TigerSoft New Service 7/23/2010

TigerSoft New Service 7/23/2010

Make

Money. Use TigerSoft To Track Key Insider Buying and Selling in All Your Stocks

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 -

william_schmidt @hotmail.com

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Street Professionals Now Rig Stock Prices

with

Extra FED Help and Approval

WALL

STREETOCRACY

How They Do This. How We Tiger Users Can

Profit

by William Schmidt, Ph.D. (Columbia University)

C) 2010 All Rights Reserved.

Market Professionals Now Rig Stock Prices

with Extra FED Help and Approval

by William Schmidt, Ph.D. (Columbia University)

C) 2010 All Rights Reserved.

Read also my:

April 9, 2010 The Power Elite's

Biggest Gamble of All. They Cannot Afford to Lose.

That's Why The

Market Looks Like It Will Keep Rallying.

April 4, 2010 Why The Stock Market

Keeps Rallying:

The Secret Deal

Obama, The Fed and Wall Street Have Reached.

April 9, 2009 Goldman Sachs Is "The GREED CONNECTION"

between Wall Street and

Washington

April 25, 2009

Massive Federal

Reserve Fraud and Corruption Story Breaking..

Bernanke Covers

Up Hundreds of Billions of Dollars in Losses

from Bad Loans

The Fed Made To Banks Using Toxic Collateral.

WALL STREETOCRACY

My main thesis since March 2009 has

been that Obama, rhetoric aside,

has done the bidding of Wall Street.

March 23, 2009 Monopoly Finance

Obama Obama's Biggest Wall Street Contributors Fleeced

Shareholders on

The Way Down And Now Will Fleece Taxpayers on The Way Up.

March 25, 2009

Why Is The Stock

Market Rallying? Wall Street Now Sees That Obama's

Populist

Rhetoric Is Designed To Fool The Angry Public Obama Is Signaling Wall Street

He Will Protect

Them

Obama and the FED have given Wall Street nearly

everything it wanted

and wants. In return, Wall Street has

agreed to use its powerful program

trading tools to pump the market up and limit

short selling. The low trading

volume and very good breadth shows this.

Program trading by

firms like Goldman, JPMorgan and Bank of

America (through Merrill

Lynch) push prices up and up. Volume

remains low because the public is

absolutely traumatized, mistrustful and

dangerously pauperized.

Nor are Institutions are big buyers. They

doubt the rally, because

of how far the advance has outpaced the

economy, especially in

the area of job creation. What institutional skeptics fail to appreciate

is the power of program traders now.

These Wall Street go-go types

are safely backstopped AND bankrolled by the

U.S. FED and there

is no challenge from any significant political

force is being made to

this FED policy under Bernanke.

Obama has

recklessly and cynically gambled that a rising stock

market will eventually inflate the wealthy's bank

accounts so much

that they will start spending their profits and that

will boost business

and job creation. Meanwhile millions wait and

wait for a job that

never appears. How long must thet wait for

Obama's trickle-down

gamble to pay off.

Eventually there

will be more jobs. Even old cars and dish washers

need replacement. But without jobs, people are

poor consumers for

a long time to come. Only marginal gains are

coming. I suspect

more jobs are going overseas than are now being

created. One of

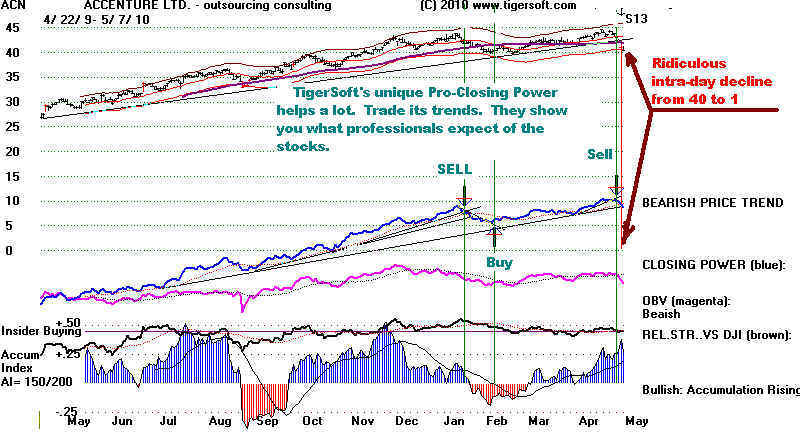

the hot areas now to invest in are the companies

specializing in

outsourcing.

