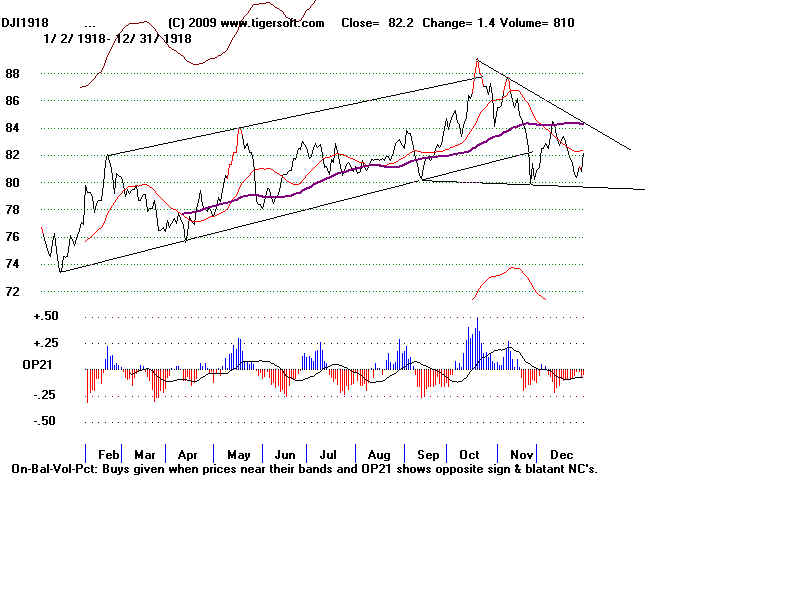

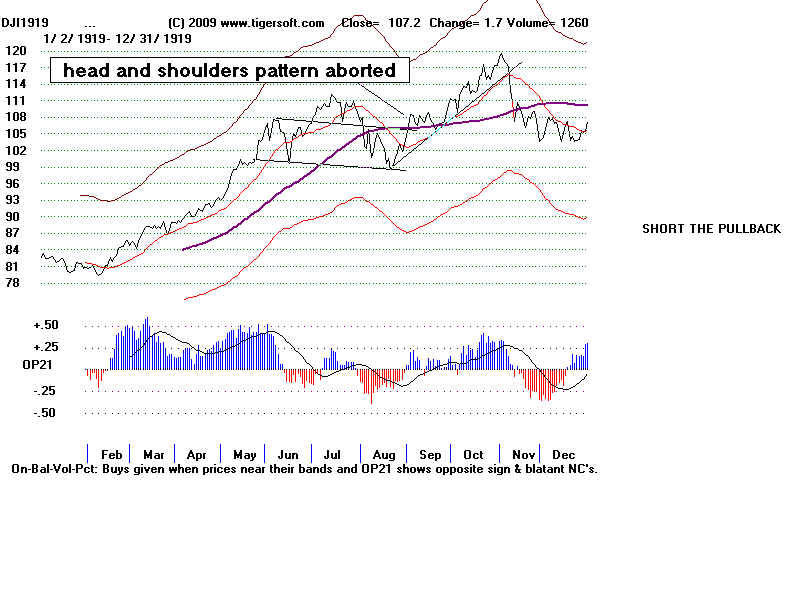

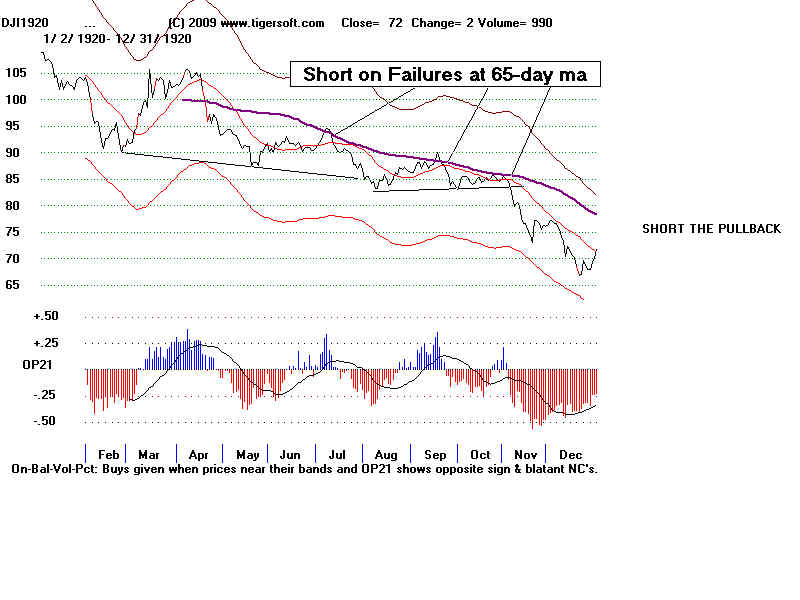

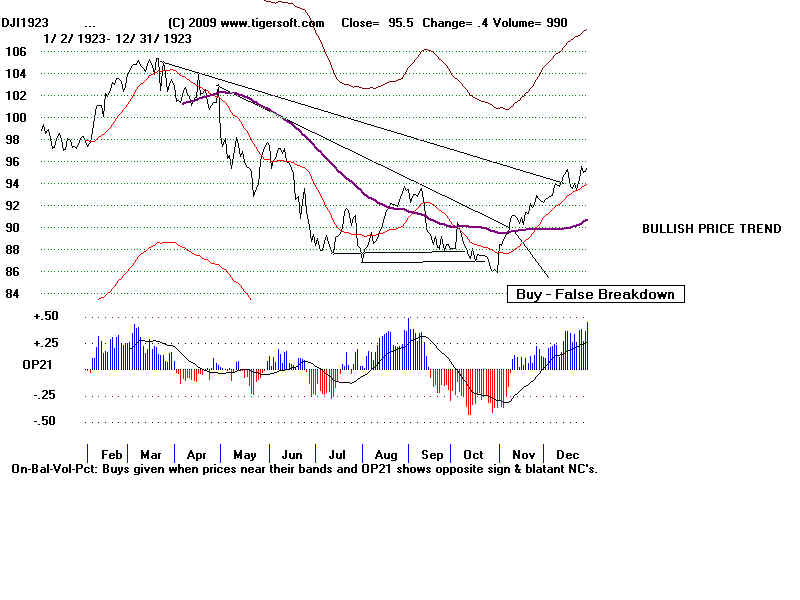

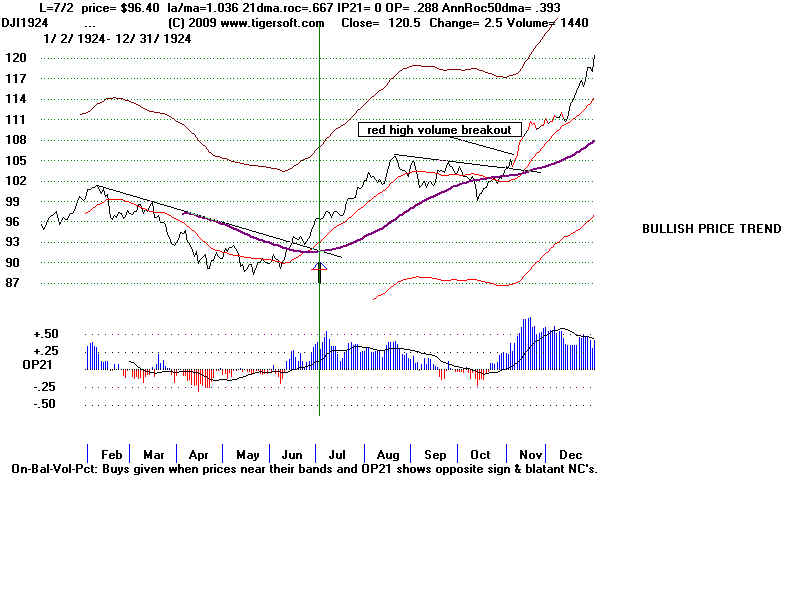

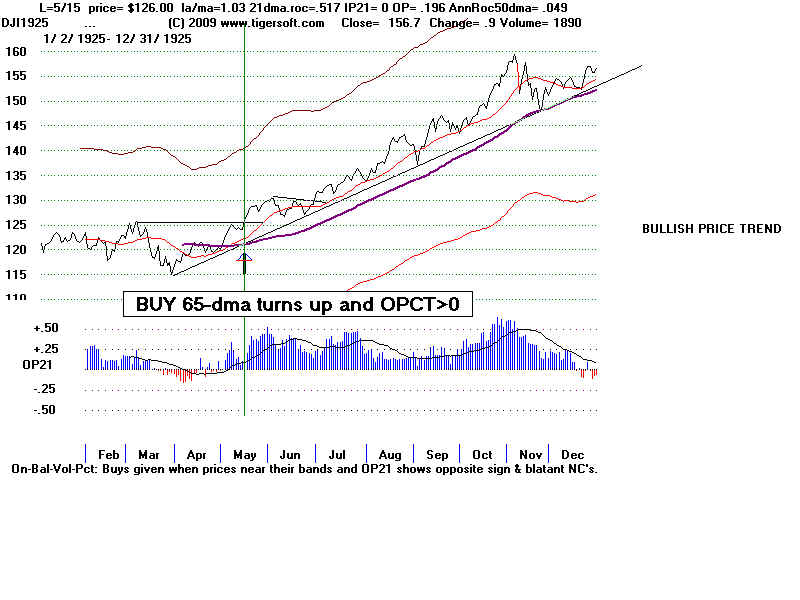

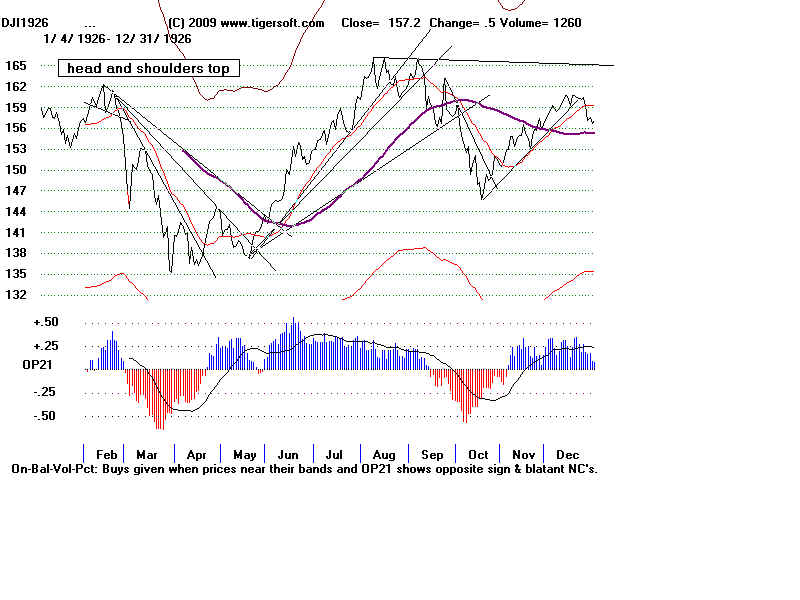

