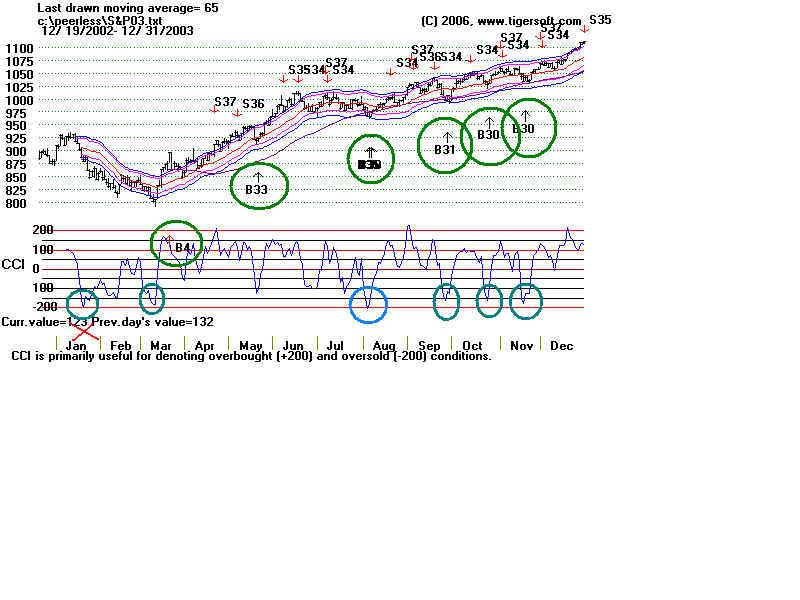

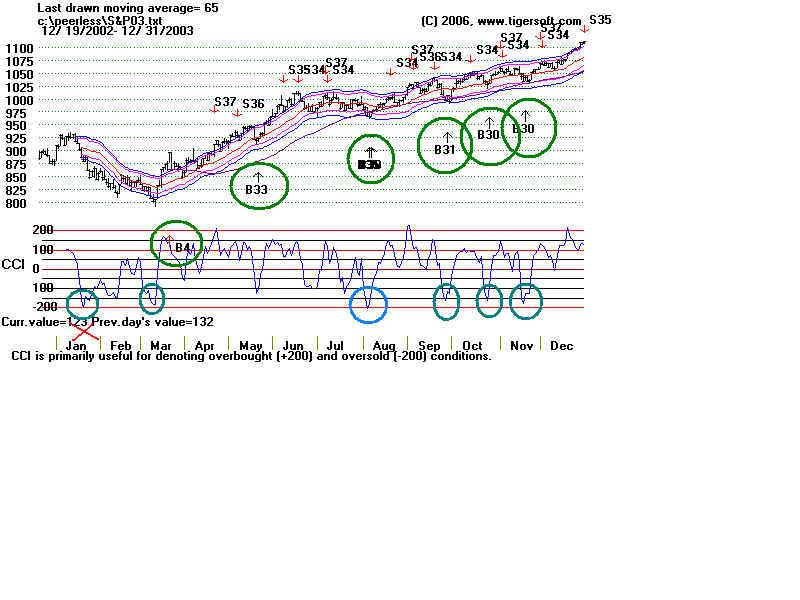

CCI Buy Signals

They are more reliable after the CCI has failed to confirm

a new price low than after simple over-sold conditions

below -150 or below -200.

To avoid losses, do not use them when price uptrend has

ended.

What do drops by CCI below -200 portend?

In 11 cases the SP-500 was at a spot that was good

place to buy immediately. 47.8% of all cases.

In 9 places, it was best to wait one to two months.

39.1% of all cases.

In 3 places it was a very bad time to buy. 13.0% of

all cases.

