TIGERSOFT Power-Ranker.

(C) 2009 William Schmidt, Ph.D.

7/1/2010

2010

Traders should be running ANALYSIS from Peercomm

and

the using the "BULLISH"

searches of the "MAXCP"

stocks,

whose Closing Power is making new highs...

or

using the "BEARISH"

searches of the "MINCP"

stocks

whose Closing Power is making new lows...

STEP

BY STEP

From

Tiger Data Page, download data using MAXCP.exe and MINCP.exe

From

PEERCOMM, Click SELECT FOLDER button and choose C:\MAXCP or v:\MINCP

After

ANALYSIS is done, return to PEERCOMM menu.

Choose

upper button on right, CHARTS-2010

Click

DAILY STOCKS button

Instead

of picking a stock, chose #12 BULLISH or #11 BEARISH

Toggle

through the graphs using the down-arrow (2) key on right of keyboard with

NUMLOCK

turned off. The (8) key will take you up a stock.

SPREAD SHEET ANALYSIS

Alternatively,

look at the qualifying stocks in a spread sheet.

From

the Main Tiger Page (tiger menacing bull and bear), use pull-down menu

and

choose one of the items there: Bullish, Bearish, Groups...

The

spread sheet shows you from left to right the following values for each qualifying

stock:

Power

Ranker value - composite index of strength:

>500

is normally bullish and <-500 is notmally bearish.

AI/200

- how many days of last 200, the Accum. Index has been positive.

>140

qualifies as bullish and <-70 is bearish.

OBV%-Pt%

shows divergence between price and OBV for last 100 days.

>+30

is normally bullish... <-30 is normally bearish.

0

shows there is no divergence:

which

for new highs means a bullish confirmation of a new high

and

for new lows means a bearish confirmation of a new low.

IPA%-Pr%

shows

divergence between price and IPA for last 100 days.

>+30

is normally bullish... <-30 is normally bearish.

0

shows there is no divergence:

which

for new highs means a bullish confirmation of a new high

and

for new lows means a bearish confirmation of a new low.

Current

IP21 - Current value of Accum. Index

>.45

shows insider buying and <-25 shows insider selling

new

highs need an IP21 of +.20 to confirm and

new

lows need an IP21 of <-.12 to confirm.

Close

= Closing Price

Trend

of 50-day ma

AR

= Above rising - bullish

BF

= Below falling - bearish.

AF

= above falling and BR = below rising.... Neutral.

CL/21-dma

= Close divided by 21/dma.

UP%

- percentage of days a stock is up on a daily basis.

60%

is over-bought

40%

is oversold.

MACD

Signal

TGR

Signal - first D or U relates to Opening Power's momentum on a 21-day basis.

-

second D or U relates to Closing Power's momentum on a 21-day basis.

-

Closing Power best predicts price.

-

Opening Power can be wrong for a long time.

DD

declining Opening Power and declining Closing Power - BEARISH

UU

rising Opening Power and rising Closing Power - BULLISH

TIGERSOFT SUPPORT AS YOU START USING THIS SOFTWARE

Call (858) 273-5900 or email william_schmidt@hotmail.com.

Important - More studies that will help you are posted on www.tigersoft.com, on TigerSoft's data page

and the The Elite Stock Professional Sunday reports.

===============================================================================================

