---TigerSoft HOTLINE --- 4/1/2022 ----

I M P O R T A N T

LOOK for Email on Saturday giving new HL Address....

-----------------------------------------------------------------------------------

We are using www.tigersoftware.com again.

(C) 2022 William Schmidt, Ph.D. - All rights

reserved.

http://www.tigersoftware.com/211BL/INDEX.htm

==============================================================

Applicable Studies:

The DJI-30 can hold up a lot longer than bears may expect even when the A/D Line

has been bearishly diverging for months. That is a key lesson from 1929, 1937,

1957,

1960, 1969, 1973, 2000 and 2007, among others.

http://www.tigersoftware.com/tops/INDEX.htm

(New)

Days where DJI was 3.7% down in one day but then rose and closed up for the day.

This is what happened on 1/24/2022. Can the DJI lead a weak market back up?

http://www.tigersoftware.com/BEARISH/BIGRDS.htm

As long as DJI does not close down more than 10% from its peak, buying when the red

Stochastic-20-K-Line has fallen below +10, showing very oversold status, its rising back

above it blue Pct-D gives short-term traders a good buy

signal even if Peerless is still on a Sell.

See Stochastic-20 charts of 2021 and 2022. The 6-day Inverted MKDS MA functions

much the same.

Previous Hotlines -> www.tigersoftware.com/211BL/INDEX.htm

www.tigersoftware.com/123ABCH/INDEX.htm

www.tigersoftware.com/1111H/INDEX.htm

====================================================================================

Always CLICK REFRESH. To refresh -

Point mouse at page and Hold down Control Key and hit F-5.

===> Please report any broken or

out-of-date links. william_schmidt@hotmail.com

Friday 5:53 AM PCT Futures: DJI +150

NASDAQ +70 Data through 3/31/2022

| Nearly 300 points of the 500-point sell-off

today came in the last hour. This makes the decline a mite suspect. But the Closing Powers did break their uptrends. So, though the DJI may rally a bit up from its 65-dma again, where can it go with up-day volume lagging and down-day volume so heavy, like it was today. When we look for leadershop in Table 1 and 3 below, we find the sources of Inflation and Gold on top. That helps explain the weakness in housing stocks (see bearish MINCP leaders). That Professionals prefer the safety of utilities to semi-conductors (SOXL) now is worrisome. Most often Aprils bring rallies. Perhaps, that's so we all have the money to pay taxes. In the short-term, let's see if DIA can rebound from its 65-dma. I take the Sell S9 now to be clinched by the trend-breaks in the closing Powers. I would hedge by shorting some the very weakest home-building stocks or ETFs shown in the bearish MINCPs and stay long NVDA. Mostl likely GLD will rally again. I say this based on the B7s on its chart showing that its Closing Power way above its price-level. |

|

Table 1 QUICKSILVER on ETFS - 3/31/2022 Bullish = 6 - GLD OIL/OIH CPER CORN WEAT Bearish = 3 - RSX. RETL and YINN ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX ================================================================================================== DIA 346.83 -5.29 348.54 -3.3% Bullish RED .098 ---- ---- --------------------------------------------------------------------------------------------- SPY 451.64 -7.06 452.69 12.6% Bullish RED .129 .01 . 139 --------------------------------------------------------------------------------------------- QQQ 362.54 -4.55 359.35 39.7% Bullish RED .118 -.001 .117 --------------------------------------------------------------------------------------------- MDY 490.45 -7.34 494.2 -2.7% ------- RED .056 .012 .068 --------------------------------------------------------------------------------------------- IWM 205.27 -2.19 206.12 -13.7% ------- RED .051 .014 .065 --------------------------------------------------------------------------------------------- FAS 117.57 -7.45 127.23 -204.8% Bearish RED .019 -.087 -.068 --------------------------------------------------------------------------------------------- RETL 19.2 -1.84 20.89 -607.4% Bearish RED -.073 -.26 -.333 --------------------------------------------------------------------------------------------- SOXL 38.78 -2.57 42.01 -387.2% ------- RED .098 -.227 -.129 --------------------------------------------------------------------------------------------- TECL 61.44 -2.6 60.58 55.6% Bullish RED .146 -.058 .088 --------------------------------------------------------------------------------------------- IBB 130.3 -.67 128.16 10.4% ------- RED .067 -.002 .065 --------------------------------------------------------------------------------------------- GLD 180.65 .07 182.38 -68.6% Bullish RED .232 .06 .292 --------------------------------------------------------------------------------------------- OIL 17.32 -.36 17.91 -137.1% ------- RED .103 .173 .276 --------------------------------------------------------------------------------------------- OIH 282.55 -3.22 293.52 -13.3% Bullish BLUE .131 .286 .417 --------------------------------------------------------------------------------------------- CPER 28.71 -.11 28.61 -3.5% Bullish RED .296 .07 .366 --------------------------------------------------------------------------------------------- UUP 26.3 .11 26.41 -19% ------- ---- .152 .037 .189 --------------------------------------------------------------------------------------------- CORN 27.16 .8 26.88 88.6% Bullish BLUE .15 .234 .384 --------------------------------------------------------------------------------------------- WEAT 9.86 -.16 10.61 -278.3% Bearish RED .044 .309 .353 --------------------------------------------------------------------------------------------- YINN 4.62 -.54 4.72 -320.8% ------- RED .145 -.483 -.338 --------------------------------------------------------------------------------------------- RSX 5.65 0 5.65 0% Bullish ---- -.211 -.754 -.965 |

Table 2 Count of Stocks in Key Directories

20220331

-------------------------------

NEWHIGHS 208

NEWLOWS 198

MAXCP 55

MINCP 121

TTTNH 76

TTTNL 67

CPCROSSA 16

CPCROSSD 213

ACCUMVER 11

HIGHIP21 10

HIUPPCT 73

VHIP21 50

LOWACCUM 220

REDSELL 131

AUGSELS7 8

TRAPDOOR 6

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/31/22

Bullish = 24

Bearish = 24

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

GOLD .913 .913 .913 .913 .934 .956

COPPER .875 .875 1 .875 1 1

UTILITY .871 .846 .871 .82 .794 .743

OILGAS .819 .847 .838 .819 .866 .828

FOOD .816 .816 .816 .775 .795 .816 INSURANC .8 .8 .88 .76 .84 .72 COMODITY .794 .794 .794 .743 .769 .794 TRANSP .789 .789 .842 .736 .684 .631 SOLAR .75 .875 .875 .875 .812 .875 MILITARY .73 .769 .807 .769 .807 .807 HACKERS .7 .75 .75 .7 .7 .65 EDU .666 .833 1 .833 .833 .666 INFRA .666 .666 .727 .696 .696 .696 REIT .653 .684 .792 .561 .492 .4 INDMATER .652 .694 .75 .708 .694 .708 INDEXES .648 .735 .767 .659 .589 .556 HOSPITAL .625 .687 .687 .687 .75 .625 FIDSTKS .585 .621 .668 .579 .544 .52 GREEN .526 .578 .578 .526 .526 .473 SP500 .522 .588 .632 .536 .524 .477

NIFTY .521 .565 .63 .565 .521 .565

SOFTWARE .517 .553 .571 .482 .446 .464

NASD-100 .515 .546 .597 .494 .474 .494

============================================================================================

JETS .5 .428 .428 .285 .214 .142

============================================================================================

RETAIL .489 .531 .638 .553 .553 .531

RUS-1000 .483 .531 .572 .475 .475 .453

SP-100 .477 .555 .588 .555 .555 .522

HIGHPRIC .469 .567 .621 .512 .41 .429

DOWJONES .466 .533 .6 .533 .533 .466

=====

LOWPRICE .463 .478 .503 .478 .519 .531

DJI-13 .461 .538 .615 .538 .538 .461

GUNS .461 .461 .538 .384 .384 .307

BIOTECH .448 .484 .54 .42 .426 .431

BEVERAGE .428 .571 .571 .357 .428 .357

GAMING .421 .473 .526 .421 .421 .421

ELECTRON .398 .458 .563 .473 .503 .473

CHEM .391 .456 .608 .456 .478 .456

SEMI .357 .442 .578 .463 .515 .473

COMPUTER .35 .5 .5 .45 .45 .4

AUTO .339 .377 .433 .339 .377 .358

ETFS .327 .4 .436 .272 .29 .272

FINANCE .219 .329 .439 .378 .414 .353

CHINA .18 .3 .3 .24 .2 .28

HOMEBLDG .166 .166 .277 .166 .166 .111

REGBANKS .16 .28 .4 .28 .4 .24

BIGBANKS .142 .142 .142 .142 .142 .142

BONDFUND .011 .011 .011 0 0 0

MARIJUAN 0 .5 .5 .25 .5 .25

|

====================================================================================