Date

Result

---------------------------------------

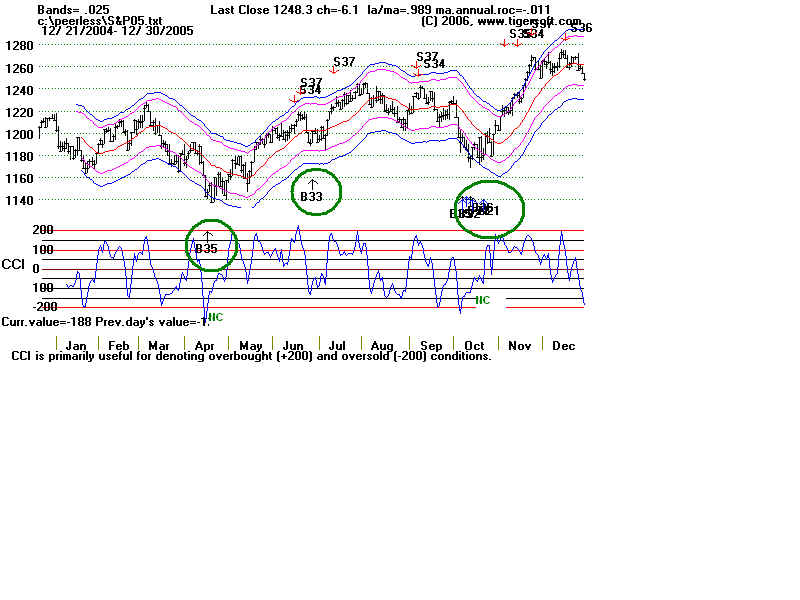

Aug 2003

Good

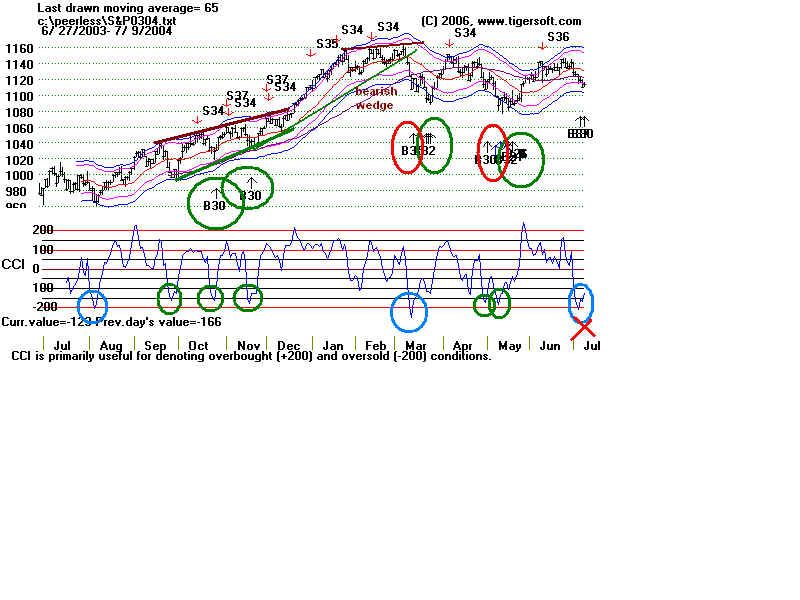

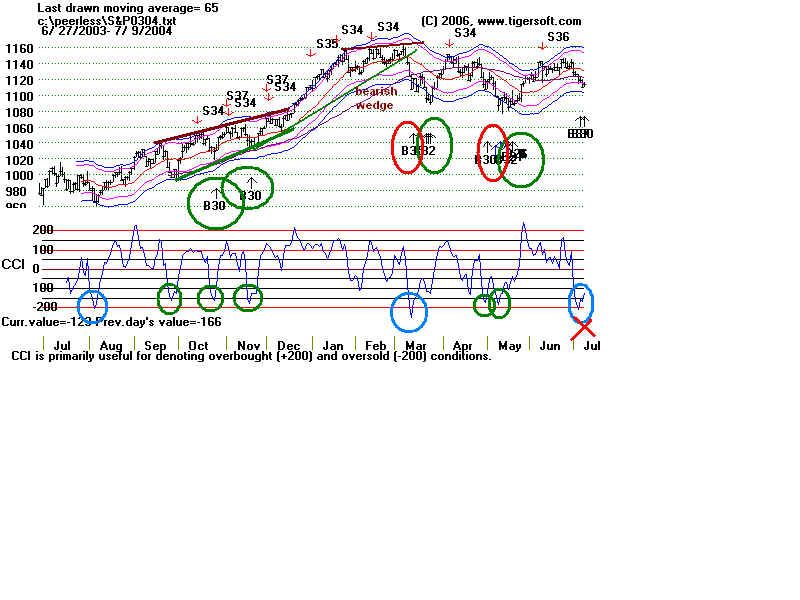

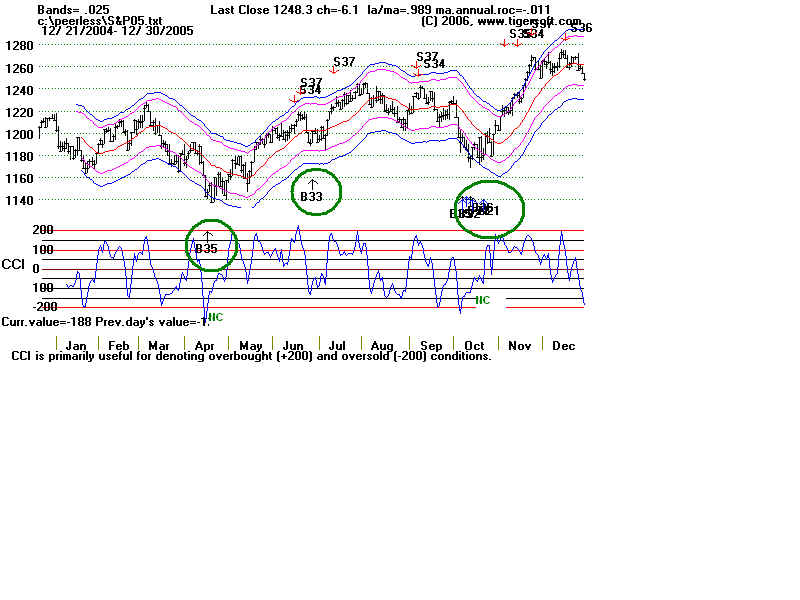

March 2004

Early.

July 2004 Early.

