An ideal Biotech breakout in late 1999 was IMCL

on the base and flat topped breakout above 22.

Note the high Accumulation before the breakout.

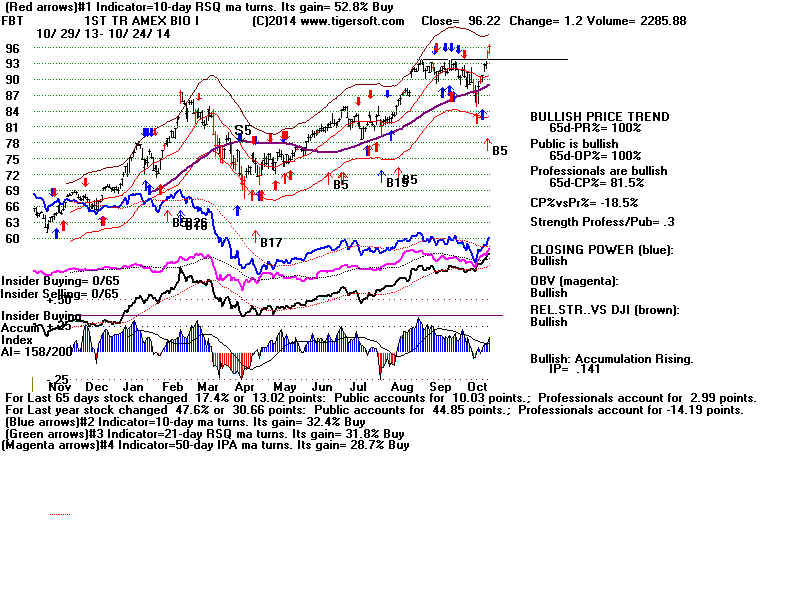

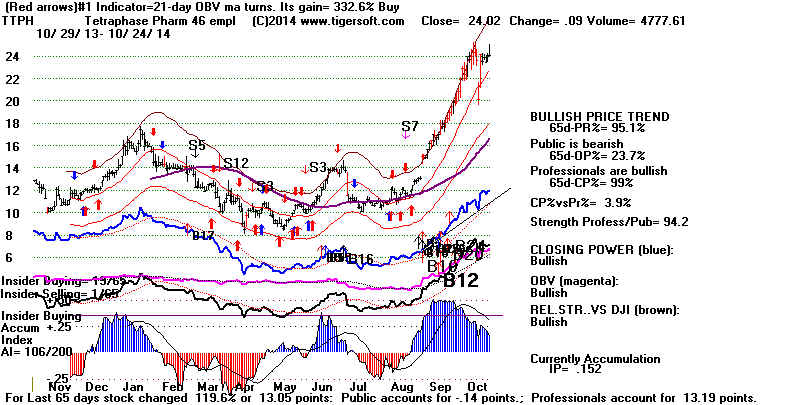

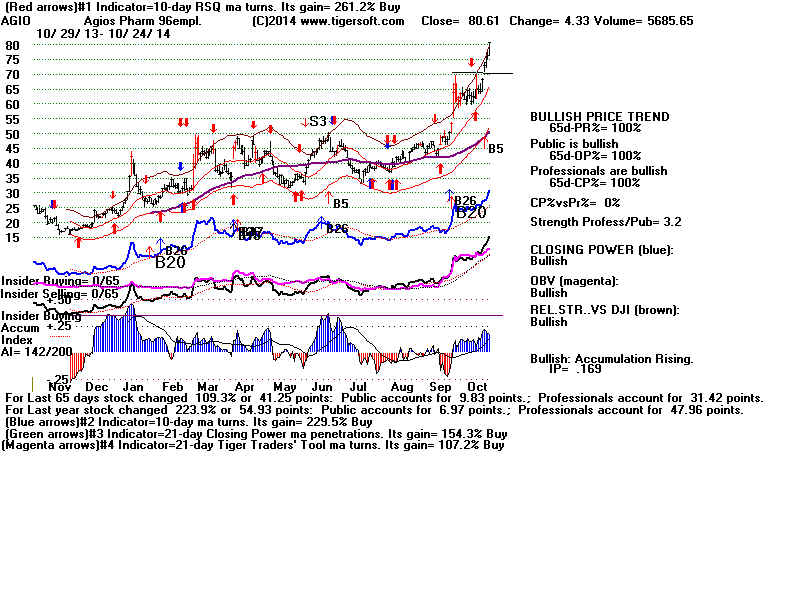

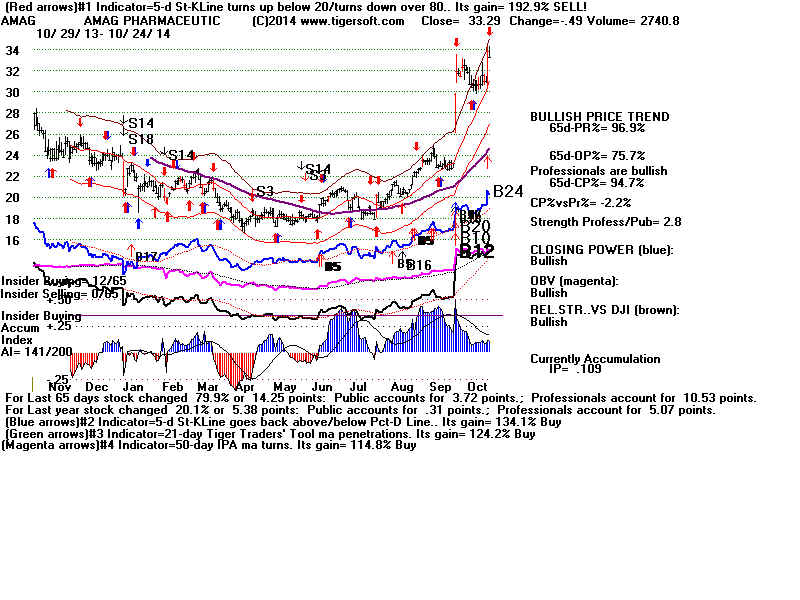