Thursday 5:53 AM PCT Futures: DJI -29

NASDAQ +28 Data

through 3/30/2022

| The DJI, NASDAQ and

QQQ still having rising price and Closing Power uptrends, so let's wait a little longer before considering the recovery ended because of the Sell S9. The strength in the Utility sector suggests that Professionals are becoming cautious and risk averse even as the FED signals privately that it wishes to avoid "rocking the boat" with any quick rate hikes. SOXL would be a natural place to invest if Professionals were more optimistic. But the SOXL rally has stopped at its falling 65-dma. Gold is rising again. This probably puts a time-limit on the rally. Another quiet day in the DJI seems ahead. Low volatility after a questionable rally like we havejust seen is probably more likely to lead to another decline rather than a rally, unless the war in the Ukriane were to suddenly end. The Bonds have mostly disappeared from our list of bearish MINCPs. In their place are more and more home-building stocks. With the housing shortage in the US becoming more and more acute, one would think home-builders would be doing much better. I take this as a sign that private home-buying is reaching a point of exhaustion while the actual costs of.the building of a house are "going through the roof". Watch Von's. Here in San Diego, a strike looms there. Wages are not keeping up with wages any better than renters' incomes are keeping up with rents. Strikes and rent controls hurt profits and are going become more and more prevalent. Right now this probably hurts the Democrats and the Biden Administration the most. Wall Street's response will be interesting. Let NVDA do a little base-building. Let's avoid short-selling now until we see clearer evidence that our Closing Powers have turned down. |

||

|

Charts - 3/30/2022 2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Pct of All Stocks above 65-dma Inverted Traders Index Cum. Inverted Traders Index DJI-IPA DJI-OBV NASDAQ S&P OEX NYSE DJI-15 DJI-20 DJI-30 DIA QQQ SPY IWM TNA Short-Term Rates Ten Year Rates DOLLAR-UUP ALLSTOCKs recent 2006 vers-Peerless signals http://tigersoftware.com/NEWPEER/UPD80330.BMP MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) STOCKS: MRNA DIS GE PYPL GME ZOM XLE NRGU AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX MRK MSFT NEM NFLX NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM Bullish MAXCPs http://www.tigersoftware.com/UPPING/3-30/BULLISH.htm Bearish MINCPs http://www.tigersoftware.com/DOWNING/3-30/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/28/2022 Bullish = 6 - GLD OIL/OIH CPER CORN WEAT Bearish = 1 - RSX ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX ================================================================================================== DIA 352.12 -.85 347.06 125% Bullish ---- .157 ----- ----- --------------------------------------------------------------------------------------------- SPY 458.7 -2.85 450.49 164.5% Bullish RED .208 .01 .218 --------------------------------------------------------------------------------------------- QQQ 367.09 -4.1 359.65 211.1% Bullish RED .177 -.004 .173 --------------------------------------------------------------------------------------------- MDY 497.79 -7.73 490.72 128.2% Bullish RED .15 .009 .159 --------------------------------------------------------------------------------------------- IWM 207.46 -4.25 205.84 86.1% Bullish RED .118 .003 .121 --------------------------------------------------------------------------------------------- FAS 125.02 -3.48 122.73 186.8% Bearish RED .082 -.083 -.001 --------------------------------------------------------------------------------------------- RETL 21.04 -3.08 21.86 -29.7% ------- RED .073 -.211 -.138 --------------------------------------------------------------------------------------------- SOXL 41.35 -4.23 42.09 557.2% Bullish RED .156 -.256 -.1 --------------------------------------------------------------------------------------------- TECL 64.04 -2.7 60.74 625.6% Bullish RED .192 -.064 .128 --------------------------------------------------------------------------------------------- IBB 130.97 -1.74 130.03 100.3% Bullish RED .117 -.014 .103 --------------------------------------------------------------------------------------------- GLD 180.58 1.44 183.13 -34% Bullish BLUE .249 .071 .32 +++ --------------------------------------------------------------------------------------------- OIL 17.68 .34 17.8 -158.9% Bullish BLUE .149 .194 .343 +++ --------------------------------------------------------------------------------------------- OIH 285.77 .98 283.31 64.6% Bullish RED .173 .274 .447 +++ --------------------------------------------------------------------------------------------- CPER 28.82 -.1 28.73 -57.2% Bullish RED .336 .079 .415 +++ --------------------------------------------------------------------------------------------- UUP 26.19 -.14 26.4 -34.1% ------- ---- .088 .026 .114 --------------------------------------------------------------------------------------------- CORN 26.36 .32 26.69 -118.2% ------- ---- .139 .212 .351 +++ --------------------------------------------------------------------------------------------- WEAT 10.02 .13 10.43 -275.2% Bullish RED .046 .368 .414 +++ --------------------------------------------------------------------------------------------- YINN 5.16 -.07 4.94 70.4% ------- ---- .18 -.422 -.242 --------------------------------------------------------------------------------------------- RSX 5.65 0 5.65 0% Bullish ---- -.463 -.749 -1.212 |

Table 2 Count of Stocks in Key Directories

20220330

-------------------------------

NYSE ADV 1420 vs 2744 yesterday

NYSE DEC 906 vs 1420 yesterday

NEWHIGHS 198

NEWLOWS 108

MAXCP 93

MINCP 43

TTTNH 55

TTTNL 40

CPCROSSA 14

CPCROSSD 175

ACCUMVER 9

HIGHIP21 10

HIUPPCT 68

VHIP21 49

LOWACCUM 207

REDSELL 122

AUGSELS7 7

TRAPDOOR 11

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/30/22

Bullish = 31

Bearish = 17

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

GOLD .913 .913 .913 .934 .956 .956

COPPER .875 1 .875 1 1 1

SOLAR .875 .875 .875 .812 .875 .937

OILGAS .847 .838 .819 .866 .828 .819

UTILITY .846 .871 .82 .794 .743 .743

EDU .833 1 .833 .833 .666 .666

FOOD .816 .816 .775 .795 .816 .836

INSURANC .8 .88 .76 .84 .76 .72

COMODITY .794 .794 .743 .769 .794 .82

TRANSP .789 .842 .736 .684 .578 .526

MILITARY .769 .807 .769 .807 .807 .769

HACKERS .75 .75 .7 .7 .7 .65

INDEXES .735 .767 .659 .589 .551 .4

INDMATER .694 .75 .708 .694 .708 .68

HOSPITAL .687 .687 .687 .75 .625 .562

REIT .684 .784 .569 .492 .415 .361

INFRA .666 .727 .696 .696 .696 .666

FIDSTKS .621 .668 .579 .544 .514 .461

SP500 .588 .632 .536 .522 .477 .419

GREEN .578 .578 .526 .526 .473 .421

BEVERAGE .571 .571 .357 .428 .357 .214

HIGHPRIC .567 .621 .512 .41 .407 .312

NIFTY .565 .63 .543 .521 .543 .456

SP-100 .555 .588 .555 .555 .511 .466

SOFTWARE .553 .571 .482 .446 .464 .428

NASD-100 .546 .597 .484 .474 .494 .412

DJI-13 .538 .615 .538 .538 .461 .461

DOWJONES .533 .6 .533 .533 .466 .366

RETAIL .531 .638 .553 .553 .531 .489

RUS-1000 .531 .572 .475 .475 .455 .44

==============================================================================================

COMPUTER .5 .5 .45 .45 .4 .35

MARIJUAN .5 .5 .25 .5 .25 0

===============================================================================================

BIOTECH .484 .54 .42 .426 .426 .381

LOWPRICE .48 .503 .475 .519 .526 .496

GAMING .473 .526 .421 .421 .421 .421

GUNS .461 .538 .384 .384 .307 .307

ELECTRON .458 .563 .473 .503 .466 .353

CHEM .456 .608 .478 .456 .478 .434 SEMI .442 .578 .463 .515 .463 .347 JETS .428 .428 .285 .214 .071 .071 ETFS .4 .436 .272 .29 .309 .236 AUTO .377 .433 .339 .377 .358 .377 FINANCE .329 .439 .378 .414 .365 .317 CHINA .3 .3 .24 .2 .28 .32 REGBANKS .28 .4 .28 .4 .24 .24 HOMEBLDG .166 .277 .166 .166 .111 .111 BIGBANKS .142 .142 .142 .142 .142 .142 BONDFUND .011 .011 0 0 0 .011 |

====================================================================================

Wednesday 5:15 AM PCT Futures: DJI -101

NASDAQ -66 Data

through 3/29/2022

| The Peerless S9 has failed to stop the DJI at its

falling 65-dma. That resistance has been convincingly surpassed and will likely act as support. Instead, the DJIA seems to be moving up to the resistance above created by its broadening tops. 1981 and 1986 show this has precedent as long as the key Closing Powers (as shown below) and the NYSE A/D Line keep rising. The absence of many MINCP stocks and the fact that new highs on NASDAQ and NYSE rose above their new lows for the first time in many weeks today offers additional hope to the bulls. So, stay long some of the now rising growth stocks, especially NVDA. Watch to see if SOXL can bullishly get past its falling 65-dma. But AAPL, has now risen 10 straight days. Avoid it. It is overbought. The beaten down bonds, likewise are due for a reversal. If you are a trader, take some profits in our bond short sales. This last recommendation stems from the breakout today in leading utilities and the reversal day shown in the 10-year and short-term rates. We are starting off with a lower opening. Let's see if Professionals come in again to support the market before much damage is done. |

||

|

Charts - 3/29/2022 2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Pct of All Stocks above 65-dma Inverted Traders Index Cum. Inverted Traders Index DJI-IPA DJI-OBV NASDAQ S&P OEX NYSE DJI-15 DJI-20 DJI-30 DIA QQQ SPY IWM TNA Short-Term Rates Ten Year Rates DOLLAR-UUP ALLSTOCKs recent 2006 vers-Peerless signals http://tigersoftware.com/NEWPEER/UPD80329.BMP MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) STOCKS: MRNA DIS GE PYPL GME ZOM XLE NRGU AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX MRK MSFT NEM NFLX NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM Bullish MAXCPs http://www.tigersoftware.com/UPPING/3-29/BULLISH.htm Bearish MINCPs http://www.tigersoftware.com/DOWNING/3-29/BEARISH.htm |

|

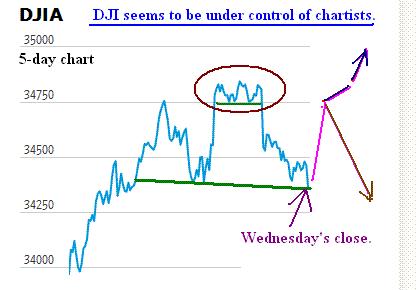

There are three possible scenarios (shown as pink lines on right side of DJI chart below. As long as A/D line uptrend is not violated, the 65-dma should act as support. |