October 15, 2009

Unemployment Statistics: The Real

Story.

Obama's Shame Is His Total

Subservience to Wall Street.

Today, July 23,

2010, the Administration said that they do not

expect unemployment to drop below 9% for two

more years.

Why should the unemployed continued to show

patience? Obama

and the Democrats are seen as failing them.

Meanwhile Wall Street

is happy. Big banks that are "too big

to fail" are not "too big"

for this Administration or Democratic

Congress. Easy Fed money

without strings is reely available

in exchange for toxic debt

collateral. Commercial Banks can be

stock brokers and vice verse.

Goldman has gotten away with

massive fraud for a slap on the

wrist. And today, the Obama

Administration announced it was OK for

publicly subsidized

banks to pay their chief executives $1,5

million a year.

Obama is clearly a Wall

Street puppet. He has no backbone or

experience. He depends on ex NY FED

Geithner and Larry Summers,

long a friend of Wall Street.

Larry

Summers, Tim Geithner and Wall Street's ownership of Obama

The

Corruption of Larry Summers

Larry

Summers Defends Megabanks

Hedge

Fund Paid Summers $5.2 Million in Past Year - WSJ.com

Is

Larry Summers Taking Kickbacks From the Banks He's Bailing Out

With the help of these

Wall Street promoters, Obama is gambling

big time that a rising stock market will lift

the economy and create

millions of Amercian jobs. With so little

job improvement taking

place, the disconnect between Wall Street amd

Main Street gets

bigger and bigger. Obama has forgotten the words "public works".

Now he takes up the bankers hyocritical call

for balancing the budget.

The danger of another bubble and then a market

collapse grows.

That is the reason we now see a massive head

and shoulders pattern

in the major market indexes.

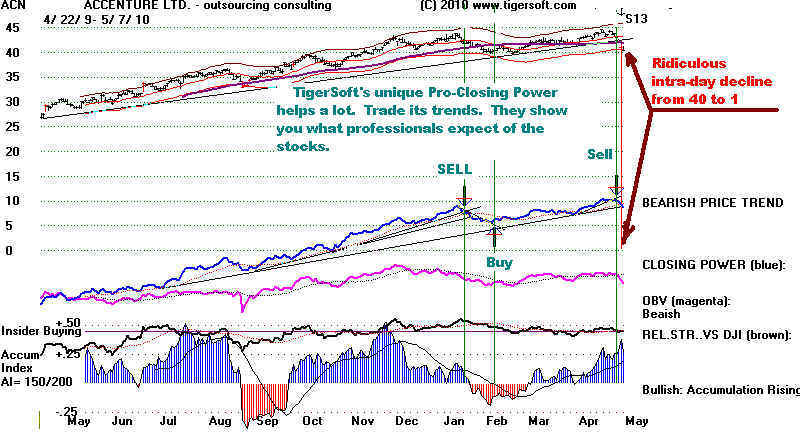

Tiger Hotline used are

watching the market closely now. We have

learned to trust the automatic Peerless and

TigerSoft's Buys and

Sells AND watch especially Tiger's Closing-Pro Power

Indicator's

trends. As long as Closing Power keeps rising

we know the

Wall Street Program Traders are still net buyers.

Professionals are

still pumping the rally from the recent lowsm knowing

that the bears

will be in for a bad surprise if the head and

shoulders pattern fails.

Our nightly Hotline has discussed this possibility

and pointed out

the cases in July 1951, July 1983 and July 2009 when

similar head

and shoulder patterns failed.

More TigerSoft

reading:

"How can I tell whether professionals are buying or

selling now?

I

want to trade in the direction that they are pushing prices, i.e. rigging the

market? "

Watch

the Trend of Tiger's Professional Buying Power Line.

