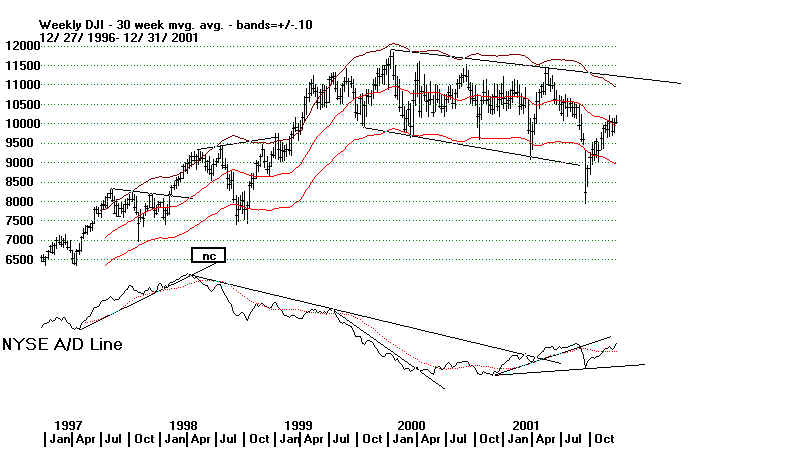

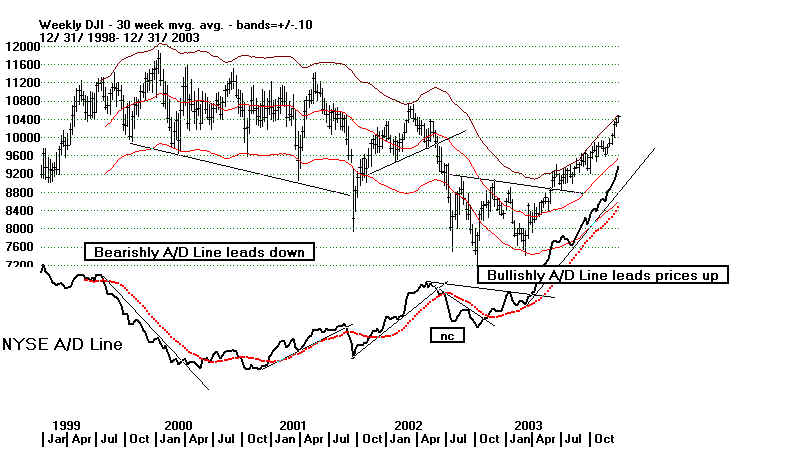

WEEKLY DJIA and NYSE A/D Line Charts since 1928

These are new. They will be in new Peerless book.

