Very Profitably Buying and

Selling Low Priced Stocks Using TigerSoft

(C) 2013 William Schmidt

by William Schmidt, Ph.D. last edited 9/16/2013

Creator of TigerSoft - www.tigersoft.com

OUR GOALS

Typical Examples of

Trades We Should Be Able To Make Regularly.

Introductiory Rules

Making money trading with TigerSoft using low priced stocks is not that

much different than using TigerSoft to

trade high priced stocks. But there

are some key differences. I suggest

the following rules to start with:

1) Low priced stocks do a lot of sitting

around doing nothing. Look at their

charts. This should readily become

apparent.

This makes it imperative to pick your

stocks carefully using the right technical

cues to time your purchases so that they

have the highest chance of moving

in a reasonable period of time.

Otherwise, you will surely feel trapped holding

stocks that seemingly do little or

nothing in a rising market. Waiting weeks

or months for your stock to move when the

general market is rising is very

frustrating. It shows a mistake was

made. Review your trades and learn

from them.

2) Very important. Sell when a key

support level is violated even if the

Accumulation Index is positive and the

Closing Power is rising. I've found

that the folks who try to accumulate and

rig low priced stocks are

much more likely to be wrong. Don't

fight price downtrends with these

stocks. There is no need to.

Pick stocks that are above their rising 65-dma and

show good internals. Even if the

Closing Power is rising, the Accumulation

is positive and the stock keeps falling

on very low volume, sell when the

stock violates the neckline of a

head/shoulders pattern or when the stock's

65-dma turns down or when the stock

breaks key price support.

3) Diversify. Do not just buy one

or two low priced stocks. Buy a

handful, 5-7. This will increase your

odds of getting one or two really big winners.

This is what will increase your gains at

the end of the year.

4) Take 50% profits in 1/2 of your

position when you can. Too many times,

a hot low-priced stock quickly cools off

and falls back to where it started its move.

This rule can be varied, of course, as

desired. One could work with a stop beneath

a winning trade that guarantees you a 50%

profit in half the stock.

5) Avoid stocks that trade less than

250-500 lots of ine hundred shares

a day. The spread between the bid

and ask are just too wide and the market

makers will more easily take your shares

away at unfair prices.

6) Use the Opening and Closing Power to

decide whether the stock is

apt to open high or lower. Use that

knowledge to your advantage.

7) Mainly buy low priced stocks that show

the BOTH UP condition. "UU" in

the spread sheets under "Tiger

Sig" tell you this conditon is present. Chart

the stock's Opening and Closing Power,

too. With low-priced stocks, the risk is

always that the stock will fall asleep

for weeks and months. When both Opening

and Closing Power are rising, the stock

is bullishly openng higher and then

closing still higher than that each day.

8) When stocks under $10 appear

among the BEARISH MINCP stocks,

sell them short while they are

still over $5. This allows them to be margined.

If they show very bearish

Accumulation, a CLosing Power that is making new lows

ahead of price, a falling Relative

Strength Quotient, they are very apt to

drop much further. Just

because a BEARISH MINCP stock is low-priced

does not not mean it won't fall

much further.

You Just Cannot Be Too Cynical When It Comes

To Wall Street

Wall Street's Dirty Little Secrets.

1) Democrat or Republican in the White House: It doesn't matter:

