--User

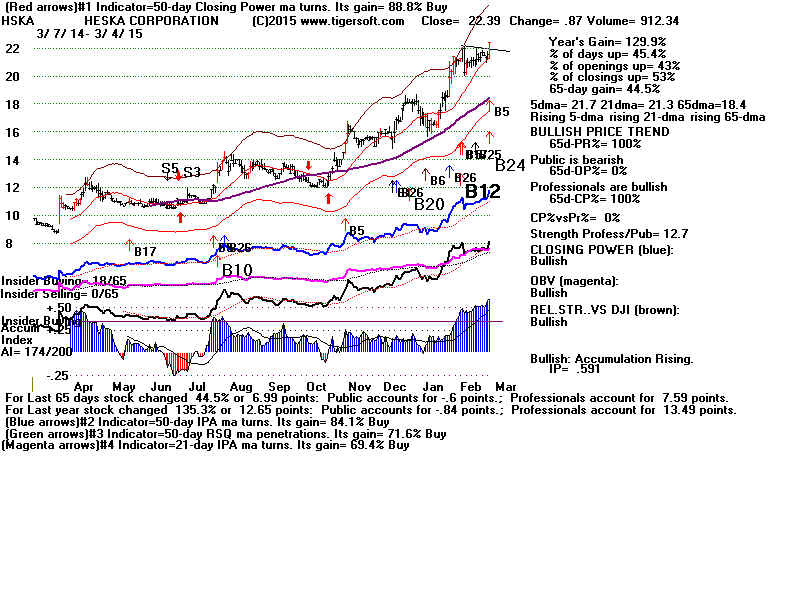

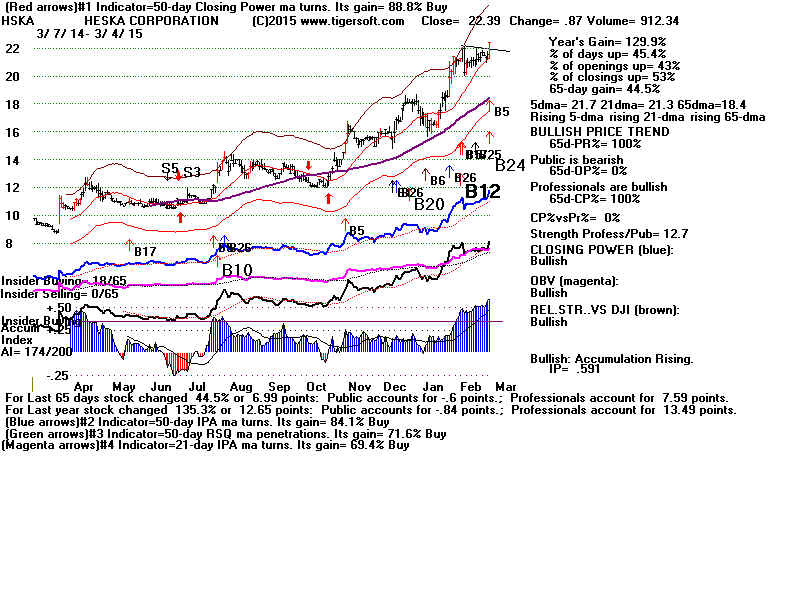

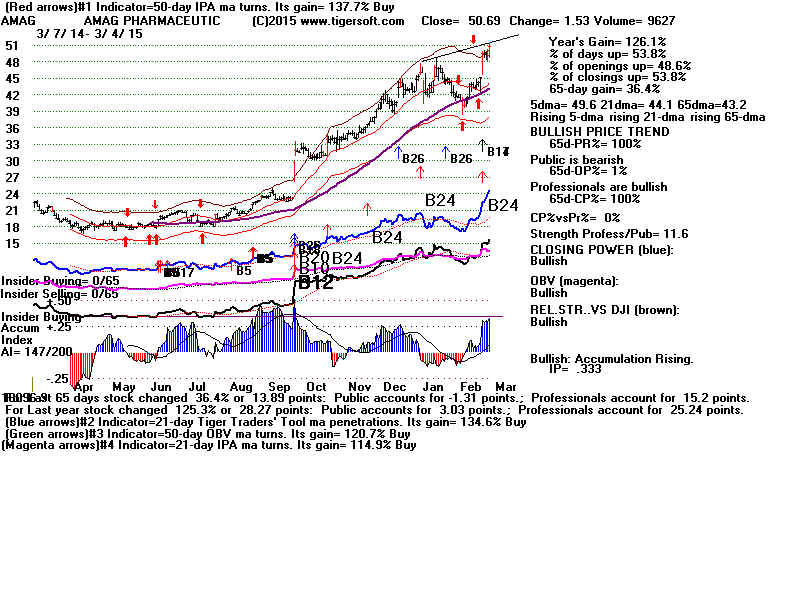

comment----> The new AugB10s folder is interesting. They're

almost all overextended now. I'm assuming the strategy is to wait for a pullback to

at least the mid-band?