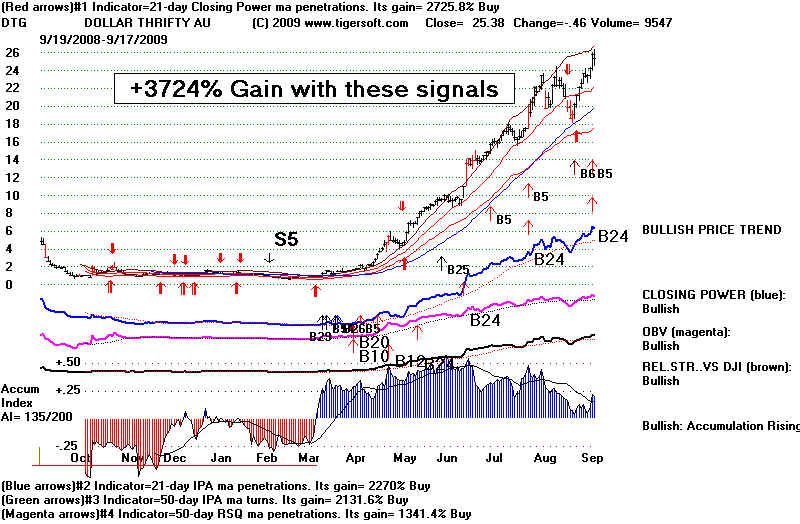

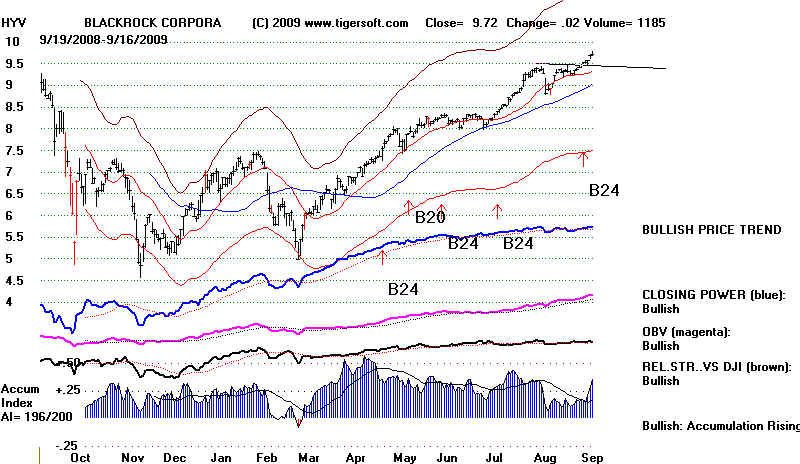

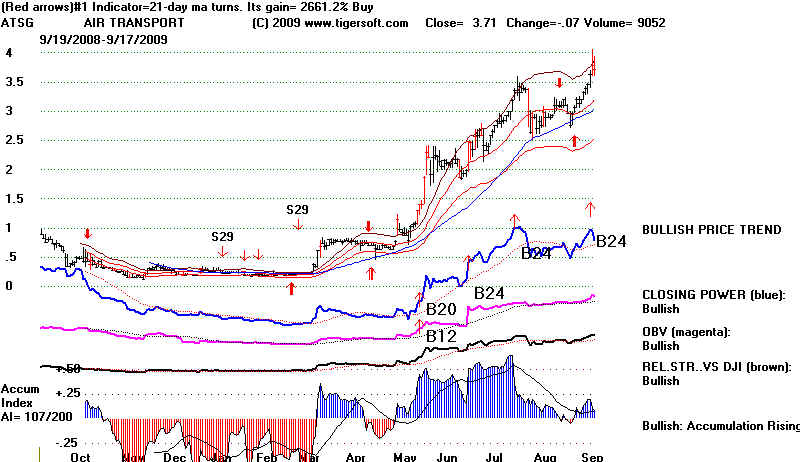

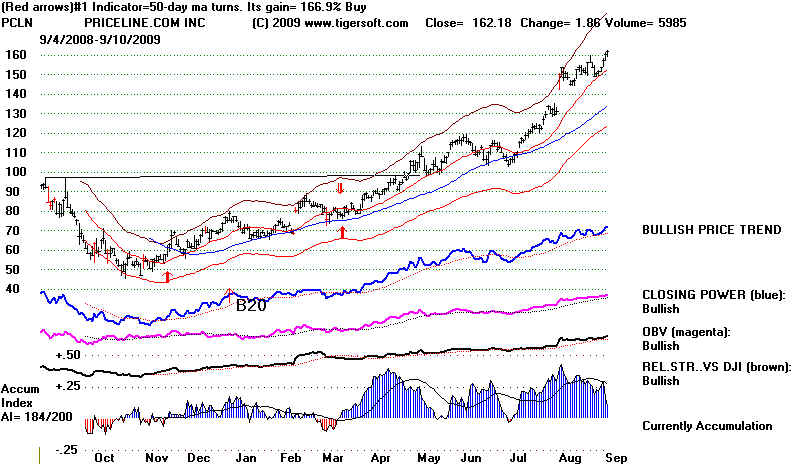

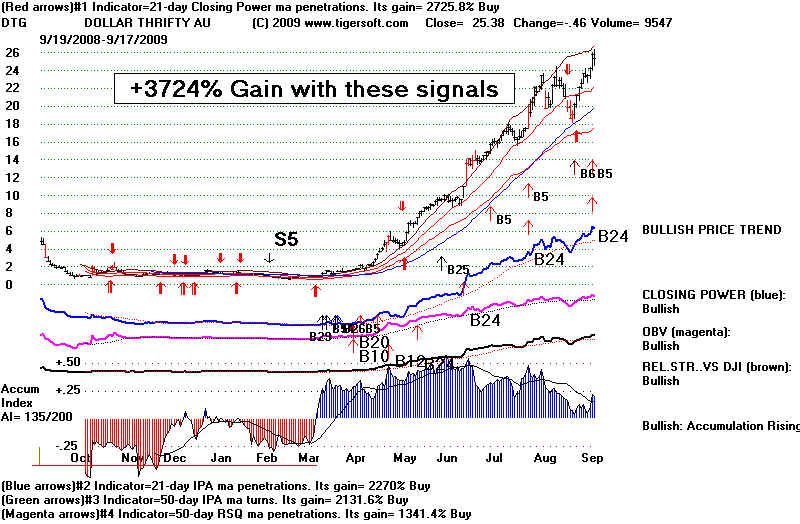

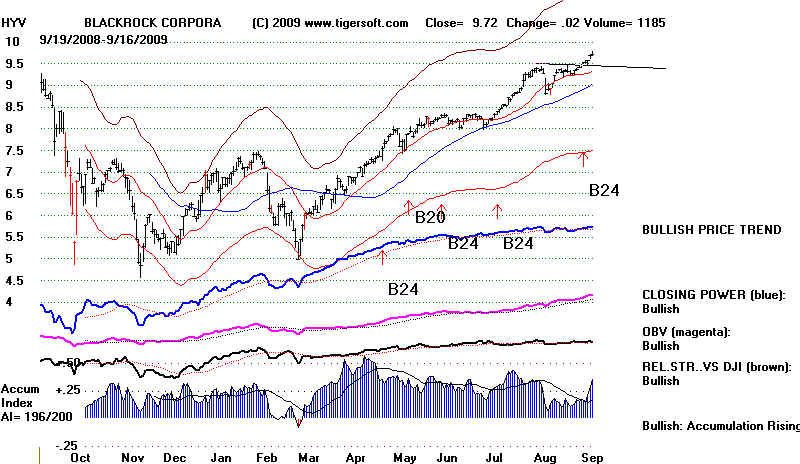

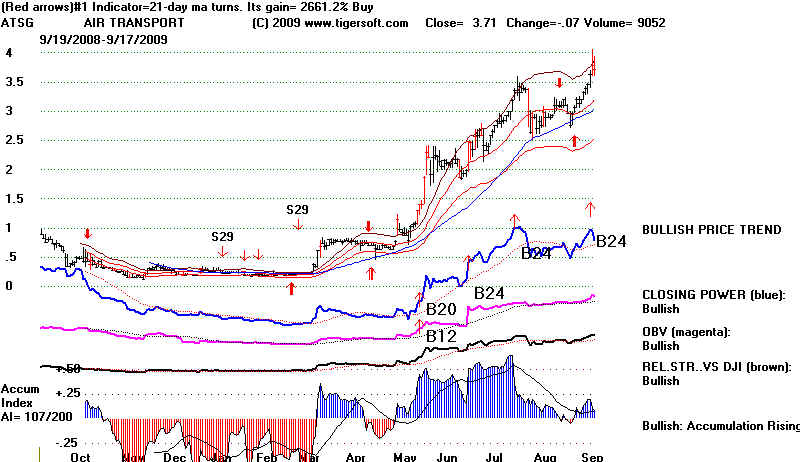

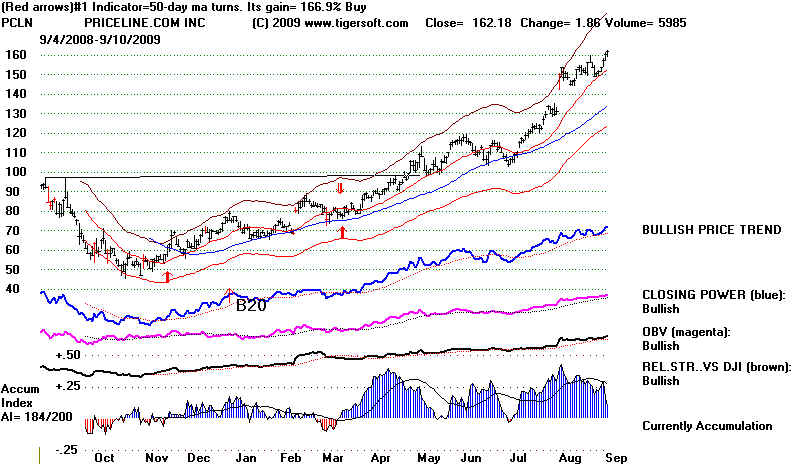

WHAT AN

EXPLOSIVE SUPER STOCK LOOKS LIKE.

Screening fpr BULLISH,

B!2, B24, BOTH UP and NEW HIGHS

finds stocks like these..

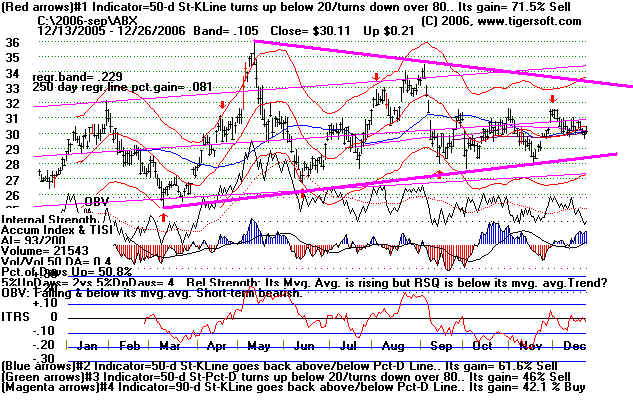

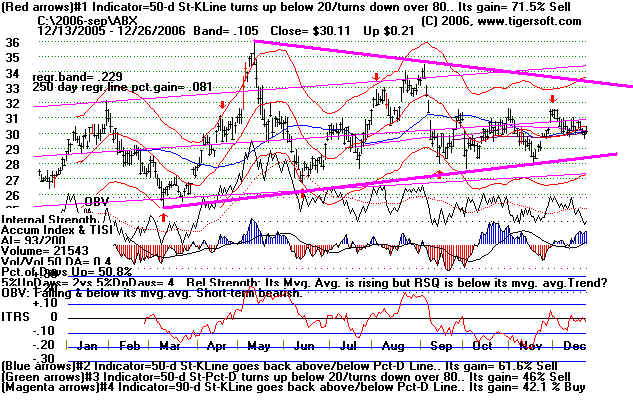

WHAT SUPER BEARISH STOCK

LOOKS LIKE.

Screening fpr BEARIISH, S12, BOTH DOWN

and NEW LOWS finds

stocks like these.

PLEASE - 2 FAVORS WE ASK OF YOU

Read this manual carefully and, please, do not share with others the discoveries of

our hard work and original thinking.

The materials are copyrighted and except for your own use may not legally be reproduced in

any form without our written approval.

If you have not already, purchased them, you will find the following books by Dr.

Schmidt helpful.

Twenty Five Percent A Year: The Experience of TIGER’s

POWER-STOCK-RANKER,

1970-2000, with Safer Blue Chips. Long-term invetsors should read this

carefully.

Over and over, the highest accumulated stock in DJI-30 is a steady gainer for the enxt 21

months.

Explosive Super Stocks: How To Recognize Them Early but Not

Over-Stay One’s Welcome.

Traders will find this our most comprehensive treatise on trading stocks. An update is

being worked on.

Short Selling: Fun and Killer Profits in Any Market. While

this would seem to be of valuable mainly to

aggressive traders, it will help anyone learn to recognize the signs of impending weakness

in a stock.

Hereafter Blue = Commands to be entered.

Features of TIGERSOFT with Summary of Operational Commands:

1) Automatic Buy and Sell Signals on all charts.

---- The DJI Peerless signals have been backtested for the period 1915

to 2008.

---- The optimized / user selected stock signals are

based on internal strength and momentum formalae

which are

discussed in the HELP routines.

The optimized signals appear automaticaly.

To change the number of signals appearing:

TigerSoft + Run/Setups + Set Initial Screens' Signals + Y (upper right)

+ any number (0-4, 1 is the initial setting.

