TigerSoft

News Service 8/17/2011

www.tigersoftware.com

TigerSoft

News Service 8/17/2011

www.tigersoftware.com

The Importance of a Full Recovery

after A Sharp Sell-off

following a Long Bull Market

Usually when the DJI falls 13.5-15% from its highs, as it did

in July-August 2011, a bear market follows. The only two exception,

I can readily find, where the DJI turns right back up and resumes

its bull market was in July 1950 and July2010. In both cases

the DJI was down 13.5% exactly from its highs. Continuations

of a bull market are quite commobn when the intermediate-term

decline was only 8%-13%.

Notice how the 1950 and 2010 cases showed very quickly

recovering A/D Lines, that moved up to new highs faster than

the DJI itself.

1950

2010

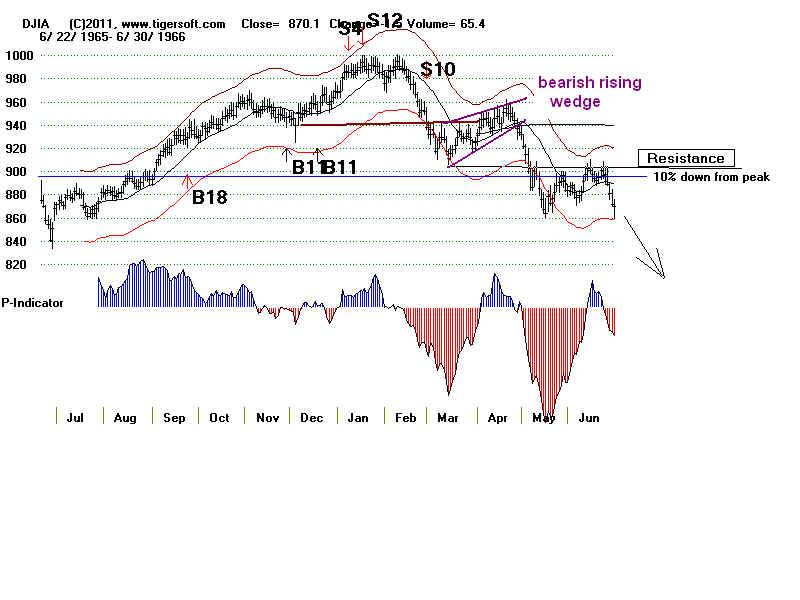

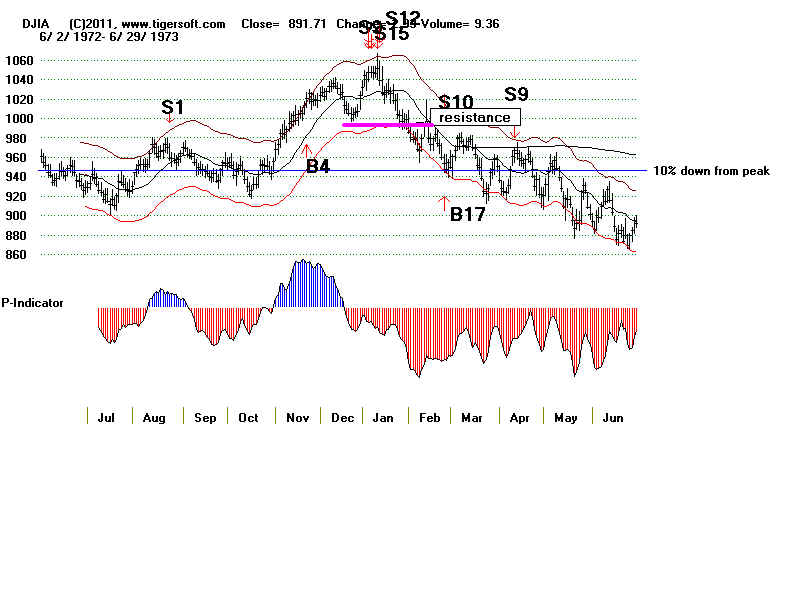

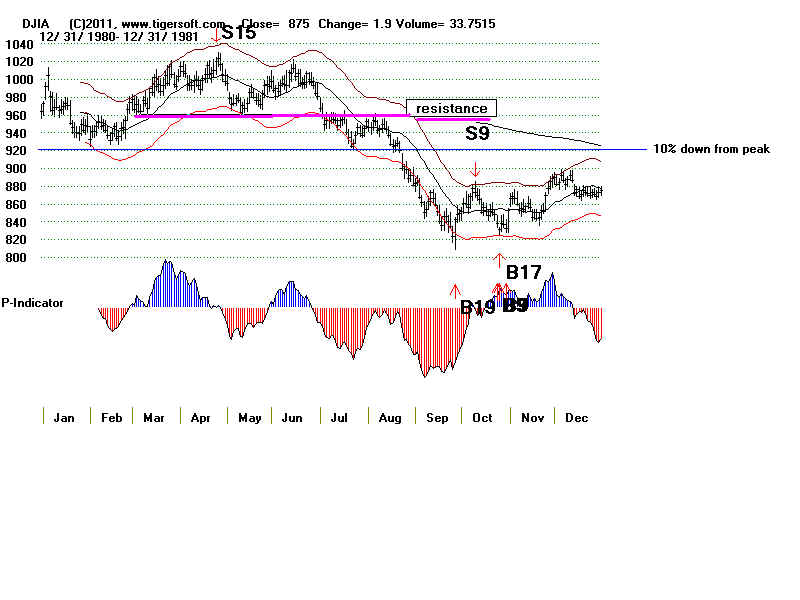

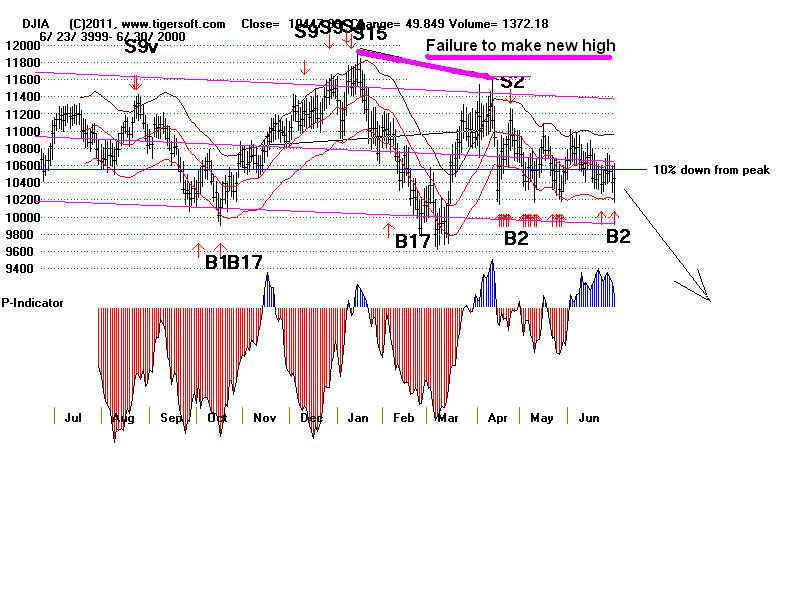

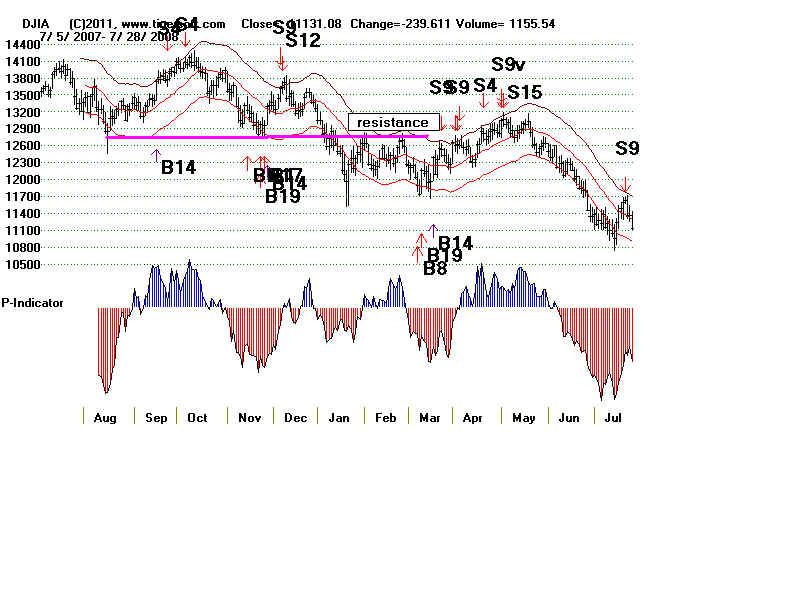

2010 A deeper decline often followes when the the DJI rallies