| |

Table 1 QUICKSILVER on ETFS - 3/28/2022 Bullish = 6 - GLD OIL/OIH CPER CORN WEAT Bearish = 1 - RSX ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX ================================================================================================== DIA 352.97 3.48 343.41 69.5% Bullish BLUE .11 -- ---- --------------------------------------------------------------------------------------------- SPY 461.55 5.64 443.8 132.7% Bullish RED .175 .01 .185 --------------------------------------------------------------------------------------------- QQQ 371.19 6.28 351.83 198.4% Bullish BLUE .176 -.006 .17 --------------------------------------------------------------------------------------------- MDY 505.52 10.57 485.12 114% Bullish BLUE .131 .015 .146 --------------------------------------------------------------------------------------------- IWM 211.71 5.52 203.9 102.2% Bullish BLUE .114 .005 .119 --------------------------------------------------------------------------------------------- FAS 128.5 2.22 120.35 48.1% ------- RED .026 -.107 -.081 --------------------------------------------------------------------------------------------- RETL 24.12 2.55 21.17 358.6% Bullish BLUE .127 -.143 -.016 --------------------------------------------------------------------------------------------- SOXL 45.58 2.87 36.69 737.4% Bullish BLUE .154 -.276 -.122 --------------------------------------------------------------------------------------------- TECL 66.74 3.85 56.35 640% Bullish BLUE .17 -.082 .088 --------------------------------------------------------------------------------------------- IBB 132.71 3.64 128.37 39.4% Bullish BLUE .126 -.028 .098 --------------------------------------------------------------------------------------------- GLD 179.14 .08 181.81 -6.1% Bullish BLUE .285 .073 .358 --------------------------------------------------------------------------------------------- OIL 17.34 .55 18.24 -110.2% ------- BLUE .148 .201 .349 --------------------------------------------------------------------------------------------- OIH 284.79 3.7 282.09 130.3% Bullish BLUE .163 .265 .428 --------------------------------------------------------------------------------------------- CPER 28.92 .17 29.15 50.4% Bullish BLUE .347 .084 .431 --------------------------------------------------------------------------------------------- UUP 26.33 -.16 26.37 -1.9% ------- BLUE .039 .05 .089 --------------------------------------------------------------------------------------------- CORN 26.04 -.65 26.99 -145.4% Bullish BLUE .185 .21 .395 --------------------------------------------------------------------------------------------- WEAT 9.89 -.37 10.59 -380.4% Bullish BLUE .059 .402 .461 --------------------------------------------------------------------------------------------- YINN 5.23 .34 5.09 80.7% ------- RED .195 -.423 -.228 --------------------------------------------------------------------------------------------- RSX 5.65 0 5.65 0% Bullish ---- -.602 -.756 -1.358 |

Table 2 Count of Stocks in Key Directories

20220329

-------------------------------

NEWHIGHS 209

NEWLOWS 151

MAXCP 154

MINCP 18

TTTNH 49

TTTNL 13

CPCROSSA 88

CPCROSSD 21

ACCUMVER 8

HIGHIP21 20

HIUPPCT 62

VHIP21 49

LOWACCUM 235

REDSELL 119

AUGSELS7 7

TRAPDOOR 7

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/29/22

Bullish = 38

Bearish = 11

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

COPPER 1 .875 1 1 1 1

EDU 1 .833 .833 .666 .666 .833

GOLD .913 .913 .934 .956 .956 .956

INSURANC .88 .76 .84 .76 .72 .84

SOLAR .875 .875 .812 .875 .875 .937 UTILITY .871 .82 .794 .743 .743 .743 TRANSP .842 .736 .684 .578 .526 .526 OILGAS .838 .819 .866 .828 .828 .847 FOOD .816 .775 .795 .816 .836 .836 MILITARY .807 .769 .807 .807 .769 .769 COMODITY .794 .743 .769 .794 .82 .82 REIT .784 .561 .5 .415 .361 .438 INDEXES .767 .659 .589 .551 .4 .545 HACKERS .75 .7 .7 .7 .65 .65 INDMATER .75 .708 .694 .708 .68 .652 INFRA .727 .696 .696 .696 .666 .696 HOSPITAL .687 .687 .75 .625 .562 .625 FIDSTKS .668 .579 .544 .514 .473 .514 RETAIL .638 .553 .553 .531 .489 .553 SP500 .632 .536 .522 .475 .427 .487 NIFTY .63 .543 .5 .543 .456 .5 HIGHPRIC .621 .512 .41 .407 .316 .443 DJI-13 .615 .538 .538 .461 .461 .461 CHEM .608 .478 .478 .456 .456 .413 DOWJONES .6 .533 .533 .466 .4 .433 NASD-100 .597 .484 .463 .494 .402 .463 SP-100 .588 .555 .555 .511 .477 .522 GREEN .578 .526 .526 .473 .421 .526 SEMI .578 .463 .515 .463 .347 .421 RUS-1000 .572 .475 .475 .455 .443 .468 BEVERAGE .571 .357 .428 .357 .285 .285 SOFTWARE .571 .482 .446 .464 .428 .482 ELECTRON .563 .473 .503 .466 .353 .443 BIOTECH .54 .42 .426 .426 .373 .412 GUNS .538 .384 .384 .307 .307 .384 GAMING .526 .421 .421 .421 .421 .473 LOWPRICE .506 .475 .516 .526 .503 .478 ============================================================================================== COMPUTER .5 .45 .45 .4 .35 .35 MARIJUAN .5 .25 .5 .25 0 0 FINANCE .439 .378 .414 .365 .317 .414 ETFS .436 .272 .29 .309 .254 .29 AUTO .433 .339 .377 .358 .377 .377 JETS .428 .285 .214 .071 .071 .071 REGBANKS .4 .28 .4 .24 .24 .32 CHINA .3 .24 .2 .28 .32 .3 HOMEBLDG .277 .166 .166 .111 .111 .222 BIGBANKS .142 .142 .142 .142 .142 .285 BONDFUND .011 0 0 0 .011 .011 |

==================================================================================

Tuesday 4:55 AM PCT Futures: DJI +136

NASDAQ +53 Data through 3/29/2022

| Professional buying

during the day and especially at the close keeps overcoming and dominating early selling in the key ETFs shown below as well as in AAPL, NVDA and other growth stocks like TSLA, AMZN, GOOG and MSFT, all of which have easily moved past the potential resistance of their 65-dma. At the same time, bond funds keep tumbling. They will likely go a lot lower. The explanation seems clear. Peace talks between Russia and Ukraine bring hope for an end to Russian brutality and aggression on its neighbor. Moreover, late and slow, the FED is steadily raising rates. With Inflation well above 8%, rates must go much higher. That keeps plenty of pressure on Bonds. But so slow is the FED to raise raise rates, investors need a lot more signs of an economic slowdown to worry about high PE growth stocks whose rises now seem destined to challenge their recent highs. Such advances are typical so long as the FED raises rates slowly and there is little that points to a recession. The Sell S9 signal might still work out. But we will need to see new Professional selling and a break in all the Closing Power uptrends. A 3% or 4% paper loss precedent on an S9 is a possibility if the Peerless key indicators bulge much higher. We do not want any part of that. (See the DJI charts of mid 1929 and mid 1987, for examples) A broad trading range can also make Sell S9s apprear prematurely. See the example of 1986 below. Prices then did not stop at the bands, they stopped only at the rising resistance line. See the first chart below. As I have said repeatedly, our bearish MINCPs, where we would normally look for short sales, consists almost entirely of bond funds.. Stick with these shorts here. Avoid others. As for longs, hold growth stocks like NVDA. Each day seems to bring another new institutional recommendation of NVDA. It shuld rise until there are serious signs of an oncoming recession. |

||

|

Charts - 3/28/2022 2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Pct of All Stocks above 65-dma Inverted Traders Index Cum. Inverted Traders Index DJI-IPA DJI-OBV NASDAQ S&P OEX NYSE DJI-15 DJI-20 DJI-30 DIA QQQ SPY IWM TNA Short-Term Rates Ten Year Rates DOLLAR-UUP ALLSTOCKs recent 2006 vers-Peerless signals http://tigersoftware.com/NEWPEER/UPD80328.BMP MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) STOCKS: MRNA DIS GE PYPL GME ZOM XLE NRGU AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX MRK MSFT NEM NFLX NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM Bullish MAXCPs http://www.tigersoftware.com/UPPING/3-28/BULLISH.htm Bearish MINCPs http://www.tigersoftware.com/DOWNING/3-28/BEARISH.htm |

|

Compare DJI chart-formation of 1986 with 2022 DJIA 2021-2022 Upper band may not be able to stop present rally. It may have to rally to rising resistance-line. |