2) Update/Flag/Rank and Edit up to 10 directories of stock data. Each directory

can hold a maximum of

1,000 stocks with one command. Note thgat the data we offers is usually limited to a

maximum of

about 400 stocks. If you use Dial Data as an outside data - source, you put any 1000

stocks you want to

in the directory.

(Run flagging/ranking

program against assumed directory) TigerSoft + Run/Setups +

Run Nightly Analysis

(Run

flagging/ranking program against a set of specified directories,)

TigerSoft + Run/Setups + Run New

Analysis/Ranking/Optimization

Enter the Tiger Data directories to be used in left(white) column.

Click Save you Entries (at bottom)

Click Check your entrys (To be sure each directory is updated.)

Click Start Flagging/Ranking 2004

Viewing Results:

3) View POWER rankings and Pct.Change Rankings with Rank Divergences on up to 1,000

stocks.

Then immediately graph a stock by clicking on the row containing the ranking data for that

particular stock.

This is a great time-saver.

TigerSoft + Ranking Results + (21, 50, 100, 200)

Pct/Change and Ranking Divergences

4) View Flag up to 1,000 stocks using more than 300 bullish and bearish conditions. You

may immediately see a

graph by clicking on the key value’s row for that particular stock.

TigerSoft + Tiger Selections + Tiger Groups, Lists and

Explanations

5) Find special stocks that meet up to six different TIGER criteria.

TigerSoft + Tiger Selections + Multiple Factor Screenings +

seclect conditions (up to 6) + Display

6) Find stocks that had a particular TIGER Buy or Sell signal in the previous 10 days.

TigerSoft + Tiger Selections + Tiger Groups, Lists and

Explanations + HistB1-B37 or Hist1-Hist37

7.) Back-test various combinations of signals to see what happens to $10,000.

Place the signals on a chart. Operations + What Happens to

$10,000

8) Without running the Full Power-Ranker and Analysis, you may rank the stocks in a

directory

by Percent Change, AI/200, Current Accumulation for as many days

back as specified.

TigerSoft + Ranking Results + User Set Rankings + number of

days + (1-5)

TYPICAL DAILY TASKS FOR

TIGER USER,

AFTER STOCK DATA HAS BEEN

UPDATED.

Below you will see the typical sequence of activities followed by most TIGERSOFT users

as they run our software. Soon they will become easy and routine. Note that you may change

these to suit your own needs. Tiger’s POWER-RANKINGS will save you an enormous amount

of time.

They let you find the stocks that our techniques consider the most bullish and bearish

over the

next three to six months. If you are bullish, because of a Peerless major Buy or even for

short-term

trading Buys, look at the “Bullish” stocks in the directories of data that you

maintain. If you are bearish,

look at the “Bearish” stocks. If you use our data, don’t forget to look at

the “Bullish” stocks in the

“HOTSTKS” data, and the “Bearish” stocks in the “NEWLOWS”

data. This should be right at the top

of the list of things to do.

Run the TIGER POWER STOCK RANKER programs.

There are three ways to do this.

1) The easiest way - using just the data in the current assumed directory is:

Peercomm Menu + Tiger Menu (older Graphs) + Run/Setups + 1st Choice

in column.

This

unfortunately does not flag B24s.

2)

Peercomm

Menu + Analysis

This

requires the files flag2000.exe and rank2000.exe in c:\peerless\winpeer

If there is

a problem here, we will send you you the links for these files.

It also

does not run the Optimized Buy/Sell Status Report.

3) You may also run the Ranking and Analysis for all your directories.

First, set up the directories you want to use. Designate them by going

to the

Tiger Menu + Run/Setups + 2nd item in column.

This

unfortunately does not flag B24s.

If any of these stops unexpectedly, note the stock with the bad data and delete it.

When the Power Ranking programs are finished, you will be instructed when to close

the flagging/ranking run. Closing this operation at that time and return to the

PEERCOMM screen.

Viewing the Power Ranking Results.

Peercomm

+ View + Check off the Tiger Power Ranking circle.

Note the results that appear. The stocks are ranked by “POWER” as we define it.

At its extremes, it is a fine predictor of where a stock will go in the next few

months.

Favor the top 10 of 500 or more. Those that are rising fast in rank are also attractive.

Remember the top Power Ranked stocks and those that have the highest IP21/200

scores generally do much better than average. The highest ranked stocks using

Accumulation or Power Ranking will almost always be the top performers

over 3-6 months. The only exception is at the start of a bull market when beaten

down and heavily shorted stocks get big plays for a couple of months.

Long Term Investors, Buy The Stock with The Highest “IP21/200” (also called

“AI/200”)

The very highest “IP21/200” stocks are those we buy using the TIGER

blue chip system

that has gained 25% per year on average since 1970. This we call the Tahiti system because

of its simplicity. Do not use this approach with non-blue chips if they are below their

200-day ma.

Low priced stocks with high Accumulation shouold be making new highs or, at least,

be above their 50-day ma to be considered good long speculations.

Note now that “OBV%-Pr%” measures how much stronger the OBV

(aggressive buying)

Line is than price. We suggest that the OBV%-Pr% should generally not be much below 0

in a stock that is being bought. A reading below -.30 is bearish and a distinct warning.

OBV shows aggressive buying or selling pressure. When a stock has overhead supply

created by earlier peaks, it usually takes aggressive buying to eat up that supply of

stock

and let the stock rally.

“IPA%-Pr%” measures how much better the IPA (patient buying) Line is

compared to

the line of price over 100 days. IPA%-Pr% values greater than +.40 typically show the

stock

has ample support to make buying it on weakness near price support advisable. Later you

can study Dr. Schmidt’s manuals and inspect the HELP routines for more explanation of

these concepts and how best to use them as trading and investing tools.

Now close the screen and go back to the PEERCOMM menu.

GRAPHS

With the Analysis completed, let’s graph the highest POWER Ranked stock.

From the

PEERCOMM screen click the grey button that says CHART. This takes you to the

“Main Tiger Menu”. On this screen our logo, a tiger menacing a bull and a bear,

appears.

Use the Pull-down menu at the top that is labeled “Ranking Results”.

Now choose “Tiger Power Ranking”. This shows the same table you saw

before except

that there are some new columns of key data.

“Current IP21” is the current value of the TIGER Accumulation Index,

as opposed to how

consistently the indicator has been positive for the last 200 days, which is what

“AI/200” or

“IP21/200” measure. Experience teaches us that the best stocks to Buy have an

IP21 greater

than .20. Stocks making new highs near their upper band with an IP21 less than zero (red)

are

vulnerable and frequently are excellent shorts.

“TISI” is the 21-day moving average of IP21. We teach traders to buy

stocks whose IP21

is above a rising TISI and to sell short stocks that have an IP21 below their falling

TISI.

Short-sellers will discover that they can capture the biggest gains by holding a stock

short

only while its IP21 is below its TISI Line.

The direction of the 50-day mvg. avg. is also shown. This is important for

intermediate-term traders. We generally recommed buying stocks that are “AR”,

above a

rising 30-week mvg. avg. (“BF” would signify that the stock is bearishly

below its falling

50-day mvg. avg.). If a stock’s 50 day moving average is relatively flat, take the

red Buy

signals as a sign to take “long” positions and the red Sell signals to initiate

“short positions.”

“Cl/21dma” tells you by how much percent the stock is above or below

its 21-day mvg.

avg. Since strong stocks typically bounce up from their rising 21-day mvg. avg, this is

a useful measure as to how close the stock is to being a BUY. You will want to inspect

the chart to see more information.

Click on the row of the top ranked stock (or any other you may like) and then click

on the Graph button. A chart of this stock appear. It will show the optimized

signals

automatically.

Before showing what this graph means, we want to show you how you can graph any stock..

GRAPHING ANY STOCK OR ALL STOCKS

IN A USER-SELECTED GROUP OF STOCKS

Close the screen until you return to the main TIGER Menu (the tiger is meancing the

bull

and bear.) At the lower left of this screen click on the button that says “Graph

Daily

Individual Stock”. Find the stock’s symbol in the list on the left

side of the screen

and double-click on it. For example, enter MSFT (Microsoft). A price chart appears

on the top part of your screen. It shows the the last year’s daily price ranges as

vertical

bars. A horizontal bar shows each day’s closing price.

GRAPHING A SPECIFIED GROUP OF

STOCKS

AND BUILDING A LIST FOR AN INDEX

Instead of choosing an individual stock to graph, you may also graph all the stocks

that

are in a particular group. These groups represent all the stocks that have met certain

flagged

conditions. These flagged stocks are discussed at more length below. In addition, you may

also graph all the stocks that you pick to be in a particular watch list. Watch lists

always

begin with the prefix “$$”.