up from 10%-15% down levels but then fails to get up much

one or more broken support levels. When traders see

this resistance is too much, the decline continues and deepens.

This pattern was seen in 7 of 12 cases from 1966 to 2010

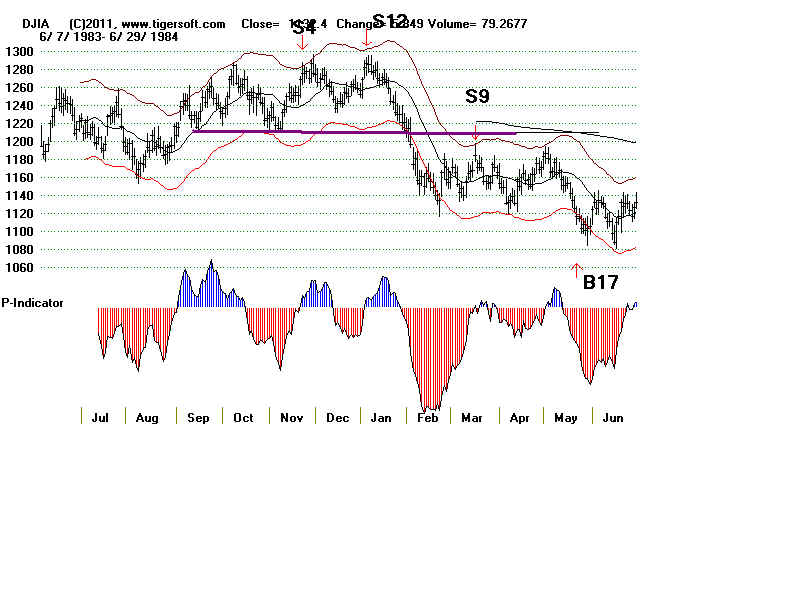

Cases where there is no recovery are, of course, bearish.

But so are cases, where the DJI fails to make a new high.

1) No recovery - Bear Market Scenario

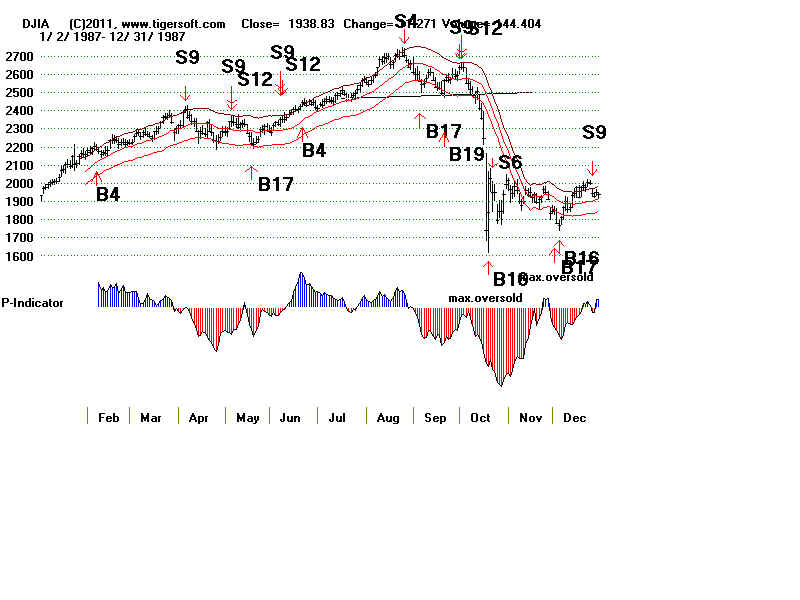

1984, 1987 (2)