| |

Table 1 QUICKSILVER on ETFS - 3/28/2022 Bullish = 6 - GLD OIL/OIH CPER CORN WEAT Bearish = 1 - RSX ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX ================================================================================================== DIA 349.49 .95 348.14 58.4% Bullish BLUE .138 == ======== --------------------------------------------------------------------------------------------- SPY 455.91 3.22 449.59 128.5% Bullish BLUE .177 .014 .191 --------------------------------------------------------------------------------------------- QQQ 364.91 5.56 356.96 208.5% Bullish BLUE .167 -.001 .166 --------------------------------------------------------------------------------------------- MDY 494.95 .75 494.31 37.6% Bullish BLUE .117 .006 .123 --------------------------------------------------------------------------------------------- IWM 206.19 .07 207.5 18.2% Bullish BLUE .098 -.004 .094 --------------------------------------------------------------------------------------------- FAS 126.28 -.95 127.3 196.3% ------- RED .049 -.128 -.079 --------------------------------------------------------------------------------------------- RETL 21.57 .68 22.57 85.9% Bullish BLUE .096 -.263 -.167 --------------------------------------------------------------------------------------------- SOXL 42.71 .7 39.59 465.2% Bullish BLUE .138 -.258 -.12 --------------------------------------------------------------------------------------------- TECL 62.89 2.31 59.07 530.8% Bullish BLUE .167 -.099 .068 --------------------------------------------------------------------------------------------- IBB 129.07 .91 131.69 -6.2% Bullish BLUE .099 -.033 .066 --------------------------------------------------------------------------------------------- GLD 179.06 -3.32 179.36 -44.4% Bullish RED .278 .085 .363 + --------------------------------------------------------------------------------------------- OIL 16.79 -1.12 17.73 -312.5% Bearish RED .099 .204 .303 + --------------------------------------------------------------------------------------------- OIH 281.09 -12.43 277.4 41.9% Bullish RED .141 .318 .459 + --------------------------------------------------------------------------------------------- CPER 28.75 .14 28.63 34.8% Bullish BLUE .351 .078 .429 + --------------------------------------------------------------------------------------------- UUP 26.49 .08 26.34 26.5% ------- RED -.013 .074 .061 --------------------------------------------------------------------------------------------- CORN 26.69 -.19 26.82 -11.2% Bullish BLUE .171 .273 .444 + --------------------------------------------------------------------------------------------- WEAT 10.26 -.35 10.69 -174.7% ------- ---- .059 .467 .526 + --------------------------------------------------------------------------------------------- YINN 4.89 .17 5.15 306.2% Bullish ---- .225 -.427 -.202 --------------------------------------------------------------------------------------------- RSX 5.65 0 5.65 0% Bullish ---- -.688 -.744 -1.432 - |

Tsble 2 Count of Stocks in Key Directories

20220328

-------------------------------

NEWHIGHS 140

NEWLOWS 301

MAXCP 91

MINCP 37

TTTNH 37

TTTNL 25

CPCROSSA 35

CPCROSSD 61

ACCUMVER 6

HIGHIP21 21

HIUPPCT 56

VHIP21 46

LOWACCUM 211

REDSELL 116

AUGSELS7 8

TRAPDOOR 6

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/28/22

Bullish = 27

Bearish = 22

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

GOLD .913 .934 .956 .956 .956 .956

COPPER .875 1 1 1 1 1

SOLAR .875 .812 .875 .875 .937 .812

EDU .833 .833 .666 .666 .833 .666

UTILITY .82 .794 .743 .743 .743 .769 OILGAS .819 .866 .828 .828 .847 .847 FOOD .775 .795 .816 .836 .836 .836 MILITARY .769 .807 .807 .769 .769 .73 INSURANC .76 .84 .76 .72 .84 .76 COMODITY .743 .769 .794 .82 .82 .82 TRANSP .736 .684 .578 .526 .526 .473 INDMATER .708 .694 .708 .68 .652 .666 HACKERS .7 .7 .7 .65 .65 .65 INFRA .696 .696 .696 .666 .696 .696 HOSPITAL .687 .75 .625 .562 .625 .75 INDEXES .659 .589 .551 .4 .529 .432 FIDSTKS .579 .544 .514 .473 .514 .473 REIT .561 .492 .423 .361 .438 .392 SP-100 .555 .555 .511 .477 .522 .488 RETAIL .553 .553 .531 .489 .553 .51

NIFTY .543 .5 .521 .456 .5 .369

DJI-13 .538 .538 .461 .461 .461 .384

SP500 .536 .522 .475 .425 .485 .453

DOWJONES .533 .533 .466 .4 .433 .4

=====

GREEN .526 .526 .473 .421 .526 .473 HIGHPRIC .512 .41 .407 .316 .432 .341 ============================================================================================= NASD-100 .484 .463 .484 .402 .453 .36 SOFTWARE .482 .446 .464 .428 .482 .428 CHEM .478 .478 .478 .434 .434 .369 LOWPRICE .478 .516 .524 .503 .47 .427 RUS-1000 .475 .475 .455 .443 .46 .432 ELECTRON .473 .503 .466 .353 .436 .421 SEMI .463 .515 .463 .347 .421 .389 COMPUTER .45 .45 .4 .35 .35 .35 GAMING .421 .421 .421 .421 .473 .368 BIOTECH .42 .426 .426 .373 .406 .348 GUNS .384 .384 .307 .307 .384 .307 FINANCE .378 .414 .365 .317 .414 .353 BEVERAGE .357 .428 .357 .285 .285 .285 AUTO .339 .377 .358 .377 .377 .358 JETS .285 .214 .071 .071 .071 0 REGBANKS .28 .4 .24 .24 .32 .28 ETFS .272 .29 .309 .254 .309 .236 MARIJUAN .25 .5 .25 0 0 0 CHINA .24 .2 .28 .32 .3 .2 HOMEBLDG .166 .166 .111 .111 .222 .222 BIGBANKS .142 .142 .142 .142 .285 .142 BONDFUND 0 0 0 .011 .011 0 |

=====================================================================================

Monday 5:20 AM PCT Futures: DJI +56

NASDAQ +35 Data through 3/25/2022

|

Professionals Remain Steady Buyers. The S9 has tried its best to reverse the rally. It seem only able to send Bonds into a tailspin as interest rates rise and rise. But Professionals, as seen by our rising Closing Power in all the key ETFs, keep buying in pre-NYSE weakness and then steadily buying more during the day, mainly in blue chips, SPY and growth stocks like AAPL and NVDA. S9s can fail. We won't be selling short anything but bonds until the Closing Power for DIA, SPY and QQQclearly break their uptrneds. The NASDAQ has reached the resistance of its 65-dma but its Closing Power also is rising. QQQ has still not reached that target. So, higher prices are expected. And that could take the DJI well above its 65-dma and turn that key boundary into support. At that point, the broadening price pattern in the DJIA will take on more significance. Ten-year rates are still a percent or two below where they will compete with stocks for investments. And as long as the economic news is good and there is no recession, investment money may just keep flowing into blue chips and growth stocks to beat inflatioin rather than bonds, which seem a dismal choice now. Perhaps, many traders do not want to be unpatriotic and sell. In any case, we should watch AAPL now. Its Closing Power has risen nine straight days. A break is due. That should invite a wider reversal. And also watch UNH. It is the highest and most heavily weighted DJI-30 stock. I take NVDA to be the perfect growth stock now. As they used to say in the early 1970s, it is a "one-decision" stock. One buys it and then plans never to sell it. The collapse of 1973-1974 showed that this was a poorly planned strategy. |

||

|

Charts - 3/25/2022 2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Pct of All Stocks above 65-dma Inverted Traders Index Cum. Inverted Traders Index DJI-IPA DJI-OBV NASDAQ S&P OEX NYSE DJI-15 DJI-20 DJI-30 DIA QQQ SPY IWM TNA Short-Term Rates Ten Year Rates DOLLAR-UUP ALLSTOCKs recent 2006 vers-Peerless signals http://tigersoftware.com/NEWPEER/UPD80325.BMP MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NUGT OIH RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) STOCKS: MRNA DIS GE PYPL GME ZOM XLE NRGU AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX MRK MSFT NEM NFLX NKE NVDA PG PYPL REGN SO SQ QCOM TSLA TXN XOM V VRTX WFC WMT ZM New ANET EXTR FTNT SCSC also AVYA FSLY RNG Bullish MAXCPs http://www.tigersoftware.com/UPPING/3-25/BULLISH.htm Bearish MINCPs http://www.tigersoftware.com/DOWNING/3-25/BEARISH.htm |

|

Table 1 QUICKSILVER on ETFS - 3/25/2022 Bullish = 6 - GLD OIL/OIH CPER CORN WEAT Bearish = 1 - RSX ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX ================================================================================================== DIA 348.54 1.48 345.44 19.5% Bullish BLUE .173 ===== --------------------------------------------------------------------------------------------- SPY 452.69 2.2 444.39 91.5% Bullish BLUE .197 .001 .198 --------------------------------------------------------------------------------------------- QQQ 359.35 -.3 350.08 111% Bullish RED .177 -.033 .144 --------------------------------------------------------------------------------------------- MDY 494.2 3.48 491.26 16.5% Bullish BLUE .146 .009 .155 --------------------------------------------------------------------------------------------- IWM 206.12 .28 205.44 -27.9% ------- ---- .118 -.006 .112 --------------------------------------------------------------------------------------------- FAS 127.23 4.5 121.42 227.4% Bullish BLUE .069 -.127 -.058 --------------------------------------------------------------------------------------------- RETL 20.89 -.97 21.2 -395.3% Bullish RED .133 -.293 -.16 --------------------------------------------------------------------------------------------- SOXL 42.01 -.08 39 361.2% ------- RED .144 -.31 -.166 --------------------------------------------------------------------------------------------- TECL 60.58 -.16 56.66 316.7% Bullish RED .181 -.187 -.006 --------------------------------------------------------------------------------------------- IBB 128.16 -1.87 129.23 -108.8% ------- RED .133 -.057 .076 --------------------------------------------------------------------------------------------- GLD 182.38 -.75 180.67 85.2% Bullish BLUE .315 .108 .423 + --------------------------------------------------------------------------------------------- OIL 17.91 .11 17.91 228.1% Bullish BLUE .146 .28 .426 + --------------------------------------------------------------------------------------------- OIH 293.52 10.21 278.72 433.9% Bullish BLUE .168 .377 .545 + --------------------------------------------------------------------------------------------- CPER 28.61 -.12 28.55 -19.1% Bullish ---- .362 .067 .429 + --------------------------------------------------------------------------------------------- UUP 26.41 .01 26.35 30.4% Bullish ---- -.038 .078 .04 --------------------------------------------------------------------------------------------- CORN 26.88 .19 26.75 163.2% Bullish BLUE .128 .27 .398 + --------------------------------------------------------------------------------------------- WEAT 10.61 .18 10.63 296.2% ------- BLUE .039 .497 .536 + --------------------------------------------------------------------------------------------- YINN 4.72 -.22 4.59 -519.8% ------- BLUE .233 -.475 -.242 --------------------------------------------------------------------------------------------- RSX 5.65 0 5.65 0% Bullish ---- -.716 -.749 -1.465 - |

