BEARISH HEAD AND

SHOULDERS PRICE PATTERNS

Recognizing head/shoulders patterns and

learning how

to play them is a key part of making successful short sale

trades. First, recognize the pattern. After the first

decline,

there is often a weak rally back to the 65-dma. When prices

turn back down from it, sell short again when the IP21 drops

below its 21-dma or the Closing Power breaks its minor uptrend.

You can also wait for prices to break their minor support.

This decline will often test the bottom of the developing down-

trend channel. EHTH below shows these developments in

a

a still uptrending general market. Properly taken short

sales

can be quite profitable even in what is a bull market for the DJI

or SP-500.

Recognizing

Head/Shoulder Tops.

Our software does not automatically spot head/shoulders tops.

You will need to

be able to spot them

yourself. Look at the charts in this section. See the variations

on this theme that they

provide. This will help you gain the necessary confidence

to recognize and trade them.

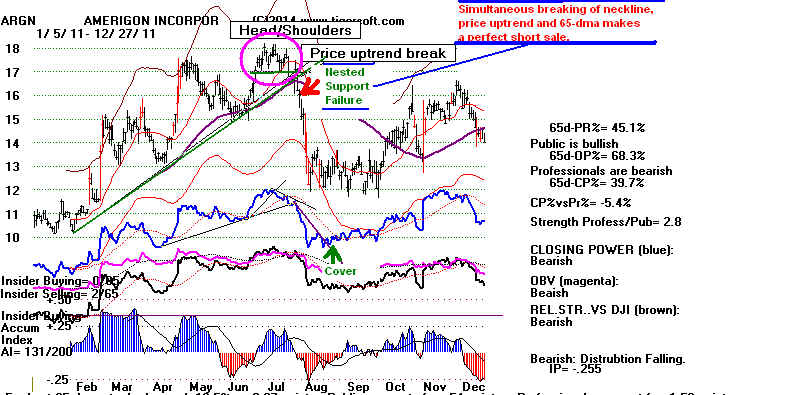

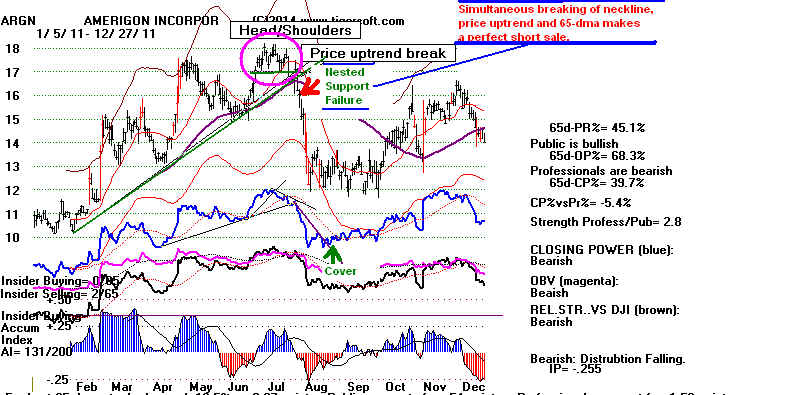

Neckline and 65-dma Violations Ordinarily Complete The Pattern

A close below the

neckline and also the 65-dma completes the pattern and

increases the chances

for a significant decline. Quite a few head/shoulders

patterns turn back up

from the 65-dma if the Accumulation is high

or there is no major

Peerless sell at the same time.

In bear markets when

the DJI declines more than 20%, having a high

Accumulation Index will

not save a stock with a clear head/shoulders

pattern from falling

dramatically. Examples in 1987: AVP, BMS and CAT

and in 1990: AET, BA,

IPG, JCC, NSM and PEP. When there have

not been multiple

Peerless Sells and a support failure, avoid shorting

stocks that show high

Accumulation.