Wall Street Runs The

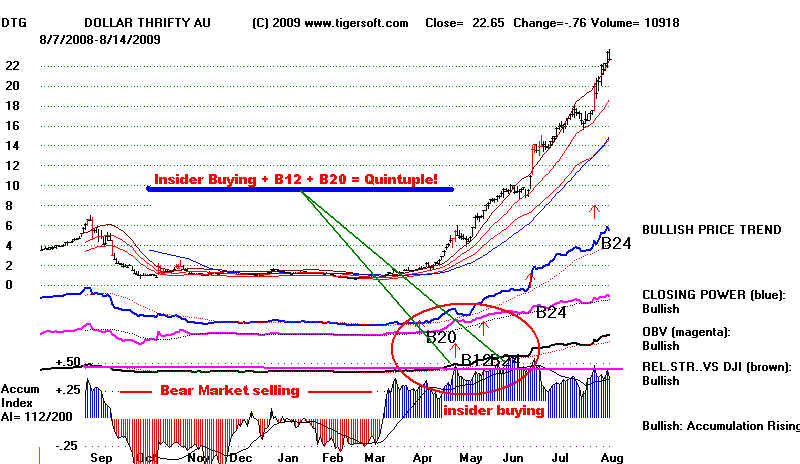

Whole Show. Early in 2009,

Wall Street insiders bought heavily at

the bottom with money

given them by the Federal Reserve.

They also were secretly

guaranteed by the Fed that interest rates

would be kept very

low for a long time.

2) The fat-cats there keep the best

investing opportunities to

themselves. I vividly remember realizing this

working at

the main office of stock brokerage

Harris, Upham. I saw how the

partners kept the best stories to

themselves and did not disseminate them

them to their clients until they had

taken their own big positions

in stocks about to go up.

Not surprisingly, Wall Street kept the start of the 2009-2013 bull market

a secret from the Public. Our

indicators showed Professionals were

steady buyers early in 2009 and for many

months after the March 2009

bottom, all the while the Public was

steady net sellers. Only years later

in 2013, is the Public finally invited to

the party, probably just in time to

buy what Wall Street and the Insiders

want to sell. (Download 09-Q

from our Tiger Data page look at the

Opening and CLosing Power for

QQQ.)

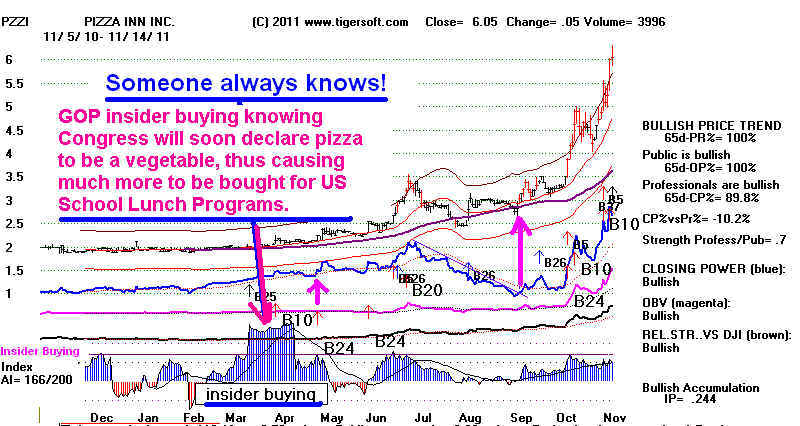

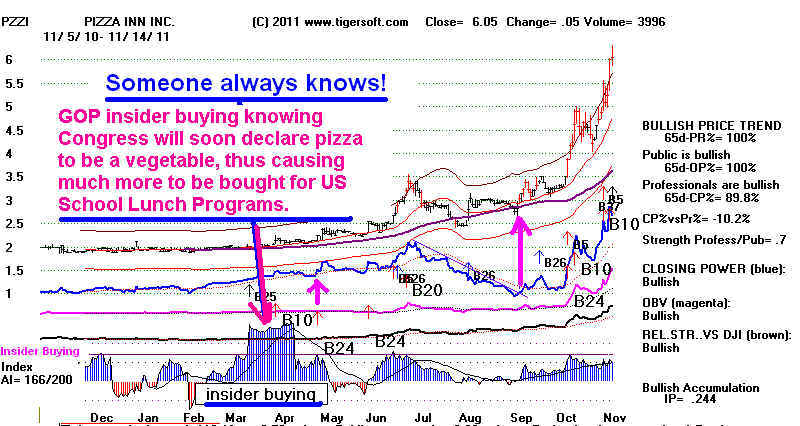

3) Wall Street Insiders always know first

when there is insider information

that will affect a stocks prices.

