Tiger

Software 3/9/2011 www.tigersoft.com

Tiger

Software 3/9/2011 www.tigersoft.com USE TIGERSOFT TO BEAT WALL STREET.

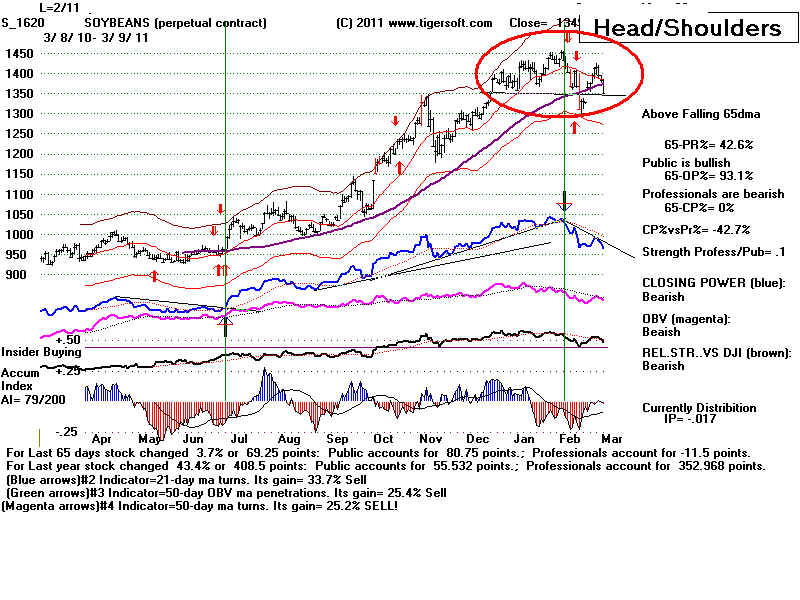

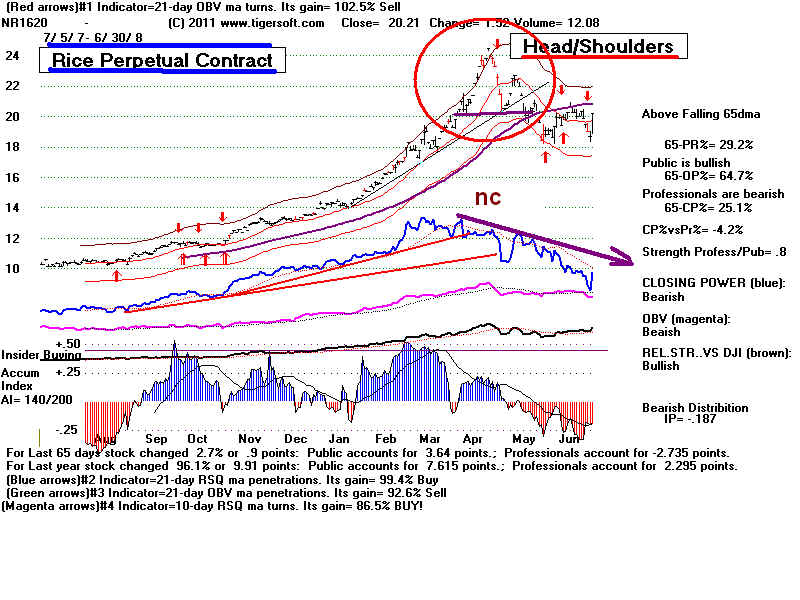

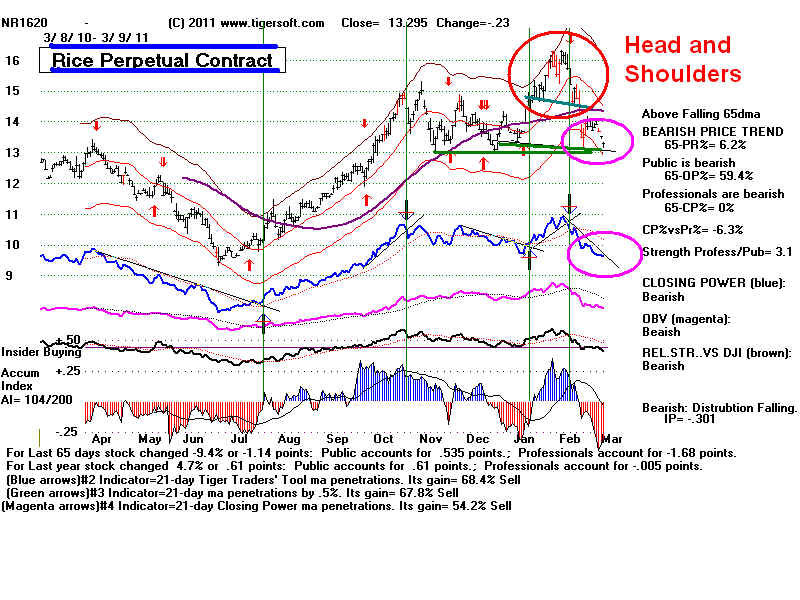

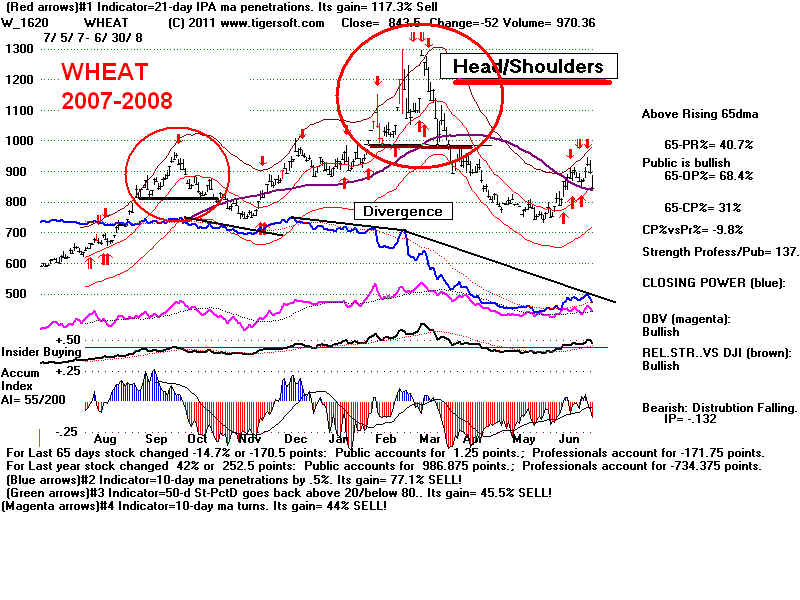

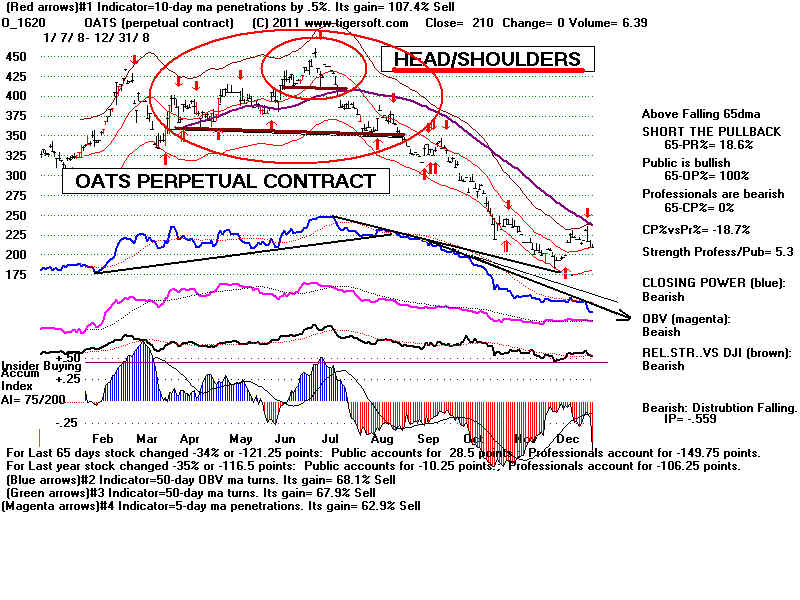

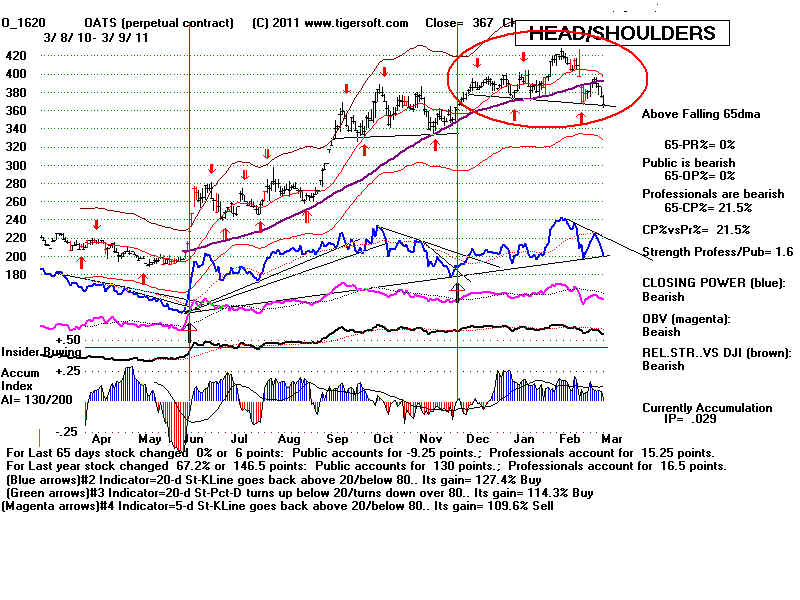

RICE, SOYBEANS, WHEAT

and OATS all form BEARISH

HEAD and SHOULDERS TOPS

Will 2008 Be Repeated?

3/8/2011 (C) 2010 William Schmidt, Ph.D. www.tigersoft.com

Significant tops in stocks, ETFs, currencies and commodities usually appear with most

or all of these characteristics:

1) red TigerSoft Distribution,

