TigerSoft

News Service 7/31/2009 www.tigersoft.com

TigerSoft

News Service 7/31/2009 www.tigersoft.com

TigerSoft's "Day Traders Tool"

and IBM:

1999-2009

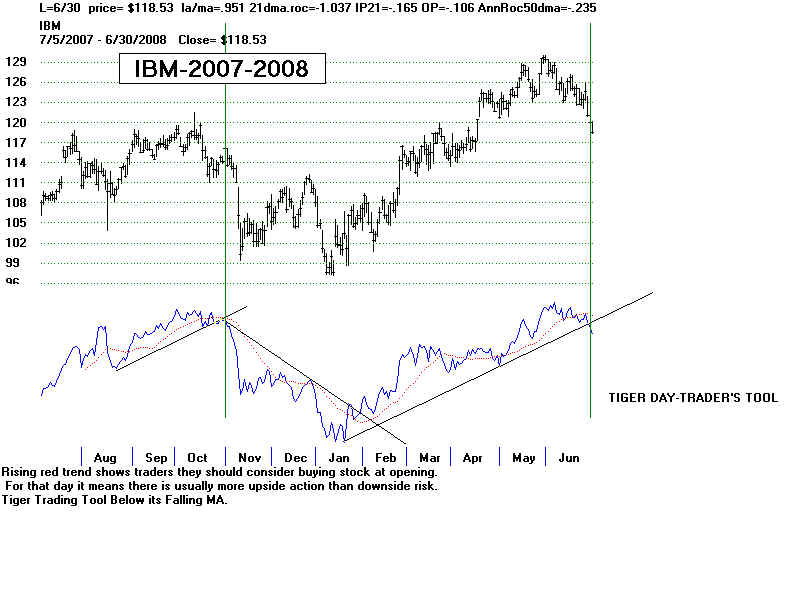

Tiger's Day Trading Tool is primarily meant to assist

day

traders, so that they can appreciate whether there is more

upside or

downside potential after the opening. Past trends

in it tend

to continue.

Just

as Closing Power was originally designed for day

traders,

but is very helpful to intermediate-term investors,

so, too, is

the Tiger Day Traders Tool.

I

would rate the Tiger Accumulation Index as the most

important

internal strength indicator. After that, I would

put the

Closing Power Tool, Relative Strength and OBV

and then

the Day Traders Tool.

Price

patterns and trends are the most important.

Look

for divergences betwen prices and the Tiger Day Traders

tool.

They may continue for a few months. But eventually,

prices

go in the direction portended by the TTT.

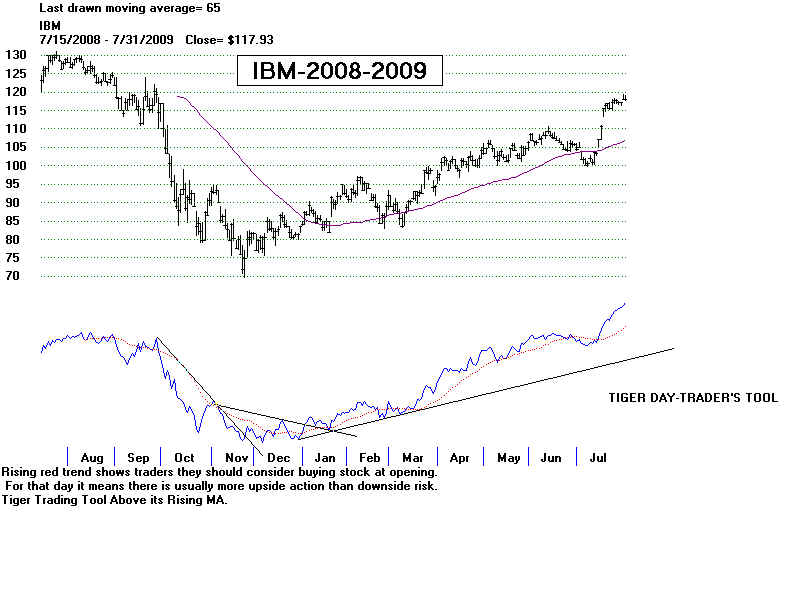

Breaks

in a TTT or price downtrend after a bullish divergence

by it

from falling prices bring good rallies to play.

