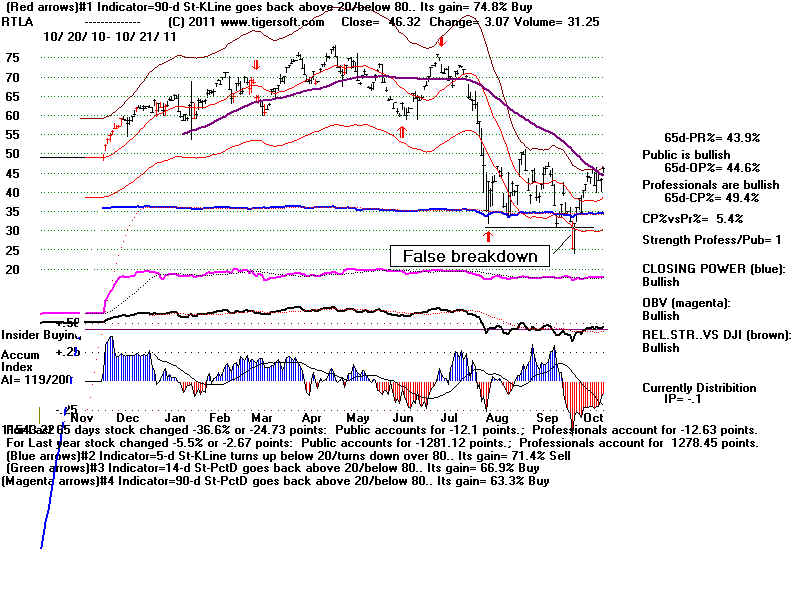

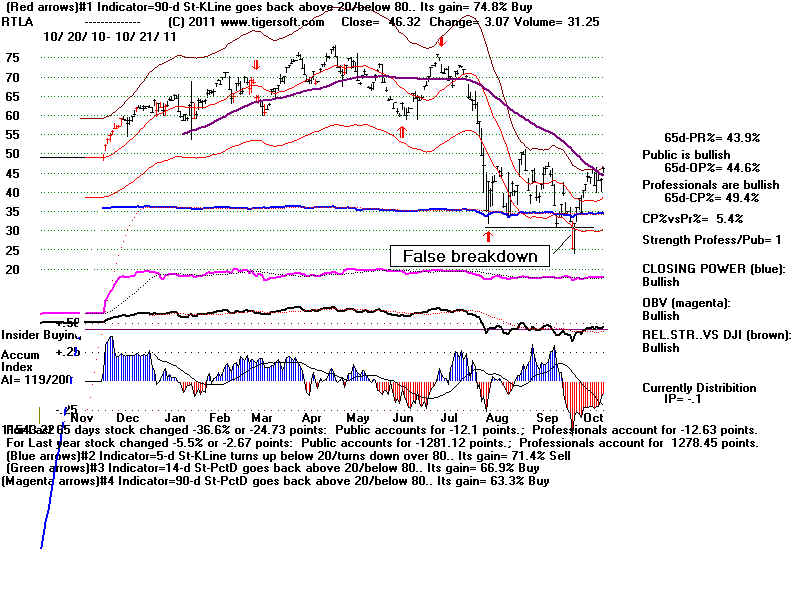

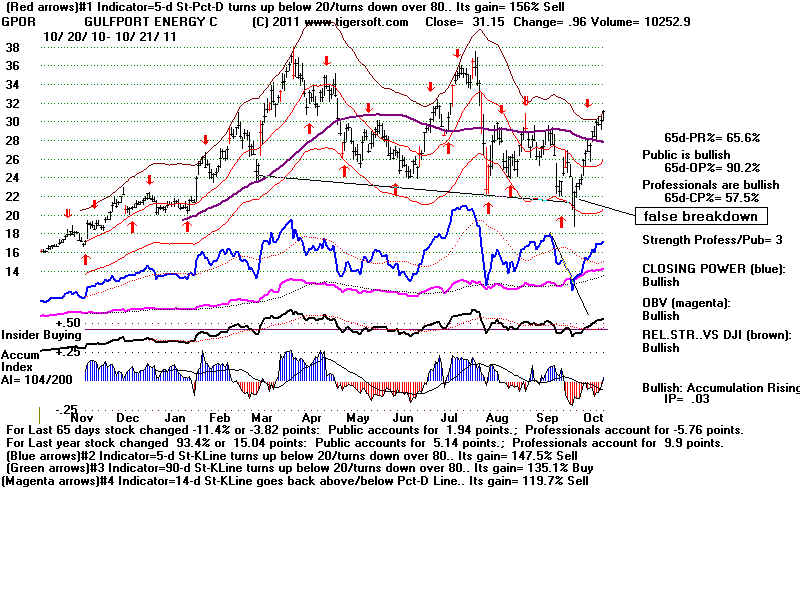

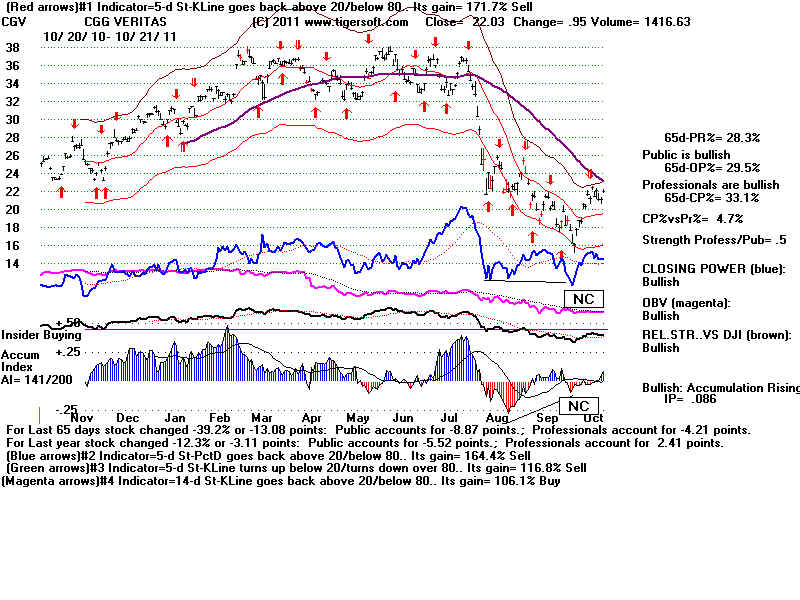

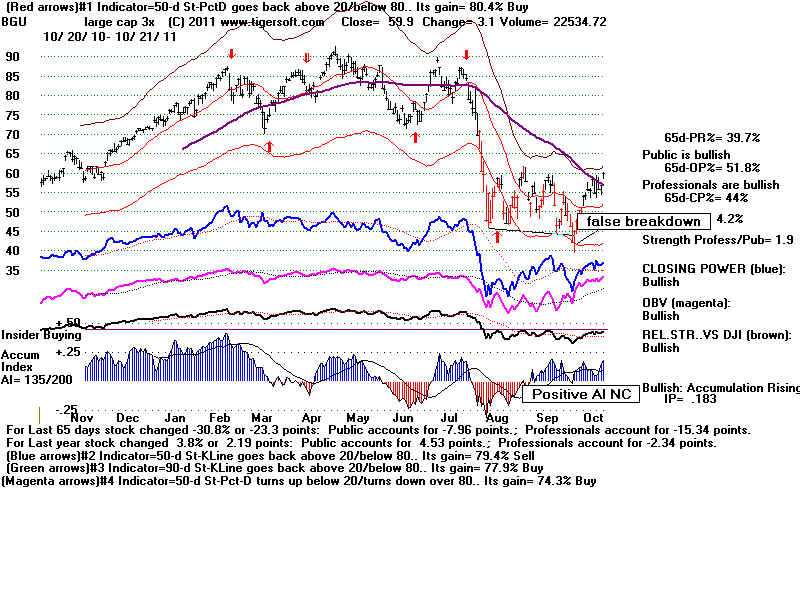

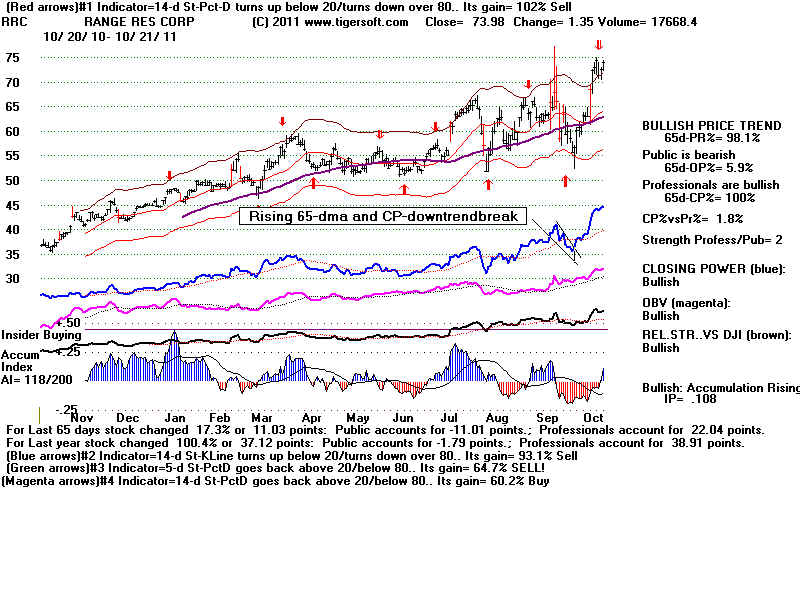

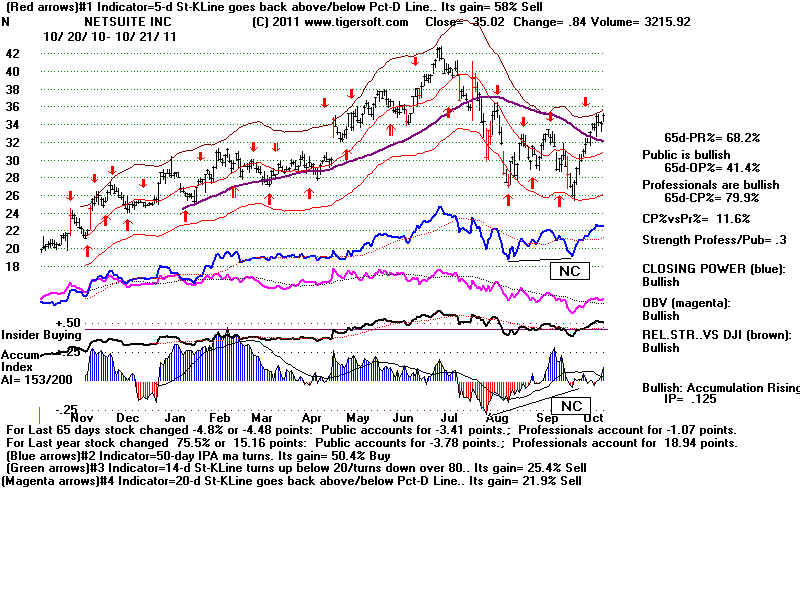

| TigerSoft: Best Stock Recoveries from 10-4-2011 Bottom. Many of the same technical characteristics repeat. Oversold Oil Stock - down more than 50% from year's high. ERX, ERX, OAS, WLL, TRAK, CGV, IOC, DIG, KNXA, CNH, CRZO Leveraged ETF ERX, MWJ, TQQQ Failure to make a new low in September SCSS, TQQQ Professional Buying great exceeds Public's B7s SCSS, BXUB Positive Accumulation on new lows. OAS, TKLC, BGU, TQQQ, BXUB, DRN Buy B7 - Extreme CP divergence from Opening Power HAYN False breakdown and quick recovery SCSS. RTLA, TRAK GPOR, MWJ, TSO, BGU, BXUB Accumulation (IP21) Index and CP NCs OAS, TRAK, GPOR, CGV. IOC , DIG, CRZO, HAYN, N, DRN Quick to get above 65-dma ERX, OAS, RTLA, TSO, TQQQ Gap and high volume breakout above 65-dma or flat resistance. SCSS, TKLC Rising 65-dma and CP Downtrend-Break RRC |