Table 2 Count of Stocks in Key Directories

20220325

-------------------------------

NEWHIGHS 259

NEWLOWS 355

MAXCP 153

MINCP 50

TTTNH 78

TTTNL 32

CPCROSSA 117

CPCROSSD 116

ACCUMVER 5

HIGHIP21 23

HIUPPCT 42

VHIP21 45

LOWACCUM 196

REDSELL 109

AUGSELS7 6

TRAPDOOR 12

|

Form 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/25/22

Bullish = 27

Bearish = 22

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

COPPER 1 1 1 1 1 1

GOLD .934 .956 .956 .956 .956 .956

OILGAS .866 .828 .828 .847 .857 .838

INSURANC .84 .76 .72 .84 .76 .72

EDU .833 .666 .666 .833 .666 .833 SOLAR .812 .875 .875 .937 .812 .812 MILITARY .807 .807 .769 .769 .73 .769 FOOD .795 .816 .836 .836 .836 .836 UTILITY .794 .743 .743 .743 .769 .743 COMODITY .769 .794 .82 .82 .82 .82 HOSPITAL .75 .625 .562 .625 .687 .75 HACKERS .7 .7 .65 .65 .65 .65 INFRA .696 .696 .666 .696 .696 .666 INDMATER .694 .708 .68 .652 .666 .652 TRANSP .684 .578 .526 .526 .473 .578 INDEXES .589 .551 .4 .529 .427 .443 SP-100 .555 .511 .477 .522 .488 .466 RETAIL .553 .531 .489 .553 .51 .553 FIDSTKS .544 .514 .473 .514 .479 .491 DJI-13 .538 .461 .461 .461 .384 .384

DOWJONES .533 .466 .4 .433 .4 .366

=====

GREEN .526 .473 .421 .526 .473 .473

SP500 .524 .474 .422 .48 .456 .476

LOWPRICE .519 .524 .501 .47 .43 .44

SEMI .515 .463 .347 .421 .378 .389 ELECTRON .503 .466 .353 .436 .421 .443 ================================================================================================ MARIJUAN .5 .25 0 0 0 0 NIFTY .5 .521 .434 .5 .369 .347 REIT .492 .415 .369 .438 .392 .469 CHEM .478 .478 .456 .413 .391 .413 RUS-1000 .475 .455 .443 .46 .43 .465 NASD-100 .463 .484 .391 .453 .36 .381 COMPUTER .45 .4 .35 .35 .35 .35 SOFTWARE .446 .464 .428 .482 .446 .41 BEVERAGE .428 .357 .285 .285 .285 .214 BIOTECH .426 .426 .373 .406 .348 .403 GAMING .421 .421 .421 .473 .368 .421 FINANCE .414 .365 .317 .414 .353 .378 HIGHPRIC .41 .407 .316 .432 .341 .378 REGBANKS .4 .24 .24 .32 .28 .28 GUNS .384 .307 .307 .384 .23 .307 AUTO .377 .358 .377 .377 .358 .377 ETFS .29 .309 .254 .309 .254 .254 JETS .214 .071 .071 .071 0 .214 CHINA .2 .28 .32 .3 .22 .16 HOMEBLDG .166 .111 .111 .222 .222 .333 BIGBANKS .142 .142 .142 .285 .142 .142 BONDFUND 0 0 .011 .011 0 .022 |

===================================================================================

Friday 5:40 AM PCT Futures: DJI

+92 NASDAQ +63 Data through 3/24/2022

| Sell S9 - Seems unpatriotic.

Buy SOXL and hedge with top and bottom ranked SP-500 stocks using tables shown below. UNH's unusual weight in DJIA shows us how manipulated the DJIA is. This argues that the Closing Power is now more important than the NYSE A/D Line. The DJI has almost reached its 65-dma again. The chart of the 1977 bear market shown below tells us that the DJI could still slightly surpass its 65-dma even with the IP21-Accumulation Index positive and then we could still see a resumption of the bear market. If this history were to repeat, the DJI would soon drop below its 10%-down-from-the-peak level and oil and NASDAQ growth stocks would then be turning down. So, the next few trading days are significant. We do have a Sell S9. But the Closing Powers for the key ETFs keep rising even after up-openings. There are just too few Bearish MINCPs presently. Bonds make up most of that list. What is happening is that more and more investors including some who owned bonds are now considering growth stocks, like NVDA and AAPL, to be the best way to deal with Inflation, at least until interest rates rise much higher. And there is another factor supporting the market. That is the United States is now in a proxy war with Russia, with Ukraine being the proxy. While this is very dangerous, Wall Street is patriotic. It wants to support the war by not unpatriotically selling short. What to do? I would think that SOXL and other semi-conductors will play "catch-up" with NVDA. If today finishes strongly, Buy SOXL and the top SP-500 stocks shown below and to hedge, consider shorting the lowest Power Ranked, too. |

||

|

Charts - 3/24/2022 2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Pct of All Stocks above 65-dma Inverted Traders Index Cum. Inverted Traders Index DJI-IPA DJI-OBV NASDAQ S&P OEX NYSE DJI-15 DJI-20 DJI-30 DIA QQQ SPY IWM TNA Short-Term Rates Ten Year Rates DOLLAR-UUP ALLSTOCKs recent 2006 vers-Peerless signals http://tigersoftware.com/NEWPEER/UPD80324.BMP MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NUGT OIH RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) STOCKS: MRNA DIS GE PYPL GME ZOM XLE NRGU AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX MRK MSFT NEM NFLX NKE NVDA PG PYPL REGN SO SQ QCOM TSLA TXN XOM V VRTX WFC WMT ZM New ANET EXTR FTNT SCSC also AVYA FSLY RNG Bullish MAXCPs http://www.tigersoftware.com/UPPING/3-24/BULLISH.htm Bearish MINCPs http://www.tigersoftware.com/DOWNING/3-24/BEARISH.htm |

|

One stock in DJI-30, UNH, is weighted as much as the 8 or 9 lowest priced DJI stocks. Each 10 points it rises contributes 67 points to the DJIA. It is now running in all-time high territory. |

| The red 5-day

Stochastic Sell at the SP-500's 65-dma confronts a very high SPY IP21 and a number of stocks in its top 10 Power Ranked that look quite bullish. Hedging, we might but the best here and sell the weakest short. There was considerable difference in the performance today of the two groups. Time permitting, I will try to post the top 10 and bottom 10 Power Ranked several times a week. |

Bottom 10 Power Ranked of SP-500 |

|

NVDA and AAPL are two premier growth stocks in the current era. Bonds may drop, but the tempatation is very strong to deal with inflation by buying the best growth stocks and hodling them tightly. SOXL would seem to have to follow NVDA's big rise today. |

| Semi-Conductors are likely to follow the lead of NVDA, TXN and

INTC. |

|

Rising Interest Rates' Trend makes Bond's future look bearish. Hedgers should be short some of the many bearish-looking bond funds shown in the Bearish MINCP lists. |

Table 1 QUICKSILVER on ETFS - 3/24/2022 Bullish = 5 - GLD OIL/OIH CPER CORN WEAT Bearish = 1 - RSX ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX ================================================================================================== DIA 347.06 3.65 347.19 23.3% Bullish BLUE .242 ---- --------- --------------------------------------------------------------------------------------------- SPY 450.49 6.69 444.52 105.9% Bullish BLUE .245 .002 .247 --------------------------------------------------------------------------------------------- QQQ 359.65 7.82 351.49 216.7% Bullish BLUE .227 -.025 .202 --------------------------------------------------------------------------------------------- MDY 490.72 5.6 492.58 5.6% Bullish BLUE .153 .002 .155 --------------------------------------------------------------------------------------------- IWM 205.84 1.94 207.27 17.7% ------- BLUE .169 -.011 .158 --------------------------------------------------------------------------------------------- FAS 122.73 2.38 121.65 106.8% Bullish BLUE .115 -.152 -.037 --------------------------------------------------------------------------------------------- RETL 21.86 .69 22.62 2.3% Bullish BLUE .234 -.286 -.052 --------------------------------------------------------------------------------------------- SOXL 42.09 5.4 39.17 671.4% ------- BLUE .181 -.292 -.111 --------------------------------------------------------------------------------------------- TECL 60.74 4.39 56.91 622.6% Bullish BLUE .227 -.172 .055 --------------------------------------------------------------------------------------------- IBB 130.03 1.66 130.99 54.3% ------- BLUE .213 -.051 .162 --------------------------------------------------------------------------------------------- GLD 183.13 1.32 179.3 62.1% Bullish BLUE .25 .118 .368 +++ --------------------------------------------------------------------------------------------- OIL 17.8 -.44 17.1 256% Bearish RED .09 .286 .376 +++ --------------------------------------------------------------------------------------------- OIH 283.31 1.22 269.38 250.9% Bullish BLUE .149 .327 .476 +++ --------------------------------------------------------------------------------------------- CPER 28.73 -.42 28.72 24.4% Bullish RED .388 .106 .494 +++ --------------------------------------------------------------------------------------------- UUP 26.4 .03 26.25 34.2% Bearish ---- -.125 .074 -.051 --------------------------------------------------------------------------------------------- CORN 26.69 -.3 26.01 107.4% ------- RED .058 .263 .321 +++ --------------------------------------------------------------------------------------------- WEAT 10.43 -.16 9.99 91.1% Bearish ---- .011 .452 .463 +++ --------------------------------------------------------------------------------------------- YINN 4.94 -.15 5.24 396% ------- BLUE .241 -.416 -.175 --------------------------------------------------------------------------------------------- RSX 5.65 0 5.65 0% Bullish ---- -.515 -.744 -1.259 - |