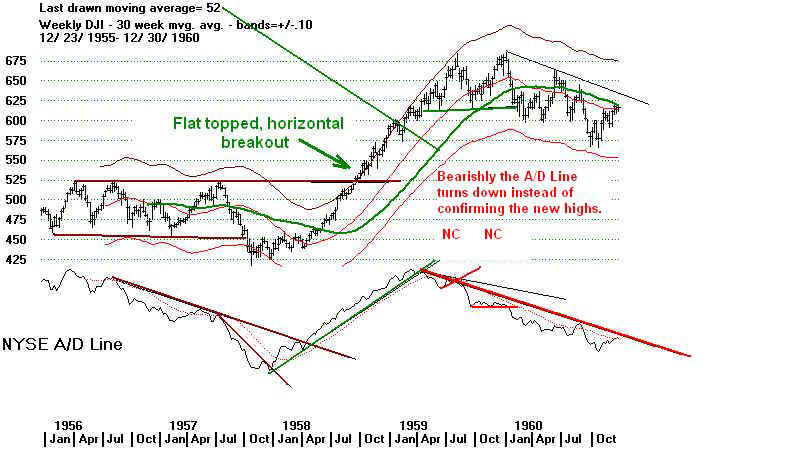

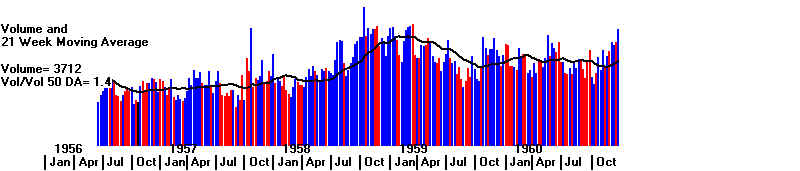

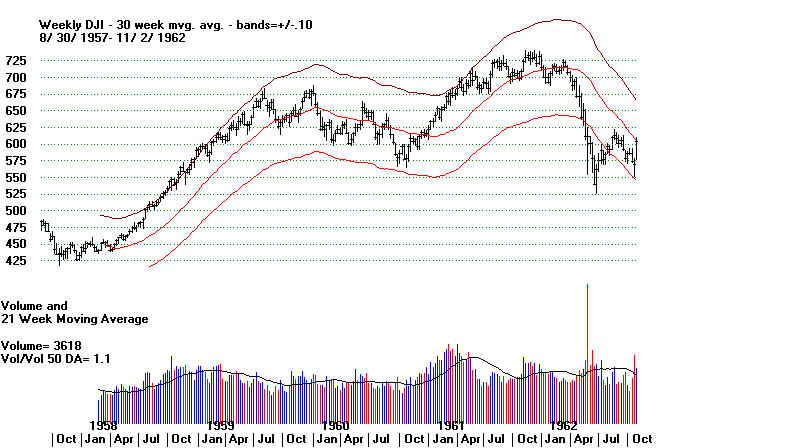

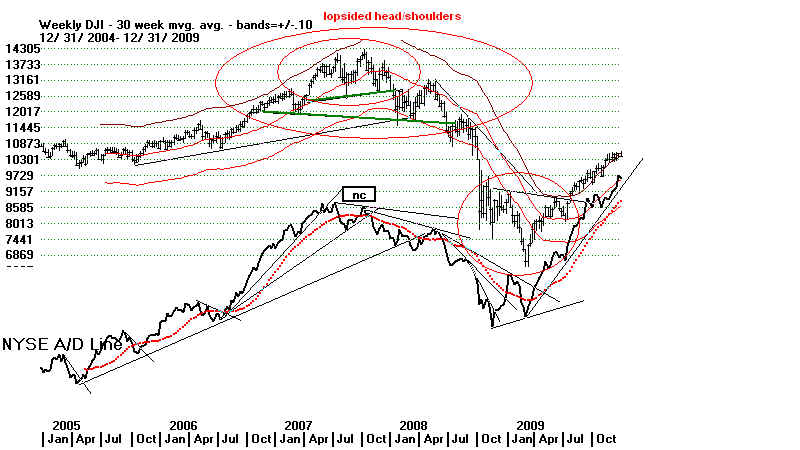

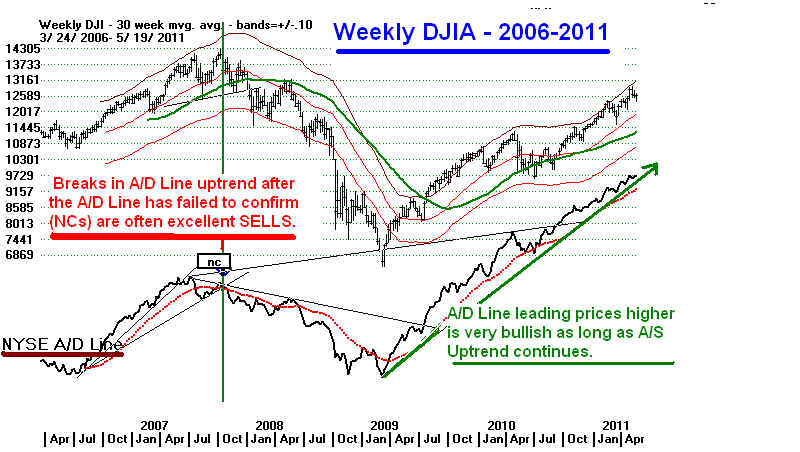

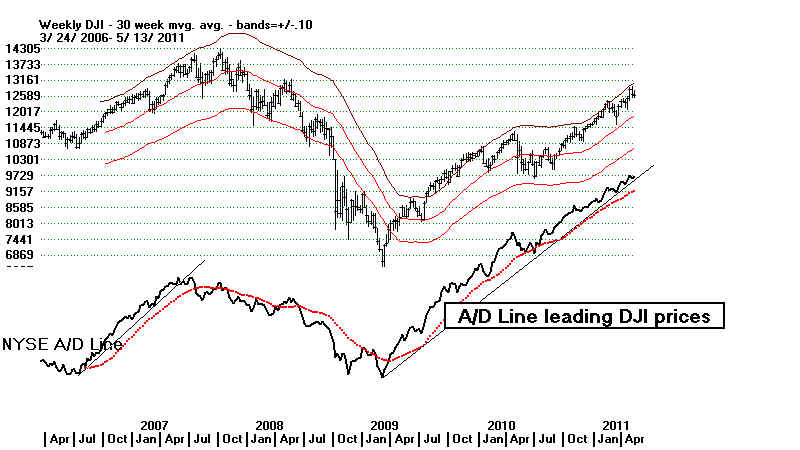

Study them forr A/D Line trend-breaks, A/D Line NC's, h/s patterns, price breakouts...

by William Schmidt, Ph.D.

