TigerSoft

News Service 8/22/2009 www.tigersoft.com

TigerSoft

News Service 8/22/2009 www.tigersoft.com USING TIGER'S POWER STOCK RANKER

IN A MARKET ALREADY UP 45% OFF ITS LOWS

by William Schmidt, Ph.D. (Columbia University)

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

|

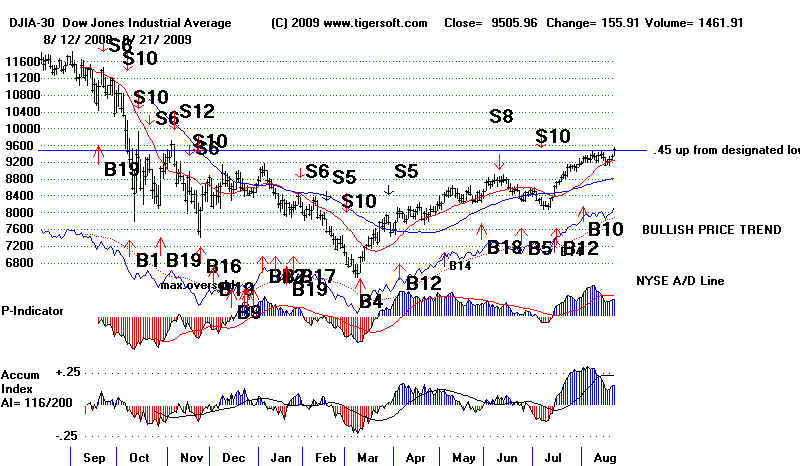

USING TIGER'S POWER STOCK RANKER IN A MARKET ALREADY UP 40% OFF ITS LOWS by William Schmidt, Ph.D. The first order of business with the DJI up 45% from its lows, is to consider how much upside potential there still is. The chart below shows we are still on a major Buy from Peerless and that the NYSE A/D Line has already made a 12 month high. The P-Indicator has hardly had its high levels be reduced from when it was 1000 points lower. The Tiger Accumulation Index, like the P-Indicator, is not as high as it was a month ago, but it is still very positive. So, no Sell S9 or Sell S12 is insight at this point.

