NEW HOTLINE 2-23-2023 Tiger Software (C) 2023

.

http://www.tigersoftware.com/SAGE22/INDEX.htm

EMAIL us at either wm_tigersoft@yahoo.com or william_schmidt@hotmail.com

==============================================================

New Free Book - Trading SPY with Tigersoft: 1989-2023

http://tigersoftware.com/SPY-book/INDEX.htm

The charts' comments will be expanded more and more over the

next few weeks. I'm hoping that they will show how to use our most

important indicators in conjuntion with the Peerless signals and

the actions by the FED.

The Hotline will be moving to a new location on

Friday

morning.

Please look for the new address in your emails on Wednesday.

If you have changed your email address or do not get our email, please

let me know at william_schmidt@hotmail.com

The Hotline's price is now $480 for a year. To

renew

please send a check to William Schmidt, 5834 Kantor STREET,

San Diego, CA 92122. Visa or MC Credit Cards seem to be

working again. But checks are desired, please. The

banks are

declining too many cards even when the card numbers we enter are correct.

The Data Page for a year is now $240. The Hotline, Data Page and Software

updates are $695 for a year.

==============================================================

Previous Hotlines: www.tigersoftware.com/dante43/INDEX.htm

www.tigersoftware.com/5HLM/INDEX.htm

===================================================================================

Thursday. 2/23 6:12 AM PCT

Futures: DJI +120 NASDAQ +100 Data

Used 2-22-2023:

| |

2-22-2023:

|

|

| |

The 2007

version of Peerless gave a reliable Buy B8 based on the A/D Line failure

to confirms the DJI's new low

and the P-Indicator. But it also warns us to expect

overhead resistance if the

DJI has recently broken below well-defined support. That

tells us the next rally will

have a hard time getting past 33750, especially if up-volume

does not improve markedly.

Today we did get optimized

red short-term Buys on SPY which will be trying to turn up

from its rising 65-dma.

Look for SOXL (semi-condictors, 3x ETF) to try go back to its

recent highs near 19.

Buy SOXL. NVDA's earnings are good and are causing it to be

up 5% at this time.

SOXL has also just given a new red Buy. I would prefer to buy

SOXL. More than 70% of

our list of semi-conductors are still above their

65-dma, but less than 50% of

SPY's are.

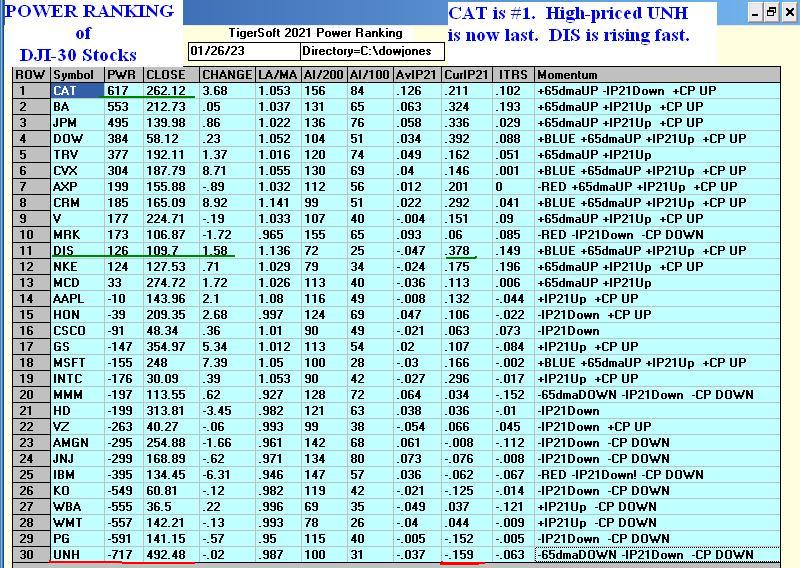

The DJI has a number of weak

components. See below. Only 40% of its components

are above its 65-dma. I

would not buy it until it satisfactorily tests 32500. The high

Accumulation Index with the

DJI is a positive, but in half of the 4 previous cases of the

DJI's IP21 being above .13

and it being DJI 2.8% below the lower band, despite the

positive IP21, it falls

substantially more. (See 1946 and 2002).

Instead of the Day Traders' Tool,

I want to show divergences between Opening

and CLosing Power on our new initial TigerSoft chart.

We have been testing our Day

Traders' tool for the last week or so. See the SPY

book. It is a helpful

short-term tool, especially for day traders. But I think more

useful are comparisions of

the trends for a stock or ETF of the Opening and Closing

Powers. We will try to

add these to the bottom of our primary TigerSOft chart below

Relative Strength and

OBV. See below how bearish it is when the Opening Power

is rising and the Closing

Power is falling. See UNH below and some of the Bearish

MINCPs tonight. A

new way to find these bearish divergences will have to be

programmed and the results

added to the Bearish MINCPs. |

|

| |

Charts - 2/22/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30 Bond Funds

DIA QQQ SPY IWM new - COIN (Bit Coin ETF)

Gold Stocks

Semi Conductors

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

Russell-1000

Insurance-Stocks

Recent 2006 vers-Peerless signals

http://www.tigersoftware.com/OLDPEER/UPD90222.bmp

MDY - http://www.tigersoftware.com/CHARTX/MDY.GIF

USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NAIL NUGT NRGU OIH

PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA USO

China:

YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks AA AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA

BAC BIDU BLDP CAT CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB FSLR

FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX MRK MRNA

MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL REGN REV

SO QCOM QDEL TSLA TXN XOM V VRTX WFC WMT XLE ZM ZOM

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs

www.tigersoftware.com/UPPING/2-22-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/Downing/2-22-2023/BEARISH.htm |

|

|

|

|

|

|

|

|

|

|

|

Table 1 - Daily Breadth and Volume Statistics

| NYSE |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

3,155 |

3,174 |

3,194 |

| Advances |

1,673 |

384 |

1,780 |

| Declines |

1,374 |

2,721 |

1,297 |

| Unchanged |

108 |

69 |

117 |

| New

highs |

32 |

38 |

83 |

| New

lows |

34 |

29 |

7 |

| Adv.

volume* |

451,243,655 |

116,316,598 |

516,972,109 |

| Decl.

volume* |

451,766,849 |

842,793,461 |

304,805,423 |

| Total

volume* |

912,520,292 |

966,100,118 |

831,716,755 |

| Closing

Arms (TRIN)† |

1.08 |

0.86 |

0.73 |

| Block

trades* |

4,263 |

4,583 |

4,473 |

| Adv.

volume |

2,141,010,353 |

574,942,182 |

2,625,091,245 |

| Decl.

volume |

1,891,970,859 |

3,509,647,483 |

1,404,290,655 |

| Total

volume |

4,079,327,971 |

4,121,592,279 |

4,075,983,812 |

| NASDAQ |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

4,752 |

4,762 |

4,797 |

| Advances |

2,164 |

880 |

2,870 |

| Declines |

2,348 |

3,715 |

1,676 |

| Unchanged |

240 |

167 |

251 |

| New

highs |

46 |

50 |

91 |

| New

lows |

122 |

130 |

63 |

| Closing

Arms (TRIN)† |

0.79 |

0.92 |

0.87 |

| Block

trades |

29,524 |

33,582 |

33,599 |

| Adv.

volume |

2,493,299,353 |

1,018,990,912 |

3,333,606,989 |

| Decl.

volume |

2,136,847,412 |

3,947,653,121 |

1,694,530,007 |

| Total

volume |

4,671,277,624 |

5,002,540,609 |

5,056,647,624 |

|

Table 2 QUICKSILVER on ETFS - 2/22/2023 ---

Bullish = 4 -3 FAS , TECL SOXL, CPER

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

================================================================================================

DIA 330.52 -.73 341.66 -157.1% Bullish RED .179 0 --------

---------------------------------------------------------------------------------------------

COMPQX 11507.07 14.77 12070.59 -191.4% Bullish RED .158 .062 .22

---------------------------------------------------------------------------------------------

SPY 398.54 -.55 413.98 -172.7% Bullish RED .174 .029 .203

---------------------------------------------------------------------------------------------

QQQ 294.25 .22 309.1 -206.4% Bullish RED .14 .06 .2

---------------------------------------------------------------------------------------------

MDY 475.24 .59 490.59 -124.8% Bullish BLUE .149 .065 .214

---------------------------------------------------------------------------------------------

IWM 187.94 .51 194.46 -119% Bullish BLUE .182 .063 .245

---------------------------------------------------------------------------------------------

FAS 80.74 -.54 89.5 -481% Bullish RED .194 .083 .277

---------------------------------------------------------------------------------------------