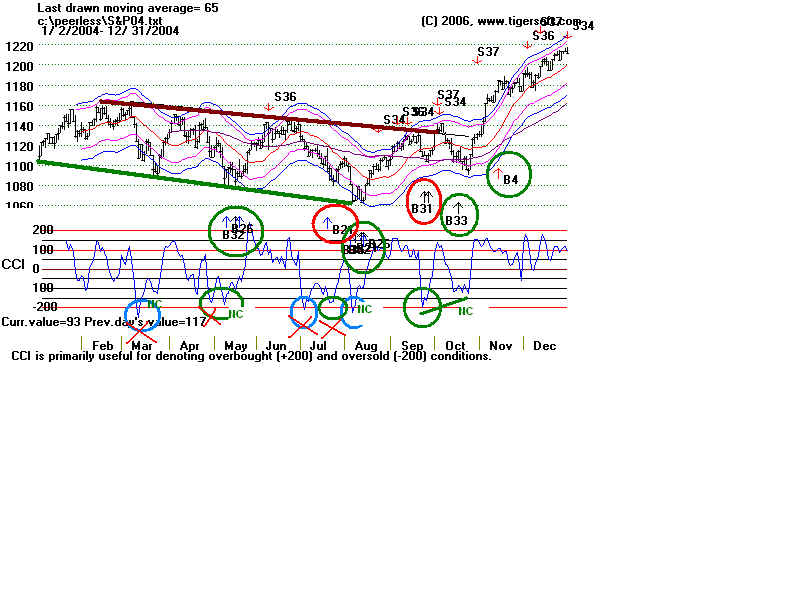

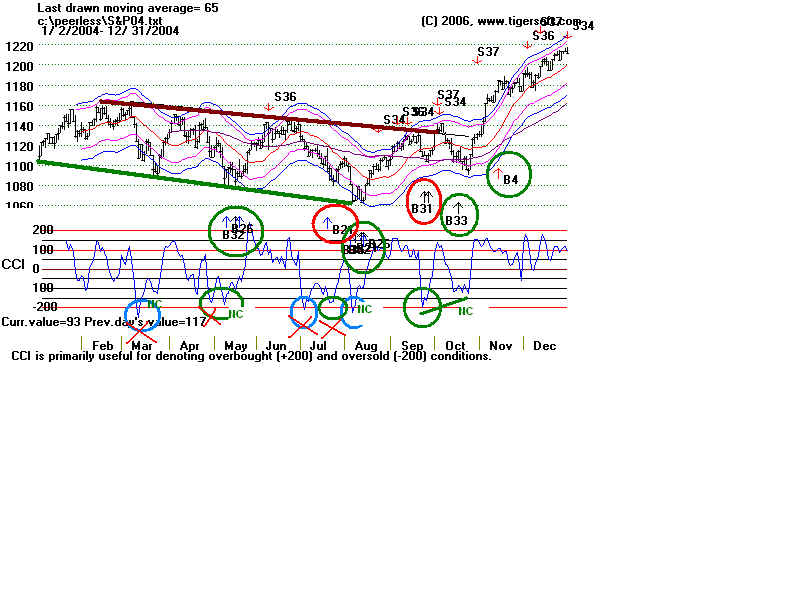

August 2004

Good

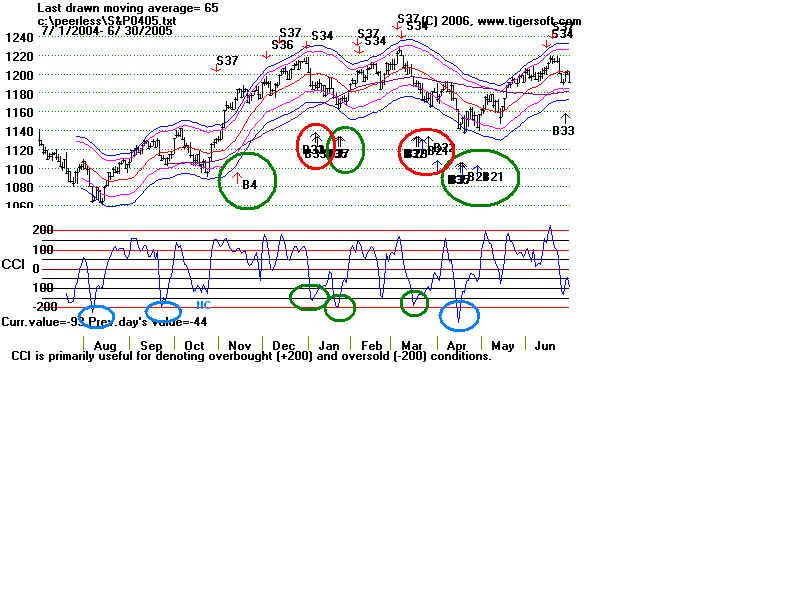

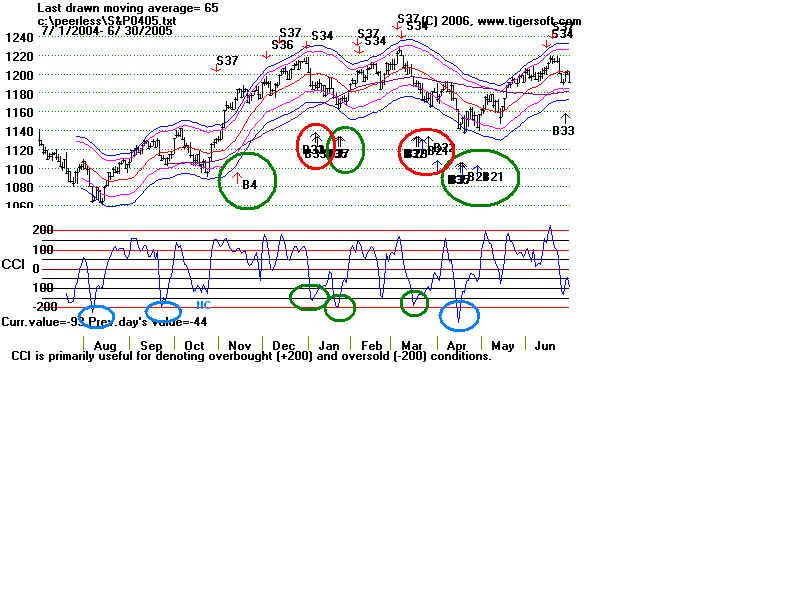

(Sept 2005 OK CCI was

marginally below -200)