Some of them will keep rising without a pullback. But waiting

for a pullback and CP

hook back up is a good approach. The trick is to not chase too far too often if

you buy in the breakout itself. Maybe develop a scoring system for breakouts.|

This might help start one.

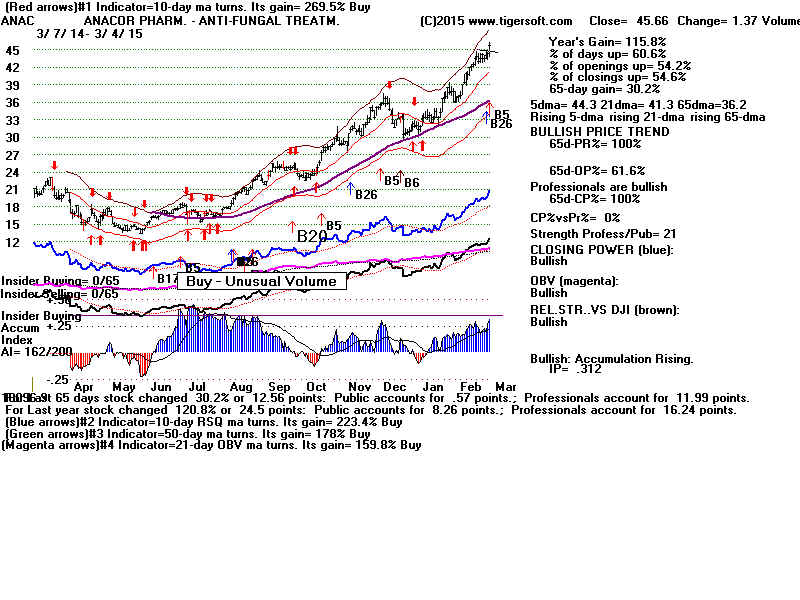

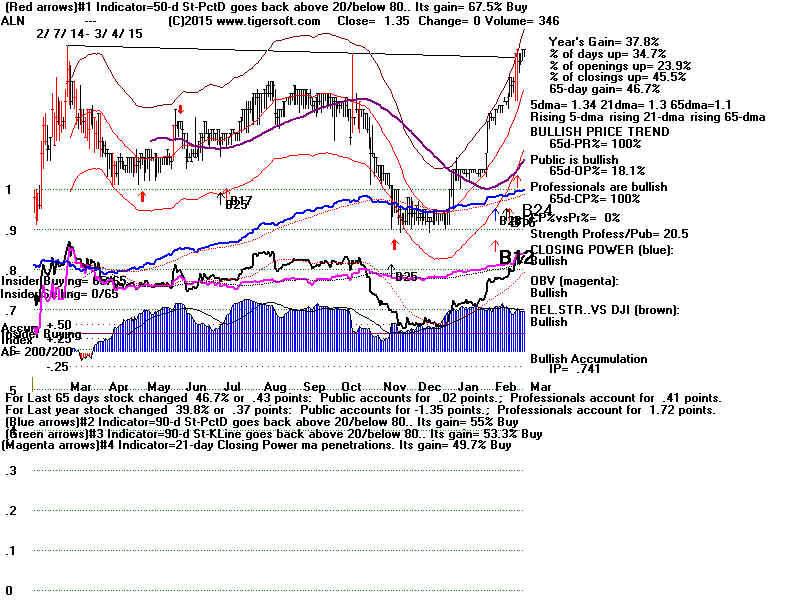

Positives

3 points for preciseness of 3x well-tested

flat top.

2 points for high volume and gap

3 points for very high Accum (over +.50) with the breakout

2 points for very high Accum (over +.375) with the breakout

1 points for very high Accum (over +.225) with the breakout

2 points for all-time high

1 points for a stock that has doubled in the last year.

1 points for Relative Strength new high

2 points for confirming OBV New high

2 points for confirming Closing Power new high

2 points more when Closing Power has been leading price to new highs.