When

to Sell a Stock

A

LITTLE HISTORY

The

Federal Reserve has always helped the big banks. Their

creation in 1914 came about, it was said

at the time, because the

Government wanted to prevent another

1907-like financial panic.

Severe economic slow-downs also followed

the bankers'' panics

and financial collapses of 1873, 1893 and

1896. Bankers wanted

a back-stop and a sugar daddy. They

wanted access to emergency

funds courtesy of the US taxpayer.

The theory of how monetary policy

could by incremental tinkering smooth the

business and investing

cycle conveniently became the mantra of

the new Federal Reserve.

All along, the Fed's real purpose has

been to bail big banks out

in an emergency.

At Best, The Powerful Fed Is A Work in Progress

with Its Own Budger and Very Little Accountability

Most often the Fed's economic far-sightedness Is as limited

as its Transparency.

The 1929-1933 financial collapse and Depression showed

that the Fed could be too stingy

and totally visionless, as it

accepted the reigning laissez-faire

philosophy of political economy.

The 2005-2010 housing and financial

bubble and collapse showed

that the Fed can also be too

generous, and equally visionless,

yet totally under the sway of the

mightiest big banks.

These failures of mission should put more political heat on

the Fed, one would think, bringing

new demands for more

Fed transparency and public

accountability. Not surprising given

the size of Wall Street's campaign

contributions to Congress

and Presidents and how extensively

Goldman Sachs personnel

now run many government

departments, the move in Congress

to control and reform the Fed is

heard only from a handful of

Progressive Democrats and the most

doctrinaire laissez-faire

Republicans.

That the Fed has only achieved a jobless stock

market rally should bring more

public outcry and outrage in

Congress. But it has not.

The Democrats, by in large, are just

as bought and paid for by Wall

Street as the Republicans are

dominated by big business.

IT IS HARD TO

OVERSTATE THE POWER OF WALL STREET

JP Morgan Issued The President An Ultimatum in 1907

In 1907, many big over-leveraged banks

failed or teetered on failure,

just as in 2008. In 1907, there

were runs on banks. There were no

government guarantees of depositors.

Liquidity dried up almost

completely as stocks lost nearly 50%.

The "bankers' panic" (as it

was called then) quickly killed business

confidence and brought

a broader economic recession and a steep

rise in unemployment.

This greatly reduced consumer buying

power making. There was

no Keynesian concept then of the positive

role of Public Works spending.

So, the economy spiraled downwards.

If the End of the Gilded Age in 1907 sounds exactly like what

happened

in 1929-1938 and 2008-2010, it is

because it was the same. Someone

needs to talk about how a very

narrow distribution of wealth inevitably

leads to an economic collapse when

stock prices fall in a financial panic.

There is just not enough buying power and

consumption depending on

the very wealth. This is sad

because there are always more than enough

public works' tasks that are needed.

Defenders of the big banks often assert

that the 1907 panic ended

because of the heroic efforts of

financial mogul J.P.Morgan to round

up massive financial guarantees for

failing banks and brokerages

at meetings he organized with other big

bankers and brokerages.

He certainly filled a vacuum of

leadership. Cynics can say he was just

protecting his fortune, but he also acted

out of a sense of noblesse

oblige that today's CEO's certainly do

not feel or show.

There is more to the 1907 story.

Just as Henry Paulson put a gun to

Congress in September 2008, so too, did

JP Morgan and his circle

of big bankers, do the same to President

Theodore Roosevelt.

HOLDING

THE ECONOMY HOSTAGE

Two hours before the Opening of

stock trading in NY, on a

still dark November Monday morning

in 1909, a new Market

Crash seemed imminent due to

imminent new larger bank failures.

The day before IP Morgan had sent

emissaries from US Steel (which

he owned) to meet Roosevelt in

Washington. US Steel's Elbert

Gary

and Henry Clay Frick informed the

President had to relax the ban

on steel company mergers under the

Clayton Anti-Trust Act and

allow the JP Morgan empire to get

still bigger, or there would

most certainly be a dire financial

collapse.