April 2005

Good

October 2005 Good

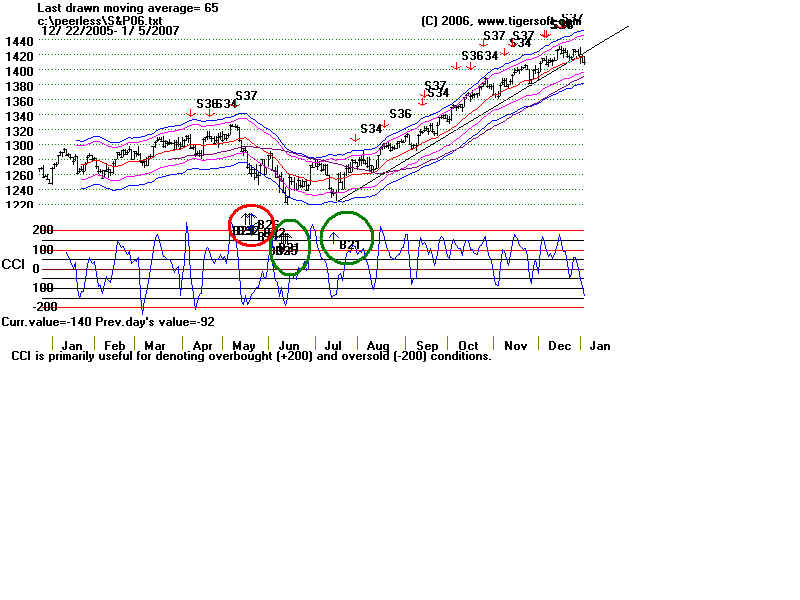

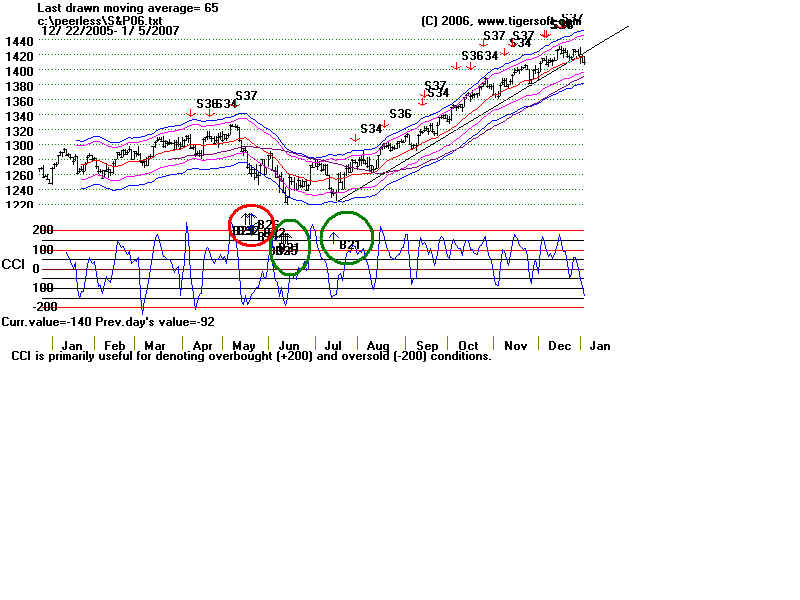

March 2006 Good

April 2006 Good

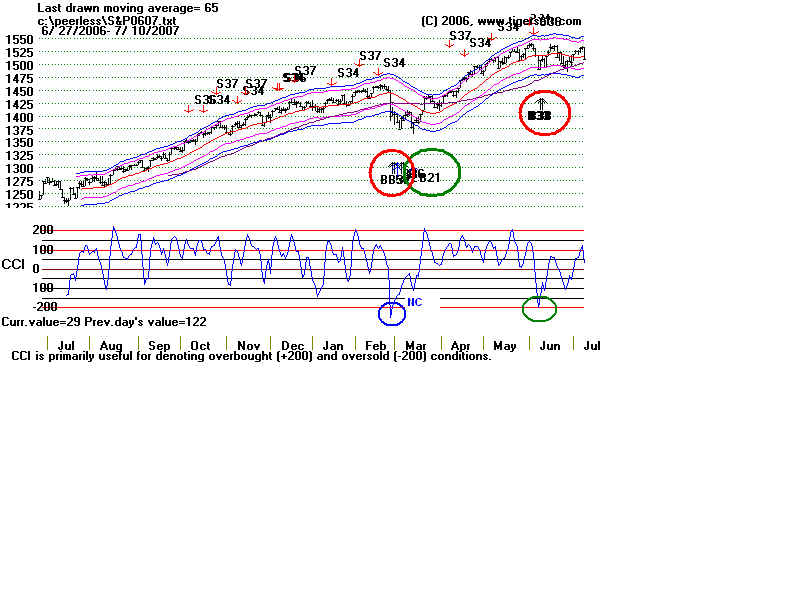

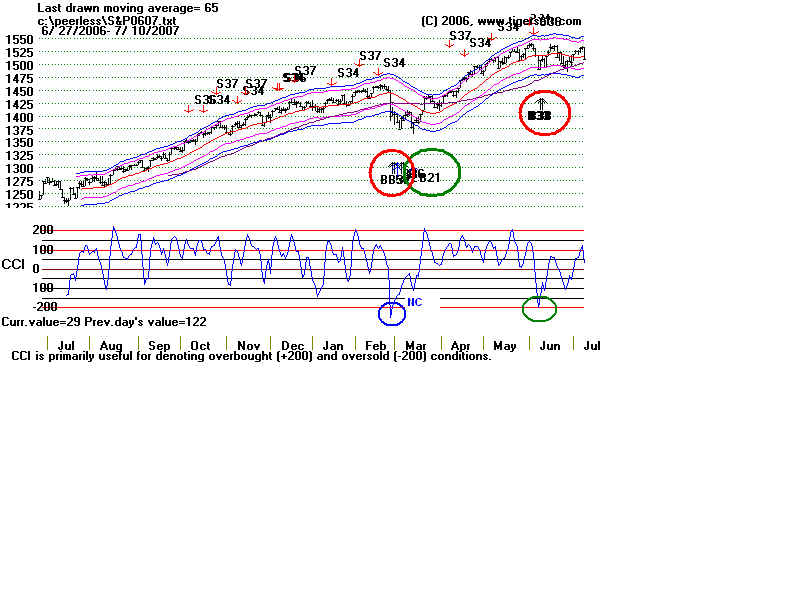

February 2007 3- weeks Early

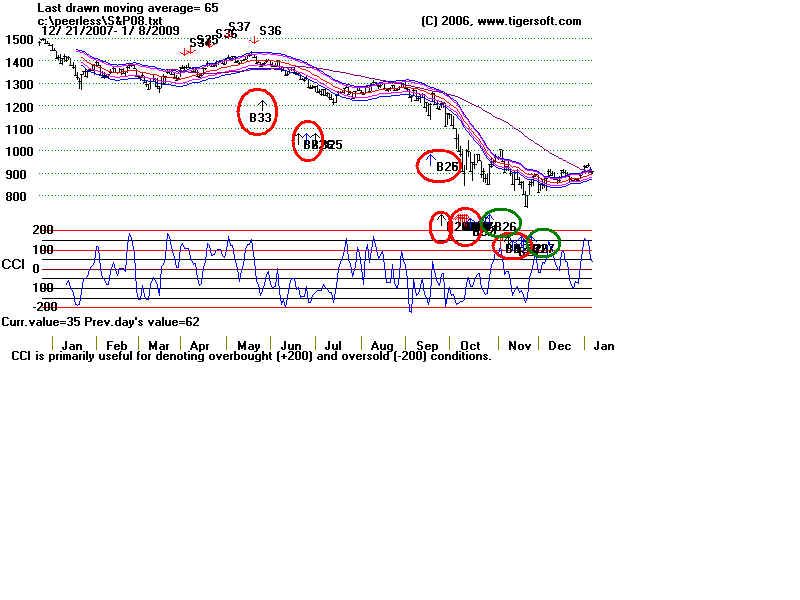

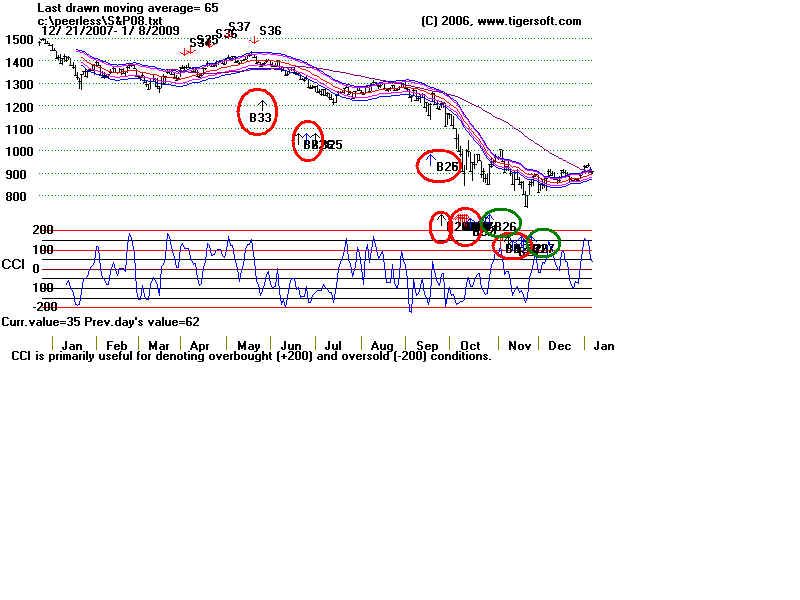

October 2007 3% rally and then

collapse.

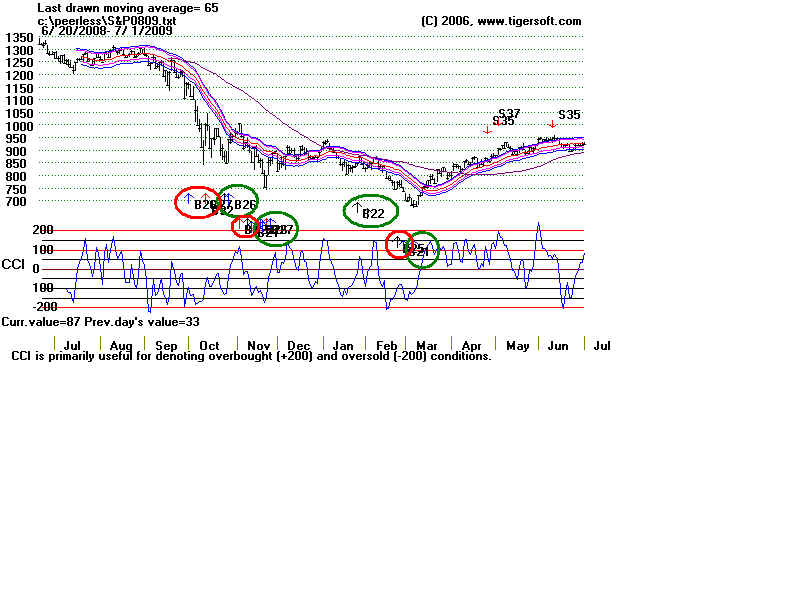

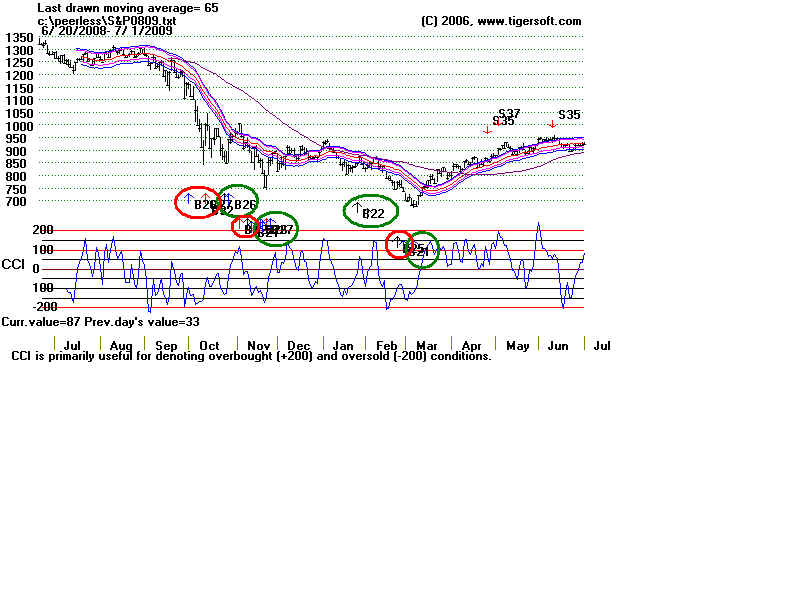

September 2008 Very Bad.

