TigerSoft New Service 7/20/2010

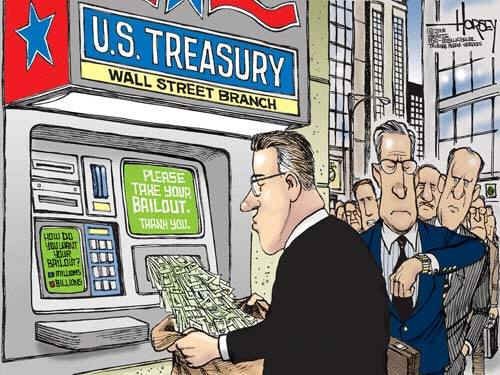

TigerSoft New Service 7/20/2010 OBAMA SELLS OUT TO WALL STREET/

WHY DO DEMS PROTECT BANKS?

WHY DO THEY NOT BREAK THEM UP,

AS WAS NECESSARY AFTER THE 1929-1933

CRASH?

COULD IT BE THE DEMS ARE BOUGHT

AND OWNED BY WALL STREET?

As predicted here and in our Hotline,

- based on (1) Obama's past catering to Wall Street, (2) their big

campaign contributions to him, (3) his protection of their excessive pay

and bonuses, (4) his generous bail-outs to them and (5) his appointments

of Geithner and Summers -

the President has again utterly shafted investors and the American people

when he failed to bring real reform and break-up the biggest Wall Street banks

in the wake of their destruction of the world economy in 2007-2010.

Obama is certainly NO FDR. He is a tool of the Wall Street Elite...

FDR and Congress in 1933 and 1934 broke up the big banks and would not let them

continue to be brokerages and also commercial and public banks. They had misuesd

public banking funds to manipulate and speculate in the stock market. The result

of their over-leveraging was the 85% losses for the stock market in the Crash of 1929-1933.

The breakup of the big banls was the purpose of the Glass-Steagal Act of 1933.

The repudiation of Glass Steagal by Bill Clinton in 1999 was a disastrous choice.

He was duped by his Treasury Secretary Robert Rubin and Fed Chairman Greenspan.

Clinton's opponents were shouted down in the Senate, but not before Senator Byron

Jorgen accurately predicted destroying Glass-Steagal would produce a disastrous CRASH

in om 10 years.

November 4, 1999. Senator Byron Dorgan's

dire warning.

"I want to sound a warning call today about this legislation," he declared,

swaying ever so slightly right, then left, occasionally punching the air in front of him

with a slightly closed fist. "I think this legislation is just fundamentally terrible." The

legislation was the repeal of the Glass-Steagall Act (alternatively known as Gramm Leach

Bliley), which allowed banks to merge with insurance companies and investment houses.

And Dorgan was, at the time, on a proverbial island with his concerns. Only eight senators

would vote against the measure -- lionized by its proponents, including senior staff in the

Clinton administration and many now staffing President Obama, as the most important

breakthrough in the worlds of finance and politics in decades. Source.

Others' warnings:

Russ Feingold: In the News - Press Releases May 6, 2010... that Senator Proxmire's

warning about the concentration of banking ... Prior to Glass-Steagall, devastating financial panics had been a ...

See earlier Blogs we have written

Monopoly Finance Capitalism 9/18/2008

Obama's "Financial

Reform" of Wall Street bank has actually made the

cery biggest banks more powerful and

dangerous to what remains of American

democracy. T

This

from Newsweek"

"Glass-Steagall, meet Dodd-Frank.... The nearly 2,000-page bill marshaled through Congress by Sen. Chris Dodd and Rep. Barney Frank falls short of that earlier, Depression-era standard. Whereas Glass-Steagall substantially altered the structure of the financial system and required the creation of brand-new kinds of firms, Dodd-Frank effectively anoints the existing banking elite. The bill makes it likely that they will be the future giants of banking as well. Legislators touted changes that would restrict proprietary trading by banks and force them to spin off their swap desks into separate capitalized operations. But banks get to keep the biggest part of their derivatives business, which is dominated by interest-rate and foreign-exchange swaps. Some 80 to 90 percent of that business will remain within the banks, and JP Morgan, Goldman Sachs, Citigroup, Bank of America, and Morgan Stanley control more than 95 percent, or about $200 trillion worth of that market."