| Days back= 13

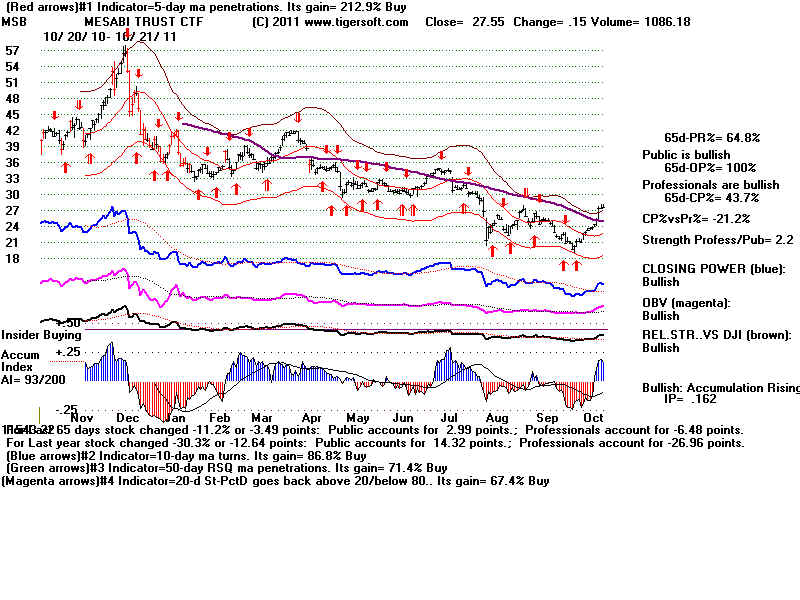

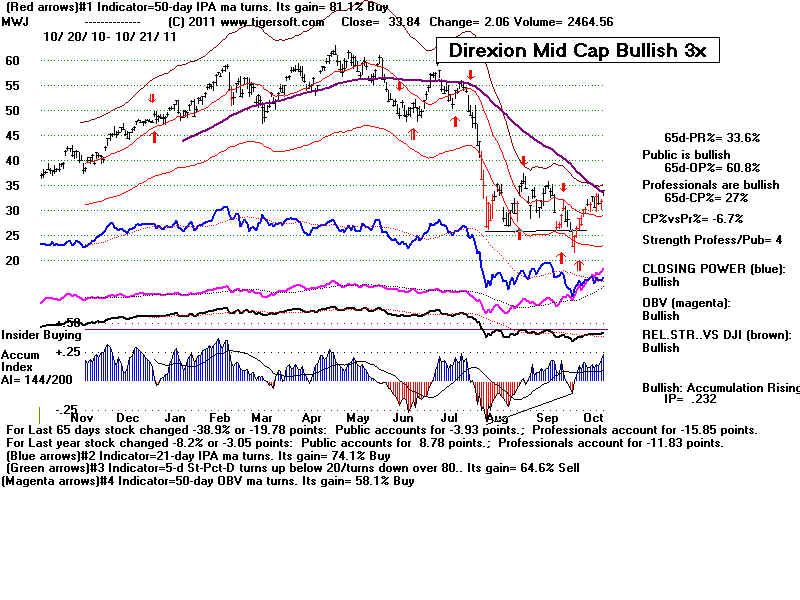

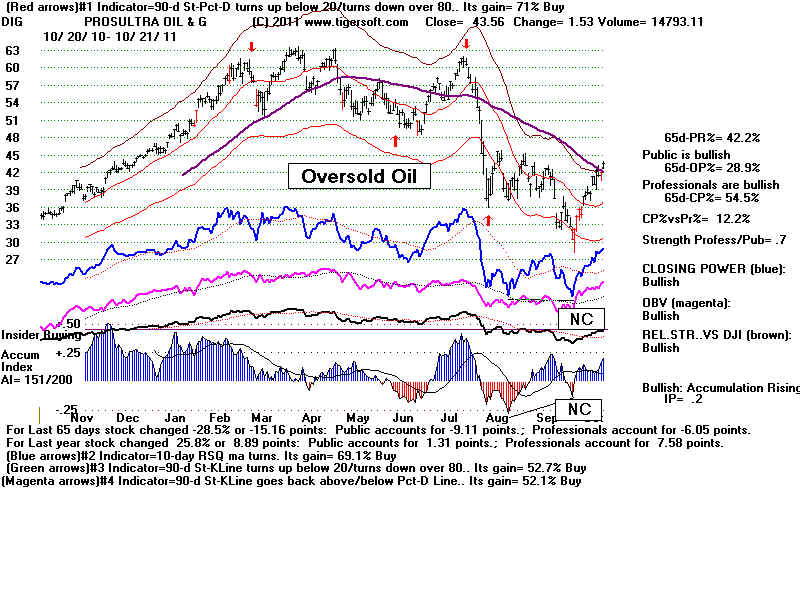

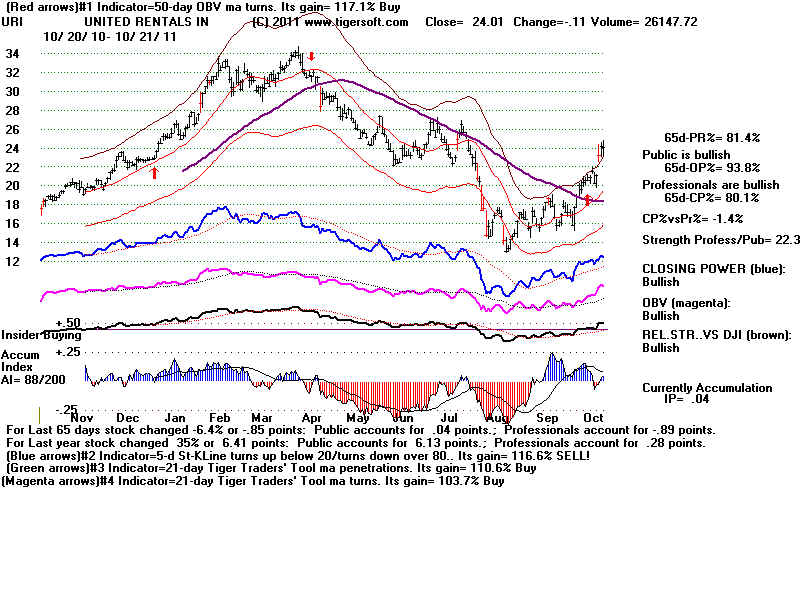

10 / 4 / 2011 - 10 / 21 / 2011 Rank Pct Gain Symbol Name Price ==================================================================== 1 68% CPX COMPLETE PROD SVC 31.03 Extra sell-off from false-breakout sellers. 2 60% SCSS SELECT COMFORT CO 21.57 Sept fails to make a new low. Professional Buying - Buy B7 Quick to get back above 65-dma Flat resistance breahout above right shoulder Gap and red high volume on breakout past 16.5. 3 54% ERX DIREXION ENERGY Bull 3x 47.16 Sept low barely conformed by CP and AI-IP21 NC 4 51% CETV CENTRAL EUROPEAN 11.07 Very oversold- Break in CP downtrend. 5 50% OAS OASIS PETROLEUM 31.4 Sept low not conformed by CP and Positive AI-IP21. Quick to get back above 65-dma 6 48% TKLC TEKELEC 9.15 Heavy Accumulation just before reversal. Decisive breakout past 65-dma. 7 46% CWEI CLAYTON WILLIAMS 59.86 6-month breaks in CP, OBV, REL-STR downtrends. - By itself, this does not explain size of move. 8 45% RTLA --- 46.32 False Breakdown and quick recovery. 9 40% WLL WHITING PETE CORP 4 6. Oversold (75 to 30) Oil Stock 10 39% TRAK DEALERTRACK HOLD. 20.75 False Breakdown and AI NC. 11 38% GPOR GULFPORT ENERGY C 31.15 False Breakdown and CP downtrend-break 12 36% CGV CGG VERITAS 22.03 Oversold (38 to 16) Oil Stock, CP and AI NC 13 36% IOC INTEROIL CORP 11. 