TigerSoft

News Service 1/25/2010

TigerSoft

News Service 1/25/2010

RAMPANT INSIDER SELLING

REPLACES

INSIDER BUYING

IN GOLDMAN SACHS

Geithner, Bernanke and Paulsen Are on

The Congressional Hot Seat.

They SIMPLY Gave $60 Billion To The World's

Biggest Banks.

Then, Geithner's NY Fed Tried to Conceal This from

The Public.

UNPRECEDENTED WALL STREET-WASHINGTON

CORRUPTION.

by William Schmidt, Ph.D. - Author of TigerSoft

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

|

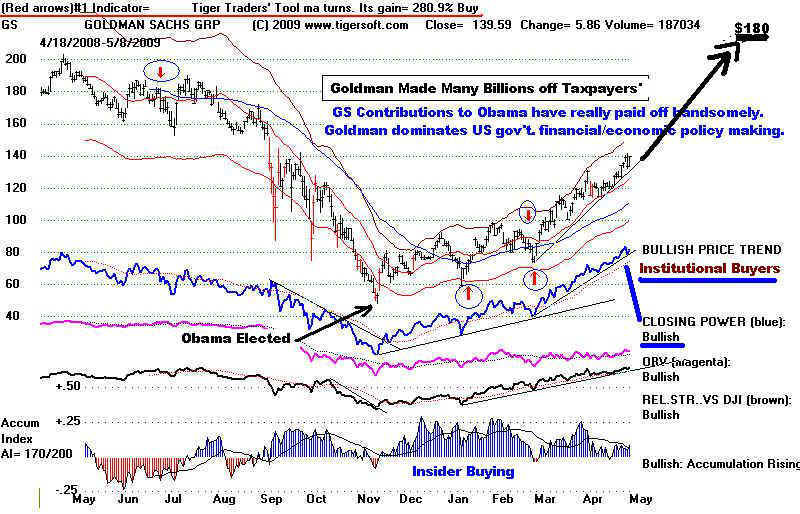

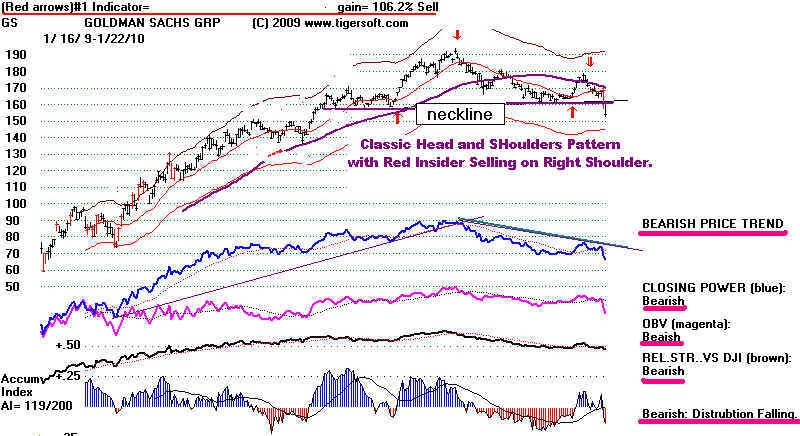

RAMPANT INSIDER SELLING REPLACES INSIDER BUYING IN STOCK OF GOLDMAN SACHS by William Schmidt, Ph.D. In September 2008, the NY Fed Chairman, Tim Geithner gave Goldman Sachs $13 Billion of Your Money and then, worse, tried hard to cover it up. Unlike with General Motors creditors, when it went bankrupt, AIG's creditors, all big banks, were paid 100 cents on the Dollar, on Geithner's and/or Fed Chairman Bernanke's instructions, on their massive AIG debts. Fully knowing this was wrong, one of them instructed AIG NOT to tell the public what he had arranged. Clearly, Geithner did not want the taxpayer payment to Goldman of such a large amount to come out at his nomination hearings as Treasury Secretary. Now old emails clearly show Geithner's NY Fed tried to prevent AIG from telling anyone where $60 billion of taxpayer money was going in these "counter-party" payments, where AIG was merely a vessel through which the taxpayers gave vast sums to big banks, domestic and foreign. Geithner claims no knowledge of this. Sure?! Bernanke claims no knowledge, too. How can anyone believe these FED leaders. They represent the interests of bankers, who pick all the members of the Fed except the Chairman. The FED is a private institution with immense powers. But it fights to not disclose who got what, when and why or what they did with the all the bailout money. FInally, a day before Bernanke's confirmation vote, Geithner has been subpoenaed by Congress to explain why he should not now be charged with criminal corruption, securities fraud, perjury and obstruction of justice. He testifies this Wednesday, the 27th. Stay tuned! The stock of the chief beneficary of Geithner's generosity with your money, Goldman Sachs, looks very vulnerable, viewing all their insiders' selling of GS stock. The rats are leaving a sinking ship. TigerSoft got the whole story right nearly a year ago. Backed by Obama, Geithner, Summers and Bernanke, and by fixing stock price movements and greedily front-running their own customers with a bankroll of $25 Billion provided by taxpayers, Goldman Sachs made many tens of billions in profits in last year's bull market, even after paying each employee an average bonus of more than $600,000. Small wonder Goldman's stock doubled in 2009. Without waiting to see the evidence, Obama said again today he fully supports Treasury Secretary Geithner. Has Obama again sold out his progressive and populist supporters? Is he all rhetoric and no backbone. Is he so dumb that he thinks he can still fool us? Study the details. It is hard not to reach the conclusion, "You Betcha!" The rush to confirm Bernanke before all the information is about about the $60 Billion gifts to big banks and the ensuing coverup shows how thoroughly corrupt Washington has become. But the truth will out! And we will report it! Why Insiders Expected Goldman To Double in 2009 . Goldman Sachs Chart - 2008-2009 - Paulsen and the US Taxpayers saved GS from bankruptcy. The bankrupting of their main competitors, the $10 Billion Bailout from Paulsen and the $13 Billion AIG "counter-party" gift from Geithner in November 2008, allowed them to make more than $25 billion in profits, $6 billion in the last quarter, while still paying almost as much in bonuses. Most of their profits were short-term trading profits, which they achieved by manipulating markets, by front-running their own clients and by being the ultimate insiders because of all the well-placed Goldman people in government. Examples: Geithner's chief of staff was Goldman's chief lobbyist. The chief government commodity regulator came from Goldman. Obama's Chief Economic Advisor took tens of thousands of dollars from Goldman right in the middle of Obama's campaign. Geithner's successor as head of the NY Fed was also a Goldman "greeder". And let's not forget GS's hefty sway over the corporate media, especially the stock market channel. CNBC.

Goldman Sachs Chart - 2009-20010-

|

|

Tags: aig,

goldman sachs, credit default swaps, aig bailout, aig bonuses, finance, economy, actuaries, economic crisis, politics, bear sterns, lehmans Geithner, Paulsen, Counter-Party, insider trading |

| |