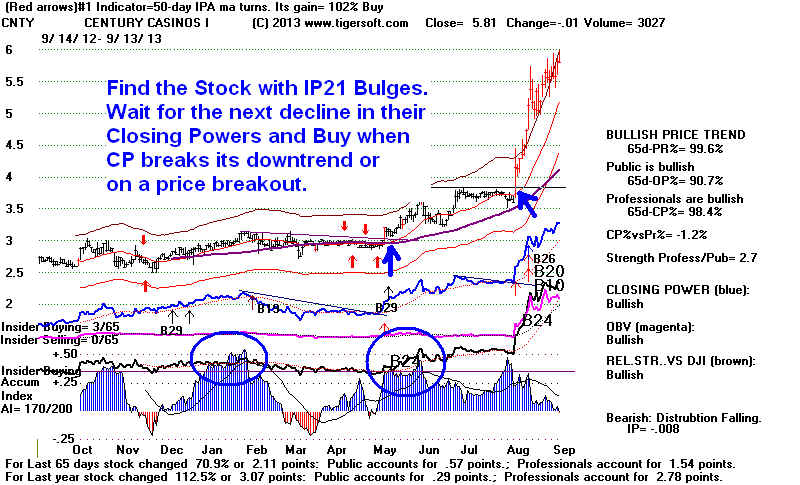

See how we spotted this with our Accumulation

Index in Pizza Hut. There are hundreds and hundreds of such cases

we could point to.

USING TIGERSOFT

1. Tiger Data Page Downloads for This Pursuit

ACCUMHOR - consistently positive Accumulation - Regularly maintained

new VHIP21 - Stocks under $5 that have shown a bulge of

Accumulation above +.45 - Regularly Maintained

LOWPRICE - Stocks under $5

- Regularly Maintained...

