TigerSoft News Service 5/9/2010 www.tigersoft.com

NON-PUBLIC RESEARCH - All rights strictly reserved. (C) 2010 www.tigersoft.com Wm. Schmidt, Ph.D.

TigerSoft

News Service 5/9/2010 www.tigersoft.com

NON-PUBLIC RESEARCH - All rights strictly

reserved. (C) 2010 www.tigersoft.com

Wm. Schmidt, Ph.D.

Peerless Needs to Judge Head & Shoulders

Pattern Completions

Head and

Shoulders Patterns Predict The Unpredictable!

Bearish Unexpected Events Are Often Marked by Head and Shoulders Patterns

CALLING ALL TOPS

Completed Head and Shoulders Tops Must Be Treated As Judged Peerless

Sells

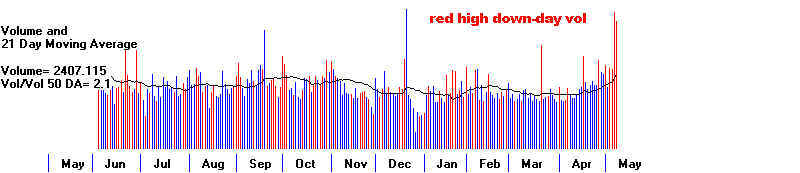

Instead of the usual Peerless Sell,

our tip-offs of a top this past week were

abundant numbers of head and shoulder tops and a

Tiger Professional Closing Power

that was zig-zagging lower after an extended, long

advance. The Closing Power is the

cumulative blue indicator just beneath the price

chart. In the chart below for the

QQQQ, you can see how well trend changes of

TIgerSoft's CLosing Power work

as Buys and Sells. The break in the CLosing

Power's uptrend served as an

excellent Sell on 4/30/2010. If there was any

doubt about the market's trend, the

completion of the head and shoulders pattern should

have removed it. In these

circumstances, we try to estimate how far down the

market will go, but this is

only an estimate. The decline we estimated was

5%, So far, we have seen a 10%

decline. Because, such guesses can be so wrong,

we have consistently said that

it is best to just wait for the Closing Power

downtrend to end. Historically, waiting

for the NYSE A/D Line downtrend also to be broken

before buying makes traing safer.

For Peerless, the presence of a head and shoulders top cannot easily be

programmed. We have to recognize it by sight

and experience. There have been lots

of them in the DJIA alone since 1915 to study.

We have discussed these at some length

in earlier studies.

A

closing price that clearly drops below the neckline is the Sell. The neckline need

not be flat and the pattern need not be

perfectly symetrical. You should be able to see

a left shoulder, a head and a right shoulder

whose formation first requires a deeper

decline to form a neckline low and then a low

volume rally that gives way to a decline

that clearly penetrates the neckline on a

closing basis. The neckline then becomes

resistance if the pattern is valid. For

this reason, after a head and shoulders top is

completed, it is better to give the market

enough chance to lay out the bearishness

of the pattern. The minimum downside

objective is the difference between the high

and the neckline subtracted from the point of

breakdown.

The

situation becomes much more dangerous when many of the most important

indexes and ETFs show clear clear and shoulders

patterns. This is partly because

the pattern's very appearance scares many

traders. The pattern's bearishness

has a large self-fulfilling aspect. But

there is more to it than that. It is the clear

closing below the neckline which is a judged

SELL. The NYSE AD Line normally

confirms the break below the neckline. In

2010, this occurred a day later. Instead,

the number of such patterns in indexes and ETFs

was the cause for our heightened

concern and recommendation to sell

over-extended stocks with declining CLosing

Power trends and sell short stocks breaking

below their 65-day ma if they showed

a head and shoulders top.

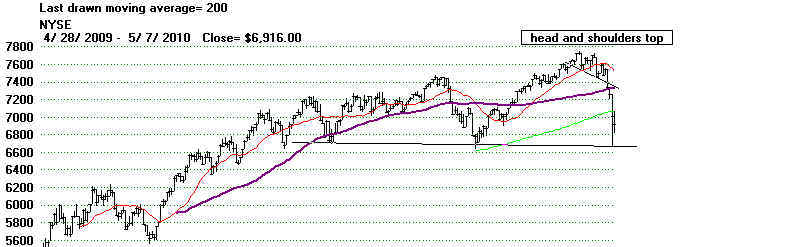

See the recent head and shoulders tops in DJIA, NASDAQ, SP-500, OEX, SPY, DIA

and QQQQ.