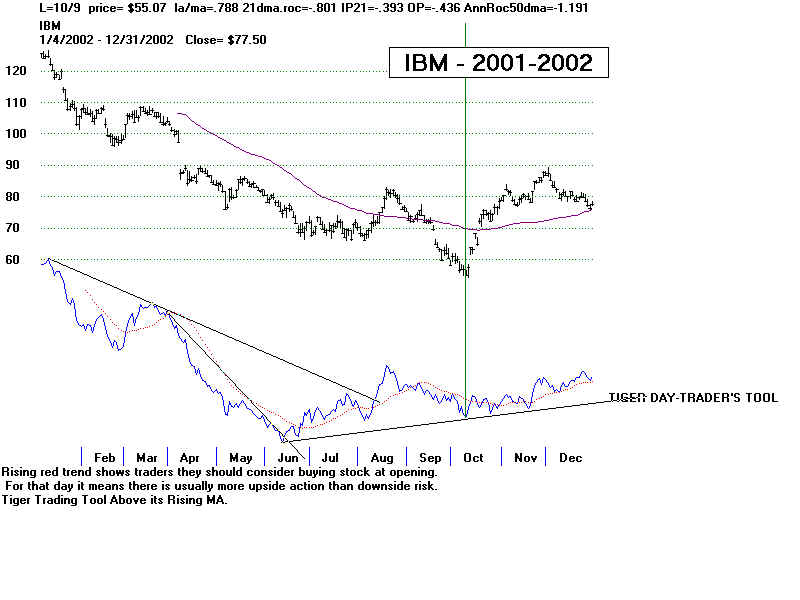

October

2001 - 100 to 125 in 10 weeks

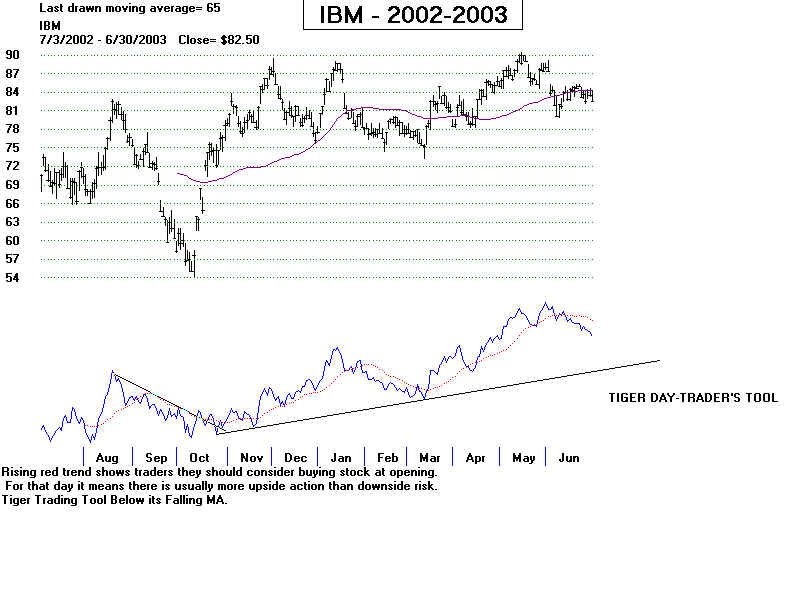

October

2002 - 70 to 87 in 8 weeks