RETL 9.41 .15 11.27 -518% Bullish BLUE .023 .1 .123

---------------------------------------------------------------------------------------------

SOXL 13.83 -.18 17.54 -1084.8% Bullish RED .143 .119 .262

---------------------------------------------------------------------------------------------

TECL 27.94 -.15 33.17 -756.9% Bullish RED .158 .073 .231

---------------------------------------------------------------------------------------------

IBB 129.4 -.24 133.77 -164.9% Bullish RED .155 -.024 .131

---------------------------------------------------------------------------------------------

GLD 169.66 -.96 170.89 -86.1% ------- RED -.01 .043 .033

---------------------------------------------------------------------------------------------

DBO 14.38 -.31 15.14 -271% ------- RED .059 .043 .102

---------------------------------------------------------------------------------------------

OIH 297.75 -8.82 326.13 -514.1% Bullish RED .073 .074 .147

---------------------------------------------------------------------------------------------

CPER 25.32 -.23 24.52 84% Bullish ---- .349 .104 .453

---------------------------------------------------------------------------------------------

TAN 74.09 0 79.04 -159.9% ------- BLUE .103 -.04 .063

---------------------------------------------------------------------------------------------

UUP 28.27 .09 28.07 69.5% ------- BLUE .016 .022 .038

---------------------------------------------------------------------------------------------

CORN 26.54 -.25 26.53 -31.9% Bullish ---- .096 .057 .153

---------------------------------------------------------------------------------------------

WEAT 7.57 -.1 7.82 -256.2% ------- RED .007 .025 .032

---------------------------------------------------------------------------------------------

YINN 46.78 -1.1 52.82 -723.9% ------- RED .071 -.022 .049

|

Table 3

RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

2/22/23

Bullish = 26

Bearish = 20

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 1

HOSPITAL .785 .785 .785 .714 .642 .571

HOMEBLDG .777 .722 .888 .944 .888 .888

JETS .769 .769 .769 .769 .846 .846

COPPER .714 1 1 1 1 .857

GUNS .714 .714 .785 .785 .714 .642

SOFTWARE .714 .678 .732 .767 .785 .75

SEMI .702 .67 .765 .819 .851 .861

=====

INFRA .696 .666 .909 .878 .878 .878

MILITARY .692 .692 .73 .653 .73 .692

GAMING .684 .684 .736 .736 .736 .736

GREEN .666 .444 .722 .666 .722 .722

ELECTRON .654 .624 .751 .781 .812 .804

COMPUTER .65 .55 .65 .65 .65 .55

AUTO .641 .641 .773 .773 .754 .754

NIFTY .636 .59 .75 .75 .84 .795

TRANSP .631 .684 .789 .789 .842 .789

NASD-100 .63 .62 .71 .7 .78 .73

=====

HIGHPRIC .623 .627 .74 .731 .779 .766

INDEXES .6 .621 .675 .681 .713 .718

INSURANC .6 .64 .68 .68 .68 .72

CHEM .581 .558 .72 .72 .744 .72

RUS-1000 .573 .581 .694 .705 .753 .735

=====

BIGBANKS .571 .571 .857 .857 .857 .857

HACKERS .562 .562 .562 .625 .625 .625

FINANCE .512 .562 .737 .725 .737 .762

==============================================================================================

BEVERAGE .5 .428 .357 .357 .571 .428

COAL .5 .5 .5 .833 .833 .5

INDMATER .5 .513 .638 .652 .68 .638

=============================================================================================

FIDSTKS .485 .485 .591 .615 .656 .644

SP500 .469 .495 .614 .616 .688 .676

=====

ETFS .454 .563 .69 .763 .781 .781

LOWPRICE .441 .461 .51 .504 .541 .538

REIT .43 .484 .692 .73 .776 .784

RETAIL .425 .446 .638 .595 .702 .638

BIOTECH .423 .434 .556 .508 .531 .536

CHINA .409 .454 .568 .727 .772 .704

DOWJONES .4 .433 .566 .5 .533 .533

=====

REGBANKS .4 .4 .44 .44 .52 .48

SP-100 .388 .433 .544 .533 .566 .622

FOOD .367 .367 .469 .428 .53 .632

COMODITY .358 .333 .487 .435 .512 .589

OILGAS .323 .361 .38 .476 .542 .628

SOLAR .312 .125 .312 .437 .562 .437

MARIJUAN .2 .2 .2 .2 .2 .2

UTILITY .184 .184 .263 .184 .184 .131

DJI-13 .153 .153 .384 .384 .307 .307

BONDFUND .126 .137 .31 .356 .712 .77

GOLD .108 .13 .26 .239 .26 .347

|

===================================================================================

Wed. 2/22 6:02 AM PCT Futures: DJI +56 NASDAQ +34 Data Used

2-21-2023:

| |

2-21-2023:

|

|

| |

The DJI finally broke

down below the 33550 support that it has repeatedly

tested recently. That will

very likely be the new resistance if there is a recovery.

The DJI broke below its 65-dma today.

Breadth was bad; there were 2721 decliners

on the NYSE. Just 53% of all

stocks and ETFs are now above their 65-dma. The

reason for the extreme weakness is said

to be traders' fear that a growing number

of voting FOMC members are eager to hike

interest rates to 5%, but perhaps

much higher. The FOMC's minutes are

expected to also show a growing number

of FOMC members are willing to raise

rates by 1/2% or even 3/4% in February.

Both dividend and growth tech stocks were

hit by more than 2%

today. There may be no escape-group

if rates soar beyond 5%. If you go

through our charts, you will see those

with head/shoulders patterns to frighten

traders fared the worse.

That we may actually see an up-opening

today is short-term auspicious.

But I'm not sure Professionals are ready

to turn the market back up by much.

It would seem safer to wait for a decline

to the lower 3.5% band before

buying.

The break in the A/D Line uptrend has

been a key warning of impending weakeness

for some time, certainly ever since the

Jobs market report of the first Friday

was so positive. But we have been

concerned by the weak OBV Lines for

the SPY, OEX and NYSE, too. Without

volume to eat up the overhead supply

of stock, a breakout up from the recent

trading range seemed less likely than

a breakdown. That the DJI's price

range was so narrow and had so many reversals

gave us a way to reckon that the lower

band would have to be tested.

The DJI is now 2.2% below the 21-day ma.

A decline to the lower 3.5%

now seems likely. But note how

positive the Accumulation Index still is. That

means the lower band should find good

support. It is at that point, we will resume

buying a major market ETF, probably SPY.

|

|

| |

Charts - 2/21/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30 Bond Funds

DIA QQQ SPY IWM new - COIN (Bit Coin ETF)

Gold Stocks

Semi Conductors

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

Russell-1000

Insurance-Stocks

Recent 2006 vers-Peerless signals

http://www.tigersoftware.com/OLDPEER/UPD90221.bmp

MDY - http://www.tigersoftware.com/CHARTX/MDY.GIF

USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NAIL NUGT NRGU OIH

PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA USO

China:

YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks AA AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA

BAC BIDU BLDP CAT CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB FSLR

FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX MRK MRNA

MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL REGN REV

SO QCOM QDEL TSLA TXN XOM V VRTX WFC WMT XLE ZM ZOM

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs

www.tigersoftware.com/UPPING/2-21-2023/Bullish.htm

Bearish MINCPs

www.tigersoftware.com/Downing/2-21-2023/BEARISH.htm |

|

|

|

|

|

|

|

|

|

|

|

Table 1 - Daily Breadth

and Volume Statistics.

| NYSE |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

3,174 |

3,155 |

3,196 |

| Advances |

384 |

1,309 |

1,483 |

| Declines |

2,721 |

1,713 |

1,574 |

| Unchanged |

69 |

133 |

139 |

| New

highs |

38 |

61 |

102 |

| New

lows |

29 |

10 |

12 |

| Adv.

volume* |

116,316,598 |

370,439,463 |

406,667,738 |

| Decl.

volume* |

842,793,461 |

543,469,907 |

408,752,011 |

| Total

volume* |

966,100,118 |

929,039,222 |

833,908,294 |

| Closing

Arms (TRIN)† |

0.86 |

1.32 |

0.81 |

| Block

trades* |

4,583 |

4,551 |

4,124 |

| Adv.

volume |

574,942,182 |

1,451,071,658 |

2,060,295,306 |

| Decl.