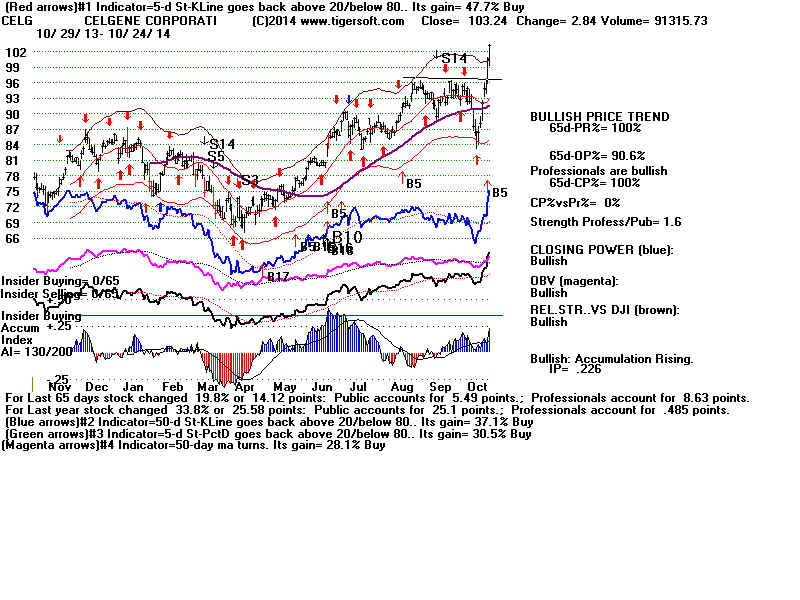

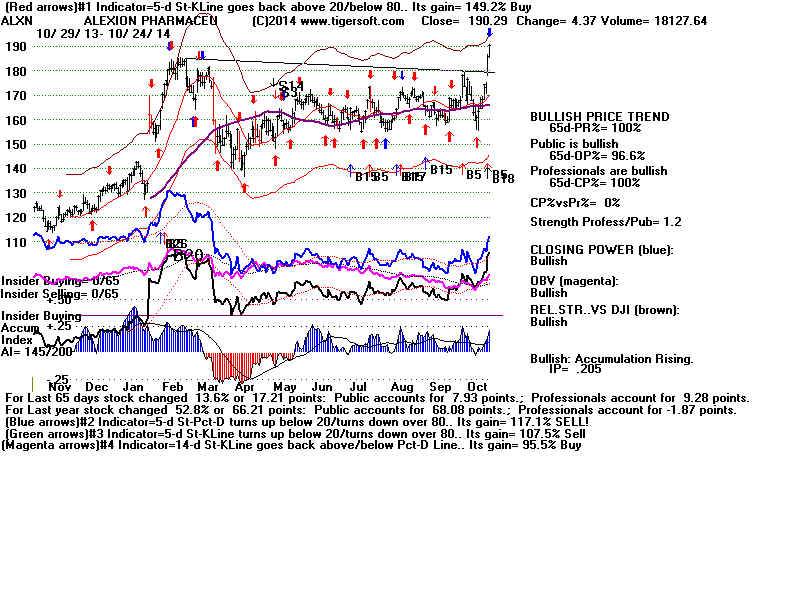

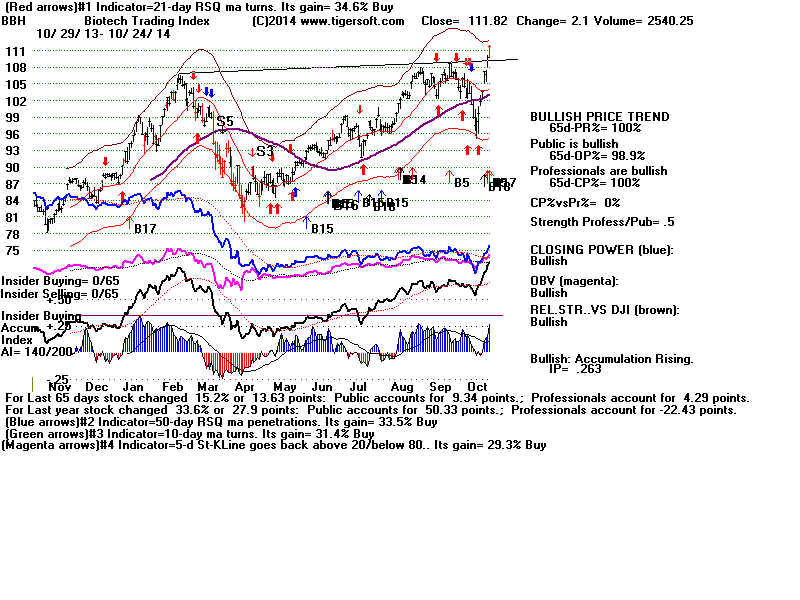

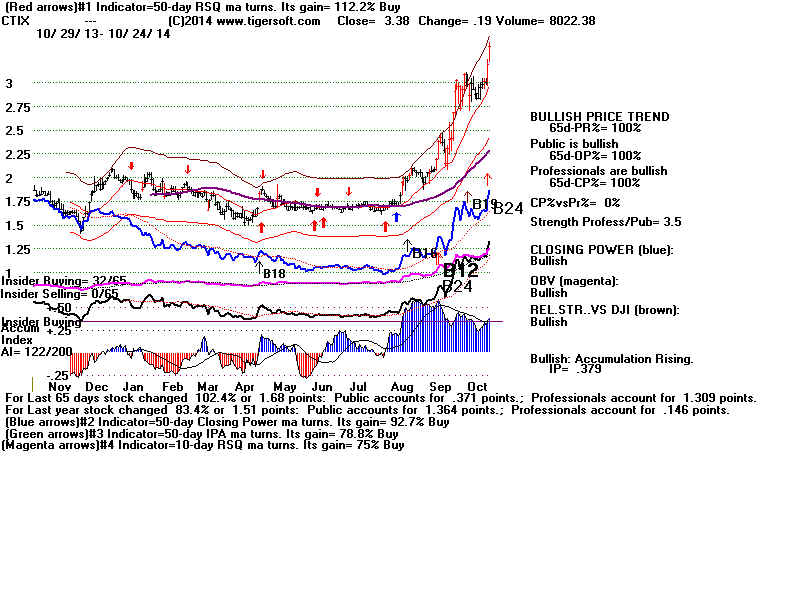

