TigerSoft News Service 2/11/2011 www.tigersoft.com

Trading Gold and Silver Stocks

with TigerSoft's Closing Power

by William Schmidt, Ph.D. (Columbia University)

(C) 2011 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Tigersoft invented the key indicators used here. They are only available to TigerSoft Users.

For more information, please visit our main website - www.tigersoft.com

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of historical research NEM - Newmont Mining. Order Here.

See the TigerSoft techniques for find Explosive Super Stocks: Oil Coal

|

Tiger

Software Helping Investors since 1981

|

Trade Tiger's Accumulation Index, Closing Power and Automatic Buys and Sells |

Trading Gold and Silver Stocks

with TigerSoft's Closing Power

by

William Schmidt, Ph.D. (Columbia University)

Most of the time, we don't

know exactly why Professionals are net buyers of sellers of a stock.

To make money we don't have

to. We just trade the direction of the trend of TigerSoft's

Closing Power, while being

mindful of:

1) whether

the general market is on a Buy or Sell from our Peerless Stock Market Timing.

Peerless was on a Buy for the

last 6 months of 2010 and most of the time from March to December

in 2009.

2) what is

the direction of the stock's 65-day ma

The 65-day ma appears as a

bright purple line on the Tiger bar chart.

3) whether

the stock or ETF shows an important chart pattern.

4) whether

or not the stock or ETF shows heavy Accumulation (insider buying) or

heavy distribution

(insider selling). Bulges of Accumulation at the bottom of the Tiger

chart that surpass a

key threshold are considered as "insider buying". New highs at the

upper price band with a

negative (red) Accumulation Index are considered "Sell S9s" and

"key

distribution" that foretells many declines.

The rules for trading the

Closing Power trends are simple. Buy on a break to the upside when

the Closing Power (CP)

downtrend is broken. Sell when the CP uptrend is broken. Use the steeper

CP trendlines when the stock

has made an extended run. Three tests of a CP trendline make it

more reliable. And we

watch for divergences between CP and prices. Bigger moves and reversals

are set up when Closing Power

fails to confirm a new price high or low by making a corresponding

new high or low. Lots

of times excellent trades are made when the stock falls back to (or rises back to)

the 65-day ma and the CP

trend is then broken. Seeing the usage here will make these rules clearer.

Buys and Sells can be placed

on the chart by the user where Closing Power breaks its trendline.

TigerSoft computes the

percentage gains a trader would make on an initial position of $10000 where

the costs of commission and

slippage are $20 per trade. The results assume trades are entered at the

opening the next day after

the Buy or Sell.

The rules can be profitably

applied to most stocks, most of the time. The exceptions occur when

the Public is heavily in the

market and the stock is running out of control of the Professionals for

a period. This occurred

briefly in 2000, for example, at the end of the Internet Bubble.

IMPORTANT

BUY ON TIGERSOFT CP TREND BREAKS FOLLOWING AN ACCUMULATION

BULGE

SHOWING INSIDER BUYING

By far, the biggest gains are

made if one buys a stock soon after it has shown heavy insider

buying when the Closing Power

breaks above its downtrend or horizontal trendline. TigerSoft

shows such insider buying as

spikes by the Accumulation Index above the key "insider buying"

threshold. Each of the

next 6 charts show such insider buying just before the Closing Power

Buys occurring after its

downtrend is broken.

Selling is best done after the

stock has made a significant advance and it makes a new price high

which is not confirmed by its

Closing Power making a corresponding new high. Note that a negative

non-confirmation of a price new

high by the Tiger Accumulation Index (Tiger "S9") also works here.

After either of these occurrences,

Sell when the Closing Power breaks its uptrend.