DJIA

NASDAQ

SP-500

NYSE

WHY WE NEED TO HEED

HEAD

AND SHOULDERS PATTERNS

The stock market does

not always discount future events. There are many

events that traders could not possibly know about long in

advance. What we

have discovered is that head and shoulders patterns are often the

way the

market quickly adjusts to bad news. The degree to which the

British Petroleum

rig would unleash a volcano of oil on the Gulf Coast was not

immediately known,

though Goldman traders knew sooner of the dangers than the

President

and so, they sold short on this news. "Suck

it, fishies and birdies!" wrote

a

Goldman trader.

What is important to

understand is just how often head and shoulders patterns

appear when a very bearish event must be quickly factored into

the stock market's

prices. We see this over and over. While head

and shoulders patterns have

long been recognized as bearish, what is new here is the

discovery of how often

the bad news which follows them is sudden and/or highly

significant.

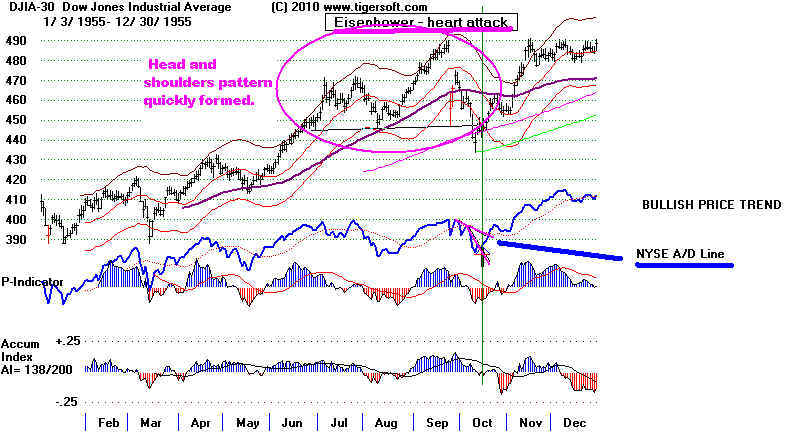

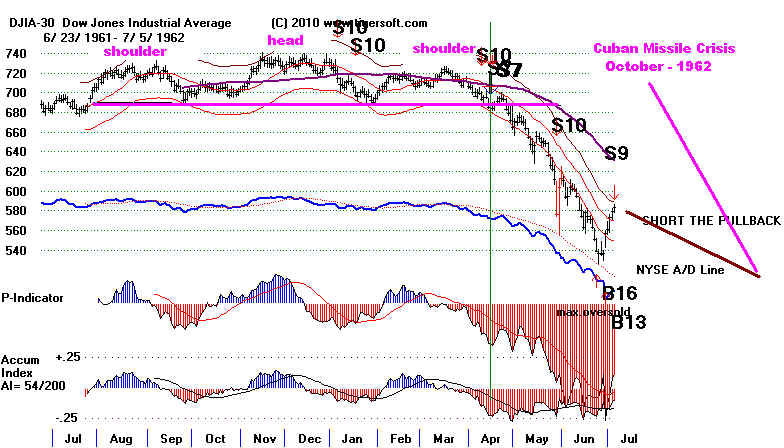

Head and shoulders tops seem to appear when the stock market must

deal with an

unexpectedly bearish event, such as:

1941 - Japanese attack on Pearl Harbor,

1950 - the North Korean invasion of South Korea,

1955 - the Eisenhower heart attack,

1962 - Cuban Missile Crisis

1963 - the JFK assassination

2001 - 9/11 Attack

2010 - the BP-Oil-Gulf Coast Catastrophe.

In each past case, watching for the A/D Line to break

its steep downtrend would have

given good signals to

BUY.

1941 - Japanese attack on Pearl Harbor

1950 - North Korean invasion of South

Korea

1955 - the Eisenhower heart

attack

1961 - Cuban Missile Crisis

1963 - the JFK assassination

2001 - 9/11 Attack

In

this case, there was no Peerless Buy signal, so using the A/D Line trend-breaks

should not have been applied to the

trading the DJIA, so much as individual stocks.

The 9/11 attack followed by 10 weeks the

completion of the head and shoulders pattern.