Table 2 Count of Stocks in Key Directories

20220324

-------------------------------

NEWHIGHS 172

NEWLOWS 201

MAXCP 84

MINCP 29

TTTNH 48

TTTNL 21

CPCROSSA 133

CPCROSSD 23

ACCUMVER 6

HIGHIP21 28

HIUPPCT 37

VHIP21 43

LOWACCUM 204

REDSELL 101

AUGSELS7 8

TRAPDOOR 4

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/24/22

Bullish = 22

Bearish = 29

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

COPPER 1 1 1 1 1 1

GOLD .956 .956 .956 .956 .956 .956

SOLAR .875 .875 .937 .812 .812 .875

OILGAS .828 .828 .847 .857 .838 .847

FOOD .816 .836 .836 .836 .836 .816 MILITARY .807 .769 .769 .73 .769 .769 COMODITY .794 .82 .82 .82 .82 .794 INSURANC .76 .72 .84 .76 .76 .76 UTILITY .743 .743 .743 .769 .743 .769 INDMATER .708 .68 .652 .666 .652 .625 HACKERS .7 .65 .65 .65 .65 .5 INFRA .696 .666 .696 .696 .666 .696 EDU .666 .666 .833 .666 .833 .833 HOSPITAL .625 .562 .625 .687 .687 .687 TRANSP .578 .526 .526 .473 .578 .473 INDEXES .551 .4 .529 .427 .437 .416 RETAIL .531 .489 .553 .51 .553 .553 LOWPRICE .526 .501 .468 .43 .437 .384 NIFTY .521 .434 .478 .369 .347 .26 FIDSTKS .514 .473 .514 .479 .491 .437

SP-100 .511 .477 .522 .488 .477 .444

=========================================================================================

NASD-100 .484 .391 .443 .36 .381 .319

CHEM .478 .456 .434 .369 .434 .391

SP500 .474 .426 .482 .452 .476 .43

======

GREEN .473 .421 .526 .473 .473 .368

DOWJONES .466 .4 .433 .4 .366 .333

======

ELECTRON .466 .353 .436 .421 .436 .36

SOFTWARE .464 .428 .482 .446 .428 .339

SEMI .463 .347 .421 .378 .389 .315

DJI-13 .461 .461 .461 .384 .384 .384

RUS-1000 .455 .443 .46 .43 .458 .42

BIOTECH .426 .373 .406 .348 .398 .331

GAMING .421 .421 .473 .368 .421 .368

REIT .415 .361 .446 .392 .461 .461

HIGHPRIC .407 .316 .432 .341 .378 .305

COMPUTER .4 .35 .35 .35 .35 .2

FINANCE .365 .317 .414 .353 .39 .378

AUTO .358 .377 .377 .358 .377 .339

BEVERAGE .357 .285 .285 .285 .214 .214

ETFS .309 .254 .309 .254 .272 .254

GUNS .307 .307 .384 .23 .307 .23

CHINA .28 .32 .3 .22 .16 .14

MARIJUAN .25 0 0 0 0 0

REGBANKS .24 .24 .32 .28 .32 .32

BIGBANKS .142 .142 .285 .142 .142 .142

HOMEBLDG .111 .111 .222 .222 .277 .277

JETS .071 .071 .071 0 .214 .071

BONDFUND 0 .011 .011 0 .022 .011

|

===================================================================================

Thursday 5:17 AM PCT Futures: DJI +136

NASDAQ +86 Data through 3/23/2022

| The Sell S9 still needs to have the DIA's Closing

Power uptrend be violated before we will want to sell it short because of the Sell S9 and the fact that it has reached its falling 65-dma. The DJI seems to be carefully under the control of chartists who are rigging a potential 5-day head and shoulders pattern. It seems that the up-opening this morning is meant to bring the DJI back above 34700 where it may then be made to turn down again, thereby forming a new head/shoulders pattern.  For now we need to see what happens on the present DJI rally back to its 65-dma. At the same, we will probably see QQQ and the NASDAQ reach the resistance of their 65-dma. This tight back-and-forth trading should be resolved in a few trading days. Ordinarily, we would simply suggest being long some of the bullish MAXCPs and short same of the bearish MINCPs. But the problem with that is that most of bearish MINCPs now are bond funds that keep getting clobbered but only by small daily percentages. So, we will just have to wait to see if the Sell S9 will be ratified by weakness from the DJI's Closing Power or whether prices will try again to get past the 65-dma resistance. One thing that stands out is that the OBV-Line for the DJI, SPY and QQQ are bearishly lagging the advance. Pre-market trading seems to have taken over. Still, without more volume during normal NYSE trading hours, any rally will likely be suspect and short-lived. |

||

|

Charts - 3/23/2022 2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Pct of All Stocks above 65-dma Inverted Traders Index Cum. Inverted Traders Index DJI-IPA DJI-OBV NASDAQ S&P OEX NYSE DJI-15 DJI-20 DJI-30 DIA QQQ SPY IWM TNA Short-Term Rates Ten Year Rates DOLLAR-UUP ALLSTOCKs recent 2006 vers-Peerless signals http://tigersoftware.com/NEWPEER/UPD80323.BMP MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) STOCKS: MRNA DIS GE PYPL GME ZOM XLE NRGU AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX MRK MSFT NEM NFLX NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM Bullish MAXCPs http://www.tigersoftware.com/UPPING/3-23/BULLISH.htm Bearish MINCPs http://www.tigersoftware.com/DOWNING/3-23/BEARISH.htm |

|

==================================================================================

Wednesday 5:27 AM PCT Futures: DJI -128

NASDAQ -114 Data through 3/22/2022

| The operative Peerless Sell S9 looks more serious

today. But a lot will depend on whether Professiojnal buyers come in to rescue the market from a weak opening. All the key ETFs still show rising Closing Powers. The DJI has now reached its 65-dma resistance and our technical goal for the current rally. Interest rates jumped sharply Tuesday and Fed Chairman Powell acknowledged that he will probably have to raise rates a lot faster and further. This will be the only way to bring a halt to the inflationary binge. It may unavoidably bring about a recession. In other words, in his words, he can not guarantee a "soft landing" for the economy or the stock market.. The rally today felt like an advance that Professionals were using to sell short. Breadth was not as positive as Monday's was negative and some of the leading stocks (like REGN and ABBV) lost a little rather than participate in today's nominal advance. It also felt like sellers of bonds may have decided to purchase blue chips to meet their fiduciary investment requirements of being fully invested. The 10-year Treasury bond's current 2.4% interest rate still does not compete with growth stocks now that Inflation is running at 7.5%. Thus, growth stocks do have a special appeal in this environment. But a lot will depend on the strength of the Economy, nationally and globablly, in the coming months. A recession or worse would hit even growth stocks because of their high PEs. A Little History The 1953-1957 boom only ended when very low rates were raised to 4%. It seems that we could quite easily (technically speaking) now get another new 10% sell-off, such as occurred twice in 1956, before we get a rally to a peak that would finally start a bear market for the DJI-30. (The top in July 1957 brought a 20% decline in October). This might or might not produce another Sell S9. The "peace" talks between Russian and Ukraine could still bring a bullish ceasefire rally. I take that as the "wild card" in this market. But looking beyond that, American financial history since 1915 (when the FED became operational) just does not show Inflation being wrung out of the Economy without a sharp selll-off in stocks and/or a recession or worse: 1919-1921, 1937-1938, 1956-1957, 1969-1970, 1966, 1969-1970, 1973-1974, 1978-1982, 1987, 2000-2003 and 2018. Even with all the price controls of World War II, the post-war spending boom was followed by a 26% bear market in the second half of 1946. |

||

|

Charts - 3/22/2022 2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Pct of All Stocks above 65-dma Inverted Traders Index Cum. Inverted Traders Index DJI-IPA DJI-OBV NASDAQ S&P OEX NYSE DJI-15 DJI-20 DJI-30 DIA QQQ SPY IWM TNA Short-Term Rates Ten Year Rates DOLLAR-UUP ALLSTOCKs recent 2006 vers-Peerless signals http://tigersoftware.com/NEWPEER/UPD80322.BMP MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) STOCKS: MRNA DIS GE PYPL GME ZOM XLE NRGU AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX MRK MSFT NEM NFLX NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM Bullish MAXCPs http://www.tigersoftware.com/UPPING/3-22/BULLISH.htm Bearish MINCPs http://www.tigersoftware.com/DOWNING/3-22/BEARISH.htm |