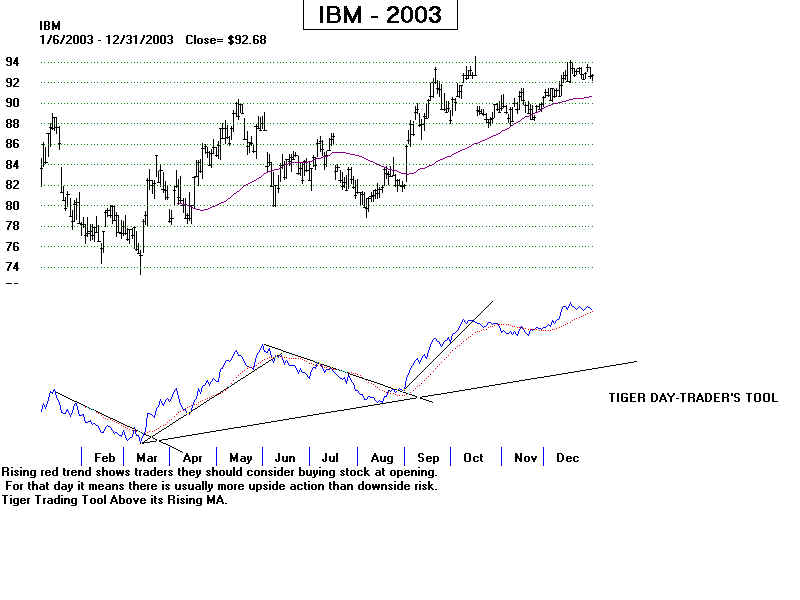

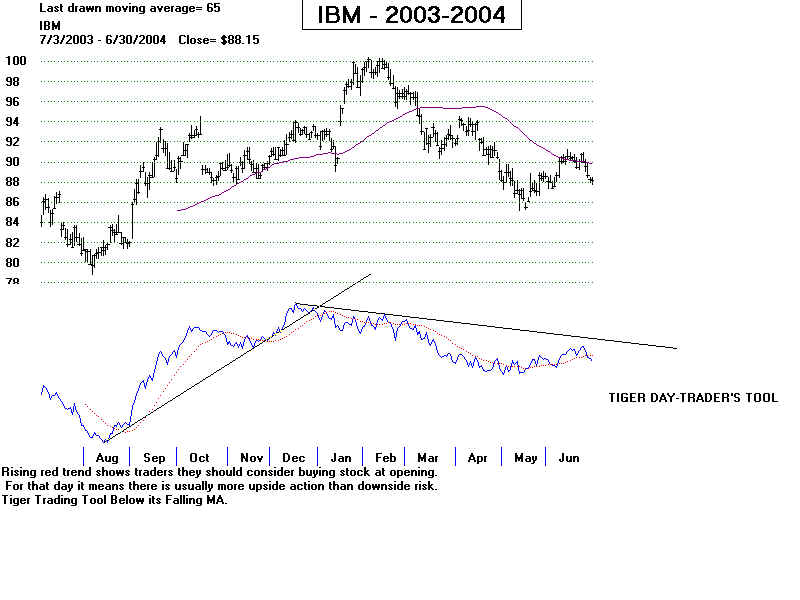

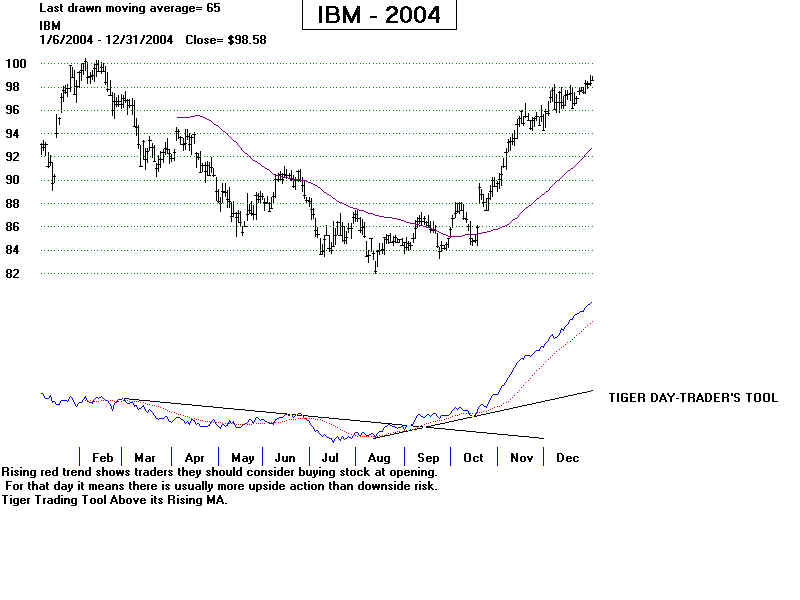

August

2004 - 86 to 99 in 4 months.