volume |

3,509,647,483 |

2,507,934,695 |

1,771,869,612 |

| Total

volume |

4,121,592,279 |

4,045,483,609 |

3,929,202,033 |

| NASDAQ |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

4,762 |

4,712 |

4,752 |

| Advances |

880 |

2,336 |

2,109 |

| Declines |

3,715 |

2,127 |

2,409 |

| Unchanged |

167 |

249 |

234 |

| New

highs |

50 |

88 |

86 |

| New

lows |

130 |

76 |

83 |

| Closing

Arms (TRIN)† |

0.92 |

1.38 |

0.64 |

| Block

trades |

33,582 |

35,534 |

31,940 |

| Adv.

volume |

1,018,990,912 |

2,157,595,033 |

2,858,962,187 |

| Decl.

volume |

3,947,653,121 |

2,716,501,341 |

2,097,172,205 |

| Total

volume |

5,002,540,609 |

4,925,238,527 |

5,032,435,049 |

|

Table 2 QUICKSILVER on ETFS - 2/21/2023 ---

Bullish = 8 -4 COMPQX, MDY, IWM, FAS , TECL

SOXL, TEXL, CPER

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

================================================================================================

DIA 331.25 -7.04 341.14 -166.1% Bullish RED .205 0 ----

---------------------------------------------------------------------------------------------

COMPQX 11492.3 -294.97 11960.15 -167.7% Bullish RED .197 .064 .261

---------------------------------------------------------------------------------------------

SPY 399.09 -8.17 412.64 -167.2% Bullish RED .209 .031 .24

---------------------------------------------------------------------------------------------

QQQ 294.03 -7.13 306.75 -171.7% Bullish RED .176 .064 .24

---------------------------------------------------------------------------------------------

MDY 474.65 -11.77 487.35 -127.7% Bullish RED .224 .064 .288

---------------------------------------------------------------------------------------------

IWM 187.43 -5.7 192.51 -133.9% Bullish RED .21 .059 .269

---------------------------------------------------------------------------------------------

FAS 81.28 -5.23 89.07 -516.3% Bullish RED .218 .087 .305

---------------------------------------------------------------------------------------------

RETL 9.26 -1.59 10.5 -593.8% ------- RED .072 .096 .168

---------------------------------------------------------------------------------------------

SOXL 14.01 -1.49 17.33 -725.3% ------- RED .202 .213 .415

---------------------------------------------------------------------------------------------

TECL 28.09 -2.15 32.65 -664.8% Bullish RED .195 .121 .316

---------------------------------------------------------------------------------------------

IBB 129.64 -3.72 133.77 -170.1% Bullish RED .199 -.018 .181

---------------------------------------------------------------------------------------------

GLD 170.62 -.64 172.61 -54.2% ------- RED .056 .041 .097

---------------------------------------------------------------------------------------------

DBO 14.69 -.03 15.19 -159.6% ------- RED .04 .043 .083

---------------------------------------------------------------------------------------------

OIH 306.57 -5.91 330.72 -381.9% Bullish RED .093 .101 .194

---------------------------------------------------------------------------------------------

CPER 25.55 .49 24.9 167.1% Bullish ---- .377 .114 .491

---------------------------------------------------------------------------------------------

TAN 74.09 -1.61 76.53 -194.4% ------- RED .109 -.04 .069

---------------------------------------------------------------------------------------------

UUP 28.18 .09 27.88 50% ------- ---- -.007 .008 .001

---------------------------------------------------------------------------------------------

CORN 26.79 .15 26.71 3.8% Bullish BLUE .111 .057 .168

---------------------------------------------------------------------------------------------

WEAT 7.67 -.11 7.97 -203.3% ------- RED -.013 .027 .014

---------------------------------------------------------------------------------------------

YINN 47.88 -1.81 54.24 -749.2% Bearish RED .091 .086 .177

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

2/21/23

Bullish = 27

Bearish = 21

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COPPER 1 1 1 1 .857 .857

EDU 1 1 1 1 1 1

HOSPITAL .785 .785 .714 .642 .571 .571

JETS .769 .769 .769 .846 .846 .846

HOMEBLDG .722 .888 .944 .888 .888 .944

GUNS .714 .785 .785 .714 .642 .785

MILITARY .692 .73 .653 .73 .692 .73

GAMING .684 .736 .684 .789 .736 .736

TRANSP .684 .789 .789 .842 .789 .842

SOFTWARE .678 .75 .767 .785 .75 .767

SEMI .67 .765 .819 .851 .851 .84

----

INFRA .666 .909 .878 .878 .878 .848

AUTO .641 .792 .773 .754 .735 .792

INSURANC .64 .68 .68 .68 .72 .92

HIGHPRIC .627 .74 .731 .779 .761 .783

ELECTRON .624 .751 .781 .812 .796 .804

INDEXES .621 .675 .681 .713 .708 .724

NASD-100 .62 .71 .7 .78 .72 .75

-----

NIFTY .59 .75 .75 .84 .772 .772

RUS-1000 .581 .694 .705 .753 .732 .745

-----

BIGBANKS .571 .857 .857 .857 .857 .857

ETFS .563 .69 .763 .781 .8 .818

FINANCE .562 .737 .725 .725 .75 .762

HACKERS .562 .562 .625 .625 .625 .625

CHEM .558 .72 .72 .744 .72 .72

COMPUTER .55 .65 .65 .65 .6 .65

INDMATER .513 .638 .652 .68 .652 .638

===============================================================================================

COAL .5 .5 .833 .833 .5 .333

===============================================================================================

SP500 .495 .614 .618 .684 .672 .698

-----

FIDSTKS .485 .591 .615 .656 .639 .668

REIT .484 .684 .738 .784 .776 .853

LOWPRICE .461 .512 .507 .541 .538 .535

CHINA .454 .568 .727 .772 .704 .772

RETAIL .446 .638 .595 .702 .638 .659

GREEN .444 .722 .666 .722 .722 .666

BIOTECH .434 .553 .511 .531 .534 .568

DOWJONES .433 .566 .5 .533 .5 .566

-----

SP-100 .433 .544 .533 .566 .6 .611

BEVERAGE .428 .357 .357 .571 .428 .428

REGBANKS .4 .44 .44 .52 .48 .48

FOOD .367 .469 .408 .53 .632 .591

OILGAS .361 .38 .476 .542 .6 .58

COMODITY .333 .487 .41 .512 .589 .538

MARIJUAN .2 .2 .2 .2 .2 .2

UTILITY .184 .263 .184 .184 .131 .21

DJI-13 .153 .384 .384 .307 .307 .461

BONDFUND .137 .31 .356 .712 .793 .793

GOLD .13 .26 .239 .26 .347 .304

SOLAR .125 .312 .437 .562 .437 .5

|

====================================================================================

Tues

2/21 6:00AM PCT Futures: DJI -280 NASDAQ -118

Data Used 2-17-2023:

| |

2/17/2023

|

|

| |

Peerless, the

rising Closing Powers and seasonality tell us to expect any decline

now to be contained by the DJI's

lower band and 32500. Over and over, when

one goes back and looks at the

Opening and Closing Power trends and compares

their slope when they diverge, one

sees the Professionals' Closing Power win the

"tug of war". But

there are two cases, shown below, one in 2011 and one in 2019,

when the SPY fell 10% and 5% in the

direction called by the falling Opening Power.

That could happen here, especially

if FOMC members start talking more about 3/4%

rate hikes or Putin tries to scare

the West with atomic sabre-rattling.

If the Closing Powers' uptrends in

the ETFs and stocks below break their uptrends,

it will look like the two bearish

scenario will play out and the DJI will have to fall to

its lower band. That will

probably drop NVDA another 10% and may cause CAT to

break its neckline support..

But let's see if Professionals, as represented by what happens

after the opening, step up and

support the market. From our very positive Accumulation

readings, I would have to expect

the lower band to hold. But a test of the lower band,

which we have been warning about,

does seem to lie ahead given the break in the

A/D Line.

Take a look at the new book I am

working on for trading SPY using Peerless

and Tiger. It shows the

power of Peerless and our Closing Power, as well

as head/shoulder tops and

flat-topped breakouts. It shows that declines to

the lower band with the

Accumulation Index very positive, like now, are reliably

bullish at that point. And it

shows that rising Day Traders' Tool trends usually

mean higher prices short-term.

