TigerSoft New Service 10/11/2010

TigerSoft New Service 10/11/2010 Make Money. Use TigerSoft To Track Key Insider Buying and Selling in All Your Stocks

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

TRADING WITH TIGERSOFT

Comments on Some Individual Stocks

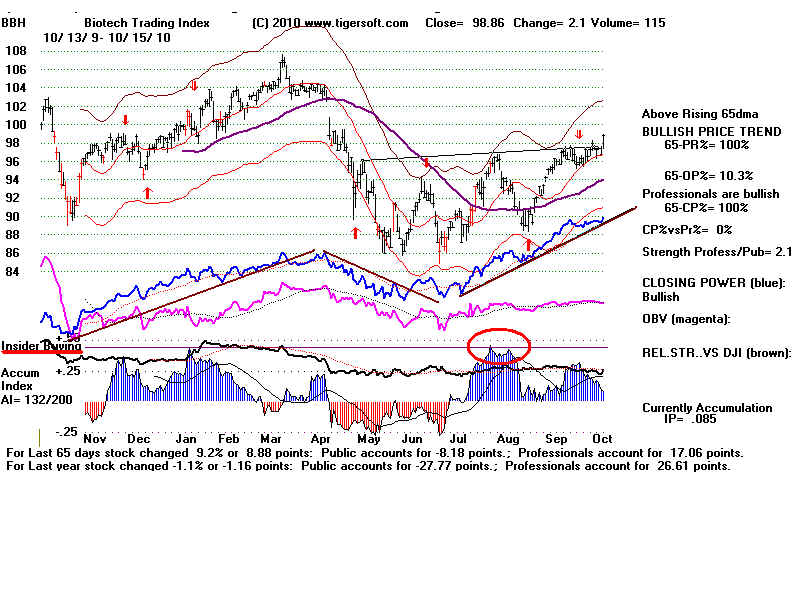

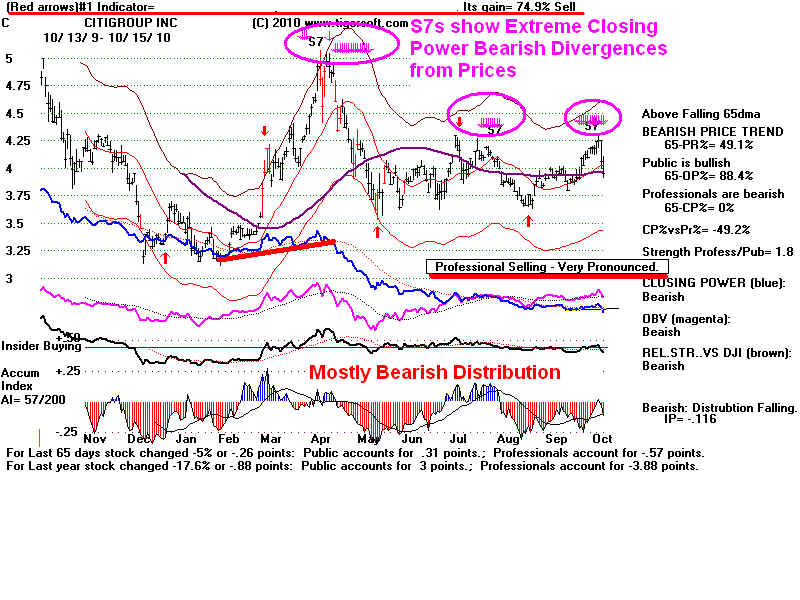

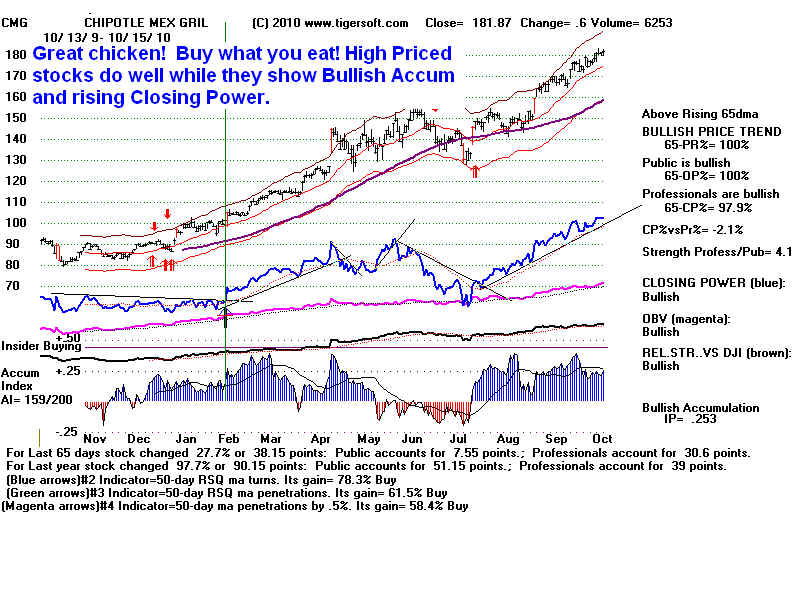