BIOTECHS

2 Tiger Indicators and

Tools

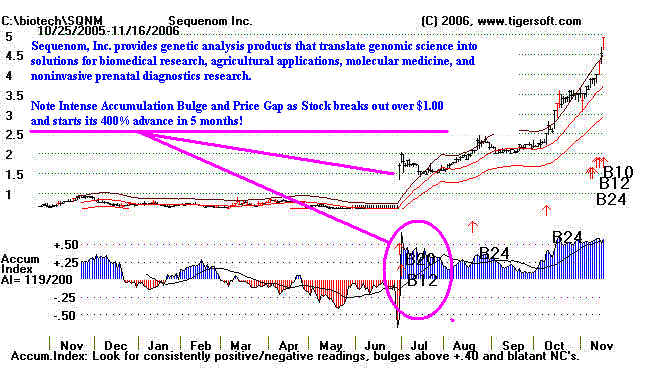

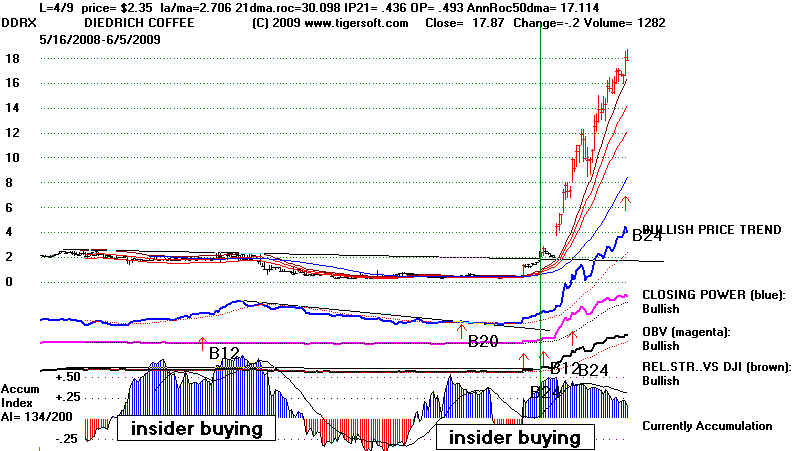

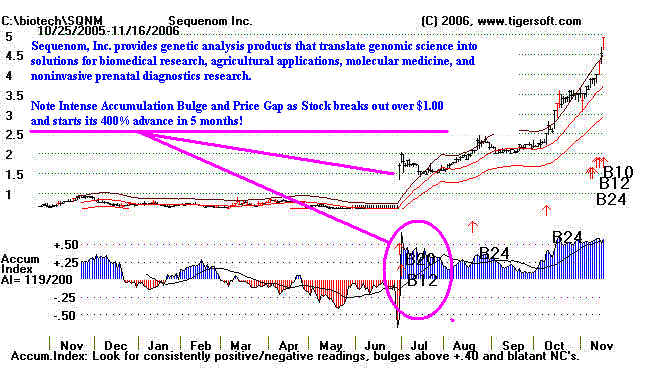

Each year Tiger reports

on the best gainers of the last year. Each year, most show big

bulges of Accumulation before they start the

best part of their moves. Flat topped

breakouts with gaps and red-high volume are

also typical of the majority of the

top 10, 20. or 50... See the study for 2007's

biggest gainers.

See also http://www.tigersoft.com/Tiger-Blogs/8-30-2007/index.htm

There are always many low priced stocks

with these characteristics that double or

triple.

Tiger Accumulation Index

Test Your Skills at Stock

Selection

Which would you have bought?

IBM or Cheyenne Software

Here's What would have happened.

IBM or Cheyenne Software

Tiger Closing Power - Read

our on-line book on this.

The Tiger Power Ranker lets you easily screens

large numbers of low-priced stocks to find the stocks

to find the best candidates that are apt to

become the next explosive super stocks.

Using the the Tiger data downloads mentioned

above run the Power Ranker's ANALYSIS.

Then either list these stocks with the

spread-sheet display or graph them in sequence.

Using these screens will find you most of the

best stocks early-on.

Find and examine

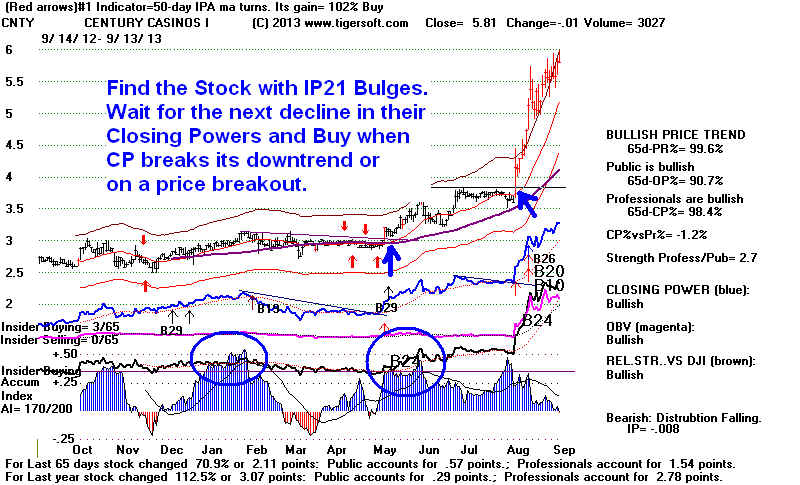

stocks showing these Power Ranked Characteristics:

BULLISH - the most important...

New Highs,

BothUp, Unusual Volume, Price Gaps, B10s, B12s, B20s,

B24s, Unusual

Volume, Short-Term Stochastic Buys,

Require AI/200 to be

above 145, IP21 to be above +.23

Require Closing Power to be confirming the new high

Require OBV and Relative Strength to be confirming the new high.

Don't chase a stock more than 10% above its flat top breakout point.

Example from the

9/3/2013 run of the TigerSoft "BULLISH" picks among the 200 Biotechs

we offered.

They were:

Power AI/200 Curr, IP21 Price

50-day Trend MACD Signal

Tiger Signal

EBS 551

175

.25

17.73

.98 (below)

Sell ?D

(Pink shows the price was too high, or the value was too low or negative)

QDEL 481

183

.18

26.69 1.02

Buy

?U

ALNY

436

158 .05

52.42 1.05

Sell

U!U

==>CUR

418

160

.13

1.64

1.03

Buy

UU

CSB

399

166

.23

1.33

1.04

Sell

DU

CUR was the only stock in the top 5

Power Ranked Biotechs that night that qualified

on all

counts. Examinatin of the CSB chart

showed it had nearly doubled since its

June

breakout. As we customarily want to find a low-priced stock that will give us a 50%

gain on a

breakout for half of our position, CUR clearly was much better. A quick look

at Yahoo

showed that its work in spinal repairs using stem cells made it a good story

spot.

the coming football season would surely highlight the need for better ways

to treat

spinal trauma.