CCI = -226

Feb 2009 Bad

CCI = -210.8

June 2009

Early

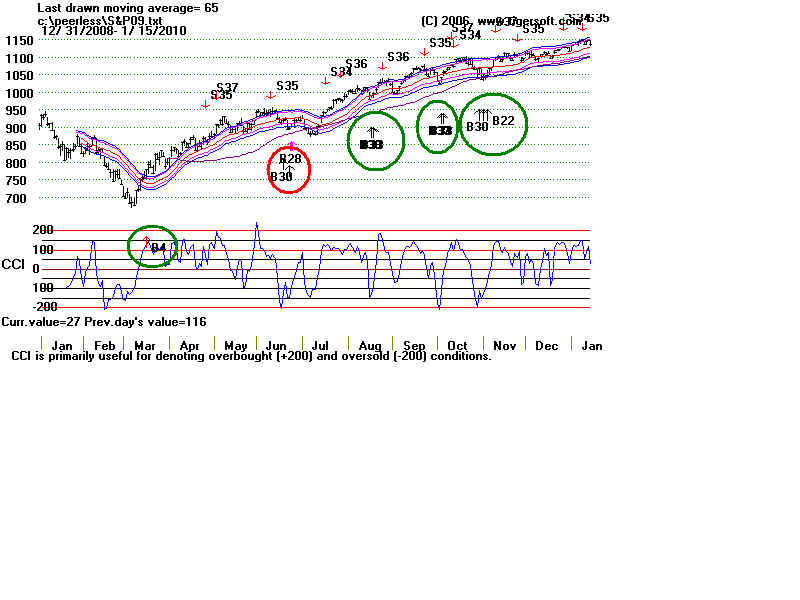

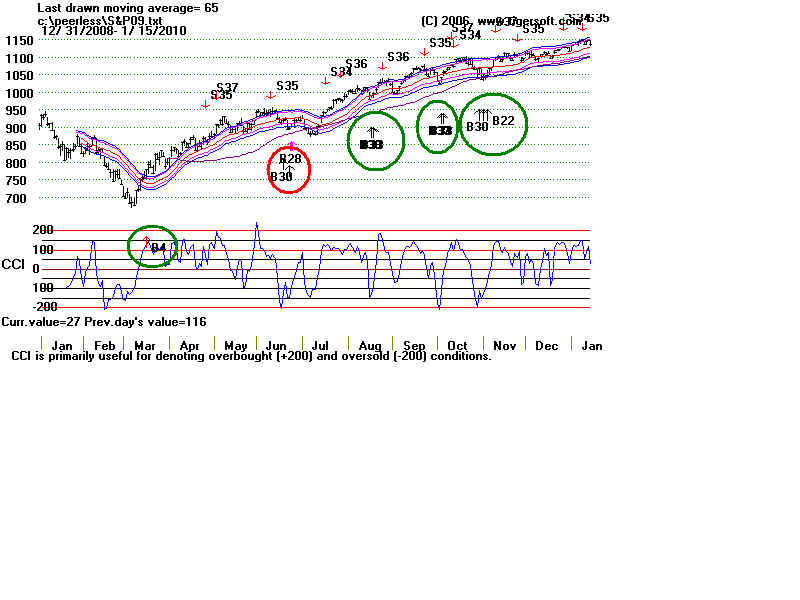

October 2009 Good (twice)