| |

Table 1 QUICKSILVER on ETFS - 3/22/2022 Bullish = 6 - GLD OIL/OIH CPER CORN WEAT Bearish = 1 - RSX ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX ================================================================================================== DIA 348.14 2.7 341.36 174.1% Bullish BLUE .186 ---------------- --------------------------------------------------------------------------------------------- SPY 449.59 5.2 435.62 267.1% Bullish BLUE .18 .004 .184 --------------------------------------------------------------------------------------------- QQQ 356.96 6.88 340.32 420.1% Bullish BLUE .168 -.021 .147 --------------------------------------------------------------------------------------------- MDY 494.31 3.05 485.45 229.1% Bullish BLUE .111 .011 .122 --------------------------------------------------------------------------------------------- IWM 207.5 2.06 201.94 288.5% ------- BLUE .1 -.001 .099 --------------------------------------------------------------------------------------------- FAS 127.3 5.88 116.35 873.6% Bullish BLUE .081 -.11 -.029 --------------------------------------------------------------------------------------------- RETL 22.57 1.37 20.92 916.4% Bullish BLUE .094 -.27 -.176 --------------------------------------------------------------------------------------------- SOXL 39.59 .59 36.3 1104.2% ------- BLUE .11 -.298 -.188 --------------------------------------------------------------------------------------------- TECL 59.07 2.41 52.63 1044.7% Bullish BLUE .16 -.168 -.008 --------------------------------------------------------------------------------------------- IBB 131.69 2.46 125.97 415.1% ------- BLUE .156 -.024 .132 --------------------------------------------------------------------------------------------- GLD 179.36 -1.31 180.01 13.1% Bullish RED .23 .108 .338 --------------------------------------------------------------------------------------------- OIL 17.73 -.18 15.87 513.2% Bearish RED .066 .302 .368 --------------------------------------------------------------------------------------------- OIH 277.4 -1.32 257.3 279.1% Bullish RED .141 .348 .489 --------------------------------------------------------------------------------------------- CPER 28.63 .08 28.31 210.1% Bullish RED .352 .104 .456 --------------------------------------------------------------------------------------------- UUP 26.34 -.01 26.28 -24.7% Bullish ---- -.042 .066 .024 --------------------------------------------------------------------------------------------- CORN 26.82 .07 25.34 115% ------- ---- .131 .257 .388 --------------------------------------------------------------------------------------------- WEAT 10.69 .06 9.84 58.5% Bullish RED .064 .501 .565 --------------------------------------------------------------------------------------------- YINN 5.15 .56 5.12 2255.6% Bearish ---- .202 -.34 -.138 --------------------------------------------------------------------------------------------- RSX 5.65 0 5.65 0% Bullish ---- -.418 -.743 -1.161 |

Table 2 Count of Stocks in Key Directories

20220322

-------------------------------

NEWHIGHS 164

NEWLOWS 204

MAXCP 55

MINCP 23

TTTNH 33

TTTNL 12

CPCROSSA 85

CPCROSSD 38

ACCUMVER 3

HIGHIP21 16

HIUPPCT 29

VHIP21 43

LOWACCUM 214

REDSELL 126

AUGSELS7 13

TRAPDOOR 6

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/22/22

Bullish = 21

Bearish = 28

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

COPPER 1 1 1 1 .875 .625

GOLD .956 .956 .956 .956 .934 .891

SOLAR .937 .812 .812 .875 .75 .5

OILGAS .847 .857 .838 .847 .819 .78

INSURANC .84 .76 .76 .76 .72 .56 FOOD .836 .836 .836 .836 .816 .795 EDU .833 .666 .833 .833 .833 .833 COMODITY .82 .82 .82 .82 .794 .769 MILITARY .769 .73 .769 .769 .769 .692 UTILITY .743 .769 .743 .769 .794 .717 INFRA .696 .696 .666 .696 .606 .545 INDMATER .652 .666 .652 .625 .597 .5 HACKERS .65 .65 .65 .5 .4 .35 HOSPITAL .625 .687 .687 .687 .687 .562 RETAIL .553 .51 .553 .553 .382 .34 INDEXES .529 .427 .437 .416 .41 .345 GREEN .526 .473 .473 .368 .315 .263 TRANSP .526 .473 .578 .473 .578 .263 SP-100 .522 .488 .477 .444 .4 .355 FIDSTKS .514 .479 .491 .443 .402 .319

===================================================================================================

SOFTWARE .482 .446 .428 .339 .303 .25

SP500 .482 .452 .474 .432 .388 .306

NIFTY .478 .347 .326 .26 .217 .173

GAMING .473 .368 .421 .368 .315 .21

LOWPRICE .47 .427 .435 .391 .33 .267

DJI-13 .461 .384 .384 .384 .384 .384

RUS-1000 .46 .43 .458 .42 .359 .291

NASD-100 .443 .35 .371 .319 .278 .206

REIT .438 .392 .469 .453 .369 .323

ELECTRON .436 .421 .436 .36 .278 .157

CHEM .434 .391 .434 .391 .434 .326

DOWJONES .433 .4 .366 .333 .333 .333

=====

HIGHPRIC .432 .341 .378 .305 .225 .167

SEMI .421 .378 .389 .315 .263 .147

FINANCE .414 .353 .39 .378 .414 .304

BIOTECH .406 .348 .398 .334 .261 .197

GUNS .384 .23 .307 .23 .307 .23

AUTO .377 .358 .377 .339 .264 .15

COMPUTER .35 .35 .35 .2 .15 .1

REGBANKS .32 .28 .32 .32 .52 .28

ETFS .309 .254 .272 .272 .254 .163

CHINA .3 .22 .16 .14 .16 .14

BEVERAGE .285 .285 .214 .214 .214 .142

BIGBANKS .285 .142 .142 .142 .142 0

HOMEBLDG .222 .222 .277 .277 .166 .111

JETS .071 0 .214 .071 .214 0

BONDFUND .011 0 .022 .011 0 0

MARIJUAN 0 0 0 0 0 0

|

====================================================================================

|

|||

Table 1 QUICKSILVER on ETFS - 3/21/2022 Bullish = 6 - GLD OIL/OIH CPER CORN WEAT Bearish = 2 - RETL, RSX ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX ================================================================================================== DIA 345.44 -1.75 336.19 226% Bullish RED .155 - ------- --------------------------------------------------------------------------------------------- SPY 444.39 -.13 426.17 316.4% Bullish RED .144 -.004 .14 --------------------------------------------------------------------------------------------- QQQ 350.08 -1.41 328.15 474.1% ------- RED .122 -.042 .08 --------------------------------------------------------------------------------------------- MDY 491.26 -1.32 472.03 272.3% Bullish RED .092 .005 .097 --------------------------------------------------------------------------------------------- IWM 205.44 -1.83 195.78 317.4% ------- RED .06 -.013 .047 --------------------------------------------------------------------------------------------- FAS 121.42 -.23 106.81 824% Bullish RED .063 -.118 -.055 --------------------------------------------------------------------------------------------- RETL 21.2 -1.42 18.71 976.9% Bullish RED .054 -.328 -.274 --------------------------------------------------------------------------------------------- SOXL 39 -.17 31.51 1613.4% ------- BLUE .118 -.358 -.24 --------------------------------------------------------------------------------------------- TECL 56.66 -.25 47.88 1292.1% ------- BLUE .13 -.215 -.085 --------------------------------------------------------------------------------------------- IBB 129.23 -1.76 121.13 384.4% ------- RED .117 -.046 .071 --------------------------------------------------------------------------------------------- GLD 180.67 1.37 178.89 -45.2% Bullish BLUE .238 .129 .367 --------------------------------------------------------------------------------------------- OIL 17.91 .81 16.01 384.8% Bearish BLUE .086 .319 .405 --------------------------------------------------------------------------------------------- OIH 278.72 9.34 262.47 85.5% Bullish BLUE .138 .38 .518 --------------------------------------------------------------------------------------------- CPER 28.55 -.17 27.44 202.9% Bullish RED .345 .12 .465 --------------------------------------------------------------------------------------------- UUP 26.35 .1 26.47 -28.5% Bullish BLUE -.042 .068 .026 --------------------------------------------------------------------------------------------- CORN 26.75 .74 26.22 144.6% ------- BLUE .119 .269 .388 --------------------------------------------------------------------------------------------- WEAT 10.63 .64 10.57 216.4% Bullish BLUE .056 .519 .575 --------------------------------------------------------------------------------------------- YINN 4.59 -.65 3.11 1713.1% Bearish RED .195 -.367 -.172 --------------------------------------------------------------------------------------------- RSX 5.65 0 5.65 0% Bullish ---- -.433 -.733 -1.166 |

|||

Table 2 Count of Stocks in Key Directories

20220321

-------------------------------

NEWHIGHS 185

NEWLOWS 187

MAXCP 94

MINCP 28

TTTNH 59

TTTNL 17

CPCROSSA 45

CPCROSSD 167

ACCUMVER 5

HIGHIP21 11

HIUPPCT 24

VHIP21 42

LOWACCUM 209

REDSELL 132

AUGSELS7 12

TRAPDOOR 20

|

|||

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/21/22

Bullish = 16

Bearish = 33

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5

----------------------------------------------------------------------------------------