Newsweek quoted a former Treasury Department official, who lamented:

"The bottom line: this doesn't fundamentally change the way the banking industry works. The ironic thing is that the biggest banks that took the most money end up with the most beneficial position, and the regulators that failed to stop them in the first place get even more power and discretion. We've consolidated the position of the five banks that were most central to the crisis. In my mind, they created six new GSEs" [government-sponsored entities like Fannie Mae and Freddie Mac—ed.]. "These mega-institutions are now the nodes of the financial system."

Sources:

http://www.newsweek.com/2010/07/06/financial-reform-or-revenge.html

"Financial Reform—With a Giant Hole" http://www.newsweek.com/blogs/the-gaggle/2010/05/20/financial-reform-with-a-giant-hole.htmlSee the piece by Jeffrey Steinberg entitled

"Dodd-Frank 'FInancial Reform' Bill Is A Sellout to Wall Street", July 2, 2010.

He makes the same points made here. But we should quote him for the record again.

June 27—One of the very rare honest comments uttered by President Obama since he took office 17 months ago, was issued in brief remarks from the White House Rose Garden, on June 25, following the all-night House-Senate conference committee session that produced the so-called Dodd-Frank financial reform bill. Obama proudly declared that the final product "represents 90% of what I proposed when I took up this fight."

That much was true: The bill had Obama written all over it. And Wall Street. And London. The rest of his prepared remarks on the Dodd-Frank bill were the kind of pathological lies that only a man suffering from severe narcissism could deliver with a straight face. "We are poised to pass the toughest financial reforms since the ones we passed in the aftermath of the Great Depression," the President declared, adding that the threat of "too big to fail" banks had been eliminated.

The reality of the situation could not be more radically different. The final bill that emerged from the marathon conference session, stripped out the few sections that were opposed by the Obama White House and by Wall Street, particularly Sen. Blanche Lincoln's (D-Ark.) Article VII, which would have forced the Big Six banks to divest their swap desks and cease derivatives trading with Federal government-insured and -lent funds.

And the efforts by a handful of Congressmen and Senators to restore the Glass-Steagall separation of commercial banks from investment banks and insurance companies, was killed by Sen. Christopher Dodd (D-Conn.) and Rep. Barney Frank (D-Mass.), before the Senate and House bills were voted on. In that move against any meaningful reform, Dodd and Frank had the full backing of President Obama and his economic team. There was not an iota of the Franklin Roosevelt-style crackdown on the power of Wall Street in Dodd-Frank bill, which has already been appropriately labeled the "Dudd bill."

The fact that the bill was released

the very same day that the Senate gave up on passage of a fund to extend unemployment

insurance by $35 billion over ten years, indicated just how much the current House and

Senate—along with the Obama White House—are owned, lock, stock and barrel, by

Wall Street and London. As the result of that action, 2 million Americans will have been

kicked off the unemployment insurance rolls by mid-July, with millions more to follow. The

message from Washington: The too-big-to-fail banks will live on, while the American people

can drop dead!

The Wall Street Journal reported, just

hours after the Dodd-Frank bill passed out of conference on strictly partisan lines, that

the final wording, permitting the Big Six Wall Street banks—Goldman Sachs, JP Morgan

Chase, Morgan Stanley, Bank of America, Citicorp, and Wells Fargo—to maintain their

trading in foreign exchange derivatives, interest rate swaps, and most credit default

swaps, was actually written by Treasury Department officials on the night of June 24!

As the conference members closed in on final language, Treasury Secretary Tim Geithner, Federal Reserve Chairman Ben Bernanke, and a team from economic advisor Larry Summers' office at the White House, hovered around the Senators, lobbying to strip the bill of any last vestiges of real regulation.

The final version that came out of the conference, in fact, guaranteed that taxpayers will foot the bill, again and again, for the Big Six banks, and even tightened the grip of these megabanks over the U.S. financial system.