(See http://www.tigersoft.com/KSS-ShortSaleBook/1987-HS/index.html

and www.tigersoft.com/KSS-ShortSaleBook/1990-HS/index.html )

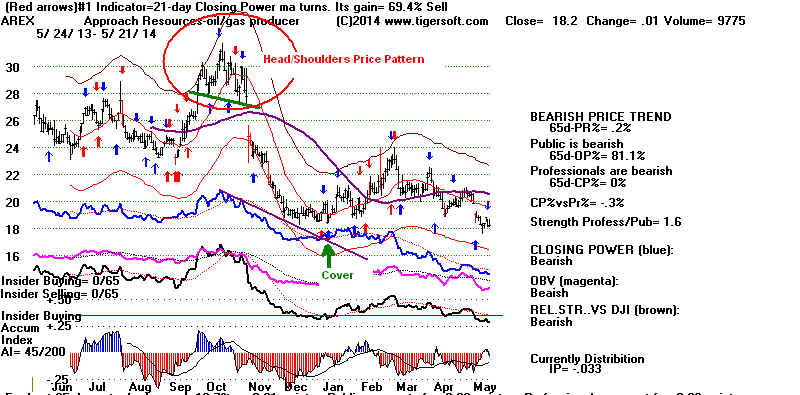

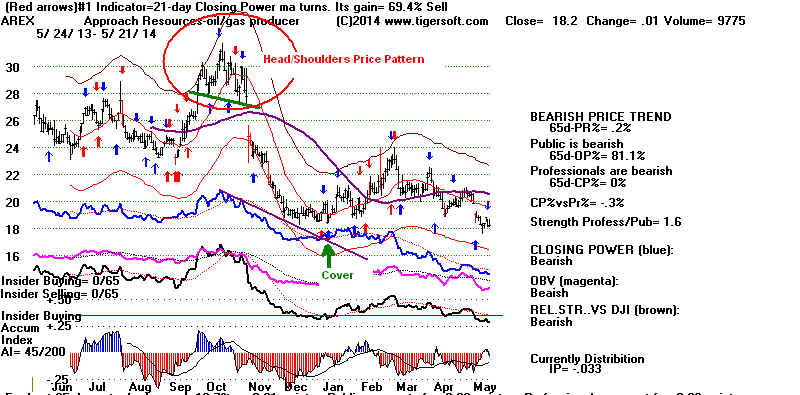

Sample head/shoulders:

What Accentuates the Bearishness in A H/S

Pattern

Head/shoulders are more

likely to bring short sales profits if there has

been an earlier H/S

pattern in the year. This increases the bearish potential.

It shows more

distribution. Avoid big losses with a H/S pattern by

vowing

to cover if the stock

closes back above the 65-dma and the Closing Power

is no longer in a

downtrend. When Red Distribution is still very

apparent,

use a close by the

stock above the previous right shoulder's apex to close

out short positions.

See ANV below in June 2011.

Downside Potential

Classic technical

analysis says the height ot the price pattern from its

apex down to the

neckline gives a point-count that should be applied from where

the neckline is finally

broken. This calculates the so called "minumum

downside price

objective" for a completed H/S pattern.

In a "normal" intermediate-term

decline by the DJI of 8%-13.5%,

it is amazing how often

this is exactly how far prices do drop before

turning back up.

Consider 1988, a year when declines by the DJI

did not exceded 12%.

Examples where post-H/S

decline fell just to minimum downside objective:

1988 AA, CLX,

CPB, DD, DOW, DUK, FDX, HAL, HUM, JCP. KMB,

NOC, NUE, R, RRD, SUN

(n=16)

Contrary examples where

the post H/S decline fell significantly below the

minimum downside

objective:

1988: AAPL, BHI, HRL,

PPL, RSH, SHW (n=6)

Examples where

the post H/S decline failed to fulfill minimum downside objective

1988: BA, MMM,

MWV, UTX (n=4)

(See http://www.tigersoft.com/KSS-ShortSaleBook/1988-HS/index.htm

)

