When Extended Negative IP21 Ends

(C) 2015 William Schmidt, Ph.D.

July 30, 2015

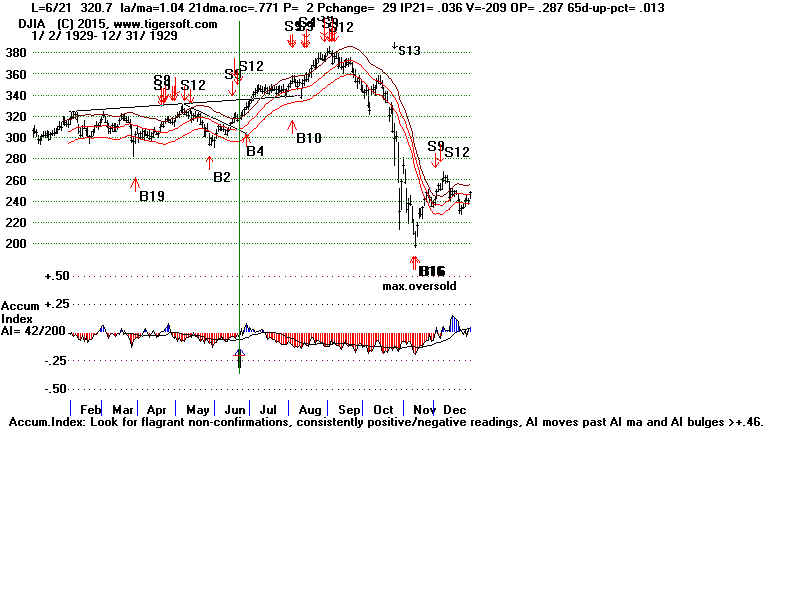

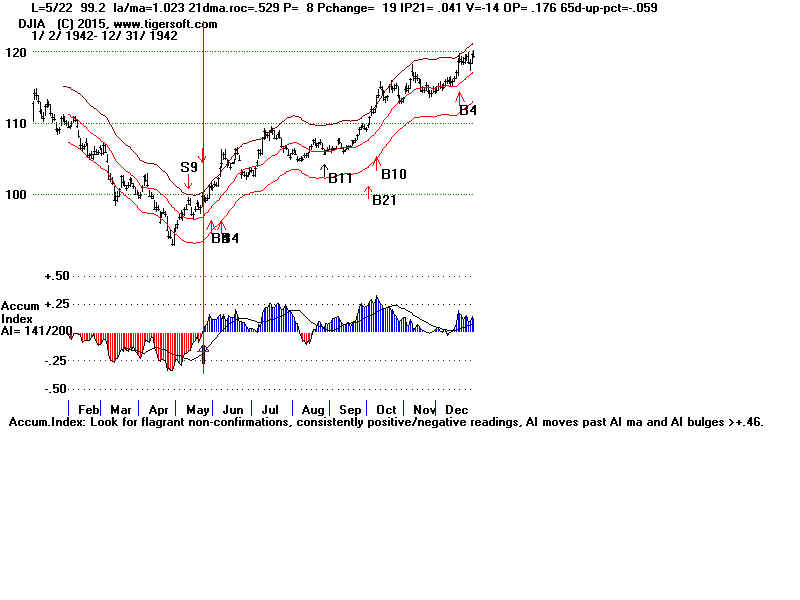

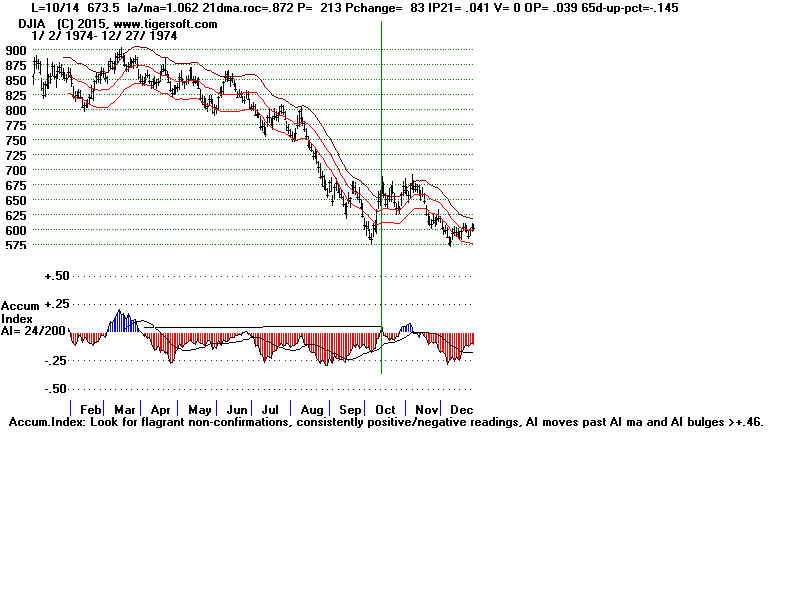

What happens when 3+ months or more of steady Red Distribution

ends with an IP121 reading above +.04. We probably should

separate out those cases where this happens without the DJI going

into a bear market. Consider the 5 bull market cases first.