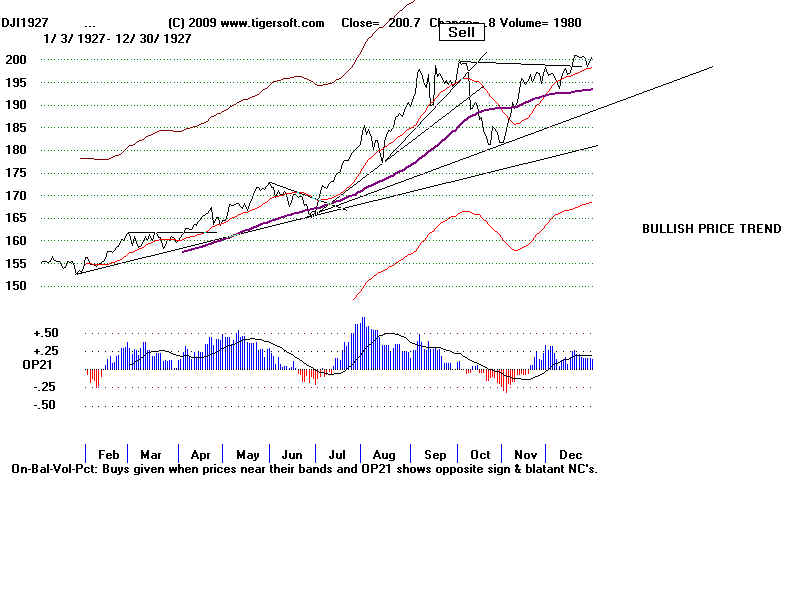

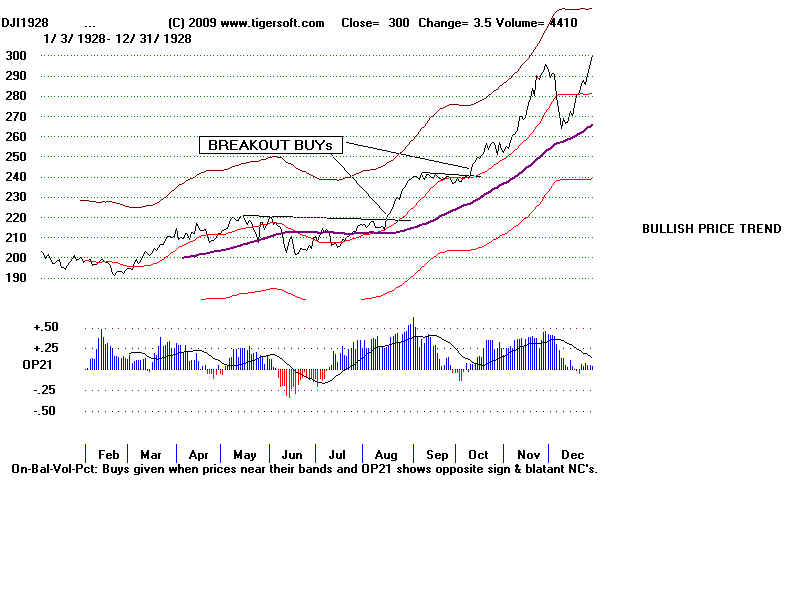

Charts here reflect that only DJIA Closings

and Volume Were Available until Late 1928.

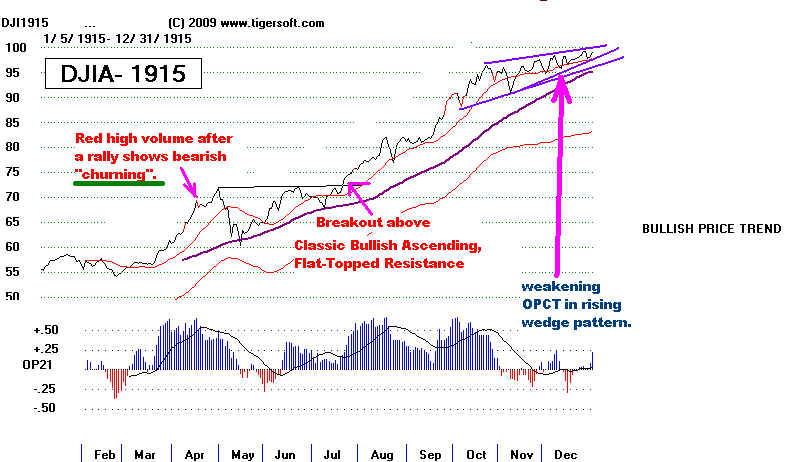

1915

-- Prohibition starts

-- Women's Suffrage Amendment