"Roosevelt relented, and he later recalled of the meeting,

"It was necessary for me to

decide on the instant before the

Stock Exchange opened, for

the situation in New York was such

that any hour might be

vital." News of

Roosevelt's concession

sent the market soaring that

Monday and the panic ended.

(See - http://en.wikipedia.org/wiki/Panic_of_1907

)

The

next year Congress created a National Monetary Commission to

investigate the causes of the panic

and make recommendations

to regulate banks. Republican

Rhode Island Senator Nelson Aldrich

spent two years in Europe where

countries did have central banks.

When he returned the nation's most

powerful bankers met secretly

in November 1910 for a week off the

coast of Georgia and crafted

Aldrich's "Currency

Report" which became the basic of the Federal

Reserve Act of 1913.

WHAT'S NEW NOW?

Ever since 1913, the Federal Reserve has had the power to create

money, by virtue of making massive

and cheap loans to banks that

belong to the Federal Reserve

system. Though the President nominates

the Chairman, it is the member

banks that pick the regional Federal

Governors that run the Federal

Reserve. For all practical

purposes,

the Federal Reserve answers to its

member banks far more than it

does to the President or Congress. Hence, Bernanke's refusal to

supply the details of his trillions

of dollars in loans to the biggest

banks.

#1 What's new first is that now the nations biggest

banks are again

allowed to be stock brokers. In 1934, that had been disallowed because

too many banks had failed as a

result of playing the collapsing

stock market with leveraged cheap

money they got from the

Federal Reserve. This law was

the Glass Stegall Act of 1933,

which also set up the Federal

Deposit Insurance Agency to insure

bank deposits, In November 1999, Congress repealed this prohibition

on banks owning brokerages and

investment banks. Politicians

were "snowed" by Fed

Chairman Greenspan and how much the

deregulation he advocated had

apparently sent the stock market

soaring. Few seems to have paused

long enough to realize that

the boom was the result not of

Deregulation as much as it was the

technological transformation caused

by the personal computer

and the internet.

There were a few exceptions. With remarkable prescience,

Senator Bryan Dorgan of North

Dakota in 1999 warned that the

repeal of Glass Stegall would cause

another financial collapse

and massive taxpayer bailout of

banks.

There can be little doubt that the removal of the divide between

Wall Street brokerages and

investment banks on the one hand

and depository commercial

banks led to the collapse of the sub-

prime mortgage market, the

Financial Collapse of 2007-2010

and the bankers' secret

trillion dollar bailout by the Federal

Reserve.

Brokerage-Banks, with all their muscle got the Fed to

relax regulations on housing

loans.

#2 What's new. secondly, is that the current Fed Chairman, Bernanke

has loaned Trillions of

Dollars to the biggest retail banks,

which are now also brokerages

and investment banks. He is not

known as Hellicopter Ben, for

nothing. As an academician, he s

studied the Fed policies in

the 1930s and concluded that the

Fed was then far too tight.

He has gone to the opposite extreme.

He made these loans without

demanding any guarantees that

the banks use the credit to

make more business or consumer loans.

What is worse, he has lent

trillions to the banks in return for the

collateral of their toxic bad

mortgage and consumer loans. All

of this has been done by the

Fed with as much secrecy as possible.

#3 The Banks are Using much of this money to play the stock

market and buy US Treasuries.

There is no prohibition now

against this.

Naturally, the stock market has zoomed upwards.

Obama's Treasury Secretary

Geitner and Chief Economic

Advisor Summers both are

closely associated with banks and

have been proponents of

deregulation. So, rather unbelievably

for a Democratic

Administration, there is Executive branch

pressure on the Federal

Reserve to require banks use the

money they get from the Fed

to make consumer and business

loans. Not

surprisingly, the stock market has gotten far ahead

of the jobless recovery,

( http://seeker401.files.wordpress.com/2009/07/goldman.jpg

)

#4 While

Geithner was the NY Fed Governor, the biggest and

most aggressive investment

bank, Goldman Sachs, was made

an honorary commercial bank,

thereby giving it unlimited access

to the Federal Reserve's

Discount Window, So, even though no

one has ever had a Goldman

Sachs Master Card, it can borrow

very extensively and secretly

from the Fed at interest rates that

are close to 0. For all

practical purposes, it has access to as

much money as it wants behind

it.