2) Failure to Get Much Past Broken Support that Has become Resistance

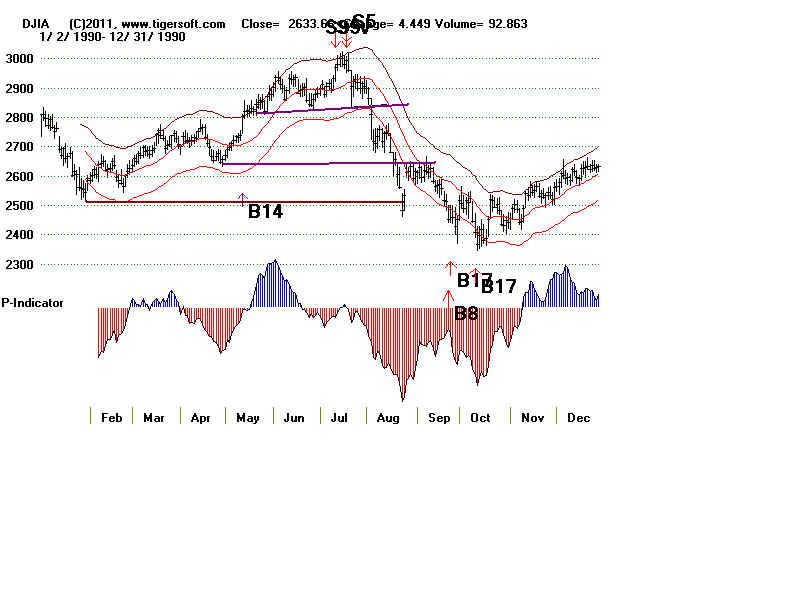

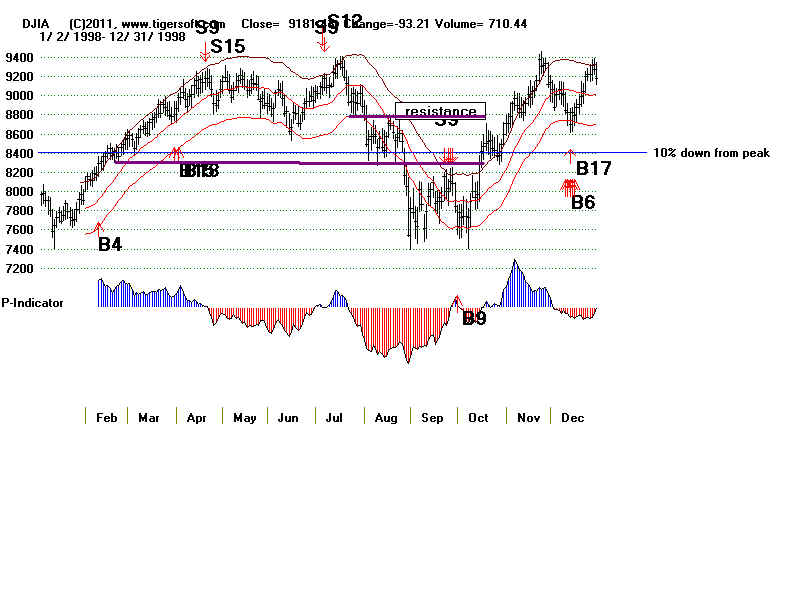

1966, 1971, 1973, 1981, 1990, 1998, 2008 (7)

3) Failure to make a New High sets up Bearish Declining Tops

1969, 1976, 1990 (3)