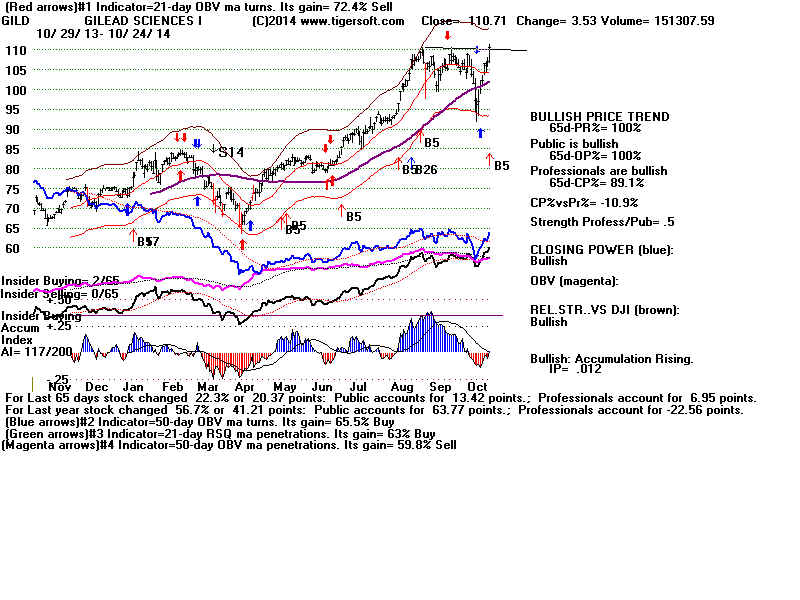

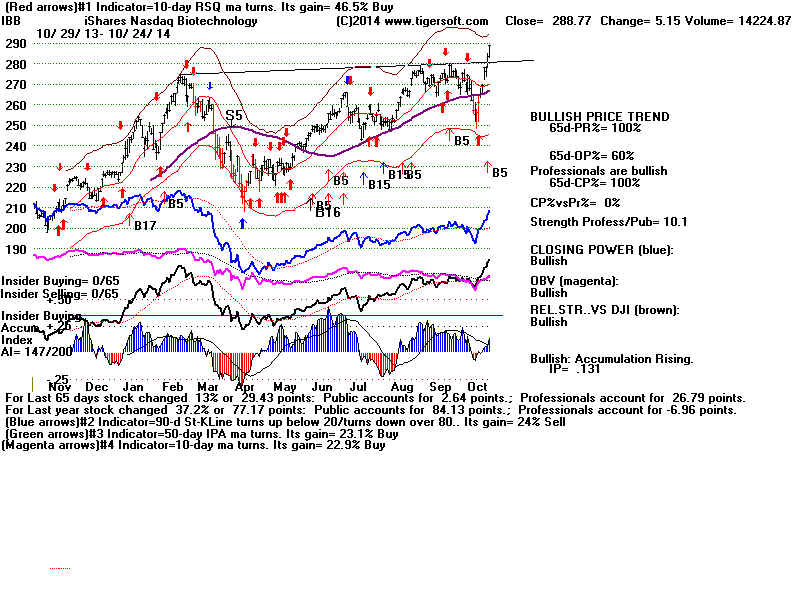

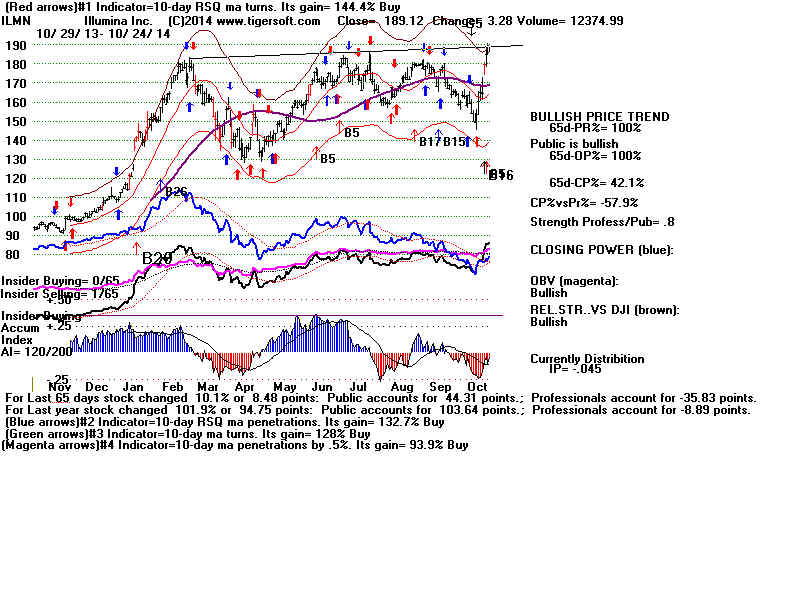

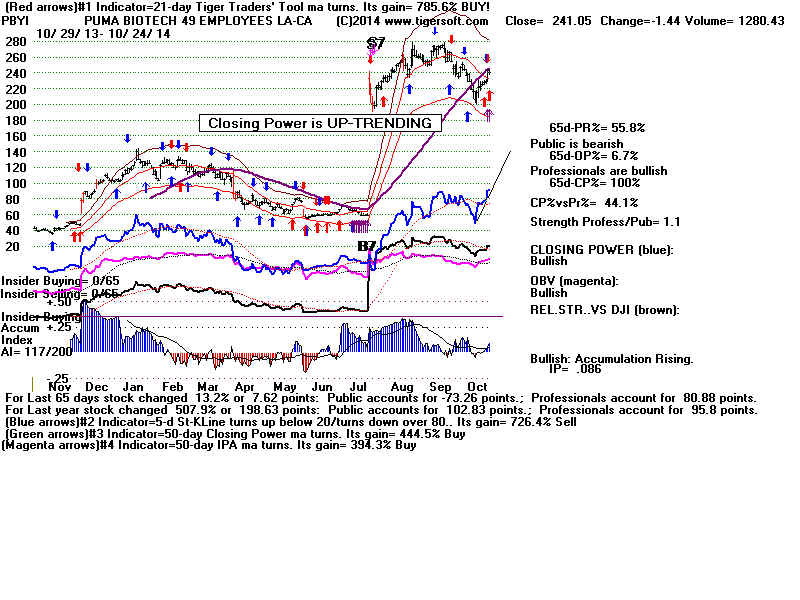