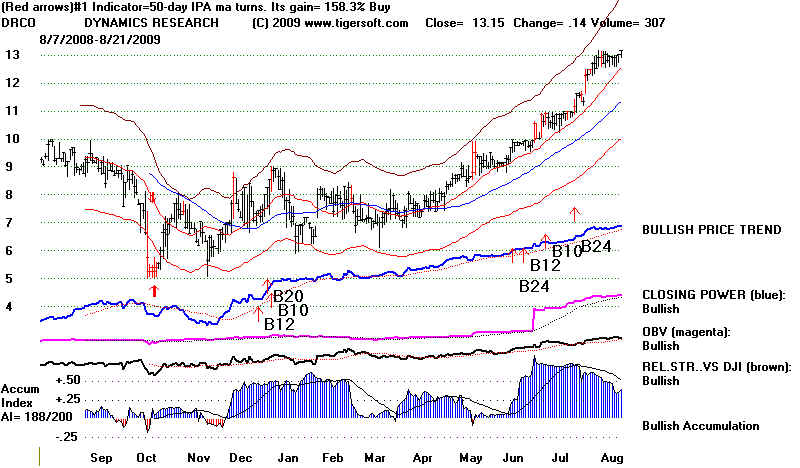

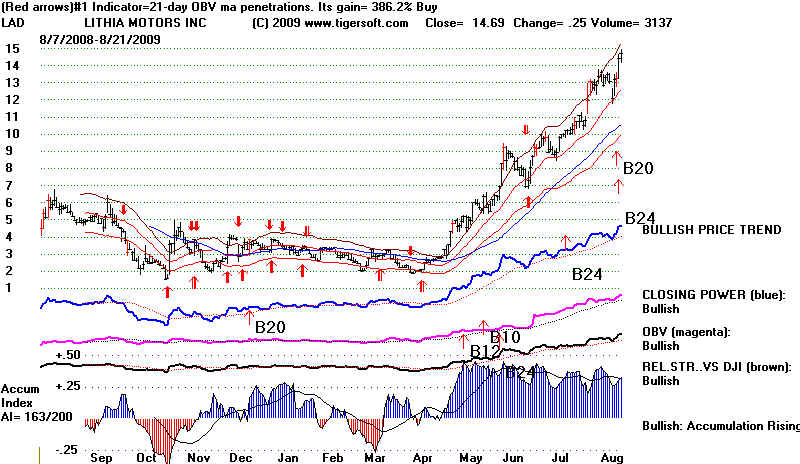

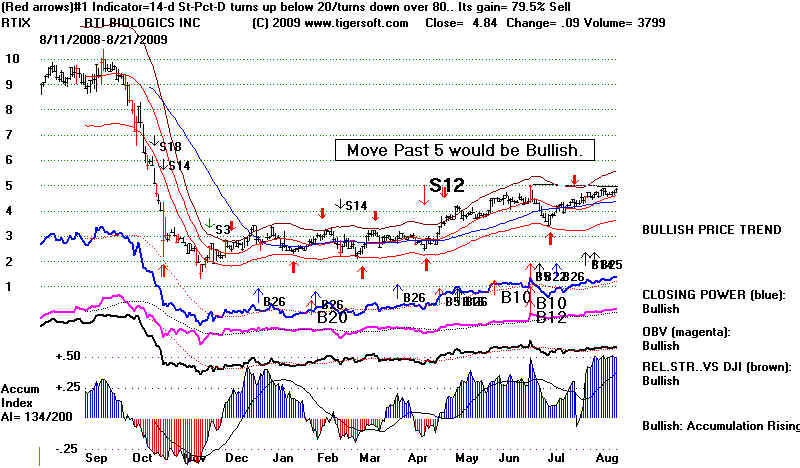

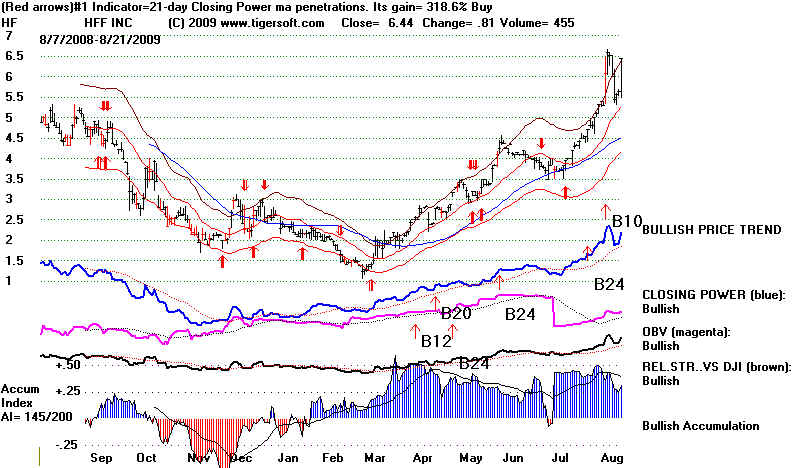

The DJIA has recently exceeded a 33% retracement (from October 2007 high to March 2009 low) and the resistance of its falling 52 week moving average, by virtue of excellent breadth and very high levels of Accumulation. Now it seems bound to test the round number 10000 level and then the 50% retracement level of 10300. The amount of upwards energy in the market must be respected. My own sense is that the broken support at 10800 seems the most likely place for sell orders to be placed abundantly enough to stop the recovery.  So, how can we play the market, if we assume that there may be 1000 more points to the upside? First, understand that our reasearch shows that the highest Accumulation Explosive Super stocks make their best moves in the second six months after their initial bulges of Accumulation. Accordingly, I would focus special attention on these explosive super stocks, all the while being aware of how far some have already risen watching for the red flags they are apt to offer shortly before they decline. Augmented B24s and B12s produce some of the very biggest gains. You can see some of the best in the following link.. New 8/14/2009 How To Find Each New Bull Market's Explosive Super Stocks: 1990-2009 and 8/7/2009 Bulls Should Be Able To Spot The Red Warning Flags in Over-Priced Stocks. At this stage of the rally, it seems unlikely that a stock will just now begin a huge advance. We are better of playing some of the ones we have found earlier on breakouts or on modest retreats to their 21-day ma, so long as their Accumulation Index is showing positive consistency with an AI/200 score above 181 and a current Accumulation Index (IP21) value above .15 as the 21-day ma is tagged. Run the Analysis against ELITSTKS or AUG1224 on the Elite Stock Professional page or against any group of stocks you wish. Then display the "HIGHAI" stocks using "Tiger Selections" form the Tiger Page + "Tiger Groups: Lists and Explanations" + "HighAI" (#66). Look in the column with the heading CL/MA for stocks near 1.0. These are the stocks whose close is at the 21-day ma. In the column just to the left is the current Accumulation Index ("IP21") value for the stock. This yields several candidates: CLose IP21 AI/200 CAMD 2.9 .38 .987 ERC 13,18 .30 1.002 NSR 23.07 .23 1.013 but looking at its chart below, we see that its OBV and Rel Str. are rated as "Bearish".  How else can TigerSoft's Power Ranker find the best stocks to play now? 1. One simple way is to use the Power Ranker's list of "Bullish" stocks from the HOTSTKS data base. Save time, by checking their current Accumulation Index (IP21) level as well as how many days their Accumulation Index has been positive for the last 200 tradfing days (AI/200) and if their CLosing Power is rising "-U" in the spread sheet's column. Tiger screen + Tiger Selections (at top) + Tiger Groups: Lists and Explanations + Bullish. The 8/21/2009 data shows: STK Close AI/200 IP21 Cl/MA TGR (Opening and Closing Power trends) IEC, 5.26 185 .36 .941 ?U SCLN 4.22 185 .20 1.103 U? COMS 4.21 189 .14 1.059 U!U FIRE 19.97 181 .20 1.123 UU RADA 2.8 195 .56 1.018 DU DRCO 13.15 184 .39 1.048 DU CNBKA 24.59 181 .43 1.086 DU MSZ 21.15 193 .55 1.012 DU TXIC 8.88 169 .04 1.076 UD WDC 32.85 173 .25 1.045 DU I would eliminate any stock with an AI/200 under 140 and any stock with a current IP21 value below .37 or with a CLosing Power that is not rated "U". That leaves the following stocks

STK Close

AI/200 IP21 Cl/MA TGR (Opening and Closing Power trends)

|

| |