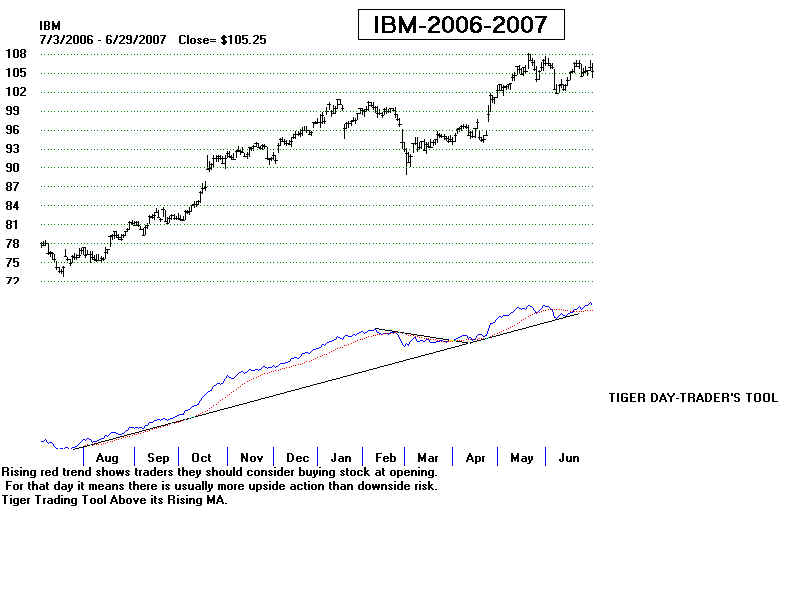

August

2006 - 76 to 114 in 14 months.