To create a watch list go back to the PEERCOMM 8-button display.

Pick the “Tiger Stocks” pull-down menu.

Then choose “Edit Watch Lists”.

Next choose “Add New List”.

Enter the name with the first two letters being “$$”. For testing purposes

enter “$$ALLSTK”.

Do not enter a name with more than 6 additional characters.

Next click on “Select All Symbols”. (Alternatively you might have

clicked on just a few stocks.)

Then click “Close” and “Close”.

Now from the 8-button PEERCOMM screen click the “CHART” button.

Then click “Graph Daily Individual Stock”.

Then choose “$$ALLSTOCK”.

GRAPHS IN SERIES

After a graph appears you can go to the next stock in the list simply by hitting the

down-arrow

key on the right side of your key-board. To go back to the previous one click on the

up-arrow key.

THE GRAPHS

See also the instructions for the TigerSoft Graphing Program.

Moving Averages as Measures of Momentum and Trend

Various colored moving averages of price are shown on the same graph. For an

explanation,

pull-down the Help sub-menu at the top right and inspect the first few items there.

Suffice

it to say here that there is a red 21-day mvg. avg. with fixed interval bands

above and

below the 21-day mvg. avg. by a fixed amount. A stock normally (93% of the time) stays

within the confines of its bands. When it exceeds the bands, it often means that it will

be moving

much further in that direction. On the other hand, when a rally fails to cause prices to

reach

the upper band, it often means the stock will be weak.

The blue-50-day moving average is vital for traders. It defines the

intermediate-term trend.

When prices drop below the 50-day mvg. avg., there is often a rush to the exits in high

tech

stocks, especially if the 50-day mvg. avg. then turns down and the Accumulation Index is

negative.

The same is true on moves above the 50-day mvg. avg.

The pink-30 week mvg. avg. is a longer term measure. When prices drop below it

on a

closing basis with the Accumulation Index negative, it is long-term bearish. Similarly

when prices

rise back above the 30-week (also treated as 149-day) mvg. avg, it is bullish, provided

the

Accumulation Index is positive.

Red vertical bars shows unusual trading volume. As you read more and inspect a

growing

number of charts, you will notice that unusual trading volume often caps a price move

unless

there has been a price breakout or breakdown beyond well-tested resistance or support.

Breakouts in RED are much more reliable.

INTERNAL STRENGTH INDICATORS

Our main Internal strength measures are:

(1) the volume characteristics of the stock

(Volume and Spilt Volume)

(2) how well the stock has performed compared to other stocks or to an

index like the Dow Jones Industrial Average . (RSQ and ITRS)

(3) how well the stock closes near the high for the day

(bullish, when occurring regularly or on high volume.)

or at low for the day (bearish, when on high volume or regularly.)

(Accum. Index, AI/200, IP21, IPA, IDOSC, Larry Williams Index)

(4) how far the stock closes away from the opening. (down in bearish and up is

bullish.)

(Closing Power, Opening Power, Closign Power Pct.)

(5) how far up from the opening is the daily high and compared with

how far down fromthe opening is the daily low. (Tiger Day traders' Tool)

Initial Choice of Internal Strength Indicators To Be

Displayed.

TIGER gives you two initial type of charts. One shows an OBV Line (aggressive buying),

the Accumulation Index (patient big-money buying, often by insiders) and ITRS

(Intermediate-term Relative Strength) Indicator. The other shows only the Accumulation

Index

and gives you written formulations regarding the stock’s OBV strength and its

Relative Strength

(how it is doing compared to the Dow Jones Industrial Average. It also reaches a Technical

Conclusion.

You can pick which of these inital graphic displays you want to appear. Go back to the

Main Tiger Menu and click on the the sub-menu “Files” at the upper

left. Choose “Initial

Graph Choice” and then enter N and N at the two queries that

follow. This produces a

simpler chart with a written technical conclusion. When you become more skilled you will

probably want to see the display that initially shows you the OBV and ITRS indicators

as well as the Accumulation Index.

Internal Strength Indicators.

Subsequent Displays of Internal Strength Indicators. Once a chart is displayed

you can pick

from numerous internal strength, volume, momentum and relative strength indicators. These

always appear at the bottom of the screen. They are placed on the screen using Indicators(1),

Indicators(2) or Indicators(3). Our HELP routines on the top right

give quick guidance.

Reading about these sub-surface measures of a stock’s strength in our manuals is the

next step.

Most important, however, is experience. The more you put into the manuals, the more you

will

get out of of our software and the more the predictive patterns of price and volume will

take on

real meaning. Look at lots of graphs. In particular, start noticing what the internal

strength readings

were on a stock just before it made a big move up or down.

Don’t be afraid to experiment. You can’t hurt anything that can’t be

replaced with a new

installation Please notice that you can always go to Operations and use one of the

choices

there to redraw your chart.

LINES - The Simplest Way To Spot Price Trends, Support and Resistance.

Drawing a line between two spots on the price chart will come in handy. Place a

chart on the

screen and draw a line through the stocks recent tops and bottoms without having the line

go

through any intra-day prices. This is done by using the pull-down menu “Lines”

at the top

of the screen. Pick “Rubber-Band Lines”. Now point the mouse at one of

the stocks recent

price highs and drag the resulting line across so that it goes through another high

without

going through any other price action. This is said to be a “resistance line”.

Do the same

thing with bottoms. This is said to be a “support line”. To be reliable

support and resistance

lines should go through 3 or more separate points each separated by at least a few days.

You may also draw lines between two points using the “Diagonal Lines”

feature. In this

case just point the mouse at two different points on the screen and click the

left-mouse key

once at each point. This should cause a diagonal line to appear. Where the line extended

to

the right now crosses is shown on the screen. You may also want to experiemnt with

“Vertical” and “Horizontal” Lines.

There are many chart patterns that books on technical analysis set out as predictive.

You will

do well to read one or two. The basic ideas in all of them are simple: try to spot a

trend

early, buy at support and sell at resistance. However, know that broken resistance

becomes support and broken resistance will probably be resistance. Our software has

tried to encapsulate these concepts into automatic buy and sell signals. As much as we

have

tried, there are still may times when a close inspection of the chart is necessary. The

computer

just can’t be trained very satisfactorily to recognize well-tested diagonal support

and resistance

lines, nor can it replace the actual search for “head and shoulders” tops.

APPLYING TIGER BUY AND SELL SIGNALS - BASICS

Using Automatic Signals To Spot Important Technical Developments in Your Stocks.

Any TigerSoft chart you choose should show OPTIMIZED RED Buys and Sells. These are

discussed at length in the instructions for TigerSoft. Market conditions change and that

can

change the Buys and Sells from day to day. So it is necessary to note the technical

condition

of the stock. Besides looking at the internal strength indicators and the chart patterns

present

by the stock, we suggest using the fixed rule Buys and Sells. When you have a chart on the

screen,

these signals may be placed on the chart using the choices under Signals-1. These fixed

rule

automatic buy and sell signals may be used for automatic trading, but it is better to use

most

of them as advisory and note

them as warnings of changing technical conditions.

The signals can be applied to commodities but not to open-end (mutual) funds, because

they

have no daily price range or volume figures.

Not all signals are equally important. The major BUY signals (B4, B10, B12 and B24)

typically

have much more power than other buy signals. They are relatively uncommon. However,

you can easily learn of new cases by using our flagging program or by subscribing to our

Elite Stock Professional (ESP) service.

The major sell signals are more varied. I classify the following as major sell

signals: SELL S4, S9, S14, S24, S25, S26, S27 and S29. Of these I believe the S4 is

most

important. This sell signal, however, does not occur until the stock violates its 30-week

mvg. avg.

Traders should make liberal use of the S29 as a way to lock in profits in over-extended

stocks.

With low-priced stocks that enjoy a meteoric rise over $20 (These we call

"piffle" stocks),

the best signals for catching their peaks are the SELL S9, S14, S24, S25, S26, S27 and

S34.

Placing buy and sell signals on the screen is easy.

First, place a chart of a stock on the screen. Next simplify the display. Under “Operations”

pick “Restore Simple Bar Chart”, Now go to the sub-menu “Signals”.

Notice the way the

signals are organized. Signals “1”-”9” should be used for a stock in a

rising trend. You can

use your own judgement here, if you wish. You can also use the “Technical

Conclusion”

our software offers. This appears at the bottom of the screen using one of the initial

graph choices

mentioned above.

The highest Power-Ranked stocks, certainly those above the 85%ile, should be considered

uptrending unless they violate their pink 30-week mvg. avg. or unless they violate major

support.