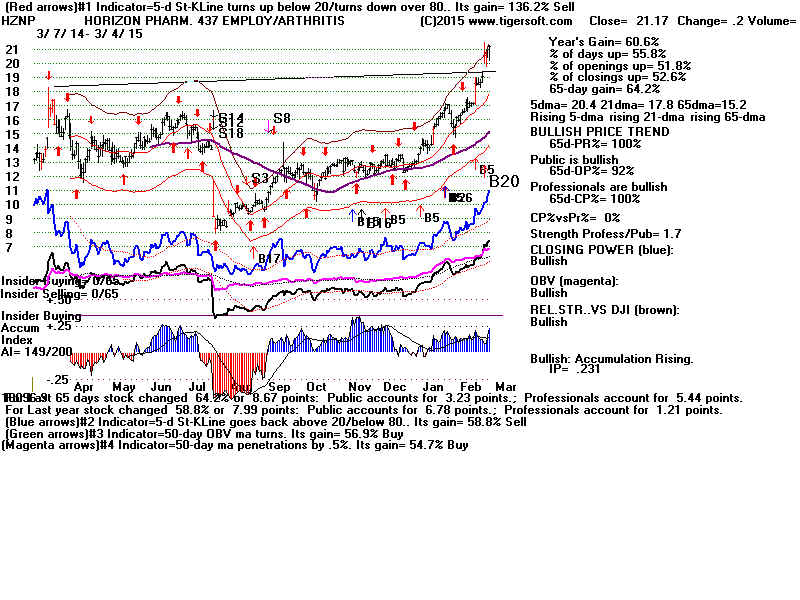

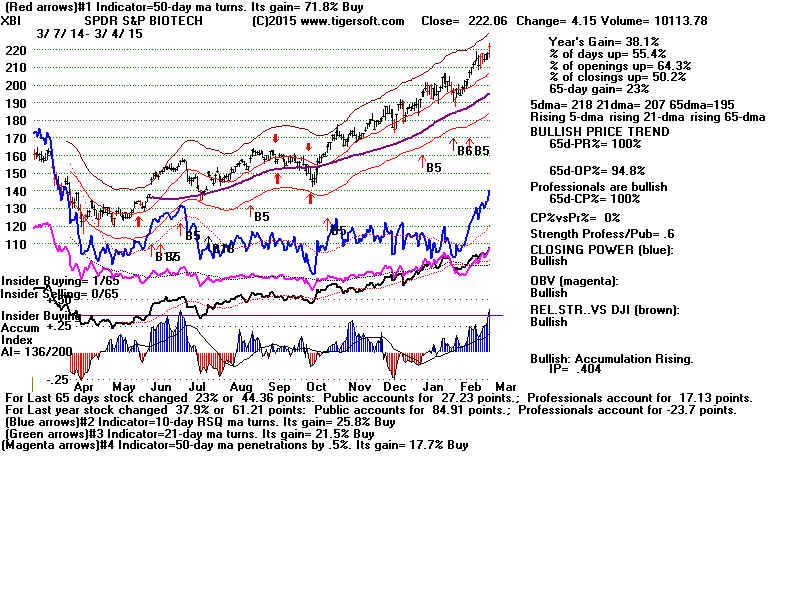

3 points if they are in a sector that populates the MAXCPs heavily.