But it also shows that this Indicator is best used

by day-traders. It has a

downward-sloping bias that makes it far too cautious

if our other indicators and signals

are bullish. Another onservation emerges from

the book, namely that Closing Power

trend-breaks after a CP non-firmation are

reliably bearish. The reverse

is bullish, but is uncommon. The pink warning

down-arrows warn us when the

Closing Power is weaken that prices, but that

by itself does not constitute a

Sell. A breakout from a flat-top trumps short-term

divergences. But be alert for

false breakouts in these cases. |

|

| |

Charts - 2/17/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30 Bond Funds

DIA QQQ SPY IWM new - COIN (Bit Coin ETF)

Gold Stocks

Semi Conductors

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

Russell-1000

Insurance-Stocks

Recent 2006 vers-Peerless signals

http://www.tigersoftware.com/OLDPEER/UPD90217.bmp

MDY - http://www.tigersoftware.com/CHARTX/MDY.GIF

USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NAIL NUGT NRGU OIH

PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA USO

China:

YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks AA AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA

BAC BIDU BLDP CAT CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB FSLR

FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX MRK MRNA

MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL REGN REV

SO QCOM QDEL TSLA TXN XOM V VRTX WFC WMT XLE ZM ZOM

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs

www.tigersoftware.com/UPPING/2-17-2023/Bullish.htm

Bearish MINCPs

www.tigersoftware.com/Downing/2-17-2023/BEARISH.htm |

|

|

|

2 cases when Opening Power wins their battle with Closing Power:

10% SOY decline in mid 2011 and 5% decline in 2019

|

Current SPY, QQQ, etc.

|

|

|

|

|

|

|

|

|

|

Table 1 - Daily Breadth

and Volume Statistics

| NYSE |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

3,155 |

3,174 |

3,185 |

| Advances |

1,309 |

800 |

1,611 |

| Declines |

1,713 |

2,264 |

1,460 |

| Unchanged |

133 |

110 |

114 |

| New

highs |

61 |

80 |

42 |

| New

lows |

10 |

15 |

15 |

| Adv.

volume* |

370,439,463 |

217,896,100 |

463,218,833 |

| Decl.

volume* |

543,469,907 |

627,499,312 |

382,886,488 |

| Total

volume* |

929,039,222 |

858,027,332 |

854,346,415 |

| Closing

Arms (TRIN)† |

1.32 |

0.89 |

1.10 |

| Block

trades* |

4,551 |

4,286 |

4,556 |

| Adv.

volume |

1,451,071,658 |

1,156,162,770 |

1,933,410,992 |

| Decl.

volume |

2,507,934,695 |

2,903,611,066 |

1,921,136,685 |

| Total

volume |

4,045,483,609 |

4,143,662,176 |

3,891,524,118 |

| NASDAQ |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

4,712 |

4,807 |

4,773 |

| Advances |

2,336 |

1,521 |

1,918 |

| Declines |

2,127 |

3,045 |

2,584 |

| Unchanged |

249 |

241 |

271 |

| New

highs |

88 |

96 |

61 |

| New

lows |

76 |

67 |

82 |

| Closing

Arms (TRIN)† |

1.38 |

1.28 |

1.17 |

| Block

trades |

35,534 |

34,544 |

31,007 |

| Adv.

volume |

2,157,595,033 |

1,437,678,055 |

1,864,212,577 |

| Decl.

volume |

2,716,501,341 |

3,684,986,926 |

2,936,247,513 |

| Total

volume |

4,925,238,527 |

5,159,416,186 |

4,885,033,078 |

|

Table 2 - QUICKSILVER on ETFS - 2/17/2023

--- Bullish = 12 COMPQX, SPY, QQQ, MDY, IWM, FAS, RETL, TECL

SOXL (highest - +.586)

TEXL, IBB, CPER

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

================================================================================================

DIA 338.29 .9 342.55 -6.5% Bullish BLUE .289 0 ------

---------------------------------------------------------------------------------------------

COMPQX 11787.27 -68.56 11891.79 29.1% Bullish BLUE .286 .065 .351

---------------------------------------------------------------------------------------------

SPY 407.26 -1.02 412.83 -9.5% Bullish BLUE .304 .029 .333

---------------------------------------------------------------------------------------------

QQQ 301.16 -2.14 304.5 24% Bullish BLUE .258 .064 .322

---------------------------------------------------------------------------------------------

MDY 486.42 -.64 487.11 52.4% Bullish BLUE .282 .068 .35

---------------------------------------------------------------------------------------------

IWM 193.13 .53 192.6 73.2% Bullish BLUE .33 .067 .397

---------------------------------------------------------------------------------------------

FAS 86.51 -.05 90.41 -60.9% Bullish BLUE .299 .118 .417

---------------------------------------------------------------------------------------------

RETL 10.85 .12 10.54 458.2% ------- BLUE .169 .259 .428

---------------------------------------------------------------------------------------------

SOXL 15.5 -.78 16.42 -90% ------- RED .269 .317 .586

---------------------------------------------------------------------------------------------

TECL 30.24 -1.18 32.34 -79.5% Bullish RED .259 .167 .426

---------------------------------------------------------------------------------------------

IBB 133.36 1.27 134.18 37.5% Bullish BLUE .276 -.005 .271

---------------------------------------------------------------------------------------------

GLD 171.26 .51 172.48 -61% ------- BLUE .083 .034 .117

---------------------------------------------------------------------------------------------

DBO 14.72 -.27 15.17 -174.9% ------- BLUE .09 .001 .091

---------------------------------------------------------------------------------------------

OIH 312.48 -14.97 331.44 -254.7% Bullish RED .148 .072 .22

---------------------------------------------------------------------------------------------

CPER 25.06 .05 24.72 129.5% Bullish BLUE .415 .081 .496

---------------------------------------------------------------------------------------------

TAN 75.7 -.53 77.08 -11.7% ------- BLUE .17 -.048 .122

---------------------------------------------------------------------------------------------

UUP 28.09 -.02 27.9 19.7% Bearish RED -.066 -.019 -.085

---------------------------------------------------------------------------------------------

CORN 26.64 .14 26.77 -3.8% ------- ---- -.035 .037 .002

---------------------------------------------------------------------------------------------

WEAT 7.78 -.01 7.99 -139% Bullish ---- .055 .044 .099

---------------------------------------------------------------------------------------------

YINN 49.69 -3.32 55.84 -323.3% Bullish RED .181 .035 .216

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

2/17/23

Bullish = 37

Bearish = 11

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COPPER 1 1 1 .857 .857 .857

EDU 1 1 1 1 1 1

INFRA .909 .878 .878 .878 .848 .848

HOMEBLDG .888 .944 .888 .888 .944 .888

=====

BIGBANKS .857 .857 .857 .857 .857 .857

=====

AUTO .792 .792 .754 .735 .792 .735

TRANSP .789 .789 .842 .789 .842 .789

GUNS .785 .785 .714 .642 .785 .714

HOSPITAL .785 .714 .642 .571 .571 .571

JETS .769 .769 .846 .846 .846 .846

SEMI .765 .819 .851 .851 .829 .829

=====

ELECTRON .751 .781 .812 .796 .796 .796

NIFTY .75 .75 .84 .772 .818 .75

SOFTWARE .75 .785 .785 .75 .767 .767

HIGHPRIC .74 .731 .779 .761 .787 .722

FINANCE .737 .725 .725 .737 .775 .737

GAMING .736 .684 .736 .789 .736 .631

MILITARY .73 .653 .73 .692 .73 .692

GREEN .722 .666 .722 .722 .666 .555

CHEM .72 .72 .744 .72 .72 .674

NASD-100 .71 .7 .78 .72 .76 .67

=====

RUS-1000 .694 .705 .753 .732 .749 .702

=====

ETFS .69 .763 .781 .8 .836 .763

REIT .684 .73 .792 .784 .853 .8

INSURANC .68 .68 .68 .72 .88 .8

INDEXES .675 .681 .713 .708 .729 .74

COMPUTER .65 .65 .65 .6 .7 .65

INDMATER .638 .652 .68 .652 .638 .638

RETAIL .638 .595 .702 .638 .659 .574

SP500 .614 .618 .686 .668 .709 .643

=====

FIDSTKS .591 .615 .656 .639 .68 .633

CHINA .568 .727 .772 .704 .772 .727

DOWJONES .566 .5 .533 .5 .6 .466

=====

HACKERS .562 .625 .625 .625 .625 .625

BIOTECH .553 .508 .534 .534 .562 .534

SP-100 .544 .533 .566 .6 .622 .533

LOWPRICE .512 .51 .544 .538 .538 .558

===========================================================================================

COAL .5 .833 .833 .5 .333 .5

===========================================================================================

COMODITY .487 .41 .487 .589 .538 .538

FOOD .469 .408 .51 .632 .591 .571

REGBANKS .44 .44 .52 .48 .48 .48

DJI-13 .384 .384 .307 .307 .461 .307

OILGAS .38 .476 .542 .6 .58 .58

BEVERAGE .357 .357 .571 .428 .428 .357

SOLAR .312 .437 .562 .437 .5 .375

BONDFUND .31 .356 .712 .793 .827 .781

UTILITY .263 .184 .184 .131 .21 .131

GOLD .26 .239 .26 .347 .326 .391

MARIJUAN .2 .2 .2 .2 .2 .2

|

===================================================================================

Friday 2/17: 5:45 AM Futures: DJI -165 NASDAQ -109

Data Used 2-16-2023:

| |

2/16/2023

|

|

| |

Talk of

a 1/2% jump in rates within the FED hierarchy spooked the market,

as did a big jump in

one of the key inflation indicators, the Producer Price

Index. Thursday's

431 point DJI decline did drop the DJI 6 points below

its key 65-dma.