Technically, CUR was perfect. You can see what the stock looked like on

9/3/2013

above

when I recommended it on our Stocks' Hotline. The factors that made me

pick

this stock were listed below. You will see that these were the classic

technical considerations we want to see in a low priced stock we buy.

So, I

suggest studying them closely.

1) It showed steady positive Accumulation. Its AI/200 score was above 145.

2) It had had a bg bulge of insider buying in early July. The IP21 went above

+.50.

3) The stock had two weeks earlier then shown s Closing Power that had broken"

its downtrend. This was the bullish "Closing Power hook-upwards" following

a

bulge of insider buying.

4) The stock had then gotten back above its 65-dma.

5) Now both Opening and Closing Power were rising. The stock was primed to

advance. We might not have to wait long.

6) Best of all, the stock had a set of earlier flat peaks at 1.80. If the flat

resistance here could be overcome, the stock would breakout and attract

new buying interest.

7) It was in the red-hot biotech group. This meant its trading would be

watched by many investors and advisors, too.

CUR did breakout. It jumped by more than 50% with two weeks. Here is

its chart right now, as I write this.

================================================================================================

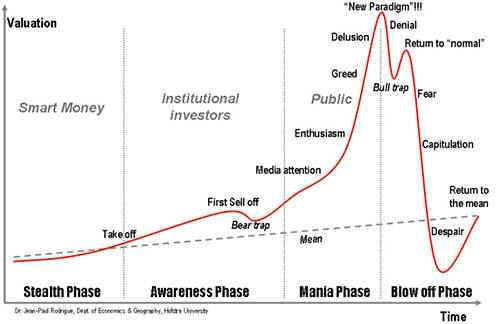

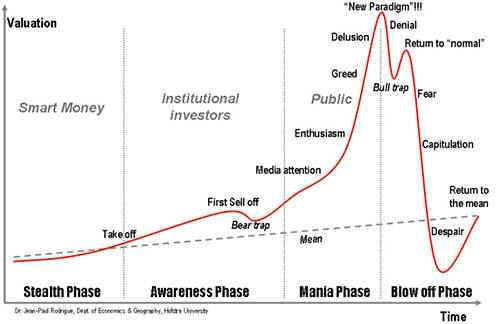

KNOW THE STAGE OF THE BULL MARKET WE

ARE IN.

ADJUST YOUR TRADING TOO IT.

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

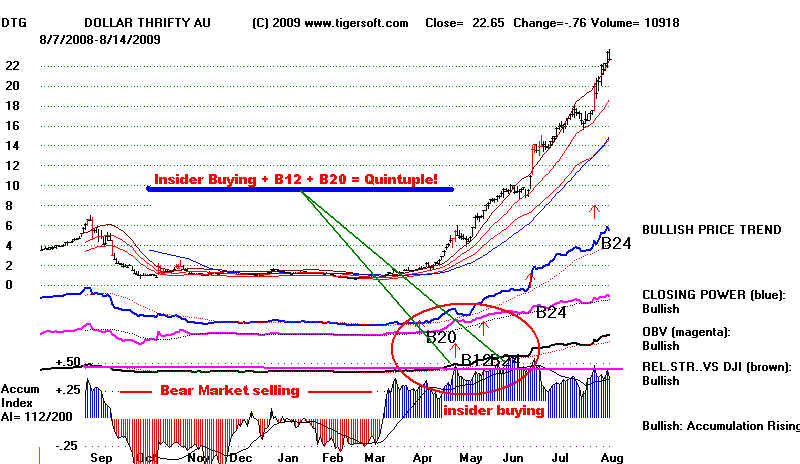

3. STAGE ONE: Buy The

First-Out-of-The-Gate Low Priced Stocks :

At the end of a long bear market, many

stocks will be low priced. Buy those

that first break their price downtrends

and that are the leaders in terms of Price-Pct change

and Unuusal Volume. As they

advance, their Closing Power should be leading Price.