COAL 1 1 1 1 1 1

COPPER 1 1 1 .875 .625 .75

GOLD .956 .956 .956 .934 .891 .913

OILGAS .857 .838 .847 .819 .78 .79

FOOD .836 .836 .836 .816 .795 .816

COMODITY .82 .82 .82 .794 .769 .794 SOLAR .812 .812 .875 .75 .5 .187 UTILITY .769 .743 .769 .794 .717 .666 INSURANC .76 .76 .76 .72 .56 .56 MILITARY .73 .769 .769 .769 .692 .615 INFRA .696 .666 .696 .606 .545 .515 HOSPITAL .687 .687 .687 .687 .562 .562 EDU .666 .833 .833 .833 .833 .666 INDMATER .666 .652 .625 .597 .5 .527 HACKERS .65 .65 .5 .4 .35 .3 RETAIL .51 .553 .553 .382 .34 .319 ============================================================================================== SP-100 .488 .477 .444 .4 .355 .311 FIDSTKS .479 .491 .443 .402 .319 .278 GREEN .473 .473 .368 .315 .263 .21 TRANSP .473 .578 .473 .578 .263 .157 SP500 .452 .474 .432 .386 .308 .258 SOFTWARE .446 .428 .339 .303 .25 .232 LOWPRICE .43 .435 .389 .33 .269 .269 RUS-1000 .43 .458 .42 .359 .291 .278 INDEXES .427 .437 .416 .41 .345 .345 ELECTRON .421 .436 .36 .278 .157 .12 DOWJONES .4 .366 .333 .333 .333 .266 REIT .392 .461 .461 .369 .323 .292 CHEM .391 .434 .413 .413 .347 .369 DJI-13 .384 .384 .384 .384 .384 .384 SEMI .378 .389 .315 .263 .147 .084 GAMING .368 .421 .368 .315 .21 .157 AUTO .358 .377 .339 .264 .169 .15 FINANCE .353 .39 .378 .414 .292 .231 COMPUTER .35 .35 .2 .15 .1 .05 NASD-100 .35 .371 .309 .278 .206 .175 BIOTECH .348 .398 .334 .261 .197 .192 NIFTY .347 .326 .239 .217 .173 .173 HIGHPRIC .341 .378 .305 .225 .167 .12 BEVERAGE .285 .214 .214 .214 .142 .142 REGBANKS .28 .32 .32 .52 .28 .32 ETFS .254 .272 .272 .254 .2 .145 GUNS .23 .307 .23 .307 .23 .076 HOMEBLDG .222 .277 .277 .166 .111 .055 CHINA .22 .16 .14 .16 .14 .12 BIGBANKS .142 .142 .142 .142 0 0 BONDFUND 0 .022 .011 0 0 .011 JETS 0 .214 .071 .214 0 0 MARIJUAN 0 0 0 0 0 0 |

====================================================================================

Monday 3:15 AM PCT Futures DJI -122

NASDAQ - 61 Data thru 3-18

| Friday's rally took the DJI closer to the falling

65-dma and 200-dma targets and resistance-levels. Despite there being four straight days where the ratio of NYSE advancers to declines was more than 2:1, Peerless produced a classic Sell S9 because the DJI closed 3.4% over the 21-day ma with the P-Indicator a very negative. The P-Indicator was not just barely negative, it was a -98. In addition, the 21-dma is still falling and the V-I and OBVPct are quite negative. My experience teaches me not to over-think a Peerless Sell S9. A reversal down here would mean declining intermediate-term lows and highs. A retest of the lows would almost certainly then be in order. We certainly could go a 170 points higher and have the DJI tag its falling 65-dma, as shown below. But that is less than 1% ore. It would be at that point that the key Closing Powers would probably turn down. The failure to get past the 65-dma would be noted by many chartists and have a bearish effect on the market. After all, what more can the FED do? It can't lower rates. Some readers are more bullish than I am. But as the "keeper of the Peerless faith", I have to warn you about over-complicating the current S9. Do some profit-taking. But let's wait to short DIA The Closing Power could rise a few more days and there could be very good breadth if the Russians and Ukrainians agree to a cease fire. That could even bring a new Peerless Buy signal. In that case, traders would return to the issue of the FED's minimal response to inflation. They would likely focus on growth stocks that can show proits advancing more than 25% in 2022 over 2021 with rising PEs. NVDA remains my favorite. The older 2006 version of Peerless produced a Buy B12 as well as an S9/S13 today. Officially, conflicting signals cancel each other out. In addition, the P-Indicator is likely to rise this coming week because of the numbers being dropped of from amonth ago. (The P-I is the 21-day ma of daily NYSE advancers minus decliners..) When we specifically ask the question of the back-data to 1929 what is the effect of four straight 2:1 positive breadth days on the DJI when it closes >+2.6% over its 21-dma with the P-I negative, we find the odds are 4:2 that the DJI will continue to rally. But - and this is important - when we also add the condition that the P-Indicator must be below -50 on the "near S9", the DJI in both earlier cases sold off to the lower band and the most recent case was at the top at the end of December last year. See the new "near S9" study - http://www.tigersoftware.com/BreadthvsS9/INDEX.htm We can resolve the conflict in breadth indications by accepting Friday's Sell S9 if it is "clinched". In other words, accept it if there are 30 more NYSE decliners than advancers on Monday at the close. That will also give a chance for the DJI to reach our falling 200-day and 30-week moving targets as well as allow a new reversing Peerless Buy signal to appear, as occured in mid-1929 and -1987 (as I showed a couple of days ago). |

||

|

Charts - 3/18/2022 2022 PEERLESS DJI, Signals, Indicators Daily DJI Volume 10-DayUp/Down Vol Stoch-20 Pct of All Stocks above 65-dma Inverted Traders Index Cum. Inverted Traders Index DJI-IPA DJI-OBV NASDAQ S&P OEX NYSE DJI-15 DJI-20 DJI-30 DIA QQQ SPY IWM TNA Short-Term Rates Ten Year Rates DOLLAR-UUP ALLSTOCKs recent 2006 vers-Peerless signals http://tigersoftware.com/NEWPEER/UPD80318.BMP MDY - http://www.tigersoftware.com/CHARTZ/MDY.GIF USO-CrudeOil DBO FAS GLD HD IBB JETS JNUG KOL NUGT OIH PALL RSX RETL SDS AGQ SLV SOXL TAN TECL TLT TMF TNA UGA China: YINN CHAU Commodities: CANE CORN DBC JJC, NIB CORN, CUT (paper) MOO, SOYB WEAT UUP (Dollar) LIT (Lithium) STOCKS: MRNA DIS GE PYPL GME ZOM XLE NRGU AAPL ADBE ALXN AMAT AMGN AMD AMZN AXP BA BABA BAC BIDU BLDP CAT CRM CVX CMG DE ENPH FB GILD GOOG GS HD IBM INTU JPM LRCX MRK MSFT NEM NFLX NKE NVDA PG PYPL REGN REV SO SQ QCOM QDEL TSLA TXN XOM V VRTX WFC WMT ZM Bullish MAXCPs http://www.tigersoftware.com/UPPING/3-18/BULLISH.htm Bearish MINCPs http://www.tigersoftware.com/DOWNING/3-18/BEARISH.htm |

Table 1 QUICKSILVER on ETFS - 3/18/2022 Bullish = 6 - GLD OIL/OIH CPER CORN WEAT Bearish = 3 - RETL, RSX, SOXL ETF CLOSE CHANGE PIVOT-PT 5-dma AROC CL-PWR CANDLE IP21 ITRS POWER INDEX ================================================================================================== DIA 347.19 1.74 330.07 255% Bullish BLUE .137 0 ------ --------------------------------------------------------------------------------------------- SPY 444.52 3.45 417 285.6% ------- BLUE .1 -.005 .095 --------------------------------------------------------------------------------------------- QQQ 351.49 7.05 318.17 409.1% ------- BLUE .077 -.039 .038 --------------------------------------------------------------------------------------------- MDY 492.58 2.41 465.06 247.9% ------- BLUE .066 .013 .079 --------------------------------------------------------------------------------------------- IWM 207.27 2.16 192.71 265.6% ------- BLUE .04 0 .04 --------------------------------------------------------------------------------------------- FAS 121.65 1.53 102.71 978.9% Bearish BLUE .043 -.077 -.034 --------------------------------------------------------------------------------------------- RETL 22.62 .77 17.24 1243% ------- BLUE .04 -.274 -.234 --------------------------------------------------------------------------------------------- SOXL 39.17 2.22 27.91 1297.7% Bearish BLUE .065 -.342 -.277 --------------------------------------------------------------------------------------------- TECL 56.91 3.21 43.5 1106.3% Bearish BLUE .096 -.224 -.128 --------------------------------------------------------------------------------------------- IBB 130.99 2.37 119.6 419.7% ------- BLUE .108 -.034 .074 --------------------------------------------------------------------------------------------- GLD 179.3 -1.59 182.3 -159.6% ------- RED .247 .107 .354 --------------------------------------------------------------------------------------------- OIL 17.1 .2 16.64 -51.4% Bearish BLUE .09 .285 .375 --------------------------------------------------------------------------------------------- OIH 269.38 -.11 274.16 -331.7% Bullish BLUE .154 .373 .527 --------------------------------------------------------------------------------------------- CPER 28.72 .13 27.41 128.8% ------- BLUE .372 .122 .494 --------------------------------------------------------------------------------------------- UUP 26.25 .03 26.5 -49.2% Bullish RED -.071 .065 -.006 --------------------------------------------------------------------------------------------- CORN 26.01 -.11 26 -111.3% ------- RED .112 .238 .35 --------------------------------------------------------------------------------------------- WEAT 9.99 -.25 10.19 -175.8% ------- RED .039 .411 .45 --------------------------------------------------------------------------------------------- YINN 5.24 .69 3.14 1649.9% Bearish BLUE .186 -.247 -.061 --------------------------------------------------------------------------------------------- RSX 5.65 0 5.65 0% Bullish ---- -.431 -.729 -1.16 |

Count of Stocks in Key Directories

20220318

-------------------------------

NEWHIGHS 117

NEWLOWS 135

MAXCP 95

MINCP 17

TTTNH 62

TTTNL 19

CPCROSSA 102

CPCROSSD 40

ACCUMVER 4

HIGHIP21 20

HIUPPCT 19

VHIP21 40

LOWACCUM 275

REDSELL 137

AUGSELS7 9

TRAPDOOR 6

|

Table 3 RANKING OF KEY DIRECTORIES BASED PCT.OF STOCKS ABOVE 65-DMA

3/18/22

Bullish = 17

Bearish = 32

---------------------------------------------------------------------------------------

Directory Current day-1 day-2 day-3 day-4 day-5