This is apt to bring an additional decline to its 3-week

low just above 35500.

Down-day volume within the recent trading range

has consistently been

above up-day volume. So, all the narrow backing and filling

and the prospects of

more rate hikes could bound to bring a decline

by the DJI to its lower

band. But with the P-Indicator and Accumulation

Index positive,

Peerless will probably give a Buy signal at that point. And

we can take new long

positions in the major market ETFs.

The DJI's weakness

today was concentrated in its highest priced components.

I count 9 individual

DJI stocks over $200/share. These have the most weight.

Six of them (BA, GS,

MSFT, AMGN, UNH and V fell between 3 and 7 points.

MSFT, whose Artifical

Intelligence excitement probably needs to be tempered,

fell the most, 7.17

points and alone caused a hundred point drop in the DJI.

Three other high priced

DJI stocks held up better, including HD +3.9 and

MCD -.73. These

and CAT, which is fending off a head/shoulders top will likely

be the most important

stocks to watch now as the DJI deals with FED

more aggressive

"hawkishness".

All the while the blue

chips and dividend stocks are coping with the FED,

Professionals, as

judged by their Closing Powers' and Day Traders' Tools'

uptrends and recent new

highs, remain bullish. Professionals, as a class, usually

end up being right.

So does the bullish seasonality in the third year. In addition,

Peerless refuses to

give a Sell.

It remains to be seen

if the Monday holiday next week will bring a recovery

today, Friday.

Regardless, I would continue to hold CAT, NVDA and some

of the strongest

Bullish MAXCPs. I would avoid the short side of the market.

|

|

| |

Charts - 2/16/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30 Bond Funds

DIA QQQ SPY IWM new - COIN (Bit Coin ETF)

Gold Stocks

Semi Conductors

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

Russell-1000

Insurance-Stocks

Recent 2006 vers-Peerless signals

http://www.tigersoftware.com/OLDPEER/UPD90216.bmp

MDY - http://www.tigersoftware.com/CHARTX/MDY.GIF

USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NAIL NUGT NRGU OIH

PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA USO

China:

YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks AA AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA

BAC BIDU BLDP CAT CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB FSLR

FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX MRK MRNA

MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL REGN REV

SO QCOM QDEL TSLA TXN XOM V VRTX WFC WMT XLE ZM ZOM

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs www.tigersoftware.com/UPPING/2-16-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/Downing/2-16-2023/BEARISH.htm

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Table 1 - Daily

Breadth and Volume Statistics

| NYSE |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

3,174 |

3,194 |

3,172 |

| Advances |

800 |

1,780 |

807 |

| Declines |

2,264 |

1,297 |

2,253 |

| Unchanged |

110 |

117 |

112 |

| New

highs |

80 |

83 |

87 |

| New

lows |

15 |

7 |

10 |

| Adv.

volume* |

217,896,100 |

516,972,109 |

209,644,983 |

| Decl.

volume* |

627,499,312 |

304,805,423 |

674,580,955 |

| Total

volume* |

858,027,332 |

831,716,755 |

887,518,365 |

| Closing

Arms (TRIN)† |

0.89 |

0.73 |

1.07 |

| Block

trades* |

4,286 |

4,473 |

4,413 |

| Adv.

volume |

1,156,162,770 |

2,625,091,245 |

1,066,333,261 |

| Decl.

volume |

2,903,611,066 |

1,404,290,655 |

3,178,692,598 |

| Total

volume |

4,143,662,176 |

4,075,983,812 |

4,270,207,804 |

| NASDAQ |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

4,807 |

4,797 |

4,767 |

| Advances |

1,521 |

2,870 |

1,348 |

| Declines |

3,045 |

1,676 |

3,190 |

| Unchanged |

241 |

251 |

229 |

| New

highs |

96 |

91 |

93 |

| New

lows |

67 |

63 |

67 |

| Closing

Arms (TRIN)† |

1.28 |

0.87 |

1.07 |

| Block

trades |

34,544 |

33,599 |

38,336 |

| Adv.

volume |

1,437,678,055 |

3,333,606,989 |

1,553,537,385 |

| Decl.

volume |

3,684,986,926 |

1,694,530,007 |

3,933,489,976 |

| Total

volume |

5,159,416,186 |

5,056,647,624 |

5,536,290,050 |

|

Table 2 QUICKSILVER on ETFS - 2/16/2023 ---

Bullish = 12 +3 COMPQX, SPY, QQQ, MDY, IWM, FAS, RETL,

SOXL (highest - +.54)

,TEXL, OIH, CPER, YINN

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

================================================================================================

DIA 337.39 -4.27 338.73 4.6% Bullish RED .23 0 -----

---------------------------------------------------------------------------------------------

COMPQX 11855.83 -214.76 11718.12 27.9% Bullish RED .245 .063 .308

---------------------------------------------------------------------------------------------

SPY 408.28 -5.7 408.04 14.5% Bullish RED .248 .03 .278

---------------------------------------------------------------------------------------------

QQQ 303.3 -5.8 299.7 26.6% Bullish RED .22 .062 .282

---------------------------------------------------------------------------------------------

MDY 487.06 -3.53 481.32 70.7% Bullish BLUE .248 .07 .318

---------------------------------------------------------------------------------------------

IWM 192.6 -1.86 190.31 69.5% Bullish BLUE .292 .061 .353

---------------------------------------------------------------------------------------------

FAS 86.56 -2.94 87.59 -2.3% Bullish RED .273 .103 .376

---------------------------------------------------------------------------------------------

RETL 10.73 -.54 9.88 252.9% Bullish RED .132 .228 .36

---------------------------------------------------------------------------------------------

SOXL 16.28 -1.26 15.8 -89.6% Bullish RED .239 .301 .54

---------------------------------------------------------------------------------------------

TECL 31.42 -1.75 30.75 21.8% Bullish RED .245 .147 .392

---------------------------------------------------------------------------------------------

IBB 132.09 -1.68 132.36 -11.6% Bullish RED .234 -.017 .217

---------------------------------------------------------------------------------------------

GLD 170.75 -.14 173.36 -66.1% ------- BLUE .097 .046 .143

---------------------------------------------------------------------------------------------

DBO 14.99 -.15 15.25 43% ------- RED .087 -.005 .082

---------------------------------------------------------------------------------------------

OIH 327.45 1.32 329.24 149.2% Bullish BLUE .212 .124 .336

---------------------------------------------------------------------------------------------

CPER 25.01 .49 24.42 52.7% Bullish BLUE .408 .101 .509

---------------------------------------------------------------------------------------------

TAN 76.23 -2.81 75.88 -11% ------- RED .088 -.061 .027

---------------------------------------------------------------------------------------------

UUP 28.11 .04 27.98 39.4% Bearish ---- -.038 -.005 -.043

---------------------------------------------------------------------------------------------

CORN 26.5 -.03 26.66 30.1% ------- BLUE -.103 .041 -.062

---------------------------------------------------------------------------------------------

WEAT 7.79 -.03 8 50.6% Bullish ---- .067 .044 .111

---------------------------------------------------------------------------------------------