46. Oversold (80 to 37) Oil Stock, Positive Accumulation on NL 14 36% MSB MESABI TRUST CTF 27.55 Oversold (57 to 20) 15 36% MWJ DIREXION MidCap Bullish 3x 33.84 False breakdown and AI NC 16 36% TSO TESORO CORP 26.4 False breakdown, CP down trend-break and quick surpassing of 65-dma 17 35% DIG PROSULTRA OIL & G 43.56 Oversold (63 to 30) Oil Stock, CP and Accumulation NC 18 35% URI UNITED RENTALS IN 24.01 19 34% PXP PLAINS EXPL&PROD 29.11 Oil Stock 20 33% BGU LARGE CAP 3x 59.9 False breakdown and Posiitve AI NC 21 33% KNXA KENEXA CORPORATIO 21.02 Oversold (32 to 14) Oil Stock 22 32% CNH CNH GLOBAL NV 32.43 Surpassed 65-dma on Friday Oversold (54 to 24) Oil Stock 23 31% . CRZO CARRIZO OIL & GAS 26.13 Oversold (44 to 20) Oil Stock Oil Stock AI NC 24 31% HAYN HAYNES INTERNATIO 57.79 AI NC, CP-Buy B7s and break in CP downtrend. 25 30% BRY BERRY PETROLEUM C 46.17 Oil Stock 26 30% RRC RANGE RES CORP 73.98 Rising 65-dma CP-downtrend break 27 30% TQQQ UltraPro QQQ 75.7 Prices held above August lows. AI-PNC and prices reversed very quickly back above 65-dma Very profitable 50-day Stochastic 28 28% BXUB Barclay Leveraged SP-500 72 Positive Accum NC, CP-NC-Buy B7s and False breakdown 29 27% N NETSUITE INC 35.02 AI and CP NC 30 26% DRN DIREXION REAL ESTATE Bull 3x 47.56 Positive Accum NC, CP-NC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|