They should show rising and increasingly

positive Accumuation.

See Tiger Blog: "The Great 2009 Bull

Market"

See also http://www.tigersoft.com/BiggestG/index.html

- See examples from early 2003

and early 2009.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

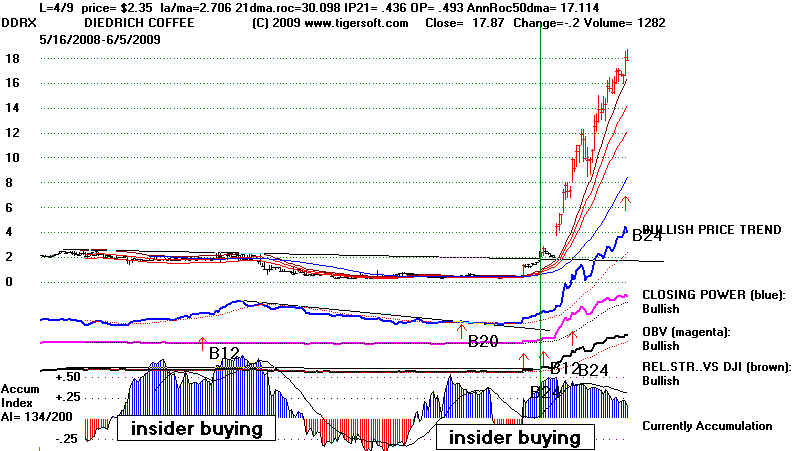

4. STAGE TWO: The bull market has now gained many believers. But not all

stocks

go up equally or together.

After the bull market is a year or two old, we must

be more selective. Use

Tiger's Buy Tiger B12s and B10s to find these among

stocks between $10 and $20.

This is the price range of the biggest gainers

ar this time. As they

gain acceptance and surpass $20/share, bigger insttitutions

will start to buy them based

on jumps in earnings and expanded PEs.

Unusal volume, big gaps and Buy

B12s will also find low priced stocks at this

time. They are most likely to

be in biotechnology, where earnings potential

stories can be spread based on

potential new drugs and treatments they are

developing.

Require these stocks to

bulges of Accumulation and flat topped breakouts.

These are stocks insiders and

professionals have accumulated preparatory

to a mark-up phase that

usually lasts a year before the bullish news finally comes

out that the insiders

expected, controlled and will use to bring in the last public

buyers near the final top.

See: TigerSoft's 1997 Study of Bullish

Special Situations --

Note that these STAGE 2 Explosive Super Stocks will usually rise a

year before they collapse.