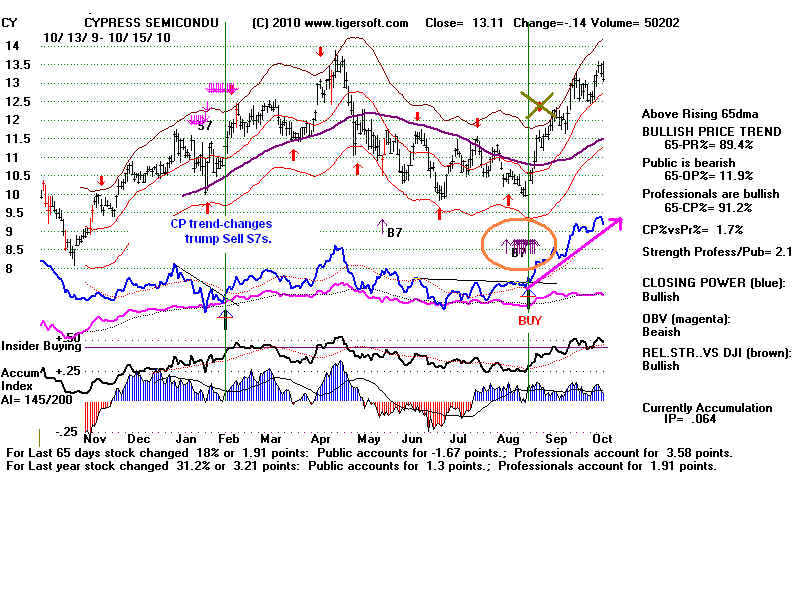

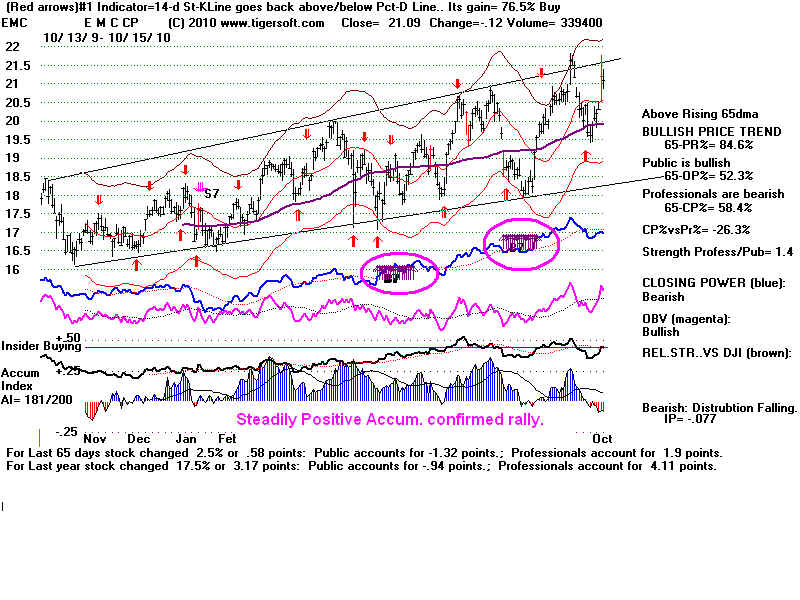

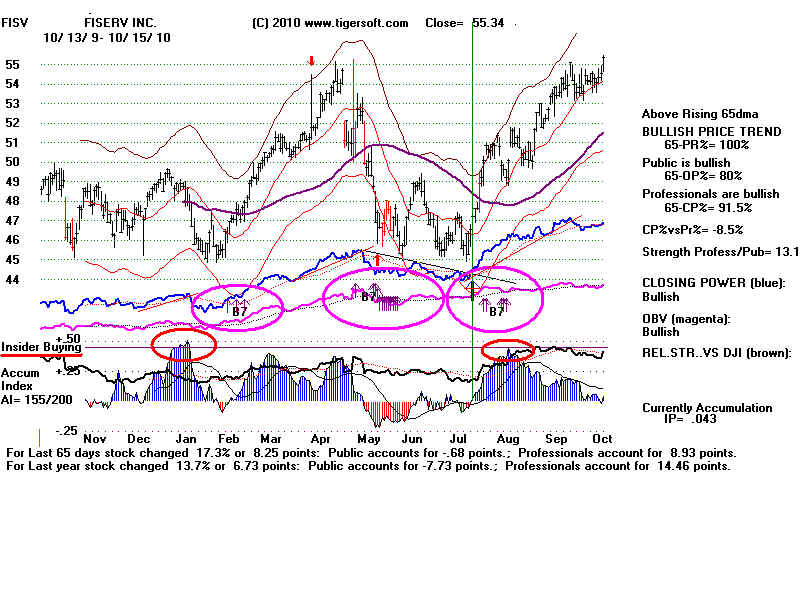

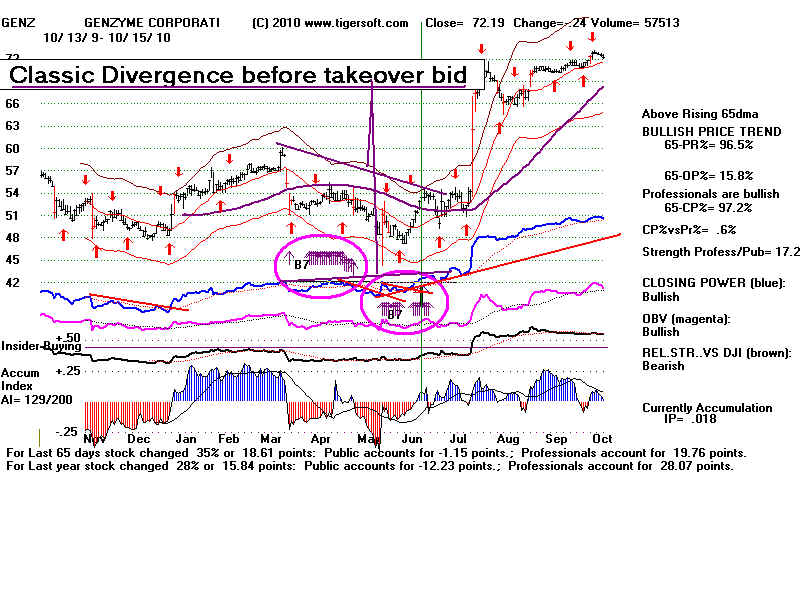