#5 Using its money to bribe Congress and the

Administration,

its massive computerized

program trading is wholly unregulated

and now undisclosed. Goldman, JP Morgan and Merrill can

run the market up as much as

they want. Their stock market

trading programs have more

impact on share prices than most

financial news. As the

biggest program trader, Goldman has

become a trading terrorist.

It can hold the market up as hostage.

When it gets caught with its

hands in the cookie jar, as when

it simultaneously shorted

mortgage bundles it was selling clients,

there are no criminal charges

and it gets its fine reduced to

not even two days' trading

gains.

So, I contend, Goldman and its big bank brethren can collude

and rig the market anyway

they want to, although one has to

believe the Administration

would privately create a fuss with

them if they did too much

short selling.

WHAT PROOF HAVE WE ABOUT SO

MUCH RIGGED TRADING?

I have written about this before:

http://www.tigersoftware.com/TigerBlogs/May-7-2010/index.html

See also U.S. Fed Rigs Stock

Market - January 11, 2010

Until July 2009, the NYSE published detailed program trading records.

From this, we can see that

"program trading

averages more than 50%

of all of the trading

done on the stock market". Among the secret

group of powerful program

traders, Goldman is the biggest by far.

It dominates the computerized

quick program trading, trading for

its own account 95% of the

time. It can put in and pull out hundreds

of millions of Dollars in the

market in minutes on a thousand stocks

at a time.

http://www.nytimes.com/2009/07/24/business/24trading.html?adxnnl=1&adxnnlx=1279926107-FFGk/KS7zyP/sXOJXv4SFQ

http://zerohedge.blogspot.com/2009/05/observations-on-nyse-program-trading.html

http://zerohedge.blogspot.com/2009/07/themis-trading-principal-program.html

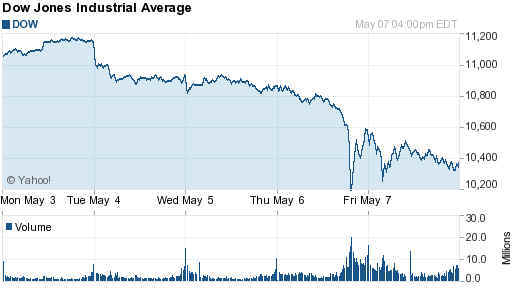

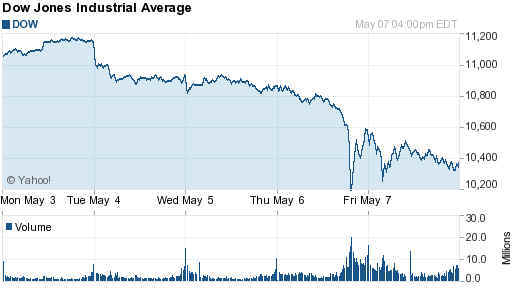

May 6th - 7% Intra-Day Decline in DJIA

THE DANGERS OF SO MUCH RIGGED TRADING

Severe declines of 5%

or even 10% and possibly more in a few

minutes or hours

WITHOUT ANY ECONOMIC JUSTIFICATION

are becoming more

frequent. 1987, 2008 and 2010 show this

dramatically.

From my Blog of

http://www.tigersoftware.com/TigerBlogs/May-7-2010/index.html

I quote

Look What Computerized Trading Did in 1987.

Are We Doomed To Repeat 1987?

Where Are The Regulators?

Must They Always Be The

Puppets of Wall Street.