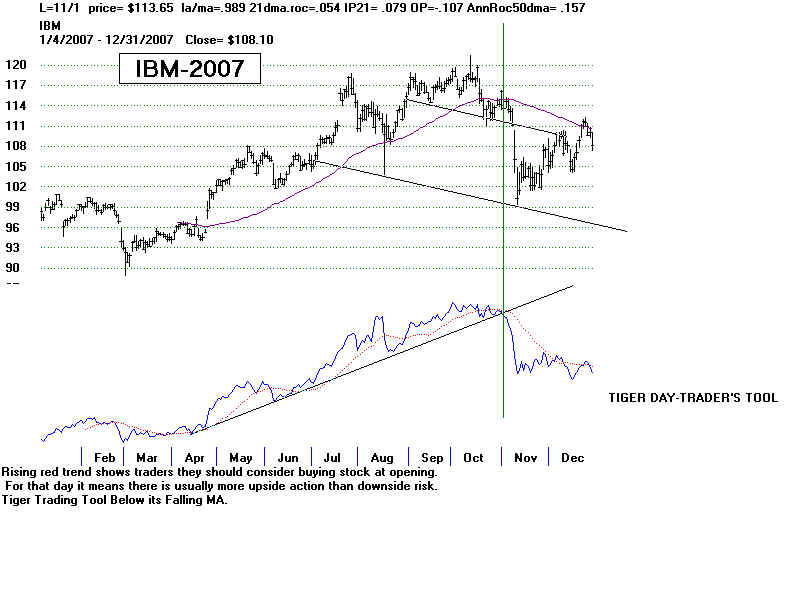

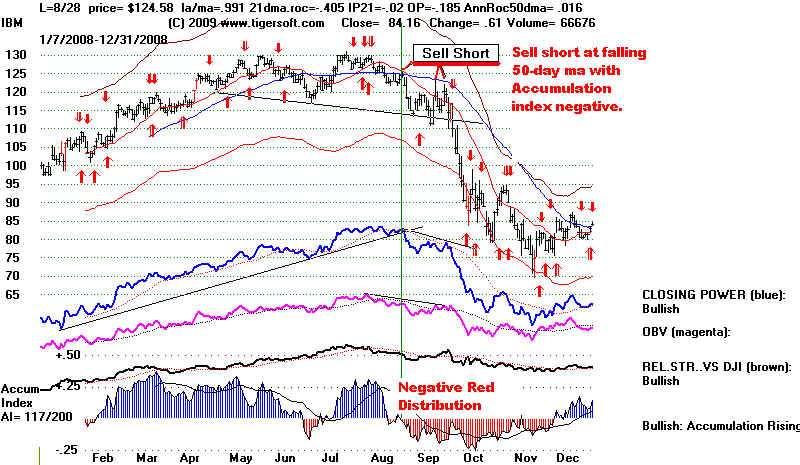

Breaks

in a TTT uptrend after a bearish divergence

by it

from rising prices bring declines to play short.

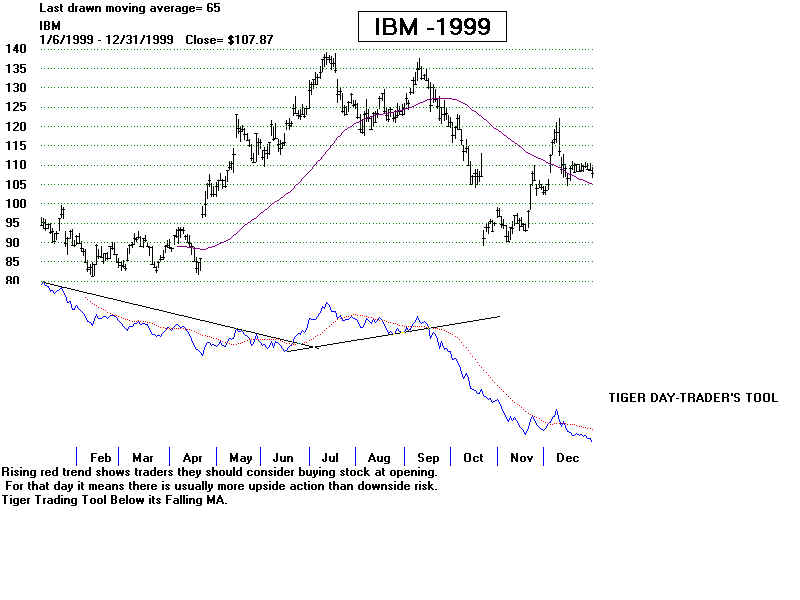

September

1999 - 120 to 90 in 6 weeks.