This will give you many

additional buying and trading opportunities with these stocks using Tiger's

Closing Power in

conjunction with the rising 65-ma and 21-dma of Closing Power. Where

there has been a

classic bulge of Accumulation and take-off with majors Buys, flat-topped

breakouts on red high

volume with price gaps, you may want to be an investor, not

a trader. Take a

position in five or six of these and just let them run. Hold them as

long as they stay above

their 65-dma. If they violate it, sell. But don't recommit the

funds until you see

whether the breakdown was actually bearish. If the stock quickly

recovers and the

Closing Power turns up sharply. But the stock back. The decline will

probably prove to have

been false.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

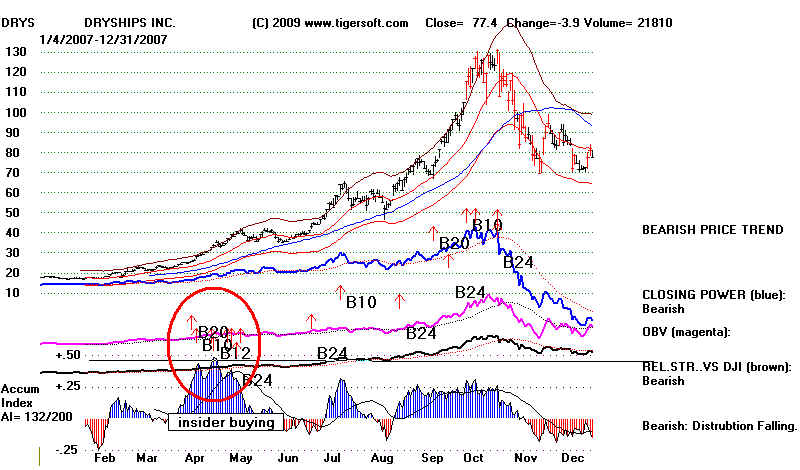

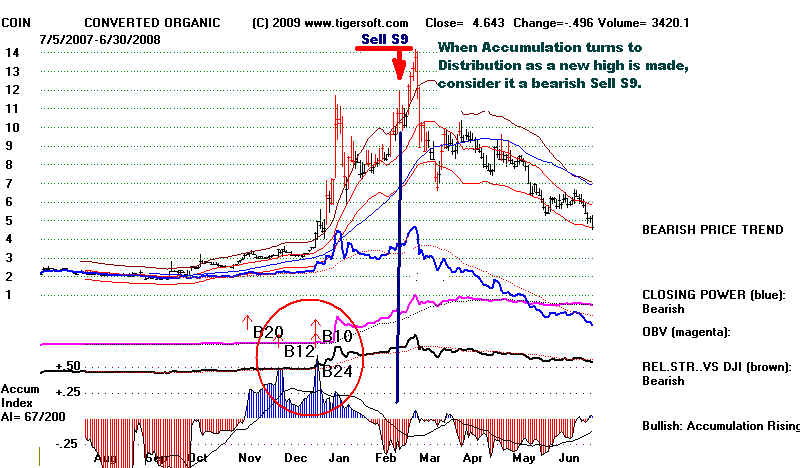

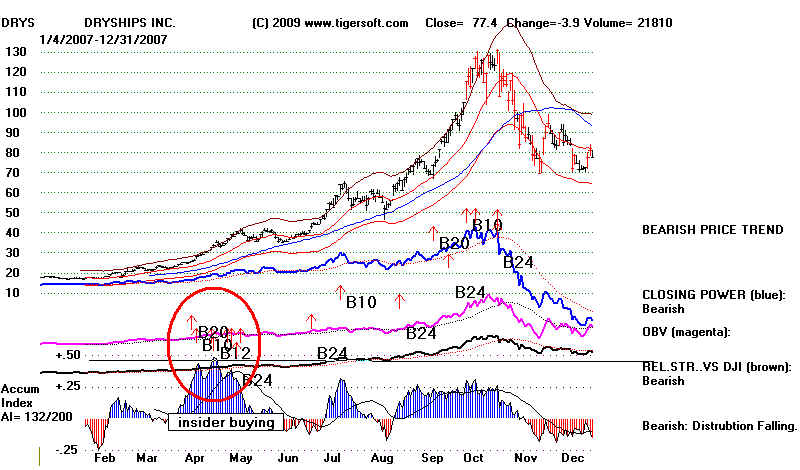

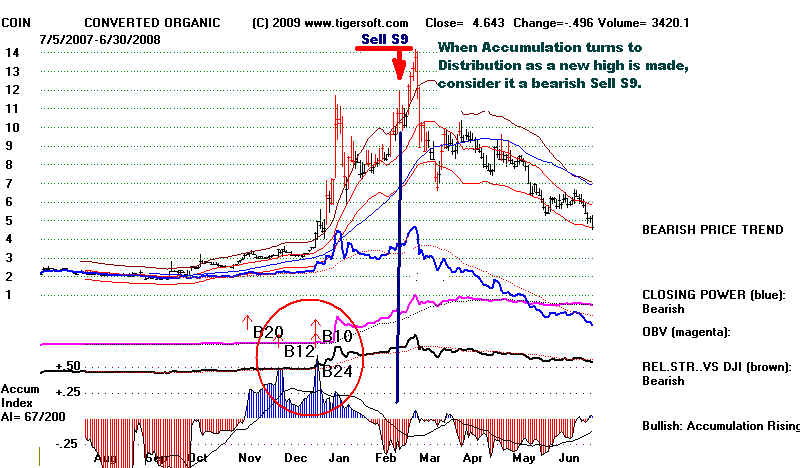

5. STAGE THREE: In this

stage, it shuld be apparent that the long bull market is coming to an end.