2 points for tech stocks, biotechs

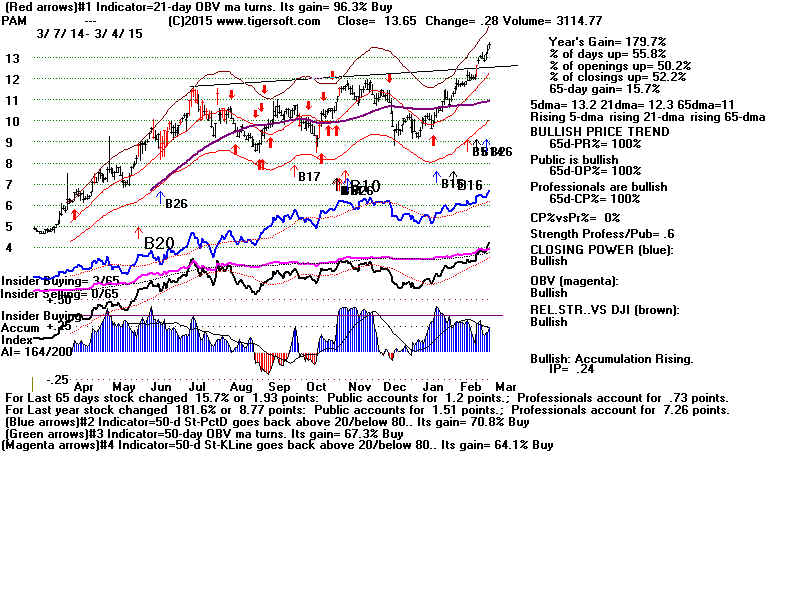

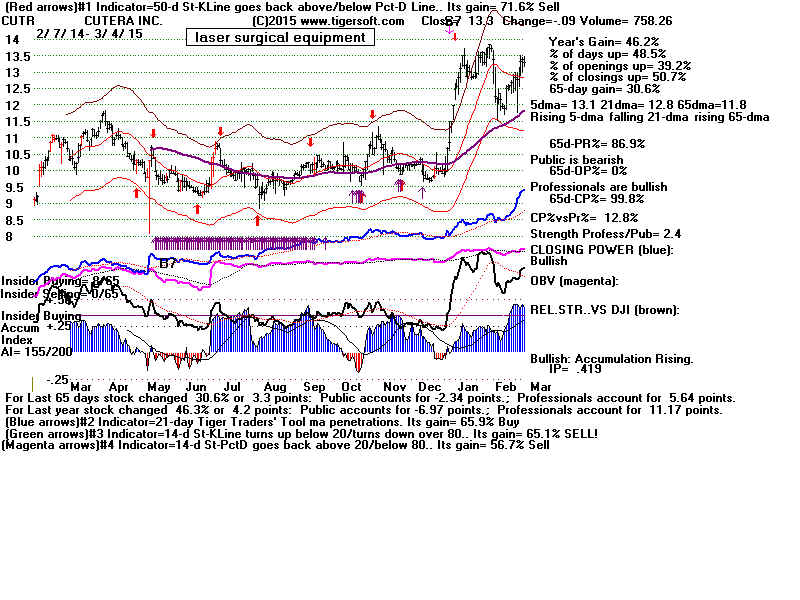

Negatives

-2 points if the stock's On-Balance-Volume Line fails to

make a confirming high.

-3 points if the stock's Relative Strength Line fails

to make a confirming high.

-5 points if the stock is up more than 10% from point

of breakout.

-8 points if the general market gives a Peerless Sell,

NASDAQ shows a H/S pattern or there are Tiger S9s and then

Closing Power uptrend breaks on major market ETFs..

-15 points if the stock falls back below point of breakout.

---> I know the red high volume they're exhibiting from gap ups,

etc. are generally places to take profit.

But not on breakouts! High (red) volume confirms the breakout.

See Explosive Super Stock section on volume.

After a big run and at the upper band, then high volume is a danger sign.

Even then, you might wait for the CP uptrend to break.

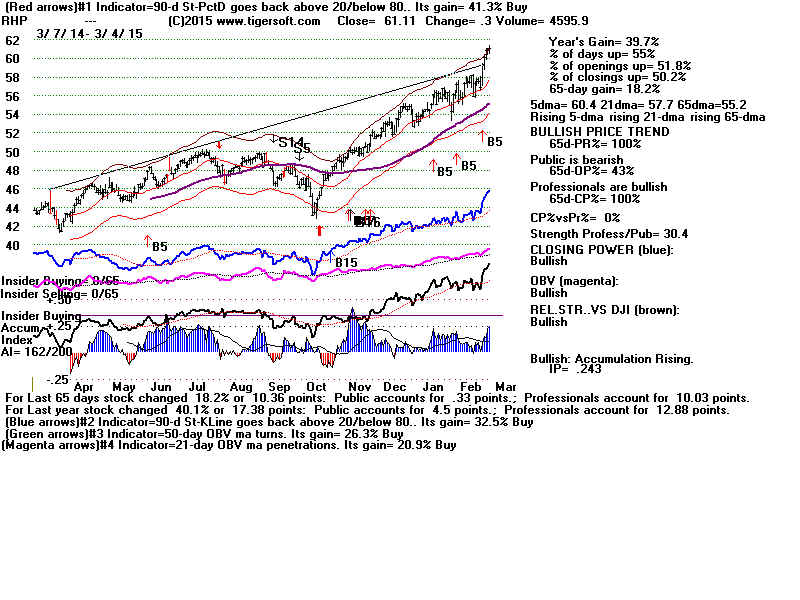

---> I'm finding that so many issues are still extended, since

the market pullbacks we had was not enough to reset the strongest stocks and ETFs.