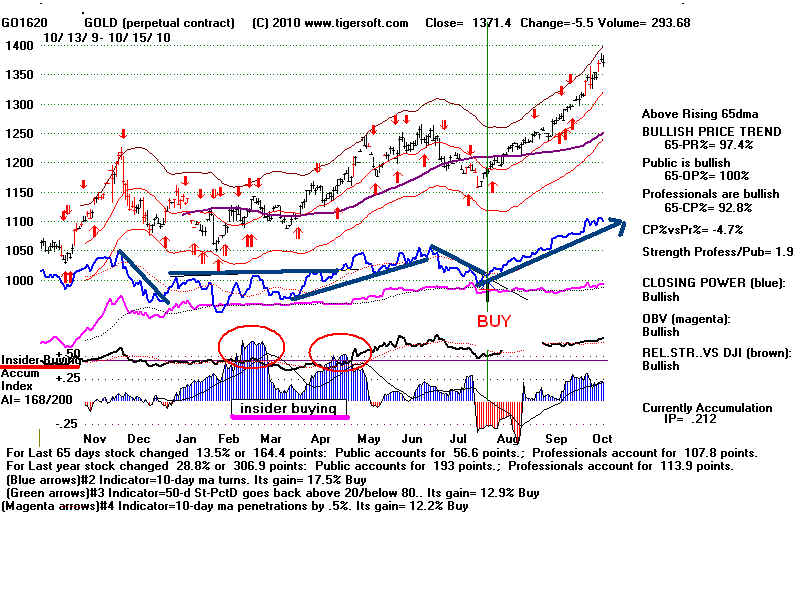

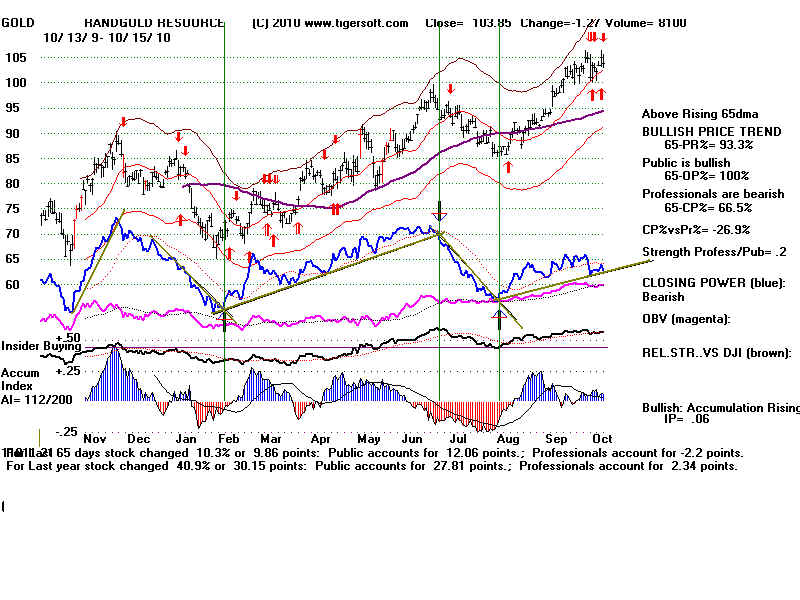

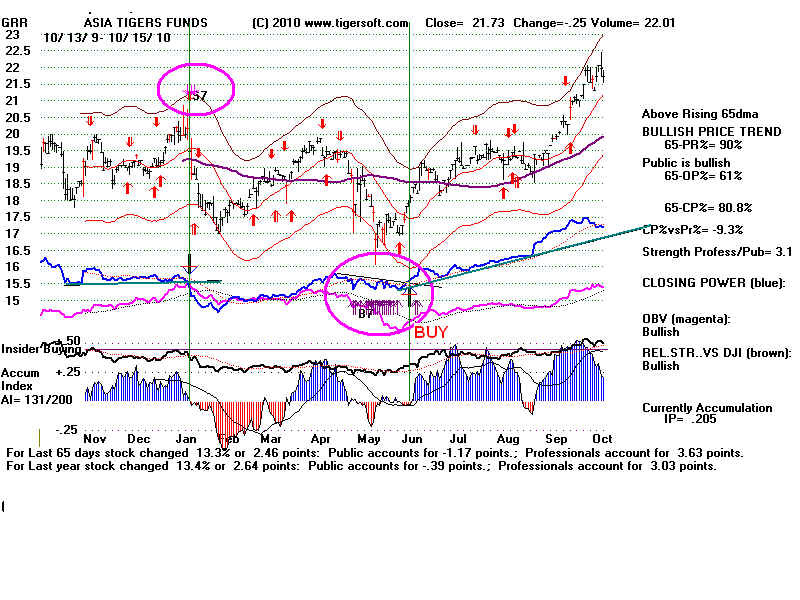

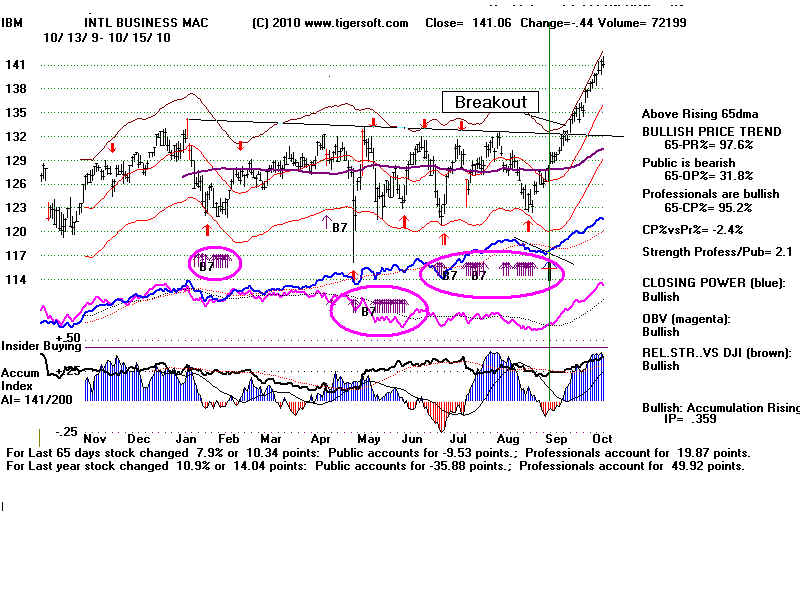

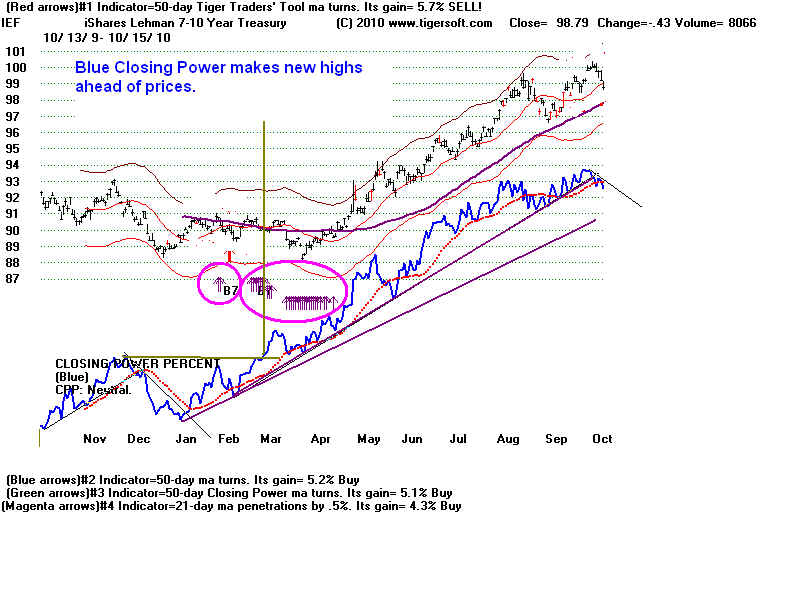