(Columbia University)

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

|

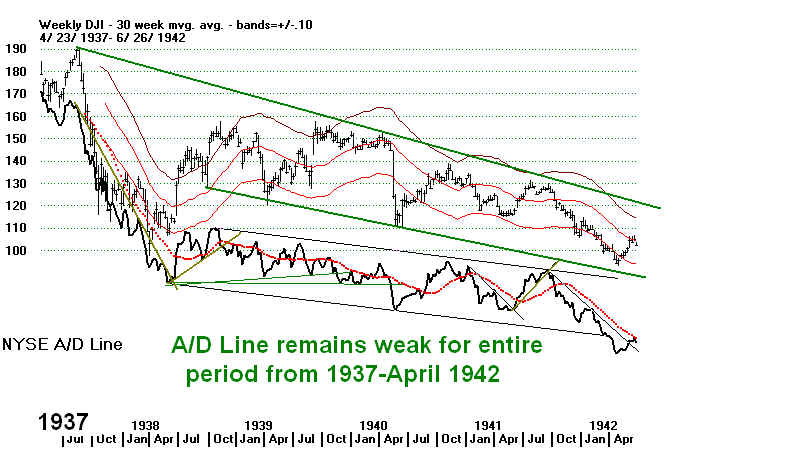

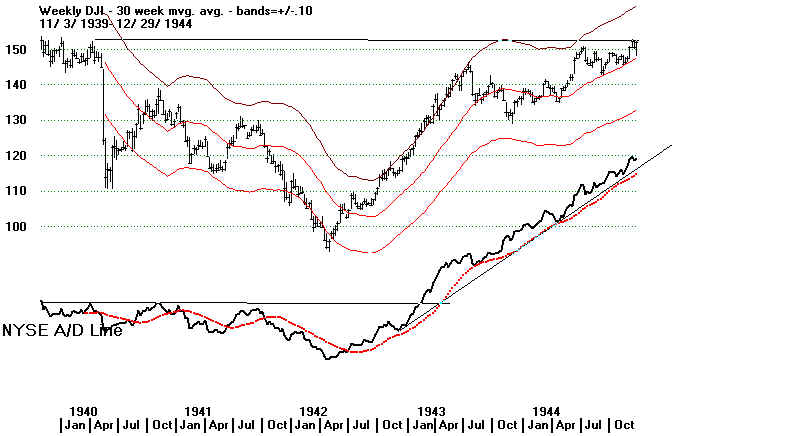

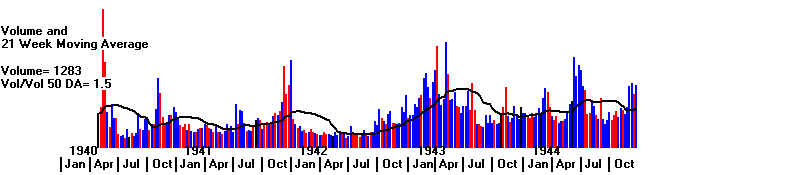

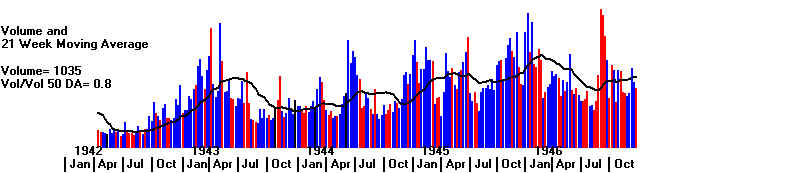

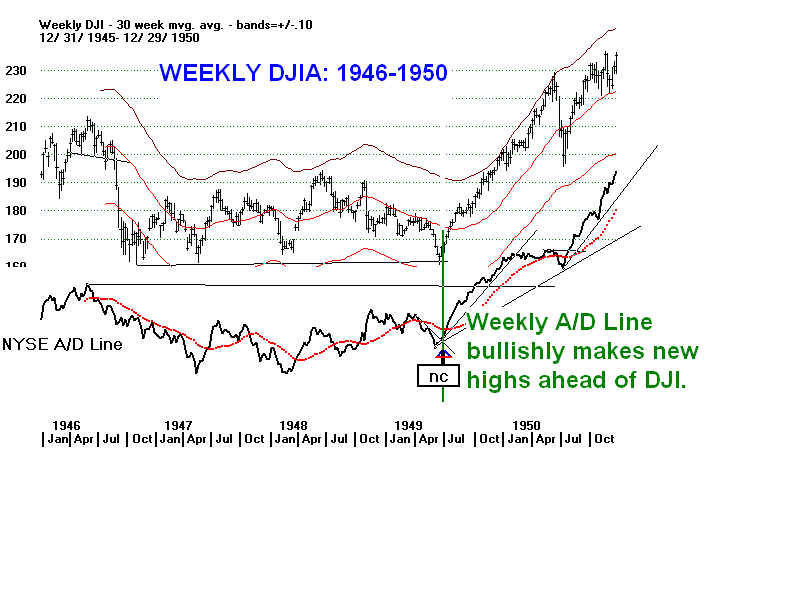

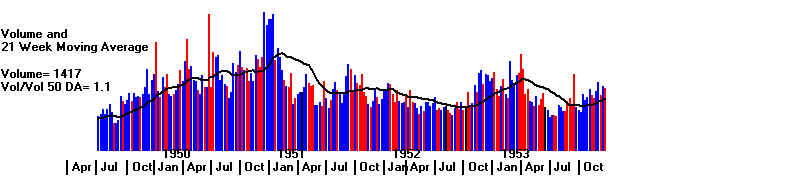

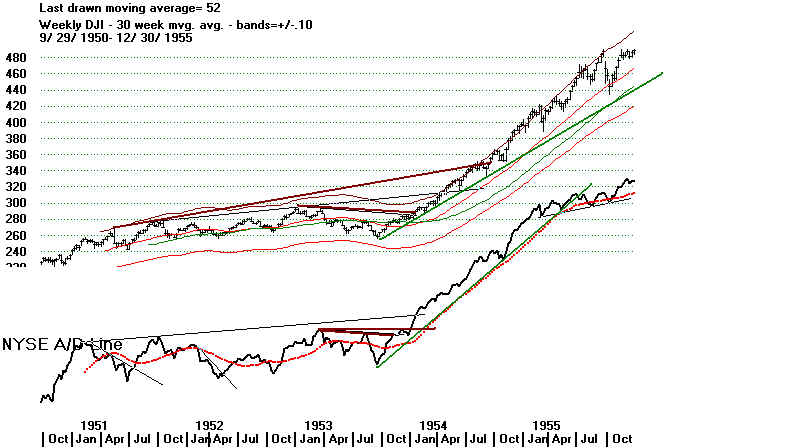

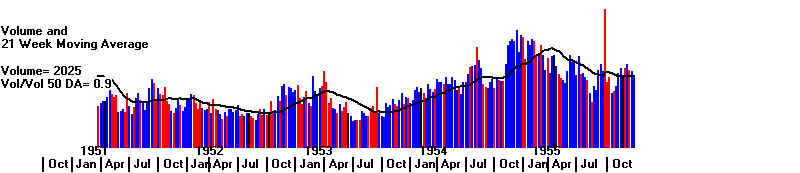