You can't always depend on pullbacks. The best stocks won't do

that. So, you don't

want to hold those with high scores more tightly and give them a chance to

run.

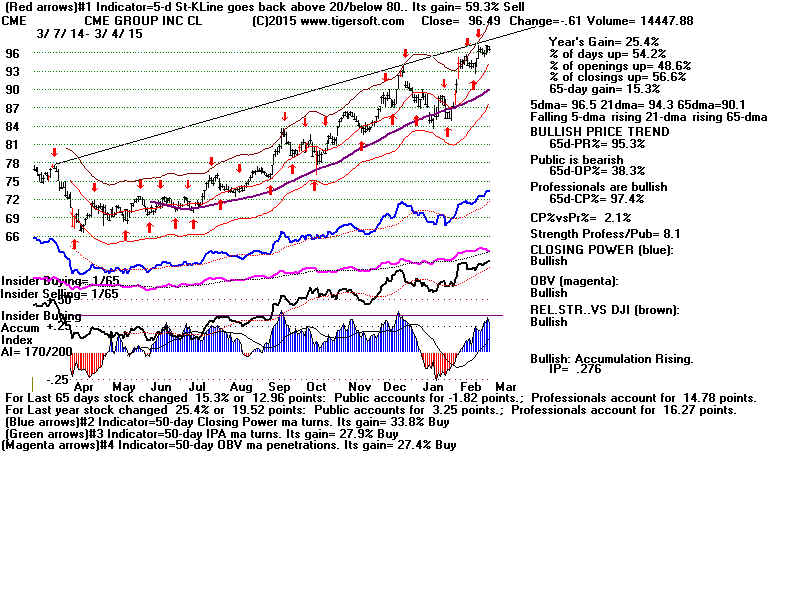

Look at the six months' charts of the 5-day ma. Really strong stocks seem to

run upwards with the best buying spots being the 5-day ma. Notice rate

of change of the 5-day ma in this.

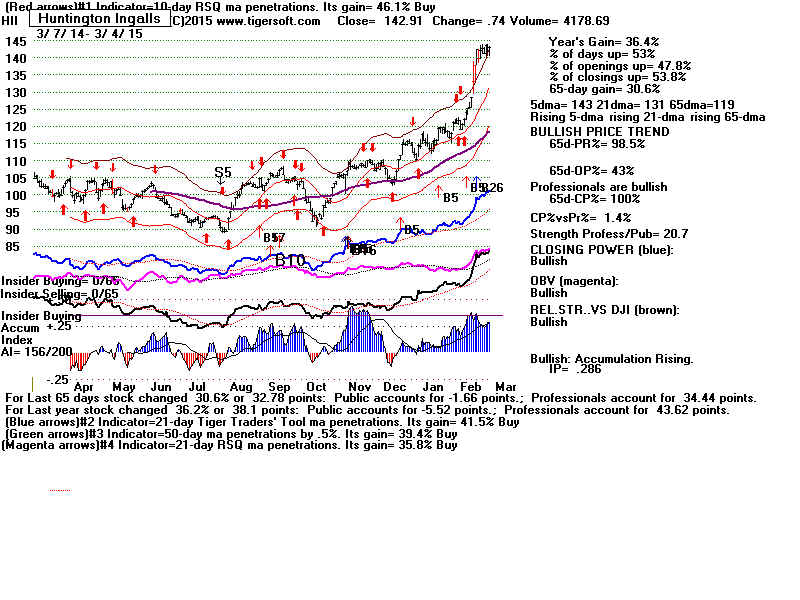

---> It is the "moving train" problem that continues to

be a challenge.

It seems like patience is the only solution.

Well, some temperaments like the extra volatility and use short-term

tools.

But this is also more demanding of attention.

The market enters different phases. Now we are seeing what may be a breakout

in slow-motion for the indexes, but for smaller stocks it may be their chance

to run upwards more quickly based on stored up energy.

Just when everyone expected a cycle pattern in a trading range to continue,

it can end. We have to adjust. Peerless remains on a Buy. So, that may

help us be more aggressive. The Fed is on side of the speculators for now.

But watch that. And right now, we want to watch the Down Volume,

if it starts to rise, then there should be another retreat.

Much more information is in my Explosive Super Stocks e-book ($42.50)