See HELP routines, particularly those “The Trend is Our Friend” to “Tiger

Stock Trading Signals”.

There is another easy way to assess the stock’s direction. Use our regression

channel tool.

With a stock’s chart on the screen, go to the “Lines” pull-down menu

and pick the “Least

Squares Regression Channel” and “Regression Channel Statistics”.

A stocks whose

regression line percent gain is more than .25 must be considered uptrending, unless it has

just

fallen below the lower regression band.

Now place the major signals on the screen for a riising or falling trend stock.

If none appear work down the list, until some minor signals appear.

Start learning what the signals mean. Use the HELP routine on the right of the

screen. Pick the

sub-menu choice: “Tiger Stock Trading Signals”. Look up the meaning of

the last signal on

your screen. Next go back to the chart and make a listing of all the signals. Use the

“Operations”

sub-menu and pick “Trading Results: All Signals” .

USER CHOSEN SIGNALS

You may readily see a listing of all the TIGER buy and sell signals by pulling down the

“File”

sub-menu at the top left when a chart of a stock is on the screen and then by and choosing

“Build/Run User Defined Signals’ Set”. You might want to print this

out. Highlight some

of the signals that seem interesting. For example, if you like to sell on strength and buy

on

weakness, you might highlight “B6” and “S6”. These are

common. And near the upper bands

they are usually reliable. Enter a name like “TEST” in the box at the

upper right of the screen.

Click the “Save Name” button. Do not use any prefixes (like

“C:\stocks” ) or suffixes (like “.txt”).

Now click the button “Apply Selections Now”. The graph with the

appropriate signals appears.

You may clear the screen and redraw the chart by using the first option under the

“Operations”

sub-menu. Now place the set of signals you have just built a name for on the new screen.

Pull

down the sub-menu entitled “Signals” and choose the third item “Display

User Defined Signals’

Set”. Enter “Test” or whatever name you have assigned to a set of signals.

The approriate signals

appear on the price chart.

TIGER automatic buy and sell signals. With a chart of the screen, you can place them on

the

screen, one by one, simply by using the “Signals” pull-down menu and

selecting

“Display User-Set Signals”. Enter a signal among these possibilities:

“B1”...”B37” and “S1” ...

”S37”.

HELPFUL INT: Note that you can switch to another stock by simply hitting the

down-arrow key on the right side of your key board, provided the NumLock key is

toggled to the off position.

HELP ROUTINES

We have constructed the HELP routines to reinforce the most important lessons and

images.

Please study these charts carefully and then look for new examples of the same phenomenon,

the same price and internal strength characteristics. In time you will see how helpful and

how

profitable recognizing these key technical signatures can be,

For Convenience I list the HELP sections here.

Stock Graph explanation.

Stock Price bands.

“The trend is Our friend”.

“Bullish Aspects in A Chart”

“ Negative Non-Confirmations”

“Bearish Aspects in A Chart”

“High Tech Stock Trend Switch to Down”

“High tech Stock Trend Switch to Neutral”

High tech Stock Trend Switch To Rising

Indicators, Terms, Concepts

Tiger Stock Trading Signals

Evaluating Stocks Already Owned

Over-Extended Speculative Stocks

Short Selling Techniques

Back-Testing The TIGER Signals

Display a stock that has been uptrending for some time, the technical conclusion should

be

wither “Bullish” or else the screen should say “Long term price trend is

Bullish” . By “bullish

rating” we mean that the stock was above its 30-wk. mvg. avg. (long-term trend was

up) ,

its 50-day mvg. avg. was rising (intermediate-term trend was up) and the stock’s

Internal

Strength rating was positive and bullish.

Using the “Signals” pull-down menu, place the bullish signals on the

screen. Know that

they most clearly apply to the period of time that the stock was above its rising 50-day

mvg.

avg. To see how well the signals did in the past pull down the “Operations”

sub-menu.

Choose “What Happens to $10,000 (buys and sells -includes short sales-) or

(buys only)”..

There are times when you might want to place buy and sell signals on the screen where

you believe you would have taken the signals. You may add or suppress a signal by

using the pull-down menu “Lines”. Choose the first item in the sub-menu.

Next point

the mouse at the signal to be cancelled or the place where it is to be added. Enter either

“X”

(for cancel) “B” (to add a buy signal - a BUY B28) or “S”

(to add a “SELL S28”).

As a result a vertical line appears at the point you have specified. Move the mouse

pointer

to the far right and left-click it. The signal still appears but not when you display the

results or

calculate what would have happened to $10,000, allowing $40 for each reversing BUY or SELL

to cover commissions and slippage (the difference between the bid and the ask.)

You might want to place a judged “B” at the point where there is a diagonal

trend-break to the

upside, or on an upside breakout over the 50-day mvg. avg. or the rising 21-day mvg. avg.

You may also want to place it after 5 tests of a support level. And you may want to use

the judged “B”

when a breakout takes place past well-tested resistance which is not signalled

automatically by a

BUY B5 or BUY B10. Use some of the ideas in our Explosive Super Stocks and

Short Selling: Killer Profits in Any Market.

You may also exclude an area of the screen for signals. This would be correct where the

main

signals do not apply. This would be proper where the stock shifts from uptrending to

neutral

because it violates a long-uptrendline or violates its 50-day mvg. avg.

This off-limits area for signals is set up as follows:

Pull the “Lines” sub-menu down from the top of the screen.

Pick the first item in the resulting sub-menu.

Then point the mouse at the line you have just drawn showing where the trend changed

from bullish

to bearish. Click the mouse once.

Then point the mouse to the far right of the screen and click again.

You will see a horizontal line under the dates. This marks the area in which no

signals will appear when they are next drawn.

Now put on the screen signals appropriate for a different trend.

Check the trading results as shown above.

To start again with the same stock and have all the signals wiped out, simply

pull down the sub-menu “Operations” and click on Restore Original

Stock

Chart. The earlier signals and exclusionary zone are blanked by picking any of the Restore

Original Chart options under “Operations”.

TIGER’s BUY and SELL Signals: Some Practical Applications:

UPTRENDING STOCKS and SIGNALS

You will have the greatest success, we believe, applying the automatic TIGER BUY

signals to the very highest accumulation and highest POWER ranked stocks.

A stock whose %ile is above 85% should certainly be considered uptrending until there

is a major SELL S4 or S9. You can determine the POWER ranking percentile by selecting

this under the OPERATIONS sub-menu after a chart is on the screen. The HELP

routines

illustrate the importance of finding and buying stocks that have persistent and massive

accumulation

and are in uptrends or are breaking out to the upside.

You will generally have much better than average success applying these BUY signals

to strongly uptrending stocks, ones that show a major B20, so long as they stay above

a rising 50-day or 30-week mvg.avg. and thus do not show an S4 or S29.

In most cases a simple visual inspection will tell you if the stock is uptrending.

Using the least squares line and getting the least squares statistic will tell you

by how much. Certainly, a least squares line that is rising by 25% or more should get

you to

emphasize the TIGER buy signals. Unless there has recently been a SELL S4 or SELL S29,

treat such stocks as UPTRENDING and apply the signals from this group.

In a stock that is in an uptrend and has an AI/200 score over 185, use

the B21 with confidence.

These signals represent temporary pullbacks below and then above a 21-day mvg. avg. In

these

cases also use the B11 - Stochastic BUY; the B13 - turns upwards of the 21-day mvg. avg;

and

the B31 - MACD BUY. In these stocks, dips toward the lower band that produce BUY B8's

should also be bought.

The B8's tell us that the stock's new low was not confirmed by any of the 3 classic

measures

of internal strength, OBV, IPA and Stochastic20. Also use the B30. This signal tells you

there

is an extreme 100-day divergence between either OBV% and Price% or between IPA% and

Price%. Since a stock's trend is more apt to continue than suddenly change, especially if

there

are ample signs that the stock is still under big-money accumulation, use the individual

minor

OBV, IPA and Stochastic-20 non-confirmations as BUYS.

In thinner, less seasoned stocks that have risen 50% or more from their base,

take profits when you get an S20 - S13 combination sell signal or an S31 MACD SELL.

These

tell you the short-term direction is now down. In an over-extended "piffle"

stock this is can be a

dangerous situation. Even before the

intermediate-term price trend (based on a 21-day mvg. avg.) has turned down, you often

get

excellent sell signals based on S21, S22, S23 using defaults, as well as the major S9,

S14, S24,

S25, S26, S27 and S28.