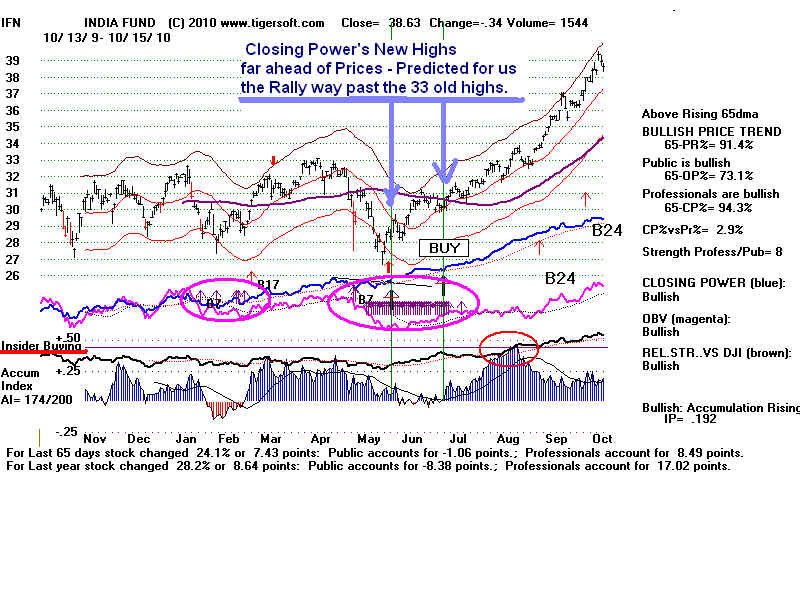

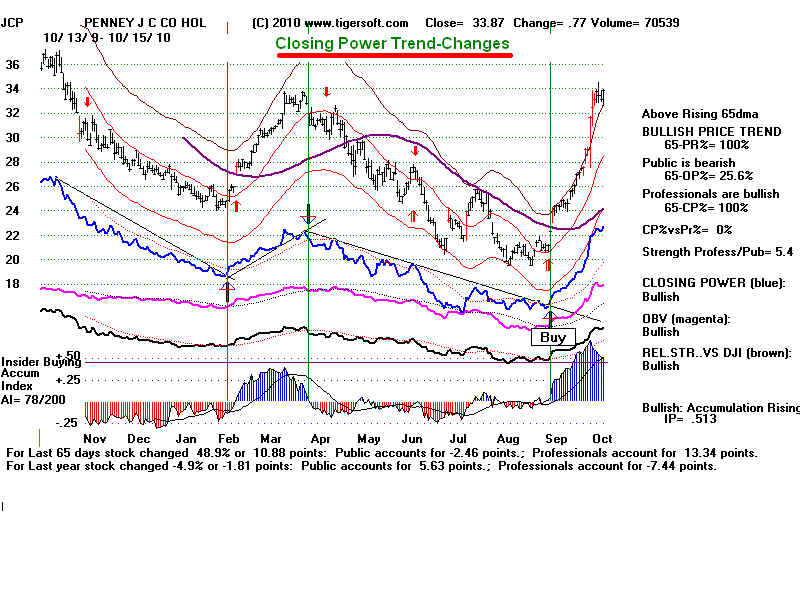

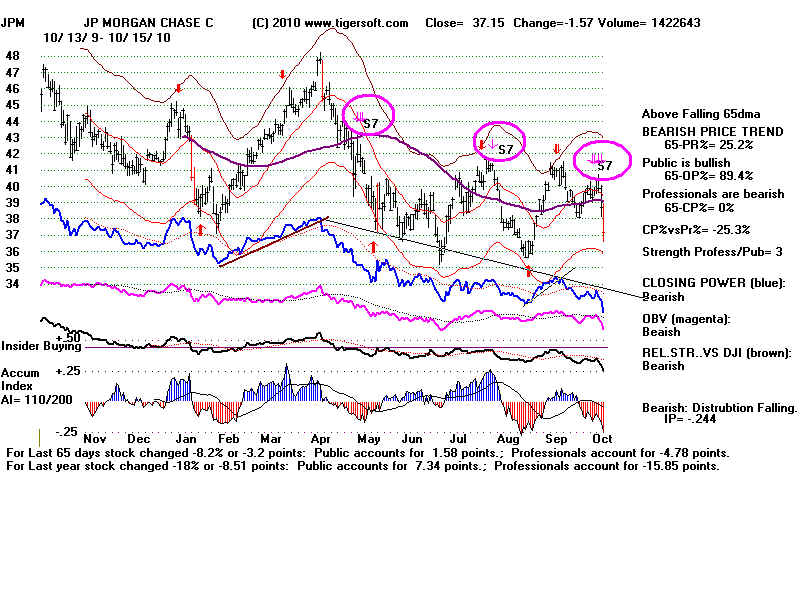

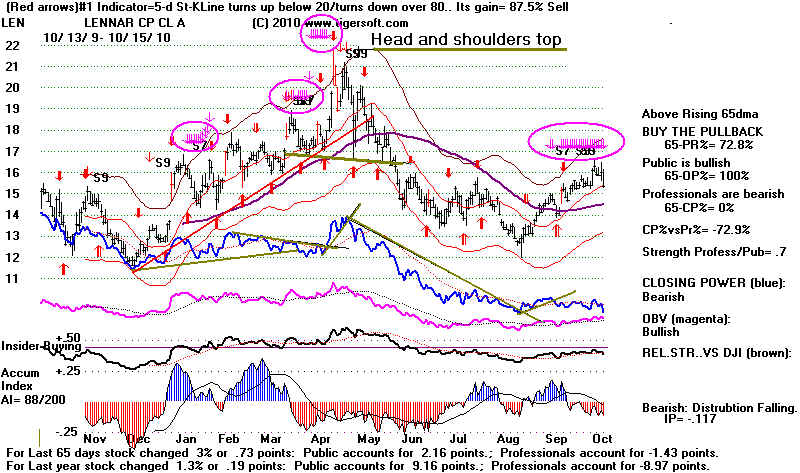

