TigerSoft News Service 11/10/2010

Visit our www.tigersoft.com

TigerSoft News Service 11/10/2010

Visit our www.tigersoft.com

What Periods in Past Most Resemble

The Stock Market Now?

The stock market's price action does sometimes repeat quite closely from year to year.

The mini-crashes in the Falls of 1978 and 1979 were my real-time alerts to this. Ten years

after the Ocotber 1987 Crash, there was a mini-Crash in October 1997. Will 2011-2012

bring a repeat ("redux" is the in-word) of 2008-2009?

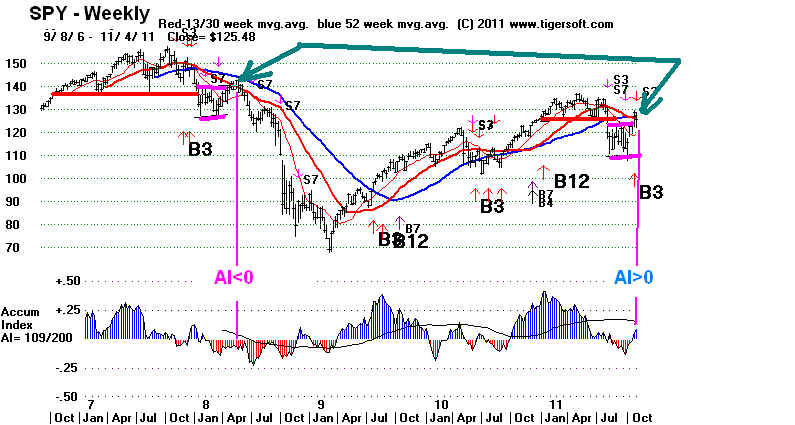

See the weekly SPY (ET for SP-500)..- As it did in June 2009, the SPY has now rallied

to its 52-week ma. In June 2009, it turned down. What will happen in 2011? The rally

has given us a key pivot point to watch. It is not so obvious as a test of a high or a test

of a low, in the Jesse Livermore tradition, but it is an important point to watch the market.

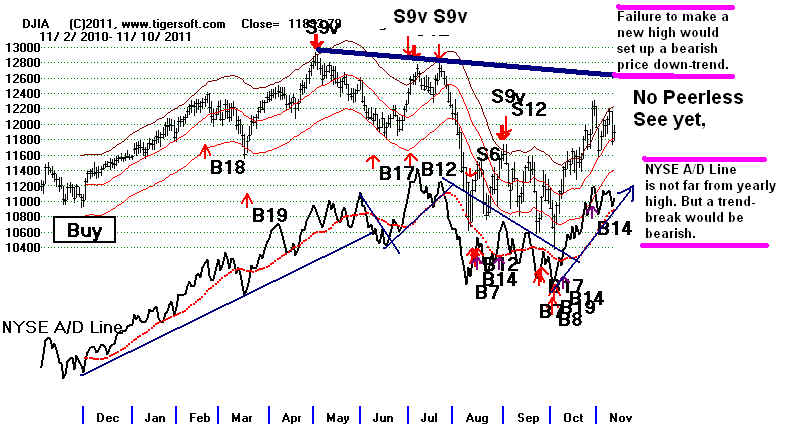

The Tiger Accumulation Index is now positive. The A/D Line (shown) in the daily DJI

chart is stronger now. There is no head/shoulders pattern in the DJI now, as

there was in June 2008. The period after Thanksgiving is normally bullish, whereas,

June is often a bearish month and followed soon afterward by September-October

weakness. And most important, we do not have the fearsomely bearish Sell S9.

2011 DJI, Peerless Signals, NYSE A/D Line

We see no major Sell, no head and shoulders top and the A/D Line is much stronger.

by William Schmidt, Ph.D. (Columbia University)

(C) 2011 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Buy and Holding Is Dangerous: See All The Peerless Real-Time Signals: 1981-2008

|

Tiger

Software Helping Investors since 1981

|

"Hi Bill, Lots of folks have been running charts comparisons to the May peak in 2008

with today. Price action does look very similar, but my glance at the Tiger indicators

shows much more strength today. Any thoughts?"