With uptrending stocks, I suggest placing preset signal-bunches on the screen using the

sequence (1), (2), (3) and (9). You can clear the screen at any time by re-drawing the

original graph

(under OPERATIONS). Note that you can place these signals on the screen individually.

The MACD - B31 (and S31) are particularly valuable trigger signals. Act on them when

there previously

has been another recent major buy (or sell) signal. Be on the look out for such

combinations as

a B8-B31 or an S9-S31 over a week.

MIXED-TREND

STOCKS - LOWER VOLATILITY

and TIGER SIGNALS

Mixed or neutral trend stocks are "YO-YOs". They should be considered

short-term trading

vehicles only. This is not to say that they make better short-term trades than purchased

UPTRENDING stocks. The optimized Buys and Sells will probably be based on a

Stochastic.

Use these signals until the stock breaks below the best support line or above the best

resistance line.

Those lines may be flat or converging.

To establish that a stock is in a mixed or neutral trend, check the Least Squares. Line

to be sure

that the line is not rising faster than 25% or falling 25% on an annualized basis. Inspect

a stock,

too. Is it holding above easier support but not making new highs? Be on the alert for the

end

of a trading range. Be able to spot points of serious price deterioration and breakdown or

strength and breakout to the upside.

The best automatic sell signals to first display show volume and momentum

non-confirmation.

"warnings". These probably should not be taken as signals to buy or sell, rather

they should

be used as warnings of an impending reversal. With mixed trend stocks apply the automatic

TIGER counter-trend signals. On the buy side these are the B1, B2, B7, B8, B9 and the B30,

B32, B35 and B36.

On the sell side, the counter-trend signals are an S1, S2, S8, S9, S30, S32, S35 and S36.

Note than the B30 and S30 register extreme divergences between the 100-day price action

(Pr%)

and its OBV% and IPA%. Treat all S9 (negative non-confirmations by the IP21) as important.

The B8's and S8's are also very useful. Of less importance are the B34's and S34's, which

register

that a 50-day high or low was not confirmed by the RSI.

Most of these counter-trend signals will work well with neutral trend stocks provided

that that

they are not above their upper band or below their lower band or are breaking out to the

upside

or breaking down below well-tested support.

The trend-change signals (B5, B10, B12, B24 and B37) will tell you when a neutral trend

is

turning upwards. Similarly, the S4, S5, S10, S12 and S37 signals will tell you when a

neutral-trend

stock is turning down.

These trend-change signals work reasonably well with stocks that have had relatively

limited volatility.

They work less well with stocks that are swinging back and forth in a broad trading range.

I have

suggested considering any stock that has a regression channel volatility greater than 40%

to be a higher volatility.

MIXED TREND STOCKS OF HIGHER VOLATILITY

and TIGER SIGNALS

When the regression channel for a stock is more than 40% wide, say, we would classify

it as being

highly volatile. In these cases if the stock's regression line is flat for the past year,

you will probably

have limited success with the counter-trend signals. These stocks have a habit of

exceeding their first OBV,

IPA and

Stochastic-20 non-confirmations. Counter-trend signals based on volume and momentum

non-confirmation

work best when the stock is approaching its year-long regression

channels.

Apply the trend-change signals with some care with these stocks. They tend to make

bigger swings

because their old highs and lows are farther apart. The B29 and S29 are still very

reliable.

With these more volatile stocks, traders should be aware of when they may be starting a

bigger move.

To see this try the B16 and S16. These will tell you when the 21-day moving avg. crosses

the 30-wk mvg.

avg. upwards or downwards, respectively. The B32 and S32 anticipate the B16 and S16. They

tell you

that the 21-day mvg. avg. is crossing above or below the 50-day mvg. avg. In a rising

general market, the B32

and then the B16 signify institutional buying is beginning in what will probably be a

trend that should last for

more than a month. Similarly, the S32 and S16 tell you that institutions are backing away

from or selling

the stock outright and it should move lower for the next month or two. Such observations

should be

confirmed by a widening movement of the Accumulation Index in the same direction.

With these broad-swinging neutral trend stocks, I would use the MACD BUY and SELLs if

the B31 and S31,

especially if there case of the B31) or distribution in the case of the S31. B31's should

also work well when a

stock is coming off a successful test of its major support. S31's should be used when a

rally fails at well-tested

resistance. Lastly, use the B31s and S31's when the longer term regression channels have

been reached.

DECLINING TREND STOCKS

and TIGER SIGNALS

Use the declining trend signals whan a stock is blow its 65-day ma.

The Least squares line should be falling at a -.25% rate.

Use it also if there has been a decisive support failure, an S4 and an S10 or S12

without a major B4, B10, B12, B20 or B29 augmented with a positive Accumulation Index a

the same time.

First, place the major BUY signals on the screen.

Secondly, place the minor sell signals from those listed under declining trend stocks'

signals

on the screen. This will show minor new highs which are not confirmed by OBV, IPA and the

Stochastic-20. It will also show the S6 reversal days and mechanical Stochastic-S20 S11

and MACD S31

sell signals. The mechanical signals should work best when they follow down-arrows

indicating OBV (red),

IPA (blue) and Stochastic (white) non-confirmations of minor new highs. I particularly

like S6's in this

environment. They show high volume reversal days downward.

Thirdly, put the trend-continuation sell signals for down-trending stocks on your

screen. These are

the S4, S5, S10, S12, S13, S14, S16, S18 and S37.

Fourthly, put the sell on-a-rally sell signals for downtrending stocks. These are the

S1, S2, S3, S7,

S8, S9, S15, S30, S32 and S35.

Last, place the minor buy signals on the screen. If the internal weakness in a stock as

measured

by OBV and the Accumulation Index is not too weak, the minor buy signals for down-rending

stocks take on more importance. The minor buy signals may be used for covering a short

sale once its

downside objective has been obtained (see my short selling manual) or the lower band of

the least squares

line has been reached.

A Word about Insider Buying and Selling.

In most cases, we can't easily identify who is buying or selling big blocks in stock.

SEC filings

are delayed and the release of these filings represents a further delay and loss of

timeliness.

Nevertheless, I have theorized the way in which a large block of stock might be

accumulated by someone

who has insider information or his pals.

"BIG MONEY ACCUMULATION" is seldom spoken of with precision and on;y

infrequently given a

working definition that lends itself to mathematical precision.

A stock would be under accumulation if it stayed in a flat-topped trading range, below

its old highs,

but still regularly closed near its highs, especially on days when volume is high. From

this behavior

we deduce that someone is watching the stock. They are stalking it. They are buying it in

a stealthy,

unhurried fashion. This is very different from the behavior of a stock behaving randomly

or being whipped

about erratically by wild public swings of greed and fear.

Stocks showing steadily positive TIGER accumulation readings are those that are likely

to have a

buying cushion underneath them and are likely also to be "TIGHTLY HELD", that

is, owned by

investors who can not easily be induced to sell their stock even on a rally of say, 25% or

even 50%.

High accumulation stocks are thus safer than most, to buy, as a general rule, but they

also are more

likely to rise swiftly, if aggressive buying is introduced into the picture, because the

stock starts to rise

quickly, thereby attracting performance-minded traders and institutions.

As I use the term "accumulation", it means that the stock's shares are moving

from the

"WEAK HOLDERS", who are more:

"emotional" (Greed, fear and impatience are money killers.), whose

stock ownership is "weaker"

(less tenacious and determined), "poorer" (less deep-pocketed and

more subject to selling from fear),

"manipulatable" (less experienced in the ways of the market), "uninformed"

(less knowledgeable about

the particular company)", and more the "impatient".

to "STRONG HOLDERS", whose stock holdings are acquired over a

longer

period of time, because they do not wish to disturb prices as they build up really

big positions, whose

holdings, moreover, are based on careful planning and serious study. These are the

"strong" hands.

Note, in particular, that they have much more money and can not so easily be scared

into panic selling.

In many cases these are the very people that make the news or start the rumors. They are

the insiders.

For further discussion of “big-money accumulation” and the role of insiders,

please see my

Explosive Super Stocks, especially page 54.

8 TIGERSOFT Methods of Identifying Insider Accumulation:

TIGERSOFT believes you can find stocks that are being accumulated using at least

different approaches.

1. Look for stocks that show lengthy posititve (blue) Accumulation (AI) readings.

Look at the data in ACCUMLA on the Tiger Data page.

2. Look for stocks that show big spikes of accumulation.

The AI readings go above .50 and then simultaneously or within a few months

the stock

makes a new high. (B12 and B24 major buys).