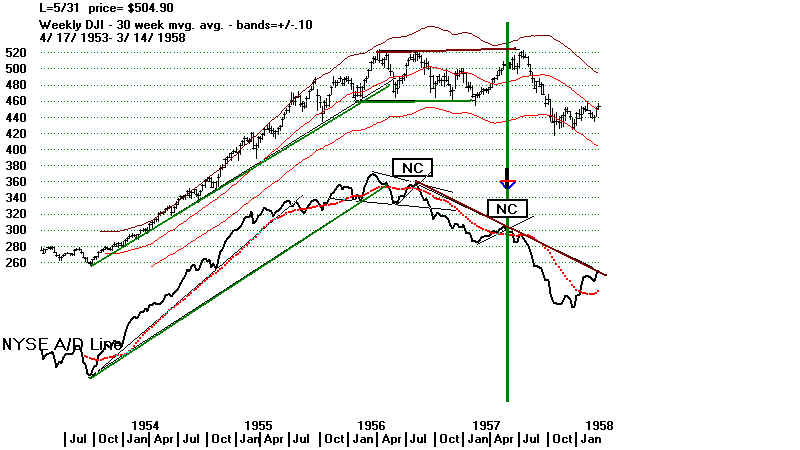

Do breaks in steep, well-tested A/D Line uptrends that have lasted more than 2 years bring an immediate big decline, as we now may soon see? Another factor here, is that the A/D Line has been leading prices higher by making its own new highs since mid 2009. DJIA Weekly 2006-2011  Yes - 1942-1946, but also head/shoulders, Peerless Daily Chart Sells. No - May 1949-Nov 1951 No - 1953-1958

|