-- 9/26/1920 - Bomb exploded in front of JP Morgan Inc on Wall Street - 38 people killed, 400 wounded.

The perpetrators were never found.

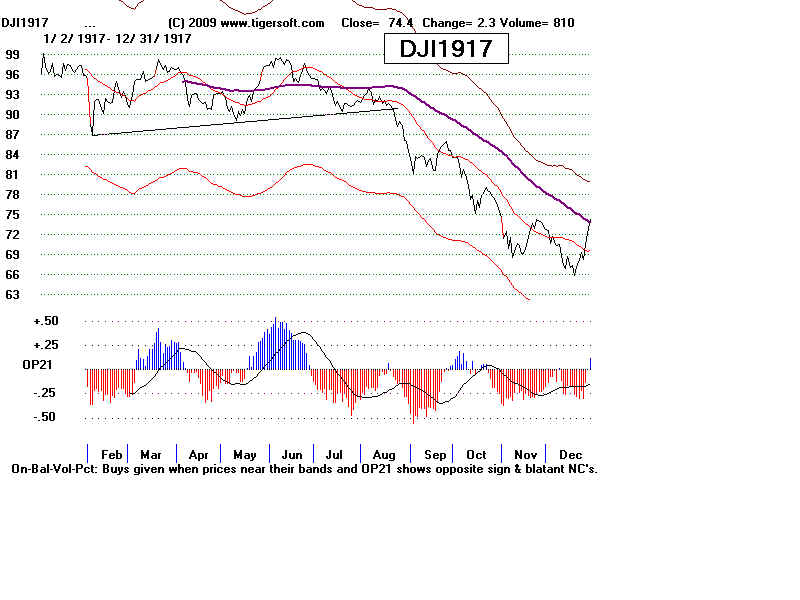

The 1919-1921, a post war slump led President Warren Harding to name Herbert Hoover as

chairman of a special conference to deal with unemployment. "There is no economic failure so terrible in

its import," Hoover declared at the time, "as that of a country possessing a surplus of every necessity of life

in which numbers...willing and anxious to work are deprived of dire necessities. It simply cannot be if our

moral and economic system is to survive". .