Jan 2010

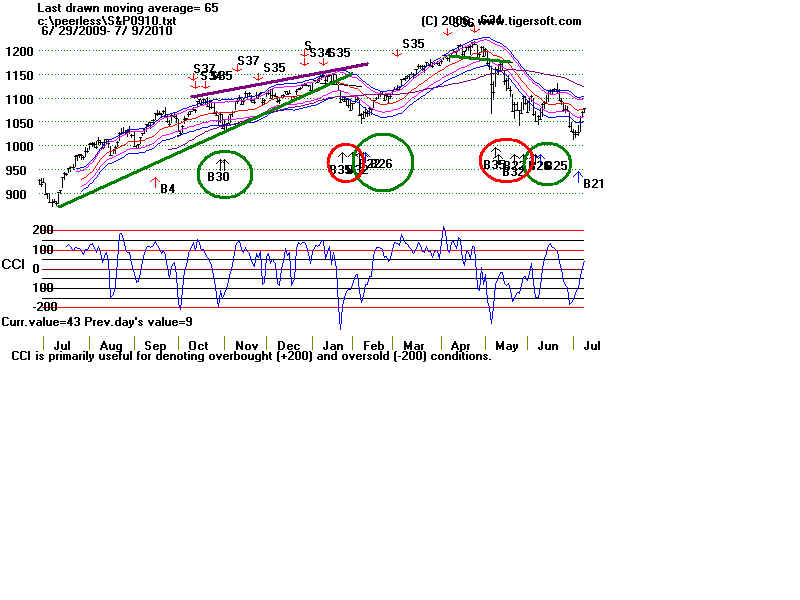

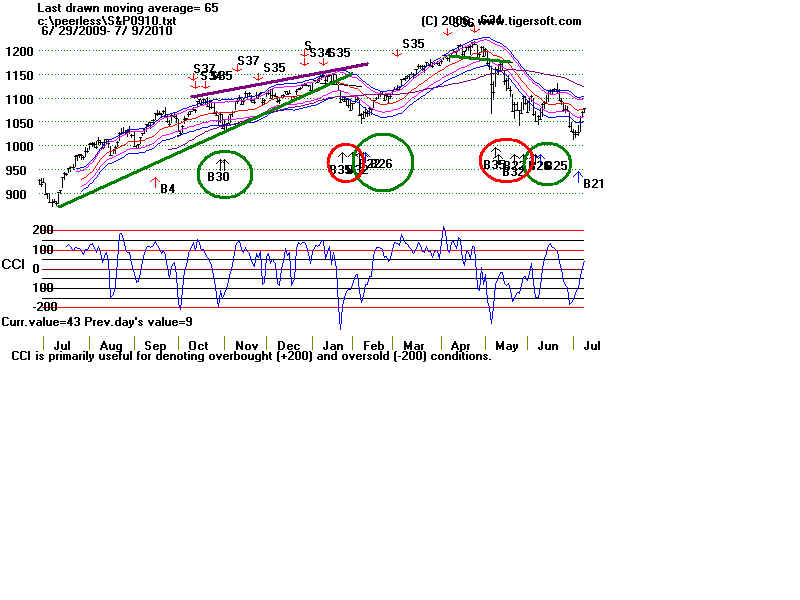

Early

May 2010 Early

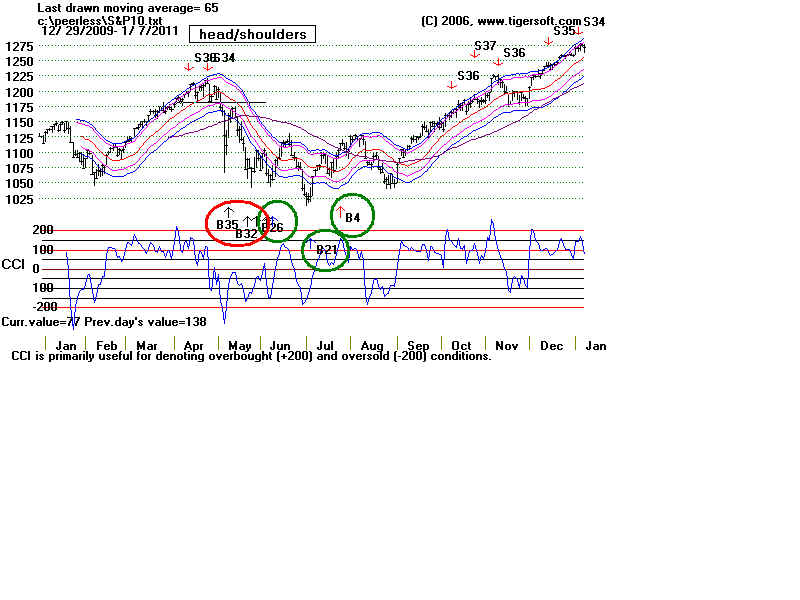

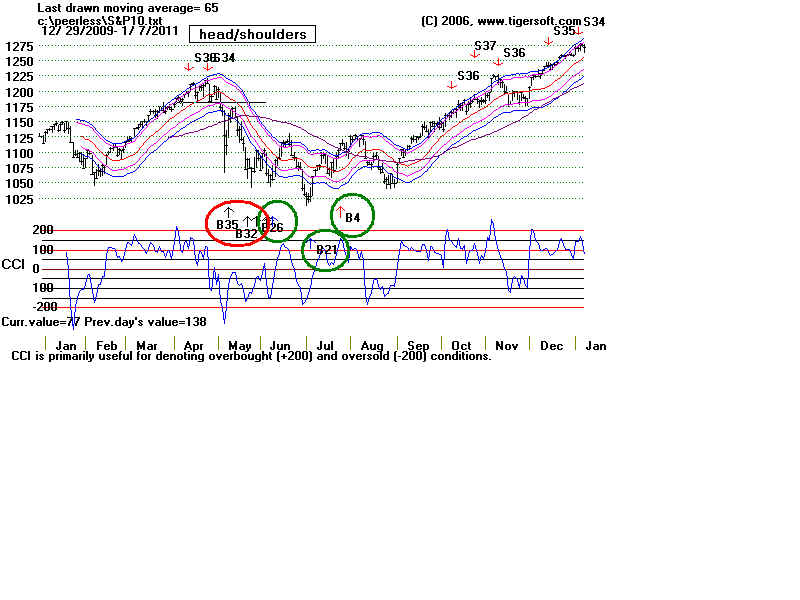

March 2011

Good

April 2012 Good

June 2012 Good

November 2012 Early

August 2013 Early

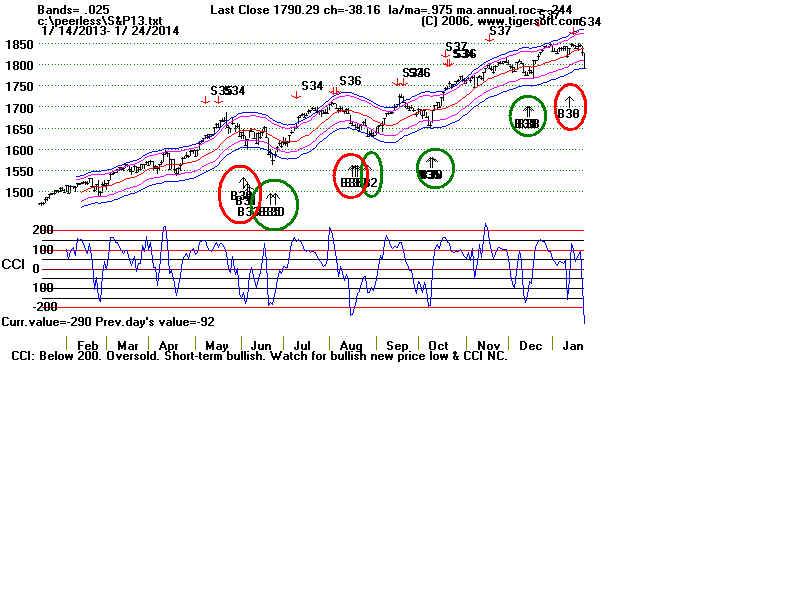

Jan 2014

Early CCI= -290.1

compared to -319.7 in October 1987

and -254.8 on 11/30/1987.