ANV 2009-2010 |

TRE |

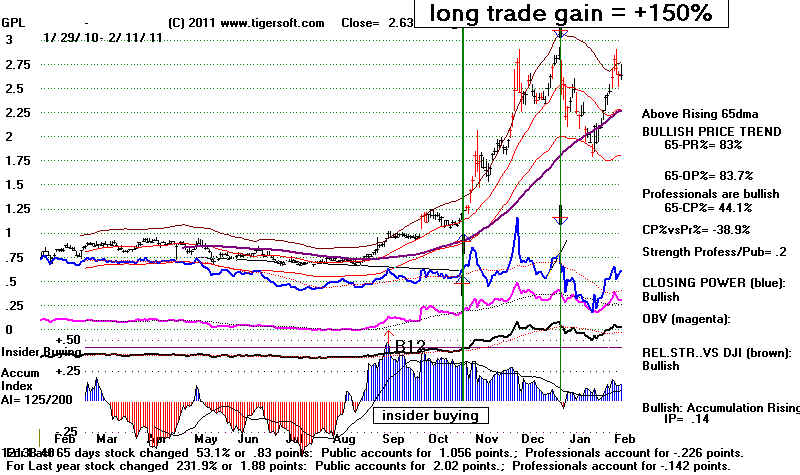

GPL

2010-2011 |

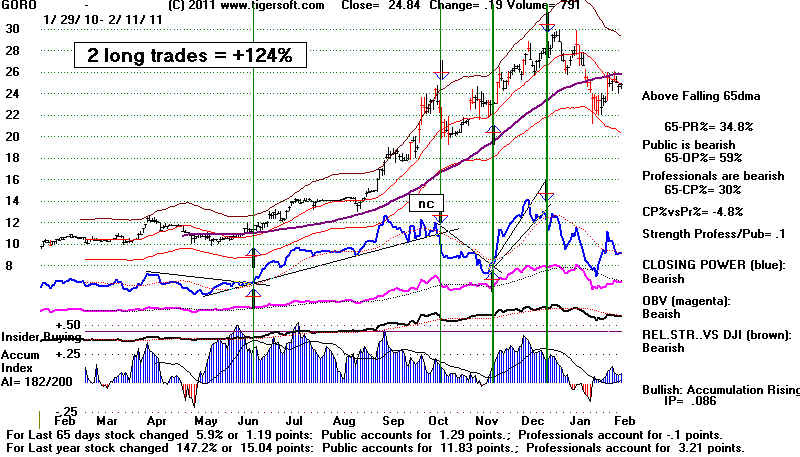

GORO 2010-2011 |

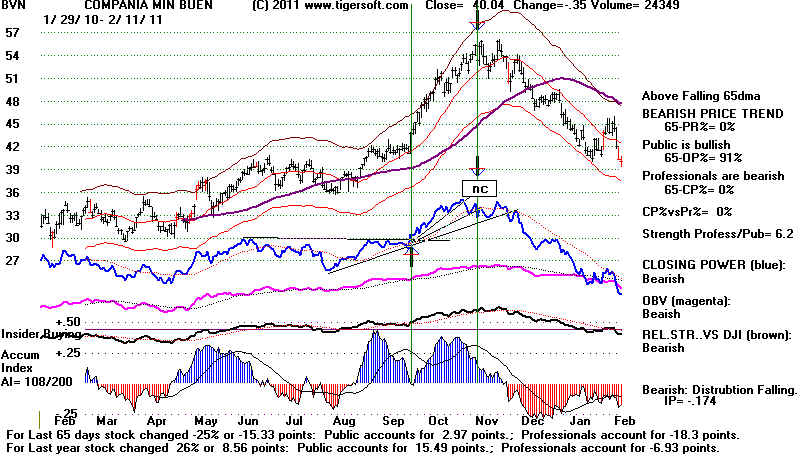

BVN

2010-2011 |

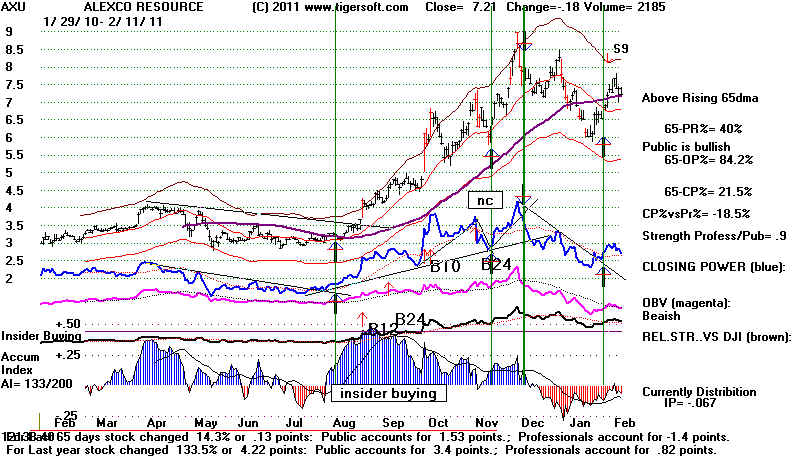

AXU

2010-2011 |

MORE TYPICAL CHARTS

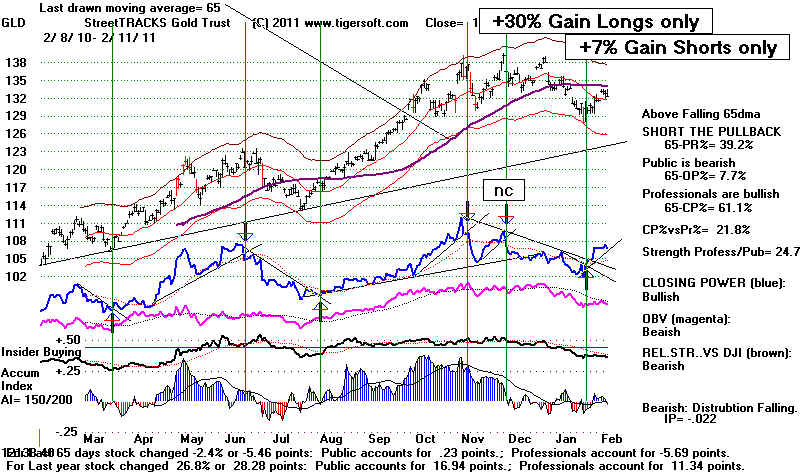

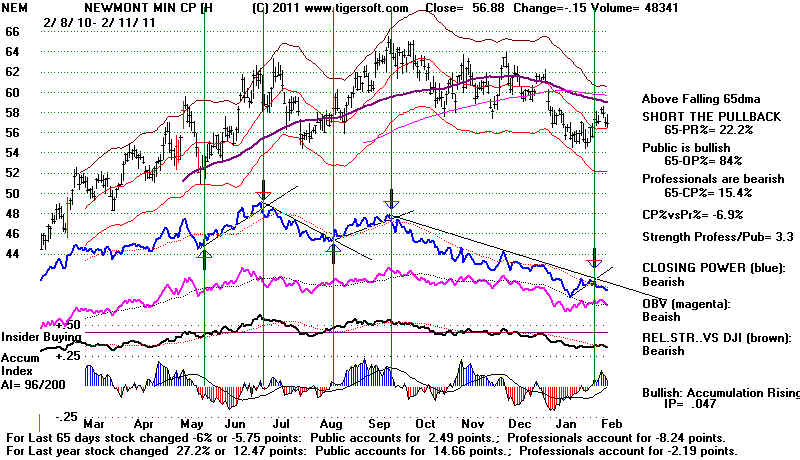

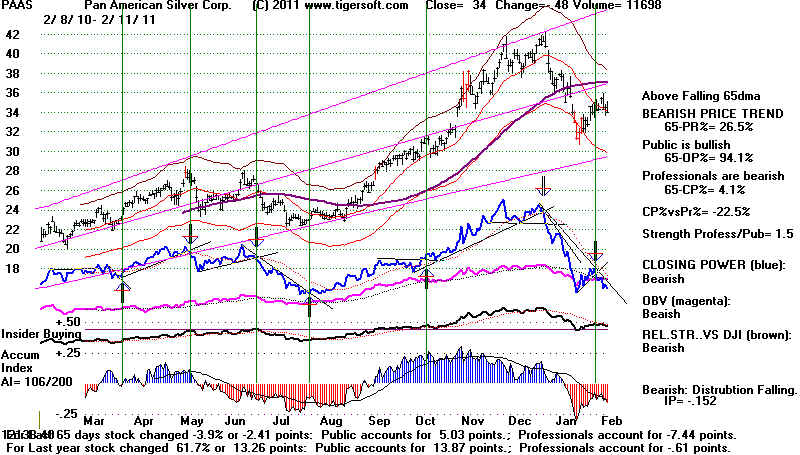

