TigerSoft News Service 8/15/2011

www.tigersoft.com

TigerSoft News Service 8/15/2011

www.tigersoft.com

TigerSoft News Service 8/15/2011

www.tigersoft.com

TigerSoft News Service 8/15/2011

www.tigersoft.com

Momentum's Tipping Point

When does a correction become

a bear market?

After a Bull Market, the AROC Dropping

Below -1.5 Is Bearish.

-1.5 (-150%) appears to be a critical level.

The 1978, 1980 and March 2001

declines

saw the AROC fall only to -1.47 and then the DJI recovered.

On 8/8/2011, the

AROC fell below -1.5. This is not good. In 11 of 13 cases,

the DJI

fell much more, sometimes in only a few days and sometimes after two months.

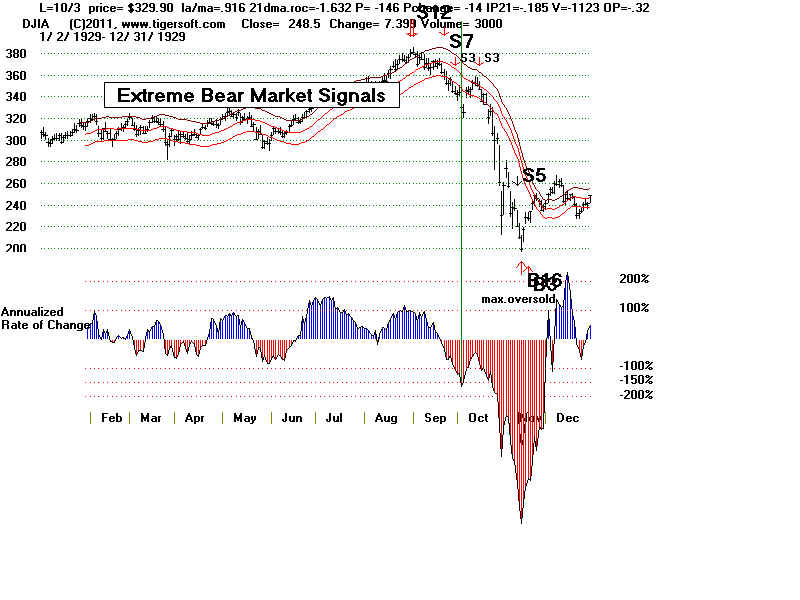

10/3/1929 AROC fell below -1.5, followed by a five day

rally and then 1929 crash.

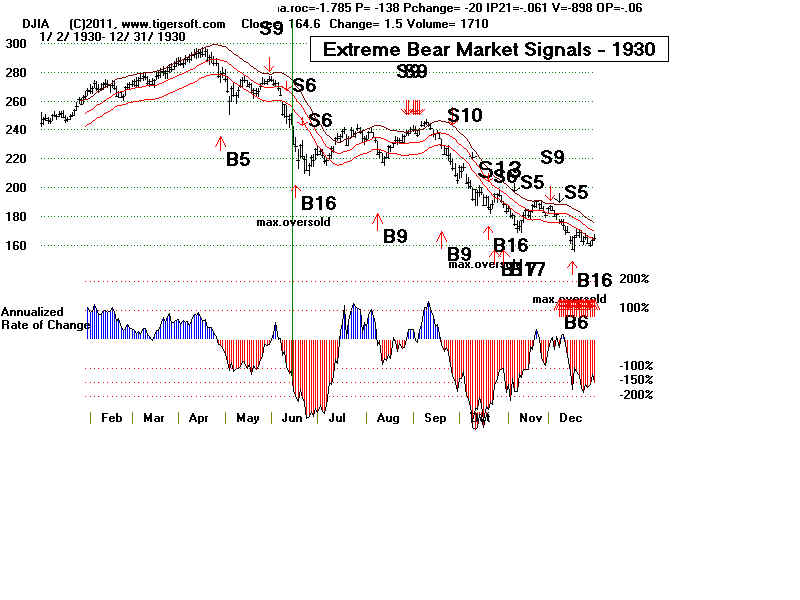

6/16/1930

AROC fell belo -1.5. with DJI at 230,11. Fell to 210 a week later.