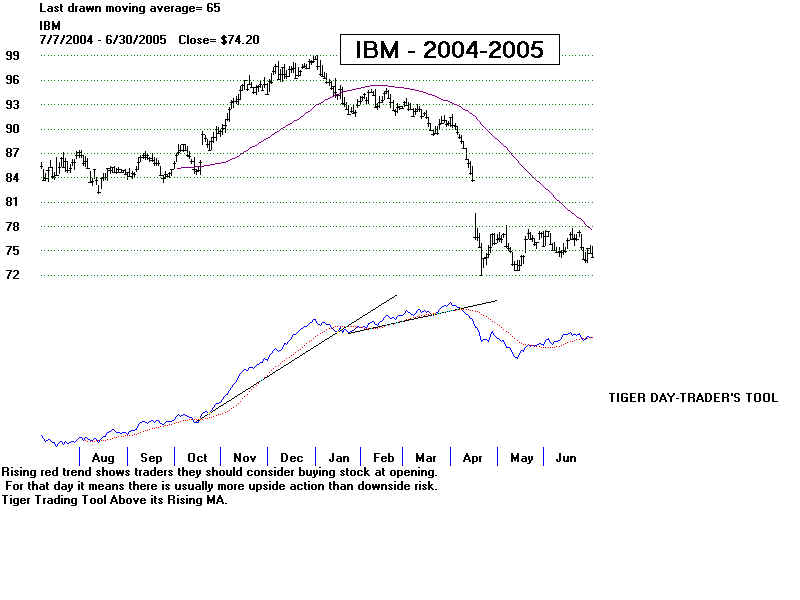

February

2004 - 97 to 74 in 3 months,

Confirmed

trends should continue until other divergences

of a

head and shoulders pattern occur.

by William Schmidt, Ph.D.

(Columbia University)

|

Tiger

Software

|

|

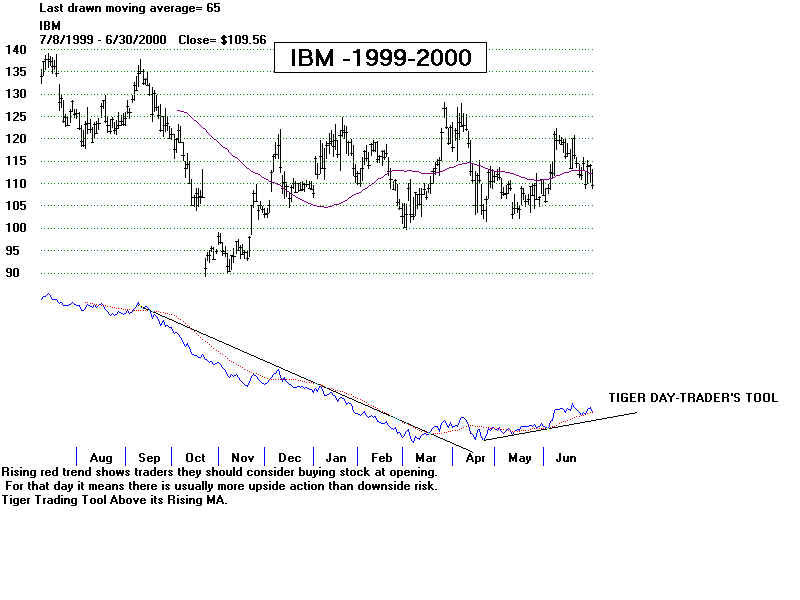

Research on Individual Stocks upon Request: Includes Composite Seasonality Graph of Any Stock for $125. Example of historical research NEM - Newmont Mining. Order Here. ======================================================== IBM: 1999-2009 Bearish TTT Weak TTT rally.

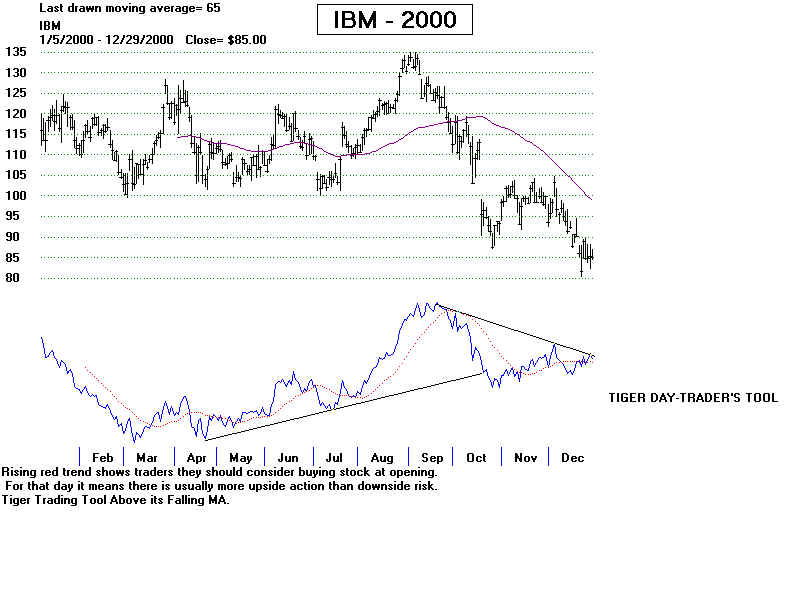

Rally suspect. TTT trying to bottom.  Given past bearish divergences, when TTT up-trend ends, SELL SHORT in SEPT. 2000.