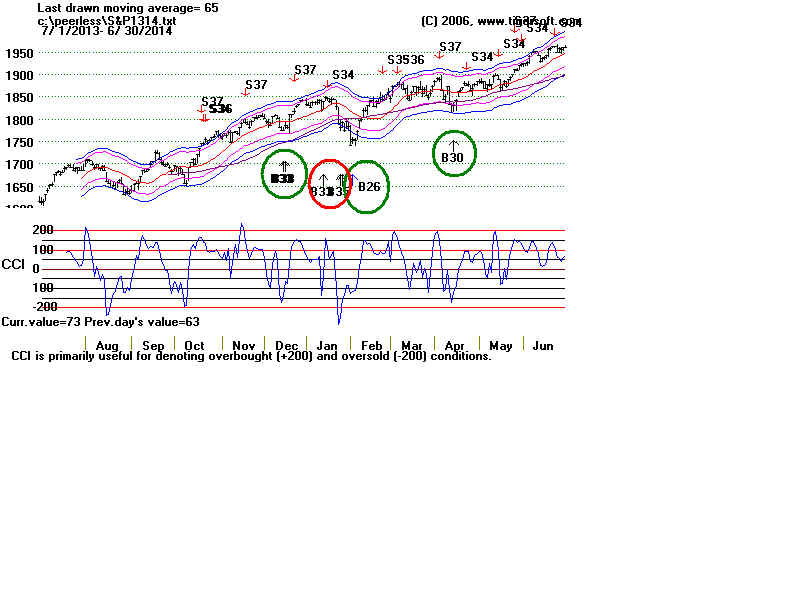

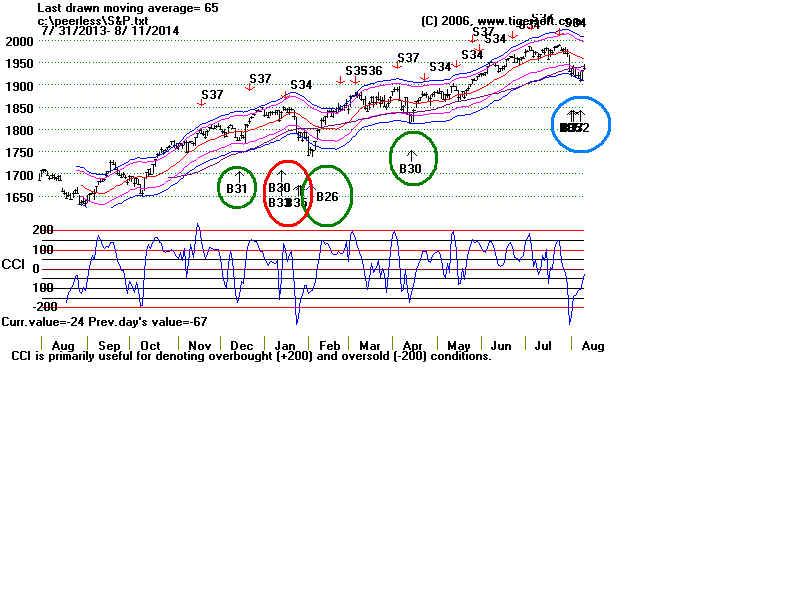

July 2014

Early

CCI= -288.8

2003 |

2003-2004 |

2004 |

2004-2005 |

2005 |

2005-2006 |

2006 |

2006-2007 |

2007 |

2007-2008 |

2008 |

2008-2009 |

2009 |

2009-2010 |

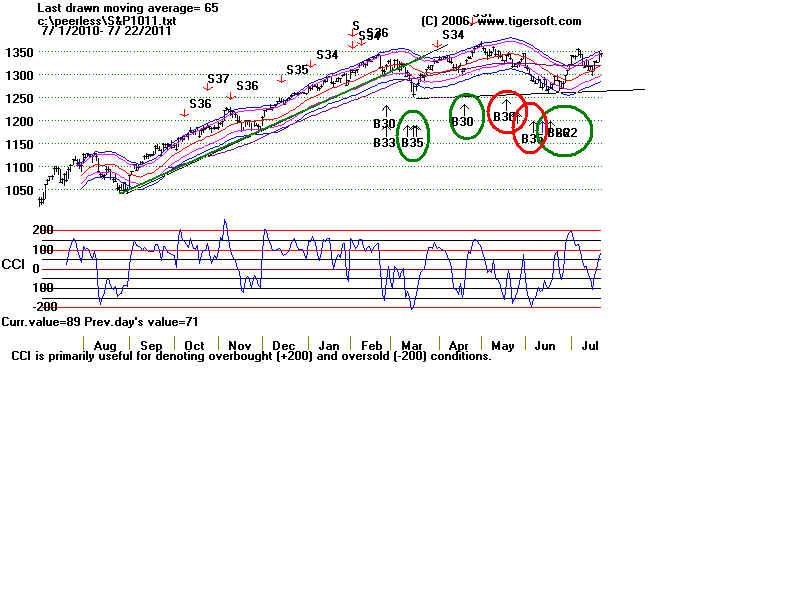

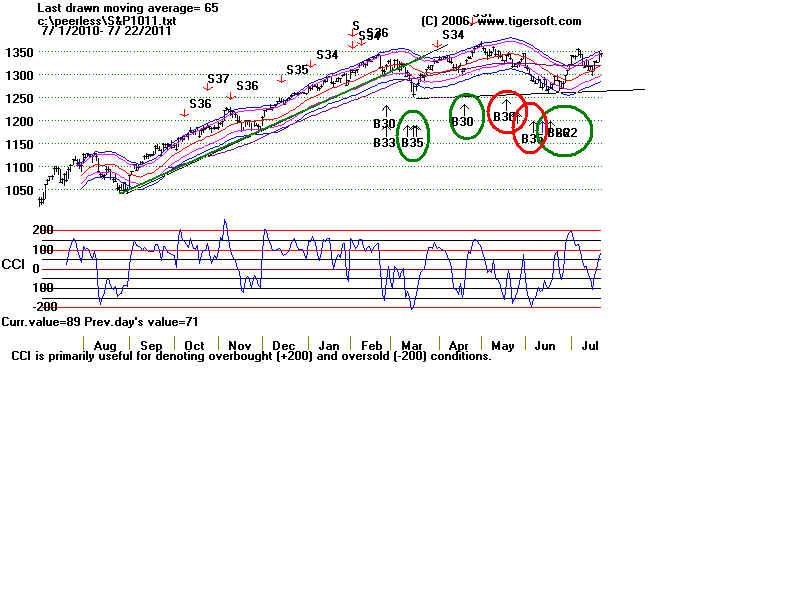

2010 |

2010-2011 |