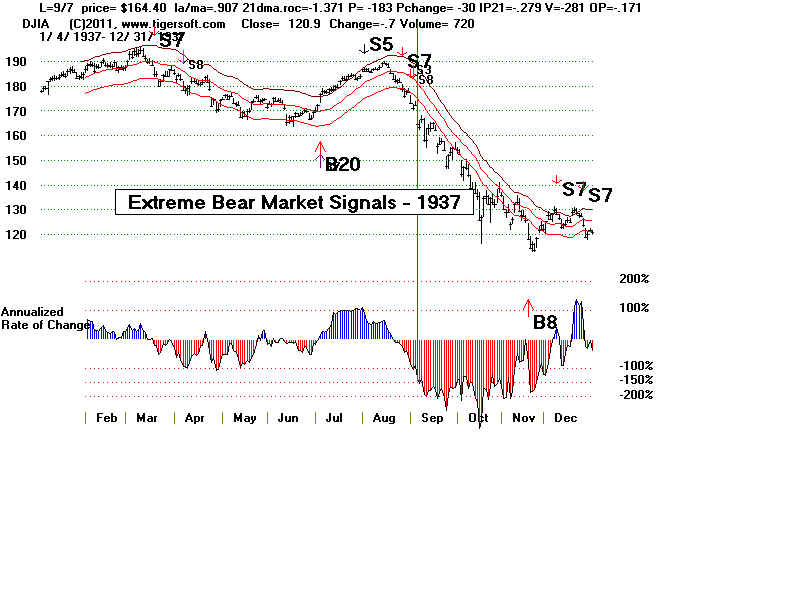

9/7/1937

AROC fell below -1.5 with DJI at 164.40 and then fell to 112 ten weeks

later.

5/14/1940

AROC fell below -1.5 with DJI at 128.30 and then fell to 115 six days later.

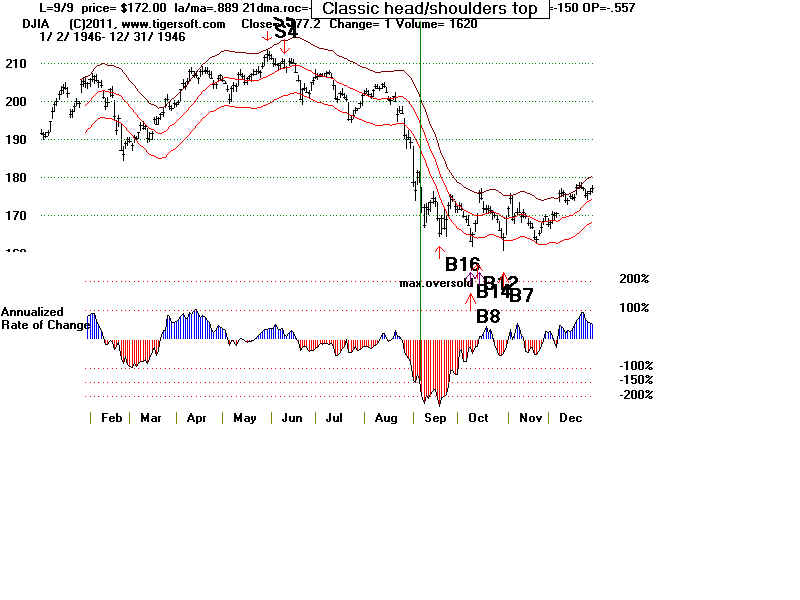

9/9/1946

AROC fell below -1.5 with DJI at 172 and then fell to 164 a month

later.

7/12/1950 AROC fell below -1.5 and turned up strongly 2 days later.

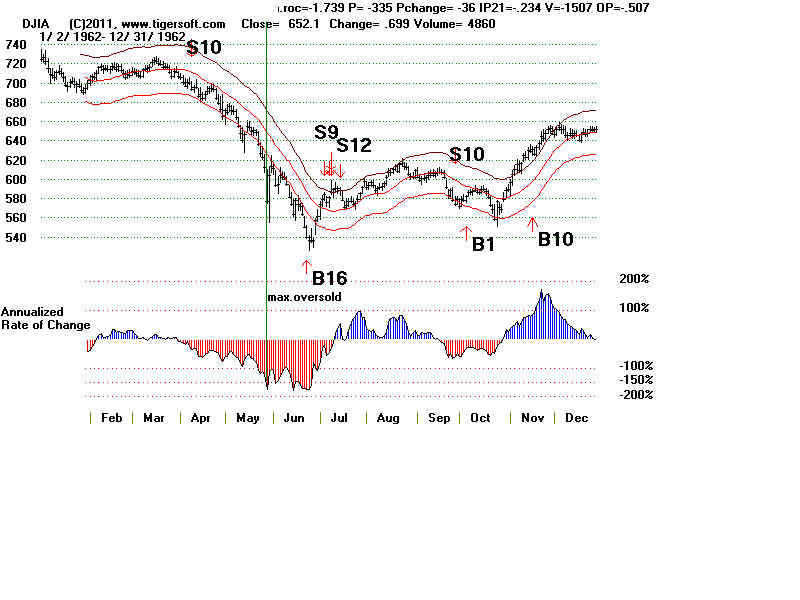

5/28/1962 AROC fell below -1.5 with DJI at 576.90 and

then fell to 538 a month later.