(You may want to look at the at the cases where the IP21 turned positive

while the DJI was in a bear market further. See further below.)

In all four cases where the IP21 rose above .040, the bull market

continued 3-5 months longer and prices went moderately higher.

But in the one case where the IP21 Indicator could not rise

above +.04, early 1966, a bear market followed.

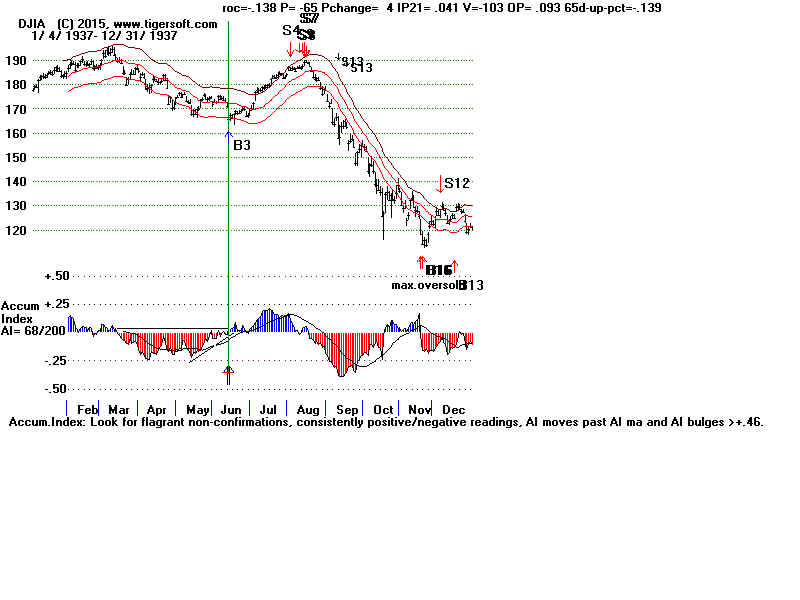

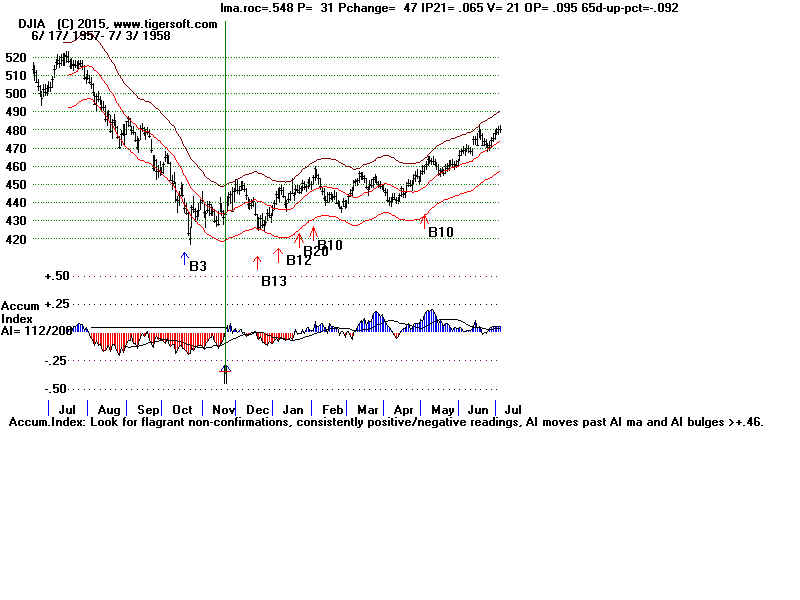

June 1937 IP21 rose to +.04 at the lower band. This was also a Peerless Buy B3.

DJI rose from 167 to 190 in 2 months

-----------------------------------------------------------------------------------