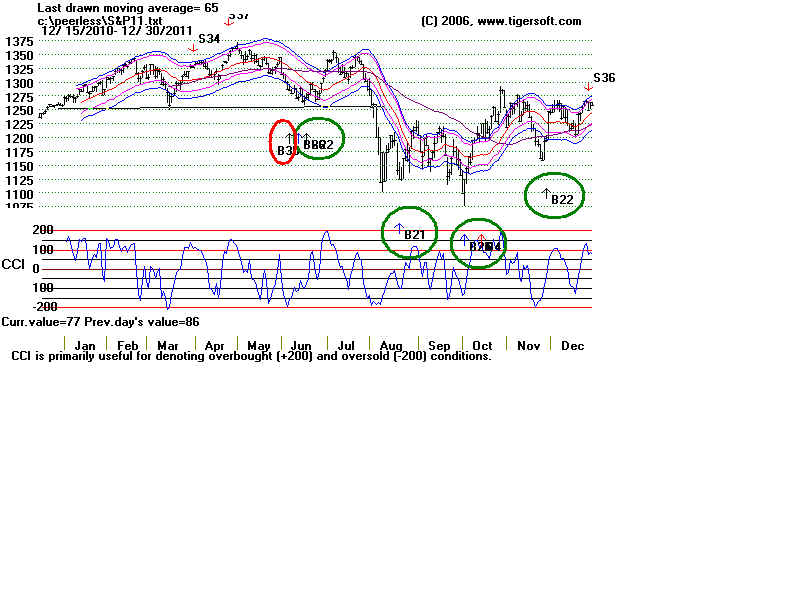

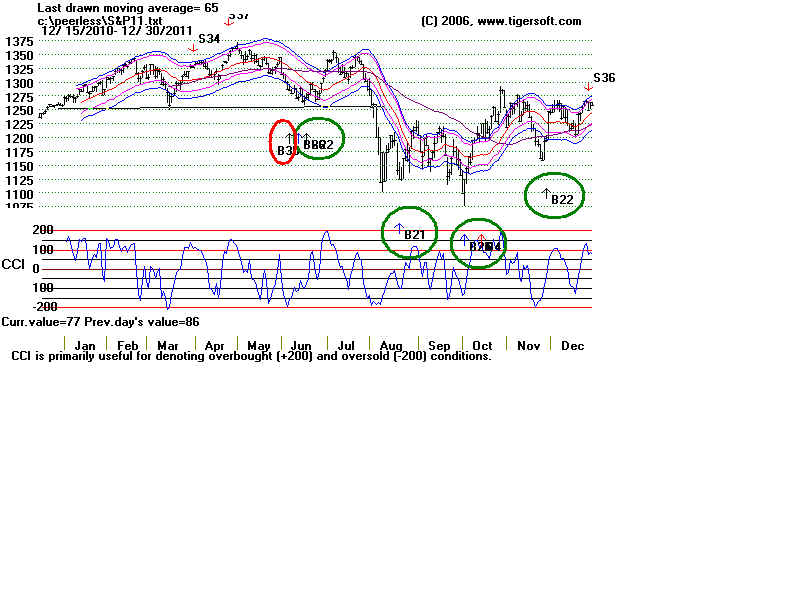

2011 |

2011-2012 |

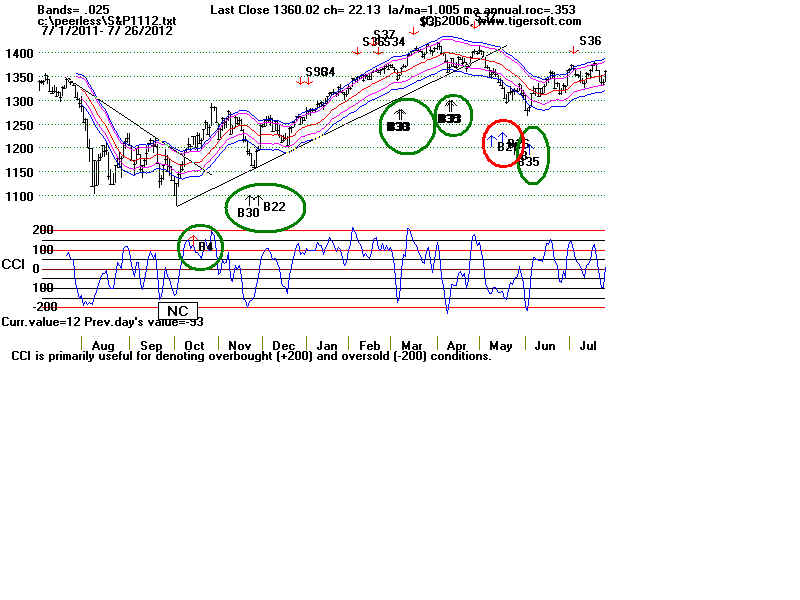

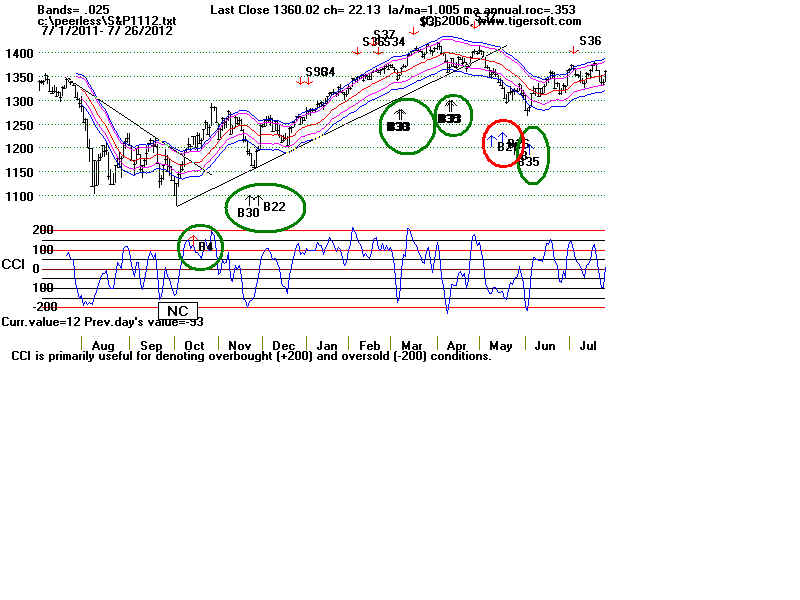

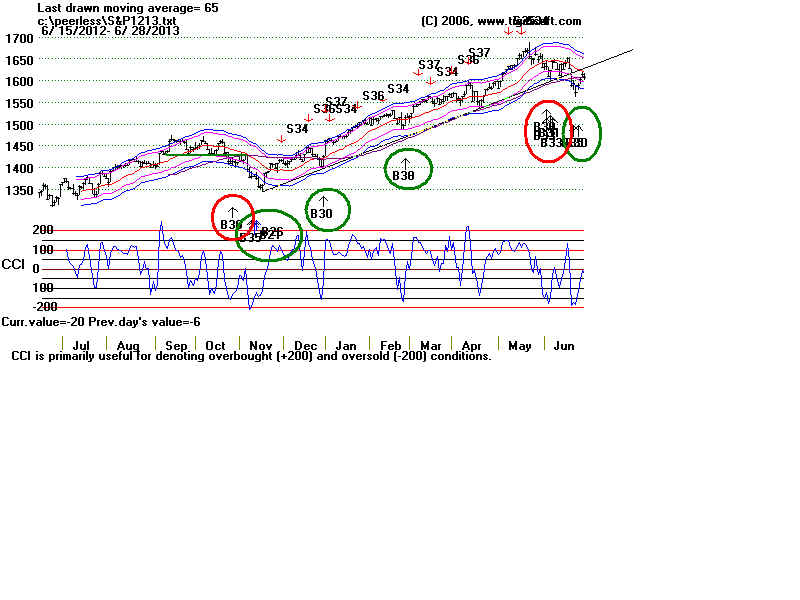

2012 |

2012-2013 |

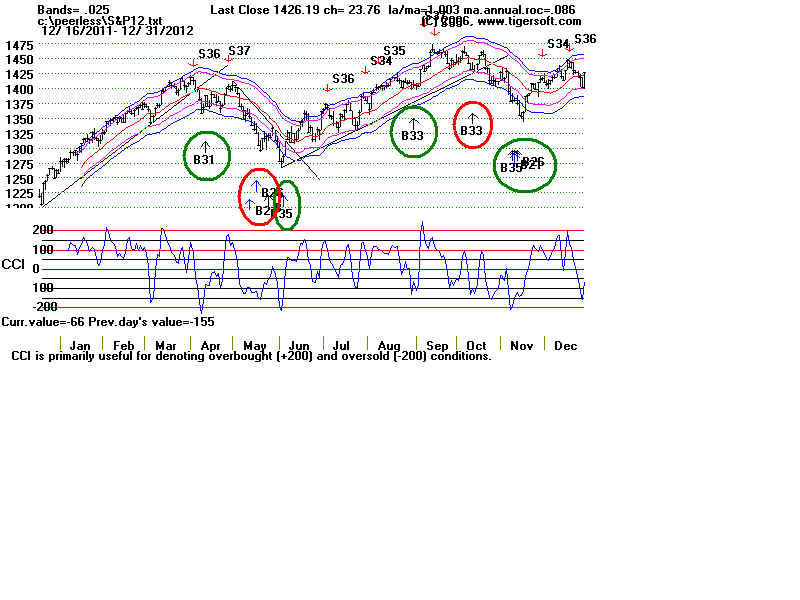

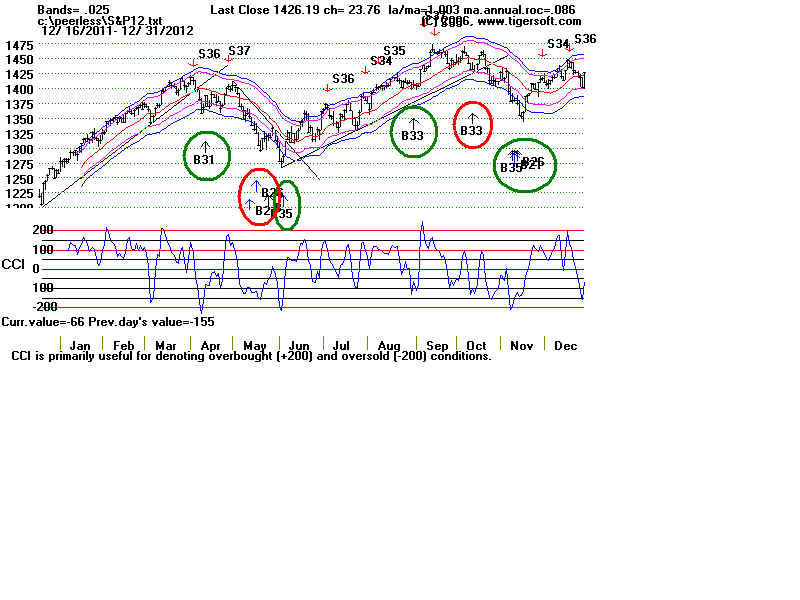

2013 |

2013-2014 |

2014 |