2) Trendbreaks of CLosing Power.

3) Non-Confirmations of Price New Highs by TigerSoft Closing Power,

4) Tiger's Closing Power Zig-Zags Downward.

5) Completed Head and Shoulders Pattern.

6) Confirmed violation of the 65-dma

7) Failed attempt to get back above 65-dma and neckline of head/shoulders pattern.

If this is to be a big decline, you will also see multiple Sells and a Peerless Major Sell Signal

on the DJIA. See these characteristics plus bearish head and shoulders patterns

in Rice, Wheat, Oats and Soybeans in mid 2008 and now in 2011.

Fair warning. Consult Peerless to see if this final piece has fallen into place.

And watch the Head and Shoulders patterns below to see if they are bearishly

completed. Peerless Stock Market Timing: 1915-2011

See also:

4/19/2008 - TigerSoft Blog - 4/19/2008 - TigerSoft News Service - Food Riots

2/26/2008 - TigerSoft News Service - 2/26/2008 - Famine, Drought, Commodity

10/7/2007 - William Schmidt's Blog 10/7/2007 - Food Commodities and TigerSoft

We offer: Peerless

Stock Market Timing: 1915-2011

We offer: Peerless

Stock Market Timing: 1915-2011

On-Line Nightly Hotline TigerSoft Insider Trading Charts Trading Buys/Sells

Explosive Super Stocks Killer Short Sales in Any Market

2007-2008

2010-2011

2007-2008

2010-2011

2007-2008

2010-2011

2007-2008

2010-2011