Understand that in a serious DJI decline,

prices will mostly drop far below

minimum downside

objective. See

1987: AA, CAT, CI,

DIS, F, GD, HES, HON, HUM. IFF, JWN, K, KO,

LNC, LOW, LUV, MAT,

MHP, MKC, MO, MRK, MUR, NTRS, NYT,

RRD, RSH, S,

SIAL, SNA, TAP, TMO, TXN, USB, UTX, WAG, X (n=36)

in 1987, prices only

fulfilled their downside objective in two cases:

CLX, PEN

(See http://www.tigersoft.com/KSS-ShortSaleBook/1987-HS/index.html

)

Markedly lower Accumulation on the right

shoulder adds to the bearishness,

as does a price gap

down on red high volume when the neckline is broken.

Most of the significant

H/S patterns are built over a 3-week to 6 month

time interval.

But be aware of the "mighty mouse" miniature patterns

that last only 10 or 12

days and the weekly head/shoulders patterns that

can last longer than 30

weeks to complete.

Earlier head/shoulders patterns in the

same year, definitely ripen a

stock for an even

bigger decline. The same thing is true when a larger

head/shoulders pattern

has imbedded smaller patterns built into

its formation.

See the 1987 H/S

patterns for many examples of both

of these phenomenona.

When Peerless gives a

Sell and the DJI declines, stocks with H/S

patterns normally go

down much more quickly than other stocks

once the neckline is

broken. I have studied the H/S patterns in SP-500

stocks from 1987 to

2012. Any glance at this many H/S patterns should

convince you about the

reliability of usefulness as bearish signs

to sell short.

A

Multi-Varied Pattern

As you can see from

these many examples, perfect symmetry between

the right and left

shoulder is relatively rare. And does not matter much.

The same is true

whether the neckline slopes moderately up or down.

More important is the

amount of red Distribution on the right shoulder.

Its presence confirms

the pattern's bearishness from the point of view of

insiders and their

friends. Very Blue Accumulation Index readings will not

prevent a H/S shoulder

from bringing a significant decline in a weak

general market, but

will help hold the stock up if the general market

is not weak.

Often the H/S price

pattern forms way above the 65-dma. When this

happens, the decline

often stops at the rising 65-dma. The 65-dma

often acts as support

even after a H/S pattern's decline has been

violated. For

this reason, it is usually best to not consider a H/S price

pattern completed until

the 65-dma is closed below.

When prices do break the neckline and the

65-dma, they usually

fall quickly.

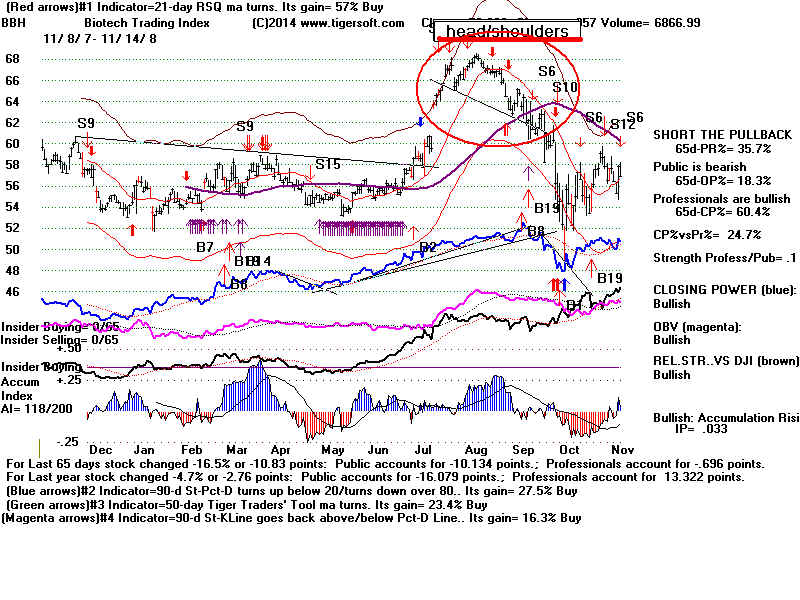

However, in perhaps 35% of the cases there is a

"pullback"

back up to the broken neckline or 65-dm before the

decline resumes in

earnest. We like to short these as soon as

the Closing Power hooks

back down when prices have failed at

the 65-dma.