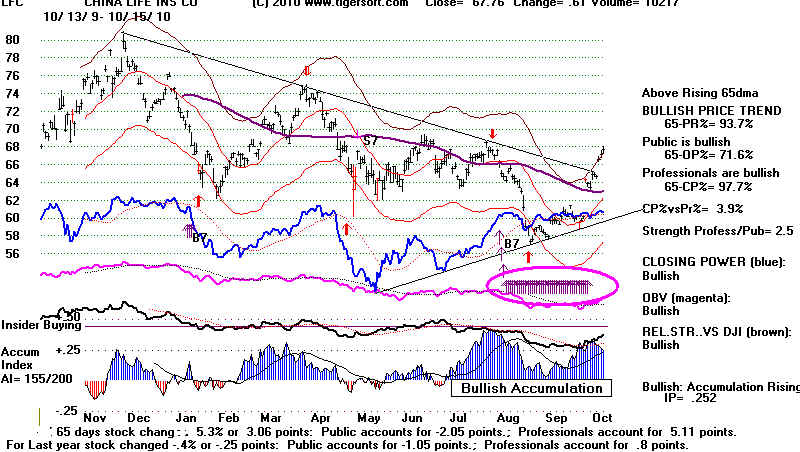

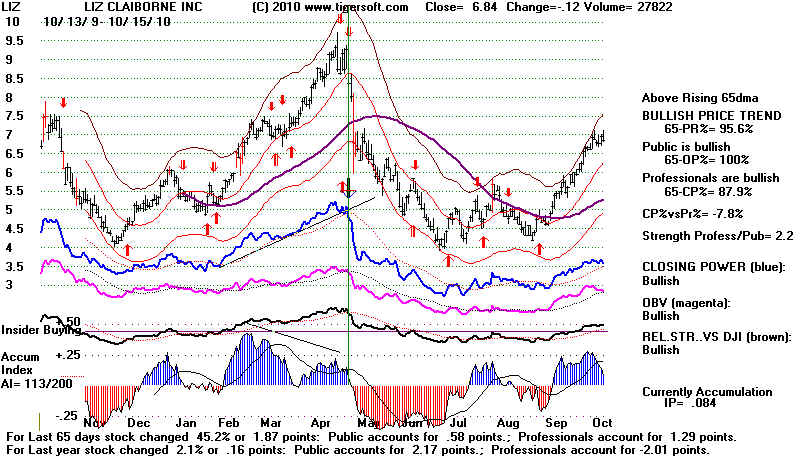

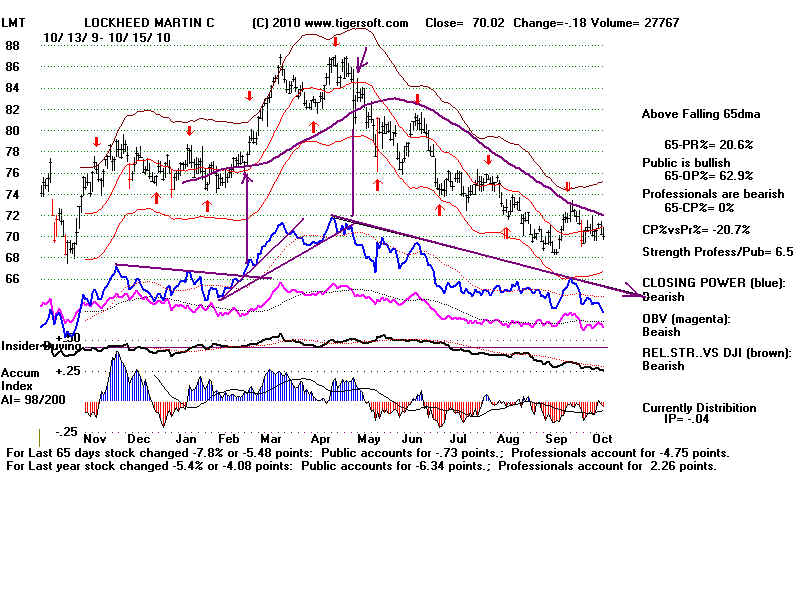

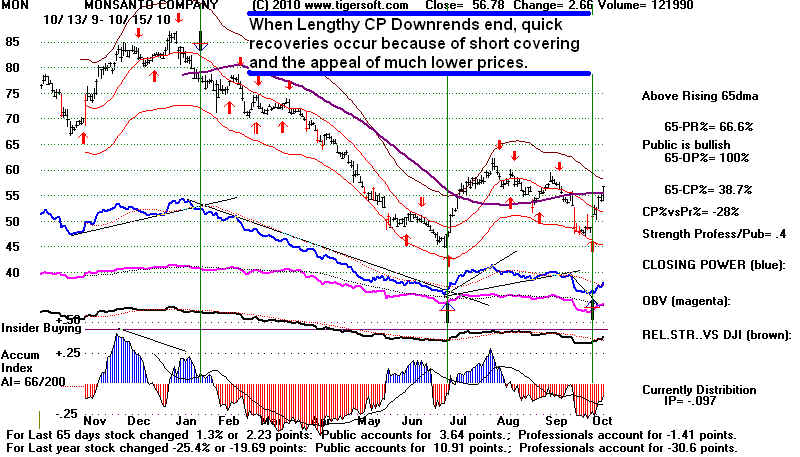

Here we emphasize the new B7s and S7s.