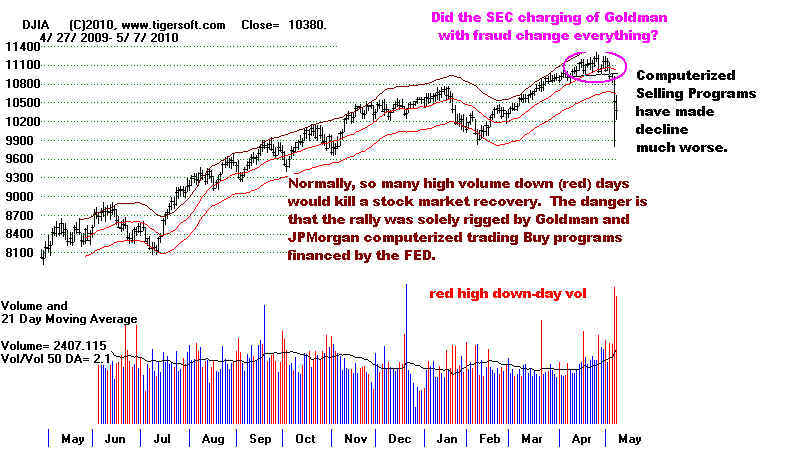

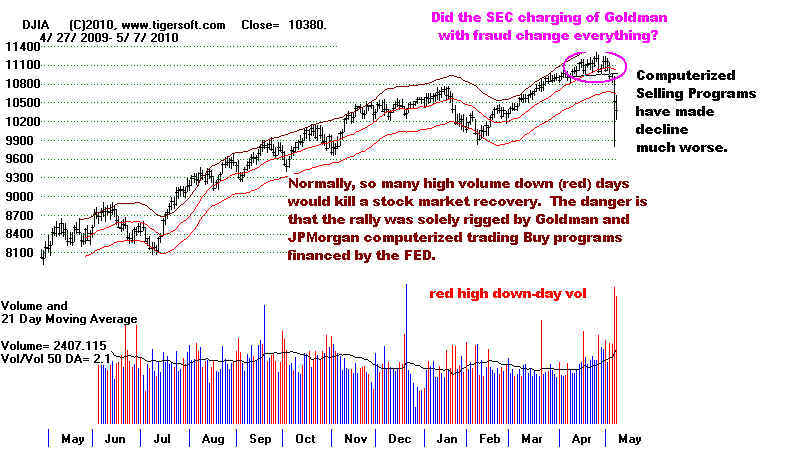

What Goldman's Program Trading Gave Us

in 2009, It Could Take away in 2010

Is Goldman Sachs Playing "Hardball" with

The Administration?

The market

started down immediately after the SEC announced it was going after

Goldman Sachs for fraud. It is quite possible that

Goldman wishes to show Obama, the Treasury

and the SEC who is really boss. The Fed already

knows. That's is why it has given trillions

My view has been

that Goldman Sachs has been a key member of the Power Elite that

has been boosting

the market since March 2009. The Fed has been providing the money. Goldman

and JP Morgan have been program-trading stocks

upwards. And the Obama Administration

has been laying off the populist rhetoric and

slipping Wall Street favors under the table.

But now that alliance seems to be breaking up.

Obama's Attorney General has let it slip

that criminal fraud charges will be brought against

Goldman. That could spell big trouble for

the stock market if it's true that the gains for the

last year have been mostly artificial, i.e. they

do not reflect an improving economic outlook. If

Goldman starts using Sell Short programs

as effectively as it has its Buy programs, much of

the last year's market gains are in

jeopardy. But would Goldman really want now to

declare war on the US Governmnet like

it has Greece? That would make the Government

go after it with total vigor and resolve.

More likely, the government will let Goldman off the

hook for what seems like a big fine,

perhaps $100 million, and things will return to

"normal". In return, Goldman will not use its

computerized sell programs and, in return, continue

to get the full support of the Federal Reserve

and not be prosecuted criminally.

In the last few years, high-frequency

100% automated trading has come to dominate ALL

NYSE and NASDAQ trading. This trading is conducted by

Goldman Sachs, Barclay’s Capital,

Wedbush Morgan, Credit Suisse, Deutsche Bank, JPMorgan and

RBC Capital (Royal Bank of

Canada). Goldman is the most active in using this

type of trading for its own account. Such

trading is very lucrative. Look at Goldman's

earnings, $9 Billion in the lat two quarters along.