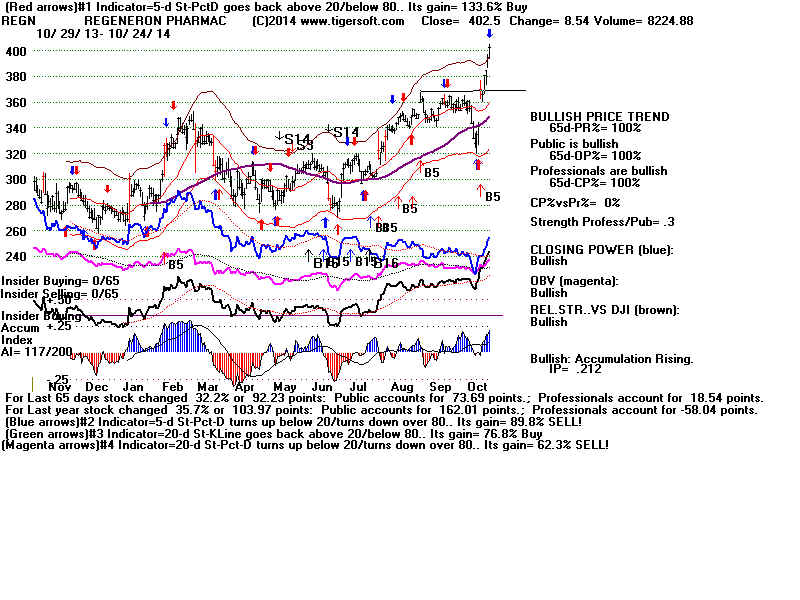

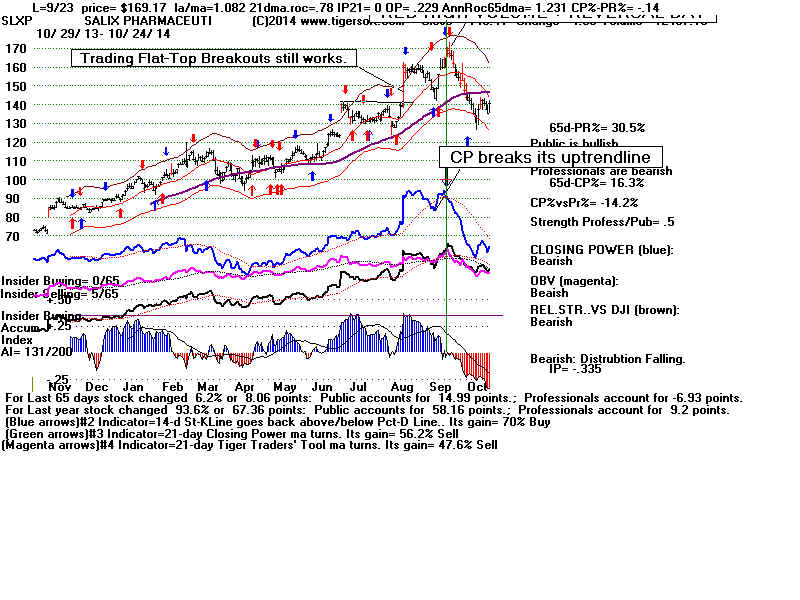

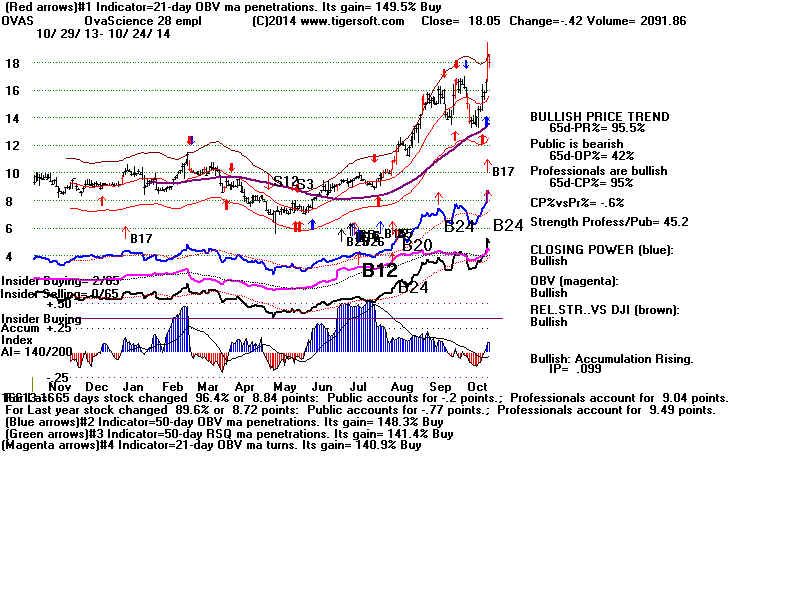

We might want to compare/contrast the recent breakouts

shown below with this ideal example to see that the

moves now will probably be much more limited,

though AMAG, CTIX and possibly IMMY look very good.