My friend who sent this email, could have been referring to:

2008 crash deja vu: We'll relive it, and soon

Is 2011 2008 redux?

Market Rumors Attack: 2008 Redux… Bear Stearns to Lehman top ?

Sure Looks Like 2008

2008 Redux? - Playing the Ponzi

2007-2008

My reply

If we got an S9

or even an S12, I would worry about another sell off now..

But a 53% decline like occurred in

2008 would be a stretch. Sounds like far-right

fear-mongering, too. There are big

differences between now and 2008. The A/D Line is

in an uptrend and near its all-time

high. May 2008 was 7 months after the peak in October 2007.

November 2011 is only 3.5 months

after July peak of 2011. The market was made

much more vulnerable in 2008

because leading up to 2007, there had not been a 10%

correction for 53 months straight.

We had been rising since March 2009, 28 months,

half the time, in July 2011, when

the market turned down. The rise from March 2009

to July 2011, saw two corrections

deeper than 10%.

So what is our closest

parallel? My

three favorites...

November 1934 - Bull Market of 1935-1937 lay ahead.

November 1934, following a

9-month 20% decline, which came after a recovery that more

than doubled the low made in the

1929-1932 Crash with high unemployment still everywhere,

as now, the market was setting up

superior gains to be made in 1935 and 1936. Breadth is

better now, in that the NYSE A/D

Line than in Nov-Dec 1934, in that it is now much close to its

12 month highs. See the

current DJI chart with the NYSE A/D Line at the top of this page.

1934

December 1971 - Bull Market of 1972 lay ahead.

December

1971. 1969-1970 brought a deep bear market, 70-71 saw a recovery

and

then 16% correction, much

like we saw the DJI fall in July and August 2011. As now, the next year

was a Presidential Election

year. Nixon got Arthur Burns, the Fed Chairman, to lower interest

rates to accommodate his

re-election needs for 1972. As a result, the DJI rose gradually in 1972

and did not decline

deeply.until after the Presidential Election of November 1972 was past

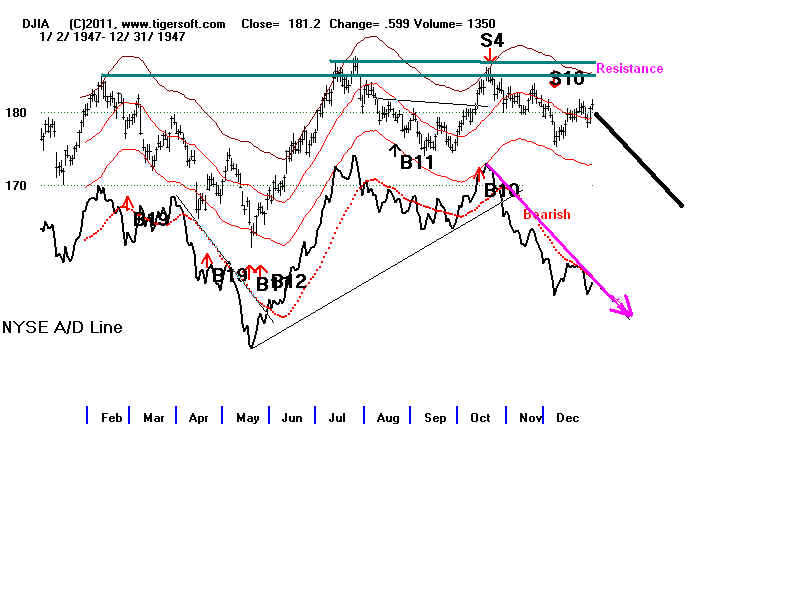

October 1947. - 15% Trading Range set

up by break in A/D Line

uptrend and Peerless Sells.

October 1947. 1946 saw a bad sell-off but the 1947

recovery stalled out short of the highs

just below 200 several

times. This is like the DJI which may stall out on a fourth attempt to

get past 12800.

In 1948, Truman called the then Republican controlled Congress "do nothings",

like Obama does

now. After the DJI failed to surpass 200, the NYSE A/D Line broke its uptrend-

line in October and

sold off to test its yearly lows. The result was a 10% decline from the

October

1948 peak, after which

another rally back to 200 began.