3. TigerSoft's Closing Power is in an uptrend and above its 21-day ma.

Opening Power may be falling. If it is

also rising, the stock may be approaching a

climax. Draw trendlines with the Closing Power. Treat this as the

price. Look

for price patterns from it, breakouts and breakdowns. After a long run,

draw steeper

Closing Power Trendlines.

4. A strong stock has flat tops and only minor pull-backs.

5. The stock’s OBV Line is rising to new highs ahead of price and when the stock

declines the OBV Line hardly declines at all.

6. The stock is outperforming the DJI or other key averages. It has high relative

strength.

7. The stock is at the top of the price change ranking for 50-days.

8. The stock shows a Closing Power that is making new highs ahead of price doing the same.

9. The stock frequently advances on days when the DJI goes down. The Asynchronicity

Index

(under Indicators 2) is making new highs even when the stock is not.

10. The stock is among the first to make a 12 month high after a bear market.

Lengthy Positive readings from

the TIGER Accumulation Index.

If the stock is gradually rising, this probably represents steady buying on weakness by

institutional buyers

who are purchasing big blocks of the stock regularly on nearly all intra-day dips. Here we

use the TIGER's

AI/200 score. This is simply the number of days the Accumulation Index has been

positive of the last 200.

Finding the stocks in the DJI-30 that have the highest AI/200 scores has

regularly found fine blue chip gainers for us. See my Twenty-Five Percent A Year Can

Make You

Rich. DJI stocks that have an AI/200 score greater than 194, have an average gain of

74% over 21 months.

EXAMPLES - KO in 1989 or UK in 1994.

BUYING TACTICS

Tactic #1

Short-term traders should consider selling puts on the highest Accumulation

Stocks in the DJI-30 or SP-500 or NASDAQ-100 on every three or four day dip.

Then when the stock rebounds, which is expected because of the high accumulation's

cushion

of support, close out the put positions. Repeat this operation until you are put the

stock. Because

of the superb long-term track-record of buying the most accumulated DJI-30 stock or stock

in the

SP-500, the ownership of the stock will probably soon prove to be profitable. Only a CRASH

like

in 1987 would upset this plan.

TACTIC #2

Buy on MARGIN the top DJI-30 stock as soon as it becomes #1. Don't wait for the end of

the quarter.

Assume that other TIGER users and big institutions will push the stock up higher over the

short-term.

The average gain for a top AI/200 DJI stock over the first quarter was 5.99% from

1970-1994. Using

margin, this would have been about 12% a quarter or 48% a year.

Lengthy periods of Accumulation and Rising Uptrends even as the DJI is going

down for several months,

can provide you a great way to find explosive super stocks that are not in the DJI.

EXAMPLE AMGN 1990.

In Amgen's case doctors, we believe, were accumulating AMGN in 1990 before the FDA gave

approval

for two new block-buster drugs. They could se the efficacy of AMGN's drugs in clinical

trials.

TACTIC#3

After the DJI has fallen 10%, look for a PEERLESS MAJOR BUY signal. After that occurs,

buy the highest AI/200 or POWER-RANKED Stock in the NASDAQ-100 or among smaller companies,

provided its AI/200 score is above 190 and is above its 50-day mvg. avg.

After that, buy such stocks on temporary pullbacks to their rising 21-day mvg. avg. or

on breakouts

above their flat horizontal tops. TIGER B21 and B10 signals will help.

FLAT-TOPPED TRADING RANGES suggest simple profit-taking by traderswho have simply

placed their SELL ORDERS at the old highs. FLAT-TOPPED patterns are seldom major tops.

They usually are broken above with big price surge soon afterward. Flat-topped patterns

may

represent the signature of big-money accumulators trying to hold the stock back so that it

will not

look too good, too soon. If successful, yhey can buy more or stock, so long as the float

is not

exhausted. B5’s and B10’s signal breakouts. Check these to see if the patterns

that are being broken

out can be considered truly flat. If so, they are very bullish.

SHALLOW-PULLBACKS ARE BULLISH. If a stock does not retreat much below its rising

21-day moving avgerave and then begins another run to new highs, it signifies that

profit-taking

is easily being overcome by new aggressive buying. Tiger’s “B19’s”

flag and signal such relentless

upward momentum.

TACTIC#4

Buy flat topped breakouts just after the breakout on a closing basis, if the stocks

show recent

high accumulation. The Accumulation may dip slightly negative territory if the stock's

relative strength

is good (ITRS >+.25) and aggressive buying is evident from an up-sloping OBV Line

(OBV%-Price%>-5.

These are BUY B5's and BUY B10's.

TACTIC#5

Find potential breakouts above flat topped patterns with good accompanying

internal strength using

the TIGER Spread Sheet Program using the 100-day Price Pct. column, clicking on the top of

the

column and then inspecting the stocks from 99 to 90 to see if they have flat tops. Those

with high

accumulation should then be bought by day-traders on their intra-day price breakouts. Note

that this

tactic takes time. I prefer to follow each night all the stocks that are at the top of the

POWER RANKING,

50-day Pct.Change Rankings and are in such lists as TOPREL.

Regarding breakout buying, do not use these tactics unless you are willing to work with

stops

8% or 10% below the point of breakout. Do not use them when the number of new lows on the

NYSE or NASDAQ exceeds the number of new highs. This approach is exciting. But it also

takes patience. Anticipating breakouts can be very costly. It is also frustrating. Many

stocks do

not price breakouts at convenient times. Often they seem to occur late on Friday

afternoons

or in after hours trading.

SMALL CAPS and THINNER STOCKS

Small stocks often can not easily be accumulated over a long period of

time. Their floats are too thin.

Sometimes, too, the breakthrough that permits a stock to go up significantly, occurs in a

way that too

many big institutions learn about it all at once. In these cases, it is not practical to

quietly accumulate

a big position in a stock while it is still sitting in a trading range. Big-smart-money

will show its hand

in these cases by increasing their activity quickly. This frequently causes the Tiger

Accumulation Bulge

to spike upwards. Accumulation Index Spikes above +.40 signify such buying. If at the same

time or

within a few months after, the small stock starts making a series of new highs, BUY it.

Tactic#6

BUY smaller technology and other exciting stocks when they show fresh BUY B12's or

B24's. These

major TIGER BUY signals also factor in relative strength. If we are going to buy an

unknown smaller

stock, we want to see it behaving much better than the overall-market as measured by the

DJI-30. Not

only does this factor give us some compensation for the added risk we are assuming, it

also suggests

that others will be attracted to the stock because of its superior price performance. Not

all of these

will work out. However, selling the poorer performers and adding to the best performing is

a well-tested

proven system.

Insider Distribution and

Selling

Believe the evidence of red distribution when you see. When the stocks then breaks

down

below key support, even in a bull market, expect it to decline further, usually by at

least

height of the price pattern above the point of breakdown. Disregard the automatic

Buys

just after a breakdown.

PERFORMANCE TRADING

When a stock's price looks cheap, it usually is no bargain - unless there has been a

bear

market in it for a year or more. Buying stocks just because they are down 50% from their

highs

is usually unwise. Either buy at long-term support or on price breakouts that occur as the

stock makes all-time highs. There's little reason to buy a stock that has a large supply

of stock

offered just overhead, and that's exactly what you'll be getting if you buy a stock that

has pulled

back 50% , or so, from its yearly high.

In an on-going bull market traders in growth stocks should look for stocks that are

making

new all-time highs. They should have doubled in the last year. They should have polite,

shallow

corrections. One of the best ways to find such stocks is using the concept of Relative

Strength.

This shows how the stock is doing against the DJI or other stocks.

Tiger Measures of Relative Strength:

RSQ (Relative Strength Quotient)

TIGER's Relative Strength Quotient is simply the stock's closing prices divided by the

DJI's

closing prices on the same day. This we call 'RSQ'. We then smooth this data with a 21-day

moving average. You will see how a trending stock will frequently make minor retreats in

which

its RSQ falls back just to its rising RSQ-21-day mvg. avg. When the RSQ is then deflected

back up from that rising mvg. avg. the stock usually starts another advance. When the RSQ

is decisively violated and the RSQ moving avg. turns down, the stock is apt to either

retreat

or go into a consolidation for at least a month or more. We believe that turns downward by

the 21-day mvg. avg. of RSQ are a good sell point in a stock that has made a big advance.

That is the basis of our Sell S23. You will later see that we have a full set of

I would be more cautious about using turns upward of the RSQ 21-day moving avg. as a

buy point.

To be taken as a buy the stock should show good accumulation and rising up-volume. Keep in

mind that it almost always takes rising volume to make a stock rise significantly."