10/16/1987 AROC fell below -1.5 with DJI at 2245.70 and then

fell to 1738 a trading day later.

8/22/1990 AROC fell below -1.5 with DJI at 2560.15 and then

fell to 2360 two months later.

8/31/1998 AROC fell below -1.5 and then built a base for a month

without going lower before rallying.

9/17/2001 AROC fell below -1.5 with DJI at 8920.70 and then

fell to 8100 three trading days later.

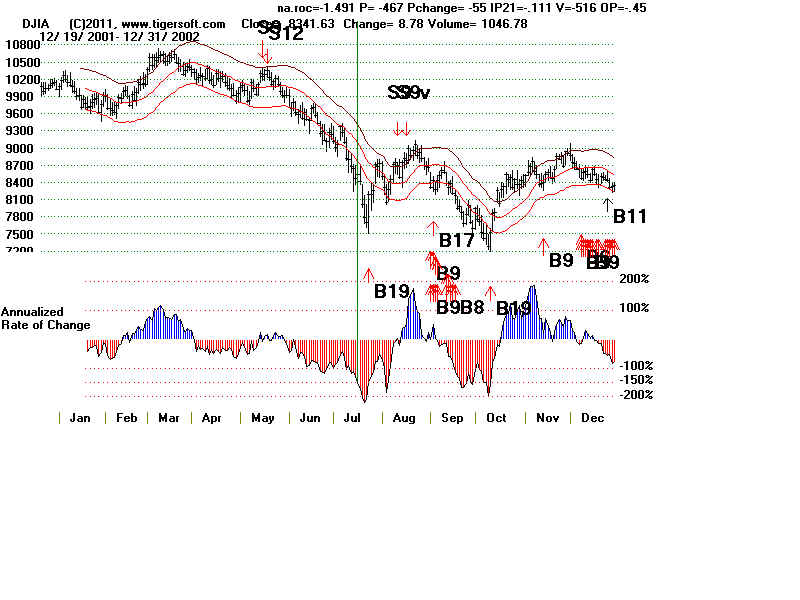

7/17/2002

AROC fell below -1.5 with DJI at 8542.48 and then fell to 7700 three trading days

later.

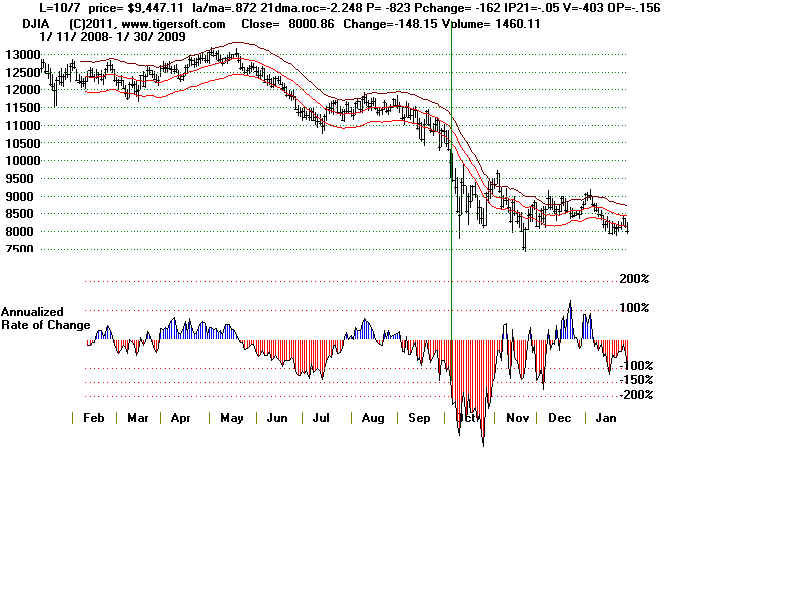

10/7/2008

AROC fell below -1.5 with DJI at 9447.11 and then fell to 7500 seven weeks later.

|

|

|

|

|

|

|

|

|

|

|

|

|