Automatic computerized

trading now accounts for 20%

to 75% of any given day's trading.

Barrons's provides the

data on the weekly

NYSE buy, sell and arbitrage trading each week

as a percentage of NYSE

volume.

Last July, as the market was leaping upwards, computerized

trading amounted to 75% of all NASDAQ trading, of which

Goldman accounted for 90%. Last

July, I wrote: "Goldman now trades

much more aggressively for its own account, as principals,

far more than any

other brokerage or investment bank. The current ratio of trading for

themselves as

opposed for clients is 5:1, among the very highest on Wall Street."

Last year

the code for Goldman's computerized trading was

stolen by a Russian who had worked

for them.

Imagine what might have happened if this Russuan programmer had sold

the code to some country that wanted to destroy America.

Wall Street tell us that their

trading provides liquidity and depth to the market. Thursday's

volatility shows how fraudulent such a defense is.

Clearly rhere is real danger in their uncontrolled

high frequency computerized trading. on Thursday, the

DJIA fell 700 points in 10 minutes! At

that point it was down almost 1000 points intra-day,

9.997%, from the previous day's close. A week

of this type of action will wipe all the gains of the last

year.

Last week's computerized trading

and downside volatility are very worrisome. Does

Goldman think the US market is on very weak underpinnings?

If they can send it up, then

why can't they send it down the same way? And who will want

to buy in a market with

so much volatility. Thursday's decline was not due just to

a "trading glitch". If it had been,

the market would have risen Friday. Instead it fell

another 140.

Besides their magnitude, speed and

ubiquity, the central trading issue here is that these high

frequency computerized buy and sell programs are often

"pile-on programs". The computers don't

care what caused the initial move in the first place.

It could be a news event or it could be an

error in an order hand-entered, which says sell billions

instead of millions of dollars of stocks.

The computers don't care. They just trade and

reinforce the trend. The danger here, of course,

is that they usually exaggerate market moves, very

dangerously and totally recklessly. And

in the process, they quickly destroy investor confidence.

That affects retirement accounts,

business confidence and thus jobs for working people on

Main Street.

Where are the regulators? No

where! For years and years, the regulators have just done

whatever the biggest Wall Street firms want, as when

Goldman saw a bear market coming in mid

2007 and prevailed upon Securities Exchange Commisoner Cox

to allow short sales on downticks

for the first time since the Depression. In June

2007, the SEC bowed to pressure from Goldman

Sachs and suddenly allowed short selling on down-ticks and

stopped policing the requirement that

shares first be borrowed before they were sold short.

From 1934 to 2007, selling short on

down-ticks and naked short selling had been banned because

of how pernicious rigged selling by

bear raiders had been between 1929 and 1933. In

the New Deal era is was appreciated that

Wall Street could not be allowed to run wild.

Businesses would be bankrupted if big organized

Wall Street bear raiders were free to create panic and

ruin.

The computer programs often buy and sell

automatically when prices rise or fall a certain amount

or trade past a certain price level. trading firms

have computers that are programmed to automatically place

buy or sell orders based on a variety of things that happen

in the markets. Clearly, allowing this

relatively new type of computerized trading gives the

fastest firrms an advantatge. But that removes

human conrols. And the end result is a sharp increase

in downside volatility when days are already

down a lot. We should have learned the dangers of

allowing this trading from the October 1987

experience, but de-regulation and the domination of

"regulators" by the biggest Wall Street firms

have made matters much worse.

Some circuit breakers do

exist. These were instituted after the 1987 crash, but they were very weak,

did nothing to limit the growth of computerized trading and

, worked only for a limited amount of time during

the day and only went into force when the DJI was down more

than 10%. Worse, there is no halt in trading

in the last hour and a half unless the market is down 20%.