Peerless will have given Sell

S9s and Sell S12s. The DJI may be desperately trying

to hold up above its flat

65-dma. At this point, the few, remaining stocks making

new highs get an inordinate

attention from breakout buyers and high-performance

chasing funds. This

makes them go up faster and further. The general public is now

in the market now. They

prefer low-priced stocks. These are usually very thin. After a

suitable period of insider

and professional Accumulation these stocks breakout with

flashy increases of volume

and big price gaps. They show the usual major TigerSoft

Buy signals: B10s, B12s, B20s

and B24s. The difference is that they are "shooting stars".

Their extraordinary gains

from start to finish usually are made within 6-9 months. Then

they collapse completely.

They give back all their gains in the bear marlet that has

now hit all shares.

Act accordingly with these stocks. Work with tight stops. Look

for

the signs of a top, such as

head/shoulders patterns, false breakouts and breakdowns

below nested price

suppport/the 65-dma/the longer price uptrend/the Closing Power uptrend.

We saw this in many small

oil/gas "penny stocks" in 2008 when crude oil prices

briefly rpse from 110 to

$150/bar.

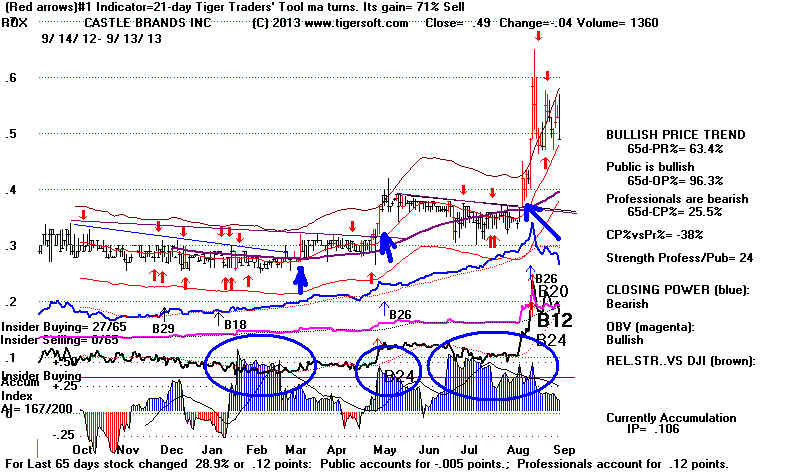

6. THINGS CAN GO VERY WRONG WITH LOW PRICED STOCKS.

Actually this is true for any priced stock. But low priced stocks are manipulated

mostly by "small-time" operators. They are "small-time" for many

good reasons.

Their judgement and control of the stock is much mor elikely to be wrong.

This means the Accumulation and Closing Power can fail to call a top or

a support about to give way, as they do with higher priced stocks. This makes

sense I think. The manipulators and Accumulators of these stocks are

not nearly so smart, well-endowed with money or have as much control

of news and events as the much bigger operators do. Goldman is successful

because it has money and because it can control Washington DC. The small-time

operators working with low-priced stocks are much more likely to be wrong

as a result.

Warning - Sometimes low priced stocks fool even the

professionals and

the

Accumulators. It is best to work with stops with these stocks underneath

well-tested flat support. Below, I

recommended SFEG at $1.00. It rose

nearlt to our 50% goal for half the stock, but then started falling back when

the

take-over of another company they were attempting failed. As gold

prices

fell, the stock dropped and dropped, hitting 10 cents two and a half years

later.

See how this happened and why you must use sell stops and sell

when prices

break below these support levels.

Jan15,

2012 SFEG

Santa Fe Gold Shows Bullish Insider and ... - TigerSoft