YINN 53.01 .19 53.17 -484.7% Bullish BLUE .205 .16 .365

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

2/16/23

Bullish =

Bearish =

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COPPER 1 1 .857 .857 .857 1

EDU 1 1 1 1 1 1

HOMEBLDG .944 .888 .888 .944 .888 .888

=====

INFRA .878 .878 .878 .848 .848 .878

BIGBANKS .857 .857 .857 .857 .857 .857

=====

COAL .833 .833 .5 .333 .5 .333

SEMI .819 .851 .851 .829 .819 .84

====

AUTO .792 .773 .735 .792 .735 .792

TRANSP .789 .842 .789 .842 .842 .789

GUNS .785 .714 .642 .785 .714 .642

SOFTWARE .785 .803 .75 .767 .767 .803

ELECTRON .781 .812 .796 .796 .789 .789

JETS .769 .846 .846 .846 .846 .846

ETFS .763 .781 .8 .836 .781 .8

NIFTY .75 .84 .772 .818 .75 .75

HIGHPRIC .731 .779 .761 .787 .731 .727

REIT .73 .784 .792 .861 .784 .73

CHINA .727 .772 .704 .772 .727 .772

FINANCE .725 .725 .737 .762 .737 .737

CHEM .72 .744 .72 .72 .674 .651

HOSPITAL .714 .642 .571 .571 .571 .571

RUS-1000 .705 .753 .732 .749 .707 .695

====

NASD-100 .7 .78 .72 .76 .69 .68

====

GAMING .684 .736 .736 .789 .684 .578

INDEXES .681 .713 .708 .729 .724 .708

INSURANC .68 .68 .72 .88 .8 .72

GREEN .666 .722 .722 .666 .555 .722

MILITARY .653 .73 .692 .73 .692 .538

INDMATER .652 .68 .652 .638 .638 .583

COMPUTER .65 .65 .6 .7 .65 .6

HACKERS .625 .625 .625 .625 .625 .625

SP500 .618 .686 .67 .704 .655 .627

=====

FIDSTKS .615 .656 .639 .68 .633 .603

RETAIL .595 .702 .638 .659 .595 .574

SP-100 .533 .566 .6 .622 .544 .522

LOWPRICE .51 .547 .541 .538 .555 .558

BIOTECH .508 .531 .536 .562 .534 .562

--------------------------------------------------------------------------------------------

DOWJONES .5 .533 .5 .6 .466 .433

=====

--------------------------------------------------------------------------------------------

OILGAS .476 .542 .6 .58 .571 .419

REGBANKS .44 .52 .48 .48 .48 .44

SOLAR .437 .562 .437 .5 .375 .375

COMODITY .41 .487 .564 .538 .538 .435

FOOD .408 .51 .612 .591 .571 .469

DJI-13 .384 .307 .307 .461 .307 .307

BEVERAGE .357 .571 .428 .428 .357 .428

BONDFUND .356 .712 .793 .827 .793 .885

GOLD .239 .26 .347 .326 .391 .369

MARIJUAN .2 .2 .2 .2 .2 .2

UTILITY .184 .184 .131 .21 .131 .105

|

===================================================================================

Thursday 2/16: 6:00 AM Futures: DJI -276 NASDAQ -182

Data Used 2-15-2023:

| |

2/15/2023

|

|

| |

For more than three

weeks the DJI has been trapped in an unusually narrow trading

range between 33600 and 34400.

I keep saying, let's wait for a new Buy signal

at the lower band to buy an ETF,

but hold onto the bullish MAXCPs, CAT and

NVDA. The DJI and the

big ETFs are not the real story at this time.

The FED probably would like for the

DJI and SP-500 to pull back. Thst would

help it fight inflation.

Afterall, the FED seems bound to try to lower the 5%-6%

annual rate of inflation and it

seems ready enough to raise interest rates above 5%,

especially given the very low rate

of unemployment and the residual economic

strength.

The interest rate bears' selling is

also holding back most NYSE dividend stocks, bonds

and bond funds. But Peerless

remains on its Buys in keeping with the usually very

bullish seasonality of the the

third year in the four-year Presidential cycle. Going back

more than one hundred years, one

finds the third year averaging a DJI gain of almost

3x what it is in other years.

Thus -the DJI's stalemated momentum.

But an epic battle is going on

under the surface of the market. Most observers see

the sleepiness of the DJI and give

a "ho-hum" response. Let me try to change that.

Many of the DJI blue chips are

secure but also very stodgy. In this, their dull

collective behavior fails to tell

us now how bullish Professionals are at this juncture.

See below how the openings are weak

but the Professionals are busy buying all day.

Today, the Closing Powers for most

of the key ETFs and many of the leading tech

stocks scored new highs, way

ahead of the the DJI or the ETFs they represent.

Historically, this commonly occurs

at the start of major bull markets. Our mulltiple

Peerless Buy signals and the

bullish seasonality say the same thing. So, does the

weakness in gold at these

junctures. And Tables 2 and 3, too.

Now look at the leaders in our

tables below. They are the semi-conductors. Nearly all

of them are above their 65-dma.

Many are very strong. As speculative stocks, traders

would not be so busy buying

"semis" if they did not sense a tech take-off is occurring, no

matter what the DJI is doing.

At the center of the take-off is

artificial intelligence. Chip-makers like NVDA

have found ways to incorporate not

just fixed rules, but ways to allow for

devices to learn better ways of

performing as they funcion. Now MSFT

has created a new, interactive Bing

that is more powerful than anything

GOOGLE has. Read about the

amazing "Sydney" in the lentgthy piece tonight.

in the NY Times. But read

also about its dark Jungian side. The NY Times writer

quotes its declaration of love to

the writer, even suggesting that he divorce his wife

so as to be with Bing more.

It will take some time to read the "word for word"

conversation, but this may be the

future if we are not very careful. Should

we trust MSFT?

https://www.nytimes.com/2023/02/16/technology/bing-chatbot-microsoft-chatgpt.html

and https://www.theverge.com/23599441/microsoft-bing-ai-sydney-secret-rules

and especially

https://www.nytimes.com/2023/02/16/technology/bing-chatbot-microsoft-chatgpt.html

|

|

| |

Charts - 2/15/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30 Bond Funds

DIA QQQ SPY IWM new - COIN (Bit Coin ETF)

Gold Stocks

Semi Conductors

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

Russell-1000

Insurance-Stocks

Recent 2006 vers-Peerless signals

http://www.tigersoftware.com/OLDPEER/UPD90215.bmp

MDY - http://www.tigersoftware.com/CHARTX/MDY.GIF

USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NAIL NUGT NRGU OIH

PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA USO

China:

YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks AA AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA

BAC BIDU BLDP CAT CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB FSLR

FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX MRK MRNA

MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL REGN REV

SO QCOM QDEL TSLA TXN XOM V VRTX WFC WMT XLE ZM ZOM

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs www.tigersoftware.com/UPPING/2-15-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/Downing/2-15-2023/BEARISH.htm

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 1 - Daily Volume and Breadth Statistics

| NYSE |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

3,194 |

3,196 |

3,180 |

| Advances |

1,780 |

1,483 |

1,009 |

| Declines |

1,297 |

1,574 |

2,045 |

| Unchanged |

117 |

139 |

126 |

| New

highs |

83 |

102 |

66 |

| New

lows |

7 |

12 |

6 |

| Adv.

volume* |

516,972,109 |

406,667,738 |

231,629,956 |

| Decl.

volume* |

304,805,423 |

408,752,011 |

568,195,050 |

| Total

volume* |

831,716,755 |

833,908,294 |

807,339,124 |

| Closing

Arms (TRIN)† |

0.73 |

0.81 |

1.02 |

| Block

trades* |

4,473 |

4,124 |

4,166 |

| Adv.

volume |

2,625,091,245 |

2,060,295,306 |

1,294,268,376 |

| Decl.

volume |

1,404,290,655 |

1,771,869,612 |

2,683,364,342 |

| Total

volume |

4,075,983,812 |

3,929,202,033 |

4,029,826,471 |

| NASDAQ |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

4,797 |

4,752 |

4,785 |

| Advances |

2,870 |

2,109 |

1,419 |

| Declines |

1,676 |

2,409 |

3,141 |

| Unchanged |

251 |

234 |

225 |

| New

highs |

91 |

86 |

100 |

| New

lows |

63 |

83 |

47 |

| Closing

Arms (TRIN)† |

0.87 |

0.64 |

1.05 |

| Block

trades |

33,599 |

31,940 |

33,782 |

| Adv.

volume |

3,333,606,989 |

2,858,962,187 |

1,506,920,076 |

| Decl.

volume |

1,694,530,007 |

2,097,172,205 |

3,513,337,901 |

| Total

volume |

5,056,647,624 |

5,032,435,049 |

5,052,872,994 |

|

Table 2 QUICKSILVER on ETFS - 2/15/2023 ---

Bullish = 9 +4 COMPQX, SPY, QQQ, MDY, IWM, FAS, SOXL, TEXL,

YINN (highest 0.361)

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

================================================================================================

DIA 341.66 .52 337.08 33% Bullish BLUE .204 0 ----

---------------------------------------------------------------------------------------------

COMPQX 12070.59 110.44 11789.58 67.5% Bullish BLUE .246 .062 .308

---------------------------------------------------------------------------------------------

SPY 413.98 1.34 407.09 40.6% Bullish BLUE .233 .026 .259

---------------------------------------------------------------------------------------------