ITRS (Intermediate-Term Relative Strength)

ITRS is TIGER's Intermediate-Term Relative Strength indicator. It shows how much better

or

worse the stock is doing than the DJI over the last 50 days. A reading above +.3 would

mean

the stock has outperformed the DJI by 30% or more over the 50 days. We have found that

new readings above +.3 are often associated with big advances when speculative sentiment

is generally strong. We believe that a stock that has its ITRS fall below -.1

probably should

be sold or avoided.

However, cross-overs by the ITRS back above the 0-line are bullish if the stock has not

recently

had a play. This indicator is best used with our Accumulation Index to gauge how tightly

the stock

is held. When the Accumulation Index has been consistently positive for a long time, a

stock that

has its ITRS cross above +.3 can often run a long ways.

You can find all the stocks that have just had their ITRS cross above +.3

by using the reserved symbols' list-name 'ITRSA30', or 'B12' for the stocks

that simultaneously

have an IP21 (current AI) greater than .40

Percent-Change Rankings: 21-day, 50-day, 100-day, 250-day:

TIGER’s Pct-Change Ranking program shows you stocks ranked for their percent

change over

4 different time periods. Us the 21-day, 50-day and 100-day if the market has recently

reversed

and turned up or down for approximately 21, 50 or 100 days. In this way you can see the

stocks

that are “first-out-of-the-gate”. 200-days is preferred once a market

advance lasts longer than

six months. If there are 800 stocks, a Price Change rank of 800 would be tops in this

universe.

We believe that most On-Balance-Volume and Accumulation Index divergences

from price are usually reconciled with price following the TIGER internal strength

indices.

The TIGER Pct-Change Ranking program lets you quickly compare a stock’s price change

ranking

with its OBV ranking and its IPA (similar to the Accumulation Index ranking). A

stock’s OBV and

Accumulation Index (aka: “IP21” rankings are also shown.

The TIGER ranking programs show you the difference in rank order between a stock’s

price percent change and its OBV. They also show the “rank difference”

between a

stock’s pct.change rank and its Accumulation Index.

Using the TIGER ranking program you can not only spot the stocks that are

first out of the gate, or strongest for a substantial period of time, you can also

readily spot those that have the highest ranked supporting internal strength.

These are the stocks that have the highest “Across-the-board”

strength”.

Strong stocks are expected to stay strong. However, our rankings do not predict the

expected

order of subsequent performance. Work with the strongest of the strong.

HINTS

HINT: Cherry-pick. High-grade. Traders should buy the stocks that are

very highest ranked in pct. change, not the 30th or 50th, provided it is over, say,

$20, or better, $50.

HINT: Buy the highest pct. change ranked stocks that also have a positive

rank divergence, external price change rank minus internal (OBV or

Accumulation Index) rank. Work from the top downwards. Such a stock would be

tops in “across-the-board strength”.

HINT: Look at the top ten performing stocks and among them, those that are

above $50.

Then buy the highest AI/200 stock among them; or the stock that has the highest current

Accumulation Index (IP21); or that has the highest Up Pct. value. (Up Pct. shows the

percentage of days of the last 200 that the strong closes higher on the following days.)

HINT: Notice any industry whose stocks are appearing frequently at the top of

the list.

This is telling you there is a powerful trend in an industry as a whole. These last for

long periods

of time usually.

HINT: Use dips by the 5-day and 14-day Stochastic to buy the highest

Accumulation stocks,

those with an AI/200 score above 195.

HINT: Traders should make use of the short-term swings in volatile high techs and emply

the 5-day Stochastic if its optimized results are good.

Short-sellers: Short-term traders should look for stocks with very big negative

divergences

between their price action and their internal strength rankings. In my short-selling book,

I

suggested building a directory of stocks that are those that are most heavily shorted. I

suggested

taking al the NASDAQ stocks with more than 800,00 shares shorted. This will usually give

you a

good universe of stocks which professionals think are over-priced. Then closely inspect

for

timeliness those stocks that have the most bearish divergences. I call this “low-grading”.

POWER RANKINGS AND FUTURE PRICE PERFORMANCE

The nightly analysis TIGER programs produce a ranking of stocks based on

TIGERSOFT’s

concept of “power”. Six factors are weighted:

1) The number of days of the last 60 that the Relative Strength Quotient’s 21 day-

mvg. avg.

is rising minus 30. I have given this a weight of 4.

2) IP21/200 or AI/200. This is the number of days in the last 200 that the Accumulation

Index

has been positive. I have given this a weight of 5.

3) OBV%-Pr% (how much is the 100 day OBV% above the 100 day price Pct.

I have given this a weight of 2.)

4) IPA%—Pr% (how much is the 100 day IPA% above the 100 day price Pct. I have

given this

a weight of 1.)

5) If the stock is below its 50-day mvg. avg. subtract 50 from the Power Ranking.

6) If the stock is below its 30-wk mvg. avg. subtract 150 from the Power Ranking.

Studies done in 1988-1994 show that the top ranked stocks significantly outperform the

bottom ranked stocks, assuming that the volatility (Beta) is the same for the top and

bottom

ranked stocks. The best performance occurs 3-7 months after the ranking.

Note, when the market turns up after a long decline, there is a brief

period when the heavily

distributed stocks outperform the highest accumulated. Presumably, this is a function of

professional short-covering, which takes place because much higher general market prices

are

expected.

The POWER Rankings are intended to quickly tell you which stocks are

exceptionally strong

and which are exceptionally weak. Their best powers of prediction extend 3-7 months. They

do not attempt to judge the short term (under 1 month) or advise you when you should act

on their high or low rankings. This must be done using techniques derived from standard

technical analysis and various “trigger” systems notably trend-breaks,

Stochastic BUYs (B11)

and MACD (B11) signals. Automatic Buy signals on the highest ranked and those most

“Bullish”

are advised. In a bear market, the opposite is true.

Explosive Super Stocks

We all want to find stocks that double or triple or more in a year. The Tiger-Power-Ranker

offers you a great way to find these stocks. Extensive real-time use and back testing

teaches

us to look for stocks that show the following conditions:

1.) They have just made a new 12 month

high.

2.) They have an AI/200 score of 150 or higher. This shows longer term (blue)

Accumulation.

3.) Their current Accumulation value, called “IP21” is above .37.

4.) The readings of the Accumulation, “IP21” or vertical accumulation, spiked to

above .60 at

some point in the last 6 months or is doing so currently.

5.) Neither the current IP21 spike or the earlier spike in the last 3 months must have

been above .80.

6.) The current value of ITRS (Intermediate-Term Relative Strength) must be above .0574

but below

.5435. This indicator shows the difference between the chosen stock’s percent gain

over 50 trading

days and the DJI-30’s.

7) OBV should confirm the new high by making a high of its own.

Stocks meeting all these criteria have an average gain of 36% when holding for 12 months

and have averaged gains of more from 15% to 65% a year, since 1990, when simply held for a

12 month period. Of course, better gains will usually come when the general market is

rising,

as signaled by Peerless major Buys. Multiple Sell S9s and a breakdown below major support

should also be heeded. Much better returns than this are gotten by adding to positions

that are

up more than 12% after the first month or 21-trading days. Selling the stocks in this list

that

are down after a month, if market conditions have been good, and buying more of the best

performing stocks is highly recommended. The study done here shows the average gain for

such a stock from the 21st trading day to the 252nd trading day (1 year) is 52.2%. There

were

105 such cases between 1990 and 2006, so these results are viewed as highly significant.

More details will be found on www.tigsoft.com.

How can these stocks be found? TigerSoft

will publish them each week in the weekly Elite report

($575/year) and keep track of all such positions currently held. These are called the

“Tiger Super

Stocks”. Most of them will be in the “NEWHIGH” data list we provide Tiger

data customers.

They are best found by examining all the stocks making new highs or that have a Buy B24.

You can see the key values for the current IP21 and AI/200 by viewing going to the

Tiger Page + Tiger Selections (at top) + Tiger Groups and then choosing new highs or Buy

B24s.

The parameters set out above constitute a “sweet spot”, an ideal zone. Very good

gains are had by finding stocks that come very close to these parameters. Many are thin,

low-priced stocks, and the high, average gains come about because of some very big

gainers,

more than 200% a year. So, buy a batch of them. Diversify. Then hold tightly for a year,

unless Peerless gives multiple, major Sells Of course, when a hyperbolic up-trend develops

and you have a gain of, say, 300% or more you may choose to see on a violation of either

a 50-day moving average or you may want to use a stop sell on a close below the 10-day

moving average.