H/S patterns can occur in any general market environment. They can

cap a long bull market

or occur on a brief rally in the middle of a

bear market. Head/shoulders often appear with

the DJI, SPY, NASDAQ, NYSE

and OEX. When

prices rupture the neckline, they produce very tradeable declines.

All the averages

produced compact H/S patterns right before the

mini-crash of 2010.

Many traders come to rely on them, perhaps, too much.

Stocks and general

markets can also decline without their appearance.

. Compare the outcome of the completed

head/shoulders pattern

in VLO (below) during

the 2013 bull market with head/shoulders patterns

at the start of general

bear markets in 1987(AA),

1990(LOW), 1998 (CL),

2000 (CSC), 2002 (GR) and 2008

(HOT).

It is a fact that these

patterns cannot be searched for by the computer,

except to examine one

by all the stocks that have just violated their 21-day

or 65-dma. Then

note the ones that have just completed a head/shoulders pattern.

While this sometimes

making a short sale a day or two after the neckline has

been violated, the

Power Ranker lets you easily find the weakest of these,

those with the lowest

IP21 score and those with the bearish "Both Down"

condition (both Opening

and Closing Power are falling.)

Examples

See DJIA Head/shoulders

patterns

SPY Head/shoulders

patterns

a

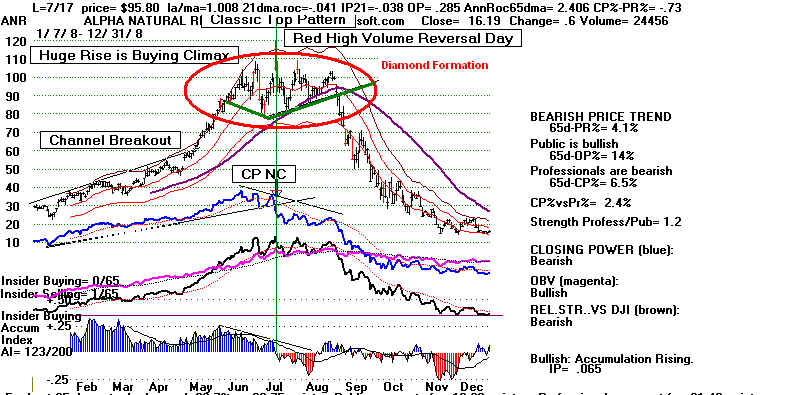

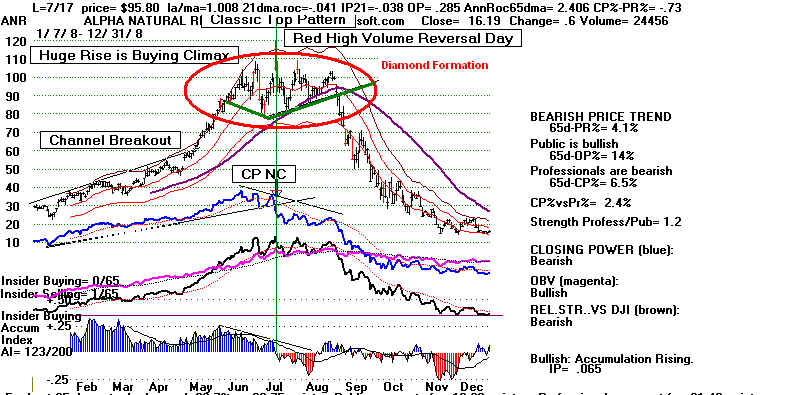

Diamond Top Patterns and Hands-above-the-Head Patterns are really variations

of the classic Head/Shoulders pattern.

The same rules apply.