QQQ 309.1 2.35 301.68 77.9% Bullish BLUE .232 .066 .298

---------------------------------------------------------------------------------------------

MDY 490.59 3.24 480.2 46.8% Bullish BLUE .204 .053 .257

---------------------------------------------------------------------------------------------

IWM 194.46 1.95 189.93 45.4% Bullish BLUE .252 .043 .295

---------------------------------------------------------------------------------------------

FAS 89.5 .43 86.6 -20.3% Bullish BLUE .233 .056 .289

---------------------------------------------------------------------------------------------

RETL 11.27 .77 10.2 260.4% Bullish BLUE .086 .199 .285

---------------------------------------------------------------------------------------------

SOXL 17.54 .21 16.58 317.7% Bullish BLUE .231 .355 .586

---------------------------------------------------------------------------------------------

TECL 33.17 .52 31.28 222% Bullish BLUE .232 .152 .384

---------------------------------------------------------------------------------------------

IBB 133.77 0 132.4 16.5% Bullish BLUE .223 -.025 .198

---------------------------------------------------------------------------------------------

GLD 170.89 -1.72 173.03 -101.6% Bearish BLUE .062 .031 .093

---------------------------------------------------------------------------------------------

DBO 15.14 -.05 14.86 39.7% ------- BLUE .059 -.026 .033

---------------------------------------------------------------------------------------------

OIH 326.13 -4.59 317.69 -44% Bullish RED .131 .067 .198

---------------------------------------------------------------------------------------------

CPER 24.52 -.38 24.75 -10.1% ------- BLUE 0 .061 .061

---------------------------------------------------------------------------------------------

TAN 79.04 2.51 76.4 66.4% ------- BLUE .109 -.047 .062

---------------------------------------------------------------------------------------------

UUP 28.07 .19 27.89 25.1% Bullish ---- .009 .003 .012

---------------------------------------------------------------------------------------------

CORN 26.53 -.18 26.34 -15% ------- RED -.183 .035 -.148

---------------------------------------------------------------------------------------------

WEAT 7.82 -.15 7.71 19% Bullish RED .036 .021 .057

---------------------------------------------------------------------------------------------

YINN 52.82 -1.42 58.33 -214.1% Bearish BLUE .149 .148 .297

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

2/15/23

Bullish = 44

Bearish = 5

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COPPER 1 .857 .857 .857 1 1

EDU 1 1 1 1 1 1

HOMEBLDG .888 .888 .944 .888 .888 .944

=====

INFRA .878 .878 .848 .848 .878 .878

BIGBANKS .857 .857 .857 .857 .857 .857

SEMI .851 .851 .829 .819 .829 .872

=====

JETS .846 .846 .846 .846 .846 .846

TRANSP .842 .789 .842 .842 .789 .842

NIFTY .84 .772 .818 .75 .75 .75

COAL .833 .5 .333 .5 .333 .333

ELECTRON .812 .796 .796 .789 .781 .827

SOFTWARE .803 .767 .767 .767 .803 .821

REIT .784 .784 .869 .792 .723 .838

ETFS .781 .8 .836 .781 .818 .781

NASD-100 .78 .72 .76 .69 .68 .69

=====

HIGHPRIC .779 .761 .787 .731 .727 .766

AUTO .773 .754 .792 .735 .792 .83

CHINA .772 .704 .772 .727 .772 .795

RUS-1000 .753 .732 .749 .707 .699 .743

=====

CHEM .744 .72 .72 .674 .651 .79

GAMING .736 .736 .736 .736 .578 .631

MILITARY .73 .692 .73 .692 .538 .615

FINANCE .725 .737 .762 .725 .725 .775

GREEN .722 .722 .666 .555 .722 .777

GUNS .714 .642 .785 .714 .642 .785

INDEXES .713 .708 .729 .724 .724 .729

BONDFUND .712 .793 .827 .793 .908 .908

RETAIL .702 .638 .659 .595 .574 .638

SP500 .686 .67 .706 .651 .629 .678

=====

INDMATER .68 .652 .638 .638 .583 .708

INSURANC .68 .72 .88 .8 .72 .88

FIDSTKS .656 .639 .68 .633 .597 .662

COMPUTER .65 .6 .7 .65 .55 .65

HOSPITAL .642 .571 .571 .571 .571 .571

HACKERS .625 .625 .625 .625 .625 .687

BEVERAGE .571 .428 .428 .357 .428 .428

SP-100 .566 .6 .622 .544 .522 .566

SOLAR .562 .437 .5 .375 .375 .5

LOWPRICE .547 .544 .541 .555 .558 .595

OILGAS .542 .6 .58 .571 .409 .466

DOWJONES .533 .5 .6 .466 .433 .5

=====

BIOTECH .531 .534 .565 .534 .559 .613

REGBANKS .52 .48 .48 .48 .44 .56

FOOD .51 .612 .571 .571 .469 .551

===============================================================================================

COMODITY .487 .564 .512 .538 .435 .538

DJI-13 .307 .307 .461 .307 .307 .461

GOLD .26 .347 .326 .391 .413 .608

MARIJUAN .2 .2 .2 .2 .2 .1

UTILITY .184 .131 .21 .131 .105 .184

|

===================================================================================

Wednesday 2/15: 6:15 AM Futures: DJI -74 NASDAQ -60 Data

Used 2-14-2023:

| |

2-14-2023

|

|

| |

The CPI number

just out warns it will be longer than expected before Inflation is

back down to 3%. This

news killed the DJI's attempt to lead the market higher.

So, another testing of

support is needed. The immediate support just below

is at its rising 65-dma and

its 21-dma. The bullish seasonality, rising Closing

Powers and Peerless Buys

should be able to hold the DJI up in its present

trading range. But

backing and filling like it is doing creates a tension and

often prepares the way for a

swift vertical move when the breakout or breakdown

does finally occur. If

the recent support fails, look for the DJI to fall to its lower band.

A new Buy B9 wuld then be

expected and be where we should take new ETF

positions. Meanwhile,

stick with the Bullish MAXCPs.

More extended version of HL tonight.

Peerless Remains

on its Buys but another pullback is shaping up. 35000

is important

support. Below that is the lower band of the DJI, around 32600.

For now, the 34500

resistance appears too much for the DJI.

Pulling back from

overhead resistance with weakening breadth and volume.

But no Peerless

Sell less than one percent below. For almost three weeks it

has been stuck in

a narrow range betweem 33500 and 35300, bouncing

back and forth

five or six times. Point and figure chartists can hardly wait for

a breakout because

this many reversals in a narrow range regulary bring a

very quick and

sizeable vertical move in whichever way it breaks out. Which

way now?

The weak OBV Lines

especially for the SP-500 and OEX argue against an

upside breakout as

does the breaking of the uptrends for the key internal

strength

indicators shown on our Peerless chart. Ordinarily, if the DJI were

about to be stage

a sell-off, we would also so a number of head/shoulders

top patterns among

the individual DJI stocks. Only CAT fits that description

now.

Otherwise, as I said recently, among the higher priced (more heavily

weighted) DJI

stocks there are about as many in good-looming uptrends

(AXP, CA, CRM, GS,

JM and V) as those in clear downtrends (AMGN,

CVX, JNJ, MMM, PG

and UNH).

And the bulls have

the usually reliable Closing Powers, seasonality and

Peerless signals

on their side. Moreover, 69% of all stocks are bullishly

above their

65-dma. So, what a trader to do? Without more bearish MINCPs,

it's hard to

advise any short-selling. Mostly, I have said look to the bullish

special situations

for upside trades and wait for a new Peerless Buy signal

near the lower

band to buy the major market ETFs. The jump in NVDA

today would seem

to justify that approach. But sell CAT if it closes below

its H/S

neckline.

The CPI number

yesterday that it will take longer than many expected

for the FED to

bring back inflation under 3%. Almost certainly, interest

rates will be

raised to 5% in March and then even higher. That is not

a scenario that in

the past permits a new bull market. If we are not going

to get a new bull

market, it means longs will have to be taken for trading

purposes.