Break

in TTT uptrend brings sell-off

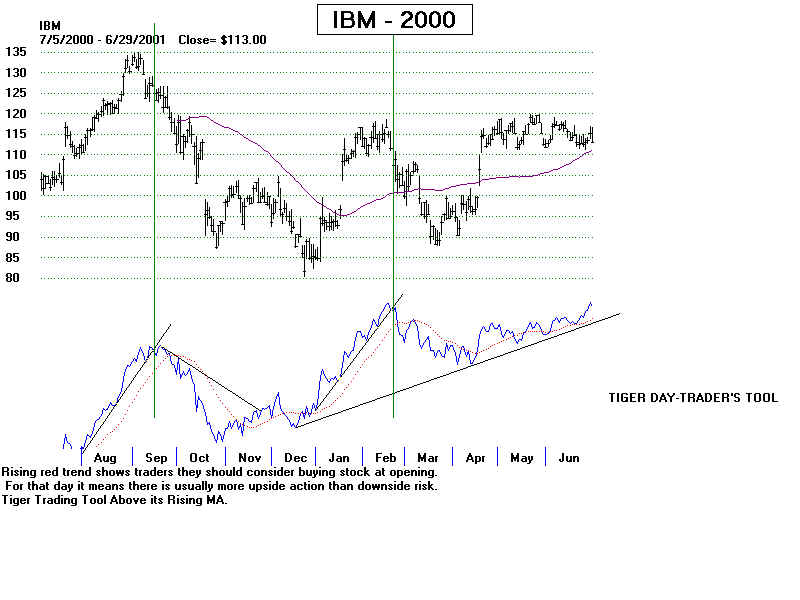

Gradual TTT uptrend matches gradual rise in prices.

Bullish

Divergence by TTT sets up a big rally when |

TTT

decline is bullishly shallower than

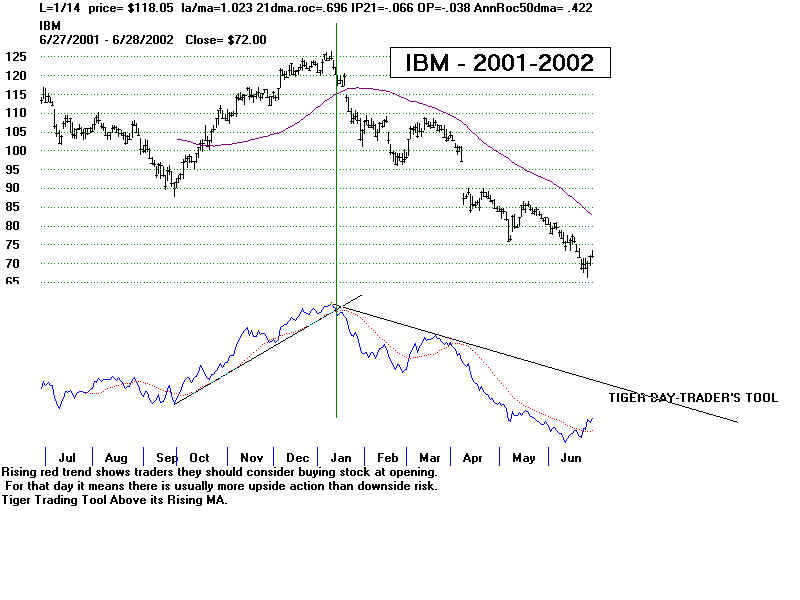

TTT

decline is bullishly shallower than

Bullish

Divergence

Bullish

Divergence