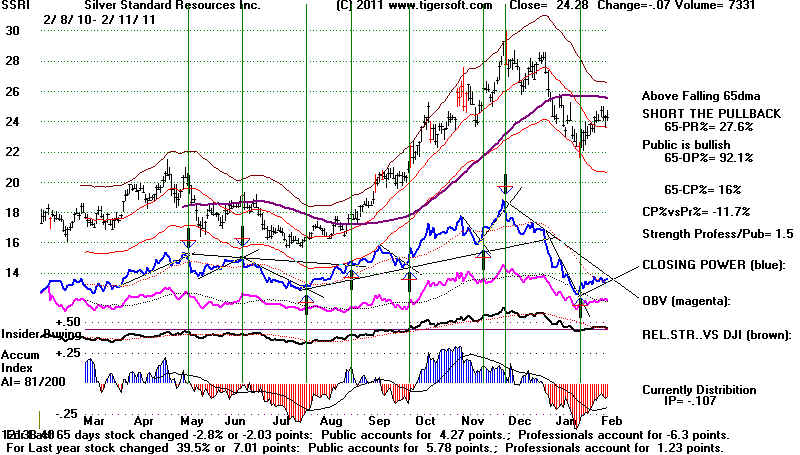

Here are GLD (gold ETF), SLV

(silver ETF) and three stocks: NEM, PAAS and SSRI. Simply

trading the trends of Closing

Power is consistently profitable. The gains were generally less

because insider buying was

not present.

GLD

2010-2011 GOLD ETF |

SLV

2010-2011 Silver ETF |

NEM

2010-2011 |

PAAS

2010-2011 |

SSRI

2010-2011 |

+