The regulators have clearly failed

the small invetsor again. In one egregious case on

More

Information

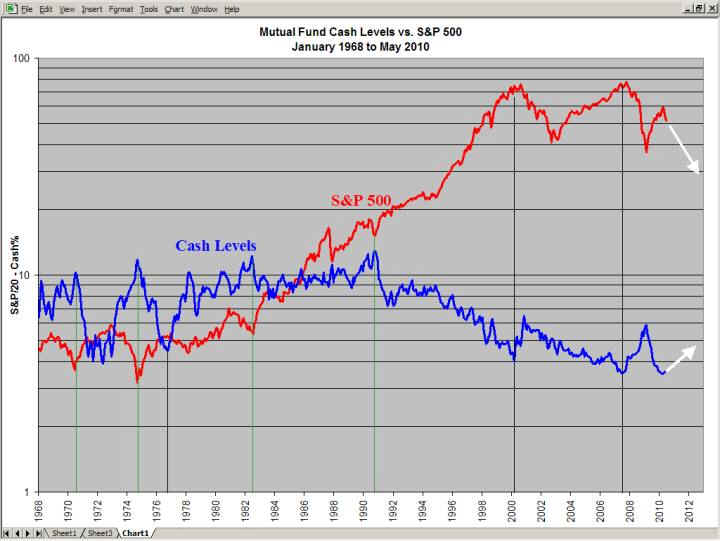

http://home.comcast.net/~royashworth/Mutual_Fund_Cash_Levels/Mutual_Fund_Cash_Levels.htm

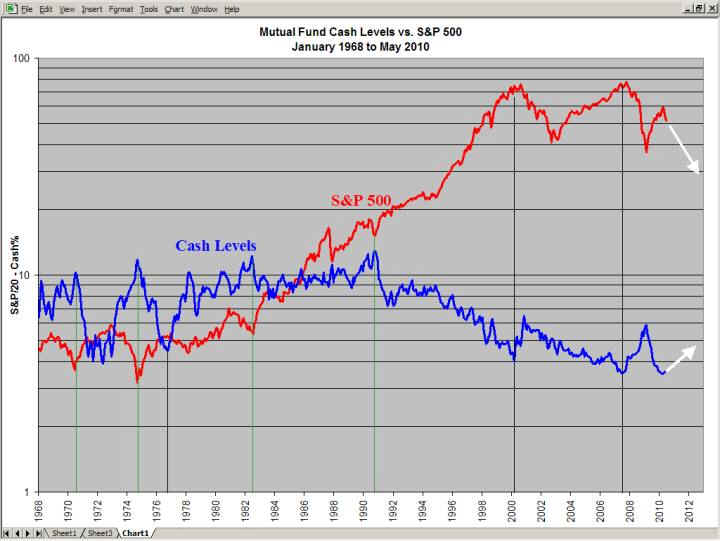

1) Major

rallies occurred in 1974, 1982, and 1990 when the cash levels were greater than

11%.

2) The

market sold off in 1973, 1976, and 2000

when cash levels were below 4.5%.

3) The

old historical low was 3.9% in 05/1972. The market top was 12/1972 followed by a 46%

decline. The next historical low was 4.0% on 03/2000 followed by a 43% decline. New

historic lows of 3.5% were set in June and July 2007.

4) Cash

levels reached 6.5% in November 2000 but the market declined to a bottom in October 2002.

5) Cash

levels reached 5.9% in February 2009 then rolled over sharply.

6) The

May 2010 level was 3.6% compared to 3.5% in April and 4.8% in May 2009. Cash levels are at

a historical low. The last historic low of 3.5% was set in June and July 2007. The S&P

top occurred several months later in October 2007. This suggests the next top around

July-August 2010.The next decline should be similar to 2000-2002 and 2007-2009 (50-60%).

7) Cash

levels will have to move much higher before the secular bear market ends.

Stock funds posted an outflow of $24.67

billion in May, compared with an inflow of $13.24 billion in April. Among

stock funds, world equity funds (U.S. funds that invest primarily overseas) posted an

outflow of $5.75 billion in May, vs. an inflow of $8.21 billion in April.

Funds that invest primarily in the U.S. had an outflow of $18.92 billion in

May, vs. an inflow of $5.03 billion in April.

TigerSoft New Service 7/23/2010

TigerSoft New Service 7/23/2010