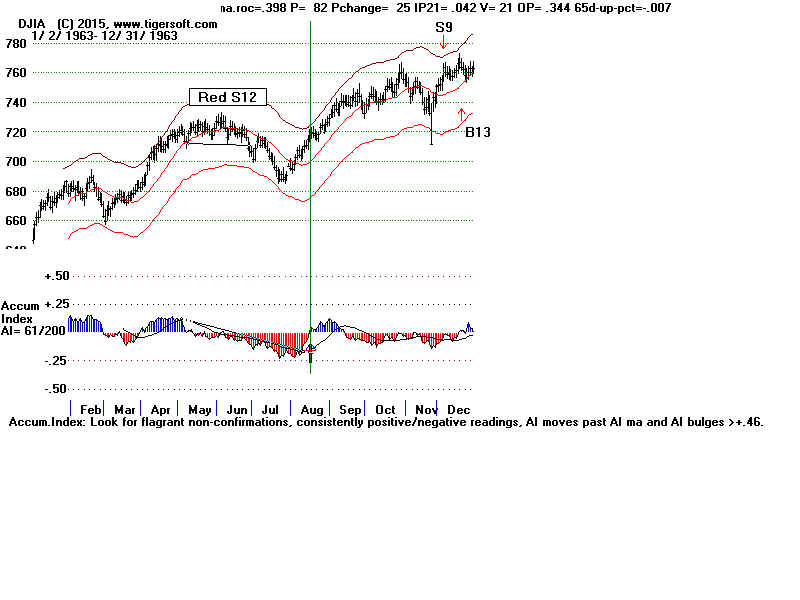

August 1963 IP21 rose to +.041 with the DJI 3% over the 21-dma.

There was no Peerless Buy signal. The DJI rose from 720 to 760 in 2 months.

-----------------------------------------------------------------------------------

July 1964 IP21 rose to +.042 with the DJI 3% over the 21-dma.

There was no Peerless Buy signal. The DJI rose from 845 to 890 in 5 months.

-----------------------------------------------------------------------------------

January 1965. IP21 rose to +.043 with the DJI 3% over the 21-dma.

A Peerless Buy B13 was operative. The DJI rose from 890 to 940 in 5 months.

-----------------------------------------------------------------------------------

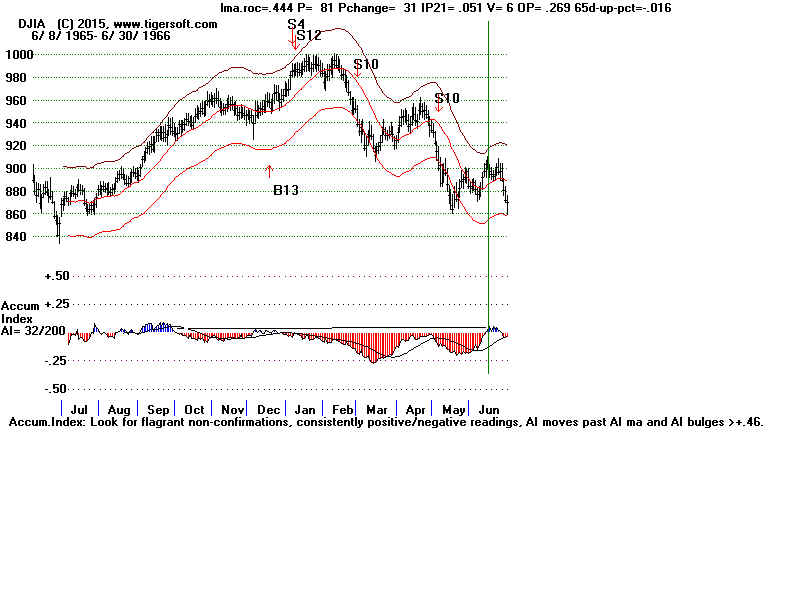

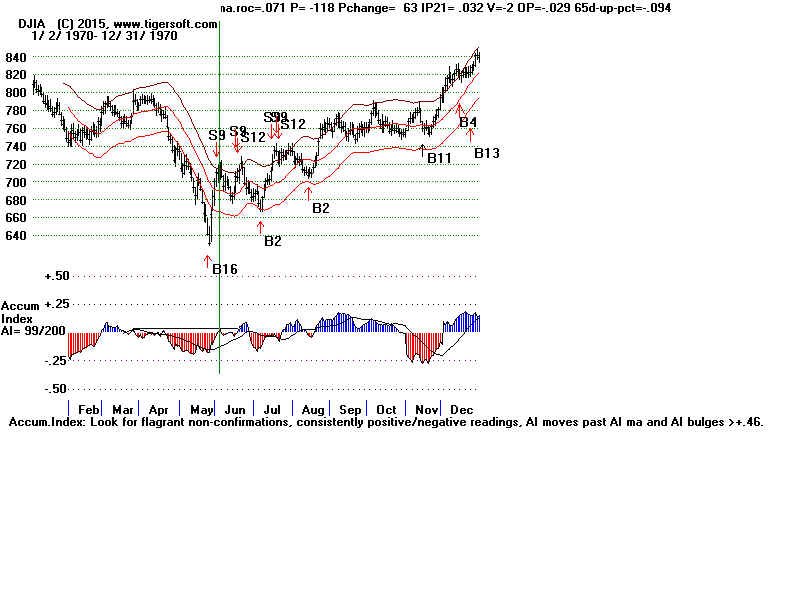

Jan-Dec 1966. The IP21 could not rise above +.043. A Sell S12 was given

and a bear market started.