This was done a week ago for Hotline subscribers at

www.tigersoftware.com/TigerBlogs/10-10-2010/index.html

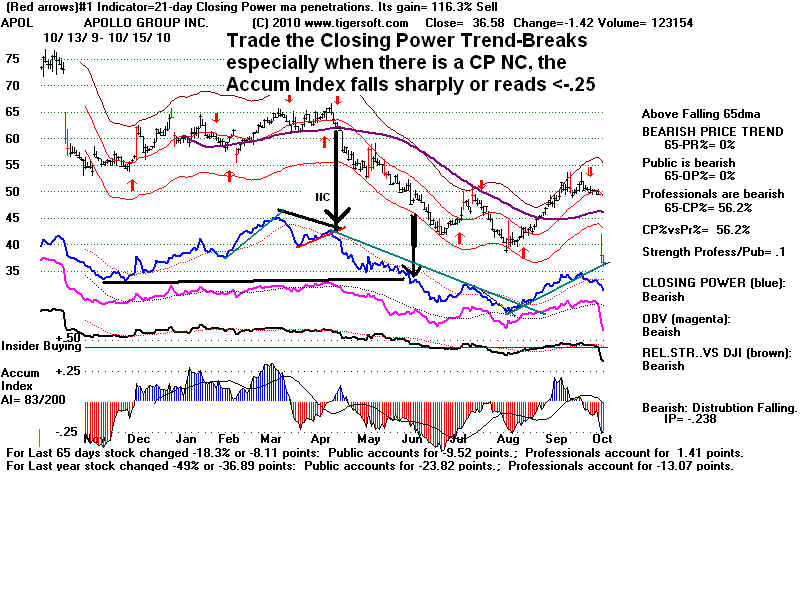

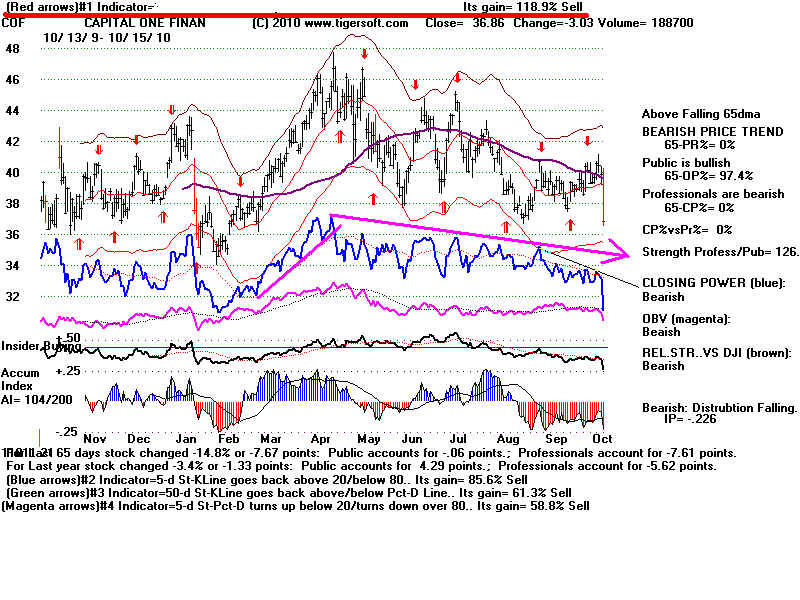

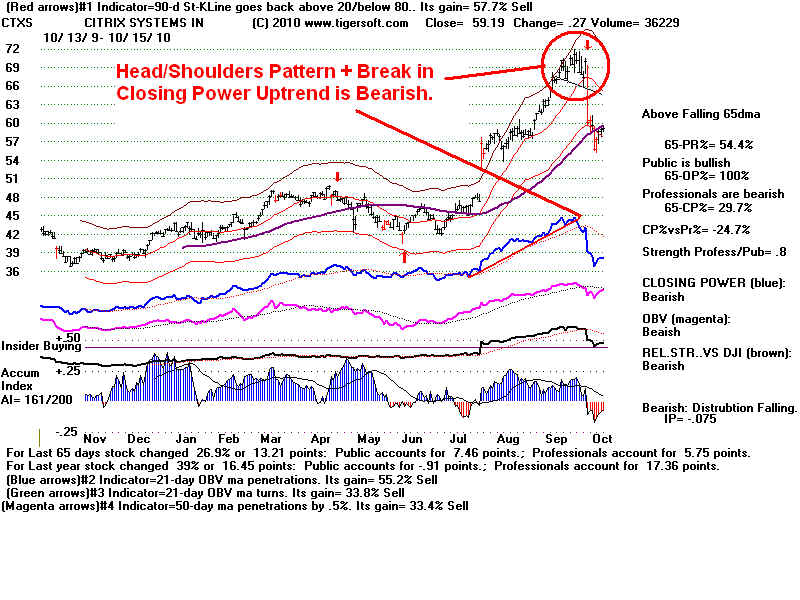

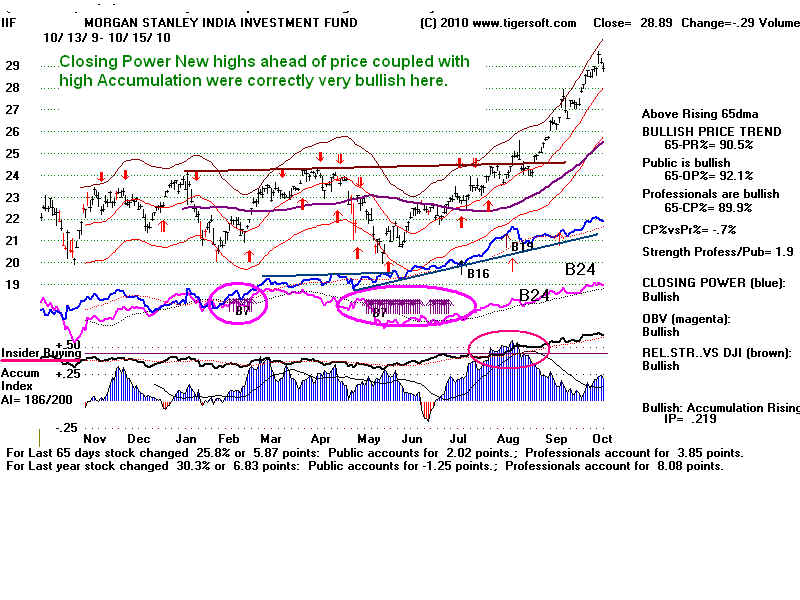

These take place when Closing Power diverges

from price significantly over the last 65 trading days.

These are advisory in the sense that it is usually

best to act when the CP breaks its trend or

when other factors also point out reasons

for a reversal of trend, such as a Sell S9 (negative

Accum. Index on new high) or very positive or

bery negative Accumulation.

The revised display on the right side shows

how far up from the 65-day lows to the 65-day

highs, price, Opening Power and Closing Power

are. These are shown, respectively, by

65-day PR%, 65-day Opwr% and 65-day CPwr%.

Strength Professionals/Public shows how much prices are

moved by openings and closings over the last 65 days. A number

above 1.0 shows professionals are in control. A number below

1.0 shows the public moves stocks more. You can see how much

each moves the stock at the bottom of the new charts.

The Tiger Data page will likely start to offer downloadable directories

containing stocks with recent B7s or S7s, as soon as additional

research is done to see how well we can tighten the parameters

for effective stock trading.

See also the rules for trading Closing Power trendbreaks.

Trading Closing Power Trend-Changes

Rules for Trading with TigerSoft's Closing Power