Pools - to buy shares, spread rumors and news and "paint the tape". Example RCS - and specialist. Michal J. Meehan.

JFK's father. Joe Kennedy formed a brokerage partnership that engaged in insider trading and stock manipulation.

He cornered the market in certain shares, putting out phoney information that the stock was good, ran the price up,

then raided as a bear.

“ (It) was a strikingly information-starved environment. Many firms whose securities were publicly traded published no regular reports or issued reports whose data were so arbitrarily selected and capriciously audited as to be worse than useless. It was this circumstance that had conferred such awesome power on a handful of investment bankers like J.P. Morgan, because they commanded a virtual monopoly of the information necessary for making sound financial decisions. Especially in the secondary markets, where reliable information was all but impossible for the average investor to come by, opportunities abounded for insider manipulation and wildcat speculation. ”

10% Matgin. With $100 down, one could buy $1000

"As early as 1925, then-Secretary of Commerce Hoover had warned President Coolidge that stock market

speculation was getting out of hand. Yet in his final State of the Union Address, Coolidge saw no reason for alarm.

"No Congress...ever assembled has met with a more pleasing prospect than that which appears at the present time"...

said Coolidge early in 1929. "In the domestic field there is tranquility and contentment...and the highest record

of prosperity in years." In office, Hoover warned NY bankers, but "received in return a long, scoffing memorandum

from Thomas W. Lamont of J.P. Morgan and Company. When the Federal Reserve Board that August

did take steps to check the flow of speculative credit, New York bankers defied Washington, the National

City Bank alone promising $100 million in fresh loans. An angry Hoover let the president of the New York Stock

Exchange know that he was thinking of regulatory steps to curb stock manipulation."

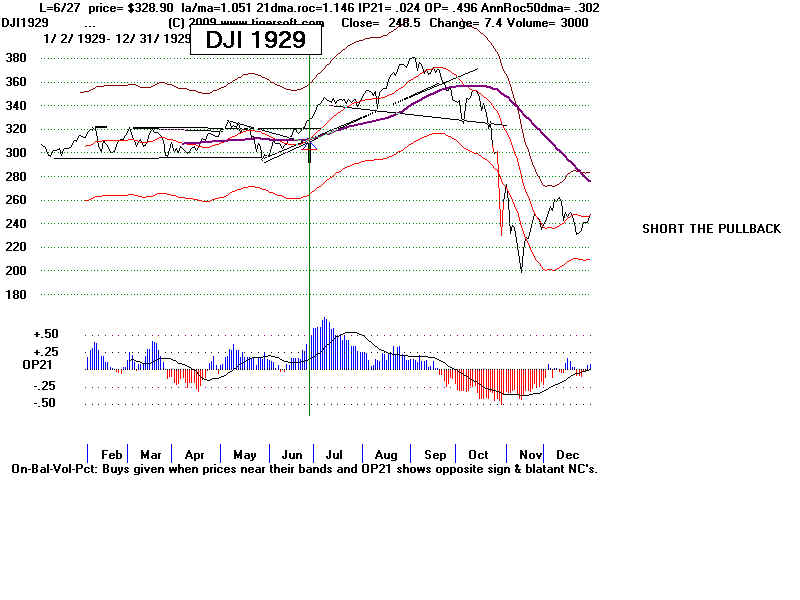

The U. S. economy was in recession by the summer of 1929.

The Hawley-Smoot Tariff Act dramatically increased tariffs, with effect being to limit world trade--which

effectively made this a global depression.

What caused the recovery in December 1929? "Hoover summoned industrialists to the White House on

November 21, part of a round robin of conferences with business, labor, and farm leaders, and secured a promise

to hold the line on wages. Henry Ford even agreed to increase workers' daily pay from six to seven dollars. From

the nation's utilities, Hoover won commitments of $1.8 billion in new construction and repairs for 1930. Railroad

executives made a similar pledge. Organized labor agreed to withdraw its latest wage demands. The president

ordered federal departments to speed up construction projects. He contacted all forty-eight state governors to

make a similar appeal for expanded public works. He went to Congress with a $160 million tax cut, coupled

with a doubling of resources for public buildings and dams, highways and harbors.

Source: The Herbert Hoover Presidential Library and Museum