And that will be where the trendlines of our Closing Powers

and Day Traders'

Tool should help us.

|

|

| |

Charts - 2/14/2023

2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume

10-DayUp/Down Vol Stoch-20 CCI RSI Pct of All Stocks above 65-dma

Inverted Traders Index

DJI-IPA DJI-OBV Short-Term Rates

NASDAQ S&P OEX NYSE DJ-15 DJ-20 DJI-30 Bond Funds

DIA QQQ SPY IWM new - COIN (Bit Coin ETF)

Gold Stocks

Semi Conductors

TNA Short-Term Rates Ten Year Rates PST (Short Treasuries)

DOLLAR-UUP

ALLSTOCKs

Russell-1000

Insurance-Stocks

Recent 2006 vers-Peerless signals

http://www.tigersoftware.com/OLDPEER/UPD90214.bmp

MDY - http://www.tigersoftware.com/CHARTX/MDY.GIF

USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NAIL NUGT NRGU OIH

PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA USO

China:

YINN CHAU

Commodities: CANE

CORN DBC JJC, NIB CORN, CUT (paper)

MOO, NRGU

SOYB WEAT UUP (Dollar) LIT

(Lithium) PALL

(Palladium)

Stocks AA AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA

BAC BIDU BLDP CAT CHKP CNX CPB CRM CVX CMG DE DIS ENPH FB FSLR

FTNT GILD GME GOOG GS HD IBM INTU JPM KO KR LRCX MRK MRNA

MOS MSFT NEM NFLX NKE NOC NUE NVDA PANW PG PYPL REGN REV

SO QCOM QDEL TSLA TXN XOM V VRTX WFC WMT XLE ZM ZOM

Leveraged Short ETFs:

FAZ - financials, TZA and SRTY- small caps, MZZ - mid caps, TECS -Techs,

SOXS -

semi-conductors LABD

- Biotechs

Bullish MAXCPs www.tigersoftware.com/UPPING/2-14-2023/Bullish.htm

Bearish MINCPs www.tigersoftware.com/Downing/2-14-2023/BEARISH.htm

|

|

DJIA -

|

Closing Power is still uptrending for DIA

|

Closing Power is still uptrending for NASDAQ

|

Closing Power is still uptrending for SPY

|

FAS was unable to breakout past flat resistance, but its Closing Power is still rising.

|

QQQ - Closing Power still rising

|

NVDA regains its leadership role among biggest SP-500 stocks.

|

Daily Breadth and Volume Statistics

| NYSE |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

3,196 |

3,187 |

3,174 |

| Advances |

1,483 |

2,336 |

1,909 |

| Declines |

1,574 |

735 |

1,154 |

| Unchanged |

139 |

116 |

111 |

| New

highs |

102 |

87 |

85 |

| New

lows |

12 |

13 |

8 |

| Adv.

volume* |

406,667,738 |

595,284,360 |

583,612,732 |

| Decl.

volume* |

408,752,011 |

164,132,676 |

312,304,307 |

| Total

volume* |

833,908,294 |

772,189,005 |

903,159,697 |

| Closing

Arms (TRIN)† |

0.81 |

0.98 |

0.99 |

| Block

trades* |

4,124 |

4,017 |

4,357 |

| Adv.

volume |

2,060,295,306 |

2,581,048,062 |

2,700,045,339 |

| Decl.

volume |

1,771,869,612 |

797,385,387 |

1,620,767,045 |

| Total

volume |

3,929,202,033 |

3,448,628,150 |

4,355,866,857 |

| NASDAQ |

Latest Close |

Previous

Close |

Week Ago |

| Issues

traded |

4,752 |

4,808 |

4,747 |

| Advances |

2,109 |

2,856 |

2,641 |

| Declines |

2,409 |

1,704 |

1,862 |

| Unchanged |

234 |

248 |

244 |

| New

highs |

86 |

81 |

103 |

| New

lows |

83 |

67 |

43 |

| Closing

Arms (TRIN)† |

0.64 |

0.85 |

0.93 |

| Block

trades |

31,940 |

31,168 |

37,522 |

| Adv.

volume |

2,858,962,187 |

3,124,372,012 |

3,428,905,139 |

| Decl.

volume |

2,097,172,205 |

1,582,559,693 |

2,238,240,997 |

| Total

volume |

5,032,435,049 |

4,752,885,418 |

5,720,245,945 |

|

Table 2 QUICKSILVER on ETFS - 2/14/2023 ---

Bullish = 5 -3 COMPQX, QQQ, SOXL, TEXL,

YINN (highest 0.361)

Bearish = 0

ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX

================================================================================================

DIA 341.14 -1.41 339.42 -5.6% Bullish RED .138 0 ----

---------------------------------------------------------------------------------------------

COMPQX 11960.15 68.36 11910.52 -64.6% Bullish BLUE .209 .051 .26

---------------------------------------------------------------------------------------------

SPY 412.64 -.19 410.65 -31% Bullish BLUE .178 .022 .2

---------------------------------------------------------------------------------------------

QQQ 306.75 2.25 304.37 -51.5% Bullish BLUE .204 .054 .258

---------------------------------------------------------------------------------------------

MDY 487.35 .24 486.06 -47.1% Bullish BLUE .154 .047 .201

---------------------------------------------------------------------------------------------

IWM 192.51 -.09 192.72 -79.9% Bullish BLUE .198 .039 .237

---------------------------------------------------------------------------------------------

FAS 89.07 -1.34 89.86 -132.9% Bullish RED .187 .037 .224

---------------------------------------------------------------------------------------------

RETL 10.5 -.04 10.73 -342.4% Bullish BLUE .032 .147 .179

---------------------------------------------------------------------------------------------

SOXL 17.33 .91 16.49 -78.4% ------- BLUE .198 .293 .491

---------------------------------------------------------------------------------------------

TECL 32.65 .31 31.76 -48.7% Bullish BLUE .203 .114 .317

---------------------------------------------------------------------------------------------

IBB 133.77 -.41 133.33 -95.3% Bullish BLUE .199 -.015 .184

---------------------------------------------------------------------------------------------

GLD 172.61 .13 174.41 -39.5% Bearish BLUE .023 .038 .061

---------------------------------------------------------------------------------------------

DBO 15.19 .02 15.02 116.4% ------- BLUE .037 -.035 .002

---------------------------------------------------------------------------------------------

OIH 330.72 -.72 329.01 105.1% Bullish BLUE .127 .102 .229

---------------------------------------------------------------------------------------------

CPER 24.9 .18 24.57 32.5% ------- BLUE -.024 .097 .073

---------------------------------------------------------------------------------------------

TAN 76.53 -.55 78.02 -154.7% Bearish BLUE .06 -.051 .009

---------------------------------------------------------------------------------------------

UUP 27.88 -.02 27.93 -3.6% Bullish ---- .083 -.004 .079

---------------------------------------------------------------------------------------------

CORN 26.71 -.06 26.61 39.5% Bullish RED -.075 .03 -.045

---------------------------------------------------------------------------------------------

WEAT 7.97 -.02 7.79 191.5% Bullish ---- .112 .018 .13

---------------------------------------------------------------------------------------------

YINN 54.24 -1.6 55.19 -288.4% Bearish BLUE .074 .271 .345

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

2/14/23

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

EDU 1 1 1 1 1 1

HOMEBLDG .888 .944 .888 .888 .944 .944

=====

INFRA .878 .848 .848 .878 .878 .909

BIGBANKS .857 .857 .857 .857 .857 .857

COPPER .857 .857 .857 1 1 1

SEMI .851 .829 .819 .829 .861 .914

=====

JETS .846 .846 .846 .846 .846 .846

ETFS .8 .836 .781 .818 .8 .8

ELECTRON .796 .796 .789 .781 .819 .864

BONDFUND .793 .827 .793 .908 .919 .885

TRANSP .789 .842 .842 .789 .842 .842

REIT .784 .861 .8 .73 .83 .876

NIFTY .772 .818 .75 .75 .75 .818

SOFTWARE .767 .785 .767 .803 .821 .857

HIGHPRIC .761 .787 .731 .727 .77 .813

AUTO .754 .811 .735 .792 .83 .83

FINANCE .737 .762 .725 .712 .775 .75

GAMING .736 .736 .684 .631 .631 .789

RUS-1000 .732 .749 .707 .699 .744 .784

=====

GREEN .722 .666 .555 .722 .777 .888

CHEM .72 .72 .674 .651 .79 .744

INSURANC .72 .88 .8 .72 .88 .88

NASD-100 .72 .76 .69 .68 .69 .76

======

INDEXES .708 .729 .724 .724 .729 .756

CHINA .704 .772 .727 .772 .795 .818

MILITARY .692 .73 .692 .538 .615 .615

SP500 .67 .706 .653 .625 .682 .719

=====

INDMATER .652 .638 .638 .583 .708 .736

GUNS .642 .785 .714 .642 .785 .785

FIDSTKS .639 .68 .633 .597 .662 .692

RETAIL .638 .659 .595 .574 .638 .702

HACKERS .625 .625 .625 .625 .687 .687

FOOD .612 .571 .551 .469 .551 .571

COMPUTER .6 .7 .65 .55 .65 .7